The Fed’s credibility shifted from Inflation Fighter under Volcker to Wealth Disparity Creator and Inflation Arsonist under Powell. And everyone knows it.

By Wolf Richter for WOLF STREET.

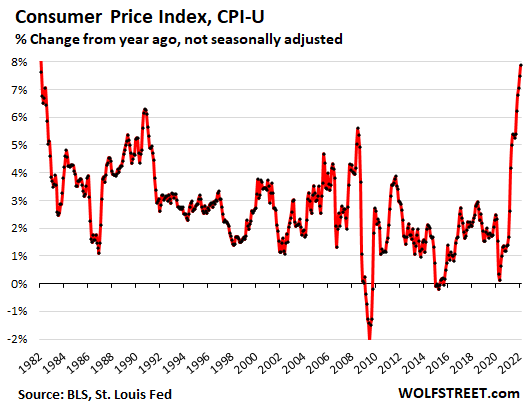

As stunningly and mindbogglingly bizarre as this sounds, it’s reality: Inflation has been spiking for over a year, getting worse and worse and worse, while the Fed denied it by saying, well, the economy is recovering, and then it denied it by saying, well, it’s just the “base effect.” And when inflation blew out after the base effect was over, the Fed said it was a “transitory” blip due to some supply chain snags. And when even the Fed acknowledged last fall that inflation had spread into services and rents, which don’t have supply chains all over China, it conceded that in fact there was an inflation problem – the infamous pivot.

By which time it was too late. The “inflationary mindset,” as I called it since early 2021, had been solidly established.

I’ve been screaming about it for over a year. By January 2021, I screamed that inflation was spreading broadly into the economy. By February 2021, I screamed that inflation was spreading into the service sector. And I screamed about inflation in the transportation sector. By March 2021, it was obvious, even to me, that “something big has changed,” based on the fact that consumers were suddenly willing to pay totally crazy prices for used cars, when many of them could have just driven what they already had for a while longer, which would have brought the market down, and with it prices.

But no, consumers suddenly started paying whatever. And I documented how companies were able to pass on higher prices because suddenly everyone was willing to pay whatever. And by April, producer prices were blowing out, and companies were able to pass them on, no problem. And in April, I started using a term for this phenomenon: the “inflationary mindset” and how it had suddenly become established.

By that time in April, it was clear beyond a reasonable doubt that inflation would become a massive problem because the inflationary mindset had been established with companies paying higher prices, confident they could pass them on, and with consumers willing to pay whatever.

And all along – despite our screaming in the trenches – the Fed stuck to its “transitory” nonsense, while continuing to throw huge quantities of gasoline on the already raging fire, by interest rate repression and money-printing, as only a true inflation arsonist would.

And then when the Fed finally could no longer brush it off in the fall of 2021, as inflation continued to get worse and worse, the Fed made its infamous pivot, verbally. But it continued to pour the gasoline on the fire.

The Fed eventually started to slowly dial back the amount of gasoline it was still pumping directly on the fire: It reduced QE gradually instead of ending it cold turkey right then and there when it did the pivot. And it put rate hikes on the table for 2022, instead of hiking them on the spot. And inflation got worse and worse.

Policy error after policy error – with massive consequences. QE is just now winding down, but the Fed’s policy rates are still at near 0%. And CPI inflation has shot up to 7.9%.

But a lot of individual categories of prices have totally blown out, particularly those where the less well-off spend a lot of their money. For example:

- Used Cars: +41.2%

- Gasoline: +38.0%

- Gas Utilities: +23.8%

- Beef and veal: +16.2%

- Pork: +14.0%

- Poultry: 12.5%

- New Cars: +12.4%

- Eggs: +11.4%

- Fresh fruits: +10.6%

- Fish and seafood: +10.4%

- Electricity: +9.0%

The most reckless Fed ever.

So now we have this crazy situation, where the Fed is still repressing the effective federal funds rate (EFFR) to 0.08% while CPI inflation is raging at 7.9% and will likely go over 8% soon.

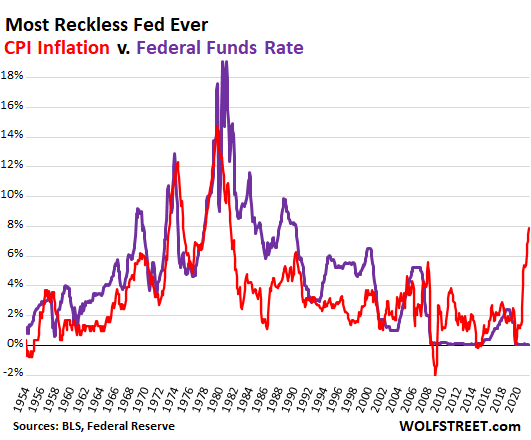

Back in the days of high inflation – the 1970s and 1980s – there were moments when CPI inflation was at 7.9%, crossing it either on the way up or crossing it on the way down.

But at those moments when CPI was 7.9%, the EFFR was:

- Oct 1973, inflation shooting higher, EFFR = 10.8%

- Sep 1975, inflation declining: EFFR = 6.2%

- Aug 1978 inflation shooting higher: EFFR = 8.0%

- Feb 1982, inflation declining: EFFR =14.8%

And this is what this absurdity looks like, going back to 1955, when the EFFR data begins. Red line = CPI; purple line = EFFR. This chart documents why this is the most reckless Fed ever:

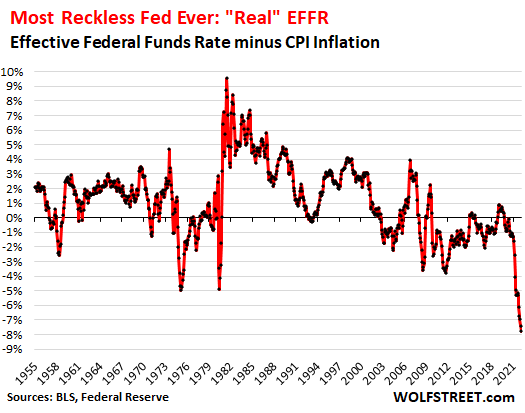

The “real” EFFR: nothing ever came close in recklessness. The EFFR minus CPI produces the inflation adjusted or “real” EFFR. The real EFFR is now -7.8%, the lowest and worst in recorded history, another chart that documents why this is the most reckless Fed ever:

The Fed’s credibility as inflation arsonist is going to be tough to change.

The Volcker Fed, back in the early 1980s, earned the credibility as inflation fighter. This has benefited the economy for nearly 40 years. It even got the Fed through the money printing spree during and after the Financial Crisis without triggering rampant inflation of the type we now have.

But by pumping large amounts of gasoline on already raging inflation for over a year – when lots of people, including me, were screaming about it because it was so obvious – the Fed has wiped out its credibility as an inflation fighter, and has instead become the world’s biggest inflation arsonist. And everyone knows it.

No one is going to believe when the Fed says it’s serious about tamping down on inflation. Inflation is in part a psychological phenomenon – the “inflationary mindset,” as I call it – and the Fed has blown its credibility. So good luck dealing with it.

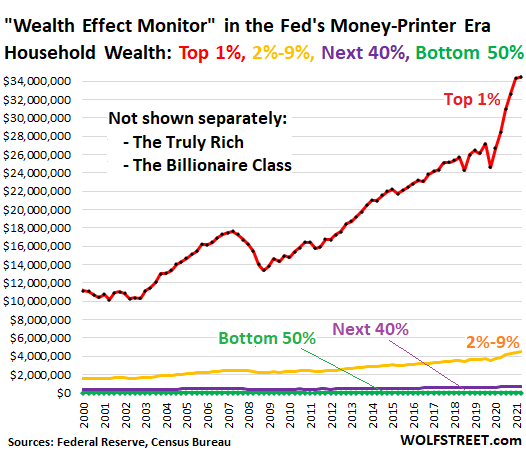

The Fed’s meme that money-printing helps the working people turned out to be BS.

The Fed has been couching its crazy monetary policies and refusal to deal with inflation as way of helping the lower end of the labor market. But that is patently BS. And the Fed knew it. This blowout of inflation has resulted in hourly earnings falling behind CPI inflation for the 11th month in a row, compared to the prior year, starting in April 2021.

