“Not only have the last two months seen supply shortages develop at a pace not previously seen in the survey’s history, but prices have also risen due to the imbalance of supply and demand.”

By Wolf Richter for WOLF STREET.

The signs of inflation building up in the economy are now everywhere. IHS Markit, in its release of the Flash PMI with data from companies in the services and manufacturing sectors, added to that pile of evidence.

For companies, inflation happens on two sides: what they are having to pay their suppliers, and what they can get away with charging their own customers, which may be consumers, governments, or other companies.

And increasingly, companies are able to pass higher input prices on to their customers – meaning, their customers are not totally balking at paying higher prices and they’re not switching to other sources to dodge those price increases. That’s the inflationary mindset, and it nurtures inflation.

This PMI data is based on what executives said about their own companies (names are not disclosed) and the conditions they face in the current month. No quantitative measures or dollar amounts are involved.

And this is what they said about their two aspects of inflation, according to Markit:

On surging input prices:

- “Inflationary pressures intensified as supplier delays and shortages pushed input prices higher.”

- “The rate of input cost inflation [in January] was the fastest on record (since data collection began in October 2009), as soaring transportation and PPE costs were also noted.”

- Amid stronger expansions in output and new orders, manufacturers experienced “significant supply chain delays, raw material shortages, and evidence of stockpiling at goods producers” that “pushed input prices up.”

Passing on higher input prices via higher selling prices:

- Manufactures raised selling prices “at the sharpest pace since July 2008 in an effort to partially pass on higher cost burdens to clients.”

- “A number of firms were able to partially pass-on greater cost burdens … as the pace of charge inflation quickened to a steep rate.”

- “The impact was less marked in the service sector as firms sought to boost sales.”

“Capacity constraints are biting amid the growth spurt,” the report summarized. “Not only have the last two months seen supply shortages develop at a pace not previously seen in the survey’s history, but prices have also risen due to the imbalance of supply and demand.”

“Input cost inflation consequently also hit a survey high and exerted further upward pressure on average selling prices for goods and services,” the report said.

These pricing pressures woke up in June, after the demand collapse in the prior months. Markit reported at the time that “inflationary pressure returned as both input prices and output charges rose for the first time since February, with both increasing at solid rates.” And “firms partially passed on higher supplier prices to clients through greater selling prices. The increase was solid overall and the sharpest for 16 months,” it said.

And since then, pricing pressures have risen in much of the economy, with food commodities, steel, and construction materials having seen a huge surge.

Food inflation – which the Fed ignores in its core PCE inflation measure – is off to a good start. Prices for wheat, corn, and soybeans have spiked to levels not seen in over six years amid strong export demand from China and low US stockpiles. Rising prices of agricultural commodities raise the input costs for food producers, which are already passing on those costs in form of higher retail prices for consumers.

Construction materials too, amid shortages due to the current land rush underway, as high-rise dwellers in some expensive cities are suddenly trying to buy or rent a house in the suburbs or the countryside, and homebuilders have jumped on board.

Lumber prices started spiking last June and hit all-time records in August and September, amid huge volatility, and nearly matched that record at the end of December. Though prices have backed off a tad in January, they still exceed all pre-August records.

“Lumber shortages are starting to bite: 31% of contractors report a current lumber/wood shortage, up from 11% last quarter,” according to the Q4 2020 US Chamber of Commerce Commercial Construction Index. More broadly, 71% of contractors reported some shortage in building products and materials, up from 54% in Q3, particularly steel, electrical products other than copper wire, and lighting products. Contractors also reported a skilled labor shortage, with 83% reporting “moderate to high levels of difficulty in finding skilled workers.”

Inflation pressures despite a weak economy and 10 million missing jobs.

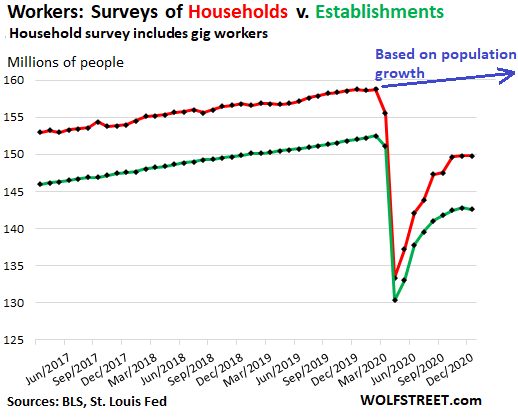

It is interesting that these price pressures are happening even as the overall economy is not exactly booming, with GDP down 2.8% in Q3 compared to a year earlier, while 10 million jobs have disappeared, according to the BLS jobs report for December, amid a suddenly weakening employment scenario since late last year:

Price pressures are now being reported across the economy. While lamenting the further deterioration in their business, companies in the service sector – the biggies are finance, insurance, healthcare, information services, and professional services – in the district of the New York Fed also reported rising prices and wages, as the Weirdest Economy Ever is playing out. Read… To Put it Succinctly about Services: Everything Drops, incl. Jobs, but Prices & Wages Rise

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Wolf,

Interesting! Great articles written by you again. Last two especially. I think of push-pull inflation, or demand and supply. Probably the latter. I’m in the weeds in this market waiting for that rotation. Stay safe. I have to get paid off course, and pay my taxes.

to bad we can’t pass UNEMPLOYMENT/RETRAINING Costs back on corporations

I propose any new unemployment be tied to $25,000 stipend for retraining

companies COMPLAINING ABOUT NO QUALIFIED HELP ought to be required to take on APPRENTICES(which the $25k is for) at minimum cost to TRAIN NEW WORKERS

but I doubt big corporates would appreciate SIMPLE SOLUTIONS

Congress should fund a national job guarantee program, making the government the ’employer of last resort.’ This would produce something akin to full employment and create a more healthy economy. Such a program would certainly be more efficient and far less wasteful than our current unemployment system.

Some seeds of Green New Industry (deal) dialogue?….just hoping…..

A proud Communist screed. amazing

Youbetcha, got my little red book to prove it. Just like FDR had his.

We are coming for yer “freedom fries” first.

Huh? Like the WPA or the CCC?

Send your sons off to build bridges for a dollar a day with room and board included? Hmmm. That employer of last resort could happen again. But will we stupidly trust our leaders again?

Weimar Republic V2.0. Hyperinflation when economy recovers. “Aprez moi me deluge” is most appropriate saying.

Darn spell checker: me deluge not me deluge.

LE deluge!

?

You need to take your autocorrect out the back and shoot it.

A p r e s m o I l e d e l u g e is “Federal” reserve motto now.

A $600 relief check that comes at the tap of a keyboard will cost what in compounded interest, inflationary pressures? It’s like two economic passenger trains switched onto the same track coming at each other, the engineers knew about it and knew they each needed one mile to stop but only had one mile of track separating them. Even with brakes fully engaged there was nothing they could have done to prevent mass destruction. The engineers did what they could- and snuck off at the last station. The train wreck will panic everyone, they will insist that those two engineers not be jailed for not warning the passengers but will be lauded as having the right kind of experience to clean up the carnage. Playing the game of chicken by hoping to jump at the last moment is risky at best. Get off the train, sell your ticket and buy a horse while there’s still one to be bought.

What goes up, must come down. Simple explanation and reasoning for what seems to be coming. Whether bear or bull, at this juncture the bubbles in the economy keep expanding and it seems as though inflation (among other issues) may be the pin(s) that pop them. Anyone else see a pattern here? Have a gut feeling? Can’t be only myself.

I ordered in a batch of bearings I needed to build some garden tractor implements for a customer of mine. Their stock was low so I got them in two shipments. I just purchased them from a web site so I did not have a fixed price contracted ( they had not changed in price since 2014). The first half was shipped and billed on Dec 1 and cost $17 each. The second half was shipped and billed on Jan 12 and cost $20.50 each. These are commodity level bearings from a major industrial wholesaler. The same thing has happened to steel prices in the last two months. These are price increases at the bottom of the retail chain. Before they get to the consumer they will be marked up by me ( the manufacturer), the wholesaler and the retailer. Hold on tight.

