Supply is coming back, demand is not. Prices are still way too high.

By Wolf Richter for WOLF STREET.

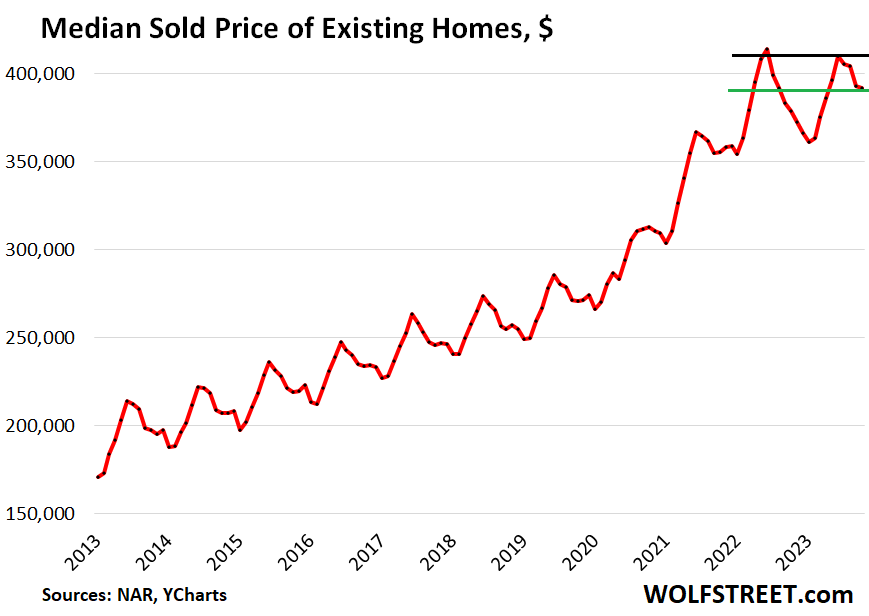

The national median price of existing homes of all types – single-family houses, condos, and co-ops – whose sales closed in October dropped to $391,800, down by 5.1% from the peak in June 2022, according to data from the National Association of Realtors (NAR) today.

First “lower high” since Housing Bust. The median price in June 2023, the seasonal peak, was below the all-time peak of June 2022. This was the first such event of “lower highs” (purple line in the chart) since the Housing Bust, and prices have dropped further since then (historic data via YCharts):

Generally, there is an uptick or flat-spot in October from September that might also reach November. This year, the price fell in October from September. But last year, prices just kept plunging, which was very unusual, following the pandemic pattern of normal seasonality going out the window. Due to the steep plunge in prices last year in July through December, the median price was up year-over-year by 3.4%.

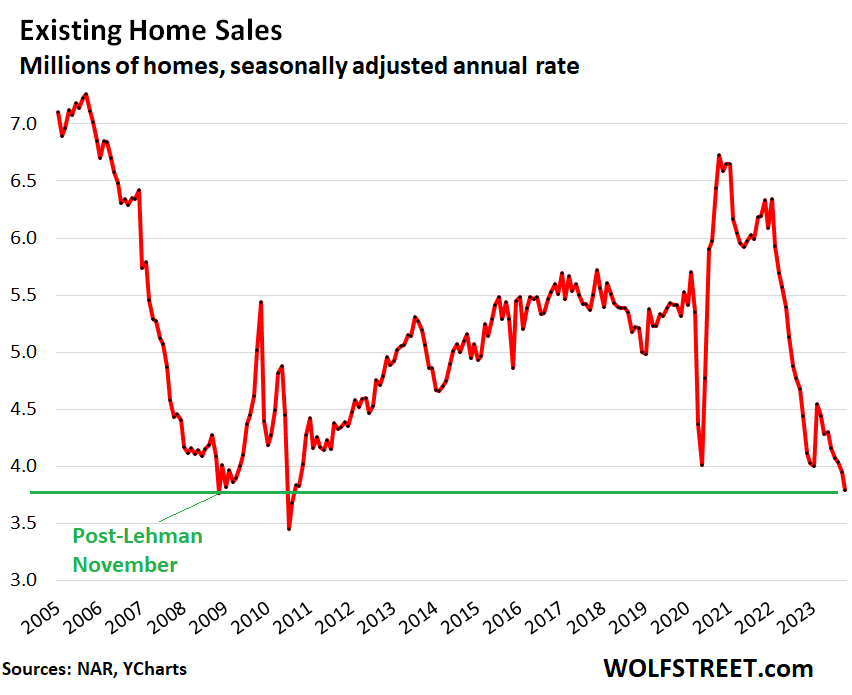

Sales of previously owned houses, condos, and co-ops, at a seasonally adjusted annual rate of 3.79 million homes in October, have collapsed to levels not seen since the worst three months of the housing bust: The post-Lehman-bankruptcy November in 2008 (matched it) and July and August 2010.

Sales compared to prior Octobers (historic data via YCharts):

- From 2022: -14.6% from already crashed sales

- From 2021: -38.8%.

- From 2019: -26.8%.

- From 2018: -29.9%.

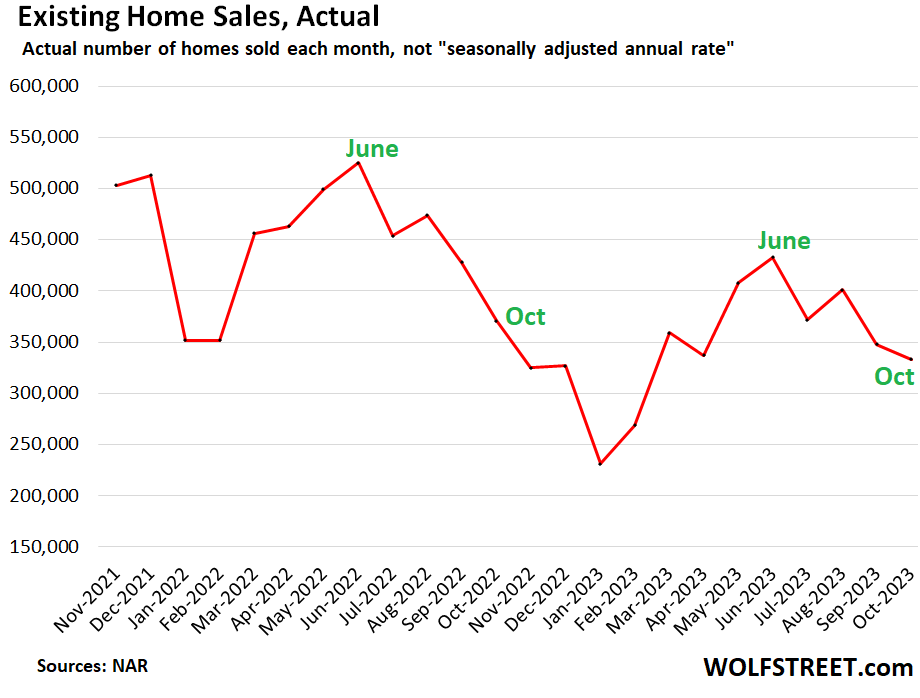

Actual sales – not the seasonally adjusted annual rate – fell 10.2% from the already depressed levels in October 2022 to 333,000 homes.

Seasonally, January and February mark the low points of the year in terms of sales. Sales that closed in those two months reflect the lull in activity over the holidays. June marks the peak volume in closed sales, reflecting the end of “spring selling season.” During the second half of the year, sales head down, as we can see in the actual sales data, not seasonally adjusted and not annual rates (data via NAR):

