Lowers GDP growth projections and PCE inflation projections for 2024.

By Wolf Richter for WOLF STREET.

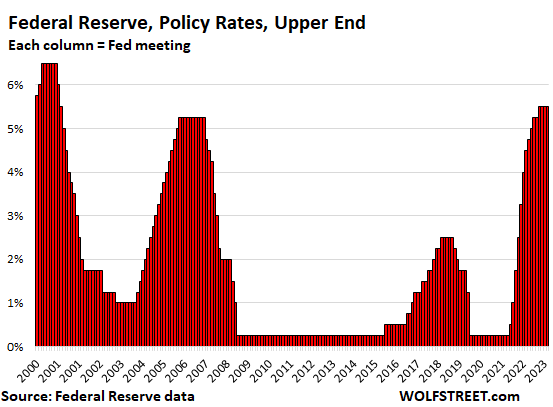

The FOMC voted unanimously today to keep its five policy rates unchanged, with the top of its policy rates at 5.50%. It was the third meeting in a row when the Fed held its policy rates, after the rate hike at its meeting in July. The decision had been widely telegraphed.

The infamous “dot plot,” where individual members of the FOMC jot down how they see the trajectory of policy rates in the future, indicated three 25-basis-point rate cuts in 2024, ending the year at 4.75% top of range.

Today, the Fed kept its policy rates at:

- Federal funds rate target range between 5.25% and 5.5%.

- Interest it pays the banks on reserves: 5.4%.

- Interest it pays on overnight Reverse Repos (RRPs): 5.3%.

- Interest it charges on overnight Repos: 5.5%.

- Primary credit rate: 5.5% (what banks pay to borrow at the “Discount Window”).

The statement changed a tad, by adding “any” to the key sentence, thereby toning down the chance of additional rate hikes, but leaving the door cracked open, just in case:

“In determining the extent of any additional policy firming (changed from “extent of additional policy firming”) that may be appropriate to return inflation to 2 percent over time, the Committee will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments.”

QT continues, with the Treasury roll-off capped at $60 billion per month, and the MBS roll-off capped at $35 billion a month.

The “dot plot.”

Three rate cuts in 2024. In its updated “Summary of Economic Projections” (SEP) today, which includes the “dot plot,” the median projection for the federal funds rate at the end of 2024 was 4.675%, or 4.75% top of range, so three 25-basis-point cuts by year end.

Of the 19 participants, 2 saw no rate cuts; 17 saw one or more rate cuts; 8 saw two or fewer cuts; 6 saw three cuts; and 5 saw four-plus cuts.

These are the projected mid-points of the target range by the end of 2024, compared to today’s mid-point of 5.375%:

- 2 expect: 5.375% (no cuts)

- 1 expects: 5.125% (1 cut)

- 5 expect: 4.875% (2 cuts)

- 6 expect: 4.625% (3 cuts) = median

- 4 expect 4.375% (4 cuts)

- 1 expects 3.875 (6 cut)

The median projection for GDP growth for 2024 dipped to 1.4%.

The median projection for “core PCE” inflation dipped to 2.4% by the end of 2024. The projections see core PCE inflation returning to the Fed’s 2% target in 2026.

QT continues, with the Treasury roll-off capped at $60 billion per month, and the MBS roll-off capped at $35 billion a month, as per plan. The Fed has already shed over $1.2 trillion in assets since it started QT in July 2022, and this will continue on autopilot.

I will cover Powell’s preconference in a little while. Stay tuned.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

All time highs in everything coming right up…the Fed caved…

The Federal Reserve always caves to Wall Street when they have the political cover to do so. Inflation has now come down enough that they have this cover.

CPI going to 10%!

Big tech at all time high despite my QT!

Recession is YET to come. Just ride along with some hedges. Don’t fight the Mkt. Fed has given up with dovish statement and rate cuts pivot for next year.

Next is FOMO mania near the year’s end. Santa rally after year end tax selling!

You guys keep hoping for a recession and ignoring economic reality.

There’s never going to be a recession if we keep expanding credit. It’s mathematically impossible

“There’s never going to be a recession if we keep expanding credit. It’s mathematically impossible.”

Exactly. They’re rendering the future of the young into profits today for pigmen, via monetary and fiscal stimulus. The national debt is exploding, and they’ve just stolen about 25% of our purchasing power (labor value) in a few short years.

But hey, the billionaires and hundred millionaires have become so obscenely wealthy and powerful that MISSION ACCOMPLISHED.

Dear Warren G. Harding:

It appears you see jubilation ahead, but I wouldn’t be so sure. Remember, even during the Great Depression, a very substantial number of families improved their lot in life. There are plenty of indicators to suggest the economy isn’t as rosy as you think it is.

It may be true that the Fed has figured out how to balance stimulus to maintain this economy, but even in the wealthy parts of my community, it is clear to see many people are struggling. Then we have the throw-away people- those many millions who have nothing and have grown desperately envious. I don’t enjoy being heckled by them as I am not much better off than they are.

Personally, I am wary of what is to come. I don’t see us being in a strong position, and regardless of whether or not we are the least dirty shirt in the world’s economy, the conversations people openly discuss about major social changes does not bode well for this nation’s elite class.

Mr. Powell is not our friend- unless you are one of our nation’s preeminent class.

I get the feeling that the two percent inflation goal is going to keep getting kicked further and further down the road. Why would you talk about lowering rates 3 times next year when you still have not reached 2 percent inflation? What is the purpose of loosening already loose financial conditions. I would really like to know how you see this ending Wolf. I know you dont like making predictions but The Fed seems not just feckless but reckless.

How do you guys figure they caved? They’re keeping interest rates up, continuing QT, and they continue to reaffirm they WILL NOT lower rates until they reach 2.0% core inflation.

I call that holding the line, in spite of everyone claiming they were going to cave. Sorry guys. Higher for longer is sticking until we have a recession or inflation comes down.

It’s the stock and bond markets that are caving and getting ahead of everything… stocks at all-time highs and 10-year rates down a full point????

🤣, you should know that, as per our honorable and beloved commentariat, the Fed ALWAYS “caves,” no matter what it does.

Are you serious? Powell has NEVER been serious about inflation…this is all one big joke…they are going to ram everything through the roof to monetize the debt…there was no reason to talk about rate cuts yet…but they did…as usual…housing up another 50% next year…food another 30%…they just keep changing the definitions to say there’s no inflation.

If they will not lower rates until they reach 2% core inflation, why are they talking about lowering rates by a full percent today?

Because they WANT inflation of 3-6% every year for the next few years to inflate away the debt and make the rich richer.

They just have to have plausible deniability.

Sorry, these are not serious people — to borrow a phrase from Logan Roy.

Signaling near-term rate cuts when core CPI is still 2x your official target, GDP growth is at 5%, and the labor market remains exceptionally tight?

There is no justification for rate cuts on the horizon, only an election.

Alba, exactly. You signal cuts when they’re necessary, not before hand when they’d be destructive, unless destruction is what you desire.

Powell wants inflation. There’s no two ways about it.

When did he say “higher for longer” today? I heard, paraphrasing the Q&A, “Yes, core inflation is sticky/entrenched at 4%, there is labor tightness and robust wage growth, but that’s not a good reason to not cut rates.”

Powell had every chance to push back on ultra easy financial conditions and what did he do? Added more fuel to the fire. I cannot help if you’re thinking this is ‘holding the line’

Don’t fight the Mkt.

Mr. Powell showed his dovish flags with coming pivot in rates ( 3-4 cuts). where will be his credibility if he punches a rate, next qtr. Mkt has to make that decision for him.

Meanwhile I am riding along with hedges, some investing but more trading. NOT going to wait for the recession like many.

To each his/her own

“they continue to reaffirm they WILL NOT lower rates until they reach 2.0% core inflation”

They affirmed no such thing. On the contrary, Powell today explicitly stated that the time to start cutting is “well before” the 2% rate is reached–lest they (gasp) “overshoot.”

(Overshooting, of course, is only acceptable to the *upside* where inflation is concerned–the people who bear the costs in that case are not the kind that Powell, or for that matter the DC press corps, meet at cocktail parties.)