In other words, “real” earnings declined for the 11th month in a row, thanks to the Fed’s raging inflation – despite big wage increases and the tightest labor market in our generation. Inflation hits those people the hardest that make their living from actual work, rather than those who are sitting on a pile of assets.

That is the price of interest-rate repression and money printing, and the price is being paid by people who’re working for a living.

But wait… there was a small group of huge beneficiaries from the Fed’s policies.

The Fed has long had as its official monetary policy goal the “wealth effect.” The wealth effect has been promoted in numerous Fed papers, including by Janet Yellen in 2005, when she was still president of the San Francisco Fed. Under this doctrine, the Fed used monetary policies (interest rate repression and QE) to inflate asset prices that make asset holders (the already wealthy) even wealthier. The idea is that the even-wealthier spend a little of this money, and that this will trickle down somehow.

What this wealth effect doctrine has accomplished – and with exponential efficiency during the crazed QE and interest rate repression since March 2020 – is the greatest wealth disparity ever.

My “Wealth Effect Monitor” is based on the Fed’s data about household wealth (defined as assets minus debts) by wealth category for the “1%,” the “2% to 9%,” the “next 40%,” and the “bottom 50%.” My Wealth Effect Monitor takes the Fed’s data down to the per-household level.

What the Fed should do now to mitigate the effects of its reckless policy errors.

The Fed cannot undo the enormous policy errors it has committed over the past two years. But it can end them going forward, it can mitigate the devastating effects now playing out in the economy, and it can prevent those effects from spiraling totally out of control.

So this isn’t what the Fed should have done – that’s a different story – but what it should do now, starting after its meeting on March 16:

Start unloading the balance sheet (Quantitative Tightening) now at a rate of something like $200 billion a month, by both, allowing all maturing securities to roll off without replacement, and by selling outright the securities with the longest remaining maturities, such as 30-year bonds with 29 years left to run; they need to go first.

Run QT in the foreground, with the stated and explicit purpose of driving up long-term yields. Running QT in the “background” on automatic pilot, as Powell said, is just goofy. The purpose of QT is to push up long-term yields, just as the purpose of QE was to push down long-term yields. The purpose is to steepen the yield curve while the Fed is hiking short-term rates.

Specifically, sell MBS outright. MBS have maturities of 15 years and 30 years. Holders such as the Fed receive pass-through principal payments from mortgage payments and when mortgages are paid off, such as in a refi or the sale of a home. In a housing market with declining mortgage rates, refis and home sales are booming, and these pass-through principal payments turn into torrents, and the MBS on the Fed’s balance sheet would fall rapidly.

But in this rising interest rate environment, the housing market slows, and refis slow, and the pass-through principal payments slow to a trickle. This is why the Fed should sell its MBS outright to get them off the balance sheet entirely in a couple of years.

Time the market with the sales of securities: Every time long-term yields decline a little, use the opportunity to sell even more securities. Any good investor trying to unload debt securities would do that. This would keep the yield curve steep.

Raise short-term rates by 100 basis points on March 16, to communicate in a way that everyone would understand that the Fed is serious about ending its reputation as inflation arsonist and regaining its ruined credibility as inflation fighter. Then continue raising rates at smaller increments, such as 50 basis points at every meeting this year. That would bring its policy rate up to about 4.5% by year-end, with inflation likely over 8%.

Front-loading the rate hikes and breaking that “inflationary mindset” might help get inflation back down sooner. Dilly-dallying around will drag this out and let inflation get worse and worse, with higher and higher interest rates needed to have any impact on inflation.

Officially abandon the “Fed put.” Let markets find their own way. Markets are good at that. Sell-offs bring a much-needed cleansing of excesses and lots of opportunities. Markets need to be allowed to function properly as markets do.

Remove QE from the toolbox once and for all. QE is a destructive policy that creates wealth disparity, asset price inflation, and ultimately consumer price inflation. Its effects on the real economy are minimal. It needs to be thrown in the trash.

Instead, use the Standing Repo Facilities if the Treasury market locks up. The Fed has likely for this purpose re-established the repo facilities in 2021, after shutting them down in 2008. No QE needed.

Allow debt restructurings and bankruptcies to resolve excessive debts in the economy. If companies have too much debt, they need to restructure this debt at the expense of investors. This is a healthy essential process of capitalism. For two recessions in a row, the Fed has stopped that process from playing out. Now there are huge excesses, further fueled by years of ultra-low interest rates. US laws and markets are well-suited to sort this out.

But instead, Powell will try to engineer a soft landing.

Yup, the Fed is going to raise rates and it’s going to reduce its balance sheet. But they will pussyfoot around and insist on being able to achieve a soft landing by not doing enough, and the longer they pussyfoot around, the more entrenched inflation will get, and the longer it will drag on, and the harder it will be to dislodge it, and the longer the Fed will ultimately struggle to contain it.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Wolf Richter for fed president. Please someone nominate him!!!

LOL. No one needs to worry about that. I’m a foreign-born American, forever unable to run for Prez, thank goodness :-]

Not “US President”, Fed President! You should have Powell’s job Wolf.

The requirements for Fed President (Chairman) don’t include citizenship. It appears the main rule is that you can’t be a bank shareholder or employee etc. (12 U.S. Code § 242, 244 etc).

And looking globally, Central Bank heads don’t even need to be citizens (e.g. Mark Carney). Says a lot that someone can be chosen to run a nation’s central bank without even having that nation’s interests at heart…

OOPS, I misread. Didn’t see “fed.” Apologies.

Right now, Fed president is probably the worst job in the world to have.

People of true character would take that job and do what is necessary. They will get recognition years later (see Volcker). Unfortunately, Powell doesn’t have what it takes.

I would gladly switch places with him:

$50M net worth

Just ride the 2nd term out and retire to China.

Wolf as fed president makes perfect sense… for the Fed cronies. Bring in someone from “outside” to do the dirty job of fixing the mess and, in the process, make himself enemy of the elite (and to the public*, whose opinion is influenced by the elite). The fed cronies get away unscathed.

* “consumers suddenly started paying whatever.” That statement is key. They don’t mind paying more; what they do mind is stock market and assets bubbles crashing.

Does FED chair have to be US born?

No, I misread the comment :-[

“The Fed’s credibility as inflation fighter.”

If your starting point is wrong it’s like taking a wrong turn and just keeping going – then the further you travel in life, the further you become distanced from the truth.

End the Fed is a 2009 book by Congressman Ron Paul of Texas. The book debuted at number six on the New York Times Best Seller list and advocates the abolition of the United States Federal Reserve System “because it is immoral, unconstitutional, impractical, promotes bad economics, and undermines liberty.”

You can’t run for POTUS but you could be Fed president, no?

Wolf, I’m with you on all of this. We know, though, that this list would hit the economy hard enough to create streams of new legislative acts with all kinds of stupid names using words like “American” and “Rescue”. To us, it would be merely the price we should have paid the covid struck but refused to do so at the time. Unfortunately everyone else would look at it as unfair and…crazy.

In short, most people will take inflation over recession and collapsing markets.

Inflation hits everyone (330 million people), and it hits the lower 200 million the worst. A recession will only hit the people who lose their jobs. Crashing markets will only hit the 10% that have any significant amounts in the markets. That’s why inflation is absolutely the worst.

@Gattopardo: “most people will take inflation over recession and collapsing markets.”

It’s not an either-or choice this time. We already have inflation AND collapsing markets. No doubt recession and unemployment are coming soon too.

“In short, most people will take inflation over recession and collapsing markets.”

Disagree

First, in 2018 we had 2% inflation and 2% Fed Funds…..and the economy did not go to recession.

Second, markets that have run too far, have pumped PE ratios to new heights SHOULD not be defended by monetary policy

And finally, lets remember, the FED intentionally FORCED (their word) investors to take on more risk as they flattened the yield curve. This means the FED altered risk/return ratios and PE ratio normalities. They have no business doing such…and now the cattle drive they conducted is heading to the slaughter house.

A 10% correction in the Dow Jones is hardly “collapsing markets.” And the continued strength of the labor market, retail sales, etc. show the stock market isn’t the economy.

