But gasoline plunged and durable goods dropped. Food rose further from already painfully high levels.

By Wolf Richter for WOLF STREET.

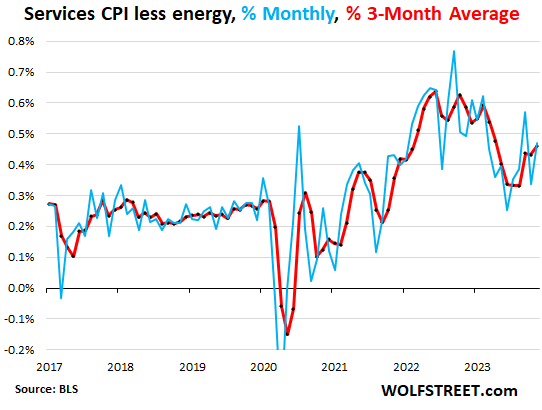

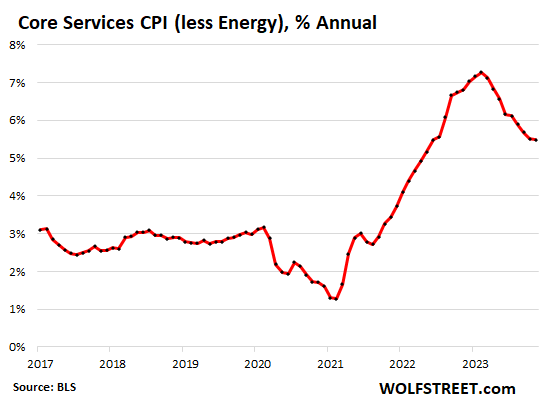

Inflation in services accelerated in November for the second month in a row, to an annualized rate of 5.8%, driven by housing, healthcare, and insurance. Services is where about 65% of consumer spending goes, and it continues to be the driver of inflation.

But gasoline continued to plunge. Durable goods prices (cars, electronics, furniture, etc.) continued to drop, though used car prices suddenly jumped again – surprise, surprise. Food prices rose to a new record from already high levels. So here we go.

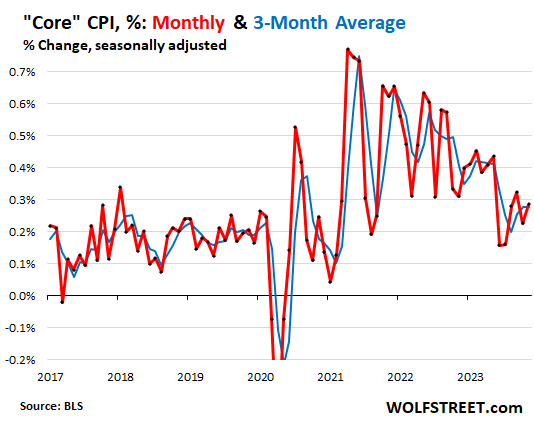

Core CPI, a measure of underlying inflation that excludes the volatile movements of food and energy products, rose by 0.28% in November from October (red line), according to the Consumer Price Index data released today by the Bureau of Labor Statistics.

Core CPI was pushed down by the decline in durable goods, but pushed up by the jump in core services.

The three-month moving average, which irons out the month-to-month ups and downs, also rose by 0.28%, the biggest increase since June (blue):

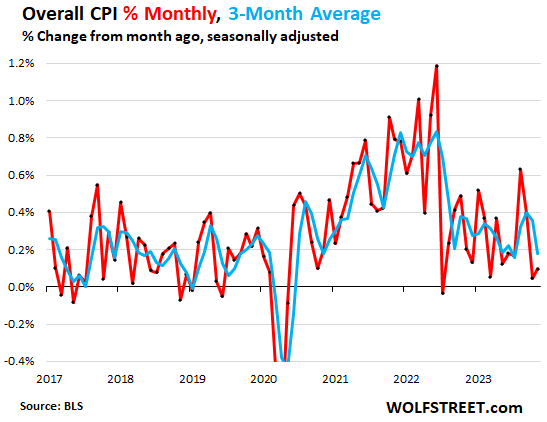

The Overall CPI inched up by 0.1% in November from October, driven down by the 6.0% month-to-month plunge in gasoline prices and the drop in durable goods. As you can see, this index jumps up and down a lot, driven by the often-massive movements of energy prices (red). The three-month average, rose by 0.18% (blue):

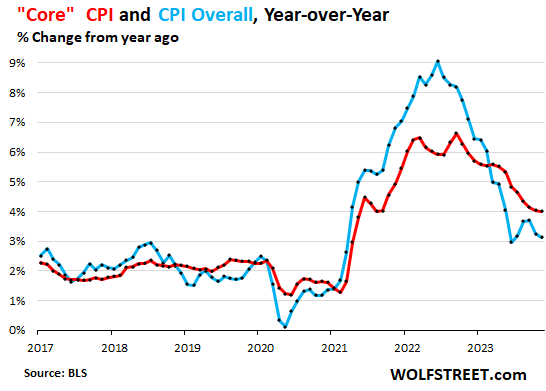

The year-over-year “Core” CPI rose by 4.0% year-over-year, same as in the prior month (red line).

The year-over-year overall CPI decelerated a hair to 3.1% (blue line), pushed down by the 8.9% year-over-year plunge in gasoline prices and by the 1.6% drop in durable goods, while the 5.5% increase in core services pushed in the opposite direction.

Core services got hotter, rents glow in the dark.

The CPI for core services (without energy services) on a month-to-month basis rose 0.47% in November from October, or by 5.8% annualized (blue line).

The three-month moving average rose by 0.46%, or 5.7% annualized, the sharpest increase since April (red line).

The acceleration of the three-month moving average in September, October, and November is very disconcerting:

Year-over-year, the core services CPI rose by a red-hot 5.5%, same as in the prior month, despite the 30% collapse of the messed-up year-over-year health insurance CPI within it that we’ll get to in a moment:

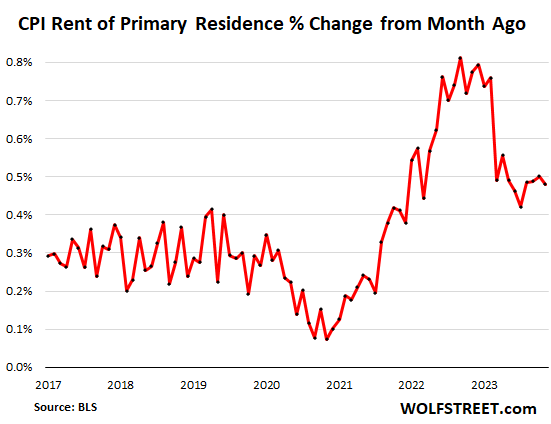

The “Rent of primary residence” CPI further accelerated to +0.48% in October (+5.9% annualized) and has been in this range since March, except for the outlier July, when it had dropped out of that range.

The Rent CPI is based on actual rents that tenants actually paid. The survey follows the same large group of rental houses and apartments over time and tracks what tenants, who come and go, actually pay in these units.

