“In determining the extent of additional policy firming that may be appropriate to return inflation to 2 percent over time…”

By Wolf Richter for WOLF STREET.

The Fed’s FOMC raised its five policy rates by 25 basis points today, which pushed the upper limit of its policy rates to 5.5%, the highest since January 2001. The Fed had broadly telegraphed this move after the “very hawkish skip” meeting in June, when it projected two more rate hikes this year. The Fed has hiked by 525 basis points in 16 months, the fastest rate-hike cycle since 1980, to deal with the worst inflation in 40 years. The vote was unanimous.

And the Fed also put another rate hike on the table for this year. Today it hiked:

- Federal funds rate target to a range between 5.25% and 5.5%.

- Interest it pays the banks on reserves to 5.4%.

- Interest it charges on overnight Repos to 5.5%.

- Interest it pays on overnight Reverse Repos (RRPs) to 5.3%.

- Primary credit rate to 5.5% (what banks pay to borrow at the “Discount Window”).

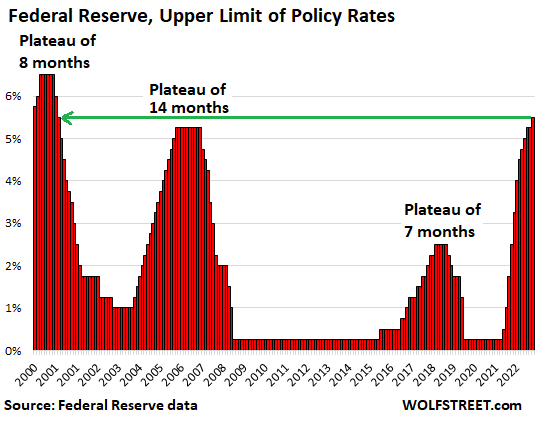

And amid all the hype about insta-rate-cuts that has been bubbling over for a year, we note that plateaus after a series of rate hikes are the rule:

Leaves the door open for additional rate hikes. The statement repeated the language of the June statement, which leaves the door open for more rate hikes:

“In determining the extent of additional policy firming that may be appropriate to return inflation to 2 percent over time, the Committee will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments.”

QT marches on at the normal pace, with the Treasury roll-off capped at $60 billion per month, and the MBS roll-off capped at $35 billion a month, same as in the prior months.

Dot plot, not now. The Fed releases its updated “Summary of Economic Projections” (SEP), which includes the “dot plot,” four times per year, near the end of each quarter. Today was one of the four in-between meetings when the Fed doesn’t release a SEP.

In the SEP from its “very hawkish skip” June meeting, the median projection for the federal funds rate at the end of 2023 was raised by two rate hikes, to 5.625%, meaning an upper limit of the target range of 5.75%. The Fed now has the first of those two rate hikes in the can.

And in that SEP’s projections, there was no rate cut for 2023; not a single member projected a rate cut this year. There was nothing in the statement today that changes that.

In response to the banking crisis in March, the Fed’s statement on May 3 had discussed its impact on inflation; today’s statement repeats the same language for the second meeting in a row: That the “tighter credit conditions for households and businesses are likely to weigh on economic activity, hiring, and inflation.” And it repeats that “the extent of these effects remains uncertain.”

At the press conference, Powell managed to pull the rug out from under some widely held assumptions. Read… Without Actually Pronouncing “6%,” Powell Said 6% Several Times. Inflation Not Vanquished in June. Even if the Fed Cuts Rates Next Year, QT Could Continue

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Powell should have telegraphed seriousness with a surprise 50bp hike

I’m getting really tired of this same-old same-old silly drive-by thoughtless nonsense, after 525 basis points in rate hikes, to 5.5%, far higher than anyone even dreamed of when this started.

And it’s going to need to go even higher. For longer!

Sure the heck should. Here’s an easy way to see how real estate is doing in your neighborhood. Don’t need to look at any government or financial charts. Go to Zillow or Realtor.com and put in your zip code. See if prices are holding, if listings are pending and if prices are going up or down. In my neighborhoods that I monitor (I am a landlord of several properties) they are all pending or at higher prices than when we had the crash of 2008. Grocery prices have spiked!!! So, after going anywhere from 33-100% over the last couple years if there is no more increase or just 5% then things are normal? C’mon man! Use common sense and your own two eyes. They need to raise by 0.50% until they break this trend. Also, as someone that uses HVAC, plumbers and other specialty tradesmen, the Fed is having no effect on these guys. They are raping people with charges of $200-700 per hour. Total rip off these people. They are lucky I’m not President, because I’d look to have the IRS audit them, bring in people that have this trade and expedite their licensing and fix prices. I see no answer right now unless the government raises interest rates to Volcker era. The Fed lacks gonads and is only making things worse. I’d rather they be disbanded and let Congress destroy everything because I know Congress is incompetent, but these idiots are supposed to have some education. Totally clueless.

JK, I vehemently disagree with you regarding specialty tradesmen. No one bats an eye when bankers charge a $150 million fee on a large M&A transaction, and no one bats an eye when top lawyers charge $2,000 per hour.

Good for tradesmen that are able to charge whatever they want. They are a beneficiary of society denigrating their work, and encouraging people of average intelligence to go to college for no real benefit. That leads to a shortage of tradesmen, which means the remaining ones can charge more. Good for them.

Einhal: You hit the nail on the head. As a college dropout-turned-contractor, I’ve always wondered if my high school guidance counselor mindlessly pushed everyone into college because those were the times (early 2000s) when college was still cheap. Now there are shortages of tradesmen, while the number of deferred home repairs has skyrocketed. Thank you for seeing through the haze.

JK: While I’m not a financial expert, I don’t think there is anything monetary that can be done to lower the price of skilled labor. The Fed can’t convince kids that HVAC, electrical, plumbing, or carpentry isn’t a shit career, so the remaining folks will charge what they want. Plus, it IS a “shitty” career, you risk your life every day in some fields. Not everyone has the character to do this work. I have an internal safety meeting with myself before picking up a single power tool or climbing a ladder or scaffold. I’ve seen people lose limbs, get depressed because of the strain of accumulated injuries on their bodies, been put out of business because they got outmaneuvered by GCs and/or customers to find some clever way to not pay. And the codes have gotten stricter, pricing out cheap labor and one-man-crews. It’s the trade of equivalent of not being able to find a starter home. I don’t mean to be severe with you, I just wanted to share what a contractor goes through, so others can see what’s motivating this shortage of workers.