During the ugly 2000-2003 bear market, unemployment never exceeded 6%.

that’s the crux right there. the idea that we were entering a new “roaring 20s” and that the economy was “booming” was nonsense in that we actually did suffer economic damage from covid (whether from the virus or from the government response to it is irrelevant). you don’t “come out stronger” when you haven’t increased production at all, like during ww2, and only printed and borrowed to fund consumption.

consumption does not a strong economy make.

really, we should have paid the price for the past 6 or 7 years, but it was especially true that we should have paid it during covid. instead, the governments printed and dumped trillions onto the economies, and made it look like things were healthy. they weren’t, and they aren’t.

I have to agree with Gattopardo. The FED is not willing to have a recession, but rather prolonged inflation, because it fears that the recession will be way worse than the 2008 recession. And probably the reason is 30 trillion debt … and all its ramifications (unicorn companies etc.).

I don’t disagree with any of the responses to my post. I would personally take a recession and all of its consequences versus inflation anywhere near what we have now. And I would have greatly preferred that we endure the hardships of covid when they struck rather than deferring (and compounding) them.

What I don’t buy is that the Fed is some evil org out to get us or enrich banks, etc. They aren’t stupid either….they’re making the tradeoff that most of us here on this site don’t like — inflation over recession/etc. They know at least as much as we do, they know what they’re doing, and they are making a bet that this route is better. I’d take my chances with the Wolf Plan.

Gattopardo,

“tradeoff that most of us here on this site don’t like — inflation over recession/etc”

That’s a red herring. There is no such trade-off. Low inflation doesn’t trigger a recession. What might trigger a recession is if you wait too long and inflation gets out of hand, like right now, and then if you let it further get out of hand, and then if you finally crack down on inflation because it’s eating everyone’s lunch, well, then you might get a recession.

But if you wait too long and don’t crack down, you might also beforehand get a recession with high inflation — and that’s an even worse scenario.

The Fed has already pissed away all the good options.

Gattopardo…..

Dead wrong….. “most” people won’t. Just most of those invested in the market.

Idols for destruction by Herbert Schlossberg

If the state were the only beneficiary of inflation, it could not be continued for long.

A society that inflates its currency tampers with a moral value.

… it is an error to think that venal officials simply take advantage of a helpless public. The willingness of government officials to buy support from voters with printing press money cooperates with the willingness of the citizens to profit from it. Those dishonesties combine to foster a moral climate in which other excesses take place.

As George Lukacs put it: “The inflation of society ran ahead of the inflation of money.”13 The moral state-of-affairs gives rise to the policy.

Inflation is both a cause and effect of moral decline. The citizens like it because they perceive that it gives them something for nothing. Like many of the policies of the modern social democracies, it transfers wealth from some people to others. People will tolerate increasing prices because their paychecks seem to increase apace. The value of their houses and other hard assets goes up, while their load of debt becomes less burdensome. The benefits they receive are visible—the state makes certain of that, since if they were not visible nobody in the state apparatus could profit by providing them—while the costs are as invisible as political and bureaucratic genius can make them. As long as people think they are advancing economically, the pressures to continue inflating outweigh those for stopping. When a society becomes pragmatic, the moral considerations seem less important than the economic ones.

Bri I’ve been screaming this for 25 years this isnt just a recent issue. The city if living going up wealth disparity these have been issues since the early 80s when I was in elementary school n tbh it’s sad I knew what u all went to school for at 7 years old. Buy yeah go on keep thinking ur the ones lmmfao. I could fix all our problems in a year or less.

Agreed. The current mess was started when Alan Greenspan decided to cut interest rates to near zero and promote massive tax cuts to help George W. Bush and the Republicans win the next elections. This, coupled with de-regulating the financial markets, boosted the economy in the short-term, but the resulting scams led to the Great Recession.

Successive Fed Boards have kept interest rates low to try to help the economy recover from Greenspan’s damage. it didn’t help that President Obama kept on the same set of Wall Streeters that had served up the Great Recession.

What we need here is massive re-regulation of the financial markets. Tax policy can hekp as well – boosting the definition of long-term capital gains to, say, 5 years would help reduce speculation in many areas. Once enough people again see the stock market as a means for investing rather than a casino, we can stop reliving the boom-bust cycles so prevalent in the Gilded Age.

Henry Kissinger had a much thicker accent than Wolf but served in the US army as a translator/interrogator during WWII, then later as National Security Adviser AND then as an effective Secretary of State. He is the guy who negotiated the peace treaty to get the US out of Vietnam. He turns 99 later this year.

Only the good die young

…OK? He sure was “effective.” Can’t say I have as glowing of an opinion of Kissinger as your comment suggests.

Let’s not forget that Kissinger was an effective war criminal too.

Yeah he did such a great job negotiating US exit from Vietnam he avoided chaotic helicopter evacuation from Saigon and refugee crises, right?

Inflation will become problem when foreign countries stop selling goods in exchange for dollars, for now USA government can simply print more money and give it away to people for purchasing products.

So don’t worry, things are under control.

The US is doing just that right now to Russia, forcing Russia to stop using the US dollars in its foreign exchange. Russia is going to trade with China and India using non dollar based system. The results of such sanction on Russia is to force the formation of such alternative trading system to become mature sooner than later. Perhaps soon we will see the dumping of US dollars in all those non allied countries in the world.

Nice plan, Wolf! Unfortunately, the FED will do the exact opposite of what you’re suggesting. They’re scared to death tanking the housing market and significantly raising interest payments new debt and rollovers.

“Raise short-term rates by 100 basis points on March 16”.

I was wondering why I wasn’t hearing this till now.

Because the Fed isn’t listening to me anyway :-]

Because it’s not going to happen.

Really?

Foreign born Americans are eligible to run for President.

They have to have lived in the USA for at least 14 years. That domicile requirement counts time in the service of the USA overseas as “time in the USA”. For example, working officially for any entity of the USA overseas including the military.

A perfect (well imperfect in reality) was the warmonger John McCain.

A foreign born American that doesn’t have enough “official” time as a US citizen is, however, unable to pass on their US citizenship to their children.

Illegal aliens and visitors that have children while in the USA means that those children are US citizens.

So there are very interesting situations that can arise as a result.

Those two idiot former members of the Royal family now have a child who is a US citizen by birth and is now subject to every imaginable IRS reporting requirement including FACTA and income tax………….

Wonder if they will file the forms though…….

Bernard,

This is what the Constitution says, verbatim:

“No Person except a natural born Citizen, or a Citizen of the United States, at the time of the Adoption of this Constitution, shall be eligible to the Office of President;”

McCain was born on a military base overseas, so this is interpreted as an extension of the US.

Ted Cruz was born in Canada which is considered the 51st state. :)

Simple reason. Inflate away the humongous debt.

I second this.

Will anyone of the Fed people ever suffer the slightest disability for what they have done, financial or otherwise? Of course not. Why should they change their behavior? No matter what happens, (unless Putin goes “physics”) they have a virtual guarantee of a safe, comfortable, easy life.

What would ever make them follow a different path?

“What would ever make them follow a different path?”

Criminal liability for counterfeiting ? A national referendum requiring

criminal prosecution of these thugs? And regurgitation of their obscene and stolen wealth ? Powell is up to about $85 million in his ripped-off loot.

The current FOMC isn’t just the most crooked & corrupt, but also the wealthiest ever. Look at their financial disclosures: all multi-millionaires, often with substantial stock holdings, which affects their decision-making. These aren’t people who are tuned in to the financial struggles of ordinary Americans.

Greenspan certainly contributed to this mess but at least he put all his assets in treasuries and didn’t trade.

“Will anyone of the Fed people ever suffer the slightest disability for what they have done, financial or otherwise?”

It is absurd to place important decision making into the hands of those who pay no consequence for being wrong.” Thomas Sowell

and let’s not forget, or fail to notice..

all those who speak to “transitory” and the like..

They seem to all have inflation protected pensions awaiting them….for life…courtesy of us…but what of us?

Yellen must have three, at least (U of C, Fed , Treasury)

Between those and “Speaking fees” (some called delayed compensations) she need not worry.

Have any of these rulers of ours every had an hourly wage job, touched a shovel, or been to a lumber yard?

historicus,

How many members of CONgress or Presidents have ever had a real job?

How many of them have served in the military?

