Mortgage rates dropped a lot, but not nearly enough to hit the magic level that thaws out the housing market. Now they rose again.

By Wolf Richter for WOLF STREET.

Hype in the media about real estate going to the moon or whatever is a never-ending drama. For example, on CNBC this morning, we read this headline: “Mortgage demand jumps nearly 10% to start the year, even as interest rates tick up again.” Which was a joke?

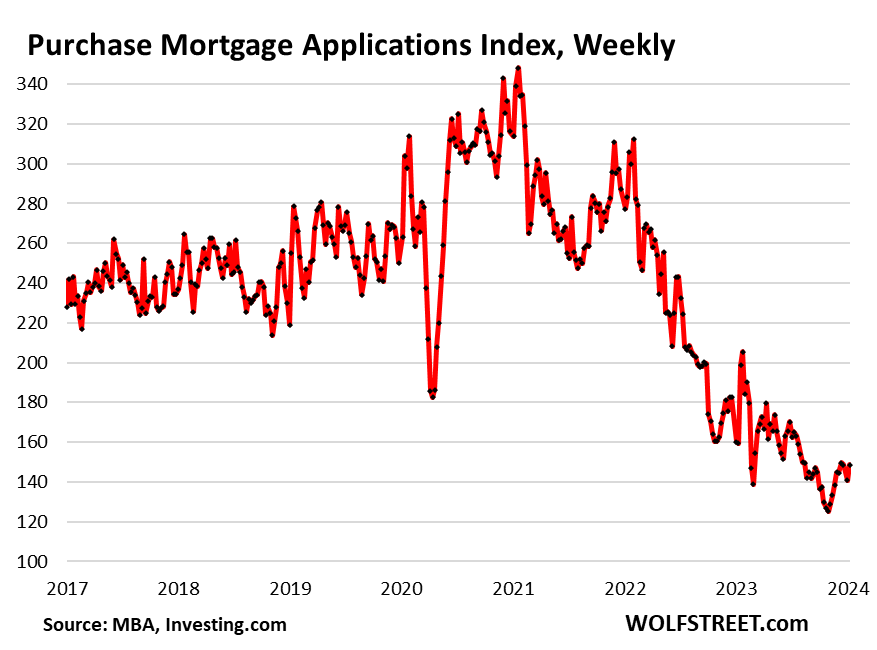

This was in response to data by the Mortgage Bankers Association today that mortgage applications to purchase a home during the week ended January 5th had risen by 6% from the prior week, seasonally adjusted. But in that prior week, applications had plunged from the week before the holidays, and so today’s reading didn’t even go back to where it had been two readings ago, and was down from the same week in:

- 2023: -16%

- 2022: -48%

- 2021: -56%

- 2019: -42%

That tiny uptick today barely registers in the three-year 50%-plus plunge of mortgage applications to purchase a home, which in late 2023 had hit the lowest levels in the data going back to 1995 as the housing market has frozen up:

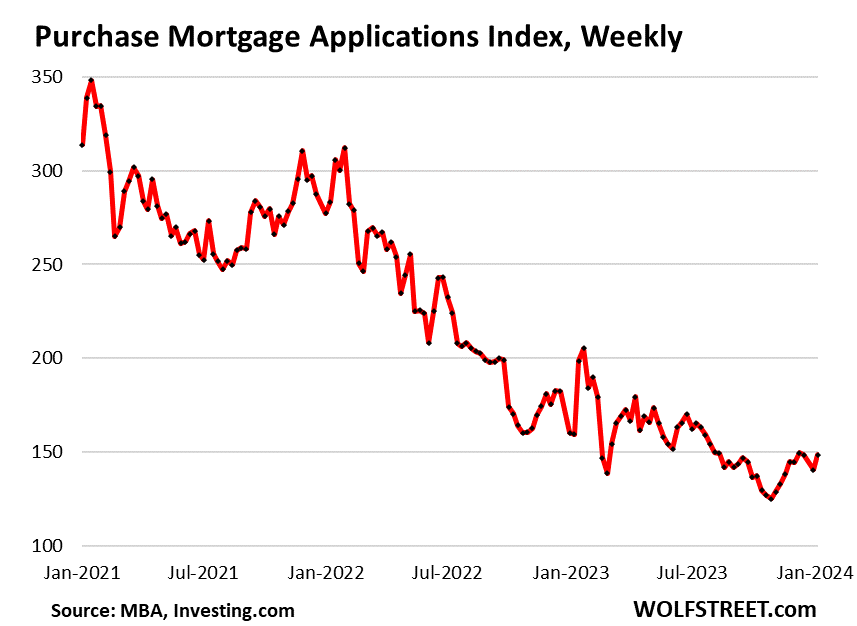

Even in the close-up of the three-year decline, that tiny uptick today is hard to see amid much bigger ups and downs, and the total remains near the historic lows of last November:

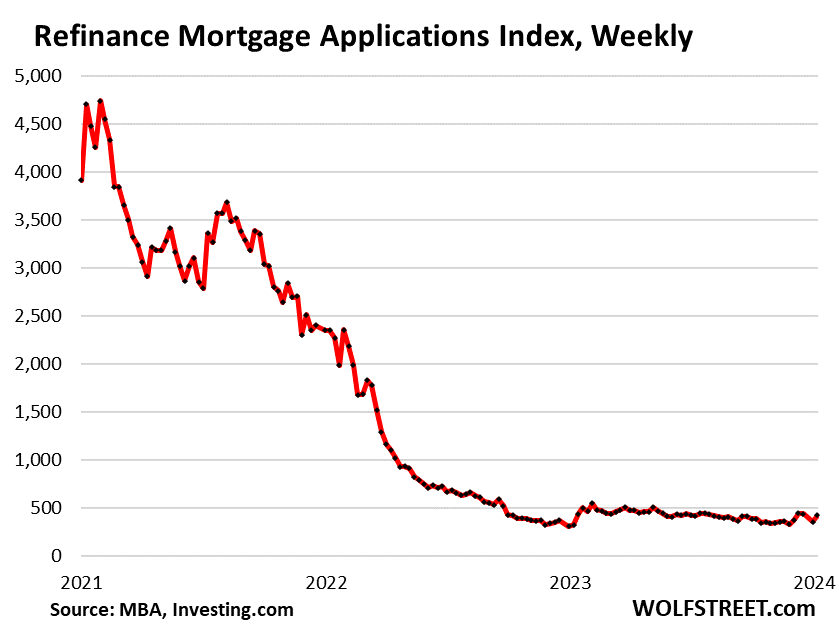

Refis are still in the deep-freeze. Mortgage applications to refinance an existing mortgage jumped a bunch from near-zero in the prior week but remained embarrassingly close to near-zero. Compared to the same week in 2022, refi applications were down by 81%; and compared to the same week in 2021, they were down by 91%:

The entire mortgage industry got waylaid by the 80% to 90% collapse of the demand to refinance mortgages, and thousands of mortgage bankers got laid off over the past two years. Refis had been a big part of the business, and it collapsed when mortgage rates started rising.

Makes sense: Who’d want to refinance a 3% mortgage with a 6.7% mortgage, unless you desperately have to pull a bunch of cash out of your inflated home-equity, hoping to sell the home in the near future, or to refinance it again after mortgage rates drop back to 3% or something?

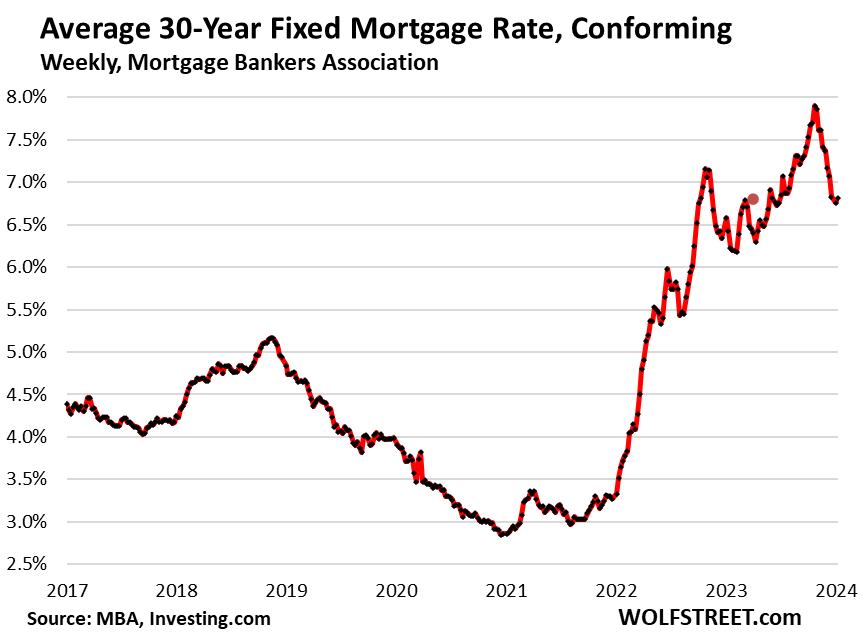

Mortgage rates have dropped a lot, but not nearly enough to hit that magic level that would thaw out the housing market. And now they ticked up again.

In the latest week, the average conforming 30-year fixed mortgage rate rose to 6.81%, up from 6.76% in the prior week, and up by 40 basis points from a year ago, according to data from the Mortgage Bankers Association today.

Is the hope of lower mortgage rates freezing the market further?