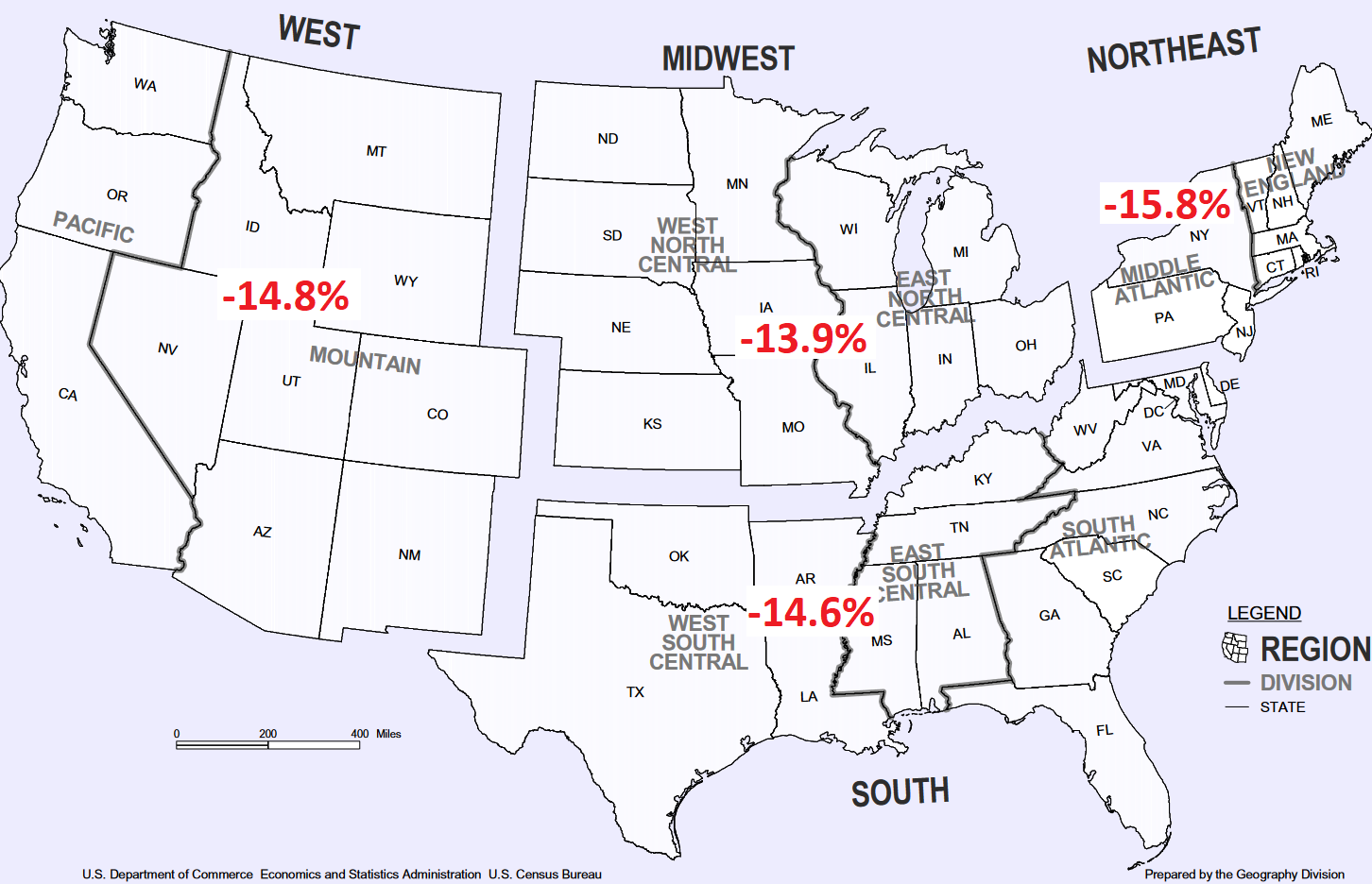

Sales changes by region, year-over-year, from the beaten-down levels last year:

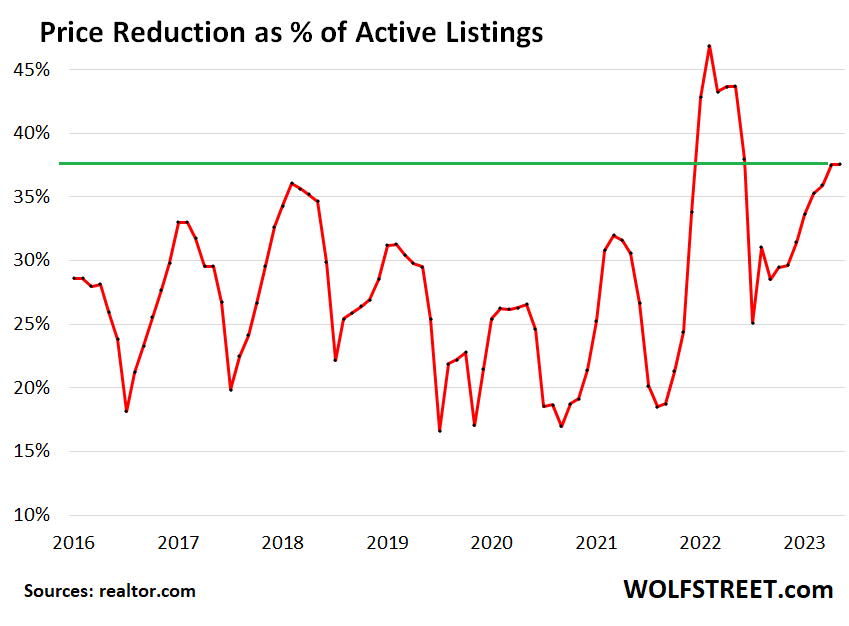

Price reductions at 37.6% of active listings in October blew by the pre-pandemic highs. Sellers are getting more motivated to sell their homes while buyers have vanished at these prices and sales volume has collapsed (data via realtor.com):

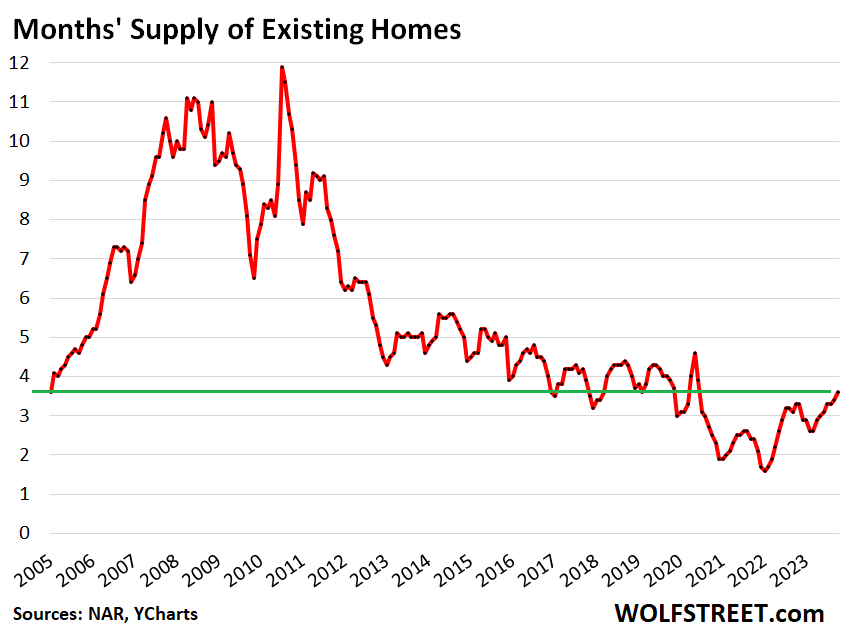

Supply rose to 3.6 months, the highest since June 2020, with 1.15 million homes for sale, according to NAR. Supply in 2017 through 2019 ranged between 3.0 and 4.3 months (historic data via YCharts).

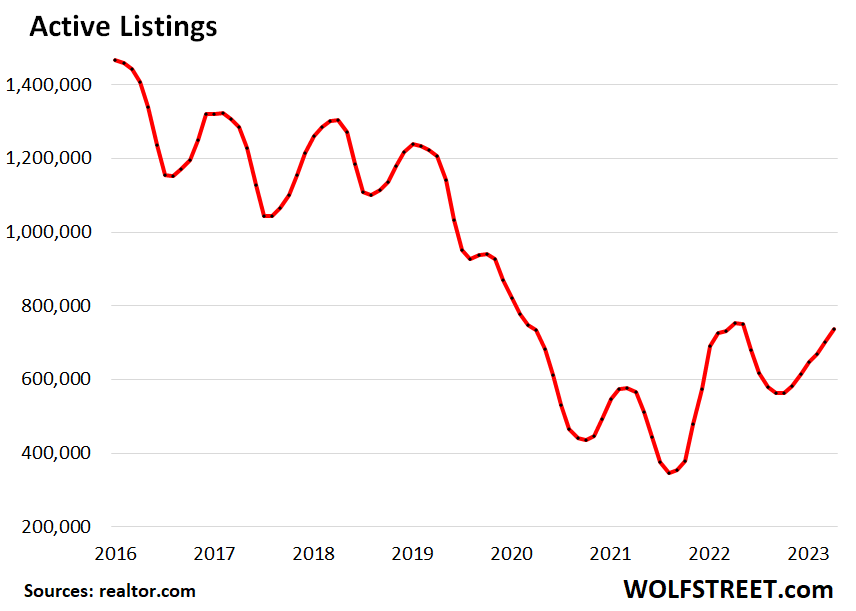

Active listings jumped by 5% for the month to 737,480 homes. This 5% month-to-month was a huge increase for October, when active listings normally (pre-pandemic normally) didn’t move much or dipped. Active listings are inventory minus homes listed as “sale pending” (data via realtor.com):

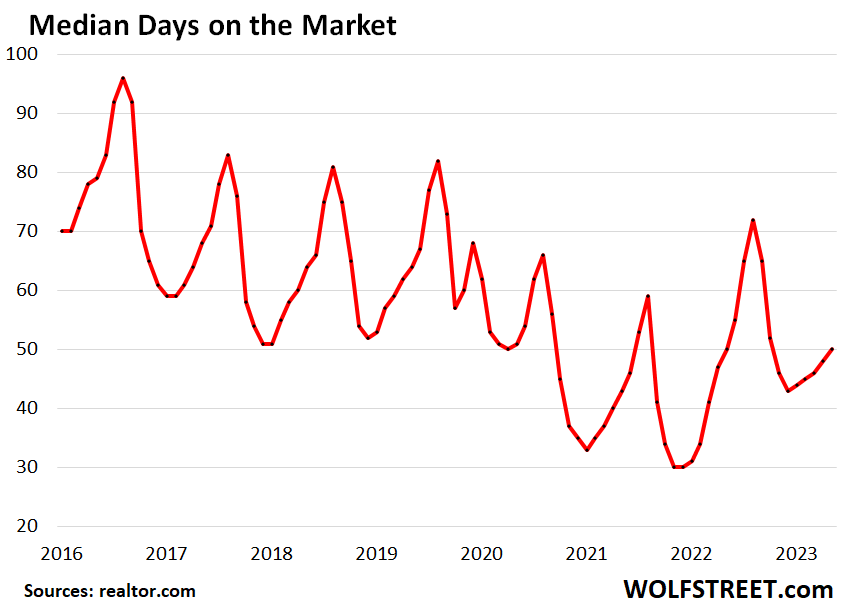

Median days on the market rose to 50 days in October before the homes were either sold or pulled off the market, according to data from realtor.com. This metric reflect in part how aggressively sellers pull their listings back off the market when they don’t get the response they’d imagined:

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Perhaps when housing prices fall by around 80% some folks will start finding them somewhat attractive to consider owning.

our problem is CA people keep coming to town

rents going up

prices stable

I get other area’s, biggest thing is asking for loan buydown $$

I just put up rental and have interest from CASH buyers

they need to place money

I’m looking to raise $$ for new investments

if not I’l cash flow as usual

That 80% fall can happen in just 1 month if I sells all my MBS outright causing mortgage rates to jump to 30%.

