Some are hot, some are very cold.

By Wolf Richter for WOLF STREET.

In terms of employment, some industries are red hot, some are slowing, some are dealing with layoffs now after a huge surge in hiring recently, and some are in long-term decline. A declining trend over the years can stem from a structural change, such as changes in demand, or automation, or the shift of retail sales from brick-and-mortar retailers to ecommerce, which replaces typical retail employees (so they decline) with employees in warehousing, transportation, and various technology fields (so they gain).

Earlier today, we discussed overall job growth, the plunge in part-time workers, the self-employed, multiple jobholders, and the surging hourly wages of nonsupervisory employees (here), based on data from the Bureau of Labor Statistics. Now we’re going to look at employment in major industry categories in the private sector and in government.

The private sector.

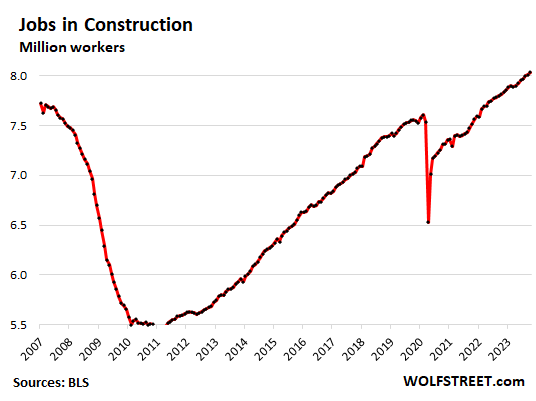

Construction – all types of construction, from powerplants to single-family housing:

- Total employment: 8.0 million

- 1-month growth: +23,000

- 3-month growth: +66,000

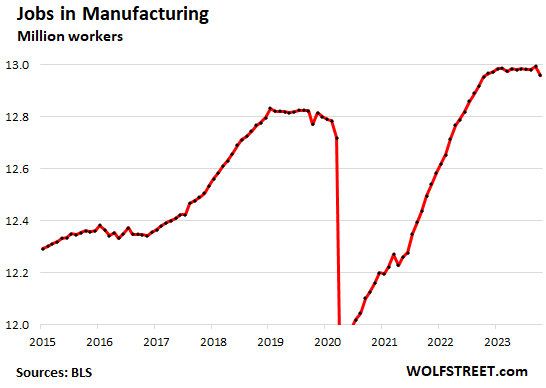

Manufacturing: After leveling off in recent months from the post-pandemic boom, employment in October got hit by the strikes in the auto and auto-parts sector, which lost 33,000 jobs in October, “largely” due to the strikes, according to the Bureau of Labor Statistics. As we already know, many of the strikes either have been or are on track to being resolved, and many of these workers will be back in November.

- Total employment: 13.0 million

- 1-month growth: -35,000

- 3-month growth: -23,000

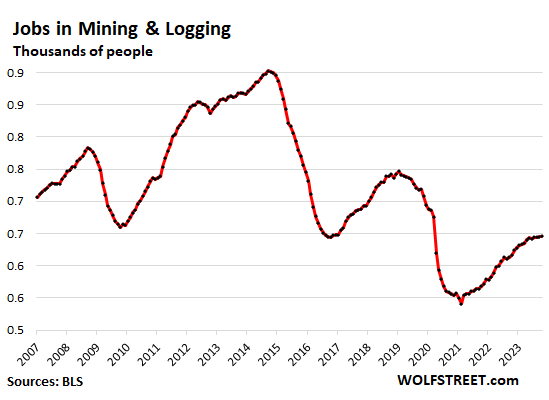

Mining and Logging:

- Total employment: 646,000

- 1-month growth: +1,000

- 3-month growth: +2,000

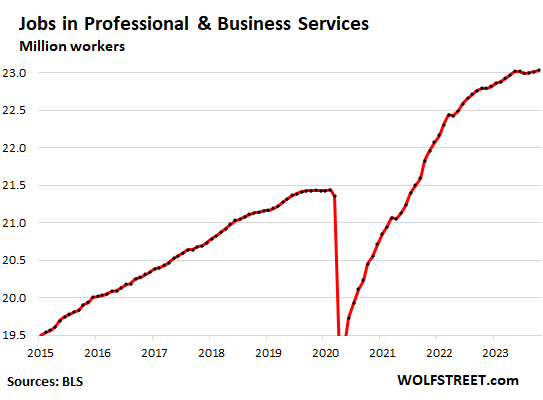

Professional and business services, the largest sector by employment, includes Professional, Scientific, and Technical Services; Management of Companies and Enterprises; Administrative and Support, and Waste Management and Remediation Services.

