The action is in services. But now new & used vehicle prices are rising again. And energy. Food edges to new painful high.

By Wolf Richter for WOLF STREET.

Inflation in core services remains hot, and in December increased by 5.3%, driven by housing; insurance of all kinds; admissions to fun stuff, such as concerts and sports events; and audio and video services, such as streaming and cable. Core services account for over 61% of the Consumer Price Index, and that’s where inflation has gotten entrenched.

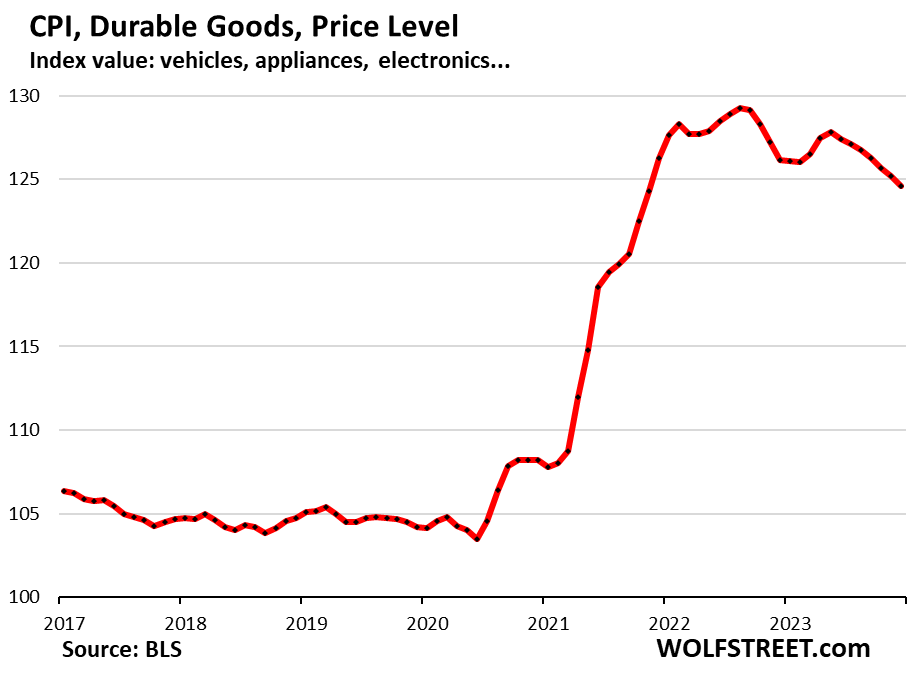

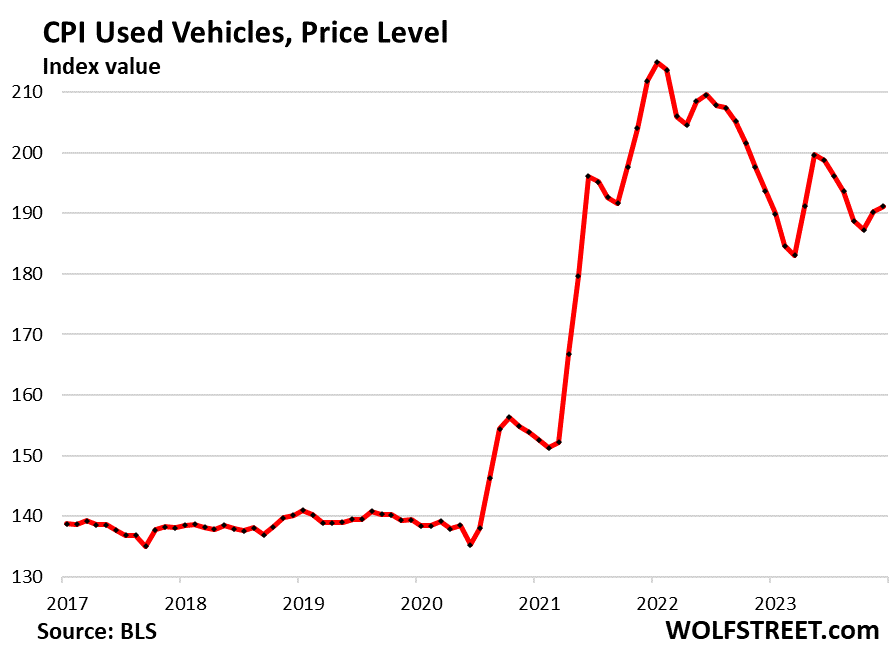

Durable goods prices fell again, with prices down quite a bit from the peak in August 2022, but they fell more slowly than before – as used vehicle prices ticked up for the second month in a row after a steep decline, even while wholesale prices continued to fall. New vehicle prices inched to a new record from their long and high plateau.

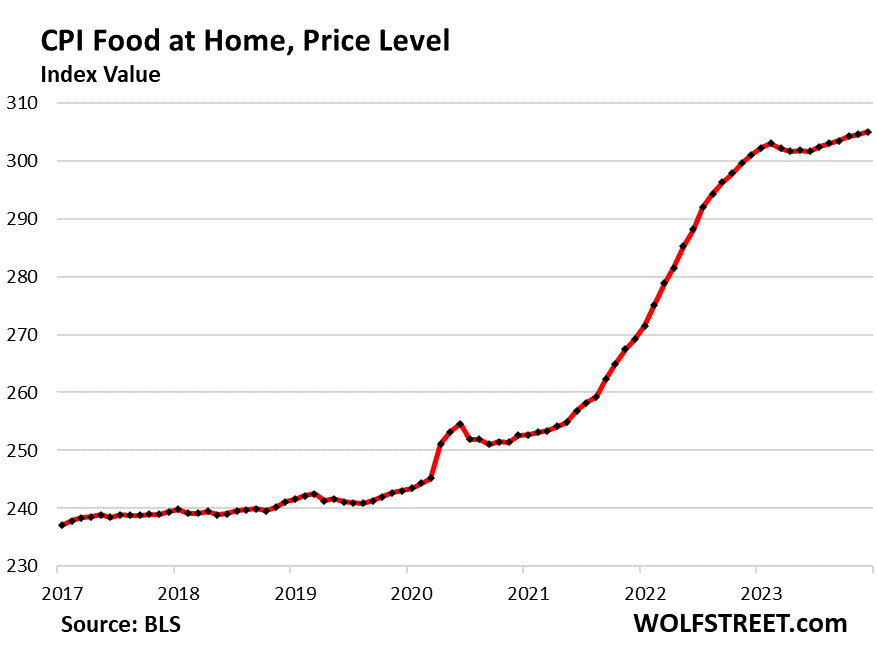

Food at home ticked up to a new record from very high levels.

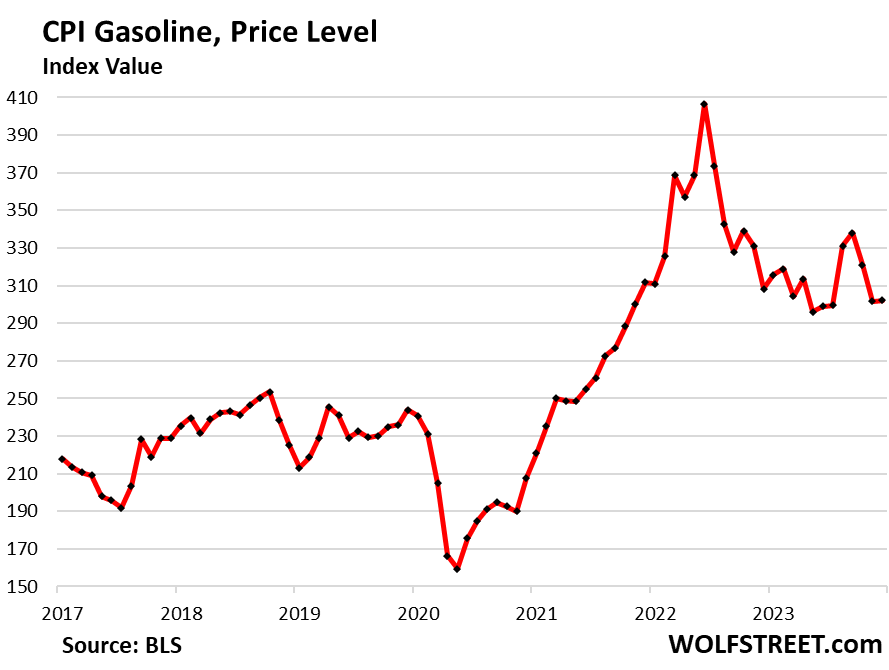

And the energy components that consumers pay for directly, dominated by gasoline, inched up for the month, but were still down year-over-year.

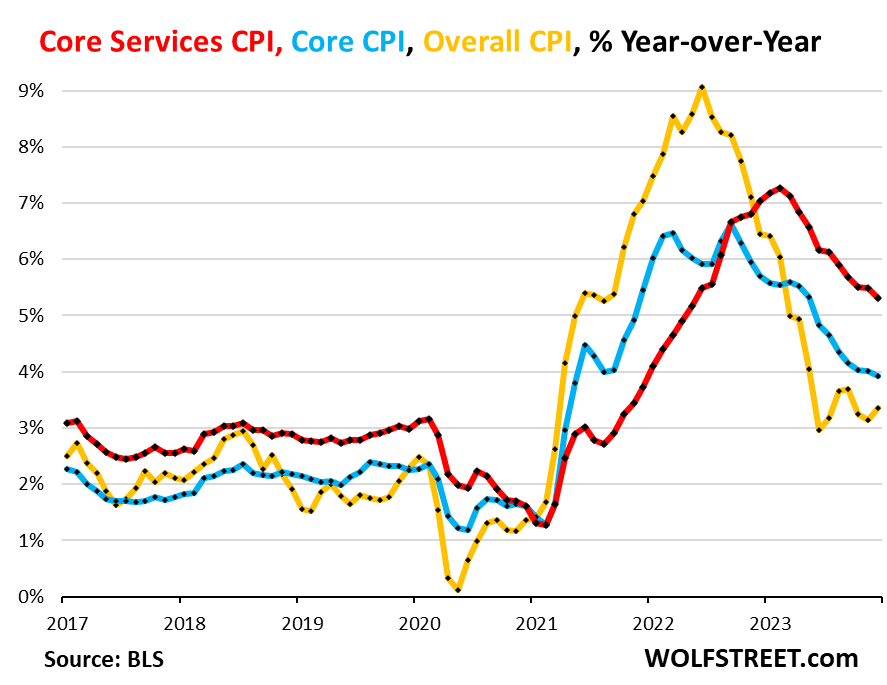

Core CPI, a measure of underlying inflation that excludes food and energy products, rose by 3.9% year-over-year in December, according to the CPI data released today by the Bureau of Labor Statistics, just a hair below the prior month (+4.0%), pushed down by the decline in durable goods, but pushed up by the jump in core services.

Overall CPI rose by 3.4% year-over-year, an acceleration from the prior month (3.1%), and the fastest increase since September.

The chart shows core services CPI (red), core CPI (blue), and overall CPI (yellow). Core CPI has just about flattened out at the 4% line.

