Plunging gasoline prices and dropping prices in a few other categories hold down overall CPI. A mess for the Bank of Canada.

By Wolf Richter for WOLF STREET.

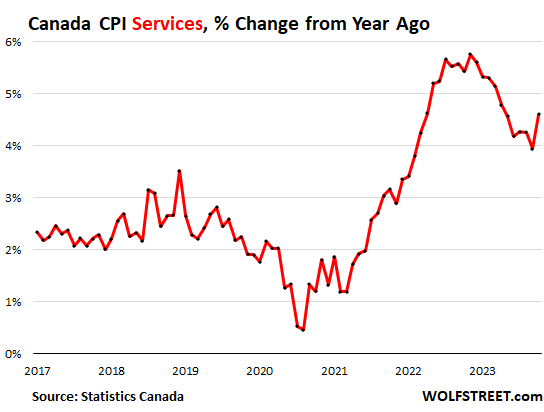

The overall Consumer Price Index for Canada in October decelerated to +3.1% year-over-year, due to plunging gasoline prices, according to Statistics Canada today. Without gasoline, it would have risen 3.6%, just a hair more slowly than a month earlier (3.7%). Food price increases also decelerated to a still hot +5.4% year-over-year. But the CPI for services accelerated to +4.6% year-over-year, up from 3.9% in September, due to higher travel costs and housing related costs, including rents.

Rents exploded.

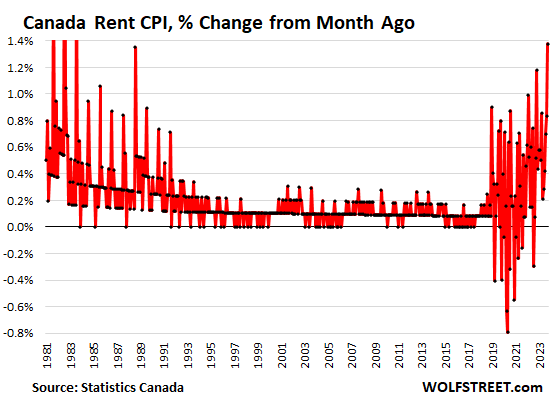

On a month-to-month basis, the CPI for rents spiked by 1.4% in October from September, annualized 17.9%, the biggest month-to-month spike in 40 years, since August 1983. The data has become very volatile, but you can see the pattern of ever bigger and now crazy month-to-month spikes:

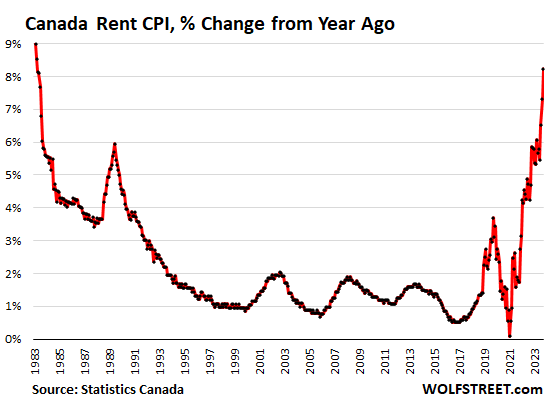

Compared to a year ago, the CPI for rent spiked by 8.2% in October, up from 7.3% in September, and the biggest year-over-year spike since April 1983.

Rent isn’t a discretionary item that people can easily choose to forego if it gets too expensive. It’s an essential, and it is on a crazy-scary spike, not matched by wages or anything else. Rent inflation has become a relentlessly worsening problem for Canadians:

The Bank of Canada has pointed at inflation in the housing sector as a big problem and as one of the reasons for its tightening. Housing inflation, as measured by CPI in Canada, comes in two big flavors: Rents and homeownership costs.

Before the BOC started tightening, it pointed at inflation in home prices which at the time were spiking, driven by the BOC’s own near-0% policy rates and massive QE. Now home prices, amid the 5% policy rate, have started to seriously sag: The Most Splendid Housing Bubbles in Canada: Prices Drop to where They’d Been 2 Years Ago, Sales Swoon, Supply Rises. But rents are going the opposite way.

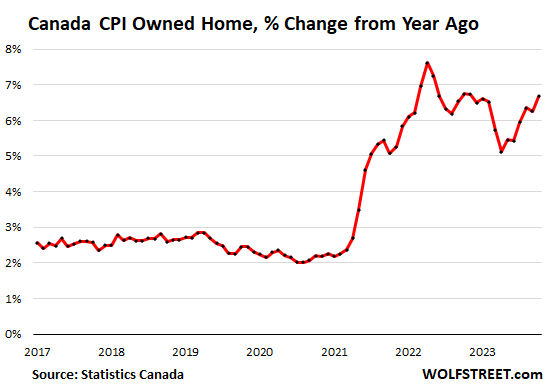

The CPI for homeownership, or “owned accommodation,” spiked on a month-to-month basis by 1.04%, or 13.2% annualized, in October from September:

Year-over-year, the CPI for homeownership accelerated to 6.7%, right back where it had been last year. The index includes the following items (% year-over-year), and note the aspects of services inflation in this list:

- Mortgage interest cost: +30.5%;

- Homeowners’ replacement cost (the dropping home prices): -1.2%;

- Property taxes and other special charges: +4.9%;

- Homeowners’ home and mortgage insurance: +7.7%

- Homeowners’ maintenance and repairs; +3.5%;

- Other owned accommodation expenses: 0.4%.

Services inflation spiked 0.88% month-to-month, or 11.1% annualized. On a year-over-year basis, it re-accelerated to 4.6%, back where it had been in May:

The Bank of Canada has a complex problem on its hands. In the overall CPI, plunging energy costs and decelerating food costs, and falling inflation in some other categories hide the surge in rents, housing-related costs, and services generally. The BOC has kept its main policy rate at 5.0% since July. It faces a slowing economy, but surging inflation in services, particularly in rents.