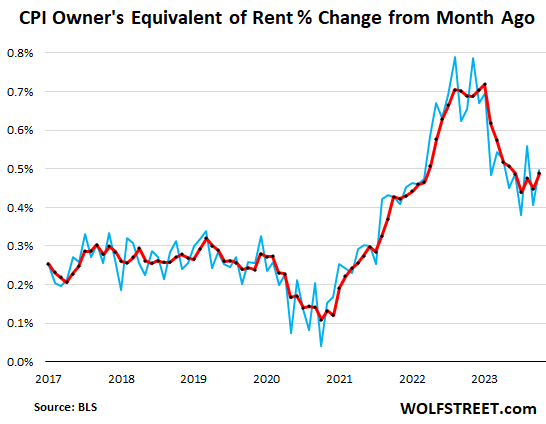

The “Owners’ equivalent of rent” CPI rose by 0.50% in November from October, or 6.2% annualized, a hair higher than in March.

The three-month moving average rose by 0.49%, the highest since June, and there hasn’t been any real improvement since May.

The OER index is based on what a large group of homeowners estimates their home would rent for, and is designed to estimate inflation of “shelter” as a service for homeowners.

What both CPIs for housing costs tell us is that the big month-to-month rent spikes in 2022 through February 2023 are over, and that the rent CPIs have settled at month-to-month increases of around 0.5%, or about 6% annualized, which also roughly matches what the largest landlords have reported in their earnings calls that they’re getting in rent increases. So about since March, it seems rent increases have gotten stuck at a rate close to 6%, and that’s very disconcerting.

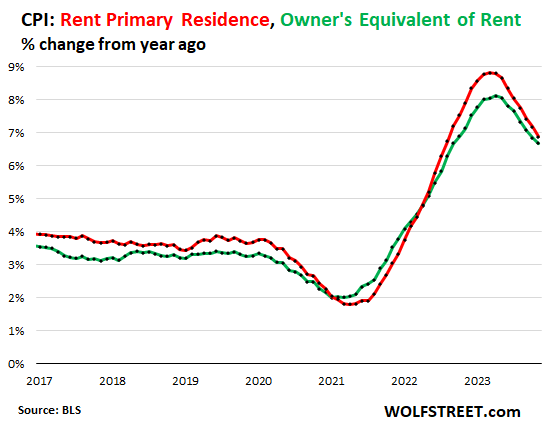

Year-over-year, the Rent CPI increased by 6.9% (red in the chart below). And the CPI for OER increased by 6.7% (green):

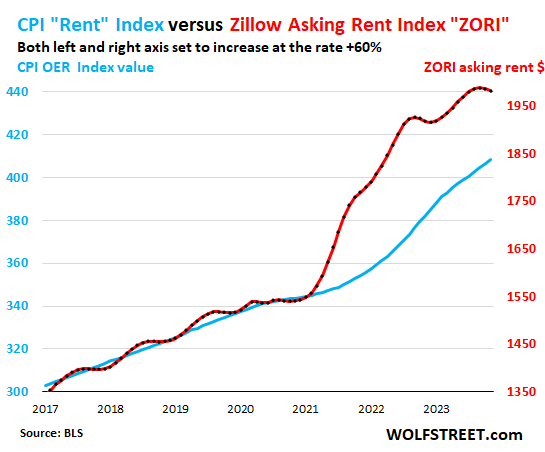

“Asking rents…” The Zillow Observed Rent Index (ZORI) and other private-sector rent indices track “asking rents,” which are advertised rents of vacant units on the market. Because rentals don’t turn over that much, the ZORI’s spike in 2021 through mid-2022 never fully made it into the CPI indices because not many people actually ended up paying those asking rents.

This time of the year, the ZORI typically dips a little. In October it had dipped by 0.12% from the prior month, and in November it dipped by 0.23% to $1,982. The dips were smaller than a year earlier.

The chart shows the CPI Rent (blue, left scale) as index values, not percent change; and the ZORI in dollars (red, right scale). The left and right axes are set so that they both increase each by 50% from January 2017, with the ZORI up by 47% and the CPI Rent up by 35% since 2017:

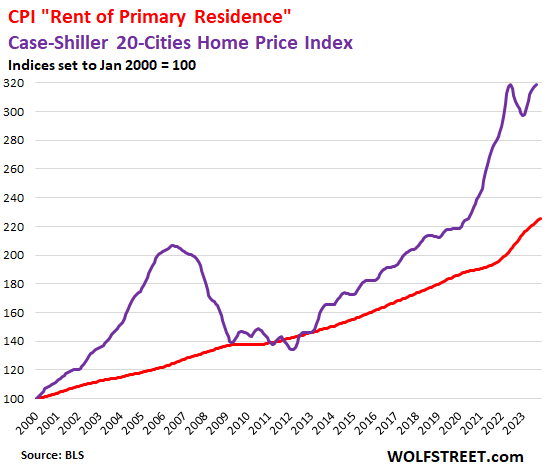

Rent inflation vs. home-price inflation: The red line represents the CPI for Rent of Primary Residence (tracking actual rents). The purple line represents the Case-Shiller Home Price 20-Cities Composite Index. Both lines are index values set to 100 for January 2000:

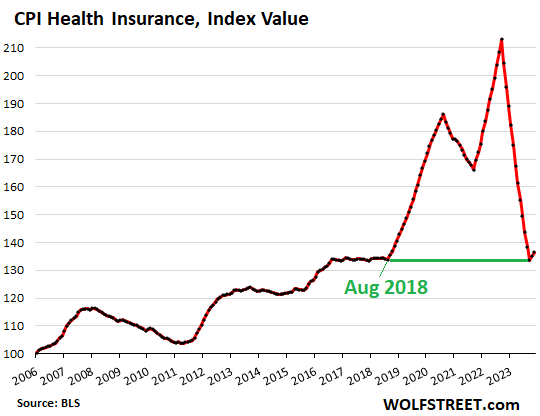

The collapse of the health insurance CPI. November was the second month without the monthly push-down adjustments to the health insurance CPI, which started with the October CPI in 2022 and went through September 2023.

These odious health insurance adjustments had caused the health insurance CPI to collapse by nearly 4% month-to-month every month for 12 months through September, leading to the 37% year-over-year collapse by September. The problem arose because the pandemic healthcare distortions had blown up the model the BLS used to estimate health insurance costs, and the BLS was slow in changing the model. It has now tweaked the model. I discussed the old and new versions last month here: The Collapse of the Health Insurance CPI (How it Became Chickenshit).

Starting in October and continuing in November – and at least for the next four months – the health insurance CPI flipped the other way and jumped month-to-month by 1.1% for the second month in a row. Those two month-to-month increases reduced the year-over-year spike to +30.3% in November from +37.3% in September.

Here is the infamous chart of the Health Insurance CPI as index value, which back to where it had been in 2018, which is outrageously ridiculous. Now the index is reversing, and that little hook at the bottom represents the two months of 1.1% increases in a row:

Services CPI by category.

The table is sorted by weight of each service category in the overall CPI. The CPI for medical care services is the third largest item, with a weight of 6.3% in overall CPI, and over 10% in the core services CPI. The year-over-year drop of 0.9% was caused by 30% year-over-year collapse of the health insurance CPI within it.