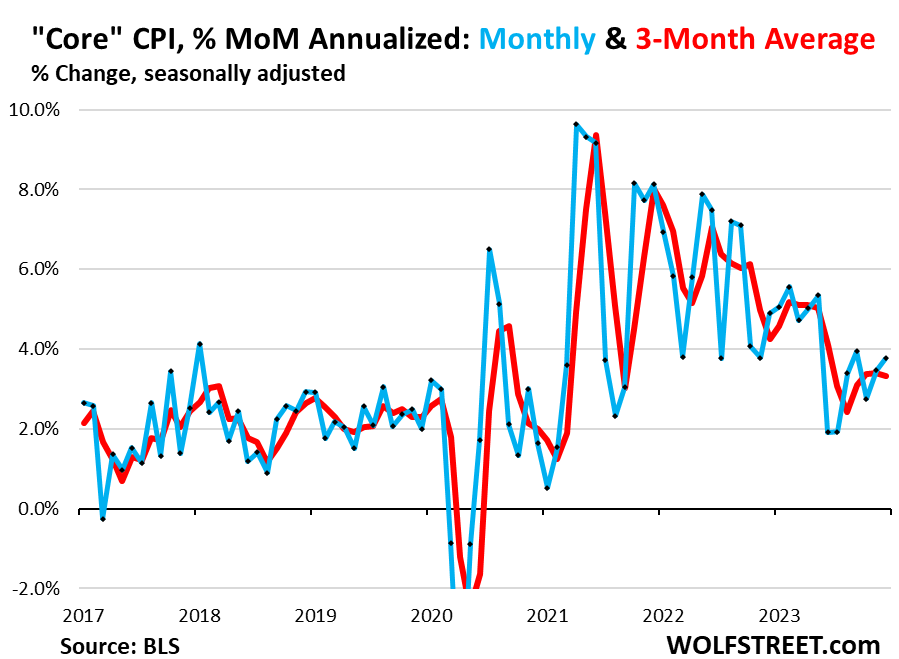

Core CPI, month-to-month, accelerated to 0.31% in December from October, the second month in a row of acceleration and fastest increase since September. Annualized, this increase amounts to 3.8% (blue in the chart below).

The three-month moving average, which irons out the month-to-month ups and downs, rose by 0.27%, and has been increasing at roughly the same rate over the past three months (red). The chart shows the annualized percentage changes:

Core services – where the action is.

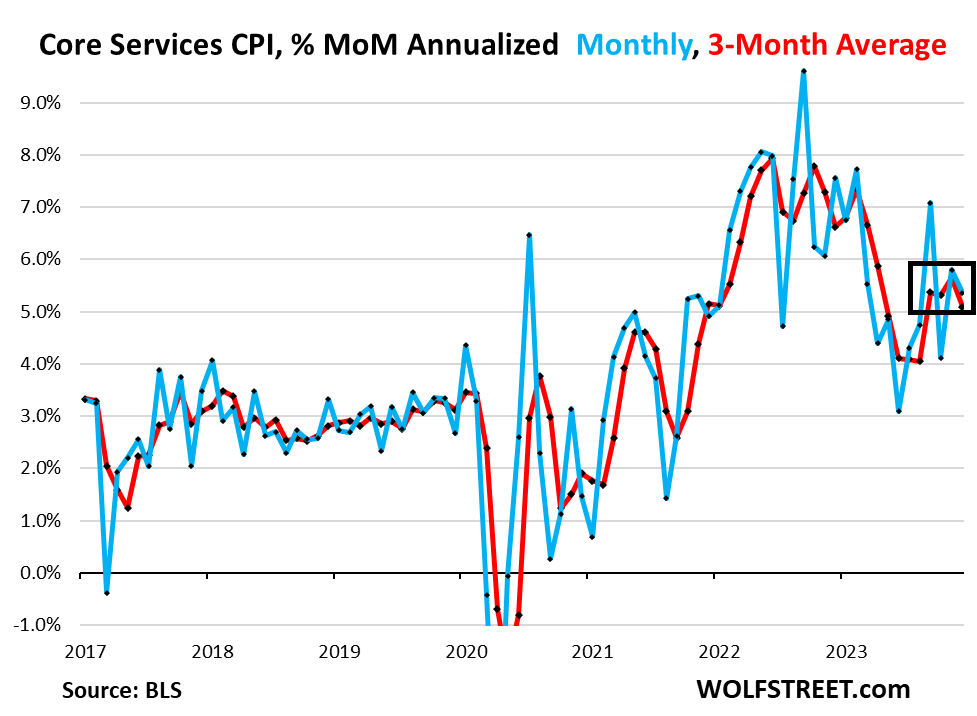

The CPI for core services (without energy services) on a month-to-month basis rose 0.44% in December from November, or by 5.4% annualized. The three-month moving average rose by 0.41%, or by 5.1% annualized.

Inflation in core services had decelerated in early 2023 through the summer but then began to accelerate again. Month-to-month annualized, the three-month moving average has accelerated from 4% during the summer to over 5% for the past four months, which is very disconcerting. The chart shows the annualized percentage changes:

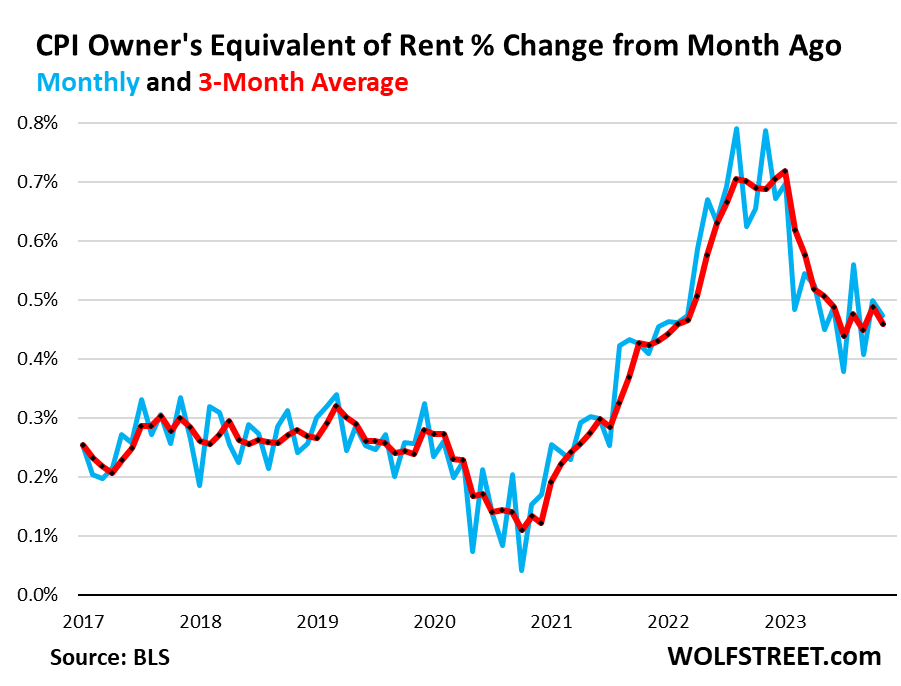

The Owners’ Equivalent of Rent CPI rose by 0.47% in December from November, or 5.8% annualized. The three-month moving average rose by 0.46%.

The three-month moving average (red) shows how this rent index has re-accelerated from July onward. It looks like housing inflation, on a month-to-month basis, has now gotten hung up somewhere near the 6% range.

The OER index accounts for 26% of overall CPI. It is based on what a large group of homeowners estimates their home would rent for and is designed to estimate inflation of “shelter” as a service for homeowners.

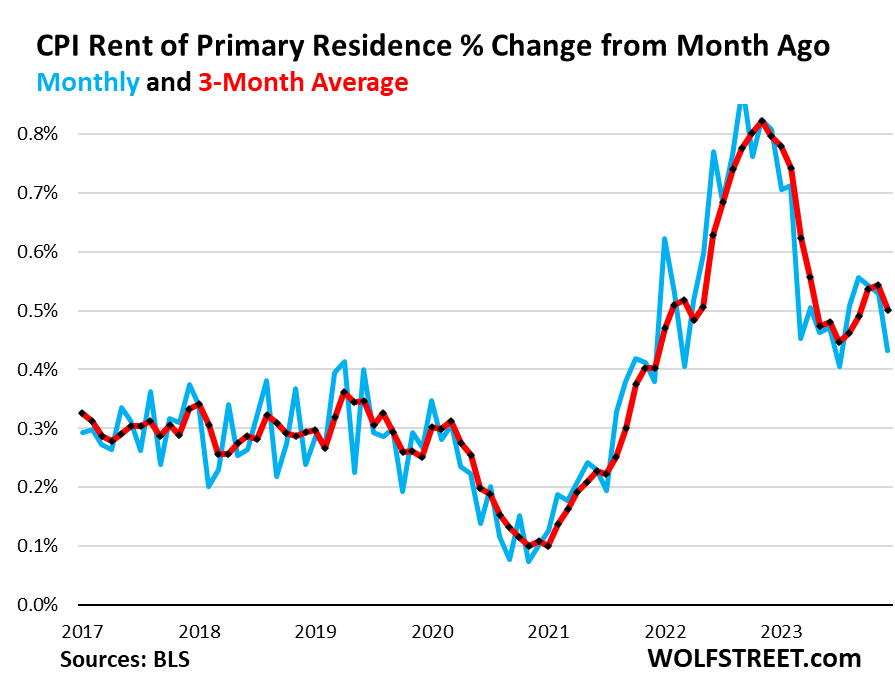

The Rent of Primary Residence” CPI decelerated to +0.43% in December from November, after having run very hot four months in a row. But the increase remains higher than during the summer.

The three-month moving average rose by 0.50%, or by 6.2% annualized, another indication of housing inflation getting stuck in the 6% range.

The Rent CPI accounts for 7.7% of overall CPI. It is based on actual rents that tenants actually paid. The survey follows the same large group of rental houses and apartments over time and tracks what tenants, who come and go, actually pay in these units.

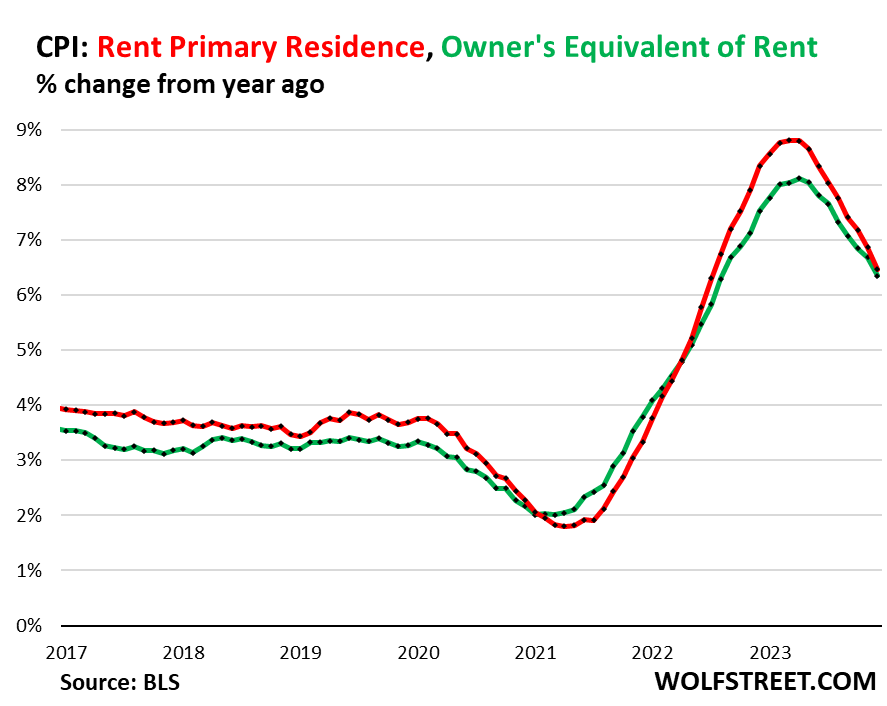

Year-over-year, the OER CPI rose by 6.3% (green in the chart below) and Rent of Primary Residence rose by 6.5% (red).

