RRPs heading to their normal level of zero. And it’s time to talk about the revived Standing Repo Facility.

By Wolf Richter for WOLF STREET.

As the Fed’s Quantitative Tightening hums along on autopilot, its assets have fallen by nearly $1.3 trillion as of its weekly balance sheet released on Thursday, and its liabilities have fallen in equal amounts. The dropping liabilities are a result of QT. Here we’ll discuss two of the Fed’s big four liabilities: ON RRPs and Reserves.

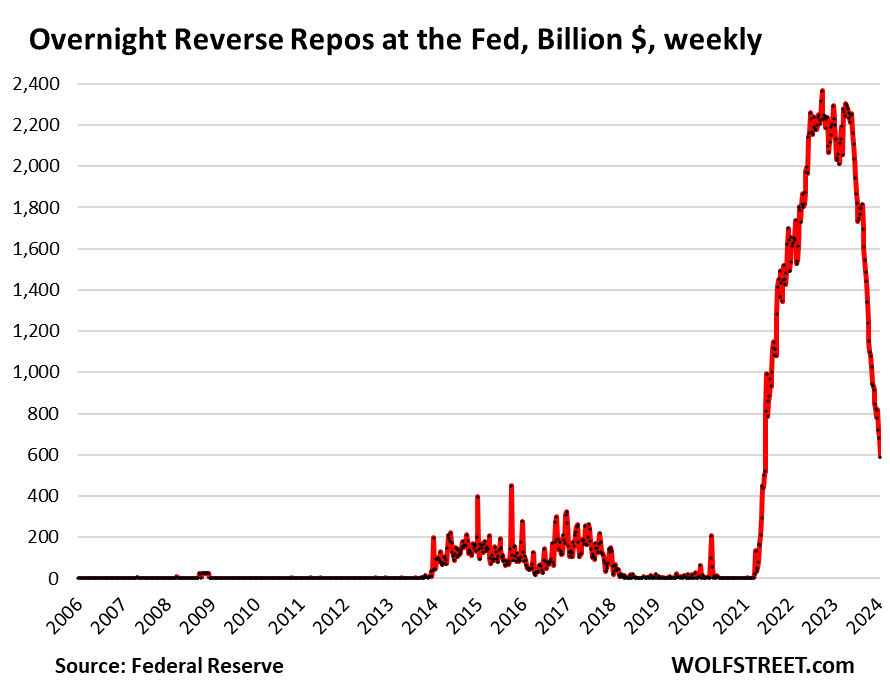

“Overnight Reverse Repos” (ON RRPs), where money market funds park their extra cash to earn 5.3%, have plunged by $1.78 trillion from the peak in September 2022, to just $590 billion, as QT is draining liquidity from the system. Most of the plunge has occurred since June 2023.

As the chart shows, ON RRPs are normally near $0 or at $0. Now they’re going back to their normal non-QE condition. But Wall Street gurus are having a cow about it, and some predicted that all kinds of mayhem would break out if it fell below $750 billion or whatever, which it did without breaking a sweat:

The spike of the ON RRPs resulted from mega-QE liquidity that overwhelmed money market funds (MMFs), which then temporarily lent the cash to the Fed via ON RRPs to earn some interest.

But starting in 2023, money market funds redirected this cash into buying T-bills, which paid more interest (around 5.5% currently at the short end) than the Fed’s RRPs (5.3%); and they engaged in the regular repo market, effectively lending cash to counterparties, especially via “term repos” such as two weeks or longer that earned more interest than the Fed’s 5.3%.

MMFs are now absorbing much of the huge flood of T-bills, and they’re lending to the regular repo market, and that’s what MMFs are supposed to do. The ON RRPs at the Fed were just an outlet for this QE tsunami of liquidity.

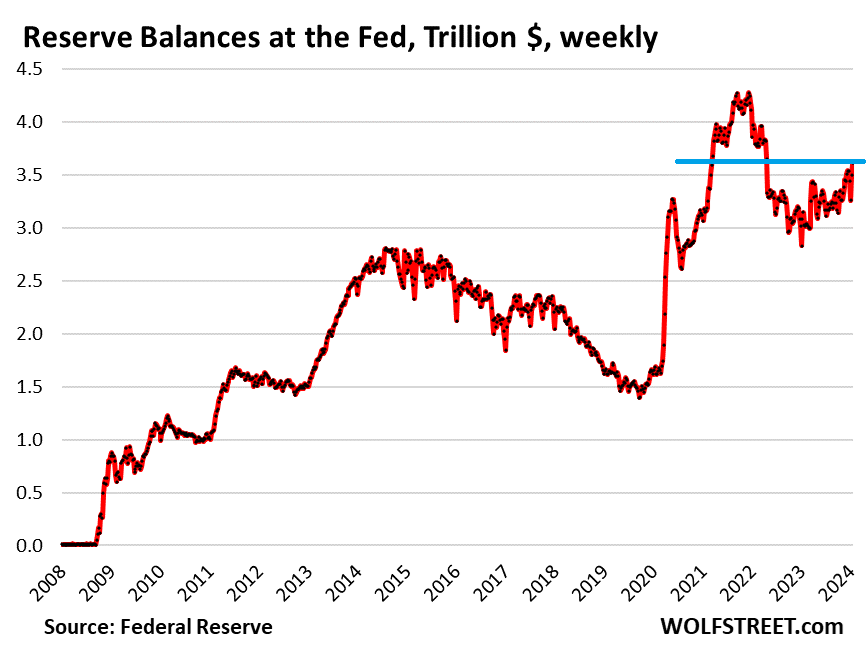

“Reserve balances,” where banks park their extra cash to earn 5.4%, have dropped by $664 billion from the peak in December 2021, to $3.61 trillion.

But they’d dropped a lot more in 2022. Then in 2023 and so far in 2024, they’ve re-risen, as huge amounts of excess liquidity started shifting around the financial system, including a portion of the liquidity that got drained out of RRPs.

