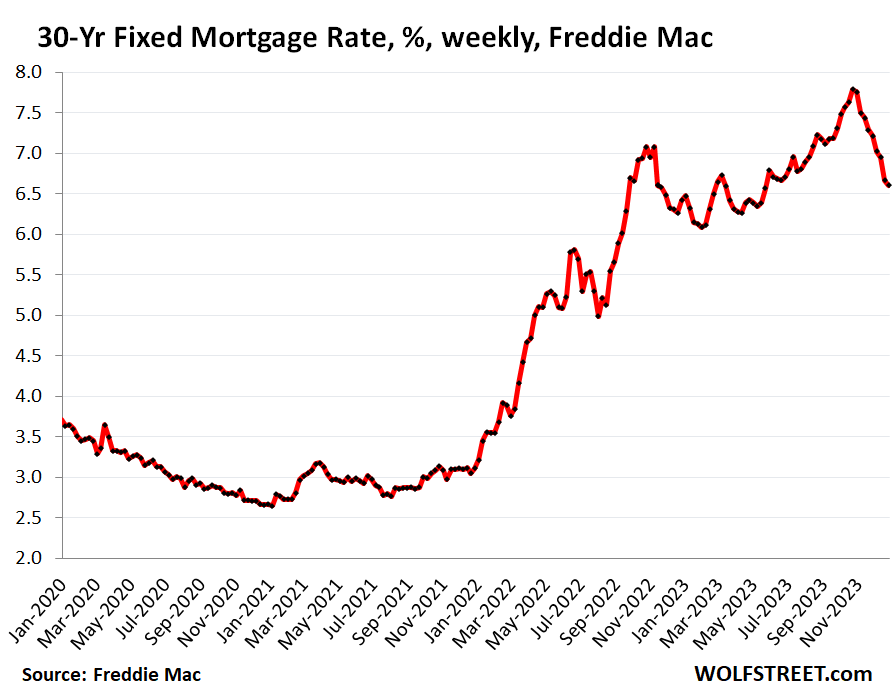

A similar drop in mortgage rates a year ago to even lower rates didn’t turn up sales volume either – on the contrary.

By Wolf Richter for WOLF STREET.

The dream is, or was, that mortgage rates dropped enough in November and December to push potential home buyers out of their buyers’ strike and to sally forth and start bidding wars all over again, so that we could amuse ourselves with headlines touting the new craze, while millennials and GenZers are trampling all over each other to outbid each other and to drive up prices to make each other miserable, so that sellers could maximize their gains. The media just loves touting this kind of stuff.

And mortgage rates dropped a whole bunch, and new listings are now suddenly showing up in larger numbers than a year ago, but buyers not so much. Clearly, mortgage rates haven’t dropped to the magic level yet, folks are waiting for them to drop further, and the market remains frozen.

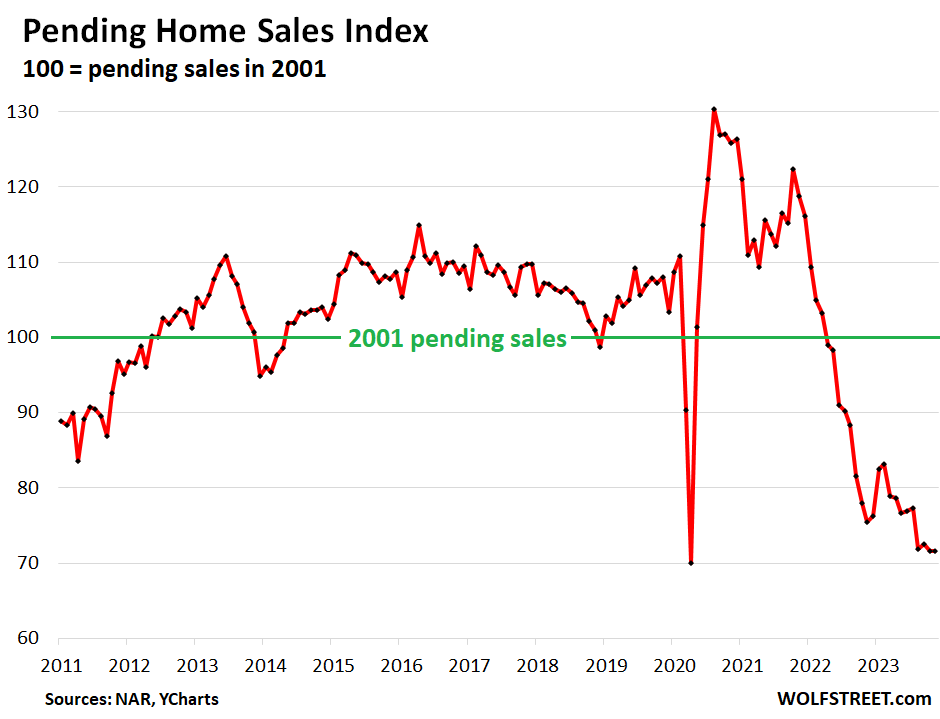

Pending home sales – a forward-looking indicator of sales of existing homes, based on contract signings – in November were unchanged from October, and both occupy the second-lowest historic low, after the historic low in April 2020, according to the national Association of Realtors today. So this is not exactly what people figured in their wildest dreams (data via YCharts):

The NAR defines a “pending sale” as a transaction where the contract was signed but it has not yet closed. At this point, the deal can still fall through for a variety of reasons. If all goes well, the sale usually closes “within one or two months of signing.”

The index value was set at 100 for contract signings in 2001. Today’s value of 71.6 is down 28.4% from the index average in 2001. Compared to the prior Novembers, the index value of contract signings plunged…

- By 5% from the already collapsed levels of November 2022

- By 40% from November 2021

- By 43% from November 2020

- By 34% from November 2019.

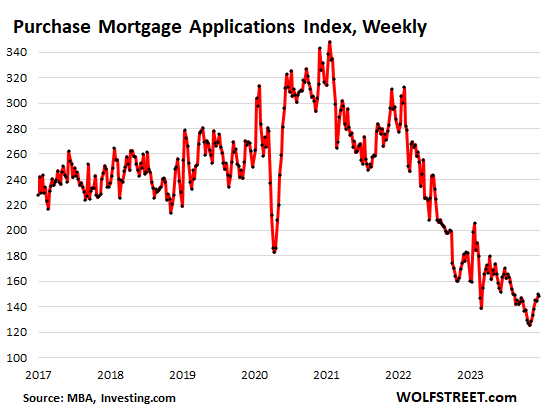

Applications for mortgages to purchase a home dipped in the latest week, after inching up a few weeks in a row, according to the latest weekly data released on December 20 by the Mortgage Bankers Association.

And these purchase mortgage applications remain at totally collapsed levels, down by 18% from the already collapsed levels in the same week in 2022, down by 48% from the same week in 2021, and down by 43% from the same week in 2019.

Mortgage rates have dropped a lot, but not nearly enough to hit that magic level that restarts the whole zoo all over again, apparently.

The average 30-year fixed mortgage rate ticked down to 6.61% in the latest reporting week, from 6.67% in the prior week, according to Freddie Mac today. Today’s average is down by 118 basis points from the peak of 7.79% in the week at the end of October.

Ironically, there was a similar drop (101 basis points) a year ago, to even lower rates of just above 6%, and it didn’t turn up volume either – on the contrary.

The issue with the frozen market for existing homes isn’t the mortgage rate – it’s the price of the home that people want to buy. Prices have shot sky-high over the past few years, from already very high levels, and the solution is lower prices. A continued buyers’ strike goes a long way to making that happen. And in some markets, that’s already happening.

Homebuilders who have to sell their homes and cannot sit out this market have figured this out. They’re building smaller homes with fewer amenities to get prices down, and as their incentive to induce people to buy those smaller and cheaper homes, they’re also buying down mortgage rates which takes the place of other incentives they would normally offer.