There was a frenzied rush into housing, a total no-questions-asked mania in 2021 and early 2022 as mortgage rates began to rise, inflation was kicking off, and higher Fed policy rates started cropping up on the horizon. Everyone and their dog wanted to get out there and “lock in” the low mortgage rates while they still could, even at 4%, and those buyers, largely Millennials and GenZers, trampled all over each other and elbowed each other out of the way, and outbid each other, and thereby bid up prices in a historic manner.

And in addition to locking in lower mortgage rates until they have to move for a job or whatever, the winners of these bidding wars also locked in those high prices. That frenzy was caused in part by the fear of missing out (FOMO) on low mortgage rates.

Now the opposite is here. People are seeing lower mortgage rates on the horizon, and they decided to wait a little while to let rates come down further, to maybe 5% or better 4% with 3% dangling out there as the big carrot. But rates already came down a bunch, and may not come down further, and then people wait a little longer and start praying for lower mortgage rates?

In reality, home prices are way too high for these kinds of mortgage rates – they’re way too high, period – and so the market is frozen: sellers don’t want to sell at prices that they could sell the home for; and buyers refuse to pay those prices. And so sales of existing homes have plunged, it’s not getting better in any significant way, as we can see in the mortgage applications, as we can see in closed sales of existing homes, and in pending sales of existing homes – now in part driven by the hopes of lower mortgage rates.

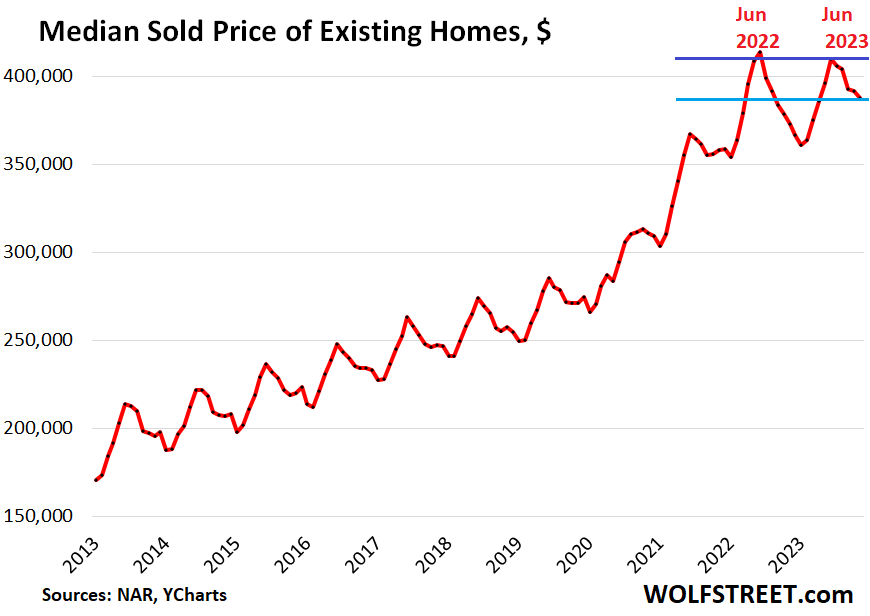

And the national median price, per the national Association of Realtors, after hitting its highest level in June 2022, failed to take out that high in June 2023 – a first since the Housing Bust – and now the trend isn’t looking not so hot anymore:

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

“Everyone and their dog ” except Freewary!

True though, all my friends bought houses. literally every single one. I’m the last one still renting. It’s a bit lonely.

Waiting for 1X salary or forget it. Looking at alternatives because the rent sucks too.

Sometimes it makes sense to rent rather than buy a home. In a time of housing bubbles such as we still live in (despite some deflations) it might be better off to wait until sanity returns to the market before you make your purchase. Your friends might regret jumping into the market so soon.

The problem is that you may be waiting a lot longer than you’d like or think you’ll have to.

The Fed & Congress have gone full on MMT, so when the next downturn happens, they’re going to roll out all sorts of goodies to keep housing from cratering, most certainly rent & mortgage relief.

The days of Great Recession housing slumps are a thing of the past, or at least until we have our financial reckoning, whenever that may be. And that reckoning isn’t going to be in 2024. That comes when Congress has to get religion and is forced to start taking a whack a mole to our $2T annual budget deficits.

thing is you’ll need same amount of fiat $dollars to make same purchase

so yes VALUE might go down, but price remains same

and then it starts taking even more and more and more and more

—-

The Fed and Congress will have “gone full on MMT” when they institute a Federal Job Guarantee, which is its only policy prescription — as a superior price anchor and a countercyclical automatic stabilizer.

I’m not holding my breath …

Best to rely most on what you know. Do you plan to move again soon, or are likely to stay put for many years? You know more about your circumstances and goals and your local environment than you know about the future of markets.

I’d agree with those comments in a normal market, but this is different.

“What we know” is that housing affordability is at all-time lows right now. Also, the rent v. buy analysis is heavily skewed in favor of renting in many locations, particularly the high-priced locations on the coasts.

Those factors indicate the potential for future home price appreciation is not good. Arguably, price deflation is more likely.

Here’s some other things we know, which should encourage renters:

If you choose to rent, it’s a temporary decision for the next year. If conditions change, you can change your mind at any time.

Rent increases are generally 3-5% per year. Home price declines can happen a lot faster. Thus, renting has less short and medium term risk (defined as variation from expectations).

Home prices can go down over 30% in hot markets, as the past has proven.

Renting doesn’t require upkeep, maintenance, yard work, etc. You have more free time to spend on more value-added activities, including your job.

Renting creates significant option value. You can deploy your capital anywhere. Buying locks up your capital into a potentially depreciating asset with a 6% transaction cost. If homes appreciate less than other investment categories, you suffer opportunity cost.

Everybody has to chose what’s right for them, but I think renting is undervalued right now, in general.

A move in ready home in a prime location moves. Sanity in our economy is difficult to find.

no supply

no reason to offer cheap

turning home into rental because I have been low balled by investors

——

gonna offer for sale or rent

my guess is I get renter 1st – so 1,300 SF in cheap Tucson is $20k in rents

Greg, you dont want to rent longterm. Evt., you price yourself out of the market. Every increasing rents. If you buy, you lock in your PITI which will be much lower than rents after just a few years. Plus, house prices only go up in the longrun. Sure, some schmock will say, prices are down!! but the reality is if you look at housing for 30+ years its nothing but higher highs and higher lows. Once you buy, you dont really worry about price fluctuations…..in the rare case of prices crashes (2008 was a once in a lifetime) you just buy a second house as a rental….its not complicated.

There are a number of examples where it currently might cost $2000/month more to buy the same place as rent after spending $150,000+ in down payment money.

If you can put away $25,000/year that will net $1125/year before taxes in a 4.5% HYSA. So that can give you some relief against rent increases. Also, rent doesn’t always go up.

Everything is just so warped.

And this AI stuff can easily wipe out a TON of well paying jobs.

Ethan, I used to rent a room for 500 dollars a little over ten years ago when i lived in SoCal. That room is now 1.5K – 2k a month. Yep. Rents have absolutely exploded over the past decade.

The GFC has screwed with a lot of heads…..make belief of Real Estate crashing 40-50% is a thing that just keeps repeating. The longer you wait the more you screw yourself because: RE prices and rents ONLY GO UP IN THE LONGRUN. ONLY GO UP >>> IN THE LONG RUN.

Take a deep breath and relax renting offers so many options and opportunities vs owning including

1. best financial option with home prices inflated

2. Flexible options for job seeking

3. Known repair costs

4. Low insurance rates for content

5. Cash flow improvement

A well known financial advisor in Houston followed his own advice and sold his family home and they have rented the last 2.5 years . The wait is long but your money is earning 5.5 percent risk free. Relax and save the money .

If he sold a house financed at 2.5% , he was not that smart.

You must think housing prices only go up.

If housing prices fall, you are better off closing out that 2.5% mortgage. It doesn’t make sense to pay any amount of interest on a depreciating asset that won’t recover for many years.

It all hinges on what you think RE prices will do.

exactly

but if you want to sell today

I’m willing to assume your low rate mortgage and give you cash to mortgage

if you want cash and me to pay off said mortgage deduct 25%

holy crap….you dont ever wanna walk away from a 2.5% mortgage …..to rent??!! and pay off someone else’ mortgage???…..wish they would teach Real Estate 101 in school…..a low locked in mortgage is like a win in the lottery.

Maybe he didn’t walk away from a mortgage. Maybe he sold the house to pocket the huge gains and lock in those gains, and earn 5%-plus on the proceeds, and save on all the expenses. So if he sold the house for $2 million, locked in a $1 million gain, and then earns 5% on $2 million = $100,000 a year, or more if he invests in corporate bonds, and no more TX property taxes, hurricane insurance, etc. Maybe not a bad deal.

Freewary-

You said “all my friends bought houses. literally every single one. I’m the last one still renting. It’s a bit lonely.”

Maybe this thought applies:

“Men, it has been well said, think in herds; it will be seen that they go mad in herds, while they only recover their senses slowly, and one by one.

— Charles Mackay, Memoirs of Extraordinary Popular Delusions and the Madness of Crowds, 1841

There’s a tension between confidence and humility.

Be proud to be thinking for yourself instead of relying on the “crowd” to think for you…

Cheers!

John H (and others)

Quoting Charles MacKay’s 1841 Memoirs of Extraordinary Popular Delusions and the Madness of Crowds………….that’s why I love Wolf Street and it’s commentators.

And along these lines: I believe Elenor Roosevelt was quoted as saying: “what other people think of YOU, is none of YOUR business.” Which is to say, believe in yourself and not care at all about what others might think or do.