Guess what I am not gonna do that, it’s “MY PRECIOUS”

That would have zero impact on mortgage rates in Los Angeles County where nearly all mortgage are now JUMBO and totally outside of the low-value mortgages that comprise MBS instruments.

If they Fed did what J. Pow promised, it would push up ALL long-term rates a LOT, from junk bonds to mortgages.

That’s funny because I live in Los Angelels and it’s not a jumbo

That’s never going to happen. They will devalue the dollar and make people who don’t know any better happy by paying them more of them.

You just think a $500,000 house is expensive because you’re not making $125,000.

The gov’t knows if the real estate values go down they lose tax revenue. They hate that, and they will do anything they can to keep it from happening.

Besides, if your income goes up then so does the amount of tax you pay. Nobody cares about buying power except the folks on fixed incomes and their lobby is non-existent.

That’s exactly why they made the Fed not accountable to politicians on a daily basis.

80%??

You forgot to put the /sarc tag on your comment

It depends on interest rates, available jobs in each area, and type of home. While not all baby boomers will be able to sell or want to sell (at greatly reduced prices) their homes, the availability of cheaper, used homes and lack of buyers able to afford mini-mansions will cut demand and prices. I predict this will later accelerate as baby boomers die but inflation may continue to conceal the price plunges.

We better hope that AIs truly arrive, can embody in robot bodies, and are interested in buying all our homes. LOL. Otherwise, the real estate market will take many, nasty plunges! Alternatively, we must pray that the reports of extraterrestrials are true! LOL

Kidding aside, newer generations will at least be able to get cheap housing.

but but but…you know what I am going to say…not in paradise SoCal..price decline then a crash? Not going to happen /s

Although I have to say still disappointing to see some people still buying at some insane price…guess you always need to last min FOMO folks to join the party..was monitoring this one house in Long beach just for fun (Josie Ave) $1.6M 2770sq ft just changed to under contract..one look at pricing history, clearly see it’s a fix it up flip and seller still got out near the top..

One has to wonder if SoCal will ever come anywhere close to fair market value by looking at similar examples right now..

It may come but time take quite some time.

We need people to keep buying so that we have price discovery.

We’ll have to wait after the next year on the 1st quarter 2024.

I understand the market is moving very slowly but where I live in Bergen County in NJ situation is quite different. The town I live there are 3 houses for sale, in 20 mile radius 8. I am talking about single family in decent shape not in flooding zone etc. Nobody is selling and if someone does it sells 100k above asking price. It is insane. The same applies to rents.

Nobody is buying either. The buyers have left the chatroom.

Wolf,

I’m still looking, but things are still

just too stupid in the Boston area.

I actually offered about 30% above

the asking price on a place that sold

this month. It sold for, uh, a lot more

than that: 73% over the asking price.

It was clearly “priced to sell”, but the

used house salesman overshot the

mark, methinks.

It will be interesting to see if the new

owners keep the house, or if they

raze it and build condos. I’d guess

20 to 30 percent of the houses that

catch my attention are permanently

removed from the market by getting

razed when sold.

J.

J

“I actually offered about 30% above the asking price on a place that sold this month.”

Quit doing that shit. YOU are the problem, don’t complain, you’re causing it, LOL

Not that I believe your “30% over” stuff, but that doesn’t matter.

They buy, they run to buy with an overasking price in Lovely Los Angeles!

Look at the Y over Y prices.

From realtor website statistics,

Los Angeles, CA housing market

In October 2023, the median listing home price in Los Angeles, CA was $1.2M, trending up 21.3% year-over-year. The median listing home price per square foot was $721. The median home sold price was $968.5K.

Please keep in mind that real estate is a local thing!

Poor but Educated Millennial,

Median “listing price?” LOL, bullshit.

“They buy, they run to buy with an overasking price in Lovely Los Angeles!”

LOL, Bullshit. You’re wallowing in it. You’re spreading it. You’re dragging it into here.

The “median sold price” dipped in Oct to $893k and was up only 4.6% from a year ago. And it was close to the same price as in September 2021v — see green line in the chart below.

Sales fell 5.8% from Oct 2022, which had collapsed 40% from Oct 2021, so in Oct 2023, sales collapsed by about 45% from Oct 2021

All data from the California Realtors Association.

Here’s a novel concept. I have no idea if it’s accurate or not, but here goes….

What if there has been a structural change in our housing market where it’s becoming more like those in other areas – europe, latin america, etc.

A lot of folks in thise places rarely, if ever sell their homes. They buy/build their houses, live in them, enjoy them, raise their families in them, improve them and eventually die in them. Then one of the children moves into it and the cycle starts over again. Its very commonplace. Houses there are homes instead of commodities or investment vehicles.

What if Americans simply aren’t going to move as often and the supply of homes for sale is now going to be much lower than before, permanently.

40% of homeowners own free and clear. For them there’s no benefit to selling when they can take out a reverse mortgage.

There’s no benefit to selling to downsize if your RE taxes and insurance rates are going to skyrocket when you move, and they will.

There’s not much incentive to sell if your empty nester house is now being reinhabited by boomerang kids, some even ñwith their grandkids.

And a really cheap mortgage is another good reason not to sell for the next 30 years.

Why would you sell under any of those scenarios.

Just a thought.

CCCB,

Yes, I see this too. And I already explained this a while ago. People who don’t sell their homes but stay put means they’re NOT BUYING either. So sellers and buyers vanish in equal measure from the market, and the entire market — sellers and buyers — shrinks by about 20% -25%. So less inventory and fewer buyers in equal measure, and it’s in balance.

https://wolfstreet.com/2023/07/21/entire-housing-market-buyers-and-sellers-may-have-shrunk-by-20-25-because-of-the-3-mortgages/

Wolf,

As I said, the place was obviously

priced well below everything else

on the market.

I’ll admit to being part of the

problem the very first time I

actually buy a house. After about

thirty years of looking, albeit with

several years where buying was

just totally out of reach due to

circumstance. Now, the only

thing keeping me from buying is

an unwillingness to pay what I

consider a insane price.

J.

————————————————

The 30% over ask is true, whether

you believe it or not. I am pretty

sure I mentioned making a way

above asking offer in a comment

here about the time I made it,

and that the offer was not accepted.

If you want to, you can check the

listed and sale price for:

251 Calvary St in Waltham, MA.

That at least shows the sale for

73% above the asking price.

I’m probably in violation of your

repetitive commenting terms,

since it seems like most of what

I post is just venting about the

stupidity of the local real estate

market.

CCCB

*What if there has been a structural change in our housing market where it’s becoming more like those in other areas – europe, latin america, etc.*

Wow, People in Europe and around the world are the same as those in the US.

There are many speculators who buy in a hole and when the building is built they want three times the high price.

Make no mistake, housing everywhere in the world has become an investment, not a shelter.

I know a woman named Patricia who is living in a slum shack in LaCarpio, San Jose, Costa Rica..she is quite happy with her four kids and I can’t wait to get back to see her, away from a this insanity

Hey J, post the Zillow link to the property so we can verify your claim. Should be easy to do, no?

NYguy,

Does this work for you?

https://www.zillow.com/homes/251-Calcary-St-Waltham-MA_rb/

The only remarkable thing about

the house was that it was priced

too low. And maybe that its robust

construction, as in the exterior

walls were solid stacked timbers.

Which is sort of pain, regarding

insulation or wiring.

J.

J

This is why this stuff is BS, per your Zillow link:

1. there is NO PRIOR SALE listed on Zillow. So we don’t know what the house was worth, and how much it went up in price. Zillow data goes back to 2014, so this was the first sale of this house in many years.

2. It sold $50,000 BELOW the tax assessment, which tells you something:

2022 tax assessment: $557,200

2023 tax assessment: $595,000

Nov 2023 sale price: $545,000

Wolf,

I was really responding to you saying

that there are no buyers, so this whole

thread about this particular house

(which I have mentioned was listed at

a price below market in every post

about it) is a bit of a tangent. I am still

looking to buy a place.

Regarding this particular house:

The previous owner recently died.

It was his parent’s house before him.

Any records of the house or property

previously being sold would be on

paper only, since it would have been

before 1950 or so, by my guess.

The house was solid, on a large lot,

and not in bad shape, but was not

exactly up to modern expectations.