Bernard: 74 representatives and 17 senators, according to https://www.americanveteranshonorfund.com/veterans-in-congress-by-party-state/ I think there are also some active reservists. And more with “intelligence” agency backgrounds.

He just had to state the Fed funds rate should be higher than the real or true inflation rate which is in double digits presently.

Changing the Fed president at this point is like changing the Captain of the Titanic AFTER hitting the Iceberg.

Good one.

It’s intentional, Wolf. There’s too much debt. Too much federal debt. Too much municipal debt. Too many pension obligations. Too much mortgage debt. Too much corporate debt. The fed decided long ago they won’t allow that house of cards to collapse. No politician will ever be forced to make a difficult decision. No one will ever be underwater on their house.

The inflation will continue. The fed will pretend to be concerned. Maybe even throw in a few meaningless rate increases. But the money printing can’t stop. Buy Bitcoin or continue trying to make it in this corrupt game.

I completely agree with you…all but the Bitcoin part.

The Fed will change how they calculate inflation. I’m sure they can get it below 2%

Yes, they could still switch to trimmed mean or another inflation measure that’s even lower than PCE.

Like the Bank of Canada’s bogus rate of inflation. They’ll factor out residential rents.

Housing collapsed in 2008. People have very short memories these days.

I’ve lost track of how many times Bitcoin has collapsed.

Great article.

Andrew,

“Too much debt”…

In the second to last paragraph I explained how the corporate debt issues should be resolved. This also works for municipal debt. States cannot file for bankruptcy protection, but their debts can also be restructured.

Pension plan benefits are often inflation adjusted, and so inflation does nothing to lighten the burden; on the contrary.

Here is what I wrote in the 2nd paragraph from the bottom:

“Allow debt restructurings and bankruptcies to resolve excessive debts in the economy. If companies have too much debt, they need to restructure this debt at the expense of investors. This is a healthy essential process of capitalism. For two recessions in a row, the Fed has stopped that process from playing out. Now there are huge excesses, further fueled by years of ultra-low interest rates. US laws and markets are well-suited to sort this out.”

And in terms of your recommendation: “Buy Bitcoin or continue trying to make it in this corrupt game.”

Hahahaha, corrupt game? BTC now is at $39,200. Exactly a year ago, it was at $59,300. Bitcoin has plunged 34% year-over-year, and you want me to buy this crap?

> ” … If companies have too much debt, they need to restructure this debt at the expense of investors. This is a healthy essential process of capitalism. …”

Absolutely. Buyers of equities TOOK THIS RISK going in. It is impossible futility to try to bail out everything and everyone. Making that promise after the fact is ripping someone else off.

That is government operating as an insurer that would be guaranteed to itself go bankrupt and, in some way or other unwind. We cannot afford that. We will fall into brutal stark winner-take-all gangster rule. Hello failed USSR.

But the system had already started to become unstable. Too many bailouts had already been printed. He was trying to keep the plates spinning. It became a runaway process, a sorcerer’s apprentice tragic-comedy.

agreed fully. the fact that the u.s. has gotten away with these games for the past 20 years just shows how much political and economic capital we built up in the aftermath of ww2. at this point, we’re no better than third world banana republics that have tried to subsist on borrowing and printing, it’s just that we have a credit card with a higher limit.

but higher limit doesn’t mean an unlimited limit.

Bitcoin and every other crypto is literally nothing. It’s not a currency. It’s speculating on nothing and even where the supply of one is limited, an infinite number of others can exist.

Bitcoin has brand recognition and nothing else. When this house of cards falls apart, it’s destined to crash with it.

If it lost 99% of its current value, it would still be 100% overpriced.

The price of BTC tends to revert to the cost of mining Bitcoin. The amount of work it takes to solve a block and earn Bitcoin for miners self adjusts based on how much miners are working. BTC is the only crypto truly decentralized. The other cryptos were like IPOs where founders kept lots of the coins.

You are saying crypto is based on nothing, under an article ranting about the devaluation of the USD! The FED is destroying the dollar but you guys don’t appreciate that nobody can flood the world with new BTC.

WR cherry picks BTC crash time-frames. Just last week it was at 44k after being as low as 32k in the last month. Dollar cost averaging into BTC over a long time horizon at anytime in the past 12 years would have made someone beat almost any other store of value.

Bitcoin is old school. NFT’s are where it’s at now.

Bitcoin “mining” wastes a lot of real resources (energy and some human labor).

It’s not a real currency and has no prospects of ever being used as one at any scale due to its price volatility.

It might be better for hiding “money” from the government than the competition, but governments can and will squash it if it ever poses a serious threat to national fiat currency monopolies which I don’t think it will.

I’ll change my mind if it holds most of its value after the asset mania crashes and burns.

duke, referring to the past 12 years, which people not only do for bitcoin, but for amzn shares, real estate, or anything else is really irritating.

yes, in retrospect, you would done very well buying bitcoin 12 years ago and selling it today. but if we’re going to play that game, with a crystal ball, why not sell it at its peak at $68k and then rebuy in today?

the question is not what turned out to be a good trade when viewed with a rearview mirror, but what is a good investment *today*. and i’ve seen little reason to think that bitcoin fits that bill.

BTC is a perfect, incorruptible currency. You guys are so funny co planning about USD losing purchasing power and not realizing that BTC is the answer. Pulling out old tropes about it being wasteful and such. It is much more complicated than that. You would have to weight BTC energy usage against all the armoured trucks in the world trucking currency from vault to vault and all the costs of securing the currency and all the costs to society from devaluing it.

Also Biden just issued an executive order saying USA needs to sort out regs in the space so we can keep our competitive advantage in the web3\crypto future. And the crypto space welcomes that as regulation will equal trust and further adoption.

What is any currency? Just something a government made up. bTC isn’t much different except that nobody can print more of it. It’s supply is fixed. Imagine if we had kept to the gold standard instead of inflating our savings away.

Also, if you guys understood the Lightening network, you would know that transaction cost of sending BTC is approaching zero.

Wolf, I enjoy you candid remarks and educated understanding of markets and finance. I learn a lot from you and appreciate you. Thank You!

“This is a healthy essential process of capitalism.”

And in the words of Jim Grant ….”they are called corrections for a reason. They correct.”

The central bankers have been focused on ironing out all cycles…but cycles are part of the correction process. They flush excesses. And to prevent such is to allow excesses to be built up, making the inevitable flush worse….systemic threatening on occasion. But that occurrence then brings the central banker into prominence, rescuing and accruing more power, more self authored mandates, like “2% inflation”, which didnt exist prior to 2008.

historicus said: ” like “2% inflation”, which didnt exist prior to 2008.”

————————————

whatever their self authored mandates …………. the bastards have been creating inflation for decades …………..

all self serving to their owners

Wolf I’m surprised your not more interested in Bitcoin. It operates on the basis that it has an automated “central bank” which creates new coins at a set rate, until a specified date where it will stop. Yes there is investment mania. I’m speaking only to it’s core concepts. Of only we could run the fed that way. Maybe interesting to see USA interested in a digital currency.

Wolf, perspective is everything. Powell has done everything he could do to save this country by forcing us to return to a gold standard. And you, by writing articles like this, are trying to stop this natural progression of fiat. Anyone over 70 remembers the safe gold standard days back when there were work, savings, accountability, and moral ethics. All the positive Fed choices are not past, it is just sooner or later….

Andrew…

So, you seek no solution?

One thing for certain…

The CAUSE of the problem can not also be the SOLUTION to the problem.

Debt and fake rates continuing is not the answer.

Inflation is a race to the bottom.

Trying to spend my bitcoins.

Can’t seem to get anybody to accept them.

Silver & gold coins and cash seem to be a medium of exchange that gets things bought.

B

Wolf, thank you for your steady stream of insightful articles. Probably among the minority of your audience, but as a younger millennial, what would you advise us to navigate these times?

Pickle,

This site has a lot of millennial readers, but not that many millennial commenters (though there are some self-professed millennials here).

In terms of your question – “what would you advise us to navigate these times?” – I’m not giving advice. But I can tell you that these are totally crazy times, as you can see from my innumerable WTF charts for the past two years, with things spiking and plunging in a crazy manner all over the place. I have never seen anything like this, and I never-ever thought I would see anything like this.