All i know is I am gonna really miss my 5.25% HYSA that had a pile of cash in it. That was super nice to be compounding risk free. Guess I have to buy a house with my cash now.

Well put CCCB, some questions but still not a Fed pivot, even if the financial press starts up again with this dumb headline. A lot of us aren’t sure about the Fed’s direction here because theres been so much cumulative inflation and it’s still above target. And not like there’s anything special about 2%–it was a random idea from a meeting years ago, and with all the high inflation of previous years would seem to make sense to push the inflation below that level to at least help it to average out to the 2% since 2021, obviously now a lot higher. The way the US dollar just plummeted in value today shows the currency markets have doubts about the Fed’s determination on this, and with things as expensive as they already are the last thing we need is the dollar dropping and making imports even more expensive. Then again, with cheap options like Temu and Shein coming online and cheaper prices for both ICE and EV cars, it’s going to be a lot harder for Amazon and the big boys to keep spiking up prices like before, so at least the cheaper competition can help to put more down price pressure. Not to mention PPP fraud getting prosecuted and the billionaires getting more scrutiny on taxes, to help remove at least some of that excess liquidity from the system.

But still it’s not a pivot. The door is open in the future was the main point, including for rate hikes if inflation starts up again esp for things like rent and groceries, rent esp is just awful in a lot of the US now. At the very least higher for longer is here, borrowing is staying expensive and it makes sense to keep money in a higher yield savings account with the guaranteed gain. But mostly like you said, it’s the QT that matters. This was an even bigger loose monetary policy sin with covid than the overzealous rate cuts, it’s the QE with MBS more than anything that caused the US housing bubble that’s pricing out our kids even with professional backgrounds from getting a home. And the Fed is going full steam still with the quantitative tightening, that balance sheet is still rolling off. And thinking about it, if the short term rates hold steady or at least don’t go too much higher, that actually gives the Fed even more flexibility to keep pushing the effects of QT, doing more than anything probably to affect the housing market.

Attributing everything to Powell is an easy shorthand, but of course not accurate. According to the dot plot, I think two governors predict no cuts to FF rates next year, one predicts one cut next year, and 15 predict 2, 3, or 4 cuts by the end of next year. But I can’t currently tell which members are making which predictions and which ones who have predicted various cuts are voting members. See Figure 2. https://www.federalreserve.gov/monetarypolicy/fomcprojtabl20231213.htm

Which says nothing about what long rates might do. I would have vastly preferred it if Powell had mentioned the loosening the markets have done in the last month and a half through the drop in long rates and the bang up in indexes, and that these kinds of movements are a factor in their analysis, but I didn’t hear it. And that may have been a factor in the additional short covering that I think we saw during and after his speech. I’d love to see the bond vigilantes come back to life and reverse all of the last six weeks as a starter. 6% long rates and then some can still happen next year. They’re necessary for a lot of reasons.

Quoted from the article above, quoted, all you have to do is read it:

Of the 19 participants, 2 saw no rate cuts; 17 saw one or more rate cuts; 8 saw two or fewer cuts; 6 saw three cuts; and 5 saw four-plus cuts.

These are the projected mid-points of the target range by the end of 2024, compared to today’s mid-point of 5.375%:

Stocks are of course soaring today, and mortgage rates will have a 6 handle in the next few days. But, you see, this is what Powell wants, because it gives him cover to continue his bold inflation-slaying program of standing around with his thumb up his ass while conditions loosen and inflation rages well over 2%!

Opendoor up 20% today. We now know the 2% inflation target is a joke, the fed is happy with 3+ and that’s based on the phony inflation stats so it’s really at least 5.

Working class in this country is so screwed. Maybe they’ll go full Solent green on the rich boomers who destroyed this country, they’ll have to start hiring private security 24/7.

One can only hope! The middle class is so screwed.

Thankfully the elite were 20 years ahead in their strategic thinking and they implemented the patriot act so that they can monitor and track any opposition before it manifests into anything of substance. Gated communities are not new. The people you are talking about have not just private security, they also have the police who will show up at their house in 5 minutes or less (2 hours or more for the plebes), judges, and even the national guard to protect them if things go sideways. I’m sure the spawns of ol’ Blackwater are still around to provide a private militia for those who can afford it. I would bet money that rich people are much smarter on average than the general population (although I suspect that they are in decline themselves due to IQ lowering chemical exposure of our industrialized world and a life lacking challenge due to decadence, but still above the average). They knew that extremely distorted wealth distribution and accumulation would result in resentment over time that leads to being targeted by the have-nots. So why wait for it to happen when it’s undeniable to anyone with intelligence that it will happen eventually based on an accelerating trend. Techno-feudalism…………………….

Mortgage News Daily top of website already showing 6.82% on the 30 year, down 0.27% today. I don’t see it going back over 7% with the loosening we’re seeing in markets. 10 year probably will go below 4% tomorrow at this rate.

Ah, of course. I checked too early. I stand corrected, but not at all surprised.

And you and all the clairvoyants here “know” what Powell wants because???

Most of the “fed will cave” theorists in this commentary have been predicting the fed would cave for at least 6 months now and some for well over a year.

Hasn’t happened. Won’t happen.

As Yogi Berra said – “it’s hard to make predictions, especially about the future.”

He just caved on national TV!!!

I can’t help but laugh at all of the people who are saying the FED caved.

They caved by holding the line on rates and continuing QT. Only in bizarro, nutter world is that caving.

Logical people look at evidence and then make decide where the world is going. Illogical people already have their mind made up about where the world going and then seek out cherry picked evidence to support it.

Beg pardon, Wolf, I did read the article, but more like skimmed rapidly to get the gist, then wanted to see the dot plot myself, googled, went to the Fed’s site, forgot that you had already listed the governors’ predictions, and wrote my post, which didn’t add much. Thanks, as always.

Inflation was guaranteed to rage next year regardless of the Fed’s dreams. Deficit spending is inflationary and until congress cuts spending we will continue to have raging inflation. The Fed is chartered by a congressional act and is beholden to congress.

FED never cares about the asset prices skyrocketing. They only care about the consumer inflation, which never reflects the true increase in living costs.

On the bright side, now I can get back on my toes, someone just pissed in the cereal.

Based on today’s meeting, they don’t even care about consumer inflation unless it’s at or above double digits. Now they’re saying they need to make sure they don’t cut too late but inflation is double their target on their preferred measures. It’s game over, Weimar here we come. All to keep a corpse in office i guess.

What the hell is the matter with you people? The overall CPI is at 3.1%, thanks to the plunge in energy. So if it stays around 3% going forward, the Fed’s rates shouldn’t be at 5.5%, they should be lower, so maybe 4%. So if you think that inflation will stay at around 3%, the rates are too high and need to come down.

If you think that overall inflation will rise again and sharply, once energy stops plunging, and durable goods stop dropping, and services pick up further, then this will show up in the CPI readings (and PCE readings), and they will head higher, and then the Fed will hike again, and we’ll get those higher rates and higher inflation.

The only thing that will push interest rates up is higher inflation. You don’t get short-term risk-free rates that are permanently 3% higher than CPI. That doesn’t happen. That’s just nonsense to expect it.

Don’t be so sure the Fed caved. As an organization it has been around awhile and recognizes political realities. Did the Fed cut rates? No. Was the Fed being pressured by the WH to cut? Yep. So here is the bone guys…no rate cut, a little change in language and some movement in the dot plot. Ooooo, scary stuff. We are being “bungee jumped” by the Fed. While the Fed is making us run around in circles they are “normalizing” rates. Expect higher rates and the Fed to take back some of this nonsense next meeting, if not before.

Well said diving, I agree. Everyone so angry. I agree he should’ve struck a more hawkish tone, but nothing has changed. The word “any” changes nothing. Increases are still on the table, and there has effectively been tightening with the pause as inflation (temporarily) decreased. Everyone here is so worried about inflation taking back off but they don’t understand that will lead to more hikes. Let’s take it slow and avoid more bank failures that would undo everything and stop QT in its tracks. So much short sighted thinking here, has no one learned anything reading this site?

All time highs in stocks, crypto has been exploding, RE is next

Wolf, get the zapper ready for the press conference!

Pay per view, with slo-mo highlights for each zap, would be a big financial winner.

