Higher interest rates bit, but builders adjusted to them.

By Wolf Richter for WOLF STREET.

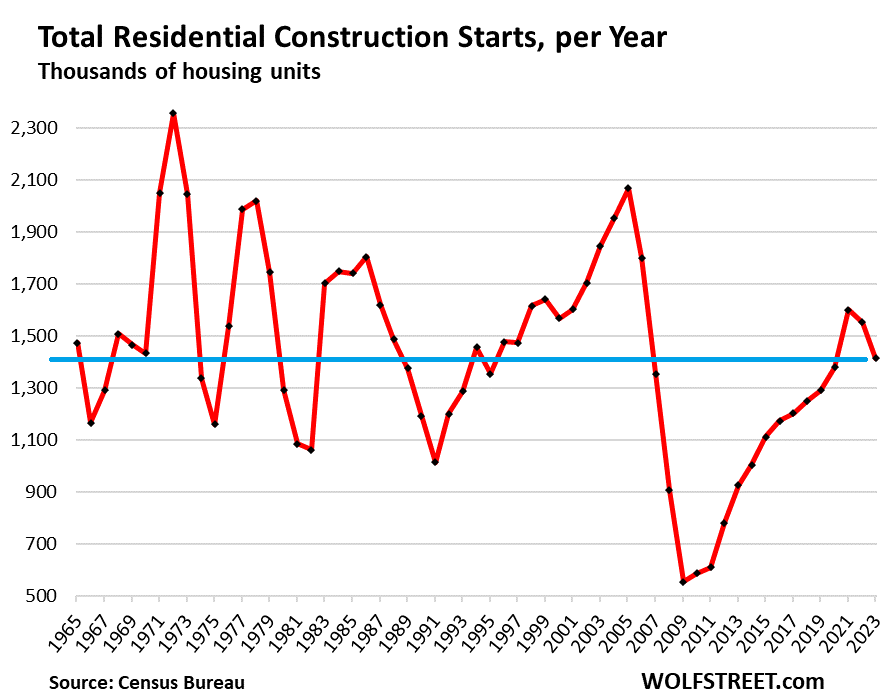

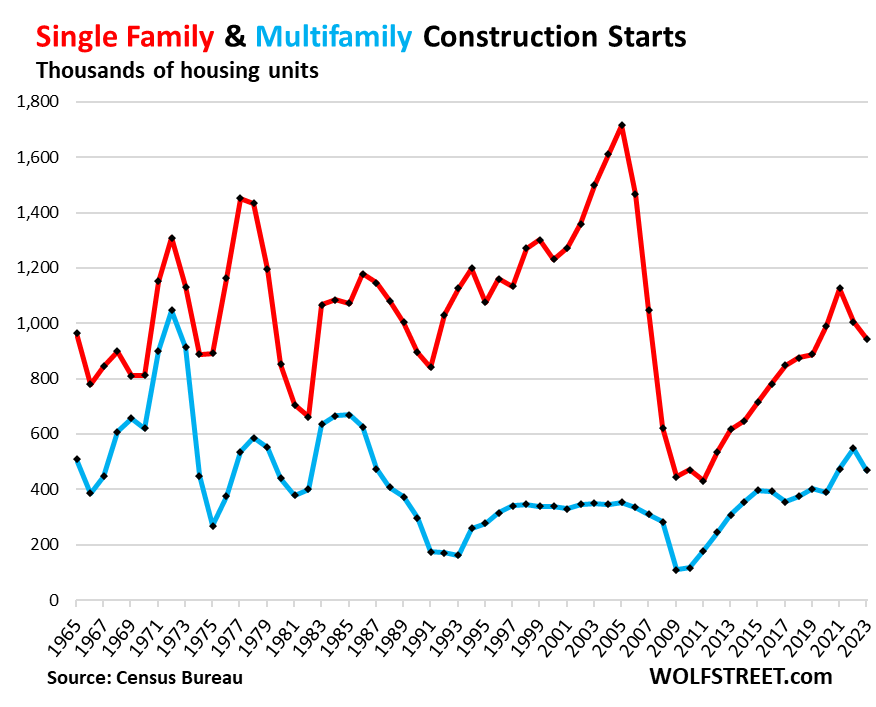

Construction starts of single-family houses and units in multifamily buildings (condos and apartments), fell by 9% in 2023, to 1.41 million housing units, the second year in a row of declines, from the 15-year high in 2021 (1.6 million housing units), according to Census data today. Compared to the 15-year high in 2021, construction starts fell by 11.7%.

