At the tippy top of the greatest bubble ever, all kinds of stuff can happen.

By Wolf Richter for WOLF STREET.

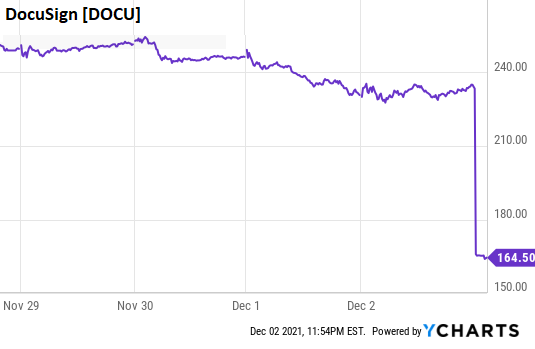

Shares of DocuSign [DOCU], purveyor of eSignature services, collapsed by 30% in afterhours trading, from $233.82 a share to $164.50 a share in no time, taking its $46 billion in market capitalization down by about $14 billion. Since their peak in August, shares have plunged by 47%:

But shares didn’t collapse because the company had strung together a perfect score of annual losses during its four years as public company on top of the years before it went public. With today’s earnings report for Q3 – another loss – it is on track to perpetuate its perfect record of losses for the current year.

And shares didn’t collapse because they were trading at 23 times revenues, which is ridiculous, and they should have collapsed long ago and should have never gotten this high.

And shares didn’t collapse because the company has been touting non-GAAP measures that bedazzled investors with fake profits, when in fact its net income under GAAP was that perfect score of actual losses.

No, shares collapsed because the revenue in Q3 came in as expected, “billings” in Q3 came in short, the forecast for Q4 disappointed analysts, and “the environment shifted more quickly than we anticipated.”

DocuSign, in its Q3 earnings announcement afterhours on Thursday, forecast Q4 revenues in the range between $557 million and $563 million, when analysts were expecting about $574 million, according to Refinitiv.

And “billings” in Q3 increased by only 28% year-over-year, “as we were impacted by the shift in customer buying behavior,” CFO Cynthia Gaylor explained during the conference call.

The company has strong revenue growth, and it could make money under GAAP if investors forced it to, but they didn’t force it to. Bedazzled by fake non-GAAP data, they rewarded each other by pumping the shares to ridiculous levels, touting revenue growth, and it worked until it didn’t.

Year-over-year revenue growth in Q3 was still 42%. But that was as good as it would get. In Q4, revenue growth would recede to 30% year-over-year, the company said.

In the conference call (transcript via Seeking Alpha), CEO Dan Springer explained: “As we moved through Q3 and into the second half of the year, we saw demand slow and the urgency of customers’ buying patterns temper.”

“While we had expected an eventual step-down from the peak levels of growth achieved during the height of the pandemic, the environment shifted more quickly than we anticipated,” he said

And “demand kind of started to come back to normalized,” he said and added some mea culpas about not executing in this normalizing environment.

Despite the 47% drop in the share price since the peak in August, they remain ridiculously valued, compared to the company’s revenues, revenue growth, and endless losses.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

How are they even allowed to discuss non-GAAP numbers? Any “investor” who makes a stock purchase based on non-GAAP “profits” deserves to be taken to the cleaners.

Rather than “investors,” there may be a neat mix of knaves and fools. This selloff sorted them out.

Maybe ‘gamblers’ is a better term.

Yup

What rough percentage of afterhours movement is offshore investors? Non-US investors?

“Commodore Vanderbilt, though he often had the Street in the palm of his hand, was often driven into a corner where he had to do battle for his life; and so it had been with every great speculator, or combination of speculators, until the men who control the Standard Oil took hold. With them, manipulation has ceased to be speculation.

Their resources are so vast that they need only concentrate on any given property in order to do with it what they please. With them the process is gradual, thorough, and steady, with never a waver or break. How much money this group of men have made, it is impossible even to estimate, and there is an utter absence of chance that is terrible to contemplate. ”

Written in 1900…

Commodore Vanderbilt = Warren Buffett ???

