One more reason why the Fed isn’t “trapped.” And the banks came out ahead.

By Wolf Richter for WOLF STREET.

What happens when $11 trillion of fiscal and monetary stimulus are handed out in 22 months? That’s how much it has already been: $4.7 trillion in printed money that the Fed threw at the financial markets and $6.6 trillion that the government borrowed and handed out. On top of which came the huge forbearance programs and eviction bans that allowed consumers to not pay their obligations, and not get their credit dinged when they fail to pay those obligations.

There are a lot of consequences, including the worst CPI inflation in 40 years, the most splendid housing bubbles ever, along with spiking rents, and the hugest speculative asset bubbles ever with wealth inequality ballooning to the worst levels ever, and consumers, flush with money, went on a huge spending binge, leading to the worst US trade deficit ever.

And then there is this consequence:

Consumers used some of this tsunami of money and the policies that came with it – the forbearance programs and eviction bans and the like – along with the house price bubble, to “cure” their delinquent debts, including by moving delinquent debt into forbearance programs where they didn’t count, and thus improving their credit scores despite the delinquencies.

So we’ll walk through it, chart after chart, based on data from the New York Fed’s Household Debt and Credit Report for the fourth quarter.

Mortgage delinquencies & foreclosures drop to record low.

The mortgage forbearance program had the effect that delinquent mortgages were put on ice, and the “delinquent” status was removed, while homeowners didn’t have to make mortgage payments.

Then the Fed’s $4.7 trillion in money printing and its interest rate repression triggered the biggest housing bubble ever. With home prices soaring, homeowners could sell their home, pay off the delinquent mortgage that didn’t count as delinquent anymore, and walk away with cash. Or they could modify the mortgage or refinance the mortgage with new terms with lower rates. And this is what happened.

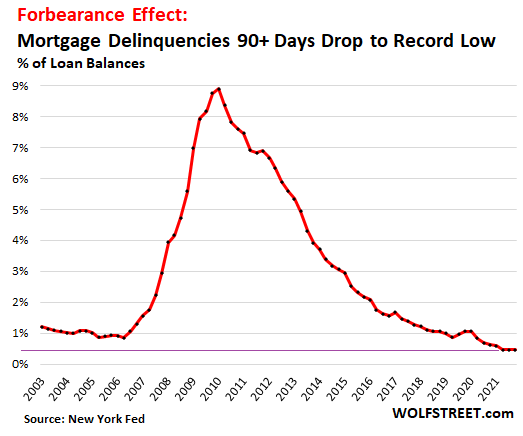

As a result, the 90-day and over delinquency rate hit 0.46% of outstanding loan balances, the lowest on record:

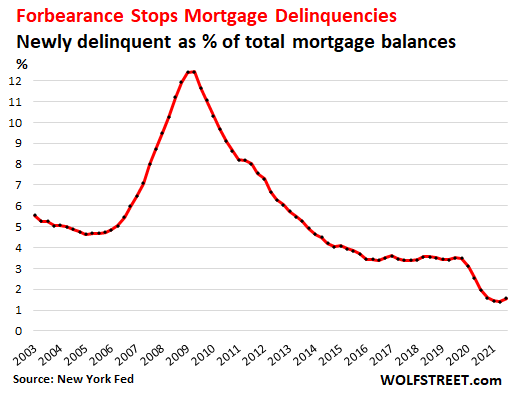

The forbearance programs saw to it that troubled mortgages were moved into forbearance programs before they became delinquent, and the rate of newly delinquent mortgages dropped to a record low in Q2 2020. And each quarter, it kept dropping to a new record low, and by Q3 2021, it dropped to a new record low of 1.4%.

But then the mortgage forbearance programs began phasing out, and by Q4, the rate of newly delinquent mortgages ticked up for the first time since 2019, to 1.6%:

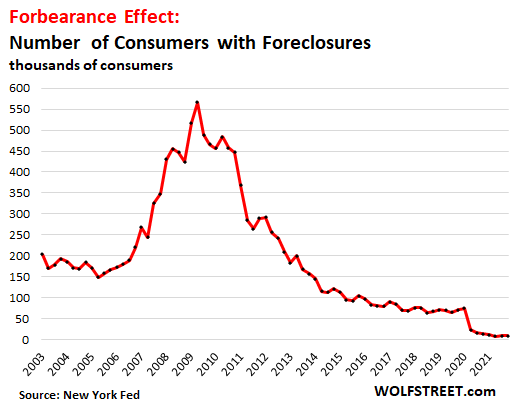

The number of consumers with foreclosures dropped to a record low of 8,100 consumers in Q2 last year and remained in the that range since with a barely visible uptick to 8,880 in Q4. By comparison, during much of the mortgage crisis, over 400,000 consumers per quarter had foreclosures:

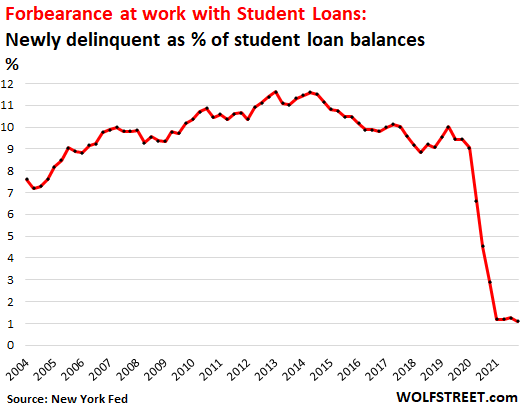

Forbearance “cures” gigantic student-loan delinquency rates.

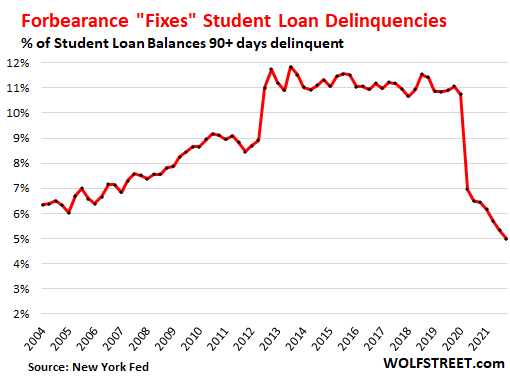

The official student loan delinquency rates had been running in the 11% to 12% range before the pandemic, despite numerous programs that allowed student loans to be deferred without triggering delinquency status.

With the pandemic came automatic student loan forbearance, and borrowers stopped making payments, and delinquent loans were pulled into the forbearance programs and then were no longer delinquent. These forbearance programs will continue through May 1.

So here we go: The 90-days-plus delinquency rate plunged to a record low in Q4 of 5.0%:

And the still ongoing forbearance programs were preventing newly delinquent student loans from being tagged “delinquent,” and the rate of newly delinquent student loan balances dropped to a record low of 1.1%:

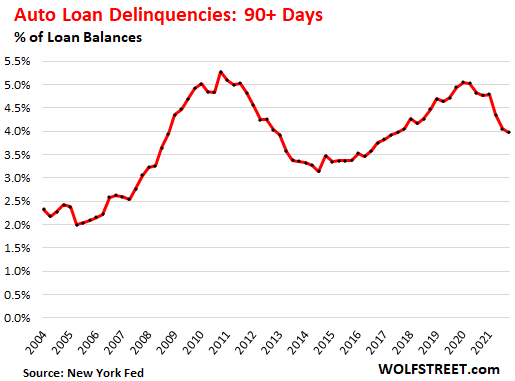

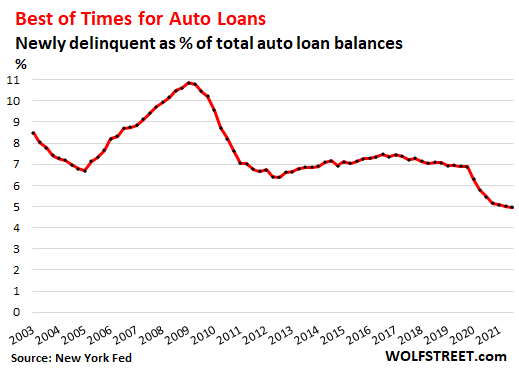

Auto loan delinquencies drop from very high levels.

In the years before the pandemic, I covered many times the issues plaguing auto loans after lenders got aggressive trying to maximize their profits by issuing high-interest-rate loans with loosey-goosey underwriting to subprime customers. Just before the pandemic, auto loan delinquencies hit 5.1% of total auto loan balances, the highest since the peak of the Great Recession.

