How messed up the economy has become, fueled by government moolah and Fed manna, when nothing and no one was ready for it.

By Wolf Richter for WOLF STREET.

When the government spends trillions of borrowed dollars to boost demand from all sides, and when the Fed prints trillions of dollars to monetize the borrowing binge by the government and also to inflate asset prices so that asset holders feel richer and start spending these gains (the Fed’s doctrine of the Wealth Effect), well, then you’re going to get some demand, a lot of demand, suddenly, particularly for goods. And this sudden demand has been ricocheting through the economy for over a year.

And supply? Duh. Maybe they thought supply would suddenly materialize. But supply chains are long and complex, and then there were all kinds of additional issues, ranging from container shortages, spiking ocean-freight container rates, the blockage of the Suez Canal, a capacity shortage among container carriers and freight companies, a ferocious winter storm that hit the Texas petrochemical industry and semiconductor plants that then created further snarls in supply chains, while a fire at a chip plant in Japan wreaked further havoc with the semiconductor shortage for automakers.

Among commodities, sudden demand from homebuilders and remodelers for things like lumber caused all kinds of distortions and supply issues. And retailers ran out of products across a wide spectrum, from bicycles to hot tubs and importantly – since they weigh so heavily in retail sales – new and used vehicles.

“Turns out it’s a heck of a lot easier to create demand than it is to bring supply up to snuff,” Jerome Powell mused at the press conference. And now the economy has the biggest mess in decades to deal with.

This mess has shown up in inventories, which also indicates that this will take a while to get straightened out.

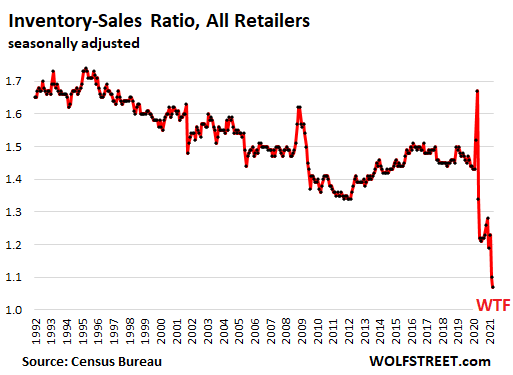

Inventories at retailers, from grocery stores to new and used vehicle dealers, dropped to $602 billion in April, down about 9% from April 2019, according to the Census Bureau, even as retail sales skyrocketed 20% over the same period, producing the lowest inventory-sales ratio in the history of data going back to 1992:

The inventory-sales ratio (inventories divided by sales) is a metric in the retail industry to show whether retailers are overstocked or understocked, at a given level of sales. Since both inventories and sales are measured in dollars, the effects of inflation get canceled out in the ratio. The spikes in the chart above were the brief periods when retail sales collapsed, which pushes up the inventory-sales ratio. This happened twice this century, during the Lehman moment in September through December 2008, and in March and April 2020.

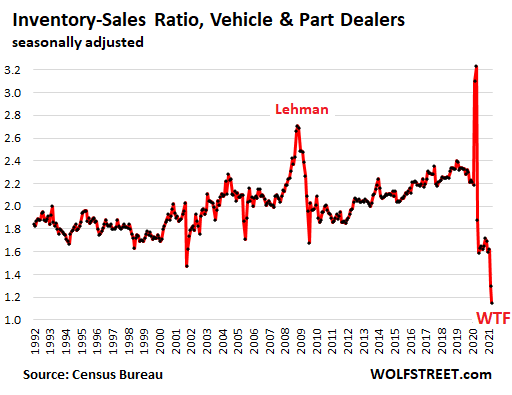

New and used vehicle dealers have been encountering strong demand from retail customers, but their supply has come under heavy pressure. On the new vehicle side, the semiconductor shortage has been hitting vehicle production globally.

On the used vehicle side, it was the collapse of the rental car business in 2020 that triggered a collapse in orders from rental car companies for new vehicles to put into their fleets, which triggered a shortage of rental cars in 2021 as travel picked up, which is causing rental car companies, desperate to increase their fleets, to hang on to their vehicles that they do have, instead of selling vehicles from their fleets. The rental vehicle market churns over 2 million vehicles a year. And that whole flow has been thrown into disarray, and dealers, desperate for inventory, have bid up prices at wholesale auctions into the stratosphere.

And inventories at motor vehicle dealers and at auto parts dealers plunged to $162 billion, for a record low inventory-sales ratio of 1.15, when a ratio of about 2 is considered healthy. The two spikes in late 2008 and spring 2020 were the months when sales collapsed:

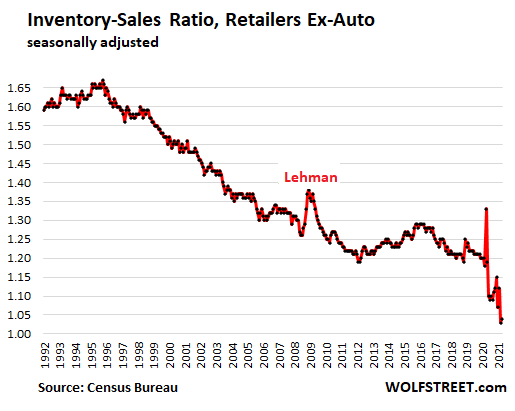

Motor vehicles and parts sales account for about 22% of total retail sales. Without auto and auto-parts sales, the inventory-sales ratio at retailers “ex-auto” ticked up a minuscule bit in April, from its record historic low, to 1.04.

This “ex-auto” inventory-sales ratio depicts the decades long efforts to get an ever tighter control on retail inventories outside of auto dealers, with ever smaller inventories on hand in relationship to sales, which was one of the conditions that contributed to the shortages: the lack of inventories when supply chains got tangled up and demand suddenly took off.

With two retailer segments, the ratio deteriorated further in April: auto & auto parts dealers, and furniture dealers. At other retailers, the ratio ticked up, including building material and garden supply stores (such as Home Depot), clothing stores, general merchandise stores (such as Walmart), and department stores.

