And there’s Still No Recession!

By Wolf Richter for WOLF STREET.

Every month, the Conference Board publishes its “Leading Economic Index” (LEI), which is a leading indicator for turning points in the business cycle and is designed to predict business-cycle recessions. It predicted the 2001 recession and the Great Recession. It didn’t predict the pandemic recession because that wasn’t a business-cycle recession but a pandemic with a lockdown that suddenly shut parts of the economy down; instead of predicting it, it reacted simultaneously with it, which is how it should have reacted. So its track record is good.

We here at WOLF STREET have been on recession watch since about mid-2022, and we’re still watching, and so this is fascinating and hilarious.

Today’s LEI predicts a recession in the “near term.”

“The Conference Board expects elevated inflation, high interest rates, and contracting consumer spending—due to depleting pandemic saving and mandatory student loan repayments—to tip the US economy into a very short recession,” said the report for October 2023, released today.

“The US LEI trajectory remained negative, and its six- and twelve-month growth rates also held in negative territory in October,” the report for October 2023 said.

“Among the leading indicators, deteriorating consumers’ expectations for business conditions, lower ISM® Index of New Orders, falling equities, and tighter credit conditions drove the index’s most recent decline,” the report for October 2023 said.

For the whole year of 2024, it forecasts “that real GDP will expand by just 0.8 percent.”

The 10 components of the LEI: Average weekly hours in manufacturing; Average weekly initial claims for unemployment insurance; Manufacturers’ new orders for consumer goods and materials; ISM® Index of New Orders; Manufacturers’ new orders for nondefense capital goods excluding aircraft orders; Building permits for new private housing units; S&P 500® Index of Stock Prices; Leading Credit Index™; Interest rate spread (10-year Treasury bonds less federal funds rate); Average consumer expectations for business conditions.

But the LEI predicted a recession for late-2022, early 2023, mid-2023, and late-2023.

Recession to start late 2022 or early 2023, first outlined in the report for August 2022. “The US LEI declined for a sixth consecutive month potentially signaling a recession,” it said in the report for August 2022. And it added: “Economic activity will continue slowing more broadly throughout the US economy and is likely to contract.” And, “The Conference Board projects a recession in the coming quarters.”

After the report for August 2022, there came a litany of monthly recession predictions that moved the coming recession from late 2022 across all of 2023 to finally 2024. For example:

Recession to start at the beginning of 2023: In the report for November 2022, it said, “As a result [of this parade of horribles], we project a US recession is likely to start around the beginning of 2023 and last through mid-year.”

Recession to start in early 2023: In the report for December 2022, it said, “The US LEI fell sharply again in December—continuing to signal recession for the US economy in the near term.” And it added: “Overall economic activity is likely to turn negative in the coming quarters before picking up again in the final quarter of 2023.”

Recession to start in mid-2023: In the report for March 2023, it said, “The U.S. LEI fell to its lowest level since November of 2020, consistent with worsening economic conditions ahead,” it said. “The weaknesses among the index’s components were widespread in March and have been so over the past six months,” it said. And “economic weakness will intensify and spread more widely throughout the US economy over the coming months, leading to a recession starting in mid-2023.”

Recession to start in Q3 2023: In the report for May 2023, it said, “the US economy will contract over the Q3 2023 to Q1 2024 period. The recession likely will be due to continued tightness in monetary policy and lower government spending.”

That last reason for a recession to start in Q3 – “lower government spending” – tickled my funny bone.

Recession to start in Q4 2023: In the report for July 2023, it said, “The Conference Board now forecasts a short and shallow recession in the Q4 2023 to Q1 2024 timespan.”

And there’s still no recession.

None of these recessions that were forecast to ply the land since late 2022 have actually occurred. On the contrary, “Real” GDP” (GDP adjusted for inflation) jumped by an annualized rate of 4.9% in Q3 from Q2, following the 2.1% increase in Q2 and the 2.2% increase in Q1.

Obviously, as I said when the red-hot GDP data was released, “as we can see from the chart, big increases are generally followed by smaller increases, or sometimes quarter-to-quarter dips. And that history of quarter-to-quarter changes alone, without knowing anything about Q4 yet, would lead us to expect a smaller increase in Q4. That doesn’t mean the economy suddenly hit an air pocket, but that growth reverts to trend.”

The predicted recession-Q3 turned out to be one heck of a good quarter, even if future revisions knock off a few chunks of the 4.9% growth. And if Q4 growth comes in at 1% or 2% (2% growth is roughly the longer-run average of the US economy), we’ll still condemned to wait for that recession.

We will get a business-cycle recession eventually because there always is a business-cycle recession eventually because it’s part of the business cycle. The question is when.

Why predictive models that used to work well are failing spectacularly with their recession predictions in this crazy economy will be the topic of a future brainstorming article here when I can wrap my brains halfway around it.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

When I was a kid I used to think that you could save gas by pinning the gas gauge in the car to Full. These folks are thinking on a similar level. They think that their Official Predictions Of A Recession, or Official Bets on 87.34% Chance Of A Rate Cut, will cause the recession or cut.

No, they’re really not. What they’re learning is that there is an important economic “state” not included in their model or not included with enough weight. That state is now significantly different than in the past and makes reality different from the model. This is always the case with models but this time it is big enough to make the model very inaccurate.

If I were to guess, I’d say its all that QE and stimulus money in the economy that hasn’t been there in previous cycles.

But I’m with you in laughing at news of “an 87.34% precent chance of a rate cut/hike/etc” based on reversing the numbers of derivative prices. That’s nothing more than a consensus of knowledgeable people and couldn’t possibly be accurate to more than a single digit.

Brian – the ‘state’ of a zombie? Frankenstein monster? Godzilla? Perhaps a more-benign creature?

may we all find a better day.

That’s the difference between things such as physics as opposed to economics. In physics, electrons don’t suddenly decide to behave differently. In economics, people can suddenly change their minds about, say, tulips.

Electrons suddenly behaving weird is like half of modern physics, lol

Good one, Deep water!

Though he’s absolutely right. I studied engineering but my economics classes fascinated me for that very reason. Like physics, economics is a study of natural laws yet those laws (of large groups of people) are much softer and flexible and yielding even if equally unbreakable.

They are also learning in their model that whats happening with the top 25% of earners does not(should not) reflect an economy. If you look at the bottom 75% of earners only as the economy, you would know we are in recession and have been for quarters. You would also know that the bottom 25% if that were an economy, would be in near depression, all due to inflation. My business of good used work vehicles cash only no financing has completely collapsed in the last few months worse than recession levels. Its not the price, I’ve lowered things to my cost and still nothing. People are just broke now, and scared. The mideast war has people locked up frozen with fear and uncertainty. A better conversation imho is not of recession, but current/future living standards of each quartile of income earners. Then maybe we stop letting the top 25% represent the economy and see reality, before its too late to make wise preventative decisions. Drunken sailors living yolo does not mean they dont go home after eating out, take depression meds and count their change for their their next party. But according to my business anyways, thats what I see.

absolutely! Thanks for pointing this out.

That’s an interesting hypothesis. Most numbers that go into calculating these things have no way of breaking it down by net worth or similar so I don’t know how you’d measure it. And though I appreciate your plight, anecdotes don’t prove anything as somewhere there will be the opposite.