“Before they get to the consumer they will be marked up by me ( the manufacturer), the wholesaler and the retailer. Hold on tight.”

Until you have no more customers.

That may be true, but it is the predicament of our time. The made-in-america garden implement business( for Italian made tractors) has very thin margins all along the chain so sucking up significant price increases from lower on the chain is not really an option. That might be why you can’t buy an American made hair dryer any more. I think these prices increases are a sign of the times and will force people to buy just what is really important. Do they buy tools to grow food or a power massage chair from Costco?

Dang!

I hope you’re right.

If no-one goes to Costco, I’ll be able to get that sweet chair on sale!

…. an’ all the beer and pretzels a guy can eat….

Hurry! Buy your chair before the price goes up! As that mentality spreads costs will accelerate.

At the place where you buy your new metal, do they still have a “pay by the pound” scrap pile, or are those long gone along with day old bread stores?

I bet even the scrap (non car junkyards) dealers have tightened up.

I even hit the JC auto shop (where the whole campus dumped metal stuff) during times when few were around, and was eventually busted for it. Traded it to custom fabricator friend for use of shop and work on my container house project. 2013 or so.

I recently priced a bandsaw which is made in Austria. In 2015 this model was about £1500? collected price from the showroom here in the UK. Today’s price is £2500 collected BUT has an 18 to 22 week lead time 20% deposit required. That means 6 months wait imo. I asked if they would guarantee to hold the price. Salesman seemed surprised I asked that question.

Seems to me that people are buying stuff NOW because either they expect it to be more expensive in the future or totally unavailable. (stocking up. TP, canning jars (which are still outrageous despite being off season, what does that say?). And they have “free” money right now (fed $600, payment holidays (rent, mortgage, student loans), better stock up now cuz money might not be there in the future.

LG,

Remember, if you have lots of, or a surplus of stuff and friends need some of it, you can lend it to them for an IOU.

Bill asks Joe, “I need ten pounds of 10 penny nails, there are none at the store. I will replace them in two years, no matter what the cost.” Joe also can trade those nails to Bill in exchange for ten pounds of pasta.

None of this works if their shelves are barely stocked however.

You people are all acting like they can’t or won’t produce more stuff (not true). People are temporarily buying more than the output of the economy due to monetary distortions (and where they spend the money) which drains inventory now, BUT, prices, wages, and the amount of stuff produced will still seek a new equilibrium. Since a lot of this demand is temporarily from stimulus checks, and shifted consumption patterns that business can’t adapt to quickly, this all suggests short to intermediate-term inflation.

You still can’t get around the issue that individual income with respect to aggregate income still represents the divvying up of economic output. The increasingly richer rich take a huge chunk of that income and then don’t spend it, they just buy assets. The cash, however, has to sit somewhere, and as long as someone is sitting on it and not rushing to use it, then you probably won’t see sustained high level inflation. Perhaps I should say stagflation should theoretically be temporary. Unless profit margins explode, wages are usually the largest cost input that determines the end price. I don’t see those going up soon though either, the stats in the headlines over wage growth are probably statistical illusions.

If prices, wages and production naturally found an equilibrium, then we wouldn’t be having a wage stagnation crisis in the first place. Selective laissez faire policies are building cushions for the upper class and voids for the lower class.

That IS the equilibrium. The modern economy is eliminating low skill jobs and generating most of the gains for the owners of capital especially as technology keeps on progressing. Ever look at the job postings at various companies just to see what they’re looking for? It’s an awful lot of cyber security analysts, data scientists, machine learning experts, developers and so on. The rich are looking to hire stewards of their capital, but they need consumers as well. Unfortunately most of those consumers aren’t getting the jobs needed to command higher pay. I agree with your second sentence, because that’s exacerbating the trends, but not your first sentence. Without a ubi or minimum wage, incomes will probably continue to stagnate for the lower half of earners. I do not believe that is entirely the result of conspiratorial lobbying efforts. However, moving forward I would not be surprised if the rich elite tried to dissolve democracy and resurrect inhumane eugenics efforts simply because they would have to support the lower classes otherwise.

Peta-Rhodium-

“Equilibrium” is a SWIPED Science concept….actually just the word was swiped, and using “natural” adjective makes it even worse.

The “Economy” isn’t DOING anything. It is just a result of people’s ACTIONS. Something to be studied like the rest of the SOCIAL sciences about what people DO. And it’s close relative, accounting, is just a well refined language for using the human social construct of “money”.

Government lobbying IS the almost all controlling conspiracy, and always has tried to be, at least since the corporate/big money/big land guys began hiring “borers” soon (10-20 years?) after the Revolution.

With one goal. Promoting the interests of those who can AFFORD to hire the most, or most powerful lobbyists. Punching far above their true democratic weight.

No rules, people are bought, sold out, cheated, and controlled. They are constantly forming one little conspiratorial group after an other, with SHORT (and long goals, in the sense of adding a bit of law or whatnot, so as to move things in a general direction) term goals. A powerful lobbyist can easily have a congressperson “in his pocket”, maybe even a prez?

Lobbying has to be banned along with the ultra wealthy’s vote manipulating stuff like Citizen’s United, etc……. If we want this pursuing of Democracy thingy to work. And corporate law must be “adjusted” in very major ways.

Nothing about corps or lobbyists mentioned in the constitution, that I know of.

But you have a good point, the present oligarchs may have to figure out how to thin the herd if they want themselves and theirs to stay way on top, instead of working out a more democratic solution, where they lose power.

It’s why I am “kinda” glad for the A-bomb….too many of those birds fly ALL lose. We might have had WW6 by now, without it.

Quite a pickle for them, eh? Wondering what their next move is or if they are organized enough, occupies a lot of my thinking time.

In the Classical Economic trade-off between Capital and Labor, the wise old men never contemplated Central Banking using Fiat money to fund Capital with unlimited, costless money to run up asset prices.

By robbing savers of their honest rent on savings, and giving it to the new Princes, then Labor is knee-capped.

Capital systems and Machinery are dishonestly subsidized at the expense of the voiceless.

Such is the Totalitarian State we live in, masked as “Capitalism”.

Too Big to Fail was a Political imperative, not an Economic necessity.

Yep, Kam.

Marx, Ricardo, et al, never had the even slightest clue that bit of “financial engineering” would enter the mix..

Yeah. When I lived off grid EVERYBODY had a good sized “boneyard”, 1/8 to 1 acre depending on how much building and how much scrounging they did. (40 acres min parcel size).

We did a LOT of swapping, not with food very often, maybe good sausage or smoked pig.

Go OLD School and reuse storejars.Everything in life needs not to come from store pr benew!! :-)

Has the basket of goods used to measure inflation started to include services like health care and education yet? or “services” like housing yet?

How’re we looking on that front? Is this what it means to live in a “service” economy?

The Fed is working on that and will some announce it’s updated services inflation index to include a basket being the price of dirt on Mars, salt water amongst deep sea worms, and hydrogen on the Sun. The Fed is forecasting zero inflation for the foreseeable future based upon this new and improved index.

at least we have iphones now.

The iPhone prices are stable due to Hedonic Quality Adjustments. No inflation here.

Timbers,

You domestic terrorist you.

To the re-education camp with him. ?

Until he understand justice and equality and a wept those things into his heart. It’s good for him and back up with data.

?

Just want to add that it’s not just companies that face “inflation on two sides” – individuals are squeezed the same way. Individuals pay “suppliers” (payments for food, clothing, taxes etc.) and also have to worry about “what they can get away with charging their own customers” – i.e. their employers.

The details are different, but the principle is the same.

Once you start thinking of yourself as running your own business – no matter what you do or who pays you – many useful ideas from the business world carry right over to the personal financial world. And vice versa.

Anyway, the inflation is out there, and the Fed is deliberately stoking higher inflation expectations (2% is now a “symmetric” goal), so a lot of practices predicated on a stable dollar need to be thrown out and rethought.

