We noted the softening beneath the surface in the prior two months. In January, we saw it creep to the surface. And there’s plenty of supply.

By Wolf Richter for WOLF STREET.

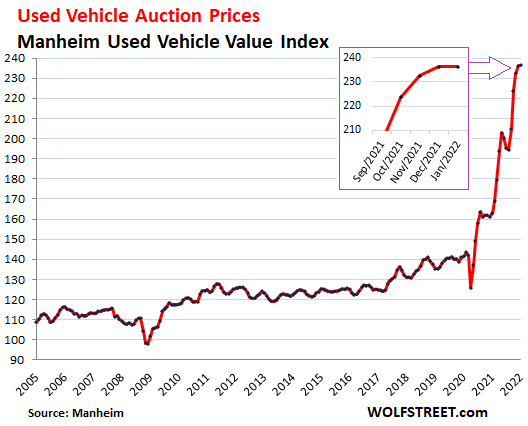

Used car and truck wholesale prices that had gone berserk last year were essentially flat in January, the first hesitation since August, at ridiculously high levels, as pricing resistance in face of this craziness is finally setting in.

Two months ago, I noted the first signs of softening of some of the beneath-the-surface pricing-dynamics. And a month ago, I noted how this softening beneath the surface expanded in December. And in January, the softening broke the surface just a tad with flat prices for the first time in months, halting the mind-boggling spike of the Manheim Used Vehicle Value Index.

There had already been indications last summer that these prices-gone-berserk had turned around and were heading south, but then the next leg of the spike set in.

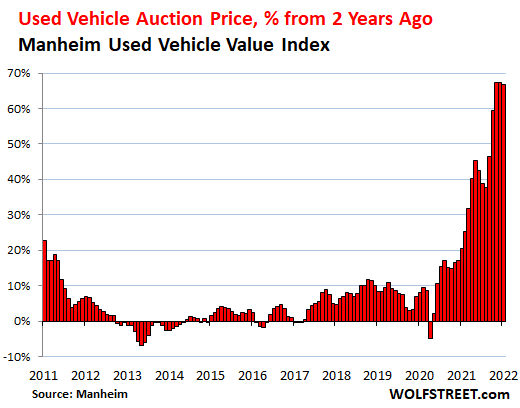

These wholesale auction prices, as tracked by Manheim’s seasonally adjusted and mileage-adjusted Used Vehicle Value Index, were still up by 45% from January 2021, and by 67% from January 2020.

This doesn’t mean that used vehicle prices will suddenly plunge. Prices are sticky on the way down. But it indicates that price resistance is setting in, amid plenty of supply and slightly lower sales at those ridiculous prices.

The underlying softening progressed further in January.

The Three-Year-Old Index declined 2.9% in January, according to Manheim, the largest auto auction operator in the US and a unit of Cox Automotive.

The average daily sales conversion rate at Manheim auctions declined to below-normal 50% in January. For example, in January 2019, the sales conversion rate averaged 51.5%.

“The lower conversion rate indicates that the month saw buyers with slightly more bargaining power for this time of year, and as a result, most vehicles showed price depreciation,” Manheim said.

“However, price patterns in the month varied by vehicle age and segment. Older vehicles were more likely to see price stability, while younger vehicles tended to see larger declines,” Manheim said.

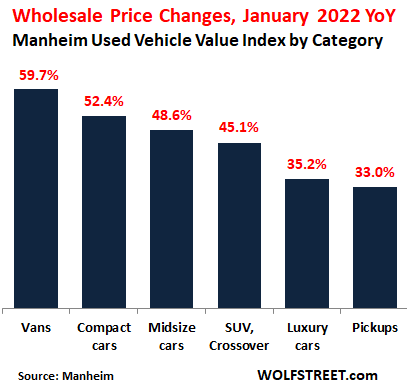

While month-to-month price declines were cropping up, the year-over-year price spikes remained enormous, and across all major vehicle categories, vans at the top with a price spike of nearly 60%, powered by super-hot demand for cargo vans on the used-vehicle market, driven by the boom in ecommerce delivery fleets.

The spike in van prices started when cargo vans — fleet sales in general — were deprioritized by automakers that got caught by the chip shortages and prioritized their high-margin retail sales. For example in January, fleet sales by automakers plunged by 48% from a year ago, sending fleets scrambling to the used vehicle market.

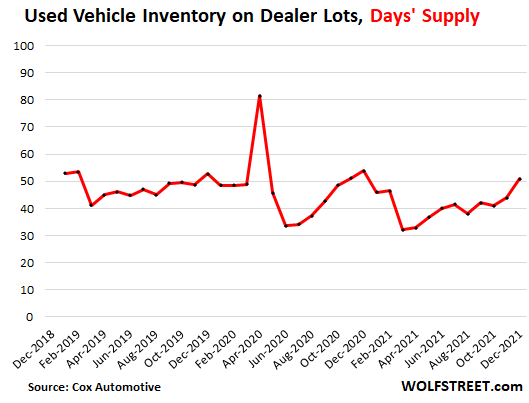

January started out with plenty of supply on retail lots and in the wholesale system, thereby reducing the pressure on dealers to purchase vehicles at auction at no-matter-what-prices, which is what we’re starting to see.

