Denial works great until it doesn’t.

By Wolf Richter for WOLF STREET.

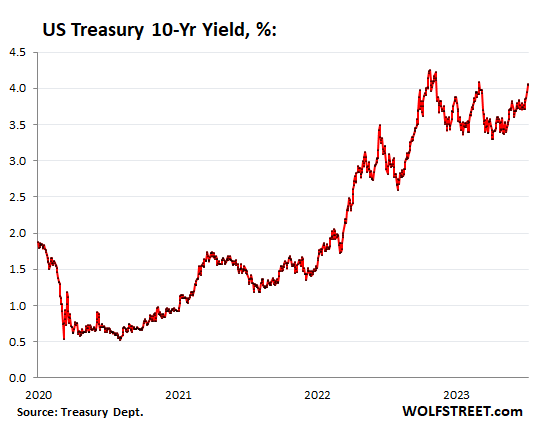

The 10-year yield closed at 4.06% on Friday, the highest since early March, when it went to 4.08%, at which point the Fed’s intervention to halt the bank-panic unleashed a massive rally in all kinds of assets, including longer-term bonds, on the fervent hopes that this would be the beginning of QE all over again. It knocked the 10-year yield back down to the 3.3% range. But that rally in longer-term bonds has been replaced by a selloff, and yields have shot higher.

The last time before this rate-hike cycle that we saw a 10-year yield of 4.06% was during the Financial Crisis in 2008, when it was on the way down.

Over the three months from early August through early November last year, the 10-year yield spiked by a lightning-fast 1.6 percentage points from 2.6% to 4.2%, as bond prices plunged. This was followed by a rally in prices (yields fell again) – logical after that kind of move. And then in February, yields worked their way higher again until mid-March, when the Fed’s reaction spawned fervent hopes for QE, prices took off, and yields fell again.

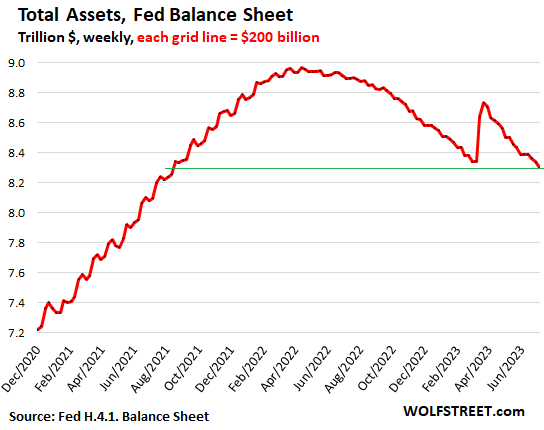

But the bond market rally fizzled as it became clear that these QE hopes were in fact a fantasy, and that QT has in fact continued, despite the bank liquidity support measures: The Fed’s balance sheet has dropped below where it had been before the bank-panic bailout, to the lowest level since August 2021 (details here).

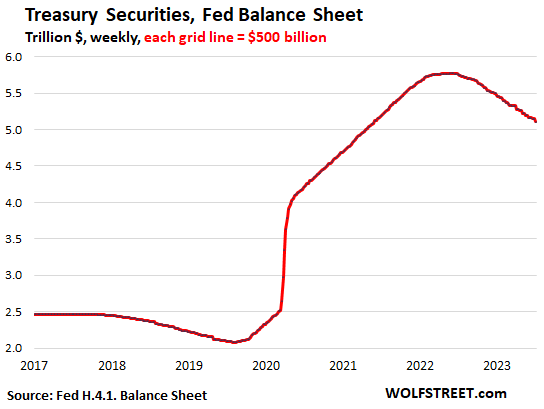

In addition, the market needs to absorb a huge amount of new issuance of Treasury securities, as the Treasury Department wants to refill its checking account, the Treasury General Account (TGA), and at the same time fund the ballooning deficits. So far, this additional issuance has been concentrated on short-term Treasury bills. But going forward, the Treasury Department is expected to increase the auction sizes of notes (2-10 years) and bonds (20 and 30 years). More supply coming on the market that needs to be absorbed, and higher yields will attract more buyers.

This flood of new longer-term notes and bonds is coming even as the Fed has stepped away from the Treasury market, has unloaded $665 billion in Treasuries from the peak in June 2022, and continues to shrink its Treasury holdings by about $60 billion a month. The Fed has already shed 20.5% of the Treasury securities it had bought under the pandemic QE.

So the longer-term Treasury market is beginning to come out of denial. It’s ever so gradually acknowledging that inflation is going to be higher for longer, and that interest rates are going to be higher for longer, and that some of these old assumptions about inflation and interest rates and pivots and QE are out the window.

Short-term Treasury market not in denial.

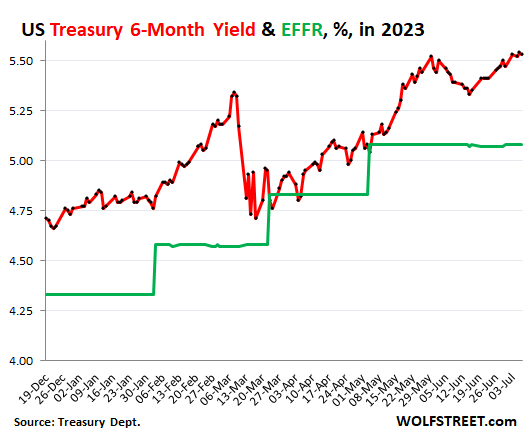

Short-term yields went haywire during the bank panic in March, and then again they went haywire during the Debt Ceiling fight. But they calmed down and dealt with the two rate hikes in March and May.

Now they’re confidently projecting two more rate hikes this year, having now gotten memo from the Fed’s FOMC meeting in June. The first hike, likely in July, is fully priced in, and the second one later this year is mostly priced in. Two rate hikes would take the Effective Federal Funds Rate (EFFR) from 5.08% now to about 5.58%.

The six-month yield closed on Friday at 5.53% and has been in this range for four days. Securities with a remaining maturity of six months mature by the end of this year, and that is the extent of what concerns them. They’re not in denial of anything, they’re on target:

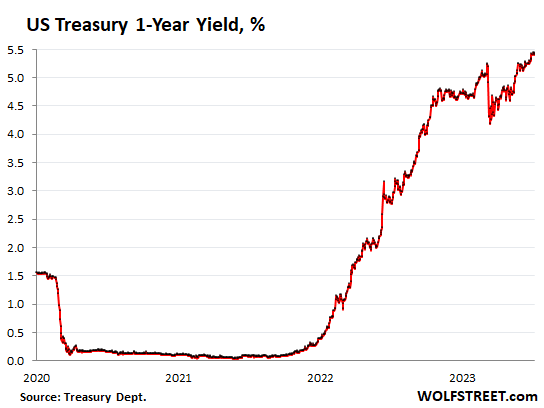

The one-year yield, which eyes events that would happen over the next 12 months, closed on Friday at 5.41%. It has been above 5.4% for six days in a row. It is now fully pricing in one rate hike and getting closer to pricing in another rate hike. And it’s not pricing in a rate cut over the next 12 months, which makes sense, and there is no denial of higher for longer within its 12-month window.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Touching 4% for a few days doesn’t matter. It has to stay there, it has to break mismanaged banks and overleveraged companies, and Fed has to sit and watch and let it break, rather than intervening with a “new vehicle” thus preventing a drop to 3.5% like in March.

So let’s not celebrate victory yet, Nasdaq just rallied 30% on 10 year drop, 30 year has moved too little, there is still a long way to go before celebrating victory and there is a very flaky Fed that can intervene again!

That’s the moment, when (if) over leveraged businesses go under and Powell comes out, says

> Suck to be you

End of press conference.

That would be when the penny drops and we move onto the next leg.

gotta love the 1 year at 5.5%

REAL PROBLEM is govt spending with no offsetting revenue

IT’S like they planned it that way so as to go exponential

and then hit GREAT RESET button

wiping out 99.9% population financially

“You will own nothing and be happy” ?