Cool, then definitely no need to cut rates or pause hiking next year especially when inflation is still close to double the 2% (I can certainly appreciate that with those decent yield from Tbills) or are the crybabies thinking of that mythical unicorn scenario, ultra plush landing, no recession and inflation will magically disappear too…guess we can all use more fantasy in our daydream

Lol right? It’s interesting to read Wolf’s commentary as it almost seems like he’s in that boat with his constant ridiculing of those expecting a recession given the current economic trends. The Keynesian outlook on this phenomena is completely misplaced. Yes, the recession will occur as predicted given the massive government spending and printing of money. It’s just a matter of when as a matter of consequence of those policy decisions and not because business cycles are business cycles.

And it will probably be triggered by something which none but a few see coming, just like the GFC.

We’re pricing in a “terrorist” attack during the holiday shopping season, but since 2006 risk management has been all about the false positives.

That said, if one of tomorrow’s mass shooters shouts allahu akbar watch how fast the party ends.

“Yes, the recession will occur as predicted given the massive government spending and printing of money.”

To me, the whole “recession” debate smacks of the intentionally misleading wording of the MMT national “bankruptcy” debate (wherein the MMT proponents baldly state nations “can *never* go bankrupt – because they can print unlimited amounts of money…but those MMT’ers know full well that “bankruptcy” is meant as “national ruin” – via inflation or otherwise – and not as an exact legal term. It is a bad faith denial of very real dangers.)

Similarly, I don’t know if politically engineered/massaged definitions of “recession” will be met or not, but the deficits apparently required (a la Keynesianism) to “forestall” official definitions of “recession” simply make all the more certain that the accumulated cancer of the national debt (100%+ of GDP) will destroy the US economy.

And it is *very* bad faith for DC to express “astonishment” at where all this inflation comes from even as annual DC expenditures run at 150% of DC revenues (only made possible by money printing).

In an instant, DC could suspend/delay/cancel the unexpended portions of the engorged pandemic spending bills and undercut inflationary trends.

But that is *never* the DC way – the unethically printed money, once forged, *must never* be recalled regardless of the consequences to the public.

Otherwise, where will DC’s kickbacks come from?

Question on the calculation of real GDP growth – does the CPI calculation impact this percentage, and if so, does the Fed’s 2023 adjustments result in an inflated growth rate %?

I’m sure we still see growth, but if it is inflated, in combination with the increase in labor participation rate % and population growth, do we actually see a relatively flat lining economy?

Usually this all just noise, but I’m curious whether noise all pointing in one direction could add up to a big number, which can just as easily reverse in the following year.

“Real” GDP is adjusted for inflation NOT via CPI (by the BLS), but via a deflator that is based on the PCE price index (via the BEA) that the Fed also prefers.

Thanks, that’s interesting. Strange that there is so much focus on CPI.

CPI, or versions of it, are used for the social security inflation adjustment, various tax code adjustments, and to calculate principal adjustments to Treasury Inflation Protected Securities. CPI does have an impact in other areas.

When the jobs numbers do not directly translate into the number of persons employed which can mask the number of persons with multiple low paying jobs and the BLS as you have previously reported inaccurately calculates various inflation components it is a recipe for over stated economic activity.

In terms of this myth about multiple job holders:

1. When a Google engineer who makes $250k a year plus stock compensation, buys a few houses as investment properties and rents them out, he’s landlord on a part-time basis and counts as multiple jobholder. 14 million single-family houses are owned by small-scale investors, many of these small-scale investors hold multiple properties. If they have another job, it makes for a lot of multiple job holders.

2. Since some people never read the articles here, I have to post my articles in the comments????

https://wolfstreet.com/2023/11/03/manufacturing-jobs-hit-by-strikes-job-growth-still-decent-we-look-at-trends-in-part-time-jobs-plunged-in-oct-self-employment/

The number of multiple jobholders as % of all workers, at 5.2% in October, was where they had been in October 2019, both of them historically relatively low: In the 1990s it was over 6%.

The number of workers on salaries and wages rose by 64,000 workers to 150.2 million, after a dip in the prior month, per the survey of households.

But the number of part-time workers plunged by 670,000, the biggest plunge since the collapse in April 2020, as more part-time workers were able to get fulltime jobs. Turning part-time workers into full-time workers — those who want to work full-time — is a good thing. The BLS defines part-time work as 34 hours per week or less. Part-time employment is lower than it was before the pandemic in absolute numbers.

Part-time employment as a percentage of total employment has been on a long uneven downtrend. In October, the three-month moving average (which irons out some of the month-to-month variability) dipped to 16.8% of total workers. In 2016, it was still above 18%. This long-term trend contradicts the silly meme that the US economy just keeps creating part-time barista jobs.

And the number of self-employed dropped by 43,000 workers. The pandemic had created a burst of self-employment that has been tapering off and has returned to pre-pandemic levels:

Self-employment as a percentage of total employment has dropped to the low end of the range before the pandemic, with the three-month moving average in October at 5.5%:

I have also been waiting and waiting to see a recession unfold. I cannot believe that it has not happened yet. For us in BC a huge indicator is layoffs in the forestry sector. Then supporting industries and suppliers start layoffs big time. However, despite some legacy pulp mills shuttering forever, and sawmills retrenching, logging continues full out. But one huge event did just happen. Western Forest Products recently sold off 34% of shares to several coastal First Nations bands. Now Western is a lean mean machine and has done well during US import tariffs and rising interest rates affecting housing starts in North America. But now they are divesting to new buyers who are using Govt settlement cash to stake their position. Taxpayer money is buying the shares, but the Company will still be doing the work and employing the same contractors and legacy employees. I have to think they are doing this for a reason, plus it will limit protests and political interference with their operations.

One thing about recessions though, they are always uneven. It isn’t just numbers. Some folks get creamed and others just carry on as if nothing is happening. I’ve been in both positions and I would not wish layoffs and under-employment on any family, ever. It’s brutal. Going through it made me a saver and careful investor, but it was very hard with little kids at home and a mortgage to cover.

If people are making profits then all is well.

When that stops you may see problems.

I think China coming with their hat out in San Fran was an excellent sign that the US is doing very well indeed.

Wow, interesting read!

Xi Jinping Thought:

Extend one hand with hat.

Keep other hand behind back with gun.

It wasn’t China desperately cleaning up the street consequences of its economic and social policy failures in SF.

That was SF and the US (which on a per capita basis, is *much* poorer than staggering SF)

SF was desperate to impress the landlord.

In the end, China has many newer and more productive real asset factories than the declining and decaying US.

That is why the US has been running massive trade deficits with China for 25 years and the broader world for 50 years.

Chest thumping has led America to this ruinous place and it won’t get us out.

It’s like the old joke…

When it happens to your neighbor it’s a recession. When it happens to you it’s a depression.

The big money is in fieldstone not lumber. All custom built homes for the Chinese out west in British Columbia are all all built with fieldstone. The same out east everything is built with fieldstone instead of bricks and always black or dark grey fieldstone.

Maybe fieldstones for the basement level, but that doesn’t affect the amount of lumber or timber used in the rest of the build (i.e. walls, floors, roof)

“But now they are divesting to new buyers who are using Govt settlement cash to stake their position.”

Please elaborate: What is this “government settlement cash” etc. you are referring to?

If they keep consistently predicting a recession, they’ll be right eventually!

Unlike the late 1970’s rising interest rates are aiding the retirees which will soon outnumber workers. The converse was true in the late 1970’s workers dramatically outnumbered retirees. For this reason rising interest rates should actually increase GDP and going forward in time exponentially increase GDP if interest rates actually do stay high.