That reserves would rise during QT – as they have in 2023 and so far this year – has been one of the big surprises to the financial world, which expected reserve balances to drop in parallel with RRPs.

Since November, reserves have been rising for an additional reason: Banks started gaming the Fed’s new bailout facility, the Bank Term Funding Program (BTFP), that had been conceived in all haste over a weekend in March 2023 and was announced on Sunday, after SVB had collapsed on Friday.

When Treasury yields of one year and longer began to plunge in November, the cost of borrowing at the BTFP dropped to around 4.8% by late December, and banks could then deposit this cash (borrowed from the Fed at 4.8%) in their reserve accounts at the Fed and earn 5.4% from the Fed on it. This roughly 60 basis point spread is risk-free income for the banks. The BTFP will expire on March 11. We’ve been discussing this BTFP arbitrage for a while, including here with a chart.

Since the plunge in yields made that arbitrage profitable in early November, BTFP balances have jumped by $40 billion to $161 billion; this additional $40 billion since November never left the Fed.

It seems, however, that the Fed is looking askance at this trade, or else JP Morgan might be doing it with $1 trillion.

Ample reserves.

Reserve balances cannot go to zero, unlike RPPs. Reserves are cash that banks put on deposit at the Fed. They’re essential liquidity for the banks that they have in reserve, so to speak. Banks can collapse if they don’t have enough liquidity to meet cash outflows, as we have seen in the spring of 2023.

When the Fed undertook QT last time, and reserves dropped below $1.5 trillion in the fall of 2019, banks stopped lending to the repo market, and repo market yields blew out, triggering fears of contagion, and the Fed stepped in and lent to the repo market to calm the turmoil.

As a result of the experience, the Fed defined its new concept of “ample reserves.” It would make sure that reserves in the banking system are “ample,” and at the time that meant somewhere around $1.6 trillion. Today that floor would be somewhat higher. And QT will end when the Fed thinks reserves are somewhere near that floor of ample reserves.

Where that floor may be will be subject to speeches by Fed governors, and Powell will get hammered at the press conference over it, and discussions will crop up in the minutes, and it will lead to wild and woolly speculations and grotesque distortions, as all this stuff does.

Rebirth of the Standing Repo Facility.

In July 2021, before the Fed even announced QT, it re-implemented its Standing Repo Facility (SRF).

“This is back to the future. The Fed had an SRF that it used for decades as part of its monetary policy tools and to provide instant liquidity to the market when the big S hit the fan, such as during 9/11 and during the early parts of the Financial Crisis – instead of QE. This facility nearly always carried a balance, but of varying amounts, and most of the time, fairly small amounts,” we wrote at the time.

The Fed, under Bernanke, had killed the old SRF in 2009 because it was no longer needed as QE was washing over the land. When QT removed some of the liquidity in 2018 and 2019, and then problems cropped up, the Fed didn’t have an SRF anymore and had to improvise a repo facility.

This SRF can supply liquidity to the market and to the banking system with repos, and when those repos mature, they’re paid back and don’t stick on the balance sheet like QE bond purchases.

“But this looks to me like an effort to get back to a situation where not every run-of-the mill crisis triggers more knee-jerk QE, one bout bigger than the previous one. And it looks to me like some form of preparation to make “balance sheet normalization” work out better next time than last time, which ended in the repo market blowout,” we wrote at the time in July 2021. That’s our story and we’re sticking to it.

Now “balance sheet normalization” has progressed by $1.3 trillion on auto pilot, the SFR is ready to resolve issues the way the Fed used to resolve issues before QE, including after 9/11 when markets froze up. There was no QE after 9/11, there were a few weeks of heavy repos, and then markets went back to functioning, the repos matured and came off the balance sheet, and the Dotcom Bust continued.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Thanks for your thoughtful way of presenting the topic. Apparently the world is not ending. Don’t tell the nullhedgers as they might run out of click bait…

So James Grant of early 1980s Barrons fame and publisher of Interest Rate Observer is a nullhedger? the phenomenal growth of shadow banking in the form of private credit (used to leverage the returns with private equity) replacing traditional middle-market lending by banks is of no concern to the glorious Fed or UST?

Jan29 the UST will release its funding schedule for rest of 2024 and 2025 with likely empahsis on short duration ( a huge gamble). No one discusses the supply/demand concern………who is going to buy the UST debt (technically except for wartime) the Fed cannot do so)?

No it’s not. In fact, private credit is better than direct bank lending, from the Fed’s point of view. The Fed does not care that some pension fund gets blown out because they invested in some private equity debt. They do care if a bank does so. Even in the depths of the 2007/8 crisis, the Fed only cared about banks, MM funds, and other players in the finance industry like investment banks.

To the extent that debt is now securitized and spreads default risk out into the non-financial world, instead of keeping it concentrated in the banks, the Fed seems that as making the finance industry *more* resilient to monetary shocks.

(Fwiw, I’m not so sanguine about the change myself, because this also encourages banks to engage in fraud since they can always sell off the crappy debt to unsuspecting individuals. But the Fed and the government has shown they don’t care about fraud — or else half of wall st would have been jailed in 2008 — only solvency)

Correct. If indeed the Fed and government actually prosecuted fraud, 2008/2009 would have gone very differently. Most of the banking institution and insurance giants of today would have gone extinct. Capitalism is long dead, along with contract law. Interesting times.

Lots of people will still buy the US debt. Money markets, banks, insurance companies, foreign countries, private investors, retirees, etc. Yields might rise if there are not enough enthusiastic buyers, but if yields do rise, then new buyers will show up at the higher yield.

Yield solves lots of problems.

Very good explanation, thank you.

What are your thoughts on the dropping of Required Reserves?

And, what of all the “chatter” of the Fed deciding to taper or halt QT?

Remarkable the rebound in markets and some assets with the advertised restrictive 5.25 – 5.5% Fed Funds target. Seems any suppressing from these rates has been swept aside.

