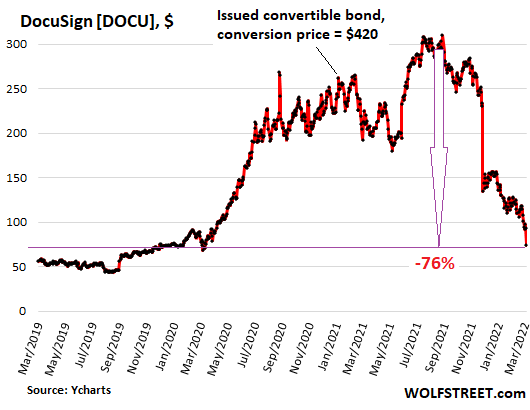

And then there were the raging-mania Convertible Bonds with a conversion price of $420, hahaha.

By Wolf Richter for WOLF STREET.

It’s amazing – I mean, not really if you’ve been through the dotcom bust – and brutal how these hype-and-hoopla stocks of money-losing companies are now getting abandoned and taken out the back and shot, one by one, after they’d been driven from already high levels to ridiculous levels starting in March 2020 when the Fed began throwing what would become $4.7 trillion at the markets.

The companies are still the same money-losing companies they were before. There was never any logical or fundamental reason for these stocks to get whipped from already high levels to these ridiculous levels. It was just a raging market mania, fueled by reckless money-printing and, as we’ve seen, by stimulus checks that went straight into the stock market.

But now these stocks are going to heck, though not it a straight line – and it has nothing to do with the Ukraine. And whoever ended up buying them directly or indirectly after they’d been whipped to ridiculous levels just transferred their wealth to whoever was selling this stuff.

So today, it’s DocuSign again.

I say “again” because a quarter ago, after the company reported earnings, shares collapsed 30% in afterhours trading, and by 41% the next day in regular trading. In terms of dollars, that was a huge drop, from $231 a share to $135 a share.

Dip buyers came in – the shares were “on sale,” and “40% off,” or whatever and it was just irresistible – but the bounce was small and soon turned into a slide, going lower and lower, interrupted by futile dip-buying.

Last night, DocuSign released another earnings report. At the close before the release, shares were at $93.88. And oops. In regular trading today, shares plunged 20% to $75.01, down where they’d been at the low of the crash on March 20, 2020, and back where they’d first been in December 2019 (the company’s IPO was in April 2018). They’ve collapsed by 76% from the high in August 2021 (more on that convertible bond offering in a moment):

But $75 a share is still ridiculously high.

It gives the company a market value of nearly $15 billion – over seven times its annual sales in 2022 of $2.1 billion. And this is a company with a perfect string of six years of annual losses, amounting to $1.12 billion, including the loss it reported last night for 2022 of $70 million.

To cover up its net losses, as reported under GAAP, it is still touting non-GAAP fake profits made up of its own metrics, including fake non-GAAP earnings per share.

This toxic mix of actual losses, for a company that has been around for years and has $2.1 billion in revenues, and fake non-GAAP earnings should turn every investor off instantly.

But it doesn’t, apparently. What turned investors off was slowing growth in “billings” and slower-than-expected revenue forecasts.

The 40% crash last December was triggered when billings in Q3 had slowed to 28% year-over-year.

In Q4, reported last night, that growth in billings was down to 25%. And in its forecast for Q1, the company projects billings growth of 9%-11% year-over-year.

If you have signed contracts electronically in recent years, you have used DocuSign or a competitor. The meme to whip up the ridiculous stock price movement from March 2020 was that henceforth everyone and their dog would sign all contracts electronically via DocuSign, and even if that theory had worked out, the stock price would still have been ridiculously overpriced. But that theory hasn’t worked out. There are other companies that offer electronic signing of documents, a system that has been around for many years.

Turns out, DocuSign isn’t some miracle company that walks on water but a normal company with decent revenue growth and with a product that is, like most products, dogged by competitors. And it’s a company that is still losing a ton of money. So how much is a company like this worth? That’s the question that keeps getting answered as the stock plunges.

The raging-mania bonds convertible at $420 a share, hahahaha

DocuSign also loaded up with debt, including convertible bonds. It issued the most recent one, a $600-million three-year bond, on January 13, 2021, when its shares were still riding high and higher and only the sky was the limit.