Also note the continued spike in motor vehicle insurance.

| Major Services without Energy | Weight in CPI | MoM | YoY |

| Services without Energy | 62.7% | 0.5% | 5.5% |

| Owner’s equivalent of rent | 25.8% | 0.5% | 6.7% |

| Rent of primary residence | 7.7% | 0.5% | 6.9% |

| Medical care services & insurance | 6.3% | 0.6% | -0.9% |

| Food services (food away from home) | 4.8% | 0.4% | 5.3% |

| Education and communication services | 4.8% | 0.1% | 1.4% |

| Recreation services, admission, movies, concerts, sports events, club memberships | 3.1% | 0.1% | 4.8% |

| Motor vehicle insurance | 2.8% | 1.0% | 19.2% |

| Other personal services (dry-cleaning, haircuts, legal services…) | 1.5% | 0.3% | 6.1% |

| Motor vehicle maintenance & repair | 1.1% | 0.3% | 8.5% |

| Water, sewer, trash collection services | 1.1% | 0.3% | 5.4% |

| Video and audio services, cable, streaming | 1.0% | -0.2% | 4.1% |

| Hotels, motels, etc. | 0.9% | -1.1% | 0.3% |

| Pet services, including veterinary | 0.6% | -0.1% | 6.4% |

| Airline fares | 0.5% | -0.4% | -12.1% |

| Tenants’ & Household insurance | 0.4% | 0.5% | 3.4% |

| Car and truck rental | 0.1% | -2.2% | -10.7% |

| Postage & delivery services | 0.1% | -0.6% | 0.8% |

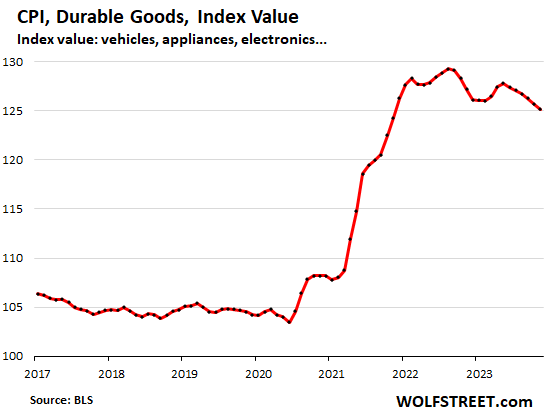

Durable goods continue to drop, after huge spike.

The CPI for durable goods dropped 0.37% for the month and by 1.6% year-over-year, having now declined somewhat waveringly ever since the peak in July 2022, as the pandemic-era shortages, supply bottlenecks, and transportation chaos that created a historic price spike have receded

The index is dominated by new and used vehicles, information technology products (computers, smartphones, home network equipment, etc.), appliances, furniture, etc.

| Major durable goods categories | MoM | YoY |

| Durable goods overall | -0.4% | -1.6% |

| New vehicles | -0.1% | 1.3% |

| Used vehicles | 1.6% | -3.8% |

| Information technology (computers, smartphones, etc.) | -2.7% | -8.3% |

| Sporting goods (bicycles, equipment, etc.) | -0.6% | -1.8% |

| Household furnishings (furniture, appliances, floor coverings, tools) | -0.7% | -0.3% |

This chart shows the price level of the index, not the percent change:

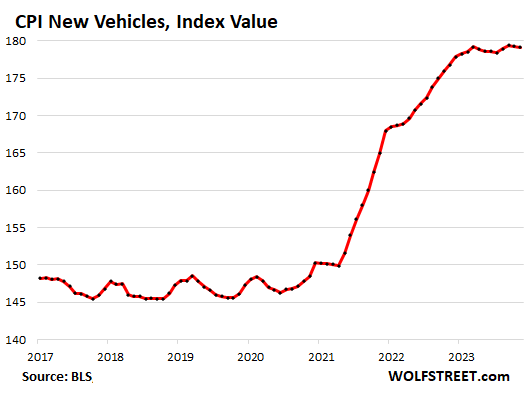

New vehicles CPI has been roughly flat all year, after the 19% surge from April 2021 through March 2023. In November, it edged down by 0.1% month-to-month. Year-over-year, the index rose 1.3%.

For many years before the pandemic, the new vehicle CPI was essentially flat with some ups and downs, despite increases of actual vehicle prices. This is the effect of “hedonic quality adjustments” applied to the CPIs for new and used vehicles and also other products (here’s my chart and detailed explanation of hedonic quality adjustments).

The chart shows the price level as index value, not the percentage change:

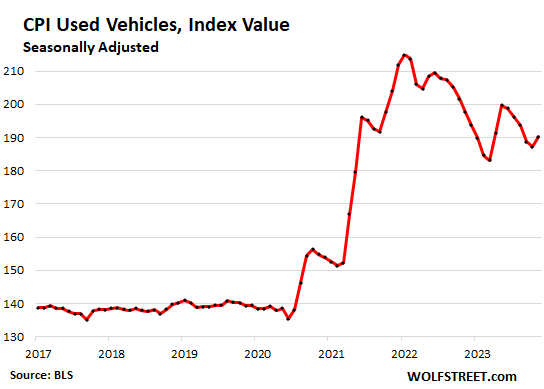

Used vehicle CPI had spiked by 55% from February 2020 through January 2022. Since that peak, it has dropped by 11.5%. But it’s still up by 35% since February 2020.

Food & Energy.

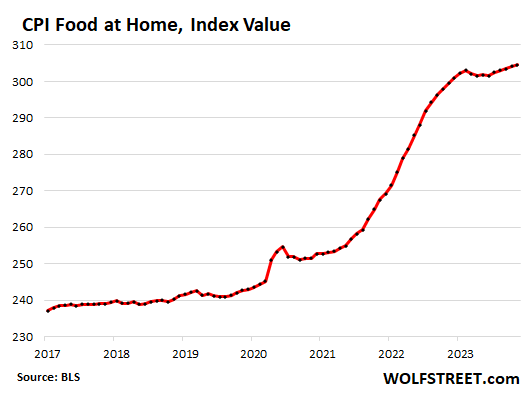

The CPI for food at home – food bought at grocery stores and markets – rose by 0.1% month-to-month and by 1.7% year-over-year. Those increases come on top of already painfully high food prices that had spiked by 24% during the pandemic.

| Food at home by category | MoM | YoY |

| Overall Food at home | 0.1% | 1.7% |

| Cereals and bakery products | 0.5% | 3.4% |

| Beef and veal | -0.3% | 8.7% |

| Pork | -1.0% | -0.5% |

| Poultry | -0.9% | 1.0% |

| Fish and seafood | 0.4% | -1.5% |

| Eggs | 2.2% | -22.3% |

| Dairy and related products | 0.1% | -1.4% |

| Fresh fruits | 1.6% | 2.1% |

| Fresh vegetables | 0.3% | -3.1% |

| Juices and nonalcoholic drinks | 0.5% | 3.6% |

| Coffee | 0.4% | -0.1% |

| Fats and oils | 0.5% | 3.0% |

| Baby food & formula | -0.4% | 7.6% |

| Alcoholic beverages at home | -0.1% | 2.9% |

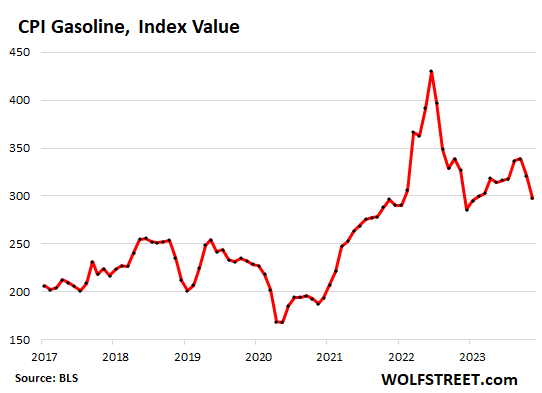

Energy prices plunged, driven by the plunge in gasoline. Energy prices are linked to commodities which tend to jump up and down dramatically, which is why they’re excluded from “core” inflation measures to see the underlying inflation.

| CPI for Energy, by Category | MoM | YoY |

| Overall Energy CPI | -2.3% | -5.4% |

| Gasoline | -6.0% | -8.9% |

| Utility natural gas to home | 2.8% | -10.4% |

| Electricity service | 1.4% | 3.4% |

| Heating oil, propane, kerosene, firewood | -2.2% | -19.3% |

Gasoline, which accounts for about half of the energy CPI, plunged by 6.0% month-to-month. Since the peak in June 2022, it has plunged by 31%.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

So you are saying there is chance the Fed pivots tomorrow? 😂

Its tragic to see the American people getting poorer at such a clip. How many more years can they take 6-8%+ declines in their wealth?

