The US still exports a lot of stuff — record amounts. But it drowns under a tsunami of imports. And the services surplus fizzled.

By Wolf Richter for WOLF STREET.

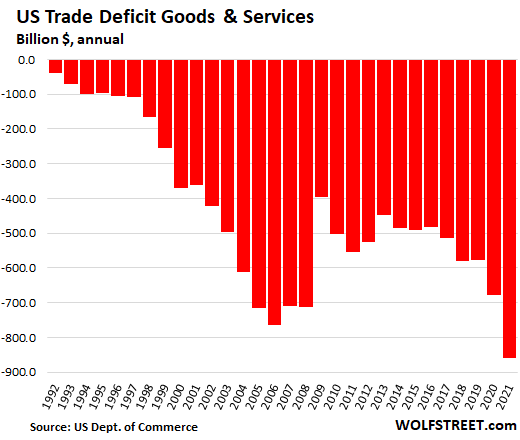

The US trade deficit in goods and services in 2021 exploded by 27% from 2020, to $859 billion, according to data by the Commerce Department. This is the result of 30 years of rampant and government-policy-encouraged globalization by Corporate America, from Walmart, Amazon, and the vast auto industry to the pharmaceutical industry.

The trade deficit is a negative for GDP, and a negative for the overall economy in America, and it contributes substantially to the current supply-chain chaos. But US trade deficits are a huge positive for China, Germany, Vietnam, Mexico, and many other countries that we’ll get to in a moment. The driver behind the trade deficit is Corporate America.

And inflation, if the US trade with the rest of the world were balanced, would roughly cancel out in trade with higher prices both on exports and imports. But this trade is stunningly unbalanced.

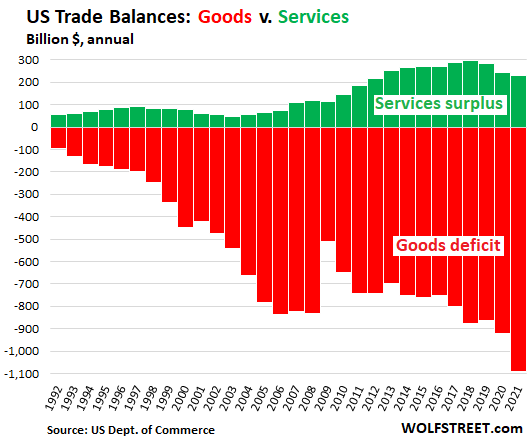

Services trade surplus fizzles. Trade deficit in goods blows out.

The US services trade surplus in 2021 dropped by 5.6% to a measly $231 billion, the lowest services surplus since 2012, and the third year in a row of declines. Imports of services soared by 16% to $535 billion. Exports of services – which include spending by foreign tourists and students in the US – rose by 8.6% to $767 billion.

The trade deficit in goods worsened by 18% in 2021, to a blistering $1.09 trillion, by far the biggest and worst ever.

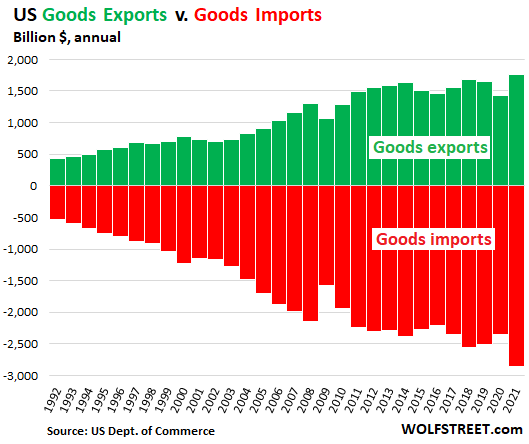

Exports of goods (green) rose by 23%, to a record by a slim margin of $1.76 trillion, driven by massively higher prices for prime US exports products, including petroleum, petroleum products, natural gas, and the products of the petrochemical industry.

Imports of goods worsened by 21% to a stunning record worst of $2.85 trillion, driven by higher prices and a flood of imports.

But the US still exports a lot of stuff — record amounts of stuff.

Exports of Capital Goods, including motor vehicles and automotive products, rose by 12.7% in 2021, to $663 billion, accounting for 38% of total US exports. Here are the largest categories:

| Exports of capital goods, incl. automotive | 2021

billion $ |

2020

billion $ |

% growth |

| Total | 663.2 | 588.2 | 12.7% |

| Largest categories | |||

| Industrial machines, other | 68.4 | 57.3 | 19.4% |

| Semiconductors | 66.1 | 55.1 | 19.9% |

| Passenger cars, new and used | 53.7 | 45.2 | 18.7% |

| Other parts and accessories of vehicles | 47.4 | 44.9 | 5.6% |

| Electric apparatus | 42.8 | 38.1 | 12.3% |

| Medical equipment | 39.8 | 36.7 | 8.6% |

| Engines-civilian aircraft | 37.4 | 37.5 | -0.1% |

| Telecommunications equipment | 32.6 | 31.1 | 4.9% |

| Computer accessories | 29.1 | 25.2 | 15.6% |

| Civilian aircraft | 24.2 | 16.6 | 46.4% |

| Measuring, testing, control instruments | 24.1 | 22.3 | 7.8% |

| Industrial engines | 23.3 | 21.6 | 7.7% |

| Trucks, buses, and special purpose vehicles | 20.9 | 17.5 | 19.4% |

| Computers | 17.5 | 10.4 | 68.2% |

Exports of Industrial supplies and materials jumped by 36% to $636 billion, accounting for 36% of total exports of goods.

The largest categories in this group are crude oil, petroleum products, natural gas, petrochemical products, and coal, whose combined exports soared by 52%, to a record $294 billion in 2021, largely driven by huge price increases. These exports accounted for 17% of total goods exports:

| Exports of fuels & petrochemicals, major categories | 2021

billion $ |

2020

billion $ |

% growth |

| Crude oil | 69.3 | 49.5 | 40.1% |

| Petroleum products, other | 63.9 | 38.7 | 65.1% |

| Plastic materials | 43.7 | 34.3 | 27.5% |

| Gas-natural | 39.8 | 18.5 | 114.7% |

| Fuel oil | 32.1 | 26.5 | 21.1% |

| Natural gas liquids | 30.8 | 16.1 | 91.6% |

| Metallurgical coal | 7.4 | 4.5 | 63.7% |

| Coal & other fuels | 7.3 | 5.4 | 35.7% |

| Total | 294.3 | 193.5 | 52.1% |

This group of industrial supplies and materials also includes precious metals. The US exported $55.8 billion of gold and other precious metals in 2021, up 36% from a year ago:

| Exports of gold & precious metals | 2021

billion $ |

2020

billion $ |

% growth |

| Nonmonetary gold | 30.9 | 23.2 | 32.9% |

| Precious metals, other | 24.9 | 17.7 | 40.6% |

| Total precious metals | 55.8 | 41.0 | 36.2% |

Exports of consumer Goods jumped by 27% to $222 billion, accounting for 12.6% of total exports. The largest category of consumer goods are pharmaceutical products, $83 billion.

| Consumer goods | 2021

billion $ |

2020

billion $ |

% growth |

| Total | 222.1 | 174.8 | 27.1% |

| Major categories | |||

| Pharmaceutical preparations | 83.3 | 59.2 | 40.7% |

| Cell phones and other household goods, n.e.c. | 30.2 | 24.2 | 24.5% |

| Gem diamonds | 16.7 | 11.7 | 43.1% |

| Toiletries and cosmetics | 13.2 | 12.5 | 6.1% |

| Toys, games, and sporting goods | 10.9 | 8.2 | 33.4% |

| Jewelry, etc. | 9.2 | 6.9 | 33.8% |

| Artwork, antiques, stamps, etc. | 8.7 | 8.2 | 5.9% |

| Apparel, household goods – textile | 7.4 | 6.1 | 21.0% |

| Household appliances | 7.0 | 5.8 | 20.4% |

Exports of food, feeds, and beverages jumped by 18.6% in 2021 to $165.2 billion, accounting for 9.4% of total exports.

| Foods, feeds, and beverages | 2021

billion $ |

2020

billion $ |

% growth |

| Total | 165.2 | 139.3 | 18.6% |

| Major Categories | |||

| Soybeans | 28.6 | 26.6 | 7.4% |

| Meat, poultry, etc. | 25.1 | 20.5 | 22.7% |

| Corn | 19.9 | 10.2 | 95.6% |

| Other foods | 17.6 | 15.7 | 12.2% |

| Animal feeds, n.e.c. | 11.0 | 9.3 | 18.0% |

| Nuts | 9.6 | 9.3 | 3.9% |

| Fruits, frozen juices | 8.7 | 8.1 | 7.0% |

| Wheat | 7.4 | 6.5 | 14.9% |

| Vegetables | 7.2 | 6.8 | 5.1% |

| Dairy products and eggs | 6.6 | 5.4 | 20.5% |

| Bakery products | 6.3 | 5.8 | 7.6% |

The Goods Trade Deficit, by Country.