At the time of the bond offering, the share price was $262.65. The deal was that each bond (face value = $1,000) could be converted into 2.38 shares on January 15, 2024, when the bond matures — hence, at a conversion price of $420.

The bond doesn’t pay interest. Investors lent the company this money in hopes of being able to convert the bond into shares that hopefully would be well above $420.

If the shares are below $420 when the bond matures, bond holders would get paid face value of the bond, for no gain, and no interest earned for three years. So this is not a catastrophe for bondholders.

But what these numbers show is that the market expected DocuSign to trade at well over $420 a share by January 2024, a totally ridiculous price that was seen as realistic in early 2021. What these numbers show is that the market had become a gigantic Fed-fueled blind raging mania where no one could have a single clear thought and money no longer mattered. And the hangover from this raging mania is now being felt across these hype-and-hoopla stocks.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

A semi-serious question:

Is there really any statutory or standard contractual reason (in bond agreements) that would keep money-losers like Docusign from issuing debt and then more-or-less using a fraction of the proceeds to immediately buy back shares (temporarily propping up share prices at whatever level mgt wants)?

Not really sure if this would be *illegal* but always kinda assumed that no creditors would be so dimwitted as to allow it contractually (ie, debt/equity ratio rqmts preventing it).

But now I’m not really sure.

Relatedly, had also kinda always assumed that perpetual money losers wouldn’t have the *cash* to buy back shares (even with GAAP net income distortions) but if some idiot creditor climbs onboard in the middle of such messes, that is a cash injection right there.

Of course. such pokery-f***ery consigns such companies to even more certain bankruptcy, but these insiders might be playing a very, very short term game.

cas127,

Issuing debt (such as bonds) to buy back shares is standard practice.

The bond covenant could include language that would prohibit share buybacks. But in this era of interest-rate repression and yield chasing, which spawned the tsunami of “covenant-lite” bonds, issuers can do almost anything, as bond investors have become sheep.

Guy in my business capstone college class did just that to come out on top of the competition based on the scoring metrics of the game.

Issuing debt to buy back shares is normally done to buy back the free shares issued by the company to it’s directors and top executives ats part of their package. So the amount bought back for is totally profit for these people.

Another point is that the people buying these shares at the amounts that would make a glass eye water are fund managers using other people’s money, and for which they then get a surprisingly large commission from the company who’s shares their clients have bought.

These things may not be illegal, but the only reason they aren’t is because the law was changed to enable the first, and hasn’t been changed to outlaw the second.

It might be legal … but it sure isn’t right and proper, now is it?

Bastiat had something to say about this, way back when… when plunder becomes a way of life for a group of people in a society…

I ask because it would explain how ZIRP’ed debt costs can be transmuted into insane equity valuation ratios…

Corporate debt proceeds (with few to no restraints – due to hyper competition among lenders) simply being plowed into share purchases by corp mgt – regardless of *any* fundamentals (profitability, etc).

Sounds nuts, but without legal prohibitions or lender covenants, corp mgt might be free to do such things.

It would explain “who buys this sh*t” equity-wise…debt-empowered insiders do.

Two types of moral hazard. The one everyone talks about here by the government, mostly the FRB put.

The second is financial intermediation. Virtually no one talks about it.

Beginning with the 80’s bull market, mutual funds and later ETFs replaced the majority or a substantial minority of direct stock holdings. These instruments also enabled individuals to own garbage like low quality debt they never would have owned before.

Index funds and ETFs are on auto pilot and have worked because of the unprecedented duration of this mania. When it ends, “investors” will find themselves indexed to a bear market and someone will ride it to the end, all the way down to unprecedented losses.

With actively managed funds, fund managers often or even usually don’t care about buying garbage because it isn’t their money and “investors” are mostly clueless about what they actually own.

Fund managers only care about increasing assets under management and not getting fired.

In a bull market, this means matching or beating your benchmark,

In an extended bear market which hasn’t happened in over four decades, customers leave anyway.

So, you might as well “swing for the fences” during the good times and then when everything falls apart, claim you acted prudently because after all, most other fund managers were also acting recklessly and no one could see it coming.

Yup. Sounds about right.

Hoocouldanode? The Holder-Geithner “let ‘em walk” rationale. Or maybe Prince’s brilliant “when the music is playing you have to dance”

> It would explain “who buys this sh*t” equity-wise…debt-empowered insiders do.