With all his homespun wisdom and pithy quotes he is a Thing of the Past…

Standard Oil = ???

Nowadays EVERY asset or group of assets can soar 40% in a day.Or plummet 90% in 12 hours.

Same s… with > $2T crypto market.Up 12%,down 15% up again 10% ad infinitum

Forcible, sharp moves are magnified in each new bubble, by the speed and low friction of new trading tech. I await a lovely mess when enough punters correlate. I have my dry powder waiting, though I don’t see any neat way to reckon where prices will go. There will still be so much darn liquidity sitting there (thanks Powelly), on instant poise to re-enter markets, even after the biggest fools are swept away. It is a game, to borrow Schiller’s and Akerlof’s book title, of “Phishing for Phools.”

Did you read that book? I read a review on Amazon that basically summarized the main points of the book. Sounds like Shiller is shilling for more government regulation in that book?

One of the biggest financial and economic fallacies is that it’s possible to “prudently” regulate moral hazard. Accommodate and encourage the biggest bubble in history and then try to “manage” it.

That’s an unstated concept behind “macro-prudential” regulation. No different for SEC regulation, as is evident by Madoff.

What is this actually?

Historically unprecedented hubris. There is no “wizard behind the curtain” to pull the strings because people aren’t robots.

This is a lot like 1929. Bonds are easy to determine return as long as borrower can pay you. Stocks that have consistent earnings are somewhat easy to value and you can be conservative with your future income estimates.

Companies that make no money, where earnings are all in the future are very susceptible to hope and dreams of investor. They are speculations where market value can disappear in a flash.

Standard Oil = MegaCap Tech with their legally-sanctioned monopolies, competitor Kill Zone etc.

As for the banks … Wall Street = Wall Street and in particular J.P. Morgan = JPMorgan. Some things don’t change ;)

Leaving aside that Standard Oil did succumb and was broken up and that the Great Crash would take down many Masters of the Universe, why on earth name Buffett in connection with a piece about ridiculous excess in valuations? He is the most prominent billionaire refusing to speculate in the everything bubble, especially so called ‘tech’. He has of course ‘lost’ billions by not participating in the last few months.

He has just done a share buy back, not to support the stock price like IBM etc. etc., but because it was the most tax efficient way of returning investor money. Why return their money? He told us: everything is overvalued. He is at his highest ever level in cash and figures they might as well be.

And no, Burlington Rail Road, one of his buys, is not going to go up 40% in a day and then go down double that after hours. He likes rail because of the ‘moat’. You can buy locos and cars but you will never get another right- of- way like one belonging to a major. Kind of the opposite of an e-auto start up.

Burlington will just keep on moving stuff and trundle along. Not the next big thing, boring, but profitable. That is the Buffet formula, out of fashion at the moment.

Companies like Burlington Northern may have “low” P/E ratios but profits are still vastly inflated by the asset mania.

Did I say a bad word about Mr.Buffett ?

No.

I like this guy.He lives in a modest.apartment.When he complained about the price of his daily cup of coffee going over $1 I started crying 😁

But his investing wisdom makes no sense anymore when Anonymous Dark Pools of Limitless Liquidity pump & dump assets on a daily basis.

Similar transition took place around 1900.

Peacocks -> Plungers (actual terms)

People said Buffet was all washed up right before the tech crash. Turned out he was right, the stocks were too high and couldn’t grow to the sky.

Precisely where you are wrong.

You are correct in terms of daily or short-term movement, which may be of immense importance to you.

He could not care less and is focused on the cash his assets are making.

From your standpoint, he may appear irrelevant. But all that money sloshing around in dark corners of the market is ALSO chasing cash surpluses and will eventually capitulate and return to sanity once these 40% drops take the wind out of its owners.

How much Apple stock does Mr Buffett own?

I see where Munger said the bubble is bigger than tech bubble. That was 83% drop in Nasdaq if I remember correctly.

Vanderbilt and Rockefeller had to settle accounts in GOLD.

That put a break on many modern financial games.