To be fair, almost every recession (except the sudden COVID lockdown “recession”) feels like a soft landing at first, before the pain hits. Corporate layoffs also tend to happen in waves.

The post-COVID economy is a little wacky so it seems like traditional predictive metrics (yield curve, LEI, federal funds futures, …) aren’t as predictive as they used to be.

There are essentially 2 possible outcomes:

1) Recession. The predictive indicators’ timing might be off, but eventually depleted savings & lagged effects of high interest rates finally break the economy.

2) No recession, and higher for longer interest rates.

Wall Street wants to have the cake & eat it. Somehow there’s going to be no recession AND 3% of interest rate cuts by year-end 2025.

I’m still trying to wrap my head around the big emphasis on calling something a recession. Usually, don’t they usually call them after we’ve already been in it or through it based on data lag? So, who cares what and when we call it, we still have to deal with the current economic effects on our money, right now, today, and suddenly saying, “yep, it’s a recession” doesn’t change how much I make on my investments or how much I spend. Maybe someone can tell me how my life will change if I find out we’ve been in a recession or are in one.

For most people — those who don’t lose their jobs — a recession is a total nothing-burger, a non-event. They don’t notice it. They just hear about it.

For people who lose their jobs in a recession, it’s a depression.

Unless it’s a great recession like 08, then even if you don’t lose your job you certainly felt the impact one way or another.. but a garden variety recession you are right

There are knock-on effects even for the 90-95% of workers who don’t lose their jobs.

Just the knowledge that there is a recession (especially being widely reported in the media) is usually enough to depress consumer spending, even among those who aren’t laid off. Businesses may try to cut costs in other ways besides (or in addition to) layoffs.

If the negative impacts of recessions were truly limited to the 5-10% of the workforce losing their jobs, politicians & central bankers wouldn’t run to rescue the economy with trillions of dollars every time there’s even a hint of a recession.

Yes, but if you are employed it is largely an inconvenience. Much better than homelessness or moving back to your parents because you have no choice, or walking the streets of NYC with a resume billboard (albeit I believe that guy got a job). In 08 the largest impact on me was my operational budget was cut. Which actually made my job easier. Invested, bought cheap property, made out quite well. Services and products generally get cheaper. The only downside is the general blues from knowing those who are not doing well and not being able to do much about it. One can assist, but it does not replace employment.

Around 39% approve of the current economy per Presidential pools, with I’m guessing the other 61% owning stonks, and as such ecstatically watching their stonks approach all time highs, again.

It’ll only take another agency USA credit warning to push stonks up another 10%…LOL!

Stonks, Stonks, Stonks. Is a recession even possible if 60% of stonk owners are making 15-20% returns on paper wealth holdings???

Recession is when your neighbor is out of work. Depression is when you’re out of work.

“When your neighbor loses his job it’s a recession”

“When you lose your job, it’s a depression”

“Hey Todd why the moving truck?”

“We’re moving in with Sally’s parents”

According to this definition, I have been in recession-depression since covid, when my business was ruined. Maybe there is some light shining on the horizon for me now.

National Bureau of Economic Research (NBER) Business Cycle Dating Committee calls the recessions. There is no cut and dried set of rules. They more-or-less look at all the usual economic indicators and after a few meetings and beers, decide to “officially” call a recession. I actually know a couple of the current members, as they were some of my former professors. One was pretty good.

A “slow motion” recession is when your wages dont cover the inflation rate.

Drip drip drip.

The recession in these times depends on your salary. If you draw less than $30 per hour, yep, you’re in dam bad shape and maybe in depression mode. Who can make rent or mortgage on those wages not to say a car payment, food, insurance, utilities?

Having children is a curse in these economic times, there is never enough money. No wonder abortion freedom is so prevalent. Who can afford a child?

“Who can afford a child?”

I dunno, like 10s of millions of Americans every year?

Didn’t American consumers lock their mortgages at super low rates for a long period. It gives them additional fire power at the buying / consuming game.

Or umm you could save?!

Oh wait who am I kidding?

Many still have high mortgages thanks to inflation being out of control and house prices doubling in a couple of years, something that never should have happened, and the Fed should have stepped in sooner.

If no recession appears in 2024, the economy is probably safe. Another factor to consider is the 2017 Tax Cuts & Jobs Act expires in 2025. The results of next year’s elections will determine the exact terms of the extension, but whatever happens, the tax cuts for lower & middle income brackets are assured to be extended, along with the possible extension / reauthorization of the Child Tax Credit and numerous corporate tax breaks & carve-outs. If it’s divided government, both parties tend to trade spending for more spending, instead of austerity for austerity. The tax cut extension will add trillions to the national debt, but are a tailwind to the economy.

There’s still too much liquidity in the system from the COVID stimmy, prolonged interest rate repression, and excessive QE.

Nah not enough QE apparently, crackhead WS is already betting on the next fix from daddy Pow Pow..I think they all have plans to make this a “white” Christmas with the recent rally

They’ve been betting on it for a year. They are making it a white Christmas without uncle sugar Jerome. Stonks keep rallying. God, I wish something would take this shtshow down.

What would be that something? And what is the shtshow? I have my own viewpoint but curious as to yours.

Glen,

I don’t care what takes it down as long as it’s taken down. I think we are probably on the same page with the definition of shtshow in this case.

Ask Realtors if there is no recession. We are in a rolling recession right now. Housing is in a dumpster file and the carnage there will affect every industry tied to housing. Next look for the auto industry to crash. Went to buy a used car the other day and noticed over 3000 cars in the lot collecting dust. No one wants what Detroit has produced over the last 3 years. Over priced, over overly tech, over sized crap made from parts from China. Next, look for the retail sector to roll over join in. We’re in a recession with inflation just like in the late 1970s.

1. “Ask Realtors if there is no recession….”

Realtors may have lost their business model as the 6% fees they’d gotten fat on may be history, and I would be depressed too. Home sales have plunged because sellers don’t want to deal with reality. But that has very little impact on the economy. Shuffling used houses around just isn’t a big contributor to the economy and to GDP.

I understand that you’re pissed off because you retirement gig is in real estate appraisals. So you personally got a little problem.

2. “Next look for the auto industry to crash….”

That’s ignorant BS or just silly wishful thinking. New vehicle sales, which are very important for GDP, are up 20% year-over-year. New vehicle sales is one of the horses that’s pulling this economic wagon. This is fueled by pent-up demand from the shortages. I said a year ago this would happen, and it’s happening. The rest of your comment on autos is just total nonsense.

3. “..look for the retail sector to roll over join in.”

LOL. Walmart’s same store sales up 4.9%, ecommerce sales up 24%.

Overall ecommerce sales are rocking and rolling.

Read this:

https://wolfstreet.com/2023/11/16/walmart-consumers-no-longer-willing-to-pay-whatever-prices-of-goods-fall-broadly-as-inflation-shifted-to-services/

and this:

https://wolfstreet.com/2023/11/15/surging-mortgage-demand-and-declining-spending-really-lets-have-a-look-at-reality/

“I understand that you’re pissed off because you retirement gig is in real estate appraisals. So you personally got a little problem”

Not quite. We’re enjoying the time off. Have had time to upgrade all my 11 computers and business infrastructure. Found a few in my garage that I’m now using productively. Couldn’t do this when we were swamped with business during the pandemic, dealing with all these losers in the Real Estate industry. I just heard from the NAR that RE agents will not be able to collect 6% commissions anymore. They will be lucky to get 1% under the new rules.