Some of the tech and social media companies are included, others are in “Information” (below) or in other categories.

- Total employment: 23.0 million

- 1-month growth: +15,000

- 3-month growth: +40,000

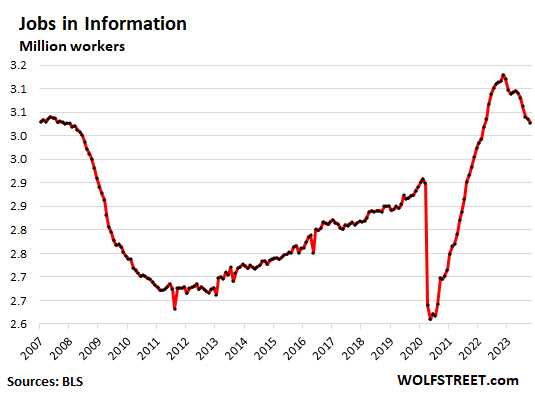

“Information” is a small sector that includes web search portals, data processing, data transmission, information services, software publishing, motion picture and sound recording, broadcasting including over the Internet, and telecommunications. Some of the tech and social media companies with big layoff announcements are included here.

The sector has been losing jobs since the peak in late 2022 after the blistering hiring boom during the pandemic. Employment in the sector remains way above the pre-pandemic levels and is roughly where it had been during the peak of the dotcom boom.

Some of Alphabet’s operations are in this category. The company announced huge layoffs in January for its Google division. I discussed its actual headcount, including a chart of its headcount — rose in Q1, fell in Q2 but only by a portion of the layoff announcement, then rose again in Q3 — here.

- Total employment: 3.03 million

- 1-month growth: -9,000

- 3-month growth: -35,000

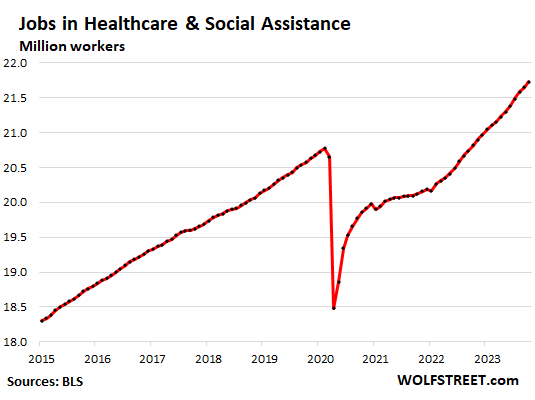

Healthcare and social assistance:

- Total employment: 21.7 million

- 1-month growth: +77,000

- 3-month growth: +243,000

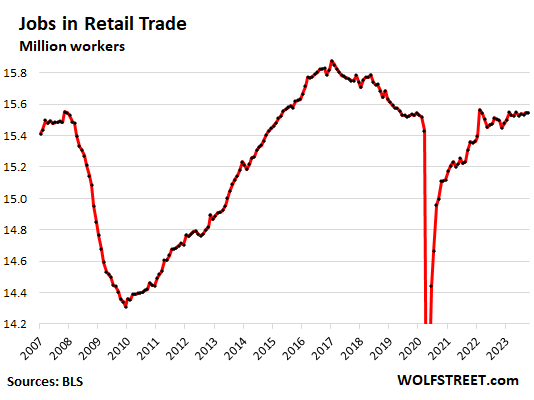

Retail trade includes workers at brick-and-mortar retail stores – malls, auto dealers, grocery stores, gas stations, etc. – and other retail locations such as markets. It does not include the tech-related jobs of ecommerce operations, and it does not include drivers and warehouse employees. A big portion of this sector has come under heavy pressure from ecommerce operations:

- Total employment: 15.5 million

- 1-month growth: +1,000

- 3-month growth: +8,000

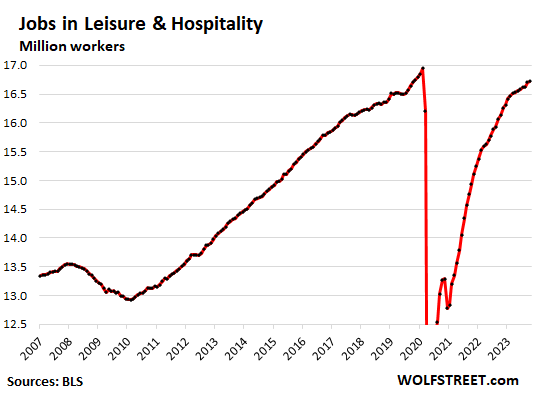

Leisure and hospitality – restaurants, lodging, resorts, etc. – is almost back to pre-pandemic levels. This sector has had a hard time hiring, as working conditions are often tough, including split shifts and weekend and evening work, and pay can be lousy.

