The Fed shed 33% of the Treasury securities it had added during pandemic QE and 24% of the MBS.

By Wolf Richter for WOLF STREET.

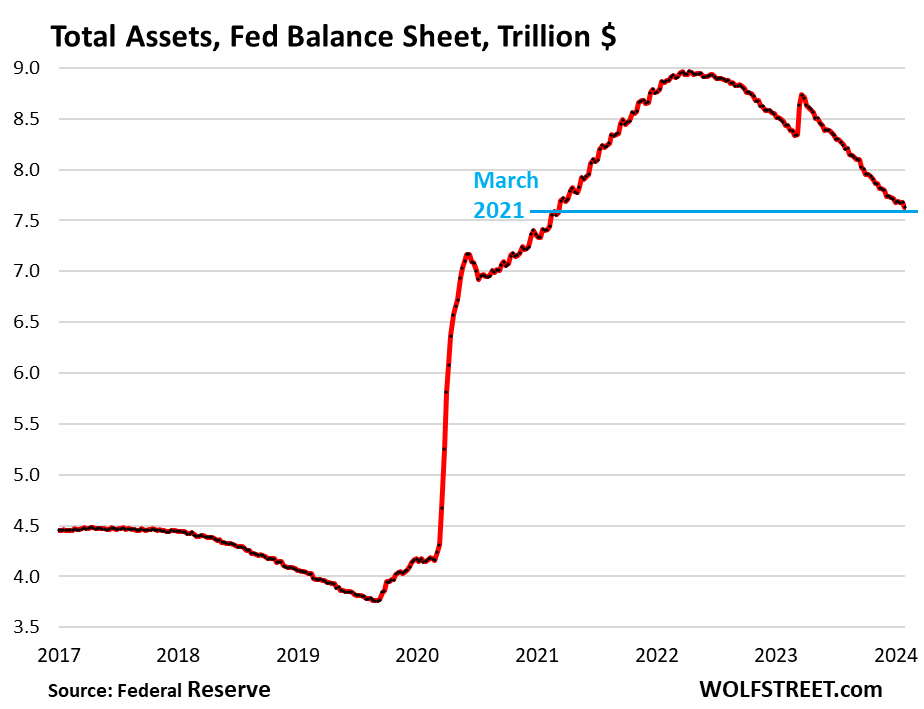

The Fed’s Quantitative Tightening continued on track in January. Total assets on the Fed’s balance sheet dropped by $51 billion in December, to $7.63 trillion, the lowest since March 2021, according to the Fed’s weekly balance sheet today. Since the end of QE in April 2022, the Fed has shed $1.34 trillion. The Fed re-affirmed QT explicitly in yesterday’s FOMC statement and in Powell’s press conference.

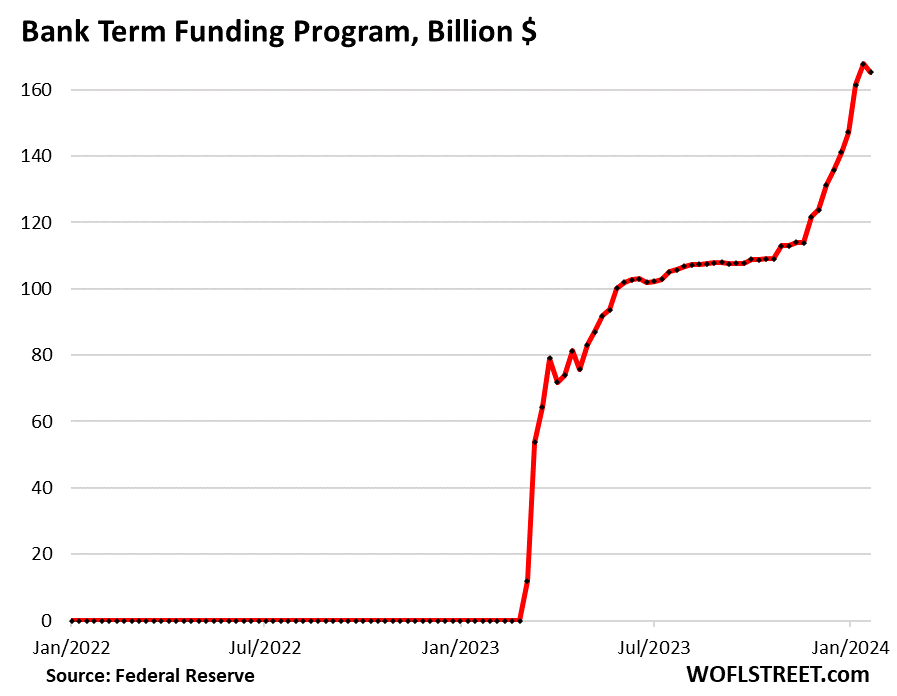

And the Fed finally shut down the arbitrage opportunity at the bank-bailout facility, the BTFP, that had opened up in early November when longer-term yields plunged. We’ll get to this mess in a moment. But in the first three weeks of January before the loophole was closed, banks ran up $27 billion in BTFP loans, which is why total assets dropped by only $50 billion in January, and not by close to $90 billion.

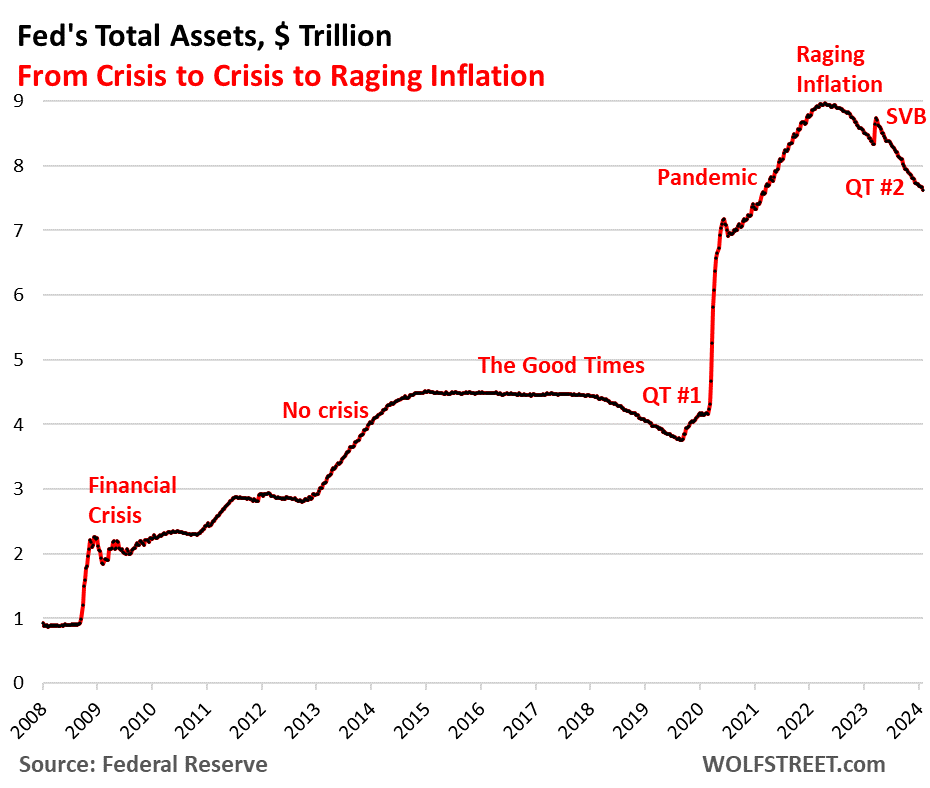

During QT #1 between November 2017 and August 2019, the Fed’s total assets dropped by $688 billion, while inflation was below or at the Fed’s target (1.8% core PCE in August 2019), and the Fed was just trying to “normalize” its balance sheet.