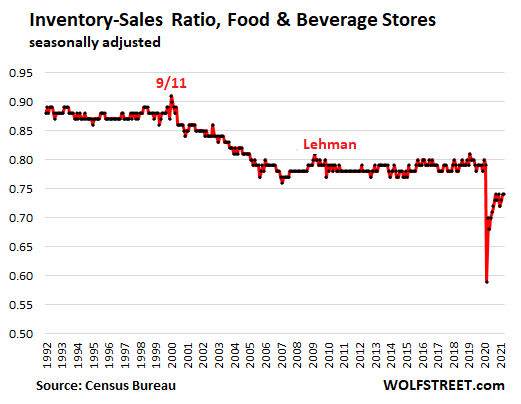

Food and beverage stores live in their own world amid perishable goods that require tight and finely tuned inventories. The inventory-sales ratio remains relatively stable normally. But when the panic-buying at supermarkets set in in March 2020, with stores running out of things like pasta and toilet paper, inventories collapsed amid the empty-shelf syndrome, and the inventory-sales ratio collapsed with it, hitting a historic low of 0.59 in March 2020.

Panic buying eventually stopped, and inventories caught up to some extent, but sales remain hot as some consumption has shifted from the office to the home, and the inventory-sales ratio, now at 0.74, remains below historical levels. Note that the Lehman moment had practically no impact on supermarkets, but 9/11 did for just a moment:

These charts are signs of just how messed up the economy has become, hit by a sudden WTF spike in demand at the retail level, fueled by government moolah and Fed manna, when nothing and no one was ready for it.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Crutchfield has a handful of home theater receivers at the moment. Everything else is sold out!

15 weeks ago today I ordered, through a brick & mortar audio shop in the Twin Cities, a pair of USA made JL Audio e112 subwoofers.

At that time, the anticipated wait time for delivery was 5 – 6 weeks, and two weeks ago, I was informed that the may arrive in a week. Nope, no word yet.

I would rather wait a bit longer and get my subs made in Florida than get a pair “Designed in the USA – Assembled in China” (although it would be nice to have them in my system already). The shop owner speculates that the delay is caused by, “Catching up with back orders & The chip shortage impacting how fast they can catch up.”

Last week, for one day, the Penske BMW dealership had an M4 come and go. It was a 2015 with three previous owners and 94K miles. Asking price was $42k. Plus, it had presumably seen Minnesota winters and salt. When I bought my 2016 M4 last May 2nd, it was a one owner (no MN winter salt) with 19k miles. Asking price was $41.5k & I paid $40k. There were two for sale at the time.

Now, mine has 24k miles and would retail at close to $50k.

P.S. That’s the first used M4 that’s been at the dealership in five or six months.

The average person buying many used cars, to resell later, is a common way to store wealth in inflation racked economies.

The Wolf Street effect is working as I was just notified that the subwoofers have arrived.

Hahahahaha!!! ?

Oh yeah, definitely worth the wait on the subwoofers! Fantastic sound & build quality. Plus, for the years to come that I enjoy listening to them, I will take satisfaction knowing that they were designed and built in-house in Miramar, Florida.

Manufactured 6/17/21. Making music in my living room 6/23/21.

Dan,

I would sell it now if you can indeed get $50k because they will crash in price in the future and anyway the service and repair bills are the killers of BMWs. BMWs generally fall in value fast because nobody wants them because of service and repair costs.

A new 3D printer I seriously want to buy from a major manufacturer has been unobtanium from its “release” months ago.

Intel claims the chip shortage could last “several years.”

HP has raised consumer PC prices by 8% and printer prices by more than 20% in just a year. The CEO blames the rise in prices on “component shortages”.

Digi-Key Electronics [a huge electronics parts supplier] has raised prices of semiconductor-related components by roughly 15% this year. They blame it on “pressures from the supply crunch”. Certain components now cost 40% more than they used to according to the company’s vice president of global supplier management.

Contract prices for computer memory have risen about 34% since the beginning of last year.

The median price of the top 20 bestselling microcontrollers is up by more than 12% since the middle of last year, according to Supplyframe Inc.

Electronics Account for 40 Percent of the Cost of a New Car

No technology has so consistently and dramatically rebooted the car as the computer chip.

MAY 2, 2020

https://www.caranddriver.com/features/a32034437/computer-chips-in-cars/

It’s ironic that things are so bad now that all of Wolf’s charts end in WTF.

WTF stands for WE THANK the FED.

What does it stand for?

What the F**k

I notice empty shelves and shortages where ever I go now.

That used to be what I saw in socialist countries.

It used to be companies fought for every inch of shelve space.

Now it’s like…yeah, whatever we got in the back.

I repair what I can and DO WITHOUT for ‘shortage’ crap

silence is golden

I had to order a multi-function switch, fancy name for turn signal with windshield wipers control, headlamps, etc. It was for my neighbours Plymouth Voyager. I was expecting it to be unavailable. I was pleasantly surprised it came in the next day. In fact, I simply could not believe it. The old one had a data/power ribbon hanging from it so I was expecting a big oh oh in price, plus it is obviously on the column next to the driver airbag. I would have bet it would be $800, cdn. It was $216 for this retail peon.

Then my daughter bought the last bathtub shower enclosure at her local Lowes, new ones to be determined. Go figure.

We needed a new dishwasher. Wanted the best-rated model in our price range, a GE. Zero available with an unknown restock date. So we settled on a Bosch, partly because it was available. Delivery was bumped three times, getting it five weeks late. But we got it.

Never seen anything like this in my 60 years.

my 5th wheel AC went out – so I’m out of town in rural merica

tech guy said he couldn’t get part for week

called my AC guy back home and we figured out work around(common)

went to store and bought parts, educated AC worker on how to hook it up and now have AC

I find the Philippean dish washers the best.

They seem so versatile and have many more programs than Bosch.

IN my local home retailer, they have tons of bath rub enclosures, I am in Southern CAlifronia

Bathroom fittings are widely available. My plumbing source tells me this is because plumbers are both fully booked and struggling to get the pipework to connect them. Thus the shortage of ability to connect fittings leads to a glut of them.

shortages in plumbing is PEX and many components associated with PEX

new water heaters are problem – isn’t JIT great

our local supplier sells 200 a month and finally got 1 shipment(6 weeks late) with 100 on truck

he routinely shuttles 3-4 trucks to Phoenix supplier to get new water heaters

of course the suppliers all have most parts – with 30-50% increase in price

“When the government spends trillions of borrowed dollars to boost demand from all sides, and when the Fed prints trillions of dollars to monetize the borrowing binge by the government and also to inflate asset prices so that asset holders feel richer and start spending these gains (the Fed’s doctrine of the Wealth Effect), well, then you’re going to get some demand…”

Absolutely and contrary to some opinion out there, QE is much more than an innocuous asset swap that only creates excess reserves that sit idly with the banks. Primary-dealer banks buy bonds from investors and sell them to the Fed. As a result, the Fed obtains the bonds on its balance sheet, the pd bank gets excess reserves and the investor receives a cash deposit.