Supply at wholesale auctions at the beginning of January was 26 days, above the average of 23 days.

The number of used vehicles on dealer lots at the beginning of January reached 2.38 million vehicles, the highest since February 2021, which amounted to about 51 days of supply, compared to an average supply in 2019 of 48 days, according to data from Cox Automotive.

That there is plenty of supply at the current rate of sales simply means that dealers on average are not awash in inventory, and they’re not facing shortages either, though some hot models are hard to get.

And retail customers shopping for a vehicle will find choices – and ridiculously high prices.

The used-vehicle price spikes of last year are a historic and mind-boggling phenomenon without precedent in our lifetimes. How this gets worked out will make history: Whether prices ease off somewhat, only to consolidate and then start rising again but somewhere near the rate of CPI inflation; or whether prices drop sharply toward long-term trend; or whether prices suddenly take off again for that fourth leg of the even more ridiculous spike. The first scenario seems the most plausible; the third scenario seems unlikely, given where prices already are.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

I bought my current car five years ago, a used current year model. Ideally, I’d like to keep it another 10 years and buy one more time.

Gas prices up a lot near me. Got to hurt pickup and SUV prices if it keeps going. Easy money should be draining out of the system this year as well.

OMG, Jack in the Box tacos are now $1.50 for two!

They had been $1 for two for over a decade.

That’s 50% inflation for this year!

Now I’m upset……………

But think of all the lives saved by not eating a 50 cent JackBox taco (truly awful, btw…only Del Taco presents greater threat to humanity).

Gandalf

maybe they just added value and had to charge more for real meat.

Maybe they’re using real meat instead of powdered sawdust now?

What kinda of meat goes in a $.75 taco?

The heavily seasoned, marinated, so-awful-its-delocious kind.

Jack-In-The-Box tacos are a guilty pleasure. Those mini taco packs are a nice indulgence.

If you’re going to a fast food place, you already know what you’re in for.

Road Kill

Meow.

Don’t ask, don’t tell.

Soylent Green.

Lips and – well, you know what else.

None. It appears to be seasoned pureed beans or refried beans. Or similar.

I hope they taste 100% better than the old ones.

If you use the app they are still $0.99 for two.

Not sure you have lived through real inflation before. It almost makes you feel helpless as virtually every single expense you have goes up. Electricity, gas, insurance, property taxes. About all you can do is shimmy down the standard of living ladder a couple of rungs.

Either you’re gambling in crypto, stocks and houses right now, or you’re getting absolutely slaughtered. It’s the Jerome Bowel Movement way.

It’s the gas and electric bills that will finally tell. Global warming!

If you been living beneath your means, it’s not a big deal. If you are like 70% of Americans, living from paycheck to paycheck, inflation is a bitch.

You’re implying that many people are spending profligately.

One can only live so far beneath their means. Starvation is a real thing.

Huzzah inflation is dead! Back to QE and BTFD.

Hahahaha, no. Wholesale prices still up 45% from a year ago. Used vehicle CPI still up 35% from a year ago and will be up 25% and more for months to come. And when it finally settles down, other prices are spiking, including rents which are already up 12% across the US and are much more important than used vehicles. No, this is the game of inflation whack-a-mole. Price spikes shift from item to item and around and around for years.

Sure, but the FED and it’s pea shooter aren’t going to defeat an atomic bomb. Quite the contrary. Walking around talking big with your pea shooter doesn’t even work in cartoons. Jerome Bowel is a clown.

We need a like button. Lol. Jerome Bowel

They were going to replace him except for some “uncertainty” that would “cause in the markets.”

45% is exactly correct, or was for the pick up/camper we sold last week for exactly that much more cash than the cash offers we received in January 2021.

Took a year for me to find an older beauty in pristine/cherry condition inside and out in spite of being almost 20 years old.

Had driven the ’19 truck less than a thousand miles last two years, and do not plan to drive across USA again anytime soon, as had been the plan 3 years ago.

OR, if the various and sundry hysterias currently prevailing stop, we will be looking at a hybrid that gets 50 miles per gallon instead of 20!,,, and upgrade the motel/hotel experience with the difference, eh?

Who knows, with continuing improvements in battery technology and infrastructure we might even be able to wander along the incredibly beautiful pacific coast in an electric one more time before kicking that ol’ bucket!!!

I worked in operational banking from 1974 to 1981. I’ve seen inflation. At the peak, we were paying over 17% on 6 month CDa and charging our best customers 21% for loans.

Paul Volcker we need you now. :-(

Funds Rate: 0%

Inflation: 10%

Funds Rate: 0% -> 0.25%

Inflation: 10% -> 0%

If this actually works out, I’ll never understand how it was this easy.