Now inflation has come down a lot, driven by price drops in durable goods, and a plunge in energy prices, but it’s still rocking and rolling in services, with “core services” CPI at an annualized rate of over 5%.

QT on autopilot.

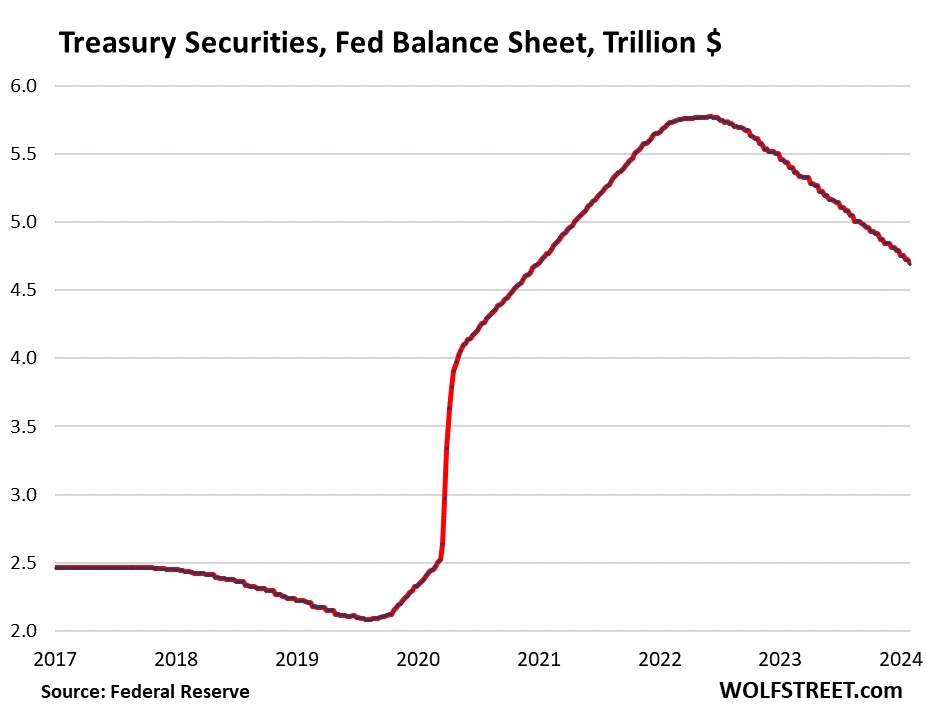

Treasury securities: -$61 billion in January, -$1.08 trillion from peak in June 2022, to $4.69 trillion, the lowest since December 2020.

The Fed has now shed 33% of the $3.27 trillion in Treasury securities that it had added during its pandemic QE.

Treasury notes (2- to 10-year securities) and Treasury bonds (20- & 30-year securities) “roll off” the balance sheet mid-month and at the end of the month when they mature and the Fed gets paid face value. The roll-off is capped at $60 billion per month, and about that much has been rolling off, minus the inflation protection the Fed earns on Treasury Inflation Protected Securities (TIPS) which is added to the principal of the TIPS.

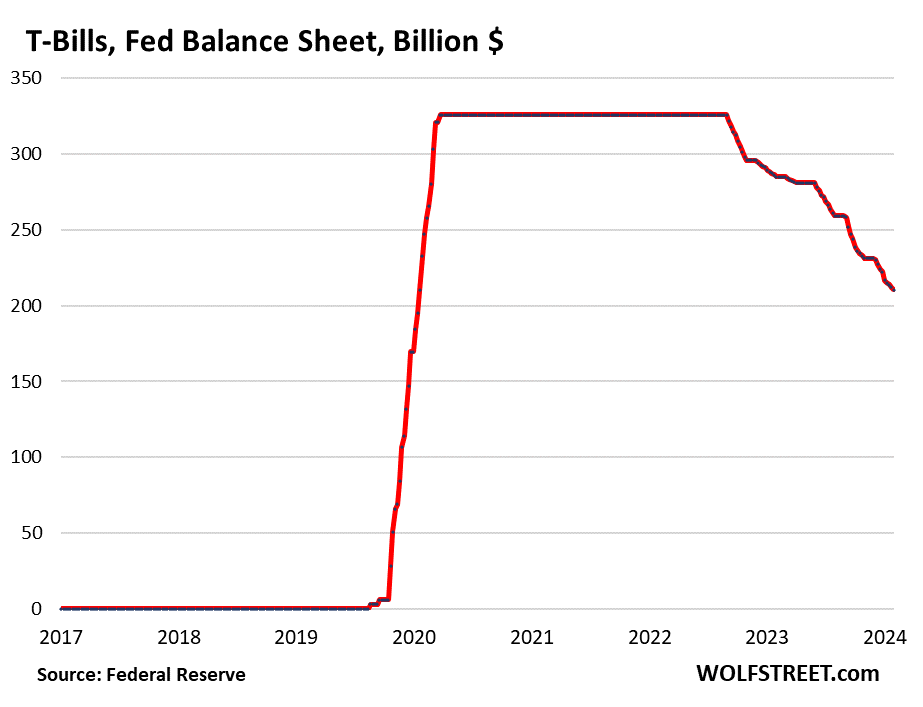

The function of Treasury bills to steady the pace of QT. These short-term securities (1 month to 1 year) are included in the $4.69 trillion of Treasury securities on the Fed’s balance sheet.

The Fed lets them roll off (doesn’t replace them when they mature) if not enough longer-term Treasury securities mature and roll off to get to the $60-billion monthly cap. As long as the Fed has T-bills, the roll-off of Treasury securities can reach the cap of $60 billion every month.

When the Fed runs out of T-bills to fill in the gaps, the Treasury roll-off will start to fall below the $60 billion cap.

From March 2020 through the ramp-up of QT, the Fed held $326 billion in T-bills that it constantly replaced as they matured (flat line in the chart). In September 2022, T-bills first started rolling off to fill in the gap to get the Treasury roll offs to $60 billion a month.

In December, $6 billion in T-bills rolled off, reducing them to $210 billion.