Investors with the new cash deposits are prodded to speculate in the asset markets with ultra-low interest rates (financial repression). This is one mechanism of how QE provides liquidity to inflate asset prices. It’s the classic monetary one-two punch of new money creation coupled with ZIRP that is juicing asset markets while vicious housing inflation is being dumped on the masses.

And new money is indeed being created as the Fed pays a higher price for the bonds (with printed money) than a non Fed-intervened market would pay, so this is not some neutral asset swap.

Additionally, QE allows the government to spend more because as the govt debt is monetized (nullified), there is not the corresponding increase in interest payments (borrowing costs) with all the debt issuance. The increased spending which is transforming into helicopter money for the multitudes is also producing inflation in the economy.

In other words, QE increases deposits via asset purchases and govt stimulus-spending which shows up in the surging M2 money supply. And this new money is driving up asset prices and consumer spending leading to greater wealth disparity and inflation. What will the social and political ramifications be?

Pretty good restatement of all the convoluted dynamics of money printing.

At the end of the day, I personally always try to keep in mind that all the G’s tortured monetary manipulations tend to only have indirect, oblique impacts upon physical reality – even Powell is now basically admitting that “reality is hard” in his supply related comments.

That isn’t to say the G’s supra Constitutional actions are benign (especially in the longer term) but rather that most of the Fed’s f*ckery pokery is seen through by physical goods producers, who have to deal with the constraints/trade offs of actual production every day…and who do not live in a finger snapping, magic money printing world.

May be difficult to understand the oblique impacts on reality but the important considerations are that they’ve completely changed the financial system and wealth distribution of the nation which will have meaningful consequences going forward.

PD don’t necessarily buy from investors. They buy from the Fed or Treasury auctions.

A lot of PD SELL to others. Daiwa Securities and Mizuho Securities sell debt to Japanese buyers. BNP Paribas, Barclays, Deutsche Bank and NatWest Group sell the debt to European buyers. Goldman Sachs, and Citigroup sell to many American buyers.

By law the PD must participate in both Fed OMO and Treasury auctions.

What makes you think the PD sell secondary market bonds to the Fed? Numbers? My impression is that in the secondary market they act more like market makers and make their money on the spreads.

What makes you think that banks can “prod” the owners of the proceeds of bond sales to purchase “assets”? There are plenty of reasons to liquidate bond holdings besides “asset purchases “. One might be to reduce debt since creditors usually won’t accept payment in financial instruments.

If I sell bonds the proceeds can be deposited elsewhere. Chances are that the transaction will be conducted through my brokerage and the proceeds placed either in my brokerage account or transferred from there to my bank account.

I fail to see the connection you allege.

It’s not the banks prodding investors. It’s the Fed’s ZIRP that is pushing investors out of cash and into assets. And the “connection” to all this is the surge in M2 deposits. If it were only going to excess reserves, it would not increase the money supply. QE increases deposits and even Powell said it was being used to increase the money supply.

There are a couple of articles you should read that discuss the dynamic. In the Bloomberg article, it talks about how the banks were going to have to pay up for T-Bills because they did not have enough to sell to the Fed. In the Wall Street Journal article, it actually says that the Fed buys directly from investors without (correctly) mentioning the bank intermediaries. Follow the money which is showing up in M2.

Google: “The Money Boom is already here” -WSJ and “Fed’s Plan to Buy Treasury Bills Could Be an Expensive Ordeal” – Bloomberg

Low interest rates don’t “prod”, they change options. In many cases, they “herd”. But not everyone follows the herd.

You still haven’t explained how I would sell a Treasury security to a bank without a brokerage. If I go through a brokerage I have plenty of options besides depositing the proceeds in a bank.

I can buy overpriced stocks, bonds, and real estate. I can buy overpriced cars. I can go to overpriced restaurants.

I can buy crypto or gold.

I will often invest where the herd doesn’t go. In 2007 Faberge went out of business. At the time they were still making replicas of their famous eggs. Neiman Marcus sold then for $1500. My sister is in the jewelry business. She asked me if I wanted to buy some eggs when Faberge liquidated. I bought 20 of the 15th Anniversary eggs at $300. I still have them. Try finding the 15th Anniversary Egg. You won’t find any. I own all the remaining ones that aren’t already privately owned.

After 9/11 while everyone was watching the planes fly into the towers for the 50th time I was researching security-related companies. When the market finally re-opened I was in there buying with both fists.

Or I can sit on cash or buy CDs. I can hear the eyeballs rolling right now about inflation, but if you do that you are guaranteed to have at least the same amount of money tomorrow as today. You can’t say that about stocks, bonds, PM or crypto.

Those of you too young to have been through 2 major drawdowns since 2000 might not understand the implications. Losing money slowly to inflation is nowhere near as painful as losing half your assets over a course spanning years.

Sure, sure, you won’t get shaken out and sell at the bottom to lock in your losses when we get Papa Bear. And I call bullshit. If you allow yourself to be herded into “assets” by low rates you don’t have the balls to hold through a grinding bear market.

The 2000 bear lasted 2-1/2 years and took half the value of your stocks. It took almost 5 years to recover – just in time for the 2007 bear, which only required about 1-1/2 years to chop you in half. Recovery took about 4 years despite QE.

The 2020 bear lasted a month. Despite the 1/3 haircut I don’t think it lasted long enough to break even the weak hands, and the recovery took 5 months.

It’s very hard to watch your wealth wither away. The 2000 crash didn’t bother me much because I was still in old-fashioned value investing. I rode through it collecting dividends.

2007 was different. It didn’t just hit dot-com stocks, it hit everything. I remember the point where the market bottomed very well. The pain was becoming unbearable and I wanted to sell. And I realized that my sentiment indicated a market bottom. If you want to be contrarian watch the small investors and do the opposite. If you want to see a small investor look in the mirror. You’re your own contrarian indicator.