LOL, as I was watching the Q&A I went “zap” a few times, but it didn’t work. A couple questioners tied themselves up in knots to ask a convoluted questions in order, I guess, to look good to their bosses, both present and potential.

I think Powell needed a zap himself, seemed very happy with himself today. I guess he should be, but maybe hiding it a little better would’ve been more prudent. I see more bubbles in the coming weeks. Or will they burst all over our Holiday pies.

Those first two questions were extremely dumb and deserved a zap.

All he had to say was nothing has changed…..inflation still above range, economy still at full employment.

but…….his grandchild probably has those market calls someone bought last night.

Yep. The man is a thug.

I started to be very long few weeks ago. Even better that his grandchild … :)

You gotta get votes, Fed is independent but not so if you look back economic history books

lol

Housing prices are going to explode once those tiny rate cuts hit mortgages and buyers know its the only relief theyre going to get while facing doubling rents. Let the feeding frenzy begin.

The Federal Reserve looks at inflation minus food, energy & housing now (ie super-core inflation.) So if housing prices are rising by double digits they’ll just subtract this out.

Rent goes up $900 a month (50%), eggs are 50 cents cheaper (50%), consumers are paying the same for all goods and services! These people should be fed into a woodchipper.

The Federal Reserve has NOTHING to do with any price gouging by some greedy parties in the US economy.

I would imagine America’s Louis XVI moment isn’t that far away at this point. The current ruling class of the USA is one of the worst in history.

@SoCalBeachDude

What is price gouging? If you mean “businesses increasing prices because their underlying costs are rising”, then I agree. You think for instance that insurance costs will stay level when the cost of repairs is 30% more than in 2019? Wages are rocketing up and prices will follow.

Kinda ironic that they eliminate the three of the most important factors in monthly budgets to judge inflation, doesn’t it? I understand that they are “too volatile”, but still…

1. Price of gasoline collapsed. Do you want the Fed to think that inflation has gone away because the price of gasoline collapsed? Did you want the Fed to cut rates by 100 basis points at today’s meeting because the price of gasoline plunged? I didn’t think so. That’s why we have to look beyond the volatile food and energy components.

2. No they do NOT “eliminate the three of the most important factors in monthly budgets to judge inflation.” But they — and we here — look at various factors of inflation and groups of factors, including services, housing, fuel, food, used cars, durable goods, etc. to understand what the unlaying inflation is. “Core” inflation (without food and energy) is just one of them. And they (and we here) also look at overall inflation.

Read this, which explains it:

https://wolfstreet.com/2023/12/12/beneath-the-skin-of-cpi-inflation-november-core-services-inflation-accelerates-as-rent-cpi-glows-in-the-dark-insurance-spikes/

If you don’t need food, energy and housing and don’t pay for services, then inflation is quite low. Infact, goods prices are deflating.

No need to complain about inflation.

Services are 65% of the economy, housing is 30% + of average household spending, food and energy probably 10%. Who exactly are you describing, a caveman?

Lol

Like sand through an hour glass these are the dot plots of our lives!

Is there really any evidence that not cutting rates as inflation falls represents further tightening? When you take out loans, do you look up the current CPI/PCE value and subtract it to calculate the real interest rate, then decide whether or not it’s worth it?

CAPE ratio is still at a nosebleed 31, Buffet Ratio still at a ridiculous 167%..

Though a bit off the highs maybe, the bubble is still raging.. and they are thinking to cut interest rates?

Wow..

[BTW, every post I ever make seems to go into moderation first… was it something I said?]

Welcome to the club

Every recession starts after the Fed starts to drop rates.

Why is that?

Wall Street’s next demand will be ending QT. If rate cuts start in March, QT’s days are probably numbered too.

JPow must have read the CNBC article yesterday with 35 respondents to survey saying average of 85 basis points cuts next year beginning in June. They also see the Fed stopping QT in Nov 2024 and balance sheet bottoming at $6.2T (with bank reserves at $2.6T that are currently at $3.4T). I bet they will get what they want.

My next article, out later today, will be about what Powell said about maintaining QT while cutting rates. Pretty interesting.

Looks like the FOMC may fold like a cheap lawn chair. Looking forward to your next article, don’t hold back!

At its prior dot plot in September, the Fed indicated 2 cuts in 2024, now it’s 3 cuts.

In the 2022 dot plots, it indicated rate cuts already for 2023. But in December 2022, it shocked markets when it nixed the rate cuts for 2023 and moved them to 2024.

Why did this ruffle so many feathers?

Bottom line is Mkts believed him and the indexes shot up.

DJA is in record territory. S&P is around 70 points from it’s peak but of course Nasdaq has a long way to go. AI mania might pull it up by year’s end.

I was in fact highly disappointed by his out right dovish talk. But I have decided NOT to fight the mkt ever since October. Riding along with hedges. Still enough cash in 3 month T bills

Very much looking forward to it!

Wolf, in your next article, would you comment on Powell’s response to the question from jennifer at yahoo finance where she asked if the fed would wait until 2% was reached before cutting rates, and he said they would have to start cutting “well before” 2% was reached? That was interesting as he did not talk about needing to look at all the data in that instance. Thanks, Shocka

It would be totally nuts for the Fed to start cutting rates when inflation is down to 2%. With risk-free short-term rates at 5.5% and inflation at 2%, it would strangle the economy. It’s ignorant bullshit to even ask the question.

Powell should have Tasered her. ZZZZAPPPP. Next question.

Well, in the previous article, I commented I would bet my first and second born if Pow Pow would do the unthinkable and actually raise rates this time around and surprise the market…

Lucky for me and unlucky for longer asset valuation, guess I won’t have to give up my kids anytime soon :)

I mean, it’s good news I guess… I just wish they hadn’t allowed this all in the first place.

Huh?

This is a joke. I’ve had it. Screw wall street and this country. There was no reason for them to reinforce what wall street wants. The Fed is in bed with wall street as always. No surprise there. I wish I were young enough to leave this hellhole of a corrupt country. I’m done.

Only makes sense if Powell has insight to a massive stealthy deflationary phenomenon, already in progress.

Shiloh,

You are assuming that the Fed really knows what it is doing. What in the past 20 years convinces you of that?

When you look at US real growth/employment, the past 20 years are some of the worst in US history. Not Depression level bad…but more Depression adjacent than most of the past 250 years.

Rough guess…probably in bottom 35%-40% of those 250 years by those metrics (real growth, employment percentage growth).

“When you look at US real growth/employment, the past 20 years are some of the worst in US history. Not Depression level bad…but more Depression adjacent.”

In a depression, employment FALLS, plunges, actually. In a recession, employment FALLS. Employment grew by 19% over the past 20 years:

Prices have not declined that much, 2-1/2% for food, new cars. Gasoline is the only thing that has dropped considerably. Rent, Housing, insurance premiums still climbing. The 1980’s was the lost decade, Inflation for a decade. Deflation I believe happened after the Market Crash of 1987, the market lost half of it’s value in 2 days.

Wolf,

Has the homeless problem gotten better in San Francisco the past 20 years or worse? Also, have you worked any of those jobs that have been “created” in the past 20 years? Curious

1. Not sure about the 20-year span. But it’s gotten better from where I sit since the pandemic. But I was shocked when I went back to Tulsa for the first time since 2006, and stayed at a hotel downtown, and saw all the homeless people milling around in the otherwise desolate downtown.

2. I “created” about 100 of those jobs myself back in the day, expanding our activities and revenues over the years. And then later, I “created” my own job here at the Wolf Street media mogul empire.

“1. Not sure about the 20-year span. But it’s gotten better from where I sit since the pandemic. But I was shocked when I went back to Tulsa for the first time since 2006, and stayed at a hotel downtown, and saw all the homeless people milling around in the otherwise desolate downtown.”

I lived in a mid size city from 2008 thru 2021, it went from hardly any homeless to mass amounts. Along with a big heroin problem, surprised you can’t remember 20 years ago. How many depressed places have you ever lived in?