Your #1: The Fed reduced the reserve requirement to 0% in March 2020. That was a mistake. It should have been raised to 20%, and SVB likely wouldn’t have collapsed, but the executive bonuses would have been smaller, and shares wouldn’t have been so high back then, but today they’d still be around.

Your #2: The Fed’s Logan laid this out pretty logically a little while ago. She said as RRPs approach zero (so another $590 billion to go), the Fed should start slowing QT so that liquidity can easily flow from where there is excess to where it’s needed, that yields in the system (higher where liquidity is needed and lower where it’s in excess) make this happen, but that it’s not instant, that this takes time, and reducing the pace of QT at that stage would give liquidity time to move to where it’s needed, which would prevent the kind of problem that caused the Fed last time to halt QT “prematurely,” and that a slower pace of QT at that stage ($590 billion from now) would assure that QT could go for a long time without getting halted “prematurely.” I posted her QT speech here four times for people to read. It was a very good and logical layout of the issues.

Here is the QT portion of her speech:

https://wolfstreet.com/2024/01/09/the-fed-will-let-the-btfp-expire-in-march-fed-vice-chair-for-supervision-michael-barr/#comment-563497

Before she was appointed president of the Dallas Fed, she was the head of the market operations (SOMA) at the New York Fed and managed the Fed’s securities portfolio, and she knows this stuff inside out. But the headlines and comments about it were grotesquely distorted manipulative BS.

One the biggest distortions is paying interest on those reserves, something that was never done before the GFC. It’s even worse now that there’s no difference between required reserves and excess reserves. At least before, interest was paid only on excess reserves; now it’s paid on all reserves (since all reserves are basically “excess” now)

If they reduced the interest paid, it would incentivize banks to start deploying that capital as market liquidity *now*. While there’s still flexibility to make rapid adjustments using the overnight repo facility as needed.

But of course, banks will howl in protest if they don’t get to earn risk free interest on what is essentially free money for them (checking deposits still pay lousy interest) so the Fed is loathe to do so.

Gradually reduce the interest paid and force banks to start doing their job of providing credit and liquidity to the markets rather than just letting it sit there, and you’ll see that reserve balance go to zero pretty quickly.

PS. I agree with you that the Fed should never have gotten rid of reserve requirements. But now that they have, why should there be any reserve balance at all? Or does this mean that even the Fed governors don’t believe their own BS about how banks can now be properly capitalized with non-reserve assets only? And that getting rid of required reserves was just a way of paying interest on *all* reserves rather than just excess reserves?

Looks like the Fed is slowly returning to normal. Interest rates on treasuries are returning to normal. Now if we can just narrow the spread between the governments income and expenses and we might see some reduction in underlying inflation. Then half of YouTube content creators are going to have to find real jobs.

YouTube is going to get rid of cat videos?

Why will I ever return to normal. No one will praise me in normal times. I want attention, I want media to dance around me.

The markets are at unsustainable levels, they will jitter soon, media will create panic and I will become the messiah that will create SPVs and press the magic button to print trillions.

That’s exactly what I fear, that the Fed will print trillions if the choice is letting a bank like JP Morgan or Wells Fargo go down.

“J. Pow” is a satirical account – a form of humor 🤣

No, I know, but I think his satire unfortunately will become reality. The Fed will tolerate minor disruptions, but they won’t allow a large bank to go down, and they won’t allow the credit market to seize up. They should, as that would fix inflation and clear out the deadwood, but they won’t.

If something happens for long enough then isn’t it just the new normal? What normal are you expecting a return to, as none of this happened overnight but over decades?

Howdy Mr Powell. The FED has so many tools in its tool box. How about a Greenspan trick? That could work for years.

Debt-Free-Bubba-

James Grant recently referred the “tools” as an assortment of “broken screwdrivers and dull hacksaws.” One of his colorful analogies!

I can speak from experience: tattered or malfunctioning tools often lead to the emergency room.

Cheers!

Greenspan was directly responsible for “Black Monday”.

Got a screwgie?

There is a Fed put and it explains why we’re at all time highs. No satire, either. The balance will be the escape valve and short selling is ill-advised.

The non-death of the Fed put was signaled loud and clear in March 2023. Markets, unlike permabears, got the message, and have appropriately resumed their bubbliciousness, with only a few brief interruptions ever since.

Kent, What’s wrong with creating YouTube content? At least that is producing something that can be of value or entertainment. I’d prefer less asset speculators than YouTube creators.

Lot of people envy the content creators. Youtube is drastically cutting share of income to content creators. Lot of original content creators and freedom of speech people also feel betrayed. Alternative platforms such as bitchiness, rumble are becoming popular but do not pay like youtube and views are also low.

Once upon a time 100K subscribers can afford a sustainable living. Not anymore. YT baited the viewers and content creators but now they are switching to low pay system. YT is also censoring sensitive topics including fights between countries, health (c and v), politics (Nov 7) and so on. Insta, FB and other platforms might follow YT.

Amazing that YT creators can make a living with these videos. The power of advertising and why Google and Facebook have such high equity value and keep rising . I don’t understand the logic but the results are there

I love this article. It explains a lot, and brings up questions too.

1. Does the “normalization” that is discussed in the article, and by Kent above, include a return to 0% interest on reserves? IOR (along with the ON RRP facility used by government money market fund) seems to me to be a a direct subsidy to privately owned banks (or MMMF industries).

2. Related to my question 1, does normalization” include a return to positive operating results at the central bank level, or is that a thing of the past?

3. Related to my question 2, I assume the eventual return to a positive yield curve would impact the operating results of the Fed?

Thanks

IF 0% return on reserves is indeed part of the plan it will likely have to wait for a long time.

Otherwise we risk releasing this massive liquidity into the real economy, stroking price and asset inflation.

Which begs the question….why not bring back reserve requirements to 20% instead of offering interest on reserves? Both actions achieve the same goal which is to park the money with the bank and curtail spending.