But then came the tsunami of free money, and by Q4, the 90-days-plus auto loan delinquency rate dropped to 4.0% of total auto loans, the lowest since Q4 2017:

And the rate of newly delinquent auto loans dropped to a record low of 5.0%:

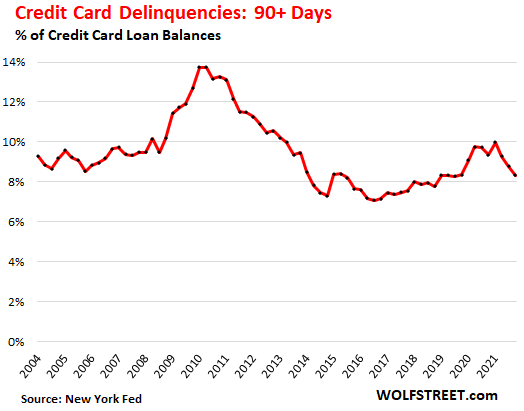

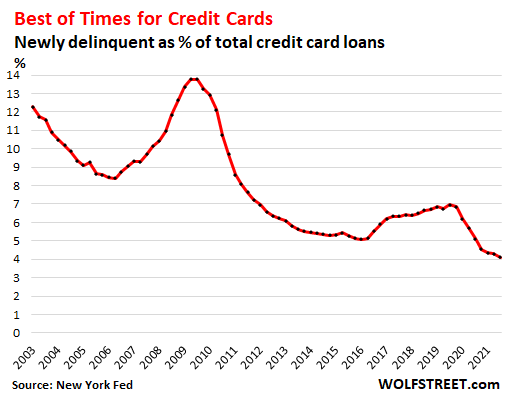

Credit card delinquencies fall.

The 90-day-plus credit card delinquency was running around 8% of total balances, amid loosey-goosey underwriting and an aggressive push into subprime credit cards where banks would charge interest rates of 25% or 30%.

Then came the free money, and some people used it to catch up on their credit card debt, and the seriously delinquent balances peaked in Q1 2021 and then started falling. In Q4, they dropped to 8.3%, the lowest since Q3 2019:

And newly delinquent credit card loans fell to a record low of 4.1% of total credit card balances:

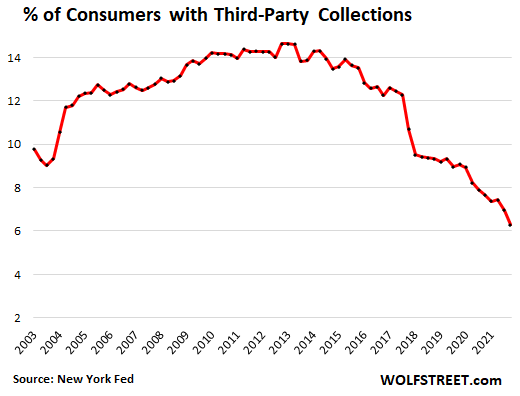

Third-Party Collections plunge.

Flush with free money, consumers caught up with their auto loans and their credit cards. The percentage of consumers whose loans had been sent to third-party collections plunged throughout the pandemic, continuing with a trend that started in 2015. In Q4 2021, a record low of 6.3% of all consumers had third-party collections:

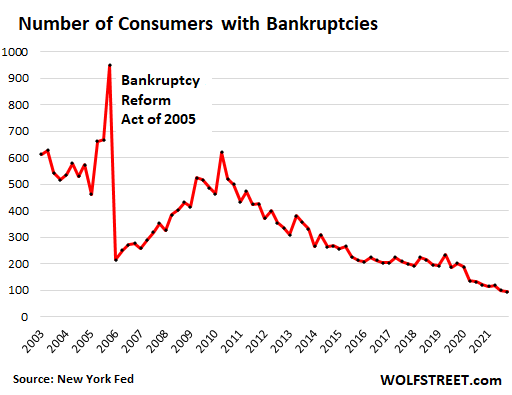

Ah, the collapse of the bankruptcies.

With free money, forbearance, and eviction bans, consumers were let off the hook in a historic manner, as the above charts have shown. As a result, the number of consumers bankruptcies in Q4 dropped to the lowest on record of 93,800.

Note the effect of the Bankruptcy Abuse Prevention and Consumer Protection Act of 2005, that caused a swarm of consumers to front-run it to file for bankruptcy before the deadline of October 17, 2005. After the new law took effect, bankruptcy filings plunged. The Financial Crisis fueled another bout of bankruptcy filings. But since then, filings have dropped, and the drop accelerated during the pandemic:

The banks came out ahead.

This sharp decline in delinquencies, defaults, and foreclosures across the consumer credit spectrum is a huge benefit for the lenders – the entities that the Fed primarily represents and regulates – because their consumer-credit charge offs plunged. Risky loans that the lenders were issuing at high rates? Suddenly no problem, thanks to this free money, they generated huge incomes and few credit losses.

Fed tightening not getting derailed by consumers.

Some folks have been saying for months that the Fed can never taper QE, that it can never raise rates, and that it can never shed its assets (QT), that in fact the Fed is “trapped,” and one of the reasons they enlist is the state of the consumer, that consumer credit couldn’t handle any kind of tightening.

Alas, as Powell has been pointing out as part of his reasoning why the Fed can tighten monetary policies just fine: Consumers are in historically great shape in terms of delinquencies, foreclosures, collections, and bankruptcies.

The $11 trillion in stimulus, spread around in 22 months, with much of it still trying to find a place to go, has had a huge effect. And it would take a lot of monetary tightening and financial disruption and much higher interest rates and some job losses to return these consumer credit measures to even the historical mean.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

i hear your point, but if the fed does in fact end the suppression, the fake economy illusion falls apart, people lose their jobs at the zombie companies, of which there are a lot, and suddenly the consumers aren’t in such good shape anymore.

I don’t think Wolf disagrees with you. I think his summary point is that the “fake economy” isn’t going to implode anytime soon. The FED simply is not likely to raise rates fast enough or high enough to really make a huge difference in the next 12-18 months. And JPowell certainly isn’t Volcker.

Be that as it may, this is one of Wolf’s best write ups that really lays out for us the high-level picture of all of those secondary effects of the $11T stimulus.

It doesn’t require much tightening to end the fake economy because much of it is contingent upon the asset mania and the loosest aggregate lending standards ever which aren’t directly connected to central bank monetary policy.

Both are psychological.

They’re now calling for a 50-basis point increase in March which the market has started to price in with the last couple of dips. Look for the DOW to be approaching 33K around mid-March.

As we all know by then, QE will have ended and that the BLS understates home & rental prices. So the real 1982 BLS level of inflation is at least 10%, possibly as high as 12%. The FED is simply NOT going to raise rates fast enough to doom the housing market anytime soon. By doom, I mean something more than a healthy & needed 5-10% drop that WILL occur over the next 18 or so months. JPowell is not Volcker by a LONG SHOT.

Again, Wolf’s point is there’s still a lot of money and general inflationary support sloshing around in the system which will take quite a while to drain out. I do tend to agree with his assessment. And, as I’ve said many times, the real fireworks start when the FED begins running off its balance sheet. I just don’t see this happening before early 2023.

For what it’s worth, I think most of here on WS.com agree that we’re dealing with a fake economy. And unless Russia really invades the Ukraine, I don’t see much systemic risk in the system. China’s real estate market maybe?

Jake,

This is pretty much my question for Wolf too…simply forbearing/suspending/altering the definition/status of “delinquency” does not seem to equate to an actual improvement of individual *economic* status…so the “gains” would seem to reverse once the definitions revert to their old form.

Perhaps the charts reflect actual economic improvement…but it isn’t crystal clear that they aren’t simply reflecting definitional/administrative changes that can/will be reverse.

One big reason to believe this may be the case, is the truly epic size of the economic dislocations made by the pandemic…it isn’t entirely self-evident that everyone and their dog was made 100% whole (and then some) by the also epic Gvt money print.

And I’m not talking about the inflationary consequences…I’m referring to un-offset business closures and the 2-4 million fewer employed compared to pre-pandemic…both of which continue to exist well after the pandemic offsets have ceased.

Does a 2% decline in national payroll size *really* yield marked improvements in delinquencies?

It may be theoretically possible…but it doesn’t seem likely.

It is hard to see the reductions in delinquencies aa being real (vs. substantially definitional) in light of those ongoing consequences.

I think more digging into the methodologies behind the charts may be in order.

If reporting creditors have changed their definitions/classifications of delinquent, then the charts may be misleading.

“it isn’t entirely self-evident that everyone and their dog was made 100% whole (and then some) by the also epic Gvt money print.”

Well, not everyone. Elon Mask went from something like $2 Billion, to $200 Billion. In a year.

Warren Buffett whose is known as a prudent capital allocation has underperformed a lot of gamblers and shysters. This obviously is not a permanent situation if country is to thrive.

another thing from decades ago should be in play: windfall profit taxes. market share has been sucked into the biggest players, thru absolutely no fault of the small businesses that were shuttered by gov’t edict

In the cases of those individuals who lost their jobs & couldn’t pay their mortgages, skirted foreclosure and sold their homes, then yes they got a huge benefit. BUT, my guess is this was a relatively small number of people, so the offset / gain would be relatively small.

IMO, the key is the fact that the government has now shown itself to be a MMT-based financial system for ever more, so gone are the days of high foreclosures and in are the days of forbearance and big QE. I see no reason that the government will reverse itself to more traditional ways of dealing with recessions.