Also, the value of their holdings were based on actual, real profits, paid out in Dividends. What may fluctuate was the amount of dividend and what rate of return you wanted. A stock paying $8, was an 8% rate if you stock (or bond) price traded at $100.. BUT, the value of the stock was on the dividend. Never phony ratios used today.

Andrew Carnegie’s partners hated him since he never paid Dividends out. He owned at least 51% and thus had the control to do so. He constantly re-invested into his 3 major Steel Mills. His desire was domination, status, and power, not the money. This is why, when Henry Frick sued him, the world found out they were making around $12 Million a year. And this was 1890 money. Frick wanted his pay-off based on the value of the stock based on that potential dividend, had one been paid.

Also, another interesting bit. When Carnegie sold, he required that Morgan pay him in Gold Bonds, payable at 5% in Gold. All the other partners did NOT get Gold Bonds. I think he knew his enemies, Morgan and Rockefeller, were planning the FED and creating inflation with paper money. He wanted none of this and why he was not part of the FED stock holders. The Vanderbilt family, nor Astors, were ever invited into the FED. They, nor their representatives, attended the meeting on Jekyll Island.

The Old money worked for it. The New money planned to steal it.

Still worth a lot!!!!!!!!!! Buy the dip!!!!!!

All of this horrible badness of transitory share price drops will end soon and they will be replaced with happy memories of buying the dip! Mmm, I love dip!

Buy the abyss.

haha I was going to say that….activate buy the dip lemming force…don’t worry, uncle Powell got your back…

Don’t rug pull the market JPOW!!! We need our stonk stimmys so poor people can get jobs!!!

Buying the dip, will not work going forward, at least non consistently!

After nearly 13 year expansion with easy credit creation, global economy starting contracting is no longer secret. Fed is/was the mkt since GFC. Without that support, volatility and confusion with opposing forces will increase as evidenced, last week. Covid is still here.

Again hope is eternal. Negative comments about the mkt is least liked. No surprise if this is deleted, as some of my previous posting. Inability to accept opposit point of view defeats the purpose of exchange of ideas, is a reflection of insecurity.

I’ve used it quite a bit over the last decade for real estate transactions. But as other providers have come out with more of an “all-in-one,” many people have converted to other programs. There are others like dotloop which provide our boilerplate contract documents with an e-signing ability in one step. Much easier than converting a pdf over to docusign, or dealing with the glitches when you export and the signature tags are placed incorrectly by the template installed.

It’s archaic at this point, but I keep it for personal use.

A company with such a simple product should have better technical ability. These are simple problems to fix for any good programmer. Notice I said programmer not the plural.

It’s amazing how little the big legacy companies spend on tech. I was asking one of the biggest insurance companies in America about paying a bill, and they don’t take payments online or over the phone.

Petunia, those companies usually want direct access your bank account.

AA-and, like a tick, once in they are problematic, if not difficult, to extract…

may we all find a better day.

For many years our insurance company has provided homeowners and vehicle coverage and offers payment via the internet. It is regional with a good reputation, unlike many others. I don’t think I would do business with any company so antiquated in their payment processes that they don’t offer an online payment option. It shows me that there are too many entrenched employees that don’t have a clue.

I heard someone say there is a software bubble going on. Yes software can make things better but the digital world is getting marked up too much.

There is a physical world too, where you need to eat, have shelter, get from point A to point B, have toilet paper. A lot of software is a luxury. Do you really need your bathroom exhaust fan blue tooth? Do you need to control your lawn irrigation on your phone?

I’ve used it too but as a consumer only, for mortgage closing. It’s useful but reminds me of Netscape with their browser. The type of product that will eventually be provided free by MSFT or someone similar as an add-on.

Under no sane financial environment would such as company ever be worth $70B, current value or anything close to it. Maybe if it was actually making money consistently it should be worth hundreds of millions.

Never seen it but would be an eye opener to get a list of similarly ridiculously overpriced companies. I suspect it’s a noticeable percentage of market capitalization.

This would be a great analysis to run!

Wolf – if you’d like I can do this analysis, I have the data just have to convert number formats to get the ratio.