- Total employment: 16.7 million

- 1-month growth: +19,000

- 3-month growth: +101,000

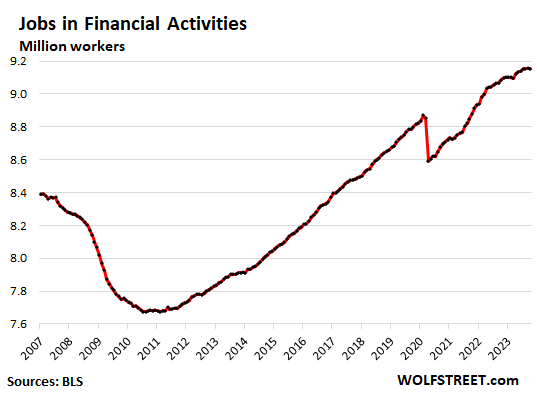

Financial activities include finance and insurance plus real estate (renting, leasing, buying, selling, and management).

- Total employment: 9.2 million

- 1-month growth: -2,000

- 3-month growth: +1,000

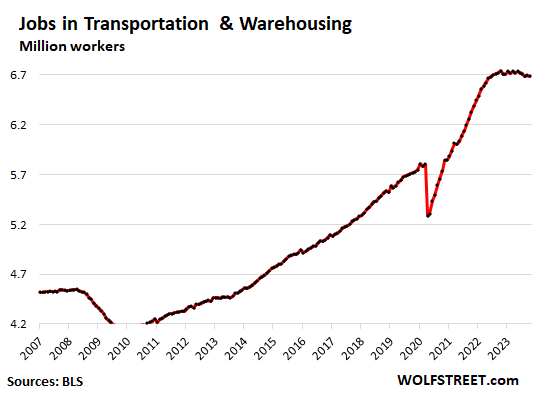

Transportation and Warehousing:

- Total employment: 6.7 million

- 1-month growth: -12,000

- 3-month growth: -27,000

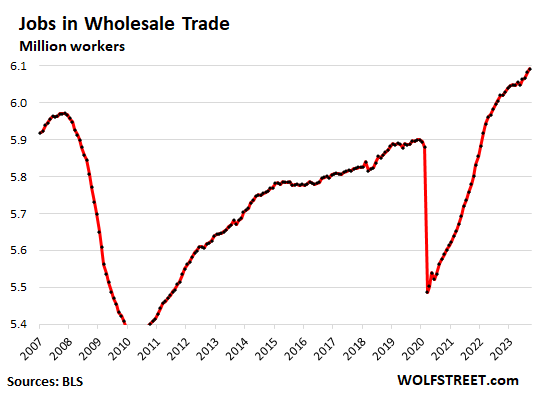

Wholesale Trade:

- Total employment: 6.1 million

- 1-month growth: +9,000

- 3-month growth: +28,000

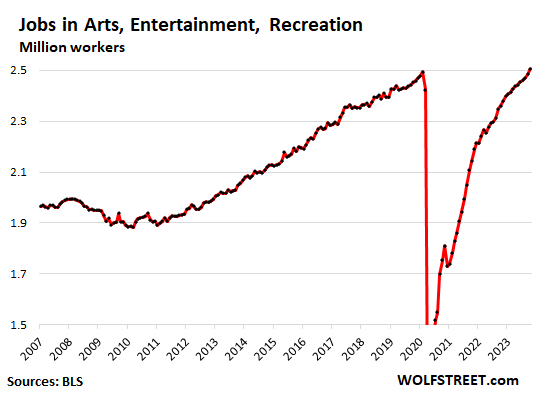

Arts, Entertainment, and Recreation includes spectator sports, performing arts, amusement, gambling, recreation, museums, historical sites, and similar:

- Total employment: 2.5 million

- 1-month growth: +20,000

- 3-month growth: +45,000

The gubbermints, oh dearie

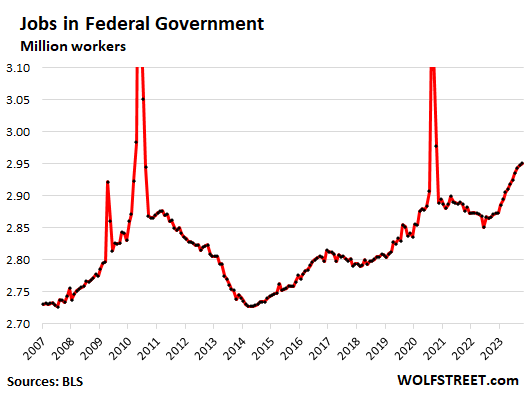

Federal government civilian employment: the spikes occur every 10 years when the census is taken.

- Total civilian employment: 2.9 million

- 1-month growth: +3,000

- 3-month growth: +16,000

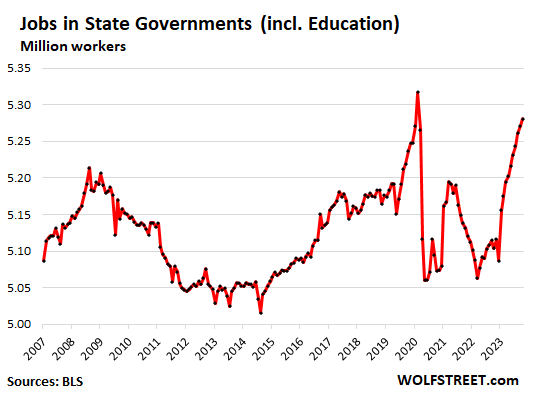

State governments (includes education, such as at state universities).

- Total employment: 5.3 million

- 1-month growth: +10,000

- 3-month growth: +38,000

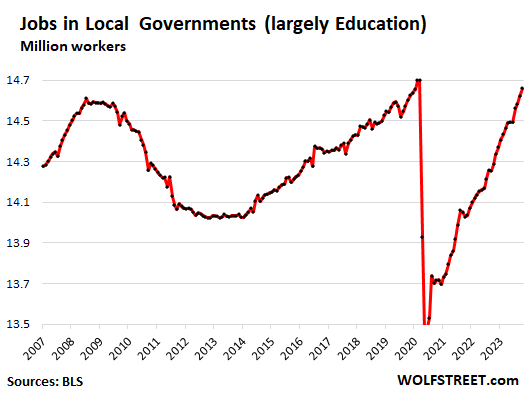

Local governments – employment is dominated by education, such as teachers. After the pandemic, school districts found themselves with massive teacher shortages.

- Total employment: 14.7 million

- 1-month growth: +38,000

- 3-month growth: +99,000

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

I work in IT for the state. Do all state jobs get lumped together or would I be in the information category? Always lot of hiring in the Federal, State and county levels as modernization is just starting with a lot of IT systems that date back to the 1970s. Can’t even find some of the skill sets as there are still programs in assembler and IDMS.

Yes, if you work for the state, no matter what you do, your job is part of state employment.

Ditto. I work for local gov in transit. A lot of small transit agencies (areas where pop os less than 50k) are now moving from hand counting ridership ON A PEICE OF PAPER to installing APC (automated passenger count) equipment on their buses and cutaways

I can’t sleep on a Friday night, so I came here for the comments. Based on the slope of the chart for construction, I’m assuming there’s some room for growth.

On my way to the local CNG station, I noticed what looked to be a former mid-rise office building belonging to a bank being demolished. Possibly the first of many in that business district. It’s a beautiful area overlooking the Mississippi River, my guess is more apartment buildings will pop up there.

By the intensity of that Cat 5 hurricane in Mexico (and the catastrophic high rise damage), if NYC ever is hit with a 5, it’s going to be bye bye buildings.

That will be the largest loan to a state in the history of the nation.

I wonder if the stories about NYC being underwater at the end of the century are true. If it’s bogus, and the powers that be choose to rebuild, then yeah that would be a historic building boom. For the young people that are in good health, and want to make six figures in less time than it takes to get a college degree, they should get into construction.

Union apprenticeship programs are a good start. Best thing is to then work for yourself.