I think “capital preservation” and “purchasing power preservation” are going to be elevated into an art form and may turn out to be mutually exclusive. In other words, people seeking purchasing power preservation may be tempted to take such risks that, if it doesn’t pan out, they lose capital doing it, and end up with neither. So this is going to be tricky to navigate.

Pickle-…i would add, always, always, always ask “…who/what is trying to tell(sell) me there is a free lunch…”, including yourself…

best of thought and fortune to you, and…

may we all find a better day.

What about your longest short ? Could pay out I guess.

Due to the end of globalization and the beginning of deglobalization currency pairs should move like the USD/CNY in favor of the latter.

Millennial reader here who rarely comments.

I struggled for a few years to grasp what Wolf was always going on about “asset price inflation” and why he was so insistent on not adjusting home prices for consumer price index.

Then I wondered why he was obsessing over inflation when no one else was talking about it (well, nothing that I was reading).

Now it all makes a lot of sense. Thanks Wolf. I’ll donate to your Fed presidential campaign. That’s how it works, right?

LOL. Thanks!

My take on that is to have a side hustle that generates cash by actually doing useful things that people will pay for. Ideally have a use for it yourself too so if/when the recession hits you will have time to develop your property/business yourself, investing your time there instead of moping about.

One way to do potentially do this is to invest cash in real assets like low hours used equipment that will hopefully have low repairs while you earn your money back plus excess returns. You might even be able to hire somebody to do it for you and become self employed.

Don’t buy on credit tho…

Totally agree. Get a little side job that gives you the cash to enjoy the things you like to do (for your sanity) without breaking the bank. Those hobbies are all getting more expensive, but also are needed now more than ever.

That and don’t buy a new car ever.

For Tom:

Just sold the most recent new car for slightly less than it cost 3 years ago; basically drove it for 35 months for approximately $100/month,,, much less than total of repairs, etc., for any used car I have ever had, not to mention the convenience of being able to drive across USA — the only reason to buy new IMHO — without concern for unknown unknowns…

( And would usually agree with you except for this recent crazy used car market. )

btc or a digital dollar will turn most into serfs….where the US can take everything in one key stroke….BTC is the end of freedom and the beginning of slavery….

I think that is one of the reasons the Chinese dictatorship is lining up to use digital money as a way to continue to enslave their people.

All major countries seem and central banks seem to be promoting digital money, not just the Chinese.

Don’t place all your bets on the Fed not killing inflation. Dimartino Booth says the Fed has got things set up in banking system where they can tighten without risking the banking system.

It will not take that many hikes to get the job done. If stock market goes down 50% inflation will go down as people stop spending and will roll us into a recession.

If Fed doesn’t print the cure for higher prices will be higher prices and consumer will reduce spending and start cutting out discretionary spending.

I am not sure. Fed’s legal mandate is controlling inflation.

By the most basic measures Price to Sales or market cap to GDP the SP500 should be about 1500. Might as well kill inflation and get stocks back to a reasonable level at the same time. Get the big recession over with so economy can restructure. US running these huge trade imbalances is not a sustainable policy.

I agree except for the Bitcoin. I think the best way is to have real tangible assets that can produce food in the long term. Land, houses, farm land, animals, precious metal, tools, etc. Anything that is tangible and have real intrinsic values are better than the collapsing dollar. Bitcoins are not real tangible and have no intrinsic value.

PMs also have little or no ”intrinsic value” for some folks rt, the exception being used to enhance electrical conductivity, etc…

just another ”con” of the elite using PMs as a control mechanism, etc.

PMs have a 5000 year unbroken history of being accepted as a store of value.

The trucking company my son works for has told all of their drivers to fuel their trucks at the end of their day/shift. Because diesel prices are rising fast enough they’d rather top off today than tomorrow…

Yes real reason for gas lines in the 1970 s. Inflation is by now not later.

The gas lines were caused by the Arab oil embargo that started in Oct. 1973 and lasted for months. The embargo also caused massive inflation over the next few years. In the summer of 1973, regular gas cost only 30 cents a gallon in the suburbs of Detroit.

The Oil Shock was a contributing factor, but not the primary reason for the “great inflation” that began in 1972 and lasted a decade.

Blaming Arabs is a convenience. The “inconvenient truth” was perhaps closer to home.

To plagiarize Investopedia: it was US monetary policies, which financed massive budget deficits, that were the main cause.

Upon his inauguration in 1969, President Richard Nixon inherited a recession and the Vietnam War.

Nixon began his term by imposing politically convenient wage and price controls in 1971. Once removed, they fired up inflation as individuals and businesses made up for lost ground. We call that the “inflationary mindset” today.

In 1971, Nixon broke the last link to gold, turning the American dollar into a fiat currency. The dollar was devalued, and millions of foreigners holding dollars, including oil barons in the Middle East with tens of millions of petrodollars, saw the value of dollars slashed. Is anyone really surprised that these oil barons responded as they did?

Fearing a recession, Nixon then fired the Chairman of the Federal Reserve and pressured the new Chairman to force down interest rates and expand money supply. Sound familiar?

By 1980, inflation reached 14%. The eventual cure was a brutal period of tight money and recession.

Right now it seems Powell’s Fed can’t make a move without political cover, lest they blow their chances of keeping their jobs –

Congress stalled the reappointment process a month ago.

The news blackout since then has been very intriguing. At a time when inflation has ignited, the stock market is melting down, there’s financial stress from a major war, somehow Congress isn’t able to agree on who the financial leaders should be, and no one in the press wants to talk about this?

Meanwhile, guess who’s top of the list among that “small group of huge beneficiaries from the Fed’s policies”? Yep, Fed leaders and Members of Congress front-running their own policy changes.

Somehow I don’t think Congress just wants a little more time to get wildly short the market before they give Powell the green light to jack rates back to where they should be. That’s not consistent with the needs of who owns them.

” Yep, Fed leaders and Members of Congress front-running their own policy changes.”

what a game….and people think this is capitalism. Those games are nothing but criminal.

Bravo, Wolf! Please continue your expose’ and educational explanation about how the detailed mechanisms work behind the scenes in the Fed nightmare machine, the “creature from Jekyll Island.”

The chances of an inflationary depression are steadily increasing.

Agreed. Having reached this point, I think market discipline must at some point play its hand, no matter what the Fed does. If it has any decency, it should at least do some of what Wolf prescribes, in order to preserve some shred of purchasing power. The relative soft landing adjustment will be painful at best for the masses. Let’s get on with it. Otherwise despite my best efforts and prudence, this farce will deepen, and I and many others will be made destitute.

The ultimate market discipline is on the value of the national currency. That’s the basis of any central bank’s power.

The DXY is at about 99 now. It’s not in the danger zone which is around 70, so still a way to go but it doesn’t take long to get there with a change in psychology.

August….

that is one metric

But here is the one that really matters..

https://wolfstreet.com/wp-content/uploads/2022/03/US-CPI-2022-03-10-dollar-purchasing-power-since-2000.png

@ historicus –

and the dollar is what is what must be used to satisfy debts, and will determine those who survive, perish or profit when things get shaken up ……………………..

excepting the ability of the FED to create dollars from nothing to bail out their boy’s, which they have done many times and will continue to do as long as they can ……………..

we have been played for fools

The DXY index is 99 and headed for 74.

Maybe.

In the US, there won’t be a depression without a (massive) credit contraction which is normally deflationary.

If you are thinking in terms of other countries, developing economies until recently didn’t have substantial reliance on credit for “money”. Not sure where this stands now but none have debt to anywhere near the same extent as the US.

The only close analog (and it’s not really close) is Weimar Germany. Although the debts and external factors were different. There is some analogous activity going on.

No definetely not. The reasons for Weimar Hyperinflation were totally different. And something like this definitely will not happen.

Due to the Versailles peace treaty Germany in the beginning intentionally wanted to inflate away this unbearable debt which had gagged its development perhaps forever. This is a result from the WW1.

The Reichsbank (by which model the Warburgs formed the US FED by the way) had to finance the occupation of the Rhineland through the german army by spending their last gold reserves. In doing that the Reichsbank lost their ability to defend the Reichsmark and the big Inflation game started. So whenever the Reichsmark lost some ground against the USD the bakeries increased the bred prices. Wall Street speculators could acquire enormous assets particulary in the big cities. This laid the basics for the success the Nazis had – though they never won an election.