Bear markets offer buying opportunities but not to those who allowed themselves to be prodded, enticed, forced, led, or otherwise convinced that cash is trash. They have no ammo left.

As long as we’re recommending reading, try reading about Nassim Taleb’s strategy instead of people talking their book in the MSM. He’s willing to lose money year after year betting on black swans, which are not as rare as people think. And when the swans arrive he makes a fortune.

jrmcdowell, you ask “What will the social and political ramifications be?” A Pandora’s box of unintended (a charitable interpretation) consequences, which will constitute the next set of emergencies needing to be addressed in the future. The only question is when, not if.

Its amazing to me how fragile these mature industries are.

Bad weather, interruptions in supply chain, etc. Is there any business that can manage without government help and assistance?

Right now there is a major shortage of chlorine to be used to disinfect water and wastewater. Originally it was just a plant in Longview Washington due to a blown transformer. Now a plant in Florida and one in Louisiana are down. There are only a handful of plants in the US that make the chemicals that are essential to remove pathogens from municipal drinking water. Some smaller cities will be running out this week with no resupply in sight.

Makes me glad I drink spring water right out of the mountain behind me.

False sense of security. You can’t count on spring or well water to be pure. You should have your water tested every year for both biological and chemical contaminants.

Nah, the fragility is a result of profit maximization, specifically monopolization and just-in-time manufacturing.

If you think about it, if you can sell X sheets of plywood for $100, why would you produce 2X sheets of plywood at $50??????

First rule in government spending: why build one when you can have two at twice the price?

Because if I can produce for $30 and sell for $50 I’ll steal each and every one of your customers.

But do that maximise your profit?

Monopolies, cartels and the like are far more effective ways to maximise profit than competition.

Sams, a monopoly or a cartel gets rid of the competition in order to become that entity. Sometimes they do it by aggressive pricing, sometimes by bullets, and sometimes by buying out the competitor. Maximizing profit comes after that.

Harrold,

Most industries are not being given assistance from the government. The government, during this pandemic has been very harmful, rather than helpful. Inconsistent rules that change by month and state, forced shutdowns, worker shortages caused by paying people more than they used to make, and much much more. Alot of factories still have worker shortages, because of enchanced unemployment, those shortages get passed up the supply chain.

The basic problem is Just-In-Time, which not only assumes a steady-state situation worldwide, but also leaves companies without the infrastructure, knowledge, or indeed the flexible personnel, to deal with disruptions.

So now that the government stimmies are ending, another whiplash is coming. Increased supply and falling demand!

Lumber commodity down in the low $900’s off of its $1686 / thousand Board feet in May. 2x4x8′ still over $8 at Home Depot today 6/21. The stock was plentiful. No hurry to lower prices? Plywood so outrageous I’d better lock my 3 sheets up in a safe.

The $9 8′ long 2×4’s in our local HD are starting to dry out and turn into bananas. No one is buying them. Actually, the store was pretty empty Saturday when I was there. Quite a switch from the Pandemic days.

Suggestion:

Find a proper lumber yard that contractors use. The only users at HD are retail homeowners. Their lumber and plywood are the shits, and over priced. Plywood sheathing spruce 3 ply…crap, warps and bends.Good bathrooms, though.

Alot of small home builders and most local contractors use the local hardware stores for alot/most building materials. Home Depot is inferior, but there are better Hardware stores in many areas like Menards.

Hard costs of 2×4 SPF/SYP around $300-400 U.S. dollars.

So $900/Mbf is still printing money for the mills.

A 90 year old Billionaire in West Vancouver controls both Canfor and West Fraser.

W

Wait for it!

Fed Tapering Policy

1). Thinking about thinking about how many years before tapering.

2). Thinking about how years before tapering.

3). Thinking about talking about how many years before tapering.

4). Talking about thinking about how many years before tapering.

5). Talking about talking about how many year before tapering.

6). Taking about how many years before tapering.

Mr. Market tantrum over Talking about how many years before tapering.

Back to #1 and start over.

The economy is such a jumbled up mess now that I am just trying to give it time to see what new situation is going to look like before taking risk-on investments. Once every few months I buy some precious metals otherwise just running a portfolio that might keep up with inflation if I am fortunate.

Yep. Same here. We convert excess retirement income to metals regularly. Bought 40oz gold last year, 1500oz silver this year. Savings are getting darn heavy……

I’m sticking with my 1 yr CDs for the time being. Kicking in some bucks every month to compensate for the loss in purchasing power, so I’m keeping even.

Or camp out with t-bills. Right how holding cash using cash equivalents isn’t going to protect against inflation very well but I agree it mitigates some of the damage.

How can you possibly break even with 1 year CDs though? I’ve seen rates around 0.6 – 08% at credit unions but that won’t keep you entirely whole.

Groundhog days at the Fed. Bill Murray was weatherman Phil Connors. But Murray is versatile and could easily play Jerome in the sequel.

Timbers,

If I were a better person, and I am not, I would find a way to reply with a link to “Talk Talk” by Talk Talk here. Just ran the lyrics through google and they are spot on for both your comment and Jerome’s Power Freakshow: “All you do is talk talk…”

JWB

I am still waiting for one day when I can casually order a RTX 3080 or PS5..I expect that to happen sometime around 2025 and it will probably cost 3 times the price it is today, not to mention by then I am sure I will be 2 generation behind and the latest and greatest will be out of stock at that time.

Its insane! 1660 Ti cards are now selling north of $800.

About a year ago I had a local computer shop create a gaming system for me. The 1080TI I wanted ran $1,000. I was shocked. But I took it anyways :-)

A YouTube PC tech channel analyzed an online benchmark database where one can determine what graphics cards are most commonly in use for gaming. They were surprised to find that, unlike at any other time including past tulip bulb mining surges, nearly everyone is one or two generations of graphics cards behind.

Prices are so insane that they made the heretical statement for PC gamers that it would be far better to just buy an XBox.

It’s such a distorted market that there has been coverage of eBay sellers buying entire lots of gaming PCs from manufacturers just to get the graphics cards which they remove and replace with far cheaper and far less capable cards not desirable for tulip bulb mining. They then sell the machines as “gaming PCs.”

Since at least the year 2000 the gov and the FED have been doing a bang-up job on everything, don’t you think? In fact, it’s the government alone that has ruined the economy, jobs, and savings for citizens. Now, no one wants to work even if there were industries left. 28 Tril in debt too, with nothing to show but broken down bridges and potholes.