Below are the 13 countries with which the US has the largest trade deficits in goods. The opaque nature of international trade, such as trans-shipments through third countries, trade invoicing via third countries, tax dodging, etc., can produce peculiar results, such as Switzerland and Ireland, as you can see below. Vietnam has become a major transshipment center for the China trade to dodge US tariffs.

The Goods Trade Deficit with China & Hong Kong.

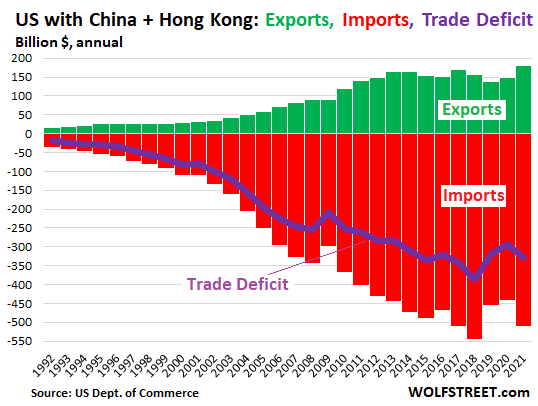

Imports of goods from China and Hong Kong combined jumped 15% in 2021 to $510 billion, after two years of declines (red columns below).

Exports of goods to China and Hong Kong rose by 22% to $181 billion, with not much improvement since 2013 (green columns).

The goods trade deficit with China and Hong Kong worsened by 12% to $329 billion, after two years of improvements with 2020 having been the least terrible deficit year since 2013 (purple line):

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

China has so far failed to meet its committed purchases of U.S. goods under the “phase one” trade deal that it struck with the Trump administration. In 2020, China imported $100 billion of the U.S. goods agreed to in the deal — roughly 58% of the targeted $173.1 billion, according to data compiled by Peterson Institute for International Economics. From January 2020 through November 2021, China’s total imports of covered products from the United States were $221.9 billion, compared with a phase one target of $356.4 billion ======>>> so much for this getting any better. …………At least they are exporting better products…The Wuhan virus has lasted 2 years….far above the 90-day warrenty??

Wolf – Was it not a fact that the obligations under the trade agreement referenced by Seattle Guy would be relieved if a global pandemic occurred and why is that not allowed to be stated on your site?

That’s not what you said. You tried to abuse my site to spread BS about the virus.

But think of all the cheap stuff we got.

We wanna complain about price increases, but also complain about jobs being sent somewhere they’re “more efficiently” priced?

You’re going to need a theory of the economy that can account for both.

Chris,

Who is “we”? YOU have been trolling my site for years under different names from a foreign country, and you want the US trade deficit to get larger because the countries the US has this huge trade deficit with benefit from it. I’m so tired of foreign trolls telling the US what to do.

EXACTLY. It’s like the guy from China trying to tell us in the last thread how our votes don’t matter (projection much?), or the troll from Canaduh and his unrelenting rage towards the past US pres.

The American from China who told you that your votes don’t accomplish anything is me. If you are still caught up in the Dem/Rep, red/blue, left/right, lib/con then you are too busy with the Bread and Circuses to see what is going on. It’s all as real as “professional wrestling”.

Our votes do not matter much. From a CA guy who has thought this way for 35 years.

Democrats and Republican are a corporate duopoly. The two-headed enemy of the American people.

“People Trade, Not Governments

Trade deficits and surpluses are merely accounting conventions with no explanatory relationship to the underlying reality of an economy, which is why accountants and economists have different world views. If a free trade zone works internally for the United States, why would it not work internationally among the countries of the world?

It helps to keep in mind that countries do not trade, people do. In any transaction, as Adam Smith pointed out, both parties must gain for it to take place at all––the antithesis to a zero-sum condition.

You buy a Lexus only because you perceive it as being of higher value than the price you are paying. The government, for all practical purposes, has nothing to do with it; nor is it any of its business.

As individuals, we run trade surpluses and deficits all the time. I run a deficit with my local grocery store, importing more from them than I sell to them. You run a large surplus with your employer, who pays you more than you buy in products or services from them in return. So what? The resulting accounting deficits and surpluses simply do not reflect the economic reality behind these billions and billions of individual transactions around the world.

This is what Adam Smith meant when he wrote, “Nothing can be more absurd than this whole doctrine of the balance of trade.”

The gains from trade are what we import, not export. The purpose of production, in the final analysis, is consumption. The more imports we can acquire for fewer exports, the wealthier we are, either as individuals or as a country.”

Adam Smith died in 1790. He had no idea about the modern economy. If you base your logic on his writings, you end up creating a fantasy world.

you had fantasy world 1900

Thomas Jefferson:

“As government grows, liberty decreases.” “It is in the natural course of events that liberty recedes and government grows.”.

There’s No Political Freedom Without Economic Freedom.

Leonard E. Read, the founder of the Foundation for Economic Education in 1946, used to say that Americans live in a country in which various levels of government extract over 40% of their productivity, yet they call this system freedom.

“They don’t know the difference between freedom and coercion.”

in 1900 no income tax

All import/export duties /taxes amount to 5%

Life expectancy for men in 1900: 46.3 years. I would long be dead. No thank you. You can go back to those times, if you want to. You reap what you sow.

love your comment ; the #1 thing to always check or investigate what is motivating the writer.

it’s like the banks telling you to buy XYZ when in fact they need to offload XYZ. Or telling that XYZ is doing really bad when they want to buy it from you.

Or all this ponzi crypto stuff, all those that are “invested” in it telling how great it is and you should buy –and not telling they are those that want to offload their crypto that does not have any intrinsic value.

And in a catagory apart are the politicians, whatever they say, investigate how they personally benefit from it.

Obama is building a beach-front mansion in Waimanalo, Oahu, Hawaii.

I suspect its chinese paid bots.

But they seem to have our elited wrapped around their fingers.

Dalio, charlie munger, buffet….all pro chinese communistic slavery .

Chris:

Here’s my “theory”:

I want to purchase quality goods at a fair price. I have no problem with the US (and me as a consumer) competing thru globalization except:

For too many years we have been exporting our good paying jobs in exchange for poorly made goods. For example it used to be commonplace to purchase metal house materials such as screws, slide locks, hasps, etc., made with good metals and lasted more than one to two years before going to rust! How many of the newer home decks surrounded with those (when new) metal railings have weld joints that go bad/rusty after only couple years exposed to the weather?

The list goes on and on.

Of course you also have to have an educated public that has past experience of what really good “goods” were/was like.

I’m thoroughly sick of the attempt to compare imported “inexpensive” goods being compared to what we used to have as “honest goods”!

American consumers have been duped by economists, politicians and themselves.

S7-again, an excellent observation that the farther a society retreats from, and has respect for, a significant portion of its population’s involvement at some point in its life with ‘hands-on/hands dirty’ production of actual goods/raising of food, the farther it separates from its ability to discern and demand actual quality from much of those goods and food…

may we all find a better day.

I buy socks and pants from China direct instead of paying a landlord and middleman via a “western” supplier. If I go to a shop every label says “made in China”, same for most goods.

You will always have a huge trade deficit while you worship the rentier.

The USA glorifies “good business” where the bigger the profit %, the less value created. The ultimate profit being doing nothing and leeching off the producer and consumer.

End neoliberalism.

There really needs to be an environmental import tariff for consumers like you that pollute the world by buying cheap products from countries that have no environmental regulations.

… and human rights tax as well.

But I think georgist is entirely right that if you worship financial gains and quarterly profit, the result is what the U.S. has.

The U.S. has let some very valuable businesses, which you’d think have a national security component, decay. I’m particularly thinking of machine tools (the U.S now has 7% of the market) and IC manuafacturing (the U.S. has now a little bit under 10% if I read the charts rightly).