Most Americans have no wealth.

But don’t they have Apple iPhones and iPads :)

Incorrect. “Some” Americans have no wealth. 65% of Americans are homeowners. 35% are renters, and a big part of them are “renters of choice” that have plenty of income and wealth to pay for the $4,000+ rents. Nearly every single-family built-to-rent house and nearly every apartment building built over the past 10 years is marketed to renters of choice, because that’s where the money is.

@Wolf it is important to not that ~65% of American’s “live in a home with a homeowner” that is a big difference from ~65% of American’s “are homeowners” (few people have everyone that lives in a home on title and with ~35% of America is under 24 and only a small percentage of the people own homes).

Meant to say “households” not “Americans.” Sloppy writing in the heat of the battle. All this stuff is measured in households, not individuals.

I am about to cut rates. Don’t worry, BLS will start using health insurance formula for all services and we will have no inflation.

We had a guy here who predicted “Americans are destined to become poorer, or a lot poorer”. I think he lived in Japan and Brazil for many years.

Augustus Frost.

stock Markets went up saying inflation is going down which is true. It was 9%+ at one point in time and now it is at 3.1%.

FED would come and declare victory with a dovish tone setting markets for ATH.

OTOH: financial conditions have never been this loose.

How are financial conditions in any way loose now?

Tight for Main St, loose for Wall Street.

US had so many recessions and boom and bust cycles and emerged stronger.

The last 15 years of “No Recession” has done permanent critical damage to US, more than any boom-bust cycle.

It has destroyed value of labor, invaldiated moral values and made majority of Americans poorer.

It should have gone down with yesterday’s print. Wall Street needs to be taken down. Yesterday’s CPI and last week’s jobs report are the opposite of wall street wanted. That’s how corrupt the system. They are jawboning the market up with propaganda.

Who cares though? If Wall Street jumps 50% on bad news, stocks are just 50% more overpriced. Doesn’t matter if people sell the bad news now or hold at high prices until things crash, end result will be similar. If anything, people idiotically jacking up stock prices is just more incentive for Powell to stay higher for longer. Fine by me!

Ben R, the reason we should care is that people feeling “rich” because of their stock holdings are driving up inflation.

If the rich who have been buying luxury goods, taking vacations and generally spending in huge numbers the past 3 years feel poorer and stop, inflation will be under control in no time.

True Einhal, but then wouldn’t rates be lowered sooner and inflation would take back off? IMO, the eventual outcome is similar either way. Wall Street’s constant push towards extremely overvalued speculative assets will take us down a bumpier path than markets responding rationally (or maybe a smoother one depending on how you look at it- falling off a cliff seems like a pretty smooth ride!).

Of course, if you listen to MSM, it’s another Mission accomplished talking point all over these numbers and WS is going all in rate cuts Q1 next year….

Best we can hope for is Pow Pow hold it where it is and hoping 10 yrs yields won’t go down anymore…I would bet my first and second born, there won’t be a rate increase this meeting.

What difference does the Federal Funds Rate make?

There are many indices that track this. In addition, you can look at BB-spreads and other stuff to see just how loose financial conditions are.

Here is one index of financial conditions, and it shows that financial conditions are looser now than before the Fed began to hike rates:

https://www.chicagofed.org/research/data/nfci/current-data

I stopped paying attention to the MSM a decade ago. Their business model is to keep you in panic mode so you’ll tune in. PS — the fed has never lowered rates unless we were in recession.

PS — the fed has never lowered rates unless we were in recession.

Did you forget your sarc tag?

I don’t think that’s going to work this time. People are more willing to believe their lying eyes than the media, finally. Last year I got a raise of 1% (I was a new employee and not entitled to raise or promotion) to adjust with inflation. It’s to the point that, in order to adjust for inflation, companies would have to start handing out raises typically reserved for top performers.

One of the reasons we’ve seen people leaving jobs and seeking new ones (and usually finding them) at higher pay is that the raises simply can’t keep up with inflation. It sounds counter-intuitive to anybody older than 55, but the surest way to increase your wealth in terms of earning power is a series of lateral or semi-lateral career moves every 2 years, increasing your pay requirements every time and sometimes opting for a higher level of responsibility.

The gig is up. Everybody knows the current situation is untenable. Wages are not going up anywhere near commensurately with inflation. Most things cost more. Even if inflation comes down from its current level, it’s never going down to a level that matches up with wages. The best the inflation-profiteers can hope for is that people’s relief from being down from psychotic levels of inflation keeps people complacent. Kind of like gas prices. People are relieved it’s back down to $3.00 around me. A decade ago, there would have been mass hysteria if it went above $2.50.

Cool, looks like I won’t have to give up my first and second born after all, no increase this time around.

Would love to play poker with Pow Pow, the man has no poker face period…

CPI is no longer increasing. That is amazing news. We are in soft landing. So soft that it will take 10 years to get the inflation to 2% with this speed.

Today is the best day ever. So is yesterday and tomorrow and Thursday until forever. Let me buy some more stocks.

Try as they might they can’t kill it.

Which kind of suggests that they aren’t quite trying hard enough, doesn’t it?

It’s not the elephant in the room, it’s the one feeding it.

And amazingly, the DOW just hit the third highest close in history. The gap between what “the market” expects the Fed to do and the acceleration in inflation is astonishing.

If Powell does not raise tomorrow and we hit DOW 40k soon and ten year back to 3.5% it will be all on him. Financial conditions have eased greatly since the last Fed meeting so he can afford to raise one last time this year.

I so agree with everything you said.

What will be all on him? A Nobel?

Interestingly enough the awards are presented in Stockholm, Sweden while the menu is written in French.

Is there an underlying cause for the increase in domestic oil production these past two months? Seems convenient the health care adjustment rolls off the exact same time oil production goes through the roof. Pure coincidence?

Nah, just the oil biz. Domestic oil production is spread across innumerable small and large drillers. Frackers can ramp up production very quickly. So when prices spiked in 2021 and 2022, they hedged part of their production at high prices and then it was drill baby drill to get those higher prices. And then they overproduce… this is the same thing over and over again, which is why, in commodities, the best cure for a high price is a high price because it stimulates overproduction, which causes the price to crash. Oldest song in the book.

Everyone is talking about how Fed did a great job and how they flattened the curve. Let’s see how they beat core to 2%, it’s sticky and it’s hard to achieve in the next 3 years. They want 2% and promised 2% lol. Just suck it up, now 3-4% core for decades.

Make that 3-4% core annual inflation over the next decade, plus potential for 15-25% additional “one-time” inflation resulting from excessive non-reversible stimulus provided during “emergencies” like pandemics, wars, and bank bailouts.

