Quantitative tightening powers along in the euro area.

By Wolf Richter for WOLF STREET.

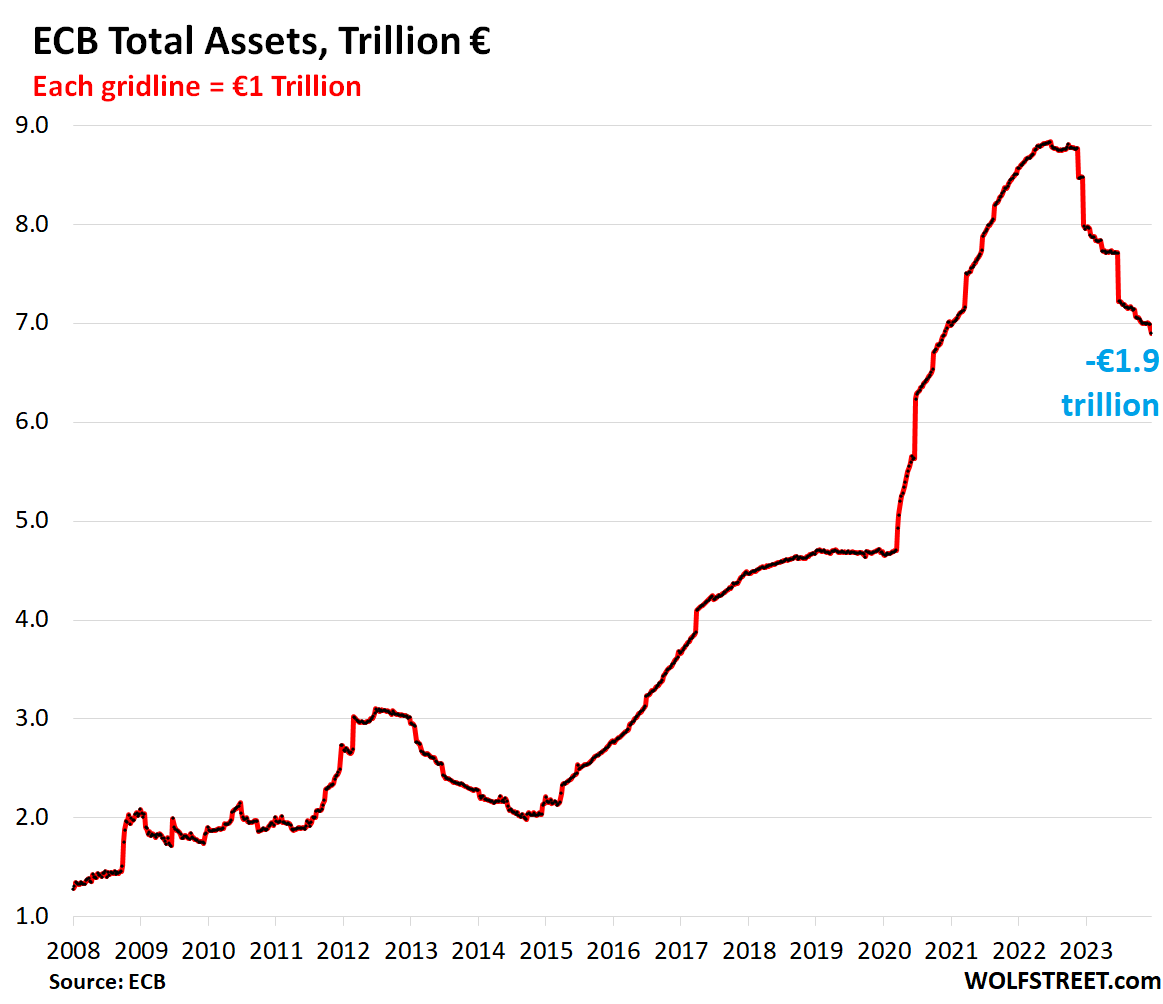

Under the ECB’s QT program, kicked off in October 2022, total assets have plunged by €1.94 trillion, or by 21.9%, to €6.90 trillion, the lowest since November 2020, according to the ECB’s weekly balance sheet released today. This includes the €88-billion drop in the latest reporting week.