The furnace was actually an old coal

burner, that had been converted to

use heating oil. One bedroom had a

single electrical outlet. I think the

other two bedrooms each had two

outlets. The electrical outlets for

the exterior walls were either in

the baseboard trim, or in the floor.

It was a nice 1850s house that was

last updated in maybe the 1940s. It

did have a new electrical panel, with

a pile of screw-in fuses sitting in a

bowl nearby.

J.

There are two separate things to house: the land, and the building. The building’s ultimate value is normally $0 because most buildings will eventually be torn down. This looks like a larger lot (from the pics), so a developer might have bought it, hoping to put 8 townhouses on it, or a 5,000 sf mansion, or do a total remodel, or whatever. For a developer, what has value it the land.

Zillow says: “This house calls for a full interior gut- bring on your creativity and vision!”

So it’s likely that someone with a plan bought it.

The point is: forget the shack. Look at the land and what you can do with it.

Jumping into your exchange with J, here’s my latest adventure in Ireland, October 2023:

There was an unfinished shell of a property, a 2-bed bungalow, left unfinished, unwired, no plumming, heating, water or wastemanagement, only part of the windows installed, boarded up and left like this for 20 years.

It was listed at a sub 150k level and as expected, a lot of buyers entered into a frenzy. I still went to a viewing and was consequently asked to enter an official bid, which I refrained from doing knowing it’d be used against me.

These realtors have lost their mind and are deliberately abusing the supply demand imbalance and are purposefully aiming for biddingwars.

Ultimately, the property sold for 220k with an estimate cost of at least 150k to connect the property to essential services.

This bungalow was tiny and by no means exceptional. Keep in mind it was left out in the elements for 20 years, there may very well be consequences to that in the foundation or timber roofstructure because of it.

I did not participate in bidding up the price. From the very start I told the realtor I’ve been through similar extortionary practices too many times and in all fairness, he got the message. Still, he was asking several times for an additional offer on top of probably dozens he already received.

The conditions of the sale demanded an all-cash offer as well.

By no means is this an isolated case. This is common practise. If you just observe the pricing of properties, it’s utterly disconnected from reality or past valuations.

a 100% increase in 4 years isn’t sustainable, normal or based on reality….it’s greed, pure and simple. Remember the Celtic Tiger boom and bust? This is version 2.0.

The reality is that despite a recession there’s such a massive shortage of homes in this country (Ireland) with a massive influx of immigrants, refugees, rich foreigners and investors that this situation has gone from hopeless to outright impossible.

There’s just no play here, no ‘right thing to do’ when conditions are this skewed and distorted.

The only condition that will force a change is a dramatic increase in supply. Anticipating an economic decline in the EU isn’t that farfetched and already most EU economies are in recession. Add to that government policies that favour the investorclass and new construction that has ground to a halt, it’s not a pretty picture.

This is what happens when you have fraudulent monetary policies of negative interestrates, banks colluding to financially repress savers and pensioners, meanwhile having record profits.

I’ve never experienced anything like this in the 50 years I’ve been alive. This isn’t normal or anything resembling normal.

This is an out of control ruling class completely disconnected from the working class to uphold positions of power rather than fixing the basic principle of having shelter.

@ Wolf & J

Just had to check this out. Yeah someone got this for way over asking and probably thought they had a deal because it was less than the assessed value.

But they need to put a lot of work into it; here’s some of the description presale

ATTENTION INVESTORS/FLIPPERS/CONTRACTORS! Here’s the perfect winter rehab project

This house calls for a full interior gut-

I guess someone out there thinks they can still squeeze a profit out of this place or will put a ton of $$$ into an already overpriced home.

So is J a flipper?

MarkinSF,

I grew up a po’ country boy. So

when I look at that house, it

reminds me of my grandparent’s

place. They say “full interior gut”,

I say “move in ready starter home

in a convenient neighborhood”.

There’s a footbridge across the

river that takes you almost directly

to Tacqueria el Amigo. Neighbors

in the back are quiet and unlikely

to complain. The place did have

some quirks though, like the back

stairs up to the second floor ending

in the bathroom.

Harry,

Are the prices and practices like

that over the whole range of the

market there, or is it mostly the

very low end? What’s rent like,

compared to buying, and

compared to income? I’ve read

that rent tends to be more

expensive in Europe than it is

in the US.

J.

Wolf,

Regarding the land value, I am acutely

aware; In my first comment in this

thread, I mentioned that maybe 20 to 30

percent of the houses that pique my

interest wind up getting razed by the new

buyers. Maybe another 20 percent get

the paint and spackle treatment and

flipped for maybe +$200k.

One place I looked at got purchased,

underwent a gut rehab, and flipped for a

profit. The new buyer who bought the

flipped house immediately razed it to

build condos.

J.

@ J

I did a quick glance at your project house. It is old and has a historic designation which means you can not tear it down without going through the historic review board, which means almost no way. It backs into a cemetery (ugh!) but you have your old, historic romantic views of old Mass.

The realtor wanted to have a little bidding war for this house and I am pretty sure your realtor or the listing agent told you so, then why your 30% over asking? You are kind of full of crap to support your pov. It appears that normal (Indian?) folks bought it to live in, not flip. Kinda near the Charles, but semi industrial area with a graveyard kicker, but doesn’t look too bad. Looks like a pos places my friends lived in Boston area back in the day. Good times.

Saw the link J, thanks. Contingent for 3 something and sells for 200 over? Something is very whack. My knowledge of RE fraud is rusty, but the only thing I can think of is a straw buyer from another country was able to get a liar loan and scored a nice payday as theyll get a lot of cash back after close and go back home or to another state to life high off the hog. Saw this at the tail end of the last bubble in San Diego and was even approached by someone when I was selling to do something similar. I don’t associate with sleazeballs so I passed.

Prices in SoCal or for sure coming down, it’s a basic math problem. The average price for a house in San Diego is $1.3M, after putting $260k down, your all in payment is $10k/month, meaning your income needs to be about $300k plus. That puts you at a top 5% income required to buy the average house, there aren’t enough of those people to sustain this AND even fewer of those people want to buy the average house for that kind of money.

oh I hear you…I am losing my minds as well since the numbers for buying at these ridiculous price couple with high interest rate makes no sense, especially compare to rent but here we are…some people are still buying apparently….maybe they are last of the bagholders, maybe not or maybe everyone is a VP and making $500k a year…it’s just insane..

Not clear how this resolves. Interest rates are historically okay right now but of course a lot of people locked in with very low rates. My first house, a starter, in was 100K or so in 1993 in CA with an interest rate similar to today, perhaps higher. Locked in 30 year rates are great for predictable mortgage payments but have their obvious downsides with a long period of very low interest rates. I would just expect the median tenure of a homeowner increases and those who can’t afford it will have to wait until supply outstrips demand, boomer generation decides to downsize in mass or regulations limit the ability to own multiple homes( can’t see that happening).

It’s easy to trade one overpriced asset for another. As long as you can sell for similar to the buying price of the next place then the total cost is just the transaction. It’s the same for lots of assets.

“One has to wonder if SoCal will ever come anywhere close to fair market value”

If any homes at all are selling, that’s FMV. You and I may not like it, but that’s the market, by definition.

My personal observation is that we lag the national market but it gets her e eventually.

As far as I can see, (most) buyers are not going strike (at least voluntarily). Most just don’t have the enough money/income to buy at these prices and rates.

The interesting thing is that many (to be) sellers having multiple (vacant) homes are also in strike since 2022 (which I think mostly voluntary). They still haven’t started selling meaningfully. That’s why inventory is still crazy low when compared to prepandemic levels.

I feel like in last 10 years, FED and govt successfully taught the multiple home owners never to sell their property, by giving them a generous more than 100% return in 10 years for their RE investment. Many believe that they will get another 100% in the next decade. So they are not selling much.

Isn’t that true for stocks too? There is the wisdom that the Fed will never let asset prices drop much or for long, and that “no matter what happens, stocks will be higher in 5 years than they are today, so it’s better to hold.”

If people truly believe that, most people with assets will never sell, meaning there will never be selling pressure, only buying pressure, even if buying demand has dropped.

This is the problem with blowing an asset bubble in the first place.

As we have seen with stocks, the wealthy will sell, and they will sell first while the selling is good.

Your 5-year time frame is off. The Nasdaq didn’t go back to its 2000 high again until 15 years later, in May 2015, LOL, following lots of money printing and 0%. And the Fed wasn’t worried one iota about the Nasdaq plunge; it tried to keep the banking system up and running.

People make up all kinds of stuff about the Fed to make themselves fell better?

I’m seeing a lot of CASH with no place to go

I hear about NON-CASH using FHA/VA(ie no down payment)

and others wanting $10k for rate buydowns

and we have LOTS OF BUILDING – 500 new starts this month

trades people are crazy

got demo’d rental – 600SF stripped to 2x’s

electrician – just to pull wire, recepticles, etc.(all open walls/ceilings) service is fine

$7,500

I love it – because I’ll put small crew together and we’ll do for 1/2

Oh I don’t disagree at all, I’m just stating what I hear from people on a regular basis, that stocks will always go up over a few year period, that houses will always go up, and therefore, there’s no reason to ever sell. It’ll take a protracted bear market where the Fed doesn’t ride to the rescue to break this mentality.

Lol, ‘fell better’, regarding the Nasdaq ‘plunge’!

“Price is what you pay, value is what you get.” I forgot if it was Warren Buffet or Benjamin Graham who said it.