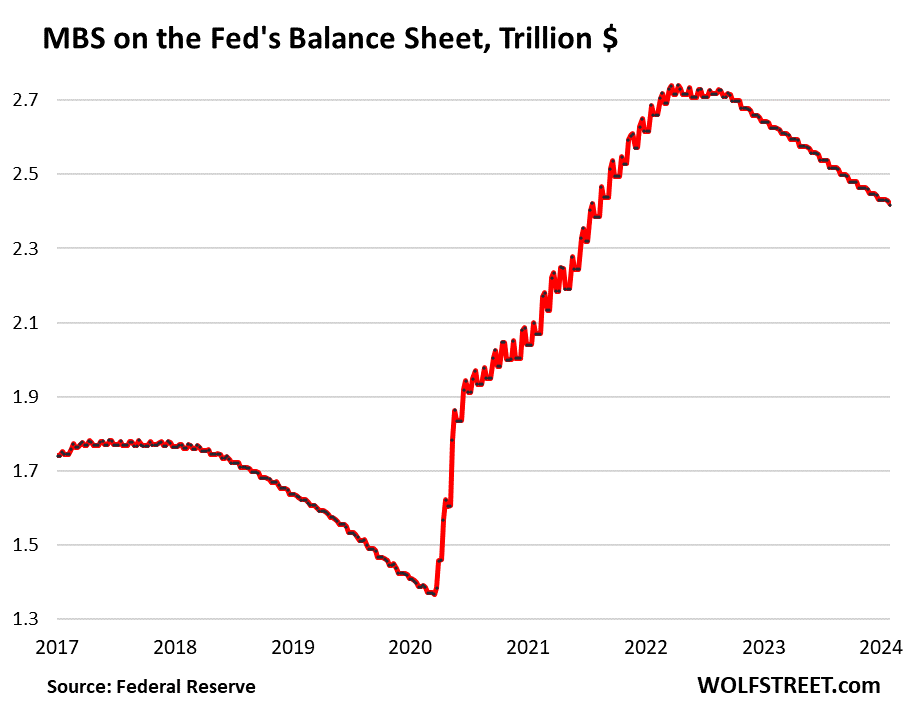

Mortgage-Backed Securities (MBS): -$15 billion in January, -$323 billion from the peak, to $2.42 trillion, the lowest since August 2021. The Fed has now shed 24% of the MBS it had added during pandemic QE.

The Fed only holds government-backed MBS, and taxpayers carry the credit risk. MBS come off the balance sheet primarily via pass-through principal payments that holders receive when mortgages are paid off (mortgaged homes are sold, mortgages are refinanced) and when mortgage payments are made.

Amid the higher mortgage rates, sales of existing homes have plunged 33% in 2023, so fewer mortgages were paid off, and mortgage refinancings have collapsed, which dramatically slowed the mortgage payoffs. As result, the pass-through principal payments to MBS holders have also collapsed, and those MBS are not coming off the balance sheet very quickly, with the MBS run-off between $15 billion and $21 billion a month, well below the $35-billion cap.

Bank liquidity facilities.

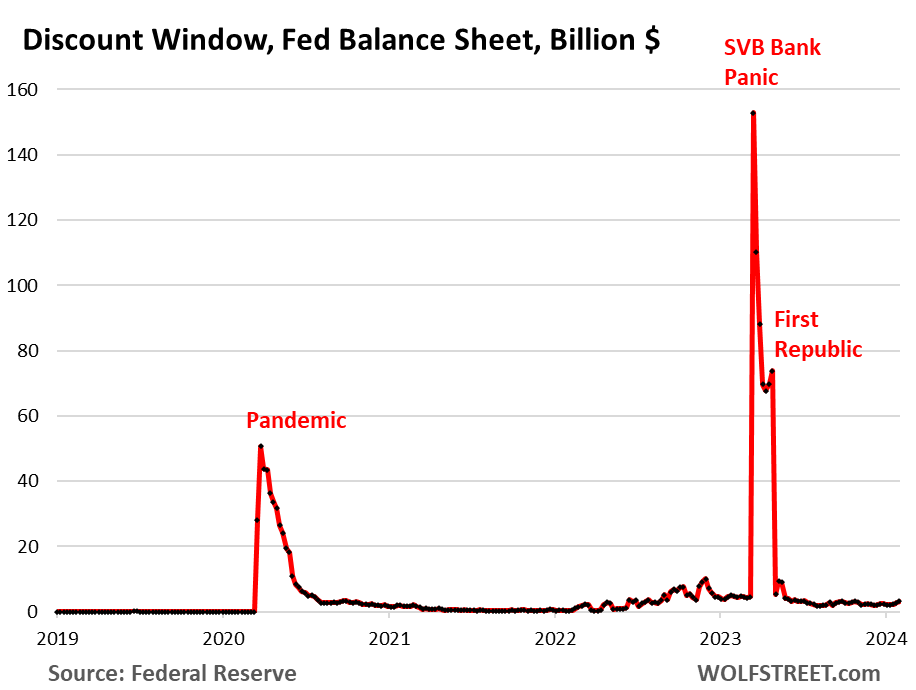

Discount Window: $3.2 billion. Roughly in this range for months, and down from $153 billion in bank-panic March. The Discount Window is the Fed’s traditional liquidity supply to banks. The Fed currently charges banks 5.5%, and demands collateral at market value, and that’s expensive money for banks, unless they need to pile up some liquidity.

Bank Term Funding Program (BTFP): The BTFP was cobbled together in all haste over the bank-panic weekend in March 2023 after SVB had failed. To borrow at the BTFP, banks had to pay the Fed a rate equal to the one-year overnight index swap rate plus 10 basis points, fixed for the term of the loan of up to one year. That rate worked out to be a little lower than the rate at the Discount Window, and collateral requirements were looser. So banks used it.

But starting in November, Treasury yields and related yields began to drop amid general rate-cut mania. The 1-year Treasury yield dropped from 5.4% at the end of October to 4.7% by the end of December.

The one-year overnight index swap rate runs a little lower. By the end of December, banks could borrow below 4.7% at the BTFP, and then keep that cash in their reserve account at the Fed and collect 5.4% interest from the Fed, earning risk-free income off the difference. As rates dropped, they could refinance the loans they had taken out with lower-rate loans.

The BTFP balance had been steady for months at about $108 billion. But in early November, with rates dropping, it exploded with this arbitrage. Wednesday last week it reached $168 billion. The cash stays at the Fed and doesn’t go anywhere, it just makes the banks some risk-free moolah.

We’ve been discussing this BTFP arbitrage for a while. It made everyone angry, including the Fed, apparently.

On Wednesday last week, the Fed shut down the BTFP arbitrage opportunity by changing the term sheet for new loans, to where the interest rate banks have to pay on new loans from the BTFP cannot be lower than the interest rate they earn on their reserve balances. And that stopped it.

The BTFP will expire in March, and no new loans can then be taken out, but existing loans can be maintained until their term ends, which is one year after it was issued.

In the current week, the BTFP balance dropped by $3 billion, after having surged by $27 billion in the prior three weeks.