Why is revenue only talked about needing. offsetting… How about offset spending. Quit treating the US citizen like a tax cow

All policies seem to be spend today and worry about it tomorrow. Running huge

huge budget deficits at end of business cycle means deficit is going to blow out to massive numbers next recession.

That is certainly the mentality of a dopamine-hit junkie, glued to CNBC and trained like Pavlov’s dogs to bid up tech stonks every time a talking head screams “muh pivot!”

Put more politely, recency bias is at work here.

I’ll gladly pay you Tuesday for a

HAMBURGER today

Wolf, can you do a bit on how the rise in yields impacts social security et al. that are to a large extent government bond allocated and have been eating yield shortfalls? Has the outlook improved in a qualitative manner for such funds? Thanks!

We need real positive rates across the board because time has a value.

Interest rates should never have been at zero for 14 years. For having 1,000 PHD economists, they sure are stupid…or communists.

Now interest rates should be at 8%….not 5%.

Have you noticed the adults left the room in 2001?

….or criminals.

Well, while the largest debtor on Earth also controls the printing press, certain things become pretty predictable.

“…certain things become pretty predictable.”

Inflation. Which also eventually stops the printing press.

Historically, the printing press never stops, but the currency does.

Or they drank the Kool-Aid of irrational exuberance delusional thinkers that sustains the markets the media and this stupendously amazing and resilient American economy

The presses do stop when they can no longer trade paper dollars for new paper & ink.

Inflation does eventually stop the printing press…though that was clearly delayed for decades (e.g., export of industry and labor abroad for cheaper imports to meet excess demand).

But at what a cost in respect to wealth redistribution!

“Now interest rates should be at 8%….not 5%.”

That’s probably true but HOW you get there is also important. An instant hike to that level would be murderous to a great many banks and corporations. Some may deserve just that but the collateral damage would be huge and, IMO, that is what the Fed is trying to avoid.

Agreed, the big error was keeping the interest rates at zero for 14 years and robbing savers of a decent return while at the same time leading to massive malinvestment based on these artificially low rates. In order to correct the problem there is no other way that a hard landing with a lot of pain for everyone including those who had nothing to do with these boneheaded decisions.

We just did our first foreclosure in the last 3 years. More to come.

There’s needs to be a hard landing?

Sorry, but we are already in a hard landing. Inflation was 20% in a 2-3 year period. It’s currently running 5% and set to continue for a long time. This is a massive devaluation of ordinary peoples’ pensions and fixed income, as well as an impoverishment of younger generations.

I find the Fed’s talk of a soft landing very odd, given the huge damage he’s already inflicted on people who don’t own assets, including younger generations.

if i recall, QE and zirp may goal was to lower unemployment at the expense of higher asset prices that would benefit the wealthy. The Fed knew the outcome.

That was their plan as long as inflation would stay low.

Remember they were raising rates and doing QT in 2018.

One could argue that Covid messed up their plans to normalize?

But they kept rates artificially low for too long

Read Melody Wright. CRE will crash. Ben Bernanke 2007…there will be no contagion.

The issue is why did they keep interest rates low?

One can imagine a use case in which both Keynesian and monetary theory were intentionally mis-applied in service of paper wealth owner interests.

When Larry Lindsey left the Bush Administration as head of the Council of Economic advisors in 2003 the whole house of cards began to collapse.

… communists and criminals.

I was at my dentist the other day and he was coming un-glued about the Phd’s on the Fed.

Ha I come unglued about dental prices inflating for last 15 years unbelievable!

Greenspan only has a masters degree from New York University…and to me he is a very smart man…

When a dentist starts talking about the irresponsibility of the Fed, you know we’re in serious trouble.

Well there are yes men and then there are geniuses like Nash. The geniuses cannot really take the boring ness of govt service.

I think the words you’re looking for are greedy and corrupt. Look at Bernanke. Let’s not, actually.

We see the carnage of what 25 years of zero interest rates did to Japan. Other countries tried the same thing and got the same or an even worse result.

What carnage is there exactly in Japan?

Arnold, 30+ years of essentially non existent growth and constant deflation. Their policies never kept up with their demographics. There’s a reason they are so advanced in robotics. They HAVE TO BE because their population tree is a nightmare. They need automation to remain relevant as an economy because they are literally out of working age population individuals.

Sdarules,

“constant deflation” is one of those BS statements that refuse to die. Japan is one of the few countries that had something like true price stability for a while, with mild inflation followed by mild deflation followed by mild inflation, and on balance their prices stayed roughly the same, until inflation started blowing out last year.

I think it is group think. You ever think if these guys are so smart they would be running billion dollar hedge funds and getting their 2 and 20.

Five thousand years of history says if you want to borrow my stuff I need to get something in return.

The people at the Fed don’t do anything without consulting with the heads of Wall Street, as though they can be trusted as socioeconomic stewards.

Fed economists are neither stupid or communist.

They are smart and are worth 100s of millions of dollars by front trading the fed policies.

Fed does not work for common joe .

Now to bring this craziness back to normal lot of common people need to lose job

Rich people would chug along just fine

Too right.

The Fed works for its shareholders, and the US public be dammed

Howabout we disband the fed ,Not even a government agency but a private corporation run by ,oh I can’t say it Wolfe will delete my comment

“Not even a government agency but a private corporation run by”

Common misconception here, it’s BS, and I have shot it down a gazillion times, so here we go again:

The Fed is a hybrid organization.

The Federal Reserve Board of Governors is a government agency, and all its employees are federal government employees with a government salary and a government pension, including the seven members of the Board, including Powell. These seven members of the Board of Governors are appointed by the President and confirmed by the Senate. The Board of Governors has lots of employees, and they’re all employees of the Federal Government. They’re headquartered in the Eccles Federal Reserve Board Building, the main office of the Board of Governors of the Federal Reserve System. This is a federally owned building on 20th St. and Constitution Avenue in Washington, DC.

The 12 regional Federal Reserve Banks are private organizations that are owned by the largest financial institutions in their districts. They include the New York Fed, the San Francisco Fed, the Dallas Fed, etc. All their employees are private-sector employees.

The FOMC – the policy-setting committee – consists of the 7 members of the Board of Governors who are federal employees and have permanent votes on the FOMC. The New York Fed governor also has a permanent vote. The other 11 regional FRBs rotate into and out of 5 voting slots annually.

The FOMC is designed to give the 7 government employees a voting majority over the 6 presidents of the regional FRBs.

right you are

now get out of CA

and a positive yield curve.

The inverted yield curve is the voting members telling us there is a recession ahead.

Quite reliably.

Good article that, once again, focus’ on what the data are.

My own interpretation of the information that you presented, is more structural than the breathless, orchestrated recitation of what the marginal buyer, or trader if one prefers, is doing.

I recommend short term securities, 6 mo and under with the caution that ” you snooze, you lose”. When a short term bond or bill matures, the principal and interest must be reinvested for the strategy to work. Check your propensity to procrastinate and decide for yourself whether it is a virtue or a fault.

Dang, Damn Right! One does need to roll… Maturity, Rate and Closing Date.

Agree…. but that is becoming the biggest sport in the nation…

6 month bill purchases from your savings account. The govt is draining money from the banking system it seems, and crowding out private finance.

Longstreet,

If banks didn’t try to rip off depositors, but offer 5.5% on 6-month CDs and 5% on savings accounts, depositors wouldn’t yank their money out. Yeah, banks would make a lot less money, and their stocks would go down further. But if your stock price depends on ripping off your customers, you’ve got a problem when customers decide enough is enough.

Truly said.

I don’t keep my money in banks at all.

They make money on the spread ripping people off.

My credit union is finally marketing CD’s again and the rates are pretty competitive, but still less than same duration treasuries. Money market rates are not competitive at 2% when Vanguard is 5.04% and current compound rate is 5.17%.