Oh man, you might need to record a few episodes on HGTV, and have some employees assume the ‘inerested buyers’ role!

I hope the new 1% (or less) commission rule goes into effect quickly. Realtors have been overcompensated to a ridiculous degree for a LONG time.

There was the “Gas station from hell” last year.

Now I ran into the “Realtor from Hell”. This lady was on a property we were doing an inspection on in a relatively nice neighborhood in the DC Swamp. I went in to see how Ms Swamp was doing after 1 hour in there. I usually wait in the car. The relator lashed out and told me she needed to get going and to hurry up. It went downhill from there. Many of these Realtors want their $20,000 commissions but don’t want to do any work. This has been repeated over and over. I don’t lose one night’s sleep if their commissions are reduced to 1%.

Swamp – or, as we tended to say in those flush times at the moto shop: “…the good thing is, we’re busy! The bad thing is, we’re busy!…”.

may we all find a better day.

Wolf,

Are purchases through mail order catalogs calculated in retail sales? Where are these figures posted? I buy a lot of stuff that way. I’m even buying shoes and jeans from mail order catalogs. I hate going to malls.

Yes, in “nonstore retailers” along with ecommerce sales. Non-store retailers are the second biggest retailer category behind auto dealers. The vast majority of nonstore retail sales are ecommerce though. But the surviving catalogue retailers are included here. I cover this stuff just about every month in my retail sales report.

In my county there is a serious glut of cars. The dealer lots are packed and about a month or two ago I started noticing new cars bring stored all over town – empty lot by my credit union, lots out by the airport, in various lots in the industrial area and even at the stadium! Thought there must be some big sporting event going on but the field and adjacent fields were empty so I drove over to investigate.

I would not be surprised to see this translate to much lower prices. I’m already seeing prices drop 5k on a couple vehicles I own and one I’m interested in as a replacement.

Those lower prices have already happened for a year. And that’s a good thing. That’s what consumers and this economy really needs. And that’s why sales are up 20% yoy.

Legacy automakers don’t cut the MSRP. Instead, they’re using incentives, rebates, dealer cash, rate-buydowns, etc.

For example, here in the Bay Area, San Leandro Ram dealer, in inventory on their website:

New 2023 RAM 1500 Big Horn, stock #230710

$57,665 MSRP

-$5,020 Dealer discount

$52,645 “sales price”

-15% Off “sales price”

$43,995 “Net price”

The dealer has a bunch of trucks priced like this.

The first 2024 models have shown up, and they come with discounts that include a “dealer discount” which varies by truck, plus “National Retail Consumer Cash” of $4,500, so even on these 2024 models, you’ll get around $5,000 to $6,000 off MSRP.

So these are huge price cuts. That’s how they work. Tesla cuts its sticker price by a bunch. But the legacy automakers hand out incentives to bring prices down without cutting MSRP. This has always been the case. And now they’re doing it instead of tacking on the odious addendum stickers.

In Canada all the car lots are empty with the exception of Hyundai especially the new car lots.

We tried to buy a new hybrid that got 50+ MPG in late ’21, but balked when the bottom line included $2K ABOVE MSRP for a ”dealer fee.”

Glad to see at least some reality returning, but having spent to update existing, likely to wait until that spending is amortized properly over next few years.

Would ABSOLUTELY love to see a modern hybrid WITHOUT ALL the unneeded ”tech.”

Fantastic reply Wolf

I am a hoping the ruling against NAR changes the industry. It is a racquet and contributes to housing prices being that much more expensive. We paid 90K to realtors after my parents passed and they literally had to do almost nothing in the area it was located. Hope it all changes before I move in a few years as for 25K I will list it myself.

I’m hoping for the end of the NAR and realtors period. It is not that hard to buy and sell a property. Any legal concerns, hire a lawyer.

Glen,

As I commented recently, technology may be the key to opening the door, and letting real estate brokers go out of the equation.

When I was a sporting event ticket broker, and before the internet websites like StubHub, my commission on sales from clients’ tickets was 33%. But sales were done to customers who reached out to me, or on the street before the event. Those were really the only options.

Before retiring a few years ago, my commission was 15% for listing, monitoring and adjusting prices online which netted a sale, and 25% for sales to customers or for sales on the street. The profit margins were thinner, but the dollar numbers were bigger, so it worked well — until Covid in March 2020.

Now with everything all-digital, no printed hard-copy tickets, and a few other technical changes in the way things work, the business is basically over. Which, after 43 years in it, is fine with me. But it seems like things are going to change in the real estate brokerage business too.

As Wolf commented above, 6% total transaction commission for a house may be history. My guess is a 1.5% rate for the seller’s agent and the same rate for the buyer’s agent is right around the corner.

While not with real estate but others technology has made it worse. Robots buy up things like tickets and limited demand items and then are resold for more. Was nice to go see the Curr and reselling of tickets was illegal and only could be transferred. 2 tickets was only $90 to Shoreline for I could drink plenty of $20 cocktails!

Part of the problem with “robots buying up tickets” and that definitely is a problem, is in the distribution procedures used by venues and promoters when concert tickets go on sale.

My clients were season ticket holders to sports teams in the Twin Cities. With 81 home Twins games, it is a lot of tickets, and a lot of money in the seats, especially box seats, as an example. Typically, I would get the tickets that weren’t going to be used by the owners days in advance, to be sold on consignment.

The public has changed though. A decade ago, a lot of fans would arrive at the stadium or arena without tickets, knowing that there was a good chance to get some from the box office, from brokers like myself or from fans with extras looking to sell a couple on their way into the game. That is no longer the case. The secondary market doesn’t exist anymore in this way. Everything is on your cell phone and traded online. Really, no one walks up to a game looking for tickets on the street nowadays.

For the foreseeable future, there will be real estate agents. The business will evolve and change. But think about this: StubHub was sold to Ebay in January 2007 for, I believe $309M. Who, and what will be the “HomeHub?”

I do wish the auto industry will crash down to earth and then some because from where I am sitting, dealers still asking for the moon especially on desirable cars like Corvette C8 Z06 or any 911 or Cayman GTS from the last 5 years…if it’s crashing I am not seeing it sadly. Would love to buy a Z06 below sticker

The kind of people who buy those sre still fat off unearned pandemic stimulus and wealth transfer. They’ll be the last to go.

…supply and demand, PI, supply and demand. (…or find a time machine and return to the thrilling days of early ’90’s yesteryear when the ‘vette/Ferrari/exotic bubble crashed for awhile…).

may we all find a better day.

There is a 2022 911 GT3 Touring Coupe with less than 2k miles for sale at my local Porsche dealership. Manual transmission stick-shift & normally aspirated 4.0 litre flat-six — which is an absolutely wonderful engine that revs and sounds out of this world. A machine for old-school performance driving if ever there was one.

1 owner, “Certified,” and looks fantastic. MSRP was $214k. Asking price now is $300k.

My guess is that the frozen housing market is why a recession has failed to materialize. The vast majority have been unable to size up. Shelter has been the largest component of inflation for quite a while which means if you aren’t changing houses it’s past you. So the income gains far outstrip inflation minus shelter for that group. I saw a thing that indicates a record number of people now own their home out right but didn’t dig into if they meant in absolute terms or in a meaningful way.