And so sales of new houses have not collapsed to historic lows – unlike existing homes – but are at the muddling-through levels of the years before the pandemic. Homeowners who want to sell should keep an eye on the market for new houses because that’s where their competition is, and that competition is getting fairly aggressive to try to sell new homes.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

The sellers in Phoenix metro are beyind unrealistic. You’d have to be desperate to pay the prices they are asking here. Sellers are not budging but glad to hear buyers aren’t either. Let the standoff continue. I wouldn’t pay the prices they are asking.

I’d definitely consider a new home over paying the outrageous prices sellers are asking for their existing homes, many of which are 1970s, 1980s, and 1990s homes and all the problems associated with older homes. Some of the outrageous prices are in bad areas too where investors went in, put lipstick on a pig with their “luxury ” vinyl flooring and tacked on 200k markup after a one month, cheap remodel. None of the systems have been updated. Lol Glad people aren’t falling for it.

Yes, same here in South Florida, which is why there are so many new developments closer to the Everglades.

If people are going to pay stupid prices, they’d rather get a brand new house that’s hurricane proof.

Soon a Real Estate agent will drop in here talking about how these mortgage rates are lower than long term averages. When asked about house price to income for this long term average, they will dismiss it as justified.

Good to see house sales volume fall. It shows that the whole market is unstable now and RE agents are making way less.

Despite bankruptcy spiking in RE industry, NRA wants lower rates, but not lower price. Looks like NRA also wants to screw RE Agents.

Yes. The NAR is an advocate for RE agents, but not their clients. When prices are too high, buying is difficult, so the NAR is out there trying to tell potential buyers its a great time to buy. When prices are too low, I imagine they’d be telling potential sellers it’s a great time to sell.

As a buyer or seller, don’t listen to anything the NAR has to say. It’s propaganda that’s not in your best interest. Whenever I see an article published by the NAR, I immediately discard it.

As a real estate broker, I disagree. Prices are not sustainable right now. You have greedy sellers that gained $100-200k in equity by owning a home for only a couple years and that’s not fair. Prices are too high and have been for a long time. I sold a lot of dump fixer uppers this year… 9 to be exact. All below $500k. Multiple offer situations that honestly made no sense. I don’t do real estate sales as my main gig because it’s not sustainable. What needed to happen is happening and it’s drawing the price of rentals down. Due to inflation people are turning to roommate and multi generational housing again. Those folks with 2 and 3 % mortgages are renting out their homes instead of selling. This combo is bringing down rentals about 18% in my area, and it needed to happen. Nobody can sustain paying 50% of their income on housing.

im seeing this all over facebook and IG from friends wives who are RE. making their short reels of ‘rates are the lowest theyve been in a year, if you got off the bus waiting for prices to come down you better get back on now because its only a matter of time before youre priced out again!’

i put a laugh emoji after each video because we all know its complete BS.

Idk why Long Island seems to defy the odds, housing that is priced close to appropriate still ends up in a bidding war and overpriced homes seem to sit but they still move at some point. average mortgage here is $5100/month…..or maybe 4200 if you want to buy a cape that was built in 1904 and hasnt been updated since the 80s.

What about the gators?

Exactly!

They’re having difficulty getting financed, so they’re relocating to Louisiana.

@Apple: “What about the Gators?”

They are free with the purchase of any home 😂

Taste good & wear good.

The Pythons are eating them.

They better realize there is a snake problem,buyer beware

I’m fine with NOT SELLING at MY price

and renting – need garage space I won’t be allowing with rental

also watching foreclosures now for another rental

My dad lives in Cedartown, GA, okay town but nowhere’s ville.

There’s a semi-custom house with 4 BR, 5 BTH that sits on .69 acres. The listing doesn’t state the SF. It’s on a slab and sits right in the middle of rundown, 1000 SF houses. It was bought after getting to the drywall stage and sitting unfinished through COVID.

The current owner is asking $595K which is beyond ludicrous. 5 years ago, the house would have sold for MAYBE $250K.

I agree with Wolf; the issue is NOT rates but prices. And with $1.7T in deficit spending, a recession isn’t in the cards anytime soon. With lower rates, housing will stabilize this spring and begin to turn around. The only question is what happens to inflation in ’24? Does it keep dropping slowly or will there be a modest rebound?

My money is on the later.

When I see “luxury vinyl flooring”, I scratch it off the list. “Luxury” my azz. I call it “quick flip linoleum”.

Yeah, and that’s only what you can see on the surface. Check those luxury cabinets for particleboard which melts under high humidity or once getting wet. Same with the wafer board roofs hidden by pretty shingles. The list goes on.

Wow! It’s incredible!

LVP is perfect for those who love living throw away society… or won’t spend the time/effort necessary to take care of anything.

My home is 2020 so only a matter of time before 15K or more for new HVAC and of course other expenses. Plus not wired for Internet and some of the convenience features that are invaluable today. On the flip side more square footage, larger lot, and no HOA compared to newer homes where you can high five your neighbor leaning out your windows.

You can buy land and build your own house and avoid all that HOA nonsense. I’m with you on HOAs. Many of the older homes here are also in HOA developments, so it’s hard to avoid them even with an older home.

When was yours built???

2020 home? New hvac soon? Wired internet is invaluable? Dude, you ARE in a newer home! Another FOMO whiner.

Oops 2000 home!

3 year old house needs a new HVAC *soon*? What kind of sh*tbox did you buy? I have a 22 YO Trane heat pump that sits on the roof in direct sunlight here in the desert where it gets to over 100 degrees for months on end…. it’s called maintenance. Try it. You’ll like it. Clean the coils… you can DIY with a garden hose while drinking a beer. Runs cooler and last longer. Change the capacitors every two or three years. Cheap insurance if you know how to turn a screwdriver and not electrocute yourself (aka have common sense).

Who has wired internet anymore?

I’d rather have an old house sheathed with CDX and older growth framing than the cardboard boxes built today.

Sitting in Hicksville, Flyover with 62 year old Bastian-Morley hot water gas boiler made in La Porte, Indiana, came with the house. No plans to replace, but may buy some new ones to put in storage before they are banned, for back-up or barter purposes.

My house in SF was built in 1908 with huge redwood beams.

Wolf’s first paragraph illustrates the chaotic considerations that occur when the market fails. The case in point is the asset bubble in housing prices. Price is suspended while the market develops an alternative, kind of like watching water boil.

one thing I’m not finding is cost of UTILITIES for these older non-energy efficient homes

this past weekend at church I spoke with friend who has 90’s+ newer home that was certified energy efficient

said he hasn’t turned on heat – I’ve had on for month

It’s fine as in Tucson 30’s are super cold nites and 70’s in winter are norm

NORM for all you winter visitors

I am convinced no one has the stomach for devalued asset prices. And I mean NO ONE. We have all been trained to rely on 2% inflation and low interest rates. Everyone is suppose to make money, all the time with no losses, especially in real estate.

I would gladly reset my home price to restore the purchasing power of the dollar.

Praying for a good old fashion deflation.

“There is no money!” Javier Milei

Eminent domain and commie block housing. Divert all social security funds towards the effort.

Certainly a fitting nom de plume, herpderp.

When I calculate my “net worth” I value my primary residence around $250k (about 30k below what I paid for it) even though Zillow values the home at over $420k. When I sell, if I make more then $250k great! But I am always realistic about my home. It is NOT an investment, it is not my retirement income, it is just a place to live.

Why is it that a home just a place to live and not an investment? That sounds like some ancient saying from old. I would think it’s the biggest investment one could have. If one stays flexible and keeps the crust off the fart, selling is good if the timing is right. But many reasons and excuses not to sell, where will we go? What about the dog, the kids won’t be able to find us, a big headache.

Well that is one way to look at it, my home is not a financial investment. It is a place for my kids to grow up.

Meanwhile the preponderance of buyers have a different point of view as indicated by the churn that underlies the buying and selling market. Anyone that is not buying or selling is not in the market. And therefore, what they think is irrelevant.

Something’s gotta give. I am personally looking for a starter home near my workplace in a high priced metro. The wife and I both work however I don’t want to pierce my monthly budget of 4k.

With the high cost of entry and elevated mortgage rates I am essentially priced out of the market outside of purchasing a mobile home or aged condo. We are both young professionals making reasonable incomes and I know we aren’t the only ones on the sidelines.