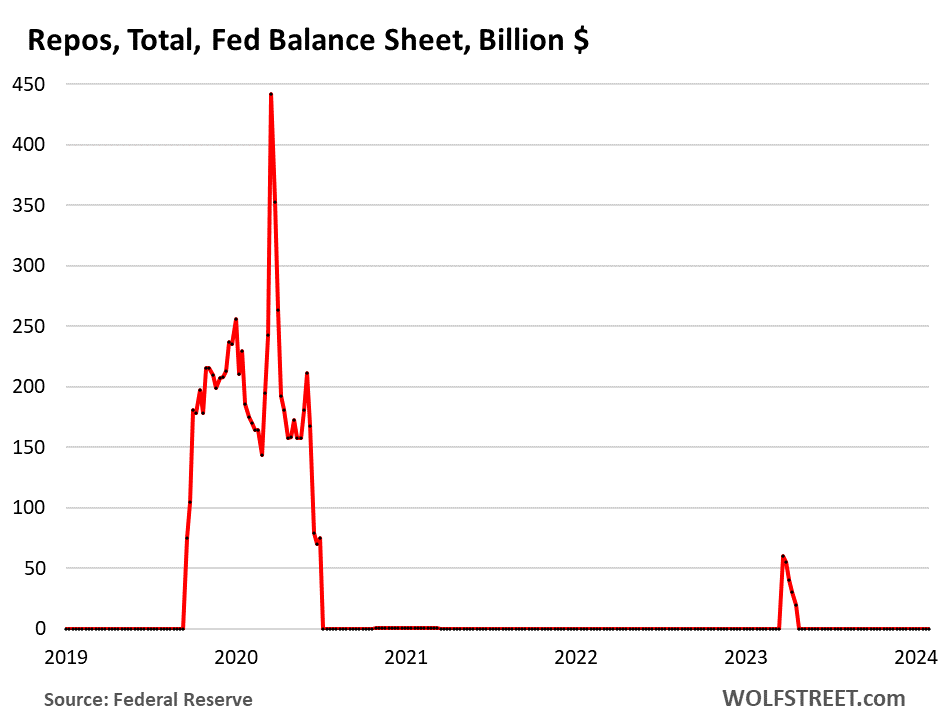

Repos: $0. The Fed’s repos come in two flavors: Repos with “foreign official” counterparties were paid off in April 2023. The repos with US counterparties faded out in July 2020 and have remained at around zero. The Fed currently charges counterparties 5.5% on repos, as part of its five policy rates.

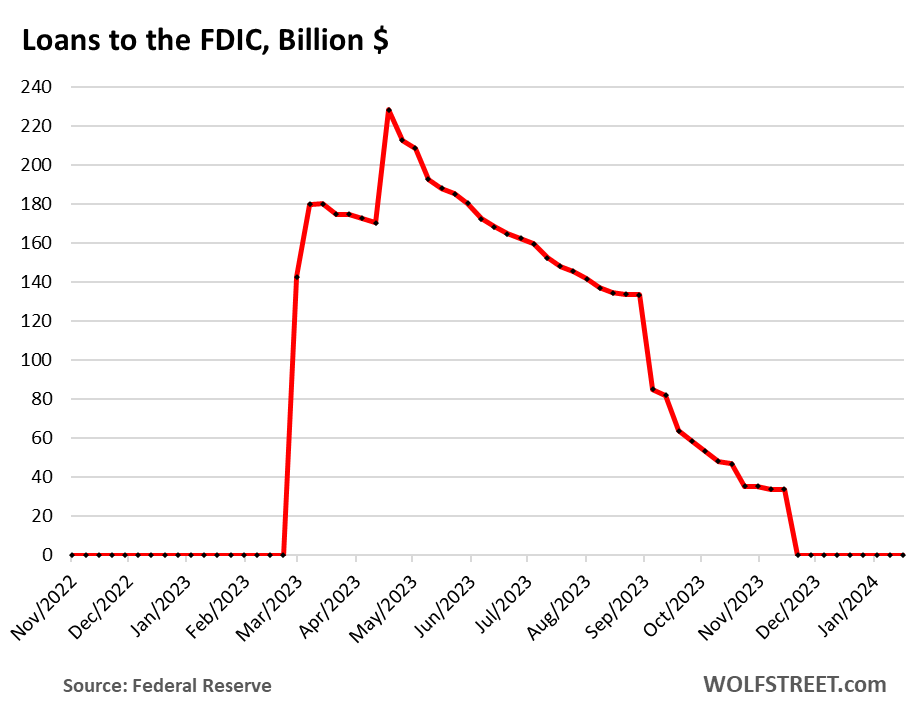

Loans to FDIC: $0. This facility was also cobbled together over the bank-panic weekend in March. The funding allowed the FDIC to quickly make whole all depositors –not just the insured depositors – of the failed banks, before it could sell the failed banks’ assets. The FDIC paid off the remainder in November.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Between March and June the Fed is going to sell $180B in bonds through QT AND force banks to buy back their old, low quality bonds for about $110B plus whatever MBS happens to mature. If I understand correctly, those dollars just disappear once they go back to the Fed. That’s a lot of liquidity gone all at once. Is it going to cause problems?

No, it’s not going to cause any problems. The Fed has been doing that for over a year. There is way too much liquidity still out there. There is still a long way to go.

Wolf,

—–

Between March and June the Fed is going to sell $180B in bonds through QT AND force banks to buy back their old, low quality bonds for about $110B plus whatever MBS happens to mature.

—–

What Matt is referring to? Is it correct/true? Can you share more details if correct news.

Will FED sell at loss (180-110 Billions)? Or those securities will just rollover as part of QT. If Rollover then no loss.

No, Matt is not using the correct language, but I understood what he was referring to, and that’s good enough for me. The Fed doesn’t sell bonds, it lets them mature…

I think that summarizes it.

B

What is the reason for it taking 3 times as long to lower the balance sheet as it did to grow it?

Would a higher QT rate crash the economy? It would push market interest rates higher but that seems to be exactly what the economy needs to slow it down.

Liquidity flows are a funny thing. And they’re unpredictable. The Fed can inject or extract liquidity only in a couple of places, but liquidity is everywhere, and it’s constantly shifting and moving. So if the Fed extracts liquidity too fast through its two pipelines, then the liquidity that is elsewhere might not be able to move to the pipeline intakes quickly enough, and the area around the intakes runs dry, and then things begin to collapse in that area, while other areas still have lots of liquidity, By limiting the pace of the liquidity outflow through those two intakes, liquidity in other areas has a chance to make its way toward the intakes (this was probably the worst analogy ever?)

Liquidity moves via yields… that’s what yields are for, but it takes time, or else you get panics, runs, and collapses.

Is it the shift over the last 20 years from a “scarce reserves” regime to an “ample reserves” regime that necessitates a balance sheet that is over 6 times larger than it was in 2003, which balance sheet we only expect can be trimmed to $5 trillion and change?

I can’t help but feel like we’re living through a global, slow motion, grand experiment, orchestrated by Washington technocrats and Wall Street bankers.