Fascinating that federal payroll shrunk from 2008 through 2014 then headed higher with each 4 year election cycle . I was very surprised to see the federal government shrink in numbers. Maybe military spending ? Just a guess ? Now headed higher again.

All while federal offices are now 80% vacant. Just amazing.

Well they need a place to try thugs, cheats and wannabe mob boss presid… woops, too soon?

Heh

I’m guessing here but I remember the push to outsource a lot

of work to the private sector that was previously done by government employees. Of course the short term savings later

disappeared when the contracts were renewed.

Note that the civilian employment at the Federal government is just a little larger than “Arts, Entertainment, Recreation.” It’s just a small fraction of the largest industries. It’s really fairly small number, 2.9 million out of 161 million workers.

I don’t know if the statistics reflect this but as a long time federal employee I saw a sustained trend over many years of hiring freezes on federal employees and a sustained increase in contractors employed by Uncle Sam. In other words, outsourcing jobs to the private sector. When I retired from the FAA, the agency had roughly 48k actual feds on the payroll and a nearly equal number of contract employees. I’m fairly certain this is true across the federal government.

Wasn’t that the time of “sequester”? The last time there was restraint in the federal government.

This is civilian employment only, not military.

The state government chart look weird to me. Could you comment on that.

Higher education and other state learning institutions shut down for part of the time during the pandemic and then switched to learning from home. Lots of staff didn’t work. And then they eventually came back or were hired to fill the open jobs. The variation of top to bottom was about 300,000 workers of 5.3 million total, so that’s a little less than 6%.

As I recall, Wolf discussed the Bay Area tech industry basically engaging in a competitive accumulation of office space in anticipation of future needs that have to date not been realized. The net result being an over-accumulation of space that created in effect a bubble that has since been popped due to the work from home phenomena and other factors. According to an article published in the San Fran Chronicle: San Francisco’s office market hit another grim milestone in the third quarter, with a record-high 33.9% vacancy rate — nearly 30 million square feet listed for lease or sublease — according to preliminary data from real estate brokerage CBRE.

I wonder if a similar phenomena has occurred with hiring, meaning tech companies, fulfillment companies, etc. have competitively overhired based upon future expectations that may or may not be realized? If true, will there be massive layoffs and firings of should the economy ever start to falter? Going back to the explosion in office space vacancies, very few analysts, property management companies, and market pundits saw this coming. Will the same thing happen with employment, if not with overall employment perhaps in certain sectors?

“I wonder if a similar phenomena has occurred with hiring,…”

Yes, and I even made a whole podcast out of this back in January 2023. I highly recommend listening to it:

https://wolfstreet.com/2023/01/22/the-wolf-street-report-whats-behind-the-mass-layoffs-in-tech-social-media/

Obviously, it’s a lot easier to get rid of people than it is to get rid of leased or owned office space. So they shed people starting in mid-2022 through the spring of 2023, and now most of the shedding is done, and they’re hiring again, but more slowly.

Here are Alphabet’s numbers — the huge layoff announcement versus its actual headcount, including a chart of its actual headcount, which rose in Q1, fell in Q2, and rose again in Q3:

https://wolfstreet.com/2023/10/25/alphabet-shows-the-mega-layoff-announcements-were-just-that-headcount-dropped-far-less-and-is-rising-again/

Thanks, Wolf.

Slim checking in from Tucson.

I have a friend who owns one of our city’s largest and oldest fulfillment houses. According to her, employee hiring and retention are ongoing challenges. She couldn’t over-hire if she tried.

Businesses are amazingly creative at what they do. I am in Sacramento so massive amount of government. The pandemic, and post pandemic(because of 60-100% teleworking) wiped out a lot of small businesses, especially restaurants, but many new restaurants have returned focusing on different clientele. The big challenge for the city is the decline in parking revenue which was helping to find Golden One Center. Many retail spaces are being rezoned and turned into housing with a focus on smaller units with no parking spaces and such. Interesting to see the evolution and the jobs that go and those that return.

If the pandemic and the lockdowns created such an economic boom, why not have them every year? In reality, there will be hell to pay through stagflation, we’re only getting started.

I like seeing that construction chart. The infrastructure and chips bills must be helping there now. Earlier in the chart there was probably a lot of multifamily which I dislike. I wish the rich had to live in them.

Wait till you see the chart about spending on factories, coming soon. Semiconductor plant stimulus, avoiding China, whatever, it’s quite a stunner, and sorely needed.

Thomas Curtis

Multifamily … “I wish the rich had to live in them.”