THEWILLMAN,

Hahahaha, I wish it were that easy. But no.

Inflation is a game of whack-a-mole. The price spike shifts to other items, such as rents, which are a much bigger factor in consumer spending, than used vehicles. And asking rents are spiking by around 12% on average across the US.

And the CPI for used vehicles will continue to be above 25% for months, hahahahaha

And new vehicle prices are still spiking, even faster than before.

And lots of other prices are spiking too, many services…

And when one item slows down, the next items begin to spike. And so it goes around and around for years.

I was in my local Giant Food grocery store today and noticed some gigantic inflation in prices of fish all of a sudden. Fresh Halibet $29/lb, same with Rockfish and some others. Who the hell is paying this money for fish. Also noted bargains in frozen fish, but upon inspection of the country of origin was surprised to see that it was all from China, Vietnam and Indonesia.

I have been buying frozen Alaskan Salmon at my local Hanaford Store and noticed a while bag in the fine print that the salmon are processed in China..

In Socal, the price per pound of king crab legs is up 100%. And what’s available doesn’t even look great.

Funds Rate: 0%

Inflation: 10%

“Transitory”

Funds Rate: .25%

Inflation: 10%

“We’re so aggressive”

Keeping a close eye on it.

If the number is hot on Thursday, and the Fed doesnt jump it .50 right away, the veil is down, and the fraudsters that they are is revealed.

The veil came down long ago, with Greenscum.

There’s only so much pain the lower half can take…

I’ve noticed a weird uptick in violent crime in my area. Not a ton yet, but things happening that I haven’t heard of in years. I suspect it will get worse before it gets better.

We here in Midwest have record number of car break in,now breaking out windows to get gym bags and etc ,baseball bat justice soon

Great numbers being bantered about, how about providing me with six good numbers, so that I may play the lotto. In my personal universe, I would certainly break the inflation bogey man.

In all seriousness, the discussions are spot on even with humor.

Carvana, like Zillow in housing, has been grotesquely overpaying while driving up prices for the people who actually need the products. These companies make no money and shouldn’t even exist. Only in Jerome Bowel’s stinky money printing world is this garbage even possible.

just like uber and grubhub and the like have destroyed numerous productive businesses. enabled by money printing that allowed them to book losses forever.

Exactly

Government licensing requirements limiting taxi supply also provided an opening for Uber due to monopoly level pricing.

Otherwise, I agree with your theme.

i agree. i think the taxi monopoly was long overdue for disruption. but it’s one thing for uber to disrupt it with superior software and access to freelance drivers. it’s another thing to disrupt it by using tens of billions of “investor” money to subsidize its operations.

Carvana, like so many companies these days, generate wealth for their owners (the Garcias have done extremely well), without generating any profits. Making money without having to make any money! Oh, the glories of financialization! Truth is they don’t really need JP – they have MBAs

Well, the good news is, I get new lexus with a driver to get me places for $12, that a cabby in old crown vic would charge $45 for. Who buys these cars now is the question.

That’s a good point. One scenario is we are only a year or two away from the greatest fire sale of cars and houses as people lose jobs in a recession. Government is no position to dump another $5 trillion in the economy.

Petrol prices here in New Zealand have just hit $3 a litre. Not a gallon, a litre. Now costs $150 to fill a Toyota corolla. We bought a new Mercedes Sprinter work van 3 and a half years ago. Dealer says he will buy it back for what we paid!

Do you guys even need a car anymore? I thought your dictator had you guys locked up inside your houses and apartments.

Kiwi man

If Russia invades Ukraine, look for the gas to hit $120 a barrel and gas to go to $7/gallon here in the US. I have a Toyota Corolla and it only costs about $20 for half a tank right now. Doesn’t bother me one bit. At $7/gallon it will cost about $35 for half a tank. I fill it once a week. Big deal.

“At $7/gallon it will cost about $35 for half a tank. I fill it once a week. Big deal.” Many people are forced to drive long miles because of work. Not good. Not optional. BIG deal. I used to be in that miserable situation.

Dealers say many things. You are likely due to buy next new mercedes van.

Wonder how used EV prices will hold up since, if the battery craps out, it costs more than the vehicle is worth to replace it? And, why do people pay so much for them in the first place (even after subsidies) knowing they will eventually become a gigantic paperweight?

Also, short of having some youtubers dynamite the thing, how do you properly dispose of it?

They ought to sell only the EV and the batteries should be like getting a propane tank for you BBQ. No one should have to repeatedly pay for and own a expensive, rapidly depreciating auto part.

Tesla is changing to lithium iron phosphate batteries. They are cobalt free.

They have been using them faor a few years here in Qingdao for the city buses. They weigh more than Li-ion but charge much faster. Half the 6500 buses are compress natural gas. 25% are battery electric, and 25% diesel. Also, all the taxis are CNG except for a few new battery electric ones.

Happily owned a 2015 LEAF for 6 years. Between dealer/Nissan incentives and Fed/State rebates I paid about 40% of sticker price (new).