I like Mike Tyson’s quote, which might apply to today’s buyers at all-time low home affordability:

Everybody has a plan…until they get punched in the face. (Paraphrasing)

Bobber-

Gotta write that one down!!

great comments team!

Especially like the Mackay quote and BS Ini’s analysis.

The trends Wolf studiously documents here are not favorable for the avg, person. Not even for a person with a track record of high pay like me. It’s possible that US Houses may never ever be cheap again.

Like I said, rent, or alternatives. There are alternatives. Working on a great one right now.

Do I understand your comment? “Waiting for 1X salary or forget it.” = Home price is same as my annual salary?

Yeah. I see no reason to slave away for years just to live in one place for a very long time. Not a good deal. Plenty of other things to do and see.

A lot of my colleagues with similar income are paying $500-$600 for houses. 2.5 – 3x pre tax salary. Galling transaction costs! Step aside from monthly payments and think about that. Do you really want to pay 3x your annual salary for a place to sleep and keep your stuff? That can buy a lot of travel, renting in interesting places, adventures. etc. Do you really want to live in the same house for a very long time? What about when you are old and can’t do the chores anymore? What if job changes? What about if friends and kids move away- you are still stuck paying a stupid mortgage and property taxes and have a load of chores, just to live in a place you bought 20 years ago. What if the neighborhood changes? At my grandma’s house, neighborhood declined. Section 8 investors bought several properties. A person moved in next door and decided to breed pit bulls in the back yard. Once they got out there were 10 untrained adult pit bulls roaming around. Charming neighbor.

Others can do this if they want, but I’ll pass!

Can’t quite comprehend why people think the US RE market is going to crash. Everyone wants to own and there is no inventory (okay a little bit of inventory). Posting online won’t change the fact that people want to own. Who da F wants to pay someone else’s mortgage?? Who wants to rent long term? We all know inflation and time will do the heavy lifting???

So why is Sweden’s RE market not doing so great? Everything you said about the US market applies to the Swedish market, no?

Same in Germany:

https://wolfstreet.com/2023/12/24/qe-giveth-qt-taketh-away-german-home-prices-tank-as-ecbs-balance-sheet-drops-by-e1-85-trillion/

My rent is less than just the INTEREST if I were to buy an equivalent home right now (Utah). In a market where houses are….depreciating

Either you’re lining the pockets of your mortgage provider/investors or your landlord. Landlords are more “real” and so it seems to bother people more to give them money instead of a nebulous banker

“Paying off someone else’s mortgage” is an emotional argument based on a scarcity mindset. All that matters to me is cash flow, savings, and yield. Renting makes far more sense in most markets right now

Lower rates mean prices will likely remain elevated. In a recession, if rates drop significantly, prices tend to go up not down. Look at historic recessions……2008 was a once I a lifetime due to loose lending and NINJA loans. If you buy, you lock in your PITI. If you rent you hope rents won’t keep going up by 3-5% annually. I’d never go back to renting. Homeownership offers so much more.

My anecdote from today. Metro Detroit. 3BR total fixer upper needing major repairs (not livable as is), cash sale only….on market for two days…list 109k. I offered 130. Found out today sold for 150k. Sounded like 7+ offers. This crap sure is annoying and I cant wait for things to return to normal again….one day! Things may be turning but it sure is hard to see it if you’re a current home shopper.

Why were you bidding on it??? If you “cant wait for things to return to normal again,” STOP BIDDING!!!!

Our company has mandated return to office. So the short story is I have to move. And even at high prices and high rates….I still have to move. I wish I could wait 5 years to see what happens and hope for lower prices, but unfortunately I cannot.

Can’t you rent and wait out for couple of years ?

No one knows which way house prices would go but likelihood of it going high is less.

BTW: I do own 2 homes in So Cal and this is not a biased view.

Usually, people with multiple homes have their reasons to say home prices won’t go down. People waiting out to buy would have their own reasons to say the opposite.

But if you look at the current prices and rates, something has to give in and if recession ever arrives, then its a big game over for home prices.

Sure. I could rent for two years and hope for a real estate plunge. The cost of doing that is 18k/year, so 36k to test that out. Think I’ll save 36k+ on a home by making such a move? That’s a 10% drop in homes in just two years….if we nail the timing (starting now…), which nobody even knows. I wouldn’t make the bet….. given policymakers strong push to prevent real estate depreciation, and America’s acceptance of inflation (or maybe it’s ignorance, I don’t know)

For me, life has to go on. I rented in 2018 for a couple years waiting for home prices to drop. It didn’t work. At all. I won’t do it again.

Make sense in your case when you are looking at homes at ~$200K and paying rent ~$18K/year.

IN SoCal, the different is quite a lot. A home may cost $7K/month to own at current rates/price but you may be able to rent it for $5K. So, it’s a different dynamics.

Put your 130k in fixed term deposit. In two years you already earn 8-9%, almost enough for your rent.

Sounds like you are planning to do a cash buy, so you should also consider in your rent vs buy calculation that you are getting positive real yields on your savings. Why not just wait it out with long dated TIPS at 2%? Maybe housing could appreciate more than that 2%, but with valuations high by most historical metrics, chances are slim.

“Think I’ll save 36k+ on a home by making such a move? ”

Blake,

1) Look at Wolf’s median price chart (which doesn’t incl terrifying 30%-50% plunges of Home Bust 1.0…which took 5+ yrs to sorta “recoup”…that kind of volatility is possible in the ZIRP era. The upward trend line that Wolf does show…was entirely the result of demented DC ZIRP (mother of toxic inflation).

2)a) As is common, you think of rent as “wasted money”. In point of fact it is *exactly identical* to mortgage payments of equal amount…unless home prices increase from your buy price – how likely is that,

b) from today’s nosebleed prices…see price chart,

c) if future interest rates are anything other than super ZIRP,

d) in a world where median HH income (*after* pandemic inflation) is maybe 65k (in other words, who the hell will be able to afford prices in the future much higher – or even as high – as today’s).

Bottom line, unless a home’s price significantly rises (to offset all the many costs unique to home buying), a home mortgage is exactly the same as an equivalent rent – without renting’s huge flexibility advantage.

Both are “wasted money” for housing. It is only dreamed of appreciation that makes a home mortgage any different *at all* from paying rent.

And that dream/delusion has to take into account a bunch of macro-economic factors way, way, way beyond your control (most importantly, the degree of DC incompetence/ass-h*lery).

Wanna really roll the dice on *that*?

Blake – If you looking in Detroit, it is undervalued. Rocket Mortgage says the median price home is 81k. What other city can you find such a price? From my understanding is Detroit has been turning around? That is something to factor.

I went to zillow and you can find some nice homes in the $200k to $300k that would cost $200k to $400k more in overvalued markets like Austin or Nashville.

Look at your risk. Lets say you buy a $200k home. Even if we have a 10% correction, your house value drops 20k. If you are in Austin, that 10% correction could be 80k or it would be 150k in San Fran, New York, LA, etc.

Also, if Detroit is turning around, it could still see house appreciation. If you can get a house for less than $100 sq ft – 110 sf ft. in a good neighborhood than you consider It cost at least $200 sq ft to build a house these days. At $100 to $110 sq ft, your getting a house that is 40% to 50% cheaper than a new house.

Couples wanting a kid usually prefer to have a home.

I know some people reading this blog that have been waiting for home prices to makes sense since 2014. Wolf has also continuously maintained or insinuated that real estate was overvalued. In truth they didn’t make sense but it was senseless to discard Fed coming to the rescue.

Abandoning house purchase is really not a solution but rather the dire reality Fed (and our government to be fair) has created by manipulating free market and making life much harder for young people.

Wolfs reader’s provide wolf with a lifetime of entertainment and worry. Haha

Yeah we do!

I will never cease to be astounded by the number of posts and comments I see that read the same way–people complaining about bidding wars while contributing to them.

It became a running joke on the RE Bubble subreddit. “When oh when will all these fools stop bidding into this bubble? I just got outbid again!” Posted over and over again, without a trace of irony or self-awareness.

Just because you’re forced to participate doesn’t mean you don’t want it to end. I would rather not participate in a bubble but I also need a place to live, so there’s a conflict of interest. Oh…rent you say? Let me just become one of 20 applicants trying to get the home that went on market today. That won’t drive any bubble either. Only those fortunate enough to have already ‘gotten theres’ get to not participate. That could mean solid rent contract, house, parents basement, you name it. Everyone else needs a place to live. Though I’m debating buying an acre and throwing up a heated military tent

Overbid 50k and lock in the price now.

Rent another year, spend 30k on rent, overbid on a house the next year by 50k.

Should have overbid 80k the first year. Youd have made a year of payments already.

Thanks Blake for your patience to repeatedly providing additional details and the through process behind your very personal situation.

Interesting on the internet comment can always bring out the “why do this? just do that!” mentality and I have to say everyone is not immune. It’s the usual opposite reaction to someone else asking “why is price so high? why is system like this/broken?”

Food for thought for everyone: Not asking any seller/buyer to make concessions, no other purchase necessary, no government red tape or hand out to specific groups…

Why don’t we create an RE environment to publish of the price of all the offers made (anonymously of course) ? Kind of like Glass door?

Currently, only seller and agents have this information, you as the potential buyer only have partial information. If out of 7 total offers, one is 80K, five are near your offer at 130K, and only the winner at 150K or hypothetically another higher value, then I would really like everyone to see it to draw their own conclusions on price.