In both cases, we used to have much more. The U.S. led the world in machine tool production in 1975 and before and led the world in IC production at least up to 1990.

Yes I’m making a systemic point about a deep flaw in USA culture/identity, which was met with emotion, not reason.

People rightly critique China, but the USA ideology made this setup. Therefore USA ideology must be critiqued for real change to occur, not just mindless nationalism of “China bad”

Ed-nail struck squarely…

may we all find a better day.

Ed (and others):

There is a good interesting written history of the sad saga of the “machine tool” and “machinist” corporate capitulation to early globalization (back in the ’70’s or so). How too many machine manufacturing (machinist technology) companies gave up to Japan raising the technological advances then being made in machinist manufacturing processes. They, the corporations just refused to invest.

Sound familiar?

Of course they will always blame labor being “too expensive”.

Economic criminals, all.

To georgist: No worry at all! We still keep Wall Street here! That is the only thing that matters. LOL!

The “clean air act ” circa 1970 spelled the doom of foundries in America. This killed off most of our machine tool industry.

Turlock-would posit that the reasons for cleaning up our industries was/still is clear-not invoking verifiable/enforceable standards/tariffs on foreign imports (example: any imported steel would have been required to have been produced under equivalent labor/workplace/environmental laws in effect in the U.S.) at the same time paved the road to the present in much more than a purely environmental way…(in effect, all the U.S. did was export a great deal of our own pollution and then crow about our ‘successes’ on ‘Earth Day’ while the great American working class offset their decline in real wages with a lot of oh-so-easy revolving consumer credit…).

may we all find a better day.

You didn’t read what I wrote.

If I go down the shops every pair of socks is made somewhere like China, but now I pay them and a western landlord.

It is actually worse than you think.

Think of it this way: We are not just “printing” notes of paper to give to these countries for real things, we are SELLING what we have, to get Yuan, etc, for the things we don’t want to make.

We all want to be Lawyers and YouTube influencers…..

This is exactly like the Wealthy Family that own thousands of acres of farm land but are too lazy, and stupid, to farm. So they sell of pieces of land, decade after decade, to live “high”. Then the day comes that the new Owners, speaking a strange foreign language, show up and kick them off the land.

That is what we are doing and we are incredibly stupid.

I offer a two step solution:

1) If you want to make it here, you sell it here.

2): Only real American Citizens may own property (of all types) in America.

(Those who are upset, relax, it will never happen.)

Unfortunately, this will continue and probably get worse absent drastic action. Eventually, the increasing losses in the purchasing power of the US dollar will cause the world to turn away from it as the world’s reserve currency. For example, instead of providing an exemption for foreign earnings from US income taxation (so long as the foreign earnings are not FORMALLY brought to the US), the US could impose a surtax on foreign earnings higher than the tax that such US investors would pay if they had their factories in the US.

Then, those same investors would earn more if they invested their funds in factories in the US (or allied countries given special protection) than if they invested in China or other countries that may attack US allies and in that conflict dramatically disrupt US supply chains, to put it mildly. Currently, the incentive is to invest in China and similar countries, not just due to the exemption from US income taxes but due to CCP subsidies, quasi-slave labor, lack of environmental protections, effective, USPS subsidies on shipping of packages from China(!), etc.

A graduated tax on any imports surplus would take care of that? That is, no tax on imports as long as trade is 50/50 in dollar value. First 10% of Chinese surplus, 50 to 60%, taxed at 1%.

Second 10%, 61%-70% trade surplus taxed at 2% etc.,

with that tax going ONLY to American vocational school funding, tax offsets for new domestic manufacturers, and relief to Rust Belt communities.

Biden could with a stroke of the pen create a U.S. tax dollars can only spent on American made products Plan.

Good idea. We need strong incentives for fair balanced trade, not unrestricted free trade, which encourages global concentration of profit, consolidation, and wage repression.

The US is one of the few countries in the world with worldwide taxation.

Foreign earnings of US based corporations are predominantly from sales outside the US, not necessarily imports into the US for final sale to US based buyers.

With Mexico, it’s my understanding that much or most of the increase since NAFTA is from US foreign subsidiaries. From China (including Hong Kong), no.

I can’t tell you the proportion between both, but when Walmart imports, it’s from an unrelated entity since they do not manufacture anything.

No tax system anywhere in the world to my knowledge assesses income taxes against entities who only export but don’t make the final sale in that country.

Going by the history of trade and trade agreements, the only mechanisms to noticeably reduce the trade imbalance is through tariffs or import quotas. An example of the latter were the “voluntary” limits on Japanese autos during the Reagan administration in the 80’s.

Quantifying the trade imbalance is also more complicated than it sounds too due to trade accounting. A product is exported from a single country and the final value is credited to it, but with inputs potentially from many. I’ve read elsewhere that when Apple imports an iPhone from China, as little as $10 actually represents economic output attributed from there.

I’m glad I found this site. I went back to college for Accounting and finished just before the pandemic. Globalization, JIT, and other concepts were taught as-is and in seemingly the most glowing terms in business school as “The Way.”

No critical thought it seemed put towards its weaknesses or balancing it out with any concerns like working conditions. Made business decisions seem always reactive to in-the-moment, on-the-ground circumstances as dictated by data.

Duh, some of you might say, but I’d like to think we’re seeing the net negative issues and lack of counterbalance by how people going into business are taught on what to think about and prioritize.

Oh, the guy who won our business competition came did it through stock buybacks.

Yes, these institues of “higher” learning seem unaware of their own glaring hipocracy. While screaming about global warming, they advocate outsourcing production to countries that pollute and dump everything in the oceans like it’s one big garbage dumpster. And they have no problem doing business with a human rights abusing country that has real slavery — not the soft kind that seems to bother them much more.

40 years ago China was primitive. Now they are modern and rapidly building their military. Given how they treat their own people, imagine the fun when they decide it’s time to extend their influence over the neighbors. But but, we got cheap t-shirts!

I think the differing opinions, in general, come from different departments within the institutions of higher learning, while the leadership of the schools follows the money.

Your Harvard Business School, which teaches how to outsource to its eager young students, presumably disagrees with the Harvard Poli Sci and Environmental Studies Departments.

We just don’t hear this anymore..

“Trade Deficits Don’t Matter” because the dollars must return.

But what they miss is that with the return comes a change in ownership and power.

I noticed Nat gas exports doubled, which explains why my heating bill doubled.

Remarkable, all this trade with “bottlenecks”.

Our dependency and thus our lack of self sufficiency is glaring.

Trade deficits or surpluses matter most definitely, as you point out especially because of power to buy up the hard assets. Also, if trade surplus wouldn’t matter China would never become global power.

On the other hand, these graphs are also showing that psychotic money printing and subsequent inflation are the cause of the low inventories and “bottlenecks” not the other way around. The way I see these graphs is that physical volume of imported goods into USA is roughly equal or little bit higher to 2019 ( value adjusted for inflation and assuming similar type of imported goods). If these volumes were enough in 2019, bottlenecks can only be explained by highly unbalances demand for goods caused by magic money.

Corto

“Also, if trade surplus wouldn’t matter China would never become global power.”

Exactly. Countries with trade surpluses ascend, those with deficits must print TRILLIONS.

We followed the monetary policy of Japan, but Japan has a trade surplus.

And agree again, the Inflation Awareness Demand (IAD) created the demand for goods and inventory that caused the bottlenecks. Inflation awareness triggered the bottlenecks, not the other way around as the Fed would have you believe.

Every purchasing agent ran for inventory, for to not have inventory in an inflation is to be out of business.

The Fed pushes the blame, but their argument doesnt work.

The Federal Reserve Board is lacking in fundamental real life economics. Too many Georgetown Prep and Ivy Leaguers, IMO.

In 1 generation the USA has gone from a producer nation to a welfare state.

Only increasing debt has kept the U.S. economy functioning.

One would think that those behind this were actually working for the enemy. But that would be wrongthink. No ?

The current account deficit is much lower than the trade deficit. When a U.S. company manufactures goods abroad and sells these goods abroad, it may not be counted as an export even though cash flows back to the U.S.

iPhone sales in China do not count as exports because the phones are made in China. Apple may profit from the cash that flows back to the company without having exported phones to China.

David Hall,

Can you put some numbers to those dynamics? I am honestly interested since you seem to make a valid point, but I don’t know the scale of it.