Drove 60+ miles daily. Many positives: virtually zero maintenance over the 6 year period; only work was new tires (at 50k miles) and a new 12volt battery ($100 from Costco). Fast. Comfortable. QUIET (amazingly quiet). Drove conservatively and could average about 105 miles (indicated) on a full charge when new; dropped to about 98 (indicated) after 50k miles. So about an 8% degradation. Really no negatives. Sold it and got roughly half of what I paid.

If my “mission” was 60-75 miles of daily driving, would absolutely buy one again. And I suspect that I could have gone to 150k miles or about 15 years without a new battery. Factor in fuel and maintenance on an ICE vehicle, it’s a wash.

This entire eCONomy is built upon fraud. The biggest companies are fraudsters. Banks, social media, big tech, big pharma, big anything – a house built 100% on fraud.

Imagine my surprise when I logged into my checking account last night to find a charge of almost $500 from an “SQ gosq.com” entity which I never authorized. There was the name of a plant nursery in the midwest attached to the debit. I filed a dispute with the bank, had the card closed, and in the meantime asked the bank if it would be ok if I called the company to see if they had any info on this purchase, which they said was fine.

The nursery was as surprised as me. They do not even accept SQUARE transactions, and had not sold any products for the amount that was debited from my account. They asked if I could call them back because they were going to call SQUARE themselves to get some info. It turns out that some fraudster opened a SQUARE account, impersonating the business, then ran a bunch of stolen card numbers through it as legit purchases.

I have never lost my card and do very little online shopping. It is a great mystery as to how my card number was stolen. It could have been an online retailer, it could have been from a major retailer, it could have been from my insurance company, it could have been from the bank itself – nobody knows, nor will they ever know.

But I DO know one thing – Jack Douchey and his SQUARE company are fraudsters. They are allowing people to set up accounts for businesses they do not even own, without any ID or associated paperwork that a normal company would require. Normally, a company would have to set up a business account with the appropriate credentials to be able to run card transactions. Now, Douchey has just introduced a whole new world of fraud to the fraudsters.

It appears you need to “calm down, dude.” You don’t know WTF you are talking about. I have less than 10 retailers I have ever used my card at. I have no recurring payments, I don’t “browse seedy websites, “click on links from dubious emails,” or any such nonsense. You appear to be one of those idiots who just makes assumptions and casts aspersions about anonymous people. Now sit down, Junior.

Similar thing happened to me with my Visa debit card for my business which I never ever take anywhere, and on one ever sees it. Some store in Cincinnati ran a charge through on it. I called the bank, and they canceled the card, sent me a new card, and removed the charge, no biggie.

These numbers can be bought on the dark net. Maybe someone got hacked, and the hackers sold the millions of numbers to some fraudster. This is common enough. But in the US, we as consumers have pretty good protections. You generally don’t have to pay for the charges and banks are quick to respond with new cards with new numbers.

Identity theft is a different issue of an entirely different magnitude and a huge hassle.

Re “You generally don’t have to pay for the charges”

Not quite. We all pay a share of the fraud bill in the form of higher prices. The banks aren’t losing money over this, they’re passing the buck.

BTW, after not having any issues for over a decade, 3 different cards in my immediate family have had trouble in 2021. Something is breaking down. One of the cards was lost/stolen but 2 others were never in the wild and hardly ever used for any transactions (few times/year, only online). They were with different banks but both were Visa cards.

Be interesting to see if any bank CFOs start making a point about fraud chargeoffs. However, given the likelihood of much of this fraud coming from bank-employee (or Visa?) insiders with access to the data, that would mean the government wanting to “help” the banks solve their internal fraud problems…. doubt any CFOs want that…

Interesting. Two nights ago I had 2 Visa cards rejected by an online aboveboard (apparently) merchant. Called my accounts to see what was going on and was told that they were fine and had not been tapped (yet?) and the merchant must have had some glitch in his billing system (?).

I would guess my best move is to get new cards but then there are all the auto deductions that would have to be changed.

Has anyone else had this kind of card rejection?

I use to work IT for a local big bank. The customer service agents that did not hit goals would take card number info from customers, write it down on notebook paper, and after work sold those numbers at the bar across the street. The security group busted 5 individuals that end up selling over 2000 card numbers in one month. They knew that more agents had been involved, but could not bust them. The 5 individuals lost their job but never faced jail time or fines. The insurance agency for Visa reimbursed the bank 80% of fraud charges. The 20% is covered by fees charged to business accounts. The more you know…..

This happened to me 5 times in 2019. I cured the problem by buying a $500 gift debit card at the local supermarket. I use it for all on-line purchases, especially Amazon which always gets hacked. Even used it for a donation to Wolfstreet. It hasn’t been hacked. I’m on my 7th $500 card with no problem. Once the card is used up, you cut it up. Another safeguard is don’t let the on-line vendor store your credit card info. Always re-enter it every time you buy something.

^^

This, x1000. I do the same thing. And I’m a Nigerian prince!