Just eyeballing I can see several overblown bubble companies with Price/Rev > 10x. With maybe a couple of exceptions (genuinely fast sustainable growth), the complete list will be a who’s who of blowups in the next crash…

Software and biotech will feature heavily I think…

TDOC (10x) Teladoc

NVAX (12x) Novavax

FTNT (18x). Fortinet

FIVN (20x). Five-9 Networks

RGEN (25x). Repligen

VEEV (~25x). Veeva Systems

TXG (32x) 10x Genomics

MARA (50x) Marathon Digital Holdings

XLRN (100x). Acceleron Pharma

Wisdom Seeker,

Good idea.

But be careful with biotechs. Some of them are still just research outfits with no product and essentially no revenues. They do IPOs and sell shares to fund their research.

Investors buy the shares to bet on the success of the eventual drugs. If the drug fails, investors lose everything. If the drug succeeds and becomes an actual product, these investors reap huge gains. This is a special case of public shareholders funding research, and I don’t think it’s an appropriate target for a price/revenue analysis.

That said, biotechs with one or more drugs on the market are fair game.

My only objection would be TXG. Proteomics could be bigger than mRNA. I sold my TXG a while back when the covid bubble broke and it hit my trailing stop but I plan to repurchase it.

You forgot Microsoft. It’s not just small companies trading at 10x revenue.

I was also thinking about companies like Uber. Price to revenue is not particularly high (by today’s inflated standards) but still one I think should be worth close to zero instead of billions. It’s a cash burn machine offering a taxi dispatch service. Nothing revolutionary in that.

The overwhelming percentage are also inflated because the P/E ratio is “low” due to the fake economy inflating profits. Burlington Northern is an example due to operating leverage, even though its revenues are more stable than most.

Another noticeable proportion (maybe still the majority) are also inflated from excess leverage which looks “manageable” due to artificially low interest expense. This is more of a “liquidity event” risk versus profitability, since it takes time for higher rates to show up in new borrowing and refinanced debt.

BIOTECHs various ETFs could be alternate choice with some bets on a few dominant names. PFE p/e ratio is 15, JNJ 23, GLD 12 (with 4% div/yield) MRK is a bit rich p/e 26 with 3.7% div/yield.

These are focused on covid vaccines and therapy. A lot to choose from! I am sure if one disagrees, just delete this post. Will not be surprised!

DocuSign has become so pervasive that a lot of people don’t even know that they use it from time to time.

Could be correct. But what use it that if they are losing money? Also what use high market share if it is in a industry that isn’t a natural monopoly.

Most of the successful tech companies have managed to achieve a high market share in a industry of natural monopolies. Meanwhile there are dozens of mangey horses pretending to be unicorns while losing money in markets in which being the largest doesn’t give you monopoly power.

Not sure I would call it natural monopoly in most instances. I think of it as first mover advantage where it would cost a fortune to try to displace them.

An example is Google. It’s predominantly an advertising company. There is nothing other than money (no intellectual property) from challenging their market position. It’s just too expensive.

Not sure I would agree. M$ competes in the ad space, I would be happy use anyone (or both) – but M$ just sucks and Google simply works like a clock, like it or not. It’s hardly about just the money.

If you think we’re at the tippy top you’re an amazing optimist Herr Richter.

Exactly. We are a few years off from the tippy top. We are not building to a 2008 or dot com type of downturn We are building to a 1929 event that will take a decade or more to bottom.

It’s different this time – it’s worse.

Wolf is not of German descent. I believe his family was driven out of Czechoslovakia during WW2. I’d avoid any German references such as “Herr” out of courtesy to what happened to his ancestral home.

Thanks.

The drop after slowing growth rates is totally rational. The crazy things happened before, as you said.

Disillusion will help in the end.

When you buy these “unicorns”, you’re not buying a company, you’re buying a lottery ticket in the tulipmania space.

No profits? No problem! No revenue? Even better!

If you have revenue and positive profit, then you’re a business that can be valued by traditional metrics, and thus not worth gambling on.