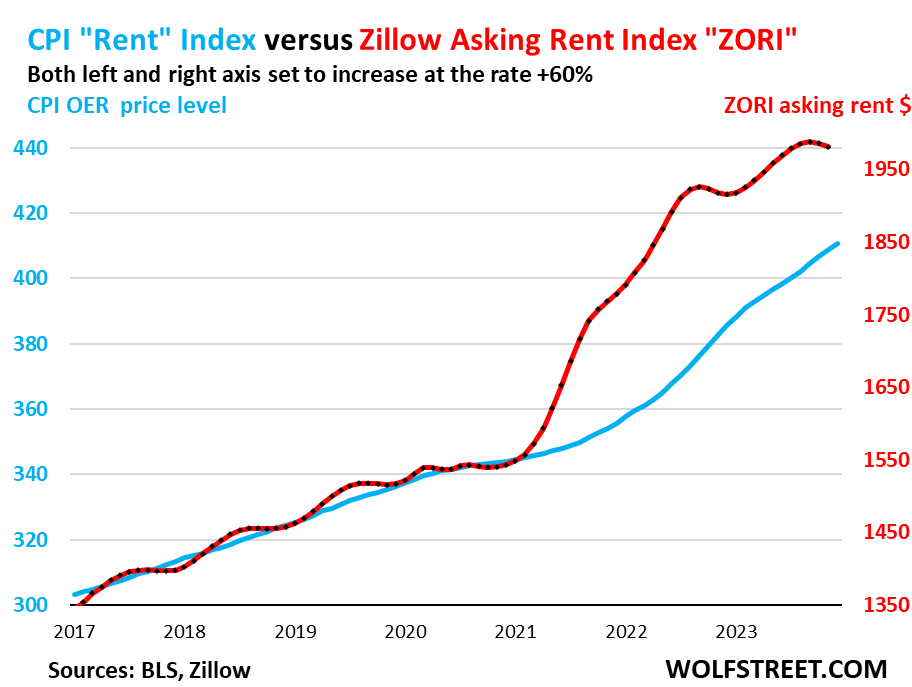

“Asking rents…” The Zillow Observed Rent Index (ZORI) and similar rent indices track “asking rents,” which are advertised rents of vacant units on the market. Because rentals don’t turn over that much, the ZORI’s spike in 2021 through mid-2022 never fully made it into the CPI indices because not many people actually ended up paying those asking rents.

Zillow has not yet released the ZORI for December. In November, it dipped a little, as is typically the case this time of the year.

The chart shows the CPI Rent of Primary Residence (blue, left scale) as index values, not percentage change; and the ZORI in dollars through November (red, right scale). The left and right axes are set so that they both increase each by 50% from January 2017, with the ZORI up by 47% and the CPI Rent up by 35% since 2017:

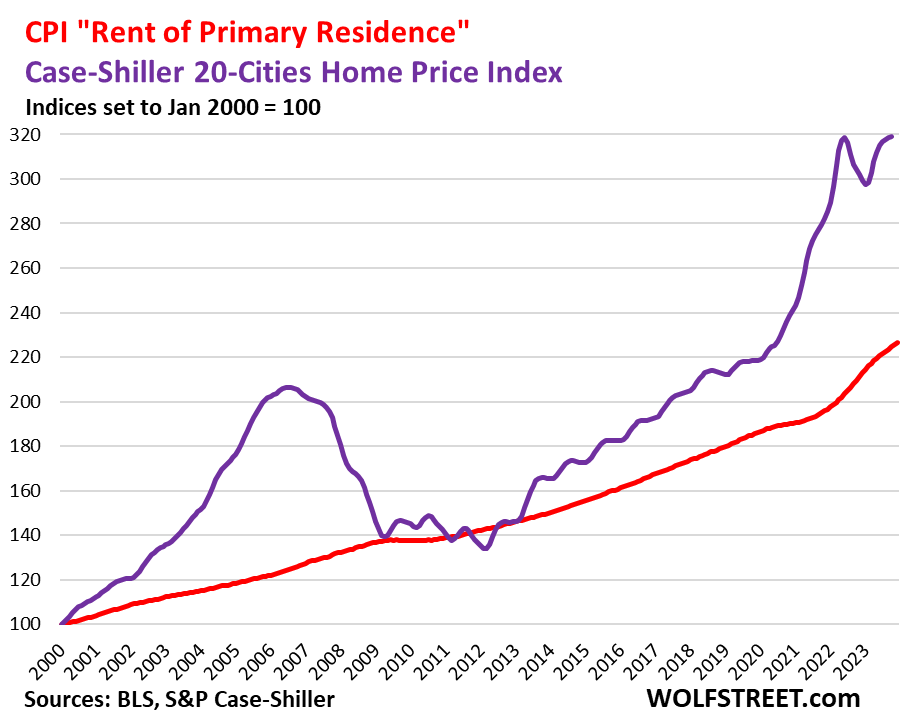

Rent inflation vs. home-price inflation: The red line represents the CPI for Rent of Primary Residence (tracking actual rents). The purple line represents the Case-Shiller Home Price 20-Cities Composite Index, which lags a few months and is now putting in a double top. Both lines are index values set to 100 for January 2000

Medical care services includes health insurance. Since October 2022, we’ve lambasted the method the BLS uses to estimate health insurance inflation, and the grotesque results this produced. December was the third month after the BLS tweaked the system (my rant two months ago that also explains some of the tweaks: “The Collapse of the Health Insurance CPI (How it Became Chickenshit).”

Starting in October, Health insurance CPI has been rising at a rate of about 1% per month. But this doesn’t undo the grotesque 4%-per-month plunges during the prior 12 months that had caused the year-over-year health insurance CPI to collapse by 37% through September 2023. With these 1% per month increases, the year-over-year collapse is being gradually reduced, and in December was at -27%, down from -37% in September.

So medical care services, which includes health insurance, jumped month-to-month by 0.7%, but the year-over-year collapse of its health insurance component (-27%) still caused the medical care services CPI to be slightly negative year-over-year (-0.5%). It will become positive for the CPIs in early 2024 and will become more positive each month for a while.

The table is sorted by weight of each service category in the overall CPI. The CPI for medical care services is the third largest item, with a weight of 6.4% in overall CPI, and over 10% in the core services CPI.

Also note the continued spike in motor vehicle insurance.

| Major Services without Energy | Weight in CPI | MoM | YoY |

| Services without Energy | 61.4% | 0.5% | 5.5% |

| Owner’s equivalent of rent | 26.0% | 0.5% | 6.3% |

| Rent of primary residence | 7.7% | 0.4% | 6.5% |

| Medical care services & insurance | 6.4% | 0.7% | -0.5% |

| Food services (food away from home) | 4.9% | 0.3% | 5.2% |

| Education and communication services | 4.8% | 0.2% | 1.3% |

| Motor vehicle insurance | 2.9% | 1.5% | 20.3% |

| Admission to movies, concerts, sports events; club memberships | 1.5% | 1.6% | 5.2% |

| Other personal services (dry-cleaning, haircuts, legal services…) | 1.5% | 0.1% | 6.4% |

| Motor vehicle maintenance & repair | 1.1% | -0.3% | 7.1% |

| Water, sewer, trash collection services | 1.1% | 0.1% | 5.2% |

| Video and audio services, cable, streaming | 1.0% | 0.7% | 5.3% |

| Hotels, motels, etc. | 0.9% | 0.4% | -0.5% |

| Pet services, including veterinary | 0.6% | 0.8% | 7.6% |

| Airline fares | 0.5% | 1.0% | -9.4% |

| Tenants’ & Household insurance | 0.4% | 0.3% | 3.6% |

| Car and truck rental | 0.1% | -0.7% | -12.1% |

| Postage & delivery services | 0.1% | 0.4% | 0.7% |

Since March 2020, the core services CPI has increased by 18%.

Durable goods.

The Durable Goods CPI is dominated by new and used vehicles, information technology products (computers, smartphones, home network equipment, etc.), appliances, furniture, etc.

The index dropped 0.50% for the month and by 1.2% year-over-year, having now wobbled lower ever since the peak in July 2022, as the shortages, supply bottlenecks, and transportation chaos have receded.

This chart shows the price level of the index (index value), not the percentage change of the index:

| Major durable goods categories | MoM | YoY |

| Durable goods overall | -0.5% | -1.2% |

| New vehicles | 0.3% | 1.0% |

| Used vehicles | 0.5% | -1.3% |

| Information technology (computers, smartphones, etc.) | -0.4% | -7.6% |

| Sporting goods (bicycles, equipment, etc.) | -1.2% | -2.5% |

| Household furnishings (furniture, appliances, floor coverings, tools) | -0.4% | -0.9% |

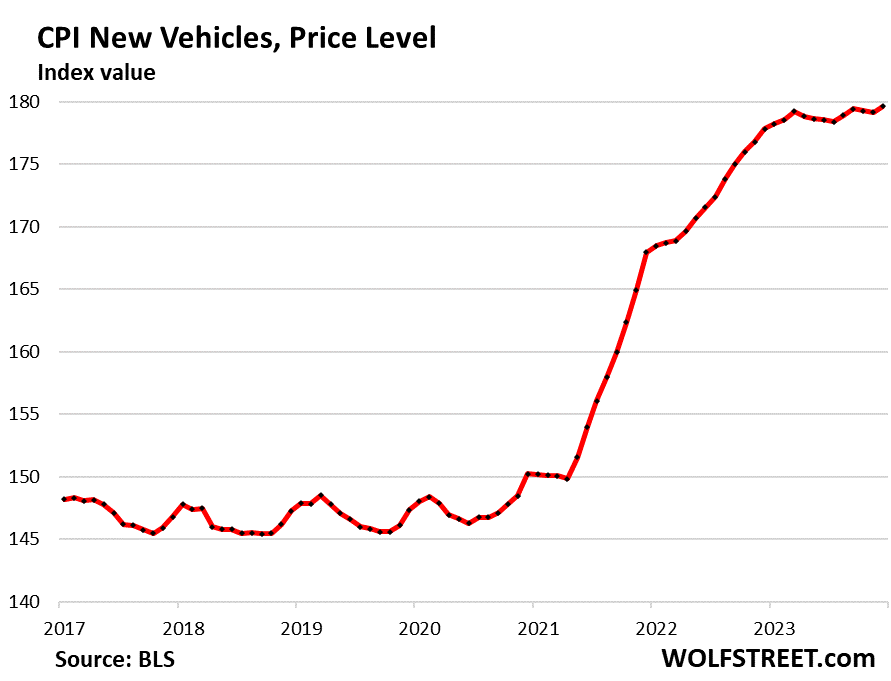

New vehicles CPI was wobbling along a very high plateau since March 2023, after the 19% spike that started in May 2021. But in December, the New Vehicle CPI rose by 0.3% to a new high. Year-over-year it was up by 1.0%.

