But it was so much fun while it lasted?

By Wolf Richter for WOLF STREET.

At least 21 companies that had gone public via SPAC during the SPAC mania starting in 2020 filed for bankruptcy in 2023, according to Bloomberg. In 2022, 11 from from that era filed for bankruptcy, according to Skadden. These companies filed for bankruptcy because they burned huge amounts of cash and then ran out of cash to burn. But that didn’t matter in the era of consensual hallucination, as we’ve come to call it.

The latest bankruptcy filing came from electric-scooter rental outfit Bird Global, which filed for bankruptcy just before Christmas, 25 months after having gone public via merger with a SPAC. It was dogged by endless losses and endless cash burn – the result of the self-destructive business model that was so popular during the era of consensual hallucination. And it was hit by a flood of personal-injury lawsuits.

The stock once had a market cap of $2.5 billion. It’s still being shuffled around over the counter but is essentially worthless. Before its delisting, the ticker was BRDS, as in “for the birds.” They did have a sense of dry dark humor.

In addition, about 140 other companies that have gone public via SPAC merger will likely need to raise more cash in 2024 in order to kick the can down the road, according to Bloomberg. And raising more funds is going to be tough for endless cash-burn machines, given the losses hapless investors have already taken.

In addition, 44% of the companies that went public via SPAC merger and that have filed annual reports in 2023 have included “going-concern” warnings in their filings, indicating that their auditors think they may not have enough cash to make it through the next year. This rate was double the rate for non-SPACs, according to Bloomberg, citing Hudson Labs, which analyzes SEC filings.

In addition, the stocks of many of the companies that went public via SPAC, have totally collapsed, after spiking to ridiculous highs. We’ve looked at a bunch of them here in our pantheon of Imploded Stocks, which we kicked off in March 2021, following that infamous February 2021.

Speed records from SPAC merger to bankruptcy were set and broken. EV maker Electric Last Mile Solutions once held the speed record: 12 months from SPAC merger to bankruptcy filing in June 2022.

But that record was soon broken, including in December 2022, when Bitcoin miner and crypto-hosting-platform Core Scientific filed for bankruptcy 11 months after going public via merger with a SPAC in January 2022.

And record continued to be broken, including most recently, by software firm Near Intelligence, which filed for bankruptcy on December 11, 2023, just nine months after going public via SPAC in March 2023. The stock kathoomphed 75% in its first week as a public company and is now worthless.

WeWork took its time, finally filing for bankruptcy in November, two years after going public via merger with a SPAC, after burning through at least $16 billion raised over its 13 years of existence, much of it from SoftBank and its Vision fund.

In 2019, before WeWork’s scuttled IPO, its “valuation” was jacked up to $47 billion, a masterpiece of Softbank scheming. After it went public via SPAC, peak market cap reached nearly $10 billion. The stock still gets shuffled around over the counter for a few cents, giving it a market cap of less than $20 million. And many landlords, or their creditors after they took over the properties, have gotten hung out to dry.

EV maker Proterra filed for bankruptcy in August, 25 months after going public via SPAC merger. The company made a few electric buses a year. At the peak, it had a market cap of $4 billion.

EV maker Lordstown made the trip from SPAC merger to bankruptcy in about two-and-a-half years, and class-action lawsuits have been filed against the company for misleading investors. The shares of other EV SPACS have totally collapsed, and many of them are headed for bankruptcy.

Post-SPAC stocks were a show all on their own. By industry group, cannabis firms are the winners, in terms of kathoomph of their post-SPAC merger stocks since 2009, according to SPAC Insider. Here are the top five, in terms of kathoomph:

- Cannabis firms: -97.6%

- EV makers: -91.1%

- Healthcare: -87.6%

- Technology: -86.0%

- Consumer: -85.7%

The CNBC Post-SPAC index, which tracks stocks after their merger with a SPAC, peaked in February 2021 and has since then collapsed by 82%.

But don’t cry for the sponsors. The sponsors of the blank-check companies – the Special Purpose Acquisition Companies or SPACs – make money no matter what as long as their SPAC succeeds in merging with a privately held company. So the motivations are all wrong.

During that era of consensual hallucination, celebrities started riding the SPAC gravy train, promoting all kinds of outfits, sponsoring and touting their own SPACs, to the point that the SEC issued a warning in March 2021 about “celebrity involvement with SPACs.”

By which time it was already too late because in February 2021, the whole SPAC-IPO schmear started coming unglued, to the point we mused here on March 3, 2021: “Was That the IPO Stocks Bubble that Just Popped?” A number of those celebrity SPACs have now gotten sued by their investors.