Don’t think you’re the only one feeling this could be a potential scenario…after all, how do we get over gaslighting from Pow Pow that inflation is transitory and here we are…..

If they move the goal posts to 4% target, I am sure they will just come up with some S*** to justify it, especially if it means it will stall or remove the risk of next recession hitting anytime soon.

If they moved the neutral rate to 4%, I would be ecstatic. That would force leverage down and kill a lot of zombie companies. Net result? Noticibly lower financialization of the economy.

Theyve never once wavered from the 2.0% core inflation target.

As a matter of fact, Powell has been adamant about not stopping tightening until 2.0% is reached and the fed is certain it can be maintained.

Only people here and on Wall Street keep saying the fed is going to change their target to 3 or 4%, which is absolute bs. Whats your agenda?

CCCB, the Fed couldn’t come out and announce that, or long term yields would blow out. It would have to be surreptitious.

CCCB,

Try telling that to long bondholders who lost 50% of their savings.

The Fed’s 2% average inflation target was dust in the wind.

No, they lost 50% on their long term bonds because they foolishly loaded up on 2% 30 year bonds, assuming that the Fed could hold rates at 0 with no inflation forever.

That was all on them.

@CCCB,

The dot plot just released says the long term neutral rate is 2.5% or higher. There’s your proof. It’s moving up from 2%.

It is starting to seem that the Fed is running a stealth inflation and/or a rate normalization game. The Fed clearly wants/needs its curve inversion and wishes inflation to “stabilize” at a higher level for longer. Its view I suppose is that it can always increase interest rates again, break the system and then bring rate back to where they are now, hence normalization. My apologies if I am upsetting the narrative but I am increasingly feeling as though I am being played. This probably means the Fed is okay with 35 or greater PEs and inflation running hot for the next 6-12 months while it tells everyone that it is very “concerned” with inflation. Sorry but it just rings really hollow.

I have given this thought before when article talk about todays high 20+ PE ratios compared to historical averages of the teens

I think what we have is fewer stocks now than in the past plus more people are investing in stocks. The Wilshire 5000 was created in the 1970s I believe and it was supposed to capture all the stocks in the US stock market. Of course there were about 5000 publicly traded stocks at that time and that is why it was called Wileshire 5000. The number of stock in this index kept increasing and peaked at 7,500 in the 1990s. Well now there are only 3750 stocks in this index. So the number of stocks we can invest in coupled with the growth of 401k retirement account from the 1990s until now, you have a lot more participants buying stocks but the number of stocks they can buy has dropped by 50%. More money chasing fewer products. Thus I think high PE ratios are here to stay. Your really cannot compare PE ratios of the pre 1990s with today PE ratios. IMHO.

If you go look at the SP500 PE ratios from 1920s until 1990, PE ratios rarely ever got above 20 and the range was 10 to 20. From 1990 until now, PE ratios range is 20 to 40 and they rarely drop below 20.

PE ratios sometimes drop into negative territory and historically were around 6 to 15.

I might be missing what you are saying but seems like “lots of money and has to go somewhere.”

Yep. That is what I am saying. ;)

Ru82-

If Felix Zulauf is correct and the 10 years grinds into higher single digits over the next several years, might not that bring PE ratios back down toward more historical averages?

Cheers (I think…)!

“10 years” should have said “10 year US Treasury”

Zulauf: “often wrong, never in doubt”

Until recently there was nowhere else to put your cash.

Even before, there still was. Nobody forced investors to buy 10 year treasuries at 0.5% or 30 year treasuries at 2%.

Had the bond vigilantes been out, long term yields would never have gotten as low as they had, and people would have had other options.

ru82,

I agree. Essentially the move to 401K and index investing is forcing a rise in the market tide.

Secure Act 2.0 stands to vastly increase the rate of the 401K capital pump into the market. Several states including Cali and Illinois already have passed similar legislation which has been contributing. These will add many millions more contributing to these funds. Initially at 3 or 4%, with mandatory yearly increases to 10 or 15%. I expect the market to go gangbusters after Jan. 2025, when the changes go into effect nationally. We’ll see how quickly people take those profits.

Interest rates are set relative to the inflation rate, so if the Fed says it wants interest rates to be “higher for longer”, it is tacitly agreeing to accept inflation that is higher for longer.

The better plan was to withdraw excessive monetary stimulus quickly before inflation had a chance to occur. They let inflation run past 5% before taking it seriously. Even then, the response wasn’t strong enough to stop inflation before it hit 9%. That’s a disaster for what is supposed to be an advanced economy. I can’t help but think the Fed lacked a sense of urgency or was prioritizing other issues besides inflation.

It’s not an inflation fight if you don’t attack it with full force. It’s more like a wish.

This whole fight against inflation is on the same trajectory as one of my many fights against weight gain.

🤣❤

The Federal Reserve does not own stock and does not in any way control the PE ratios of stocks which are driven up by manic speculators. That is not even a matter for the SEC.

There are many (quasi-)governmental organizations in place to control margin requirements and various kinds of leverage, apparently all managed by speculators.

LOL! So the Fed’s actions have no influence on prices then? Care to enlighten everyone on the actions Blackrock and Vanguard? How is it that these private corporations get to act as fiduciaries for the Fed, and profit as they have been?

This isn’t “capitalism” comrade.

We had an opportunity to restore things in 2008/2009, bt instead of prosecuting all the fraud (call it what it was) and sending these financial wizards to prison, we bailed them out. The Fed was, and still is the enabler of all this fraud.

interesting times for sure.

WB,

I expect the next shock may come from Wall Street’s manipulation of index investors. SPACs and mergers to stack the deck of broad indexes with lower-quality stocks they can dump after IPO.

The government is running a huge, recession level deficit, so it’s not surprising. Powell should try doubling QT.

I second your opinion. Core inflation seems to have settled at 4%. Bullish investors are constantly loosening the financial conditions by aggressive asset purchases. Inflation won’t go down if they are not punished.

To slash the bullish investors FED must immediately let the T bills to roll off, shut down the BTFP back liquidity door and sell the mortage BS.

Who wants to slash investors in pre-election year?

Well, deficits can be reduced by greater tax revenue. That can be accomplished by higher asset prices and when assets sold they trigger a taxable event the government takes a cut. So if JPow sees full employment, 3% headline CPI (and falling), I doubt he will care that much about high asset prices that keep going higher. Remember that state, local, and federal govt all benefit from higher asset prices because of tax revenue…

That services cpi less energy chart is concerning, though…

“I don’t have to spend less, you just have to give me more money”

I am sorry but this is nonsense. Assets have been rising for quite a long time and at the same time the deficit picture has gotten worse.

Basically you are saying that expenses don’t matter if incomes were to rise, but that’s only true if you are spending less than your income, which is clearly not true when it comes to the government. California alone if facing a 68 billion dollars deficit next year, and this is during the good times.

Indeed, and California is facing fiscal catastrophe even though it has the high income taxes in the US.

California has a rainy day fund, but yes, it likes to spend money and that will catch up and often does. If revenues continue to come in low they can cancel some money that hasn’t gone out or reduce education via prop 98 which would be hugely unpopular. Not clear how much impact next year will have as people moved from equities to treasuries. On one side capital gains but on the other no income from treasuries.