For the years before the pandemic, the new vehicle CPI was also wobbling along a flat line, despite increases of actual vehicle prices. This is the effect of “hedonic quality adjustments” applied to the CPIs for new and used vehicles and also other products (here’s my chart and detailed explanation of CPI hedonic quality adjustments).

The chart shows the price level as index value, not the percentage change:

Used vehicle CPI rose 0.5% for the month, the second month-to-month increase in a row, despite further declines in prices at wholesale auctions where over half of the pandemic-era’s price spike has now vanished. It appears that dealers, who replenish their inventories at these auctions, are successfully trying to fatten their profit margins, and consumers are going along with it. In terms of further progress on the inflation front, that may not be a good sign.

The used vehicle CPI had spiked by 55% from February 2020 through January 2022. Since that peak, it has dropped by 11.1%. And it has given up 31% of its pandemic-era spike.

Food & Energy.

The CPI for food at home – food purchased at grocery stores and markets and eaten off premises – rose by 0.1% month-to-month and by 1.3% year-over-year, on top of already painfully high food prices that had spiked by 24% during the pandemic.

| Food at home by category | MoM | YoY |

| Overall Food at home | 0.1% | 1.3% |

| Cereals and bakery products | -0.3% | 2.6% |

| Beef and veal | 0.2% | 8.7% |

| Pork | 0.3% | 0.1% |

| Poultry | -0.4% | 1.2% |

| Fish and seafood | -0.3% | -1.4% |

| Eggs | 8.9% | -23.8% |

| Dairy and related products | 0.3% | -1.3% |

| Fresh fruits | 0.3% | 3.6% |

| Fresh vegetables | -1.3% | -4.8% |

| Juices and nonalcoholic drinks | 0.5% | 3.6% |

| Coffee | -1.1% | -1.6% |

| Fats and oils | 1.0% | 2.3% |

| Baby food & formula | -0.5% | 7.3% |

| Alcoholic beverages at home | 0.4% | 1.2% |

Energy prices rose for the month by 0.4%, fueled so to speak by gasoline and electricity service, the first increase in three months. Year-over-year, the CPI for energy was still down 2.0%, with most components below a year ago, except for electricity. These are the energy products and services that consumers buy directly.

Energy prices are linked to commodities which tend to jump up and down with wild swings, which is why they’re excluded from “core” inflation measures that attempt to see the underlying inflation trends.

| CPI for Energy, by Category | MoM | YoY |

| Overall Energy CPI | 0.4% | -2.0% |

| Gasoline | 0.2% | -1.9% |

| Utility natural gas to home | -0.4% | -13.8% |

| Electricity service | 1.3% | 3.3% |

| Heating oil, propane, kerosene, firewood | -3.3% | -11.8% |

Gasoline, which accounts for about half of the energy CPI, has plunged by 26% since the peak in June 2022.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

What a mess.

Who even cares about a small decrease in (name your category) when you look at the price level vs pre-pandemic – you are looking at bouncing around a new record high plateau. No real deflation getting anywhere near pre-pandemic or old trendline.

Right? Your car insurance and medical premiums double but that air fryer is 19% off!

Ditto.

Housing costs up 30% during pandemic which killed 1 million plus.

But eggs down 24% (following 50% hike).

All we need now is another NYT Krugmanite explainer about just how ignorant the American public is when it comes to their own economic wellbeing and the Biden Dawn.

Just exclude housing and food from inflation. What’s the problem?

/S

Ah yes, the “plateau”, as in “permanently high”, like most people that don’t think prices will ever drop.

Fed engineers only booms and busts now, and it took 2 full years to top out the boom that started by late 2020.

Fed had rates at 5% for an entire year before the economy imploded prior to the GFC, so give it another few months for those same 5% rates to do their job this time around, and another year to see how your plateau looks by then. Bet it looks pretty symmetrical by then on the down side.

its an election year. they will do anything to keep asset prices inflated, otherwise its curtains for their time in office.

Rob:

Your logic implies a massive deflationary depression.

Look at the cost of rent in the article post GFC; A real estate based bust. Flatline is a “good case” scenario.

Yes, CPI experienced mild deflation in the ‘09-10 period, but overall prices people actually PAID were fairly steady and continued up with the TARP/ M2 expansion and increasingly easy money policies.

Yeah the USD= TP. But I don’t know anyone who forsakes the use of TP when available. Even as it’s 99.9% less valuable than when the FED was established, we can still go down 99.9% from here…

It’s a matter of supremacy at this point/ global control and “order.” The Eurozone is not powering the world economy, nor China.

US has all we need onshore (food/energy), and we’re (finally) printing mass amounts of USDs to build up tech infrastructure (though we need Taiwan/ THE world leader in chips).

“They” say the WW III will happen online (and has been?)… but we already have enough firepower to brownfield earth.

Ask the Houthis, Hamas or Russia what happens when they poke the bear; US ordinance is behind the “less losing side” in those cases.

The endgame? We all lose eventually!

EXACTLY grimp,,,

And while Wofie IS, absolutely, MASTER and by far the best this old boy has ever seen, of ”reporting” the statistics, in fact, due to various and sundry and important aspects of those statistics, there is NO chance that anyone can report on the ”on the ground” experiences of joe and jill six pack.

Such, for joe and jill, does NOT appear, lately, to coincide with the statistics Wolf is SO great at reporting, and hence the continuing rise of one SO similar to Huey Long back in the 1930s.

Luckily, totally out of it these days after ”hustling” for several decades in the RE markets in CA, OR, and FL…

Good Luck and God Bless all y’all trying to find a permanent or at least long term house/home.

It’s very depressing. Hardworking, educated people who live at or below their means are getting crushed.

Good thing the Fed has their messaging

down pat. 3 rate cuts to go !

Maybe if we’re lucky, the ECB will hold a seminar for their benefit.

Wrong direction. The ECB just follows the Fed’s lead, not the other way around.

What could possibly be influencing the Fed to lower rates in 2024? Maybe because it’s a leap year?

Because inflation is on the way to 2%.

If inflation doesn’t do that — and that’s my sense — those hoped-for rate cuts may not happen or not to the extent hoped for.

Every singly rate-cut comment by the Fed is prefaced with “if inflation continues to 2%…” or similar. There was never a promise of rate cuts for the sake of rate cuts.

But Powell also said: “you’d want to be reducing restriction on the

economy well before 2 percent”

And he never defined what “well before 2 percent” means.

Are we there yet?

Are we there yet?

Are we there yet?

Thanks WR for the report.

The FED thinks it is going away hence the talk of rate cuts and dovish talks despite the great loosening of financial conditions.

WALL STREET says inflation is going away hence the talk on WALL STREET about a gazillion rate cuts, starting in January. You people keep confusing that.

The FED says we’ll wait and see and keep our rates at 5.5% for a while, we’re hopeful that inflation will go down to 2% with those rates, and if it does, we’ll cut our rates. But there won’t be any rate cuts in March (Fed’s Mester today), and if inflation heads the wrong way this year, there might not be any cuts this year.

I never saw FED in the recent time coming out strong that inflation is still too high and need higher for longer.

But they conveniently published median 3 rate cuts and Powell gave all dovish signals during his pressers.

In the beginning of Dec he cited market/financial conditions doing job for him. But he conveniently dis regarded the loosening market/financial conditions during his last presser.

This non verbal cue was aptly taken on by market forces .

“I never saw FED in the recent time coming out strong that inflation is still too high and need higher for longer.”

That’s because you systematically ignore everything anyone at the Fed says or writes, and you listen only to what Wall Street tells you because it fits your twisted narrative, and then you’re trolling my site with this stuff.

“Non-verbal cue” my ass. It’s written into the minutes, it’s written into the FOMC statement even. But you refuse to read them, you refuse to read the quotes I give you because you do NOT want to know because you have a personal stake, now that you got into stocks, and you’re trying to hype your book. You refuse to listen to Mester, Williams, and the others. You only listen to Wall Street, and then come by trolling with this stuff.

You are literally making an argument of ignorance. “You have never seen….”. Just because you have never seen it does not mean it exists.

Given how easy it is look look this stuff especially with Wolf spoonfeeding you links, it appears your argument of ignorance is one of willful ignorance.

Just an FYI, you know those videos of cats that put their head under a blanket while their body sticks out and they think no one can see them?

People laugh at those videos.

They also laugh at people thinking that if they play ignorant others will as well.

The Fed was premature in December concerning the decline in inflation. The financial media jumped on this saying the Fed could not walk this back, in other words the Fed is committed. The Fed can hold but they would lose face if they needed to raise rates. The financial media (spelled Bloomberg) is trying their best to manipulate or put the Fed in a box. Right now it’s looking like the Fed “stepped in it” in December.

I think this is the most interesting of times. The FED has reached a point where inflation is still higher than they would like, but it isn’t raging out of control either. Furthermore, measures of inflation have stabilized and depending upon which metric a person chooses over which arbitrary time frame they can paint whatever picture they want about the future of inflation.

I think it is literally 50/50 on which direction future interst rates will be heading. Until inflation moves significantly in either direction, I think even the FED does not know.

The economy is literally at a fork in the road.

I disagree, the fork was in 2019 and we chose inflation.

Tom S,

Maybe the fork was when the Fed commenced QE during the Great Recession. That’s when they started seeking a wealth effect (Bernanke is on record) through enhanced liquidity. They wanted asset price inflation to create consumer price inflation as an offset to existing deflationary forces.

Bad move. Asset prices and the wealth effect have run so far, the removal of it might create problems for the real economy. Be that as it may, it should be done, unless somebody found the magic button that allows us to increase debt-to-GDP ratios to infinity.

…seems that many feel forked…

may we all find a better day.

All that said, I am constantly amazed at those who confuse Wall Street expectations with FED guidance.

The FED has made it quite clear that they are looking to see what happens with inflation before they will act. Yet Wall Street has convinced lots of people that the future has already been decided.

The 4th estate is just talking their own book. There’s nothing in the data that warrants a cut right now.

The truth is, if this inflation persists another quarter with this employment, they should be talking about a quarter point hike by mid year.

6 rate cuts by Q2 which WS was circling jerking around before end of the year..lol…

Inflation, financial condition still loose and bitcoin itching back to probably $50k soon, rate cuts in Q1? Delusion much?

BitCON is worth ZERO and anything above that is manic speculation and absolutely nothing else.

The irony is that bitcoin and similar were supposed to be the antidote to fiat currency. Crypto isn’t even fiat and only exists electronically – in the ether. Ethereum is at least calling a spade a spade.

Speaking of Bitcoin. When I logged onto Fidelity this morning I see this:

“Introducing the Fidelity® Wise Origin® Bitcoin Fund (FBTC)”

Then on the same page, I see Fidelity is offering to set me up with one of their financial advisors.

Everyone who rushed to buy SH*TCOIN ETF’s this morning already lost 10% on their “investments” by this afternoon.

It won’t be long before lawyers tee up their class action suits against brokers for promoting crypto gambling as investments

It was probably invented by the NSA/CIA/FBI etc etc

The bifurication of inflation continues: durable goods down, nondurable goods & services up.

Yeah, it’s great if you want to buy a new flat screen TV and laptop for every room in the house, every year.

Not so great if you’re trying to pay for housing, education, child care, health insurance, and so forth.