If i remember correctly you owned or worked at an auto dealership correct? I also worked in the auto industry for quite some time. My father ran the business from the 70’s until the very end. He told me the market was nothing like it was from the 70’s thru the 90’s in the early 2000’s. I worked for him from the 90’s thru 2010 and i can back up his observations, at least during that time frame. I can also state that i watched the aftermarket parts go from being made in the USA, to Mexico and Canada, to everything coming from China. First the Jobbers went out due to corporate owned chains, then a bunch of wholesalers started going out in late 90’s due to Pep Boys (which is funny because they hardly exist anymore) And now its dominated by debt saturated companies that should have went out in 08, but the credit markets were saved and those who ran off profits felt the squeeze. I feel its disingenuous sometimes, having watched the market get eaten up by those who had unlimited credit and then those who bought the market with that credit being bailed out. We keep telling you things are getting worse and sometimes it feels like you’re gaslighting us with charts.

If things were so great, why would we have to bailout student loans? If jobs were so great, why are those people having problems paying them back? If things were so great why would we have to keep rates at zero for a decade? If things were so great why is the tension in the country so high? During the great recession i didn’t know a single unemployed person, i now know four, yet the rate dropped in the last report.

1. “surprised you can’t remember 20 years ago.” There are lots of things that I can’t remember from 20 years ago, LOL. I don’t do homeless counts. The Tenderloin has always been bad. I walk through it, but I can’t tell whether it’s gotten better or not. Some parts of the city have gotten a lot better, others have gotten worse. Part of the problem is that chasing the homeless from one area (e.g. the old bus depot to tear it down) caused the homeless to move to other areas where you didn’t see them before. They just spread out. So homeless people might have moved into your part of the city after they got chased out of the old bus depot. So overall, nothing changed, but your corner looks a lot worse, and now there is a modern high-rise where the bus depot used to be, and the homeless are mostly gone so that part looks a lot better. That’s why anecdotal stuff is meaningless.

2. Fentanyl is starting to decimate the homeless population, it seems. We’re looking at 600 to 800 deaths a year, quite a few (many?) of them homeless.

3. “How many depressed places have you ever lived in?” I have lived in only one truly depressed place, and that was Tulsa. It went through a true depression during the oil bust of the 1980s – when all the oil companies moved their headquarters from Tulsa to Houston – and never recovered while I was there. It lost population. Young people left because there were no jobs. Brain drain was a huge problem. Home prices collapsed and stayed down for decades. Back in the late 1980s, there was only so-called fine-dining restaurants left in Tulsa (the Polo Grill). All others had died. It was really bad. It has recovered some now, and I’m rooting for Tulsa, but downtown was desolate when I went back.

4. Can confirm everything you said about the parts business. We were in it through our W/D, delivered into five states, biggest Motorcraft W/D in the area and many of our customers were Ford dealers, and we did well while I was there (through 1995); and we even distributed import sheet metal, but back then, the quality and fit were so bad that our body-shop customers constantly complained about it, and so we threw in the towel on import sheet metal. But the problems in terms of the part business were already everywhere. Lots of our jobbers went out of business.

5. In terms of your last para: There is no “need” for student loan forgiveness and much of the other stuff. These are just vote-buying schemes. During the Great Recession, a bunch of my best friends lost their tech jobs and lawyer jobs (partners!) at some point. It was bad. Now I don’t know anyone who lost their job. I know one guy who got aged out a few years ago and cannot even get an interview in tech anymore due to his age, at companies that are hiring young people hand over fist. He’s now retired. Anecdotal proves zero.

“Anecdotal proves zero.”

Perhaps, but rates at zero for a decade and on again off again QE aren’t anecdotal.

I don’t know what everyone is pissed off about. There were of opportunities to buy hundreds of cheap equities. Not only during the crash of 2022 (FB, Meta, Google, Netflix were shamefully cheap), but also throughout the entire summer and fall for three months when everyone was all bear doom and glooming.

No. Equities were only “cheap” if you knew that rates would return to ZIRP and that QE would resume. I guess the big boys knew that the “higher for longer” was a joke.

Yes, I am convinced this is all pre-programmed and set up for the wealthy and politically connected. Sounds like next year will be another push for “all up” and get that DC crowd re-elected!

You are complicit. I wish for some catalyst that takes down all of it. Stonks shouldn’t be the only place to put your money. You are too dumb to see that there is a reason for that. They can pull the rug whenever they want, and you will be left holding the bag. You aren’t one of them, so good luck.

Pretty much. When people buy stonks at absurd valuations, what they’re saying is that they trust the dollar even less.

That’s much more of a long-term problem for America than anything else.

I agree. I wish had the capacity to get my family out of here before this powder keg explodes. The American plutocracy is going to end the same way most of them do, in tears and blood.

I knew having a South American (Peru) spouse would come in handy some day. We’ll go play ball on her turf. Way cheaper and laid back.

It’s not really a surprise why FOMC members bootlick Wall Street CEOs like their lives depended on it.

Ben Bernanke is now making millions working for PIMCO.

Richard Clarida is now making millions also working for PIMCO.

Janet Yellen made over $7 million delivering speeches to Goldman Sachs, Citadel, PWC, UBS, Barclays & more between her service at the FOMC & Treasury.

They can’t afford to upset their future employers.

All of these people and more need to be on death row for treason and crimes against humanity. They are 100% intentionally destroying the US for their own selfish, rapacious greed.

Is it that the FED is corrupt, or is it that they are straight and there are just smarter people on Wall Street who can read the FED tea leaves better than you?

Weak people always whine and blame others for their failures.

White House weighs in again. Extend until 2025. Property tax hikes are already huge and the number of prospective buyers shut out of the market is huge. So the Fed rewards the gamblers again.

Wall Street doesn’t have enough yet. Nice campaign, eat what you kill.

People being shut out of housing is a feature, not a bug. Powell and the rest of them should be in gas chambers.

Absolutely. Large, angry young crowds should be shadowing Jerome Powell with a steel iron maiden adorned with his name. Instead, they were intentionally hooked on fentanyl and smartphones while the pigs stole their future.

Hahahaha. Go Depth Charge! You are the man. To this day, everyone is tuning in to the Fed like it’s the word from the bible.

It’s almost time to dig in. Away from the crowds into a place like the Ozarks where the breeze through the tree tops is the only sound. No big-city thinking allowed.

LOL…..

Trying to find others to blame for your failures?

It’s going to happen eventually. Not that long ago words like yours would have been extreme, now they are commonplace. Eventually America’s oligarchs are going to create too many peasants with nothing to lose to protect themselves.

My property taxes, actually went down a little here in Utah !

I am confused on why Pow would telegraph 3 rate cuts next year? Inflation is still above target. The health insurance premium will keep rising. No end for service inflation to end.

What does he see in the market/banking that would require 3 rate cuts?

Haven’t you heard? He’s the new Paul Volcker. Everyone says so. Signaling rate cuts while service inflation rages, animal spirits riot, and housing costs soar is actually courageous and hawkish!

^^This.

Powell is a total fraud. He CAUSED the inflation, then had the audacity to supposedly channel his inner Paul Volcker.

Powell is no Volcker, he’s a modern day Rudolf Havenstein. Curse Powell, curse him to you know where…

Inflation rages?

I think you don’t know what the word “rages” means. 3-4% inflation is not “raging”.

He didn’t say that. The SEP is made up of predictions from all the FOMC members.

He specifically said they don’t deliberate on these predictions, they just poll the FOMC members and the dots are each of the members’ individual predictions.

I understand, just using Pow as a stand in for the median. I read the article.

For the record, I too was disappointed the dots, on average, weren’t higher for next year.

My TLT puts are getting smacked down right now LOL

Well, he didn’t say anything about the loosening of financial conditions which actually matters, instead he wasted a couple of lines on things “they don’t deliberate on”. What does that tell the market? The whole thing was just nonsense.

In his (extremely grudging and halfhearted) defense, the apple polishers in the press corps didn’t exactly press him on the loosening of financial conditions. Or soaring rents, or the rebound of house prices to near their 2022 peak, or anything that you would expect actual journalists to press him about.

He just said their theory that high inflation was due to supply chain issues and he said it appears they were correct.

Commodities have crashed this year. So maybe his was correct?