Services inflation is part of the “underlying inflation” that the BOC keeps fretting about. But it’s politically tough to hike rates past 5% with the overall CPI at 3.1% and a slowing economy – though the BOC has consistently kept the option of more hikes on the table.

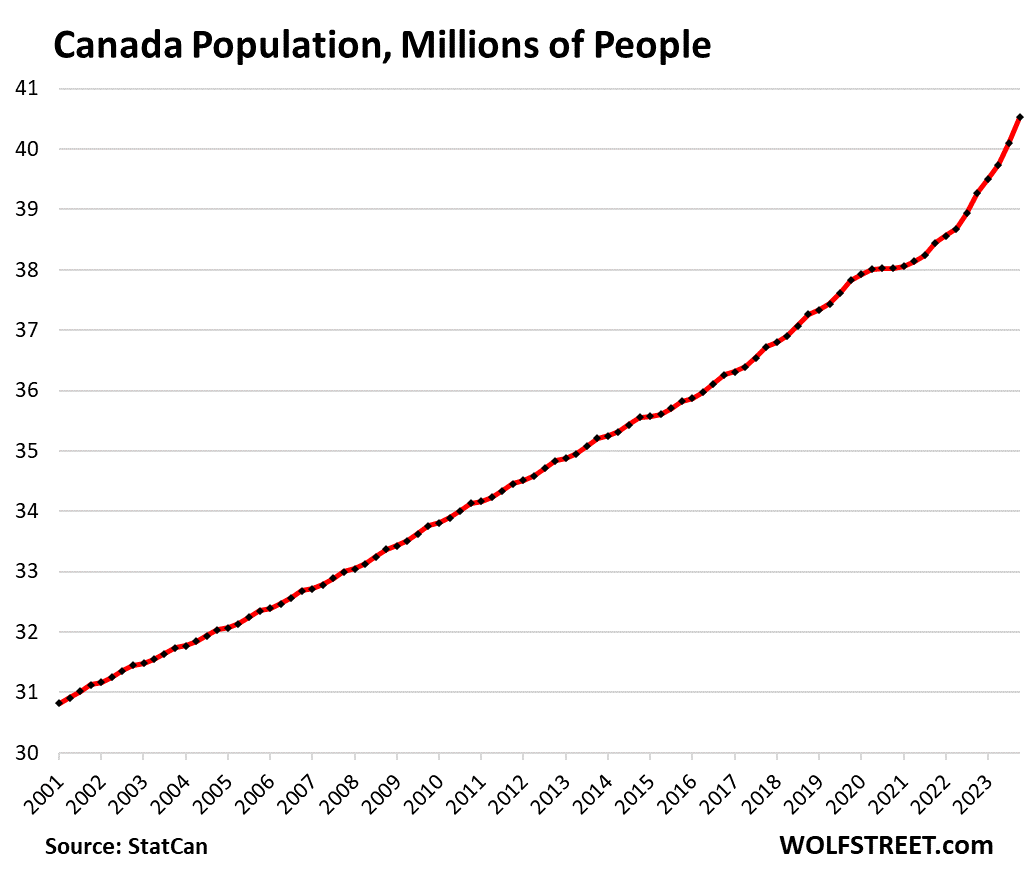

A historic spike in immigration is one of the drivers behind the spike in rents, and housing costs more generally, following the government’s decision to open the floodgates to immigration as a solution to everything?

Canada’s population soared by 1.16 million people over the past four quarters, or by 2.1%, to 40.1 million in Q3, according to Statistics Canada, between two and five times the growth rate in prior years. People pouring into Canada need housing, and most of them will initially chase after rental units, pushing up demand at the lower portion of the rent scale, and rents then jump, and those increases move up the ladder. This is another crazy chart – but it explains in part why rents are exploding, even as home prices are sagging:

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Looking at the YoY chart, was the big spike in 1983 driven by the Canadian economy being so tied to the US economy experiencing inflation, or was there some country-specific thing that caused it?

A good summary, Wolf. Your last chart belying that things don’t go to heck in a straight line.

The monetary inflation story is over, and there is no need for the bank to do any more rate hikes. Higher rents because of excessive immigration is not monetary inflation and there is nothing a central bank can or should do about it, other than perhaps leaning on the government behind the scenes to get their act together and slow immigration back down to a more reasonable level.

The story now is a population/housing market story. Still, sometimes short term pain brings long term gain. The severity of the housing squeeze is bringing about some long desperately needed reforms to open up rules around zoning, parking and other red tape that prevents the construction of new housing in Canada.

Ideally, political backlash, tensions with India, and the miserable experience of new immigrants, and the fact that much of the recent pike in immigration is non-permanent residents all combine to bring population growth back down to a more manageable level, the high (by recent standards) interest rates keep housing prices falling (at least in real terms) down towards a more reasonable level, and supply side reforms eventually bring down rents and housing prices over the longer term.

But the reality is, when you have underbuilt housing for as long as Canada is, and allowed the price of housing to get as far out of hand as Canada has, digging out will be a long painful experience.

Some Guy,

“The monetary inflation story is over, and there is no need for the bank to do any more rate hikes”

LOL, “monetary inflation…”

A big part of inflation is mass-psychology, the inflationary mindset: consumers willing to pay higher prices; businesses and landlords raising prices/rents because they’re confident that they can get away with it without losing business; businesses paying higher prices because they’re confident that they can pass them on, etc. etc. And they’re all including those bigger price increases into their plans and expectations. That’s the inflationary mindset, and once it takes off, the genie is out of the bottle and it’s very hard to get the genie back into the bottle.

By now, EVERY central bank knows this, they’ve known this for a LONG time, including the BOC, and they know that, because the inflationary mindset has taken off, their inflation fight is going to drag out for a long time.