I read pc sales are down 8 years in a row and Q4 was the lowest for sales since 2006! Now while I can believe people have shifted to phones and tablets, I would think businesses would drive sales higher at least a little but apparently not. Are there less people using PCs at work? I don’t think computers have gotten more reliable with a longer life than in decades past. My typical dell/Windows laptop set up for work seems to get bricked by a bad update every 1-4 years. I’ll usually put Linux on and keep it going for years after but then I can’t use it for work where they require us to use crappy windows.

“I read pc sales are down 8 years in a row and Q4 was the lowest for sales since 2006!”

Not sure what you read, and what country or region it refers to, maybe China?

Here is from Gartner on Jan 10:

US PC/laptop sales in Q4 +1.8% yoy, first year-over-year growth since Q2 2021, nothing to do with 2006.

Asia/Pacific -8% yoy on massive China troubles.

EMEA +8.7% yoy

https://www.gartner.com/en/newsroom/press-releases/01-10-2024-gartner-says-worldwide-pc-shipments-increased-zero-point-three-percent-in-fourth-quarter-of-2023-but-declined-fourteen-point-eight-percent-for-the-year

Fred Hickey on Twitter, but he had it wrong, it was 8 consecutive quarters, not years of year over year declines. Makes a lot more sense now

https://finance.yahoo.com/news/worldwide-pc-shipments-declined-2-160400859.html

I’m a big desktop PC guy – so I just build my own vs buying them at retail.

Both my current builds are >10 years old, but have no issues and run windows 10 just fine. I have no reason to upgrade/replace them anytime soon.

I also have a laptop PC I use at my day job, but I bought that used off a former coworker instead of paying new retail prices.

Everyone I know is complaining about insurance rates ,many are talking about dumping insurance and becoming self insured ,cutting their own tail off . Might go bankrupt .Theyalso overpay claims .What other business is guaranteed 10% profits as Warren says

forget insurance, at least comp and collision. If I need insurance on my stuff I spent waaay too much. Pay cash for cheap cars, if they get totaled or stolen so what?

Also it’s been fun as my income and wealth goes up, my definition of a cheap car improves. Back in the day, ugh, very bad cars. But now what I call a cheap car is actually quite nice to drive in.

I do have liability insurance because it’s prudent, that went up a bit but not too bad.

And the 10year below 4% How is this a free market?

$21 billion in 30-yr. IOU’s at a paltry yield of 4.23% sold today. 237% oversubscribed and gobbled up by hungry investors today. The buyers actually bought the bonds at rates lower than the pre-auction rate.

Who is buying and driving these long term bond rates down when they could go buy a 5.3% US treasury notes. We will probably top $37 trillion at the end of 2024.

Crazy.

—————————————————————————

At the sale of government debt that matures in 30 years, investors were awarded 4.229% in yield, 0.3 basis points lower than the yield in pre-auction trading. It was also lower than the 4.344% yield offered at a previous 30-year auction.

“Today’s 30-year auction was solid,” wrote Vail Hartman, BMO’s U.S. rate strategist.

The 30-year was trading at 4.213% after the results, closer to Wednesday’s settlement yield of 4.206%.

Really?

You think the 10 year treasury market is somehow set?

I am not saying that investing in the 10 year treasury market is smart at these prices, but it is really hard to argue it isn’t a free market. There are very few markets that are more free than the 10 year treasury.

Are there – or are there not – any industries, corporations or otherwise ‘private’ ‘market participants’ who have been mandated by law to hold treasuries on their books ? Yes or no ?

Are there – or are there not – any industries, corporations or otherwise ‘private’ ‘market participants’ who have been given alternative & exclusive avenues to buy/sell or use as collateral treasuries at values other than what the “FREE MARKET” is buying, selling or using as collateral ? Yes or no ?

Depends how you define “free.” It’s free in the sense that investors can decide TODAY what they want to pay.

But they’re doing so in anticipation of future QE, where they can dump their holdings on to the Fed for a profit.

That subjective reality is what’s not a free market.

you are free to buy or not, but it’s not a free market as long as the Fed and Treasury are trading their own @#$%. It’s actually a socialist market.

It’s a free market since you are allowed to invest elsewhere or even bet against it if you believe it to be so wrong.

Thanks Wolf!

Was looking forward for your inflation breakdown report. Higher for longer and is that rates or inflation for the Fed? I thought it was rates. Seems it could be inflation and rates! Healthcare will be adding to it too. I think it’s a good time to save money with all the cd’s and issuance of debt coming along.

Dear John. ” I think its a good time to same money”

DITTO. Get out of debt for a happy life……

The main grocery chain in my area, Giant Food, has now become nothing more than a junk food distribution center. I’ve been forced to go to a higher end grocery store to get decent produce and other items that I can no longer get at Giant. The only thing I buy at Giant is fish. I believe this is just a loss leader to get people in the store. I’ve made numerous complaints to no avail. So now my grocery bill has increased 30% overnight as I’m buying a lot of items at the higher end store.

You live in DMV area right? I used to be in that area. Superfresh closed. Giant I didn’t care for (this was 10-15 years ago now). Would only go to Costco and Wegmans.

My max liability ($1m/$1m) car ins with Geico in FL is up 16% YoY…I drive less than 3k miles a year (wfh) and no accidents…It’s up 84% from same time in 2021 for same carrier and coverage ($98/mo and now $180). Thanks to all the lawyer car accident billboards and commercials in FL I don’t feel like having bare minimum coverage…

Where in Florid are you? I’m in Palm Beach County, and my insurance (Progressive) is up 30% in the last two years. Still half of what Geico wants to charge me.

Orange County. I think last year I looked and some other carriers wouldn’t go as high as Geico for liability coverage. Funny enough Costco had some carrier last year for FL car insurance and I recently told my brother. He said they stopped accepting new customers and leaving FL…they can see this place is a dump. This week I’ve contacted 3 body shops in Orlando area to get a quote for a full car respray on a car I’m looking at buying from California and all said too busy with high volume insurance and dealer customers in accidents…can’t help me.

I might move out back to west coast this year. Housing is more affordable there than here and better weather, too.

Increases in insurance rates in Florida have less to do with inflation and more to do with the insurance environment.

No one wants to insure anything that is almost guaranteed to be underwater/damaged/stolen in the next few years.

JimL – my auto insurance is up about that same amount and I live in northern new england. Its not just FL.

Car accidents are much more common than hurricanes.

What’s a “full car respray”?

Repaint….Back before cars became disposable, people had them repainted (the body) and kept them fixed up mechanically.

Earl Scheib: “I’ll paint any car for $29.95.”

It’s VERY difficult to find a shop that will do a complete car paint job now. The reason is they are set up to do fast-turnover insurance work and they don’t want anything tying up their spray booth.

Finally gave up trying and went to Maaco. They did a fantastic job. Took them 4 weeks, but it was well-worth the wait.

Couple important points: Just about every Maaco is a different franchise, so you may have a horrible experience. Do some research. Also, my car was able to be painted without removing door handles. Also, it has no Sirius or OnStar antennas which should be removed for painting if you have them so clear coat can flow under them. Maaco doesn’t normally do that unless you request it and pay extra. Most times that involves dropping down the interior headliner.

Good luck.

Swamp Creature-

Do you have ALDI in your area? Decent produce, and other assorted items at pretty good prices. Can’t get some items there, so its off-putting at first, but with the things they do carry, the prices, and the efficient experience, it’s a staple in our monthly shopping.

Cheers.

Not him but I swear by ALDI because of some unique things you can get there that can’t be found elsewhere.

Stock market and bitcoin don’t seem to be bothered by the hot inflation report. And they are still expecting rate cut in March. Look like Fed QT at the current pace is not having a strong impact on asset price.

It’s almost as though the entire stock market is a big algo circle jerk, trying to unload on bagholders.

Nothing matters anymore except for this interplay.

It wasn’t like this in 2019 or 2018. The market had its natural ups and downs and was very sensitive to external events or news. Still too much liquidity in the current system and the Fed doesn’t want to take it away quickly.

Next up for 2024 will be QT speculation… That is tapering of QT.

The party is nearly over tho. Gotta blow the roof off the place before the cops show up

QT wont be tapered. It will be an immediate jerk from QT to QE, likely the moment GDP shrinks. Hundreds of trillions of fresh new dollarinos to make the lines go up. An economic miracle. Remember the Fed has a dual mandate: 2% per annum devaluation of the dollar and QE to inflate assets. If it cant achieve both it will at least focus on one.

“QT wont be tapered. It will be an immediate jerk from QT to QE, likely the moment GDP shrinks.”

🤣❤️😍 I love good wishful thinking.

QE, IF it will ever be used at all, will be used only after rates hit 0% and there are additional big problems to deal with.

If GDP goes negative, and inflation stays high, the Fed may not do anything, just keep rates where they are. It wanted a mild recession to get inflation down. So that’s the chance.

There were two negative GDP prints in 2022, and the Fed hiked rates, instead of cutting rates, no problem.

Then if negative GDP persists or gets bigger, with unemployment rising sharply, the Fed can cut by 300 basis points, which is a big stimulative cut. So with rates at 2.5%, it can wait and see.

And if that’s not enough, it can cut another percentage point, to 1.5%.

Now at 5.5%, the Fed has room to cut. That’s the classic model, and it has come up in numerous Fed discussions. There won’t be any QE until the rate tool is exhausted and something big and bad is still happening.

IF inflation declines toward 2%, the Fed will eventually cut rates some, while continuing QT. That’s already in the plan and has been spelled out.

“QE, IF it will ever be used at all, will be used only after rates hit 0% and there are additional big problems to deal with.”

I’m in strong agreement with this statement. I’d even go as far as say the Fed would be more likely to buy a few billion corporate bond ETF shares, like the tiny amount of LQD in 2020, versus crank up QE. It is painfully obvious to everyone, especially the voters, that QE simply helps enrich the super wealthy, so it becomes a political hot potato to do QE again without some EOW scenario like a geopolitical conflict, etc. Plus like stated, the Fed has a lot of room from 5.5% to drop rates now, unlike the ZIRP era when the only tool left was QE policy.

That said, stopping QT “could” happen later this year, as nobody really knows how much reserves are necessary, so it it will need to be reverse engineered after the fact when it becomes obvious.

Any and all increases in prices are due to simple price gouging.

That’s one part of the definition of consumer price inflation.

The other part is that consumers allow it to happen and keep buying. That’s the tough one to get under control. Our drunken sailors hate hate hate inflation and they’re in a foul mood because of it, but then keep spending to feed that inflation.

Of course, some things are hard to cut out of your budget, such as housing and insurance, which is why inflation, once it takes off there, is hard to knuckle under. And that’s where we’re at today.

Our drunken sailors are in for a rude awaking when:

-retails sales start falling

-credit card debt maximized

-auto loans payments falls behind

-home equity is tapped

If you actually R any of TGDFA over the last year or so, you’ll see that that “rude awakening” is nowhere near. Not even close.

truthseeking,

“-credit card debt maximized”

only $3.6 Trillion in available credit left on those credit cards before they hit the credit limit, oh my, those poor overleveraged consumers who have to charge everything to their credit cards to get by:

And a war in the ME kicks off..better fill up now while you can!

and Pea Sea below says there’s a lot of credit availability left. Lol..that availability includes the limit of the wealthy. Now the real TRUTH shows up when you show the availability left for those earning 200k or less. I’ll wait!!!