I believe ‘MMT’ stand for the famous ‘magical money tree’? One of the marvelous terms used here which I love.

@ Rudolf –

The select have had access to the “magical money tree” for a long, long time.

When risk is mispriced and not transparent, it’s hard to know actual credit quality. That’s where we are now.

Pretending loans are performing through intentional obfuscation doesn’t make it a “high quality” asset.

funny that GDP would fall, when the IRS just took in the largest 1/4ly amount of tax payments ever

Yes, and the other big question is when do all the forbearance policies end, so that the true accounting begins?

Forbearance is temporary. In the end loans are either paid off, or they aren’t… Someone has to pay either way.

Rental assistance was not temporary

My friends were paid 10s of thousands as rental assistance

Also ppp loans were not really loans as they were all forgiven

Was reading somewhere that out of 800 billion ppp loan only 25 percent went to the real needy ones

The remainder were kind of legally stolen

Very true but not stolen = forgiven ,taxpayer theft

I knew they were forgiven but stolen in the sense that most of the money went to undeserved using legalities and loopholes.

Rental assistance started and is now done as far as I know (except perhaps CA, but I’m not trying to track this). Isn’t that temporary by definition?

The PPP “loans” were a wealth transfer from the future of the young to the already wealthy of today. They went shopping for houses, RVs, boats, cars and other toys funded by the future labor of today’s young people. It’s important to start putting things into context so people see what’s really going on. They got free houses, you got higher rents.

Jon,

My point was that the offsets you mentioned stopped months and months ago…meanwhile, national payrolls have remained lower than pre-pandemic by 6 to 2 million (rough range during post offset period).

Even assuming 100% offset (or slightly greater) during offset period (which I think is at least disputable given epic pandemic dislocations), the *post offset* period has seen millions and millions fewer employed than Feb 2020…which really makes me wonder exactly how delinquencies (*if* consistently defined) can be *lower*.

As I said, it is theoretically possible, but it seems unlikely on a macro scale…which makes me wonder if definitional/methodological changes lie behind the surface representations of the charts.

November 9, 2022.

Not anymore in the sense that they’ll be brought back as soon as we see the next recession. The FED has officially moved to an MMT-based financial system supported by Congress. Deficits & national debt, to them at least, don’t matter anymore.

Jake W,

Yes, but it will take a hefty deterioration just to get back to the mean. And this doesn’t happen overnight.

The forbearance is cured by high home prices. If the homeowner cannot afford the house, the home is sold and the mortgage gets paid off, and there may be some cash left over. If the homeowner can make payments, the mortgage is modified or refinanced. That’s how most of these homeowners exited forbearance. And most of them have exited by now.

So what could derail that is a large drop in home prices and lots of people losing their jobs who then cannot make mortgage payments, and who cannot sell the home because they’re underwater. This can of course happen sometime in the future. But we’re far away from that today.

Frequent reader since 2017 Wolf. May I interpret what you are saying today is we are used to 2 cups of coffee a day for the past 22 years, and only shot up to 10 cups of coffee since early 2020, but it’s ONLY been 2 years, so don’t start freaking out about withdraw symptoms until we get down to at least 5 cups of coffee a day?

Same comments as some early commenters I think the question about “Where are the consequences?” stems from more of a truth seeking perspective than to try to counter argue QT and rate hikes, or looking for a crash.

I’m afraid the apparent wealth on the debt and credit report is as the stock market, simply paper wealth in aggregate as a direct result of money printing, can kicking, and socialized loss. The only direct tangible contribution I can see from this bill is that people got to stay in their homes and people received 3 shots of miracle of health science, IMO this has got to be worth 11T.

Stimulus per person for 2020, 2021 was about $3,400. To people who didn’t need the money it likely contributed to the stock market and trade deficit. To people who really needed it, I double that’s enough to cover more than a few months of living expenses. I don’t think they are reflected in the statistics. When forbearance ends, it’s time to re-enter the work force.

That’s the silver lining then? I suppose government is only half of the puzzle. What to do after this lift off is up to ordinary Americans. I wish the pandemic officially ends this year and that we are all healthy enough to pick up where we left off in 2019…

Wolf, why would there be a large drop in home prices? There won’t be mass foreclosures, because they will just do the forbearance cost shift again. Isn’t that what we should expect going forward?

You may argue NEW mortgages at the higher rates will have less purchasing power. I agree. But won’t the feds just subsidize that as well?

I just think being so sure of a bad outcome is unwarranted. The can kicking gov’t will do what ever it takes to not be blamed for a recession. In an election year that goes double.

“…they will just do the forbearance cost shift again…”

What will the rationale be for starting forbearance again? Last time they had the cover of a pandemic. What will it be next time? You can’t simply start letting millions of people live rent-free without political cover, can you???

Wolf-thanks, as always, for providing superior sonar in very turbid waters…

may we all find a better day.

The largest asset of most households is their home and rising home prices gloss over alot of problems. With record low interest rates (until recently) and all that free money, it makes sense that debt defaults are gone.

But I really dont see this holding up very long. We have record trade deficits, which means alot of that money has been spent buying goods that pump up foreign economies. And alot of people who are no longer working, probably living off gains in the stock market, bond market and real estate.

The Treasury auction today had very high buying from indirect parties, meaning investors, which is a sign of strength, but if you look carefully at rates, they only had a very small decline by the end of the day, bouncing back from a pull-back in the middle of the day. If rates continue higher, those buyers of debt are going to be in the red and will turn into sellers.

The Treasury has only been back in the game of financing deficits with more Treasuries for about a month now. I think the higher rates are attracting investors, but give it a couple months time where the Treasury is adding $250 billion per month of Treasury sales and we will start to see demand weaken (in my opinion). There are still a few uptrending support lines for bond funds, once those are broken, the trend followers will want to liquidate bonds.

Much higher rates are coming soon. I see 5% 30 year mortgage rates within 3 months. Significantly higher mortgage rates will cool off housing purchases and erode pricing, but inventories in the housing market need to build before we get real price decreases. This all just takes time. Mortgage delinquencies will probably start to edge up this year, but are a lagging factor and will probably gain speed in 2023.

I do believe that there will come a time in 2023 where all this extra money will have been wasted in unproductive consumption and we will start to see real economic distress. Too many people have stopped working and are spending too much money, it is not going to end well.

Very well put, gametv. I approve of this message ;)

Government can be too small, optimum size or too big. USA has reached the point that government is too big and any further growth in spending turns a $1.00 into less than a $1.00.

It’s a new place for the US. We got here in the last 20 years. France got there a long time ago.

We tumbled down the rabbit hole when we put things that are inherently governmental (for the good of all citizens) on the auction block…

Not to mention Citizens United…

Citizens United was the death knell for the American Experiment in Democracy. RIP

I personally believe that the problem is that noone requires government to be efficient and special interests prevent it from doing things that would eliminate certain businesses.

As an example, why the heck doesnt the IRS have a tax portal where 90% of Americans can calculate and file their taxes online, and then have automated ways of managing your tax account? Can you imagine if a bank decided to not have online accounts and you had to do everything by mail? It is a joke, but Intuit has lobbied effectively to prevent it. Taking it a step further, why doesnt the government set up a payroll processing system for free that would calculate and file everything with the touch of a button? The efficiency could be enormous and save businesses so much time and money.

My wife’s social security number was incorrectly entered or read by their system several years ago and it took literally 30 phone calls to get it sorted out. It screwed with the whole return. A completely broken system that is costing Americans countless hours and increases the ability of people to not pay what they owe.

Is there really ANYTHING the government does well?

Bigger or smaller is not the issue. Competence is the issue.

A lot of people don’t grasp that the profit motive is about the only thing that can make a system do the tough work to make things more efficient. Otherwise the status quo rules.

THIS. Most people talk about whether we should allocate more or less funding, while the reality is that many forms of government can work, it’s a question of effectiveness. It’s much easier to sit on your butt and accept “the way things are done” than to piss off your higher-ups by demanding efficiency from your government employer.

And even if the desire were there, it’s still much easier to write another line of spaghetti code (or another law) than to simplify the overall system.

The tendency to claim and enforce ”this is the way we do it because this is the way we have always done it” is NOT only part of GUVMINT folks…

Lots of companies have that same mentality, and either don’t see it, or don’t want to step on toes, etc.

An elder told me a long time ago, ”There are none so blind as they who WILL NOT SEE.”

Doesn’t really matter the venue, etc.

@VintageVNvet, The difference is, in private industry, it is self correcting. When a company loses sight of efficiency, they go out of business (at least before our present version of crony capitalism).

@ Old School –

Profit is a motive to make or keep government inefficient.

Hence, the proliferation of lobbyists and bought politicians.

Well, at least in France you don’t die like a dog in the street because of health care. You don’t die in the street like an ignorant dog because you can’t afford an education. Yeah, lots of problems in France, but at least our deficits went to helping people instead of building tanks and subsidizing billionaires.