Amazingly still today, the phenomenon of inflation remains a badly understood mix of dynamics that tends to dish up all kinds of surprises and head-fakes.

Agreed… and this implies we will have signifacantly higher interest rates for years into the future, not months or quarters.

All you have to do is look at a long term chart of interest rates.

I guess time will tell, but I don’t see much inflationary mindset here in Canada. I did see a big grocery chain announce that they were freezing all their prices for the next couple of months – PR stunt yes, but not exactly inflationary mindset. I’m sure that there will still be some ups and downs like you always see, and the services CPI will lag on the way down due to inertia, but I am pretty confident the direction is going to be mostly down from here.

From Feb – Oct, the country has actually seen deflation if you carve out ‘owned accommodation’ (ie. central bank interest rate increases, where the y/o/y rate of increase will rapidly decline in the coming months) and rent (which is a real problem, but reflects too many people and not enough houses, not an inflationary mindset).

There is still some lagged impact from higher food prices as well, but that is fading out of the index as well.

“Amazingly still today, the phenomenon of inflation remains a badly understood mix of dynamics that tends to dish up all kinds of surprises and head-fakes.”

All of that money-printing caused this. The central banks did it on purpose. The idea that they didn’t know that almost $10 trillion in monetary and fiscal stimulus would lead to something like we are experiencing is ludicrous.

Depth Charge,

Wait a minute… why didn’t we get this inflation in 2009 or 2010? That’s what I mean. They did a lot of money printing, and consumer prices didn’t react. That was a complete surprise. And then they printed more money (QE2) and consumer prices didn’t react. That was also a complete surprise. And then they did QE3, the huge QE3, and consumer prices still didn’t react to it. That’s what I mean. We don’t know why it didn’t cause lots of inflation back then. We can guess, lots of people have guessed, I have guessed why. But we do not understand all the aspects that go into what causes inflation. Because back then, QE didn’t cause inflation. It didn’t cause inflation in Japan for 20 years. It didn’t cause inflation in any of the QE countries, until suddenly in 2021, inflation explodes. We don’t fully understand, for example why money printing (and deficit spending!) didn’t cause inflation, and then why suddenly inflation explodes almost globally.

You can guess, and you can cling to simple answers, but they don’t answer the contradictions we have had.

Thank you, Wolf, for that desperately needed response to the vulgar monetarism that plagues the public discourse. I understand that it’s like shouting into a hurricane, but every little bit helps.

Simple answer, Wolf, they went biblical with their money-printing as compared to the first QE. It was on a whole new level. They shut down the workplace and were paying people an “extra” $2,400 per month for doing nothing on top of regular UE bennies, in conjunction with allowing them to not have to pay rent, mortgage, car payments, etc. These people had more money than they had ever earned in their lives. And they spent every last penny and then some.

And they levered it, going into massive debt on cars, houses and everything else. “Stimmy ballers” the car dealerships were calling them as they handed out loans like candy. 175% LTV on an auto and you wonder why car prices set fire? WTF are banks doing lending money that far beyond the asset value? And then there’s the fact that there weren’t enough cars to go around, so do the math.

Further, they hammered rates to zero and started juicing the housing market to levels unconscionable with their MBS purchases, and banks lowered lending standards there as well. Everybody was doing cash out refis, buying 2nd, 3rd and 4th Airbnbs, and just spending like mad. And so house prices went into an insane price bubble, and very quickly. People were “paying anything,” and of course appraisals are apparently not even a thing anymore.

With so much money sloshing around, in conjunction with a shortage of products from factory shutdowns, you had a veritable sea of liquidity chasing any product available. People had no respect for this money anymore, because they didn’t work for it. It was “free.”

And then there were the PPP gifts, I mean “loans.” What a disgustingly repulsive trillion dollar program. Whoever came up with that should be doing hard time in prison. Talk about handing a bunch of people who needed nothing millions of dollars in cash. YUCK. And that money flowed into houses, cars, restaurants and everywhere else.

This inflation is about as surprising as a dog lifting its leg on a fire hydrant.

“Because back then, QE didn’t cause inflation. ”

Sure it did, in the asset markets. But WOLF likes that kind of inflation.

Mr. House,

We’re talking about consumer price inflation here. That’s the topic of the article and the discussion here, not asset price inflation or wage inflation or grade inflation.

Inflation is inflation, if i can’t afford to buy a house, what difference does it make?

2008/2009 ?

The money went into patch the nuclear hole in Wall Street.

Little slippage into the real economy.

Depth Charge,

I like what you wrote below. I didn’t know people were getting $2400 per month for… doing nothing ? I did know some people weren’t paying rent.

I’m a renter, always paid my rent on time. Received UE only once in my life. Thought it was generous.

It really bothers me, the $2400.

Four years ago I was very disappointed in the lack of substance in the Democratic party debates 2019-2020… I’ve always voted Democrat or Socialist. I’m slowly becoming more independent (party orientation) not along the lines of Trump or most Republicans. Basically disassociating from Democrats, but not joining conservatives.

Wolf and others pointed out the MBS purchases… up to May or June of 2022 if memory is correct. Why did JP continue so long ?

Thank you for providing this info.

Thanks Wolf a great reminder. I am in Pennsylvania for Thanksgiving from East Texas and at least in this area a real eye opener for consumer spending. The area around Malvern and Paoli PA is very affluent but still supports a large number of poor and middle class folks. Long lines at chic fila , parking lots full and roads full of expensive cars. The area is full of millennials that have young families and buy things every day. The area is in the heart of Radnor Hunt. The only comment my son in law had was that housing upgrades had slowed down only because of higher rates. No conversation about higher prices or the need to tighten one’s spending . A real eye opener for a senior citizen. They want to spend when they can ! And do feel things will just be higher later so buy when you can . No recession in sight

“Desperately needed reforms… parking “

I assume you are referring to new zoning allowing no parking for apartment buildings, even large 100+ unit buildings. I mostly walk and bike but even I have a car. In the real world many people will use cars, at least part of the time. I look forward to autonomous automobiles becoming a reality but we aren’t there yet.