Tag onto that, the insiders granted themselves options based on “performance” as measured by that stock price. It is so circular and self-feeding. Money makes a neat round trip from a bondholder/investor into the pocket of the insider. Then the shares tank, but the insiders have long ago cleared their cash.

The dotcom frenzy had some of this nifty feature too. The claim was that the options “aligned” the insiders’ interest with the shareholders’.

There used to be a law against share buybacks because it was thought to be inherently fraudulent, but the law was repealed in the 90’s.

No, it was Reagan, in 1982.

And, now, finally, more people are starting to realize what a long-term disaster his Presidency was.

Oji:

Why do people always have to blame a person or entity that is not responsible for the implementation of a rule for which they had little or no responsibility because they don’t like the person because of their political persuasion?

IIRC the SEC was responsible for adopting the rule.

It wasn’t a law.

this for oji:

if you happened to be in berzerkeley when Reagan, AKA ronnie raygun ordered thousands of folks in the entire ”southside” area to be sprayed with tear gas because one or two bad guys, later considered to be guv mint stooges, were very deliberately doing property damange, you would have known right away what a disaster Reagan was…

seriously, why would anyone expect otherwise from a guy who was a rat fink during the Joseph McCarthy witch hunts???

Lookup IBM. This has been their MO for at least a decade. Stuck in mature markets with no revenue growth, you can still increase increase earnings per share by reducing the shares outstanding. So they issue debt and buy shares. They’ve been doing this for a very long time and have been accurately called a company eating itself from the inside out.

Perfectly legal and done all the time when stock prices are more important than your product or your customer.

Funny you should say that…

IBM is also represented on the board of directors…

The cul du sac of board membership..

Jim sits on Bill’s board

Bill sits on Ralph’s board

Ralph sits on Jim’s board

and they all vote themselves big compensations and stock options followed by share buy backs.

Tech is not a mature market.

IBM prefers to buy its own shares rather than invest or acquire startups.

“Buybacks were illegal throughout most of the 20th century because they were considered a form of stock market manipulation. But in 1982, the Securities and Exchange Commission passed rule 10b-18, which created a legal process for buybacks and opened the floodgates for companies to start repurchasing their stock en masse.”

Don’t ask any government to impose regulations on a business to protect the more money than brains club members from themselves. Otherwise every business will suffer and Socialism in its worst garb emerges.

“A Fool and his money are soon separated”.

The only cure for this is the financial pain of massive losses. It is the great teacher of Capitalism. The more it is cushioned or as in this case, postponed, the worse the disease gets.

In the worst case scenario, a Chinese company will see some technological value in Docusign and snap it up, happliy baling out the big early investors.

Appreciate these articles so much, Wolf. So happy I don’t own this crap. Good luck out there everyone.

Sure hope Docusign has the $600 million to pay back the bond buyers on Jan 15, 2024 if the stock is under $420/share then!

> $420/share

Elon wants his meme back! TSLA going private at 420, funding secured, Elon puffed a big splif on camera in that time frame, remember? TSLA is a different drama because a mega zillionaire after generating scads of absurd inside jokes nudging (fool fan-boys in intoxicated) markets around, is lawyered up and now doing to try a war of attrition with the SEC. Only he can prolong the madcap spirit of the early 2020s, with his horde of cash. Docusign is not so lucky: it is not a rock star.

It seems so long ago, so passe, the dizziness of 1920s style mania.

Good one p leap!

Especially your last sentence, ”It seems so long ago, so passe, the dizziness of 1920s style mania.”

While absolutely TRUE,,, we saw exactly the same thing in late 2006 in SWFL: was in line to pay at a gas station when I heard the CLERK telling how he had purchased a waterfront condo next door the previous morning and had sold it for a very good profit THAT morning!!!!

Immediately called my friends who were speculating and told them to sell as fast as they could; some did, some had just bought canal homes with sailboat water and no bridges to the GOM did not sell and then did sell, for about 25% of what they had paid, a while later.

Fun to see all those saying it won’t happen again, eh?

I know the area you are referring to.

A long term, good friend of mine, put his house on the market in the Fall of that year.

The WEEK after the closing, the R.E. agent was talking to him, and then me, how everything stopped. One day it stopped. It was uncanny and eerie.

He got top dollar for the home, which was not worth it, from a buyer in California who thought the price was fantastic.