Sponsors take their SPAC public via regular IPO. At that point, the stock trades publicly, usually around $10 a share, but the company is just a shell with some cash looking to acquire a privately held company, such as Bird Global, which then becomes the publicly traded entity, and the ticker is changed to reflect the acquired company’s name.

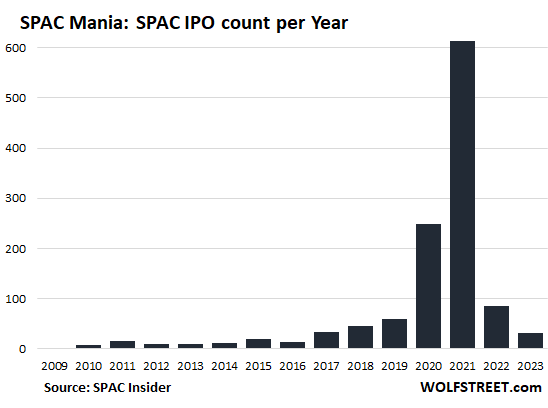

The number of SPAC IPOs, where sponsors turn their blank-check companies into publicly traded stocks, had been rising even in 2017, 2018, and 2019. But in 2020, they more than quadrupled to 248 SPAC IPOs, and in 2021 they exploded to 613 SPAC IPOs, according to SPAC Insider. In 2022, as this stuff was already coming unglued, another 86 got pushed out the window, and in 2023 another 31:

Of those SPACs that went public since 2009 – the chart above – 564 completed a merger with a target company, such as with Near Intelligence, which now filed for bankruptcy.

Another 369 SPACs liquidated and returned the funds to the shareholders of the SPAC, or announced that they would liquidate, after they failed to merge with a target company within the two-year window, or the extension, according to SPAC Insider. In those cases, the sponsors took some losses, and public investors mostly did not, which is why sponsors are motivated to merge with a target company, even if it’s an instant kathoomph for investors.

And there are still a bunch of SPACs out there looking for a target (129) or trying to complete an already announced merger (142), according to SPAC Insider. And if those efforts fail, which would be the best-case scenario for investors, they will also have to liquidate.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

SPAC-a-licious!

Thanks Wolf.

Oh baby!

Be…haaave!

Hehe

Every wolf post should start with an austin power’s reference.

It feels so right.

Hilarious. Last Mile and Near Intelligence?! The warning was right there is the name! Simply Crash, an airbag company, is probably next.

It was just another con

And yet a virtual valueless nothingness like “crypto” rages on. I mean, BitCON alone has a market cap of almost a TRILLION dollars. Bizarre. At least Bird had a product and business plan.

It is just another form of currency so as long as people view it as such and demand exists for it then it will be fine. Obviously many in the world want to reduce hegemony of the dollar although Bitcoin probably isn’t in that camp in the same way. The dollar really has no intrinsic value except what it allows us to purchase. And even though companies with significant market cap indeed produce goods/services the valuations are very high. People basically agree Teslas market cap of 819 billion is the value of the company. I’m not hear to argue that is indeed true but obviously most do. Admittedly the people are a fairly narrow band of society who control wealth but then they should be the most intelligent on such matters.

“It is just another form of currency so as long as people view it as such and demand exists for it then it will be fine.”

Cryptos are gambling tokens, not currencies, and everyone knows it. There are by now close to 10,000 of them. Many have become worthless and no longer trade. Stable coins are gambling tokens that help you getting in and out of the other gambling tokens.

“It’s this way and everyone knows it.” That sounds like some politician I won’t name.

Most crypto tokens are worthless gambling chips, yes. Bitcoin, Etherium, and maybe Ripple, not so much. Those cannot be forged or duplicated and have some intrinsic value, especially Ether, which is used to run actual services.

That’s not to say that they’re worth their current price or that someone should own them. But then I’d say the same for an original Picasso.

Above & beyond gambling tokens (which they clearly are), I’m curious about how much of the crypto trade is just 21st century money laundering, from drugs and cybertheft, small fry to billionaire thieves.

CC, some to be sure but reputable exchanges follow the “know your customer” rules which can make it difficult to anonymously convert crypto to cash.

A bigger problem is the ability to easily send value to other countries that don’t care, bypassing export restrictions for things like terrorist groups.

Note that most crypto tokens, Bitcoin and Etherium included, are not anonymous but pseudonymous meaning that it only takes one leaked association to their real identity and every transaction they’ve done is now associated with them.

“The dollar really has no intrinsic value except what it allows us to purchase.”

The dollar has tons of intrinsic value. It has the backing of the most dominant democracy in the world with the ability to tax one of the largest, most dynamic economies in the world.

There is huge value there.

US court judgments can be satisfied by dollars.

If the US government has such a power to tax “the most dynamic economy” in the world, why is it borrowing so much ? Because there are forces in place that limit it’s ability to tax.