In USD, the ECB has now shed roughly $2.14 trillion in assets at the current exchange rate. By comparison, the Fed has shed $1.23 trillion in assets.

During the pandemic, the ECB piled on €4.15 trillion in assets; it has now shed 47% of that pile.

The ECB engaged in QE via two categories, and both are getting unwound, but at a very different pace:

- It offered loans under very favorable conditions to banks, and it was up to the banks to deploy this cash.

- It purchased government bonds, corporate bonds, covered bonds, and asset-backed securities, thereby handing the financial markets this cash, under two programs: APP (asset purchase programme), starting in 2014; and PEPP (pandemic emergency purchase programme), starting in March 2020.

In October 2022, the ECB announced the first steps of QT. It made the loan terms unattractive, and it opened more windows for banks to pay back those loans, which caused the banks to pay back those loans in big waves, which removed liquidity via the banks.

In December 2022, the ECB announced the initial phase of its bond QT with a start date in March 2023. It has since then accelerated the pace of the bond-roll-off, and announced a further acceleration at its December meeting.

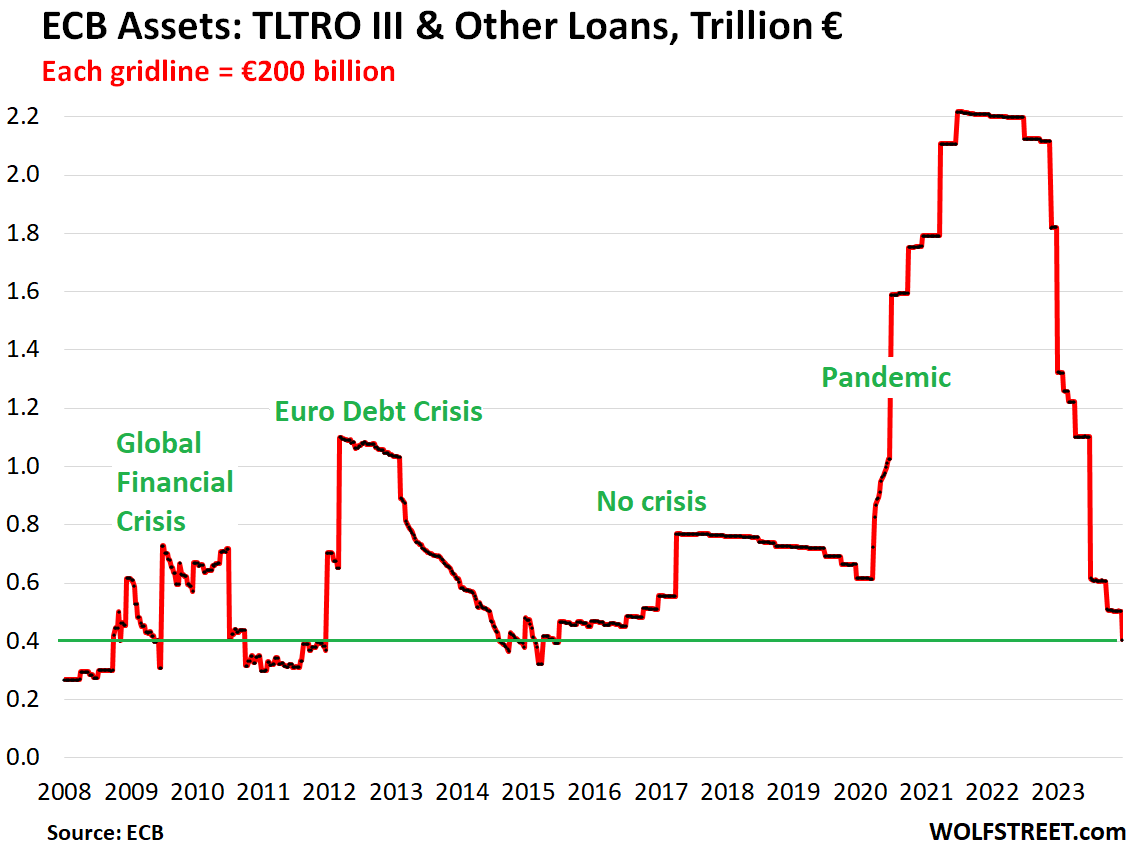

Loan QT: -€1.79 trillion

The ECB has always handled QE via waves of loans, starting with the Financial Crisis, then the Euro Debt Crisis, then the period of no-crisis, and finally the pandemic. The waves had names, at first: Longer-Term Refinancing Operations (LTRO), then Targeted Longer-Term Refinancing Operations (TLTRO), and these waves were numbered. During the pandemic, the ECB’s lending operations were called TLTRO III.

These pandemic-era TLTRO III loans amounted to €1.6 trillion at the peak, on top of the still outstanding prior loans, to total €2.2 trillion at the peak between June 2021 and June 2022.

In the week of the current balance sheet through December 22, banks paid back €98 billion in loans. Since the peak, they paid back €1.79 trillion, with only €405 billion in loans still outstanding.