Yellen is saying we could have a recession which is an unusual thing for a treasury official and former Fed head to say. Usually they don’t like to say things to reduce confidence, but maybe its to jawbone the labor market raises down a little.

My understanding was the big priority one year ago was making government guaranteed loans from pandemic government programs and rates and CDs were nearly zero.

No one should believe anything coming out of Yellen’s mouth. If she’s saying everything is fine, you better believe something is wrong. If she says there’s going to be a recession, you better believe inflation will be burning and ling dated bonds are drastically overpriced.

agree

Banks suck. I’ve had bad experiences with all of the 5 major money center banks. I don’t know if Wells Fargo is incompetent or crooked. I think they are a combination of both. No bank could screw so many things up just by accident. They are based in SFO.

Banks make easy money off their ignorant depositors. If not for their stupid depositors, most banks would fail.

That’s why I tell my friends to put their money in something like a Fidelity Cash & Spend account. You can invest the extra in brokered CDs, treasuries, stocks, ETFs, whatever.

Granted, you’ve got to drive to a not too close branch, if you need something in person, but these day’s that’s not all that often.

Wolf, your facts keep me coming to new enlightenments. Ha.

“And it’s not pricing in a rate cut over the next 12 months, which make sense,”

Should be “makes”, according to the Grammar Grand Inquisitor.

I wonder if it’s time to start moving out a bit on the maturity curve again. Although 10-yr at 4% isn’t screamingly cheap either.

I’m keeping it closer than 10 years, but I have been moving out a bit… I don’t know why. It just seems like the right thing to do.

As long as the Fed uses the money printer to address any deflationary prospects, inflation will error on the high side.

Unless you’ve been sleeping the past 15 years, it should be clear the Fed will accept long periods of elevated inflation in exchange for high investment prices.

It’s important to recognize that Jerome Powell speaks to wealthy bankers and investors all day long. But when is the last time he spoke with a person who suffers from inflation? The old saying “out of sight, out of mind” applies here.

Drawing a quartering the bottom 50% will not get him fired. Stepping on the toes of the top 1% will.

Powell said he wants to be volker….

But he is another clapping seals down on pier 39 in embarkedero st, San Francisco

I love San Francisco. Superfresh Boudin bread bowls (intelligently replicated at Disney’s California Adventure), too many 5 star restaurants to visit, world class seafood, surrounded by the best minds capitalism has to offer.

Yes, I even love the 45 acres on Pier 39 because I am a tourist… even the noisy stinky sea lions bordering on obnoxious.

Just do not expect to find a parking spot.

C’est ce que la vie a de mieux à offrir.

I’m happy to keep adding to my PNC high yield savings, current APY 4.65%, any extra will go into 6 month Tbills, when it looks like rates might be peaking will move to 2-3 yr CD.

Paul, you may want to consider a brokerage, like Schwab. You can get a range of short-term T-bills, 3, 6, 9 mons. and more. And some aren’t exactly those increments (e.g. may be 84 days instead of 3 months…). The yields are now about 5.47% for 6 mos. Also, you get a tiny tax break on treasuries vs. savings accounts.

Powell was very upset about the homeless tents he had to see on the way to his office on Constitution Ave. He told the President at his weekly luncheon that he wanted them removed. He got his wish. They are no longer there.

Good comment. I have been hearing similar sirens about wetting me beak in the 4% swill. Then the other side of my brain, reminds about all the times I was certain and wrong. So, naw.

The current yield curve is still controlled by QE, synthetic, as the Fed attempts a controlled implosion of the QE bubbles.

Control of the long term interest rates is the monkey wrench that fulfills the untidy, yet obvious, philosophical discrepancy between fully informing the great unwashed of the objective or consequences.

My core of investments are companies that extract natural resources and have a track record of paying strong dividends. Natural resources have pricing power against inflation. Long and deep recessions are much less likely post Bernake which make natural resources even a better play. I also do swing trades when opportunity presents itself.

We are part of an ever more finite planet who’s dominant specie is struggling to grow up. More than perhaps ever the future is cloudy.

Thomas Curtis,

Be careful.

Commodities like copper collapse during recessions.

Check charts if you don’t believe me. Also strongly tied to China.

If people are suddenly using 1/2 as much copper… bad things happen lol

Water Dog

“Commodities like copper collapse during recessions.”

Yes and so does everything else.

Long term a basket of dependable resource extraction companies with good histories of dividends will be a safe inflation outperforming play and that is what I want for old age.

What are you betting on Water Dog?

Farming Treasuries and CDs is more profitable than growing cannabis.

Nope. Dispensaries enjoy 10%+ profit margins from what I read. 500M tax revenue in my state last year, twice that of liquor.

I can’t remember ever seeing a dispensary go out of business. They are busy from day one and their staff? Always smiling…they know their product well and are exceptionally friendly!

Simple Google search shows all the publicly listed pot companies heading to BK and many shops closing this year. I’m guessing you’re too stoned to be able to do that search though, just stuck on the couch in a pile of cheetos.

Fair enough but maybe those profits are plenty and you just don’t know about it….

Yep, here in Washington a lot of pot shops are established and there isn’t often much movement of who is in and out of business. However someplace like Montana with recent recreational legalization have seen shops popping up and going down constantly until the market stabilizes.

Then once it become federally legal, the whole industry will reshape to fit the corporate farming model and big money will mold the business into the corporate world.

There will be winners and losers until the big players are established and the little guys get squeezed out. Marijuana behind the pharmacy counter in a Walmart and such.

If that’s a cup and handle on the chart. A 5 percent 10 year is likely and very few think that’s possible. Beware.

My grandmother cautioned not to leave the tea cup on the table because the fairies would chip it. So yea a little of the old technical analysis being expressed in spite of how absurd it seems.

Thank goodness that you think like you do. What would this world be without you.

Predictable ?

As the generations mature, the new becomes mundane.

The future of “social media” will not be like it is today, charging through and breaking things. Like the current reigning surveillance capitalist model that is already obsolete.

Democratic reform is in the wind.

Cup and handle”?

We used to call it a “Homesick Angel” chart formation

Minutes

“A 5 percent 10 year is likely”

I wouldn’t argue against that but it may take a while. The Long-bonders have to adjust.

At this rate, we may have positive real returns on risk free debt by the end of the year. For the first time since what, 2008?

Gary Fredrickson,

🤣😍🥂You guys break me up with your ridiculous gold-backed toilet-paper-currency BS. “Russia and Iran” have among the worst toilet-paper currencies in the world. Venezuela’s is even worse, it’s not even toilet paper, LOL. Glad you mentioned all three. You left out Zimbabwe though. They have no idea how to manage a currency. They’re screwing their own people with the perma-collapse of their own currency. I have no idea what moron on Putin’s propaganda TV channel RT came up with this braindead BS. But this dumb shit sure is going viral among certain folks in America. The bigger the BS, the more viral it goes.

Watching the average mortgage rate approach 8% for very good credit borrowers…

I keep looking at the housing market waiting for it to crack.

“The suspense is killing me… I hope it lasts.”

— Willy Wonka

The smug 3% mortgage holders with asking prices in the stratosphere are about to meet a tsunami of airbnb real estate tycoons drowning in losses.

I certainly hope so. That stat from a couple of weeks ago that showed 10x more ABNB rentals than homes for sale encapsulates housing problem nowadays: way too much of housing has shifted over to rental / investment vs individual ownership. I hope for a significant recession with a GOP sweep that ensures Congress doesn’t trot out rent & mortgage relief again.

Check out Suncadia vacation area outside Seattle, which is chuck full of $1.5 to $4M vacation homes, at current prices.

Per Redfin, that area had 48 listings and only one sale last month. In the past 30 days, one home sold but over 10 new homes listed.

The area is set for a price avalanche, after rising 100% since 2020.