Exactly ivanislav. A textbook example of the “greater fool” theory. Very similar to the ridiculous valuations during the dot com boom.

But when will the supply of greater fools run out? Those lottery tickets are changing hands at a furious pace right now. Possibly many of the ticketholders were not of age to be investors the last time this happened.

“When you buy these “unicorns”, you’re not buying a company, you’re buying a lottery ticket in the tulipmania space.”

Well stated! In other words, the markets have become casinos.

@I

Spot on!

There are basically 2 investing ‘styles’,’Value’, which is mathematically based on earnings and fundamental economics.

And ‘Growth’ which is based on trying to predict future changes in societal demand and investing ahead of the curve.

Low interest rates favour ‘Growth’ against ‘Value’ because the value of earnings is discounted at a low rate.

Because interest rates are currently under question as to going higher, this puts pressure on all ‘growth’ stories and the weakest ones can no longer carry. You see who has no trunks when the tide starts to go out.

If interest rates do normalise, the ‘growth’ carnage will be horrendous, at least ‘value’ might still have some earnings to fall back on. IMHO

It’s all fun and games, until you’re the last one holding the bag and realize it’s full of sh!t.

1) SPY new backbone (BB) from Nov 5/ 10 is a failed BB. It failed to keep the uptrend running.

2) The lowest point of this BB, Nov 10, is a swing point.

3) SPY got support from K of the cloud (18, 52,104).

4) SPY retraced 50% of the move from Oct 4 low to Nov peak.

5) The DOW retraced 0.86 of the run from Sep 21 low to the peak. The previous retracemnt from June 18 low to Sept 21 low was also 0.86. Both are very deep.

6) The DOW BB #2 is : Apr 16 hi/ 20 low. It was followed by BC/ AR : May 10 hi /12 low.

7) And this is where we are.

Mr. Engel,

What kind of “backbone” is a “failed backbone”? Maybe it’s only a herniated disk.

8) If the DOW will drop to BB #1 : Mar 18 hi/ 25 lo area, it will form a megaphone, BB#2 will be the center line.

There is absolutely nothing unique to DocuSign’s business. Digital signatures has become a commodity business and as time goes buy, more and more DocuSign copycats are entering the business. This, couples with market saturation having been reached due to the pandemic means the company’s valuation can only go one way… down.

Nobody needs these services. You can just check a box, text, or email somebody agreeing to their terms. Simple and the same outcome.

Zillow should spin off their internal/subsidiary Docusign alternative and make a cool 30-40 billion, i.e. ~3x Zillow Group’s current market cap.

Then they can replace the losses on the 7,000 + houses they sold (selling) at a loss. Good pan!

Duke Cunningham, Rep CA 50 did eight years for steering a phony defense contract to a close friend and taking kickbacks. The contract was to store DOD documents on PDF. There was no company, just one guy and a front. Things which earned you jail time ten years ago are SOP.

Back in 2016 when the DNC was getting shelled for behavior such as advancing the primary-debate questions to Clinton (but not others), the DNC head at the time asked a reported “why are you criminalizing behavior that is normal”, and all I could think of is…

How on earth have people gone so far off the rails “normalizing” unethical behavior that ought to be criminal?

You have to make the distinction between private and institutional corruption. Institutional corruption has made our financial system the envy of the world. At the margins corporate malfeasance deters personal corruption, forces the activity into regulated organizational units. Think of Eminent Domain, 100 years ago if you wanted someones property and they didn’t want to sell, you had various methods you could use, including bribing public officials. Now the institution does it for you, with judicial constaints. SCOTUS is currently arguing R v W, but no one questions this.

I have been penciling Q1-2021 as the end of this bubble for more than 4 months now.

I don’t claim to have any special knowledge or expect to time it perfectly; the view is entirely because I believe inflation is so serious that the Fed will be forced to act sufficiently to change the liquidity environment – this is the prerequisite to pop the bezzle.

The actual break in “animal spirits” will occur with some huge scandal or a bankster company failing – impossible to say which just yet.