If macro-wide is too hard to accumulate data on, perhaps you could use Apple alone as a proxy (10K should have a lot of data…hell, given the growing trade pressure, Apple should maybe *publicize* such numbers).

Gunlach says dollar will most likely fall to about 75 from 95 in the near future because of twin deficits. That’s going to reduce imports as stuff will cost 25% more.

I have tried to beef up my portfolio with precious metals and retain some an international index stock fund to help if dollar tanks.

74 is the inflection point on the DXY index. Should that break its a long way down. The 74 level should be tested in 2023 when hyperinflation grips America.

When the dollar tanks not if. Its all downhill for the U.S. dollar once the midterm elections are over.

LOL for the dollar to fall to 75 from 95, the Eurozone would have to get their act together, Japan would have to start a baby boom, China would have to let their currency actually appreciate (cutting their trade surplus and goring a lot of their domestic financial cash cows)… and the rest of the world would have to somehow get their act together too. Not Gonna Happen.

Guys like Gundlach aren’t out there talking to benefit You.

Wisdom Seeker said: “LOL for the dollar to fall to 75 from 95, the Eurozone would have to get their act together, Japan would have to start a baby boom, China would have to let their currency actually appreciate (cutting their trade surplus and goring a lot of their domestic financial cash cows)… and the rest of the world would have to somehow get their act together too.”

————————————————-

How does this work? What is the linkage? the cause and effect?

Horrendously out of control:

Inflaion, trade deficits, annual budget deficits, national debt, FED, housing prices, rent prices, asset prices, auto prices, drug use & deaths, violent crime, illegal immigration, healthcare costs

SS & Medicare Trust funds are going bust. Medicare Part B is $500 in the red.

Military readiness is worsening. We are politically & socially polarized.

We need Wolf to give us Good News Wednesday with charts that accentuate the positives, if they’re are any.

Just watched Lacy Hunt’s new presentation on Wealtheon. Seems like good 50,000 ft of where we are with debt bubble.

Bottom line I take from it is Fed ran experimental policy on debt saturated economy and that will end up being a big mistake as they will not be able to get us out of the hole they dug without a lot of economic pain.

Jay,

Medicare part b is going bust because it is being outsourced to private companies who provide little to no care for a big payout. Every enrollee of a free advantage plan is costing SS an average of $1,000 a month, $12,000 a year. The lobbyists are pushing hard to outsource the entire system to private companies.

On top of the $12,000 a year the plans get from SS, their deductibles are up to $11,000 each and every year. These plans are bankrupting SS but they are considered “free” by the enrollees. The system is not broke, it is being bankrupted on purpose to eliminate the low cost option of traditional medicare.

Petunia,

Advantage plans get $1000 a month to INSURE that person. Medicare does not pay the Advantage plan when the patient has a $1 million cancer problem, it’s the Advantage plan that pays for it. You go find private health insurance of this type when you’re 70! It’ll cost you a lot more than $1,000 a month.

All Advantage plans must offer deductibles that are no higher than Medicare’s deductibles. Many Advantage plans have lower deductibles than Medicare. A bunch of stuff is included without deductibles. The Advantage plans I know include a better version of Part D (no donut hole, etc).

Many Advantage plans have caps, including annual maximum out-of-pocket costs, which Medicare doesn’t have. Medicare is open-ended in terms of how much you pay in deductibles and copays.

Etc. etc.

But yes, if I lived in a place like Texas that is so pro-business and so pro-insurer, I would not want to put an insurer between me and Medicare. I agree with that. I used to live there. I know the difference. There are other places like that too. So if you live in one of those pro-insurer places, you’re on the right track to avoid Advantage plans.

It’s more than just the economic or accounting surplus which makes China a global power.

As Mao himself said, power comes through the barrel of a gun. Hopelessly optimistic people have somehow convinced themselves that large scale war is obsolete but it isn’t.

It’s based upon two delusions. One, that the current US led order will remain in place forever and be accepted by everyone else. Two, that US foreign policy belligerency won’t ever trigger a major power conflict. Neither are even close to true or believeable.

In a future conventional war, China is in a similar position to the US. Their industrial production in many industries dwarfs anyone else. An example is steel.

They can make a seemingly endless supply of guns, bullets, artillery, aircraft….the list goes on and on.

Similar to the US during WWII.

You missed a very important point. China produces the most graduates with engineering and science degrees every year. In comparison, our smart kids choose law, finance and medical major. That is how we as a country start loosing our competitiveness.

Natgas is now going to Europe to save them from Russia’s evil grip, so cheer up! I’m sure they’ll send thanks – I hear Europeans love and respect us ;)

Russian gas is flowing, yes. American …. Nope.

They will have to build the infrastucture to unload it first and they have to find a way to sell the stuff. The current branding: “4x the Russian price, Now enhanced with Random Sanctions” doesn’t really work here.

Most of that shipped American Nat gas was sold to Asian countries.

@fajensen, I saw a map of US natgas ships headed to Europe a few weeks ago. Atypical.

@anthony, yes, that was part of the problem for Europe in the first place, US supplies redirected to Asia. But now some is headed to Europe as well, I believe.

“ They will have to build the infrastucture to unload it first and they have to find a way to sell the stuff”

So all those big ships full of LNG that crossed the Atlantic to the European Middle East are just floating offshore waiting for little boats with propane tanks to come out and get filled?

Yeah, I’m not buying that…

Throwing the BS flag on that one…

“ The current branding: “4x the Russian price, Now enhanced with Random Sanctions” doesn’t really work here.”

You’re right… Euros in the fireplace works way better…

I am a seaman from EU (Croatia) sailing on LNG carriers. There is no way that USA can save EU from gas shortages. First of all, almost all LNG ships in the world are long time chartered project ships (can not be leased for voyage or short period of time), and there is lack of LNG ships even at this time when most of NG flows to Europe by pipelines from Russia. Ships which are now under construction are also mostly project ships and it takes two years from order to delivery of new LNG carrier. NS2 has capacity for which you would need additional 45 conventional oceangoing LNG ships (almost 10% of present world fleet) on USA-EU trade, and to build this ships Korean shipyards would need years. There can be found maybe 20 ships for long time charter on this trade but I would say not more – that is less then half of NS2 capacity. Now you can imagine what would happen to Europe if Ruskies shut off some other pipelines on their own. So more or less, there is no way out of this circus for EU other then to turn their backs to USA. This is unfortunate for me and most of my fellow europeans, but I see no other way around it.

Thank you for your insight Corto,

May the wind be at your back, and may the sea be calm when you’re moving across the water.

You are still buying NG at a discount, the fracking business shutdown, (but there is a new generation of technology coming online) The point on those dollars returning (in good faith) has a caveat. Foreign Reserve dollars are issued in the form of 30yr Treasury bonds, which you could call seigniorage , the cost of money. That money recycles back into US RE markets, ostensibly in the form of hard cash. China puts on capital controls to reduce the backflow, and some of it is tendered through third party currencies, like Mexico, or bitcoin. So yeah dollars do return, often through foreign donations to US political candidates! (Super Pac money). Calling Walmart a US corporation is specious. They make their money in China. US policy has been to sell those foreign reserve bonds at a discount to cash, and that’s where they make their money. They take cash on the other end. Should bond yields rise the question is for whom, those issuing debt or those collecting interest… (already China is cutting back, re: supply chain issues) The bond market is bifurcated and the dollar is going to make an adjustment. China is firming its currency and some high profile investors are long China short the dollar. So far that hasn’t worked. US policy makers don’t want China to take over reserve currency status.

@ Ambrose Bierce –

How about providing support for your claims.

Start with “Foreign Reserve dollars are issued in the form of 30yr Treasury bonds,”

Doesn’t sound true. Foreign Reserve dollars are issued as dollars. To the extent that 30 yr Treasury bonds comprise some portion of Foreign Reserves, that is only because Foreigners choose to exchange their dollars for 30yr Treasury bonds.

Don’t forget Biden is still sanctioning Iranian and Venezuelan oil.

Biden could lift those sanctions if he really cared about crippling energy prices.