No corporation wants to produce in the states and they can squeeze out anyone less than a billionaire from entering any retail market start-up. What’s worse, the few corporates will use this inventory situation to their advantage to bleed out every dollar they can from us with inflation or goods supply distortion. The pandemic has been a blessing to them. Go stock market! GAG.

I’m sure the shortages will improve once we decouple from China. Might take 2-3 years though…

Yep, across the developed world, from America to Europe to South Korea to Japan, there are major plans to build semiconductor factories, those factories will be located in those regions to prevent them from being cut off again. I’m sure alot of vaccine factories, pharmaceutical raw ingredient producers, plastic factories for daily stuff and much more; will also be built in those respective regions to ensure a steady future supply. Most other things like furniture and textiles will continue to be outsourced though, unless super automated factories emerge.

It seems to me that someone is preparing to just make a compromise with China and that a fall-guy has been proposed: An almost prototypical James Bond villain character* that could, with a bit of mental agility, make all of the stakeholders “be right” about their views of the world and get them boxes ticked

https://www.dailymail.co.uk/news/article-9710875/Peter-Daszak-removed-COVID-commission-following-bombshell-conflict-report.html

*)

British – We know all villains are English, according to Hollywood.

But not so English that the English, English defining the Tory party will care.

Not Chinese, so not Chinas fault, instead China was deceived and it’s trust abused,

…. As was the WHO and the “scientific consensus”, ….

Working for some shady NGO, that happens to be such a blank canvas that anything can be painted on it. Some TLA can take a short break from the regime changing and fill it all in, just so.

It’s been known that China threatened to cut off pharmaceutical supplies to America, if America pushed too hard into discovering exact CCP-19 origins within China. Around the world more and more countries are seeing through the CCP’s nonsense. Most countries are just going to wait until the more critical supply chains are moved out of China before saying or doing anything. At the minimum most countries aren’t going to do or say much of anything until pandemic and it’s effects are over.

The CCP humiliated vast numbers of politicians, businessmen, and many others of influence throughout the world; they aren’t just going to forget that. That isn’t counting the enormous money losses throughout the world, because of the pandemic. Every single country in the so called “belt and road initiative” lost way more money from this pandemic, then China ever “invested” in them. Very few outside China, will fall for the CCP’s claim that CCP-19 originated outside China.

Just when you thought housing inventory might loosen up, it won’t.

Jeff Bezos just sunk 37 Million seed money into a start up that is buying SFH, with up to 20% investor participation, on the open market to purchase and then monetize the rental income with quarterly payouts. Individuals are/will be priced out of housing for ownership.

Arrived Homes. And the it will go public.

More reason to sign that petition to not allow Bezos to return from trip from space. Pure symbolic but it’s a tough in cheek start.

Now if Musk goes to space, we will probably need to step up the effort in not allow him to return for sure.

“Do not allow Jeff Bezos to return to Earth” has reached 68,487 and is growing pretty rapidly. The other “Petition To Not Allow Jeff Bezos Re-Entry To Earth”.

Lynn:

I have a difficult time “blaming” Jeff Bezos for his taking advantage of the prevailing economic/political system with all its distortions, amibuities, corruption et al. I also may not like him but he has exposed the weaknesses of systems that made him the billions it has.

I condemn the systems, not JB.

Phoneix_Ikki,

What do you have against Musk?

Good news. It’s becoming a very crowded market. Ultimately positive for those they hope to fleece

$37 million won’t even buy 100 houses. I suspect this is more him just talking for the sake of talking.

A couple of months ago, I heard Amazon was buying up new homes in Slidell, LA near their new warehouse facility. Now most of that town is underwater from the latest tropical storm.

Jack Ma now owns a huge ranch south of here. I also traced a “we pay cash for homes” advertiser and found he is at least an affiliate of Alibaba. Hard to know how close of an affiliate- each house bought is listed as a separate corporation with hidden owners etc.

Google has also bought large tracts of land on the coast.

I recall late 80’s when Japan was buying property hand over fist in the U.S. After they bought Pebble Beach GC that was the top. 30 years of market downturns and stagnation ensued. Beware when Jack Ma buys a golf course!

Blackrosk tried this in Spain went bust 37 million peanuts to bezos won’t lose a dime government write off

PlayStation 5 shortages are so bad and have been going on so long that launch titles are being severely discounted despite the fact that a large segment of the interested market of console buyers hasn’t been able to play them.

The times, they get more interesting.

Fortunately not one single mortality has been reported due to not having a PS5.

Grandson is still trying to buy a new model X-Box since early Spring. He thought he would be able to get one for Xmas but all sold out.

Series X: US$499 – the most powerful new model that is mostly unobtanium even at over two times the retail price because it’s the one everyone wants.

Series S: US$299 – less powerful new model few want that CAN be found at the retail price, but does not include any optical disc drive, thus requiring the user to gain all software via digital distribution (which means downloading via an internet connection).

I need a headlight switch and door latching mechanism for a ’98 Tacoma.

Backordered 10 days ago, no estimated delivery date.

My plain unpainted wooden screen door ordered August 2020 just came in! The lumber store guy was so excited to tell me! Things are getting better!

Did you try Rockauto.com?

Try car-part dot com, it’s a junkyard search engine. Really, really cheap, and parts I’ve bought were like new. The parts get cheaper as the yard gets farther from population centers, and shipping is usually pretty cheap, too.

TSMC

Own it or regret it.

Untilchinese confiscate them

Precipitating a war? No.

I bet that SMIC will be at 5-7nm within 3 years.

Yes, bring the manufacturing here before it’s lost

Jeff B. sat at home thinking, “how can I make myself even more hated than I already am?” Apparently he came up with an answer.

I don’t think anyone could have said it better. Maybe he thinks that petition is funny and is goading it on.

Hate the player or hate the game. What are you going to do about it? Write a strongly worded letter to Nancy Pelosi?

The US production economy ( durable goods, chemicals, parts, food, ) and its supply chain is like a prosperous farm family with an out -of production special machine needed to harvest its lucrative product. Earlier generations went to engineering and trade school to learn how to keep the machine running. A well equipped shop was kept in top shape along with inventories of spare parts to insure the “machine” kept running. Then younger members felt so flush from the income off the farm and its special machine they became lawyers and actors and such. Then when extra money was needed to repair the pool or go on vacation the sold the shop equipment and spare parts, but the “machine was running fine. Then one day it broke and they blamed the government, or their suppliers or the stimmies. But as they watched the farm get auctioned off bit by bit they realized they had done it to themselves.