And since this is my 3rd bubble – I expect multiple compression across the board. The “good” companies, the ones that are merely ridiculously overvalued – will see market caps drop at least 50%; Cisco was $700B at its peak in 2000/2001 in the Y2K bubble and went down as far as $140B. They’re in the $260B range now despite have 3x the revenue and 8x the profit vs. then.

The bad companies will fall 80%+ – some will disappear (i.e. fail or become penny stocks/delisted), some will “bounce” to a small fraction of zero activity (see Microstrategy before they became a bitcoin fund). A handful actually will recover or even exceed their previous capitalizations, somehow.

But more importantly – a huge number of “traders” will be crushed.

I firmly believe tens of millions of people are vacuuming nickels in front of a steamroller. It is easy to do this when asset/stock/crypto prices are unilaterally up; it is infinitely harder when the trend changes.

The overvaluation this time around is so enormous that the above mentioned falls/multiple compression is very likely to be even greater than guesstimated, but it is impossibl to be precise when political actions are involved.

I personally think we will get the worst of all results: Fed breaks the back of the animal spirits, then vainly tries to push on a noodle when the rush to the exits precipitates historic falls. 2008-like where there were nearly daily/weekly swings of 1000 points in the Dow (when the Dow was only 12000-ish).

Maybe the circuit breakers will prevent the 3000 point equivalents today, maybe not.

Interesting times.

Yesterday I sent this response to an email from my FA entitled “End of Year Planning”

There is no planning anymore.

True Marketplaces don’t exist.

Only kids betting they can land their nickel closest to the wall, winner take all.

It is sad.

I don’t recall CSCO ever reaching $700B. It peaked at $82 in 2000 and fell to $8, as opposed to the NASDAQ which “only” lost 83%.

CSCO is at $55 right now and I don’t recall any splits.

The $700B number looks right according to what I see on macrotrends dot net. The “market cap” category only goes back to 2005, but I see that the 2007 market cap peak was about $200B. Based on the relative stock price between the two dates (80@2001 vs 25@2007) that roughly works out.

Way off on that market cap… there were no companies that size back then.

https://companiesmarketcap.com/cisco/marketcap/

Captain Jealous,

Check your linked chart. It’s a monthly chart (one value per month) that only goes back to Jan 2001. That was 9 months AFTER the collapse began, which in Cisco’s case started on March 27, 2000.

Note my comment from earlier, just below, which gives you the actual market cap numbers.

If you’re going to criticize something, first make sure you know what you’re talking about. If you don’t know when the dotcom bust began, you need to leave this discussion to adults who’ve lived and traded through this stuff.

Captain Jealous, I meant to say “80@2000” based on August Frost’s comment, not “80@2001”, it was a typo/mistake

Augustus Frost,

Hahaha, the good ol’ times. I just looked it up for the fun of it (YCharts): CSCO hit a peak market cap at the close of regular trading of $556.6 billion on March 27, 2000 before collapsing by 89% to $62.6 billion in 2002. Those were the times!

Today, $237 billion.

Cisco is a great company.

Amazon is great company.

Tesla is a great company.

But… it is time to sell now, just like there were times to sell great companies in the past. In the past bubbles we did not have Wolf. His wisdom is priceless.

The Fed overstimulation has necessitated the bust.

It is our job to profit on the way down.

Intraday, the $700 billion figure might have occurred. That would mean a 20% intraday drop. And those plunges did occur.

MP, your description sounds like I could replace the name “Docusign” with a lot of other zombie names and the description still fits … TESLA, WEWORK, TRUMP MEDIA, RIVIAN, CRTPTO etc.

I know things are bad when I hesitated to include BItcoin in that list – only because it has so many rabid followers

It’s too bad the nation’s Notary Publics never thought of organizing their profession into an IPO. They could have been bigger than GM, if they could convince venture capitalists that a rubber stamp is a Technological Innovation.

Actually, NPs provide a decentralized services which adds a layer of security to the information. If an NP is hacked, the level of damage is minor compared to a centralized networked system of private information, where the entire system is compromised. Think blockchain.

Smash & grab is very humiliating, but it generate the highest

turnover for designer pcs, bad & slow moving items.