If the economy is so dynamic, why are even current tax receipts declining ? Maybe they are not. Thats one thing Mr. Wolf has taught me, can we really trust that assertion or any assertion made in the popular media ?

In theory each USD should be a claim on the productive capacity of our economy. But how much of our economy, anymore is dedicated to production of goods and useful services ?

During the last 2 years the DOD has worked hard to increase production of 155mm artillery rounds from 14k/month to 28k per month. Meanwhile, as best we can tell, Russian production has increased to 250k-300k per month. In addition, while just guessing: I’d bet that the cost per round has increased in the US and declined in Russia. This guess is based on EU reporting that the cost of 155 production per round has doubled in the EU.

It’s still possible for the US to save itself, but it will take a massive change in sense across a large segment of the population. Something that rarely happens

“with the ability to tax one of the largest, most dynamic economies in the world.”

Is that why,

1) Fed debt to GDP is well over 100% (and likely higher, with implicit debt (see entitlements, Greek book cooking, etc) and G spending GDP bootstrapping),

2) We’ve had 53 years of essentially uninterrupted federal deficits,

3) In desperation, DC turned to “quantitative easing” (the policy formerly known as money printing…) to pay its bills…at the cost of creating consumer inflation…thereby secretly, undemocratically transferring wealth from savers to DC?

But everything is just peachy, right?

You are living in a “reliable dollar” world that hasn’t existed for many years (and started unravelling over 50 years ago).

The AltCoins may all have their flaws (some/many/most/all of them massive) but they *all* have their impetus originating from the 20 years of ZIRP betrayal of the USD as a store of value.

There is definitely something wrong with your thought process as noted in all your posts. What is that something wrong? It’s called greed and lack of ethics, something we need less of in this country.

You forgot the /sarc tag! I am sure the Argentines used to say the same about their peso. Eventually their currency was only used transactionally and the USD as a store of wealth. What does it tell you when Costco is selling gold bars and the PPT spends all their energy selling precious metals short with paper?

dang – and it’s very risky for someone in a position of charge here in ‘Murica to tell ‘we the people’ (ESPECIALLY ‘the people’ who ‘vote’ with ‘big money’ or can effectively mobilize large voting blocs) that they/we, as a whole, cannot thoughtfully afford certain ‘nice things’…

may we all find a better day.

dang/danf51 – apologies, idiot autocorrect converted ‘danf’ to ‘dang’ in the salutation (hoping it doesn’t do the same again…another instance of digital ‘timesaving help’ doing exactly the opposite…). Best-

may we all find a better day.

Many EV SPACs have a product and a plan, but the path is looking long to profits and the EV market is set to grow at a more normal pace next year. I don’t suspect them all (LCID/RIVN) to survive at the current cash burn rate.

The govt is not as involved as during the pandemic, rates are higher, and barring an unforeseen event I feel close to the end of the pandemic inflationary period. The cash is still flowing around, sure, but finally there is a directionality to prices of various goods and commodities, as opposed to only going up.

I wonder now if 2024 can offer a controlled disinflation or if the steering wheel comes off the ship. The 10-yr has gone vertical.

“I wonder now if 2024 can offer a controlled disinflation or if the steering wheel comes off the ship. The 10-yr has gone vertical.”

I hope it is catastrophic deflation. I hope they lose control. I’m so tired of all of it.

You obviously have never been through catstrophic deflation. It really is catastrophic

CCCB,

I don’t care. We need a huge reset from the inflated prices we have from the past three years. I am not okay with continuing the status quo. Continuing to pile on more inflated prices on top of the inflated prices we already have, especially in housing, insurance, etc., will be catastrophic in itself. I guess you don’t see that. 10 you cratered some more today. Until the Fed decides to do its job, all I can do is hope for deflation and continue to hoard money.

Oops, 10 yr

Be careful what you wish for…..for you may get it.

But I hear you…the monetary circus has gone to far and something bad is going to happen sooner or later. However if history is any guide it is always finally inflation and not deflation.

Any sign of deflation and the monetary boozooka will be reloaded and fired pretty soon.

The best case for the Fed is that inflation remains low and assets stay flat for 15 years without a big drop.

The worst case is indeed deflation leading to very high inflation.

And we shouldn’t rule out the possibility of significant productivity increases from new technologies. Although this is very unlikely but non zero

We don’t need a reset from inflated prices. You just need to learn what anchoring is and why it is bad to do so in decision making.

I get it. You failed to see the signs and now it sucks for you so you think your only choice is to hope it sucks for everyone else as well.

I look at it as deflation will be the result from private debt defaults and inflation from public debt defaults (with fiat that would mean printing to make “good” on prior debts). I don’t see the deflationary force countering the inflationary force enough….imo.