You don’t see the value in paying those prices for those homes. Someone else does. You value things different than they do. Is that so bad?

Einhal, that’s so true for big stocks. The start-up stocks are almost all crushed though. Many are much lower than 5 years ago. But RE story is different. As far as I see, nearly everybody around me is 500% sure that RE prices will be definitely higher one year later than now, without any doubt.

Yep. I refuse to put new money into stocks at these prices, but there are tons of people who still do and some who will still buy houses, as they’re sure that a house or share of MSFT or APPL bought today will be worth more in 2 years. They can’t conceive a 15 year bear market like Wolf described above or a Nikkei situation, where the 1989 peak has never been reached again.

Big stock, or you could say the big seven. Can’t say I know most but I did work with Apple computers a while ago and I wonder what the possible drop in sales in both China and Russia( due to USA sanctions) will do to phone sales. On top of that, Europe and the UK are definately slipping, with its 450+ million popualation feeling a bit poorer.

I do get a pension from my Apple days but I’ll only buy a recon phone now insted of new. They come with 12 months warranty and only cost £200 instead of a new £800 phone ( also with 12 months warranty lol)

If apple drags down the top seven it could be interesting.

That’s what they thought in China too. It will be fun watching people hodl these stick frame houses all the way down as boomers slowly die and taxes and maintenance costs mount.

Would love for you to be right….I doubt we will get there but a man can hope…

Or knowing my luck, it will happen just right after I pass..

Millennials are here to take the burden

Wolf, maybe higher rate isn’t the solution. NIMBY is the problem here. The real solution is to loosen the zoning laws and regulations so more houses can be built cheaply. .

There’s lots of housing construction going on. We here report on residential construction from time to time. There is no shortage of housing. There is a shortage of reasonably priced housing. Lots of people own multiple homes that no one lives in. Some might use them a few weeks/months of the year as vacation rentals. Lots of these houses are now coming on the rental market, and then get pulled off the rental market. People wanted to ride up the price spike all the way with their multiple homes, and now they’re stuck with vacant houses and high carrying costs. Me? I’m surrounded by vacant condos that occasionally see some people with luggage show up.

so my son’s father in law(realtor-sells 50+ homes year) and now licensed contractor doing rehab(has 8 contracts signed yet to do – had license for 6 months – lots of $85k kitchen remodels)

—

he just bought home with land, has NICE 2000’s built 2,400 SF

put on airbnb – $300 nite, has it rented for 2 months at $6,900 month

barely moved out of it

The towns we’re looking in, builders are starting to take the approach of “can’t afford to buy any more? No problem! You can half this house for 65% of the price.”

Frustratingly, it’s working. The drive to get off the awful rent wheel is strong.

Seen that here along the So Cal coast, too! They divide by 4 or 8. Crazy. Yet it seems to work.

Shortage of housing is a myth.

There is absolutely no shortage of housing.

People/companies are hording houses as they are trained to think by FED that home prices always go up.

Exactly. The way you break the idea that housing should be an investment is to make it an unappealing investment. The Fed has no credibility after the last 20 years, so it’ll be a long road to restore it.

Those like us who have spent our lives investing in RE as our retirement plan I guess might have to start making this a central voting issue. You can’t change the rules of the game when people have followed the rules for decades to establish retirement security. Also, there is a big difference between huge corporations that buy thousands of houses versus mom and pop landlords. And I’m otherwise extremely liberal but not if this party line continues to pick up steam.

The key to watch will be unemployment. In my opinion, if unemployment ticks up even about 4-4.5% levels, there will be an increase to supply, even incremental & with an increase in supply, it may trigger a FOMO on the seller side, especially with the Boomer generation wanting to secure the top price from the sale of their property. Wolf has mentioned this phenomenon in the past: the earliest who lists, the most they will get out of their property.

Morgan Stanley predicts a modest 3% decline in prices next year. The thing is, usually, if the upside was as violent as 40-50% in the included, the decline is not as orderly as many predict.

Those are my thoughts; I can be completely wrong. I don’t believe anyone knows what happens next. But it’s fascinating to live through it. 😊

As a former homebuilder, I can say unequivocally that in the past, jobs drove housing. Employment going down, no buyers; employment increasing, lots of interest. This basic force is moderated by interest rates, which can exacerbate or moderate the trend in either direction. Supply is just not a market driver.

Genti –

That’s “FMA”: first mover advantage. It is an element of marketing, but also resides within the study of market cycles, especially on the bust side. First movers fight to get out the door quickly, and next thing you know, there’s a rush of followers…a classic “run.”

The first place I remember it catching my eye was in Lael Brainard’s work in limiting price volatility for money market funds (breaking the buck; gating of fund redemptions under certain circumstances). In the case of MMFs, a “gate” to redemption is a coercive control that severs shareholder liquidity and forces continued ownership.

This is how Fidelity explained gates in 2014 (below). Not sure if the regs discussed are up-to-date, but that the subject arose then speaks to the issue of regulatory risk within the mutual fund industry.

Another reason to own treasuries directly, perhaps?

[Wolf- feel free to pull this post, of course—it’s admittedly off topic, but it seems important to me….]

https://www.fidelity.com/bin-public/060_www_fidelity_com/documents/fidelity/Understanding-Liquidity-in-Money-Market-MFs.pdf

Some years ago, I had some nice little arbitrage action with a Fidelity Asian mutual fund, which was highly correlated with the SP500, with an overnight lag. Completely legal. Fidelity eventually decided to reprice the fund just before market close using something called “fair value”. Basically some guys got in a back room, looked at the change in the SP500 before market close, and made up a NAV for this Asian mutual fund. Pissed me off. I will never have anything to do with Fidelity. They seem more crooked than most. With “fair value” pricing and added redemption fees, my scheme ceased to work. Other companies followed Fidelity. I am a big advocate of not owning any mutual funds, other than money market mutual funds, and I am not too crazy about them either.

As I understood it from middle office colleagues, fair valuation of mutual funds was imposed by regulators.

In any Ponzi scheme, the first ones out win. The last ones out lose everything. I think this is well known. A lot of money is made off of people’s innate sense of greed and fear along with stupidity, probably more than on innovation or productivity or efficiency. Read Huckleberry Finn, the great American novel, and see how Mark Twain spends a lot of time on the “Duke and the Dauphin”, a couple of cheats and swindlers. As P.T. Barnum said, a sucker is born every minute. It is our history.

In Huckleberry Finn, it was the Duke and the DOLPHIN. Another aspect of our history – not knowing much about languages other than English.

Genti S,

Unemployment is always #1. Came in tame this morning so the rally continues…

A lot of what you’re saying assumes that the next housing recession will be like 2008 but it’s more likely to be like the early 80s or early 90s where prices just flattened out and then dropped about 10 percent or so over a number of years. That’s just not enough of a difference to really affect the decision to move now or later for the vast majority of buyers and sellers.

Wolf,

What do you think happens with STR’s?

It strikes me that you’d be foolish to have much equity in them, and AirBnB owners are lucky in that the homes are already staged for showing, do you anticipate a rush to the exits as cities get draconian on them?

I don’t have an opinion on this. I do know that these vacation rentals have massively distorted the housing market in many cities. They’ve taken business from hotels, so now we have hotels that are in trouble. The travel boom is still going on, but I don’t know how much longer. I can smell a big shakeout coming. Even a mild recession would do wonders to pop the travel boom, and then those vacation rentals will be back on the market. This world needs a recession more than anything, but where the heck is that recession when you need it?

I know we haven’t seen it in the numbers yet, but it feels like it’s coming. I’m in life sciences industry, and sales have dried up big time second half of this year. We are reducing staff and I know many others in our industry are as well. Just one sector, maybe others are holding stronger… businesses/investors/government entities seem to be tightening up from where I sit.

But AI is hiring feverishly and expanding and leasing large amounts of office space. There are other areas with lots of growth.

The solution to vacation rentals is to require the same charging of fees and taxes as the hotels. Also, tighter fire Marshall regulations would seem advisable; especially in the area of automatic fire sprinklers, at least two exits from the upper floors, and fireproof material construction (concrete floor layers, metal studs, etc.)

New York City put the kibosh on vacation rentals. “September 10, 2023 – Local Law 18, which came into force Tuesday, is so strict it doesn’t just limit how Airbnb operates in the city—it almost bans it entirely for many guests and hosts. From now on, all short-term rental hosts in New York must register with the city, and only those who live in the place they’re renting—and are present when someone is staying—can qualify.”

Agree. If hotels have to pay 15% taxes, then AirBNB rates should as well. But much of the banning of AirBNB (like in NYC, referenced below) was done in bad faith at the behest of the hotel lobby. It’s not that they don’t want short term rentals to compete on the same financial terms, they don’t want them to compete at all. It’s the same reason the yellow cab lobby tried to ban Uber, although they were fortunately unsuccessful.

If there was this much demand for short term rentals, clearly the hotels are not providing enough supply.

Not sure you need a recession to kill the short term rental biz, the easy money was made years ago and i’d guess a good many are barely making it as is, because everybody and their mother-in-law piled in when the getting was good.

Wolf,

“This world needs a recession more than anything….”

I totally agree.