I suspect that the shift to ample reserves policy will be be critiqued with incredulity by our grandchildrens’ generation, echoing the early Fed’s post World War I policy actions that lead to the turmoil of the 1930’s.

Guess I’m feeling a bit “Debbie Downer”-ish (as aptly stated by a recent commenter).

Not quite. The $180 billion in bonds will roll over through normal QT. The low quality bonds that secure loans made under BTFP must removed from the facility within 1 year of that loan being originated. So while after the program ends, there will be no new loans, the existing ones don’t all disappear at once.

At least that’s my understanding.

The BTFP is made of loans to banks, not bonds. The bonds are posted as collateral, in case the bank defaults on the loans. Like when you get a mortgage from the bank, the bank doesn’t hold your house, it holds the loan to you (but it may come get the house if you default on the loan).

Right. I just was trying to disabuse people of the idea that when this program ends, all loans are immediately coming due.

For me it’s obvious to attack the top one or two items which are top contributors to the “problem”. Treasury Securities $4.7T and MBS $2.4T are both making good progress in reduction. While I would personally prefer a more aggressive pace, I understand the risks (considering first QT as a learning point). It is tedious to pull all this information, and I really appreciate what Wolf does to educate everyone on the FACTS and DATA about this versus fake opinion pieces in the disinformation media. THANKS for what you do for us.

And who audits this balance sh!t ?

The balance sheet is weekly. Weekly balance sheets are never audited. Not even Apples QUARTERLY financial are audited. It takes months to audit financial statements. Only annual financials are audited, including the Fed’s. The auditing firm that audits the Fed’s annual report also audits Halliburton, GE, PepsiCo, Rolls Royce, Pfizer….

“Only annual financials are audited, including the Fed’s.”

This is plain wrong. The Fed has never been audited. You should correct this if you care about your credibility.

You’re abusing my website to spread ignorant BS.

Here’s the Fed’s latest annual report (for the year 2022). Search for KPMG and you’ll see who audits them:

https://www.federalreserve.gov/publications/files/2022-annual-report.pdf

KPMG audits every annual report by the Fed. You can check every one of them here:

https://www.federalreserve.gov/publications/annual-report.htm

It’s always been audited. I’m sure you’ll just say KPMG is in on it.

That’s why it’s impossible to argue against a conspiracy theory.

Any evidence that goes against the theory is dismissed as part of the coverup.

An “audit” can be many things. There are financial statements audits, internal control audits, operational audits, compliance audits, effectiveness audits, and lots more.

The Fed sure could benefit from an external review of its QE program and all the negative impacts of that “experiment”. Also, there obviously is something wrong with Fed models that cause it to buy MBS when housing inflation is in the middle of huge rise. WTF were they looking at? Also, what made them think inflation was transitory?

Those questions are deserving of a review, whether we call it an audit or something else.

In general, I think the Fed needs to be more transparent and accountable. Powell can speak all day, every day, but if he never analyzes and communicates what went wrong with his policy decisions, he’s a liability. Absent explanation, people start to wonder if the Fed wanted excess inflation.

Bobber,

“I think the Fed needs to be more transparent and accountable”

1. The Fed is fairly transparent. Just about everything it does is posted online now, including its daily operations, its holdings, etc. It didn’t used to do that. Back in the 1980s, there was not even a weekly balance sheet, and no one really knew what the Fed was doing.

2. The Fed is accountable to Congress. But Congress wanted QE, and Congress wanted the Fed to buy MBS, and get into the SPVs, etc. This was all approved by Congress. The SPVs were partially funded by the Treasury Dept, as per Congress. You need to complain to Congress about it. Congress LOVES free money, and that’s why Warren hates Powell, and she wants that free money back.

Wolf,

Thank you for the detailed analysis. Appreciate it.

How about ON RRP? Coming soon?

I did the last one a couple of weeks ago:

https://wolfstreet.com/2024/01/19/feds-balance-sheet-qt-liabilities-rrps-1-78-trillion-from-peak-to-590-billion-but-reserves-rise-to-3-6-trillion-as-liquidity-drains-and-shifts/

I won’t do another one for at least two more weeks.

ON RRPs are a liability for the Fed (money the Fed owes), not an asset, so they go with the liability side of the balance sheet (reserves, ON RRPs, currency in circulation, and TGA).

You do Yeoman’s work here Wolf. My hat is off to you. Thank you for calling out the nonsense perpetrated by the smarmy senator from Kentucky who calls for the auditing of the Fed when anyone with an ounce of interest would already know the Fed does get audited. Thank god for the Fed. Since 1913, they have navigated the most difficult of journeys and are once again navigating such masterfully, I might add.

LOL!!!!

Yeah, great depression and two world wars enabled by The Fed, not mention the largest increase in wealth inequity in human history (this is well documented).

In addition, handing our free money for NO reason that benefited the 1% at everyone else’s expense (See Russell’s comment below and Wolf’s response). At best the Fed is irresponsible and corrupt and have most definitely violated their charter.

Simple put, and setting aside all the evidence of the Fed’s enabling of bad behavior, their number one responsibility is STABLE PRICES.

Bernanke’s actions destroyed price discovery in the most important market of all, the capital/bond markets.

It’s time to end the Fed and prosecute some perps on wall street, K-street, and in DC.

They’re navigating it badly, after having navigated it dreadfully (and in a manner causing incalculable harm to the prudent) for the last twenty years or so.

But that doesn’t change the fact that they do get audited, regularly, and people who claim otherwise are either clueless or lying.

Ha ha ha ha! Ever heard of the Great Depression? The Fed made it much worse with extremely tight monetary policy. We would all be better off without the Fed purposely eroding the value of our currency.

So in March this year when BTFP loans taken a year ago matures, what will happen? Balance sheet jumped ~$400 billion March 2023. Can we expect the same decline in March 2024?

BTFP loans taken in March 2023 were not $400 billion, so I suppose there were other facilities in play?

Thank you for writing about all this. It is very educational and entertaining.

We don’t know because those loans can be refinanced at any time before March 11. So it’s possible — but not likely — that these banks that have loans at the BTFP will all refinance them on March 10, and then they’re good for another year, and then they’d all come off on March 9 2025, and the balance will go to zero on that day. One way or the other, the balance will go to zero on March 11, 2025.

I love these breakdowns of the Fed Balance Sheet and QT progress!! thanks

I have said it before, and I will say it again. The Fed will not be able to get their balance sheet below 7 trillion. Time to end and audit, this corrupt enabling criminal organization.

Why is 7 trillion the limit? Wolf laid out a pretty good case for his much lower number, why do you disagree?