Oh come on ha

We’re the “exceptional nation” …… with a third world infant mortality rate. Cuba has a first-world infant mortality rate.

The rich don’t walk over the poor as they die in the streets in Cuba.

Parisian bread, Chanel store at 31 Rue Cambon with a special rear entrance to the Ritz, the best food and waiters in the world, a culture dedicated to liberty and of course, the language…

What’s not to like?

With all the unfettered immigration into France, what do the trendlines look like?

How many no-go zones are there now in-country?

It doesn’t have to be one or the other. There is a third, fourth or even more options.

False equivalence fallacy.

Make that false dilemna fallacy.

When was the last time the US government was “too small”?

By my reckoning, sometime before 1913 if ever.

@Jeff. There is not “unfettered immigration” into France. And I don’t appreciate your obviously racism. I guess you are white and the son of immigrants so you should listen to Native Americans and get out of America; you are ruining it.

“No go zones”? I’ll trade you any French inner-city (they are actually outer cities here) against American violence, especially gun deaths. Try researching your own failed society before casting racial aspersions on a nation that, while wired to whine, is much happier and safer than America.

I think you will see distress from corporate bonds first. Banks have overextended debt at very high risk levels to corporate junk bonds. In a borrowers market with very low interest rates and unprecedented stimulus money and liquidity, banks would have had nothing to do but give money to corporations. The higher risk bonds pay more back to the lender in interest payments and have been competing to hand those out.

Now as interest rates rise, those same junk bonds will be worthless and they are all shorter term and need to be rotated into new debt sooner than high grade investment bonds or mortgages (cough cough).

So will the so-called zombie companies be allowed to rotate into new loans at the higher rates? No because banks see the risk of default.

Will they collapse under their debt? Yes. Will that lead to a massive devaluation of all junk bonds if it hits a large default rate? Yes.

Can that default rate spiral into failure of CLO’s now widely held in pension funds due to the historically very low yields of treasuries? Yes.

10+ years of the easy money policy removing any gain of holding the safe asset of federal treasury bonds, led to pensions and other “stable” funds using mostly corporate bonds for fixed income investments to achieve some gains. Now those are not safe. They will not be safe. Pensions will again not be fast enough to sell those assets (unlike banks). Americans lose a lot. Banks pick their teeth and move on.

But hey this scenario is contingent on the Fed not putting a floor back under markets. The Fed “put” does seem like a friendly reach around to the market ongoing. So maybe it’s not doom and gloom, just inflation for your grandchildren’s grandchildren.

Grandchildren’s grandchildren? That’s a generous time horizon for ANYTHING.

“At first you go bankrupt slowly, then all at once.”

— Hemingway, The Sun Also Rises

My question may betray my ignorance on this – but can’t the yield on long term bonds (10 yr +) simply be reduced if the FED buys them too.

Wouldn’t this FED created demand keep those rates low as well – thereby resulting in consistent low mortgage rates etc?

You’ll know the Fed is serious about normalizing if the dump their longest term holdings in highest proportion.

“Much higher rates are coming soon. I see 5% 30 year mortgage rates within 3 months.”

That seems much too soon. It might take years, if ever.

Don’t forget the rule of supply and demand. Rental vacancies are low. Homes for sale inventory (active listings) is low in terms of real numbers. The number of months supply of homes statistic is nebulous. People wished to lower the price of homes without increasing the supply of homes. It is difficult to increase sharing of existing heated space. Zoning ordinances prevented cheap affordable housing. Some jurisdictions do not let you rent out an RV in your side yard.

US Govt and Fed will do anything and go any far to save the rich asset and stock holders.

The only constant now in US is ever growing stock market, asset prices, net worth, money printing, wealth gap, homelessness, inflation, and declining USD, middle class, infrastructure relative to the rest of the world, and quality of living.

Everything else that Fed says is just talk and lie to fool the sheep.

The Fed will do whatever the incumbent political party wants of them (and their member banks). So if politicians need inflation to go down, they will do that for them. Isn’t that how it works? ;)

Unfortunately both parties work for the elites and rich donors in the end. They will never bite the hands that feeds them.

Big money is going to emerging markets,but there will be nowhere to hide ,check history last depression

It’s clear the politicians are already working for the asset holders, and no one else. If politicians cared about what the voters thought they would have aggresively quashed inflation. They are at the end of a year long smoke break, where they were thinking about thinking about how they could pretend to care about inflation without actually doing anything.

Fed might save stock market because they don’t want foreigners to sell as well. A lot of foreign money in big tech stocks.

All you need to know about central banks is what the UK central banker said. Having facilitated 7.5% inflation he is asking working class to eat it and not ask for big raises.

Cheap money will always lead to disaster

Not for the rich and asset holders for whom Fed and US Govt. works;

Agreed

And why are we buying frozen fish from China? Saw a pile of it in the supermarket today.

To keep inflation down, clearly. It’s cheaper than the “I can’t beleive it’s not meat” meatballs.

Wow. I wouldn’t knowingly buy anything from China to consume based upon what I’ve seen about the near total lack of imported foodstuff inspections as a percent of total volume of any item imported, so I assume fish inspections are equally useless.

Even OTC meds whose active ingredients are sourced from China as nearly all are these days can be a problem. For example, Zantac, which contained highly variable, but sometimes insanely high levels of a carcinogen NDMA which was later found in other common generic meds made in China, including very common ones like Metformin.

Chinese companies have ZERO ethics, they even poison their own people regularly with so many examples that never reach the international news, so if Chinese imports aren’t very carefully monitored HERE to an economically impossible level, good luck.

“Chinese companies have ZERO ethics”

Why? It’s cultural:

Civic honesty around the globe

SCIENCE • 20 Jun 2019

Abstract:

Civic honesty is essential to social capital and economic development but is often in conflict with material self-interest. We examine the trade-off between honesty and self-interest using field experiments in 355 cities spanning 40 countries around the globe. In these experiments, we turned in more than 17,000 lost wallets containing varying amounts of money at public and private institutions and measured whether recipients contacted the owners to return the wallets. In virtually all countries, citizens were more likely to return wallets that contained more money. Neither nonexperts nor professional economists were able to predict this result. Additional data suggest that our main findings can be explained by a combination of altruistic concerns and an aversion to viewing oneself as a thief, both of which increase with the material benefits of dishonesty.

———–

In 40 countries, research assistants posing as average citizens, turned in over 17,000 fake wallets to banks, theaters, post offices, hotels, police stations, and other civic buildings. They then waited to see if employees at these locations contacted the owner of the wallet.

The wallets held business cards (with a name and contact information where they could be returned), a grocery list, a key and either had no money or a little bit of money (US $13.45/€11.88 or the adjusted equivalent based on each country’s purchasing power).

-DEAD LAST- to an incredibly significant degree was China. Almost exactly in the the middle were the US and UK. At the top to a very significant degree was Switzerland.

———–

JOURNAL OF CHINESE ECONOMICS, 2014 Vol. 2. No. 2, pp 73-78

Call for Copy – The Culture of Counterfeit in China

by Ling Jiang

Abstract: The aim of this paper is to deepen the understanding of Chinese counterfeit phenomenon by exploring the effect of culture. Counterfeit activities are shaped by Chinese historical, social and political reasons. Intellectual property rights protections don’t have an obvious presence on Chinese soil. The discussion of counterfeit consumer behavior research via the effect of culture is provided.

Book:

To Steal a Book Is an Elegant Offense: Intellectual Property Law in Chinese Civilization (Studies in East Asian Law, Harvard University) – 1997

As with many goods, most of the fish imported from China has simply “stopped” there for (cheap) processing. It is caught elsewhere.

Disaster for whom?

The inflation is making the irresponsible string pullers rich.

Workers, earners, savers not so much……

Nonsense! You’re not seeing the opportunities my man! You gotta lever up and dance while the music’s playing!

Here’s how ANYONE could’ve already bought their own island, in our glorious eConomy, starting with $0:

1) A year ago you made up a really juicy sob story and raised $100K on GoFundMe.

2) Used the $100K to buy 50 used trucks for $30K each ($2K down, rest borrowed) last spring. “They’re not making enough vehicles, and someone will need these…”

3) Sold all the trucks for $50K each last summer. Less expenses you now had a cool $1 Million.

4) Used the $Mil to buy 10 of the $2,000,000 fixer-upper homes in SoCalJim’s territory, for $100K down each.

5) Repainted the homes to hide the mold and water damage, and sold them all for $2,500,000 each (after expenses) last fall. At this point you had $5,000,000 and thought about early retirement.

But why go so low? You decided to play with the big boys now.

6) After watching TSLA put in a classic base pattern all summer, you finally opened that brokerage account you’d dreamed of, and bought $10,000,000 of TSLA for $1200/share. Yes, after margin that’s a $5M profit. Now you have $10,000,000.

7) Buy put options in PTON on Nov 2, 2021, after the stock fails for the 4th time at the 50 day moving average. “Gotta be bad news about to come out!” Sell put options for est. 300% profit on Nov 7 after the plunge. Now you have $40,000,000.