Motorcycle Guy (and Guys), it appears that Harley Davidson is in a permanent recession. Are the Hog enthusiasts slowly disappearing from above ground? Do the younger generations buy into that brand anymore with religious conviction? Their electric bikes with simulated Harley motor noise are so blatantly pathetic that it will further erode their position in the market, I’d imagine.

Any opinions? The company’s stock is in the crapper.

Harley spun off its LiveWire ebike division via merger with a SPAC in Sep 2022. It’s now publicly traded as LVWR. Harley still holds a big stake though.

Revenues have collapsed 40% in Q3 yoy – effectively since the SPAC merger, LOL

But smaller ebikes are getting very popular as a way to get around.

I love motorcycles. Prices rose and rose over the past few years to the point where a BMW R1300GS is now *more* expensive than a brand new Toyota Corolla. I’m sorry, but that is not value and that is not a good deal. Recession will bring balance.

HowNow – I think Harley will go out with the boomers. Most of my peers and younger just don’t feel the same towards motorcycles as the 60s generation. We didn’t grow up with Easy Rider.

I drove through Badlands in August this year. Obviously tons of bikes out, but everyone was grey haired.

Nothing says “geezer” like a Harley or a Corvette.

When everyone agrees that a cataclysm, such as a recession, is coming, it doesn’t, and conversely, when everyone says things are fine, the unthinkable happens.

Murphy’s Law

Friend who grows veggies and runs a farm stand on about 8 acres of inherited land in an upscale tech-oriented Chicago suburb tells me sales dropped off 5% in September and October despite unseasonably mild weather. Also sells handicrafts; craft sales off 50%.

Money is getting tight.

Zillow shows major price reductions on homes in the suburbs. Multiple $10k drops on some properties.

Never ever extrapolate from one small company to the vast overall economy. You WILL be lead astray.

Walmart U.S. same-store sales were up 4.9%; and ecommerce sales jumped 24%. Walmart is a lot bigger than your friend.

At some point, the Fed need to be called out. What were they thinking in 2020? This was so overboard, it was insane

Buwhwhahaha…..have you ever seen any real accountability to the FED…they can’t get away with pretty much anything…just look at recent insider trading scandal….amounted to early retirement and a whole lot of nothing burger for them..

Right, it was 100% foreseeable what was going to happen when you printed $4 trillion in two months. And there was no good reason to do it. The data coming from Italy at the time made clear that the virus mainly affected very old people. There was never a risk of 35% of the population dropping dead.

Now that mortgage rates have fallen from 8% to 7 1/3% (before rate buydowns), a lot of desperate realtors out there will be agressively calling buyers who couldn’t qualify for a loan at 8%, but can qualify at 7 1/3% (before rate buydowns). The December closings report, coming out in January, will be interesting. I expect prices to spike higher, due to buyer competition for active inventory.

Nope, not happening. Purchase mortgage applications, weekly, as of last week, just talked about it a few days ago:

https://wolfstreet.com/2023/11/15/surging-mortgage-demand-and-declining-spending-really-lets-have-a-look-at-reality/

Wolf – I noticed the percentage of mortgage free owners is almost 40%, having moved up from the lower 30% range over many years. Has this affected the mortgage application charting over time in a meaningful way?

In fantasy-theoretical-what-if la-la-land, a 100% mortgage free owner could become a 100% cash buyer. And a 100% cash buyer would not need a mortgage. So every percentage increase in cash buyers would tend to have a impact, correct? How big is that impact at the moment with almost 40% of owners mortgage free? Not easy to filter the data I suspect, as even a cash buyer can get a mortgage at a later date, etc.

That said, it seems like as the percentage of mortgage free owners increases, that is a higher sign of a healthier house ownership market.

Honestly I’m shocked is is close to 40%, which is great news for Americans if those stats are statistically accurate…

After second thought, perhaps I’m forgetting the fact that home ownership rates have peaked and are dropping. So as the percentage of people who can’t afford housing drops, the percentage of those who are mortgage free, after a melt up in housing prices, may not be the best indication of previous said “healthier house market”.

Housing is complicated. Time for an adult beverage, only wish I had a JPow Mug to make it more entertaining…hint, hint…HA

Nah. The percentage of cash buyers has been about the same for years, running around 22% to 30%. The share moves up a little, moves down a little. Now the SHARE is higher because they’re the ones that can still buy. But in terms of absolute numbers, the cash buyers have dropped off too, just not quite as much as the borrower-buyers.

State and local governments make a lot of money from rent (property taxes). Be vigilant in making sure that real estate “investor” lobbiests don’t stop new home construction as builders can build an infinite supply of homes. For some reason the home builders’ lobby seems weak, perhaps it is the aforementioned government apparent conflict of interest.

Do other parts of the US not adjust the mill-rate after assessment to meet the budget? In the three states Ive lived in the towns will raise and lower your taxes as needed regardless of assessment, so assuming your home value increased at the same time others did due to macro trends and not improvements to your one property, youll likely pay similar taxes at the end of the day because the mill-rate goes down once they do the math and divide it accordingly. City shouldnt care if its getting $100 from 1000 units or $10 from 10,000. (ignoring the likely increased costs of servicing 10x as many residents in this made up situation).

Our state has a property tax cap (percentage based), so if there are such adjustments here they are limited. I don’t have any idea of how common this is.

SocalJim here. Too many people are blaming the near historic low supply of homes on the 3%ers who will never give up their mortgage, and this is partly true.

But, another and perhaps more important factor is in play. You see, many people have so much equity that the 250K/500K gain exemption on real estate is not helping them.

If you are sitting on 2M gain in a 2.5M property, and you decide to sell, look at what you lose. Many properties bought 25 years ago are in this situation. Capital gains on 1.5M, assuming you are married and owned it for long enough, and an 8% transaction cost. In California, you are looking at $600,000.

No one wants to hand over $600,000 before they start looking for a new home. So, they just keep the property. They might pass it down in an estate, or they might remodel. But, there is no way in heck that they are selling to forfeit $600,000. What a disincentive to trade up.

So, that leaves us with no inventory in highly appreciated zip codes. This is playing out up and down suburbs on both the east and west coast. Bergen County, Norfolk County, Orange County, CA, ….. the list goes on and on up and down the east and west coast. Even Marin County is seeing this.

It’s kind of cute to look at $2.5 million properties, but in terms of the overall market, they don’t matter. They might account for 1% of total US sales, practically irrelevant, though the media likes to turn them into clickbait (apparently it works).

The median price here is $391K (NAR). Median means that half of the properties sold for LESS than $391K, and half sold for over $391K.

Properties of $1 million or more made up only 6.7% of total sales (NAR). $2.5 million properties must be around 1% of sales. This high-end stuff has zero impact on the overall housing market, though they might matter in a few small high-cost pockets, that themselves are irrelevant for the overall US market (though again, the media likes to turn them into clickbait).

In terms of those owners, they can choose to pay taxes on their gains, or hold on to the properties and lose the gains and pay for the carrying costs. This is why people sell stocks and pay capital gains taxes on their gains, because they don’t want to lose their gains and maybe plus some.

The median price is $391K. Properties over $1M are only 6.7%.

C/S is a clickbait bs.

“C/S is a clickbait bs.”

FYI, this is NAR data not C/S data.

In Orange County, 60% of the listings are priced at or above 1M. And, 23% of the listings are priced at 2.5M or above.

Sure, in San Francisco the median price is around $1.6 million, meaning half sell for over $1.6 million. But that’s only about 150 sales a months, out of 330,000 sales across the US in that month. Do you see why your calculus doesn’t matter in Tulsa or in Omaha or even in Dallas because so few sales are $2.5 million? You gave that as a reason why nationwide inventory is so low. And that’s what I shot down. It’s not an issue nationwide, it might be an issue for a few hundred sales in a few high-priced pockets. But we’re talking nationwide inventory and nationwide sales here, as were you in your comment.

I do think, however, that the “rolling over” of gains should be allowed again, for both residential owner-occupied real estate and for stocks. If someone sells a share of MSFT and uses the proceeds to buy a share of something else, I don’t think that should be a taxable event, as it discourages price discovery.

Then no profits in investing are going to be a “taxable event.” You’re clamoring for tax-free profits from investments — because they’re nearly always rolled over into other investments. Just tax labor, and keep profits from investing tax free? There are some people who’d like that a lot.

My understanding is for real estate the IRS doesn’t tax gains up to very high limits. While this might be a problem for a small percentage of very expensive home it is virtually tax free at a federal level for many.

The big problem is, way back when homes were cheap, they set the 500K exemption into law. Very few paid capital gains above 500K. Now, prices have doubled and doubled again. But, the 500K exemption has not been raised. This is locking up inventory in more and more areas as home prices continue to rise.

The 500K value should be raised to 1.5M since home prices have risen so much. This would increase inventory and decrease prices in high end areas.

“The 500K value should be raised to 1.5M…”

No, the 500k value should be removed entirely, which would create more tax revenues, which the US needs more than anything.

Wolf, is that right? Are most people selling stocks only to buy other stocks? I would have thought most people were selling stocks to finance their retirements or expenses.

You would have thought wrong. Ever heard of trading? Of capital accumulation? Of building a nest egg? Of, well, “investing?”

For example, 117.9 million shares of Tesla traded on this ultra-quiet day today. Do you think that’s all retirees selling their Tesla shares so that they can pay for dinner? Nope, people sold to take their gains or losses and then invest the cash in something else.