Finally, going back to Ben Franklin is the idea that the real measure of an economy is not GDP, not profits, but the collective output of all the labor and resulting quality of life. It’s harder to measure that in something other than dollars, but it’s possible to measure some of it, and it’d be valuable to consider it. Many goods and services can be measured in units rather than dollars. Leisure hours would be another metric. And so on.

The best metric of “inflation” might then be whether those quality of life metrics are improved (or not) by whatever combination of supply and demand price changes occur. It’s not necessarily the case that price changes themselves are bad.

@Wisdom Seeker

That’s a neat formulation, the worker as having his client, but applies only to the worker’s grave disadvantage in the gig economy, for one, and barely much in un unionised industries

Organised labour is an answer, but that looks unlikely

Well being is rather communal than individual, can be measured in this sense, as per- evidently- physical health, but is impossible to quantify in the other, for this is idealistic, unrealistic and of boundless scope and ambition, designed in other words not for this world

Maybe just equal number of pro-worker decision making seats on the board of directors of a corp by law? As opposed to their separate organization and striking being the only thing that brings their viewpoint and insights to the table.

Corps at present are just fascist states (bigger than many countries) allowed by laws they fought for, to exist within our overall democracy effort….and not fitting in well at all, if that is our common goal.

Indeed. Remote workers like myself who left HCOL metros for super LCOL areas are enjoying a massive deflationary effect that inflates quality of life, the measure that matters.

Accepting inflation is optional to a huge degree. Americans can still vote with their feet.

This is true for Americans who can vote with their feet. You do need transportation and money available. Connections are helpful too. Too many of us are trapped like drowning rats.

Feels more like quicksand.

Till the day comes you can’t login to work. Better save rather than inflate that “quality of life”. Hope you are learning that “LCOL” lifestyle.

Fine thoughts. Thanks.

Indeed, most of macro and micro economics laws may be applied to the personal life.

Yet two big limits.

First, the return on investment is low. It is like practicing day trading with $100 and no leverage.

Second, what is statistically true at macro level, regularly fails at nano level due to inherent uncertainty of personal life.

In short, nothing wrong with applying golden rules for personal life, just don’t forget the common sense and overall proportions.

Yes, thanks for the reminder that MacroEcon is generally wrong.

Disagree about “returns on investment”. Micro returns in personal life are actually enormous, especially on a percentage basis. There are many ways in which making (or foregoing) a small expenditure can provide huge returns, and vice-versa. One of our best investments ever was a sun shade (fabric) that we hang off the side of the house in the summer months; cost was $30 and every year it saves us $100 or more in A/C costs.

On the other side – minimizing expenses – kicking that daily Starbucks (or smoking, or alcohol) habit is worth, say $5/day, $150/month, $1800/year, $72K over a working lifetime. Even without interest that’s worth 2 years of median-wage retirement income after 40 years. With investment compounding it’s even better. Toss in making your own lunch (instead of buying one) on workdays and you double that benefit.

Which reminds me of that classic joke:

Wife: “Honey, it says here that if you’d saved your beer money, you could own your own airplane by now!”

Husband: “Yes Dear. And since you don’t drink beer … where’s your airplane?”

I used to be one of those people who went to the local coffee house every day. I finally did the math and went and bought my own espresso machine in 2007. It was like $500 or something, but a few years ago I added up the savings and it was over $15,000 I had saved by making my own. And the machine is still going strong today though I make coffee more often than espresso.

Nice to have a frugal upbringing of yours, eh? Bet you even shopped around for used expresso machine. Many to choose from?

?

David,

I believe the inflation is the physical stuff here on earth Timbers was writing about. I think hydrogen is like a dog chasing its tail though. Dirt not so much without a house on it. The fed has debased the dollar so much we need more dollars for everything.

Timbers,

Salt water amongst sea worms. Haha!

Not nice to laugh at present day relatives of one’s own direct ancestors, have you no respect for the dead?

There are other inflatory signs which are not recorded. One example would be flyer offers. The flyers round here are about 1/3 the number of pages they were before the pandemic, and the offers usually less good. It is still possible to get staples at close to last year’s prices, but the offers are less frequent. Lots of processed foods have similar prices to a year ago but shrinkflation in package size is very common. In practice therefore, Joe Average is paying higher prices than last year.

This being deep rural, many have resorted to doing things for themselves. Portable sawmills, distilling vessels and seeds are very hard to come by. This may actually put downward pressure on prices of the finished products in the stores in a few months.

Shrinkflation is common these days, and I bet if flies below most consumers radar.

I’m not sure how gubvermint accounts for shrinkflation in their official CPI prints, since shrinkflation means product weight or amount is reduced while package size and sticker price stays same.

Just how widespread shrinkflation is in economy is a big question, but I bet it is significant and will increase.

Food product shrinkflation will reach its logical extreme I guess when, for example, a snack product shrinks from a satisfying small meal to just a single bite or gulp but you are still paying full price.

Not unlike that tiny bag of peanuts served on airline flights.

Kudos for distilling vessels!

I’m skeptical. This could just be transitory price increases.

I don’t see how you get wage growth in a country that’s pushing a million new unemployment claims a week, and I bet the velocity of money is still in the gutter. The Fed reports the Q4 number next week.

Without demand from the economy (velocity) or workers (wage growth), where does real inflation come from?

In the most simple way, as the article pointed out, inflation comes when demand outstrips supply, assuming a free market, and a perfect vacuum.

It’s essentially a bidding war for the same level of production.

Or what a shrewd business owner will do to prices when they realize they have no competition.

More money floating around an economy helps, but inflation only occurs at the point of purchase.

I’m not playing, ever hear of a low buy year, it’s a millennial thing which I will be copying.

Forbes has an article on it. Sounds good except it requires taking a real hard look at your lifestyle and what to give up.

Good luck and keep us posted!

Depends on your starting point to a large degree, eh aa?

Quite easily done for those of us who only have to give up that daily dose/bottle of, say $100 per bottle ”liquidity”,,, and replace it with a $10 bottle of almost equal taste and effect.

Really amazing how the quality of various liquidities at the $10 range has increased SOOOO much in the last 20 years or so!!

OTOH of course, those of us who have been rippling for years already might have to go without…

Depends on your starting point, fa shore…

If you still have commercial cable TV, get yourself an Amazon Firestick, learn how to program it (with the help of YouTube web sites) and cancel your cable. You can plenty of free or low cost programming via your Firestick.

If you have a Roku device and a local library card, ask your library if it is a participant in Kanopy.com. My county gives free access to 8 programs (movies and documentaries) a month via Kanopy.

Businesses which had to spend a lot of money making their facilities Covid compliant will be raising their prices. Some may just shut down if they can’t make their prices increases stick.

Are we entering into a period of stagflation, like in the mid 1970’s?

I cancelled my gym membership because of covid and bought a recumbent exercise bike for home use. I have already recovered more than cost of the bike and some other exercise gadgets because I am not paying high monthly gym dues.

Just as the Fed practices bond yield control, they will slow up on the free money for inflation control; it will especially control stock market inflation.

Joe in LA,

I tend to agree with you. The wage-cost spiral has broken, and increases we are seeing in inflation arise from (1) COVID caused supply shortages and (2) one time impulses from Fed stimulus programs and Gov spending programs. It seems to me there is still a strong undercurrent of deflation underpinning the economy relating to, again COVID caused, demand decline mostly in services. Yes it is the wierdest economy ever.

Right, if we are in an inflationary phase, why does the Fed have to pump QE and buy MBS to prevent market-crashing asset price deflation?

Yup, short term supply shocks from covid vs long term on open “market” operations via BOJ, ECB, PBOC, FED…

Maybe the markets dont belong this high.

Maybe the Fed put them here and is trying to keep them here.

So the aberration is the issue, and the need to perpetuate the aberration. Nothing more.

Joe,

Who owns the FED and how do they make a large amount of their money…?

“…why does the Fed have to pump QE and buy MBS… ”

That’s the inflation!