8) Short NFLX on max margin on Jan 6 “broke below the 200-day, crash ahead”. Double your money (“again, baby!”) when you close out on Jan 24. Now you have $80,000,000.

9) Short FB on max margin on Feb 2 on thesis that “it bounced back to the 50-day-moving average and failed, so next it’ll retest the lows”. You had no idea the earnings outlook would be so bad, or that the market would react so hard, but hey, you were in the right place at the right time! Sell on Feb 3 for overnight 50% gain (after margin and a huge champagne bill).

You now have $120,000,000! Which island would you like?

P.S. As you settle into your new island this weekend, drop a tweet to thank Mark Z for lending you his shares. I’m sure he’ll appreciate the gesture.

Correction: in (6) I lost some text due to bad use of angle brackets. You bought $5M of Tesla for under $800/share in late August “classic chart pattern, breaking out to new highs baby”, on max margin, and then sold for $1200/share (100% profit after margin) on Nov 2 or so. Still made the $5M profit and had $10M to play with.

Great, now let’s get Doc Brown’s Delorean and we’re all set.

…and then you wake up.

don’t forget taxes.

But J-Pow says I can forget taxes! I own my own sovereign island now! LOL.

That’s what the good Lord made South Dakota for. And British Virgin Islands. Etc. And the also-Brit-derived divine receptacle, the trust. Oligarchs’ paradise. A nice big Swiss based bank (to remain unnamed) might finance your yacht and securitize the debt, to boot.

You’re assuming when you’re making $120m bets, Wall Street’s trillion-dollar whales won’t be actively trading against you.

Ahh, but you missed the part where it was Zuck himself who lent me the shares! He wanted to rip my face off…

Sure, $120M is pocket change to a guy like that, who already has his own island and his own Metaverse to live in, but it seemed like an easy way to swat away a fly and score a small trophy.

Seems he forgot how much Wall Street hates it when you don’t quietly warn them before dropping turds on Earnings Day!

Meanwhile, on the days of the trades, volume was over $120Billion so my little $120M was invisible to the other whales anyway. It’s important to do the huge trades on the most liquid stocks. Good thing Peloton blew up when I didn’t have as much cash!

(All /SARC boys and girls, the real Wisdom Seeker is far too timid… Best of luck to those who do trade and I hope you get your Happy Retirement Island someday.)

Guys, I’ve been reading comments like this for almost a decade since the Global Crisis back in 2009.

I remember when real-estate was crashing, there was a dude selling a seminar (in LA in 2008) about buying homes – and he was saying “Interest rates will not stay low for long”. Here we are 14 years later – and guess what – they are even lower.

Personally, I don’t like artificial low rates – it hurts savers and funds stupidity. But these “games” can go on for a LONG time – possibly until I’m in my 80s (40 years from now). I’ll still be yelling about low rates, but for the next generation, it’s all they’ve ever know – and may ever know.

It’s a global thing now – US, EU, China, India…..you name it – they’re all stuck with the fragile economies they’ve built.

I hear you. I have been thinking the same.

So, “this time, it’s gonna be different” (it’ll go 40-50 years without a stock market crash, or a black swan moment), right? But I think simple laws of probabilities say otherwise.

Risk is a beautiful swan and a cruel mistress.

We’ve had WTF moments and variances about every 10 years lately.

Low rates will end with the end of credit mania.

Central banks lack the power to prevent it absent the mania. If they did, rates would have been this low since central banks came into existence.

Until another Reagan/Volcker combo comes along…

Monopoly my favorite game

It’s a financial mirage…..but always in the distance. Unless the Fed and DC continues to extend and pretend this will end badly like 2008/2009.

Extend and pretend is ending badly. So do more of it? Things are falling apart, and they know it. They’re just printing homeless people at this point. Look at the wealth gap – the more they print, the more consolidated the wealth becomes. Their blunt tool is crushing almost everything in its path, and society is coming apart at the seams.

“ They’re just printing homeless people at this point”

Dude, that’s in the infrastructure bill…

Gotta have something to hold the overpass up :)

It’s a party. Are you ready if music stops today?

Wow, great charts. Essentially a debt jubilee, via money printing & policy. Coordinated globally!

Ok so… central banks / governments CAN bring back capitalism… but why would they? Who wants to get blamed for causing suffering?

I think our self-proclaimed caretakers have discovered they can create largess out of the public treasury. And it will work. Until society breaks.

In any case, current prices on everything are completely artificial and meaningless, and I give up!

gg

Canada is only the beginning,of people tired of politicians overstepping there authority

Inflation is here for awhile, but those debts have low interest rates and wages are rising. Yes, “stuff” is getting more expensive (inflation), but the debts get cheaper. When asset values drop, defaults will increase, but prolly not as much as expected.

The Fed is expecting inflation to start falling, so they don’t need to raise interest rates!

So we get 5% inflation rate……

but you will never hear that the 5 is tacked onto the 7 ……

a decrease in the increase is NO VICTORY.

Was anybody else paying attention when Powell stated they would consider letting inflation run hotter than they wanted to make up for when it was lower…

That tells you everything you need to know about the intelligence level from the Eccles building…

And he also admitted that he understands that inflation hurts the poor people the most. So he publicly announced that he is intentionally hurting the poor. He is an eCONomic terrorist – a deranged madman who is destroying the very fabric of society for his own personal financial gain, and that of his rich buddies. He is to be stopped at any and all cost.

DC

Powell never held a shovel or has been to a lumber yard.

He is born from the connected mega rich, then to Georgetown Prep, Princeton, Dillon Reed, Treasury Dept….then the Fed.

Powell lives in a bubble. Hoenig, the dissenting voice on QE through the Bernanke years, from Kansas City, labored, and worked his way up the ladder. Thus the two views, and the two realities… the lack of consideration for the working people by Powell…(he might not know they exist)….and Hoenig’s monetary prudence.

Powell should spend the rest of his days in a prison labor camp.

@ COWG –

What it really tells you is their intent. They are plenty intelligent to know exactly what they are doing. They often lie about it, but sometimes a truth slips out.

It is all purposeful.

Problem as Europe has found out, when you suppress interest rates it just grows the debt bubble at a faster rate. Just remember equation Savings = Investment.

When Fed prints the money they are destroying real savings and therefore destroying future investment. Selling the farm one acre at a time til you are left with a farmhouse on a one acre lot. At some point you have to stop.

Actually they might just be destroying your savings, while providing money so others can invest. Recognize what they are doing – tranfering your saved wealth to chosen beneficiaries.

My kernel of hard assets (I can also live in) is my lifeboat, by now. All my cash is for keeping stability around that, not for some insipid fantasy of “leisure time fun” of the cash-burning variety. My leisure time fun is all set up at next to zero cash burn, maximum health and fitness yield, good food and sleep.

Only fixed-rate long-term debt gets “cheaper,” such as a 30-mortgage. But you have less money to spend because more of your income gets eaten up by higher prices, and making that “cheaper” mortgage payment could suddenly turn into a squeeze. Inflation is a shitty thing.

Yes. this. And since it was 40 years ago more or less since it raged in the USofA, many have either forgotten or were not around. It was not good times.

Wolf’s Whac-a-Mole analogy of inflation is well worth the price of admission… oh it’s free….

Be sure to contribute.

I remember before the turn of the century, you never ever ever heard the word ‘trillions’.

Sadly, I can remember when you never heard of billions! And I am not that old!

Yep, and we can remember when being a millionaire was a big deal.

Now it’s just that guy down the street who finally sold his house, thinking he was “now rich”, only to realize that the interest won’t even pay for a dogfood-in-a-tent retirement plan.

And a 1963 half dollar is now worth more than $10. That’s the Fed keeping their mandate.

In a conversation with my daughter this weekend, we were discussing jobs we had as kids. In 1970, I had a summer job at O’Hare Field in Chicago working for the gubmint. The pay was $14 an hour.

She put the $14 an hour sum into an inflation calculator and it returned the amount of $101.45 per hour. For mowing runway infields…

Xavier…

You didnt hear of a TRILION dollar spending bill until rates went to ZERO.

Now the word is tossed around like a frisbee on campus in the Spring.

I would like someone to ask Powell, any Fed Governor, or high spending Congressman (Pelosi)…in public this question:

If a billion seconds is 32 years…..how many years is a TRILLION seconds?

Answer: 320 CENTURIES

Love the youtube videos “How much is a Trillion Dollars” measured in stacks of fresh hundred dollar bills 3 feet high filling a pallets, forming blocks of pallets, forming bigger blocks, forming high rises of blocks, dwarfing the Statue of Liberty etc.

Single stack 620 miles high, but whats a few miles of Benjamins here and there?

Highest denomination Japanese Yen note stack would wrap around the world 36 times for all the debt they created. Maybe I dreamed that?

That’s a process that will take time, several years IMO. Definitely “suddenly”. But we should plan for and expect consumption patterns to revert to prepandemic levels.