Which is to say the high interest rates have kept people from over leveraging household finances.

“We here at WOLF STREET have been on recession watch since about mid-2022”

It’been longer than that. The “Everything Bubble” and “Housing Bubble 2” article stretch back over a decade. Wolf Street has been on reccession watch for over a decade because every rational person has been waiting that long for a business cycle recession as well.

But our gov hasn’t allowed business cycles for a solid 15 years. And it remeains to be seen whether they will allow the business cycle to resume. I’m not willing to call a recession until a recession hits for which the Fed does not pivot. Traditionally reliable indicators are now unreliable because they didn’t factor-in trillions of helicopter dollars. Since we’ve never done QE followed by QT before, we don’t know what that will look like in the long term and neither do the models.

Traditional predictive models rely on patterns derived from historical record, but the last 15 years of data doesn’t look anything like the century or two before it! Hopefully traditional models will eventually come back into play, but that would require the Fed to hold back on another round of easy money in the next financial collapse… I wouldn’t hold my breath on that one.

I think the difference this time, and why the historical models don’t work, is because Federal deficit spending is at record-setting, World War 2 type levels. The brake pedal from the Fed is offset by the gas pedal from Bidenomics, and the result is a set of very contradictory signals and statistics. Bulls focus on the positives. Bears focus on the negatives. So far, the positives are more than offsetting the negatives. I have no prediction for the future, based on this theory. Seems like spending wins though.

Possibilities:

1) input to the models is garbage (garbage in -> garbage out)

2) the models themselves are garbage

probably a combination of 1 & 2.

This. It’s probably difficult for the economy to tip into recession while the US Federal government is running a record peacetime deficit of almost 6% (which is predicted to be even larger next year).

That’s a LOT of stimulus.

The Fed continues to play the role of the Great Enabler to congressional deficit spending and growing national debt. “Lags,” and systemic leverage are the two large flies in the ointment.

A “soft landing” will ensure that the game continues for at least one more cycle, propelling the debt level ever-higher. But, the chances of an under-reaction by the Fed (to inflation), or an over-reaction (to eventually rising unemployment) create huge risk of hard landing or return toward double digit inflation. Possibly one followed by the other.

Either case leads back to currency devaluation as the likely triage drug of choice.

Bingo! As I read comments, the deficit spending was the first thing I thought of, and wolf ‘s previous article about QT was the second thing. I’m wondering if we’re still in a free money environment, where deficit spending really doesn’t have any cost associated with it- it’s not crowding out business or private investment.

Only when they RRP and reserves hit zero will the squeeze of a recession start

Starting from a FF rate of 0, along with unprecedented and ongoing stimulus is likely to make the long and variable longer. My instincts say a recession is unavoidable, but I’m not comfortable saying when. If I recall correctly, it’s about a 3-year lag from hiking to recession historically? We kicked this party off from zero in March of 22, not even two years ago.

1. Indicator is a turn signal. Just be weary. The driver is texting his sidechick.

2. In the swamp area, there is milk, honey and excess of everything. DC area will not see a recession until all voters agree. My local chines restaurant increased the take-out charages by $1.23. Don’t know why.

3. Change the predictors, index and indicators to fit the narrative. Recession or not. Six months from now.

4. If you approach a women in the gym, you can be jailed for 6 months or $2000 fine which ever hurts you the most. Don’t ask me how did I find it

5. After myself, Engles also predicted the same recession just as LEI. Still, there is no signs of recession.

6. Recession will not occur as long as the definitions of recessions are sketchy

‘It’s tough to make predictions, especially about the future.” Yogi Berra.

Amen. Despite that savvy observation, the big business of selling predictions continues unabated. The MSM financial channels are saturated with predictions, with many of the commentators contradicting each other. Predictions sell – and that is the problem.

I have often wondered what would happen if one of the financial “gurus” actually stated the truth when asked about, say, the direction of the stock market in the next quarter. Can you imagine the reaction if they said “To be honest, I just don’t know. It may go up or down. It also may stay the same.”

I think that would be their last appearance on that show. “Now back to Jim Cramer with his latest hot stock predictions….”

– Gross Domestic Income is going down = Recesssion.

Such goofball BS. It’s NOT going down. LOOK IT UP!!!

OK, I looked it up for you. From the BLS, Sep 28:

“Real gross domestic income (GDI) increased 0.7 percent in the second quarter, an upward revision of 0.2 percentage point from the previous estimate. The average of real GDP and real GDI, a supplemental measure of U.S. economic activity that equally weights GDP and GDI, increased 1.4 percent in the second quarter, an upward revision of 0.1 percentage point (table 1).”

https://www.bea.gov/sites/default/files/2023-09/gdp2q23_3rd.pdf

There is a “credit crunch” going on = Recession.

There is no credit crunch. Subprime lending got a little tighter, but that’s a small part. Some tiny startups with no business model might not get more funding. Stuff that should have happened a long time ago. But look at junk bonds and leveraged loans, they’re off to the races, LOL. You have no idea. Financial conditions have loosened like you wouldn’t believe.

Yes, it’s as though the markets are trying to front run the Fed’s pivot. If they Fed doesn’t pivot, they’re stuck with overpriced junk bonds.

Hi Wolf, thanks for the insights!

I’m not in the US but am reading in a number of different sources that tax revenue is down. Is this this true? If it is true would the lower revenues then purely be a product of tax cuts. It’s all very confusing, so thanks for helping us get our heads around what seems to be inconsistencies.

I’ll just repeat this here:

Tax receipts are down in 2023 from 2022 because capital gains taxes collapsed in 2023 because 2022 was a shitty year for capital gains with stocks and cryptos and bonds plunging. And so the Q1 and Q2 tax receipts, which include the capital gains taxes for 2022, fell. But capital gains taxes had a historic spike in 2021 and 2022, due to the huge amounts of money made in 2020 and 2021. And in 2023, they fell off that spike because 2022 was a shitty year for stocks, bonds, and cryptos.

Everyone knows this, and it has been predicted back in 2022, when markets were tanking. That’s not a secret. If bloggers or reporters didn’t figure this out, they’re idiots.

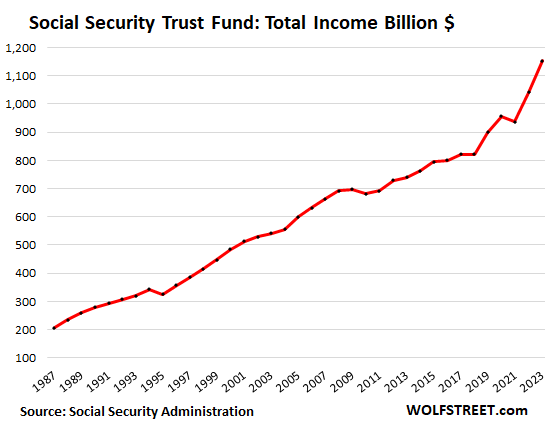

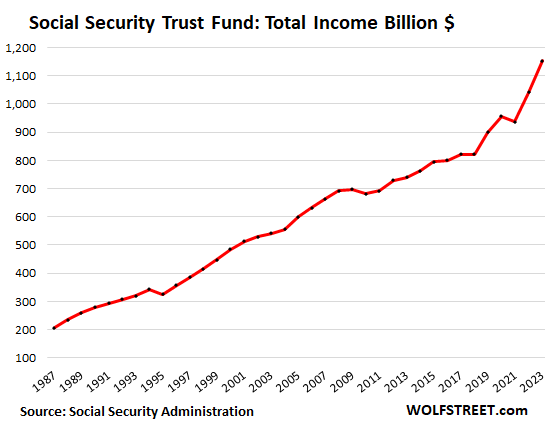

Employment tax revenues (social security contribution, etc.) spiked to a record in 2023 because a record number of people are working, making the highest wages ever:

For varying reasons I have spoken to a number of small business owners over the last 12 months. I have also looked at their books.