Classic “ashes to ashes” story in 3 generations!

“Prosperity breeds idiots.” – Aleksandr Solzhenitsyn

Cute story; but the average family farm will never be as profitable as a high paid professional working in a city.

If farm is not profitable, why Bill Gates is the largest private owner of the farms in USA? Because, Gates cannot bite his megabytes.

If US farms are worth nothing why Peoples republic of china is buying farms in US?Peoples republic of China needs farms to feed their own people. Its not all about profits or how much money you can make. Ultimately, no one can eat money.

I am really worried, they will give me government cheese and nabisco biscuts. May be I will drop the extra weight.

Gates’ farmland sits on the biggest aquifer in flyover country. It’s about the land and the water rights. The Bush family owns huge land tracks, over 100K acres, in Paraguay for the same reason, land over drinkable water.

I guess the answer is yes, interesting…..

CP

Government cheese and biscuits!

You just ruined my faith in the future!

The story is an analogy for what happens when you forget what is important. The family farm represents the supply chain. Once it collapses due to neglect and seeking of easy money it is hard to get back. Not much point in being a big city lawyer if there is no food, water or gas.

I guess it depends on how you define “high paid professional working in a city”, but I wouldn’t be so sure Nicko2. Wait a couple of years and revisit this statement.

Corn and beans prices are holding steady at almost double the 2015 to 2020 average. Crop farm incomes for 2021 are on track to be the highest in almost a decade. Beef would be too, except the four meat packing companies who control 80% of US beef supply are determined to bankrupt as many beef farmers as possible.

The last good decade for agriculture was the 1970s when we had… stagflation. Agriculture has been one of the most undervalued sectors of the last 40 years, (at least Jim Rogers thinks so). This new economic landscape may actually be to their favour. I wouldn’t be surprised to see farmers out-earn engineers, lawyers and other city professionals over the next few years.

re: Earlier generations went to engineering and trade school to learn how to keep the machine running. A well equipped shop was kept in top shape along with inventories of spare parts to insure the “machine” kept running.

That is my home and home shop. Work was just work. Seriously.

Today tilled up the spud patch. maybe $300 dollars worth of spuds and every summer throw 1/2 of last years away, but enough to round out the salmon and veggies in the freezer that would keep us from starving. Did inventory the other day on salmon. Have 19 meals left to use up before the new runs start…3rd week in July.

I am not sure why anyone is surprised by any of this. When you put people in charge of doing something they are incompetent to do, you might as well accept that they are going to screw it up very badly.

That is exactly what the American people have done. They have elected people who have no economic knowledge or experience, have never run a business, are completely oblivious to how the real world works, and are basically a group of lying, criminal, sociopaths.

Then when faced with an emergency, they do what they feel is best for their political career, with no knowledge or regard for the consequences.

WTF should be what you expect.

+1000

Yup

Knee jerk reactions and kick-the-can, muddle through solutions. Politicians gotta politic don’t ya know. And, somehow the wheels keep turning…until they don’t.

Powell and his ilk have behaved the same way through out human history. His ilk treats the arduous process of production with contempt. His ilk also has contempt for any money standard that is outside of their ability to manipulate that standard. His ilk has had a powerful tool through out history that so far has been infallible. That tool is ignorance of the masses. The people do not know nor do they care what are the inalienable properties of money is.

With it’s stultified management and ponderous supply chains, American retailers were so unable to take advantage of the mass infusion of moolah that much of it went to paying off credit cards.

Maybe just-in-time inventory management needs a second look.

It’s just in time from overseas orders placed 6 months ago.

This ends only one way, not with more jobs like the fed had hoped, but with more trade deficit and more poverty as the dollar weakens much further than anyone expects. It seems unlikely that a corporation focused on profits would do anything other than raise prices. The manufacturers overseas will realize this soon enough.

California gets about 20% of its electricity from solar panels. In LA County the payback for solar cell installation may be less than seven years. There is a shortage of polycrystalline silicate glass used to make solar cells.

Soon there will be a shortage of water in California needed to wash off the solar panels so they will continue working. The question is will Californians have the wisdom to prioritize cleaning the solar panels over filling the swimming pools and watering the golf courses?

1) Gulliver (Auto inventory/sales) and Liliputs (furnitures, food…)

dragged the All retail inventory/ sales down.

2) Toyota “just in time” sent this ratio down since 1995. Detroit learnt nothing from the tsunami.

3) Since the cost of labor and fixing stores was up, inventory

must be down.

4) Deep pockets retailers like Dollar General and Sherwin Williams (SHW) were doing well, until May 2021. Something is wrong.

5) Colgate package of intellectual property package is half empty.

6) Keep it simple, like FDR : in DG one dollar equal two. SF drug stores closed many stores.

7) Car dealers, shrunk capital prevent them

from buying expensive 2021/22 inventory. Mfg trinkets inflated retail prices.

8) pickup trucks are up 50% in three years. Dealers parking lots carry shrunk inventory, few 2021 pickup trucks and plenty bad items to sell.

9) Businessmen know : don’t touch, bad is bad. Their financial troubles means will send your invoice will shredded.

10) Putin will poison Hamlet. Rus 1 : 4 Denmark. Ukraine invasion is a feint. Shevchenko is hiding under his bed.His wife will get him and beat him up.

I bet Inventory/Sales ratio could go to 0 for many goods.

We have the tech now for an economy without stores, warehouses or inventory. Just order direct from the manufacturer, wait for your turn in the production queue, and have the goods transported directly to you when ready.

If sales exceed production on a given day, prices rise and some people will have to wait for the backlog to clear. If capacity exceeds sales, the manufacturing crew goes home early that day, or they work a few full days and then take a few days off?

Without the overhead costs of warehouses and retail, perhaps both buyers and manufacturers could be better off?

Wisdom : special orders are pain in the neck and expensive. Mfd inventory spectrum must be wide, deep inventory in popular items, light in others and nothing for most. Mfg have to waste time, call suppliers and click their special for missing parts. Your car MechE : if you need a muffler,

he will bargain with his suppliers, buy from the second market, finish within 24H. After a major accident, you can wait several month for the missing parts, without a car.