I don’t believe in the conspiracy theory nonsense regarding 15 minute cities. But sometimes I do wonder…

As a Canadian I love my country. However I think Canadians acceptance of the idea that we can deal with our aging population through massive immigration is nuts. It’s just kicking the can down the road. In the meantime we deal with consequences like a shortage of housing, not to mention a lack of timely health care.

Canada would have negative population growth and a stagnating economy (like many European countries) if not for robust immigration levels. The Liberals are in charge for at least two more years, that’s another 2 million new Canadians. Let them come.

Right, so, instead we have 2% population growth into a stagnating economy.

Many working class Canadians are against the policy, because the bureaucrats live in suburbs and semi-gated communities where many newcomers do not live, thus the bureaucrats don’t feel the fallout of their unsustainable policies.

Only an academic could figure Canada needs more immigration.

Vancouver/the Fraser River Valley and all it’s farmlands are a Paved Paradise come Parking lot.

Toronto/Southern Ontario is quickly running out of land.

Why is Canada’s Policy set on Immigration? Not because new immigrants want to settle into the 99% of Canada that mimics Siberia, but because Canada’s Federal Liberals, like their U.S. Democratic Party brethren, think these newbies are votes for them.

Ghettos. All around.

With respect to parking, rule changes give developers and purchasers the freedom to work together to build and pay for as much parking as they want. It removes the statist requirements that the government knows best how much parking is required in the market and government forcing developers to build it and buyers to pay for it, whether they want it or not. There is a crazy excess of parking in private buildings in the cores of many Canadian cities thanks to government requirements.

Some conspiracy, to give people more freedom to do what they want. If you want parking for your car, pay for it yourself directly, don’t have government pass a law to force everyone to pay for it.

You’re ignoring the fact that mortgage interest also drives rent costs. As the cheap 5 year loans close out the higher rates the owners have to pay to finance their properties will continue to be passed on to the renters. If rates stay high then rents will increase, and even if they level off all the follow on loans maturing will continue to raise rents for 4-5 years.

Wage gains are coming in at 5.5 percent a year in Canada compared to 4.2 percent in America with the Bank of Canada rate half a point below the Fed funds rate in America and this Tiff character still has a job. In any other country he’d be fired on the spot. Any decrease in interest rates in Canada and home prices will quickly regain back all their losses and make new highs. That will drive rents from $2,500 a month for a studio apartment to $3,500 a month.

Demographically Canada needs the immigrants to fill the holes in the work force left by the retiring baby boomers.

The “timing” isn’t exactly ideal to do it now but they are big time as you can see and everyone here in Canada is paying the price.

Short term pain for long term gain? Let’s hope so.

Highly doubtful they want to or will raise rates again.

Gov’t comes out today with new policies to ease the mortgage renewal problem here to save the housing market as well.

“Demographically Canada needs the immigrants to fill the holes in the work force left by the retiring baby boomers.”

That’s ridiculous. Millennials are the biggest generation ever. They’re really eager to fill those holes. You’re just trying to screw around the millennials so that you can have cheap labor to take care of your lawn and work for you, because Canadian millennials don’t want to work for your slave wages to enrich you? Be honest, dude!

Bingo! You nailed it wolf!

Yep. Population growth in Canada is all about wage repression.

Millennials and Gen Z are also left behind here. They can’t compete with even renting a room these days.

The trend is that a professional husband and wife, sometimes with an infant, rent a “private room” with a walk-in washroom for about C$1,200 to C$1,500 a month. In 2015, a two-bedroom apartment was C$1,500 a month in Toronto. In Montreal, a one-bedroom was…C$700 a month!

This shows how something went terribly wrong in Canada where renting a room today is more than renting a 2-bedroom apartment 8 years ago.

Now the powers that be want to drive down wages, create a nation of people sharing rooms for rent, while those who already own property and capital become richer from this misery.

Been reading some preceding comments about a country so massive and varied……comments that seem to indicate it is the same condition everywhere. It just isn’t so. Your comment and others implies that renters are stuck sharing rooms, and someone above stated two professionals were in that same boat where they lived. My nephew in Victoria pays $1850 per month for a 1 bedroom apartment. He lives on his own. He is a glazier apprentice and makes $28 per hour plus bennies and OT. He knows and accepts that he will have to relocate in order to buy a home or a building lot, and plans to do so asap. In the early 70s I was in a similar position, couch surfing while working construction. Also in Victoria. One summer I shared a converted boat shed with a fishing guide in some forsaken hole in NW Ontario. You do what you have to do in order to get the leg up. My son in law dug ditches installing irrigation systems while my daughter finished Uni. They got into a crap condo, fixed it up and made some sweat equity cash and traded up to a house in Ladysmith, fixed that wreck up and are now mortgage free at age 44. They have one child.

The immigration comments floor me. My sister in law manages 58 front end staff at a large grocery store, plus fills in on the floor as needed. She cannot find or keep enough staff. Yesterday a new hire told her that he could not be expected to work any day shifts Mon-Fri this winter as he planned to be up the mountain skiing everyday. People work a week or two and then blow shifts. She would hire more immigrants, but many already hold several jobs and can’t always be available. She prefers to hire retired people who are sick of being at home and want to work a few days per week. It costs approx 3K to train a cashier and they go through them steady….from high school kids to people in their 30s.

I don’t know how many companies manage to operate in our entitled work ethic environment, to be totally honest, and I’m union pure through.

I am currently renting out a 640 sq foot cottage to a 22 year old couple who are saving for a home. The place is just 5 years old and perfect for them as we charge just $600 per month. Could we get more? Certainly, but that is the problem. Greed prevails on the back of the helpless these days. Too many are chasing the almighty dollar, and so many are now doing this that all levels of Govt are now stepping up to impose restrictions on RE speculation and vacation rentals.