In some ways good fences make good neighbors. I have long thought the headlong drive to erase every difference, distance and barrier a kind of insanity. It certainly turns the world into an entropic, gray, difference-less place. If everybody goes to Hawaii, it won’t even be Hawaii anymore. Americans have been spoonfed to be utterly blind to this, and jump on the tram to “experience” other places in their garish stupid theme-park way. But all this has been relentlessly promoted as maybe the core value of an expansive empire-that-dares-not-say-its-name. And the peons were just pawns. We were throwing dollars around to our imbalance since at least the early 60, and this started the dollar unraveling. It was the Pax Americana, with the seeds of its undoing. Most of us took the “freebies” that were bait in this trail.

We import trinkets and tee shirts…..(that end up in a dumpster) and they take the money and INVEST in hard assets and our politicians.

historicus

This may be true, but we are importing from so many different countries, it’s not like our systems (form of govt) will change.

They still accept our worthless currency and produce what we want for cheap. We print, they work, we consume. It’s a pretty good deal and not likely to change for a long time.

Yes. I understand the benefits to the consumer. But the undercurrents are not good for the United States of America.

IMO

1/3 of corporate residential real estate purchases are foreign, I have read. The foreign money that came into Canada and ran housing out of the reach of the citizens is stunning. Our currency is IOUs in effect, and way too easy to create at the whimsical decisions of the unelected mandate ignoring Federal Reserve.

The “worthless currency” has driven an enormous change in per capita wealth, infrastructure, technological development etc in China over the past generation.

That same “good deal” has seen wages in the US for non-PMCs (professional managerial classes) stay flat for 20+ years – hence is a significant driver of inequality in the US.

So the good deal is good mostly for other countries in general and the oligarchy in the US, but not good for the US overall.

If you ain’t in the club, like me, It’s a good idea to have a lot of that worthless currency piled up and no debts. If 50% of its value evaporates in a poooof…. The remaining 50% will keep you safely behind the ranks of the bottom 40% if they decide to bust a move. I don’t see no one wanting to bust a move. The message is therefore a simple one. Shut the F?$k up as inflation de-flates and transfers what remains of the buying power to those that own government. Remember vassal , the problem is wrong think by your neighbor, not theft by de-basement to those we have voted our fealty to. A more appropriate description of wrong speak should be up-graded to newspeak as in the now not so futuristic novel 1984.

Beardawg,

Read or listen to Ray Dalio’s Principles for Dealing with the Changing World Order: Why Nations Succeed or Fail and you will understand a little bit more of the history of how and why empires fail.

What is going on in the USA today is typical of how a failing empire deals with its inadequacies.

Our *leaders*, for their own benefit and short term gains, have put the USA in a position of extreme risk and potential failure.

It is what others have done in past empires. It is how human nature works.

Most humans always think that the past is the future and discount risks and change. The risks build, they ignore them or make up stories how this time it will be different and they use leverage.. And they dig the hole deeper until the walls cave in.

It isn’t that we can’t learn from past mistakes, it just appears to me we don’t want to. Arrogance, ego, hubris, greed all play a part.

What is your definition of a “long time”?

The US share of global GDP is shrinking and the market is becoming less important.

It will be a noticeable factor when the USD FX rate dives and doesn’t recover. It will make Americans noticeably poorer.

Augustus Frost

I would say it can go on for at least 40 more years based upon how long it will take the USD to become realistically challenged as the reserve currency AND because our military dominance will be the last thing to fall. We got a head start on everyone in becoming the world’s caretaker and I suspect most of those we caretake will not want other entities / nations doin the caretaking.

Beardawg said: “We print, they work, we consume. It’s a pretty good deal and not likely to change for a long time.”

_________________________________

It was a shortsighted deal that has become a very stupid deal. It is is now “we print, they work, we consume, we degenerate, they buy us, we rent”

There are those who are benefitting from this and will stay above it all.

The $ started to unravel with the Vietnam War. We did this to ourselves.

The U.S. $ was dethroned by the astronomical rise in the E-$. The contraction in the E-$ market has bolstered the U.S. $ since 2008.

If it weren’t for the contraction in the E-$, the U.S. $ would be diving during these high trade deficits.

oh yea ………………. everyone knows what the E-$ is.

Wolf, please ban acronyms even is the E-$ means Eurodollar.

During WWII and in the Fifties, money flowed into America. Rebuilding Europe and Japan’s infrastructure made us richer. Money flowed into the US at a record pace. By the Sixties, Europe and Japan were selling a lot of cars, machinery, and electronics in the US. Money began to flow out and has never changed. Of course, unwarranted wars of aggression all over the planet didn’t help things either.

Anon 1970: Late stage Empire is a bitch ! Not to worry, not to fret . We will be allowed to suck on the peach seed after its its flesh has been et’.

Numbers in my college classes have collapsed. I’m recalling on 9/11 I had tons of students from all over the world including the Middle East, Saudi and Iran with the hijabs and everything. I was also exporting the kind of business culture I revere, exemplified by this site. That first wave of security tightening thinned that bunch. It was another form of botched export, the Forever Wars. More recently (into 2017 or so) I had crowds of Chinese students, also renting in the district of my college. I guess that was another side of globalization, but again, an import of money and export of US prestige, and viewpoints such as Constitutional Law. Those students too have vanished. Oh well, it looks like the Constitutional Law compliance seems to be fraying right here in the homeland. Hard to unring these sorts of bells. The skills and culture have to be built fresh in each generation. I hope the locals are getting the skills somewhere, and something other than cannibalizing whatever value is still around. Record Super Bowl gambling? Digital bread and circus.

Facebook and TikTok are educating the younger folks these days.

What may be even worse coming is Metaverse! We may all can feel artificially wealthy and happy! LOL!

@ phleep – the locals are competing with the imports to pay tuition and rent ………………………….

Truly remarkable and scary, Wolf.

I’ve always placed the trade deficit problem at least partly at the doorstep of the consumer, who ever since the ascension of Walmart has demanded “every-day low prices” over “made in America.” I’m not saying that either of these demands is right or wrong, just suggesting its been largely consumer driven.

Also, how do American wage controls and labor regulations fit into the foreign outsourcing conundrum?

A full discussion of the government policies that encouraged globalization would be helpful in understanding how we got here, and shed light on how we get out.

Walmart may have pioneered it, but Amazon is likely the bigger culprit now. Amazon was behind the change in foreign direct mail tariff minimum increase from $200 to $800 – unsurprisingly, stuff mailed directly from abroad has exploded in number and dollar volume.

As for government policies: there are many factors but it is increasingly clear that it is the assistance of the US oligarchy that is at fault. NAFTA and later, China in WTO unleashed outsourcing – Ross Perot was right.

“I’ve always placed the trade deficit problem at least partly at the doorstep of the consumer”

The issue must necessarily be resolved at the level of national trade policy, not individual consumer choice, for several reasons.

What reasons?

* Consumers do not have the wherewithal to look into the supply chain and production of each and every purchase. Proper decisions can only be made if they are informed decisions.

* Some would cheat or simply disagree that domestic production is important. Those consumers must be forced into compliance, else the least ethical would be advantaged.

* Planning and coordination is necessary to properly weigh tariffs by sector and in light of the national agenda; an all-or-nothing approach on all products (complete trade blockade or consumer boycott of foreign products) is nonsensical. Each individual cannot be expected to consider this complexity in each purchase.

Ivanislav-

“Consumer do not have the …. to look into the supply chain..”

My shoes say “made in Mexico” on them. No research other than that and price needed to make informed decision. And why can’t I decide which I prefer, purchase by purchase?

——-

“…Must be forced into complaince…”

That sounds like slavery to the authoritarian master.

———

“Planning and coordination…”

Command economy has never worked: USSR, the Great Leap Forward, Venezuela, Cuba, etc., etc., etc. throughout history.

Tragedy of the Common Consumer, then.

Careful that all that individual freedom doesn’t end up being all our undoing. Like with climate change.

But hey, got yours.

John, if you want to rehash free-market-utopia talking points, go right ahead. That’s what got us into this sorry state of affairs in large part. There needs to be balance, and yes, planning. I didn’t say the government needs to do BE the economy, but it should seek to prioritize certain sectors and set the terms.

@John – your shoes may say “made in Mexico” but where were the components of those shoes made? I bet the laces aren’t from Mexico. The sole is probably from someone’s oil well somewhere, with processing somewhere else, and the leather might have come from the ranch 10 miles from your house. Ivanislav is right that Consumers really don’t know where the stuff they’re buying came from.

My car says it was assembled in the US, but I know from doing some homework that half or more of the components came from overseas. And the labor for those subassemblies was likely elsewhere too.

Globalization isn’t all bad but it needs to be rebalanced.