Why not just go 100 basis points on a Saturday night unannounced a la Volcker?

Why take half measures with a 50?

LOL.

Take that, stock market.

All in all, I think Powell is doing surprisingly well given the political constraints he is subject to.

Because he promised some sound good slogan “soft landing”. As stated before, it means that the bag gets distributed equally among everybody, instead of few. Oh and wall street got to eat.

“All in all, I think Powell is doing surprisingly well given the political constraints he is subject to.”

Agreed here. There’s much to criticize in the MBS QE, ZIRP and “inflation is transitory” mis-steps in 2021, but in all the fairness JPow is one of the few Fed chairs in 40 years to actually move when inflation hit and take active measures against it, and to be aware of how damaging asset bubbles really are. Greenspan, Bernanke (single-handedly turning the Nobel Prize into a joke award) and Yellen all got so sucked into their own delusions about the “wealth effect” they fueled a lot of this mess to begin with and began this bad tradition of ultra loose monetary policy. Powell could have backed off with the deceptive light CPI report but he kept his eye on that ball seeing that core inflation and services are too high, ignored the pivot monger idiots and kept going.

If there’s one thing to still criticize it’s QT hasn’t been determined enough, if anything Canada and ECB have been more on this. But he does has reasons for using the pace he is. Even he isn’t Volcker, Powell has been a lot more aggressive at tackling asset bubbles and inflation than any Fed chair in a while

care to elaborate on those ‘political constraints’?

last i heard, the fed was supposed to be INDEPENDENT of political whimsicality.. so that means they can do what they will and not fear political repercussion.

now, perhaps a ‘politically incorrect’ move could mean no re-appointment for a next term.. but aside from that, what you allude to should not even be a point of discussion.

“far higher than anyone even dreamed off when this started.”

And far lower than Volcker’s 20% Federal Funds rate

But inflation is a LOT lower now too. I remember what inflation was like back then. It blew your ears off.

…say again, please…

may we all find a better day…

Wolf my thoughtful response to the Feds drive by theft is that 5.5% is not high at all and its a sad joke that anyone believes this will contain inflation. Also that the recent .25 basis point increases are a joke. Rates in a corrupt fiat currency system rates should start at worst case monetary growth + 5-10% for borrowers with excellent credit. At least double for risky borrowers. Since Trump and the Fed proved they are eager to increase the money supply 40% in a single year, I won’t lend below 45% to AAA borrowers or junk borrowers below 100%.

Not that I’m in favor of the Fed doing this or that, really the Fed & fractional banking system is an illegal corporation for insiders that would be immediately abolished if the people or the officials read and upheld the law of the Constitution. (not the flim flam politically expedient fake law of supreme court opinions)

The historical norms for moves like this is a 10-year trend in rate hikes. (c.f. Marc Faber)

We aren’t going down – and certainly not until Ukraines is “resolved”.

Moreover – the Chinese are selling their long-dated US Treasury book – how are we going to get lower rates with THAT hanging over the market. We are on our way to 10%.

– Why ????

At this point I’m largely indifferent to what the Federal Reserve does as long as the 2% inflation target remains intact (or if the target is raised, QE is permanently retired from the policy toolkit.)

As a saver I would like to see rates as high as possible, for as long as possible. A soft landing seems like the best way to achieve that, while a hard landing would take us back to the days of endless ZIRP & QE.

Most banks – and certainly the major banks such as JPMC and Wells Fargo – have no reason to pay ‘savers’ a single dime over the current 0.10% interest as demand for lending is very low and they have no interest in getting further funds in deposit accounts to loan out. I’m very happy with the current $8.00 or so a year I earn on almost $200,000 in funds on an IRA I have inside JPMC and so should be anyone else who has a private banking client with this excellent and financially sound bank.

You need to get out a little more. Banks are offering 5.3% brokered CDs for 1 year and shorter. T-bills pay over 5%. Money markets pay over 5%. There are a bunch of banks that offer 4%+ on savings accounts. Heck even my own most-stingy bank wants to sell me a 4.3% CD.

I’m getting 5.15% through several accounts facilitated by Raisin. The nice thing is they have several you can choose from, and you get a full $250,000 FDIC limit for each one.

Also, T-bills are not taxed at the state level which matters a lot for us in states like California. What’s more, they are far more flexible than a CD if you want your money back early because there is no early withdrawal fee. These two points blow my ears off.

I was able to pick up (through Charles Schwab) JPM CDs at a rate of 5.5% and 5.6% for a duration of 12 and 18 months respectively. I bought them through their trading platform.

Synchrony bank, 4.5%

Unfortunately, there are still plenty of people out there like this, sarcasm or not.

Where’s you sarc tag? (Hoping it’s sarc).

haha.. hahah.. haaahahah

/sarc?

in case not, your first mistake was….

banking with JPMC in the first place: otherwise known as ‘bernie madoff’s bank’

and

‘the private bank of jeffrey epstein’

just a couple of upstanding, totally legitimate (former) clients..

Chase stole $400 from me. They refused to step in when a online class I signed up for my son during covid turned out to be a turd. The management at the class told me Chase put a hold on the transaction so they could no longer issue a refund. I never saw the transaction revert, so ended up being on the hook for it. Closed all accounts with Chase after that. They can go to hell.

Have you considered that maybe the class was the one with dishonest people in this situation?

Jackson Y,

Your prediction is as good as mine, but I doubt we’ll ever see QE again. Having shot itself in the face once, why would the Fed want to repeat that experience?

LIFO,

I don’t think the Fed will introduce a QE phase for the benefit of the “wealth effect”. That, at least, has been (finally) retired.

But if there is a major disruption in the credit markets (think “2019 Repo Crisis”), a major risk to the Banking industry (think “2023 SVB Bailout”), or a sudden need to “goose” demand for US Treasuries (e.g. War with China) – they will enact QE so fast your head will spin all the way around.

I think the chances that NONE of the above would happen would in even the next 12-18 months are LOW. If nothing else, many people are very worried about a CRE-induced banking crisis or lack of demand for US Treasuries (I’ve already commented that Japan’s desire to double its defense spending could have pretty big ramifications for US Treasury demand).