I have never ever taken money OUT of my brokerage account. But I sold (and the bought) lots of shares. Meaning each time after I sold, the cash went into some other investment, each time!

Maybe a lot of potential landlords can’t make the numbers work

with higher interest rates and no asset appreciation ? Of course

5.5% on cd’s seem a much easier way to generate income.

“I can smell a big shakeout coming”

Everyone ( that I talk to anyways) feels the pressure building.

imo

We are at the point in time Zappa prophesied.

Between the “pandemic” and the 2020 “election”, and the gov reaction to both, the curtain at the back of the theater was momentarily blown open and everyone got a glimpse at the brick wall behind the stage. The ptb are desperately trying to hold the curtain closed but the wind keeps blowing it open exposing the brick wall. Scenery is now being moved , curtain soon to be pulled back for everyone to see if the glimpse they caught was real.

Hey time for a new sheet of tin foil, that one’s looking worn

At around 40 trillion, real estate is the largest asset class in the US. Housing sales in US just had worst year since nineteen ninety three. But compared to a bear market in stocks, the decline in RE prices happens very slowly. That’s why the recession hasn’t happened yet. A recession, not just a downturn, needs a sea- change in consumer sentiment, and a decision to curb spending. Giving back 10 %, after a run up of 200 %, or more, is not enough to seriously dent the ‘wealth effect’ and make a majority retrench.

For a look to the future, see the Canadian petri- dish, where things for RE are much worse, happening much faster, even though its Fed Govt finances are better.

Canadians were always more prone to RE investing, with few world- class companies in its stock market.

Three major developers are in some stage of BK. Ongoing saga Coromandel in Vancouver; a new one, Vandyke, in Ontario with about a thousand condos under construction. Then on the flagship corner of Yonge and Bloor in TO, the largest tower in Canada, ‘The One’ at eighty- five stories, owing about 1.7 billion, maybe half complete.

The petitioners re: Vandyke are especially upset, saying they doubt its ability to finish the many projects ‘in a timely fashion, if ever’. This one is going to be a can of worms to unwind with hundreds of units presold.

But these are just the high profile stars. Even in Nanaimo, Van Isle, the butt of many Canadian jokes, there are half a dozen cranes. In Victoria they are everywhere. The Canuck RE industry has been caught completely off balance by the run up in interest rates. And so have the banks or at least one we know about. After getting fed up with staff at Big Six member BMO, the regulator insisted on addressing the Board. His complaint: once the HELOC was added to the mortgage balance, the bank was over extended on too many.

There are no 30 year mortgages in Canada, or none of any significance, and 2 million come up for renewal in the next 2 years. Hundreds of thousands are variable, meaning they’ve tracked rates up all the way already, with the extra monthly payment no longer available for consumer spending.

Pressure is mounting on the BoC to maybe not follow the next Fed hike, or even cut, but with the C$ having gone from eighty two cents a few years ago to 73 cents now, there is not a lot left in that shock absorber.

“Sea change in consumer sentiment”. Good description of what it’s gonna take.

Patience is required..it took 4-5 years to play out in 2007 to 2012…and will wait and keep preparing in the meantime. This isn’t the time to buy now..

Obviously individual impacts but not clear how much the housing slowdown impacts the collective economic picture. For me, I bought a house for 405K in 2016. It probably could have been sold at the height for 640K(after subtracting commissions and so forth). Now it would be perhaps 550K ballpark. If interest rates decline that could bring in more buyers but to people in the Bay Area that is still a deal for 2500 sqft.

Doesn’t seem at least in my area that asset bubble is massive. Builders mostly got in under the wire after building moratorium was lifted in 2015 although some of that inventory they are struggling to move at 800K with HOA fees on top of that.

So the impacts seems to be a lack of mobility for those that want it and can’t do cash sale and those that want to buy a house with a low down payment. I don’t think that is the recipe for recession at least if my part of the state. In my mind it just is one more factor in wealth disparity in the country but that is hardly new.

Unemployment rising and then recession, once there, we will see a clearer scenario, and everything seems like it would be the next.

I agree, we won’t see a crash in prices without a significant recession. On top of all the previous comments, relocation for work is at a historical low. There just isn’t much incentive to sell.

If you are an investor and people are still short term renting, no sale. If short term rentals dry up, but starter homes are needed, long term rental.

If you’ve locked in a historic low interest rate, why would you sell?

They may be few buyers, but there will be no big push to sell until the economics change.

Here is my interpretation of what I read:

Scenario (1) short term rentals in a “free money” environment, where people were willing to “pay whatever”, say $250/night.

Scenario (2) switching to long term where people end up paying, say $80/night, maybe even less because these new rentals add to local rental inventory, possibly pulling down area rents.

I don’t think the DSCR bros can stay solvent under these very different revenue conditions. Selling is probably their best option, *if* they can come up with the closing/selling costs and still come out ahead. Otherwise, likely a lot of extend and pretend payments on their part.

Home sales are down only 26 % from pre-pandemic levels? That doesn’t strike me as a huge drop, relative to the severity of mortgage rate increases. Almost 3/4 of the buyer group is still purchasing. How are they all qualifying for loans with home affordability at all time lows?

At least these buyers are funding somebody else’s retirement, so not a total waste of money.

So, ongoing story continues.

A lot more money needs to be lost to reach homeostasis (if such goal exists) in the stocks and bonds markets.

In my experience of private house buying and selling price is determined by free market principles, the buyer paying the maximum he can afford is usually the determinant. This is of course related to macro factors such as interest rates and employment etc. With an active market of buyers, agents and sellers prices adjust within weeks to changes in these factors. No Conspiritors!

A price drop of 5 percent is a huge drop especially with where prices had been. This percentage drop was applied to a very large number. Inventory rising price dropping.

I do like the article that Wolf wrote in July this year about the buyer/seller relationship. I do know of a baby boomer that bought a second home in the Keys for 1 million. He cashed out some retirement funds and paid cash 1 MM for a 1000 sq Ft winter place . This transaction was in Oct. I have another friend that is looking to purchase a third home in Oregon . This too would be a move to get close to his only son from Texas . Population growth and jobs growth hold the keys for home demand. Housing supply and cost of construction and home size are big components of housing. Work from home and mobil computing power plus the Cloud Computing availability are all creating some disruptive behaviors in possible scenarios for home location .

Just drive through many rural parts of the USA to see that job availability is a key component to home price growth may never occur in those regions. Same thing occurred in parts of Europe as well.

I am very interested in seeing how this plays out .

WOLF – despite your overall housing market analysis, my personal existing home market remains “hot” in terms of the actual comp prices maintaining where they have moved up to… Sure, it might be taking a tad longer to sell, but there really are still record low amounts of existing homes for sale. Inventory is tight. I have gone to a few open houses and they are usually quite full which is nuts to us. When a existing home comes on the market, it is often sold in hours/days. So yes, transactions, refis, etc., are way down but who cares unless you are a commission earning realtor or loan broker? As a home buyer, I can tell you this market is a nightmare. Comp prices remain quite firm here. The sellers are still very much in control. Is there a housing shortage?…no. Is there a massive shortage of existing homes for sale?…yes. Now the FED is “hawkishly” pausing…LOL! They are done raising, and will be cutting going into the 2024 election year. “Home prices – higher for longer”

I’m really tired of your manipulative BS. Once a month at a housing article, you show up and drag out the same BS about the “hot” housing market in your area, which, as you said before, is Sacramento; and every time you post this BS, I post an updated Zillow chart of Sacramento, and you vanish for another month until you resurge from the ashes yet again with more BS. So here is yet another updated Zillow chart of the median home price in your area:

JG had said nothing about value. He’s talking about days on market and low inventory. Wolf gets offended when low inventory is mentioned. lol. Or he won’t post the comment (like my last comment about inventory levels). But on the other hand he asks us for donations. It’s a clown world we live in

Robert B,

“JG had said nothing about value.”

Effing BS. This is what JG said right at the beginning.

“…my personal existing home market remains “hot” in terms of the actual comp prices …”

You RE promo trolls are an endless nuisance and time-suck.

Bit harsh, Robert B? Happy Thanky Day to you, too.

Sure, Wolf’s sometimes a little fast ‘n’ loose with his BS brush. But Wolf is a bit like that scratchy professor you loved/hated: he pisses you off, maybe; but you know better than to let your ego frustrate your higher pursuit of objective analysis.

It gets harder & harder to find unadorned trenchant investigative analysis, and yes, it’s worth a couple of bucks now & then. Don’t make it ugly. You’re here, after all and you know you love it.

Be nice.

I hear a lot from regular folk that another cause of the housing supply shortage (respectfully, supply in terms of actual listings not potential,) is the entrance into the single family housing market by large investors such as blackrock, creating etf classifications.

Could this be as, or more, impactful than people whom own vacant, extra housing?

Happy Thanksgiving Wolf!

What you heard is ignorant BS. I’ve shot it down many times before, including here:

https://wolfstreet.com/2021/06/22/no-blackstone-didnt-buy-17000-houses-out-from-under-desperate-homebuyers-and-blackrock-didnt-buy-a-whole-neighborhood-but-built-to-rent-is-a-h/

Large investors have stayed out of buying individual houses for years. They did that in 2012-2015 when money was cheap. Now they buy new built-to-rent developments from builders that are already filled with tenants, and they buy big portfolios of existing rental properties from other landlords that want to sell. And they’re building their own rental developments. No big investor buys individual houses at these crazy prices. They have been very clear about that. Many of them have SOLD some of their properties.