Well, a starter with stipulations is, probably, not a realistic expectation even though your power program insists that you be obnoxious.

Having been forced to move from Tulsa ok and Castle Rock CO during oil field recessions housing does not always go higher short term. 2 homes in Ok lost 30 percent in 2 years and the CO home lost 20 percent in 3 years. I had to sell to eat and took decades to overcome home buying purchases . Asset prices do drop look at plots by Wolf and CRE transactions

“Your wish is granted” –not god. The emperor has no clothes: who will lose when real estate corrects in 2024 after losses in low interest rate securities already borne? Who is the ultimate risk taker given anti-deficiency laws and no-guarantee-bad-security, crony loans and overleveraged companies’ bonds?

That is one fine bundle of joint hypothesis that might set the world right, if we just all agree to be friends.. That, in fact, is a facsimile of Ben Bernanke’s solution to the greatest financial crisis since the “great depression”, both caused by the bad gambling bets placed by the entitled.

Lucky me, I live in a blue state (greater Boston metro) where the nimby’s are far too numerous to allow multifamily housing in quantities meaningful enough to move the needle. Naturally, the end result is exorbitant prices due to high demand, no inventory, and mass gentrification.

I too am in greater Boston. I’m so happy we bought our home in 2016 and in our mid-40s are on track to pay it off before our 50s. This housing market is insane and we wouldn’t be able to afford our house today.

There also isn’t much in the way of new homes for sale here in the bean – unless you want to live in a condo or townhome (with the added HOA fee).

no problem I live in your backyard or front yard anyway. Love blue states.

Interesting that you claim Boston as a blue state. Only in the sense of Bill Clinton’s definition of a new, blue state.

Previously, a blue state was the home of returning WW2 veterans who fashioned a social capitalism for America that was meant too prevent the atrocities they witnessed from happening again.

With the nearly set-in-stone rate reductions planned for Q12024, why would any buyer plunk down their deposit now? A brief wait of 3 months, and they can save hundreds per month for the next 10-20-30 years, right?

If the Fed hadn’t telegraphed the potential for said rate cuts, that hesitancy might not exist. Only the most YOLO/FOMO buyer is going to buy right now.

FED does not really control the 10year /bonds yield or mortgage rates unless they are doing QE or QT or buying selling MBS.

Right now, they are doing QT. Treasury has to sell lot of bills/bonds to fund deficit .

These factors may add pressure to bond yields over time.

As they say, nothing goes in a straight line.

US debt grows and grows. All older debt needs refinancing when the bill/note/bond matures as we spend more than we raise in revenues.

QT continues at 60 billion/month.

How do long term rates come down in any significant manner when supply of debt is increasing and buyers are fewer?

Without the Fed buying US debt, rates will fall much more slowly than most people anticipate.

Because they telegraphed that they are thinking of rate cuts (not discussing but thinking according to Powell) it means if you believe them then if you buy now then ostensibly you could front run the rush when everyone tries to buy and sell in 2024 when they cut rates. Then you can refinance. It is not going to surprise me that if mortgage rates drop then the buydowns and closing cost assistances that new home builders are incentivizing would cease as they try to maximize profit. There is going to be a lot of hindsight on what the right play was.

Dirty Work,

“With the nearly set-in-stone rate reductions planned for Q12024,”

🤣🤣🤣🤣

I think ever single word in this line, other than “the,” is BS.

But yes, in terms of the rest of your comment, I think you kind of nailed it, buyers are going to wait until mortgage rates drop further, and then mortgage rates don’t drop further, and then prices have to drop to move the homes.

Isn’t it very likely that rates don’t drop that substantially more? The market has front run the Fed.

Yes, the market has gone crazy with wishful thinking. It will take the Fed a long time to catch, and while waiting for Godot, market yields will come back up. This stuff is volatile.

Also I strongly suspect that the Fed strongly suspects that inflation will dish up nasty surprises, because inflation always does that, and so they’re in no hurry to actually cut rates. The market has done the cutting for them, and the Fed can wait.

Where do people get these fantastical ideas?

Houses are still priced like 3% mortgages are a thing. Even a few percent drop in mortgages won’t move them.

I may be off but it appears to me that people buy houses according to their monthly payment (kind of like cars). When the interest rates dropped, all of a sudden potential monthly payments dropped so there was a windfall. Now the issue was who gets the windfall. Buyers could now buy much more house at the same monthly payment or sellers could sell the same house at the same monthly payment by simply raising the cost. It seems the sellers won.

John,

There are three parts to the equation.

You hit one part of the equation. Yes, payments, payments, payments — for people who finance. But rates may have bottomed out for a while amid this recent market frenzy, and those lower rates didn’t stimulate buyers at all.

So the only thing now that will stimulate buyers is a lower price — for people who finance. Price price price — for people who finance. Sellers can’t change the rates, but they can change the price. If the price is low enough, it will sell. That’s the second part of the equation.

Then there are the cash buyers, and they don’t give a hoot about payments or rates. All they care about is price. Price, price, price. That’s the third part of the equation.

Homebuilders, who are the pros, figured out all three parts of the equation. And they’re following through.

John,

and this:

“(kind of like cars).”

So, 21% of new-vehicle buyers pay cash and 63% of used-vehicle buyers pay cash. They don’t give a hoot about payments. All the care about is price.

We went through this here:

https://wolfstreet.com/2023/12/06/subprime-comes-home-to-roost-for-specialized-auto-dealers-lenders-their-investors-car-mart-was-next-to-confess/

The interest rate part of the payment equation is WAY more likely to move substantially lower than price.

If the fed lowers 1.0% (assuming we get to 2.0% inflation), and the risk premium on mortgages rekative to bonds goes back to normal, that is a 30% decrease from here and isnt out of the question.

As for prices, even in the great crash of 2008-2010, which isn’t likely to be repeated in 2024, prices only dropped 25%. Will they drop 30% from now? I seriously doubt it, but it could happen.

I thought the same in 2008 then after that I think anything is possible in either direction.

Btw.. fed cutting rates don’t impact mortgage rates or long term bond yields.

Bond yields may go up a lot in the future if the govt does not control deficit.

Covid was also a huge part of this as 650K to somebody living in the Bay Area and could move to Sacramento was a steal, especially to get 2500 sqft. That may have flipped a bit since some employers are getting back to in the office but at least where I am at and in my profession teleworking seems to be here for good and that’s great. Can’t even imagine a return to a commute although admittedly it would be 15 minutes or 20 on a bike!

But the thing is: if you buy when rates are too high, you can always refi (assuming you think rates will come down).

But if you overpay for the home, you can’t go back in time and change that if it comes dowm in value later.

You can refinance if you can refinance. Many people could not refinance loans when rates dropped in 2009/2010 not due to income, but because asset values fell too far. Buying at the peak of prices and rates and assuming you can refinance is riskier than people presume.

This is where Realtors drive me crazy is with the “marry the house date the rate” talk. I hope many of these 2022-now homebuyers don’t end up like the buyers who bought 2004-2006.

Great point!

MM,

In essence buyers are being told that they can “time the market”. A true life anecdote (and I’m dating myself):

Parents purchased a home in late 1973/early 1974 (don’t remember exactly but in that time frame). 20 year mortgage. I remember my mom saying that years later that the interest rate was 9.75% (and looking at FRED, I think it was probably 8.75%). When parents purchased it, her employer (an attorney) mentioned that she could refinance when the rates went down. So how long did it take for the rates to go down to below the rate when purchased?

Eighteen (18) years.

Now 50+ years ago is not the same as today, but this idea that we’ll return to the mortgage rates of 2018 is delusional.

Fast Eddie,

Oh I absolutely agree – I personally think we’re at the start of a generational up-trend in rates.

I should have worded that comment better. Hadn’t finished my coffee yet. Buying at peak prices, regardless of where rates are right now, is a recipe for overpaying.

I think that is the correct way to think about the purchasing decision. A cash flow decision rather than a capital purchase. Americans are not dumb. The first 15 years of a 30 yr fixed rate mortgage is primarily interest payment.