Many of these homes were purchased as AirBnb investments.

Vacation homes… in Seattle? Really?

I’m from the midwest. I didn’t know!

East of Seattle in the mountains is absolutely beautiful with a lot of tourist towns.

Year long mild 4 season weather, stunning views, low population density, endless outdoor stuff, and only an hour or two drive into one of the nicest major cities in the US. And you might see a roaming sasquatch, and he doesn’t have to pay state income tax.

The cascades have utterly insane real estate prices for a reason. I’ve been all over the US and lived East and West coast and Midwest.

There’s a reason why areas like the cascades, Western Montana, and North Idaho are still seeing home prices rising with tripled mortgage rates. Everyone that knows wants to be there.

I’ve been looking at some rentals in SoCal and a whole bunch of them have decor that makes them seem like former short term rental attempts. They are still asking too high, but I’m starting to see things like asking lower deposits or 8 weeks free.

In an area overrun with AirBnB (lakes, skiing, hiking, etc.) The media has been greatly downplaying the impact of an AirBnB implosion while still citing a ‘housing shortage’.

I have seen a handful of former AirBnBs going up for long term rental, but probably won’t be put up for sale anytime soon unless the owners get real desperate.

Family friend flew in from the West Coast and stayed in one in Carmel. Windows nailed shut, smoke detectors missing batteries, floor had rot clear through to the crawlspace. If any of them are a fraction of that kind of Landlord Special, they’ll only be unloaded to cash buyers.

The housing market will not crack unless the economy goes into a major recession/depression with unemployment going up to 8% or more. There are no listings here. When one goes on the market it is snapped up in less than 18 days if priced right. People are buying properties on “the wrong side of the tracks” just to get a roof over their head. Get over it.

I remember hearing the same things in 2006 and 2007 too

Because there was massive widespread fraud in the mortgage market back then. Completely different situation

It has already cracked and will get worse. Sounds like you have a denial problem. Unfortunately for you we can look at things like Case-Shiller and see that what you’re saying is not true. Not that I would expect honesty from a man who worked for the Swamp.

Ryan Merritt

Good thoughts on the problem of interest payments vs tax receipts.

Do you have further thoughts on possible combination(s) of spending cuts, tax hikes, and continued inflation to straighten out this increasing problem?

Housing market prices all over the US are already sharply declining in 2023 with few to any exceptions.

I am in your camp.

We need a major recession and house prices to drop over 20% before we start seeing any kind of significant number of houses that will be underwater and foreclosed on that would lead to any kind of 2008 bust.

There is so much home equity in many houses that people can tap into the 2nd mortgage or HELOC if things get tough. They will not sell if they have equity to tap into.

Thus, we would need a long recession to get people to burn up their equity. It could happen but the FED will probably step in if things start looking dicey. IMHO

Where is here? General geographic location when trying to evaluate markets is helpful (and more specific the better).

Many stock market bulls’ core assumptions is that once COVID disruptions are resolved (with a time lag), the low-inflation, low-rate environment of the last 15 years will return.

But what if that assumption is wrong? The 1930s’ low rates never returned until 2008.

Current trends contributing to a high-inflation economy:

1) Deglobalization, particularly with China

2) Declining immigration

3) Declining birth rates

4) Retiring Boomers

5) Resurgence of unions (it’s nothing like the 1970s, but membership is up in the last few years)

I really don’t think your list is all that compelling…

1) Deglobalization??? CHINA may lose a lot of jobs but it is doubtful they will be going anywhere except other low-cost countries. Vietnam, Philippines, Mexico, Central America, Bangladesh, Africa… lots of poor people in this world looking to work for cheap.

2) Declining Immigration??? Have you seen what is happening on our border recently?

3) Declining birth rates??? Are they really… or are we already past the biggest decline in that? It is the rare mother that I have ever talked to who didn’t wish they had “one more.” As the economy improves and jobs are plentiful, it is more likely that there is some catching up that will occur rather than a continuous slide.

4) Retiring Boomers? This is a factor for disinflation rather than inflation.

5) Unionization??? It is hard enough to get Millennials to listen to ONE boss… I don’t think they are going to be signing up in droves to PAY to have TWO.

Birth rates are absolutely declining on any measure and accelerating down. That’s tracked…

https://fred.stlouisfed.org/series/SPDYNCBRTINUSA

The chart is birth rates per 1000 people. There are a lot more 1000s of people today compared to the year 1965 when the chart begins.

Still, with low birth rates not all of those thousands will be replaced…

Its too expensive to have children these days.

2) Declining immigration of educated people to fill positions in medical, scientific, etc., communities. Those people usually aren’t border jumpers. We don’t need more “mow-blow” crews.

3) While mothers may wish they had another, many *potential mothers* choose not to have any at all. While marriage is not a requirement, the rate of tying the knot is also down, which also likely has an impact. If you actually read comments on this site, you’ll find that young families are in financial distress and can’t withstand the loss of income from one spouse having to stay home with their rug-rat or absorb the child care costs that often negate any benefit of the additional income from another working spouse (some dads stay home too).

4) Not really. Retiring boomers still buy stuff – and many can afford to buy lots of it. There’s also the medical inflation from them requiring more services as they age, with the added bonus of more individuals on Medicare that may not previously have had health insurance and access to prescription insurance. One medical test my wife recently was subjected to had a charge of $7,000 for the injections alone – not counting the technicians, the lab costs, and imaging. I’m sure that shows up somewhere. And it cost me a few hundred in non-related costs because we went to lunch at some fancy place and I went clothes shopping during the three hours I waited for her to finish.

5) Unionization: You might be surprised. After the misbehavior/mismanagement of many corporations and industries, unionization is gaining popularity among younger peeps. My daughter is union. A staunch defender of them as well. The topic is a “third rail” during our conversations (among many other things) as, while I’m not a fan, I see the rising need for them to fend off the frat boy MBA mentality that has infested corporate management.

I think the reason a lot of people, myself included, have a negative taste of unions is because of the abuse from the 80s on. I’m thinking of government “workers” who get 30 sick days and pensions after 20 years, and I’m thinking of contracts that require a union electrician to plug in floor lamps.

The higher interest rates are very inflationary for the retiring boomers who soon will outnumber the workers. If interest rates hold or go higher a massive increase in spending will take place.

Re: declining birth rates. Suggest instead of interviewing mothers about what they would like, look up the data. In this matter it is rock solid because in the first world, births are registered. They have been in decline for years in all of them.

Now my anecdote: I am a boomer raised Catholic and our family with 4 kids was average, or below average. My lady friend 10 years younger also raised Catholic had ten siblings.

Her generation still in the labor force, was pre-pill. Depending on location, condoms were either illegal like Ireland, or sold discreetly in NA as rubber goods.

But apart from the means of avoiding more children if desired, it just wasn’t commonly desired.

As for financial means, more kids were affordable. Wives could stay home and raise kids. Housing was cheap. The first serious post- war recession didn’t hit until 74.

Someone born in 73 is 50 today. This is not ancient history.

Jackson Y, you left out war, which is always and everywhere reliably inflationary

If yields on longer term Treasuries spike, and/or banks begin to wobble again, the first move the Fed will probably contemplate is to stop QT and again begin reinvesting all of the proceeds of maturing bonds. Maintaining a bloated balance sheet at level keeps the Fed in the Treasury market in force on a regular basis but allows plausible deniability on QE. Wall Street will see it as a harbinger of a pivot but it might not be.

Perhaps,

I think the Fed policy has become to rectify the effects of it’s monetary malfeasance which includes the illogical long term interest rate curve.

A controlled implosion of the wrong headed bubbles in asset values they intentionally inflated.

When do treasury yields and the scale of the debt held by the public cause a crisis for the US federal budget?

Or will they at any reasonably conceivable point now?

Or is this simply not predictable?