Your #1 A: “Normalization” means higher rates in normal times so that rates can be cut during a recession. The Fed lamented for years that when rates were at near 0%, that it couldn’t cut rates further (the “lower bound”) and that it had to use QE to stimulate. Higher rates allow the Fed to stimulate by cutting, and QE is not needed to stimulate — which is how the Fed used to do it.

Now with rates at 5.5%, the Fed can cut by a lot and not even get near 0%. It can cut by 300 basis points to deal with a recession, and rates would still be 2.5%, and then it can cut by an additional 100 basis points, and rates would be at 1.5%, by which time the recession is over, and the Fed can hike again. That’s “normalization.” That’s how the Fed used to do it.

This assumes that inflation is back to 2% by then. But if inflation is at 5% by then, and there is recession, the Fed might not cut at all, but just let the recession force inflation down to 2%.

Your #1 B: interest on RRPs goes to people with shares of money market funds, including readers here that are making 5.2% on their MMFs. And it forced banks to compete for deposits from people who were yanking their money out of banks and putting it into MMFs and T-bills. The Fed’s paying interest on RRPs was one of the factors that has forced banks to hike their deposit rates. That’s why banks are offering 5%+ CDs. Otherwise banks could have continued to screw their depositors with near-0% rates.

Your #2. Yes, eventually. But with much smaller incomes than during QE.

Your #3. I don’t see that having a big impact on the Fed’s operating results. What does have a big impact are the Fed’s policy rates (interest it pays on reserves and on RRPs) and the size and type of the Fed’s holdings. Those holdings are shrinking, so interest income will shrink. But when QT ends, the holdings stop shrinking, and maturing low-yielding bonds will be replaced with higher yielding bonds, so income will then tick up. At the same time, RRPs will be near zero, and interest expense on them will be near zero, and the reserves will be much lower, and interest expense will be much lower as well. So that’s when the Fed will start making money again, but not as much as during QE and 0%.

Thank you, Wolf.

Does your statement:

“The Fed lamented for years that when rates were at near 0%, that it couldn’t cut rates further (the “lower bound”) and that it had to use QE to stimulate”

portend the potential return to a similar use of QE under similar circumstances in the future?

Or has the money/banking somehow been changed so that those circumstances can no longer occur?

More pointedly, is the lower bound problem a “thing” of the past??

Thanks for your clarifications!

The fundamental problem is the 5.5% is still TOO LOW for the relative risk. As hard as the average person works, there needs to be an appropriate return for the relative risk.

We have rewarded bad behavior for far too long, it’s long past time to reward SAVERS appropriately.

As far as the yield curve goes, T-bills still have the highest yield, and there is a TON of new issuance coming. CONgress better balance that budget ASAP, tick tock…

I hope IOR specifically goes to zero (not talking about RRPs), but it doesn’t have to go that far. Cut it significantly below current short term Treasury bonds and banks will yank their deposits and place them in treasuries instead.

Right now the Fed deliberately keeps the rate close to it’s overnight Fed Funds rate specifically to keep the deposits from flooding the markets and undoing the effects of QT. Which is why, IMHO, we haven’t seen drastic changes in non-debt-fuelled asset prices like stocks (housing has dropped due to so much of housing being affected by mortgage rates).

What I hope is that, when the Fed starts to see some liquidity issues, rather than restart QE (or even slow down QT), they reduce these interest rates and make banks step in, as they should.

Maybe on your next version of this article, you can discuss the TGA since it is the most volatile of the 4 main liabilities of the Fed. It looks like since the last debt ceiling agreement, the treasury has targeted an average balance in the TGA of $750B. I assume that as federal spending continues to increase (as it does every year), this average balance would continue to grow as well. Seems this could also put a limit on how low the Fed can reduce its assets.

Yes. I’ve discussed this before, and I’ll discuss it again. But just a quicky reminder: a higher TGA can mean lower reserves, as banks buy T-bills instead of keeping cash in their reserve accounts. So that liquidity would just flow from one liability account (reserves) to another (TGA), and might not increase assets. Liquidity flows are a funny thing, as we’re now seeing.

Cash in circulation is another Fed liability update waiting to happen. It does directly impact assets. But cash in circulation has flatlined, which is rare, and is very interesting.

I would say that the reasons it has flatlined are:

– With interest rates at 4 to 5% for savings accounts, there is less of an incentive for people to hold currency. This probably applies less to foreigners holding US currency who don’t trust banks (thinking of Argentina, Russia, etc).

– The fintech effect. From my own personal observation, a overwhelming amount of people are now using Zelle, Cashapp, and Venmo for peer-to-peer payments (some even seem to be bothered when you pay them in cash). I have also heard of the increasing use of these apps (specially Cashapp) in transactions involving illicit activities. This has been the subject of articles by the WSJ and Rolling Stone.

Jury is still out whether currency in circulation has flatlined, or merely returned to long term trend line growth curve. If only we could get money supply to do that. Maybe in another year, or possibly sooner with recession.

‘Where that floor may be will be subject to speeches by Fed governors, and Powell will get hammered at the press conference over it, and discussions will crop up in the minutes, and it will lead to wild and woolly speculations and grotesque distortions, as all this stuff does.’

No where else in the world does an institution of this importance communicate like the gossip ‘grape vine’ in a girls’ high school. Even a political party usually appoints a ‘whip’ to keep yappy members from straying off the party line. Just a few days ago there was a big market sell- off when one of these guys we’ve never heard of, and don’t want to hear from, sounded off hawkish, briefly disturbing the dovish waters.

This has since subsided, in prep for another member’s turn on the open mike.

If the board members of a major company trading on Dow or Nasdaq, wandered around spouting their conflicting individual views, the shareholders would have a sh$t fit, as would the SEC.

Because it’s all theater?

Nick,

You mean like Tesla?

Wolf, you are the first one that im aware of who was on to the idea that reserves can drop far lower than anyone thinks because of the SRF…hats off to you!