The rich “choose” to live in them. They don’t “have to,” LOL.

It’s certainly not the poor that live in them in places like Manhattan, San Francisco, Boston, etc. Check the rents. Zillow says the average 2-BR in SF rents for $4,000 a month. That’s average. A nice unit with views etc. quickly goes to $6,000.

So there is a concept that you need to understand or else RE investment will never make any sense to you: “renters of choice.” People with plenty of money who “choose” to rent for a variety of reasons, builders are building for them.

Multifamily includes condos, and they’re not cheap in those cities, dude! Zillow says a median condo costs over $1 million in SF.

Nearly all the multifam that got built over the past 10 years in the big urban cores are higher-end units for “renters of choice” and expensive condos — which is of course part of the housing problem, that they’re building multifam for the rich, because that’s where the money is.

Where the old St. Paul Ford factory used to be, home of the Ranger truck in its last days, there’s a ton of very upscale townhouses and condos that have been built. Construction is non-stop, and running very strong on building what look like “pods” that are six or so stories high. These things just keep multiplying, like something out of Sci-fi movie, I swear.

Multi family & senior living are the two main types. Prices run from about $500k to $1.5M. Ryan Companies has the contract for development. They are making bank!

Located just to the east and south of Mississippi Lock and Dam No.1; they are along a fantastic stretch of road and trails for running and cycling. Being Minnesota, lots of people out roller-skiing this time of year. Wolf, you’d enjoy skiing along the river’s groomed trails where this is. Winter is near . . .

I’ve been wondering why you’re not cross-country skiing. It’s the perfect winter sport for cyclists (in addition to cyclocross). Greg LeMond and his ilk always did part of their winter training up there in your bailiwick on skis.

Yes, I’d love to cross-country ski without having to deal with the effects of going from sea level to 7,000+ feet in three hours and then doing a very strenuous sport. This altitude is getting tougher on me every year because I’m seemingly not getting younger or whatever?

As a boy, at age three, I was skating. The proverbial rink-rat, and hockey was my sport. My maternal grandfather raced on the velodromes over a century ago. Biking is in my blood. And I always biked to train for hockey.

Bike racing replaced hockey when I graduated from University. There’s a Zen I get from riding, that for me that is unmatched by anything. A fast ride for an hour each day is my addiction. Why quit, when I can get my fix again tomorrow? Plus, I have the gear to ride outside in winter, so that’s what I do.

Seems to be working, so far anyway.

Wolf, move to Reno. You’ll be acclimated and you can still do your swimming in Sparks Marina ;)

Sure renters of choice exist, lots of them.

Probably more that rent by necessity.

In general renters can have extremely different experiences depending on the city, location and complex they live in.

Do read the comments renters leave at apartment websites. Its like much elsewhere: some will say its a good place to rent, others will list 3 to 7 reasons why its a terrible place to rent.

Who’s telling the truth… maybe both are.

I live in one such complex, eastern Washington state. Its been okay for me, decent maintenance people, but I do get stuck shoveling a lot of snow every year (sidewalks no big deal, parking lot more problematic).

I owned a home for 10 years (lost $$ on it…nice area, bad timing, Rowlett TX, 80s-90s).

I have rented in Rome, NY (east of Syracuse), Dayton, OH, Red Bank and Ocean Township, NJ, Redwood City, CA, Garland, TX, Lynnwood, WA, and eastern Washington state.

No terrible experiences other than my current apartment when for nearly 2 years I had a very loud (voice) resident below me. Fortunately no drug dealers or entitled I can-play-loud-music-whenever neighbors.

See my other comment about renting.

I’m not poor but definitely not rich.

This website has a certain affluence vibe to it.

I dont dislike wealthy people in general but kind of wish the commentators were more down to earth people.

My apartment rents for $895 a month. Low end for a 1 BR in eastern Washington.

Most commentators here probably are of a libertarian bend. I am and I am not, both.

I wish citizens…consumers…had some say in the products (services) produced in this country. I dont think that quite qualifies as socialism…call it consumerism. I’m suggesting they quite literally define the requirements, specifications, attributes for some (not all) of the products produced in the US.

As such, the not so rich singles like myself as well as childless couples could opt for low priced, small but not quite tiny, basic homes and apartments. And homebuilders would have to comply with our desires… in proportion to our numbers.

I have a relative who lives in Basalt, Colorado (near Aspen).