It’s a blessing for business, if they have the right insurance, paying

top retail prices.

People with money don’t like to feel unsafe anywhere. Any hint of a criminal element sends them scurrying away. The illusion of safety is dead.

I could see the Brazilian model of high end shopping coming to America years ago. In Brazil, you must be a registered shopper with an appointment to enter and the guards have big guns.

Discourages shoplifters as well?

Hi Petunia ,

I am not saying here is the safest place in the world but I am not aware of such thing

I imagine the insurance company would let a retailer get away with that one time, then no policy renewal.

The insurance will cover what they paid not what they MIGHT have received. Second: many policies exclude mass events: riot etc.

My thought after seeing video: the cops and security can’t shoot the thieves but unlike mobs in the past these escaped in cars: why not shoot the tires?

Take a minute and do a background read on DocuSign history and the cast of characters that have been involved. Interesting who made the money 🤑🤑

Gee……things change quick in the economy……what do you know!

so……why does the fed have to taper……..why not just stop buying bonds……..today……..after all inflation is raging…….unemployment is at full employment 4.2 percent……….are these officials so stuck in the mud that everything needs to take six months……….get the rates up!

Nope………we move at the speed of a turtle………the sign of a country on the decline.

As a Realtor that is required to use their clumsy and stupid Docusign software, I’m glad to see them get hit so hard. Docusign is scary from a security standpoint. I’m amazed at how many use this third-party garbage.

The Federal Reserve is a paper tiger. Its threats to increase interest rates (to keep inflation expectations from becoming embedded) are hollow because increasing rates *meaningfully* would make the national debt unserviceable.

They are chained to a policy of perpetual low rates.

Buy the nacho bean dip! Daddy Powell’s got you covered.

Over on ZH apart from all the paranoid stuff there is serious comment from finance outfits that the Fed may be on the verge of a ‘policy mistake’ that could, horror of horrors. take the market down by 20% like 2 years ago when Powell was ‘forced’ to reverse the taper.

It wouldn’t be a policy mistake to take the market down 20%, or to raise the lowest interest rates in centuries. The policy error is in thinking that normalization of rates and valuations can be achieved without upsetting the speculators. If Powell wants to be popular with Wall Street, he is in the wrong job.

It should be the policy objective — not a policy mistake — to take the craziness out of the asset prices.

They will probably try to tighten until a big zombie or two goes under. They can’t let everyone fail, but they will have to do enough to take out some froth out of Wall Street.

@ Nick Kelly

Mr Powell consistently refused to accept responsibility for increased (at least partly) wealth & income inequality under his tenure! Declaring ‘transient’ (word) inflation being non-operative, after a long time insisting it is just transient reflects on the lack of credibility of Fed,

The same way Mr. Barnake repeatedly claimed the ‘wealth effect’ will trickled dow and help economy grow. Another delusional propaganda repeated in the press, since most of the Wall St wealth, 50% or more to the top 1% and nearly 90% to the top 10%. MSM never challenges it, since 90% media controllled by mere 3-4 mega corps!

DocuSign is a wannabe AdobeSign (former EchoSign). The latter has a great product and profits. DS is college-grade copycat, inflate-marketed by its former stockholders.

e-signature is relevant for a world with email. e-sig is a hard problem to solve in the email world. AdobeSign is leader (and Microsoft, Google, Apple could do it too if they were interested in the small profits, or if pioneers like AdobeSign weren’t doing it well already). DS is half-baked.

It is no surprise that DS makes no money by GAAP.

DS company is akin (kin of/to) the daddy of all ‘makes-no-money-but-its-majority-stock-is-held-by-funds-that-use-it-for-hedging’ companies, aka sales-force. DS owns stock in other a-kin companies. It’s a merry go round and round and round. That Wolfstreet has a page on DS is all DS wants. The rest, as they say, is in the future!

Bet DS will have the word NFT in their annual financial reports next year.

Wolf

I you carrying a vendatta on me, by rejecting my posts, without logical explanation, but permitting some one’s similar comments, is hypocrisy. If you don’t want me to post any of my comment, please decent enough to let me know. I won’t waste my time. Are you that insecure? Is this too much to ask? Thank you.