The other sources of liquidity (which Wolf has also covered) will be drained long before we get to Wolf’s estimated limit. Moreover, CONgress will make everything worse through an “unexpected” increase in deficit spending…

Bernanke NEVER should have monetized the debt by getting into the long bond market and manipulating interest rates on the long end of the curve, period, let alone do this for damn near 15 years. He was buying time and knew that the would blow up balance sheets when rates “normalized”. His also knew that this would increase the wealth of those at the top and closest to the cheap money. If CONgress had actually followed the rule of law and allowed more REAL bankruptcies (i.e. the corporate owners must sell ALL their assets to pay off creditors and management goes to PRISON for violating contract law, which is what MBS did) and prosecuted fraud at the top (MBS were FRAUD plain and simple, fraud that was then leveraged/gambled upon). If CONgress had actually BALANCED the f&%$ing budget, we might be in a different place.

Instead, we got the Cantillion effect, a return to feudalism, and destruction of our official currency (The Federal Reserve Note). The numbers are mind-bogglingly huge, and the moral hazard that is being unleashed will be unlike anything humanity has ever experienced. The MATH is what it is…

Just my two cents.

I agree with you 100% on the deficit spending and a need for a balanced budget. That would improve our situation immensely.

It is still a bit early to assume inflation is going to ramp up and get out of control. It may, but the FED has been a lot more effective in the inflation fight than I would have thought. I am beginning to think it is possible there will be a new FED paradigm when the dust settles. They may choose a bout of manageable inflation (violate stable prices mandate) via future QE to prevent, or reduce, recessions (maintain low unemployment). It’s going to be hard for the FED to see it differently if the “soft landing” thing is achieved while also achieving sub 3% inflation and QT.

That of course doesn’t speak to whether it is moral or causes a ripple effect of other problems in the economy, but I doubt the people at the FED care much about that.

I also think the issue of wealth disparity is overstated. While we have experienced unprecedented disparity, at the same time the world has experienced the lowest level of actual poverty. Also, the US has perhaps the most pronounced wealth disparity, but also the richest population. Not saying things can’t, or shouldn’t, be improved, just that we shouldn’t be distracted by quixotic goals.

You are going to be a very surprised duck at the end of this year then. With just QT alone the Fed will have its balance sheet under $7 trillion in about eight more months. Add in how much gets pulled by banks when the BTFP gets cancelled next month and reaching the $7 trillion goal by the end of summer is pretty much a layup.

So the results from Amazon and Facebook make me realize we have a very weird economy.

Basically, the stock market (which is incorrectly used as a barometer for the overall health of the economy) is held up by a handful of trillion+ tech companies. Analysts talk all over about their “moats” and “ecosystems,” but obviously, they can’t make tens of billions in profits selling goods and services to each other.

It’s now becoming clear to me what’s happening. Massive debt, both private and public (and in the case of public, enormous federal deficit spending) is propping up the economy as a whole. That debt, whether in the hands of businesses or individuals, is partially used to buy advertising on Facebook and Google, and to buy web hosting from Microsoft and Amazon.

The tech companies DO appear untouchable as long as the rest of the economy stays propped up. But if and when businesses start failing and consumers have to actually cut back, AND Congress decides not to replace that lost private spending with public spending, revenue and profits at the Mag7 will correspondingly tank.

This all aside, I still think the tech companies are grossly overvalued. I’m looking at my investment accounts, and my FB and MSFT are up absurdly over the past 2 years or so. The P/Es are still extremely rich, which makes sense if you forecast 35% growth every year. But the thing is, every time one of these companies has a “blowout quarter,” rather than analysts just saying that the companies were growing into their valuations, they bid the stocks up even higher, as though the forecast growth will continue forever.

Am I missing anything here?

I agree with you where do they go from here. Tech companies pretty much invariably rely imo on monopoly power. Imagine an aggregate feed for facebook, twitter, etc Imagine a messenger client that you could just say peterJm123@facebook, susan34@hotmail. I -have- to keep messenger on my phone, i have to keep line, i have to keep skype, gchat etc because there is no interoperability.

Its like old Verizon and AT&T blocking calls. Look at the EU telling Apple they have to allow private downloads for apps. Its one thing when US companies have a global monopoly, its another when the monopoly only exists in the US. Interoperability obligations are coming from outside the US, like battery replacement, and all these shares will take a tumble.

There will be a secondary market for European iphones in the US so how Apple get round that I don’t know. Facebook relies on extremely intrusive tracking, all can be gone at the stroke of an administrative pen.

Per CNBC, Meta is going to buyback $50 billion in stock at a current market cap of approximately $1.2 trillion lol. If you think they’re overvalued, why aren’t you selling?

I did sell about half of mine and put it into a 5.5% CD.

Congrats on the win.

Nice. Did the same, but did not buy a CD. Instead I have been cycling through short duration (4- and 8-week T-bills) just to stay nimble and the interest has been similar (5.0-5.5).

@Einhal: I generally agree with you, but wanted to add some additional perspective.

Though most of the hype has been on the Mag7 and some tech stocks, there are several hundred large cap and mid cap stocks that are sporting obscene PE ratios. All of them will have to come down to earth and it is likely they will as QE is drained from the economy.

Right now, there is still $3 trillion left over on the Fed balance sheet from the pandemic-era QE which is masking problems in CRE and the banking sector. This $3 trillion is what is still driving the economy to create 355k jobs in spite of the increase in rates since 2022.

At some point, this will break, then it will be watch out below.

The only alternative to breaking is for inflation to continue at 5% per year for the next 10 years until that extra $3 trillion becomes structural.

1972 wants their mantra back Einhal. That $3 trillion (and then some) will become structural. Higher for much, much longer. We have only gone over the first wave in the set of inflation…

Pardon the surfer analogy.

Einhal may be on to something. The FED never wants deflation.

They do not want to be too restrictive and 5% is not terribly restrictive in regards to historical rates. Just a tad. The timeframe from 2005 to 2020 when we were exporting a lot of inflation to China via manufacturing…etc is over. Maybe we can export some inflation to Mexico, Vietnam, India next?

Commodities have crashed. As long as oil stays in the 70s to 80s. Nat gas in the $2ish range. I think the economy could hum along even with 5% Fed Fund rates.

Yes. There is still Covid money being spent.

A 300 million college football stadium just broke ground and the state is using extra covid money to fund the project.

With the stock market hitting ATH. I wonder if housing is going to go up this spring with all this stock market paper money gains?

Sean – The Mag 7 may have just left everyone in the dust.

Think about it. They are global. Almost all advertising revenue in the world (except China and Russia) flows into Meta, Google, and Microsoft pockets. The profits are insane once you have the infrastructure.

Now they are buying up all the AI chips. Meta has stockpiled billions of dollars of NVDA top of the line AI chips. It keeps the competition from having any too. They also have the money and R&D from all that advertisement money to build their own AI chips.

It will be super difficult for Europe or other countries will be able to catch up in the short term because the above companies will own the AI infrastructure? If AI is where a lot of the next productivity gains come from, how can a company in Europe or Asia compete with the MAG 7 if they do not have the AI chips?

Just thinking out loud.

ru82, great points.

I think the main risk to them is regulatory. I can see the European Union and other government bodies saying “Hey, we’re not allowing a few companies to basically act as monopoly public utilities, and to extract tons of wealth from our own companies for the benefit of these huge monopolies” and regulating their rates.