BigAl,

I’m glad we agree on the wealth effect.

If we have another bank failure, why wouldn’t the Fed just lend, lend, lend as before? If we go to war with China, selling Treasuries will be the least of our problems.

Never say never. One could argue that US should have never gotten itself into inflation as sticky as during Volcker.

Heck after last housing bubble, i remember hearing “prices of houses will never be as high as before” and that market will be priced fairly going forward…

I beg to differ on that. The Fed has stated QE isn’t the problem. They believe it’s supply chain problems and deficit spending that created inflation.

People should have zero doubt that we’ll see lots of QE in the future. It’s the only tool the Fed has to directly support distressed assets in time of “crisis”, which the Fed defines as anything more severe than a stubbed toe.

Bobber,

Wrong as can be. you need to stay with the times. There is a recognition now that QE has done a lot of damage. Powell and others have said that rates will be the primary tool, and QE may not be used again. They will do brief liquidity support via repos — which is the classic way the Fed addressed issues, such as during 9/11. Repos vanish quickly because they have overnight maturities, or one-week maturities, and just not renewing them causes them to go away. Repos don’t involve asset purchases. In the summer of 2021, the Fed reinstituted its “standing repo facilities” that it had shut down in 2008 when it started doing QE. Now it stopped QE and the SRFs are back. The world has changed while you weren’t paying attention.

My 17 week T Bill auction came in at 5.47% this morning. I am thrilled. Loving this stuff as an old retiree.

You don’t actually get the “investment rate” as that is an annualized comparison rate only. You get the high rate, which is slightly lower but still darn good considering that it has no state income taxes also.

Almost all the retirees and all the savers would like to see interest rates as high as possible. These people have been fleeced for the past 42 years. With more and more retirees and less workers with each passing year you’d think the Fed could figure it out? They need to help the retirees not the diminishing amount of workers at the expense of the retirees.

The retirees lived and worked through a never to be repeated golden economic environment handed to them by the greatest generation and ran up an obscene amount of debt at the expense of every other generation to come. And you want more!? Go look at some generational wealth charts and tell me again who needs help

“almost all the retirees and all the savers would like to see interest rates as high as possible”

well thats just.. smashing. nothing like a hefty dose of greed to go along with all the other excesses in todays world eh?

your statement reminds me of those payton manning commercials for nationwide insurance and doritos.. the man is a millionaire several times over. he is famous and well-regarded.. why in the world does he need to debase himself to do such low-brow commercial spots? oh thats right.. almightly $$$. because companys pay him. as if he doesnt already have enough?

“these people have been fleeced for the past 42 years”

please do explain.. where are you getting 42 years from? and how exactly, aside from the ZIRP fiasco since 2008, have they been ‘fleeced’?

“they need to help the retirees not the diminishing amount of workers..”

are you suggesting society/social institutions operate for the SOLE BENEFIT of retired people? thats a laugh.. really. who is going to provide the services for all those retirees, do you suppose? yeah, forget those people, who needs them.

In his defense, low rates and the resulting inflation is bad for workers too.

So funny….market loves rate hike, who would’ve thought…and even more to come telegraphed they still rally up the market….

Either the delusion is thick out there or they know something we don’t…

Seems like the market liked the hike, but when Powell said they are no longer forecasting a recession, market dropped like a rock.

Could just be a coincidence.

Recession means trillions in QE and asset bubble building. Market is upset to learn the average american will keep their job. :(

Phoenix_Ikki

“So funny….market loves rate hike, who would’ve thought…”

S&P 500 is red. Nasdaq is red. Not a lot of love here.

Actually no. That’s the good thing. If they hike one more time to 5.75% at the top, and a recession shows up, they can cut by 300 basis points over a series of meetings, to 2.75%, without QE, and the recession will be gone.

That’s the advantage of higher rates: The Fed has a lot it can cut. When rates are at 0.25%, there is nothing to cut, and so QE gets dragged out of the closet.

Market ended flat today (S&P 500 dropped by 0.01%, to be exact.)

That’s because most corporations issued tons of new debt at near zero percent interest rates in 2020, and are now doing a carry trade against short term rates. Win-win-win for those corporations, with a 4% tailwind in liquid earnings. on all the money they took out.

I’m watching the press conference right now… why do these reporters ask such stupid questions?

That AP reporter clearly didn’t understand that inflation is the *rate of* price increases, as evidence by his implication that 3% headline CPI = inflation is gone and no longer burdening the public (and therefore the Fed should cut rates).

If your paycheck depends on you being stupid, you’d ask these.

The pressers in these press conferences are well vetted and they can’t afford to ask tough questions lest they’d be kicked out.

That doesn’t surprise me.

But regarding your assertion that Powell is dovish: did you notice that none of the reporters asked if the Fed felt 25bps wasn’t enough, or if their rates were still too accomodating? Most of them implied inflation is gone and the Fed should stop raising rates or cut, and Jpow kept swatting these questions away and saying the Fed is committed to getting inflation under 2%.

I agree with you that rates should be higher, and find it frustrating that no one in an official position to question Jpow is bringing this up. Instead they complain rwtes are too high.

Here is your answer about what Powell said: He managed to pull the rug out from under some widely held assumptions:

https://wolfstreet.com/2023/07/26/without-actually-pronouncing-6-powell-said-6-several-times-inflation-not-vanquished-in-june-even-if-the-fed-cuts-rates-next-year-qt-could-continue/

As I expected and wrote before multiple times: Powell would hike by 25bps ( as expected by all ) with a Dovish comment. This is evident by the reaction of the market.

Financial conditions are as loose as it was when Powell started hiking.

If Powell have been serious, he’d have hiked by 25bps or at least increase QT.

I didn’t interpret the comments as dovish tbh… these reporters are basically begging him to confirm that rates will be cut when this or that inflation target has been reached, and he keeps swatting these dumb questions away.

He said at one point that rate cuts wouldn’t be on the table until an entire year from now.

The FOMC – and not Jerome Powell unilaterally – decides by consensus vote by its 12 members on the policy rates at the Federal Reserve.

jon,

You’re being silly again. There was nothing “dovish” in Powell’s comments.