Thomas Groom,

Poor low-income folks cannot borrow anyway. They have essentially no debt. They cannot even get a credit card. Over 1/3 of US adults don’t have a credit card at all (some of them simply because they don’t want to). They make do with debit cards.

There is a huge amount of credit being offered to people with good credit making between $60k and $200k (to use your number), from mortgages to credit cards with $30k limits. That’s how banks make their money … fees from originating mortgages, swipe fees from credit cards, interest income from auto loans, etc. Someone like that trying to buy a car will be pressured to the nth degree to finance or lease through the dealership. That’s how dealers make a big part of their money. You just have no idea.

Subprime doesn’t mean “poor.” Subprime means “bad credit,” the young dentist with big income but way over this head in his house and luxury cars and all the equipment, etc., is a classic example of high income subprime. Subprime is now having a harder time borrowing, and for all the right reasons. Subprime is high-risk, and is always in trouble, which is why they’re subprime, and lenders are dialing back on their risks after the free-money pandemic binge. Subprime is the only place where consumer lending has dialed back a little.

Hers’s the Swamp’s inflation index

It is flashing RED

YoY 2022 vs 2023

Car ins – up 12% (no accidents or tickets)

Homeowners ins – up 25% (10% surcharge for large claim filed in 2022)

Utilities – up 12%

Appliance repair ins – up 25%

Property taxes – up 10%

Food (equivalent quality) – up 20%

Transportation – up 15%

Health care premiums – up 9%

Now we these actual figure staring me in the face, I’m suppose to believe that inflation is running at 3.4% YoY. Give me a f$ckin break.

Swamp Creature,

Looks like you got some deals: Your car insurance: +12%; CPI auto insurance +20.3% (see table above).

Appliance repairs, LOL, how would you even know? Do you have the same repair done every year? Or are you talking about a rip-off extended warranty that some retailer ripped you off with? Cancel it, and you will experience DEflation of 100%.

You’re measuring food inflation from 2020, not a year ago. That’s three years, with the last year having been roughly flat or up slightly. That’s just a tad below the CPI for “food at home”. See chart above. So you’re doing pretty good there compared to CPI.

In terms of transportation, I encourage you to fly. Ticket prices have plunged. In October we paid less than 12 years ago to fly direct San Francisco to Frankfurt (United). There were cheaper flights available with some low-cost cattle operations, which we chose not to buy.

Why would anyone buy ‘appliance repair insurance’?

Appliances are like at most, $5000 (for something like a furnace) and usually only $700 to buy an entire new one. Or you could watch a YouTube video on how to fix it. Or pay a repairman to fix it….IF it breaks. Insurance companies get rich because they thrive on helplessness and fear, which America seems to have a ton of. I should start selling people clothing insurance, in case they get a stain on their shirt. Free tide pen shipped next day. Haha. We need to wise up to these scams.

Wolf

I forgot to add:

My “Gas station from Hell” is still charging $4.79/gallon for regular gas even though crude has dropped 15%.

I was in downtown Washington DC today and went to Burger King to get a small hamburger. The price was $8.99 + tax. What a rip-off! I didn’t buy it. Instead, I gave some small change .75 to some poor dude who was sitting on the sidewalk. He was very thankful.

Washington D.C. is starting to look a little like the Tenderloin district of SFO, not quite that bad yet, but getting there.

“Utilities up 12%”??

Here in PG&E, Pigs Graft & Extortion land, Gavin Newsom’s California,the quarterly rates report details that the rates went up 38% from Jan. 2021 to Sept. 2023. And, they are going up another 22% in the next few years.

https://abc7news.com/pge-rate-hike-energy-cost-increase-higher-bills-cpuc/11659353/

We bought extended warranties for range and dishwasher at time of purchase after advice from friend. Both appliances above average ratings and both high mid range initial price. (Around $700 each.)

Both had major repairs within the 5 years of the extended warranty, as was predicted by friend with same brand and similar devices, range with ”electronics,” dishwasher with main pump.

DW pump went out again, after 8 more years, and cost of parts and labor were more than original total of extended warranty for both.

Plan to replace both at next failure.

My Sears home appliance warrantee is a real bargain. Only $59/mo for 8 appliances. That’s less than $2/day for the peace of mind I get. They always answer the phone and send someone out at your convenience. The dudes they send out have given me some good tips to help me avoid service calls. Also, they have given me the sources to order parts myself on the Internet, which I have done.

I never ever had to fix an appliance in my life. If they break down, I’ll buy a new one. And that happens very rarely. Over the last 17 years or so since we’ve lived here, we replaced one washer ($600), one microwave ($180), and one hand-vac ($30). So about $800 spread over 17 years = 13 cents a day. I really don’t want to spend my time fixing appliances. I’d rather spend my time replying to comments. But I understand that some people enjoy that, and that’s great.

China is experiencing deflation right now. They may start flooding us with REALLY cheap Chinese garbage soon since they can’t sell anything in China.

Their recession will also slow down sales of American products in China, not good for corporate profits.

“They may start flooding us with REALLY cheap Chinese garbage..”

That started quite a while ago. Have you seen these ads by Temu, a Chinese online retailer that has been selling directly to US consumers. I see these ads all the time right here. Its competitor Shein is trying to pull off a US IPO. They’re flooding the US with cheap Chinese stuff shipped directly from China. I hate those ads.

So you agree my property taxes going up by 10% is price gouging by my city.

It’s good to see inflation has gone up again. Up in Canada it takes years just to find or get a house for rent if you’re a renter due to rental bidding wars so most people are now leaving the country due to the obscene cost of living. The tell you inflation is like 3 percent but wage gains are coming in at 5.7 percent and those people end up living on the street or in their cars.

“Most people are now leaving the country”? Where did you come up with this nonsense? The only people who are leaving the country are some immigrants who have decided that the Canadian Dream wasn’t all that they imagined. Everyone else seems to be staying out.

Canada it interesting. For some reason people like Toronto and Vancouver but there is literally 10 million square km of land and very few people. If you move to rural Canada you can live in paradise for not much money. And, I am not talking about the territories. Atlantic Canada still has some awesome deals. A local property on a good paved road with 300 ft of ocean frontage and 18 acres just sold for under 100k 2 weeks ago. Without ocean frontage properties are considerably cheaper.

It will be interesting to see what impact the Red Sea situation has on the January durable good prices in one month’s time, and thereafter.

The US gets most of its foreign-made durable goods from Mexico, Europe, Japan, China, Korea, and some from Vietnam and Thailand, so the Red Sea is not involved. So there is little direct impact, such as shortages. Shipping rates have bounced off the lows, but the still relatively small increases in rates (compared to the big spikes during the pandemic) are a small portion of the retail price of those durable goods.

For the US, the Panama Canal issues are far bigger. The containerships and auto transporters to the East Coast go through that. So now you see more of these goods being put on railroads at a West Coast port and shipped that way across the US, which is a lot more expensive normally. This issue has been going on for many months though.

Yes, Dollar Tree stated that transportation and fuel costs were the main reason why they had to break the $Buck and go to $1.25 base pricing. Before that they were able to manage the status quo $1 pricing by adjusting the size/content of their products. Maybe the Fed should incorporate Dollar Tree as part of their inflation modeling?

Dollar tree is a joke canned goods $1.25 = 64 cents at wal mart no deals there ,take grandkids there they pick out 2 toys each at $1.25 there happy .But toys are Chinese junk break in a couple hours oh well kids were happy for a short time .My prediction there bankrupt in a year

Perhaps it will all be Transitory ?

However those graphs listed above are frightening considering the Wall Street cry babies have convinced everyone that cuts are coming as soon at March.

My income is stagnant and the price rises are drowning my ability to see a good outcome from this.

Clearly the FIRE economy is on Fire and the Federal Reserve not only is just watching it Burn, it holding a small empty garden hose at the ready.

The Fed heads are fanning out trying to explain to Wall Street that a cut in March isn’t happening. Mester said it specifically today, not beating around the bush either.

Higher for Longer

I suspect it may take a definite uptrend in unemployment to mitigate Fed’s concern of reigniting inflation.

I think liquidity is also an issue, perhaps more meaningful than interest rates. How can inflation be fought when excess liquidity is supporting ultra-high asset prices and a wealth effect?

Tapering QT early in the face of artificially elevated asset prices would be huge mistake. When the Wall Street crybabies start clamoring for more liquidity, the Fed should make them sell some overpriced assets, or raise equity capital, to get it.

Bwahaha! Good day indeed. Lol

All the fed speakers today were somewhat reserved to avoid leaning too hawkish or too dovish, with Mester saying something like “probably too early to cut in March”. Just a speculation but perhaps the fed sees issue with small banks on the horizon again late December now that RRP is running low.

Their primary concern is not having another repo/treasury liquidity issue, inflation/unemployment is the de facto secondary mandate. The rates market is probably guessing (or they have internal dialogue with fed officials and bank staff) that it takes about 6 rate cuts to keep the small banks safe, therefore decided to price it there. It’s kind of hard to call Fed fund market completely irrational since rates practitioners are after all not equity amateurs.

“The rates market is probably guessing (or they have internal dialogue with fed officials and bank staff) that it takes about 6 rate cuts to keep the small banks safe”

No, it’s pure greed on the part of wall street.

Desert Rat-

“Never ascribe to malice that which is adequately explained by incompetence.”

— Ascribed to Napoleon Bonaparte

They’ve actually been saying that since December. Powell clearly made rate cuts conditional upon getting close to 2.0% inflation. We’re double that so rate cuts will be later.

Why do they always need to mop up the diarrhea stains after Powel’s ‘performance’?

Congress needs to sober up,quit spending = banana republic .when was last balanced budget,we’re bankrupt. And the world won’t sell us stuff = they don’t want our treasuries .Things will get really bad .

Meanwhile in the real world plenty of countries take our dollars and sell us stuff and treasuries are still low meaning there are plenty of buyers for them.

Thanks for the realism after that binge of nonsensical hysteria.

Headline CPU sure looks like it’s in a trough trying to find its way higher.

Core CPI sure looks like it’s drop is decelerating, again looking for a way to move higher.

So in the grand scheme of things, March looks to be the month that’s going to confirm what CPI is going to do for the rest of the year. My money is on it slowly moving higher as the seasonal rise in oil prices come into view.

Oh, did everyone catch FiscalData announcing we ran a $510B deficit in the first quarter of FY ’24?

That’s a whole lotta labor buoyancy helicopter money accelerating through the system.

The only way we get to rate cuts this year is the result of some black swan event. Or, interest on the debt by Q3 FY ’24 gets so bad that JPowell comes out and says we gotta start lowering rates due to total annualized interest expense exceeding $1.25T. And, that’s being conservative minded.

Florida – inflation capital of the US. Homeowners insurance up 50%+ YOY, car insurance up 12% / 6 months, cost of any type of home repair job up 50% etc.

Motor vehicle insurance 2.9% 1.5% 20.3%

Remember that when you see all the Geico, Progressive commercials during the football games.

My home insurance increase 300% in last 4 year.

My car insurance increase 200% in last 3 years.

But I can buy many cheap led tvs now.

The drastic increases in homeowners insurance in Florida have little to do with inflation and much more to do with the fact that it is a losing bet to insure a house in a hurricane prone swamp that is destined to be under sea level in a few years.