And the health care comment blew me away. I just did the driving for my wife who had cataract surgery yesterday. No charge or co pay. No health care premiums. We saw the ophthalmologist today twice for follow up pressure checks, no charge. The travel is tax deductible. Next week I am due for a scope as cancer runs in my family. It is preventative maintenance, pure and simple. There will be no charge for any part of the ordeal. Not one cent. Timely? This is done before anything even exists. How is that not timely medical coverage including a yearly physical and blood testing array. No premiums or co pays. None.

This is a wonderful country as far as I’m concerned and I am pleased enough to pay taxes for what we have.

regards

Immigration is intended for votes for Canada’s Liberals and New Democrats.

The Ghetto vote is critical for division.

And Canada Pension? Like U.S. Social Security, it has gone from completely underfunded for 50 years to 12% of payroll today.

My parents collected Canada Pension for 35 years after contributing less than 1% of their earnings for less than 20 years. Like all economics, politics steers the ship, usually into the ground.

From what I’m seeing the baby boomers must have been at least ten times more productive than the entities filling their former jobs as productivity falls lower and lower in Canada as more immigrants flood in mostly from the third world.

Curious as to how inflation would change based on price of oil. For example what if it went to $115 again versus the $82 or whatever it is today. So much is influenced by it but seems like government expects a certain amount of stability in oil markets we seems we have little influence. I get the US is a net exporter marginally but that doesn’t protect the consumer from price increases.

When oil was $140 a barrel 15 years ago a gallon of 87 octane was around $5 in California, now that it’s almost 1/2 of that rate, gas is still about $5 a gallon.

How’s that work?

I can’t break this down completely but $5 in 2008(15 years ago) is $7.10 today. California also has unique gasoline it creates part of the year and increases its taxes. We also have expanded our capacity in the US which I would think drives down some costs. I think more accurate to compare national price per gallon as California and gas is a much more complex puzzle.

I was more curious as to the predictability of inflation based on barrel of brent crude for example.

It got up to $4.11 per gallon nationally in 2008.

Taxes.

They just need to build housing.

I believe provincial governments recently eliminated rent control laws and this is the reason for the current spike.

Perhaps a Canadian reader can provide some insight?

Quebec has strong rent control laws allowing about 2-3% increase per year (even if the tenant moves out- same increase for new tenant). Other provinces I’m not sure about but since average rents in Montreal are about 2/3 the rent in Moosejaw, Sask. (no offence to moosejaw, I’m sure it’s lovely there 😁) I suspect the laws are more lax outside Quebec.

Quebec is a hive of it’s own. Governments finger is in everything.

They were set to institute the Covid Card before you could buy groceries.

I’m not an expert in rental laws but that doesn’t sound right, there is still rent control in BC where I recently moved out of, I was paying just over $1500/MO and the next renter will be at almost $2000/MO for the same unit, if I had stayed I was looking at a pretty small increase of 3% or something like that. Likewise in ON where I live now there is still rent control, I think for this year the increase is in a similar range as BC.

Maybe what you’re thinking of is the 0% increases we had durring COVID years, I believe there was some kind of moratorium on increases so my rent stayed the same for an extra year, that’s over now. However, that’s just a few percentage points, not the stratospheric increases that Wolf illustrates so nicely here.

Reality is rent control applies to a limited number of rental units, I’m not sure about the specific rules around which buildings are regulated but I do know new privately owned condo units are not controlled and so we’ve had a ton of them constructed in our cities and they’ve been appreciating and rents in the ones that are rented out by owners/investors have also been appreciating, while strictly for rent buildings become old dumps and very few new buildings were constructed for that purpose. Also, rent control applies when you move into a unit, but between you moving out and next tenant moving in there’s no limit landlords can charge, so if you’ve a lot of newcomers to the country they’re going to be charged at current rates, it’s the old timers who’ve lived in their units since the 90s or something that get to enjoy the benefits of rent control, newcomers get inflated rents.

There’s no rent control for buildings built in November 2018 or later in Ontario, Canada. Renovictions also dramatically push up the cost of rent. The Chinese own virtually all the newer units, townhouses and apartments built since 2018 as no one else can afford to buy them.

Seba:

But according to Justin (Deficits fix themselves) immigration doesn’t affect rents.

A large proportion of new immigrants to Canada return within the first 5 years.

Now with these rental prices, with the job market cooling, and with the lower wages newcomers are getting, I think the number of people leaving Canada will increase compared to years past

Howdy Julian. Do they return where? How many use Canada to then enter the US?

Hi Debt-Free-Bubba,

They return to where they came from.

I am one of the returnees.

And some go to the US using different methods such as marriage or study

A small number of immigrants go somewhere else after getting landed Immigration status No country hands out citizenship complete with education healthcare child care benefits welfare etc to half a million strangers every year Only Canada which is another reason we’re going bankrupt.

Sorry this is BS.

And the USA and Europe and Australia and New Zealand accept immigrants and give them all the rights. But what makes Canada flood the market with immigrants is unfair and nasty targeting people who don’t know what they’re going to find there.

Be sure that not a single educated and intelligent person will remain in Canada after he understand how the state remains trying to exploit and enslave him.

“Be sure that not a single educated and intelligent person will remain in Canada after he understand how the state remains trying to exploit and enslave him.”

Canada is fully WEF’d. Canada doesn’t tax Capital, only Labor.

e.g. To pay someone $30/hour, which nets =/- $25 or less after taxes, it takes $40 in our industry. 12% CPP, 4% unemployment insurance, 5% Statutory Holidays (1 every month, including the new Native forgiveness Holiday), 5 paid sick days every year, WCB, and all those Stat Holidays and Sick days get CPP and EI taxed on top.

And believe me, $30/hour an hour in Canada, you are still the working poor.