JimL

You are part of the problem. Your greed will be your downfall as it will for the rest of this country. I can’t wait to watch it.

I’m far from a failure, but go ahead and think that if it makes your insecure self feel better. I’m doing well but don’t agree that the increase in prices in the last three years should stand. No one with a brain thinks so. It’s only disgustingly greedy types like you who can only make money unethically who think it’s okay. Can’t wait until you have to eat crow.

Anyone playing chicken and rooting for the financial apocalypse has lost credibility to try to “holier than thou” on another person. At least someone using their brain to stay ahead of inflation has value to society whereas the anarchists with molotovs who pray for the end of a society they’ve become dependent on have no idea what they’re asking for.

…attractiveness of nihilism possibly a subliminal result of many generations of nightly-viewed (‘prime time’) US mass-entertainment wherein violence in some form (overt or covert) is the preferred method to neatly solving all problems in a 30-to-180minute-to-miniseries package (most viewers probably not having the benefit of surviving an up-close, personal, enduring experience of the real thing…), while heavily-laced and absurdly counterpointed with smiling, happy, aspirational advertising…

Agree, beware of what you ask for, but be prepared as possible for many, many, chilly outcomes when (as our human history illustrates) they occur, in spite of our best, and/or aided by our worst inclinations…

may we all find a better day, perhaps a better year.

They promised 2% inflation. The fact that the price level in Czechia (for example) is 50% higher than pre-covid is a breach of trust and a flagrant violation of the Social Contract. Unless this inflation injustice is rectified (taking price levels back to pre-covid plus 2% p.a.), this will have serious consequences going forward. Loss of trust equals not just dislocations in the bond market, commodities markets, currency markets, labor union issues, street discontent and protest votes at the ballot box but has also many unknown repercussions. Loss of trust is forever – they should keep that in mind. Once they achieve pre-covid plus 2% p.a., they can do whatever they like. If they want to target 10% inflation, fair enough. Or declare that they give up on inflation targeting

“Unless this inflation injustice is rectified (taking price levels back to pre-covid plus 2% p.a.),”

Nah. Inflation is “rectified” by higher incomes.

If incomes rise as fast or faster than consumer price inflation, people are OK. That was the case in 2023 (US), when incomes outran inflation by quite a bit, including the 8.7% Social Security cost of listing adjustment, allowing people to catch back up. But it was not the case in 2021 through mid-2022 when incomes rose also quite a bit but not as fast as inflation which was spiking.

So if you want prices of consumer goods and services to go back down to where they had been four years ago, EVERYONE — including pensioners — MUST give up ALL their income gains and go back to 2019 income levels. That sound OK for some people who for some reason didn’t have income gains. But for other people, their income doubled over those years, and EVERYONE would have to give up all of that. In overall economic terms, that kind of collapse of incomes can only happen in a huge depression with massive unemployment which would be catastrophic for the economy.

People need to quit spouting off this idiocy of prices of consumer goods and services having to go back where they had been years ago. These people ignore the income increases.

Bitcoin has one and only one purpose, that is to facilitate criminal activity. criminal activity includes the bribing of government officials such as legislators and regulators. You can draw your own conclusions about bitcoin.

Are you Janet Yellen under a pseudonym? 0.24% of Bitcoin was linked to illegal activities in 2023.

OK then, criminal activity and raw gambler speculation, looking for a bigger fool. FIFY.

What’s the source on that number, SBF?

It is very successful, then All that criminal activity is secretly conducted and can’t be detected by the authorities.

…perfect crimes are the ones never discovered (…or generally acknowledged…)…

may we all find a better day.

And in Cali crime is low because criminals are not arrested.

“Bitcoin has one and only one purpose, that is to facilitate criminal activity.”

That truly was the value of it originally so I think you are right in extending that to what it does today.

circumvention and obscure transactions

The dark net created a need for it, and it fulfilled many of those needs. Then the rich realized that they could circumvent taxes and capital gains instead of using it for buying drugs and much worse things on the dark net. (the dark net is not as dark as people thought, the government was able to monitor it very well, they even invented the onion router, could track what people thought was untraceable, and could bypass encryption and obfuscation techniques)

The dark net was largely a tool of intelligence agencies to move information and money between operations around the world so that other agencies could not track it. The criminal activities of the rest of the users helped to create the need extra traffic to drown out and make it harder to monitor intelligence agency operations. The dark net and those criminal activities were needed to make it harder to see the bigger operations going on.

Some years years ago we has some friends, and friends of friends, over for dinner. One of the guests told us about buying 4 bitcoins for 22 dollars each. She was an economics professor at a local college, and more than a little bit odd. I thought, what an idiot to spend 22 hard earned dollars for some made up thing that only exists on the internet. And here we are today.