Wage growth will come with the higher minimum wage. When the new employee is getting the same wage as the trained employee the employer must increase the wages of the trained employee or be ready for a lot of turn over in his work force. Good skilled trained employees are hard to fine regardless of the industry or pay level of the employees.

A noticeable amount of inflation comes from the Marketing Department when new research shows they can sell the same thing for more money.

Reporting from a small/mid sized manufacturer serving the transportation industry…

We are feeling rising prices all around. Steel prices are rocketing higher – up 30-40% on core materials from 2020 lows. Suppliers of other manufactured components have been hitting us with low single-digit increases pretty broadly. Plenty of material shortage warnings, but nothing has stopped production yet.

Healthcare expenses have risen to a point where we had to take action adjusting the plan benefits and raise our prices. Total expenses usually land around 4% of revenue, and they hit a record over 10% in 2020. This is without any COVID related hospitalizations! In an industry where 3-5% net profit margin is admirable, this one stings.

Luckily orders seems to be picking up from a fairly rough slowdown in 2020, most of which we attribute to pent-up demand as several good customers spent $0 last year.

Who knows what the future holds, but this feels a lot like the start of rising inflation to me.

> Healthcare expenses have risen to a point where we had to take action adjusting the plan benefits and raise our prices. Total expenses usually land around 4% of revenue, and they hit a record over 10% in 2020.

Aren’t you better off asking your employees to sign up for ACA (if you have under 50 employees)?

We have over 50 employees. Plus we are those weird (maybe naïve) business operators who still believe long term success is a result of treating our customers and employees well.

David,

So it is not the market, it’s the fed!?, with the push. The demand would be the pull. All in all it is the dollar!? Stocks being pushed and commodities. Right Wolf?john

Since when has the Fed controlled production of commodities?

They can give out free money all day long, inflation only happens at the point of purchase.

When production of goods, doesn’t keep up with demand, the forces of capitalist market competition, no longer keep prices, from increasing, by opportunistic business owners.

Lay off the conspiracy theory sauce.

You do realize there are a myriad of inter-business purchases before anything gets in front of the consumer at the point of purchase?

David,

Point of purchase started in the market with fed printing money, to banks who bought and pumped up assets, or pushed up assets, driving up prices now like commodities. Driving demand for those eventually, with a weaker dollar. No velocity needed with constant money printing. So with covid and unemployment high and losses on small businesses I don’t see how it’s not the fed and the banks. I’m sure Wolf could explain it better, but when it comes down to it, it works for me.

It’s amazing you can double down on being wrong, and expect wolf to show up and back you up.

At this point is clear you’re just spouting canned ideology instead of thinking about fundamentals.

You have a right to be wrong, but a responsibility not to be.

We have seen lumber price increases in small town fly over country. I priced some 4×8 plywood at the local lumber yard last week. Now up to $40/sheet vs around $10 last year. I want to buy local when I can, but didn’t even buy any.

And:

“Lumber shortages are starting to bite: 31% of contractors report a current lumber/wood shortage, up from 11% last quarter,” according to the Q4 2020 US Chamber of Commerce Commercial Construction Index.”

Here’s a great idea, let’s put a 27% tariff on Canadian softwood lumber to protect the inefficient skidder logging industry of the US south and NE. pssst, don’t tell anyone, but it’s winter here and I see logging is still going gangbusters on the BC coast. Low level winter shows, but they still cut framing lumber out of it and use the big stuff for peelers. How much does that add on to new construction?

The piss off is I have to pay more in Canada for our own product. Every market is global these days unless you’re buying farmers market produce or companionship.

Companionship can be global too. Mail ordered that is….

As for the produce… obviously you need a Costco and a Walmart in your neck of the woods.

?

I mean that’s the whole point of tariffs isn’t it? Are you saying people should not expect to pay more when tariffs are in place?

It’s LITERALLY the extra price you pay to support your local industry. Questions about whether or not the industry “deserves” to be supported due to being “lazy and inefficient” are a separate question.

It sounds to me like the shortages are large enough that the tariff isn’t the driving factor in most of that 4x price increase. It’s the cause of some of the price increase, for sure … but that part is the part where we’re paying extra to USA lumber producers. People can’t complain about “keeping jobs in the USA” without being willing to pay more for the products those jobs produce, and this is EXACTLY an example of that.

Z, it seems tariffs are to support your Federal government. After the government massages the take some lesser amount may trickle down. Does your county have local import tariffs?

Yeah, “inefficiency is a separate question”. I’ve often thought we should terrace all the hills around here and grow corn for big hillside ethanol plants. Then CA could slap a big tariff on Iowa corn AND ethanol. Tens of thousands of local jobs would be created.

Speaking of efficiency anyone else not yet seen this drone outfit? Appears to have found a drone type and niches where it is efficient and seems to work well. (Note the big time investors who feel the same way I do.)

https://en.wikipedia.org/wiki/Zipline_(drone_delivery)

…and note that high aspect wing….that thing is running powerless glider efficiency!

Lisa_Hooker I guess you don’t understand the purpose of tariffs? It’s to raise the cost of an imported product artificially so that locally produced products can compete more easily on price.

I think you’re bringing up the federal government because you expect the tariff charges to somehow trickle directly down to local companies producing products that compete directly with foreign companies subject to that tariff?

It doesn’t work that way. The benefit to local companies is in artificially increased price competitiveness. Consumers who pay the tariffs are essentially paying taxes that will (theoretically) eventually benefit themselves like tax receipts are supposed to do (providing government services).

Zantetsu,

Tariffs are a tax on corporate gross margins. That’s just as simple as it gets. That’s why Corporate America hates tariffs. And that’s why there is so much propaganda out there against tariffs.

Some of that tax may be passed up the supply chain (we have seen lots of that recently, with suppliers eating the tariffs), some of it may be eaten by the importer, and some of it may be passed on to the end-user.

Every company already charges the maximum it is able to charge while still being able to accomplish its sales goals. That’s why it is hard to pass on tariffs. There is resistance out there.

A company can dodge that tax by using suppliers within the US.

Tariffs remove some of the incentives for Corporate America to offshore production.

@Zantetsu – it’s obvious you have never read any US history. Tariffs were a primary source of government funding along with excise taxes, for a long long time. Weren’t you required take US History in high school in order to graduate?

Lisa, I’m talking about what tariffs are used for now, why we have them now, why Trump put them into place NOW, I’m not talking about their purpose in 1877. But I mean that’s obvious, and I am getting so tired of having to state the obvious.

Paulo, covid19 has severely affected the short term “companionship” business.

Some of the mills shut down earlier because of Covid and created a backlog of lumber products. Possibly started again with new lock down measures on the west coast.

Small town in Texas…..

I’ve been putting up a new outbuilding, so have been watching lumber prices.

Bought a load of pressure treated 2×4-8 for $5.99 each 2 months ago.

Went back yesterday, now $9.29 each.

!!!!!!! A 55% price increase in a couple of months!!!!!

Maybe I’ve lived a protected life, but in my six decades of life I’ve never seen bare shelves at local retailers…even Walmart. I understand the reasons why, but it is an alarming experience.

Gets me thinking. A ‘new normal?’

Yeah but remember when those shelves weren’t half a mile long and the produce and seafood was seasonal – so you didn’t get strawberries in winter?

Now you can pump your own gas, doe.

“Manufactures raised selling prices “at the sharpest pace since July 2008”

Ah yes, the legendary hyperinflation crises of July 2008…if we are comparing to that we should be right at the bottom in a jiffy.

In all seriousness though it says a lot doesn’t it.. manufacturers passing costs…it didn’t mean anything then it doesn’t now. 10 mil jobs have vanished, 10 million families without income without spending power, a deflationary economical disaster and a human catastrophe, yet somehow out of this we are expecting inflation to arrive anytime soon now all because a 6000USD per family on average that is meant to last a month to offset a loss of income that lasts a year at best.

You forgot the real stimulus – the “extra $600 per week” on top of regular UE bennies that was carrying the economy all summer and into the fall, which is now an “extra $300.”