This is obviously not how bidding has been done in the past hundreds of years, however, i think transparency can have a number of improvements on RE market dynamics, If at the minimum we know how much this property is valued at, and separate this from how much “extra wealth transfer” the winning bidder provided to the seller for the privilege of this purchase. (This will be a strongly anti-inflationary dose, much better than the Fed’s interest rate I’d say)

Pure wisdom served up fresh daily.

:) FOMO is a strong feeling.

The capitalists have the serfs jumping like a dog for a treat.

Let me give my view based on what you said rent 18K per year getting wasted. After 40 years of home ownership I went for a $2100 pm good home, good neighborhood rental at Tucson realizing that is a better option overall. Let me break down the cost.

With that 1500 pm. you are out of other expenses (well, probably you ended up paying for renter Insurance). The owner has to pay

Real estate tax

Property tax that doubled in many places.

Take care of repairs as they show up. Fridge breaks or water leaks and what not.

Or buy warrantee insurance that refuses to pay for any repair.

Most renters have, well renters mentality who ruin the house. May not pay rent on time, now the drug issue even among so called better group. After we moved in, a local Sheriff showed up for the previous renter (divorce, child custody, missed payment etc).

So, the owner is banking on tax savings; the 1986 Reagan tax act made that difficult too. Passive loss Vs earned income etc.

My house is managed by an agency. So, they eat up a month of rent or more.

The owner is expecting appreciation of the property. But I am learning I should stay away from buying a former renter property.

So here too he is facing a problem. I notice some homes oscillating between For sale to Available for rent status in their history.

Some folks dream of AirBnB outsized income. But these things have very small life with our First World Mentality.

@Blake, sounds like you ready made up your mind, so go and buy now and overpay bidding if need to. Are you waiting for us housing doomers to convince you otherwise? Not going to happen, have fun buying and who knows in couple of years you might be laughing at us when home price aim for the moon again..us doomers been getting pie in the face for the last 10+ years so we are used to being wrong especially on timing

haha you nailed it here. I am going to overpay for a home, im good with it. I dont think its worth waiting on a price drop renting, myself. But anyone who feels they can, more power to them! Its hard to be right and/or time anything when there is no logic at play here, just decisions from the powers that be. Home buyers have been getting rewarded and renters have been getting punished for a while, i dont expect policymakers to do anything that changes that: like *gasp* allow housing prices to correct to affordable or historic levels

The status quoa is unacceptable. Prices either have to fall significantly or interest rates need to drop. Since we know that asset owners (including homeowners) have a God-given right to have 500% appreciation on their assets in a short period of time, the Fed CANNOT allow house prices to drop.

So clearly the only solution is for the Fed to start printing again and agreeing to buy up every mortgage at a 2% rate (if 2.8% at the trough in 2021 or 2022 was good, 2% or even 1.8% would be even better!). That way homeowners get the capital gains they’re morally entitled to, and the housing market can continue it appreciation up.

Here! Here! Best. Comment. Ever.

I mean… If the shoe fits!

👏

Yeah, and can anyone remember what all that 34 trillion deficit was spent on? We should have streets of gold.

I can.

Wars…….. past and ongoing.

You do realize that the Pentagon budget only covers the cost of the five sided war box on the Potomac and some of the 800 military bases in other countries.

Wars are financed through deficit spending and thus make up the lion’s share of the 34 trillion dollar debt.

That’s where all the money went.

Political ads?

///

To reverse the QT into QE swamping the market with additional liquidity by asset purchases and lowering the interest rate would be economic suicide by hyperinflation. The FED needs to stay out of this. The damage done by the negative interest rates can only be cured by long term stable policies and targeted interest rates without QE or other interventionist policies.

///

Just to be clear, I do not believe in the “invisible hand” of the market, an ideological statement of the “new economic religion”. Economy is about numbers not opinions. Government regulation is a must in the field of setting up the rules and making sure everyone plays by the rules.

///

The government is not some godlike rulemaker, bur merely an economic actor with a (near) monopoly on the legal use of force.

Truth.

In the past everyone believed in an all-powerful God who, with the right incantations (prayers) , could be induced to provide health, prosperity, and happiness to all. Now everyone seems to believe in an all-powerful Government who, with the right incantations (laws), can be induced to provide health, prosperity, and happiness to all. Delusion. It is all is destined to end in failure and the dustbin of history.

Ideological statement Corey.

Government is what it is. A tool that serves a purpose and that must be managed like anything else.

Government is neither good or evil.

I find it strange those people whose religion is to hate Government. It is like hating a hammer.

Ideology is the realm of the weak.

That $0.77 can of 540ml beans in 2019 that became $1.97 today, will be worth about $3 or $4 if the Federal Reserve does QE again.

I would have never known that a can of beans was 540ml. Until I read the wolf Street comments

And that’s a very small price to pay to ensure that anyone who has a lot of houses, crypto or stonks gets 20-30% appreciation every year.

Why do you hate these people? Why shouldn’t some upper middle class couple in their 60s who had $3 million in stocks in 2009 be entitled to have $20 million today? And it wouldn’t be fair to them to have a sideways decade. By the end of 2030, they have a right to have it be worth at least $50 million.

They deserve a dignified retirement of a $50,000 vacation and new Porsche every six months. Only a commie who doesn’t respect his elders would feel otherwise.

Isn’t it a coincidence that the Bank of Canada injected more billions into the repo market (last week), while the 5-year bond yield bottomed out and started trending upwards?

Socialize the landlord losses, privatize the landlord profits.

You have it backwards. You used buy $0.77 with a can of beans, and now you can buy $1.97 with that same can of beans! The value of the beans stays roughly the same. It’s the value of the dollar that is decreasing.

Same goes for other assets like houses. The value of the house hasn’t really gone anywhere. It’s the value of the dollar that moved.

In 2025, the value of the dollar will be less than it is now. Less in 2026, and so on. It’s perhaps the most reliable economic prediction one can make.

This is why I prefer to measure the cost of oil in gold rather than dollars.

Not quite. It’the tens of billions of dollars of SNAP and medicare OTC “free money” that are pushing up the “pay whatever” price of that can of beans, not devaluation of the dollar.

The Fed is trapped – they cannot print due to *geopolitical* reasons.

The only way the Fed can cut or ease, is if there is a major recession. In any other circumstance it would be suicide by hyperinflation.

The Fed also needs to out-hawk other central banks in order to defend the dollar. If another country’s bonds start yielding significantly more than treasuries, the latter could sell off causing UST rates to spike.

Argentina has some high-paying bonds.

I should have specified, but I was thinking of G20 countries’ bonds.

In what currency ?

Just like there’s more than one way to skin a cat, there’s more than one way to create a dollar. If more debt is created by the commercial banks than is removed by QT, the money supply will still grow. M2 dropped pretty impressively at the onset of QT and rate hikes, but it pretty much hit the brakes on its descent back in April 2023. Per FRED, the M2SL is now on a bounce in the upward direction, and WM2NS has now clearly broken a downward trend.

I like M2, Wolf doesn’t. But pick any money supply indicator and you’ll see pretty clearly that it’s going back up at worst, or significantly flattening out at best. The money supply never shrinks for long, so the dollar (unsurprisingly) never deflates for long. Even the GFC was a tiny blip of deflation. Certain products may have deflated over time. But where it counts, the dollar has spent its existence losing value. QE, QT, or otherwise. Assets (houses) have really responded to the dollar’s decline in a big way, but house prices doubling or even tripling in a decade is not unprecidented (look at the 70s & 80s). The Fed grew the money supply by 30%+ in a very short period of time. Enough for pretty hot inflation, but not nearly enough for hyper-inflation.