I taught economics as well and had a student offer to sell me Bitcoin. I think it was about $1. I turned him down.

Somebody tried to pay me 2 BTC for my book back in the day. And I would have to write about it. They had fanned out globally trying every which way to hype it to everyone.

We know one thing for sure: BC can’t be a currency which as the word implies is currently or normally a medium of exchange. The max transactions of BC is less than 10 per second as the ecosystem checks the distributed ledger for a double spend: has the guy sent you some BC while a tenth of a second later sent it to another site. If busy it can take an hour to send BC, while VISA etc., have done millions.

Buying BC to transfer value is like getting a checking account where the check book, or the digital version costs 40K $.

PS: If a currency is a subject of everyday speculation, this invalidates its use a currency. For buyer and seller to agree on a volatile currency, they would have to agree on its future direction, up or down, and by how much.

If you have a car for sale for X US $, you and buyer are unlikely to debate next week’s US $ fix vs euro, yen, etc.. Because the US $ is a currency, you know you can spend it tomorrow without the other party being bullish on the US$.

If a car ad does accept crypto, this a sign of a motivated seller. Offer 25% less in dollars.

Nick: have you ever done a transfer on a pure PoS network like Algorand?

Its quite literally faster and less expensive (lower fees) than using Venmo/Cashapp etc.

But the downside is, you have to convert your dollars to Algorand first, and the recipient has to convert them back.

JM Bullion accepts Bitcoin at 3% discount from the credit card/PayPal price, but paper check, E-check and bank wire all receive 4% discount. One percent is a lot in a bullion transaction. Any Bitcoin received is instantly converted to fiat, and refunds are in Bitcoin at the price at time of refund.

There’s a reason that only a few third world s-hole governments accumulate crypto reserves, and also why few big boy governments seem to be concerned about their citizens acquiring crypto assets. As our host says, they’re gambling tokens. Impossible to hide and easy to tax. Excessive luck brings excessive taxes and Coinbase has confirmed their cooperation with the US Department of Justice, so the crypto cops will be sitting on every offramp to fiat and you can’t outrun the radio, like they used to say. That’s the best outcome if nothing else goes wrong and a lot of things go right for them. If crypto was truly everything that the number-bugs say it is, they would presumably be morons to ever sell any.

Like PM’s, lots of butt-hurt to sort through, no point in taking things personally, just a game.

If you think that’s weird, then try thinking about the dollar also. The dollar, at best, is ink on paper that is mass produced. Most often the dollar is just a pattern encoded by a electrical voltage difference or magnetic field difference. The only thing that backs up the dollar is faith and trust in the Federal Government of the United States of America. That sounds alright if we were in a 1950’s TV show, but what is the government that I am trusting. The Pentagon’s military power is one of the critical components to the dollar having value. Again, even kids laugh when explaining the concept of money to them because even they easily point out that “it’s just paper” and anyone can make something like that. Well, the difference is faith and trust in ………..(The Fed, the Pentagon, US Politicians, ?…..)

If it is those things, and the money is paper and not the older practice of precious metals, then why do they put “In God We Trust” on the currency. They made sure to put it on the paper money before removing the country from the gold and silver standards. “Let’s replace metal with empty words.” I say they are empty words because nothing else in this country seems concerned with “God” and the logic related to the concept of a “God” and it’s connection to “Trust.” It sounds like blowing smoke to me and being insincere. How can you have a secular country, with separation of religion and government, but then base the value of your system on a concept that is mocked by actions and intentions. It really comes off like dealing with a schizophrenic nutcase who is operating on self contradicting broken logic that leads to nowhere but spinning in circles chasing tail.

BRW – another take and rejoinder to: ‘IGWT’ has been: “…all others pay cash…”.

may we all find a better day.

I don’t own bitcoin, but I respect it for the experiment in alternative money that it is.

“The monopoly of government of issuing money has not only deprived us of good money, but has also deprived us of the only process by which we can find out what would be good money.”

— F. A. Hayek, A Free Market Monetary System, lecture Nov. 11, 1977

New ideas, whether they are successful or not, are needed to eventually address our failed money/banking system.

Yeah… I am starting to agree.

1) They have hung around for too long to just be written off as another example of “Tulip Mania.”

2) And there is obviously value in something that allows us to “own” something on the internet… that was not possible before crypto currencies.

3) There is also value to people in places that have unstable currencies to have a somewhat ready substitute for dollars that their own governments won’t allow them.

But all said it seems a bit overhyped (and overbought) to me. Like the famed Segway that was supposed to “transform transportation”… and ended up being an overpriced toy… crypto currencies seem to be a solution in search of a problem to solve.