The Fraud Reserve’s current monetary policy is a complete dereliction of duty. To this day they are STILL buying treasuries & MBS at a $60B/month pace. Later this month they will reduce to $30B/month, then end QE.

With the current 40+ year high inflation readings, what they should be doing is calling an emergency meeting to immediately halt QE (Canada did that) and raise the FFR by 0.5%. Instead, they seem to do emergency meetings only when the stock market crashes – they don’t care about anything else.

Simply trying to pray or jawbone inflation away won’t work. Even now, the full committee refuses to state firmly that every meeting will live for rate increases, or that “full employment” has been attained. They’re trying to move as slowly as Congress & political sentiment allows them to.

Jackson

“complete dereliction of duty. ”

There is no consequence for being WRONG when you are in Government…..or Chairman of the Federal Reserve.

But worse than being wrong is INTENTIONALLY shirking the duties, not standing to your post, answering to another power. Powell is guilty of all three. Stable Prices and Moderate Long Term interest rates has been ignored by the Fed since 2009.

The Fed apparently has been hijacked….and in a system of “checks and balances”, WHO CHECKS THE FED?

The only time a government official is “wrong” is when they don’t do what the TBTF corporate lobbyists and the Citizens United gang leaders tell them to do.

I am curious to know how people on this thread vote. Much of the commentary could be considered Libertarian and anti-socialist so I assume most are Republicans. I might be wrong.

Is there any logical reason to assume that the Republican party cares any more about the issues here than any other party?

Why isn’t everyone voting for the Greens or independents?

Expat,

Yes, I vote. Yes, I am a “Moderate Libertarian.”

I do vote “Independent” as well.

As I have commented here, the idea that the USA government can and did create, by edict, “… the huge forbearance programs and eviction bans that allowed consumers to not pay their obligations, …” is a testament to how far the USA government has gone off track regarding property rights and contract law.

From James Madison:

“The rights of persons, the rights of property, are the objects, for the protection of which Government was instituted.”

“Where an excess of power prevails, property of no sort is duly respected. No man is safe in his opinions, his person, his faculties, or his possessions.”

Other than registering once each side of the uniparty, to vote FOR a particular candidate, I have always, since 1966 been an independent voter, and plan to continue.

Have regretted both times registering for Dems or Repubs due to the incessant arrival of snail mail and robo calls, etc., including 4 calls from POTUS prior to the 2016 election.

They all crooks IMHO, so mostly just deciding which crook would do the least damage, etc…

My voting process orientation is similar to VintageVNvet. I switched to “independent” decades ago.

The data-driven “issues here” are not of interest to the vast majority of people. They don’t have the education, motivation, and / or ability to understand the complex machinations of macroeconomic power players.

I don’t vote for U.S. “Greens” because so many of them act like they are in a cult, and piss me off with their self-righteous idealistic fantasies.

I’d vote for any candidate, regardless of party, who convinces me they are against gridlock, bipartisan, and want to improve, not destroy responsible government.

Expat,

Slick Willy’s Nafta deal was the last straw for me with the dems. I mostly vote repub because they mostly stay out of my way. I voted third party against Mittens because a hedge fund manager was a bridge too far for me.

Expat,

There is no practical difference between Republicans and Democrats, only at the margins mostly.

I’d never vote for any Green party, as I consider every platform of theirs insane.

Not registered with any political party… both my wife and I are “independents”. Fiscal conservative, social moderate.

Voting for “independent” candidates has traditionally been a waste of your vote. Most people don’t bother to follow actions vs. the BS fed during the prior election, so the veracity of any campaign promise goes unchecked. Therefore, people vote with emotion and pick whatever talking head appeals to their desire to get “what they deserve” from the gubmint and believe what they read in the slick campaign propaganda or attack ads. Often, one is forced to pick from the lesser of two evils – or sometimes the greater of two evils – to level things out as much as you can and keep the lunatics from running the asylum.

The greenies? They’re nuts.

It looks to me like voters of each party are betting on what politician will die of old age the last, it’s the only way they are replaced.

In Congress, if someone notices a certain member hasn’t moved in his/her seat for over a week or if there is a worse smell, then his/her seat is up for election.

Thanks for the answers on voting and alignment. I think anyone who votes Republican these days is a fascist, racist misogynist, but that’s my view from abroad. I think anyone who votes Democrat is quaintly, but terminally, optimistic. Anyone who votes Independent is delusional. As for the Greens, if you don’t vote for them, whatever marginal insanity they may show, you are ignorant or suicidal. That’s my four cents.

Government grows because of the demands of the people. The major component of the US budget is military spending. Americans love war and violence so paying for bullets and tanks is prioritized. To justify those expenditures, America needs enemies so they are found or created. Then you all whine about the cost of public libraries and school buses as if that is really the problem.

I personally think that America is doomed, but given its size and power, it will take the rest of us down with it.

Try this. Try not voting for the same guys over and over. Obviously you are voting for the wrong people. Seriously, a nation that elects Donald Trump has severe and fundamental problems with its political system. Vote them all out and send amateurs. They could hardly do worse.

“jawboning” shouldn’t be used relative to the FED. They lie and mis-direct. And, never once have they “jawboned” inflation away. Any “jawboning” they do is self serving stalling —– an extension of their theft.

we should never let the bastards define the terms.

Great article, great charts. Conclusion #1 : a banking crisis #1 between May 2022 and Mar 2023. // Conclusion #2 : the starving lawyers will have a lot of work to do.

Dentists $100K smile is out. Sheriffs and the repo trucks will work day and night.

“ Sheriffs and the repo trucks will work day and night”

All the while being recorded by the YouTube vigilantes on the iPhones screaming “ OH MY GOD… OH MY GOD… They just took his BMW he wasn’t paying for… OH MY GOD…

Wasn’t there a reality show where guys were in the vehicle repo business? That’s some good tv.

@ Michael Engel – “Conclusion #1 : a banking crisis #1 between May 2022 and Mar 2023. ”

—————————

Why this time frame?

The hangover to this kind of spending is usually a (post war) recession. None of the major market events happened in that kind of environment, (save mid 1970s). Instead of worrying about apocalyptic market crashes we need to focus on our micro economic plan. Our job, our investments. If they take the air out of the bitcoin bubble it is just going to reinflate the others.

AB

A recession would now, in today’s Fed mindset, be an excuse for MORE QE.

More rate suppression and money pumping.

We are at the point where the decision makers must realize the CAUSE of our predicament can not be MORE OF SAME.

Ambrose, I’m worried that you don’t seem to realize that if/when Bitcoin trades for $10K less tomorrow than it did yesterday, NO ONE will “get the money” that “went out” of the bitcoin bubble.

Once that one trade takes place, every Bitcoin owner is just that much poorer. Instantly. There’s no “air” to inflate other bubbles.

When valuations drop, nothing happens other than paper wealth vanishing from this earth and going to eternal heaven.

WS

good point, but this is only true if there is a gap without any trades in between old and new prices.

by definition of price, there is a gap

Sorry Alku, but even when there are trades in between, it’s still true. Valuation is a real b**ch that way. I really, really recommend that you think it through until you see why it’s true (and Wolf will back this up if you ask him).

P.S. On a philosophical note – humans live in a world where matter (and energy) are conserved. For most “stuff”, the total quantity doesn’t change – whatever you eat and drink has to come out the other end, right? And the base money in the economy is also conserved – when people buy and sell with paper money, the dollars don’t get destroyed, they just change hands, and you can see it happening. So we have all sort of basic intuitive subconscious thought processes built around the idea that Stuff Is Conserved, Including Money.

But Credit and Valuation are NOT conserved, they can appear and disappear and follow very different rules than Normal Stuff. That makes them very, very unintuitive for most people, and it leads to a lot of Really Bad Decisions.

It kinda understood this intellectually, but I never got the gut feel until it hit me in the wallet a couple years ago. When you own something that loses 50% overnight and never recovers, you are powerfully motivated to “get your money back”, and find the bastards that “took your money” so you can sue them for damages. But then as you dig into the details, you realize that no one “got the money”, because the share “value” was never money, it was just a price put on the anticipation of future returns. Anticipation can turn into great things – but it can also prove to be worthless.

Frankly, the whole system should be criminal because it basically enables those who understand credit to rip off those who don’t, and there’s no need for that. I call it Bank Robbery – when banks get money from people who don’t really realize what they’re getting into. But it’s not just banks.

Wisdom seeker-

“But Credit and Valuation are NOT conserved, they can appear and disappear and follow very different rules.”

Excellent observations about concepts of “valuation,” “price,” and “credit,” which can materialize, change and disappear because they are subject to the opinion of other people. This connects one’s holdings and your perceived wealth to “the crowd.”

You’re getting dangerously close to the subject that the crypto industry is forcing:

— What Is Money?”