But construction starts in 2023 were still the third-highest since 2006, after the recent records in 2021 and 2022, and were up by 10% to 50% from the range between 2013 and 2019.

As we’ll see in a moment, the blistering boom-and-bust cycles of overall residential construction are composed of epic multifamily and single-family booms-and-busts that occurred at different times.

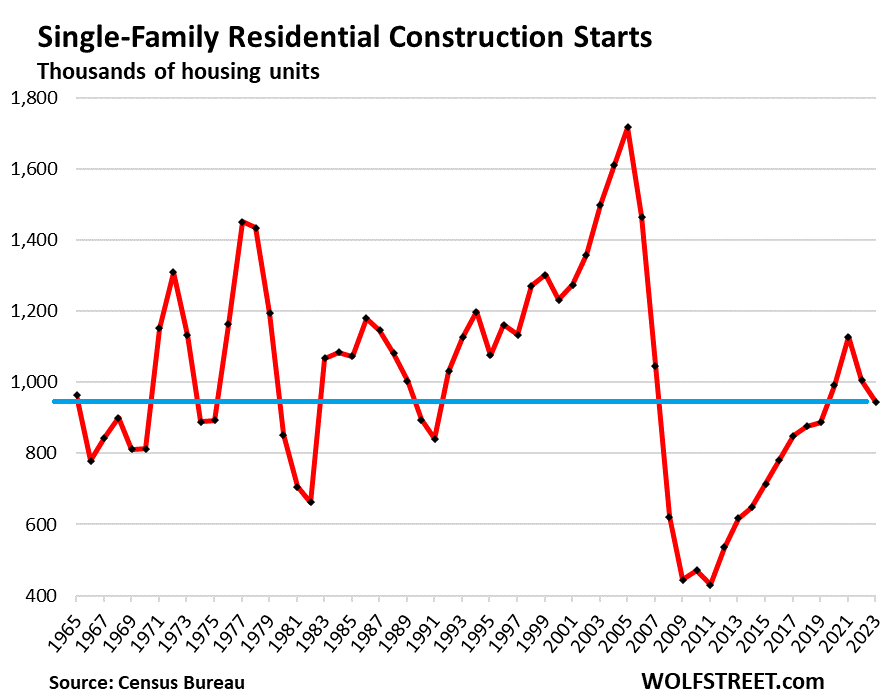

Construction starts of single-family houses fell by 6.0% in 2023 from 2022, and by 16.2% from the 15-year high in 2021, to 944,500 starts, after a decade of increases that followed the Housing Bust which nearly destroyed the homebuilder industry.

Mortgage rates started rising in late 2021 and surged in 2022 and 2023, and the entire math changed. Homebuilders responded by building smaller homes at lower price points, buying down mortgage rates, and throwing other incentives at potential buyers, and this has kept their volume at still fairly high levels:

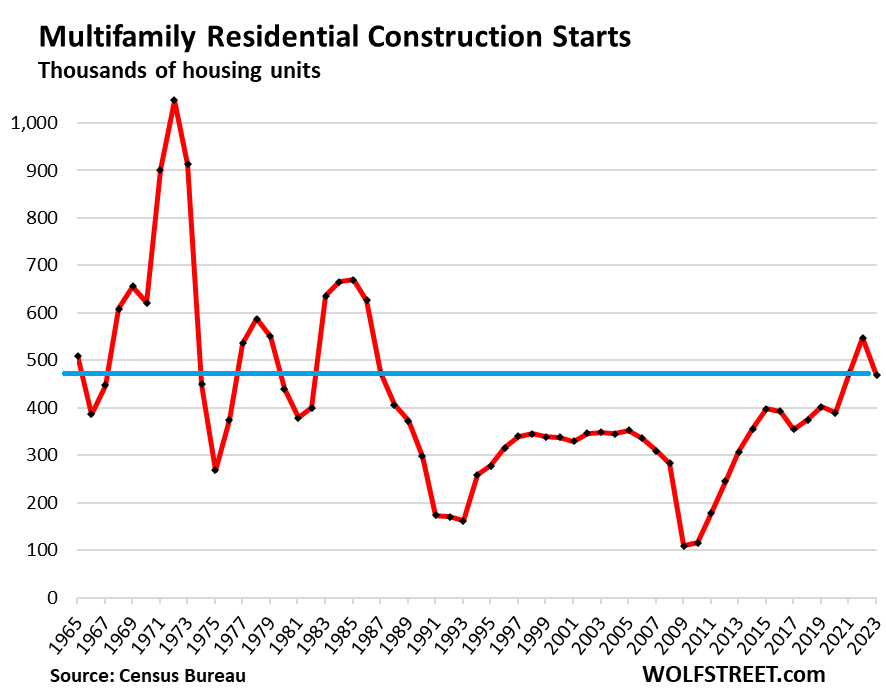

Construction starts of units in multifamily projects, such as condo and apartment buildings, fell by 14.4% in 2023 to 468,600 units. But 2022 had been the biggest year since 1986.