The one thing I see a lot of is small business owners saying we ARE in a recession. Their sales are down 10-40% versus previous years (depending on industry, Covid impact, etc).

Admittedly, my sample size is only 10 or so, so I’m wondering if anyone else is seeing this?

Be really really leery of extrapolating from a few small businesses for the overall economy. You will get company-specific issues that clog up the view. If a small business loses sales to another (larger) business, that’s not a sign of a recession. And that’s what happens a lot.

This is what matters, in Q3:

The huge trade deficit is a big negative to GDP, which is why those three add up to more then 100%, with the trade deficit and inventories bringing them down to 100%

The rich get richer. Not just for citizens, but businesses as well. Expect the wealth gap to continue to widen for both. For the have-nots it will feel like a recession/depression whereas the haves will have whatever they want when they want.

Our small manufacturing business in the truck transport equipment industry does not agree with this observation at the moment. Things have calmed down some from “peak crazy” but we are still buried in work. Production is up 20% above normal and we still aren’t really keeping up with demand. Every time I think we are getting slow, a pile of orders comes in and it pushes the slowdown horizon off another few months.

I think some is pent up demand from underproduction in 2020 and 2021. Some seems to be customers being scared of being left out of the equipment backlog so people are ordering earlier than they might have in the past.

Even a broken clock is right twice a day

“But the LEI predicted a recession for late-2022, early 2023, mid-2023, and late-2023.”

Best to watch for a few other indicators, such as when the 2 / 10 to un-invert. Then, we’re within the 6-month ‘danger window’.

An agglomeration of leading and co-incident indicators should all point to the same thing.

Looking at any one indicator can be a tad misleading, akin to seeing someone sneeze once (or even twice) and declaring they have C-19. Without additional context, how could anyone KNOW for sure what the symptom(s) are indicative of? Could the person who’s sneezing be suffering from an allergy (hay fever, grass, ragweed, pollen) or not (dust, chalk, etc)? More context is necessary.

This is why I don’t look at any one indicator by itself to determine whether we’re in (or out of) a recession, because usually 4 or 5 leading / co-incident indicators should all be clearly ‘sounding the alarm’ at the same time (or very close to the same time).

I saw from Eric Basmajian (EPB Research) today on X / Twitter that only 2 other times where TCB’s LEI index went this long in presaging a recession that wasn’t immediately imminent: prior to the 1974 and 2008 recessions.

And I believe those were both a doozy (the ’08 one I know was, but since I was -8 when the ’74 recession hit, I can only go by historical record, for that one).

Haven’t “double-dip recessions” usually been a near-equivalent ‘hell on earth’? And what sort of timeline would a double-dip recession need to meet to qualify for someone to call it that?

Lastly: the Fed broke the economy until at least 2031, and I’m sticking to it.

“…from Eric Basmajian (EPB Research) today on X / Twitter that only 2 other times where TCB’s LEI index went this long in presaging a recession that wasn’t immediately imminent: prior to the 1974 and 2008 recessions.”

I haven’t checked 1974. But the 2008 mention is BS. The recession redline trigger was breeched something like three months before the beginning of the official recession. It went very fast. The LEI predicted it but with little advance notice.

Odd that consumer expectations plays in. Perhaps it was historically true but most people think the economy is terrible but their actions show completely the opposite. It does make sense that it is conflicting because how we feel and think aren’t always consistent with our actions.

My spending is influenced by this publication as everyone talks about Voodoo Ranger so couldn’t pass on the Costco assorted case.

My prediction is the Fed finds an excuse to lower interest rates by mid 2024 so as to help the housing markets and continue to issue more 10 year and less treasuries and try to artificially keep inflation limited to avoid interest on debt to be under 3% of GDP. None of that is meant to be serious just showing anyone can pull a prediction from anywhere but doesn’t make it true. Schrödinger’s cat if you will.

Costco has an assorted Voodoo Ranger case now? I need to get in there ASAP. Not enough beer in the world though to deal with this “shtshow.”

10,000+ economists playing forecasters using $Billion in software, computer hardware, AI, data analytics, large data sets, dozens of econometric models, – yet cannot provide even a marginally reliable / accurate forecast than a few economists 50 years ago cranking out forecast calculations in long hand manually calculated formulas, with stubby pencils on ruled sheets of paper.

Our economists cannot forecast recessions and other major economic activities and our Intelligence agencies cannot forecast major international events, like wars, invasions, insurrections, coup d’état, etc.

Are we getting our money’s worth in these services?

We could just have a classic “Three body problem” on our hands. I thought it was cool sci-fi but perhaps it was an allegory instead of Western economic systems. Nah, probably cool sci-fi!

It takes expensive college degrees and years of experience for 10,000+ experts to agree on the timing of the greatest recession of all time.

Just wait until they start saying there will be no recession & everything is fine, THEN and only then you will know its time to worry…

Wolf:

Most of the previously formed market paradigms are proven wrong (don’t fight the FED; hiking ST interest rates would slow the economic growth and so on). I wonder if and when the recession comes, would it be just shallow and narrow (in duration) as they say or that would also be proven wrong (given all issues the country faces).

I would like to see someone compare this period to 1920’s (pandemic, what kind of response, the end of WW I and the distortion it caused) that seems to have gone to the level of shoe shine boys (or gentlemen) giving advice on stock purchase to crash and depression. Also worth knowing how many guns were in the public at that time Vs now. Another difference is that the (average) general population seems to be not that well off at that time and faced the depression, famine with not much turmoil. But now we have got used to living like kings, thanks to our global economic slaves (especially the Chinese) — which goes under the euphemism of Labor Arbitrage, — how we would take it as we get forced to slide to South (on the economic graph) too fast?

Things and conditions are different (especially information travel). Those factors also would complicate what we would see.

Recession predictions…blah blah blah.

If unemployment claims start climbing quickly then I will sell 20% of my portfolio, my trading positions (not my long term holds) and short the Russell 2000, or some volatile index that does more poorly during recessions, and hang on to most or all of my profits.

Meantime I am enjoying this ‘Santa Claus/End of Rate Hikes’ rally. I expect it to continue into tax selling in late December. Me and all of ‘Wall Street’ expect that…

Nothing but jobs matters…

I guess this is the essence of the Sahm rule — you have good company there.

Economics predicts nothing. Let’s try science.

Are you capable of writing a post that doesn’t brag about your money?

Einhal,

You said, “Are you capable of writing a post that doesn’t brag about your money.”

Einhal, you tickle me.

I’M SHOCKED!

STILL NO RECESSION??

🙀

In the early eighties, I read a textbook on investment that surprisingly listed war as being negatively correlated with recession. I read somewhere more recently that it’s not true and the long-run impact of warfare is definitely to reduce GDP — because of the destruction of capital caused by the war, if nothing else. Perhaps it depends it depends on whether you take into account only the effect on the economy supplying the equipment and munitions or the effect on both that economy and the economy of the battlefield as well.