And stimulus. You can bet if the government were still handing out free checks to 90% of Americans, and paying the unemployed more money to stay home than look for a job, prices would still be accelerating through the roof right now. The clogged supply chains were a symptom, not the root cause.

I completely agree. The supply chain hiccups and inflation were both RESULTS of overstimulus. The media has done a good job covering for our policymakers if this isn’t obvious. Not the other way around. The level of business that hit our company and its suppliers in early 2021 was absolutely stunning. Everyone wanted everything all at once. It’s still not fully back to normal. Once manufacturing and shipping processes were overwhelmed, the ripple effects went on for months. These industries just don’t run with a lot of slack capacity sitting around. It didn’t take much to bury shipping, steel, trains, trucks, etc to the point of bidding up prices to get allocation.

Tom Keene on Bloomberg TV said he got goosebumps during Powells press conference. He never thought they would be so dovish. He was totally surprised by the dovishness. He thought they would be higher for longer. The other host said this is not the Volker like talk from the Fed chairman from a few weeks ago.

They basically said so many economists got it wrong with calling a big recession this year (Does JP Morgan Mike Wilson ring a bell?) lol They will all have to revise their 2024 outlooks to up the upside. This is the turning point for MMFs. Will people start moving out of cash and into risk.

They ended by saying this was a pivot party and everyone is invited.

Screw wall street. I hope something takes it down, and I don’t care what.

RTGDFA. “Powell” isn’t telegraphing anything. The dot plot is just a poll of what FOMC members are predicting. It isn’t a commitment, it isn’t a preview, it isn’t Powell’s wishlist or anything of the sort. And it’s been wrong plenty of times, including in the recent past, so you should take it with ample salt.

Regardless of the dot plot, if inflation moderates in the coming months, they’ll probably cut, and if it re-accerates, they probably won’t. It’s that simple.

You don’t get it. It’s not just what the do but what the market thinks they will do. You don’t telegraph that to the market that is already salivating over rate cuts. The majority of them see rate cuts. The market is reacting accordingly which will screw the middle class as always. Yields are probably plummeting. I can’t even look I’m so disgusted.

Yields are plummeting. As someone with the bulk of his assets in a 6-month T-bill ladder, it’s going to hurt on Dec. 21 when it comes time to roll over a batch. And as someone who has spent the last 3+ years trying to buy a house (hence why I’m holding a lot of cash, since keeping down payment money in equity markets at these valuations seems foolish) without needing more vasoline for my ass than it can hold, it’s also going to hurt as home prices probably go up again over the next few months as well.

But the Fed’s mandate doesn’t include keeping a choke-chain on the markets, and nobody can control what the markets do anyway. Markets go up and they go down. Bulls are parading and the markets are up now, but this may just mean they fall harder and the markets go down more at some point in the future.

I’m in the camp that thinks inflation is far from over. But I’ve been wrong plenty of times before, and what if I’m wrong this time? Inflation HAS come down significantly in the last 18 months and maybe Fed policy has been sufficiently restrictive for it to continue to do so. Ordinary human cognitive bias would suggest Fed members are probably inclined to attribute the easing in inflation to their own efforts. But even if they could put this bias aside, are they supposed to deny what most see as a positive trend and continue sending hawkish messages—at the risk of spooking the credit markets and producing more unemployment—in order to keep asset markets at bay to please us bears?

I wish they would, but this doesn’t seem a reasonable expectation.

Right. The FED engages in what is commonly referred to as “jawboning,” which is to move markets without actually doing anything. Today, they “jawboned” this sh!t out of markets and speculators and everything, attempting to push asset prices even higher in their precious “everything bubble.”

They had absolutely NO BUSINESS talking about rate cuts, yet they did it. They want these bubbles. Today’s FED is a bubble-blowing machine for the wealthy, society be damned. They are treasonous filth, and a cancer upon society. We have treason laws, yet these pigmen currently operate above the law.

DC – they didn’t really talk about rate cuts tho. These reporters are putting words in Powell’s mouth. One was definitely trying to bait him into explicitly saying “if x condition is met we will cut” and he swatted that away.

I agree Powell should choose his words more carefully – but only because the reporters are morons and only hear what fits their imminent rate cut/QE fantasy.

I agree with MM here. What Powell actually said, and how it gets spun through the mainstream financial press, are often two different things. We saw the market get ahead of itself the same way in early 2023, and it got burned for it late summer. This could very well play out all over again.

@shangtrOn watch the existing home sales volume. Inventory is high, though based on Wolf’s CPI coverage yesterday, I lost some confidence that housing prices will fall. However, price increases are typically proceeded by several months of volume increases and volume right now is near housing crisis lows.

Depth Charge, you need to look up the definition of treason.

You can continue to recklessly use that charge incorrectly, but it won’t make it right. It only makes you look like an angry fool who doesn’t know what they are talking about.

Seriously stop. Better yourself. Educate yourself. Get you head out of the echo chamber.

I don’t think you understand what telegraphing means.

My main point is we are finally back to normal rates. Why would any of the FOMC be predicting rate cuts at this point when we are still way above target inflation. Are they expecting a huge correction or deflationary event? Makes no sense to me otherwise.

Wouldn’t we need less then 2% inflation for a couple of years before we average 2%?

“Wouldn’t we need less then 2% inflation for a couple of years before we average 2%?”

I don’t think that’s the way things work. What people are hearing is that the moment inflation hits 2% even once, it’s party time.

Deutsche Bank is predicting cuts of 1.75 to 2.00 percent in the Fed funds rate in 2024. Source Wion News the most unbiased news there is outside of America.

Deutsche Bank would certainly love that, talking its book. They have a big presence in the US.

In my opinion, the US is finished as we ever knew it. The bankers and politicians will make sure of it. The speculators won.

We seem to be at the beginning of a new age of revolutions. I’m glad I’m not draftable age anymore with these psychos in charge.

Sub – very sad to say, actual, bareknuckle, revolutions don’t really observe one’s ‘civilian’ status. (Gil Scott-Heron prediction to the contrary, though, they seem to be partially-televised)…

may we all find a better day.

Revolution is the opiate the masses!

bulfinch…………the masses are already using real opiates. No nation of drug addicts will ever be able to stand up to their drug dealing masters.

I agree. I don’t recognize this country anymore.

Your opinion is worth exactly what I paid for it.

Actually it is worth less than that because it will cost a person lots of money following it.

I have just become curious now what will break in the upcoming 3years moving forward this type of odd economy.

I can only see that the bottom 75% of the population will just become poorer while folks like me will see another (x) multiple of net worth appreciation like we experienced in the last few years.

I hate to break it to you kracow, but if you own homes and the renters pay you multiples more rent in confetti, your wealth didn’t multiply. If the value of the homes went from 500k to 10 million, but the money isn’t worth anything then you’re being destroyed too. :(

Sold 75% of ours homes / multifamily in 2021 – 2022, trust me doing fine.

Sure I’m being destroyed on some level but not on a level I can see or feel as I past that milestone in 2017 where time is far more valuable than money to me.

I hope it backfires on you. It will eventually.

So not really “higher for longer”, but only higher for a while, then cut.

This is a big change. Bull market begins from now.

At its prior dot plot in September, the Fed indicated 2 cuts in 2024, now it’s 3 cuts.

In the 2022 dot plots, it indicated rate cuts already for 2023. But in December 2022, it shocked markets when it nixed the rate cuts for 2023 and moved them to 2024.

Which begs the question, why even have such a nonsensical mechanism? They’re just fuggin’ jawboning, and you know it.

Jawboning is one of the official tools in the Fed’s toolkit.

‘Jawboning is one of the official tools in the Fed’s toolkit.’

And it WORKS!

“Jawboning is one of the official tools in the Fed’s toolkit.”

Indeed it is, and that’s why so many feathers are ruffled around here today. The FOMC knew full well that today’s dot plot would be read as a pivot signal.

The markets were delusional when they rallied in summer 2022, but it’s not summer 2022 anymore. Like a stopped clock, they had to be right eventually. Today’s FOMC announcement is a fully deliberate message to them that they’re very, very close to finally being right.

Pea Sea,

You are exactly right. Powell knew it would be read by wall street as a pivot. That’s what he wants. He is in bed with wall street. That’s why many of us are so pissed.