Stop comparing the Congressional budget with your household finances. Totally inappropriate. Our real danger comes from an explosion in wealth at the high end. Oligarchs kill democracies. An historical fact. We’re headed pell mell into a one party Oligarchy. Election results will be pre-ordained. My bet is that the Republican Party will come out on top. Unless Trump wins. That would be a disaster even for the Oligarchs.

LMFAO!!!!

Asset prices have been rising for 40+ years and the deficit (and M2) has increased exponentially!!!!!

LOLOLOLOLOL!!!!

(math is hard) Thanks for the chuckle Z33!!!!

My god, damn near spit my coffee on the keyboard.

I have a related question. I have a TIPS maturing January 15, 2024. As you may know, the inflation adjustment on those is based upon the CPI-U, but runs 2 months behind. So today’s November numbers are what will be used for the daily adjustment up until maturity on January 15th.

This index peaked on December 1, 2023 (which is based upon October 1st actual data). It has very slightly deflated from there. Over that 45 days deflation was .129% which makes me wonder how the report shows .1% inflation for the CPI-U. Anyone able to clue me in on what I am missing?

Thanks in advance if you can.

What was the question?

Sell it. Sell the boat while you’re at it.

Once again love the 3MMA graphs. Really shows the trend well. The “see no inflation, hear no inflation, speak no inflation” crowd foams at the mouth at the slightest monthly decrease in any of these numbers.

Housing has been in the driver’s seat for quite a while and will continue to be for quite a while. I hope it breaks before employment does because housing downturns due to employment get difficult to manage. Fed should have been more aggressive in QT with its MBS portfolio. They can drive mortgage rates higher quite easily but I’m sure they’re as afraid of housing as they are inflation. The continued stupidity and lack of even mild creativity in managing long term residential lending rates continues.

Looks like J. Powell and the FOMC are playing a game of inflation wack-a-mole. They may need more than one mallet.

Powell is letting the markets do the tightening for him.

👍 working like a charm ha

“Rent inflation vs. home-price inflation”

“A bill introduced in the House and Senate would prevent hedge funds from owning single-family houses in the United States.”

Maybe there’s some hope for lower house prices.

About 15 million SF rentals are owned by mom-and-pop landlords. Big investors all combined own less than 1 million.

Rentier capitalism!

“About 15 million SF rentals are owned by mom-and-pop landlords. Big investors all combined own less than 1 million.”

I think it’s the trend they are worried about. Skate to where the puck will be, etc.

I’ve been saying it for years now, rent control is coming to America and overdue. Short term rentals are also being taxed out of existence, good riddance.

Here in Raleigh they may be increasing property taxes as high as 40%. Scary stuff

You are now free to pack your belongings and move about the country.

Thats because home values have increased roughly 40% in the past five years

Just pull up a FRED housing chart. Fred.stlouisfed.org

CCCB,

Sure…but that “40% appreciation in home values” is largely unspendable until the house is *sold* (unless you roll the dice and find a G-backed bank to loan to you using the house as collateral).

But the local G wants *its* 40% goosed prop tax payments *in cash* *every single year*.

Funny how that works.

Petunia,

Do you know anything about rent controls and other government manipulations of markets and the results?

Economist Assar Lindbeck (socialist) was quoted, “In many cases, rent control appears to be the most efficient technique presently known to destroy a city—except for bombing.”

Take a look at any city that has passed it, or at least in the area covered by it. I’d wager you wouldn’t want to live there.

Yes, I own some rentals. All of these are currently rented to people who want to rent, not who need to rent.

I lived in NYC under rent control when I was young and as an adult under rent stabilization. Rent stabilization was better because it allowed for cost of living increases for the landlords and longer controlled leases for the tenants. I lived in the Gramercy area, one of the poshest in the city, everybody was living under rent stabilization and pleased with it.

The original rent control was flawed because it never allowed for rent increases unless the apt was somehow renovated, new sink or fridge, or windows, heating, etc. My parents lived in a rent controlled apt and the building did degrade over the decades they lived there.

The greed is so immense now that we will all be homeless if something isn’t done soon.

Looking at the indices, its’ a 30-50% increase in major categories from 2021 to 2023.

Once again only the things people actually need are rising rapidly while other luxuries are rolling over. Gas is the obvious exception. Food, rent, insurance continue to rise. Not sure how you slow down demand in those categories…

Everything is fine lol

I’d anticipate Powell and the dot plot is hawkish considering the issues with services inflation wolf has pointed out.

I actually remember the last December meeting quite well. Powell was essentially giving a PowerPoint presentation on the different categories of inflation. And he was optimistic about services and rents coming down. 1 year later here we are with assets going nuts, little movement in housing prices (except in San Fran), and financial conditions as loose as they’ve been since before the “tightening”cycle started

“I’d anticipate Powell and the dot plot is hawkish considering the issues with services inflation wolf has pointed out.”

He better be. He hasn’t been anywhere nearly hawkish enough in the face of wall street’s propaganda. He needs to raise rates to shut them up. He also needs to step up QT. The pace is laughable.

Financial conditions are largely determined by bank credit. The Fed bailed out the banks with BTFP, FHLB props them up, of course they are still lending. Probably more bailouts in March, when BTFP becomes permanent. Another bandaid on the hemorrhaging financial system.

If banks were really allowed to fail properly, credit would freeze and inflation would drop like a rock. Instead we get ‘not QE’ liquidity injections and QRA manipulation. Soon another hole to plug, the RRP.

The Fed balance sheet is almost perfectly correlated with the S&P and the wealth effect. Want to get rid of inflation? Hit banks hard, hit assets hard. Anything else is half-assed fantasy.

Barney-

Great post.

That SIFI (systemically important Coddling the banking institution), TBTF (too big to fail), and MPR (macro-prudential regulation) have become accepted acronyms in the central banking lexicon bear witness to the coddling and subsidizing of the entire banking industry that has become routine triage whenever bad commercial banking threaten to mess up the financial status quo.

As Allen Meltzer keenly noted: “Capitalism without failure is like religion without sin. It doesn’t work well.”

I’m not so sure it’s realistic to tell the bankers’ bank to “hit the banks hard,” but allowing banking decision consequences to do the hitting, WITHOUT government support, would be a healthy choice.

Please keep posting on this subject!

Yes, control the banks.

Increased capital requirements have been proposed, but look at how the banks whine against it. The banks gaslight us, saying any increase in capital requirements will ultimately hurt Mom and Pop, when we know it really would reduce bank profitability, which is in a long-term bubble. Jamie Dimon needs a muzzle.

In reality, Mom and Pop don’t get much benefit from large banks. A loan is a near commodity that should be simple to provide, not brain surgery. The biggest worry of Mom and Pop is having to bail out the banking system, again, with another decade of interest rate repression.

The inflation results continue to stray so far from stated goals, you have to wonder what is really going on.

Very basically, how can you inject $5T in the money supply (free money) in a supply-constrained environment thinking it wouldn’t create at least $5T of price inflation. Wasn’t it obvious that at least $5T of upward price adjustments would occur before consideration of any multiplier effects from bank lending? All else equal, when you throw additional money in the system, prices adjust upwards.

It is not surprising that once inflation reared its head, we saw the $5T money supply increase embed in price levels and nominal GDP very quickly, while the Fed slow-walked QT. The corporations knew additional money supply would increase demand quickly, and they increased prices to capture the benefits. Economics 101.