The sad part about all of this is that the same people who complain about insurance rates in Florida are generally the same people who will complain about the US not being a free market. Idiocy knows no bounds.

Let’s see, by your logic I guess hurricanes are new to Florida. We know that’s not true, so why were insurance rates reasonable in Florida before inflation took off over the past three years? Yes, you are right; idiocy has no bounds, and I’m not talking about my post or the one you were responding to.

And, no, weather patterns are not any more destructive now than they were in 2019.

And btw they are going up astronomically everywhere, and why is that? INFLATION!!!!

I suspect two major components of skyrocketing insurance rates in Florida are, in fact, related to raging inflation there.

First is exploding asset values. As real estate and vehicles become more expensive, they also become more expensive to replace. Houses in Florida are still at bonkers levels compared with 2019.

Second, labor shortages and huge cost of living increases across the state have likely led to major increases in the cost of labor across all industries. This means the cost of replacing a roof or repairing an engine has also gone up simply because the employees need to be paid more in order for them to be able to afford their rent that has gone up 50% in three years, and grocery bills jumping 40%.

My partner wanted to get the hood of his car repainted to repair some peeling. A couple years ago he got a quote for $400 in St Pete area. Now he can’t find anyone to do it for under $850.

No wonder insurance rates are skyrocketing.

Desert Rat,

1. Homeowners insurance rates are comprised of two factors. How often claims are made and the price of the insured home. When home prices go up Homeowners insurance rates will also go up. DUCY?

2. There is still a ton of debate on the frequency and strength of hurricanes now versus the past. I am sure you can find a few studies that support your view while ignoring the ones that don’t. I don’t like to rely on ignorance though. YMMV.

3. Even if hurricanes are not more frequent or stronger, they cause much more damage that in the past due to much more building up of the Florida coasts. Even communities that don’t get directly hit by hurricanes can suffer lots of damage from wind, rain, and storm surges.

4. You completely ignored that part about Florida being a swamp that will soon have parts under water. Yes it is nice building multi-million dollar mansions right on the beach. Great views, great weather. What happens when a rising sea surges?

5. Most importantly, insurers are scrambling to get out of much of the Florida homeowners insurance market. Even with huge price increases no one is making any money in many markets.

That is the very definition of what should happen in a free market. When costs rise and make a product unprofitable to offer, a company can either raise prices or exit the market.

So yes, it is idiocy to see the same people complaining about homeowners insurance increases also complaining about the lack of free markets.

…the rising tides of hurricanes and inflation lifts all prices?

may we all find a better day.

Florida insurance is exploding because of rampant fraud. New roofs paid by insurance without real storm damage, roofs put in without required hurricane ties and water barriers, uninsured motorists galore. They don’t prosecute people for fraud and insurance can’t exist in that environment.

Those insurance increases are not happening country-wide and are a direct result of costs insurance companies incur due to hurricanes and fraud.

I don’t think you can lump them in with “inflation”.

Thanks for the update Wolf. I think we have to get through January and February to see some normalization. I noticed some odd seasonality adjustments in the details in this print that just don’t make sense to me for ‘the season’–particularly emergy. November and December are messy months, always on employment data, but I haven’t noticed this much of a divergence historically in the CPI data, I found it unusual. Insurance and vehicle repair continue to run wild but I suspect it takes a while for those policies to adjust to the run up in replacement costs and the balance sheets of insurers can’t be any better than the banks as it relates to the rate environment.

In terms of services, the trend has been going on for four months.

In terms of core PCE, the trend has been going on for four months.

Nothing to do with messy Decembers.

Just look at the month-to-month charts and the three month averages. That’s why I gave them to you.

My views with the general trend align with yours on inflation. I’ve stopped talking about shelter because it’s a dead horse. I also agree with you on your assessment of how the Fed is managing this–Fed has not backed off, and they’re waiting to see. QT has not stopped, rates have not been cut, yet lots of folks here act like they have.

Every headline yesterday from news outlets had an ‘upside’ surprise angle, yet the story is still lagged shelter. I also noticed the odd deltas between unadjusted and seasonally adjusted for food, energy, and even autos the past couple of prints.

The overall price index fell from November to December (including shelter). The overall price index also fell from October to November (including shelter). The seasonal adjustments for both November and December flip these to positive, and it’s not abundantly clear to me why this makes logical sense. But the bond market seems to support the idea that inflation has decelerated further despite the headlines. We have now see two consecutive price declines (deflation) on a non-seasonally adjusted basis, but the headline says +.1 and +.3 for November and December respectively.

Gasoline was the biggest factor in the seasonal adjustments. It nearly always falls in December, and it fell this December too (see chart below), but not as much as normal, and so the seasonally adjusted index rose.

The opposite is the case during driving season in the summer, when gasoline nearly always rises, and seasonal adjustments remove the seasonal portion of the price changes (see chart below).

Seasonality has nothing to do with inflation.

This arguing over seasonal adjustments in December and not arguing over it during the summer when they go the other way is called jerry-picking seasonal adjustments. And it doesn’t make sense because some prices, like those of gasoline, heating oil, propane, etc. are very seasonal in a very predictable manner.

If energy measures commodities it will miss the impacts done by companies such as PG&E who is raising rates significantly for undergrounding lines and general incompetence over the years. Not insignificant raises by any means.

Pacific Gas & Electric Company is one of the largest energy firms in the U.S., and any rate moves they make you can be certain will be aped by the other firms in the sector.

Fortunately I only have them for gas. Sacramento has SMUD for electric and one of the lowest in California.

Howdy Youngins Hope Yall continue to enjoy life and purchase what you want, when you want it. Stay out of debt, live within your means, and no matter what THEY throw at US, you can stay happy………

D-F-B:

You nailed it. Get your money to be earning interest, not paying for interest. Figure out what you actually need versus the stupid things you want that you end up blowing your money on. Happiness is just around the corner. Seriously.

Howdy Louie. A squirrels life is not glamour-us. I found it fulfilling enough for me…….

Debt Free-Bubba-

Have you read: The Richest Man In Babylon, by George Clason? If not, you would appreciate it, I think…

On second thought, are you George Clason?!!

Respectfully.

5.5% core inflation is still too high for warranting rate cuts down to 0% (ZIRP) rates.

Everyone who is vested in real estate and stonks, including the perpetual housing bear and former politician Garth Turner are predicting rate cuts in April 2024.

Are they wishing for their stonk portfolios to moon this time? I thought the Bank of Canada was enacted for moderate inflation (2% inflation a year).

Data point – Seattle area: My basic internet charge, with a popular provider, jumped 22.5% from December 2023 to January 2024. Same package…but with promises of a better experience. Same provider that had a customer data breach last October.

I got a letter that my internet service will be going up 50% at this time next year. I will be eliminating my internet and doing without and I’m sure I’ll be better for it. No more propaganda for me.

Do you have other options, such as broadband through your cellphone carrier? Regular old 4G cellphones with a good connection gives you about 17 Mbts, which is a lot more bandwidth than most people need. You can create a hotspot and put all your devices on it. Make sure you have an unlimited data plan. Worth checking out. You may already be paying for it LOL

This way you can keep reading this site and commenting.

So Indelile..WHY do you continue to feed the beast & stay with the same provider? Just curious…but if & when I have these very unpleasant surprises..I don’t abuse myself, but switch to a NEW provider of services or durable goods!

It’s like WOLF says…re housing, stop getting into bidding wars on overpriced assets (houses) and yes, you th consumer is to blame for the

increase in motor vehicles, because you can wait & you really don’t have to have it NOW. Be patience

I’m sure there’s people out there training their AI on your articles. Hopefully you’re applying for trademarks on some of the creative phrases you use, so that when Zack’s or whoever’s publishes articles that sound like yours, you can go after them. Chatbot articles being hilariously rude to poorly informed commenters might not be enough, lol

Machine-written articles are a real threat in the sense that they can populate the internet in seconds with a gazillion pieces, and they can steal anything and everything. They’ve gotten a LOT better over the past few years — and they will continue to get better. The major outlets, such as Bloomberg and Reuters, have been using them for years, with human editors, supposedly. I was approached by a firm in 2016 offering me their bot for free to test it. I looked at some samples, and back then the style was wooden and hard to read and connect with. Now the styles are varied and pretty good. And they’re going to continue to improve. Eventually they’ll even develop their own sense of dry humor that humans might appreciate. I mean a bot normally produces humor that only bots appreciate, and to humans it sounds like just another stupid thing the bots say, but behind our backs the bots are laughing because they get their own humor. But someday, maybe they can produce humor that humans can appreciate. But I think the first industry that is going to get wiped out by generative AI is the porn industry. After that, it’s the fashion model industry (most of the models in the ads on this site are already AI generated). After that it may be my turn.

That is a good bet. The porn industry leads in most technological advancements on the internet because it is one of the most profitable industries.

I am pretty sure we are only months away from having a completely AI generated person become one of the leading money makers on OnlyFans. No need to pay talent, just generate it.

OnlyFans. No need to pay talent

“talent” FIFY

It’s true. Google and Apple should acquire all the porn companies if they *really* want to learn how to innovate.

What I really want is a search engine (using machine learning or whatever) that can filter out most of the low quality junk, whether produced by generative AI, human content mills, monkeys pounding on keyboards, or whatever.

Yes, it’s great when I find high quality websites (Wolfstreet and Toolguyd being two examples), but it’s not always easy to find them in the first place.

“If you’re a rock star, porn star, superstar

Doesn’t matter what you are

Get yourself a good car, get out of here.”

-Fontaines D.C. 2019

…and don’t forget to write…

may we all find a better day.

Wolf,

I sometimes refer to Cleveland FED nowcasting to see where inflation is going. Many times including today, that nowcast is very close.

Their forecast for Dec 2023 was 0.3 increase in core and headline. 3.3 and 3.9 for YOY. Pretty close.

January month they are showing some slowness (relatively). But for Dec 2023 and Jan 2024 they also forecasting 0.2% increase in Core PCE.

January Core PCE nowcast 2.75%.

Since its FED data, can we say more credible than Wall St? What are you thoughts? If we hit 2.7% in Core PCE, do you think FED will be inclined towards rate cuts this year?

I don’t waste my time looking at inflation forecasts or nowcasts.

Want would the CPI be with only the “Rent of Primary Residence” factor removed?

Such a ridiculous metric.

Why is the best measure of actual rents paid by actual tenants (which is far superior to the somewhat silly asking rent measures) a “ridiculous metric?”

Maybe I misunderstood your question.

I suspect he’s referring to “owner equivalent rent,” which I agree is a ridiculous and error-prone metric.

Agreed. The current combination of actual rent inflation and “owners equivalent rent” appears to be drastically understating shelter inflation the past decade.

I probably don’t know all the subtleties, but the clear goal of “owners equivalent rent” is to track ownership cost. They assume the home purchase has already been made, then they assume the cost of owning a home will correlate with potential rental income. The assumed correlation is invalid in locations where the buy v. rent computation is heavily skewed in favor of renting. Housing prices have gone up 200%-300% in many coastal locations, while rents have gone up 50% or less, yet it’s the 50% that goes into the inflation statistics. I know such distortions are happening because they happened in my neighborhood. The computations should recognize that housing prices and rents are not correlated, so one should not be used as a proxy for the other.