Yeah it was kind of humorous seeing the media and Twitter folks go in a frenzy over the recent mortgage rate drop being the catalyst for a new craze and going to the moon. They all forgot that seasonality is still a thing and this time of year is not a typical big selling season. With that said, this might be a glimpse of new normal sales volume (contingent upon higher for longer). The buying-sellers, i,e. owners selling their current home and moving into a new home, are not going to return unless mortgage rates drop substantially. Their supply and demand are out of the market, so overall sales and applications should be lower than before.

These people locked in their homes also have incentive to avoid moving for a job. What they save in housing cost could be lost via missed advancement opportunities. If you are a renter, take advantage of it. You may get outsized career opportunities the next decade if you are willing to relocate.

Will be interesting to see what happens when Spring hits. Prices are only down slightly in my area, Sacramento, but lots of new building occurring as well. My guess is they hold fairly well since still very affordable compared to Bay Area and job market is generally good.

I was wondering about this too. By that time, I think rates will be higher and this spring’s selling season will be a dud vs last year.

Yes, it will be interesting. Will the housing market price decline in a fashion described as unraveling or unwinding. Each is a decision, made by the wealthy.

I saw a person raise the price of his home by $30k today after it sat for 150 days at a lower price without offer. Obviously, such people are emotionally invested and are their own worst enemy. Meanwhile, builders take advantage and gain market share. The market keeps moving along without the emotional and stubborn players.

Unless you have to sell, nothing wrong with seeing if you can get a big fish. I don’t know RE but don’t think much of a cost, if any, to have it out there. There are emotional or people who just need to buy on the other side.

Keep on waiting, and waiting, and waiting. There are houses around here that have been for sale for years while holding out for that “big fish”.

Yep. I get the impression that some of the listings out there are not people who really want to sell.

It’s like this. Suppose you bought a Porsche 911 Turbo for $200,000.

If someone offers you $150,000 in one year, would you take it? Probably not.

Now let’s say there’s a supply shortage so they’re not easy to get new, and some fool offers you $400,000 next year for the car you paid $200,000 for it. Would you take it? Probably.

I think a lot of the listings we see are “If someone is dumb enough to offer me X for my house, I’d sell.”

They’re not interested in selling at market price, just waiting to see if they have one foolish buyer that really wants their particular house.

hah with SoCal prices still insane in any measure, those rates will probably have to drop to 2% before the frenzy is there again. This is assuming the frenzy will be there with the perfect combination of everyone still employed, super low rates and still limited supply…feels like there will be an inverse relationship of the lower the rates go, the more pre-owned houses we will see listed

Time will tell, current environment is still pretty damn depressing for any non FOMO buyers to feel hopeful about..

Well So Cal hasn’t been reorganized by the slip of the plates for a while. Whistling past the graveyard, is a symptom of humanity.

Yeah I wonder about that from time to time..if we do experience that big one and take out a bunch of houses…will my RE agents tell me then it’s a good time to buy cause you know inventory will likely be tight afterward?

The mortgage rates seem unrealistically low compared to the risk. Specifically, just tying the note to the 10 year treasury doesn’t account for the risk that the buyer doesn’t pay the mortgage back; mainly in case of job loss and no buyers as Mr Wolf describes. The mortgage insurance premiums are the key to providing “liquidity” and they seem unrealistically low as well as the 20% equity, and mortgage insurance can be dropped, in some of these bubble markets. Bailing out these mortgage insurance companies in the tradition of: “privatizing profits and socializing losses;” and paying for it with deficit spending that is the cornerstone of Modern Monetary Theory (MMT). It would seem an area that is ripe for Congressional oversight.

Ja, new builds are the only game in town and the resale market will not move until asking prices decline or inflation motivates buyers to gamble on existing high nominal prices. On the margin, there is built-up demand, but the cap rates on mortgages don’t compute. Sellers are using 2.5-3% cap rates while buyers are facing 7+% cap rates. Builders offer 5% cap rates.

1) AMZN will sell brand new 2024 Elantra, Tucson and Santa-Fe online at a steep discount. Ford is raising prices.

2) In 2020, when the econ was comatose until we know what we don’t,

the ratio : new 2020 models sales/ new inventory dropped sharply.

3) In 2021 new 2021/2022 sale/ new inventory jumped above 2, perhaps to 5, bc the dealers sold online effortlessly, with a min inventory. The dealers made more money than ever before. They expanded, building “brick and mortar” crystal palaces, financed by zero rates, imitating each other and competing with each other. These places are almost ready.

4) In late 2023 the ratio : new cars sold to new inventory dropped sharply.

Your item 3 above (crystal palaces) are often not the dealer’s idea. They’d love to sell out of a quonset hut and make even more money. The mausoleums are factory mandates. When a dealership changes hands, for example, or a new point is awarded, the dealer signs a letter of intent outlining the facility he’s going to build and a timeline he is contractually obligated to complete it.

I’m not completely familiar with the Hyundai / Amazon deal but the dealer is not cut out of the process. From what I have read in the trade rags, the dealer still has to physically deliver the car to the customer to comply with state franchising laws. The deal probably goes to a “delivery” consultant rather than a sales consultant at delivery and they may be paid a “mini” on the delivery (aka small fee for the delivery). That’s likely where the huuuge discount will come from (and the dealer will likely attempt to beat the customer up in aftersale. “How ’bout that polycoat?”)

Manufacturers have never really gotten a grip on the e-commerce “1 hour deal” target. Heck.. I just picked up a new technomobile last month, had everything prearranged through my industry contacts, the car was sitting in the delivery area, and it still took me 2.5 hours to get out the door because paperwork. Cash deal. Tax, license, title only *fees*…. and it still took that long.

El Katz, Dostoevsky “Notes from the Underground” 1864 : AMZN is throwing stones at the dealer’s crystal palaces.

2) High turnover/ mini commissions/ steep discounts, $200 down, in

7 min, like the doctors. Let them make money on high end cars, used cars, auto parts, service & maintenance, finance & insurance and few extras when delivery is done.

3) Hyundai & Kia is building a firewall against Toyota Corolla. They might rise to #2 spot behind GM, leaving behind Toyota, Ford and Stella, deflating them.

4) AMZN insured Hyundai & Kia survival in the next recession,

keep their labor force happy and bring strong dollars to S. Korea.

Hyundai and Kia have some serious problems with engine reliability/longevity. New cars grenading far earlier than they should. One thing to know about the Korean manufacturers… they’re not as customer friendly (aka ethical) as some of the others. Nissan was a darling at one time… look at them now.

IMHO, Hyundai and Kia are nothing more than the “luxury vinyl flooring” of the automotive industry. They look good from far, but they’re far from good.

It’s illegal for Amazon to sell new cars in many states. Free Market or something something.

People keep getting this wrong. Amazon isn’t selling cars. Amazon allows Hyundai and its dealers to use its online platform to sell cars. And the customer will need to go to the dealer to take delivery of the car. They’re not going to violate state Franchise laws.

Very nice article. The media is constantly pumping the narrative that as the rates drop more in the coming months, the FOMO buyers will increasingly start stampedes at the open houses. May be they are right, I am not sure. But when looking at the certain areas I have been looking, I don’t see the signs yet.

As an example, according to Redfin housing market data, in some metros like Philly, current median price is below 2021 levels and approaching to 2020 levels. The median price fluctuate a lot though, based on the composition of the houses sold. Some, this is surely subject to change. Especially the tech workers, who contributed to driving up prices, seem less financially stable than last year. I personally know two remote tech workers lost their jobs in 2023. I don’t expect a very sharp turn in 2024. But I don’t know. But things may change if the FED prints another 1T. We’ll see.

One only buys to fulfill a need.

1) In 2006 the ratio new house sold/ new houses inventory dropped to

about 10%, bc inventory reached 600K.

2) In late 2023 new houses sold (41K) / new house for sale (450K) dropped to about 9%. Not good enough.

3) Between 2006 and 2012 inventory dropped from 600K to 150K, about a third of today’s.

4) In 2012 the ratio : sold to inventory was the highest ever.

Starvation and dehydration turned the “survival switch” on. From 2012

low sales rose in a low slog up only to 2000/2005 lower decks.