You’ve said that same “dovish” BS for many months now, and each time Powell hiked the next time to spite you and smack you down. Powell will keep hiking and smacking you down until you quit this BS.

Or did you replaced yourself with an AI bot? That would explain it.

This made me laugh out loud.

It does not really matter what I think.

It matter what market thinks I guess.

Please correct me if I am wrong in any of these:

1. Fed balance sheet rose like crazy in 202 and 2021.

2. Fed’s fastest rate down in 2020 and 2021.

3. Stock market is still flirting with all time high , away from fundamentals.

4. Inflation still quite high according your recent articles.

5. Economy still running high.

6. Home prices ( at least in San Diego ), still quite high, it went down tiny bit but still marching up towards all time high ( I am in soc al ).

1. Yes, but now the Fed balance sheet dropped $700 billion.

2. Yes, but now we have the fastest hikes in 40 years.

3. “Flirting”? OK, not sure what that means. The S&P 500, after the huge rally, is back where it was in Sep 2021.

4. Yes. But core inflation has stabilized (at high levels), so that’s better than going straight to the sky.

5. Yes.

6. Yes — not just in San Diego, but also in Chicago, etc. Bay Area is a different story. We’re leading the pack. You gotta be patient. Homes are not cryptos.

Wolf,

Bill Gross was talking about how the Fed is very unlikely to ever cut rates below 2 to 3% as long as Powell is chair because the career risk of inflation re-accelerating on his watch is too high.

He also was talking about how long duration treasuries still don’t make sense at these levels and he was thinking of 5%+ yields before he would even take a look at it.

Given that to make money on long duration bonds at these rates, you really need a return to ZIRP, and guys like Gross are telling investors not do to it, why is the bond market still pushing this nonsense?

Short duration govt bills are more or less dictated by FED rates.

Long duration are again depended on FED.

If FED wants long end to go up in yield, they should do more aggressive QT.

If long end is low yield it’s because FED is not aggressive enough.

I only caught one dovish comment, when “Victoria from Politico” asked a question, Powell responded, “We would be comfortable cutting rates when we are comfortable cutting rates, and that won’t be this year (pause for reflection) * I don’t think * …” . If you listen to his intonation there in the audio, it is not a CYA throw away comment. The FOMC have obviously been discussing not theoretical, plausible scenarios where they may have to cut before year end, whether those scenarios materialize in reality or not.

What he said was this:

“When people are running down rate cuts next year, it is a sense that inflation is coming down and we’re comfortable that it’s coming down and time to start cutting rates. But I mean there’s a lot of uncertainty between what happens in the next meeting cycle let alone the next year, the year after that. So it’s hard to say exactly what happens there.”

Then she got back at him. Exasperated, he said:

“I’m not saying that at all. I’m not giving any numerical guidance. We’d be comfortable cutting rates when we’re comfort cutting rates. That won’t be this year I don’t think. Many people wrote down rate cuts for next year. I think the meeting was several for next year. That’s just going to be a judgment that we have to make then a full year from now. It will be about how confident we are that inflation is in fact coming down to our two percent goal.”

If core PCE is at 3% next year and heading down, and the top policy rate is 6%, as it may be, you bet they will cut, and they should cut.

But the chances of core PCE being 3% and heading down next year are not very high.

Wait, even if core PCE is at 3% (or even 2%) why does that necessarily mean that a 6% top policy rate is inappropriate?

It’s something that is credit-risk-free and has essentially no duration risk (overnight). So the “real” rate in normal times should be just above 0%, meaning, you recoup inflation and maybe a tiny bit more. If this risk-free-no-duration rate is double the rate of inflation, it becomes very restrictive. You can strangle an economy with it.

In normal times, 3% federal funds rate would translate into a 4% to 5% 10-year yield and a 6%+ mortgage rate.

This could very well happen: the Fed cuts short-term rates to 3%, and long-term rates rise, and the yield curve uninverts and steepens, with the 10-year yield rising to 5%, and mortgage rates in the 6%-7% range. This is how it’s supposed to be, and used to be.

At this point, you go out on duration, you switch your T-bills to T-notes and bonds.

The UPS union just won a good contract. Apparently, labor will continue to be strong in the face of inflation for a while longer, no help there. Companies are so huge now with monopoly strength, labor shutdowns can cause havoc in the country from these corporate monsters. The government is having to step in to avert strikes as in the cases of the railroads and UPS.

Where did you see the government stepped into UPS agreement? I knew last week that agreement was reached, and no interference from govt. I had an inside source. As a retailer a strike in the fall , 4th quarter would pose problems. I researched and knew no strike was coming….just higher shipping costs, which will be passed on to the consumer. Merry Christmas!

And they created a lot of these monster corporations,now how do they figure out how to control them . Seems china has a answer ,disappear billionaires for awhile they learn a lesson

The US gov did not participate in the Teamsters/UPS negotiations.

Incidentally, the railway workers have eventually proven largely successful in securing the asked for paid time off. This happened *after* Congress prevented the Strike via the RLA and the US Department of Labor exited the talks altogether.

Of course the US government participated in the Teamster/UPS negotiations.

They stand there with badges and guns pointed at UPS management and say “We’re warning you — you had better not even think about offering competitive offers to individual union members that would be good for them, good for you, good for the customers you serve, but not good for the union bosses. Don’t test us.”

That was settled in Kostal UK Ltd v Dunkley.

Whoa, major copy/paste mistake. I should have proofed before clicking “Post Comment.”

“Direct dealing” and “bypass” as “unfair labor practices” have been settled in multiple cases by the US government. (The Kostal case was a similar case in the UK.)

At least they’re moving in the right direction by not pausing again. Nonetheless, Powell may say we still have a long way to go to reach price stability, but we also have a long way to go before I and a lot of others are willing to trust that snake. Just a few months ago the Fed ballooned their balance sheet bailing out depositors at a few failed banks with hundreds of billions worth of not-QE… Nothing to see here, move along. Took ’em months just to get the balance sheet back down to its Feb/March level. Powell used to speak quite openly about bringing inflation down so they could lower rates. I still believe that is the eventual goal. And I’m still quite certain that the Fed will react to any major calamity with shock-and-awe loosening including QE. A few bad-actor banks went belly up a few months ago and the Fed employed $400 billion of help (let’s face it, it was QE). Let’s give that some perspective. A “crisis” that was mostly the failure of 1 bank caused the fed balance sheet to grow by the cost of operating the entire government for nearly a month!