You probably remember “First Homes” who had a remarkable business selling homes for $95,000, complete with lot. They sold out their company, in time, to a huge home builder. But, during the run up to the flipping extreme, that was affordable.

And those 420 dollar (about 300 when he made the announcement, but it did hit 420 later) original TSLA shares are ‘worth’ about 4200 dollars now.

I used to think a reasonable price was 20, and despite the split, still 20. A billion shares at 20 would be 100B market cap.

That would be 2X revenue. Profit? Making cars and other stuff, net of carbon credits, 4 bucks, so shares at 20 would be 5X earnings, pretty good. Maybe a share price of 40 is more reasonable by the old metrics – 10X earnings.

Oh but Wolf, you forgot about how Docusign somehow had enough money to put their name on 999 3rd Ave here in Downtown Seattle. Wait wait wait, there’s a bond that pays for that. As soon as they did that, I immediately shorted their stock. Companies that are losing money, yet find a way to put their name on the door of a 50-story office tower, are always in nose-bleed territory.

We still have crypto.com arena to go. Like good old Enron Field in Houston. Hubris monuments, we need a slick coffee table book.

That is probably a good idea.

If you can get glossy paper.

lets see how cryptos do in an interest rate environment that isnt zero.

Let’s see how the new, new , newfangled green energy projects that are being touted do in a “normal” interest rate environment.

As their cost of capital is next to zero that gave them a big advantage over already built fossil fuel generators that had to pay high rates of interest to build their capital stock built.

Green energy is also a creature and result of low interest rates and interest rate repression.

Bernard,

It is unfortunate that the wind and solar industries are so heavily subsidized by grants and no interest loans from you the tax payer, that the Fed’s rate increases will not reign in this industry.

It may have its place in the overall energy sector but cannot replace much more than 15% of the energy required for a decent economy to function.

Under the present climate religion, it may be getting too late now to properly order the energy production priorities to provide a stabile and reliable energy base for the US economy.

At some point very soon, green energy’s failure to provide this base of economic power, will be evident. It has already started in the petroleum markets and is spreading quickly to foods and other strategic sectors. Hold on tight if you can.

Like the one Kramer did on Seinfeld?

Last November I spent good hour staring blankly at TradingView with the DOCU ticker open. After checking my sanity, i opened a new tab and closed out my whole WealthFront account. This was the stock the broke my brain and my trust in the whole technology sector. Passive investing tools were obviously not the right tool for the time…

@JM – great story – but what did you do with the funds you cashed out?

My “mania money” stayed with the broker and is still looking for a safe home …

A lot of the “investors” were looking for violent rips to the upside, as the stock dropped, but those rips never showed up. It was a gradual loss of money, with numerous opportunities to double down and lose it all.

I see these novice investors on message boards all the time with comments such as:

Why is it dropping? I didn’t see any news.

Forward P/E is only 35. It’s a steal.

This is what investing in Amazon was like.

Why don’t they come out with a positive press release?

They have potential to branch off into dozens of new industries

The CEO is great; can’t be wrong; cares about investors

2025 sales will be 10x higher.

This satire is too on point.

We’ll see a bounce Monday for anyone who reads it B

Bond holders may well choose to convert the bond to the 2.38 shares on Jan 15, 2024 in lieu of bond redemption.

Two questions…

One…

Do you really think the stock price will be above $420?

Two…

If not… do you really think in two years this company will have or can get $600 million ?

I don’t think either scenario is plausible…

Wow – I am not a bond investor, but having your principal guaranteed 3 years after investing with a potential upside is tantalizing. As ANTHONY A states, hopefully DocuSign will have the $600M to pay off the bondholders in 2 years. If they do not – can DocuSign file BK and those bondholders via a BK Receivor get whatever the hard physical assets are worth ?

Tantalizing?

There is no additional guarantee. Every bond promises to pay FV at redemption. This is a zero coupon note with a mediocre balance sheet at best, regardless of it’s credit rating.

You must also not understand what this company does. It’s a software company. What kind of fixed assets do you think it has to function as collateral?

It currently lists $324MM in property, plant and equipment which I presume is mostly either office leases or commercial real estate., as I don’t see what other fixed assets of substance it would own. This line item has been flat since at least YE 2019 which indicates to me that no one has performed an impairment test since we know how fantastic office space has held up during COVID.

They currently have enough cash and ST investments on hand to satisfy redemption for this bond issue. Most of their other assets are accounts receivable and intangibles.