Something is wrong !

5) The real estate market might be subjected to a “systemic change” for over a decade, since 2012.

The systemic change is people are staying in their homes longer, if not forever. This is very common in all the rest of the world.

I have friends and family in south america and europe living in homes built by their great grand parents! There’s something really cool about keeping the family home in the family for generations.

Boomers can age in place (way better than a nursing home) and leave their homes to their kids at a stepped up tax basis when they die. Why sell and rent some cheap build-to-rent place.

Supply is going to be constrained for a loooonnnngggg time, in my opinion.

Supply is artificially restricted because of regulations.

Govt can loosen the regulations and we’d see more and more homes/multi family homes.

I am in San Diego and I see lot of construction o multifamily homes all around me.

Had a cousin move from San Diego to Amarillo Tx . Owned a single family home someplace in San Diego and said there were 8+ adults in many of the homes with no place to park all the cars. Very uncomfortable living conditions and crowded everything tho the weather was nice and the views spectacular. All choices one can make

BS ini..

In my neighborhood a 6 bedroom home was sold for 2 million usd recently.

4 families moved in there with 8 cars .

You may be right for the wrong reason, in several of the situations that you claim is really cool about planning too profit after the mutt croaks.

My mother was a Realtor from 1986 to 2011… and she always said that it wasn’t falling interest rates that attracted house buyers but falling interest rates that started ticking upwards. Until we see that I think everyone pretty much holds what they got.

Buyers are waiting for that 3 percent. I think deals will continue to fall apart unless you get three percent or property prices drop dramatically.

Some 4 million homes will sell this year with mortgage rates ranging from 6.0%+ to almost 8.0%.

Enough said.

There are plenty of buyers out there who can afford to buy and they’re buying.

No, they aren’t, and no they won’t. Only a few stupid people will.

About 3 million will be sold with mortgages and about 1.1 million will be paid for with cash, and no mortgages.

You’re missing out on new construction buyers with 5 to 5.5 percent interest rates financed by the builder.

By the way, from the wolf’s articles, it can be seen that mainly the builders are selling while the already existing homes are on the market and waiting for stupid buyers.

Exactly, buyers are waiting for 3% mortgage rates which can only happen with a resumption of QE which is not as unlikely as the incredulous people that comment here describe their understanding of reality.

I think we will see QE again if an asteroid hits the earth or if some such event happens

Wait for a small bank to fail for fed to start qe using the excuse systemic risk lies what they did in March 2023

Two small banks already failed in 2023 since the March/April turmoil, and the FDIC shut them down without drama the way it’s supposed to go.

I guess it’s all about location. I live in a Cincinnati suburb where we never have booms, just muddle along. My neighbor put his house on the market just after Thanksgiving at $560K, sold in a week. That was listed $20K under the Zillow estimate, and I haven’t seen the sell price yet. You want a new home but work downtown? You’re driving 10 more miles than 15 years ago.

Reminds me of 2006, when the improbable seemed possible.

It seems I was wrong, QE prevented, actually redefined the economic policy agenda for the past quarter century.

ZIRP is and was a strategy, implemented for the benefit of a select few of wealthy criminals whose losses where deemed to be so substantial that they were bankrupt. Which would have disrupted the corrupt markets that we all bitch about.

I saw some Financial YouTuber walking around an upscale residential area in Miami-Dade County.

He showed us some listings where a house was bought for $500,000 in 2017, and now wants to be sold for $1.6 million, or a mansion bought for $1 million in 2019, and is now listed for $3 million.

Property taxes are astronomical too; about $20,000 a year for the $1.6 million property, and almost $45,000 a year for the $3 million property.

My friend is selling his house in south FL and listing for $2m or so when it goes up on MLS next month. They bought it over 10 years ago for under $1m. Supposedly it’s the lowest priced house in their neighborhood with next available home $3m+ and for sale (though that one has a water view). They are downsizing as kids are graduating soon and already moved out and renting til the youngest graduates then leaving south FL. Will be interesting to see how long it takes to sell…he tells me most buyers in their area are cash buyers.

The realtors I know in CA tell me that most (over half) of all “cash” buyers write an offer without a financing contingency and are bringing “cash to close” but are still borrowing money from relatives (the bank of Mom & Dad) a HELOC on another property or a loan secured by a stock portfolio.

This sounds like typical Realtor Bullshit®. They just make up bullshit as they go. Or did you make it up??? For example, taking out a HELOC on another property where the HELOC is big enough to buy a new home in CA… LOL, try to take $1 million HELOC out of a median home in CA and see what happens. Only few people in CA own a property with enough equity in it to get a HELOC that is big enough to buy another home in CA. HELOCs are used occasionally for down payments. But HELOCs have seriously fallen out of favor. See below. And HELOCs have higher rates than purchase mortgages.

Here is to your Realtor Bullshit® 🤣🤣🤣

@Wolf I agree with you that Realtors BS a lot but when a realtor I know tells me a young couple bought a condo with a loan from their parents that live near me and might know I tend to believe them (not a lot of kids in their 20’s have the cash to buy a condo in San Mateo in their checking account). You must be aware that many high net worth individuals with millions in stock holdings tend to borrow money from a brokerage and close with “all cash” rather than selling stock (and paying capital gains) to buy expensive Bay Area homes. I’ve personally closed on multiple properties with “all cash” with money from refinancing other properties and yes, even some HELOC cash from my personal home (that was paid off once the property that was purchased for “all cash” was stabilized and got a permanent loan). Many groups of recent immigrants (especially from Asia and Eastern Europe) buy homes with informal “off the books” loans. I have no reason to BS about this and I see no reason why any Realtor would want to lie abut this (unlike when they say it is ALWAYS a good time to buy “or” sell)

Honestly your name checks out aplty.

Lawrence Yun was on the radio saying this year will be a great time to buy a home. He predicts a 15 to 20% rise in sales. People who have been sitting on 3% mortgages will have to sell for one reason or another. Same old bull S$it from this moron.

Sales will rise when prices come down enough. Prices have caused sales to collapse. So yes, Yun was correct, if prices come down enough, sales will rise.

Good luck to him. I don’t know where in South Florida, but I can tell you that Palm Beach County has slowed quite a bit, at least at the lower to mid-range prices.

Wow! That’s worse than Crook County Il burbs.

New houses are selling at nearly a 2x premium to existing homes here in Southern New England. Nothing under 1 million while plenty of decent existing homes are being listed 500-600k. Not exactly seeing new builds pressure existing inventory.

My guess is we’ve seen the bottom in purchase mortgage applications. Transactions probably remain limited and well below the 2001 average, however, as we’ve priced out a significant portion of younger millennial and Gen Z buyers. I’ve had a few coworkers still manage to buy at peak rates a few months ago (30-40 somethings), and those who really want/need to buy will find the means to do so this spring.

Longer term, I’d expect to see pending sales remain well below the trendline from the 2000’s, evening assuming a base case of a strong economy and tight labor market. If these conditions finally do loosen, housing prices may eventually drop in some of the eastern markets that continue to defy gravity. West Coast markets probably have another 10%+ downside if financial conditions take a turn for the worst.

Regardless, an entire younger generation will have to wait until mom and pop croak to be homeowners. Years of failed policy culminating in a broken housing market. Hate to see it.

Hello also from Southern New England! Not quite as bleak here for new homes, as ours are in the $750-950k range; but about $500k/existing for sure. Still way above my husband’s and my budget, and we earn nearly $250k/year. I have no idea how people can buy these things – are young couples just maxing out their monthly budgets on housing? How many have kids/want kids, and know that daycare for a toddler and an infant is probably over $500/week around here, to say nothing of diapers and formula? This housing crisis could very easily lead to a demographic bust, too. I’ll add as an apartment dweller that space considerations alone have prevented us from beginning the fostering/adopting process for the time being. And I hate that kids are probably suffering from a lack of foster/adoptive parents too because of this mess, as only older people can afford homes with any space.

My spouse and I make about a third of your combined income. I bought in southern NH some years ago – monthly, all-in PITI is about $1750/mo.