Reminds of Trading Places where the twins give a five dollar yearly bonus to their butler. Oh thanks, he said maybe i’ll go to the movies.. all by myself. :)

Look, i am not saying 6000 USD is not generous it is, but it’s not enough to offset the economic disaster people are facing, let alone produce the type of inflation that people are predicting.

If inflation could be stopped with austerity then austerity would never end. Lucky for us austerity fuels the decline of easy money. Hard money is the only cure for inflation.

The austerity that actually works is the austerity that begins at home.

It sounds like you are saying “inflation is impossible because poor people can’t possibly suffer any more”. I think you have your cause and effect backwards.

Not at all. If you kill the golden goose it stops producing.

Guess you have never experienced hurricanes, earthquakes, tornados, floods mit?

Right before and after each of those natural challenges, the shelves of most food stores are usually bare of bread, milk, eggs, even some can goods,,, and those bare shelves have continued in some places for weeks in my limited experiences.

There was no power to parts of south east FL after one of the bad ‘canes in the early oughts for 3 months, and in that case most stores either got generators going quickly or shut down.

Friends have told me of Walmarts in small towns in flyover country where many of the food and other shelves are bare almost every Monday morning, though usually at least partially restocked by Tuesday.

Working in late 1950s in the only ”super market” in a very large county in FL, we would be out of some stuff, usually the loss leader, for days between trucks arriving.

I’m with Joe in LA that most of the current shortages are due to sick personnel disrupting the supply chains and will end when this virus event is at least majorly under control, as it will be sooner or later.

And as a hedge against inflation, I have bought silver for the first time in my life…

Read somewhere all the gold in the world is $10 trillion and financial assets $400 trillion. If 5% of financial assets try to get to gold it’s a big deal.

But new “gold” can be invented now in the form of cryptocurrency. Bitcoin already took some share of gold’s market. Other cryptocurrencies will be added and do the same, relieving some of that “pressure” into gold that you talk about.

It doesn’t matter if you believe in cryptocurrency or not. It doesn’t matter if you understand it or not. It doesn’t matter if you like it or not. It’s already happening and will continue to happen.

And I for one think it is awesome. Bitcoin itself is an unfortunate reality because its technology is basically driven off of “who can burn the most power to earn bitcoins”, leading to a power usage arms race that is bad for the planet and means that the entire tech is pretty unfeasable (can only do a dozen or two transactions per second, which is laughable). And it’s the cryptocurrency that came first so it gets the lion’s share of the market.

But that will change. There are better technologies that don’t suffer from those shortcomings. And they will take over eventually.

“Eventually” we will all be dead.

“But new “gold” can be invented now in the form of cryptocurrency.”

That’s not gold, it’s an elaborate scam.

POW is saving the planet. Electricity previously not able to be transferred is now transferred globally through Bitcoin. Iceland is exporting renewable energy through Bitcoin. China is utilizing more”wasted” energy because of Bitcoin.

Between bitcoin, renewables and batteries, big oil is going to have a very rough future. Or if you were paying attention in the spring, producing oil costs more than it makes from selling it. Negative oil is the canary in the coal mine for a central bank that has zero interest in letting that ever happen again. Bad news for fiat. Good news for shorting fiat.

Smart move Silver is VASTLY undervalued and should prove to be an excellent hedge against this insanity

Oil price hikes are coming too.

Just yesterday – Canceling oil infrastructure projects, banning drilling on public lands and a plethora of proposed new taxes.

Oil is still used all throughout the economy, to include making fertilizer.

Wonder when the Fed breaks its near zero interest rate policies…

New administration is surely lurching towards some form of New Green Deal, which likely would involve incentives (taxes and carbon credit nonsense) that will result in increased energy costs (it will punish fossil fuels like oil, natural gas, and coal). So anticipate future big inflationary pressures on transportation, shipping, and other related areas.

Food inflation and even food shortages will increase for foreseeable future, based on what I’ve seen of global food production hits due to weather and trade. China is the big player here– they are buying up a good deal of other countries ag production, including US.

If new admin pushes through a large national infrastructure initiative that will only add fuel to the existing fire of surging commodities and materials supply-driven cost inflation. Real materials shortages might be persistent.

But of course the Fed will be delighted with all this new inflation. It is just what doctor Powell ordered. And the public will have to like it too … because it is for their own good.

There is already inflationary pressure in transportation and shipping as Wolf highlighted just the other day

Unfortunately it will all continue to degrade. There will be breakthroughs in science but you can’t change numbers nor climate change at this juncture.

Nor can you change human nature, greed, sloth, or deceit. Some enjoy the ride, some push the train, many lay in poverty by the trackside. There is a bright side, keep looking into sun. Great comments, excluding this.

Wolf and “gang” are a great insight

Taxes:

Pretty timid. Doesn’t even come close to reversing the massive tax cuts for the rich his prior administration made permanent.

“…households making more than $400,000 per year may open their wallets less frequently if Biden succeeds in raising the federal income tax rate on top earners from 37% to 39.6%, the experts said. He also wants to apply the higher tax rate to the investment gains of millionaires.”

Making capital gains to same rate as income is a good thing, yet it says he only “wants” to do this? Ok then. But I’ve read that unless we eliminate the interest carried forward thingy, the super rich will never pay more than about 15%.

Also why isn’t he increasing taxes on corporations? They move all their income to foreign nations and end up paying nothing while reaping benefits from QE and Fed policy. Not fair.

“Making capital gains to same rate as income is a good thing, yet it says he only “wants” to do this?”

Given the outrageous actions of the FED and its “no billionaires left behind” policies, I’d be OK with a capital gains tax rate DOUBLE the rate of income tax. Taxing labor higher than some sh!tbag is taxed for running algos to pump and dump crypto is disgusting.

You’ve chosen the most extreme example to justify your point and incite yourself. Not the smartest way to think about any policy.

For every “crypto pump and dumper” there are 10,000 investors making decisions which collectively help allocate capital in a market efficient way. It’s a big part of what has allowed us to produce technology at a rate that has basically overcome every other failure in our market system, political system, and financial system.

Without speculative capital we would only have a small fraction of the technical improvements that we’ve seen in our lifetime. Do you like the internet and all the services it gives you for free that you use every single day, including wolfstreet.com? Wouldn’t exist without all the speculation that went into the dot com boom. Nobody would bother development tech if they didn’t have those huge “going public” dollar signs dangling in front of their eyes.

Zantetsu,

No need for me to explain how legalizing illegals paves the way for the next 11 million illegals because you just did:

“Those legalized will now have to be paid minimum wage with expected benefits instead of whatever poor wages they were getting as a result of having no legal rights to demand more.”

Going just on my limited memory, this legalizing illegals thingy has been going on since at least Reagan.

Rinse, wash, repeat. As you yourself implied in your own words.

timbers, I think you replied to the wrong comment, but I see what you are saying now. Without any effort to limit the next wave of illegal immigrants, legalizing existing immigrants would just create demand for more illegals.

It would also put the newly legalized in direct competition for jobs with newly illegally immigrated, which would be bad for them and had for the taxpayer.

“For every “crypto pump and dumper” there are 10,000 investors making decisions which collectively help allocate capital in a market efficient way. It’s a big part of what has allowed us to produce technology at a rate that has basically overcome every other failure in our market system, political system, and financial system.”

This is what I call pure, unfettered horsesh!t.

Depth Charge, that is the way it was at one point. But you are correct, to extrapolate the past equities market to today is complete BS.

Comments won’t nest further. To Zantetsu, Internet was DARPA, so not exactly speculative capital.

Bidens top legislative priority is to make illegals legal.

He does not care much care about taxing more the rich or corporations.

After all these people paid for his campaign.

Yes, also noticed that. Very telling that was one THE first big actions. Driving down wages is one thing both sides agree on, and legalizing those 11 million already here paves the way for the next 11 million of cheap labor.

Timbers, even cheap labor pays taxes (SS, Medicare, Income tax). That’s what it is really all about. The more the merrier!