The credit card system is a malfunctioning mess.

I have a citicard with a $1,000 limit that allows me to create virtual credit cards. If I want to buy something that costs more than $1,000, I just prepay an extra amount enough to cover it.

I only use virtual credit cards for online purchases and use cash for everything else.

There are a few schemes around to skim card information. Phising is one, but there are several others.

To get card information skimmers at shops have been used, compromising online retailer databases to get the information is done.

“Wiretapping” the communication to cordless card readers at shops have been done, wiretapping the line from shop to card processor have been done and the information have been retrieved from the card operator database.

The last ones do not get that much publicity. Some years back I and some hundred thousand others got our card information stolen from a database processing payments. There was only a small notice about that one in the newspaper…

Your lucky. I have had some fraud charges on a Barclay card via Venmo and paypal. OI called up Barclay and they told me to contact the vendors to get them to refund the money. Does anyone have a venmo number to call?

Same thing happened with Netflix and Case credit card. Netflix charged my wife for 14 months. Credit card said to call Netflix. Netflix said yes you do not have an account and they wil confirm when chase calls. Chase only credited one of the 14 charges I never have this issue with American Expression

It used to be 4 year old cars were the sweet spot, where depreciation lowered the price enough to make it a good deal. It wasn’t too hard to find one with low mileage. For years now I’ve noticed used car prices just weren’t coming down much even after over 100k plus miles. At that point you’re not saving much vs the risk of expensive repairs.

Now with used car prices spiking up so much, I’d say it makes sense to buy new. Forget the $50k truck or SUV, unless you are young and need that show off toy. Buy the $25k sedan in the lowest option trim. Go to Consumer Reports and find one that will last 200k miles without major problems.

Harold

Buy the $25k sedan in the lowest option trim. Go to Consumer Reports and find one that will last 200k miles without major problems.

That’s a Corolla you are describing. But most re blooded Americans would have knives in their eyes than to be seen driving one.

It will be interesting to see how Ford does with the Maverick. We looked at a couple of them at the Houston Auto Show and they seem to be a perfectly acceptable basic transportation appliance. The sales folks told us they would not be accepting any additional orders after the end of the day – they were sold out through the end of the year! I wonder if other manufacturers will follow suit? In the meantime, threw a couple of thousand dollars at repairs on the existing ’95 Explorer. Will be just fine until there’s a reasonable replacement.

IF you can find them, and they ARE out there but ya gotta be patient, the best buy is older but very well cared for consistently.

Perhaps especially in ”retirement areas” there are frequently good or very good cars with low mileage in spite of 10 or even 20 years of age.

Gotta see some proof, hard proof, that the seller really IS the child, etc., of the little old person who only drove it to church on Sunday, etc.,,,

Can’t hardly believe some of the stories I saw the last year while searching for that old beauty!!!

Great, useful thoughts. Thank you.

I find that vans have had the largest YoY price change in used vehicles. After years of being one of the more unpopular types of vehicles, why the sudden interest?

I sold a commercial van…….a 5 year old Chevy last year for close to what I paid for it. I had the ad in Car Gurus. Interestingly I got a few calls on it and all of them were from people planning to convert the van into a house on wheels. No one else!!! This was in Southern California. I sold it to a couple that wanted to live in it and they both had jobs. Maybe the high van numbers Wolf is talking about are because people are moving into them for housing, not using them to do plumbing or carpentry jobs. You have problems parking an RV unobtrusively but a van with few windows is really ideal especially in an area with a moderate climate like Ca. Why have a house?

I don’t think fleet buyers look at Car Gurus. That’s a self-selective forum. The big fleets can buy at the auction directly. And the smaller ones make deals with dealers (“I need 10 cargo vans, can you get some at the auction for me?”). And we’re talking auction prices here.

They call it stealth camping on YouTube.

New age travellers….?

I’ve been buying older cargo van’s and converting them into campers as a fairly profitable side gig. I’d pay 3-7k for a van, install a hardwood floor, a stylish tongue and groove wood interior, propane cooker and heater, a 12v system, an awning and a few other features like a pressurized shower.

My customer base was vanlifers some of which were international travelers who wanted to travel the US southwest inexpensively.

I could find decent van’s in WA and OR until two things happened – auto production dropped due to covid and Amazon started contracting with ‘last mile’ distributors who needed delivery vehicles.

I spend at least 3 months a year doing what you point out and it’s a fantastic lifestyle. Freedom man!! My margins got squeezed when used van prices spiked so I shut the biz down after 3 years.

This bumper sticker was on a 1960’s van I restored:

Gas, Ass or Grass,

Nobody rides for free.

People can’t afford homes anymore? Joking/not joking…

Vanning is a thing now with twentysomethings to avoid skyrocketing housing costs.

The GenX nightmare “living in a van down by the river” is now an aspirational lifestyle. How far we have fallen.