PS- For an eye-opening revelation on overuse of Credit which addresses the wrongs committed by both creditors AND debtors, try Tilden Freeman’s 1936 book A World In Debt. Bankers, governments and borrowers are all exposed for their complicity in creating the muddled and extraordinary debt we are dealing with today. The “bankers” aren’t the only villains here…

A simple way to think outside of the “conservation theory” box is quantum physics. There, matter goes in and out of existence. Money too. Fractional reserve banking as modernly practiced allows banks to create money via credit, by fiat, within parameters set by the central bank. When loans default, that previously created credit/money can vanish. It disappears off the books. The central bank SHOULD stand ready to prevent this from spiraling into a total deflationary societal meltdown, by opening the money/credit spigot, but only REASONABLY. “Reasonably” is the problem for its credibility now.

“Reasonably” is most definitely the key word, Phleep. It’s so hard to define, that the authorities at the Fed can never be held accountable on that score.

Milton Friedman and Anna Schwartz also had trouble determining reasonableness, in their 1963 magnum opus, when they tried to ascribe causality for the Great Depression. The Fed then faced the same problem as the Fed today:

– Do we prevent a financial panic by keeping the spigots open, but risk a continuance of unsustainable speculation?,

Or

– Do we reign in speculation and risk a depression?

To give away a great punch-line to a great joke, they chose “death BY mugombo!”

Phleep said: “When loans default, that previously created credit/money can vanish. It disappears off the books. The central bank SHOULD stand ready to prevent this from spiraling into a total deflationary societal meltdown, by opening the money/credit spigot, but only REASONABLY.”

—————————————————

That defaulted loan might disappear off the books, but if the dollars from the loan was spent it stays in the system. Spent money from later defaulted loans do not disappear.

As to central banks, well ………………….

(The FED has been ruinous.)

————————————————–

@ Wisdom Seeker –

excellent and provocative writing.

WS:

I probably didn’t make myself clear. I was not referring to valuations.

I was only replying to this comment of yours: “if/when Bitcoin trades for $10K less tomorrow than it did yesterday, NO ONE will “get the money” that “went out” of the bitcoin bubble”

ONLY if the price suddenly gaps down $10K, NO ONE will get money out.

Otherwise, those who sell in the beginning of the price descent will definitely get money out.

Of course, it will be at the expense of the buyers who will find themselves in the hole after the price drop, but this again is the different aspect.

John H, thanks, my reading list was getting short and that looks very interesting!

Alku, sorry if I misread your comment. The financial media are always talking (wrongly) about money “flowing in” or “flowing out” of assets … and most people don’t realize the error. And in a genuine market or stock crash, the number of people who successfully “get money out” by selling to greater fools is very small compared to the total of all the investors.

The money was created with the click of a one computer mouse.

It will vanish with click of lots of computer mouses.

The Fed : a tag store

Read “Lords of Easy Money” and learn of the whimsical decision making from the Ivy Leaguers, plugged into the positions of unaudited power, swapping jobs between the Fed, Investment Banks, and the Treasury like musical chairs.

This would be a good thread for Wolfstreet….a book review of “Lords of Easy Money”

This swapping jobs between government, corporations, think tanks, etc. is by no means unique to Fed employees. And it’s nothing new historically.

Recommended reading: “The Shark and the Sardines” is an informative classic source describing how persons on boards of directors of U.S. corporations occupied the most powerful positions in government, regardless of what major party.

The book was written by the first democratically elected president of Guatemala. He was elected following a popular uprising against the United States-backed dictator Jorge Ubico that began the Guatemalan Revolution. He remained in office until 1951, surviving 25 coup attempts.

It’s not difficult to hypothesize what country, and what class of wealth owners, were backing those coup attempts to overthrow a democratically elected government. When I first read the book about 50 years ago, it was mind-boggling to read such a detailed account of how many people on corporate boards of directors served in U.S. presidential cabinet positions. Most government power positions were occupied by people whose corporations or personal wealth benefited directly from the government decisions that they made.

There’s a photocopy of the original book now available as a cheap Kindle download.

Wolf, I must disagree on one point. Mortgages have been sold by hypothecation and the original buyer of the loans knew that the mortgage and debt were unenforceable. The actions defy state law everywhere the bank didn’t write those laws for compliant legislatures. This is well known from 2008. You ignore facts at your peril.

Trying to rape the purchaser is the american way, and the rentiers speak loud when anyone tries to follow the laws that go back hundreds of years, with new twists to hid the fraud.

Some days you sound so much like an oligarch that it makes me uncomfortable to read such fiction. Sorry, but laws should be followed and serial RICO crimes should be prosecuted before anyone is foreclosed on. I know, I know, disagreeing with you is a terminal offense.

Brian,

Not sure what you were making a point about…

Vitriol aside, if the original mortgage holder paid as agreed, none of the subsequent actions would have ever occurred…

Only after non-payment, does anything happen…

You are correct that many of the legal processes were convoluted, however none would have occurred if not for the original action by the homeowner…

Have to disagree. The ongoing attempt to make Americans debt slaves by the FED/Bankster/WallStreet/Government cabal should be prosecuted by the RICO act for harm done to the American people. Without all the interference, house prices would drop like a rock and so would the amount of debt outstanding.

Good Lord…. As I have asked other people who are “debt slaves” and over extended themselves…. “Please show me evidence of the muzzle print on your forehead forcing you to sign those documents.” They never have been able to produce any such evidence.

No one becomes a “debt slave” without some positive action on their part.

Buy a house with a mortgage? You made a decision and acted upon it. Bit off more than you can chew? Not the banker’s nor the realtor’s responsibility. Should have thought about the consequences before you signed on the dotted line. Anyone who taps themselves out to make a major purchase is a dope. You still need a cushion of 6-12 months. Don’t have it? Don’t buy it. 12 months expenses should be enough to straighten out your situation or dispose of the property.

Student loans? Maybe you shouldn’t have borrowed $100K for a degree in underwater basket weaving, maybe foregone the spring break trips to Cancun, and the luxury dorm/apartment accommodations which added to the debt.

There comes a point when bad outcomes become a personal responsibility… not the fault of some boogie man hiding behind the lamp post.

I have young-ish adult children. Each was schooled in fiscal discipline when they were in high school and college. They learned how to use money as a tool and live within budgets. Both are mostly debt free and have positive net worth. Anecdotal? Of course. But it also shows what’s possible with a little parenting rather than buying them an X-Box and tossing them in front of a TV.

@ El Katz –

Debt slaves, rent slaves, wage slaves …………….

pick your poison …………..

If you aren’t well born, in large parts of America that is what you will be for a good period of time, maybe forever

Brain said: “Sorry, but laws should be followed and serial RICO crimes should be prosecuted before anyone is foreclosed on.”

——————————————————–

Good thought, but what point did Wolf make that you disagree with. I can’t find it. I don’t think he supports corrupt financial engineers and lenders.

“Mortgages have been sold by hypothecation and the original buyer of the loans knew that the mortgage and debt were unenforceable. The actions defy state law everywhere…”

Good lordy, that’s when I stopped reading. Total nonsense.

Most U.S. mortgages are non-recourse loans. If a mortgage debtor can not pay, only the property can be taken back. They can not go after other assets. With a recourse loan the lender may go to court to garnish wages or seize other property to pay off the debt. I met a man who lost his ranch after it was taken by a hospital to pay for his heart surgery. Health insurance is a good idea.

‘ Health insurance is a good idea.’

Yes, for all, via the govt like other ‘civilized’ ‘advanced’ countries on this planet.

David Hall,

“Most U.S. mortgages are non-recourse loans.”

False. There are only 12 non-recourse states. The remaining states and DC are recourse.

Florida (where you said you live) is one of the 38 recourse states. If you signed a mortgage, you should know what the law is in your state. If you – yes you, David Hall – default on your mortgage, your lender will foreclose, sell the home and use the proceeds from the sale to pay the fees and expenses of the foreclosure, past-due interest, and the mortgage. If the proceeds from the sale are insufficient to pay for all this, your lender will then go to court and get a deficiency judgement, and with that deficiency judgment your lender will go after your remaining assets, your stock portfolio, your bank accounts, and it may garnish your income.

The reason why it wasn’t done during the mortgage bust was because there were too many defaults, and neither the banks nor the system could handle them. But if it’s just the regular flow of defaults, that’s what you get in 38 states, including Florida.

Here are the details on recourse and non-recourse states — and the list of the 12 states that are non-recourse

https://wolfstreet.com/2018/06/20/us-style-housing-bust-mortgage-crisis-in-canada-australia-recourse-non-recourse/

Well, OK, since you’re not going to click on the link, here are the 12 non-recourse states. Also note what I said in the article about refis in those non-recourse states. In some of those 12 states, only purchase mortgages are non-recourse, and refi mortgages may be full recourse.

Alaska

Arizona

California

Iowa

Minnesota

Montana

North Carolina

North Dakota

Oregon

Washington

Wisconsin

Nevada

In all other states, ALL mortgages are recourse.

Wolf is correct DH, have had friends who have ”thought” they were only on the hook for the mortgage find out otherwise.