“It currently lists $324MM in property, plant and equipment…”

Augustus,

Obviously you are discounting the thousands of valuable employees, who., with upcoming* changes in the Bankruptcy laws, can be sold as slaves.

*Maybe…who knows?

They need to transision into a “Cloud Data” company.

Obviously they have the documents that need to be in the Cloud.

Didn’t some really funny Athenian writer, write a play, about 2,300 years ago, about “CLOUDS”?

> and those bondholders via a BK Receiver get whatever the hard physical assets are worth ?

“Physical assets?” Hahahahahahahaha.

Well, with inflation running 7%+, those bonds might lose a third of value by 2024.

“If the shares are below $420 when the bond matures, bond holders would get paid face value of the bond, for no gain, and no interest earned for three years. So this is not a catastrophe for bondholders.”

I don’t know where in the debt stack (capital structure) those bonds are, how senior or junior. The terms of the bond should have something to say on that. In a bankruptcy, each level gets fully paid off (under the rule of absolute priority) before the next level down gets a dime. Secured debt and bank debt are usually most senior.

This article suggests the firm has been vaporizing cash. I’d feel very nervous about ir producing cash a few years out, especially now that the stock prices is flashing red. Not that I’ve seen the financials.

I won’t touch this dog, so I have no incentive for that. It joins a host of other fleabags being so well described here. I’, still piling up my dry powder (inflation-risky as that is). I’d rather lose 10+ percent to inflation than 40 percent to some swift dream-sellers.

2b,

Spot on…

Basic bond investing means you establish a risk premium for your money invested…

No interest for three years ? For a high risk of loss of principle?

The only scenario that makes any sense is the main shareholders bought these bonds hoping to buy time to exit their stock positions making a net profit from selling their stock vs loss of the bond money…

With their current financials, even with an additional 90% decline in the stock price, it would still be overpriced.

Their SG&A runs at about 80% of revenue. Sounds like a great business model, doesn’t it?

Their most recent quarter also records about 20% of revenue for R&D.

At this point the market could care less what happens next Wednesday.

It is well aware that our leaders are incompetent and crooked. A nasty mix.

We are headed down big time. By the way……Apple led down again today.

Yes, the market will bounce big time if Putin caves…….but that lasts a week…..maybe two.

> the market will bounce big time if Putin caves…….but that lasts a week…..maybe two.

Good point. The underlying situation is bad. Deglobalization is gaining momentum one way or another. If all this becomes an excuse to keep the punchbowl coming, it just piles up more combustible underbrush. It just staves off the correction. But what is history, what indeed is walking forward, other than a somewhat controlled form of stumbling? Punctuated by more clumsy moments?

The Great Depression seemingly “cleared markets” briskly only when cities were cleared away and a new global order came. Yikes.

fred…

yep, 1/4pt….why effing bother.

“If you have signed contracts electronically in recent years…” I’m not a high roller, or even much of a roller. I have the MBA, so I get how value and stuff was supposed to work, but gambling bores me and makes for risk I don’t want. That said, the whizz-bang university where I worked for the past seven years converted to a “document management system” that was supposed to make everything groovy. However, working through the process of putting together a not-very-complex relationship with colleges proved to be beyond the capacity of the “document management system,” so I needed to work around that system. That was not appreciated by those that worshipped that system. The intrigues go deeper, but suffice to say that in my opinion, automated everything is stupid, encoded in algorythms, lost in spaghetti code for the pathetic – oh yeah, I also developed software for about a dozen years, so the technical jargon.

cobo…

guessing you are against a digital currency too?

It’s painful to see how little most people know about electronic data. It is not infallible for many reasons. One of the least known and talked about elements of digital data is, it has a shelf life. Digital/Electronic devices degrade over time and the data degrades. Yes, the data can change all by itself. Tell that to the crypto/nft fanatics.

There are other problems with data companies, if they go bankrupt the data can and will be sold to the highest bidder. And they don’t have to go out of business to sell your digital data. You have no privacy, ever, with these documents.

And I’m assuming the documents were signed by the correct person, which is a huge leap of faith.

“…everyone and their dog…”?? Why didn’t they call it DogUsign? “So easy, you’re dog can sign if you’re not in! Now Improved with DoggyCoin Payment Plans!! 100 thousand screeching cats can’t be wrong!!!”. Ah, Paw, quit it, will you?