^^This. It’s truly despicable. Living in a car is not an acceptable housing situation. No running water, no waste plumbing, no electricity. 3rd world shantytowns offer more amenities. And you will not hear a peep from politicians, because they are the cause and they want it this way. They are stealing the future of the young due to rapacious greed, with no shame whatsoever. Nancy P. and Mitch M. should be put on the stretching rack, in a public square. And they should be stripped of all of their wealth. Every penny.

It makes perfect sense if the intent is to equalize American living standards with the third world. Meet in the middle.

I first read this claim decades ago, back in the late 70’s before I was even in the work force. But that’s a different subject for another day.

I test drove a Pleasure way converted Chevy 3500 extended length van about five years ago. It had about 25k miles and roughly 5 years old. Lady needed to sell.

It was sweet driving and luxury. I couldn’t pull the trigger. Too cheap. Prices have gone up so much I could have enjoyed it for 5 years and still got my money back if sold at todays prices.

I think I misunderstood what everyone is referring to as a “van”. I had in mind a minivan, but it sounds like others are talking about cargo vans or other vans that are larger.

1: RAMPANT HOMELESSNESS. 2: Escape hatch “extra bedroom” vehicle for overcrowded “covid homes” with too many relatives now in ONE house, too many relatives now working from home, schooling from home, day cared at home, or who are unemployed. 3: People buying “Bugout Vehicles” in case “the SHTF” (“the shit hits the fan”). That is to say, Preppers and Survivalist types who want a vehicle to pre-pack, to flee their home at a moment’s notice, to the relative safety [real or imagined] of the countryside -or- to a “free state” (e.g. from California to Texas, or simply AWAY from whatever disaster or attack might have occurred). This is a real demographic and growing – as “normal” people see empty grocery shelves, strange weather, extended power outages, uncontrolled fires, inflation, frozen bank accounts, unprosecuted smash-and-grabbers (and rioters, before), out of control violent crime, seriously dangerous criminals being released from prison, and other unthinkables becoming the norm. 4: People who’ve given up on ever owning a home, or who just refuse to be mortgage slaves, and have gone the [very!] tiny house route, or the living-in-a-van route, both of which are whole sub-cultures (and which are glorified and promoted on zillions of youtube channels). It amounts to: BROKE population, can’t afford adequate housing -AND- Prepper/Survivalist/conservative population – being vilified as domestic terrorists, etc. – understandably on edge. Just my thoughts.

Should have read more comments before writing my long post, lol. Everyone else has already covered these points.

Cheers!

The local Porsche dealership west of town has a very nice selection of newer 911s. Two 2018 GT3 models are among the stock for those who can drop two hundred in order to drive a rocketship.

I would think that the stock market correction would pull the strings back on demand for the kinds of toys I like. And, nope, I will not be taking a road trip this spring to Chicago to look at a McLaren GT.

From Dana Carvey channeling in George H W Bush, “Wouldn’t be prudent.”

Aren’t these like ‘I have small penis’ type of cars?

andy,

Since I was an athlete wearing lycra cycling shorts for seven years, my “size” was pretty easy to see. Not worried about any opinions others may have of my endowment when I’m behind the wheel.

On that note, I got a nice 20 km in on the OTSO gravel bike yesterday, but when it’s February in the Twin Cities, I wear more than just riding shorts — nothing to see here, move along folks.

Seriously, my car takes a whole 13 seconds to go from zero to 200 kph. My motorbike does it in 8 seconds. A 911 GT3 takes less than 11 seconds. Plus, the GT3 will out-brake just about anything.

But to make the jump, it would take $150,000. So, it “Wouldn’t be prudent.”

I suggest we start an office pool over when the ultimate result of the vehicle prices.

My bet goes squarely on a sudden major collapse in the used car market, and I’ll place my chips on 3 to 6 months from today, when the weather starts getting really nice in the Northeast, the biggest population Sprawl.

Why do I say that? The weather will have people wanting to buy other things (ATVs, surfboards, wetsuits, new pets, net pet accessories….) and additional cars will cease to have such a mesmerizing hold on their thinking.

My crossover SUV is fifteen years old and nearing 144,000 miles. It still passes the “ten foot rule” with flying colors (does it look nice from ten feet away?), and I truly enjoy driving it. I did not buy it new (had 18,000 miles and was one year old). I have never bought a new car and would be happy to continue buying certified pre-owned but my frugality will bar me from shopping in that market right now, because the prices are simply unbelievable. My current car may have to be my last one (and I’m Gen X).

I do not like this everything bubble. The only “everything” I like comes in the form of a bagel.

Got a great deal on ‘73 Robin 10 years ago. Had some scratches on the sides but only 17k miles! I’m going to drive it until one of the wheels falls off!

Well the Robin Reliant was always known as a car that was happy to rock and roll….

There are a few schemes around to skim card information. Those you two you mention may get most publicity but are not the only ones. Actually those “seedy websites” are no worse than others, they make their money the legal way.

To get card information skimmers at shops have been used, compromising online retailer databases to get the information is done.