Exactly. You hit the nail on the head. How much debt is too much and what is an acceptable growth rate. Well let’s take a look at the required growth rate in the national debt to compensate for the 7% of the GDP that we import.

The way one needs to consider the paradox is that it is a condition of why America is what it is.

Here’s the answer:

This graph is the single shot, crystal clear, ‘show to any average Joe off the street’ way to prove the government & dollar are shot to sh1t WHEN that day comes.

But having spent many hours contemplating this to myself I would like to share my simple thoughts as I see it… And I know that one could layer data on top of data ad infinitum, but I think this is relevant…

1) this chart does not and could not possibly account for future unfunded liabilities – SS, medicaid/medicare, entitlements, etc. These unfunded liabilities will be historically unforgiving.

2) the Volker spike in the 80s was at a time of better demographics and right before soon to be legitimate economic growth, new industries and a less used money printer for stimulus when stimulus got you more bang for your buck.

3) we are now in a world that is not only less cooperative towards globalism but outright hostile to the USA & vice versa and thus much more likely for inflation issues to arise that need squashing with ‘higher for longer’.

In summary my argument is that the drop back down in percentage of tax receipts needed to pay interest on debt all those years back post Volker spike is only on the table for the USA now & in the future if Powell & TPTB can turn water into wine.

We will be a country of (more) old people, trying to bring back manufacturing and (more) isolated from the world.

The best question that I personally ever contemplated is “Where does money come from?”

Denial is such a nice comfortable way to live though.

Looks like its rising about 5% per quarter, so 4-5 more quarters (with continued/increased gov spending) and we’ll be above the 80s. Guess that will be interesting times.

Wolf,

One of the next phases of the inflationary fiascos is discussions of price controls, subsidies of “key industries”, nationalizations, etc.

We already are seeing rent controls making a comeback, the CHIPS act subsidies, and talk about nationalizing failing banks.

All of those policies tend to bring inflation down in the short term, only to see it slingshot up later.

How are you thinking about this in the inflation trajectory?

How would that graph look if it was “% of Tax receipts less entitlement spending”? Is it more important to look at % of the government’s income is taken up by interest on debt or to look at % of the government’s disposable income?

“Entitlement spending” is funded by SS and Medicare payroll deductions. So remove SS and Medicare receipts and expenses from the equation, and the chart would look a lot lot worse, with the percentage being far higher.

SS may run a surplus again this year, as it had done for the past 25 years, except the last couple of year.

FRED has all kinds of charts to view.

Currently, tax receipts down….interest payments

going up. And DC spending is following the interest

on debt chart.

Federal Tax Receipts are down because corporations seem to be paying very little in taxes these days. Fred does have lots of generalized graphs. The Peter Peterson Foundation has some specific graphs on corporate receipts and compares our rates and revenue with other OCED countries. He puts the Trump Tax Act of 2017 as being the primary culprit for our growing national Debt today.

https://www.pgpf.org/blog/2023/04/six-charts-that-show-how-low-corporate-tax-revenues-are-in-the-united-states-right-now

Below is a Fred graph on Gross Debt to GDP Please make sure you check out who was President on the various steep slope years.

Spending isn’t always the problem but lack of revenue is. Taking a little money off the table helps as well as some target cuts in spending.

https://fred.stlouisfed.org/series/GFDGDPA188S

Just MHPO

Cody

“When do treasury yields and the scale of the debt held by the public cause a crisis for the US federal budget?”

Inflation is a traditional way to pay off government debt.

I still wonder if the 1970s and 80s inflation wasn’t to pay off the Vietnam War.

TC – as long as you’re examining that, toss in a significant number of failed loans to South American nations in the same time period…

may we all find a better day.

91B20 1stCav (AUS)

“TC – as long as you’re examining that, toss in a significant number of failed loans to South American nations in the same time period…

may we all find a better day.”

AMEN!

But I worry that we live in ‘Interesting Times’

@Thomas Curtis –

“Inflation is a traditional way to pay off government debt.”

True…however can only have a shot of succeeding if GDP is higher than outstanding debt. Where is U.S. GDP these days, $24 T or so?

Thomas,

Inflation and the Vietnam War?

My Econ 101 professor at the U of MN in 1981 was a man with quite the curriculum vitae. His name was Walter Heller.

“The day after Kennedy was assassinated, Heller met with President Johnson in the Oval Office. To get the country going again, Heller suggested a major initiative he called the “War on Poverty”, which Johnson adopted enthusiastically. Later, when Johnson insisted on escalating the Vietnam War without raising taxes, and setting the stage for an inflationary spiral, Heller resigned.”

While I disagreed with his Keynesian views, he told the President of the United States to eff off. Gotta give him props for that. He called that one correctly.

Heller also helped create the Marshall Plan after WW II to bring West Germany back into peaceful prosperity. That worked well, I reckon.

I don’t think it’s true that inflation is how a government pays off debt. The US government’s debt to GDP ratio didn’t really fall any time during the period of high inflation.

Simply high inflation appears to be too slow. As inflation increased GDP, it also increases interest rates, causing the debt to grow at pace, and the ratio not go down by enough to matter. If the interest rates don’t go up, investors flee to other assets, and the bonds simply don’t sell, until they are at a higher rate.

The only ways the debt to GDP ratio goes down is something like a program to pay down the debt list the US post Civil War, or a straight-up default like Argentina does on a semi-regular basis.

If I was a betting man, I’m betting that the Fed is going to take the monetary stability part of its mandate seriously now that they’ve been shown that they have to. As such, expect a debt crisis, and Congress to find it has to make hard choices for the first time in maybe 25 years.

https://wolfstreet.com/2023/05/29/update-on-the-us-governments-holy-moly-debt-interest-expense-and-tax-receipts-and-how-they-stack-up-against-gdp/

The last year and a half I have been fully invested in three and six month t-bills, in a kind of laddered way. So far so good. Higher longer.

I like the way Wolf does not write much about the stock market. To me, the stock market is boring, with almost every jackass pundit giving us his useless opinion.

William Leake

Yep, boring as hell. Jim Cramer spends more time touting his investment club for $79/quarter than he does pitching his stocks.

I’m going with 6 months CD’s at my credit union. They are offering 4% now with 5% on the way. It’s time to be is cash or cash equivalents.

I likewise gave up on parking so much idle cash in my brokerage account in order to maximize buying optionality and dumped a bunch in a HISA (high income savings account) ETF, as well as a position in one of Canada’s notorious telco oligopolists for the dividend income. I still have about 13% ready cash in the brokerage account and figure that’s more than enough.

I see T-bills as cash equivalents. You can buy and sell them commission free at Schwab, Vanguard, and probably Fidelity. I buy six months or less at auction and hold to maturity. If I need to, I can sell any time with little loss of principal, maybe even a little gain. Highly liquid.

I agree. The CNBC analyses are painful. They’re never talking about the economy as a whole, or actual business advances, but about stocks, as their own beast. In other words, it doesn’t matter if the companies supposedly represented by these stocks are doing anything, all that matters is what direction that stock is moving in. It amazes me just how much of our resources are wasted on analyzing this nonsense.

Einhal – ‘systems’ to beat what lies in the casinos are evergreen. The players rarely seem to be concerned with the health of the gaming-equipment companies…

may we all find a better day.

I have a cynical view. Powell has to say “2%”, because if he doesn’t represent that inflation is the exception and 2% is the rule, a lot of overseas investors are going to have a bug up their behinds.

I also think that P/E multiples in the stock market are affected by interest rates, and if we hear that 2% has been discarded in favor of 4%, those P/E multiples could reduce. So, I wonder if there is a bit of gaslighting coming out of the Fed.

I’m still a skeptic. I think if it comes to push and shove, QE will resume. But, economy still looks overheated for the time being. They’re running fiscal deficits, and that is stimulative.

At some point, if the government keeps running deficits, they’re going to run into a problem with servicing free market interest rates on the national debt, and that is when the Fed will resume Large Scale Asset Purchases in order to reduce interest rates. And at the point that the Fed needs to do that for that reason, we will have reached a crisis point.