Wisdom Seeker-

Good points. Sort of the “I, Pencil” story put into my shoes.

I must admit, and I guess it’s my point, that I chose different decision metrics when I bought them, and they included price, fit, style and workmanship, but NOT point of origin on any of the component parts, nor the country of assembly. I had choices.

Viva la Free-trade!

@ ivanislav –

well put

@ ivanislav –

well stated

@ John H. –

do you think the US is not a command economy?

John H. said – “Viva la Free-trade!”

———————————–

Does that equate to “Viva la Globalism!” ?

If the consumer has been squeezed mercilessly, it is very aloof to partly blame him or her. Walmart didn’t come into existence on a national level without a system that aided and abetted it at every step. The consumer has no more say than in the proliferation of low cost stores than they do in the design of vehicles (which are in an arms race to get taller and larger with apparently no bounds). It’s hard to blame someone who has had all their modest savings and income increases constantly plundered.

By driving down the cost of consumer goods ( up until recently) they were able to free up more of the consumers income to be plundered in the form of jacked up rent, housing prices, health insurance and higher education costs.

By not voting for politicians who would represent and defend the national, public interest – as opposed to the corporate-donor interests – we are nearly all to blame.

We have the system we deserve.

American electoral system has no mechanism to prevent incompetence and elections seem mostly driven by charm and hysteria.

Not completely the voter’s fault.

The real fault is that nobody wants to evolve the system because they are hypnotised by the quarter millennia PR of alleged all knowing wisdom of pre-industrial Agrarian society human trafficking slave owners — better known as the “founding fathers”.

We should, at the very least, have constitutional conventions every fifth century.

I can only imagine the constitutional “improvements” that would come out of any modern convention.

Given the extent of social decay over the last half century, it would destroy what’s left of the country.

The first improvement I would make is to get rid of the universal franchise. Rich or poor, no one should be able to vote themselves benefits at anyone else’s expense.

I’d also get rid of birthright citizenship, which isn’t even in the constitution now.

I’m sure you understand how the 2 party system works. It doesn’t often give us a real choice. The choice it gives us is one of two points of views because no 3rd party has a chance in the primaries. or the general elections. And for a person to get party backing, you must be in line with that party’s agenda.

In the so called good old days, large American manufacturers would suffer through long strikes, eventually settle with their unions and then raise prices. The UAW strike at GM in 1968 comes to mind. That model does not work anymore and hasn’t for decades. Eventually, GM went bankrupt and would probably have been liquidated if the Obama Administration had not put Washington’s thumbs on the scales.

My laser printer at home was assembled in Vietnam by a Japanese based company and has been working well for over 11 years. It is much cheaper to operate than my old HP printer and was much cheaper to buy.

And then there is the pathetic case of Xerox, one of the Nifty Fifty stocks back in 1972 when the Dow reached 1000 for the first time. In those days, Xerox was a leader in high tech via its Palo Alto Research Center but never figured out how to exploit its research.

@John H.

“largely consumer driven” ?????

Without the U.S. Chamber of Chinese Commerce stocking their shelves with “made in China” the consumer had no choice.

Made in USA products lost the “economies of scale” as plants were moved/built in China.

You can’t remember the Drumbeat of “Free Trade” ?

Kam-

I’m just saying that producers react to retailers, who react to consumer’s

demands. Retailers were “stocking their shelves” with the lowest price product available because if they didn’t, consumers would buy elsewhere. “Everyday Low Prices” required global sourcing. (That, by the way, is why I asked in my original post about wage/labor policies.)

I’m not claiming the retailer is not complicit in the globalized supply chain, but that they are an accomplice, along with their customer…. That would be the consumer.

John H,

The consumer will always buy a better product for less money. Whether that less money is good for the planet or this country is another matter.

The citizens lobbied and protested and got environmental and labor laws passed in this country because the citizens saw what was happening to our planet 50 years ago.. Then the corporations bought the politicians who together went around the laws by offshoring the production with no boundaries. All so a few in the country could get more profit for the stockholders and the corporate execs. And of course campaign contributions and perks for the politicians.

That is what a good government should be deciding, not how much money will the politicians get to approve moving our production and technology off shore.

So we got cheaper products and an environment that is now on the verge of collapse. Short term gains which have now come home to affect us very negatively.

So that a few could win short term, we gave our leadership and knowledge to the Chinese who are not free market capitalists. And definitely Not Americans.

Such a good deal for us consumers. Short term anyway.. When will we learn, there are no free lunches.

“The gains from trade are what we import, not export. The purpose of production, in the final analysis, is consumption. The more imports we can acquire for fewer exports, the wealthier we are, either as individuals or as a country.”

“Lies, damned lies, and statistics”

[Life expectancy for men in 1900: 46.3 years. I would long be dead. No thank you.]

Psalm 90:10

The days of our years are threescore years and ten; and if by reason of strength they be fourscore years, yet is their strength labour and sorrow; for it is soon cut off, and we fly away.

“There is a basic distinction between life expectancy and life span,” says Stanford University historian Walter Scheidel, a leading scholar of ancient Roman demography. “The life span of humans – opposed to life expectancy, which is a statistical construct – hasn’t really changed much at all, as far as I can tell.”

Changing life expectancy throughout history

A common view remains that in the mid-Victorian era life was brutish and short: ‘The average life span in 1840, in the Whitechapel district of London, was 45 years for the upper class and 27 years for tradesman. Labourers and servants lived only 22 years on average’

Infant mortality rates were unquestionably high, and around 50% of all infant deaths at all levels of society was due to infectious diseases.

Once the dangerous childhood years were passed, however,…Victorian period was not markedly different from what it is today.

Once infant mortality is stripped out, life expectancy at age five was 75 for men and 73 for women. The lower figure for women reflects the danger of death in childbirth…

https://www.ncbi.nlm.nih.gov/pmc/articles/PMC2587384/

Yeah, once you strip out everything….

1. If you strip out child mortality in the Victorian era, you need to strip it out in today’s era. In the US child mortality is still a significant issue.

2. The reason why child mortality was high back then was because this was a very rough time to live, as I pointed out. Thank god for rules and regulations, including in healthcare that keeps kids alive. You’re the one who wants to go back to anarchy by removing all laws and regulations

3. You’re comparing England to the US. Your whole rigamarole before about the US and rules in the US. So now you need to go dig for convenient data in another country that fits your narrative. USian men have 3 years less at birth today than English men, in part due to higher child mortality in the US.

4. Life expectancy of a man in the US who is now 70 = 84.6 years. Not 75. That strips out the effects of child mortality

– A number of reasons are causing this Trade Deficit and it all has to do with a thing called “Capitalism”.

1) Increased productivity

2) the desire to make profits.

3) saturation at the consumer: US car sales peaked in the year 2000. This peaking of car sales has to do with the Baby boomers who started to retire in the year 2000.

MUST call it, ”crony/corrupt capitalism” Willy2,,,

Otherwise makes no sense IMO as one who was a ”capitalist” from age single digits,,,

Selling newspapers, on contract/piecework,,,,

in the street age 7, then to ”contractor” delivering papers when first eligible, age 11, per company policy,,,

and then, with that GREAT made in USA bicycle I bought with the profits, mowing lawns with my owned mower towed behind my bike, thanks to a great guy/owner of a machine shop ( who made most of the rides in the circus at that time,,,) ,,, etc., etc.

Feel very sad for young folks these days, many of whom most likely WANT to work and reap the harvest of their work,,, and stopped because of the ”do gooders”, etc., etc.

The global economy used to be split equally between east and west. Then the industrial revolution happened, and the west started to dominate the global economy, with all the wealth of the world accruing to a relatively few countries in the western hemisphere.

The comparative advantages of those countries is eroding, and now the wealth is flowing back.

This is just a return to the (very) long-term norm.

As long as the dollar remains stronger compared to other currencies the trade deficit could never be

tamed. Fiscal stimulus & QE (still in force) will continue to exacerbate the situation.

Instead of taxing labor, the US should tax the gross margins of importers, and the gross margins of exporters in other countries, via tariffs on everything, and encourage other countries to do the same as a way of raising revenues.

The US has to tax something, and taxing labor is not the best choice. Better to tax gross margins of importers in the US and exporters in other countries. This lowers the incentives to offshore production as a nice side effect.

But that will never really happen because the US Congress is beholden to Corporate America, and tariffs are applied only selectively.