In a SRF world, deposits will become a more valued commodity because large banks tend to hoard reserves because of the Liquidity Coverage Ratio requirement. Reserves are treated as high quality liquid assets (HQLA) irrespective of whether they were created by QE or the SRF, but it changes the outflow side of the equation for banks. QE created deposits, which had much lower outflow haircuts than repos. Therefore, if a bank gets too dependent on the SRF, it will hurt their LCR. Its going to get interesting!

Ditto. Everyone else is freaking out that RRPs going to zero will cause a liquidity crunch (despite reserves actually rising over the last couple months).

The SRF should prevent another ‘repocalypse’ a la 2019 as the balance sheet continues to shrink.

“(borrowed from the Fed at 4.8%) in their reserve accounts at the Fed and earn 5.4% from the Fed”

Good example of George Carlin’s concept that there’s a big club that you and I just ain’t in. Sure would be nice to be able to borrow vast sums of other people’s money from the Fed at one rate and then lend that money back to the Fed at a higher rate to be paid by other people or even people who haven’t been born yet. That’s a pretty cool trick there for those who belong to the big club.

Excellent post!

Again, these banksters are evil.

@Not Sure: Hey, the banks need to make their (obscene) profits and the banksters need their (obscene) multi-million dollar compensations and bonuses. What are you? A socialist? /s

…always felt that ol’ George’s terminology needed a bit of tweaking, i.e.: “…a club for the big…” (…and we still ain’t in it…).

may we all find a better day.

“If the American people ever allow private banks to control the issue of their currency, first by inflation, then by deflation, the banks and corporations that will grow up around them will deprive the people of all property until their children wake up homeless on the continent their Fathers conquered…. I believe that banking institutions are more dangerous to our liberties than standing armies…. The issuing power should be taken from the banks and restored to the people, to whom it properly belongs.”

Jefferson

“It is well enough that people of the nation do not understand our banking and monetary system, for if they did, I believe there would be a revolution before tomorrow morning.”

― Henry Ford

“At least 70% of the quotes on the internet are fake, and at least 70% of readers will repeat them anyways.”

– Abraham Lincoln

🤣👍❤️

Exactly! Direct theft, to the benefit of a relatively small group of people. The days of banks actually being intermediaries of currency, and essentially “just banks” are long gone. Moreover, the Fed has long since violated it’s charter with CONgress, and has instead enabled fraud and outright bought our representation. Remember, the primary dealer banks are essentially the owners of the Fed, many of which should have died in 2008/2009. The whole circle jerk is not constitutional and shoud have been redone a long time ago, 1971 at the latest. Honestly, it is rather amazing that the Fed system and the FRN has lasted as long as it has. Moreover, there is a lot of debt that needs to be rolled over…

Nikkei 225 on a 38yr high

SP 500 all time high

Residential real estate may have downticked, but still near all time highs

Inflation still above the questionably self authored 2%.

Debt ceiling “can” kicked down the road, again…..

And the Fed is considering cutting?

If they are, their motives seem hidden…… or is it just too obvious?

Maybe higher for longer was a comment on stock prices.

longstreet,

The S&P made all time highs due to the debt ceiling can being kicked down the road… a month long road.

This is all supported by hopium.

…ahh, the various definitions of: ‘high’…

may we all find a better day.

I hope Wolf is right. Eliminating QE is the right way to go. But why isn’t the Fed preparing markets for this change if that’s the course they intend to follow? Why don’t they talk about it?

Perhaps they are afraid asset prices will drop once they quit playing with the long end? That should not be a concern of theirs, if they stay within the parameters they tout as important.

Logan should have mentioned this in her QT update.

In my view, because they want asset prices to stay high, for their stupid “wealth effect.”

They’re willing to knock down assets to get inflation under control, but if they can get inflation back to 2% without an asset correction, they consider that all the better, not a negative.

Excellent article. Tks / Wolf

The problem going forward with always coming to the rescue with printed money and higher reserve balance sheets is , there will not be a rescission, or reset at lower levels. Excess from the previous highs in the capital markets won’t be worked off. This will cause a massive bubble for our economy. We already are in a double top looking out secularly in the S&P500. Patching holes and creating new credit cards, is not the Feds mandate..

Vio Bank is offering 5.3% on their money market account.

Are they matching the RRP rate (basically trading dollars) to stop the bleeding? Is this a sign they are in trouble?

5.3% on a MMF is just a notch higher than some MMFs and a notch lower than others. For example, Schwab Value Advantage Money Fund Ultra yields 5.38%. But Schwab also offers other funds with a lower yield.

That’s the Schwab fund with a million dollar min investment (SNAXX), which is why its yield is slightly higher.

I have a good chunk of my funds in the other Schwab MMF (SWVXX) which yields 5.24% but has no minimum.

Not clear whether there are any shocks coming to the system, such as CRE, but outside of that things are normalizing. It will get challenging if there is a significant event that occurs as asset prices are still high as well as rent and service inflation. There is of course the ballooning deficit but that isn’t exactly new and lots has to happen before that is a real crisis.

I just parked part of my portfolio in short term bills of 4, 8, 13, and 17 week durations with reinvest on and will bide my time. Hopefully the longer term yields will increase so trying to be patient there.

Outside of an increasingly possible black swan event emerging out of the middle east, you are correct.

An adoption of Wolfs approach to liquidity management would be a black swan event in itself, no? Markets have relied on excessive liquidity for a long time and are dramatically overpriced because of it.

We’ve seen both a rising debt-to-GDP and a rising liquidity-to-GDP ratio. They are the twin towers of unsustainable artificial stimulus.

Maybe I wasn’t supposed to say that out loud. Sorry.