I don’t think that QE is going to resume… but I do think that the Fed will one day announce that they are happy keeping inflation in the historical range of 3 to 4%. But first they have to GET it into that range (for an extended period of time).

They already resumed printing when svb went under, see the blip on wolf’s graphs.

There was no ‘printing’ at all for the SVB matter.

“I also think that P/E multiples in the stock market are affected by interest rates,”

I think PE ratios might become inflated like everything else..

DownFed, your last paragraph is exactly right. Fiscal dominance is in the Fed’s future; there is no other way to satisfy all of the promises made and obligations incurred by the federal government. Inflation is the ideal tax for politicians: no has to vote for it.

5.05 do I hear 5.50, I got 5.50 do I hear 6.0 the auctioneer is telling me it’s time to transfer the entire 401k to the Vanguard Money Market fund. The most sought after IPO’s are still sitting on the sidelines this year with a failure to launch, it must be fear. Glad I don’t have a home on the market that must sell, or new car note that must be paid monthly. Finally a good spot to launch a tent in the forest, the bears are taking a break to shit, while the bulls are chasing AI circus buzzwords. Feels good to coast on guaranteed income earnings if only for a little while. It feels like used car appreciation month $$$.

What’s the ‘Goldilocks’ interest rate that encourages savings over speculation? Why doesn’t the Fed ‘jawbone’ savings instead of constantly threatening to whack commerce? And where’s Congress? After a half century of tax cuts and tax loopholes that transferred wealth from labor and small business up to the Oligarchs, isn’t it time to raise some revenues? If this generation doesn’t wise up, we’re all toast.

1) US 10Y should be above US 1Y, but gravity with Germany and Japan pull it down.

2) The treasury dept can save money by financing debt with bonds and notes. It’s important for them to control and suppress the long duration.

3) The yield curve might be more inverted.

4) If the Dow will drop to 30K bond traders will make money. If below

Oct 2022 low the temp inflation will deflate.

5) The stubborn inflation might rise to test June 2022 high. The Dow might reach/breach 40K synchronized with $40T debt. The higher the debt the higher the Dow until it bonk.

6) Gov can raise debt without limits, but companies can’t. They go broke. It’s not a fair competition in the cage.

6) Gov can raise debt without limits

Note to self. Uh…OK.

I wonder if its possible for a dynamic to emerge whereby continuing QT causes yields to perversely go up, because the existing debt is chasing a smaller pool of money i.e. the government cannot borrow 100 from a population with only 80.

Government debt is unlike mortgage debt because its not credit expansion by the bank, the gov can borrow 100, spend it into the country, repeat indefinitely, the debt grows but the money supply available to service the debt doesn’t grow.

The US government, and the UK government even more so, need to cut spending. If they cut spending that will cut inflation. It seems like this obvious step is impossible to even consider.

Lots of investors are just waiting for the 10-year yield to go to 5% or 6%, and then they’ll jump in with massive buys, which will put a lid on yields. Yield solves demand issues.

Core inflation would have to go unstoppably higher, as it seemed to do in the early 1980s, to where investors would be too scared to buy a 10-year Treasury at just about any yield. This happened in the early 1980s, and yield shot up. But eventually, even then, there were buyers.

Bill Gross and Stan Druckenmiller were talking about this.

Both don’t think the 10 year will hit 5% in the near term, but get close for the reasons you mentioned. They were both thinking around 4.75% or so, then bonds would catch a bid and yields would drift down a bit (but stay above 4%).

The big question is what happens next year if the politicians are running on huge fiscal expansionary policies which need to be debt financed, especially if both parties are doing this.

Both are concerned that could be the trigger for much higher long term rates. Dalio was especially concerned.

That setup is a tight window for a trade, because of the unpredictability of the political cycle.

How do you guys see this playing out?

I think we are looking at 4% to 6% inflation long term over the next 10 year period, so I wouldn’t consider a 10 year note with less than a 6% rate. Even then, my hope would be to match inflation and not make any money. Remember, you pay tax on the interest income, even though you gain nothing after inflation.

LordSunbeam,

ES, S&P mini, reached 4,498. It might soon drop below Oct 2022 low, before rising > 5K, because the money was your money.

When is the multi-trillion$$ bailout coming for the asset holders of CRE? Afterall, this is what the oligopoly does for its constitutants, and what’s another few trillion on 34 trillion of debt that will soon be over 40 trillion$$$!

Most of the losses were in CMBS, which are held in little people’s bond funds and pension funds etc., not by banks, and they’re spread around the globe, and so it’s not an issue.

CRE investors may get help from state and local governments in terms of tax reductions and incentives for residential conversions.

That would only be indirect help though, in the sense that the special servicers could sell the properties with delinquent mortgages for higher because the buyer was getting an incentive. Ultimately, the local governments would be doing it for their own benefit, as blighted, abandoned buildings do a a lot of damage to cities.

I think it is safe to say that the rise in treasury yields is the opposite of the “wealth effect”.

Bank deposits are likely to continue to decline, headed to safe 5.5% return.

Am I the only one who thinks Bank of America’s dividend increase is just a bad joke?

Just the opposite HH.

Many Billions of dollars formerly deposited in the name of principle preservation are now providing risk free income and wealth preservation.

This is a new version of wealth effect but to doubt it would be a mistake. Free money is on the other foot and those banking it are euphoric.

Thank you for making a very good point.

In general, I think “the wealth effect” refers to the propensity of people to spend more when their assets are inflated. Higher for longer interest rates are likely to let some air out of the real estate and stock bubbles.

I have most of my liquid assets earning the safe 5+%. I wonder if other savers like me tend to be thrifty, and just save the interest instead of spending it.

The people with a lot of money make a lot more money and the people with no money don’t make more or lose more when interest rates are high or low so the net result is more people make money.

HH:

It’s just a different group of people who are experiencing the “wealth effect”.

Savers/hoarders are raking in additional income. Some of those folks are on fixed incomes, and those additional bux will flow into the economy – even if it’s their spending it on deferred purchases/repairs/medical care that they couldn’t otherwise afford.

As interest rates increase the market value of preexisting debt decreases. This duration risk is what brought down SVB and is what the BTFP was intended to address. Bond funds and ETFs are marked to market daily and are again getting whacked as higher for longer begins to sink in. Banks aren’t getting whacked because they don’t mark to market what they hold to maturity and the BTFP is valuing impaired collateral at par for lending purposes and the FHLB is also financing banks. There must be many trillions of mark to market losses in the world’s banking system but the BTFP has hypnotized markets into forgetting duration risk. The system is one bank run away from remembering it. What we have is an illusion of stability.

30 year yields are still around 4.05%. While they have never been that high since 2011, they had never been that low before 2008.

At the start of my brief bond trading career in the 1980s they were 12%.

There remains enormous faith that inflation is dead apart from a blimp.

I just can’t see that, all I see is wages falling a long way behind, extended inflationary pressures building up, and as Wolf keeps pointing out, no sign of a depression soon.

Question for Wolf:

If QT and large auctions start to jack rates up, merely from supply and demand considerations, does the Fed step in a “cap” those higher rates, OR does the Fed stand back and let it work itself out, and maybe say to Congress….”See what you have done with your spending madness?”

I can see Biden putting some kind of interest rate freeze next year to keep interest rates from going through the roof. This will lead to a “Credit Crunch” where money for mortgages and car loans will not be available.

How exactly does Biden do what you are suggesting?

Do you realize Biden had absolutely no role in what interest rates are? (Other than the power if the bully pulpit, which only one president has used in the past few decades).

Does anyone remember what happened in 1979 with the credit crunch that occurred? Seems Mortgage rates were frozen at 10% and credit dried up. You couldn’t get a loan period.