The big problem is they come here to abuse the system, the healthcare system exploit all weaknesses or loopholes in Canadian law and cry to the Canadian government if everything doesn’t workout for them. This is the main reason productivity is falling off a cliff.

Don’t get sick

You will be in the hospital for days

Don’t drive

You will need an extra hour to get anywhere

I’m pretty sure this liberal government has an agenda with immigration

Secret deals?

They think the immigrants will vote for them?

No infrastructure

Continued constant massive immigration

No matter what the population is enduring

And no end in sight because of the insistence of massive immigration despite what every economist in the country is recommending……

My life has been destroyed

And my boys

3000 a month rent for crap

We need to move to newfoundland

Bye ontario

Thanks trudeau

This is where the bureaucrats might require that applicants be married and have a young child.

It’s very hard for a parent with a child to leave Canada once they are stuck in the eroding system, but very easy for dual income couples with no kids, or single people.

This means that the former Bank Manager who is being yelled at in the meat packing plant in his own language will lie to himself that he’s sacrificing his best years for his child. Canada is one sick country in how they deal with newcomers.

By the way, the eastern and emerging markets aren’t the “low income” countries they used to be. This will be easier for single newcomers to just say “leave it” if they can’t find a job in Canada, or are told that they have to spend tens of thousands of dollars to gain a Canadian education, and still end up working in a warehouse for minimum wage.

Just to elaborate a little bit on “Gen Z”‘s “the eastern and emerging markets aren’t the “low income” countries they used to be” – I think this is a very important observation!

As a 1st gen immigrant myself, I anecdotally found cohorts of immigrants from ex-USSR countries very different depending on the decade they were coming to the US. Many people coming in 1990s were mostly leaving nothing behind, escaping $80/month wages and essentially non-existent living standards. Some of them had decent formal education (especially in STEM) and were able to capitalize on it. Their new country is their home and they are unlikely to leave no matter what (because they often don’t have anywhere to go back). It’s also worth noting that many of them were either coming as refugees (especially if they had the right ancestry) or as guests later overstaying their visitor visas.

Those coming in early 2000s were distinctly different. Many refugee programs were suspended by that time, so the core of this cohort is comprised mostly of highly skilled employment-based immigrants. There were also a lot of people who were wealthy in their home countries and they moved West hoping for an even better life. Some of them were quite disappointed and went back (I have a few people I know who did exactly that). The important thing here is that this cohort was not burning bridges with their home countries, and their skills and wealth were much easier to transfer back if needed.

I have to confess, prior to last year RU-UA war I was having thoughts of going back from time to time as well. Some of my college buddies from Russia are doing there much better financially than I do here in the US, so there is no such an income gap between countries as the one existed in 1990s. I guess it may be something similar with India/China, although I don’t know nearly enough to say anything about those countries.

Just my 2c.

99% of Canada is Siberia. A few fringe strips of Real Estate along the U.S. Border.

Is Real Estate booming in Churchill Manitoba, Slave Lake, Alberta, Fort Nelson, BC, or Northern Quebec ? Hardly. And as few Canadians know, and certainly not immigrants some of the best valleys were flooded to create cheap Hydro/Electric power for the southern cities.

Shoving millions more people into overcrowded Canadian Cities is a disaster.

Why don’t you move to Russia? Better for you

The huge jump in home ownership cpi in Canada is perhaps because mortgage rates are locked in for only five years in Canada. In the US rates are usually 15 to 30 years. A 3% rate five years ago is now a 6% or more rate today in Canada. So in a way, by keeping rates high, the BOC is stoking home ownership cpi. What am I missing?

It’s the Rent CPI that’s the big problem.

And the services expenses in general, such as insurance, maintenance & repairs, etc.

And don’t forget, the homeownership CPI was held down somewhat by the decline in home prices.

” So in a way, by keeping rates high, the BOC is stoking home ownership cpi. What am I missing?”

Nothing, you aren’t wrong. It’s just that when the opposite was happening, i.e., when the BoC was lowering rates, it was pushing home ownership CPI lower (and nobody complained because “yolo” and “free money”). Basically it was a version of the Virtuous Cycle in economics, but in the case of incorrectly low BoC rates, I would suggest a name like ScrewRenters Cycle or similar would be appropriate.

The rent spike would also be fueled by the cost of maintaining not just units but the structure

There has been a similar spike for shelter costs for condos. Eg maintenance fees and special assessments after multi decade artificially low guidelines to reserve fund pools. Per a detailed study by the Canadian Society of Actuaries

So finally reverting to reality this adds a huge push to costs of ownership and such fees are not discretionary

Further the NRCan has a green home grant and interest free loan program but not for. Condos over three stories Which would fall in nicely for a long list of retrofits including windows sliding doors etc not just heat pumps for an equally generalist of owner residing dwelling format except condos

Additionally there appears to be little interest by condo boards in containing costs by recycling for example metal railings that will be replaced by new metal railings instead leaving this as a hidden tip for contractors to survey if they are astute

For decaying rentals a repeat of the crumbling social housing of the 1960 s and 1970. Before on the 1980 s suddenly condos became the thing. And now it has swing back to purpose. Build rentals but new and lets just forget the crumbling housing infrastructure unless it happens to be mostly the more aspirational dwelling formats with a couple of exception but not condos So plenty of photo ops for politicians in hard hats clearly

Rent is supply and demand not what the owners costs are. If demand doesn’t exist the owners all lose all their money like in Edmonton, Alberta since 2007.

Better dweling

”Canada never fails to remind the public that real estate investors own this country. A few hours prior to the Oct 31, 2023 vacant home filing deadline, an extension was issued. The Minister of National Revenue pushed the deadline to Apr 30, 2024. That’s the second extension, delaying filings by a full year since originally planned.