“Wiretapping” the communication to cordless card readers at shops have been done, wiretapping the line from shop to card processor have been done and the information have been retrieved from the card operator database.

The last ones do not get that much publicity. Some years back I and some hundred thousand others got our card information stolen from a database processing payments. There was only a small notice about that one in the newspaper…

The thing with vehicles is that they are always aging and gaining miles. The US fleet is already at a, likely historic, age of 12 years. So we can hold out for a while, but eventually nearly every vehicle must be replaced. Missing is a year’s worth of production of vehicles that would have been produced over the past year would later feed into the used market. Someone has to buy new to fed the used market. So maybe we’ll have a shortage of vehicles for a while??? We’ll see how this shakes out.

Just because the average vehicle age is increasing doesn’t mean future buyers will be able to afford to replace their car. It’s only “affordable” at these WTF prices now because of basement level credit standards and artificially cheap money.

Expect the average age to increase noticeably over time.

Free money running out ,no more child tax credit or bonus unemployment, but if democrats give me 2,000 I’ll vote for them as saying goes when in Rome hahaha

“…but if democrats give me 2,000 I’ll vote for them as saying goes when in Rome hahaha…”

You do realize you would be voting for and hoping for inflation, right? Why would you do that?

Both sides are corrupt ,

I’m talking specifically about inflation. Why would you voluntarily want to destroy your financial life? Do you like the inflation we’re having? Cars alone just increased in price by 4x the “stimmy” check I got. When you factor in the increases across the board, I am paying dearly for all this money printing already, and will be for the foreseeable future. Why do people like you want this?

because some people just want to see the world burn.

Bingo. Here’s your free lunch. Enjoy it. It’s your last lunch.

Calm down. Nobody’s vote counts. The voting booth serves the same function as the steering wheel on a child’s car seat.

Great post Roddy!

Voting is a purchase with a long payment plan and no chance of a refund.

You live in China, so of course.

Right so Trump & Republicans get a pass for the bailouts, stimulus, low interest rates… and somehow it’s the Democrats’ fault. Boring.

Phil, you are a clown. Keep drinking the Kool-Aid.

I raise you to $5000. It’s all free, just takes the POOSH of a button. UBI now!

1) China PBOC don’t have zero rates, The Wimmer inflation didn’t lift the

Shanghai stock exchange to a new all time high. Their RE market is collapsing.

2) Manheim in a bubble. Maheim belong to media.

3) SSEC retraced less than 50% after 7 years.

4) A recession might send SSEC to a higher low , or worse in 2024, before moving up, to test the 2015 bubble peak, years from now.

5) The cars & automobiles media might follow Meta and the rest of the media.

6) Wolf, tell your friends to sell Manheim at peak.

You can’t sell Manheim, but you can sell at Manheim :-]

1. Births per couple has been below replacement rate for some time.

2. Worker shortage, increased job pay. 70% of US companies plan to increased automation, especially in low wage jobs?

3. Decreased immigration due to lower birth rates around the world.

4. Long term, maybe very long term:

Will all these shortages be a thing of the past, or will the up and coming developing countries take up the slack?

Will oil reach and stay at a $100+ a barrel because of reduced investment in oil infrastructure because of climate change, while renewables do not take up the slack?

Noriel Robin has a list of nine things that include what is on your list of why he thinks inflation is here to stay.

Reminds me of my youth where government was burning money in Vietnam without consequences until there was about 10 years later

My brother was in the high school class of 1970. Every boy got his number in the mail from 1 – 365. If you drew a low number and were middle class or lower your rear was drafted. A lot of kids got killed for nada.

I have been a government sceptic since.

The primary shortages in the future will be due to the inability of Americans to afford (anywhere close to) an equivalent living standard versus today.

The majority of Americans are destined to become poorer or a lot poorer.

Geez, I’m so happy to have just read this. It really reassures me when some billionaire pigman says inflation is not a problem:

“Billionaire and private equity legend David Rubenstein says don’t worry about inflation, the economy’s just fine”

Why do these jackoffs always like to broadcast how out of touch they are with the working class?

1. Hype images of fame/notoriety/money for “media” work.

2. Swamp the midway with sweet-talking salespeople, the deluded, and con artists aka “reporters.”

3. Add games that lure in everyone from beaten-down to inflated egos aka “contestants.”

4. Install lovely plug-ins for fingers/eyeballs aka “dollars.”

5. Greed in, garbage out.

What absolutely slays me is the WEEPING NPR article distressed at the South Carolina woman who couldn’t get the late model electric Audi she wanted for less than $68K. Media is just total garbage at this point. No perspective at all. Why am I sorry for her? Total insanity, so many entitled clowns in this country now.

Been watching YouTube star Itchy Boots ride through rural South America. You realize a lot of the world can’t afford a car and get around on cheap scooters and small motorcycles many Chinese made now.

You always see the Toyota small pickup as utility vehicle many of them very old and best up, but still ticking.

Didn’t Cathy Wood just said there is no inflation?

Do the opposite of what Cathie Woodshed says and you should do really well.