However, in the short term, the additional demand created by the need to produce the artifices and consumables of war may well have the effect of delaying a recession that might otherwise have occurred.

This analysis would certainly be in keeping with the high deficit being run by the US Federal government right now, some of which presumably is going to support Ukraine.

Jonathon Searcy-

You might appreciate the book Banking and the Business Cycle

(1937, Phillips, McMahan, Nelson, available in print or PDF at Mises Institute). It’s a post-mortem pre-Keynesian examination of the roots of the Great Depression, including:

– War debt

– Other systemic leverage

– Industrial production (both wartime and rebuilding)

– Commodity inflation cycle, including post-war depression

– CB interventions and eventual dithering due to Ben Strong’s death

– U.S. investor speculation (especially German bonds)

– Fractional reserve banking and its role in credit expansion.

– A general belief that the authorities were in control, engendered in the infamous “permanently high plateau” comment by one of the world’s leading economists.

Fascinating and highly readable. Not by any means a blueprint for today’s situation, but surely much that rhymes. And it all begins with your war themed question (combined with the then juvenile central bank).

(I’m not a shill for Mises, but I do donate there, too!)

Great post, by the way…

JH/JS – …and never think for a moment that YOUR OWN life, or someone’s you love, might not be one of those ‘consumables’…

may we all find a better day.

Wolf would love to hear your thoughts on the following (disclaimer: I am no economist with no economic background)

When measuring GDP via the expense method the source of funds don’t matter as long as there is spending. If a sector is accumulating debt to spend, then it adds to the spending and hence the GDP.

The US saw high growth during 2003-06 because households were spending by taking on mortgage debt. And now it is the Federal government via huge deficits. It can be argued that recession is impossible as long as debt is accumulating fast enough.

But this comes to an end if

1. Productivity growth does not compensate debt growth resulting in higher and higher debt to GDP ratio.

2. Interest costs remain do not cause insolvency for sector accumulating debt.

Therefore recession risk is definitely low as long as deficits can be financed. But the recession becomes a certainty when deficits become expensive to finance. So in a way recession calls are a call on the creditworthiness of the US government.

Is this logically sound?

The government can fund an economic expansion for a long time by gradually increasing the debt-to-GDP ratio while reducing interest rates systematically over a few decades. The cost of servicing debt will remain unchanged until the zero bound is hit and interest rates cannot be reduced any more.

At that point, the government has to start printing money and doing helicopter drops. But when that stops working because inflation kicks in, you can pretend inflation isn’t happening or say its transitory. When that is proven wrong, you can try to BS markets into thinking you’ll take inflation down to 2% by saying policy is restrictive, when it’s really stimulative, and providing justifications for a gargantuan Fed balance sheet (a new ample reserve policy).

When that stops working, you can restart QE, print more money, get Congressional approval to buy stocks and other assets (as Yellen suggested earlier), and implement yield curve control to keep bond vigilantes in their place. That could buy several more years with a little help from the Wall Street propaganda operation.

Thanks for your thoughtful response Bobber.

I guess your prescription only works with a willing Fed (which has been the case for the past several decades). The ample reserves has prevented a take off on treasury yields.

Perhaps all these are policies and options till there is an eventual blow up. I guess everything ends in a bang :)

I tend to not subscribe to the Fed is looking out for the economy and creating full employment and price stability but are also political and of course wealthy. They are not beholden to politics in the same way Congress is but certainly influenced by it. They also have really no influence on how Congress spends so only a little influence on future debt and interest payments on those. Admittedly they have 14 year terms so perhaps they as apolitical as SCOTUS.

May be it is the government spending (the Pied Piper of the drunken sailors) – past and present – that is holding up the economy.

Also the tinkering in the issuance of debt terms such that it at least temporarily increases Government’s ability to borrow without increasing the all-important 10-year yield.

The value of any statistic that is supposed to have predictive power which includes the S&P 500® Index of Stock Prices as one of its components is suspect. The LEI should more appropriately be abbreviated LIE.

Hi Wolf – a dumb “big picture” question that is probably not worth your valuable time:

Is there an argument to be made that the powers that be have figured out how to precisely modulate the US economy like one would tune an FM radio knob?

With the recession never arriving, it seems that the calamitous downturns of the past century will simply not be allowed to happen anymore.

It feels riskier to bet ON a recession at this point than to bet against one.

No one can fine-tune a vast complex economy like the US economy. This economy thrives via chaos where everyone is doing their own thing to the best of their ability, and the thing just balloons.

Enlightened self interest is the best way to allow an economy to run. One can make a lot of money off of “economic inefficiencies”, if you can find them. Sometimes I have to spend time looking for them, they usually go away pretty quickly. But the biggest economic inefficiency in our economy today is the Fed, a committee of so-called experts who arbitrarily sets short-term interest rates. So I pile into T-bills. The Fed is a classic economic inefficiency in a market economy, although people don’t like to talk about it that way.

There is common ground in econ texts that it takes a year for a Fed move to take effect. A year and a half ago the Fed rate was .25%. Interest rates had been declining for 40 yrs. Until less than 2 yrs ago, they had reached the lowest REAL rates in centuries, or in the opinion of a London banker, in 5000 years.

We are in the first real tightening in 40 years. Are the drunken sailors paying attention, tightening up, sobering up? Not as long as credit lasts.

A Mr. Carrick, writing about the Canadian RE market in the Globe and Mail, had a piece: ‘Thoughts on buying into a falling market’. You would think that the obvious advice is ‘don’t’, but he qualifies this because, after all: ‘there have only been 2 downturns since 2001’.

Carrick looks and sounds about 40-50, so for him 2001 is a very long time ago. There must surely have been several cycles by 2023?

Actually, no. We are only halfway through ONE cycle. Interest rates fell for 40 years, via massive increases in govt debt. Now they are returning to reality. It was silly to predict that this would strike the consumer in three months, or six months. It will strike him when he runs out of credit.

We are already in recession. Look at the long term rates. Look at the recent job report.

Nonsense. People have been saying the same copy-and-paste BS for 18 months.

The strikes showed up in the manufacturing numbers — see the drop in manufacturing jobs. Those people are all back to work now, or will be soon, which will cause a spike in manufacturing jobs.

Read more here:

https://wolfstreet.com/2023/11/03/manufacturing-jobs-hit-by-strikes-job-growth-still-decent-we-look-at-trends-in-part-time-jobs-plunged-in-oct-self-employment/

And by industry category:

https://wolfstreet.com/2023/11/03/which-industries-lost-jobs-which-gained-jobs-longer-term-employment-trends-in-charts-by-segment/

Here is total payrolls, looks pretty good, doesn’t it? And lots of people went from part-time to full-time, and that’s good news isn’t it? So make sure you both linked articles, they explain it with charts.

My gut feeling is the K shaped recovery is hiding a K shaped recession. The poor have been in a recession since 2022 when inflation hit hard, but the middle to wealthy are keeping the spending going.

Your average home owner has tons of equity, a reasonable amount invested, and lots of disposable income if they bought homes precovid. The wealthy are doing great.

Yep. The wealthy got most of the $4 trillion that was printed and remains printed.

You can’t get a numbers recession when the Gov’t is spending like drunken sailors….

GDI…..