Dogyousign?

Ya gotta be hip, cool cat. DawgYoSign!

Merge with Dogecoin and issue a commemorative NFT.

Ducks Oop

Many technology companies, that are new, have a bottom line “I hope someone will buy me”. Docusign held out for a bigger dollar return from Google, MSFT, or Apple purchase. The problem is these companies are so large that they offer “garage sale” prices that do not pay out the way the tech start up wants. So, competitors like MSFT will just then create the software and present it to customers as a free option. Then once DocuSign explodes into no more completion, MSFT will enhance the freebie with new pay required features. The problem of anti-trust or monopolies being correctly governed is that normal people are always hosed. The retail trader, the consumer, and small competition never gets a real fighting chance anymore.

Gabby,

DOCU has been around a while… never really went anywhere…

Pandemic gambling ran it up…

A little financial engineering ( ie, find some suckers) resulted in the bond issuance…

A conspiracy theorist might imagine a hedge fund at work… this looks like their playbook…

But wait! There’s more!

Two of the longest serving board members ARE from hedge funds. serving the board since 2013… everybody else from around 2018 or later…

One of whom might be familiar to most is… wait for it… Bain Capital…

Pandemic gambling is a perfect encapsulation. I think everything that got bid to the moon during covid will lose all of that hot air and then some. Real estate, stocks, crypto – hell, even big trucks and rvs.

Gabby Cat-

“So, competitors like MSFT will just then create the software and present it to customers as a free option.”

Exactly. Open Office is free. Why pay MSFT for Microsoft Office when you can get it for free?

Software companies only have value during the new product cycle. Once the product is copied and available elsewhere, the profitability of all providers will decline over time.

It is the classic JD Rockefeller move.

Go into the new territory selling kerosene from your refinery, in your “home” territory, for less than what the competition can even buy crude oil for.

“Give them a good sweating”, as he put it.

Then, after they are driven out of business, or sell to Standard, you raise the prices and move on to the next territory.

That, and leasing up all the oil tankers, so that your competition can’t even ship in crude, or ship our refined products, is business. No personal.

Stopped using that since clients had a hard time setting up an account on their phone – switched to Adobe E-sign product – Easier to sign your docs on a phone and cheaper. While DocuSign may own 60% of the market they have 5 or 6 newer Rivals.

Now the pandemic is over and every mortgage company/realtor/escrow assistant/Processor/ had to have this, in the great Refinance Boom – Now the 4000 folks laid off at Better.com as volumes dry up – no longer need DocuSign. The mortgage industry is shrinking big time…

Boom and Bust – Boom and Bust…the song remains the same…Just different singers.

Docusign is an interesting company.

It takes the labor of 6200 people working forever to enable us to electronically sign documents.

As long as the company doesn’t need gasoline or diesel, they should be fine.

This week I finalized an agreement with a client across the country out of my home office. I used a feature in the iOS application to sign the document. It took five minutes end to end, and was my first time using it. The next agreement I sign will literally take under a minute. This function is free. I question whether DocuSign even has a business.

Document security and confidentiality? Why should I trust them? Why implement a new software process when email and locked storage directories work just fine?

I say the stock goes to zero.

Hmmm . . .

Jung believed that the human susceptibility to deception, self-deception, delusion, and wishful thinking would ultimately prove to be the undoing of civilization. In the meantime it is disappointing to see this susceptibility cultivated, manipulated, and exploited for profit and power.

I’ll just watch from a safe distance, thanks. Maybe make some popcorn.

Good article. Points out a bigger issue that in the process of simplifying a labor intensive paperwork based system Doc became just another cash burn engine. But they made 💵💵

Hussman has a graph where he shows market performance under four market conditions. The big losses always come when market sentiment is poor and Fed is tightening. That is where we are now. If Fed really does tighten a few times you are going to see all the zombies head toward zero.

Market sentiment can and will tighten credit conditions for most borrowers regardless of central bank actions. Since the late 90’s, loose central bank policy has coincided with manic psychology which made it appear central banks are in total control when they are not.

Absent a change in sentiment, most corporations wouldn’t be impacted by the

measly increases in the FF target.

Look at DocuSign’s financials which I did last night. Interest expense is immaterial despite current debts levels since they have a zero coupon for most of it.