“… does the Fed step in a “cap” those higher rates,”

Opposite. The Fed WANTS higher long-term yields because they’re needed to get inflation under control. Short-term interest rates have only limited impact on the financial conditions. Markets have been making the Fed’s job much harder. If the 10-year real yield is positive by 3 percentage points, it would tighten financial conditions and get inflation under control, and the Fed could pat itself on the back.

I get what you are saying, yet, if I was the Fed and wanted higher long term rates to kill inflation I would be lobbying the Treasury to issue long term debt, not short term. That would have kicked long term rates higher. Yet, they keep issuing the short term stuff.

Maybe the Fed has no control or pull with the Treasury?

A real ten year yield at positive 3% would be nominal 7.6% with mortgages at 10%. Bring on the solar powered guillotines with Nancy Pelosi as Madame DeFarge. Jay Powell will be in hiding in Argentina.

higher (long) real rates would help getting inflation under control, absolutely. But if Fed really wanted higher long rates, why doesnt’t it sell more long treasuries and reduce its balance sheet a bit more quickly?

Last time the Fed did QT, it blew up the repo market (fall of 2019). Draining liquidity from markets tends to blow stuff up that then can spread across the highly leveraged financial system. QT has unpredictable side effects. So easy does it. For years.

I understand that there are commenters here who just want to blow up the entire financial system, because it would be fun to watch? But it’s really not fun to watch.

Wolf-

I’m one of those people that think the Fed has been overcautious. The Treasury Dept, after the debt ceiling fiasco, soaked up as much liquidity in a few weeks as the Fed has done in a whole year of QT, and nothing has broken. Rates have gone up slightly, but even that hasn’t induced panic or have people marching in the streets.

This shows that the Fed was overcautious. They could have easily gone twice as fast with QT (raising short term rates is another matter; there, I think they’re going as fast as they can), without anything blowing up, and probably faster given they’ve been going at it for a year vs just a few weeks for the Treasury.

And while you’re right that there are risks to going too fast, namely stuff blowing up, there’s also a risk to going too slow namely, inflation expectations getting entrenched, necessitating higher interest rates, for longer, than would have been necessary if things came under control quicker.

Right now, it looks like the risks of going too slow are coming to fruition. A year ago, there was lots of bellyaching about the price of stuff going up so fast. Now, everyone just shrugs and accepts it as the new normal. If that attitude ever spreads to long-term investors, it will cause a massive repricing of long-term debt and investment markets; that’s a much larger thing “breaking” than a few hedge funds or overleveraged banks going kaput from QT happening too fast.

Everyone, including the Fed, probably expected us to be in a recession by now. The goal was to push the economy into a brief recession by this year, maybe lasting 6-12 months, and then come out in time for the election season so that the incumbents can get re-elected (not saying everything always goes according to plan, but that was the plan). The fact that we’re not there yet also points to the Fed going too slow. And the consequences of that slowness is that labor markets are even tighter than before, inflation is even more entrenched, and so any recession will need to be deeper, and longer, i.e. more painful, than it had to be.

Where’s the concern for that part of the economy, you know, the Main St. made up of regular old wage earners who’ll need to weather unemployment for longer due to the Fed’s “caution”? Who’ll be more likely to face bankruptcy the longer a recession goes? The president of Silicon Valley Bank is doing okay. His family is not starving despite his bank blowing up. Neither are his depositors. A regular wage earner won’t be so lucky. And yet “breaking” the former seems to be a far bigger concern of the Fed than breaking the latter.

And continuing to slow roll it means eventually they’re going to break both: long-term investors will come to view inflation as permanent, causing massive repricing and disruption of risk markets, *and* wage earners will face a deep and lengthy recession that’s unable to be controlled by the Fed.

Cue the Market Rally!!!

Headline inflation per the FT is projected to be 3.1 percent on Wednesday. And: “The USA Inflation Rate by Truflation is 2.51%, 0.01% change over the last day.”

That should help bonds.

Another bond market hype piece? Wonder who planted that one?

Truflation is nonsense as an overall inflation measure.

The CPI rate is pushed down by the collapse in energy prices. Everyone knows that except the FT?

What matters is core inflation, or underlying inflation, that’s the only thing the Fed talks about. And the Fed is focused on the core PCE price index, which looks like this (next version will be release later in July):

Core PCE price index is trending downwards from around the end of 2022. At current pace it should reach 2 percent in ten years or so. /mild sarc. I am just eye-balling it.

On one of the shows on Fridays (Wealthtrack, Wall Street Week) a commenter said that core inflation without rents was 3.something% and stated that inflation reductions in rent were lagging but expected rents to catch up with the rest of core.

I didn’t catch what causes the lag.

They have been saying for nearly a year that rent inflation will vanish, and that it is just “lagging,” etc. etc. The CPI rent indices lag by something like three months. So it should have come down by now.

But rent inflation, against all expectations, isn’t vanishing because landlords are raising rents on renewals, and they’re getting higher rents on new signings. They’re getting between 6% and 8% yoy in actual rent increases across the US (some markets may be weaker, and others stronger). ALL big landlords reported the same thing in their quarterly earnings reports.

8% seems to be the upper edge; the trend may be toward 7% or 6%. So maybe that’s what we’ll get, rent inflation in the 7% to 6% range.

They’re getting these rent increases because people are making more money. And the rental business is driven by renters-of-choice that have plenty of money but want to rent a nice place for a variety of reasons.

“Asking rents” did come down late last year, but that ended, and they’ve been rising sharply again. Seen chart #1 below; it shows index value, not year-over-year percent change.

Chart #2 shows the two CPI rent indices, year-over-year percent change. They’re both still at 8%+

https://wolfstreet.com/2023/05/22/rent-inflation-re-accelerates-to-red-hot-all-three-now-agree-zillow-asking-rents-what-big-landlords-said-and-actual-rents-tracked-by-cpi/

https://wolfstreet.com/2023/05/08/why-im-skeptical-of-powells-claim-red-hot-rent-cpi-will-just-vanish-landlords-report-the-opposite-even-for-april/

I’ve noticed Truflation being cited by a lot of macro people who are wedded to the narrative that the US is already in recession and inflation is almost licked (with the implication that the Fed is overtightening).

It seems almost desperate to me, since these people have painted themselves into a corner with this narrative and the actual economy is not cooperating with them at all–labor market still tight, services inflation raging, consumer spending still huge, house and rent prices rising again, and stocks and crypto on a tear.

What is the flaw in the Truflation number? I don’t believe it at all; heck even the FED’s inflation numbers seem biased low.. Yet you are right it is cited quite a lot now as it seems to support a certain narrative. Would like to know how to dismiss Truflation as the nonsense that it is.

Wolf,

“Feverant Hope” – that seems a good description of the Long-term Bond Mkt. I have suffered from that feeling myself. Generally not a good thing.

I was encouraged by Yellen’s China trip. It would be nice if we could come to some form of constructive competition. Regardless, supply will not keep up with natural resource demand and inflation of 3% going forward might be quite a capable.

Anyone think Yellen was perhaps synchronizing the clocks on the market fall with this trip? As in “Stuff is about to hit the fan so get out your umbrellas”

I’ve watched it intently. And it did follow Blinken’s trip and Kerry is supposed to follow soon.

Interesting times!

I was glad to see that the US and China are at least still wiling and able to talk to each other. That’s hugely important. Those two economies are joined at the hip, whether we like it or not.

I wonder if fed can hike slowly enough from here to let people get used to the higher rates without having to worry about having to slow down their spending.

Managing an asymptotic approach to “sufficiently restrictive” but never getting there, and never stopping the slow increases. Like a long term bearish to bullish reversal on the bond yield charts

There is a shortage of listing on homes for sale. I am in the metro west area and that is close to boston. The buyers are making offers on homes that which are listed as rentals and buyers are making offers on homes that are not even for sale. The higher mortgage rates are not making a dent in prices. The median is down and the pricing by square foot is up. Go figure.