Tax receipts…

That’s your indicators…ask Lacy Hunt

Goofball BS on both counts.

1. GDI is NOT down. It rose! From the BLS, Sep 28:

“Real gross domestic income (GDI) increased 0.7 percent in the second quarter, an upward revision of 0.2 percentage point from the previous estimate. The average of real GDP and real GDI, a supplemental measure of U.S. economic activity that equally weights GDP and GDI, increased 1.4 percent in the second quarter, an upward revision of 0.1 percentage point (table 1).”

https://www.bea.gov/sites/default/files/2023-09/gdp2q23_3rd.pdf

2. Tax receipts are down in 2023 from 2022 because capital gains taxes collapsed in 2023 because 2022 was a shitty year for capital gains with stocks and cryptos and bonds plunging. And so the Q1 and Q2 tax receipts, which include the capital gains taxes for 2022, fell. But capital gains taxes had a historic spike in 2021 and 2022, due to the huge amounts of money made in 2020 and 2021. And in 2023, they fell off that spike because 2022 was a shitty year for stocks, bonds, and cryptos.

If Lacy Hunt didn’t figure this out, he’s an idiot. Everyone knows this, and it has been predicted back in 2022, when markets were tanking. That’s not a secret.

Employment taxes spiked to a record in 2023 because a record number are working, making the highest wages ever. DUH:

*We will get a business-cycle recession eventually because there always is a business-cycle recession eventually because it’s part of the business cycle. The question is when.*

I would add, the question is what kind of recession, shallow or deep, and most importantly, how would central banks react to this recession?

There are 9.6 million job openings and 6.5 million unemployed persons. Why is Wall Street going nuts, predicting up to 275 basis points of rate cuts next year? Wall Street has been wrong six times in a row about the direction rates would move in the future. What makes them right now? The ten trillion dollars dumped into the economy in a knee jerk reaction to the pandemic is still out there circulating and recirculating every day. The debt service burden is lower than ever due to massive mortgage refinancing at rock bottom rates that occured a few years ago. Wages are *way* up since Jan 1, 2020 for just about everyone. If the Fed cuts rates antime soon, it would be a dereliction of its duties.

“Why is Wall Street going nuts…?”

Great question, LOL

That’s a feature, not a bug of Wall Street.

Do you foresee any troubles related to the falling yields lately? Seems to me the government will need yields to be relatively high to finance their drunken sailor deficit spending and Wall Street is working at cross purposes to them. Or is this just a temporary squeeze that will play out?

Not a problem. If not enough buyers line up at current yields (I’m not lining up), yields will rise until they’re enough buyers. Yield solves all demand problems.

The drop in yields is a sign of huge demand (due to the kind of brainwashing I describe this article?).

I sold a bunch of Equities and Bonds.

Bond (ETFs) have rallied so hard you can sell them w/o a loss.

Put your money in a money market at 5.3% and buy them back on the next dip.

Hoping inflation comes hot and I can buy them back in Dec/Jan.

Current Pivot expectations are nuts.

Everyone is FOMO locking in longer yields, because “inflation is slain and a recession is coming.” Lololol

Wall Street is going nuts because there are enormous amounts of excess capital in the world economy, and lots of it gets invested in the US capital markets because they are the relatively well regulated and open.

It’s a result of the US willingness to allow free flow of capital that has kept Wall Street so profitable. Neither political party shows any inclination to change this.

Yeah, but Wall Street’s timing points to the belief that the Fed will soon cut rates. Financial conditions today are superlatively loose. Why would the Fed cut rates anytime soon? To make financial conditions even looser?

My spouse seems to think there will be an imminent economic crash.

I am more neutral.

I am speculating here, but perhaps citizens of this country are in a more stable financial situation. There have always been poor people who get chewed up and will be there for the foreseeable future.

My hunch is many people have learned some very hard lessons about money/finances/corruption/incompetence and so on after the 2008 crash.

Lots of paid off houses out there, lots of people keeping debt very low on purpose. Or using their credit cards like I do, paying it off every 2 weeks to get rewards.

I have tried to live this way for decades now, maybe it is in vogue. I am finally part of the “in” group!

I always tell my daughters debt enslaves you. Do not be a slave.

Perhaps the recession indicators haven’t worked due to greater lags caused by the “helicopter money” which has taken time burn off?

That’s one hypothesis.

You can’t tell the sailors when to stop drinking. It only stops when he fell overboard into the ocean.

With employment < 4% and 5%plus FED deficit of GDP, you can't have a slow down in economy. I don't see Congress have the gut to cut anything to bring budget to a sound level. Wait until the next Repub elected as President, we will be in another tax cut mode. As long as people around the world buying our bonds and funding out life-style, life in the US goes on as usual and our printers are happy to oblige.

Howdy Folks. Waiting for a Recession? Soup lines to return? No help needed signs? Govern ment papered over all of that and already picked the winners and losers for US. Will Govern ment have a Recession and what will that look like ????????

This might be irrelevant, but are we still seeing impacts of left over free money or the profits derived therefrom?

I love your imploded stocks articles, there seems to still be a lot of “free money” for those to burn in their cash furnaces. Do you view them as Canaries in the coal mine or a separate part of the overall economic picture?

Any majors circling the imploded stocks drain pipe, or do you see the prospects for the list starting to wane?

Hope this isn’t too far off topic but it somehow “feels” like its part of the overall situation.

I don’t see how you can forecast a recession unless the transaction’s velocity falls. We don’t have a valid velocity figure since the FED discontinued the G.6 Debit and Deposit Turnover release (then the longest standing release), we have to fall back on the growth of:

Large Time Deposits, All Commercial Banks (LTDACBM027NBOG)

High interest rates & expectations of higher prices have been both cause and effect of rising rates of Vt.

The importance of Vt in formulating – or appraising monetary policy derives from the obvious fact that it is not the volume of money which determines prices & inflation rates, but rather the volume of monetary flows (M*Vt) relative to the volume of goods & services offered in exchange.

If Oct 2022 low to July 2023 high is X, QQQ & SPX retraced 38% of X.

Option #1 : it might get worse. Option #2 : a spring to a new all time high.

If the rich are getting richer and the poor getting poorer, does that not mean that the poor are in a recession, if they are getting poorer. So, I guess we have to measure what percentage are getting poorer to see if half the country is in a recession.

As others have said, I don’t see a recession until Gov spending rate of increase is reduced. Or they destroy the dollar. When GDP includes gov spending then they can keep the GDP propped up for a long time.

These measurment tools cannot predict this recession because of extraordinary times we live in. Everything is masked by the gargantuan amount of QE, so there seem to be a lot of false flags. But eventually it will come and then everone will be surprised and burned by it.

Thank you for the response Wolf!

“…when I can wrap my brains halfway around it.”

Your posts are always very informative and insightful. Much appreciated too!

I kind of figured you had more than one brain! :)

The answer always has to do with supply and demand (my humble opinion). I think you were on the right track in a previous article when you mentioned we haven’t quite burned through the QE supply of money.

The economy, like the weather, politics, or any complex system is basically impossible to predict more than a few days out.. if even then. Doesn’t stop people from trying!

The GDP equation does not account for spending deficit, and deficit spending is included. Therefore, treasury borrows $1.7 trillion and it is spent. The deficit raises debt by some 8% of GDP but GDP only goes up by some 3% or 4%. If the debt (particularly debt financed with printed money) increases by more than GDP we are in contraction.