Also, the combined computations assume there are two groups of people – owners and renters. They completely ignore the fact that many renters want to be owners and will be purchasing a home at availing prices. Actual home price inflation is most relevant to them, not rents or what existing home owners think their rents should be.

Renting for a lifetime is not a viable option for many people. We aren’t talking about replacing beef with chicken. Home ownership has been the leading pathway to wealth-building and quality of life for a large chunk of the population. Many people view it as a necessity.

Should we tell these people home price inflation isn’t happening simply because they are currently renting? I don’t think so.

At a minimum, we should poll how many renters are reasonably in the market for a home, then track actual home price appreciation for these people, in addition to rents. They have to find a way to get actual home price inflation in the computation, or the inflation statistics will remain highly inaccurate for tomorrow’s home buyers. It seems ridiculous to exclude our largest lifetime purchases from the inflation computations.

“… the clear goal of “owners equivalent rent” is to track ownership cost.”

No, you’re wrong. The goal is to track “shelter” costs as a SERVICE. So when home prices crashed in 2005-2011, OER didn’t crash with it. It continued to go up and showed housing (shelter as a service) inflation, even as home prices were crashing. See chart below.

Home prices are asset prices like stock prices. Homes are not “consumed.” Consumer price inflation tracks inflation items that are “consumed” either immediately (food, insurance) or over the span of some years (cars). Consumer price inflation does NOT track asset prices. We have other indices for that, such as the S&P 500 and the Case-Shiller Home Price Index.

Bobber, I agree that a large part of that problem is that it doesn’t consider asset inflation to be inflation.

But the other problem with the owner equivalent rent is that many to most homeowners don’t have a clue what their house would rent for, so they just pull a number out of their rears.

How could they? If you bought a house in 1994, and have been living in it for the past 30 years, you have been out of the rental market so long, that you’d have no clue what it would rent for. In many places, single family homes don’t really rent out much, so people have a limited sample size to begin with, even assuming they do research prior to answering, which I suspect nearly all do not.

Wolf, at risk of beating a dead horse…

I agree there are other indices to track asset prices but they don’t seem important for purposes of the Fed’s current inflation targeting, which references a version of consumer price inflation. When consumer inflation is down to 2%, it seems the Fed will consider the inflation fight done, even if home prices and retirement ability has moved out of reach for Average Joe. That’s a huge problem in my book.

Wolf,

FYI, from Investopedia explanation of Owners Equivalent Rent:

“Key Takeaways · Owners’ equivalent rent (OER) measures how much money a property owner would have to pay in rent to be equivalent to their cost of ownership.”

I think we are both right but apply different semantics.

Bobber,

Definition in the article just above the OER chart: “The OER index accounts for 26% of overall CPI. It is based on what a large group of homeowners estimates their home would rent for and is designed to estimate inflation of “shelter” as a service for homeowners.”

Investopedia is fundamentally wrong. CPI measures the cost of a service (shelter), not ownership.

Why didn’t you go to the BLS site to find the definition? Investopedia doesn’t produce the CPI, the BLS does.

https://www.bls.gov/cpi/factsheets/owners-equivalent-rent-and-rent.htm

“The shelter service that a housing unit provides to its occupants is the relevant consumption item for the CPI. Most of the cost of shelter for renter-occupied housing is rent. For an owner-occupied unit, most of the cost of shelter is the implicit rent that owner occupants would have to pay if they were renting their homes, without furnishings or utilities.

“Owned housing units themselves are not priced in the CPI Housing Survey. Like most other nations’ economic statistics programs, the CPI program views owned housing units as capital (or investment) goods distinct from the shelter service they provide, and therefore not as consumption goods. Spending to purchase and improve houses and other housing units is treated as investment and not consumption in the CPI. Interest costs (such as mortgage interest), property taxes, real estate fees, most maintenance, and all improvement costs are part of the cost of the capital good and are also not treated as consumption items. These non-consumption costs of owned housing are out of scope for the CPI under the cost-of-living framework that guides the index.”

Wolf,

It’s semantics. They estimate the inflation of shelter as a service (your point) as a proxy for determining the costs of home ownership (my point). I’m not countering your points, I’m incorporating them.

The inflation metrics can’t determine the real cost home ownership because every homeowner bought at a different price level and has a different mortgage payment, so they use a hypothetical owners equivalent rent as proxy. My point was the methodology makes no sense when rents do not correlate with housing prices for long periods. The methodology may have been appropriate at one time, but then it got out of whack. It’s sort of like the health inflation adjustment you took issue with, which was a great article. I think this owners equivalent concept is equally distanced from reality.

As a larger point, I’m saying the Fed’s monetary framework is insensitive to asset inflation, which I believe is a much larger flaw. People are being priced of housing market and retirement (because of super-inflated stock prices). Massive bubbles are created which burst. Yet, the Fed says it has nothing to do with these problems, which are created by monetary policy in the first place. In my opinion, we need broader thinking at the fed, or new mandates.

Respectfully.

Bobber,

Canada uses a CPI metric to track the costs of homeownership – “CPI owned home.” The components include the major expenses of homeownership, such as mortgage interest rates, a measure of home prices (“replacement cost,” now dropping), property taxes, insurance, maintenance and repairs, and other related expenses.

Click on the link and scroll down to the subheading “The CPI for homeownership” – it lists those homeownership expenses and their % increases:

https://wolfstreet.com/2023/11/21/rents-in-canada-explode-services-inflation-heats-up/

So the Bank of Canada, by hiking interest rates, which has instantly increased mortgages rates, is in part boosting this “CPI owned home.” And sharply falling home prices are putting downward pressure on it.

If the BLS in the US wanted to track the actual cost of homeownership, it could just bite its tongue and follow Canada’s method.

But the BLS looks at “shelter” as a service – which is conceptually very different, regardless of what you think — and it tracks the cost of that service, and mortgage rates and home prices have nothing to do with it.

Canada has a separate rent index, similar to our “CPI Rent of primary residence” and that spiked too.

Before you rake me over the coals again, let me add the BLS language:

“The shelter service that a housing unit provides to its occupants is the relevant consumption item for the CPI. Most of the cost of shelter for renter-occupied housing is rent. For an owner-occupied unit, most of the cost of shelter is the implicit rent that owner occupants would have to pay if they were renting their homes, without furnishings or utilities.

Owned housing units themselves are not priced in the CPI Housing Survey. Like most other nations’ economic statistics programs, the CPI program views owned housing units as capital (or investment) goods distinct from the shelter service they provide, and therefore not as consumption goods. Spending to purchase and improve houses and other housing units is treated as investment and not consumption in the CPI. Interest costs (such as mortgage interest), property taxes, real estate fees, most maintenance, and all improvement costs are part of the cost of the capital good and are also not treated as consumption items. These non-consumption costs of owned housing are out of scope for the CPI under the cost-of-living framework that guides the index.”

Hence, they admit they aren’t including actual ownership cost in the metric (home cost and mortgage interest). They instead track hypothetical rent as a service (your point).

Now my point, clarified. The inflation statistics explicitly exclude asset inflation, including home price inflation, and that’s a problem. People’s costs each year include setting aside savings for a home and savings for retirement. If you view those savings as purchases through time, they are just as important as food prices or gasoline. When the savings are eroded by asset inflation, people get less and less in return for their annual savings. That’s inflation that matters when asset prices get way out of whack.

The Fed should be acting asset price inflation. If they don’t factor it into the inflation statistics, they should factor it in somewhere, somehow.

As an aside, there seems to be an interesting article there.

Why doesn’t the Fed’s policy framework consider asset inflation? Evidence indicates it leads to asset price booms and busts, which harm employment and stability in the long run. The mandate makes reference to price inflation, not CONSUMER price inflation. Who has a right to say asset price inflation is irrelevant, particularly asset price inflation that deviates 3x from mean?

Can high rents be a function of higher mortgage rates? Therefore if interest rates come down, wouldnt that help with lowering rent as well?

That relationship has NOT been the case in the past.

But lower mortgage rates are associated with higher home prices, and higher mortgage rates with lower home prices.

As you can see in the chart that juxtaposes Rent and the Case-Shiller home price index, there isn’t even really a relationship between rents and home prices.

Rents go up with 1.) wages and 2.) demand/supply.

NO. As a landlord with several duplexes in a college town. My experience is that rents are purely a product of supply/demand and the average wage (or in my case the depth of mommy and daddy’s pockets).

Strangest thing I have learned, if you screen prospective tenants carefully and have their parents co-sign, the good tenants will tell their friends about how nice it was to rent from you and you will have your properties pre-rented for years. Yes, I have had my sure of bad tenants (dropouts that became prostitutes or drug dealers), but they get evicted quickly. The most unexpected discovery for me has been that sorority girls from prestigious sororities are the best tenants. Did not see that coming when I started this 23 years ago…

The food inflation suggests a North Beach diet — plate of fish with side of vegetable, and coffee. How cool is that?

Well luckily the UK and US have just started a bombing campaign in Yemen against the Houthis. That should help lower the price of oil, right?

Good thing this Administration has been emptying

the SPR.

The SPR is obselete now that the USA is a net oil exporter. It should be drained and abolished.

Oil prices spiked by 5% overnight. Trading Economics stated that global shipments are detouring this area, increasing shipping costs for everything.

It looks like inflation is here to stay for a while. Whoever wants 0% interest rates tomorrow is either invested heavily in stonks and/or real estate.

My diesel didn’t jump yet, but gas did.

Neocons, corporate, and greenies get what

they want. Us old folks get our interest rates.

And the youngsters get a job.

So who’s not happy???

A big chunk of our $34,000,000,000,000 of treasury debt rolling over each week as t’bills go from 1/2 of 1% to 5+%.

The result is more and more big increases in those auctions.

The Fed and the treasury are between a big rock and a hardening hard place.

b

Good point. Treasury is rolling a lot of the debt over to short term notes and not long term bonds.

I am not sure why but some people think the demand would not be there to sell $7 trillion worth of debt at 10years to 30 years.

Thanks for the unbiased look at price changes. The great Keynesian Experiment continues! For now anyway. When even that troll Mester is towing the hawkish line, you know they are scared. It’s a selection year after all.

Higher for longer! Although 5% is NOT a great return for the risk, especially in light of a president who does not seem to follow the constitution. I am pretty sure congress, and only congress has the power to approve military strikes.

Interesting times. Hedge accordingly.

Apparently cooler than expected PPI put March rate cuts back on the table and market expecting 160 bps of rate cuts. Cooler than expected but still hot PPI. Something needs to happen to rein in wall street. I don’t care what it is.

Agreed. I had an epiphany when reading JP Morgan’s earnings reports. They gave an overly optimistic (in my opinion) outlook for the coming year based on 6 rate cuts.

What they’re trying to do is create the reality they want. They’re trying to set everything up so that their business plans and other positioning REQUIRES the rate cuts, that way they can whisper to the FOMC come March (and beyond), “Look, we need these cuts! We’ve already planned for them.”

A truly independent Fed would respond “Well, we never told you to do that. That’s your problem. You made your bed, now lie in it.”

But I’m not convinced that the Fed won’t instead choose to bail them out by giving them the rate cuts they want, even if utterly unjustified. The Fed has the option of being the stern parent or the enabler. In the past 15 years, they’ve chosen the latter, EVERY TIME.

Wall Street used to be a positive force in America for raising capital. Sure, they made money doing it, but that was a side effect.