”How soon we grow old and how late we grow wise.” might be applicable here, eh?

Wolf said: “Also note what I said in the article about refis in those non-recourse states. In some of those 12 states, only purchase mortgages are non-recourse, and refi mortgages may be full recourse.”

——————————————-

This is a real service for you to highlight this. Many, many don’t know this, even real estate “professionals.” People also get into trouble with HELOCs (Home Equity Line Of Credit) thinking they are non-recourse, when they are not, at least not in many cases.

Other laws, such as those around bankruptcy and homesteading, apply to your residence.

If you ever wondered why a former president with a fake tan would move from New York to Florida, and in violation of zoning, try to make a golf course his “legal residence”…..

Ponder this tidbit: “In Chapter 7 bankruptcy, whether you can keep your home depends, in large part, on your state’s homestead law. … Florida exemption laws protect equity in your residence up to an unlimited amount. So in Florida, no matter how much equity you have in your home, you get to keep it if you file for Chapter 7 bankruptcy.”

Wow! See… tolerant of dissent.

When a mortgage goes into forbearance, do the property taxes still have to be paid?

Yes…eventually…

The taxing authority or even an

HOA can have a claim that can prevent a subsequent sale…

Thanks, doesn’t apply to me but was just wondering. I asked this very question to a county bureaucrat and all I got in reply was a blank stare. Unfortunately, my home is under 19 taxing districts and 1 HOA. It will give me great pleasure to give the city, county, metro, and the HOA the finger when I hit the road.

Next question: do property tax debts only run (remain) with the land, or are they collectible as personal debts? I know many tax obligations cannot be bankrupted off.

“Some folks have been saying for months that the Fed can never taper QE, that it can never raise rates, and that it can never shed its assets (QT), that in fact the Fed is “trapped,” …”

I can’t help but wonder how much of such arguments is self serving. Ultralow rate policy has been a huge windfall for Wall Street and Silicon Valley for instance. A lot of money is riding on this punch bowl … maybe enough to buy creative but spurious economics … which was never that expensive to begin with.

Sounds like a PR campaign to keep ultralow rates low.

Agree Finster, too many of those who say ” Fed can’t…” saying ” Please Fed don’t..”

Jeff Bezos in his giant flying dildo and his “take apart this whole bridge so I can launch my world’s biggest ego yacht” is the antichrist – the epitome of this “winner take all” eCONomy.

He didn’t build it with any money I gave him. No stock. No purchases

I am ashamed to admit that I actually used to use Amazon 7 years ago. But I canceled my Prime account and was done with them. I realized you could buy the same stuff cheaper elsewhere, and Amazon was just a counterfeiting ring flying under the radar.

I’ve actually saved a lot of money with Amazon and have bought from legitimate businesses with physical locations that I wouldn’t have known about otherwise…

That being said said, I cancelled my Prime when they gave it to the EBT crowd at half price… that told me where the show was going…

What people like Bezos and Musk don’t realize is the terrible optics they present to the rest of the world…

IMO, there is no excuse for that… they should know better…

I quit Prime when they significantly raised the annual membership price. They justified this by a process of throwing everything but the kitchen sink into the membership.

For me, the Prime membership became like a cable TV subscription — way too big a bundle, the parts of which should be sold separately. I only wanted one service related to buying a product, with the benefit of detailed product information, and evaluations by people who had actually purchased the product.

I cancelled by automatic renewal when they kicked some conservative website (gab? parler? I forget and never used it) off their cloud hosting (EC2) with no notice.

When companies get larger and more of society relies on them, they should be treated increasingly as basic infrastructure, i.e. some sort of continuum. That’s what makes centralization of the root layers of payment processing so dangerous.

Wolf, if you change your timeline to 25 months vs 22 months ago, the bailout would be $15.5T ($11T for Corona and $4.5T repo loans).

You can’t forget about the $4.5 trillion the Fed loaned out to mostly just six trading houses in November and December 2019 after they nearly blew themselves up when the repo loan market stopped functioning. This was all right before Corona…so the banks got bailouts on top of bailouts. Congress only got involved with the 2020 brrrr machine though, us plebeians were never told at the time that the banks needed a bailout. The Fed helped them on the sly. It was Nomura, Goldman, JPMorgan, and a few other Wall Streeters.

Shame mainstream financial media never reported on it with any degree of detail.

Alex,

“…and $4.5T repo loans.”

Total BS. I know this is not your fault. I think I know where this BS came from. You fell victim to total bullshit spread by a website run by morons that don’t understand repos and that publish financial fiction.

The repo market bailout in 2019 maxed out at $255 billion on Jan 1, 2020. There are still some morons out there with websites that spread financial fiction. These folks don’t understand repos, and they invent stuff to get clicks. I won’t name names, but people know which morons I’m talking about. So you need to know this:

REPOS ARE IN-AND-OUT TRANSACTIONS.

An overnight repo of $10 billion gets paid back the next day. And if there is another $10 billion repo for another day, it also gets paid back a day later. And the peak balance of those two repos wasn’t $20 billion, but $10 billion. That’s how repos work.

You add up the INs and subtract the OUTs every day.

But these morons just add up the INs without subtracting the OUTs, and so they get these huge ridiculous balances. Bloggers who do that are clinically braindead.

Here is the total repo balance on the Fed’s balance sheet. Note that the big spike was in March 2020, which was Covid and not the repo market bailout, and it maxed out at $442 billion on March 18, 2020. The peak during the repo bailout was $255 billion on Jan 1, 2020:

I’ve seen those reports about repos, and the current numbers on “reverse repos,” Wolf. I am not knowledgeable enough to defend the morons even if I wanted to, but I must admit that a 1.6Trillion$ current reverse-facility in place makes me nervous. Two questions:

– Is there any risk in this position?

– Is there a size limit at which it would become a concern for you?

Thanks

The reverse repos are a sign — one of many — that there is more Fed-created liquidity in the financial system than it knows what to do with it.

If the Fed unwinds $1.5 trillion of its balance sheet, and thereby removes that liquidity, those RRPs are going to disappear.

We saw that happening last time as QT set in.

@ Wolf –

Are FED repo’s and reverse repo’s good business?

I contend they are bad. They encourage over leverage and irresponsibility.

Truth served up fresh daily.

Be sure to email your delivery information with your donation for the “Nothing Goes to Heck in a Straight Line” beer mug waiting list.

What a great day, SRTY on sale under $50.

oops:). I better be more diligent in believing what I read online. Dangit.

No problem :-]

I was just reading a section in “Lords of Easy Money” that describes the 2019 repo blowout. This is what I came away with (please correct if wrong):

— A group of “relative value” hedge funds were using the low overnight rates of the Repo facility in a rolling scheme (Treasuries and Treasury futures) to lever up (basis-risk trades).

— The repo rate started skyrocketing, the specific cause somewhat a mystery, so the Fed entered repo market offering 2.1% loans on September 17 (going rate was 9% that day), and bailed out hedge funds desperate for an overnight repo loan to keep their schemes rolling.

— The hedge funds saved big money on the repo loan itself they needed to survive their leveraged positions. “But they also saved a nearly incalculable amount by escaping the consequences of having entered basis risk trades that went bad. The Fed made sure that hedge funds did not need to liquidate their holdings.”

According the the book, the schemes and rescue of the hedge funds were not publicly discussed, or even understood at the time. The Fed acted as if they were just doing some needed financial engineering. Even the Fed wasn’t sure of what was precipitating the blowout. If true, the whole thing seems kind of incompetent and slimy.

Bear Stearns collapsed by relying on rolling repos every night for funding. When their access to repos dried up, they collapsed.

Yes, that’s the principal risk of borrowing short-term in the repo market and investing the proceeds long term. But bunch of mortgage RETIS and hedge funds got caught in this in late 2019, hence the repo market bailout. The repo market offers the cheapest form of funding, but it can be deadly. The Fed should allow it to blow up some day so that everyone gets a little more prudent with it.

Where in the FED’s mandate is “bailing out hedge funds?” Nowhere. This example, and the revolving door between the FED and Wall St. – Bernanke going from FED chair to Citadel – is indicative of the complete and total corruption. They’re using the US Treasury as their own personal bank account.

That book “Lords of Easy Money” keeps coming up. Might have to read it.

It would be nice to know if the episode you call out is true. If so it is just another pathetic story of how they bail out the favored. There should be enhanced RICO laws to investigate and go after Hedge Funds and Central Banks involved in such practices.

One thing we do know. The FED is slimy. Incompetent? They may well know exactly what they are doing.

Well, looks like everything got fixed that needed fixing and all it took is 5 consequences which can be ignored to some degree. We will get a new inflation print on Thursday. I expect Powell to will come out and give it his standard furious toothless gumming. And by the way while on the subject of toothless gumming ,Pelosi announced she may launch a committee on banning “member stock trades ” aka insider trading.

Gee, golly whiz, only $11,000,000,000,000.00? What a deal!