Yes, a second deadline extension. The first extension was issued months prior to the May 1st deadline. At the time, they said the amount of time they had given people was insufficient. It was very different from the last minute extension issued yesterday.

Delaying a deadline a few months in advance demonstrates feasibility issues. A few hours? That most likely means they didn’t get a suitable response, potentially indicating more vacant homes than expected. By delaying the deadline, Canada is also conveniently extending its vacant home count.”

Trudeau is all that is bad with Politicians…divisive, narcissistic, incompetent, tribal, gets in financial scandals and bad with public money. He has gone mad with immigration as 1) He probably feels that it will get him out of the financial and economic mess that he has helped put Canada in

2) He probably also feels he can get more Votes than any opposition from new immigration. This has all lead to a deadly cocktail for the Canadian young, house buyers, Renters, Taxpayers and debt adverse members of the Public

3:1: The ratio of Canada’s workers to seniors, down from 7:1 50 years ago. An aging population is fueling the change.

That’s why immigration will remain high, no matter which party is in power.

In time they keep on taking more and more money as a percentage of gross earnings out of the workers paycheques for Canada pension plan. This is another disincentive for immigrants coming to Canada and for local younger workers. Canada already claws back or fully claws back old age security and in cities like Toronto where you barely make enough to live on and they still hit you with a clawback.

The main reason for the lack of rental housing is the anti landlord residential property laws in most provinces. In Ontario, the Residental Tenancy Board is backed up 18 months to evict a non-paying tenant who often destroys the property too. All this time the landlord is forced to provide all amenities (heat, electricity, gas). The latest scam in Toronto is to rent a large house, pay first and last month’s rent, then sublease rooms for cash to new immigrants. One enterprising chap had 5 houses with some 50 rooms rented, while he wasn’t paying rent to any of the owners!

No wonder that nobody wants anything to do with rental housing.

I was considering a move to Portland, OR before this hit. Didn’t want to rent out my house in CA partly because I don’t believe in it(not against rent in general as good for some but prevents wealth accumulation for others), but on a practical level the risk and potential downsides were greater than any income I would have made. Luckily we decided to stay out until son graduates HS and reassess whether to stay or go(Clash reference intended)

Not true at all. Recently publicized numbers about the jaw-dropping prevalence of short term rentals tells us all we need to know about why there’s a massive housing and rental shortage here. These homes likely overlap somewhat with the roughly 8-10% of housing stock here that is empty (per OECD estimates), but who knows how much? Point being, there’s a lot of empty and underused housing here and it has very little to do with rental scams.

It’s really getting bad I read about one person who lives in a closet and hopefully Canada won’t end up like Hong Kong where the poor live in stacked cages or stacked birdcages.

Like, who needs food ‘eh

Would BoC take a note and hike rates ?

I doubt it.

Dual citizen here – grew up in Canada and returned after university. The housing situation is absolutely insane and the Trudeau government is attempting to prop up the economy with massive immigration. Canadians are increasingly upset and anti-immigrant sentiment is unfortunately increasing (when historically Canadians have been very pro-immigration with reasonable levels). Canada needs to right the ship by significantly decreasing its immigration, increasing housing supply, and allowing a recession to reset home prices.

Seems like immigration will be a positive over time although depends what kind. Climate change will slowly open up parts of Canada for farming where it once wasn’t possible. Most countries seem to be anti immigration but also benefit from them immensely so to me it feels often like illogical and political more than reality. In the US we could use a lot more health care workers so seems reasonable to get from immigration and even train as necessary.

Not sure about man-made climate change but the increased CO2 concentrations will certainly help farmers everywhere!

They won’t do it.

Shame to say it but I think it’s time to get out.

What is happening here is insane.

The reason for rent increase if not clear for those in USA is due to 5 year max lock in on rates. Landlords are forced to raise rents to cover their massive hikes to monthly mortgage payments as they roll over to new rates in 5 yr window. Also immigration had an effect but I think that effect is smaller since infeelnghere is actually an over supply of rentals. It almost looks to me like a kind of price fixing scheme by real estate investors. What could go wrong???

Give me a break. Price fixing scheme????? Lmao.

What, you think there was a gigantic zoom call with hundreds of thousands of property owners to decide how much rent each onr should charge across 3.8 million square miles of Canadian territories.

What bullsh###.

cccb,

“…you think there was a gigantic zoom call with hundreds of thousands of property owners to decide how much rent each onr should charge across 3.8 million square miles of Canadian territories.”

Almost.

“The U.S. Justice Department has thrown its weight behind private lawsuits accusing technology company RealPage of conspiring with property managers and owners to overcharge rent for student and multifamily housing.”

“The class-action lawsuits on behalf of students and other renters claim landlords have shared non-public information — including vacancy data — with RealPage and relied on its algorithms to keep rental prices inflated above competitive levels.”

This is all over the news. I assume that landlords in Canada also use RealPage and/or similar property-management software.

Didn’t Australia just hike after a long pause? Maybe Canada is up next.

When I compare it’s rates with inflation against the EU and the US, seems the EU faces the biggest problem but most pundits think they’ll cut first. I think all of them should keep hiking and soak up all of this liquidity of the last decade plus that’s driven up prices to insane levels. Best example is NFTs. Can’t get dumber than that!

Rent CPI % Change from Last Year – looks like a 40 year history chart with about 25 years <2% and 4 huge spikes, the first 3 followed by steep plunges and the 4th post-spike TBD.

I like looking at charts.

I saw the most dismal rental offering on Kijiji Toronto last week. An 8×6 basement space with concrete floor, wash basin, toilet on a concrete platform and a cot for sleeping. Only $500 per month! Maybe a winter refuge from camping in a park over winter but so depressing that it has come to this.

A lot of this is caused by very strict zoning rules that prevent development that should happen organically.

Canada stops development and then increases immigration.

It’s like a pressure cooker.