Still, multifamily construction starts were up by 17% from the range between 2015 and 2020, and up by 74% from the range in the decade before the Financial Crisis. They were the third highest since 1986, behind 2022 and 2021. But they were way below the crazy boom of the early 1970s that turned into an epic bust.

Multifamily projects tend to be big and have long lead times. Projects where construction started in the recent peak year 2022 were in the planning stages years earlier. It took till 2023 for the decline in multifamily starts to show, a year after single-family starts began to decline. Still, both were higher in 2023 than in the years before the pandemic.

In many densely populated cities and urban cores, such as in Manhattan, San Francisco, Boston, and other cities, multifamily is just about the only type of housing that is getting built. Most of the condos and apartments getting built are higher end. With these higher-end apartments, builders are targeting “renters of choice,” as the industry calls them, because that’s where the money is in expensive cities, which is part of the housing problem.

Single-family construction takes place further away from urban cores. This includes the hottest trend in housing construction: “build to rent” developments designed specifically as rentals mostly for “renters of choice,” and built either by large landlords or by builders that then fill the developments with tenants and sell the income-producing project to large landlords, pension funds, and other funds.

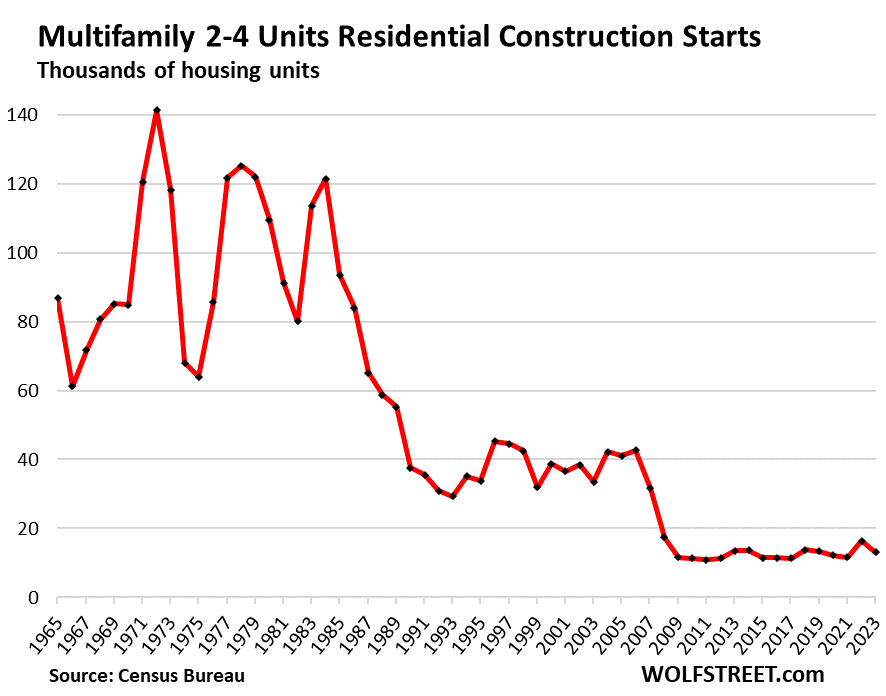

Starts of 2-4-unit multifamily projects are included in the overall multifamily starts. The numbers account for only 2.8% of multifamily starts. But they’re interesting because they testify to a shift in multifamily construction toward bigger projects. They used to be a much bigger deal but have fallen out of favor in the 1990s, and then brutally after the Housing Bust, collapsing by 80% to 90% from the peaks in the early 1970s through the early 1980s.

In 2023, starts dropped by 20% from 2022, to 13,100 units, down by 90% from the spike in 1972. But starts in 2022 of 16,400 had been a 15-year record amid speculation that this category would take off again.

Single-family construction dominates. Despite two years of declines in a row, single-family starts accounted for 67% of total residential construction starts in 2023. Multifamily accounted for 33%.

The chart shows the booms and busts in each segment, single-family in red and multifamily in blue.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Canada, where I’m from, has been undergoing a construction boom for a full generation now. All manner of things are being built: office towers, condo bujildings, single family homes … What I worry is that without a rest from all this labor, the construction workers may be getting exhausted. They’ve been in such high gear for so long.