With capitalism there is a “win-win,” but the “lose” is always being overlooked. The Federal Reserve wins boosting the big bank system that are its owners, the banks win with magic money created by this 60 point spread for zero risk. The public loses because they backstop the “private industry” Federal Reserve corporation. Since the Federal Reserve doesn’t have taxation authority, they simply use the ancient regressive tax of debasing the currency (theft); i.e., inflation. However, none of these bankers ever say where inflation actually comes from; with the half-truth they don’t know, that is because inflation originates in the myriad of Federal Reserve’s manipulations and “special” programs. As a minimum the Federal Reserve branch presidents should be Presidental appointees with an independent Inspector General (IG) like every other Federal agency.

I find it remarkable, and disappointing, that there is no discussion of the “extra” inflation above and beyond the 2% per annum since this all began 3 years ago.

Is it not a complete dereliction of duty by the Fed to turn a blind eye to this spike off the “acceptable rate” trajectory and allow this bulge in prices to remain? Or is it their game?

Markets tend to rally in the first quarter of an election year……and the hedge funds really front ran this one. Now the FOMO buying. IMO.

No apparent concern for geopolitical Black Swan potentials.

The logic in the article is sound and proposes a decline of intervention and return of market based price discovery. It’s the right thing to do, but I don’t think the Fed is willing to go there. I’d bet money.

We should know by end of 2024.

Fed likes control. Free markets are not on their radar.

It falls along the lines “they can’t handle the truth”……so they will keep the massive influx of money that occurred from 2019 to 2021 for the most part, to keep “doping the race horse”.

I agree Bobber.

” return of market based price discovery.” Are you joking right ?

FED would never let this happen.

Don’t believe me, Let’s revisit this in next 2 years or so.

Also, look at how FED has acted in last 2 decades.

As 2008-2024 has proven, the Fed governors can stay crazy longer than many sane people can stay sane. But we can all hope that the insanity is now over and at least some of it will be undone.

What ‘insanity’ are you talking about?

haha this nails it. The fed can be morons for longer than us folks can stay solvent, trying to anticipate them doing the right thing for the country

MW: 10-year Treasury yield heads for another 2024 high after U.S. consumer sentiment data

I doubt that the SRF will replace LSAPs. The deficits are too large so the FED will have to monetize a substantial proportion of this profligacy.

No the Fed doesn’t have to. Inflation can take care of that. Inflation causes tax revenues to soar, and after a while the big pile of old debt just isn’t so heavy to carry anymore. That’s the classic method of debt management.

Some articles mentioned last month that draining of RRP is causing the increase in bank reserve, which then causes money to flow into the stock market and prolong asset bubble. I wonder if Wolf thinks this theory has any validity.

I can see the first two parts of your statement/question. I have described and explained them in the article. That’s happening.

In terms of your third part, liquidity flows are a funny thing, they’re unpredictable, and they change a lot, which brought as this weird situation that RRPs dropped while reserves rose. So it’s possible that some of the RRPs liquidity went all over the place and did some magic. But if it did that, it’s not via the reserves (they rose and therefore absorbed some of this liquidity).

Think of it this way: if money market funds take the cash they have in RRPs and buy T-bills with it, that means that someone else is NOT buying those T-bills and has to buy something else with his cash, and it spreads from there.

When RRP is decreasing and reserves are therefore increasing, then the increased reserves will in turn decrease and flow into the TGA (US treasury general account) *if* used to buy+reinvest an additional amount of T-bills. Once spent out of TGA, the money ends up back in reserves.

bank reserves + TGA + RRP – RP + currency = constant (unless QE or QT)

So the question really is whether banks and the public/MMF will prefer to buy T-bills or stocks. If public buys stocks, there will be less demand for T-bills, The Fed and the UST ought not like that, because it will put upward pressure on T-Bill interest rate and other interest rates, already being at 5.3%. Bad for US government.

So it seems to me that UST should not want interest rates to go higher, nor stock market to go higher, because that means increased inflation again and we just had way too much inflation that has not even been undone.

But never underestimate the depravity of the Fed. They may stop QT and start QE and devalue everyone’s wages (labor). Except this time there might be a revolution if they do, because people are catching on to the swindle.

NARmageddon-

“But never underestimate the depravity of the Fed.”

That’s a funny line!

But sometimes its just plain, old fecklessness…. as with the BTFP arbitrage fiasco, or “inflation is transitory” claim. (On second thought… maybe you’re right!)

It is 100% depravity by the Fed. The Fed is inflating and maintaining asset prices at the expense of the value of labor (wages). That is all they have been doing since 2008. And many would argue it is all they have been doing since 1913, really.

Also, the when the Fed prints money against new government (US Treasury) debt, they are in effect creating a tax avoidance scheme for the wealthy, who are the ones that would otherwise have to pay the taxes to balance the budget. Again, the victims are the regular people, who get their labor (wages) devalued.

So, at least $590 billion of QT to go before the S&P, Dow, and Nasdaq start a decline?

I don’t think the FED cares that much about the DOW and NASDAQ.

I am not sure if the following is correct but I read an article that said 58% of the U.S. households owns some type of stock or 401k, but the top 10% own around 92% of the stock market value.

So the FED knows high interest rates really hurt the bottom 90% if they are not seeing gains in stock investments. Same with high unemployment. These are 2 of their so called mandates.

The value of the stock market is not a mandate. It is a consequence. Housing is interesting though. They really do not talk about it much?

As far as housing prices, I am not sure were to place its concern with the FED. Afterall, 65% of households own a home but it in a round about way it affects the calculation of inflation? They may want prices to be flat or drop a little but a big drop in home prices will hurt a lot of people, not just the top 10%. Especially the boomer generation who are retiring.

Just throwing out some thoughts. Not research.

The benefit of 401k and joblessness could be conflicting interests. Resolution: Hurt retirees accounts via the stock market, and they are forced back into the job market, thereby upholding the FED’s low unemployment mandate.

I think Bobber has said it best. At this point, it’s not even about liquidity, because liquidity has been shrinking pretty steadily.

Rather, it was the March 2023 bailout of depositors and the banks (not the ones that failed, but other banks that may have been holding bad paper).