BTW, rental houses compete directly with for-sale houses, and that’s one of the reasons why there are so few buyers now, because they can rent a brand-new built-to-rent house in a professionally managed rental division for a lot less than the mortgage payment on a similar house. Which is also why rents keep rising at a solid clip.

BTW2, the vast majority of single-family rental properties are owned by small-scale investors (think mom and pop), including lots of people here. There are about 14 million SFR owned by small-scale investors. That has always been the case. The biggest landlords hold about 700,000.

I looked up October 2022 and 2023 MLS data on my rural red county here in the South, and this is what I saw:

October 2022 sales: 24

October 2023 sales: 26

October 2022 avg sale price: $411K

October 2023 avg sale price: $453K

I built a barndo this time last year, and my home was dried in last week, awaiting shingles. None of the subs are hurting for work around here. Per an article in the paper, new home permits are only 10% off the 2022 high.

Finally….a recession…..most folks working in the unemployment claims offices across the country may be getting laid off. LOL…..just a bad joke.

Today….after a week or two of scare headlines because claims jumped by almost a quarter teaspoon…….claims threaten to drop below 200.

We will get a recession…….someday…….but no sign yet…….

Had a chuckle……headline screaming that the consumer at Walmart was weak……read the article……the CFO claimed that the quarter started slow……several paragraphs about what this means……buried in the last paragraph……the past several weeks have exceeded our expectations significantly. Who writes this crap.

They are building hundreds of new homes around here…..if nobody buys them…..we may have an issue……but I doubt they are spec homes. Lennar, Pulte usually expect a reasonable down payment.

A lot of people are waiting for house prices to drop, but be careful what you wish for. If you are a homeowner, you could end upside down in your mortgage. You can’t sell unless you bring a large bank check to the closing to make up the gap. Every day you see much nicer, much larger homes in better neighborhoods than yours for less than you paid. It really sucks. No problem, just live there and wait it out. What if a career move becomes available in another state and you can’t take it because your house is like a millstone around your neck? I was in this situation once. It really sucks. The worst part is, it is going to happen. It needs to happen.

Roddy – I was in the same situation. Bought my first house November 2006 (6.75% APR). A little over a year later (GFC), it appraised at 35% below what I paid. Interest rates dropped significantly. If it weren’t for HARP, I wouldn’t have been able to refinance. When I needed to move for employment, I would have needed to bring close to $40K to closing so I rented it out at a loss. It took years before I was cash positive (@2015).

That being said, people shouldn’t expect to have 20% equity after a year of ownership either. And anyone offering 25%-50% above appraisal in the past 2-3 years should have known better. In a typical market, you wouldn’t break even on a resale until at least 3 years after expenses. While my property “values” have increased significantly, I don’t think these inflated prices are good for anyone other than investors. As a homeowner, pre-pandemic, I could see big improvements between a $400K and $500K house. Now, that spread is much higher.

A recession cannot come soon enough. Housing prices went up over 40%. I doubt most people saw wage growth anywhere near that. The job isn’t over with 2% inflation…we need deflation, a correction or whatever you want to call it.

Said Realtor Left to Realtor Right, “Price birds are very trying.

They gather in yards and ‘Cheap, Cheap’ so loud, it drives out potential buying.”

“We must therefore proscribe an action to stop these fools from flying.

A five percent cage with a warning sign that reads ‘Old, Demented, and Dying!’ “.

The best advice I could give to sellers is….

Don’t give it away. Hold your ground. Ride it out. The halcyon days are coming back, just you wait and see. They’re not making any more land. You are sitting on a gold mine. You EARNED it. You deserve it. You borrowed your way to the financial promised land. A cash buyer is just around the corner, because they want your special “home.” You know, the one you are so desperate to all of a sudden get rid of…

Thanks for the good chuckle.

Please add “/sarc” for new readers. Some of us already know it is.

What desperate? Employment levels still very strong. At the mall they other day I had to wait in line to pay at every store I visited. It was not an upscale mall by any means either

I was in a car stealership yesterday to pick up my new, improved, technomobile. These new showroom designs are a hoot because you can hear everyone’s negotiation that is within earshot. The couple next to us were “get me dones” and the “4 square” presentation was hilarious. Nothing better than a “deer in the headlights” look on a guy who is trying to impress his SO with his financial prowess. (He was clueless)

Rest assured, the drunken sailors are out in force.

Wolf – Happy Thanksgiving!

You do not post anything (that I have seen) about gold or other precious metals. Is there a reason for that? I am not a precious metal investor but wondering if I should start learning about it.

Gold never changes (which is why people like it). The reasons to hold gold don’t really change either. What changes is the price. So one post every 5-10 years is enough. Here are 2:

https://wolfstreet.com/2018/09/04/my-theory-about-gold-and-silver-for-long-term-investors/

https://wolfstreet.com/2018/12/25/my-theory-about-gold-as-diversification-to-the-busted-everything-bubble/

I mean, I could modernize the pieces and include nicer charts and updated prices, but the content would be about the same.

I don’t have any numbers on demographics of who is selling but 80% of people over 60 are homeowners. As many are hitting retirement they sell which helps fund that retirement. If they also move and downsize at the same time they can be $200K that can be utilized in retirement. Admittedly the challenge with high rents is that can be a challenge but changing your zip code, especially if you are in a high tax state can make a big difference. Plus other costs such as property taxes, insurance, HVAC or energy costs aren’t insignificant as most people who own realize a paid off house can still be really expensive!

“As many are hitting retirement they sell which helps fund that retirement. If they also move and downsize at the same time they can be $200K that can be utilized in retirement.”

Right. Many of them paid 2x median income for their house, but expect a Zoomer to pony up (borrow) 10x-12x to “fund” their retirement. “Ok Boomer…..”

Homeowners do not really own their home. They pay property tax (county rent) every year, and if they do not pay it, they will see who really owns their home. I won’t even talk about HOAs.

Sorry, I never think about getting a loan. I should have added for borrowers, if you do not pay your monthly mortgage, you will also see who owns your house.

Buying a house with cash is like having a huge buy-in for a smaller than market monthly rent (property tax). But you also have to pay maintenance, HOA, maybe insurance, lawn-care, protection (security) etc. That huge buy-in also means you lose 5.5% annual interest on it (nowadays). One also has to think about the heightened risk for decrease in home value, especially nowadays. So it gets to be a tough call for cash buyers if the prices seem crazy high, like today. These are some reasons why most cash buyers are on the sidelines for now.

Yep. This is exactly me and my husband. We find houses we like and if we can get the house at an especially good price, we are willing to give up our 5.5% interest on cash, otherwise, we are waiting although remaining active in the scene as we are technically first time home-buyers but are 39 and 53 respectively, so not getting any younger!

One issue with downsizing is a limited amount of affordable homes to downsize.

I have two neighbors who are in their late 60s or early 70s and want to downsize from the 2 story 4 bedroom house they have lived in fo 20 years to a 3 or 2 bedroom ranch. They could sell their current home for 400k.

They have looked around and all these ranch villas designed for retirees to downsize into start at $550k.

Sure, they can find an old 1950s or 1960s ranch house for 350k but it is in old neighborhoods, house plans are not open, small closets and small bathrooms. etc. Not retirement ready unless you do 50k of upgrades. So they are staying put. They cannot afford to downsize. lol

My eyes tell me what is going on in the RE market here and probably most of the country. We go out 20 miles to Ms Swamps Turkish hair dresser who operates a salon shop out of her home. Its’ a townhouse development of recently built homes. There are builders still building similar townhouses in the same area. They have not been completed. There are signs on the approach roads galore of sales of the new homes. But there are NO homes in the completed townhouse development portion for sale. What does this tell you?

Ms. Swamps is a really good stylist?

The situation near me is confusing… there are numerous (four that I drive by consistently) with names like “Solitude” (we call it “solidpoo”), “Serenity” (aka “insanity”), and “Camelot” (comealot) that are all big bombers (3-4,000 square feet) stacked upon each other, located adjacent to 4-6 lane divided thoroughfares and are for sale in the $2M++ price range. Someone is buying these… another development (something-or-other-ranch) is being developed by Troll Bros on acre lots near the Scottsdale National Golf Club. These people are building like there’s no tomorrow. The infrastructure they’ve had to build (access roads, gates, flood control, retention ponds, etc.,) must have cost multiple fortunes… but someone is buying these things as there’s signs of life in them.

Yes. Today. In Snotsdale, AZ.

Another new development is permitted next to ours… along with a shopping center (amusing part is that this is all adjacent to large horse properties that are quite stinky during “the season” when the breeders bring their prized ponies to town). Drove by with the top down on Friday and it was a triple-gagger.

Here’s something strange: there’s a townhouse here in my hood that was for sale since August that just went active under contract. It hit the market the same exact time as a neighboring unit – identical but bigger by ~ 400 sq ft – hit the rental market. The asking rent on that keeps going down each month, now hovering at $2800 with no takers. The carrying cost with 20% down on the townhouse that just went pending is $3500. So the buyer could have rented the larger (and frankly slightly superior) unit right next door and kept their 100K+ deposit. Talk about a dysfunctional market.

Granted, the buyer may have offered significantly lower than asking but I’ll never know since TX is a non-disclosure state.