It is natural, considering the nature of Man, to need to rest from one’s labors. It isn’t enough to have weekends and vacations off, if your everyday existence is one of unmitigated hectic activity.

Olympia & York, the Reichmann company, based in Toronto, used to give its Jewish and Christian workers both Saturday and Sunday off, and their buildings still went up in record time. O&Y, which went bankrupt after years of success, last made its mark with Canary Wharf in London. There are now dozens of smaller firms than O&Y making their mark on the Canadian landscape, may they all thrive and succeed.

Back in those days homes were built three times faster than today as workers today are slower than molasses in January and most are physical train-wrecks but if they all slack off at the same time you can’t fire all of them at the same time.

Oof. The charts are illegal. I’d hate to be a home builder today.

so for years we’ve had about 10-20ac empty lot about 2 blocks from our in town home – ours was built in ’68

——

week ago they dropped off big eq. and now have roads cut in and stakes for 50 homes

just roads and utilities cost $5 mil ++++

What town?

That’s insane. We have a flood zone multi family property being built. It’s row homes or town home names. 1 window on the side it’s insane and will have constant flooding.

They haven’t sold maybe 3 of 100. 15 have been built. The others are coming…

Why has residential construction lagged so far behind for so long? From the 1960s up until 2009, it was strong but has struggled to recover ever since, and even at its peak in 2021, it is still nowhere near previous highs. This is a large part of the problem of affordable housing. Obviously, there is demand, yet we’re just not building.

They overbuilt spec houses for which there was no demand and the industry essentially collapsed. And then gradually, the industry recovered. Boom and bust.

The US population has grown a lot more slowly in recent years than it used to.

Build baby build?!

Now is a good moment to reflect upon just how badly the Fed has eff’ed up the housing market over 20+ years of “optimizing” the US economy through aggressive use of ZIRP.

1) In the run up to Bust 2009, the Fed spent *years* ignoring

a) the fact that builders were exploiting ZIRP to build a smaller number of McMansions at ZIRP subsidized rates/constant monthly mtg pmts…rather than a *greater* number of traditional homes at *lower* monthly payments (so much for ZIRP being designed to hike employment…even construction employment) and

b) being pretty damn clueless about the convoluted, cascade-collapse-prone financing structures that arose under ZIRP (in an industry the Fed allegedly regulates)

2) And the real kicker is this…the Fed has somehow managed to eff up the flipside for Bust 2023…now, just at this moment of greatly increased residential construction requirements (to deal with largely unprecedented housing cost increases), the inevitable consequences of the Fed’s prior 20 year ZIRP (inflation) have required the Fed to greatly hike rates…making it much harder for new construction to actually pencil out.

It is a rare talent that can screw up in opposite states of the economy.

It is enough to make one doubt the wisdom of central management of the money supply, interest rates, the economy, etc…

Cas127-

“It is enough to make one doubt the wisdom of central management of the money supply, interest rates, the economy, etc…”

Yes, indeed. Fed interventions that effect market rates (thus allowing a government agency to manipulate economic growth, and enabling crippling federal deficits) produce pernicious consequences.

Some regulatory, administrative, and research efforts at the Supra-bank level seem useful, but regulating the level of employment through price fixing and subsidization of multiple industries (including, but not limited to banking) crosses the line into blatant interventionism, IMHO.

How many times must we endure the pernicious effects of central bank interventionism. Time to fully re-examine and reform the three Fed mandates, as well as the catch-all phrase “and for other purposes.”

Shrink the Fed.

Cas27,

Add to these failures the use of bad inflation statistics. Housing price inflation is excluded from CPI under the theory it’s an investment, but housing doesn’t pay dividends or interest. It’s a purchase of a depreciable asset, just like a car or other durable good. If housing price inflation were included in CPI, the Fed would be forced to consider housing price inflation as part of rate setting, and we might not have seen ZIRP for six years.

Much of the frustration we say today results from treating housing as an investment and not a necessity for Average Joe.

People who already have housing are always excited when Midas turns it to solid gold. The next generation thats looking to buy doesnt feel that solid gold house is so wonderful a purchase. Housing as an investment has a hard stop on when the investment can no longer be afforded by individuals and moves entirely into the hands of private equity and investment firms. Over the next 100 years the number of Americans who own their homes will approach 0, and the percentage of their income dedicated to rent will approach 100%.

“The chart shows the booms and busts in each segment, single-family in blue and multifamily in red.”

Then you have the opposite color scheme in the final graph, Wolf.

Yes, thanks!!