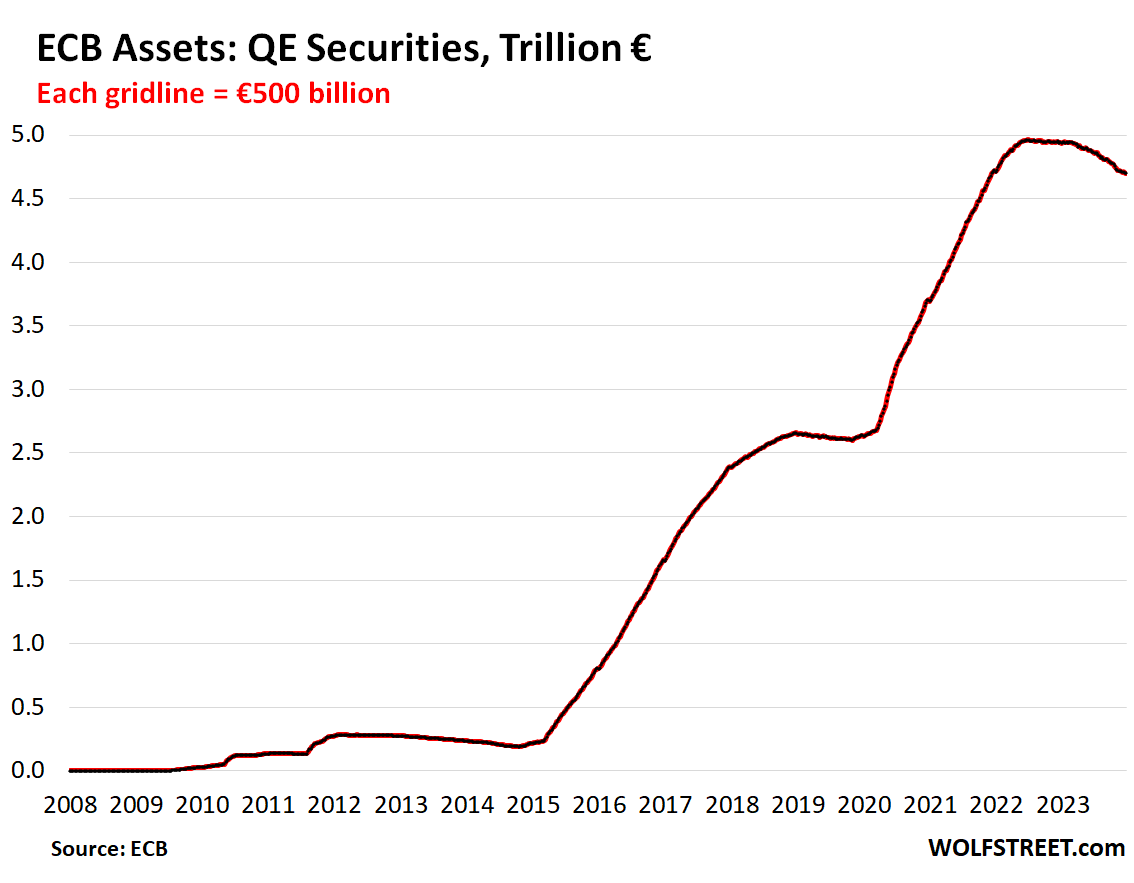

Bond QT: -€262 billion

The ECB had bought bonds under two programs: APP, starting in 2014; and PEPP, starting in March 2020.

APP bonds: The roll-off in 2023 was limited to the bonds in the APP portfolio, and for the first six months was capped. But in July, the cap was removed. Since then, APP bonds have been rolling off without replacement as they mature. So whatever matures and gets paid off, that’s the amount by which the APP portfolio declines. Current APP holdings: €3.02 trillion.

PEPP bonds have been kept steady since the end of QE. But at its December meeting, the ECB announced that its PEPP bonds will start to roll off in July 2024, capped at €7.5 billion a month. At the end of 2024, the cap will be removed, and whatever matures in the PEPP portfolio will then come off the balance sheet. Current PEPP holdings: €1.71 trillion.

Over the past four weeks, €14 billion in APP bonds rolled off (holiday periods are slow in terms of maturity dates, with the bond market shut down entirely before Christmas). For a feel for the pace of the roll-off: over the prior 4-week periods, respectively, €19 billion, €45 billion, and €30 billion rolled off.

Since the peak, €262 billion in bonds rolled off. APP bonds did all the lifting. PEPP bonds have remained steady. The entire bond portfolio is now down to €4.70 trillion, the lowest since December 2021:

QT for years to get a grip on inflation.

The December 2023 meeting has been typical since the October 2022 announcement of QT: Each step along the way, QT was accelerated, to what is now the most QT of any major central bank.