In other words, the Fed recreated its “put” meaning that “investors” now have confidence that the Fed will “do whatever it takes” to prevent any real asset decline or recession (at this point, they go hand in hand as the spending that results from the wealth effect will prevent a recession).

So while liquidity is a sufficient condition for asset price inflation, it’s not a necessary condition, as long as the mentality is that the Fed is there ready to print.

On a more general level, if you bought stocks near the pre-great recession peak, let’s say S&P 1,550 or so in mid to late 2007, you didn’t recover until early 2013, or more than 5 years later. Since that time, there has never been a time, where if you bought index funds, you weren’t up within 2 years, and often only 1 year. That’s a tough mentality to get any selling pressure in. In other words, as long as people are convinced that their stocks will be worth more in 1-2 years, why would they ever sell?

This means that unless the Fed does something to disabuse investors of the idea of the put, that means that there will always be more buying pressure than selling pressure, no matter how absurd the valuations.

It’s becoming like Bitcoin in a way. Most stocks are held by a relatively small number of people who don’t need to sell, so they won’t as long as they think that it’s better to hold. And for the past 10 years, it has been.

I don’t see inflation getting under control, in either CPI, stocks, or housing, until the Fed breaks this psychology. And frankly, I’m fairly convinced they don’t want to.

Agree with Einhal. There needs to be some type of black swan event to force the Fed to abandon the put and the market to crash. It could be a global supply chain shock with red sea and panama canal crisis getting out of control. And CPI becomes entrenched and even starts going back up, which means the Fed will be forced to raise instead of lowering interest rate. Or when QT reaches 2 trillion, the market has to respond negatively.

” the Fed will “do whatever it takes” to prevent any real asset decline or recession”

and if I may, they won’t even allow a “cycle” to occur. The “new” Fed, born from the 2008 debacle has become the micro manager …. not just creating a “fertile” economic environment, but ENSURING constant and gradual asset appreciation.

But cycles are a free market reaction to things being over/under done.

They flush excesses an leave things healthier. Not allowing such allows excesses to build and the eventual “flush” becomes systemic in nature. Enter the Fed to save, and while saving, accrue more powers. (ala 2009 and 2019)

STOCKS ALL-TIME HIGH

HOUSE SALES SLOWEST IN 29 YEARS

“There was no QE after 9/11, there were a few weeks of heavy repos, and then markets went back to functioning”

If only they’d had the sense and/or discipline to do the same in 2020.

Wolf, the S&P reached all time high today in a time of all this QT. I think I read somewhere you said that would be very difficult but it happened very quickly.

Also do you still think the 10 year will reach 5% again?

I addressed this with my theory up above.

So the S&P 500 is back where it had been over two years ago. It took a huge rally to get there. It has now gone nowhere in over two years. It just gained back what it had lost.

The 10-year gained 36 basis points since Dec 27, from 3.79% to 4.15%. That’s a pretty quick progress back to the 5% range, no?

Yes, very quick. Sticky at least.

Interest rates at the heart are either a level of risk lenders will lend, or the market’s ability to pay. I think it’s clear the desire to hold Government bonds is waning, sending rates higher.

With Bidenomics, I wouldn’t loan a dime to these creeps, so what interest rate will attract buyers of debt?

Cost of goods can not be controlled by monetary policy, Yes? I assume, I’m just a newby.

So I’d rather buy the S&P than a Biden-bund.

Milo-

“… do you still think the 10 year will reach 5% again?”

Well beyond that, IMHO (eventually).

Bond bear markets last half a lifetime. The secular bond market tune will be played by bond supply (with many interludes of fearful demand, of course!).

Consider the pyrotechnics of the end of the last approx. 40-year bond bear market:

“At their 1981 peaks, seasoned prime long corporate bonds were selling to yield 15.50%. Commercial paper yields reached 16.66%, three month Treasury bills sold to yield about 16.3%, and the Federal Reserve’s discount rate was raised to 14%. The annual average prime rate in 1981 was 18.87%.”

— Sydney Homer and Richard Sylla, A History of Interest Rates

NOT suggesting the upcoming bear market must include double digit yields, but stranger things have happened…

“That reserves would rise during QT – as they have in 2023 and so far this year – has been one of the big surprises to the financial world, which expected reserve balances to drop in parallel with RRPs.”

The RRP have nothing to do with the Reserve balances, but so many people don´t or don´t want to understand that. And it seems Mrs. Logan falls also in this category: When she would know how the Fed´s own system works, she would not say words like “when the RRP falls further we must slow down QT.”

I cannot see the sense and the logic of her remarks, this is only “wall street guru” speech.

Marus

“The RRP have nothing to do with the Reserve balances,”

I would like to know how moving from holding securities to holding cash doesnt increase reserve balances. Politely Asking

1. Your quote of my sentence: This was about QT draining reserves (bank cash) and RRPs (money market cash) at the same time because both are liquidity that gets drained during QT. That’s how it happened during the last bout of QT (2017-2019). And that’s what was expected to happen this time, and it did happen at first, and in fact, reserves began plunging in early 2022 before QT had even started, and then in 2023 they reversed. It’s the reversal of reserves, with reserves going back up in 2023, that surprised people.

2. What you said that Logan said was a lie. She didn’t say anything close to your fake quote: “when the RRP falls further we must slow down QT.”

What she actually said: “we should slow the pace of runoff as ON RRP balances approach a low level.” And she’d defined what “low level” means: “as ON RRP balances approach zero.”

Here is the actual text of what she actually said so you can quit spreading lies about it:

https://wolfstreet.com/2024/01/09/the-fed-will-let-the-btfp-expire-in-march-fed-vice-chair-for-supervision-michael-barr/#comment-563497

Ok but when Mrs. Logan said this, the question why QT should be slowdown when the RRP approaches zero still remain. I personally see no reason for that, because in my view the banking reserves are the more meaningful indicator.