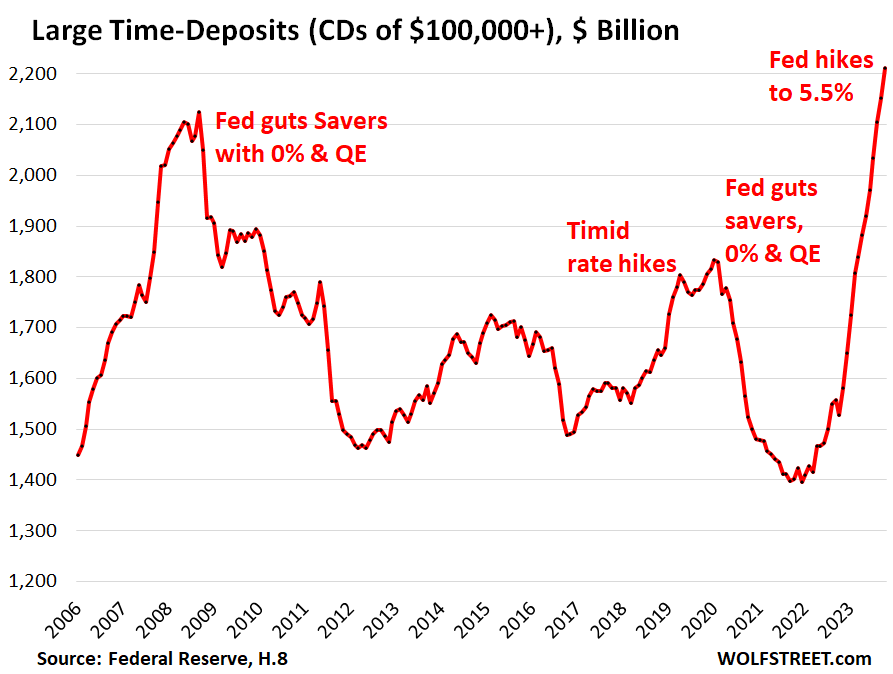

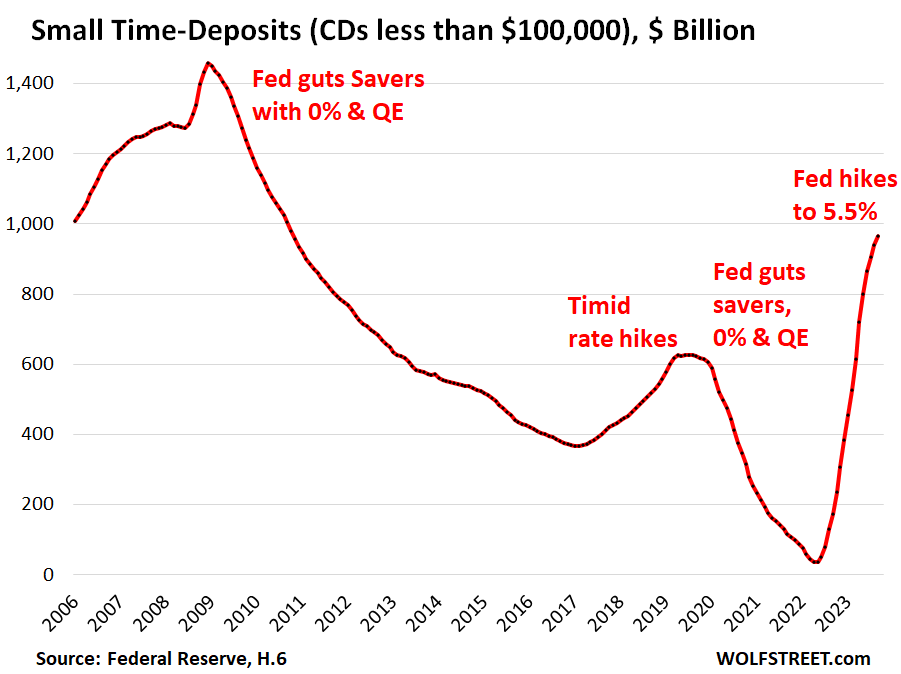

M2 is not a good measure because it excludes CDs of over $100,000 but includes CDs of less than $100,000 which produces all kinds of weird movements.

Excluded from M2:

Included in M2:

The government should outsource the housing inflation problem to Blackrock. Have Larry Fink of Blackrock buy up all the houses that are sitting out there unsold. That will free up the owners to move and buy or rent elsewhere. This will generate a lot of economic activity for the Real Estate industry and the economy in general. It’s a win, win for everyone.

If rates drop this ever growing pool of potential first time homebuyers, all slowly growing their cash reserves for that down payment will flood in and drive prices up. Until theres more sellers than potential buyers I dont see payments dropping any time soon, and theres no mechanism on the horizon that would cause that. Buy now, wait, doesnt matter. Youre going to pay the same inflated mortgage one way or another, just know every year you wait your rent is going up 7%. Tick tock.

Nonsense. As sellers wait, home builders are cutting prices and selling new homes to these first-time homebuyers, thereby decreasing the pool of potential first-time homebuyers. Tick tock.

In 20 years they might burn through the backlog. Hopefully nothing slows them down.

There are no dearth of properties to buy in my hood. But there are big shortage of affordable properties in So Cal.

The inventory shortage is all made up. Lot of people hoarding on homes in STRs hoping peak price would come and go higher. They may be correct.

But there is no shortage of homes. It ‘s not like this that in last 3 years population have increased a lot.

Population increased 4.8 million. I don’t know if that is a lot or no. It is more than the population of Utah.

H

Twenty years ? LOL

Try three years…..tops.

Builders are out in droves doing what they do……building at top speed.

No shortage of homes. Homes per capita is possibly the highest ever, and certainly since the year 2000:

https://fred.stlouisfed.org/graph/?g=Mc22

Not to mention corporations scooping up SFH by the hundreds. Unless the government limits that or taxes it appropriately, just another factor fighting against supply catching up with demand.

The number of SFH rentals by corporations is mind boggling in the thousands. That has cooled down of course with the overpriced homes and QT. The corporations can no longer mtg the home . However I don’t want regulations on home ownership usually the government messes things up. QE and the Fed I think made a mess of housing with suppressed rates.

It’s still happening even at these prices, BS. Some $100m of houses in Vegas this week, where affordability is already not in line with earnings. The only solution is taxing the corporations more. Do you think the government should abolish anti monopoly laws too since they never get it just right?

Ben R,

“It’s still happening even at these prices, BS. Some $100m of houses in Vegas this week…”

That was a portfolio of RENTALS with tenants that Starwood Capital Group sold to Invitation Homes. One landlord selling another landlord part of their rentals.

Starwood has been unloading all kinds of RE. They got into huge trouble with some of their retail and office properties.

You are abusing my site to spread braindead manipulative bullshit. This is EXACTLY THE KIND OF BREAINDEAD STUPID-ASS HEADLINES SPREAD BY MORONS FOR MORONS who cannot even read that I have been destroying manually.

I cannot believe that people keep spreading bullshit headlines because they fit their idiotic narrative without even reading the articles. That is just sick. It’s what’s wrong with the internet.

“in Vegas this week, where affordability is already not in line with earnings.”

This is surprising to read. A few years ago Vegas was quite cheap – at least relative to Boston.

Back in 2016, one of my roommates moved out and rented a plce in Vegas. She was able to rent an entire house (4/2, ~2500sqft, with a pool!) for the same rent we were paying for one floor of a triple decker.

And property taxes and insurance are going up faster .Train wreck soon ?

If you can’t afford the gas, don’t buy a Cadillac.

That’s hardly a fair comparison. Can’t afford a Caddy? Get a Toyota. Ride the bus. People can live without a car. Some people live IN their car. The housing crisis in Tampa, FL isn’t due to people buying mansions they can’t afford. Even if you make decent money (relative to the area), good luck finding a place. Between the population increase (Hello New Yorkers!) and the investors hoarding property, the locals have been squeezed out of housing. At every price point. Realtors cold-call homeowners, searching for inventory. What’s the commission on no sales?

Back to your metaphor. Say you NEED a car. There’s a rusty hatchback, midsize sedan and custom-built Lamborghini. That’s it. The hatch price is about what a new Caddy sold for 5 years ago. The sedan is a lease – and the payments are twice what they’d be if you could buy it (you can’t). The Lamborghini costs so much it would be cheaper to hire Elon Musk as your personal driver. Uh-oh. You hesitated. There’s a bidding war on the hatchback, the sedan is gone and Elon won’t take your calls. While you look for something else, the only other transportation is Uber and most of the time there aren’t any drivers in your area. But good news – you can afford gas.

If you think I’m exaggerating, consider this. Florida just edged out New York as the second most expensive state for housing. Tampa’s real estate market is the highest in Florida – higher than Miami or Palm Beach (Trump b&b). People around here aren’t homeless because they’re waiting for a dip in interest rates.

If anyone reading this is tempted to say “you could live somewhere else” that’s not always true either. I’d love to move – but I share custody of my daughter. My ex, well, I handled the finances when we were married. He won’t move.

Short version: You can ride the bus while you save for a car. Where do you sleep while you save for a place to live?

There’s two sides to that.

On the other side you have sellers attempting to get highest price, only to watch 1-3% or more of their home value decline each quarter. Meanwhile property taxes go up 10% to 20% per year and they have to stand by as others earn 5% on their capital, which is not stuck in a declining asset. Whatmore, they have to watch listings increase in most markets. Now, that’s anxiety producing.

There is effectively zero backlog at today’s prices. Some people may trade over priced assets to go back to the office, but inventory is still building. You do realize that demand is on a curve and not static, right? If no one pays the price then there is no demand for that price. The market is frozen because people aren’t paying that price. There may be people waiting to buy at a lower price, but until the prices go lower you will never know.

“If no one pays the price then there is no demand for that price.”

in which country, in which state, in which town do you see that NOBODY pays the price??? You live somewhere on this earth….and somewhere close by a house is for sale. Let us know ……ahh wait….i make it even easier for you…..let me know where you live and i show you the recent sales in your area? For Free.

Actually that’s prob pretty right.

Once the rates fall, the 30 year payment will be what drives people.

Just think, they can afford what 300k now at 7%.

If it drops to 4%, they can afford maybe a 400k-450k. That really opens up a lot of competition

Bidding wars will be back.

Except houses are still priced as if 3% mortgages are still a thing because people never stopped holding out for lower rates.

Do you think that’s why they haven’t adjusted? Because people are banking on rates going back down? The narrative out there is that there isn’t enough houses, but I think you may be right. After all, the population didn’t double

For the last 5-10 years I’ve been watching cities in CA here run some of the highest yoy price increases with either a static or declining population. If “real estate is local” then how does the shortage story explain that?

I also wonder why people are hoping the shortage story is true, because if it is we have more to worry about than house prices. Imagine what would happen if the explanation for the current food price increases turned out to be that we’re no longer able to produce enough food to keep up with demand, and that people are hoarding it and speculating on the price, and CNBC was cheering a 5% “gain ” in the MRE index today.

Matt B – …the contemporary state of the spacecraft’s resource base/renewability accompanied by the whiff of slowly-boiling (but NOT ‘for dinner’) frog…

may we all find a better day.

@Blake

The inventory shortage is not true. Think about it, no one ever heard of a shortage problem in 2019. It wasn’t until houses stopped going up 30% YoY that all of a sudden there’s a housing shortage which means prices can never go down.

“If it drops to 4%”

No way that’ll happen – that would imply a 1% 10-year.