Queue a little more of the modest 0.25% hikes, (maybe another one or two after today’s), and expect more of those $400B balance sheet bumps for every mini-crisis that occurs. Then when something bigger finally blows up, don’t think for a minute the Fed won’t go full-on QE again.

Wooo I think JPOW wants to hike more but can’t actually come out and say that. We’ll see. I’d still love QT to double.

The 12 member FOMC which votes on Federal Reserve policy rates very deliberatively and intelligently considered the appropriate policy rate and voted by CONSENSUS to keep raising those rates starting again with a 0.25% upwards spicer to the current very low policy rates.

What was the highest Volcker rate hike?

Paul Volcker – Wikipedia

The Federal Reserve board led by Volcker raised the federal funds rate, which had averaged 11.2% in 1979, to a peak of 20% in June 1981. The prime rate rose to 21.5% in 1981 as well.

Now look up the highest CPI rate during that time. Core CPI was 13.6%. Now core CPI is 4.9%.

That episode of inflation, with core CPI above 4%, lasted from 1968 through 1991 – 23 years!!! Volcker was just there are the peak.

A nothing-burger. Certainly one of the most boring pressers ever. How many times can Powell say “data dependent” and “broad picture”? I think he was trying to bore everybody to death. Still, I am glad rates are increasing. I am enjoying 5.5% on my 4 to 6 month T-bills.

Perhaps its the audience that refuses to listen to his remarks. Repeat, repeat,repeat….. Would be nice if they simply read Wolf’s column!

The people asking questions seemed quite a bit more idiotic than in past pressers. I was hoping Powell would say “How many times do I have to answer the same gd question?”

I agree – I found most of the reporters’ questions to be frustratingly repeatitive.

…think of the child who continuously repeats a question in hopes of finally getting the answer they want (…and then think of the number of parents who seem to always give in…)…

When ‘no’ never means ‘no’…

may we all find a better day.

91B20 1stCav (AUS)

Yes, lots of reporters fall into that category.

Part of the problem is that they don’t listen when Powell answers a question for someone else. And then they ask a similar version of the same question. You can see how Powell gets exasperated.

I still think that he should be given a big Taser, and when he gets asked a stupid question, or the same question he just answered, ZZZZAPPP, “Next.”

It’s nice to be able to walk into a bank and leave with something more lucrative than a lollipop…

(and they didn’t even have lollipops during the pandemic)

I got a nice little travel alarm (garnet coloured, of course) when I opened my first savings account at CIBC back in the early 70s — used it bedside right through the 80s.

I guess it payed off for them, though — they’re still my main daily banking outfit … :-/

…as entertaining as that would be, JP could run afoul of ‘reporter abuse’ laws (…being mindful, here that many of today’s reporters/editors abuse the earlier ‘laws’ of reporting…). Mebbe he could say: “…asked and answered. You’ve wasted everyone’s time and put yourself in time-out. Go stand in the corner…” (…crowded corners for awhile, no doubt…).

may we all find a better day.

ooops, blew the nesting in response to Wolf. Apologies.

may we all find a better day.

According to a quick-thinking guy on CNBC today, that’s a dumb move. Inflation will be down to 2% shortly. When your T-Bills expire in 4 to 6 months, stocks and RE will be 20% higher. You’ll have nowhere to go, because T-Bill rates will be back down to nothing.

He says to risk your wad in the stock market now, or you won’t be able to earn a yield on your investments in the future.

He seemed very confident.

Would that be Jimbo Cramer? Lol

I’m shaking in my boots. /sarc

he needs someone to sell to.

My wad was blown on Cramer’s clown face long ago!

Wolf, what’s your crystal ball say regarding food prices? You know that I feed a large defensive end here, my son, and tomorrow we have a larger offensive tackle bunking in for two-ish weeks. You also know that our budget is flexible. Fine. But what are regular folks going to do? We were in France earlier this month and it’s feeling like if this continues, heads may roll, maybe not Frenchy-style but in some still awful way.

France teenagers college looming I think inflation higher and sticky as you are able to fund teens trips and college .

Over the last few months, food prices have stabilized (at high levels). I think food inflation has run its course for a while. But I don’t expect food prices to drop back where they had been, I don’t expect them to drop at all, though some items have dropped and others have risen. I see lots of specials and discounts again, a sign that price competition is back, and that’s a good thing.

Next will be the “now larger” phase of product sizing, actually back the what they were before “shrinkflation” but at a higher price, of course.

Bud Lite has bucked the inflation trend and dropped quite a bit……

Was just at Walmart and still can’t believe how many items continue to go up in price. Ground beef and canned beans just went up yet again. Laundry detergent now priced like fine wine. Not to mention the fact that most processed food is so bad now its practically inedible

Only buy eggsand milk there,French fries, . Other than that no help no service . Get out of stock Walton’s are

Why wont someone ask him why the Fed continues to hold more than 2 trillion of MBS on the balance sheet when the housing market is so out of whack?

Sell that junk into the markets and allow the markets to return to some semblance of normalcy.

Long term rates going to more higher now. This Fed is not serious about inflation.

Energy inflation is going to come roaring back. The price of oil has reached the top end of the trading range for the past six months and will soon break out to the upside. There is no more strategic reserve oil to dump on the market to keep it down and Saudi Arabia is now an adversary to the US, so look for OPEC to keep production low and drive the price through the roof. And the shale oil production in the US has the lowest number of drills in a long time. Less productive wells are not getting investment. Along with housing inflation, this is going to mean that interest rates need to move even higher.

Why don’t they sell the MBS?

No market demand for MBS w/ 4.5% yield.

Saudi Arabia will not keep production low – China won’t let them. If they want to get out from underneath the USD – they can’t do that w/o Chinese assistance.

And in any case, raising interest rates hasn’t reduced consumer demand in any meaningful way. It has, however, begun to take a toll on firms that want to actually do useful capital investment to grow the real economy.

The problem is NOT that higher interest rates are not working at reducing inflation. It is that there is still way too much Federal government spending and Fed balance sheet. Long term rates have also not risen enough. My guess is that long term rates move quite a bit higher from here. Just wait for an auction of longer term bonds that doesnt go well.