I figured it would be expensive and indeed the housing was per my quick scan of real estate there. New construction 2 to 3M. Condos over 1M. Definitely out of my range. That’s ok. Just need to build more low end as well.

I vote consumers have more voice in our Democracy !

Consumerism ?,

“As such, the not so rich singles like myself as well as childless couples could opt for low priced, small but not quite tiny, basic homes and apartments. And homebuilders would have to comply with our desires… in proportion to our numbers.”

Who is going to pay for building apartment buildings whose future rents will never pay for the interest, the property taxes, maintenance and repairs, etc.? The taxpayer. And that’s already happening in subsidized housing.

Construction is so expensive in many areas that developers cannot build low-end apartment buildings and make them work financially. They won’t even get funding for it because they’re projections based on lower rents will show that the building will default on the mortgage. They’re building higher-end because that’s what works. Lower-end renters rent in older buildings.

Wait, why do you dislike multifamily? I understand not wanting to live in one yourself, but there are many, many people, some poor, some rich, and everywhere in between, that don’t want to do the maintenance that a single family home requires, and are glad to share the costs and responsibilities.

Just seems like a weird statement to say you “dislike” multifamily.

Einhal – perhaps TC meant to say ‘crowds’…

may we all find a better day.

“Wall Street is thoroughly pissed off at Powell and wants him to change course, cut rates, end QT, and restart QE. That’s what the rich want him to do. And they’re throwing all kinds of BS at him because of it. And you’re bitching about what exactly?”

Are you pretending to be naive?

SPX went from 2200 — 4400 now, House price +50% now, Rich and those max leverage-10-house-folks are still laughing all the way to the bank.

Wolf, you are picking a strawman argument.

Net-Net as of now, Fed still printed over 4 trillion.

Yet from your messages and blogs, Net-Net you praises Fed way more than the critics you gave in 2022.

And yet here you are, pretend does not know why people who work hard, and save are angry? lol.

Powell must have enrich your assets in San Fran a lot that huh.

“Are you pretending to be naive?”

Nah, I’m just looking at a 3-year chart. All major indices are down from where they’d been over two years ago. Traders had a good rally over the past five days. But people with long-term broad stock funds have lost money over the past two years. Bond investors got crushed. Crypto investors got totally crushed. Look at a 3-year chart of these things. Now compare that to the era of QE when stocks only went up.

Crypto investors and long-term stock fund holders only got crushed if they “bought in” at the highs. Otherwise, most of them are still doing very well. I don’t agree with Sean that you’re being naive, but I can tell you that many of my peers (30-42) are angry and frustrated that housing prices are doing what they’re doing.

Many are hoping for the housing market to crash, and think the Fed should forcibly speed the process up.

Expect prices to shoot higher as rates slowly drop over the next two years. The only way out of the housing mess at this point is tax policy changes that make homes an unattractive investment assets. They literally can’t build homes fast enough to solve the affordability crisis within the next few years. The only way to make homes affordable outside of tax policy changes is massive unemployment. The Fed is in a box, since either raising or lowering rates from current levels will decrease housing affordability, barring truly massive unemployment.

Prices haven’t dropped as much because people are expecting a pivot. A slow drop isn’t going to cause them to “shoot higher”

@Einhal,

I wonder what Wolf thinks about the potential for home prices to move higher if interest rates fall slowly?

“In which world is the Fed doing an awesome job?”

Bobber, very well said. Bravo!

To many who said recession or deflation is bad for poor. Well, Poor has the safety net of (1) Unemployment Benefits (2) Various Federal and State Subsidies. So in the worst case of recession, their wealth and life is not much disrupted. I dare say this because My in-laws are considered in poverty, and I can assure you guys recession does not affect them, given all kind of benefits they are enjoying now.

Also, if my memory serves me well, I read something like World Bank did a study back in 201x about history of Deflation, and found that there were ABSOLUTELY no concern.

So where is the social justice, when I see Max-10-house-leverage folks laughing all the way to bank, beneficiary of Easy Powell money printing even in face of 10% inflation?

“To many who said recession or deflation is bad for poor.”

Who said that?

“Which Industries Lost Jobs, Which Gained Jobs: Longer-Term Employment Trends in Charts” – This article provides an insightful analysis of employment trends across different industries. The charts and data presented offer a comprehensive view of the job market, making it a valuable resource for anyone interested in economic trends and labor market dynamics.