QT is a program that is expected to run for years on automatic pilot in the back ground. The ECB’s policy-rate decisions and the surrounding jabbering – same with the Fed’s policy-rate decisions and surrounding jabbering – get all the speculative attention. But QT runs without drama in the background, removing liquidity month after month from the financial system, and thereby removing some of the inflationary fuel.

The hope is that this ongoing QT will allow central banks to not lift rates as high as they would have before the arrival of huge balance sheets. In other words, the hope is that central banks can leverage QT to get a handle on inflation without having to jack up rates so high that they would break the economy.

The massive QE via loans and bond purchases, which pushed down long-term yields, and the negative interest rate policy, which pushed down short-term yields, caused asset prices to spike in Europe, including home prices in Germany. But QT and higher rates have now begun to reverse that process. Here are German home prices, which are now tanking after a huge spike, versus the ECB’s balance sheet.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Thanks Wolf,

That’s why the Fed has been pausing, and I don’t think the Fed even talked about just going with QT. Well now we know I guess. I see no cutting of rates by the Fed. I read the price of coco is the same price as 1978 at over 4k$ a ton. Inflation was high back then. Do you think that has any correlation to today’s inflation? I did learn about callable cd’s. I believe the bank has to hold my one year when rates drop for six months.

My vision has been to create an economy where productive hard work becomes worthless, and speculation and towing my line is rewarded. It will ensure that anyone who is not rich and not my puppet is made poorer so that he has to work more for less.

If you complain, my minions will snub you as being lazy and stupid for missing out on the great economy that I have created.