Correction:

Some but NOT all comments are ejected. But I have that feeling back in my head, and have to censor my self before posting. May be I am wrong but wanted some clearification. At Market Watch, none of the bearish comments against the Fed or the mkts are tolerated! thank you

sunny129,

There are many gray lines and slippery slopes I have to navigate all day long as moderator. It basically boils down to this: Don’t use my site to spread covid and vaccine related stuff. Don’t use my site to promote pharma products and supplements. In addition, they’re my commenting guidelines.

There are lots of trip wires that comments get hung up in until I either free them or delete them.

If something gets hung up temporarily or even deleted, don’t take it personally.

sunny129,

I just checked. I have not deleted a post of yours in at least one month.

If I remember right, I removed a link and a line from one of your posts, but I didn’t delete the whole post. And this seems to have caused this whole hullabaloo.

My paranoia got better hold me. My apologies. Again, I have already accepted that it is your blog and your rules. No arguments against that.

B/w My response posting re Biotechs was prompted by the posting of individual biotechs by Wisdom seeker in this thread’

Thank you for your understanding.

Do not self censor – let Wolf do it.

@Ambrose Bierce

Appreciate your suggestion

Thank you.

Salesforce, Docusign, ARK

The margin calls are coming. When the Russell 2000 breaks below 2080, you want to be holding SRTY.

Strap on your skis, this is a 3 Black Diamond slope we are approaching.

How about that BC eh? Down 17% in 24 hrs. Sooo, a store of value?

We already knew it’s not and will never be a currency. The ‘store of value’ is the fall back position. But what is BC? Ya I know what the block chain and distributed ledger are, but where should BC be classified in the filing cabinet of ‘investments’ where there is no possibility of earnings.

I would say it’s closest to a digital chain letter. The ONLY way anyone in the chain can make money is via newbies buying in. So just as with chain letters we have early entrants telling newbies how well they’ve done. And they have! Ponzi schemes work well for the middle as well as early entrants.

Who are the Nortel, Worldcom and Enron of this cycle?

Thank goodness, this company is a cancer on humanity.

Thanks to them, sign-it-or-leave-no-redlining contracts are far more pervasive. And unlike “click to agree” buttons this stuff most docusign stuff (supposedly) will stand up when used to seek injunctions and money judgements against the signatory.

If some megacorp or potential employer wants to have me under their thumb like that, I expect to be able to send back a signed and modified document, certified mail, and tell them “ball’s in your court” and make it clear that if they’re going to be unreasonable it will affect their reputation. Docusign lets the megacorp click a checkbox to delete this possibility.

These assholes lobbied every state to make weak-ass security like “we noted the signer’s IP address and made sure they could receive our emails” is legally equivalent to a wet signature on paper. Washington State changed their trailblazing personal digital certificate law because of this.

These clowns can go to heck in a straight line.

From my experience with DocuSign via my IRA Custodian, Equity Trust Company, they have a service one can readily do without. They provide a link online for say an Asset Sale, Transfer, or Fund Distribution form to be signed, but one can readily print out the page or pages requiring signature, sign same, scan the document into PDF format, and upload, fax, or email the duly executed forms to the custodian. Frankly, using touch created script at their site to sign my name, it often looks like I am suffering from the DT’s and I just don’t imbibe at all these days. Another ballooned Powder Puff company in U.S. stock trading.

Wolf,

Will we ever see an analysis of the major pharma firm’s financial performance over the span of this pandemic? Sorry if you did and I missed it.

As an added thought, how about all those who provide vaccination services too, CVS, Wallgreen, etc.

Just trying to “follow the money”.

Moderna has its own entry in this article. I covered Walgreens and CVS in recent weeks. They’re struggling. Walgreens already closed 600 stores in the US and is closing more. CVS announced it will close 900 stores in the US. They’re both switching to selling healthcare services (primary care) in the stores that they will keep because the regular pharmacy business is walking off to ecommerce.