Once that happens, the game is over. I just don’t see the rest of the world being willing, long term, to allow all global advertising revenue to flow into the coffers of 3 or 4 American companies.

Maybe I’m wrong.

My hypothesis is that the Treasury’s reluctance to issue more longer-duration paper is partly what’s propping up the bond market / keeping long rates lower.

Consider that tech stocks are a similar risk profile to long duration bonds. As long as issuance of these bonds remains lower, there’s more money to chase after these stocks. But if the Treasury starts to issue more coupon bonds, then money that would have chased tech stocks will get diverted to these bonds.

But as long as the Treasury leans towards bill issuance, these stocks will stay propped up. People aren’t buying bills with money they would have used for stocks – they’re using money that would have been in banks, CDs, MMFs etc since the risk(-free) profile of these investments is equivalent to bills.

By this logic, the Treasury has the power to affect the impact of QT.

I agree. However, the treasury has bills to pay, and it doesn’t have the revenues to cover those bills, so, eventually, it will have to start issuing more debt.

Where’s that a$$hole Bernanke now? Do debts and deficits matter now motherf%$#er?

Well they’ve been issuing plenty of bills to cover the debt. But bill issuance doesn’t have the same effect because they are essentially the same risk profile as cash (no interest rate or duration risk).

MM,

Well, I guess it depends on how much in T-bills you are holding. The current limit for an individual is ten million dollars worth per year, I believe. I for one have appreciated the 5.3-5.5% interest. Some may say it’s pennies in front of a steamroller but it is low risk.

Yes the yield on bills is very attractive right now.

That’s kind of my point – the demand for bills is essentially unlimited because they are the risk-free rate of return. Yellen can just keep issuing bills and the market will keep absorbing them.

Right now, money coming out of the RRP is just going into bills.

As long as Yellen keeps tilting new issuance towards bills, the effect of QT is being blunted to an extent. But if Yellen ‘pivots’ (man I hate that word) and increases coupon issuance, then these note & bonds will start to compete with risk assets.

Wolf can correct me, but I believe that their is close to 6 trillion in debt that is maturing this year. So ignoring all the stuff that needs to be funded, there is 6 trillion in debt that will need to be paid off, or refinanced in 2024. I agree with Wolf that there is still plenty of liquidity out there, and go one step further to propose that we have only come over the first wave of inflation, and another, much larger wave is on the horizon. At the same time, uncle Sam needs to refinance old debt AND issue new debt. Congratulations Bernanke, we will avoid a deflationary depression and experience an inflationary depression instead…

$6 trillion in debt is not even 20% of the Federal government’s $34 debt. It is certainly not all long bonds… one of the criticisms of the Biden and Trump administrations is that they didn’t convert enough of the short term debt to long-term debt when they had the chance.

Bottom Line: Rolling $6 trillion in debt over should be child’s play for the Treasury Department.

Yes, you are missing something.

You say that the economy is propped up by massive debt, but you don’t seem to realize that while a loan is a liability for one party, it is an income producing asset for another party.

So debt by itself does nothing for the economy as a whole. It can’t prop up the economy.

JimL-

“So debt by itself does nothing for the economy as a whole. It can’t prop up the economy.”

Doesn’t debt create chains or counter-party obligations, which enlarge systemic risk?

And doesn’t debt creation enable federal deficit spending, furnishing funds to “drunken sailors,” while boosting sales of private companies (and simultaneously boosting prices)?

Finally, when the debt is monetized through the Fed, doesn’t fractional reserve banking multiply it’s effect as it crosses the balance sheets of commercial banks?

All of these are “props” to the economy, as evidenced by the Fed’s abject fear of removing them too quickly, IMHO.

The tech companies are essentially monopolies. They can’t be overvalued because their services are essential. A business can’t just “stop buying” Microsoft Windows, because the entire business infrastructure *requires* it to stay in business.

So – between 2013 and 2014, 1.5 Trillion dollars was added. You show that as “no crisis” on the chart. Was this just an extension of the financial crisis as the economy continued to be on shaky ground?

The financial crisis was long over by then. It was essentially over by 2009. The economy was growing too, unemployment was falling, etc.

So essentially just free money?

Yes.

Good thing Powell didn’t cut rates. 353 K more jobs just added. Need to give him a little more credit!

@Russell: We will give Powell a lot of credit if he stays firm until he sees the inflation rate coming down to the 1.5-2.0% range. With the liquidity and momentum the economy has, I think that should take at least another 12 to 18 months. And then bringing rates down gradually by a point or two to a sustainable level. No zirp, No QE, No Easing of any sort.

The Fed has had a dubious track record for the last 30+ years. The onus is on them to prove that they can adopt and maintain a sensible, rational policy.

@ SS – It’s always easy to navigate from the backseat and rearview mirror. The problem has always been that economy is stable until it isn’t. Moves need to be made pre-emptively otherwise they are too late, but too early and you are just feeding more inflation. We are already six months into the rate plateau. Typically, these periods don’t last much longer. Another 12-18 months is wishful thinking.

@Russell: Can you honestly say whether or not you were hoping for a rate cut in early 2023 when the media and financial pundits started clamoring for rate cuts?

If you were, how did that turn out?

Everything depends on the data, and the data that came out today with 355k jobs created is very strong. The economy is not going to come to a grinding halt from 355k jobs!

If Powell starts cutting rates over the next few months, we are going to see inflation pop right back up…and then it will be more fun watching them try to control it.

@SS – I didn’t want to see a rate cut and wasn’t expecting one. That would have meant that the economy is starting to show signs of weakness.

I’d like to see a defined approach that is based on clear data. That approach would entirely take the fed out of the equation and could be run by AI.

I’m glad you have a deeper understanding of the economy than most. A lot of the future depends on when business loans start rolling over and how prepared the companies are to adapt. It also depends on how incomes keep pace with inflation and how willing individuals are to keep spending.

“Typically, these periods don’t last much longer. Another 12-18 months is wishful thinking.”

I wouldn’t assume past is prologue in this case. We are in some uncharted territory.

@ Russell,

Never assume anything…especially in a post-QE world.

Hate to break it to you…but…rate hikes likely have further to go…as long as the Beltway continues to fund trillions in annual deficits. Inflation embedded into services (and labor costs)…and won’t go away with FF at 5.5%.

But what about if something breaks? Wolf has stated many times that price stability is already broken…but I’ll go further. Fed guaranteed breakage 15 years ago when price discovery was taken away.

@HR01 – I’m kind of enjoying these rates. Much of my saving recently is concentrated in CDs. I keep a steady stream of them rolling over to provide a solid backdrop for the rest of my investment strategy. As long as they maintain a few points above inflation they are doing their job.

I don’t pretend to know what is coming next and always prepare for the worst. I also don’t spend my free time second-guessing the fed or relying on pundits to tell me what they think/want them to do. I like to think the fed is qualified to do their job and have much more information at their disposal than the general population.