Which are the next banks to collapse (Europe or US) and will we hear about them, or will their collapse be covered up? The banking system took a big hit in terms of confidence with Credit Suisse, Signature, and Silicon Valley being bailed out by acquisitions, and big depositors in the US banks essentially being saved by the FDIC. It is difficult to believe there won’t be more failures, especially among regional and smaller banks. Maybe this accounts for Powell’s “surprising” recent about-face on interest rate policy. He is more worried about system banking failure than about inflation. It is likely the ECB has similar thoughts.

Some people wonder why T-bills have raked in so much money. In addition to paying higher rates than banks, perhaps consumers realize they are safer than banks.

I don’t consider treasuries safer than CDs but I don’t have more than FDIC limits. The advantage for me is competitive yields but no state tax and that is a big deal in CA.

There have been a few small banks that collapsed in the US since the spring. Nearly every year, some banks collapse. It’s routine. There are about 4,000 banks in the US.

So it’s only the big banks that matter. And with longer-term yields having dropped so much, longer-terms securities have risen in value, and banks’ unrealized losses have shrunk a lot. We’ll see that in the Q4 data when it’s released in about two months.

Banks in the EU have the same situation.

Meanwhile, here are the unrealized losses of US commercial banks banks for Q3. My guess is that Q4 unrealized losses will be less than $500 billion:

https://wolfstreet.com/2023/11/30/unrealized-losses-on-securities-held-by-banks-jump-by-22-to-684-billion-in-q3-oh-lordy/

Actually there have been only five banks that have officially collapsed in the US in 2023. Silicon Valley and Signature in March. First Republic in May. Heartland Tri-State in July. Citizens Bank Sacramento in November. The latter two were small. All were acquired by other banks.

https://www.fdic.gov/bank/historical/bank/bfb2023.html

My point is I imagine many more are on the verge of collapsing or have indeed collapsed. The best way to prevent a bank run is not let anybody know the bank is “in trouble”. Really, the historically rapid increase in interest rates would almost certainly cause more bank failures (only 5 out of 4,000 according to the government, give me a break). With Powell’s recent about-face, ten-year bonds have decreased around 100 basis points, taking some pressure off of susceptible banks. It may have worked, but at the expense of possibly re-igniting nasty inflation. We shall see. My view is there was more to this “surprising” Powell policy reversal than we have heard. And I think it has something to do with the banking sector.

Willian Leake-

There’s a pretty good article in today’s WSJournal titled “Banking Turmoil Is Playing Out at Smallest Lenders Across US.” Perhaps you already saw it.

Hard to excuse a banker who’s a yield-hog as rates touched their lowest point ever, but there’s a lot of blame to go around…all the way to the ZIRP perpetrators in the Eccles building.

Wolf’s right about big banks’ systemic importance, I suppose, but the article is equally right in pointing out the social importance of the locally owned bank to a community, and in surmising that credit could be much less available in the hinterlands when a bank folds, or is folded into a nation-wide or global competitor.

Community banks risk being another unintended victim of aggregated macro-economic policy.

Most banks will get through it just fine. They’ll just make a lot less money, now that they actually have to pay interest to depositors, so that’s bad for bank profits and bank investors, but good for bank clients.

Small community banks have been disappearing by the thousands over the decades. They get bought out by a bigger bank and turned into a branch, or they shut down, or collapse.

William Leake,

Which banks collapse next? Who knows but will it matter much?

Seems likely that EU banks in worse shape than U.S. counterparts since they’re stuck with negative coupon paper. Hedging that interest rate risk is expensive so only the larger institutions can probably afford to do so but even those might not have fully hedged the risk.

Must be plenty of regional U.S. banks in trouble since the Bank Term Funding Program balance grows nearly every week. At the end of March, the total BTFP balance outstanding was something like $63 MM. Has more than doubled since. Banks have until the end of March 2024 to take advantage of the program so am expecting usage to really kick in the final month before it disappears.