But the inflation eased abruptly as the Reichsbank decided to abandon the gold standard and put other hard assets into their balance sheet.

Very interesting piece of history.

But Germans nowadays are still fearing about this somehow. It not needs stimuli to change the psychological mindset. This mindset is still prevalent in them. They still fear it and so it is a selfullfilling story.

But you still can buy cheap when you look a bit. And many drive their old Diesels and not buy new cars.

Only if we live in a society where Jerome Powell and his cronies can be prosecuted for crimes against majority of the population.

A man can dream…

Your proposals are well reasoned, so I’m pretty certain that they will be ignored by JP.

The Fed’s credibility shifted from Inflation Fighter under Volcker to Wealth Disparity Creator and Inflation Arsonist under Powell. And everyone knows it.

A minor change in this text giving credit to all the Fed Chiefs who have graced the chair since Volcker…

The Fed’s credibility shifted from Inflation Fighter under Volcker to Wealth Disparity Creator and becoming the Stock Market “Arsonist and Firefighter” under Maestro Greenspan and Money Spewer par excellence under “Housing will never go down and Saved the world” Bernanke and “No Financial Crisis during my life time” Yellen and Inflation Arsonist under “Infaltion is transitory” Powell

People like to compare the 70s and early 80s inflation with today.

In my opinion, the comparison ends here.

Under Volcker (and even Burns), we had a Fed that FOUGHT inflation.

Now, since Bernanke and to Powell…we have a Fed that PROMOTES inflation.

Who allowed, who accepted that shift in policy?

One might say they only want 2% inflation, but 2% rips 22% off the dollar in ten years…hardly “stable prices”.

And what if they over shoot? What if the inflation “dog” gets off the leash due to overly stimulating with massive injections to the money supply? Then what? I guess we are getting that now….hand wringing over 1/4 pt raises.

“So this isn’t what the Fed should have done – that’s a different story – but what it should do now, starting after its meeting on March 16:”

Hope the Fed reads. But then you can be sure that it will pass them by. They will think it is a joke.

But this is what happens to guys who think are god. Good luck to the Fed in engineering a soft landing now that Putin has queered the pitch further.

I was under the impression that faster appreciation of assets over wages was the better part of the justification for counter-cyclic money printing. This reads like a series of excuses by the Fed to keep the casino open even as the whole place is caving in. I suspect they’re more malicious than reckless.

You’re a bit too forgiving. This is more like having the casino tables located in the lobby of the Jurrasic Park Lodge with the electric grid one step away from shutting down as the storm howls outside. But not to worry, our illustrious management team has the freezers stocked full of ice cream, there’s plenty of island memorabilia available in the tourist store, and lots of people have Dine-O-Coins to make them feel safe should the registers fail to clear your credit card purchases in a prompt and timely manner. Now where are those rescue choppers?

Ha ha ha

Not just incredible wisdom, but humor..

served up fresh daily.

And all of the electric powered handguns won’t fire if the grid goes down.

And don’t forget the velociraptors roaming around and the T-Rex that just might bust in and destroy everything in any given moment!

“effective federal funds rate (EFFR) to 0.08% while CPI inflation is raging at 7.9%”

Alright, so I look at that and think ‘sure looks like a small number compared to a big one’. But Wolf, what exactly is the right ratio of EFFR to CPI, if our goal is to lower inflation?

I read that Volcker fought annual inflation rates higher than 10% with a Fed rate of 20%. So is the ratio 2:1? Is it less? How do we know? I really am asking.

The EFFR (an overnight unsecured rate between banks) should be above CPI in normal times, and further above CPI if there is growing inflation. If there is 0% inflation, the EFFR can be 0.25%

A year ago, when CPI was getting close to 4%, the EFFR should have been 4%. And QT should have started. This would have likely stopped the burst of inflation from happening.

What’s the correct price of popcorn or peanuts?

No one knows what the “correct” interest rate “should be”, as there is no correct price for anything.

Left to their own devices, I don’t believe market participants would choose to price the cost of (supposedly) risk free credit below the rate of depreciation.

But this brings up a related subject of the currency monopoly.

Left to their own devices, market participants also wouldn’t choose to use a perpetually depreciating currency either. But since currency issuance is also a national monopoly, they do not have a choice.

In a real market with adequate private property rights, money would be treated as any another product. Government’s try to make a distinction between money and everything else but in terms of potential customer preferences, there isn’t any.

No one knowingly and voluntarily chooses to use a perpetually inferior product.

This is supposedly part of the appeal of cryptos but none of it is a real currency. It’s a speculative bag of hot air.

There are compelling arguments that interest rates need to be greater than zero, and greater than inflation.

Interest rates at or below zero encourage people to save “under the mattress” rather than investing productively. This takes credit out of circulation and reduces economic growth.

Alternatively, interest rates below inflation encourage people to buy-and-hoard stuff they don’t need immediately, rather than investing productively. This makes the inflation worse as Wolf has repeatedly detailed.

In both cases, the virtuous cycle that drives economic prosperity (save, invest, grow) breaks down.

WS-your last paragraph illustrates one of the two points of view contained in the old saying: “…virtue is its own reward…”. Looking back over many decades, it seems it has become a minority opinion…

may we all find a better day.

Fed is the most criminal agency ever. Fed should be abolished immediately. There is no other cure of this cancer.

Can’t agree more! But unlikely to happen during our lifetime.

The other alternative is to have only guys with a strong backbone and do not care to pander to wall street like Thomas Hoenig.

Fed hasn’t killed people like our state department, cia, FBI, etc.

At least as far as I know

If he had said The Fed is a ” bunch of Financial Criminals” would it have been more appropriate. After all it is subset of the Criminal class and not killed anybody

You forgot CDC, NIH, FDA, all hospitals and really all forms of government responsible for vid9/11.

Suicides caused by their Policies

Fed has probably killed more people than anyone by making it easy for governments to get US involved in wars starting with useless WWI.

But it is looting you, and you parents and grandparents.

It’s absolutely criminal, and should be prosecuted as such .

But apparently, only “little people” go to jail for such crimes in America-

( ie counterfeiting the US currency ).

Kunan-

Your idea is good, but I’d modify it a little.

The Fed is not criminal…. It was created through congress. The problem is that is, by its original charter, its mission was to stabilize the money markets by interceding in the short-term interest rate markets. This kind of price-fixing can’t work without converting the money market to a government-fixed market.

A secondary problem has been “mission-creep.” In order to stave off the effects of prior price-fixing, the Fed has had to progressively enhance its “toolbox” thereby becoming ever more influential powerful. It’s progressed every single decade!

Congress created the Fed 110 years ago amid warnings that stabilization policy cannot work in the long run. But the lure of an institution that would allow congressional spending AND bank subsidization was too tantalizing. And if/when things go awry, as they appear to be now, congress can duck the blame and point to to bad management at the agency. Stabilization policy is synonymous with price-fixing and command economy.

On the brighter side, the Fed arguably does perform some needed regulatory and organizational functions for the banking industry.

Conclusion, don’t end the Fed — rather, end, or at least completely re-debate, the Fed mandates of “stabilizing” employment, inflation and interest rates. What we’ve been doing was misguided and no longer works (except for politicians).

“We will live by the stock market” being their motto, everything else takes a back seat.

While we can all debate till the cows come home, who will listen to us and more importantly can you see anyone on the horizon who can bell this cat?

All these guys seem to be interested in is to keep the game going as long as they come and if it all comes down (as it will after decades may be) be able to deflect the blame. Putin is there for now!

John H.

Reform is required, but our political system is totally dysfunctional. If the political system still worked properly, I would recommend that Congress take back the Fed’s emergency authority to use QE, repeal the Fed’s mandate to maintain full employment, and transfer that full employment mandate to the Labor Department or perhaps a new Infrastructure Department.

“Reform is required, but our political system is totally dysfunctional.”

No, it functions just fine… for its actual owners. “When buying and selling are controlled by legislation, the first things to be bought and sold are legislators.” – P.J. O’Rourke

THAT is why it will NEVER change. Of course, short sighted profit taking is causing them to drive everyone but the oligarchs over a cliff.

If you mean a functional government by the people and for the people, that has never actually existed except in VERY small towns where each vote has great effect and one can actual walk up to the mayor, talk with him and he’ll listen.