Ha!

If she did, that tells you how out of touch she is with reality.

It’s interesting to read Warren Buffett ‘s money management style where the number one criteria is safety of principal vs. modern day money management gunslingers. Not sure how these people sleep at night.

Too many people, too many cars, too much money, gas reserves spilling on too much expensive property, plastic everywhere, too many empty commercial spots, not enough covid. Extinguish the common man.

One problem is population increases are concentrated in a relatively small number of cities. My family moved back to the US in 1975. Estimated population then = 216MM versus 332MM now. In the ATL area where I live again, about 1.5MM then versus close to 6MM now. 35 cities with population above 2MM.

It would also help if the government would control the borders, something which can be done but virtually no one with influence wants to do. It’s another indication of long term extensive social decay.

10 Year Treasury came within 3bp of 2% today.

If CPI is hotter than expected on Thurs, it will likely leap over this symbolic level.

According to Bankrate:

“On Tuesday, February 08, 2022, the national average 30-year fixed mortgage APR is 3.960%”

So that symbolic level may be breached Thursday too – who would’ve thunk 4% mortgage rates in Feb?

Yea and some “experts” thought mortgage rates wouldn’t hit 3.6% till the end of ’22. Umm…. I take it the demand for mortgages is still running pretty hot. FOMO

Never listen to a expert = idiots

4% still 3% below reported inflation.

Still out of whack historically and with reality.

Hi Wolf, long time reader. Was wondering if you could cover the topic of the gas prices? I am seeing we may hit $100 a barrel soon. Does Russia conflict have anything to do with it? Or something else? Very interested to hear your thoughts. Thanks!

Oil is still cheap. It was $150 in 2008. For several years through mid-2014, it was around $100. Just about everything else has gone up in price over those years except oil. And US natural gas is cheaper too than it was 15 years ago.

I wouldn’t call it cheap at $90 though, Wolf. It was in a bubble in 2008. It’s probably fairly valued right about here IMO.

So much for getting more than $2600 for my old f350

Zillow: Our 2022 housing forecast is way off—home prices now set to spike 16%. If true this means inflation is higher then being reported.

They’re talking their book, trying to cover their losses.

It just gets worse and worse:

“Toyota cuts output target by half a million more vehicles amid chip crunch”

The global supply chains and the “just in time” inventory model has proven to be fragile, and an epic failure – corporate greed run amok.

It was a failure by the political class in responding to the Pandemic. They really didn’t know what they were doing shutting down a complicated global supply chain and then flooding the world with money. We are going to pay for a long time.

When China’s got you by the balls because you outsourced all of your manufacturing to enrich the elites for one generation, there’s not much you can do. Print and pray the rabble don’t come for you with the apple baskets

They knew exactly what they were doing.

Wow, what a website. Wolfs continuous stream of reality, and the commentators thoughtful, and sometimes fearful expressions of experiences and assumptions. Inspiration from all walks of life, evoking visions of incredibility, vulnerability, and plausibility. A taste of reality, insight from lessons learned, a drink from the fountain of life.

I am equally astonished. It is like discovering a stairway to the moon.

This is Wolf Richter’s amazing accomplishment as a media mogul; a site dedicated to truth, tolerant of dissent and intolerant of misinformation. Please do not delay getting onto the waiting list for a “Nothing Goes to Heck in a Straight Line” beer mug. Wolf deserves our respect, appreciation and support.

1) There is Manheim bubble, RE bubble , SPX bubble and a debt bubble that support all bubbles.

2) We need a stopping actions from the gov, by the Fed and in the stock markets.

3) We need to decay those multi bubbles.

4) The trend is up, the trend is strong. We need a stopping action to slow it down and avoid Anti.

5) SPX weekly : there is a line coming from Apr 2010 high going all the way up to Jan 2022. // parallels from 2010 low and from Oct 2011 harmony.

6) The stopping action have just started. Once it end it will support

the decay, whenever they come, like a backbone.

7) There will be no bond market bust. The Fed will keep the low interest to support the gov.

8) There will be no RE collapse. The accumulated inflation and the taxes will take care of it..

9) The decay will be long and ugly. We don’t have to reach zero debt. All we need is stabilization.

The good thing about relatively free markets is they can heal themselves pretty quickly as people make the adjustments necessary to improve their situation.

The danger is government will not let that happen, but will do even more destructive policies like price controls and by bailing out the irresponsible.

The big question is whether the Fed loses control of long term interest rates. Is there enough demand from investors to fund the 250 billion a month of Treasury auctions that are needed to fund government expenditures? My guess is the answer is no and much higher interest rates are inevitable, which means that bankers will win again as their profits explode higher.

Higher interest rates will reveal the very dangerous precipice that our government finances sit on.

If there is less demand for treasury at a given rate then either FED would start buying treasury again or let the rates go higher.

FED has been buying treasures for a decade plus or so, so they can keep buying, of course at the expense of middle and poor class but this is already happening for last few decades so no big deal.