BTW the demise of inflation has been greatly exaggerated. Kudos to Wolf for continuing to highlight the problems under the hood in the monthly reports. Service inflation is here to stay. 3.1%? Must be using creative accounting or New math to arrive at that calculation. Regardless, has to be much higher given that wage growth is running at 5% and accelerating.

Meant to write $63 B. Need to write these went not sleepy.

* ; : *

The banking system failed in Europe because interest rates were too low for too long. Much higher interest rates are attempting to correct a decade long fiasco.

Surprise surprise, the banking system didn’t fail in Europe. One big bank — known for its huge reckless and criminal risk-taking and screwing investors — finally failed, which was long overdue, and the debris got mopped up by another big bank.

I believe banks are underwater for sure. Seems like Powell will stay with QT and keep pausing and see how their new balance sheet tool pans out. They sure went in a hurry with rate increases! Seem like is a big experiment by them. So much uncertainty going on here, and the markets go up.

Putin raised interest rates 10 percent in one day.

///

@Wolf, I hope you do not mind but I have two questions. I would appreciate any help in understanding what gives.

///////////////////

Can you please help me understand what other assets are there on the ECB balance sheet? (unless it is already in the article and I managed to jump over it three times). I read the article two times…Am I missing something?

0.405+3.02+1.71=5.135 trillion

Current balance 6.9 trilion

What other assets are there for 1.765 trillion ?

///

My second question is: How do they intend to keep up the pace since the LOANS package is almost depleted?…Let me rephrase that…How can they accelerate the shedding of QE Securities to keep up the pace?

Assumed target 1 trilion a year.

Focus group 0.405 in LOANS and ~0.6 in QE securities.

At an average pace of 0.03 per month it gives 0.36.

Totaling at this pace 0.765 in 2024 and 0.36* in 2025.

*made the assumption that the vesting is consistent over time.

///

Just like the Fed, the ECB has all kinds of assets, including gold, the IMF’s special drawing rights, plus a whole bunch of stuff having to do with the Eurozone’s System of Central Banks.

The QE assets are for “monetary policy purposes.” That’s what the focus is here.

Here is today’s “Consolidated” balance sheet that lists the categories and amounts of assets and liabilities:

https://www.ecb.europa.eu/press/pr/wfs/2023/html/ecb.fst231228.en.html

I’ll probably get heckled for this but so far it seems like the fed’s plan is right on target. Who would have thought??? Inflation and the balance sheet are both headed in the right direction and the overall economy hasn’t crashed and burned.

Yes, prices are up, and times may be tough for a lot of folks, but nothing like it would be if we had 6 or 8% unemployment and a major asset value implosion. And a lot more folks are doing extremely well.

I honestly thought it would take 7.5% fed funds and a lot quicker QT to get back to base line. I also thought we would already be in a recession.

Then again, the game isn’t over yet, and anything can happen in 2024.

A major asset value implosion would only be tough for 5-10% of Americans.

And only “tough” in the sense of giving back unearned gains from the past 3 or 4 years.

Einhal-

“ would only be tough for 5-10% of Americans.”

I think you’re leaving out a number of cohorts who are hurt when asset values plunge , especially:

– Retirees living off pensions and personal portfolios who have already been ravaged by inflation.

– Owners of marginal businesses, and their families.

– Creditors of marginal businesses.

– Marginal employees (least skilled, newly hired, redundant, etc.) many of whom will be laid off in a severe economic pullback.

– Anyone with significant debt.

I’m not suggesting that can-kicking should be continued, but deep recessions and depressions gore many oxen. Don’t be too nonchalant.

It is amazing the silly beliefs a person can come up with when they can just make up statistics to support that belief.

How do you figure an asset implosion would only be tough for 5-10% of Americans?

People say this, but never prove it.

Most retirees don’t have personal portfolios. At most, they have a 401K. And those 401Ks have an median balance of $100,000 or something.