We live an ultra-low cost lifestyle, i.e. my food budget is $10/day, I make my own coffee at home, do basic car & home maintenance myself.

We definitely can’t afford a kid right now but we’re ok with it. $500/wk for daycare is nuts – at that point one of the parents might as well just stay home.

And many neighborhoods where mom and pop lived, which were once pleasant middle class communities, have now become no-go zones. To me, that is a big problem with buying a house and holding on to it. The neighborhood can deteriorate (fairly rapidly). I have seen it happen.

That’s what I’m seeing too along the MA/NH border. Anything reasonably-sized is going to be an existing home.

No such thing as buying a new build in this area, outside $1M+ mcmansions and condos with insane monthly HOA fees.

America has become a “No place for Young people who can have family and raise kids”.

This is a slow motion catastrophe and a sign of civilizational failure and decay.

Actually, new houses aren’t selling as the data of Wolf’s article points out the divergence between the asking price and the dwindling pool of buyers willing to agree to purchase an over priced property.

Appears to me that we Americans (and much of the world) have become addicted to the folly of massive deficit spending and the resulting inflation. As we approach $35 trillion in monetized government debt, somebody must buy it. The question is who?

We don’t know how this will end, but history provides a guide. Fiat currencies ultimately die a painful death.

Meanwhile “let’s face the music and dance!”

Cheers and happy new year!

All currencies die a painful death. That’s just how it works; we wouldn’t change currencies from metal to fiat back to metal if, at every stage, the existing currency failed for one reason or another. All currencies in the past have failed, and so they got replaced.

I say that with _zero_ knowledge, but that seems like a more obvious explanation than the inherent goodness or badness of the “kind” of currency.

The issue isn’t with the currency, it’s with the economic machine. It’s with the unpredictable movement of money into and out of a local economy. It’s with the need for money to get into everyone’s hands at exactly the right time. It’s with the asset speculation that functions as an unregulated “other” currency that is prone to currency manipulation.

I say that with _zero_ knowledge. But it seems plain that even now, economists haven’t figured out how to make simple economies that “just work”. Some part of the machine always fails; some part always needs to be papered over; if America is doing well then some third-world country is doing terribly — both can’t be doing well at the same time.

That is not a matter for the people to solve. The common good is rarely the reason for our constitutional governments actions, these days.

Our government sues the people to overthrow the Constitutional constraints, put in place to prevent an aristocracy from establishing their preferred form of government, fascism.

I’m curious what a new home sales chart (for both attached and detached) would look like for San Diego. There’s not very much being built here in the way of attached but seem to be lots of multi family popping up all over. New and existing detached are fetching a pretty penny. There also appears to have been a housing feeding frenzy here over the last few months and many folks are expecting it to continue for a while. Some of the sold prices I’m seeing on Redfin are making my eyes pop.

In big densely populated urban cores with ballooning populations, such as San Diego, multifamily (condos and apartments) should be just about all that gets built today.

New single-family houses are being built further out. But not everyone wants to live in a house, and not everyone wants to commute for an hour twice a day.

As population balloons, that’s the choice you make with new homes: new SFH in urban sprawl with longer commute; or new condo/apartment inside the urban core with short commute. And if you don’t like big-city living, don’t live in a big city. Buy a house in a small town. People get to choose what they want and what works for them.

Obviously, if you’re billionaire, you can do whatever you want. But most people don’t fall into that category. So they make choices that involve compromises, and new construction caters to that.

re: “They’re building smaller homes with fewer amenities to get prices down”

They’re not 800-square-foot Cape Cods. There’s no GI Bill of Rights giving service men low interest rate, zero down payment, home loans.

By 1945, the personal savings rate was 21 percent of disposable income.

And the unemployment rate in 1944 was only 1.2%.

During the U.S. Golden Age in Capitalism, small savings were pooled, and quickly invested by the thrifts, or George Baily’s “It’s a Wonderful Life”.

Something’s got to give.

Howdy Folks. Still a long way to go. This current RE bubble should take a decade or more to unfold. Been scratching my head bald since the Community Reinvestment Act. Made a living rehabbing, buying/selling RE, and just wish Govern ment would quit what it does with RE……….

Unwinding as opposed to unraveling. The unacknowledged real estate bubble.

The FOMO dynamic has changed.

It used to be that buyers were afraid of missing out on a particular house before someone signed a contract one minute ahead of them.

Now potential buyers are afraid of missing out on potential lower rates and prices in the future.

Except that literally is not true. Transactions are way down. No one is afraid of missing out. Sellers think they can wait to get a higher price. Buyers think they can wait to get a cheaper price.

That must be why the asset markets are pegging new highs, because FOMO is no longer the reason for buying over priced assets.

Potential buyers now are afraid of missing out on lower rates.

Which makes about as much sense as joining the marine corp in 1967, which my high school career councilor recommended.

With prices remaining sky-high, we do get used to them to some extent (known as anchoring effect).

For instance, just yesterday, I looked at a home in Phoenix listing for 1.5M and thought: Not bad, has all the features I’m looking for, decent neighborhood. Six car garage with lift, etc. Then I look at the sales history. This very house sold for 900k just three years ago and 600k just two years before that. Suddenly, I’m no longer interested. The seller is looking for a fool….

You can just look at the monthly payment to see it’s a sink hole. Imagine putting that monthly payment in the sellers pocket. It’s a nice retirement annuity for the seller.

Why fund someone else’s retirement nest egg, plus pay their social security and Medicare on the pay-as-you-go system, with your taxes?

You can rent their place for a lot less, and probably watch prices fall to boot.

Correct, and many people from my generation feel the same way.

High prices are the result of excess liquidity, which is the current economic plan. A decline in asset prices is considered a failure for the wealthy that control the economy.

The current monetary policy is hardly restrictive.

6-car garage???

Based on these pending home sales, which I can verify is happening all over the DC metro area, Realtors will be letting their licenses expire and looking for new employment opportunities elsewhere. Even Lawrence Yun may have to find another job. Good riddance to all of them. They will NOT be missed.

Commercial property, which Wolf likes to write about:

“Newmark Group Inc. said Friday it arranged the sale of the 62-story Aon Center in downtown Los Angeles for $153.5 million in what the real-estate-development company described as the largest fourth-quarter deal for office space in the Western United States. The seller of the Aon Center, San Francisco-based real-estate-management company Shorenstein, paid $268.5 million for the building in 2014, according to a report by CoStar News.”

That’s quite a hit, $268.5 million in 2014 to $153.5 million today, and it does not include the interest that could have been made on the $268.5 million, which at say just 3% per year would be a loss of another $92.3 million. Of course some of that loss would have been made up in rents and maybe other financial shenanigans.

Mortgage rates were 8% an d are now around 7% for the same 30 year loans which is not much of a drop and they have no further to fall anytime in the foreseeable future.

Housing Affordability is an 8th grade math problem (maybe some folks were absent that year?)

If you had $50,000 per year to spend on mortgage interest (ignoring taxes, insurance, amortization, maintenance, etc. to highlight the point), then when 30 yr mortgage rates were down near 2.5%, you could float a $2,000,000 mortgage.

With 30yr mortgage rates at 7.5%, the same $50,000 p/yr for interest floats a $666,666 mortgage (ominous, no?).

When 30yr mortgage rates stabilize around 8.5%, your $50,000 p/yr will get you a mortgage of $ 588,235.

It doesn’t take a genius to see why buyers have evaporated and will not return until the price drop occurs.

People are f—ing stupid. (For this comment, I would prefer to write the word out but I’m not sure if Mr. Wolf R. would find it disrespectful to the atmosphere he would rather cultivate and sustain here, so I’m trying to be considerate for the sake of his professional efforts.)

The government has created many monetary incentives to be a mindless follower.

The government has manipulated things enough to develop a highly intertwined and layered system that rewards mediocracy. It rewards premature financial ejaculation (FOMO is but one fraction of this). It sidelines those who make decisions based on mathematics, logic, ethics, morals, creative thinking, and long term goals. It reinforces selfish behaviors and disincentives family and community strengthening behaviors.