Special ordes may be expensive, but are they less profitable? Constant constrained supply can work wonders for margins and profitability…

Espesially if the product is nothing special from the production line. No problem with less volume as long as the profit is up.

Michael, I think you missed the point. I’m not talking about uniquely-produced “special orders”; I’m talking about purchasing standard items directly from the production line, rather than from a warehouse or retail store. Computers and FedEx (etc.) handle the “pain in the neck” details.

Take cars: It used to be if you wanted a blue car, you’d go to (or call) a few dealers and find one. Now you go on a website and it tells you where all the blue ones are, because there’s a database keyed to the VIN that holds the info. And if there isn’t one in your area you can get it delivered. But that same system could (and I think soon will) know what’s in the production queue (or on the next boat coming into port). So you could simply buy the next one that’s due to be available. The manufacturer doesn’t have to make anything special.

The same idea could be applied to most large items immediately, and smaller items can follow as the process gains efficiency of scale.

P.S. You can already do this with smaller craft goods via sites like etsy dot com.

Volvo, WW, Toyota does that now.

They use the low cost basic model to lure buyers into the shop, once one is in, one gets to customise exactly the car one wants and they will make it – except not really, because all of the normal choices are already sitting somewhere in the logistics pipeline, only the routing needs to be defined so it goes to the customer ordering it. And That’s what the customisation does, as well as raising the base price of the car, of course.

They will indeed, for real, build any customisation, one sees it occasionally when delivery time suddenly goes from 1-2 weeks to 6-9 weeks on an option (my case red metallic paint, rather than blue metallic. I decided I like blue better and let the algorithm win).

Your direct order plan only works if you know exactly what you want and need, and you are right, and the item turns out to be exactly as described. And it never fails so you don’t have to return it. A good local supplier stocking quality products with trained and experienced assistants can be well worth the money.

However, except for around here, most suppliers don’t hire trained and experienced assistants any more.

It’s like people who say you can replace teachers with online courses. My response is that they’ve never had a good teacher…and maybe they haven’t.

Co-worker in Florida just bought a new Jeep over the weekend. Unplanned just went out to breakfast and stopped by the dealer and walked away with a brand new JEEP w/truck bed

Inventory – Check

Motivation – Check

Financing/funding – Check

Didn’t have the heart to ask why he paid but he mentioned it had all the bells and whistles

“Turns out it’s a heck of a lot easier to create demand than it is to bring supply up to snuff,” Jerome Powell mused at the press conference. And now the economy has the biggest mess in decades to deal with.

I know the Fed has mandates but when did managing supply chains become one? Matching supply and demand is a free-market function.

Did anyone expect Powell to issue a warning? ” Watch out! Demand is coming back! Re-open your mines, start up your factories, stomp the accelerator on chip production and buy a PS5!”

I am not an expert about anything but here is my story: I needed new washer last week and I found a bunch in stock in all the retailers close by.

Could this be due to the backlog of container ships that’s currently waiting to unload their cargo in Los Angeles and Long Beach

I just looked at Covid numbers and the new cases are down to about 600 / day nationwide! My State is down to 1 or 2 cases a day. This thing is over!

I am not sure how the Federal and State governments think they can continue to justify all these subsidies. I just read where CA is considering extending the eviction moratorium, and continue paying landlords for deadbeat renters.

So long as people get free money and do not have to pay their rent, they are going to spend that money on consumables they would not normally buy and continue to drive inflation and shortages.

It was on the way to being over in March, and the Dems knew it. There was zero justification for the March stimulus bill.

“they are going to spend that money on consumables they would not normally buy”

Yes, but also, surprisingly, people a lot of that money to pay of their debts.

This might be considered a post-hoc justification for the stimmies. Non-personal and other kinds of debt is a looming problem. If a lot of people and debt-ridden entities go bankrupt, what would be the cascading effect on the economy?

My guess would be that the vast majority of those receiving UI and not paying their rent would be in the under 30 demographic. I doubt seriously that most are being responsible with the free money. I know at that age I wouldn’t.

In Cal rental assistance goes to tenant, who is supposed to pay landlord ( ha ha ), guess who keeps the money if they apply and stifs the owner. Newsome tries to buy votes against the recall.

Guess what, eventually tenant will try, need to rent another property. App review typically includes call to former landlord for review of their tenancy. Oh sorry we rented to someone else. Yes rules against discrimination in all forms, but as many ways around it as needed. A whole lot of folks got a free ride for awhile, but in the long term it’s going to screw them big time.

Wait until the 4th wave hits the anti vaxxer states….Delta variant. It’s long from over. Look for surges to add on to the revolution anger.

Only 600 K dead +. (Sarcasm) Not to be discounted.

There will be no major 4th wave. The states with low vax rates already got hammered with COVID-19 this winter for the most part, and have significant natural immunity, and even those states are near half vaccinated. The hype around the new variants of COVID-19 is hype. Sure, there will be an uptick in the fall, but it will very likely be substantially less problematic than a typical flu season. The places that are in trouble now are in Asia, which is way behind on vaccination and not economically capable of foregoing tourism (see Thailand).

Comparisons to the flu didn’t make sense 15 months ago and don’t make sense today.

The primary mode of transmission is aerosols in enclosed spaces, something one is exposed to more in winter than in summer and UV exposure kills the virus, so I think those are a factor in summer. Also, vaccinations and those already infected and recovered have led us closer to herd immunity.

However, even now things are far worse than a “typical flu season” and I worry that winter will bring another surge due to the factors already mentioned, new variants, and possibly decreasing strength of immune reactions.

Wife an I had COVID-19 twice, and it was weeks of shit both times, I think “natural immunity” can do us all a solid and go unman itself with a fragmentation grenade!

Jdog,

“… just looked at Covid numbers and the new cases are down to about 600 / day nationwide!”

What effing BS. Why don’t you look it up before posting this kind liar garbage. The 7-day average per day in new cases in the US is over 12,000 per day.

DEATHS are at 300 per day. STILL! That’s about one Boeing 777 crashing every day. That adds up after a while.

New cases are surging in counties with low vaccination rates where people believe the kind of reckless liar garbage you’re spouting off. And they die because of it.

What you said about your state is also a lie. In your “state” (Idaho per your IP address), the seven-day average of new cases is 70 per day, not “1 or 2.”