The founders’ brilliant intended benefit of having the most powerful form of government be the one most local to you with the distant federal government having few purposes other than to enforce basic rights, carry out national defense, and prevent inter-state conflicts has long since been perverted. Some small benefits of that, a free market of governments, still exist as shown by those fleeing CA for TX and FL.

Confused-

“ …our political system is totally dysfunctional.”

I totally agree that our political system is messed up. I was just saying that there is arguably a need for SOME regulation and oversight in banking, and that the Fed could do that, or some new agency could do it, as you suggest.

But the bigger issue at hand is to get the Fed and the politicians OUT of the price-fixing / interest rate setting / bailout business. This is where they have gotten the financial markets so totally screwed up.

This needs to happen by reform of existing institution or creation of a new regulatory arm (ughhh… another regulator), but either way, end the government manipulation of credit markets.

(Aside: allowing the Labor department to control employment would be worse than mandating to Fed, IMO)

Note the ECB only has a price stability mandate & no employment mandate, yet that hasn’t kept them from dragging their feet on normalizing policy.

The mandates are written so vaguely that there’s no way to enforce them.

John H….

If the Fed would be held to its mandates, which are really instructions and agreements that allow their existence, the situation would be much better.

Take the Rules of Monetary Policy that is a Fed construct as to where Fed Funds should be. The Fed omitted those “rules” in their last publication. Curious.

I encourage all to read them at the Cleveland Federal Reserve website

https://www.clevelandfed.org/our-research/indicators-and-data/simple-monetary-policy-rules/archives.aspx

The median rate of the seven calculations …has Fed Funds at 3.25% for the second quarter of this year.

The Fed ignores these “guard rails”.

The Fed ignores “stable prices ” mandate, now declaring 2% steady increase in prices is somehow “stable”.

The Fed ignores their THIRD carved out mandate, as laid out in the 1977 Federal Reserve Avct…”promote moderate long term rates”. (ie not extreme, up or down) This mandate would have prevented the Fed from pounding down long rates, flattening the yield curve, and subsidizing reckless debt creation by a spending spree Congress.

The words “stable” and “moderate” have been bastardized.

And the old saying

“The first victim of authoritarianism is language” certainly applies here.

In a system that boasts of “checks and balances”, WHO CHECKS THE FED?

“The Fed is not criminal…. It was created through congress. ”

You’re using a legal definition. By definition, anything the government does supported by statute or a court decision is “legal” and not criminal.

No matter how anyone tries to get around it, perpetually debasing the currency is a “taking” of everyone’s property and theft.

need to add it was created by congress on Xmas eve while no one was watching to control serfs…..

The Fed’s not following its legal mandate. That certainly makes it criminal.

It makes no difference whether you’re being robbed by the police, or by the bankers, you’re still being robbed.

I would argue that the Fed actually is “criminal”, a rogue agency in violation of its legal mandate. Per the Federal Reserve Act as amended in 1977, the Fed’s mandate:

“The Board of Governors of the Federal Reserve System and the Federal Open Market Committee shall maintain long run growth of the monetary and credit aggregates commensurate with the economy’s long run potential to increase production, so as to promote effectively the goals of maximum employment, stable prices, and moderate long-term interest rates.”

The Fed is in gross violation of this portion of its legal mandate and that makes it a criminal/rogue agency. Interest rates are not “moderate”, and prices are not “stable” and the “monetary and credit aggregates” have grown far in excess of “the economy’s long-run potential”.

And it’s not the first time the Fed’s gone rogue, either. The Fed’s purchases of MBS in the 2008 crisis were also rogue/criminal actions – in violation of their legal mandate to only purchase securities backed by full faith and credit of US govt. Fannie/Freddie MBS at the time were explicitly NOT full faith/credit securities, and this was printed right on the first page of those bonds. There were other rogue actions at the time.

Some might argue that the Fed should have even-more extraordinary powers “in time of crisis”. But the Fed’s current powers are sufficient. And government agencies which are capable of fomenting crises must NOT be entitled to break the laws during crises that they themselves help to create! The risk of a power-grab is too large.

FOMO

Meanwhile I get OpEd articles suggested from Google over and over again about how that mean old Fed feller Jerome Powell shouldn’t raise the rates because of… Ukraine! Or was it gas prices? No no, it was chip shortages. I think, or maybe it was housing prices…

Whatever, it warmed up enough to take the iron horse out again today. Ventured about to see some of the local lovelies of housing. Lots and lots of tear downs abound priced at 1mil plus. In rural Idaho. Places where there is no power, internet, water, or winter time access without tire chains and the dwellings listed as “Home has no value.” Nuthin under 750k. Plenty pushing 1.5 mil.

Sounds kind of familiar. Some of the counties around this area are showing 50% increases yoy asking prices on realtor.com.

But remember folks, it’s different this time, real estate only goes up, and you better buy before you get priced out!

I know several people who bought houses with a long commute who haven’t factored in the amount they will spend on gas, tires, oil and vehicles over a working lifetime as opposed to a few hundred extra dollars a month on a fixed mortgage, these are all young people

Fat fingered the t

I’ve just called the top of the housing market here in the UK by selling the only house I own for 5* what I paid in 2002.

Known my luck there will be 10% monthly increases from now on

Any excuse in a storm, as my spin on an old saying goes.

I think the people who run the FED got a taste of power and liked it,

and like the control that goes with it. I doubt they’ll ever give it up

unless absolutely forced to and I can’t see Congress doing that unless

the people demand it. So far, I haven’t heard much from the voters,

they’re too busy buying stuff.

The situation has been allowed to go on for too long, it’s now become entrenched with the FED firmly in control. I’m not sure it can ever be

undone until there’s a complete collapse, such as Inflation/Recession.

Until then, everyone’s having a great time expecting and waiting for more free money. That was a bad idea from the git go even if Biden did

have his heart in the right place.

We’ll just have to watch this play out. Meanwhile, I agree with everything you say, Wolf, and so does everyone to whom I send your column.

Scary – Scary – Massive layoffs in the mortgage field and they have NOT yet begun to raise rates… 2.5% to 4.25% 30-year fixed and 4.875% for 2nd homes and rentals in under a year.

Maybe the Feds will not have to raise rates…The market will raise rates when the guys you have the money actually start pricing their investments with realistic RISK premiums. Corporate bond ETFs and Italy’s debt are all pricing higher – and huge outflows of funds.

Thank you Wolf for explaining this slow-motion trainwreck – Please devote an article to how and where the station is …. I need to get off.

I don’t know about the “slow-motion” trainwreck ….. as James Richter

just commented about the financial repercussions :

“It takes about a week for the bodies to float to the surface” .

Surely mortgage brokers will get another job quickly?

> What’s your income? Yeah you can lie, I’m not ethical

> Okay so let me multiply that by 4

> So assuming nothing bad happens every you can borrow ….

I mean who doesn’t want to employ these legends?

Welcome to Zentropa. We wish you a comfortable night’s sleep on your journey across Europa. The conductor will see that your shoes are shined before morning arrives.

underwriters are history, I work in credit industry, AI and machine learning is the game now. If underwriter start to educate for new job….

Machine readable credit data that can utilize credit data attributes is going to hurt FICO also, I work with several AI decision engines that have taken over all underwriting…

Just taking in breath. The dragon awakes. Use cash only. As Catherine Austin Fitts has wisely warned. Be ready for when they fail.

Wouldn’t these proposals negatively effect the ultra wealthy? Can’t have that!

Started reading first class passengers on a sinking ship, sadly it’s only updated through ‘17 or so. One of the core columns of the argument though is wealth disparity which if we look at the graph has gotten.. horrifically worse in 5 years.

Why would the Fed be so stubborn about not ending QE? What if 90% of all institutional assets are owned by the 1% and mega corps. We know for a fact that over stimulation causes asset inflation. Now what happens when wage inflation takes hold?

Mega corps aren’t human beings, regardless that Citizens United says so for political purposes.

Most institutional money isn’t owned by the 1%. They “only” own 20% of all wealth.

In reply to Wolf’s ‘solution’; you can’t taper a ponzi. And the faster you try, the faster it all collapses. The Fed stops printing permanently and the only one’s left are the cockroaches.