SpencerG-

“But all said it seems a bit overhyped (and overbought) to me.”

Yes, it has am multi-level-marketing feel to it…verging on cult status.

The “value,” of Bitcoin seems to center on one or more of the following (not necessarily in order):

1. Speculation

2. Storing/Preserving one’s wealth (inter-temporal wealth retention)

3. Making payments within or without borders

4. Removing one’s assets from commercial bank system

5. Privacy (libertarian or nefarious motives)

6. Participating in technology of the future

7. Bragging rights

What am I missing?

The question I ask myself is which of these motives has staying power, and which will prove to have been temporary. The first two and last two are most subject to competition from an upstart technology, I think. The middle three survive at the convenience of Government.

I think you pretty much nail it here John. Your post is pretty complete… I would just add that it works for people who are trying to hide money/wealth from the government… and not just gangsters (although that is clearly a BIG part of cryptocurrency “Early Adopter” class of purchasers).

I once spent a lot of time in Africa for the Navy. One of the countries that I worked had a dictator who when it was time to leave not only took his Rolls Royces with him… he took a plane loaded with bales of American currency and Euros from their Central Bank with him. Just backed the truck up to that building and loaded it up with the nation’s wealth. Totally collapsed Gambia’s economy as he flew off into the sunset.

If THAT is the kind of leadership that your nation has… then keeping your money in dollars, Euros, gold, and/or cryptocurrency looks pretty appealing. And there are a LOT of countries like that.

BitCON is absolutely worthless on a fundamental value basis.t

SoCalBeachDude-

“BitCON is absolutely worthless on a fundamental value basis.”

Since 1933, the same is true for the US dollar, isn’t it?

How does one ascribe “fundamental” value in the world of fiat currency?

Is “fundamental value” the same as “intrinsic value?”

At least I can use dollars to wipe my behind…

There are Beanie Babies that still sell on eBay for hundreds of dollars.

As long as there are a few diehards willing to hang on and people to feed them crap it might never die. What matters is how big of the overall population is still diehards.

Put another way, look at volume, not price to see just how influential BTC is.

Ahem,

“look at volume, not just price to…”

Hmm…I wonder if that might apply to any “valuation”…including, say, the valuation of houses…

Any idea how many of these companies The SPAC King (aka Chamath Palihapitiya) had his fingerprints all over?

I enjoy his buddy podcast and he is obviously intelligent, but obviously someone who would sell his Grandma for a nickel.

Grandma photos?

Nickel first.

Two of my former co-workers went to Bird back in 2019.

They should call them SPANKs rather than SPACs cuz it looks like you get a whoopin’ if you buy in.

Easiest possible thing to predict as the outcome to SPAC mania in 2021, this was an obvious bubble marker. People who bought this crap fully deserve what they got.

Artificial Intelligence is great. I remember when people were all about artificial butter. Real fat was evil. Fake fat was the way to go. Artificial sweeteners are great too. Real sugar was for the slobs. Honestly, Real Intelligence is for idiots, give me AI any day, all day, and have it tell me what day it is. I can’t think of a burden any bigger in life than thinking. Years ago I always felt like having to thinking for myself was such a burden that I found myself constantly wanting someone to do it for me. Now google and other threads structures of it’s spider web can do it for me. This, coupled with not having the insurmountable and insufferable task of having to chauffeur myself around in a car due to the emergence of self driving cars has truly set me free. Driving is so hard. How do people do it? I watch old movies and see cab drivers in New York and often think that humans of the past must have had abilities that were almost superhuman in the past to be able to do that without killing people or crashing their car.

Thanks for the laughs!

Love it

I really should proof read before posting though

Read twice, send once.

AI can be a great thing but the concern of course is around jobs being taken. It isn’t really a new thing as surplus value has always been extracted from workers for the benefit of the few. This just means it impacts more people and of course the professional working class. Great South Park episode recently where handymen were the Musks and Bezos of the world. AI could be a phenomenal thing as who wouldn’t want more personal time but of course societal issues have to be addressed.

Where have you gone, Joe DiMaggio?

Our nation turns its lonely eyes to you

Woo, woo, woo

What’s that you say, Mrs. Robinson?

Joltin’ Joe has left and gone away

Fil – as long as we’re referencing Mr. Simon:

“…still tomorrow’s going to be another working day, and I’m just trying to get some rest…that’s all I’m trying, is to get some rest…” -‘American Tune’.

may we all find a better day.

+1

SPACs are set up for one reason and one reason only: To enrich the founders and the enablers. 100% of them could not exist if not for the bad influences of the Fed’s endless supply of money. Not a single one makes money, nor did they intend to, and don’t say Palantir. The latter is a stock scam masquerading as some kind of tech company.