Funny that you assume these wannabe homebuyers are saving anything, much less enough for a significant down payment. The economy hasn’t scared them enough yet.

Funny that you think people are spending money they could be saving. Hmm, I need insulin, but I could earn a fraction of a percent in my savings account. Or do you think the majority of Americans are buy avocado toast with money from their portfolio?

“Funny that you think people are spending money they could be saving.”

I don’t know your circumstances but a lot of people do.

I had roommates who whined about being short on rent, but constantly ordered junk from Amazon and paid for $3 iced coffees from Dunks every day.

Some people feel entitled to live the high life even without the income to support it.

I think those who don’t work in a field that involves consumer finance don’t understand just how common it is for people to live beyond their means. Having been a lender for the past 20 years, dealing with someone who cannot manage their finances is just another day that ends in Y. I’m not referring to someone who is dealing with an unforeseen bad break (medical issue, family issue, etc). I’m referring to the person who has stable employment and good health, yet consistently spends more than they earn. Nine times out of ten, they’ll have the newest iPhone, a new vehicle, and will be on a first name basis with employees at several local restaurants. If you go through their account with them and point out potential areas to save money, talking to the wall would provide you with better results. They don’t have any “wants” because everything is a “need”.

It just seems like there are those who want to improve their financial situation and there are those who are going to treat money as though it’s a banana. (Hurry up and use it before it goes bad.)

Mm and F, yes that is our country in aggregate and why we are in this debt and inflation mess. People want a standard of living above their earnings. They think the government has lots of money, so they vote for the politicians who say they will spend. But the government doesn’t have enough money in savings or receipts, so they just print money to satiate the campaign voters demands. Now people are experiencing the bad effects of inflation, malinvestment, but will it be enough malaise to willingly cut back before there is no choice?

@Franc

Yep, it always slowly creeps in on everyone. Since I’ve been proudly unemployed for a whopping 2 weeks now, I’ve had time to really analyze expenses and also cut back. You don’t realize just how expensive eating on the road is until you notice the McDonald’s at the hotel you frequently stay near has claimed 3k dollars of your money over the past year. God forbid I even mention how much “Love’s country stores” has claimed.

I’m extremely frugal by nearly anyone’s standards and even still, wasting money is easy to do and lifestyle creep is most certainly going to happen with rising wages.

Rent is going up? Not where I am in San Antonio. There used to be 5 condos for rent in my complex of 100 units. Now there are 7 all of them stuck with no one even looking at them month after month. A couple have lowered the rent by $50 or $100 a month but that’s not going to do it. In the meantime their units sit empty and their owners are getting nothing.

The frozen housing market is one more reason why the government needs to raise taxes, and possibly increase the long term capital gains rate for high income earners to force asset sales.

There is a lot of discussion about monetary policy reducing the amount of liquidity, the incredible levels of fiscal spending, but nothing about raising taxes which would help with both.

Raising long term capital gains rates forces a sale exactly how? There are vehicles for the *wealthy* to avoid capital gains taxes (defer them) – among them a 1031 exchange. If you don’t sell it, there’s no capital gain to tax. Below a certain threshold, real property can pass without inheritance tax and a well organized individual that has a fleet of attorneys can get around just about anything. Have you read about the speculation on why Musk doesn’t care about his *losses* at Twitter-now-X? As Leona Helmsley said… “only the little people pay taxes”.

PS: No one is preventing you from sending Uncle Sugar an extra few grand. You can do your part to “raise taxes” without any monetary policy intervention.

Because if everyone living off capital gains had to pay higher taxes, they wouldn’t be able to gobble up all these assets day after day. The rich live off capital gains and the poor live off income, basically, and the capital gainers have a distinct advantage. I myself think it’s BS, and they should be taxed just like the working folks. People making money buying and selling stocks ain’t exactly keeping the world going around, yet we tax them like they’re special, magical, and deserve a handicap. Meanwhile, the working class work, and pay their 20-40%. The capital gains ppl will always defend their lower tax rate, but logically I don’t know how you can justify it other than ‘i earned this money, I want more, I deserve it, yadayadaya’ . Which is a non argument. But saying they make the same or less contribution to society as my plumber, I think might be. Not everyone can sit at home and make money on their money, we have to maintain a working class to be a stable nation.

An alternative is a wealth tax, which doesn’t wait for capital gains to be incurred by a sale.

Think about it – why is real estate taxed but not other forms of property like stocks?

Effective federal tax rates for the working class are much closer to 0% than 20%-40%. Nearly half of households pay nearly $0 in federal income tax.

I love every bit of this comment. Every.word. This puts words to the sentiment I’ve felt for a long time but couldn’t convey. Thank you.

I totally agree with you.

Someone who made quite a decent amount of money in stocks, I have more respect for Plumbers than people like me and my friends who made out a lot in stocks of-course supported by FED’s policies.

People always eventually take it back. History has shown that.

So will the wage earners of America. The sooner it happens the less violent it will be.

I am all for labor. Duck the capitalist :)

MarMar,

“Think about it – why is real estate taxed but not other forms of property like stocks?”

Real estate taxes have historically funded local government and related services at least indirectly related to the real estate being taxed. For example, road construction and maintenance, police, firefighters, local education, other infrastructure, government programs, parks, etc. Although residents benefit in varying degrees from these services relative to the property taxes they pay, there is a connection between the quality of local government services and the value of real estate. The classic example being potential home buyers with kids wanting to move into a good school district.

In this way real estate is fundamentally different than other types of property.

“The rich live off capital gains”

I’m not sure this is exactly how it works. The uber wealthy take out loans on their appreciating assets, sort of like someone could take a new cashout refi on their appreciating home price every few years if they can convince the bank to lend to them. They can write off interest payments on loans, depreciation, etc. to offset their earnings. Most wealhy are in fact deeply “in debt”, even though they own a huge amount of assets. If people come after them in a lawsuit, what are they going to walk away with? Assuming some of the loans?

Blake-

Just throwing this out there:

If capital formation leads to job creation;

-and-

Taxing capital gains stifles capital formation,

-then-

Does increasing capital gains tax reduce job formation??

Not saying I know the answer, but ALL policy changes have unintended consequences, and to lack imagination as to the negative consequences can lead to undesirable side effects (like offshoring).

Respectfully.

Leona Hensley big mouth got her put in jail ,for telling the TRUTH

I think Leona got in trouble for tax evasion. Her comment that “Taxes are for the little people.” was her belief. She didn’t get in trouble for telling the truth. It is, however, easier to avoid paying taxes if you don’t have W2 income.

A couple of scenarios could where taxes could be an incentive to sell assets.

If the gov announced that long term cap gains was going up to 40% in a year, you would have an incentive to take a lower price today and pay less tax on your profit.

If you had big gains in other assets, recognized the gain and got hit with a large tax bill, people might sell some real estate assets to free up capital to cover it.

1031’s exist but aren’t a constitutional right. Maybe we should question if they should even be an allowable part of tax policy. Same with inheritance tax and the countless loopholes that exist.

“PS: No one is preventing you from sending Uncle Sugar an extra few grand. You can do your part to “raise taxes” without any monetary policy intervention.”

I don’t think people realize how stupid the whole “you can voluntarily pay more in taxes” argument really is.

If the government punishing assets is the solution, why would anyone want to take over ownership of those assets. Then they would be punished.

Best to let the asset holders sweat while their assets decline in value. Once they realize there is no spring selling season on the horizon houses will come onto the markets at prices conducive to making deals.

I agree. They don’t need to punish. They need to let nature take it’s course. Which we seem to be very against, as a society, with our piss poor economic policies. So we divide into the haves, and have nots. “Screw you I got mine”. “I was still able to afford MY home, my parents just had to cover the down payment” etc. We need to let things balance out so it’s not just the advantaged who can afford life

Thank you for that bit of clarity I have been missing in this analysis. I see a lot of very expensive homes in my market sitting for nearly three years. This area average family income is 80K/year for family of 4. Yet, we have nearly 20% of our market are in homes that are priced above $1M. It appears some of these homes are second and third estates inherited. Yet, none have ever gone in auction or other FC events. The second mark of clarity is the Government, which I believe from Wolf’s reporting, is a growing sector for jobs. We have a lot of government jobs that rely on taxes for salary. If they allow the housing bubble to deflate – they have to lay off. Then employment numbers look bad. Huh! In my naïveté, I always thought houses were just a place to live. A hard asset to unload and to make choices wisely. Now they are treated like an investment article that everyone (portfolio operators, small businesses, large businesses, Medicare and Government) want a piece of. Has SFRE always been this kind of commodity? Or did something change (other then monetary policies) that made this the perfect storm?

If we continue to have real wage growth and when historically average interest rates keep prices from mooning, it would make housing more affordable without nominally crashing as wages rise relative to housing cost. But nominally going down further from peak is still likely but I am not sure if nominally go down nationwide by 30%. Perhaps nominally down 15% and it loses out the rest due to inflation. Almost a crash up if that makes any sense.

I am sorry, but real wage growth is very confusing,

when discussing the house prices. Looking at the exact same house, built in the exact same location, went up 185% from 2019 to 2024. I see most wage growth, at best, topping out at 50%. Wouldn’t houses/rent need to adjust to 3x average salary for baseline prices? I am not seeing this happen yet.

What explains the disconnect between Case-Shiller (which shows prices going up every month of 2023) and the NAR index?