Average hourly wage jumped too. Expected number was .3% and it came in .6%. 100% over the expected value.

Unemployment rate dropped too.

More money to spend for the consumer.

To be fair, he probably already saw the jobs numbers.

FOMC members are allowed to see key economic reports in advance of their public release, if the numbers were already computed.

Wolf, if banks were to start utilizing the new standing repo facility created in 2021 that you have pointed out, would that show up under total repos right? Would the SRF be a different line item underneath?

The activity of the SRF will show up in the regular Fed repo account, just like it did before 2009 (before Bernanke killed the SRF).

So now the Fed balance sheet is down to where QE should have ended and QT should have started.

Not the beginning of the end but perhaps the end of the beginning…

kramartini-

Good observation.

Stated a bit differently:

“The exit is usually where the entrance was.”

— Stanislaw Lec

Happy to see QT continuing on track.

Would love to see the Treasury start issuing fewer bills, especially once the Fed has no more on its balance sheet. I wonder if the lack of coupon issuance is somewhat blunting the effects of QT.

Wolf, I apologize if you’ve noted this elsewhere, but can you comment on whether there’s any significance of the QT rate of about $61B per month? Assuming a QT rate of $61B a month, that returns total FED assets to $1T by 2033. Isn’t 2033 the projected year for a Social Security blowup? Is 2033 simply a matter of correlation?

I appreciate your input.

(First time commenting. Huge fan of your writing and how you present technical details. Not an easy job!)

“on whether there’s any significance of the QT rate of about $61B per month?”

The way Powell explained it: it was a compromise that everyone could agree on. Some wanted smaller, others wanted larger amounts.

It’s actually not such a big huge deal. This year, there are only 4 months when note and bond maturities are over $60 billion. The big 2 are February ($77 billion) and April ($90 billion). The other two months, the runoff is $64 billion (August) and $68 billion (November).

The remaining 7 months, maturities are below $60 billion, and T-bills are used to fill the gap. Once the T-bills are gone in the 2nd half of 2025, the run-off will slow naturally to just the maturities, which vary widely from month to month.

The Fed will use up about $110 billion in T-bills to fill in the gaps in 2024, leaving it about $100 billion for 2025, which will get it halfway through the year, and then the T-bills will be gone. This is when the run-off will slow naturally.

None of this has anything to do with Social Security, and there is no Social Security “blowup,” that’s just BS-mongering out there. But SS will need to be tweaked over the next few years to keep the Trust Fund intact. This explains it with charts:

https://wolfstreet.com/2023/10/23/social-security-update-trust-fund-income-outgo-and-deficit-in-fiscal-2023/

Wolf, thank you. The linked piece clears it up.

Is there any possible universe where you see the FED bringing their assets to $1T or less by 2035?

No, this cannot happen, no matter who runs the Fed. I explained it here in Sept. 2022. Due to the progress of QT, which had barely started back then, the numbers have changed as we’re further along the process today, but the principles are still valid:

https://wolfstreet.com/2022/09/05/by-how-much-can-the-fed-cut-its-assets-with-qt-feds-liabilities-set-a-floor/

Wolf-

During times of exigency, does “ample reserves” imply “limitless” reserves?

Could the present “ample reserves” regime ever revert back to the old “scarce reserve” regime?

The Fed could choose to go back to a “scarce reserves regime.” This “ample reserves regime” is what they came up with after the repo market blew out in 2019. They didn’t even have it before. They didn’t even know they had an issue there. But now that they have the standing repo facility again, like they had before 2008, they could in theory go back to a scarce reserves regime.

Thank you, Wolf.

If they did go back to “scarce reserves”, would that change your calculation in the “by-how-much-can-the-Fed-cut-its-assets” article?

What is the proper size of the Fed Balance sheet?

Besides size limitations, what other controls can be put in place to avoid banking policy mistakes that have repeatedly led to extraordinary price bubbles (1920’s, 1960’s, 1990’s, and now)?

When a bond on the feds balance sheet “matures”, the issuer of that bond has to send the fed cash – right ? If the issuer is the Treasury, they have to come up with the cash to send to the fed. What does the fed do ? Remit the cash back to the Treasury ?

As a matter of routine, a modern central bank, including the Fed, destroys any cash it gets, and creates any cash it pays out. Central banks do not have a “cash account” on their balance sheet (unlike any other business).

“Treasury securities: -$61 billion in January” versus “The roll-off is capped at $60 billion per month” ?

No problem. The cap is not to the penny. As the Fed explains in every one of its Implementation Notes that come with every FOMC statement, “Allow modest deviations from stated amounts for reinvestments, if needed for operational reasons.”

https://www.federalreserve.gov/newsevents/pressreleases/monetary20240131a1.htm

East bound and down, t-bills keep on rolling. Fed gonna do what they should’ve always done. We got a long way to go…

The last of those MBS holding a 30 year 2.65% mortgage from late 2021 isn’t going to be fully retired until 2051. The Fed needs to basically state “no matter what else happens we will let MBS roll off naturally and we’re NEVER getting mixed up in the housing market again!”. A mistake from 2009 still on the books for decades more.

RTGDFA.

What does it say how MBS come off the balance sheet??? Via pass-through principal payments:

“MBS come off the balance sheet primarily via pass-through principal payments that holders receive when mortgages are paid off (mortgaged homes are sold, mortgages are refinanced) and when mortgage payments are made.”

“Amid the higher mortgage rates, sales of existing homes have plunged 33% in 2023, so fewer mortgages were paid off, and mortgage refinancings have collapsed, which dramatically slowed the mortgage payoffs. As result, the pass-through principal payments to MBS holders have also collapsed, and those MBS are not coming off the balance sheet very quickly, with the MBS run-off between $15 billion and $21 billion a month, well below the $35-billion cap.”

Yes exactly. And the lass pass through principal payment to the Fed is going to come from the guy who bought in late ’21 and pays out the full 360. And a few will.

I’m looking forward to when your title says “lowest since September 2019” and then the next time says “since 2013” because of that long hump between.

Yes, I’m joking, I know the BS will never fall below $4T again.

The average mortgage lasts about 7 years. People get new jobs and move to a different city, people have kids and need a bigger place, people want to downsize or move from a house into a condo (easier when you get older), they die, etc. Sales have not stopped, nor have refis. But the volume is a lot lower. So maybe those older mortgages will pay off on average in 10 years, instead of 7 years. In addition, there are the mortgage payments, they keep coming, and the principal portion whittles down the MBS. In addition, when the mortgage pool behind the MBS shrinks enough, the issuer (Fannie Mae, etc.) will call it, pay holders off at the remaining face value, and put the remaining mortgages into a new mortgage pool. In addition, if mortgage rates ever drop, refis and payoffs will accelerate. MBS are really a self-liquidating instrument, which is why they’re such a hassle for small investors to deal with.

Abolish the Criminal Cabal Fed whom has inflicted nothing but Pain and Misery amongst the American citizens and the world. Central Planning is the 5th Tenant in Marx’ Communist Manifesto.