There is certainly no ‘endless supply of money’ from the Federal Reserve which has been withdrawing liquidity all year long and has lowered its balance sheet by around $2 trillion in 2023.

Palantir is more than likely deeply tied into numerous Govt agencies that are all identified by 3 initials. Just a guess. 😬😬😬😬

Federal Reserve tightening put a halt to the SPAC mania.

But now that markets are salivating over anticipated easing in 2024, it appears the exuberance is flooding back. First you’ll see blue-chip stocks going parabolic (as right now), then it’ll be IPOs of solid money-making companies (Goldman already has a huge pipeline planned for 2024), then IPOs of 2nd, 3rd & 4th tier companies and finally the unprofitable garbage with no viable business plan. The 2009-2021 bull market brought forth a ton of exuberance & malinvestment.

The bull market was in 2023. If you missed it, too bad.

There is plenty of historical information about stock markets which have a concentration of wealth in just a few corporations, but nothing as extreme as this. Currently we are enjoying an unprecedented and equally as obvious concentration of wealth in just seven stocks. My favorite is NVDA, a chip maker selling at 27 times sales which millions of humans own through indexing unaware of the extreme overvaluation which they are relying on simply getting more overvalued.

Ok, NVDA is selling at price to sales 27 but also at forward price to earnings of 25! NVDA has 3Y eps CAGR ( 3-year compound growth of earnings per share) of 90% and TTM eps CAGR (12 trailing month EPS growth) of 1270%! I don’t know what’s in store for NVDA in 2024 but just saying..

Is NVDA expected to go up?

Stock Price Forecast

The 46 analysts offering 12-month price forecasts for NVIDIA Corp have a median target of 650.00, with a high estimate of 1,100.00 and a low estimate of 535.00. The median estimate represents a +31.24% increase from the last price of 495.26.

Nvidia Stock Forecast 2023 – 2025 – 2030

12/30/2023

Nvidia stock price stood at $495.22

According to the latest long-term forecast, Nvidia price will hit $600 by the end of 2024 and then $800 by the end of 2025. Nvidia will rise to $1000 within the year of 2026, $1100 in 2027, $1300 in 2028, $1400 in 2029, $1500 in 2030, $1600 in 2032, $1700 in 2033 and $1800 in 2034.

Year Mid-Year Year-End Tod/End,%

2023 $423 $495 0%

2024 $527 $604 +22%

2025 $740 $873 +76%

2026 $1,004 $1,083 +119%

2027 $1,098 $1,120 +126%

2028 $1,221 $1,321 +167%

2029 $1,420 $1,459 +195%

2030 $1,489 $1,520 +207%

2031 $1,553 $1,587 +220%

2032 $1,623 $1,660 +235%

2033 $1,699 $1,740 +251%

2034 $1,783 $1,828 +269%

2035 $1,875 $1,925 +289%

It was a 2009 – 2023 bullsh!t market. 100% fake money-printing endeavor by the crooked FED and their toadie politicians.

BANKS AXE 60,000 JOBS…

Crisis Plays Out at Smallest Lenders…

FT year-end recap article of GLOBAL layoff “announcements” in 2023. In the US, layoffs were mostly the mortgage bankers because the refi business totally collapsed (-80%) and because the purchase mortgage business plunged (-40%). This started in 2022. I posted several articles about this in late 2022 and early 2023.

Obviously we need another SPAC to clean this up.

I was knocking those things over well before Curb Your Enthusiasm featured it. It became a game. You can’t just knock them over. I’d point to a touristy thing, a building, swivel my waist, arm extended, elbow strike expertly calculated. My goodness, what happened?

Then we started seeing dumpsters in our parking lot. We had a building with multiple suites, most of them abandoned. Somebody was always ordering a dumpster for disposal, because they were vacating the place. No cameras in the parking lot. What do you know. A scooter wound up in the darn dumpster. How did that happen?

Some more daring folk took to using a sharpie to the QR sticker.

Now, I hardly see any hipsters puttering around town on those things. They use their legs. It’s amazing.

Was there EVER a legitimate purpose behind SPACs? By the time I became aware of them (on this website) it was pretty apparent that they were a tax dodge.

SPACs are not a tax dodge.

They’re a way for sponsors to enrich themselves, almost no matter what happens, at the expense of others. It’s a scheme much more ancient and profitable than a tax dodge.

They’re also a way for startups to go public and raise funds from investors without the scrutiny and disclosures that they would have to be subjected to in a classic IPO.