As you indicated, its reduction of excessive money supply that provides the punch in an inflation fight. Interest rate hikes are a weak jab at best. Why didn’t the Fed reduce the money supply more forcefully when inflation arose? If they were afraid of breaking things, they failed, because inflation rose 20%.

But they did increase asset prices, which pleased Wall Street.

Correct. This is exactly what the Glass-Steagall act tried to do. Worked for a while…

Something similar needs to be done again, ASAP.

WB – concur.

may we all find a better day.

Not sure if Powell has any power when many analysts are saying yellen is providing lots of liquidity to boost asset prices for joetato. Makes sense when you look at the insanity in stock prices and the weirdness in bond auctions. Yellen is like that Japanese steakhouse chef, spinning plates on her knife.

Americans are shelling out more profits to corps than ever before. Of course the stock market loves that.

Corps keep rising prices and dopes keep paying them. Investors are getting rich!

It’s great. 👍

Not all is gloom and doom; California’s tax revenue went from a $100 billion surplus to a projected $68 billion deficit. Cross one’s fingers that the overheated economy Powell talks about is slowing down. Additionally, the California corporation tax rate isn’t the highest in the nation so there is a lot of room to get the state tax revenues where they need to be and hopefully take pressure off the jobs market that Powell talks about as well.

A lot of California’s tax revenue is from the wealthy who have most income from investment income so it’s pretty volatile tax revenue for them. It was like a $100bb surplus recently because of 2021 markets so a deficit now is not surprising if they increased spending since then (I’m sure they have). They should probably try finding more a stable tax revenue stream especially if the ultra wealthy decide to move out and change residency.

Related to CPI, I was at Costco today and got eggs. A box of five dozen eggs was $5.99! Down from $10.99 just a few weeks ago…and it’s been in that $11-13 range for years so not sure what happened. I haven’t seen it this low in a very very long time. 93 octane gas $2.99/gal, too…been a while since I saw a 2 as the first number (this is central FL btw). Not much relief in house prices here yet though…winter inventory lacking…

The fed will do what they said they’ll do… look at the data and respond accordingly.

The key, as always, is how they interpret the data.

Like the fed or not, they do want to kill inflation and they will

They also want high asset prices, low interest rates, no recessions, low unemployment, societal stability, and for the public to believe money will never be printed again. Which is more important when SHTF and compromises have to be made? They won’t get it all.

You can’t have artificially high asset prices and societal stability, as the former leads to massive wealth inequity, which inevitably leads to the latter.

More importantly, you cannot have an exponential increase in population, and then expect the average quality of life to be maintained without a similar increase in resources/energy. Sure you get incremental improvements in efficiency, but nothing that is exponential. Is what it is, math and physics win, period. eCONomics…, LOL, not so much.

Price Gouging Personified in Spades at Disneylaned

DM: The most EXPENSIVE place on Earth! Mother-of-two is left horrified by the sky-high prices at Disney World after she spent $70 on a bowl of CEREAL for her daughter at a Cinderella breakfast

Autumn Scott took to TikTok to showcase the hefty costs at the Cinderella’s Royal Table resort restaurant in Florida. Travel companion Kaitlin LeBeouf was left dismayed.

…perhaps time for the ‘princess’ to consider returning to her ‘rebel girl’ roots…

may we all find a better day.

I know there must be an obvious answer but why does the fed care at all about the markets or valuations? There is a ton of money and 70% of it is owned by 10% of the population. Tax cuts over the years and of course ZIRP and pandemic money just add to that. Of course wealthy people might pull money out and look for future opportunity or simply move it around but it isn’t exactly getting spent, outside a few billionaires proving they can do what the public sector did 80 years ago and try to sell that Mars is a future habitable world and such nonsense. On some level seems like a system somewhat out of control and just looking for the new normal.

Pricing of the asset market defines the financial conditions directly and indirectly.

Financial condition impact the spending and thus the inflation.

“Prices”…

Mmmm. So do you believe that we have a market that allows for TRUE PRICE DISCOVERY?

I think not.

Nothing short of a return to a constitutional democratic republic that runs on a balanced budget (fiscal responsibility) and actually prosecutes bad actors (instead of being bought and changing the “law” via K-street) will get us back to such a market.

Interesting times for sure, hedge accordingly. The math and thermodynamics of it all is what it is, and despite the best educated eCONomists are saying, my money is on the math and physics. “Finance” is simply a profession focused on extracting the value of other people’s labor. Not sustainable.

Bloomberg today:

“Meanwhile, the pace of inflation’s fall leaves it one percentage point above the central bank’s 2% target. —David E. Rovella”

LOL

I can’t quite comprehend the inflation/jobs data and how the market has been reacting over the last few months. I don’t see how the inflation is services is going to come back to 2% any time soon

Well, here’s a snapshot of how I’m cutting personal inflation:

Netflix is gone. Changed nail salons to save 25%. Stopped buying any extra food items. Changed banks to get free perks. And Xmas will be unremarkable.

Regarding Xmas, I’m not surprised they are not reporting the retail sales numbers daily/weekly as in previous years. I haven’t been out Xmas shopping yet.

Petunia, good for you!

I was taught, over 60 years ago: “Watch what those without wealth do, and then don’t do that”. Each individual has some control of their personal situations.

The U.S. stock market just moves with the DXY dollar index. Any news, earnings and unknown future events don’t matter one iota. Before 1993 news and earnings actually mattered. Before 1993 the stock market predicted the economy 6 to 8 months in the future. Today its just a three ring circus sideshow a pure ponzi just waiting to implode as the entire world gets poorer with each passing year. It’s the last of the ponzi’s as the Chinese real estate ponzi finally imploded after countless decades.

Because there is zero requirement for services inflation to be at 2%. None at all. Service inflation was 3% for much of the 2010s, with inflation as a whole brought down by lower goods inflation.

The only requirement is for overall inflation to be at 2% over the long term. There is nothing about service inflation reaching 2% in the short term.

Inflation being 3% is factually accurate – services coming in above that is only illustrating the difficulty and time that may well be required to bring the overall index down to 2%, it doesn’t diminish what the current level is.

My gripe with “hedonic quality adjustments” is that as you add more “improvements”/features to any *base* model vehicle, such as sensors, tablets, cameras, mechanical safety systems, power assists, etc. the likelihood of service goes up. There is a probability each of those features will break, and the more of them you have, the greater additive certainty of something breaking. Furthermore, the replacement cost for these complex improvements is not cheap. This *greatly* increases the overall cost of the vehicle over its lifetime. I believe this cost is captured in a separate CPI component, “Motor Vehicle Maintenance and Repair”. The problem is that the CPI weight for repair is 1.104, and the CPI weight for vehicle purchase is 8.083, so the actual cost of added features is not fully accounted for. The majority of repairs are applied to older vehicles that have less”features” that can break, so the reported repair CPI component is biased downward. Meanwhile, a console tablet may need to be replaced three or four times over the life of the vehicle due to aggressive poking at $1500 a pop for the Tesla Model 3, for instance. I believe this is a huge hole/flaw in the way “hedonic quality adjustments” are calculated.

JeffD – a corollary to the old engineering joke might be: “…if something’s truly affordable, it doesn’t have enough ‘features’, yet…”.

may we all find a better day.

It’s a Feature not a flaw. Intended to make something look better than it really is.