What the hell is the matter with you people? The overall CPI is at 3.1%, thanks to the plunge in energy. So if it stays around 3% going forward, the Fed’s rates shouldn’t be at 5.5%, they should be lower, so maybe 4%. So if you think that inflation will stay at around 3%, the rates are too high and need to come down.

If you think that overall inflation will rise again and sharply, once energy stops plunging, and durable goods stop dropping, and services pick up further, then this will show up in the CPI readings (and PCE readings), and they will head higher, and then the Fed will hike again, and we’ll get those higher rates and higher inflation.

The only thing that will push interest rates up is higher inflation. You don’t get short-term risk-free rates that are permanently 3% higher than CPI. That doesn’t happen. That’s just nonsense to expect it.

And what a truly punchable jawbone it is.

@Wolf it’s a net of 2 more cuts. The last projection included another raise at the December meeting which was canceled. The table in the SEP says 5.1 Sep -> 4.6 Dec.

Thanks for the factual coverage, and the chart, Wolf.

Much of the consternation voiced by the less patient side of your readership centers around the 3rd hump in that chart.

Borrowing a term from behavioral science you might call it: “premature de-escalation.”

It’s a confidence killer to us believers that markets set prices…

Same exact fed chair. TDS goes both ways friend.

I am not your friend. And I was not talking to you.

I picked the part of the chart where the Fed backed off of it’s course toward normalization, wabbling right back to the unhealthy pump-priming activities that have led to today’s persistent inflation problem.

Not sure where the “orangmanbad” came from, but that was not in my head.

Respectfully

What on earth are you talking about? John H said nothing about any orangeman, bad or otherwise. Please try to reply to people’s actual comments, rather than the voices in your head.

John H

“It’s a confidence killer to us believers that markets set prices”

LOL!

That notion I got disabused more than once I can count on, since March ’09 when the Fed murdered our good ole Free Mkt Capitalism in open day light. No one protested. Now it is CRONY Capitalism

I made a lot during great Financial crisis by following game rules (prior to March ’09) and then a lost a lot (of my profits, since then) This is the most anomalous Bull Mkt of my life time. (been in the mkt since ’82)

Fundamentals mean nothing. Front running and speculators got rich during QEs, ZRP,(for over a decade) stimuli, twist and what not.

During 2020, Mr. Powell was still buying 120B/month MBS+Treasury when inflation started to rise. He also dumped 4-5 trillions into the mkt. S&P recovered from 35% drop. Concept of risk is a joke in the current capitalism in America. NO significant loss is allowed, only gains.

Sunny129-

You are right. I should have said “those of us who believe markets SHOULD set prices.

Sloppy delivery.

Or maybe premature ejaculation…

Did I miss something here? Isn’t core services inflation still cooking? Ummm rate cuts? Guess I’m just slow witted but certainly seem like guidance to over inflate assets, housing, etc. to keep the fire going.

It’s disgusting, isn’t it. Corrupt worthless country. And at the pace they are doing QT, why bother.

You did miss something.

Rates were not cut.

‘Higher for longer because we learned from the 1980s fiasco’ just morphed into ‘history is repeating itself.’

Not looking forward to the upcoming surge in inflation and the resurgence of unbearably restrictive monetary policy to follow.

Central banks universally win the award for dumbest smart people on the planet.

Fed dual mandate:

Support asset prices and GDP growth?

I see that commodity prices have come down near pre-pandemic levels (sugar, wheat, oil, copper)… plus the recent inflation (5-20%). With geopolitical tensions not cooling, I think commodity will not keep cooling.

I have not seen or heard of rent, healthcare or education coming down at all. Wages and service costs will likely remain elevated and increasing.

I didn’t live through the 70s, but I am shopping for bell bottoms.

Counterargument: Commodity markets are global end there’s now DEFLATION (not merely disinflation) happening in China, the second largest economy in the world.

Side note for Wolf: is this within the range of subjects you cover and, if so, any chance of an upcoming article on it? I’m finding very little about it in publications I can trust, but it seems like a pretty big deal.

I have heard the alarm bells of deflation being sounded for over a year. Mike McGlone of Bloomberg was recently defending his stance on this point.

He reiterated commodity deflation and that he is correct, just early. That others on the team who called for asset price correction and recession are correct, just early.

When you bring China into the conversation I am reminded of the geopolitical unrest and shadow wars underway.

We blame them for the “whole mess”’ and are still fighting communism, terrorism and the war on drugs. Except that we are funding the entire world, letting billions out the door for “humanitarian reasons” and failing to keep basic control of our borders, letting Chinese fentanyl kill our nation.

The wealthy elite are convinced about the environmental catastrophe and that overpopulation is a problem.

Overconsumption is more like it (12 billionaires create the same environmental impact as 2 million people, the headline reads).

I see global depression… after another decade of global currency debasement, hot wars and “financial engineering.”

Howdy Folks. Relax, do not forget about Maestro. .75 basis points up or down ain t that much anyway. Greenspan was up, down, sideways, down and up AGAIN. 34 trillion in a matter of hours, so, nothing has really changed………….

The Federal Reserve already committed to lowering rates to 3.50-3.75% in 2025 and 2.75-3.00% by 2026. That’s a lot more “insurance cuts” than just 0.75%. And if implemented in a soft landing, it would be the most loosening outside of a recession since the 1970s.

The Federal Reserve still believes the neutral rate is only 2.5% (0.5% + inflation target), something which not even the bond market believes.

Howdy Jackson. The .75 in 2024 is not much either way. Who knows what THEY will do in 2024…… Long way to go, and my crystal ball shows Disco time once again. Years before we will know……….Maybe decades????

Jackson Y

“The Federal Reserve already committed to lowering rates to 3.50-3.75% in 2025 and 2.75-3.00% by 2026.”

“Committed” is complete total utter bullshit. Those were median projections that constantly change and that mean nothing for the Fed. For example, in the 2022 dot plots, it indicated rate cuts already for 2023 (you would say “was committed to rate cuts in 2023”). But in December 2022, it shocked markets when it nixed the rate cuts for 2023 and moved them to 2024.

You’re abusing this site to spread falsehoods!!

Why does year 2001 show twice in the chart?

The columns are not “months,” but meetings. Each column = 1 FOMC meeting at the date when the meeting occurred. There are normally 8 meetings per year. So that would line up with the calendar years. But 2001 had 11 meetings, including three in-between meetings with rate cuts, for a total of 11 meetings, which causes “2001” to show up twice. Kind of a drawback of having the columns line up with meetings not months. But showing the meetings rather than the months makes more sense to me.

Jpow’s answer to Nick Timiros was very telling:

He said the Fed doesn’t pay attention to what the market thinks (referring to fed fund futures and rate cuts ‘priced in’), and that the market will eventually be in line with Fed policy.

Aka don’t fight the Fed!

Right, which means that if the “markets” want ZIRP, all they have to do is price that in, and the Fed will follow.

CCCB – I generally agree with your comments, but disagree with your wording here:

The Fed is not ‘following’ the market – other way around, the Fed sets policy, and the market is eventually brought in line with Fed policy – whether it likes it or not.

That’s my interpretation of Powell’s answer to this question: long rates will eventually be forced up by Fed policy

Those speculators in the bond market may just be setting themselves up to get BTFO’ed again, like they were this past summer. As another commenter said above: patience. If we’re right that the still-high levels of core inflation indicate that the fight isn’t over, that will prevail over the Fed in the end.

Has anyone researched how reliable “dot plots” have been at predicting future events?

Depends how far out you are asking. For example, the June 2021 dot plot was way off for end of year 2022 and 2023 predictions, which the median was under 1% for both for FFR. The Dec 2022 dot plot had year end 2023 median in low 5% range, which ended up being right. So it seems if it’s guessing out 1 year in advance or less it’s a lot more useful than 1.5+ years out.

It’s highly asymmetric. Historically, tightening can be canceled (for example, the last 2023 hike), but loosening is almost always guaranteed out of fear of upsetting the markets (see 2019.)

In fact, after today’s meeting, the bond & federal funds futures markets went from pricing in 1.125% to 1.5% of rate cuts next year. If the Federal Reserve relents, markets will ask for more.