> I’d like to build a house in that field over there for $300k

>> you have to buy inside the gulag limits for $800k

> but then I’ll be working all my life just to exist

>> yes

As an immigrant you will never be Canadian. Canadians had access to cheap housing, allowing financial independence. You won’t.

Great article and thanks for presenting the data in the manner of a master analyst. Sunlight, truly illuminates the shadows, I think is the obvious message. The hideous rental inflation is a direct result of the equally hideous asset price inflation that preceded it.

The hideous asset price inflation is extremely correlated with the QE program. I simple syllogism; if A=B, and B=C, then A must equal C.

One would think it obvious that QE is the age old aristocratic version of the three card monty, designed to relieve the rubes of their money. Now comes the next stage: what maneuvers should the Canadian Central Bank undertake to achieve their democratically, granted and delegated mission.

Who pays the price for this colossal, failure of economics.

Quantitative easing is an interesting title that hardly belies the orgiastic extent that it was applied. Quantitative Domination, or some such alternative description, would be appropriate.

The asset price bubbles that QE inflated exceeded most of the previous bubbles recorded by human history.

The QE bubble probably lies above two standard deviation the mean expected bubble excess but is still not quite the worst bubble. For instance, the tulip bubble was worse. So was 1929.

The tulip bubble was contained to a subset of society who chose to speculate and involved a small number of people.

The housing bubble gives people no choice other than to engage with the bubble, either short as a renter or long as an owner.

The economic system has similarities to chemical thermodynamic systems, both predicated on the attainment of equilibrium. When water boils at 100c at one atmosphere of pressure, the temperature stays constant until all the water is boiled off, the energy input consumed in the phase transformation between the liquid and gas, steam.

This seems to be similar in the sense that the obese balance sheets of CB’s are maintaining a transaction level that stabilizes the temperature of a shrinking volume. Or …..

Rents are out of control in Canada. In some places more than in others. My two personal anecdotes from Vancouver BC:

Apartment 1, 1Br/1Ba, 500 sq ft. I moved out in Q3 2021, paid 1,900/month. Now on market for 3,200.

Apartment 2. 2 Br/2Ba, 850 sq ft. Moved out in Q3 2022, paid 2,500/month at that time. Same kind of apartment next door (building is fully rental) is now available at 3,600.

By the same logic, Democracy cannot survive in a society, that foolishly, allows extreme wealth to concentrate. Democracy burdens the citizens with the responsibility to legislate their own society.

The American and Canadian society that has been sold belongs to my parents when the marginal tax rate of 90 pct. A steeply tax curve that recognized that ones good fortune was a community success.

Now as old age rears it’s ugly head, I would like too say thank you for being who you are.

Love always wins is what my mother always told me.

What does that have to do with the incipient instability of the, in this instance, the Canadian rental market. Well, they can stop digging.

In the sense that whoever buys a house now at the top of bubble will lose money in two ways:

The mortgage payment will consume a substantial portion of your paycheck

And you owe more than you can sell it for.

The prices have to decline. Our children can’t afford them.

obviously pretending that the housing thing is not a corrupt artifact

well that’s the question for Chairman Powell is how does the Fed intend to deflate the housing bubble they inflated without sudden over priced asset deflation creating a hysteria.

Well, in the USA most people have a fixed rate mortgage, so they won’t suffer the capital loss of the decline in the market price of their home as long as they own the joint at 2.6 pct interest rate..

Of course, if they saved half their purchase price and invested it at the current rate for 30 years they would have paid off the house without making a house payment.

It’s dire for a renter in Canada.

For an apartment which costs C$2,500 a month in Toronto, the price is C$2,300 in Halifax, C$2,000 a month in Montreal, C$1,800 in Quebec City, C$1,800 in Edmonton, etc.

Nowhere affordable to go.

Correct, they kept pouring people in, until all the exits were blocked.

Canada is in the middle of a very, very extreme experiment that will probably end badly.

In America, job losses cause rent prices to go down (which is currently happening). Free markets.

In Canada, rent prices don’t go down because they pack more people inside a room to make up for the rent (eight or nine people in a room), so this time, job losses may not cause a huge impact to reduce rental costs. Slumlords know that they can fit more warm bodies to pay the rent.

Job loses will actually drive home prices skyward in the Chinese cities and Chinese areas as they leverage housing to the hilt. Any cut in interest rates means they can buy and own more and more properties. With them as the backstoppers for prices in a recession home prices overall may not decline as in past recessions in Canada.

What’s up with that marketing demographic you mentioned and real estate bubbles?

Aren’t there better uses to for low interest loans? Like stonks, or businesses?

Slumlords are packing 5 people (or more) inside a bedroom and collecting at least C$500 per person. A quick $2,500, though a slumlord would have to pack 7 people for a downtown Toronto condo to break even these days.

What happened to social distancing and preventing the spread of respiratory illnesses? Packing several strangers into a room as rent serfs defeats the purpose of health measures.

“Rent isn’t a discretionary item that people can easily choose to forego”

Actually rent is very discretionary. A person or a family can usually decide to downgrade from larger housing to smaller housing to reduce their rental cost. At the extreme you might have 2 people per bedroom and someone sleeping on the couch, which might not be fun, but most of us lived like that as students anyways so it’s not unheard of.

There’s also a lot of discretion in location & amenities. Switching the the shiny high-rise next to the subway, and instead, renting a run-down wood-frame 20 minutes away from the bus stop will obviously cost less.

It’s disheartening to see the challenges Canadians are facing with the surge in rents and service inflation. The delicate balance in the Consumer Price Index, influenced by factors like fluctuating gasoline prices and escalating housing costs, certainly poses concerns. It’s crucial for policymakers to address these issues, ensuring that citizens can navigate these financial pressures effectively. The impact on services inflation, particularly in travel and housing, highlights the need for comprehensive strategies to stabilize the economy. Looking forward to informed discussions on potential solutions.