I saw a graph of the excess savings in American bank accounts, which is a result of all the government handouts. It is about six months away from moving into negative territory. So I say we are nine months away from real financial hardship hitting and 12 months away from a full bite on the economy.

Hopefully the Supreme Court can shoot down Biden’s remaining attempts to forgive student loan debt and with people finally repaying what they owe, the economy will settle back down.

American Express card network went from about 13% year over year growth in Q1 to 8% in Q2. Look for it to hit 0% by end of year or first quarter 2024.

The Fed really needs to double up the pace at which it sells the balance sheet to get rid of these bubbles.

Not really. I work in financial services. Firms that have a viable business model can still get financing. It’s the cash-burning pipe dream startups that can’t.

China can’t feed its people or produce enough domestic energy to survive

And yet we’re supposed to believe that they pose a serious strategic threat despite being incapable of projecting power beyond the first island chain — how do people take this seriously?

None of the reporters questioned if QT was happening fast enough, or if 25bps was too little of a hike.

The reporters are the doves.

The reporters work for financial media like the WSJ, Bloomberg, Reuters etc. They are aligned with Wall Street, and serve the interests of Wall Street & the media’s billionaire owners (the Murdochs, Bloombergs, Thomsons, etc.)

That’s why you had different reporters asking the same question 20 times trying to get Powell to precommit to a skip at the September meeting.

That seven month plateau should have been higher and lasted longer. But no, and here we are. That chart tells a story. Thanks.

Back then (2019), inflation was BELOW the Fed’s target (per core PCE).

Now inflation is 2.5 TIMES the Fed’s target.

Why is this so hard to get?

OK, I get it. Thank you. PCE. I have to remember that. I appreciate the repetition. I find a lot hard to get, so I truly appreciate this place.

MBS: The MBS are rolling off at a snails pace, if some market condition actually comes along, Powell has even put a cap on the amount reduced; so I see no bright light there. Rather disingenuous anyway, the MBS has a low interest rate (as stated many times about people’s mortgages, MBS is the other side). How would Powell sell the MBS without discounting it, to match the current interest rate environment, and therefore book a loss?

Now it is said that the taxpayer is on the hook for the MBS loss; no they are not if the mortgage does not default, the Federal agencies (FHA, etc.) fixed rate mortgages do not have a promise of giving an increase (or decrease) variable return; i.e., the very name “fixed rate.”

Conclusion; Jerome Powell’s Federal Reserve made a poor investment business decision for the US government’s financial situation without even the benefit of a supposedly “Western Democracy” representative government process; no the FOMC are not all nominated by any US government official at all; even if they were, what government official can obligate the government for a major fraction of the country’s GDP in a ridiculously short period of time, with only a small conference table committee of cronies?

Beat and Raise.

Beat and Raise.

Beat and Raise.

S&P 4700 by Labor Day.

Stocks red.

I wasn’t expecting a big move in stocks for a meeting that did not include a dot plot update.

But I’d have to say the interpretation *was* dovish…

– Outsized gains in the Russell 2000 (the sensitive to rate changes)

– Modest rally across the board for US Treasuries

– Outsized gains for financials (on hopes that the yield curve inversion may reduce)

I think there will be significant inflationary winds blowing in a few months – so the less the Fed says right now…the better. An entirely reasonable performance from JPow today.

The “interpretation” on Wall Street has been “dovish” since March 2022. That’s the only thing their AI brains are programmed to do.

“I think there will be significant inflationary winds blowing in a few months – so the less the Fed says right now…the better.”

Totally. WTI crude is back up to $80/barrel. Home prices are rising again & the national average is just 1% off record highs per Case-Shiller (of course, with significant regional differences.)

UPS truck drivers are now making over $100k/year. Airline pilots negotiated something like a 40% pay raise. American consumers are spending are drunken sailors no matter what they tell the polls. The IPO window is wide open again. Big Tech layoffs have stopped. Retail investors are gambling in meme stocks again.

The only big question is how last year’s home price declines will show up in core CPI/PCE, because they’re being reported with a lag. So we could get more seemingly good inflation numbers for a while, which will make Wall St even more bullish.

There was almost zero net gain in headline CPI between July & December 2022. But then we got massive 6%+ inflation in first-half 2023, for an overall annualized rate of 3%. If history repeats itself, this inflation problem is far from over.

GREEN says the Russell 2000.

Bigly.

Russell hasn’t done much in a year. IMO Fed should have been more aggressive by uncapping Tbill/bond rolloff at a minimum, but to me reading between the lines they are not interested in being super hawkish. They were quick to provide liquidity earlier this year with SVB, slow to raise rates and do QT way back in 2021 now. Wages keep going up and they know core inflation is high in services. It’s all entrenched now. Just another new price floor set. No talk on fiscal policy as they just defer that it’s not their issue even though it’s the elephant in teh room. So from what I see we will keep having currency devaluation and better to be in stocks than cash. At least I will start DCA’ing again outside my retirement acct. 5.3% MMF with my tax bracket is not that great by comparison. Maybe a top 100 fund like SCHD, but I have to look into it again. S&P500 too broad with a lot of losers…

Where’s the QT when you’re massively pumping out $$$’s through deficit spending?

the DJIA closed up 82 points

the NASDAQ closed down 17 points

the S&P500 closed nearly unchanged

hardly any bleeding at all.

the only ‘red’ was in the NASDAQ, and it was slight.. it actually closed HIGHER than its open, and a tad below its prior day close..

overall, i would have to respectfully disagree with your characterization of ‘stocks red’.

Here’s the real news Powell should be providing to markets in his press conference:

-We’ve seen 20% inflation the past three years. We will preserve those price increases, at all costs. In addition, we will strive to support future inflation of at least 2% going forward. Inflation will run higher than 2% through at least 2025.

-We view QE (money printing) as a valuable tool in response to economic weakness and for ensuring high asset prices. We will use QE again when needed to support asset prices and generate a wealth effect.

-We recognize our policies to suppress interest rates and encourage debt expansion have increased asset prices by 300-500% the past 15 years. We intend to support those high asset prices in the future, even though this will permanently raise the cost of living for younger generations and deny them reasonable investment entry points.