In China they use a VAT. For example, Cotton is made into thread. The increase in value is taxed. The thread is made into cloth, the increased value is taxed. This happens every step of the way until the point of sale.

The VAT was introduced in France in the early 1950’s as a way of raising tax revenue. Even then it realized that it could not raise income tax rates high enough to collect enough revenue to pay for government programs. I think that the US is the only major advanced economy these days that does not have a VAT. Most state and local sales taxes in the US are not levied on services but VAT taxes abroad generally are.

Taxing value added is about the most stupid tax I can imagine. What is the incentive other than to add no value? About as stupid as taxing income.

Maybe better to stop taxing altogether and just get us all through the inflation tax do there is no drag of tax accounting.

We could try cutting taxes instead of constantly feeding the beast.

How much money does the Federal government really need if you took out all the corruption?

We tried cutting taxes under Ronald Reagan and George W. Bush. We got big deficits.

the US Congress is beholden to Corporate America,

behind corporations are people — Flesh and Blood.

Superclass: The Global Power Elite and the World They Are Making

by David Rothkopf

I like to buy American-made and will opt for the domestic product when given the choice, even when it is more expensive — although generally better quality.

But more and more I’m not even given the choice. So many things are made in China, that there is no other option: choice A, B, or C are all made in China. And they might all be American brands.

Some stores, such as Harbor Freight, are selling almost nothing but Chinese-made goods. Almost all the ‘hardware’ at Home Depot is made either in Taiwan or China.

Either we turn the ship soon, or this won’t end well.

Even if we changed direction now, it already hasn’t ended well.

Correct. We are hopelessly compromised. Money is in control, nothing else. Only a crushing economic collapse in China might change things.:

The Hundred-Year Marathon: China’s Secret Strategy to Replace America as the Global Superpower – Mar 2016 [I’ve read it – author was heavily involved at high levels with Nixon’s (now seen by him to be seriously foolish) playing of the China Card – BTW, as he also points out, it wasn’t a “secret,” not even then]

Stealth War: How China Took Over While America’s Elite Slept – Oct 2019 [I’ve read it – written by a retired USAF general, B2 stealth bomber pilot, former military liaison to China – and they weren’t “sleeping”]

Red-Handed: How American Elites Get Rich Helping China Win – Jan 2022 [Haven’t read it, but I have it on reserve and have heard interviews of the author about it]

You will be blown away by the contents of those first two books and from the interviews of the author of the third it sounds like it will also be mind blowing.

Additional proof: Not a single government is fully boycotting the Winter Olympics in protest for China’s clear and serious violation of WHO protocols – JUST as they did with the previous SARS which allowed it to also spread widely – which allowed a deadly virus to spread worldwide killing over 5.7 million thus far, seriously and permanently injuring the health of many millions more as shown in a just released study, and causing many trillions of dollars worth of economic damage worldwide. Apparently, ALL Western governments are corporate owned and those corporations and their countries are overly dependent on China, Inc.

A detail about Covid, in Norway they analysed stored blood samples. They found blood samples dated from before the first report emerging from China that showed that the person had been trough a Covid infection.

I is reason to belive the virus then have circulated world wide before the Chinese was able to identify the first cases.

My opinion is that Nixon was a globalist attempting to “open” China to bring them under the US led post WWII order. They didn’t and won’t go along with it.

Same applies to other countries such as Russia and Iran. They aren’t interested in ending up as a vassal colony to foreign elites.

Reply to Sam,

Now that Pandemic crisis is largely behind us, we are going to find out we got a lot wrong. My guess is US government knows a lot more than they are letting on due to financial interests in China.

“Either we turn the ship soon,”

Pollyanna.

…How many generations do you think that will take? How many generations do you think we got?

Our request and agreements reached that the Chinese to buy some more American products – as in Agricultural……has failed. China effectively bought none of the additional $200 billion in goods it promised to as part of a 2020 trade deal. They have purchased only 1/2 of what was promised….so did nothing to narrow the gap.

This is a one-sided trade arrangement …..

@Seattle Guy

The U.S. made a deal with China? (belly-laugh)

“Let’s make a deal, said the spider to the fly.”

Seattle

File this with the promises they made at the Paris Climate accord…

there is a trend here, anybody pick up on it yet?

America has started a trade war with China and suddenly America cares very deeply about Taiwan, and muslims living in China (while bombing and droning lots of other muslims outside of China).

After all what has been said and done, it has become a hard sell within the CCP to have China buy more stuff from America?

fajensen,

China can buy whatever it wants wherever it wants.

What the US has to do is remove the incentives from Corporate America to produce in China and import to the US.

Instead of taxing labor, the US should tax the gross margins of importers, and the gross margins of exporters in other countries, via tariffs on everything, and encourage other countries to do the same as a way of raising revenues.

The US has to tax something, and taxing labor is not the best choice. Better to tax gross margins of importers in the US and exporters in other countries. This lowers the incentives to offshore production as a nice side effect.

But that will never really happen because the US Congress is beholden to Corporate America, and tariffs are applied only selectively.

If you remove all laws and regulations –red tape –and profit margin get better, than all business will come back to USA.

“If you remove all laws and regulations…”

Hahahaha, yes, and then all the people will be dead? Because you know, everyone does what they want to, drive on whatever side of the road, shoot at airplanes, throw toxic chemicals into the drinking water, use forced labor at gunpoint, light up the neighbor’s house to open up the view from the living room window, shoot his barking dog, sell death-traps as cars because they’re more profitable to make, sell products that poison, make sick, and kill…. Yes, we all would be in heaven.

Hahahaha, yes, and then all the people will be dead?

in 1900 you did not have The Federal Register 50 000 pages, 3 columns –and people where not dead, there was law and order.

where was china at that time?.

They were sure building a lot of death traps of all kinds at that time. In 1900, life expectancy for a man was 46.3 years. Glad I’m not living in that time.

The incentive to offshore can be reduced by taxing the gross margins of US importers and of exporters in other countries via tariffs, and then lower some of the taxes on labor. Taxing labor that much is not a great idea. Better to raise the same funds from taxing the gross margins of importers. If they want to dodge that tax, fine, they can buy domestically.

@ idiotstick –

there were laws and regulations in 1900 …………

It will also never happen because it will take one, maybe two, decades of consistent political effort and investments to bring America up to the same level of manufacturing as China now has.

That level of stability, and the ressources wasted on people, is unwanted by the Smash & Grab Crew who are running things.

fajensen

“America has started a trade war with China ”

Placing RETALIATORY tariffs is not “starting” a trade war. It is standing up to an unfair imbalance initiated by the Chinese.

Stop buying there junk,when u.s.goes bankrupt biggest war in history ,mankind probably won’t survive GREED

Didn’t China weasel their way out of the trade agreement because there was a carefully written part of the contract that gave them an out in the case of a worldwide… pandemic?

The timing of everything seems a little suspicious…

Oh my goodness…

For decades the game has been that the fed pumps huge sums of cash into the US economy ……and due to the current account deficit……shazam…..no inflation. They were destroying our futures…..but what the heck…..nobody said anything.

BUT!…..that was not enough thievery…… the crooked fed and Congress managed to pump in so much funny money that inflation jumped in spite of this huge trade deficit. Thereby confirming that most of us will be living like Iranians in another generation.

Lets hope fusion or some other technology emerges quick to save us from them…..but they will probably steal that too.

Old Indian saying……if the pipe is missing….look for the white man in a suit.

The system will keep working till USD remains the reserve currency. Middle class and poor will get toasted in the process though without even realizing. Poor frogs will slowly be boiled by the rich and corrupt.

could it be that the system is dying because the USD(dollar) is the reserve currency?

@ fred flintstone –

there has been continuous inflation for decades ……..

to assume otherwise is to start with a false premise

Deficit will only grow with time. Its an irreversible process. As long as USD remains the world reserve currency, US will keep printing and deficit spending of both Govt. and Citizens will continue. Stocks have been rising for last 5 sessions. Asset prices are rising for last 16 years. Interest rates are going down over time (with some small bumps) and will continue till it gets deeply negative both is real and nominal terms.

US is the playground for rich and powerful and they always come out ahead irrespective of the conditions here. Even a global pandemic cannot derail the prosperity march of the rich. Welcome.

are you trolling or do you really believe this nonsense?

other than projecting into the future(which is unknowable), has Kunal mis-stated anything?