There is no significant “disconnect” other than the Case-Shiller’s long lag. It is now too doing the double-top, just with its usual lag. Here is the 20-city index released in late December, called “October” which is a three-month moving average of Aug, Sep, and Oct:

https://wolfstreet.com/2023/12/26/the-most-splendid-housing-bubbles-in-america-december-2023-update/

BUT NOTE: The Case-Shiller Home Price Index covers only 20 metros; and it only has data for those 20 metros. It has no data for other housing markets. So its “20-City Index” averages those 20 metros into one index. And that 20-city index looks like the NAR index in the article, but with the long lag of the Case Shiller.

But it also publishes a “National” Case-Shiller index, in its attempts to give the 20-City data the aura of a “National” index. It combines the clean 20-City Case-Shiller data with data from the FHFA House Price Index. The FHFA data is based on mortgage data from Fannie Mae and Freddie Mac that systematically excludes all cash deals and all deals with mortgages that hadn’t been bought by Fannie and Freddie. This systematic selection and exclusion of home price data makes the FHFA index very weird and skews it.

Nevertheless, S&P CoreLogic mixed these two data sets into a cocktail with a cherry on top, and calls this cocktail “National Home Price Index,” which the doofus reporters or bots in the media then make clickbait out of.

Excellent clarifications, Wolf! Thank you.

Upshot: Armchair economists beware — read the headlines-only at your own peril!

So who will win the standstill between buyers and sellers? Each house that is sold brings in a large amount of liquidity into the overall economy via upgrades and whatnot. If the “freeze” continues, it makes a stronger case for the much talked about recession to arrive later this year (well hopefully not).

I feel sorry these people, Carleton Place is a small town 25 miles west of Ottawa. Carleton Place homes sold for $400,000 under original selling price. These were new town homes sold in 2022. Unbelievable how much people were willing to pay when rates were low, and Canada mortgages are mostly variable rate or fixed locked in for 3 to 5 years. More pain is coming.

From CTV News Ottawa:

It’s a harsh lesson on buying at the peak of the housing market. Two years ago, newly built townhomes in Carleton Place, Ont. sold for nearly $900,000. Low interest rates were a driving force behind the hefty price tag.

“Those townhouses were overpriced to begin with,” said Jeff McGuire, who lives in the area. “I think they were asking 200k over than they should have originally.”

Some people bought high but couldn’t keep up with payments, falling into default. The builder re-listed the homes for much less at the end of 2023 — $499,000.

“They couldn’t afford the home or what they wanted to afford. So their plans changed,” explained real estate agent Peter Sagos. He sold a few properties in the new subdivision, including 182 Hooper St, both times. The original buyers who couldn’t make the payments may be in further trouble from the builder, he says.

…. “Even if I wanted to sell this place, with the current taxes and the property assessment, it’s just going to drive people away and look the other way, look somewhere else because the value of the house and the amount of taxes,” he said. “It’s not looking good for turnaround.”

The new economic rent seeking model in Canada is to advertise globally that Canada needs 500,000 workers a year (in a declining job market which produced a whopping 100 new jobs last month), so that these 500,000 new persons become rent serfs.

In other words, bring greater fools and pack them like a dozen beer cans in a case for them to pay the mortgage. Create artificial scarcity that prevents home prices from declining further.

This is the Canadian rent seeking model.

Caught your comment about the BOC printing $30 billion the first week of January. They stated it was to “inject liquidity”. A request of information by the media (which hasn’t mentioned it yet) should uncover where these newly created funds went.

Scrappy Doo-

This is from Globe and Mail recently (as reported in Almost Daily Grant’s 1/10/24):

“Ontario Granted Taxpayer Funds to Mining Exploration Companies Called Griftco and Money Money Money”

Might be part of the “injected liquidity” mystery!

They are still selling out every month on the California Coast. I am in Monterey County, a transplant from San Francisco proper. We don’t seem to be “dipping the price” to close the sale. It could be the California Coast thing.

Monterey county is the only Bay Area county where prices reached an all-time high in 2023 (CAR median price). Of course, it contains some super-high-priced enclaves.

Managed economy leading people to bad choices.

The situation will resolve if wages go up a lot (without inflation) or prices come down a lot.

I own my home but feel sad for several hard working Americans who have been priced out solely because of bad policies (fiscal and monetary). I sincerely wish our leaders took actions that were good for the long term rather than the next election.

If you think the US is a managed economy then you literally have no idea what a managed economy is.

Jim L-

How can you have a central bank in a totally un-managed economy?

Just as China is communist with some free-market elements, The US is capitalist, with many elements of central ownership and control (e.g. U.S. Post Office).

Careful, I think your “ideology” is showing…

You are being disingenuous. I never said anything about a totally unmanaged economy. Those do not exist. Anywhere.

I fully agree that every country in the world has some free market aspects and some central control aspects (as well as all sorts of other flavors thrown in). Absolutely no doubt.

Sure the FED is a measure of central control. So are zoning laws, speed limit laws, etc. But if you put all of the counties in the world on a spectrum ranging from the most loosely centrally managed to the strictest centrally managed the US is going to be way towards the loosely centrally managed end of the spectrum. It isn’t even close.

Anyone who categorizes the US as a managed economy has absolutely no clue what a managed economy really is.

As for your stupid “ideology” comment, I would really like hear what you think my “ideology” is. There are very few things in life that I am ideological about.

We just got outbid after offering $500 over asking. O well, that didn’t last long.

That $500 on a $500000 house was sure enticing!

Hey Costco goods and services aren’t cheap!

Those sellers have a family of 4 to feed. Coincidently right after checkout from said Costco.

lol /s

$429,000, but whatever.

We got a roughly 9 month lull in this multiple offers nonsense here in Houston.

Djreef,

QUIT BIDDING!!!

or

QUIT COMPLAINING that prices are too high. YOU are responsible along with all the other bidders. YOU, yes YOU, are driving up the prices.

Sorry, but living with the Mother-in-law after 2.5 years is no longer a viable option.

Here are 3 other options is not marital advice:

1. Rent and squirrel away the monthly money you save and invest it wisely. There are a lot of nice houses you can rent for a lot less than a similar house would cost you monthly as owner.

2. Stop whining about being outbid and pay whatever it takes and live with it, knowing that you contributed to this mess, and that you’re going to pay the price for it (but yawl are happy in your house and it doesn’t matter).

3. Check out new houses and see what a builder can do for you in terms of buying down the mortgage rate permanently.

Renting is dangerous because you don’t know what policymakers will do next in which case you could get screwed and miss out. Anyone who rented in 2019-now missed out on one of the biggest asset appreciation runups in history. Our policymakers create fomo because it’s not dictated by a free market but rather their (typically bad) decisions. If they feel the desire to drop rates, anyone who owns a home wins. If they raise, we may lose. It’s gambling, and they’ve taught us we need to participate to come out ahead.

Blake,

“Renting is dangerous” what kind of non sense is that? So let’s say I signed a lease, and rates dropped and now it makes more financial sense to rent. Work it out with your landlord, give notice, put some cash aside just in case they can’t get a tenant in time, make them an offer they can’t refuse, etc.

Boom, done, exited the “dangerous” situation. You people are nuts.

An opinion about Canada’s RE scene, which is in worse shape than the one in the US.

Canadian Real Estate ‘stand off’ won’t last

The first page of the Real Estate section of Canada’s Globe and Mail on Friday, Jan 5, had a piece: ‘Hoping for early spring in a chilly housing market’.

The central thesis: a standoff between buyers and sellers with neither willing to budge. The realtor being quoted opines that ‘only investors who need to cash out will be forced to sell.’

The problem with this theory is the other players: the banks. Their problem is that they are under pressure on mortgage lending from the bank regulator. New regulations requiring them to reduce HELOC, ‘Home Equity Line of Credit’ exposure are coming into effect this year.

Months ago the senior bank regulator got fed up talking to bank staff and insisted on addressing the Board of a major Canadian bank. His issue: the sample of the bank’s mortgages revealed that with the HELOC,. a quarter were over advanced. The regulator is also generally displeased with ‘negative amortization’ where the balance increases after the payment.

Add to this ‘the Bank of Canada’s estimate that roughly 50 per cent of mortgages that were initiated before interest hikes began will face higher rates this year’ and it is clear that 2024 will see the banks force sales to comply with the regulator. The prices achieved will lower the appraisals of all comparables, lowering equity and the banks’ collateral, further incentivizing forced sales.

Btw: this was sent as a letter to the Globe a few days after their piece appeared. Of course they don’t print most letters although they’ve printed a few of mine, but even their auto-reply didn’t acknowledge receipt of this letter/ email. No idea why.

Thanks for the information, Nick.

“…buyers refuse to pay those prices”

More aptly here in California, the overwhelming majority of aspiring buyers can’t qualify for a mortgage at current home prices and mortgage rates.

It’s gonna take a while. A few years maybe. There’s not much for sale in good Seattle areas. Bad houses are bringing down the overall price as time goes on. But we still have bidding wars for stuff in good locations. Even for trashed fixers I hate to say.

Remember that in a good number of states your HOA can put a lien on your house for not paying your HOA dues. Just one missed payment can lead to this.

Then, once approved (often non judiciously) they start an auction where they can sell it for almost nothing. Effectively erasing all your hard earned equity you worked your Azzzz off to save.

A nice sheriff will escort you off your own property, while the winning bidder takes measurements so they can reap all that sweet equity for themselves.

So remember, pay your HOA dues, and if you slip up. Hire the meanest damn attorney ever and sue their azzes off. Cuz you can afford a really good one to save your equity.

In closing, paying your HOA is prob more important than paying the bank. By law the bank has to follow laws. The HOA, not so much, I mean kinda, but usually not.