Easy enough to figure out…higher rates mean buyers cant afford the big house anymore so the demand for small cheap houses is up and bigger more expensive houses is down. My 1950s neighborhood has pretty small houses and for the first time since I’ve been here there is nothing available at all. The last few listings all sold within just a few days, including one with tons of mold

DM: Inside the negative equity timebomb – US homeowners lost $108.4 BILLION in equity this year – leaving more than 200,000 at risk of going ‘underwater’ if property prices fall another 5%…

US Homeowners are sitting on a negative equity timebomb after losing $108.4 billion on their property values this year, experts say.

But how much did they gain during the pandemic?

Playing with the houses money still

LOL. From 2020 to 2022 ….. about 6 or 7 trillion

…this is what happens when the machine is stuck on ‘add’ (…the thing NEVER ‘subtracts’, right?…right???)…

may we all find a better day.

US homes are the collateral (backing) of mortgages (money). The crux is that in the monetary system we have, money is debt.

That bomb is firmly placed in the financial system and the reason a real estate price crash is not wanted.

DailyMail? Are you serious?

1) The Fed wants lower bonds and notes rate to ease the debt burden. If bond traders will not cooperate the Fed might raid “other”people banks accounts and CD’s to finance gov activities. The Fed will borrow your money for an IOU to spend it on u. No printing. In a short position the trader borrows shares without owner knowledge or permission, for an IOU.

2) The Fed raised the front end to seduce investors. If investors will cash

in and stop buying bills the Fed will raid in and spend.

3) The gov increased their bank account in the Fed in preparation for the next recession.

4) The Fed will either print, raid in, or both. Your money will save the econ and lift the Dow.

5) If it’s deep, your assets and your money will be gone.

6) Us will be on dialysis machine.

Lookup an ECMO machine. You might not sleep again. Lol

An ECMO machine saved my husband’s life once…

Morningstar economist made some interesting comments. Home affordability will be back in 2025. They think the FED will lower interest rates back down to 2% by 2025 and mortgages will go back to 4% too.

They predict a 5% to 10% house correction leading up to 2025 and think the FED will then need to help the economy with the lower rates. Thus a small house price correction and then low interest rates will a gain make homes affordable.

LOL….not sure what to think to their research.

Morningstar rates bonds, they represent bondholders. ALL long-term bondholders have the fervent “belief” that the Fed must and will cut rates, because that’s the only way they will stop losing money on their bonds that they bought when the 10-year yield was were 1% or 2%. From Gundlach on down, they’re all the same. They’re losing money, and they want it to stop. But it won’t stop until the Fed cuts rates. These are the same people that in 2020 said the 10-year yield would go to 0% and turn negative.

Wolf,

Agreed. What is frightening is that Dalio, Gross, Druckenmiller and Buffet have all said to stay clear of long term bonds because of the political risks of budget deficit blowouts.

Since these guys are probably the best multi asset class investors out there, if they tell you not to touch long bonds, what does that say about the level of narcissism of the people who are diving headlong into them?

Do you feel that the long bond investors are simply trapped in a feedback loop because they didn’t/wouldn’t use stop losses?

More importantly, how much money do these long bond clowns actually control, and how long for them to get fired?

This is critical, because it seems like these bond managers are the only ones holding the market up now.

Not sure why anybody in his right mind would buy Treasuries greater than one year now. Maybe pension funds and mutual funds and etfs are legally obligated to do so.

I assume a 5%-10% national correction would involve a 15-30% correction in overheated markets, so the projection is no picnic.

Not sure why people insisting on living in the high price areas. RE taxes went up around 20% last year in many hot areas.

The Fed is growing a deferred asset account due to operating loses. Currently sits at about 75b and rising fast. It may raise the national debt without it showing up in the federal debt numbers. It will be interesting when, after rising to whatever level it does, the deferred asset account will intercept remittance to the treasury. I’m assuming that his interception will come when the Fed is forced to cut rates, ending the loss on balance, and paying down the deferral. If I understand it, that would put deflationary pressures on the economy, during a time of Fed easing (emercency rate cuts).

I’m arm chair speculating here, as I don’t see much written about the topic. Wondering if anyone has more info on such.

Nah…

The Fed has generated income of $1.36 trillion since 2001 and remitted this entire amount to the US Treasury Department (a form of 100% tax). That didn’t cause inflation, LOL.

And now when it stops remitting because it’s no longer making money, it’s suddenly causing deflation? Nah. Nothing to do with it.

But the remittances lowered the budget deficit and reduced borrowing, and now the lack of remittances increase the budget deficits and borrowing — but the annual amounts are not huge, see the chart, compared to a $2 trillion or so deficit.

BTW, the Fed is not “forced” to cut rates. That’s just the latest BS from the pivot mongers, who’ve been dead wrong for a year.

Here are the remittances (Fed income paid to the US Treasury). For 2023, they will be $0. That’s all.

https://wolfstreet.com/2023/01/13/despite-losses-since-september-the-fed-still-made-a-profit-for-the-whole-year-2022-remitted-76-billion-to-us-treasury-dept/

The current remittance is zero, yes, but the Fed is running a ledger of how negative it goes, and has to pay itself before restarting remittance. Or so I understand.

“And now when it stops remitting because it’s no longer making money, it’s suddenly causing deflation?”

No. I don’t think it’s deflationary right now because the fed is running it’s budget into the negatives by throwing money at banks through rrp and such. So reserve notes are leaving the Fed into bank balances. The Fed is accumulating an ever increasing deferred asset, negative balance, whatever one would call it. Once the Fed is profitable, it will pay off that “balance” before it pays the treasury. That is the deflationary pressure I was mentioning.

Mind you, I’m not saying it will cause deflation or anything, just that it would drain the money supply at a time when Fed would ease. I also get that they’re not forced to cut rates, wrong choice of words. The amounts we’re talking aren’t exactly small though. 5 percent of deficit now, 10 during some previous years?

Before. Treasury paid interest on securities at Fed and got some of that surplus amount back. Lowering federal debt and allowing more spending without increase in federal debt.

Now. Treasury pays interest on securities. Fed running in the red, funding banks and institutions through rrp and Fed programs.

Future rate cut. Treasury pays interest on securities. Fed running green. Fed destroys surplus by paying down the deferred asset account it set up for itself instead of remittance. Reduced amount to banks through programs, zero to treasury until payoff. This during a time when rate cuts are decided by the Fed board as needed for jobs/stability.

” the fed is running it’s budget into the negatives by throwing money at banks through rrp and such”

RRPs pull money from the system, though the Fed pays interest on the securities sold.

After reading your article, maybe I can sum up.

What happens if Fed board decides sometime in whatever future to ease rates and are still running a multi x100b deferred asset? They are after easing but paying down the deferral is tigher than QT.

Losses don’t matter to Fed since they can print out of thin air.

Us govt can never default since they can print out of thin air via their agent called fed.

End game is currency devaluation which is already happening for last 30 or so years

Some people call currency devaluation as inflation as it sounds nicer.

Dow, PnF 11x3x333.333 indicate that US econ might be on stage 4/5.

Dialysis is next.

Who doesn’t like a good cleanse?

Finally, it’s been a long time coming.

Wolf, what’s your take on truflation.com?

It doesn’t measure overall inflation nor core inflation. It measures something else. Methodology is bogus. For example, it gets its rent data from Zillow, but those are “asking rents,” not actual rents — it’s nuts to make asking rents the rent factor in an inflation index. But it’s cheap and convenient. The whole thing is bogus.

Just like Shadowstats is bogus in the other direction.

There are gazillions of these things out there, and you get to choose whichever fits your own narrative.

Thanks!

PS I had another question further up on SS if you care to respond. Thanks again!

We we may start to see places where it’s cheaper to get a mortgage on a house than pay rent.

I remember someone telling me that our pension fund put everything in double digit treasures back in the day and the government came in and made them diversify.