This is a fantasy. Tight Fed is never going to happen.

There is no political support for ending inflation. Mainstream media actually seems to believe in the fantasy of UBI. You could count the number of concerned Congress critters on one hand. The rich (political contributors) have precious little to complain about.

There are merely the latecomers to the housing market and that subset of cautious old goats with appreciable and carefully collected savings. That’s the constituency and it’s an ugly orphan sought by no politicians whatever.

Inflation is a political nightmare…unless you have something else to blame it on.

How much will the Fed use Russia to guide their path ahead?

WH Press Briefing March 10th:

Q “A question on the economy. The inflation numbers that we received today show consumers paying almost 8 percent more than a year ago, and this was before Russia’s invasion of Ukraine. So how much higher does the administration expect prices to climb?”

MS. PSAKI: “Well, as you know, a large driver of these inflationary numbers from the last — these monthly numbers were from energy prices. And we have seen the ener- — the increase, you know, happen as a result of Russia’s invasion of Ukraine.

…

Obviously, they make those assessments on a regular basis. But in terms of prices going up, we do anticipate that gas prices and energy prices will go up. That is something that the President has conveyed very clearly to the American public. We also believe it will be temporary and not long lasting.

…

So I can’t make additi- — new projections for you from here, other than to convey that, yes, it is accurate that the invasion by President Putin into Ukraine has impacted global inflation, inflation in the United States because of the impact it’s had on energy prices. And that is a significant contributor to inflation — the inflationary numbers we saw come out today.”

“There is no political support for ending inflation.”

Recent polls say inflation a bigger concern than Ukraine.

Depends upon what you mean by political support.

There hasn’t been to this point because current monetary policy seemed to be free.

When the USD starts crashing in the FX markets, this sentiment will change, contrary to the opinions of many comments I read here.

The economy, the markets, and the public will all be thrown under the bus to preserve the Empire.

For an example of that, look at the recent ban on importing Russian energy. It’s a minor inconvenience to Russia which won’t make any difference to the geopolitical situation in Europe. It might not make much difference to energy prices in the US either but it’s symbolic of government priorities.

Our politicians seem to be good at convincing the general public that inflation is good and they will make is better somehow if you vote for them. Put up a line graph of M2 and say its the blueprints for the Keystone Pipeline and people get behind it. I dont understand the willful ignorance.

What I mean by political support is any politician discussing (not even taking action to retard) the effects of Fed irresponsibility. Sure, when the train wreck finally occurs there will be a salvage effort.

I would argue tight fed CANNOT happen, because congress will continue to spend more and more every year. Why do they do that? Because gov’t spending directly adds to GDP, and they need it to rise every year so they can say they did something come election time.

So even if the fed tightens, congress will be easing by use of their check kiting and raising the debt limit every few months.

Now, if the fed does what Wolf suggests, 10s of millions will be laid off. Because many companies and jobs only exist because of super low financing. So, that means millions on unemployment/welfare = more gov’t stimulus, which is the same as loose monetary policy.

In other words, the fed would have to be tougher than anyone believes they ever will, AND they have to stay strong for the years it would take to wipe out the decades of over leverage. Anybody think the politics would ever allow that to happen?

Big mistake used by you and a lot of others. Using the words mistake and error to describe the actions of the Fed. Their actions are neither in error or mistaken. Their actions, with Jerome Powell at the helm, have always benefitted the people they were meant to benefit the whole time. Mr Powell and his cronies have done exactly what was required to benefit the correct people in the correct manner for as long as possible. Their elephant hide skins, and their private jets, and their secured homes mean that how the people feel, who pay for their enrichment, mean nothing to them.

Watch for the Fed to bail out Blackrock, Blackstone, and others taking big losses in Russia (now) and China (later).

historicus,

Misconception here.

These are fund managers. The companies are NOT taking the losses, but their funds do — meaning investors who bought these funds are losing money. So if you bought a Blackrock mutual fund with heavy exposure to Russia, YOU are going to get hit, not Blackrock.

These headlines in the media are misleading — it’s not Blackrock that took the loss, but investors of Blackrock’s mutual funds.

So the Fed doesn’t need to bail out Blackrock. Blackrock is not at risk — investors in its mutual funds are.

The Fed doing one of the things Wolf suggested is already a miracle. The Fed doing all of those things: never.

Selling MBS? Won’t someone think of SocalJim?

Great, and most certainly social media-share worthy as always Wolf.

Which I have done!

I would vote for someone or a party that would take Wolf’s stand. Am I alone? We are fighting for democracy in Ukraine……how about fighting for democracy in the US? I am sure that most voters who have an IQ over 100 (meaning in the top half) would be able to understand what Wolf is explaining and would be completely in favor of it. Studies show that our government does not generally act in ways the electorate wants. It acts in the way lobbyists want. We need to transform campaign finance reform and require our legislators and Fed leaders to take a basic economics course with an exam and they need to be replaced if they fail it. Powell is an attorney. His wealth has gone from something like 40 million on arrival to the fed to 80 million now or about that. That can explain his actions.

Sorry, but I digress. Wolf is an eternal optimist. Who gets an M.B.A. when he should be at the top of the class in a Maritime College? His advice was good right up until we passed around Greenland. But I remind you that the last operating orders of the bridge officer were essentially “full reverse and mitigate”. The next two were “full stop” followed in a couple of hours with “abandon ship”. I say, stay this course and prepare to stove in the bow. Better to crush a couple of forward compartments full of import/export junk than to sink a vessel that has proven to be essentially sound. Take the hit, anchor the ship in the berg, crank up the bilge pumps, and file all those fat asses out of staterooms and put them to work on repairs. And start moving the other passengers over on to the cold but stable mass of hard ice (a.k.a. Cash is King). Destroy anything that interferes with survival including crap coins, derivatives, credit cards, and the rest of this shit that’s been dragged onboard. The new orders should be “Get hard or get off”. No tourist class tickets will be accepted anymore.

Continuing inflation input:

Coming LA-LB cargo surge to rebuild vessel backlog: terminals – 10 Mar 2022

Projections from the ports of Los Angeles and Long Beach show that after a lull of several weeks during the Lunar New Year holidays, import volumes will surge 30 to 60 percent later this month.

The halving of the backlog of container ships in Southern California belies a surge of vessel arrivals that will hit marine terminals in less than two weeks, illustrating the see-saw recovery of the largest US import gateway after 20 months of elevated Asian imports.

Shippers face rising fuel surcharges on top of rate pain – 11 Mar 2022

Geopolitical turmoil is pushing up bunker prices, significantly adding to carrier costs that will be passed on to shippers through fuel surcharges in long-term contracts.

Port of long beach and Mitch are owned by China.

Although it will take them longer to sail there, the Chinese really need to consider shipping to the East Coast instead – where various container terminals are sitting idle.

Not only is inflation at a 40 year high and rising fast.

But unemployment is very close to a 50 year low and still dropping – in fact, unemployment has only been lower than the current 3.8% for a few months in the last 50+ years – and was never lower during the Reagan and Clinton boom years.

The Fed does have a dual mandate so if unemployment was currently say 10% that might justify a negative EFFR.

BUT under the current circumstances, it makes no sense whatsoever.

Workers don’t count as ”unemployed” when NOT LOOKING FOR A JOB DnC!

So, once again and as always, ”unemployment” numbers from BLS or any other GUV MINT org are BS.

Seen this over and over in my decades in construction industry when seeing reports of per cent of our workers ”unemployed” were much closer to those actually working, because our guys, including me once, knew we could do much better working cash under the table until paycheck work started to boom again. Had many years with NO income at all according to the official Social Security list of my income per year, and many more with very little…

That was also due to employers never filing their 941s, far shore.

5 year breakeven inflation is now at an all-time record high of 3.52%

10 year breakeven inflation is at an all-time record high of 2.94%.

Both are rising fast.

The Fed has created their own dystopia.

in cash hurt by inflation

in stocks hurt by inflation and market action.

The Black Swan of Ukraine is why you dont have the “happy buttons” pushed all the time. Record stock prices and record low unemployment and the consideration to withdraw stimulus was met with….”dont ruin the party”. Even Keynes suggested pulling back when things are good. But not the MMTers.

Rules of Monetary Policy (Federal Reserve)