Seems like a pretty easy solution to stomp out all the booms and busts

a little government incentives for something that actually need to be simulated

Worsening housing crisis and yet we hand out money to Elon musk but can’t get incentives towards building shelter for our citizens

Silly me tho if we build too many homes they can’t double in price every decade and we won’t be AS rich

It’s not only that this 🤡 of a democratic government spend too much money they also spend it on all the wrong things so pathetic

Anybody who wants to do a little homework…..look at Discover financial latest report. They added 1.9 billion to loss reserves UP one billion from last year. In addition, big increase in delinquency.

It might be starting on the fringes.

Going to have to see banks having the same issue, although bankers are usually slow to react to problems.

Still waiting for claims to crack……until they do……another day at the circus.

One of my favorite stocks to read the investor presentations. They finally threw in the towel on student loans, too.

I love the student loan saga. They thought they could simply deny bankruptcy protections from loans given to teenagers and they would run riot on payments forever and now are shocked the same insane arbitrary rule changes they abused are being used against them.

You gave a jobless 17 year old a $100,000 loan, write it off ;)

Good news: The backers of the new city in Solano County (California) just filed a ballot initiative for an election. Seems like the County government liked the status quo. There is no end of land to build homes on in California. Thank God almighty for something to reduce pressure on tge purposeful overcrowded real estate market.

As you know, propositions of this type are routinely voted down. For most Californians, the default vote on propositions is “no” — so if people aren’t sure, or don’t understand what’s going on, or don’t want to waste their time worrying about it and figuring it out, they vote “no.” So I would not prematurely break out the bubbly.

Last year the UK had 750,000 net immigrants (without the illegals of 45,000) The question was where were we going to find 750,000 beds from a small crowded England, which has a housing shortage.. Well, we did but rents went up to the sky.

I know the USA has many migrants a year. Does it also effect rents, probably not, as they appear to be falling…. Strange world…

Rents in the US are NOT falling. Actual rents that tenants are paying have been hitting new records every month, but they’re not rising as fast as they did a couple of years ago. The CPI Rent index over the past three month rose at an annualized rate of 6.2%.

Actual rents = blue line; Zillow’s asking rents (rent of apartments listed for rent) = red line.

Asking rents are a landlord wish list. Existing tenants don’t pay asking rents. They pay actual rents. In addition, when a landlord asks too much in rent for the vacant unit, the unit sits vacant and remains in the listings, and the too-high asking rent gets picked up by the algo. But a landlord, who offers an attractive rent, leases out the unit quickly, and that lower asking rent disappears off the listings and doesn’t get picked up by the algo. This is another reason asking rents are not an indicator of actual rents.

https://wolfstreet.com/2024/01/11/beneath-the-skin-of-cpi-inflation-december-not-in-the-mood-to-just-go-away/

Interesting chart! 2017 the two were almost inseparable, then 2021 or so, something interrupted the marriage. Did Zillow just get crazy?

“Did Zillow just get crazy?”

No but landlords went crazy with their asking rents, and people didn’t bite. And those high asking rents then stayed on the listings while units with competitive rents were instantly leased and came off the listings. “Asking rent” algos pick up what’s left on the listings, and those were the overpriced units that no one took because landlords where just asking for the sky. So “asking rent” metrics turned into nonsense during the pandemic, not just Zillow, all of them.

Zumper had the same problem. I documented this with the example of Newark at the time. It was just crazy. Practically no one actually signed a lease at these spiked rents in Newark, but the reasonably priced units quickly rented out, and didn’t stay on the listings, and so the algos didn’t see them, and so they didn’t weigh in asking rents. And when landlords got tired of sitting on overpriced vacant units, they cut their asking rents back to normal. That’s what you see here:

From article: “But they were way below the crazy boom of the early 1970s that turned into an epic bust.”

Wasn’t the 1970’s housing boom and subsequent bust largely the result of tax incentive legislation that completely distorted the market incentives, spurring an entire industry of real estate limited partnerships? (Same in oil drilling industry, but that’s a separate subject!)

Subsidies (after a period of delay and abuse) seem always to sow the seeds of a bitter crop of consequences. (Note: to Fed)

As a person that builds high rise residential, the numbers don’t present the whole picture. If you show condo sales in Toronto, it’s form 50%.

I’m trying to build a small 4 unit building on a lot I own. I’m getting quotes at over $500/sqft! That’s crazy, it was under $200/sqft a few years ago. I was expecting higher prices, but not 2.5x higher!

That must be dragging down construction starts as well. On the other hand, the builders must be getting tons of business if they are able to charge those prices, so maybe not?

Thanks for a clear explanation. Makes total sense.