Re cheap labor:

While eventually most immigrants, both legal and otherwise become tax payers, many of both do not join that elite group at the beginning of their stay in USA, and I have heard similar for other higher paying countries.

Worked with many many immigrants who purchased their SS card and all other ID needed to pass the E-verify a decade or so ago,,, and the one thing they had in common even though from many different countries was that they worked for cash for years until some one offered them a much better deal if they had all the ”bona fides” needed.

One example of the former is the practice in FL to have one general contractor legally sub-contract to a sub who subbed to another sub until the final sub with no insurances, etc., paid cash, usually about 1/4 of the going rate.

Have seen several times the ice folks come in and take every single person actually working, as opposed to ”managing” from a work site… and a couple years ago just the opposite when a union rep came in and took every single sub worker to the hall and ”signed them up,” with a promise of full legal status that I heard later was honored.

Weirdest economy,,, and equally weirdest labor market this old boy has ever seen in 60 years in the construction industry.

And ”hats off” to both the very hard working folks who are willing and able to work, and that particular union that realized the direct path to keep their union strong and able to fulfill it’s mission.

Suggestion earlier re apprentices from joe in LA IIRC, is right on the money and one of the reasons why LEGAL immigration into USA should not only be continued but expanded, until young folks realize the benefits and satisfactions of doing manual labor and employers are able to pay accordingly.

timbers how in the WORLD does legalizing illegal immigrants “pave the way for the next 11 million of cheap labor”?

Those legalized will now have to be paid minimum wage with expected benefits instead of whatever poor wages they were getting as a result of having no legal rights to demand more.

Please explain how increasing wages “paves the way for cheap labor”.

The trick is to get inflation so high every pizza box folder earns over 400K

Corporations do not pay taxes. Taxes are passed along to the shareholders through reduced dividends, employees through lower pay or customers through higher retail prices

Thank you Chuck. I don’t understand why everyone doesn’t see this. Corporate taxes are simply an indirect tax on the consumer.

I doubt that. The King of Saudi Arabia controls oil prices. He wants it in the $50 a barrel range. Any higher and all of OPEC will be cheating, Russia will go berserk, and the Frackers in America will start bringing production back on line.

Oil is subsidized. Price hikes aren’t coming to subsidized oil. Subsidized means there is no market for what you are already producing. Price hikes on oil when everyone is now working from home and the thought of owning vehicles for every family member is no longer needed.

Oil died in the summer and renewables won. Investing in oil means buying oil currently in the ground that may never leave the ground.

Everyone is not working from home. The traffic around here is back to normal (mostly gridlock) and the gas stations have waiting lines. Oil and natural gas are the foundation to this society. Try living with out things made of plastic for instance. Or heating your home and hot water tank.

I would LOVE to try living without things made of plastic. Yes life would be less “comfortable” for sure, but I am 100% certain that I and everyone I know would survive and still live happy lives. Even happier in the knowledge that the world wasn’t being destroyed by plastic.

And please for the love of god do not reply and tell me that I can already live without things made of plastic just by not buying anything made of plastic, which completely misses my point, which is about a world where nothing is made of plastic. Just me not using plastic will have zero effect on the world outside of the four walls of my home.

Zan,

Plastic melts, just like the oil it comes from, so it is very renewable.

Negative trends verse growth. Demographics don’t lie. Commuting was the biggest waste of time of my life. Trains were awesome because of being able to read. But driving? Forget it. Never going back to that.

A bad trend isn’t negative. A bad trend is a slower rate of growth. The trend is your friend until the end.

Living without plastic was done for 20,000 years. You can pay the carbon cost in electronics and still use polymers it’s the space age after all. But putting plastic on every apple and banana in the grocery store is just oil companies’ last dying breath.

“Oil died in the summer and renewables won. Investing in oil means buying oil currently in the ground that may never leave the ground.”

This sort of ignorance is shocking. The economy is 100% dependent upon oil.

Agree with you SO much dc, in spite of your initials, LOL.

Finally fully retired after 3 former tries after a few months of each of which I started climbing the walls with boredom AND watching several peers die quickly from what I considered equal boredom, I am living well today, but now see all this propaganda to make our economy go way down the tubes so that we can be more green more quickly is going to challenge my ”liquidity” budget HUGELY, and, more importantly the solidity of the budgets for my widow.

Been doing my best to understand what alternatives are available by studying Wolf’s great reporting and the opinions and reporting of the commentariat on WolfStreet.com, but not seeing anything anywhere that is attractive that does not carry tons of risk, including now rental RE…

I, for one, and pretty clear many are in my boat/way of thinking am hoping for some very high interest rates, ALA Jimmy Carter’s years,,, say 18%, etc…

Grand parents lived out their lives before SS with annuities with much lower rates, and according to my analyses, we can do so as well, with no debts, and in spite of the always rising property taxes and ”utilities” from city, etc.

Petunia on here has the right idea: peg all SS increases to the actual rises of utilities and property taxes and food, etc.

And first augment SS to the actual rise in COL for the last 20 years or so…

Every year oil energy losses big chunks of marketshare to…. Oil companies making plastic

Oil is so useless to humans we are paying other humans to take it from us (subsidized oil) and if we decide to stop putting it in our air the oil companies put it literally everywhere else.

Plastic is oils tantrum for not being the energy daddy anymore.

Restaurant prices are waaaaay up in the Denver area. Those restaurants that remain anyway.

Denver’s food scene sucked anyway.

Restaurant prices are way up in Phx as well. Between 20 and 30%. I guess they are trying to make up the loss in the number of customers by charging those left a lot more. I don’t think it’s going to work.

Most lunches in Phoenix area run $15 or so now. It’s really bad. Just a few years ago, it was closer to $8 to $10.

The FED needs to be abolished at this point. The game they are playing is so dangerous that it’s almost like they need to be arrested. Instead, they’re being rewarded. And now we have Janet Yellen as Treasury Secretary? This is like a bad joke. I mean, yeah, hire the person who stole everything from you as your new security guard. Brilliant.

Don’t worry. At the first sign of inflation on Mars, the Sun, or deep sea, Janet already has her WIN buttons (Wipe Inflation Now) ready, dusted, and polished. They’re sitting right next to her stamp collection. Betty Ford gave them to her at a cocktail party after Janet had been bugging her for years if she could please have them.

The Fed user to be fairly independent.

See 18% interest rates during the Reagan Administration.

This all changed circa 2010ish when they decided a recession must be avoided at all costs to defend a political party in power. And to use their power (openly admitted) to harm politicians they didn’t like.

“When you rob Peter to pay Paul, you always get the vote of Paul.”

And with that fine bit of wisdom, I’m done with this article. Nothing more to learn.

End the Fed

+1,000

Gunlach cnbc interview a few days ago was a good one. He is convinced that Fed will get inflation substantially above 30 year treasury for a long time. He is recommending a barbell strategy. 50% cash for and 50% things that will go up with inflation. Says bonds are bigger bubble than stocks.

“He is recommending a barbell strategy. 50% cash for and 50% things that will go up with inflation”

Cash gets crucified by inflation. And what “things that will go up with inflation” did he mention?

Depth Charge,

If/when the Fed is threatening to raise interest rates in response to inflation, bonds with longer maturities will get crucified. That has already started to happen with Treasuries and investment grade corporates.

Gundlach is a bond guy.

Depth Charge

Just watch the charts of LQD, HYG and HYT.

All of them close to 52 week high!

They say more than what Fed say or MSM headlines! Don’t forget the ‘jaw boning’!

Fed cannot afford to ignore turmoil in Corp Credit mkt which is the foundation upon which Equity mkt functions.

Until Fed admits there is ‘significant’ inflation effects in the economy, there is virtually NO INFLATION in their said policies, unless 10y yield shoots up above 2.5%!

I hold TLT for last few months and I am losing money every week as it is going done

It means the yields are increasing..

Using the 1970s as a case study – cash only dies a slow death, and along the way one can find bargains at the right times between the market crashes.

Starting from low yields and then tossing inflation into the mix turns Treasuries into “Certificates of Confiscation” (what they were called in the early 1970s).