There are a lot of people in this country with a very poor understanding of finance, accounting, relative valuation, and primitive competence in formal general education mathematics. Understanding of math and budgeting is not as crucial as it was in the past. The schools started teaching people that the squeaky wheel gets the grease, as if that is something commendable. People have been trained to indulge and consume, and are even rewarded for embracing (submerging themselves into) such a mindless basis of operation.

Math doesn’t matter anymore. Even a 6th grade level of educational attainment in math would indicate to anyone that none of this stuff (financing of housing as one aspect) makes sense, yet many lower-middle class to upper-middle class are certified (by GED or High School Diploma) to have understanding in mathematics well in excess of that level. Math does seem to matter, up until the point that the whole system is detached from it’s foundation, and then it doesn’t anymore.

Instead of knowing how to do math, these days it’s more important to know how to ask……….ask for everything instead of thinking and figuring it out personally and taking on the work to make it happen.

Just train the people to go to the banks and say………….”hey I can fog a mirror, run a treadmill to nowhere from 9 am to 5 pm as a ……….(fill in the blank with superficial service industry or government funded job)………..so Mr. Bank are you going to give me money like you gave all my friends who asked for money……….I want a McMansion too……..see, see that fog on the mirror, that’s how I know I make sense in asking you for it.”

There is no shame in asking anymore!

I personally find shame in asking for a great deal of things in life, though one should not feel ashamed to ask for help with certain things and from certain people, I am talking about asking for the sake of asking because that’s the only real skill a lot of people have anymore. People are completely dependent on the system and like to live like factory farmed animals with corporate financed galvanized metal infrastructure that will not be paid off because the math doesn’t work and the corporation comes in and takes it eventually.

I look at portions (not all though) of the middle and upper class the same way a lot of people look at bums on the street. So they have nicer clothes, but sometimes the bum has more sincerity and certain principles they don’t want to compromise in spite of the many that it’s obvious they do compromise on.

I agree that the every day person is looked at like a bum, a beggar on the street, trying to take dollars from the libertarian rich, those who never served or sacrificed for their good fortune.

dang – I admire your eloquence…

may we all find a better day.

Real Estate is very local and all national level may not necessarily reflect local realities. I live in Bay Area Peninsula. This month many builder already increased the prices from 20K-50K for 800K-1.1M homes. New Constructions (SFH) are happening only in outer areas like Tracy, Lathrop etc. Prices are already up from beginning of the year and ALMOST back to peak levels. May not be all at peak. But after going up 100%, coming down by 5-10% is not a correction. The city/area where I live and follow real estate, I can see sale at higher prices than listing and bidding already going on. Unfortunately there are so many idiots are out there who think prices will go only up and with rates coming down they will refinance later. May be they are smart and I am idiot. Who knows?

On thing NOT disputable is FED created this big REAL estate bubble with this easy money policy for 15 years. So yes, fiscally savers and responsible people were stupids. Savers were losers except last 1.5 years where FED increased rates.

FED says it’s policy works through tightening of financial conditions. Well, financial conditions loosens up almost 20% in last 2 month. 10 year dropped by 1.25 from peak. To me this FED has no credibility left. As someone said in earlier comments, no one has stomach for price correction and that too in Election year. They are just puppets.

Most of the People I know cant afford their own home in today’s market. I have given up on my American Dream of owning a home. There was a time I should have borrowed more than my capacity even though it didn’t make fiscally any sense. Prices kept on going up, up and up.

As much I would like think rationally and fiscally responsible, I feel its foolish when whole System is rigged and FED is at the Center of it.

re: “On thing NOT disputable is FED created this big REAL estate bubble with this easy money policy for 15 years.”

No, John Cochrane disagrees: “Money is the oil in the economy’s engine, and it’s free. Fill ’er up.”

No one has to wonder why the economy is such a mess.

There is LOTS of new residential construction happening in San Francisco, San Jose, Oakland, and all the big cities of the Bay Area. But for example, in San Francisco, which adds 2,500 to 4,500 housings units a year, nearly all new construction is condos and apartments, not single family. And that’s how it should be. If you want to buy a new SFH, go drive 90 minutes east and start there.

So you’re not going to find a lot of new built single-family houses in San Francisco. Only very few are built, mostly to replace teardowns.

Prices in the Bay Area are down across the board, back to March 2021 levels and down 17% from the peak, as California Association of Realtors:

Buyers are not on strike, sellers are. I’ve been in the market for 1.5 years. There are no houses to buy. Those that do get listed are overpriced, but get swarmed by buyers nonetheless. The ugly reality is that there was a housing shortage brewing pre-covid when all the millennials entered the market. Then the Fed poured jet fuel on the fire by dropping interest rates to zero and BOOM, a full scale housing crisis was born. Now those holding low interest rate mortgages are staying put and prices keep rising because buyers keep buying.

“Those that do get listed are overpriced,”

Correct.

“Buyers are not on strike, sellers are.”

You got this mixed up. Buyers are on strike. And sellers are also on strike. That’s what a frozen market is. Which is why volume collapsed even as overall prices headed lower.

But sellers are coming out of strike: Inventory, supply, active listings, and new listings have all been rising quite nicely.

There is no housing shortage, that’s just BS. There is a shortage of housing you can comfortably afford, I get that. If you have enough money, you can buy 100 houses in a day. Which proves this notion of a “housing shortage” wrong.

Sellers did delay putting their vacant homes on the market. But now they’re starting to put them on the market. See rising inventories, supply, active listings, new listings, etc.:

https://wolfstreet.com/2023/12/20/here-come-the-new-listings-of-existing-homes-prices-drop-further-demand-remains-at-collapsed-levels/

Wolf,

I was also referring to CAR data only (November 2023 County Sales and Price Activity)

Within Bay Area, Napa went down by -22.7% for YOY prices. But all 4 core Bay Area counties, (SF, Santa Clara, San Mateo and Alameda) are in positive price gains in YOY. e.g. San Mateo County: YOY 1.3% increase. Santa Clara and Alameda have 7+% increase. That’s why I said Prices are back to where the 2022 year began.

I understand Prices have come down in many areas and also within Bay Area. But not in same proportions in All Counties of Bay Area. When we take average, data gets skewed hence my point of Real Estate very local.

Did I miss something?

Typo in above 2023 and not 2022.

I just showed you the picture of the CAR data for the Bay Area — chart in reply to your comment. Look at that chart carefully. You will see the freak dip a year ago, and that’s why year-over-year prices are up from the freak dip. This is WHY I showed you the picture.

Prices in Nov 2023 were back where they’d first been in March 2021 and 4% below where they’d been in Nov 2021.

I need to post my Bay Area update of house prices in the 5 big counties again so I don’t have to mess with this stuff in the comments.

Well said. Here in San Diego I can guarantee that the vast majority of homeowners would not be able to buy their homes back at today’s prices. It definitely feels rigged and like those of us who were saving saving saving have been royally screwed thanks to the Fed’s policies during COVID.

Wow, see my comment above as a reply to “Dr J”. You had already posted yours but I hadn’t scrolled down far enough to read yours yet when I wrote mine. What you are saying represents the same sentiments I have and was trying to convey and many of the similar points to make. Mine is much more negative in tone and harsh compared to yours so I should give you credit for being more eloquent and having more class.

So I’m just saying, in long form, that I completely agree.

MW: US Treasury yields end mostly higher but little changed on year after wild 2023

Seattle is still having bidding wars for homes in the popular central areas. The only difference is the starting point is a little lower now. I know because I tried some lowball offers and didn’t win. The final selling price matched what the agent said. So they actually told the truth. I just want you guys to be realistic. I think prices will only come down more with mass layoffs. And “soft landing” doesn’t mean that. The fact that a hundred people are commenting on this story shows that everyone is still overly aware of housing anyway. I hope it will drop too. I also hope the Mariners will win the World Series.

“I want you guys to be realistic”

We are, which is why we read Wolf’s articles, because they’re based on data not opinions. And the data show that prices already have come down. And they will continue to do so. Ok, maybe not in central Seattle — that’s called the exception that proves the rule.