Hedonics is, in many cases, an excuse as far as I’m concerned. Yes, a modern car is safer, faster, and has better infotainment gadgets than cars from the 60s/70s/80s/90s. But the main use of the car and the underlying need of the consumer hasn’t changed. Regardless of bells and whistles, people buy cars to get around just like like they did decades ago. Since no bare-bones option is offered anymore, a car buyer has no choice but to buy the more expensive product. Since a car is a neccesary purchase for most people, it’s a cost of living increase any way around it. When the cost of the car goes up and the cost of replacement goes up (insurance cost), the cost of living goes up relative to the buyer’s income. Sure, it’s a better product, but that doesn’t negate the added dollars coming out of the buyer’s income.

JeffD,

How do we factor reductionism? For instance, the $1500 console in a Tesla comprises a majority of those features. Replace it and you have replaced all the buttons and knobs in other cars.

E-commerce is great, but AMZN lags behind July 2021 high.

Happy FOMC day folks. Here’s hoping Pow Pow pushes back against the market-expected easing. #ShortTLT

I hoped too, and I was wrong.

Sorry, you got slapped hard by FOMC.

I wish and hope you smell the coffee and come back to your senses.

FED would start cutting next year and I can assure you, QE would also start soon.

Yup but took the opportunity to cost avg down.

The Fed has been clear that they are not ready to cut. The dot plots have a poor track record of being right. Powell also specically said no change to QT.

I hope you can find some stronger coffee; higher rates and a smaller balance sheet are in store for 2024.

As you’ve pointed out many a time, CPI data really would be far more useful if they hadn’t meddled in the healthcare data. Monthly fluctuations aside, overall it seems like goods are currently deflating and services / shelter are decelerating at a very slow pace.

Rent is an interesting one, it can hit a ceiling of affordability as people downgrade their requirements/expectations, but it is difficult to have an immediate deceleration when rental competition has only increased due to the current housing market. Restrictions on foreign (non domiciled) and corporate ownership could pop the balloon (so to speak), but it doesn’t sound like this is anywhere near anyone’s agenda.

Tighter fiscal policy as a whole would have helped a great deal also at lowering inflation, but doesn’t sound like that’s happening in any meaningful way any time soon either.

Something bugging me on your food comment – you’ve used a non-inflation linked index for food prices. It looks like 238 rose to around 304. But accounting for baseline inflation we would expect this to rise to around 302 anyway. It therefore looks like food prices have barely exceeded inflation over the last few years.

Sure we were in a period of high inflation, but given increases have moderated significantly and wages have also increased significantly to keep up with inflation, can we really call them “already high” or “painfully high”? Why should we expect food prices to undershoot inflation? You’ve made it a key part of the article but I’m not sure it makes any sense.

“… you’ve used a non-inflation linked index for food prices”

Huh??? What kind of BS is this???? The index for food prices here is THE CONSUMER RPICE INDEX FOR “FOOD AT HOME.” It’s THE INFLATION INDEX FOR FOOD. It’s the CPI for food purchased at stores. You don’t adjust the CPI for food by the overall CPI.

Wolf – your inflation index should really be indexed for inflation.

/s

And use a log scale for cryin’ out loud….

Adjust CPI by CPI to adjust the CPI by the CPI, so you can see that the CPI has adjusted by the CPI

It’s CPI’s all the way down :D

…CPI: “…Can’t Parse It…”? (…thank Wolf for keeping a breeze blowing amidst the smoke…).

may we all find a better day.

The table for food (groceries) says 1.7% yoy, but the paragraph above says 2.9% yoy. Is this a typo or do these represent different things?

Thanks

1.7% in the table is correct. The other one (2.9%) was a typo.

Jerome Powell has explicitly admitted that “inflation is a tax.” He and his henchmen are purposely using it as a tool to financially rinse the working classes, the retired and the poor while personally enriching themselves and their buddies. The longer they allow it to rage, the better it works out for them. However, they have to maintain a facade of “fighting inflation,” so it’s along those lines that their soundbites are curated.

Now they’re saying 4-5 cuts next year. You were right all along. Powell was never serious about fighting inflation. He had to pretend to politically save face and to make it look like he was concerned about the stability of the currency.

Ultimately, all he wants is to divert more wealth from the working people of this country to the elite.

Exactly. Guy is a f***ing joke.

This advanced notice of rate cuts will kill housing sales further. Now the buyers will say “don’t buy now because it will be cheaper to finance the purchase later”. Sellers will hold off their properties waiting for better financing so as to raise their price further. The housing market is dead now and will be deader in the near future thanks to JP.

RE agents will be lucky to get jobs at the local car washes vacuuming cars and wiping them down to get $1 tips.

“This advanced notice of rate cuts will kill housing sales further.”

Good point! We had that sort of reaction in the opposite direction, when the housing market went totally crazy in 2021 and first half of 2022 as the first rate hikes came into view, and people wanted to lock in the lower mortgage rates while they still could.

Uh-oh, Pow Pow seems to have done the bidding of his controllers. Expected it, sadly.

Unfortunately, the lessons from 70’s have not been learned and we have to repeat them to the powers-that-be.

Now we can only hope that inflation rears its ugly head and forces Pow Pow to retreat from any hints of easing till he actually gets the job done.

Or, they have been learned, and he desires this outcome.

“Never attribute to stupidity what can be adequately explained by malice.”

He’s a weak, spineless man, emblematic of those on Wall Street.

If he had been 5-10 years older, he would have been a draft dodger, no question.

I know many “men” just like him. They don’t know how to do anything but move money around. They have to hire plumbers to replace toilet flappers or electricians to put in a ground fault outlet.

They’re pathetic.

Wow if I look at Rent of Primary Residence, there are 2 years of .4 to .9 per month. Must be a least a 10% increase over 2 years, probably more. Renters usually pay utilities so that can’t be why rents increased. Taxes have not gone up by 10%, So I suppose landlords raised rents because renters had more money. And they probably lost money during covid rent pauses. And now that the news is saying personal income is rising faster than CPI (not sure which version). I am worried that landlords, and all businesses for that matter, will push through price increases. In other words, a second round of inflation. See Home Depot who gouged under the pretense of supply chain issues. Sure that was true originally but not ever since. Companies will get the highest price they can manage. So what else could cause a second bout of inflation I wonder?

“Must be a least a 10% increase over 2 years, probably more.”

Yes, at our central Florida apartment complex we had renewals coming in north of 20% and new move ins north of 25%. Unheard of increases in my 20 years.

“And they probably lost money during covid rent pauses.”

Well it was actually the eviction moratorium. We had more tenants so far in arrears that they didn’t care about their deposit and, as such, the apartment. So when we finally retake that trashed unit, it gets the full remodel. All new floors, appliances, cabinet doors, lighting etc. $3-4K. Now that unit comes back on the market $500+/month more. As opposed to our $500 clean, fix, paint turns and maybe a 5% increase. And so, across many communities, there was a significant increase in the number of higher quality and more expensive apartments.

“I am worried that landlords, and all businesses for that matter, will push through price increases”

We will if we can but our budget is flat for 2024.

Does anyone know the nutritive value of gasoline?

Be careful if you’re allergic to corn.

One thing that does not show up in the food inflation numbers is the declining quality of the food at the local grocery chains in my area. I do most of the grocery shopping and now have to go to three different stores to get my 15 basic items that I buy every week. Many times I have to return the items the next day because of the poor quality of the product I bought in a rush, just to get the hell out of these places. Many times prices are not even marked on the items to hide the price increases. Also, noticed an increase in panhandlers begging for money at nearly all the grocery stores.