Stocks will be a mixed bag; not everyone will be able to raise prices at same pace as rising commodity input and wage costs. Profits get squeezed.

Better to be a borrower than a lender, but not borrow too much since many income streams will be disrupted?

Dr Ron Paul has been saying the same thing for decades and obviously very few listened Now perhaps they will

Ron Paul was banned from Facebook. I knew things were getting crazy but that was a shocker to me. He’s one of the few politicians that know a lot about monetary policy and his views should be in the public dialogue even if the federal reserve would like to silence him. The MIC would like to silence him also. Granted he has some powerful enemies.

Ron Paul is not banned from Facebook. Search his name and his page comes right up. His latest post was Friday.

You’re correct. He was banned but evidently they decided to allow him back on after considerable criticism of their actions.

13 Oz Bonne Mamm Preserves – Product of France

Price 1 month ago $3.50

Price Today $5.69

I call that Inflation!

And now we got Yellen as TS. That’s like putting Count Dracula in charge of your blood bank.

This is so funny and true!

His comment was based on a falsehood. You bought it because you wanted to. Do I hear an echo chamber?

I just checked walmart.com. A 2 pack of 13 oz Bonne Maman (26 total ounces) is $7.00. Exactly the same as you say it was 1 month ago.

Zantetsu,

But do you know what it cost at YOUR Walmart a MONTH AGO? That is all that matters here since this is a discussion about price increases, and not which store in the US has the cheapest Bonne Mamon.

Did you check a month ago? Without that comparison, it’s apples and oranges.

You accused Swamp Creature of producing a “falsehood,” just because YOUR Walmart in California has a cheaper product than Swamp Creature’s Washington DC store — whatever store that was.

And even if you had checked at your Walmart a month ago, and the price is unchanged over the period, all it would mean is that at YOUR Walmart, the price hasn’t been increased yet. It says NOTHING about the price increase at the store in DC.

Your accusation of “falsehood” is nuts in this context.

Wolf, I drink a lot of diet coke. I buy 20 bottles every two or three weeks, in a single in instacart order. That’s how I know what it cost a MONTH AGO.

Whoops I replied to the wrong comment thread, I thought we were still talking about Diet Coke.

Anway, the price I listed is online. I used a private browser window, it can’t be remembering cookies from a previous order of mine or something to identify my location. I guess it could be doing some kind of IP lookup thing, but I doubt it.

I’m saying that $3.50/jar is the national price. Walmart will ship a jar of that jam anywhere for that price. If you say otherwise, the burden of proof is on you given the evidence I have presented.

Also, why are we arguing about this? It’s patently obvious that Walmart did not increase the price on this item 62% over the past month.

Zantetsu,

You accused Swamp Creature of having posted a “falsehood.” And you have zero proof. You’re still trying to find the cheapest price of a product. But Swamp Creature’s comment was very specific: the price increase of Bonne Mamon at HIS store. Get it now?

I would buy gold or precious metals right now, but the last time I did, some scumbag broke into my townhouse and almost walked off with the whole lot. The burglers were so stupid that they took a used color TV worth $50 and left the $5K worth of gold in their plastic cylinders on the floor.

Ummm…..why would you have gold in plastic cylinders lying on the floor?

I can think of at least a dozen ways to hide it with little expense.

And for really not that much, to very securely store it…even in a townhouse.

It was in my file cabinet. They threw it on the floor. Luckily it stayed in the cylinder and didn’t spill out. Gold was $1.85/oz back then. 5K bought a nice cyclinder full of 1 ounce Krugerrands. I sold them and used it for a down payment on my 1st home. Wish I kept the gold.

When I got to my TH and found the gold intact I looked like Eli Wallach in the final scene of that1968 spagetti western, with Clint Eastwood.

$185/ounce

Wow! What a great deal on that gold! You did well. I started when it was around 800 something an ounce. You used someone else’s money for your down payment. Congrats.

The movie was “The Good the bad and the Ugly” . I put the gold in a safe deposit box immediatly. The banker told me if I got knocked off the box would be sealed by the DC government. My aires would have to go though probate to get the contents of the box. That’s another reason I don’t like SDBs.

That must have been a long, long, LOOOOOOONG time ago, because “$5k worth of gold” today is 2 gold eagles and a few smaller pieces. If you can’t hide that, then…..uh….

Yes it is I bought two kilos in 2016 for 80k now valued at around 120k Not too bad Silver will be the big winner this year I believe with gold doing pretty well too

You made 50% on your money in 4 years? I’d call that pretty bad actually.

Yeah, that’s only an average of about 12 1/2% per year. Really sucks! LOL

OK I will agree it’s “not too bad”.

None of these current hedonist increases are signs of Fed inflation because they are just one off parallel hedonic adjustments.

Don’t worry, hedonistic Joe has this hedonism!

Lumber prices are stalling my plans to build movable homes, sized like mobile homes. Here in the south, some people are buying large haulable storage buildings, finishing themselves into living quarters placed on their land. I’m wanting to try out the market building more finished quality buildings on my place, delivered to customers. But, dang, building materials have gone nuts in price. I don’t think it will last forever, though.

It’s a bad time to be building stuff or buying stuff built with those expensive materials.

Tiny home parks & campgrounds.

I’m working on one now. Have 2 more waiting for me.

Good timing. With the new green deal, it will be cheaper to go there

with your tesla, than hauling a camper with a 3/4 or 1 ton.

This concept intruiges me. I have been thinking that my retirement may consist of buying a small property in 4 or 5 different states and building a tiny home on each, then spending my time nomad’ing between them in a small class B RV. I would like to own five $200,000 properties and a $150,000 RV instead of the 1.5 million dollar single homes that my friends own.

Cool story, bro.

Doesn’t your Mother ever need help with the dishes or other tasks?

Just asking for a friend…

I have seen several such buildings delivered around my ‘hood. They may be offices/school rooms/whatever. Only need to be underpinned once in place, and they look pretty good.

Pump it up until you can feel it.

Pump it up when you don’t really need it.

E Costello – Classic and cool !!

Everything is still wonderful, right?!?!

Prices may be going up, but every time they do I cut back somewhere else.

Last year I gave up buying Coke products, switched to the cheap store brand, save enough to pay for Netflix. Stocked up on the nice toiletries for Xmas all on sale, won’t be buying more until next Xmas, maybe. Did my closet audit to see what I’ll be buying this coming year, and it won’t be much. But will be sending shoes to be repaired.

I could use some furniture but it will have to be a really good sale. Got sticker shock from mattress prices $3K++++, they must be kidding.

I see you are downsizing your standard of living too.

That is eventually a game of diminishing returns, unfortunately. Poverty is when you run out of options.

Downsizing since 2008 and not by choice.

Check Wayfair for a mattress for under $500.

About 40-42% of US workers earn less than $15/hr (two sources). Biden wants to raise the minimum wage. Will this result in layoffs or inflation?

It will result in justice and equality… that will be the result of $15 minimum wage, the higher the minimum wage goes, the more equal and just things will become.

Don’t forget to mention that the $15/hr folks will be paying more into SS, Medicare and income taxes. I’m sure they are all anticipating that.

The $15/hr folks may also get pushed out of the safety net programs because their income is “too high” to qualify. Loss of subsidized / free child care is one that has been previously mentioned.

If the minimum wage actually raised people’s wages, then we could make the minimum wage $1 million dollars per hour, and we would all be millionaires and only have to work 1 hour per year. But it does not work. Try it.

flashlight joe, minimum wage DOES raise certain people’s wages, by definition.

Yup, it raises wages… no doubt… the secondary effects, of which there are many and some of which have far more impact than the actual increase.

It’s called minimum for a reason.

David Hall (and others):

It’s not well to forget that those increases in the minimum wage in most cases will take effect only after several years have passed and there will be areas that will never pay that wage. By then most wages will probably again fall badly behind. I’ve always believed in a national “minimum wage” but the idea itself leaves open many, many questions as to “….how far can it take the working class?” especially in a globalized economy. Ah, the contradictions!