Many of these startup companies were created for the sole reason of the owners draining every last cent from the company on a hope and a prayer people would be gullible enough to buy worthless stock before the inevitable bankruptcy occurred. A profitable company was the furthest thing the owners had in mind when these companies were created. Shades of the old Vancouver stock exchange in Canada.

Dad’s Hat Rye Whiskey 90 proof Mish is drunk, expired.

SPX [1M] looks great, but the [1D] looks tired, very tired.

1) India wants to produce cell phones, watches, electronic devices, communication hardware and batteries. Her relationship with China

are strained. China processes the most Lithium in the world.

2) India bought 5 Lithium mines in Argentina to reduce the Chinese

threat. South America’s triangle and Australia’s mines produce 90% of the global Lithium.

3) India’s GDP is rising. China is struggling. India wants to replace China

as an industrial hub. Other ASEAN nations and Mexico are biting China. US tariffs will aggravate the situation.

4) The industrial overcapacity might last decades. Initially, tariffs will raise

prices, protect blue collar jobs in the flyover areas, but overcapacity will and new immigrants will deflate consumption and reduce the budget deficit. That’s how things worked between 1870’s and 1890’s, in the Gilded Age.

Apple (FOXCON) moving to India was obvious to the average Chinese worker. Any wonder they do not want to assume a mortgage on a prebuilt condo when the neighboring buildings are collapsing with faulty concrete?

Plenty of empty housing in China.

This is a Global Economy.

Great article! As a complete novice in all this, this concept of “consensual hallucination” is so fascinating.

I recently looked at a listing of the layoffs announced over the past year or so. First time looking at this type of data, so not sure what to make of it. But, those privately held firms that showed 100% of employees being laid off, essentially closing up shop, seem from the outside, to follow the same patterns as the “Imploded Stocks” list you so masterfully describe.

I’m guessing that someone (private investment firms) is quietly taking those losses in the neck too. Is that just another, less visible, aspect of the “consensual hallucination” wave?

“I’m guessing that someone (private investment firms) is quietly taking those losses in the neck too.”

Yes, that has been happening big time — these firms are venture capital firms, private equity firms, even hedge funds, and investment funds that invest in startups (Fidelity has one, as do others). SoftBank is all over this with its funds, such as the Vision Fund. They all invested in startups, and their investments vanish as these startups implode. SoftBank has disclosed large losses on its investments, such as in WeWork. Fidelity has written down or off a large number of its investments in startups. But they also made huge gains on some of the survivors that went public or were sold to mega-cap companies, such as Apple.

All of them are specialized investors that expect to lose money, or make little money, on something like 80% of their investments and gain huge amounts on 10% of their investments. So it’s not a biggie there. They must have figured some of this into their calculus.

SPAC’s (and other scams) got more bad news with the continued liquidity drain by the ECB. Looks like some more TLTRO III loans matured as total assets declined by €88B last week.

One wonders where the liquidity is coming from that’s ramped asset prices the last several months. China? …Japan?…or is this simply more shadow leverage being applied?

SPACs are like the sand people in “Star Wars”.

They are gone for now but they will be back and in greater numbers [when the Fed loosens]

The SPAC cycles are long. So far, there have been three SPAC booms and implosions: There was a SPAC boom in the early 1990s (when SPACs were invented), which blew up with record spectacularity. There was another SPAC boom in the early 2000s that also blew up. Then everyone learned a lesson, and there was just nothing or just a trickle for about two decades. And now all the people that had learned a lesson and knew better were reduced to old farts by a new generation that came along, eager to learn its own lesson, and unaware that this lesson had already been learned by said old farts, and so now we have this SPAC boom and implosion, and this new generation is learning the same lesson. If that lesson sticks, it may be another 20 years before the next generation comes along, eager to learn the same lesson, and then we’ll get the next SPAC boom and implosion.

“ And now all the people that had learned a lesson and knew better were reduced to old farts by a new generation that came along, eager to learn its own lesson, and unaware that this lesson had already been learned by said old farts, and so now we have this SPAC boom and implosion, and this new generation is learning the same lesson. ”

Chaos, Cosmos! Cosmos, Chaos!

Who can tell how all will end?

Read the wide world’s annals, you,

and take their wisdom for your friend.

Forward then, but still remember how

The course of Time will swerve,

Crook and turn upon itself in many a

backward streaming curve.”

— Alfred Lord Tennyson, “Locksley Hall Sixty Years After”

As usual you have hit the bullseye. I guess ” financial history lessons” are boring to new energetic investors with dreams of ocean view Miami condos, yachts, and unending parties with A list celebs. History lessons are just something for the old farts to lament about.

Looking forward to the next installment of the “Imploded Stocks” story, I find them a fascinating “history lesson”… ooops, did I just reveal my age?

I’m not proud, I’ll admit it. I got taken for a RIDE!