If Jerome Powell and the FED were serious about inflation, they would have raised by 1000 basis points today and announced that they were selling off their entire MBS balance sheet tomorrow. /s

On a serious note, I think the “2% target” is dirty pool at this point. Inflation is theft of labor and stored wealth. There never used to be an “inflation target.” How can an organization charged with maintaining “stable prices” openly aim to increase prices? I would like to understand exactly when this “target” came to be, who came up with it, and how it was allowed.

After the most insane money-printing spectacle in the history of our country, leading to a massive inflation inferno and the most unaffordable housing and autos in history, I would expect the rate hikes to be the fastest in history.

To my eye, while the FED IS doing something, it appears they are tiptoeing around to try to maintain these insane price bubbles everywhere. Even though we’ve been living it for many years now, I still recoil in horror at prices I see on many things.

And the speculators are still at it in droves, not only in the stock market and crypto, but in housing. I just talked to a Realtor who bought another “flip.” In this market. Unreal. There is simply way too much money still sloshing around in the system.

@Depth Charge,

Raising interest rates too quickly would accelerate de-dollarization across the world. A Fed tightening cycle unleashes huge inflation for buyers of the currency.

There has been very little movement in Crypto asset prices of late.

If they sold off all the MBS tomorrow, you’d have hyperinflation in a week as a result of businesses having their loans called and being unable to acquire working capital. They’d be forced to shut down and nothing would be produced.

To clarify:

Central banks in smaller/developing countries are forced to buy dollars at higher prices when the Fed increases interest rates because the currency generally appreciates sharply.

It is part of the economist lie that deflation is bad. The key issue with deflation is the cause. Is there deflation because is is the unwinding of an asset bubble? Then that is good. Is it simply that productivity growth is stagnant and there is a lack of demand. Then maybe not so good.

But what has really happened over the past decades is that there is an overall deflationary impact of the internet and technology that has been offset by inflation in basic goods and services. The lack of inflation over the past 20-30 years is due to technology and also to offshoring of production, which keeps costs low, but robs the economy of jobs.

This is what you get when you vote for the uniparty of Democrats and Republicans.

When Paul Warburg & the Banksters of 1913 created the Fed Res, they privately assigned the new fiat $ an unspoken inflation rate of 3.2%. Or a dollar 1/2 life of 21 years. That is, one human generation. This only worked for a year or two. By 1918 inflation was raging at 18%! War does this.

By 1920 the value of the USD had been more than cut in half. Your gold eagle would buy you less than half what it did in 1914.

….Unless you took that same Au eagle to Germany, where it would buy you a mansion. You think things are crazy now?

Were house prices 14x median incomes in 1920? Yeah, I DO think things are “crazy now.”

I often agree with your sentiment, Depth Charge. But actually, affordability was pretty bad back then for lots of things too. Hard to even make an apples to apples comparison because our monetary system is so different now and our standard of living is so vastly better. Most Americans were renters… Think about it. The common job in a city meant brutally long hours doing hard & often dangerous work, and you might be able to hang onto a slum apartment packed in with other median-level workers if you were lucky. The homeownership rate didn’t cross 50% until after WWII when the U.S. found itself at the top of the heap with infrastructure that hadn’t been bombed to bits. Maybe buying a median house wouldn’t have been so bad in 1920, but food, energy, and consumer goods were much more expensive vs. income. Your house was 3x-4x annual income when the roaring part of the 20s was on, but your milk was the equivalent of like $10/gal. Food was probably the average American’s largest expense by far, no? And things like a radio could easily set you back a month or two of your entire salary. Even more recently, you would have spent several thousand dollars for a half-decent desktop PC in 1990 while you can pick up a laptop today for a few hundred bucks with, what, 100 times the computing power? Some things were much cheaper in 1920 because other goods and staples were so much more expensive. Trade-offs, trade-offs.

As soon as they throw out the Russians, this carpetbagger is going to Ukraine.

hahaa haha hahahaha…

you have jokes!

perhaps you should catch up harry, because the russians arent going anywhere..

and even if ‘they’ managed to ‘throw them out’, as you say.. what exactly do you expect to gain in a war-torn country, anyway?

He has family there, from what he said.

2% target came, I think, from New Zealand central bank, and then everybody latched onto it. It sounds pretty stupid so I hope I am wrong.

You are correct as to its origin — its spread and persistence are both a triumph of groupthink.

– I am NOT surprised. Mr. Market told me some 2 weeks ago that the FED would hike.

I told you six weeks ago, on June 14:

https://wolfstreet.com/2023/06/14/in-a-very-hawkish-skip-the-fed-keeps-rates-at-5-25-top-of-range-but-sees-two-more-rate-hikes-this-year-qt-continues/

Powell said he would consider cutting rates next year once committee members are confident inflation will settle at 2%, even in the absence of any economic stress (implied.)

Historically, the Federal Reserve did not lower interest rates without at least one of (1) rising unemployment, (2) banking sector instability, (3) stock market crash.

2024 is an election year. FOMC members value their independence & traditionally don’t like to make big policy moves in election years unless clearly warranted by economic conditions (which unfortunately 2008 & 2020 were.) I hope if we get that perfect or near-perfect soft landing they just hold rates there indefinitely.

Where did he say that he would consider cutting rates in the absence of stress?

Here is what he actually said: He managed to pull the rug out from under some widely held assumptions.

https://wolfstreet.com/2023/07/26/without-actually-pronouncing-6-powell-said-6-several-times-inflation-not-vanquished-in-june-even-if-the-fed-cuts-rates-next-year-qt-could-continue/

Prime rate at 8.5%. Now it’s a party.

Depth Charge, BigAI and gametv…you are all connecting the dots!

Where are the self driving cars? The AI sillyness is just the next self driving car cash into oblivion burn barrel.

Fed buying MBS and back stopping every category of finance…Madoff.

The GFC floating lake buoy rescue plan came to a demise in late 2019.

Saturating the ocean with life buoys in 2020 and 2021 will take some time to clean up.

Life buoys to the Moon!

Styrofoam futures paid for with bitcoin, 5% reverse repo funded by bank reserves at 5% paid for with TBills sold to public at 5%.

Run out money…add a quarter point.

Run into problems. Print money.