BS. You’ve found one clickbait article and tried to make it relevant to your point. HOAs are not taking your home away after something minor like a missing payment and without it getting filed with a court, communicated to the public over 90 days, etc. etc. Your entire comment is based on clickbait BS.

Actually it’s all too true here in NC JD.

One HOA took many many houses in Charlotte and another several in Raleigh.

The Charlotte observer did a real in depth dive into what was going on.

Apparantly there were 550 liens put on by HOAs last few years. It’s growing in popularity because the HOA and the lawyers profit.

A sad tale but a guy owned a house for 20 years, they sold it and he got to live in a 1 bedroom apt now. He says he won’t even drive near his old neighborhood now. I mean the guy has trauma, PTSD over this. HOAs are horrible.

I can take a good guess on what sources you use to get your information about the world from.

Do better.

In many states, the town can seize your home and sell it for not making your prop tax payments

*after several years of not paying said property taxes and multiple warnings.

Sorry, you forgot to mention that so I thought I’d complete the sentence for you.

Yep I know a few people who don’t pay property taxes and only 1 lost the property. It takes a very long time and aggressive disregard for the tax man to end up losing your property. The guy that lost his property had been playing a game of don’t pay the taxes for a couple years, sell an acre or two to the county, start all over. Had been doing that since the 90s. He didn’t pay for about 5 years when they seized the remaining 100-150 acres.

And as to HOA’s, simple, don’t buy in an HOA if you don’t like them. Personally I don’t understand how they exist in the US when everyone yammers on about freedom this and communist that. Seems to me like an HOA is one of the most “communist” piles of nonsense ever. Neighbors sitting around all day ratting each other out to the board of busybody wannabe bureaucrats. I lived in an HOA once as a renter roommate. The HOA moaned about my truck being too old. They complained that the driveway wasn’t shoveled when it would snow when I was away. They complained about the door on the mailbox not being shut by the mailman. They complained about my motorcycle not looking street legal because it was a dual sport. They complained if any grass clippings got in the driveway or sidewalk. They fined the homeowner for me changing the oil in my truck in the driveway on the weekend saying you can’t repair vehicles on your own property.

I’d never live in an HOA and I’ll never live in a subdivision ever again. And I’ll most certainly never live around Californians again. Something about those that live around LA and NYC. They’re all lawyers and all know specifically what you can and can’t do. Like it’s their whole personality to be in other people’s business. Live and let live. I’ll stick to my country living where my neighbors are half mile away, do what they want, and don’t want anything to do with me and vice versa.

I have multiple millennial friends who have been trying to buy a house here in the Boston area (including South and west of Boston and Southern NH). Offering $25-$50k over asking and still not getting the house. One friend of mine asked me “when is something finally going to break?”. Wish I had an answer

When people start losing their jobs, probably, and can’t afford to pay these prices.

Supposedly boomers are going to give millieniels 4x as much money as they acquired thru wealth transfer. So if you think this is bad, wait for the period in 15 to 25 years. Gonna be horrid.

I mean if we don’t become a fascist autocracy with a hollowed out government first. Seems like what the angry people want.

You don’t understand how this works in the the US of A: The medical industrial complex, backed by PE firms, will attempt to rip every last dime out of boomers during their last two years before they die.

Oh they’ll def get some of them!

A medical exec who started out 20 years ago making six figures at one hospital in my state, he now is clearing 2.5 million a year!

These guys have acess to the investing of hundreds of millions for their non profit hospital system. In 2021, one company lost 125 million or thereabouts. And the board did not fire him!

These execs stifle everyone under them to get their bonuses. It’s a wild industry.

Home hospice … in my cold dead hand

The years after age 55 can be expensive from a medical standpoint. Health problems can pop up out of nowhere. I’ve seen lots of people rack up $50k to $500k in treatments, sometimes for many years. After seeing all the tough health conditions out there, I’m surprised insurance companies make any money. The interesting part is Medicare plus supplemental insurance covers just about everything for older folks. It doesn’t seem sustainable, but maybe it is if enough younger folks pay into the system.

That’s for sure Wolf as I plan on a strategy not to let that happen. Small blogs but I read about PE purchases of Medical Dental and Vet businesses at 10x EBITA with some selling to the PE at 9 figures hard to fathom. Lines in CVX long as more folks line up for drugs for health check procedures like colonoscopy. My mother in law is 88 and was complaining they had scheduled her for her annual one scaring her about colon cancer . She finally said no she had rather take the risk . The PE pressure to raise revenue over the next few decades will be relentless. Wolf you are brilliant from a macro perspective.

It’s not sustainable and represents over 30% of federal spending, 20% of GDP and is more than the entire federal, and many state’s, deficits. It used to be 4% of GDP in the 80s. The medical cartels, with the help of congress and every attorney general, robs every single person in the United States every day.

Yes, it’s crazy.

I’ve long been saying to friends what Wolf is saying here. Millenials en masse awaiting a golden inheritance may find themselves yet again dissappointed (fortunately, we’re quite used to it). Unless you are on or below poverty line, or F-U-Money rich, there are no medical parachutes in the US and retirement for Boomers will get unbelievably expensive once health needs rise.

The older gens were raised to take a pill for every symptom–cure be damned– and then take more pills for the symptoms caused by the other pills. Most of my patients now rattle in the breeze and consider doctor appointments and medical procedires their new retirement job/hobby. You can take out reverse mortgages, drop $5k+/month on Assisted Living, dwindle your funds until you hit Medicaid spend down/pooled trust. But be aware, without proper estate planning well ahead of time with a good elder attorney, your money can fly out the window much faster and many states have rules in place that allow Medicaid to tap the estate of beneficiaries to recoup expenses paid out. Medicare doesn’t cover long term care, only most of the costs associated with short term rehab stays. Medicaid divorces are very much still a thing. A lot of Millenial/Gen X inheritances won’t happen or be the substitute of lost home equity they had hoped.

Eating a steady diet of government cheese, thrice divorced, and living in a van down by the river is the new retirement goal for me. Well, once divorced is sufficient.

Yes and many family are still not trusting enough to put assets and money with family to avoid forfeiting it to the medical industry. I saw it with some of my family.

The parents were holding 1-3 million dollars in stocks and real estate in their early 60s. They died before they were 70. One died in her early 60s I think. The woman had multiple heart attacks and about 500k in medical bills racked up by her death. This was before Obamacare and what not. They paid the bills in full without even negotiating the prices because “it was the right thing to do.” The husband had a long drawn out battle with various ailments and depleted over a million dollars in surgeries, hospice care, specialized assisted living, etc. He left his house abandoned for 5 years with his vehicles parked outside it. The house was broken into and trashed/looted. Dozens of firearms were stolen and used in gang wars causing issues for the guy who were supposed to inherit them. The cars were stolen. One was found burned in the woods, the other was likely taken to the chop shop.

What dare you ask, was the reason for this? Well the father didn’t trust the sole child to not loot all the money and assets and disappear with the money leaving his old man on the street. Now the son was a stable, middle class, and upstanding kind of guy who would never do such a thing. He even offered to put the assets in a trust to guard against this possible banditry, but it was of no use. The old doddering fool lost half his net worth, gave the son an abandoned husk of a 3 story brick house on several acres near town, destroyed a nice caddy towncar and truck with only 30k miles on it, and was dragged into an investigation by the state police on stolen firearms.

Granted, I wouldn’t trust nearly anyone in my family as far as I could throw them. But I’ve seen first hand and heard of stories like this many times. The kids are decent people, the parents are nearing death with a lot of assets, and they’ll just rather blow hundreds of thousands of dollars and leave a giant mess for their working, child rearing, kids than do any planning for their imminent demise. I’ve seen old people lose their license and still refuse to sell their vehicles and also not let anyone drive them.

I’ve known 2 men who downsized nearing death and I have a lot of respect for them. Both had about a half dozen kids and knew they’d all kill each other if things didn’t go smoothly. But the parents with one child seem to be the worst about being selfish. Wonder if there’s a connection there?

Trucker – reminds me of an old cartoon depicting a hearse being followed by an armored truck, an onlooker commenting: “…guess old Smithers decided to take it with him… “. -best.

may we all find a better day.

Sadly this happened to my granduncle and grandaunt. Both died 8 years ago in their early 90s. They lived a frugal lifestyle, never had kids, no debt, owned their home outright but didn’t have any estate plan whatsoever. Both ended up in the nursing home, and bled their assets including their house and died with very little (if anything). It was sad, and I learned we all have to be careful and start a plan to protect our chess pieces as early as possible.

Tell them: QUIT BIDDING!!!!

They’re conspiring to drive up prices with their bidding. Why is that so hard to understand?

The alternative is to quit complaining that prices are too high, acknowledge that they themselves are conspiring to drive up prices, and live with the consequences.

I’m really tired of all this whining about high prices by the very people that are driving up those prices!!

If the “buyers strike” successfully drives prices down to $1, how do you suggest buyers line up to then buy the now deflated good without once again having bidding wars re-inflate it? A ticketing system? Who goes first?

And that’s why the conspired buyers strike doesn’t work. The market has to force it. People are gonna spend the money when they have it and/or feel secure enough to spend it

That’s Book 2. First you have to read Book 1.

only high unemployment is answer to this stop the bidding….

Exactly right. Once we see 10% unemployment and monthly layoffs in the hundreds of thousands, there will be some relief. The economy is like a runaway truck that needs to be crashed.

The “soft landing” is keeping prices high.

Wolf it is easier for you to say this because of your background and understanding about a whole bunch of things related to finance etc.