Asset values plunging doesn’t hurt people with significant debt as most consumer debtors are unsecured (outside of mortgage).

The fact is, assets are largely owned by the top 5-10%. They are the only ones that really benefit from asset bubbles. Everyone else at best keeps up (meaning that their 401k goes up, but so does their cost of living).

You’ve all bought into the lie fed by Wall Street and the elites as to why they need constant bailouts and ZIRP.

Einhal-

1. Define “most” when you say “most retirees don’t have personal portfolios,” then translate those that DO have portfolios into a percent of the “5-10% of Americans” in your original statement.

2. I wasn’t just referring to “consumer debtors” (your term). I’m specifically worried about the CREDITORS who carry the debt as an asset. When the crunch comes, banks (loans) and business owners (receivables) will suffer great losses. Bank funding will dry up, and businesses will be shuttered — then employees will receive pink slips. You seem to be anxiously awaiting a period of significant job loss. To the extent the person losing the job has debt, so much the worse for that household. In reverse Cantillon fashion, the waves of de-leveraging will lap at the boundaries of every community, though, as you rightly observe, not every household.

3. If you have read my past posts, you know I’m no fan of the current central banking regime. The Fed’s mandates are misguided, its size and scope are dangerous (and growing), and its tools and methods are ineffective. It blows bubbles that burst catastrophically, then its defenders blame it on exogenous “black swans.” Beyond all of that, monetary policy has enabled the chronic deficit spending that will shortly push the federal debt to over $40 trillion, and well over the 120% of GDP not seen since WWII. And yet, the institution grows…

Remember, most 401(k)s are invested in index funds. If any of the indicies crash, people will see their 401(k)s go down.

Remember, Goldilocks is a fairy tale.

Just waiting for Depth Charge’s response lol

Keep a safe distance.

Thanks for the laugh.

Inflation is only down if you look at the overall number, but its still very high in services which is problematic.

No Heckling here. IMHO, the Fed has done a masterful job of navigating the last three years mess that was not created by them. Thank god for the current Fed.

They have done a masterful job of creating the biggest asset bubble in modern history. There can’t be any excuse for the five trillion dollar they printed during the pandemic. The stock market and bitcoin going up everyday is not the right way to make money. It rewards gamblers and speculators and is a reflection of the extreme greed and excess the Fed created. I hope inflation will come back to punish them for the crime they committed.

The 5-10% are who the feds are concerned about.

Wolf, How do you think forward returns of international stocks will fare versus domestic stocks? The Vanguard S&P 500 Index Fund (VFIAX) has a PE ratio of 23.0. The Vanguard Total International Index Fund (VTIAX) has a PE ratio of 11.0. International has been lapped again and again by domestic stocks since the GFC. I have invested on the premise that international either will catch up or domestic will catch down.

one of the reasons why S&P 500 funds have such high PE ratios is because the whole world has been investing in S&P 500 stocks, at the expense of their own markets, most of which remain well below their highs from 15 to 30+ years ago! Article coming in a few hours.

Thanks. Look forward to that article.

A Bit off course from the immediate subject; I have noticed more articles regarding SOFR Surge Events.

Supposedly “SOFR “is replacing the LIBOR rate. Can anyone explain the difference?

Should it be of interest to me as an investor?

Has Wolf discussed this previously?

Don’t worry about it unless you have loan contracts (such as floating-rate loans) that still have LIBOR written into them. SOFR arrived years years ago. If you still have a loan contract with LIBOR in it, you need to get on the phone with your lender and make an appointment asap to get this changed.

Wolf,

Your figures show that the lunatics took over the asylum in 2015 and the ECB printed up a trillion euros per year for 7 years, taking the printed total to 9 trillion. And the graphs show these printed-up “assets” are now being reduced by gradually selling off the bonds and other junk thus acquired.

But selling a bond doesn’t reduce your total assets. What happened to the consideration? The cash received in exchange for these bonds etc? Does the ECB set fire to it? Or is it quietly slipped into the pockets of member countries’ central banks ?