Wolf, I don’t see exactly the plateaus you talk about. A plateau is a leveling off after a rise, followed by a fall. Your 14 months looks like 10 months and your 7 months look like 5 months. Maybe your column charts are somehow not able to show every column.

Those columns reflect Fed meetings, and not calendar months. There are 8 Fed meetings per year. The 14-month plateau went from the Fed meeting on June 29, 2006 (last rate hike) to August 7, 2007 (first rate cut).

Thanks.

Howdy Folks. Looks like Higher for longer. With months left in 2023 and dot plots showing higher for longer, wallstreet will have to make it on its own for awhile. NO QE or ZIRP for you…..

The problem with interest rate increases in the current type of economy the USA has is that the impact of rate increases only hits a small segment of the economy.

The state and federal governments are basically immune from any real impact of the rate increases especially the federal government with no debt ceiling for a couple of years.

High net worth individuals are gaining from increases in asset prices as those assets basically ignore the impact and for those that have high cash balances the result is an increase in income.

For ordinary people the impact is mixed. If you own your home free and clear then there is zero interest rate impact. Similarly those with fixed mortgages feel zero impact.

The leaves the rest of the population to feel the impact and while they suffer, the majority sail along without much pain.

Huge ongoing federal government deficits will ensure a large inflationary push through the economy, increasing oil prices will push up energy costs, and food prices will remain high or increase as a result of bad weather or geopolitical factors.

And who gets hurt by these ongoing impacts? The same ones the get the boot from the Fed.

You get it, Honolulu — these rate hikes do NOT have evenly distributed consequences. There are winners and losers ranging across the income and wealth distributions that the aggregate numbers always hide, and there are few spectacles more revolting than the winners sanctimoniously assuring the losers that this is all really for the best, and especially on behalf of the poor; as if these whited sepulchres ever gave a toss about the poors … >:-/

Yes, but when rates were zero and asset prices were climbing with QE, wealth inequality was soaring. During that period we had to endure a different set of sanctimonious winners assuring “the losers this is all really for the best.” I really didn’t understand just how badly the Fed was distorting the markets. Interest rates below inflation discourage savings and encourage speculation. That was the objective of QE. I don’t mind speculation per se, but it shouldn’t come at the cost of people who just don’t want to risk their savings. Capitalism without a cost of capital is an absurdity.

As one of those former losers, I’m enjoying some interest income now. However, I grew up relatively poor and do care about opportunities for the poor/working class. Society fails if everyone doesn’t have an opportunity to make a decent living performing jobs society needs to have performed. I’m not calling for high rates, but rather inflation plus maybe a little more depending on the duration. Unfortunately, there will be winners and losers no matter what policy path the Fed chooses. For this reason alone, extreme policies such as QE should be avoided in all but the most dire circumstances.

Services still banging higher. I run a unique, nitch service business in Austin, TX for the ultra wealthy and much of my professional competition just “evaporated” for one reason or another. I am practically “making up” prices as we go forward. Of course, it all starts dropping off when families deal with kids going back to school in August, and then more strongly dropping off when 1st cool front arrives (or significant rain). For now though I am making hay while the sun is shining. In many cases they are desperate and are paying 300% above normal.

Nitches have gotten to be the province of the ultra rich, Austin’s service proles can’t afford even a “starter” nitch today. It’s a modern tragedy.

Forty years ago it was the cheapest area in the populated parts of the state. And a great place to live.

Instead of $6,000 total price – – the job may be like $18,000 – – and it takes me like less than 8 hours to complete it, parts only cost me under $2K, often under $1.5K.

Like taking candy from a baby . . . .

robert?

could you maybe brag some more please? i dont think you laid it on thick enough..

we all here on WS are just SO impressed with your mystery ‘unique, niche service business.. for the ultra wealthy’.. perhaps i overstate a bit, but.. speaking for myself.. SO IMPRESSED.

oh and another thing.. the ‘ultra wealthy’ dont care what prices are like the rest of us normal plebs.. so, your point is rather moot, given the example you use as a basis for your comment on services. even more so if your competition ‘evaporates’, because whatever mystical service it is that you offer, CANNOT be sourced from elsewhere. so naturally, you can charge more, as a result.

so what point were you trying to make again?

The history of “plateaus” and subsequent slashing of interest rates and QE since 2000 is more predictive than whatever was going on during the Carter-Reagan years. The Fed will continue to raise rates, slowly, until something breaks–maybe it’ll be something like LTCM, or the popping of the tech bubble, or a 9/11, or a housing price collapse, or a pandemic. At which time, they will immediately step in and flood the markets with new money.

What could do it this time? A municipal bankruptcy? A major pension failure? A political crisis? A group of governors screaming for relief of their unserviceable debts which need to be rolled over into 4-handle muni paper? Two Silicon Valley Banks-types blowing up at the same time?

Powell and Company have shown a lot more resolve than I thought they would, by now. We’ll see how they do when confronting an unknown unknown. 30-year investors seem to think we’ll see 2% again before we see 7 and have trillions of dollars wagered on that outcome. Gonna be interesting.

Raising interest rates is an inappropriate tool to fight inflation that is caused by supply side disruptions. “They arise, instead,

on the supply side. If not repeated, they pass through the econ-

omy quite quickly—usually within months—because nothing

sustains them. But if they are sustained, or repeated, some other

policy would be necessary to deal with it. Such policies might

include action to reduce resource costs, to improve productiv-

ity, to reallocate resources from private to shared (public) uses,

to make peace (in time of war)—or to control prices directly.

Raising interest rates is not part of the menu in either case. All

of this had been perfectly well understood in World War II,

when prices in the United States were strictly controlled and the

interest rate on long-term US government bonds was fixed at

2 percent.” citation from James Galbraith. No doubt I will be censored.

You need to start paying attention. Two-thirds of what consumers spend goes into services, and services didn’t suffer “supply-side disruptions.” Goods had those disruptions, but the surge of inflation in goods has abated, and some goods prices have actually dipped/dropped. Nearly ALL of the inflation is now in services where there are no supply-side disruptions. We’ve been discussing the shift of inflation from goods to services for, I don’t know, a year?

Don’t services suffer from Baumol’s cost disease in a way that goods don’t?

The Treasury has borrowed around a trillion dollars in the past few months, so with QT and increase in interest rate, what are they really doing?