And the bank reserves are far higher as in the repo crisis 2019, there is absolutely no reason for any slowdown in QT, is 60 billion per month already less. Additionally, the SRF facility stands ready to address any form of repo market problems.

The wish pre GFC levels is dead forever no doubt, but when the Fed is now not consequent with QT, we never see any balance sheet levels like pre Covid, and this will be the final confirmation that the fed only do what wall street wants.

She explained why it’s a good idea to slow the pace of QT when RRPs approach zero. I’m not going to allow anymore of your nonsense comments about Logan until you actually read what she said and understand it.

Can we draw the conclusion that Fed Funds at 5.25 – 5.5% suppressed little?

We don’t heart the “rates are too high” comments anymore. Too high for what, exactly? Too high for the irresponsible creators of Trillions in debt.

Not too high for stocks.

Wall Street is not afraid of higher rates. They are afraid of faster QT. If the Fed raised QT to 200 billion a month, the market and Bitcoin would undoubtedly feel the impact.

Thoughtful people look at data to draw conclusions. Taking subjective gauges of comments from internet strangers about “rates are too high” is a terrible method to draw policy conclusions.

2023 year end suggests recession as global production is declining, layoffs seem possible, inflation rate slowing but still heavy on consumers, tightening loan/mortgage payment ability. Real estate prices declining. Will mortgages be a problem for banks/Fed coming this year?

///

Like a plague the cheap money has multiplied and infected every part of the economy. Yes, the QT will reverse some of it, and the housing market downturn some, but the revenues generated in the meantime with this money could be multiples of the initial QE…If this is the case I am not sure we have what it takes to deal with such an overabundance of liquidity.

///

Bingo

Wolf,

I really enjoy the periodic balance sheet updates. Have you considered (or already done but I missed) a dive into the “Maturity Distribution” section of the weekly releases? There is a lot in there I find inscrutable, particularly in light of the passive “roll off” doctrine I thought was happening. Some examples:

1) Jan 10 release MBS change nets to $0 but $145M of 10y+ securities are swapped for $145M of 5-10y securities. I understand there are a variety of reasons for the decrease, but why repurchase equal amounts, early in the month and far below the monthly MBS maximum roll-off?

2). My understanding of passive roll-off means that only treasury securities “Within 15 days” should be decreasing weekly, yet routinely far longer duration columns seem to decrease substantially. How can this be happening if the Fed is merely securities “roll off”. I am not sure if the RPP securities show up here, but with them increasing this would seem even more surprising.

Am I missing something in terms of reading these reports (or my understanding of how the Fed is going about QT)?

Why are you even worrying about anything denominated in “millions” — on a balance sheet denominated in “trillions”?

The “worry” is the Fed seems to be doing something other than what they are publicly understood to be passively doing with QT and their balance sheet. The strange MBS shifts are sometimes as high as $600M per week and the unexpected treasury roll off can often add up to tens of billions per week . Over the course of a year these can still add up, and understanding how the Fed is managing the duration of their balance sheet, and perhaps acting more actively than is generally known, seems like it might be worth discussion.

Quit fantasizing, LOL. Why make up conspiracy theories, when you could just look it up?

1. The Fed is doing some things in the “millions,” called “small-value exercises,” where it buys or sells MBS in small amounts to make sure its system can actually do this. They’re announced in advance. I get the schedule of these small-value exercises from the New York Fed in my inbox twice a month. Or you can just look here:

https://www.newyorkfed.org/markets/ambs_operation_schedule#all-schedules

So you’ll see these entries:

January 16 – January 29, 2024 The Desk plans to conduct approximately $71 million in agency MBS small value purchase operations over the period beginning January 16, 2024 on Fed Trade.

And the old announcements:

November 14 – December 13, 2023 The Desk plans to conduct approximately $150 million in agency MBS small value sale operations over the period beginning November 14, 2023 on Fed Trade.

etc.

2. And there is other stuff going on, such as MBS passthrough payments which lower the balance, and the inflation-protection the Fed receives on its TIPS, which increase the balance, etc.

3. And there is no “unexpected Treasury roll-off” — that’s one of the most predictable things. You look at the maturity schedule, and if the roll-off on the 15th and at the end of the month combined is less than $60 billion, T-bills will also roll off during the month to bring the total to $60 billion. T-bills mature throughout the month, and they roll off whenever they mature.

Quit fantasizing, LOL. Why make up conspiracy theories, when you could just look it up?

1. The Fed is doing some things in the “millions,” called “small-value exercises,” where it buys or sells MBS in small amounts to make sure its system can actually do this. They’re announced in advance. I get the schedule of these small-value exercises from the New York Fed in my inbox twice a month. Or you can just look here:

https://www.newyorkfed.org/markets/ambs_operation_schedule#all-schedules

So you’ll see these entries:

January 16 – January 29, 2024 The Desk plans to conduct approximately $71 million in agency MBS small value purchase operations over the period beginning January 16, 2024 on Fed Trade.

And the old announcements:

November 14 – December 13, 2023 The Desk plans to conduct approximately $150 million in agency MBS small value sale operations over the period beginning November 14, 2023 on Fed Trade.

etc.

2. And there is other stuff going on, such as MBS passthrough payments which lower the balance, and the inflation-protection the Fed receives on its TIPS, which increase the balance, etc.

3. And there is no “unexpected Treasury roll-off” — that’s one of the most predictable things. You look at the maturity schedule, and if the roll-off on the 15th and at the end of the month combined is less than $60 billion, T-bills will also roll off during the month to bring the total to $60 billion. T-bills mature throughout the month, and they roll off whenever they mature.

4. If the amount in notes and bonds that mature during the month exceed $60 billion, the Fed will buy in the amount of the excess new notes and bonds to keep the amount that comes off capped at $60 billion. For example if $63 billion in notes and bonds mature and come off the balance sheet, the Fed will then buy at auction $3 billion in notes and bonds to maintain the cap of $60 billion. But auction dates and maturity dates don’t match.