There are tons of properties available around the country under $300k. Might not be what you or I would live in. But, that’s what it’s come to. Saying the kids can’t afford to buy is ridiculous. They can’t afford to buy what they dream of but they can afford to buy something to live in.

Everyone wants to live in expensive coastal cities, then wonder why they’re so expensive.

House prices have gotten so outrageously high in certain areas that 0% mortgages don’t even reduce the payments to what they used to be with a mortgage, and the monthly payment is not even remotely supported by local median incomes.

RRP jumped to : $1.018T. RRP provides good collateral in the o/n market.

RRP : at 5.3%. US 10Y : 3.89%. RRP will not plunge to zero.

SOFR : 5.4%. Libor3 : 5.54%. > 3M = +0.2%

The volatility happens every month-end. And the domestic O/N RRP facility volumes will go to zero. Should have gone long at the close.

O/N RRP goes up a lot at the end of each quarter. I forgot the reason I read, but something about using it to meet end of quarter requirements in banks books or something…I don’t know but I know it’s not an anomaly today. Happens end of literally each quarter.

FAQs: Reverse Repurchase Agreement Operations

July 26, 2023

What are the reverse repurchase agreement operations (RRPs) conducted by the Desk?

The Open Market Trading Desk (the Desk) at the Federal Reserve Bank of New York (New York Fed) is responsible for conducting open market operations under the authorization and direction of the Federal Open Market Committee (FOMC). A reverse repurchase agreement conducted by the Desk, also called a “reverse repo” or “RRP,” is a transaction in which the Desk sells a security to an eligible counterparty with an agreement to repurchase that same security at a specified price at a specific time in the future. The difference between the sale price and the repurchase price, together with the length of time between the sale and purchase, implies a rate of interest paid by the Federal Reserve on the transaction.

When the Desk conducts RRP open market operations, it sells securities held in the System Open Market Account (SOMA) to eligible RRP counterparties, with an agreement to buy the assets back on the RRP’s specified maturity date. This leaves the SOMA portfolio the same size, as securities sold temporarily under repurchase agreements continue to be shown as assets held by the SOMA in accordance with generally accepted accounting principles, but the transaction shifts some of the liabilities on the Federal Reserve’s balance sheet from deposits held by depository institutions (also known as bank reserves) to reverse repos while the transaction is outstanding. These RRP operations may be for overnight maturity or for a specified term.

In Canada, near me anyway, the cities have increased the base zoning in the core and original 1950-70 suburbs to double or triple. The existing SFHs are maintaining their crazy prices because they aren’t priced as a SFH, because they are valued as lots for 3-6 rental units. Like you mentioned in a previous article, immigration was boosted, and landlords are benefiting. It’s the houses in distal suburbs or urban condos that are coming down in price the most.

Dead on Wolf…..I am a real estate appraiser. Inventory is rising, builders are giving away the farm, and loan apps are getting killed. Those LEFT who WANT to buy…CAN’T. They can’t qualify.

2024….the year of home price DEFLATION.

Brian Jarrard-

You said “Those LEFT who WANT to buy…CAN’T. They can’t qualify.” Your idea is good, but incomplete.

When you say “those left” you ignore those with cash. I’m a potential buyer, but am happy continuing to rent (on a cash-flow analysis basis), and besides, there’s not enough inventory around that meets my particular parameters. I sold my place up north, but am willing to sit in US Treasuries. I’m an “on strike buyer,” as Wolf says.

That said, I want to lock in a retirement place when the appropriately appointed place comes around, and the cashflow analysis works for me.

Prices are too high. That much is clear. In the meantime just rent. There are times to buy and times to rent. I never rent. But sometimes it’s better.

On Fri afternoon at 2:30 PM, after the bond market closed, institutions drained the cash markets and beefed up RRP. RRP popped up > $1T.

SPX [1M] : RSI reached 78.19 in Aug 2021 4 years after RSI peaked in Jan 2018.

SPX [1M] escaped recession for 15 years since Feb 2009. SPX might plunge into recession in late 2024/ 2025.

RRP will not go to zero. RRP might rise to a new all time high.

Well, we know one thing for certain, this time around the fed will not let home prices fall too far in prices, if this fed has any say so in this matter, which it does. They saw what took place in 2007-2009 when prices fell fast, and hard; and the snow balling afterwords with all of the masses bailing on their payments, bailing on their homes because their new found ‘piggybanks’ were upside down in value and they couldn’t HELOC anymore. Oh the horror. And the stories too, some real tear jerkers. Like the day little johnny lost his porche, or little suzy can’t go to harvard now.

I remember a guy moving into a big residential house that was vacated, in tampa fixing it up and renting that vacated thing out for years, becoming a good revenue producer for him, before a bank finally removed the renter like 4 years later. Coming to realize back then MERS didn’t actually record who actually had title, so nobody knew…. I always wondered how MERS could do so, when these mortgages were sliced and diced and then bundled by wall street and sold….AS a result many MBS simply were not getting paid out either, and the entire charade was close to collapsing the system. But the fed came to the rescue like underdog and ‘saved’ us.

So that wont happen, this time around, but my feel here is this housing ‘correction’ is in its very beginning, its pre embryonic, as evidenced of hardly a peep about such a thing on these blogs. Thats my sense. Of coarse perhaps this fed can front run this too and ‘fix’ the broken before the big mess IDK.

It would take deep recession and job losses for home prices to go down a lot.

But San Francisco area already has 20 percent down from peak with out any big job losses and fed didn’t come to rescue the home prices.

Also many other places are experiencing declining home prices.

Just stating what I am seeing and being reported here.

I hope fed realizes that declining home prices are good for the country especially with these crazy obscene prices.

At the same time I doubt fed want declining home prices as you stated.

DM: Could TRAILER PARKS solve the housing crisis? Upmarket ‘gated manufactured home communities’ offer safe, spacious properties for a fraction of the cost of bricks and mortar. Could TRAILER PARKS solve the housing crisis? Upmarket ‘gated manufactured home parks’…

Soaring house prices have prompted more people to choose ‘gated manufactured home parks’ instead of traditional homes in Massachusetts and all over the country. Unlike the old image of trashy trailer parks, modern mobile park occupants now enjoy spacious and cozy communities without having to deal with property taxes. One such resident is Jack Behan, 61, who resides in a two-bedroom manufactured home with a full kitchen and one and a half bath at Nob Hill Estates in Weymouth, Massachusetts, as reported by the Boston Globe. ‘The neighborhood is a little jewel. I have a lovely yard, I am close to shopping, a local hospital, and the highway. When my friends come visit, they are amazed,’ he told the outlet last year.

SCBD – mebbe there, but a number of ‘nice’ (usually catering to the prudent retired), as well as older, less-affluent mhparks here in Norcal are coming under rent-rise pressure, some to the point of closing and the property sold for housing redevelopment…

may we all find a better day.

I sold at the height of the crazy prices in Feb, 2022. We have been sitting on the sidelines renting and waiting for the market to turn in our favor. I have owner built and owned 3 homes since 2005 it’s what we do, I thought the market would be much more favorable by now. We have gotten to the point where we don’t feel like things will get better so I started looking for property to build our new home. My assumption was that builders were just price gouging with the price of new homes making ridiculous profit margins. Well I have been doing runoff estimates for a house and the sheer shock of material prices and labor costs are crazy!! Just a few comparisons for you. My last build was 2015 vs new pricing as of this week in the Utah market. Lumber package including trusses 2015 = 25,722 now 58,270 Footing and Foundation 2015 = 22,515 now 41,700. This is what I am seeing and it’s absolutely depressing!

Material costs have come down some from the crazy levels in 2021/2022 when builders had trouble even getting these materials (remember the window shortage?). If you had done the pricing back then, you might have had a heart attack. But obviously, they’re still be a lot higher than in 2015. I think the killer is labor costs that have soared and they keep soaring.

Yes Utah is in the top 5 states with highest cost of construction in the U.S. I also believe it’s due to the high cost of labor.

“The issue with the frozen market for existing homes isn’t the mortgage rate – it’s the price of the home that people want to buy.”

Objection, your honor. Speculation!

:-)

I will add, FOMO backed speculation