A central bank routinely and always destroys any cash it receives, and it creates any cash it needs to pay for things, even salaries. Unlike any other commercial entity, central banks do NOT have a cash account, because they don’t need one.

So you’re wrong. Selling a bond or allowing a bond to mature and roll off reduces the assets, just like buying them increased the assets.

Central bank accounting 101.

Thank you for this clarifying answer, Wolf.

Does that mean the fed effectively has unlimited cash-on-hand? If yes, what are the actual (legislative) or implied limitations on balance sheet expansion?

With the relatively new and experimental “ample reserves” policy, and “whatever it takes” mindset, it seems we have drifted into a potentially endless upward cyclical spiral of balance sheet expansion.

(I’m sincerely hoping you slap me down for my idiotic fears of Weimar redux.)

1. “Does that mean the fed effectively has unlimited cash-on-hand?”

It means the Fed has zero “cash on hand.” Instead, it creates or destroys cash as needed. But yes, cash creation it’s unlimited.

2. ” what are the actual (legislative) or implied limitations on balance sheet expansion?”

The limitation is posed by the effects of watering down the currency => inflation! And that’s where we’re now. That’s why there’s QT in the US and Europe.

Argentina, where the central bank is part of the Ministry of Finance, is a great example of watering down a currency, which has totally collapsed against the USD amid two decades of double-digit and triple-digit inflation. Now everything major is priced in USD and you pay in pesos at the exchange rate effective at that moment. That’s what happens when a currency becomes useless. It leaves the economy in shambles. And it has been known forever that you cannot allow politicians to manage a currency. They’ll just use it to buy votes and destroy it in the process.

Will the Fed have to protect the dollar with enhanced QT?

“Don’t fight the Fed.”

QT marches on, to the tune of $60B/mo. No indications the Fed will change this rate of QT anytime soon.

Likewise, the Fed is still holding short term interest rates at 5.5%.

Therefore across all yields, the Fed still has its foot on the brakes, applying exactly the same pressure since August, to slow the economy.

They’ve indicated (via dot-plots) they *might* apply less pressure on the brakes sometime in 2024, for the short-end of the curve.

But they’ll still have their foot on the brakes.

My thesis that when the yield-curve goes negative, that we’ll see a recession within 18 months has proven wrong. Mea culpa. Over the previous year, I’ve only been earning 5.5% on my holdings. I slept a bit easier, but admittedly my FOMO rose when was awake, seeing the stock market recovery.

Am I still a yield_curve_believer? Perhaps, but less so these days. It’s not the reliable “sell” signal I once thought it was.

I ask myself, is it only because of the hype around AI, and the big lift from the Magnificent 7? Or is the underlying economy actually just this strong?

“People over-estimate technological changes in the short-term, but under-estimate their impact in the long-term.” <– I'm not sure who said that originally, but it is basically a verbal description of the Gartner Hype Cycle.

I believe we're still somewhere on the upslope of inflated expectations around AI.

As my short-term treasuries mature in 2024, I ask myself, "Do I fight the Fed and put this money into the S&P500? Or reinvest in ultra-safe 5%+ yields, and control my FOMO as the market indexes climb higher?"

Most likely I'll split the difference; half in short-term Treasuries, half into the S&P500.

Just my thoughts as we close out 2023.

yield_curve_believer-

Great thoughts. Honest and introspective, and also insightful on markets.

I’d add 1 thought: if you’re thinking forward a year, can you imagine an environment where the Fed might return temporarily to easier policy?

If yes, perhaps it makes sense to build a “bond ladder” so that some of your bonds mature each year, but some remain, paying todays rates for a few more years. It’s a hedge, of sorts…

Also, the higher the rates, the longer the ladder. If rates gyrate into high single digits, lengthen your ladder.

Bond ladders are under-appreciated.

Just a thought.

Cheers