Both

For the past month a 2 liter Coke at Walmart was $1.25 and before that it was $1.74 for the entire year of 2020. Tonight it was $1.86. They did this same thing last Christmas…. lower the price for Christmas and then raise it for the following year.

I don’t blame Walmart (or Coca-Cola) for trying to squeeze out some extra profits. But it is flavored water. Not a lot of high inflation inputs.

I too started using a store brand last year. It took a couple of stores before I found a flavor that I like. But it is $1.59 for a THREE-Litre bottle of Diet Soda. Looks like that is going to be my substitution for 2021.

Unhealthy food is so inexpensive.

Have you ever seen the food section at a Dollar General? It’s right behind the ‘we accept EBT’ signs.

Yet another way it sucks to be poor.

What’s unhealthy about Diet Coke? It’s 95% water with a small amount of flavorings, some acids that your body quickly metabolizes, and aspartame which has been shown for many years to be harmless.

Drinking water is pretty much free… What’s sad is that soda is cheaper than milk. That’s backwards.

We only do flavored water on special occasions. When we want “flavored water”, we get plain sparkling water and one of the Mio (or similar) flavorings and mix our own soda to taste. Much cheaper than any premade beverage, and far more fun for the kids too!

You make no sense. Milk is a product which is hard to produce, has to be sterilized, and has a limited shelf life (unless you ultra pasteurize it which in my opinion makes bad tasting milk). Soft drinks are mostly water with some additives.

Why would you even bother writing that soft drinks should be cheaper than milk? It’s patently false on the face of it.

I mean to say “why would you even write that milk should be cheaper than soft drinks”

@Zantetsu – I was thinking in terms of the effects of government subsidies. The sugar and corn subsidies make a lot of unhealthy food & beverages much cheaper than they ought to be.

Whole milk is actually pretty simple, requires very little processing (just pasteurization – the cows feed themselves most of the year) and of course is far healthier than soda. But it doesn’t enrich global beverage companies or their lobbyists!

The idea that soda is cheaper than milk is a relatively recent thing. Milk was cheaper than soda for most of history.

In 1913, Milk was $0.35/gallon; in 1930 it was $0.26/gallon. It Meanwhile, Coca-Cola was $0.98/gallon from 1886 until 1959. It was around 1960 that milk became more expensive than Coke.

Since 1960, the CPI for wholemilk has increased 4-5x. Carbonated drinks have risen only 3x or so.

“Looking at the prices of soda in 1,743 supermarkets across the country, researchers from Drexel’s Dornsife School of Public Health found that, on average, milk cost 160 percent more per fluid ounce than soda.” – study from 2016.

I’ve been drinking ice tea for years. Pennies for a gallon. You can add sugar or not.

Diet coke is still listed at $1.25 for 2 liters on walmart.com.

Walmart will cut back prices every so often on soda. Right now it’s Coca-Cola products which are on sale, but last month it was Pepsi products selling for the same price. But now they’re selling 2 liter bottles of Pepsi products for $1.86 each.

Then what’s the “real” price 728huey? The cut back price or the not cut back price?

I’ve had diet coke delivered twice in the past 5 weeks and it’s been the same price every time, the same price that it is now, and the same price that I used to get a different local store (Smart and Final). It feels to me like it’s the standard price for this item at low cost outlets, and that it hasn’t changed in a while.

Sears had a bargain basement mattress for sale at $199. I was getting ready to buy it but the salesman told me the mattress was a piece of s$it.

Cool story bro.

Bought a mattress on sale at Macy’s several years, online. They delivered and I read the instructions, nobody over 250 pounds, and you aren’t supposed to sleep on it every night.

We bought a great king size foam mattress online a couple of years ago for $900. It was from a manufacturer called Brooklyn Bedding. Best mattress we have ever had. Delivery was in a few days and it came in a box that contained it (compressed). Put the box on the frame and opened it and in a few hours it was totally uncompressed. There’s a website called Mattress Underground that has all the skinny on what’s good, what’s not, etc in a user forum.

Petunia,

Re: mattresses – A few years ago, we bought a queen mattress from Ikea for a guest room. $500 for their top of the line. Turns out it is one very comfortable mattress and I have been sleeping on it for many months. Might not last as long as that $3k mattress, but surprisingly good quality. Worth a try!

Thanks, I didn’t think to try Ikea.

The $3K+++ was for a set close to what we have now, which we paid $1500 over 10 years ago. The “nicer” ones were $7K-$10K which is just in your face robbery.

Furniture at great prices: ReStore near you.

Mattresses:

1988 purchased a double futon bed frame and futon mattress: $200

I still sleep on that same setup with the exception of an “improvement” of another futon on top of the other.

One of my children asked me if I would next upgrade to a “spiked pallet” (bed of nails)!

I’ve tried other softer (“higher tech”) mattresses but they always leave me with a sore back in the mornings!

To each his own!

Soda waters:

One of my long ago grocery chain retail bosses always referred to the chain’s proprietary soda water labeled drinks as: “Belly Wash”.

Hate to preach tho: We raised a more than handful of children with never having soda water at our meal tables take place of tap water. “Soda” waters were a treat not a habit. And, it is gratifying to see when visiting them and their children they have done the same thing.

I’m very fortunate to live in an area where some of the world’s best water is supplied: Hetch Hetchy CA.

Inflation: I’m always reminded of that line in the old Wall Street movie: “Too much God-d#$%^& free money out there!”

Hopefully we will have better days ahead!

Petunia:

“Last year I gave up buying Coke”

I’m supposed to be impressed?

It’s not about impressing anybody. It is about how even small luxuries are now out of reach for an average person. You sound like the person who begrudges a welfare mother buying ice cream for her kids.

BTW, I just saw a video about a guy trading his Apple phone for a flip phone. He is over the never ending Apple upgrades and just bailed out. That was impressive.

Down grading is happening everywhere because people have reached the breaking point in many ways. Just too much economic exploitation in the system. If they don’t end it, we have to.

Petunia, I tried to buy a flip phone last year and they are few and far between. The one brand I found was around $300, way less than an I phone though.

I settled on a NEW Motorola G Power smart phone for $175.00. Beautiful Android phone with THREE cameras (here’s in your face Apple) and a battery that lasts 3 days.

@Anthony A

Yes, buy Android, keep for 5 years.

I bought a mattress from IKEA that didn’t break the bank and is very comfortable They come compressed and rolled up so you can carry them home in your car Pretty cool

Petunia,

My understanding is that a lot of mattress manufacturing firms got bought up by PE firms. Soooooo, higher prices and lower quality are the order of the day. When you go mattress shopping try to find a small non-PE firm. I don’t know which firms that would be however. Concentration of ownership is a big factor in the price increases we’re all seeing (and experiencing).

One way to relieve “inflation” is to renegotiate the trade war so that we can save face.

Companies will need to commit to drop their prices if tariffs are removed. I am skeptical they will do so though.

“Under one draft of the plan being discussed, the IRS would be tasked with depositing checks worth $300 every month per child younger than 6, as well as $250 every month per child aged 6 to 17. That would amount to $3,600 over the course of the year for young children, as well as $3,000 a year for older children, the officials said.”

Moar free money. Parents will no doubt put the money into the kids’ Robinhood retirement account.

“what they are having to pay their suppliers, and what they can get away with charging their own customers, which may be consumers, governments, or other companies.”

A lot of this increase isn’t inflation, but consolidation. Private Equity vultures have been really good at identifying “bottlenecks” in commerce and buying out competitors, so that they charge wtf they want.

We really need to make antitrust enforcement great again!

Me thinks gold, silver and even bitcoin might do well in the next few years.

Absolutely I’d like to get into Bitcoin but something in my stomach keeps telling me not to Plus I’m old and haven’t a clue how to buy it frankly Lots of family members talking about it though

I would buy bitcoin but I 100% do not trust the shady companies that run the markets. I would never feel safe with significant money sitting in an account on one of those operations. I still remember mtgox.