Where companies like this get in trouble is when they can’t or can’t afford to borrow incrementally, since they are continuously hemorrhaging liquidity or refinancing.

The Fed will do what is in the best interests of the banks that own it.

That should frighten you.

The Fed could have SHOULD have raised rates long ago…and the fact that Powell waits for the “meeting” is telling. He could raise rates at anytime……but slow walks. Telling it is.

I heard Jay likes barefoot walks on the beach, candlelight dinners & financial performance art.

Market sentiment isn’t poor. With everything going on right now, the Dow Jones is only down 10.5%.

The market had 3 19% corrections (2011, 2015, 2018) during the longest economic expansion in American history, which enjoyed a rare combination of stable growth, low inflation, and super easy monetary policy.

The market is still very bullish right now relative to economic fundamentals, and dip buyers are still commonplace.

The other name for expansion is.. inflation. More $$$ for the same tired e-CONomy.

Agreed, bulls haven’t been broken yet. Lots of retail money flowing in on the dips hoping JPow has their backs. We will see.

Most of the 3rd & 4th tier speculative growth stocks (high growth, negative earnings) are down 70%+ from their peaks but are essentially back to early 2020 levels.

DocuSign IPO’ed in April 2018 at $38/share.

A 100% return in 4 years still isn’t bad.

Jackson Y,

I love that logic – it soothes rattled nerves for sure. Like… My investment that once was $300,000 is now $75,000, but no biggie because I paid $38,000 in 2018 and so I’m still up a bunch from when I bought it. And I have been saying this all the way down to soothe my nerves. And in 10 months, my investment is maybe worth $42,000, and I can still say, hey, in the world where cash is trash, I’m still up 10% from 2018. And then, when my investment is worth $30,000, I can still say, look, the market is shitty, but I’m down only 20% on this stock since 2018.

Assuming I wasn’t leveraged with a margin loan. If I have a portfolio full of stuff like this and I was margined, my broker would have turned me into a forced seller, and I likely got wiped out before DOCU ever gets to $38,000. But no biggie. It was just my play-money anyway, LOL.

Reality is I don’t want to ever again drag out that logic to make me feel better. It’s a very painful experience – it’s when your dreams evaporate. It’s when lots of folks are starting to look for a job again. Been there, done that during the dotcom bust.

In 2021, Saylor’s Microstrategy (MSTR) basically borrowed 2.1 billion

– $650 million convertible note at 0.75% (So MSTR $4.875 million of interest a year) Wow…that is like paying $375 of interest on a $50k loan. The note is convertible to stock at $297. So right now these owners are up as the stock is $390. That is a pretty good return.

– When BTC was $60k and MSTR stock at $1200, Saylor issued a 1 billion note at…..get this…. at 0% interest. A loan that they do not have to pay any interest on. You heard me right….no interest loan. The selling point was these notes can be converted into Microstrategy stock in 2027 at $1427. The stock is at $330 right now.

Microstrategy created a hypothetical chart as to what would have to happen for the stock hit certain thresholds. According to Microstrategy, the the stock could hit 1430 if BTC goes to 100k and Microstrategy increases software sales by 8x. If that does not happen, the senior note holders basically gave MSTR an interest free loan for 5 years. The other hypothetical option was BTC hits 90k and MSTR increases sales by 8x.

Guess what Microstrategies sales growth is for the past 5 years. It is -0.10%. Unless they come up with a ground breaking product….you cannot count on sales growth?

Crazy.

Saylor did a great job of getting almost $2 billion in free money to go play the crytpo casino.

Tom Lee of Fundstrat said stocks will go up 20% from here this year. In December he also called for BTC to 200k in 2022.

Hi 2021 call for BTC to 100k never happened but what the heck. Lets make the call even bigger.

It’s simple the whole Shebang is headed back to the 2020 level. That juice that sent it up into the stratosphere is gone. Next up

AAPL and MSFT. For those who think the index etf are safe and diversified, think again. Some seventy percent of retail are passive investors in these instruments

Buckle up. Bumpy ride still coming

Has anyone used their product? It’s nothing. Talk about hype. It’s really a POS that does nothing more than a half dozen other products have done for years. In my mind, it’s nothing but a pdf reader with some security features. It’s awkward to use. It’s impossible to make corrections.

I like it. Beats sitting in a room full of people passing paper around. Anything that doesn’t require me to get out bed works for me. ;-)