I have a LIRA that comes due up in Canada in June 2025 so expect interest rates to be near rock bottom then.

Or inflation could rage back up, just like it did when Volker paused, forcing the Fed to hike again as Volker did. I think this will be the most likely scenario now that financial conditions have eased so much.

The Fed has printed too much money and lost control of the economy.

I’d put my money on this scenario, but we will see how it plays out. There’s a few comments in here about working class getting “screwed” and all that but I’m reading this from across the border and we also have inflation problems here like most other countries, our job creation, GDP and wage growth isn’t keeping up with US though, I think much more of the “screwing” is happening outside the US.

Oh trust me, we are getting a good reeming here in the good old US.

And the drunken sailors epic bender will continue unabated!

Today’s FOMC meeting was such a big middle finger to Main Street.

Inflation can be below-target in a recession, OR in a healthy economy like the 2010s, when PCE ran at 1.5-1.9% alongside positive employment & GDP growth.

If the Federal Reserve were serious about their 2% “average inflation” target, they would allow a period of slightly below-target (1.5-1.9% PCE) inflation IN THE ABSENCE OF A RECESSION – not a hard promise to make – to give exhausted consumers some breathing room.

But they weren’t even willing to do that. Core inflation running at 3-4%, already talking about cutting. They have to please their Wall Street masters.

I can’t even describe the level of frustration I have right now. I have nothing else to say.

“I’m not advocating violence…”

Aren’t you the fella who suggested putting people in gas chambers???

No. I suggested that they deserve that. I didn’t suggest anyone do it.

I feel vindicated with todays’ FED dovish stance. I have been clamoring that FED would give out dovish signals to support market and here we are.

It is a slap on the face of those who believed in FED’s explicit mandate to curb inflation.

The inflation would be controlled, either naturally or by govt manipulated metrics ( remember infamous coming health care adjustments to spike cpi ).

The FED would make sure the asset holders won’t suffer even an iota.

People who believed in FED’s explicit mandate has done great disservice to their financial health.

I already predicted, FED would cave sooner than later and do rate cuts. Here we are.

At its prior dot plot in September, the Fed indicated 2 cuts in 2024, now it’s 3 cuts.

In the 2022 dot plots, it indicated rate cuts already for 2023. But in December 2022, it shocked markets when it nixed the rate cuts for 2023 and moved them to 2024.

Wolf

What does this mean to an average investor?

Look, if the Fed lowers the rates some in 2024, and the economy purrs along and inflation re-accelerates, which is more likely with lower rates than higher rates, the Fed will respond by putting the rate cuts on hold, and might be hiking rates again.

This is the playbook of the 1970s and 1980s: Fed hikes, inflation drops, Fed cuts, inflation resurges, Fed re-hikes and higher this time, etc. We had three of those waves back then, I believe. Maybe more. Rate cuts and exuberance is what inflation needs to thrive.

But overall inflation is pretty low right now, after the energy price plunge, so it’s OK for the Fed to give some and see if inflation comes back up.

The underlying stuff in CPI wasn’t good, and if we get a few more months of this stuff, the Fed is going to put those rate cuts on the back burner. It did that at the end of 2022, when projected rate cuts for 2023 were nixed. It’s still all about inflation, no matter what the markets think. Powell made that clear today for anyone who listened.

Thank you

Wolf,

Is it possible we see a repeat of the Jimmy Burns era of Fed policy? A bit dismayed the Fed is reading the future!?, or gaming the future!

You mean Arthur Burns?

If inflation rebounds, they’re not going to cut. Burns made the mistake of cutting rates as inflation was surging.

The current Federal Reserve will run as loose of a policy as they can practically & politically get away with.

Yes I did thank you

That was a pretty darn dovish press conference from what I just listened to.

Powell almost said without saying the inflation fight has been won. He reiterated countless times how fast inflation is coming down and does not seem concerned with service inflation at all, only pce.

They are also forecasting a quite low GDP number in 2024 and expect a significant slowdown ( we have heard that story before). The 2 and 10 year yields are currently racing one another to get under 4%.

The CME now has the year end 2024 forecast at 4% with 3.75% coming heavily into the picture. You give wallstreet an inch on lower rates, they want a mile. If the Fed goes back to 2.5%, wallstreet will want 0 and zirp again, you know wallstreet wants it back. Its almost a joke that Janet Yellen almost laughed off the 34 trillion dollar in debt this country has. What’s the US debt going to look like in 50 years when these peoples grandchildren are old adults. And how are we going to manage exploding debt if inflation takes off again.

Well this sets things up real well into next year because Powell has basically become the opposite of what James Grant thinks. Shall inflation reignite with a vengeance after all these rate cuts, Powell is going to be in the same sentence with Benedict Arnold, not Arthur Burns.

If we go back to severe loosening and God forbid zirp, this country’s debt is going to explode, not drift higher, but explode like a rocket higher. And inflation will explode right with it.

Trump spent 9 trillion in a 4 year term last election and already publicly stated he will jawbone the fed to lower rates as much as possible if republicans win in 2024. Anyone want to guess what Trump and the republican party will spend in another 4 years if they take back the house and senate? Ill put the over under at $15 trillion by Trump in 4 years, smashing his old US president spending record which currently stands. It looks like the drunken sailor party will go on. And I think Biden will spend a ton of money too if he retakes office.

The only thing that can possibly slow down either party from insane future spending is higher rates.

Were you listening to some other Fed press conference today? Powell explicitly said the inflation fight is /not/ over and there is still a lot of progress that needs to be made.

People don’t listen to Powell ever, LOL. They just make up the stuff he said.

Take a look at the US treasuries and you tell me? Take a look at the rate cut expectation by the CME and you tell me?

This is how Powell opened the press conference.

“Inflation has eased from its highs without a significant increase in unemployment. Inflation is still too high and ongoing progress is not guaranteed and the path forward is uncertain”

Well know kidding here, all that is correct.

Then, he says this in response to Steve Liesman who was like the 2nd question asker in the press conference. Powell says

“The question of when to start dialing back policy restraint, that CLEARLY is a topic of discussion around the world currently and was a topic of discussion in our fed meeting today”

So just so I understand the captain of team transitory and what he is saying here. He came out and said he is quite uncertain of future inflation in the opening press conference. Then he said they were talking about rate cuts at their meeting today. You don’t see a problem with this language? Well guess what, yields nosedived after he said that to Liesman.

But what will rates do when interest is not cut? There’s a difference between talking about cuts and actually applying them as we’ve learned in 2023.

If Powell was really serious about his statement that inflation fight is not over yet. Then, keeping in mind how the financial conditions has loosened so much in last few weeks, he could have given a 25bps surprise hike.

On top of it, by WR’s articles: job market is hot, service inflation is hot, spending is hot, home prices flirting with ATH.

Instead, he is showing signs of caving in like he did in 2019 for no reason.

The market is able to catch his sham and thus flirting with ATH.

what was needed a little symbolic gesture.

Sadly this, and it’s so true, the pivot-mongers are a broken record. Powell and the Fed have been loudly sounding the alarm that inflation is still a problem and they’re still prioritizing fighting it. That hasn’t changed and higher for longer is basically a certainty now, even another rate hike potentially. Credit is staying tighter and more squeezed than it’s been in decades, reality is the end of the cheap money era. And like JPow said there’s a delayed effect of the rate hikes that’s only now really starting to be felt. But the dumb narrative about the pivot continues. And it’s still not clear this will do much to help equities because the bottom line hasn’t changed. Credit is more expensive and staying that way, that’s going to affect companies and consumers so the valuations have little to stand on. Interest rates weren’t very high back when the Nasdaq and tech bubble collapsed in 2000, or in 2008–equities still fall when they don’t have a leg to stand on, and when the mania doesn’t keep pace (in those cases with credit challenges that were a lot looser than they are now).

The most worrying reaction today was maybe the way the US dollar dropped, it basically plunged despite Powell being at worst balanced, maybe even at least mildly hawkish when putting everything together. If the USD continues to plummet like that it’s going to make tons of things more expensive and then we’re right back in worsening inflation territory, things become even more unaffordable for Americans and we start getting bad social unrest as more people can’t afford homes or food anymore. The Forex markets seem to have doubts about the Fed’s determination but this leaves out maybe the biggest thing JPow and the Fed did, even more than the interest rates–continuing to push hard on QT. That’s where the real action is and with interest rates at least not going much higher, that actually gives more flexibility on the QT side. And that more than interest rates is what pops the housing bubble and other asset bubbles. That above all is something that needs a lot more attention.