You can spread this manure in your back yard or wherever you want, but not here.

What we need are more 777s. It’s all about the optics Wolf. ;-)

What country were you born in Wolf? I know it is somewhere in central Europe but I forgot the name.

In the Gulag?

hahahahahha. I did not know they had Gulags in central Europe.

JD & Wolf

We have the lowest rate of infections in the USA here in Montgomery County, MD. In my Zip code 20817 infections are 1/20th of the normal flu. Practically zero. Two factors have contributed to this.

First, the people here were more health aware. You see a lot of people outdoors exercising during the worst of the pandemic.

Second – the health care system here is the best in the USA.

Third – the most vulnerable got vaccinated as soon as they were able. The rest got it later. (over 90% vaccinated or immune)

Fourth – people here practiced social distancing and followed the CDC (though flawed) guidance for the most part.

Even with these measures we’ve lost several close friends to COVID-19. Through no fault of their own they were infected and died.

There has been so much mis-information put out that it is hard for people to make informed decisions. But we could start by at least getting the available data right. I believe that’s the point Wolf was trying to make.

I was reading that in some states like Tenn and Mississippi only 37% of the people have even got one shot of the vaccine. WTF is going on down there? Isn’t 600,000 dead people enough warning!

It doesn’t seem like anybody is getting rent subsidies or extra money in CA, with all the people in CA living on the streets.

I wish people would just stop buying stuff. The mindset change is really concerning, people are spending money like there is no tomorrow. A few weeks of buyers’ strike would clear up most of these spikes quickly. Inventories would be rebuild and prices would drop.

I’ve stopped, but my wife…now that’s another story. Damn this Amazon internet shopping!

The other part of the narrative is artificially created supply shock through Tariffs. Steel in particular. The U.S. tariffs on Chinese products such as steel has had a disastrous effect on prices & lead times. There are only 2 major producers of steel in the U.S., Nucor & U.S. Steel. Nucor has gotten to the point where they’re not accepting any new orders.

Inflation is a double-edge sword. My wife & I plan to sell our home in Northern California this summer & move to a small rural farming town in Central Nevada. We want to take advantage of getting top value for our home while we can – before the market craters. We have a nice parcel of land we just purchased & we want to build a steel home on it. The problem is, it will take at least 8 months to get the material & the cost is more than triple what it was a year ago. Building depts. are flooded with applications for permits. Anyone associated with the construction industry is extremely busy & there’s a massive labor shortage.

The solution is to wait until prices & supply/demand return to normal. Travel around the country in our RV for however long it takes. We know that will get old and at times stressful, but we’re planning it works out favorably in the end.

You could maybe buy one of those small modular buildings they sell here in Sweden as guest lodges or as teenage caves for peoples gardens or as summer houses.

They are small but, IMO, cozy and modern.

Put that up, live in it, when the main house is up, then that’s your guest house or office.

Google “attefallshus” for some pictures.

Just in time meets forced business closures, stimulus checks, fat unemployment benefits, employees who get sick or fake sick, and shipping containers that are only used on the east to west leg of the journey.

The worst people of our society go into politics Private business pays better and you don’t have to go through a gauntlet of name calling and fake accusations. We should be amazed that anything works.

“The worst people of our society go into politics”

My experience and intuition tell me that the percentage of “worst people” is roughly the same in any area that involves money and power. Consider a “private business” like Boeing.

The worst psycho-bully-power-tripping managers I’ve experiences were in private industry.

More stimmy on the way starting July15! Monthly payments of $800 for my household assuming we don’t teeter over that $150k mark again. I’m figuring we save that $800 for each month this year and next year we can use it to buy a cheeseburger. Cause we know our big monies won’t buy an effing house.

I am becoming more convinced that we have hit debt saturation with all of its unintended consequences.

Any further debt will do nothing for real economy other than short term sugar high and then the hangover. We are on track to proceed to become Europe and then Japan as debt burden goes from 4X GDP to 6X over the next decade or two.

Excessive debt kills growth and feedbacks into society slowing household formation and population growth and that further slows growth.

Long term nominal growth now is about 3%. Plug that into stock valuations and you get a low number, but everyone thinks they can get out the door. Financial institutions will slam the door behind them if they can make money on it.

Its not a surprise…why do you think they threw so much paper at this problem? The market coughed in 2018 and it’s been 3 years of morphine.

Uncle Sam declares the unemployment rate is 5.8% then goes ahead and sends out checks to folks teetering on $150K (for the umpteenth time).

I wish they’d stop calling it stimulus. Actually, I wish they’d just stop.

Who wants to form a new country with me?

C’mon people, we just did the 100 year flood thing with the pandemic. Amazing we got through it as well as we did.

To paraphrase my wife: “you panic, the FED will drive”

Ron,

You can break a country apart with these policies that produce these kinds of wealth disparity results. Think about it!!

https://www.oftwominds.com/photos2020/wealth-inequality4-20.png

“Turns out it’s a heck of a lot easier to create demand than it is to bring supply up to snuff”

You don’t say.

That’s pure genius man. Good thing they have such brilliant wizheads running the show.

I’ll have to re-read Chris Hedges “America – the farewell tour”

Ima store some more dry food.

I have so much already. Doesn’t hurt.

Well Duh. You mean if you spend a lot of moolah into a resource constrained market, prices will rise? Jeez. Who would have thought? I know Wolf thinks MMT is hocus pocus, but this mistake would never have been made by an MMT trained economist. Resource constraints are the first thing MMT looks at. Repeat. The-First-Thing.

“Turns out it’s a heck of a lot easier to create demand than it is to bring supply up to snuff,” Jerome Powell mused at the press conference.

That’s the idiocy of Keynesian economics in a nutshell: Stimulating demand does not magically create supply. It is supply that creates its own demand, as per Say’s Law.

Some of this could end up long-term structural rather than temporary difficulty.

A UK story I guess could be similar for the USA.

The CEO of a card-board box company made a public appeal for homeworkers to empty their garages of laid aside delivery packaging (empty Amazon boxes). His previous source of waste material was predominantly the retail/ eating out industry which was shut down. The home delivery business had boomed, but too many people were dumping the empties in their sheds, attics, garages and they weren’t getting back for re-cycling. The mind boggles on how many other fine nuances like this are going to disrupt past norms permanently.