If BA.2 the newest variant spread, our trade deficit will shrink.

The WHO : BA.2 > BA.1

BA.2? More like BA.humbug

Biden should add tariffs. That’s something Trump did that was good for America. It shouldn’t be a political issue. Its about ensuring good jobs in the future. My opinion is that sustainable fair trade requires all countries to match their imports with exports. If that is not happening, tariffs should be imposed to balance it. In theory, a free and efficient market doesn’t care if all jobs leave the US or if large corporations accumulate all the wealth and power.

a free market requires many suppliers, many buyers, no or low barriers to entry, etc.

I don’t think large corporations accumulating all the wealth and power accommodates that

Who told you you gotta out-stupid this market!? I did! BKKT +17% right now. Everyone’s getting pumped for crypto ads at the Super Bowl.

I am in the process of buying a new machine tool and if things go as planned I will be getting as close as possible to American Made. Iron from Taiwan, engineering components, sheet metal, software and control from the USA with servo system from Japan and assembly in Indiana. All my work holding from Los Angeles with tool holders from Switzerland. We can’t make an entire machine tool here anymore as we have lost the capability of making high grade machine tool castings and servo control systems. There is a small village in Germany where they can make an entire 5 axis milling machine from scratch using nothing but components made with 20 miles of the factory. This was a choice not just the result of high wages.

I watched the entire U.S. brass and copper manufacturing industry vanish before my eyes between 1970 and 1985. Good thing I left Anaconda when I did in 1981 and go to work in Big Oil or I would have a bleak retirement, if any at all.

The company I work for just took delivery of a machine from Germany. I think the cost was around $600,000.

“Service exports” = Tax shelters.

1) Export to HK & China hit a new all time high. // Import from HK & China

hit a higher low > 2018 nadir. Our trade deficit with China is shrinking.

2) The worst US deficit with China was in 2018.

3) Goods import is rising. Goods export is rising too. Goods import

minus export : flat.

4) Export of : petroleum products, NG, aircraft (from low base) and diamonds rock.

5) A growing trade deficit with mexico feed our industries.

DX will breach 105 in 2023 on the way to 115 area. Our trade deficit

will shrink dramatically.

Agreed. That will be the time to back up the truck for gold miners!

We’ll see whose right. I’m saying it will test the 74 level in 2023. I’d wager heavy the 74 level won’t hold.

Are imports/exports inflation adjusted or absolute dollar amounts? How is the amount calculated, factory prices or whatever?

Very interesting data in this article. The two items that caught my attention are:

1.) Exports of Computers up 68%

2.) Exports of Cell phones and other household goods up 24%

I am wondering what the definition of a computer and cell phone is here?

I was not aware of any computers or cell phones produced in the USA.

Harvey Mushman,

“Computers” doesn’t only mean laptops. It means computers in general, including big machines, the black boxes in motor vehicles, heavy equipment, planes, locomotives, etc., and the computers in industrial robots, etc.

In addition, for example, Apple assembles some of its computers in the US, and many of its computer components are made in the US. And some of its iPhone components are made in the US, such as the screens, that are then exported to China for assembly into the iPhone. There plenty of other things like that… just Google around a little.

Have you noticed, the UK is not normally on the list. Why? It’s because we like similar stuff and so we import more from the US than we export. That could be a bit of a problem, because the present admin running the US don’t actually like the Brits but they do adore Europe. I can only guess its because of Brexit, where the Brits stuck it to the man….and they hate anyone who talks back…..

It’s my feeling the U.S. leadership is jealous of the Queen and the royal family. It’s the one level (royalty) that can’t be achieved here in the states. LOL!

Only the UK still cares about Brexit. The USA never liked the UK that much; Bad guys in Hollywood movies have all had English accents at least since 1765 :)

Capital Transfer Securities would sort the deficit and promote reshoring.

Essentially it creates a security for all international capital movements. The capital exports securities have a price. Capital imports do not. Refunds when you match them. So when we have a trade deficit, reflecting capital exports, the goods importers effectively subsidise the goods exporters. No tariffs or bureaucracy needed. Pure market force leveraged.

Who is going to voluntarily create such a security?

If it’s so voluntary, why hasn’t someone done it already?

Hi Augustus,

Would not be voluntary.

Needs to legal requirement.

It would be a new lever for the FED.

Jack

“Imports of services soared by 16% to $535 billion. Exports of services – which include spending by foreign tourists and students in the US – rose by 8.6% to $767 billion.”

Does that mean that U.S. tourism abroad is “Imports of services?”

What exactly are the services we import? Phone help lines? Server farms?

The services the US imports include: services provided by call centers in Pakistan, services by software developers in India, financial services from London and the EU, TikTok from China, anti-virus software from Russia, any apps that were made overseas, the services provided by server farms and the global telecommunications infrastructure, aircraft maintenance (yup, been offshored), American tourists spending money on hotels and trains overseas, a gazillion services, many of which the consumer doesn’t ever come in conscious contact with.

Imports of services are spread over these major categories:

Maintenance and Repair Services

Transport

Travel

Construction

Insurance Services

Financial Services

Charges for the Use of Intellectual Property

Telecommunications, Computer, and Information Services

Other Business Services

Personal, Cultural, and Recreational Services

Government Goods and Services

American tourists spending money on hotels and trains overseas

——————————————-

I believe that is an American export

No, it counts as an import because Americans’ money is spent overseas for services purchased overseas (hotels, etc.)

@ Wolf –

Thanks.

It’s the inevitable result of the equally inevitable rise of an oligarchy that owns America lock stock and barrel. Nothing new to see here. Ancient Greek philosophers, Aristotle and Socrates, both observed that Democracies eventually become Oligarchies. Back then a Democracy was enjoyed by a ruling class to begin with. So it was more than half way there from the beginning. The American revolution was the first to result in a true Democracy (Republic version).

Perpetual Perp:

” The American revolution was the first to result in a true Democracy”

Really?

Why does a “true democracy” need so many secrets from it’s people????

Ours is a kind of “oligarchal” democracy.

The rule of the few over the many.

And if they don’t like it they can lump it!

That’s part of why we are in such a mess!

All this pastiche of “free markets (really?), democracy, individualism has cast our country into the Devil’s pit of history just like all past “empires”.

“Globalization” as created by the globe’s oligarchs is only a race to the bottom for labor (the “commons”) and a race to the top for those oligarchs.

Anyone in between gets crushed.

There is no way to stop globalization of “markets”.

Once started it must proceed until the ultimate end: more riches into the hands of the rich and more stripping away of those hard fought gains for global labor. Not even watching our global environment destroyed on the way to those riches.

How does our foreign policy of crushing economic sanctions on those countries who don’t want to be part of our “free market” oligarchy fit into “globalization”?

Any “distortions”?

“See that guy pedaling along the side of the road on his (her) bicycle laden with plastic bags of recyclables?” That’s the future of American labor in our world of “globalization”.

Wake up America(n) people!

Just as a follow up:

American foreign policy history is well documented in most “alternate” press on our fostering the crushing of any attempts at “organizing labor” in those countries we have dominated such as Latin and South America, Europe, Asia etc.

American organizations such as AIFLD (American Institute of Foreign Labor Development), NED National Endowment for Democracy, histories of the American Labor movement, much not even aware of by the ordinary labor official or even rank and file. There is “oodles” of this kind of information available to anyone wishing to really educate themselves on American policies, foreign or domestic.

My apologies Mr. Richter for getting somewhat “political”. Most globalization “rules and regs” are just political anyway.

Keep up the great writing.

1) BRK/B a new all time high.

2) A son of congressman Howard Buffet 1943/49 and 1951/53. A friend

of Murray Rothbard.

3) During his republican days WB became a billionaire.

4) King Salomon invested in BAC, GS, HOG….and energy.

5) Farnam st is longer than Wall street.

6) The secret of his success : he plays ukulele with Bill Gates in charity duet.

I have owned brk before and hope to own it again. I would consider Buffet about the most moral in his business dealings of any capitalist.

Brk has ran up like it usually does at the end of cycle when people start rotating to higher quality, but if market tanks it will get whacked too.

Last I looked it was 1.55 x book. During last 25 years you have had a chance to buy for less than 1.0 book and that has been a great opportunity, but it is always at depth of market decline.

Oops. Should have said you have had three chances to buy at least than 1.0 book. Anything under 1.2 book is good purchase if you have patience.