Powell clearly knows that the Market will not listen to him literally (especially the case already happened several times recently), instead will grasp any dovish message he released. If he really want to emphasize “the inflation fight is /not/ over”, he would not behalf that way.

So the only explanation is that he *deliberately* wants to signal the market that pivot is coming. To repeat his literal word is irrelevant.

“Powell clearly knows that the Market will not listen to him literally (especially the case already happened several times recently), instead will grasp any dovish message he released. If he really want to emphasize “the inflation fight is /not/ over”, he would not behalf that way.

So the only explanation is that he *deliberately* wants to signal the market that pivot is coming. To repeat his literal word is irrelevant.”

That is the most illogical statement ever.

You are basically saying g it doesn’t matter what Powell actually says, he means what I say he means regardless of what he says.

Silly.

It is like the button conspiracy theorists saying the lack of evidence is evidence of the conspiracy.

Sorry if I missed this. Having a hard time understanding a lot of it, but I went back and read your Feb 8th article. In there is, “The Treasury roll-off has been near the cap, but the MBS roll-off has been far lower.” Is this still the case today and if so why?

Read the whole thing, it’s based on the most current data. It will answer your questions:

https://wolfstreet.com/2023/12/07/fed-balance-sheet-qt-1-23-trillion-from-peak-129-billion-in-november-to-7-74-trillion-lowest-since-april-2021/

Because the Fed will continue QT, can I assume that long-term interest rates (i.e. 10 year) and interest rates on MBS will continue to trend higher over the next several years?

That is a supply/demand question.

Continuing QT means demand from the FED is dropping. However the FED is not the only market participant. Other actors may pick up the lost demand. Maybe not.

Fed Reserve is making decisions based on bogus inflation numbers.

I just returned from dropping off a load of construction debris at the landfill in Atlanta, GA – they just raised the dumping fee from $35/ton to $55/ton.

That’s a 57% increase. Just anecdotal but it seems like it never ends…

Many prices including oil and gold are plunging into the basement.

Gold up 2¼ percent today to over $2,000/oz. Not exactly “plunging”.

Food and insurance skyrocketing, so what’s your point. Maintenance through the roof on almost everything. Housing prices unaffordable from the corruption during the past three years.

Someone else addressed gold.

Whats been happening with global GDP growth rates?

“Dont fight the FED”, the most important words in investing.

The 2-10 spread shrunk big today. When it un-inverts it will be much too late to get easy money.

I don’t understand why so many here scream about the FED🥺. To me that is like screaming about gravity.

You’re an idiot. Gravity is a force of nature, not a force of corrupt thugs.

Einhal,

You said of me, “You’re an idiot. Gravity is a force of nature, not a force of corrupt thugs.”

Einhal, can not you see that your constant ranting about the fed and your affect on gravity are about the same? None.

Beyond the fact that the fed doesn’t even know you are alive why are you here? What do you get out of all the time you spend here?

Are you here to learn so that you can make money? Are you invested? If you are do you control your investment strategy? If so why don’t you describe your investment strategy so others have an opportunity to benefit.

Constant meaningless ranting does nobody any good, including you.

Many of us don’t want to participate in the corrupt casino of this corrupt country.

Einhal and many like him are lost young and old men. He reminds me of myself during 2008 when I didn’t know what was going on and was powerless to do anything about it. Only difference is that I vowed never to be caught off guard again and worked my butt off to get ready.

In 16 years ago (now early 50’s), I was an average salary guy with a wife, kids, and mortgage to now, I can retire anywhere in the world. My teeth, claws, and eyes are sharp, so I still enjoy the hunt.

The real trick is to see beyond the charts and graphs and extrapolate possible outcomes and act accordingly. If you train yourself, you can hear the nuggets that some folks offer and explore those nuggets.

Problem with many folks is that they don’t understand that they need to be smarter than the government to make extra cheddar. Otherwise, if you listen to the government, they will take everything you own and throw you to the streets. Not my wisdom, but the wisdom of my very rich and older mentor(s).

Take care.

Doesn’t take a financial super-genius to be able to retire to anywhere in the world — just a bit of shrewdness & a mental divestment of most material fixation. A loving, open nature (read: not smug & avaricious) & maybe some good looks can serve as a passport to much bliss in this life. You don’t need a ton of money — at least not as much as you’re terrified into thinking that you do.

Some people want to just rant and blame others for the result of their own decisions. They don’t want to learn. Learning is hard. Whining and blaming others is easier.

The metaphor doesn’t quite work.

There are corporations and individuals who can affect markets. Such is not the case with gravity. In fact, markets can be impacted by all kinds of human and institutional engendered black swan events (for example).

Your wank is about tone.

In my own mind, any/most learning (academic and experience) is antecedent to arriving here at Wolf Street. Information collection and analysis is a different matter – quality enters the equation.

Unintended irony is the best form of humor.

Which way do you think it will un-invert? Bull or bear steepening?

Bull. How else could it?

Bear. Short rates stay roughly the same and long rates come up.

Fed Up,

Fed Up you said, “Many of us don’t want to participate in the corrupt casino of this corrupt country.”

Then what are you doing on this forum? If you don’t LOVE investing or economic thought then go do something you do LOVE.

Life is short, don’t waste it shouting at the rain.

I don’t understand the negativity. Rates and QT continue. They reacted too slowly. It’s going to be hard to do any price discovery in shelter without some stability in rate expectations. A lot of us think slightly lower lending rates are going to be what it takes to get sellers moving. 6.5% mortgages aren’t free. Real rates are positive. Fed should be standing firm now imo, there’s no reason to cut or tighten. Let things settle and reassess.

Jerry “Transitory Inflation” Powell strikes again. Looks like he lost a whole lot of credibility today. Well, there was not much left to lose.

Higher for longer LMAO

I guess 5 months was “longer” than any time in the past 15 years…

We’ll be back to ZIRP by July of 2024, mark my words.

Higher for longer indeed. What a joke. We truly are subjects, not citizens.

Good time to buy TLT if you really believe that.

I don’t want anything denominated in dollars. I did buy a large amount of gold and silver a few hours ago.

You’ll make a lot of money on TLT if they cut rates.

(Disclaimer: I’m on the other side of that trade, short TLT)

MM, yes but I’d only make money in dollars. I’m making preparations to move my family out of the U.S. for good.

Dollars will be worthless when I think what is coming finally comes.

Right on schedule to seize everything up by the end of ’24. The last time the Fed kept the FFR at 0% for far too long, then raised them to 5% for about a year, it worked out just peachy.

MW: Dow Jones eclipses 37,000 intraday for first time in history, heads for record close after Fed signals pivot ahead

DJIA 1.40% SPX 1.37%

Treasury yields plummet as market reacts to ‘dramatic shift’ in Fed’s forward guidance

Why wouldn’t yields plummet? The Fed just announced that the last year of “higher for longer” was a lie.

It’s back to a return to our regularly scheduled crack-up boom.

In order for yields to drop, there must be an excess of buyer/bidders.

WHO IS BUYING? I might continue buying on the short end (T-bills with less then 3 month duration), but only if the yield stays above 5%. NO WAY I will tie up money for ten years at these yields.

The treasury has a TON of new issuance coming. Is the Fed going end QT and start QE?!?!? If so, then buy buy dollar purchasing power and inflation REALLY takes off.

Something doesn’t add up here.

“Something doesn’t add up here.”

The system is coming to an end, thank god. Better read up on Lord of the flies ;)

They didn’t announce any such thing. You are literally making that up.

That is why you are so angry all of the time. You are responding to what you think you hear rather than what is actually said.

Here’s an exercise for the inflation deniers.

Go buy some groceries if you’re the type who eats food.

Pay particular attention to the amount of money that you are being charged.

If you don’t eat food, just go into a supermarket and look at the prices on the victuals you will find there.

Let them eat cake.