When there are suddenly second thoughts in this market powered by so much blind and crazy exuberance, the entire foundation begins to wobble.

By Wolf Richter for WOLF STREET.

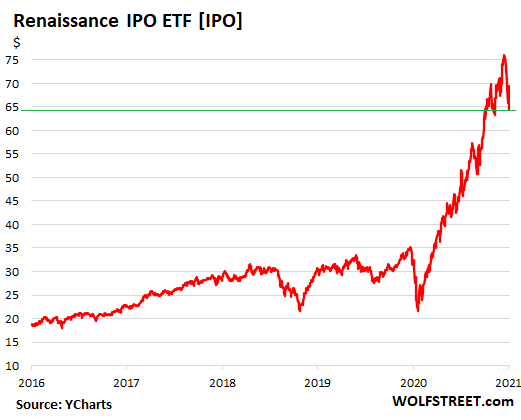

The Renaissance IPO ETF [IPO] dropped 4.7% on Wednesday, to $64.65, down 16.1% from the intraday high on February 12. This comes after a blistering 1999-style blow-through-the-roof exuberance rally of 252% from the March 2020 low to the top of the spike on February 12. From the pre-Pandemic closing high on February 20, 2020, to the closing high on February 12, 2021, the ETF surged 117% (stock data via Ycharts):

The ETF tracks the Renaissance IPO index, which reflects the top 80% of companies by capitalization that went public over the past two years. After two years, the stocks are removed from the index. The index caps a company’s weight in the index at 10%. The top five holdings, accounting for 34% of the total index, are currently (weight in parentheses):

- Uber (9.8%)

- Zoom Video (9.1%)

- CrowdStrike (8.2%)

- Pinterest (7.9%)

- Peloton (7.3%)

What is interesting here – in addition to the sudden air pocket underneath these highflying stocks – is the index’s relationship to the S&P 500 Index over the past few years, and how that suddenly changed in the spring, and what the current drop in these highflying IPO stocks might indicate about the S&P 500 Index.

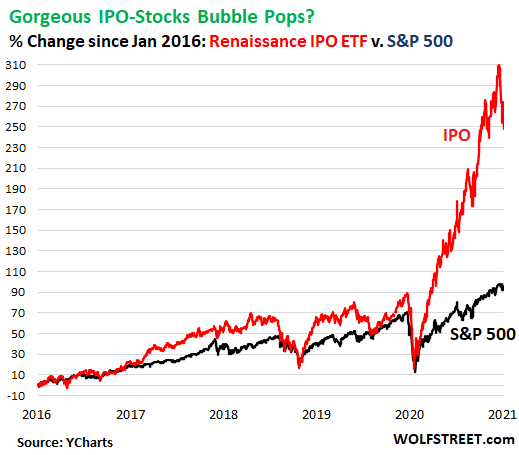

The chart below shows both the IPO ETF and the S&P 500 Index as percentage change from March 2016. For the first four of those five years, the IPO index outperformed the S&P 500 during the Good Times and fell more sharply during the sell-offs, to end up on par with the S&P 500, which makes sense, given the precarious and speculative nature of IPO stocks.

What the chart also shows is that the big sell-offs in the S&P 500 in late 2018 and in February-March 2020 were accompanied by plunges in the IPO ETF, which dropped hard in the early stages of the selloff, foreshadowing in a way the drops of the S&P 500 (data via Ycharts):

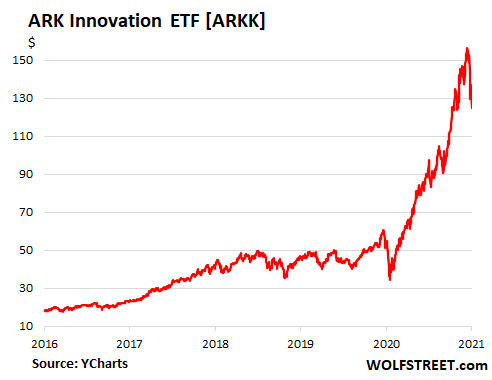

Another example of this 1999-style exuberance popping in plain sight is the ARK Innovation ETF [ARKK], which dropped 6.3% on Wednesday and is down 20.1% since February 12.

The components of ARKK are companies that ARK identified as offering ‘‘disruptive innovation’’ that “potentially changes the way the world works.” The top five world-changers in the ETF, accounting for 30.5% of the total ETF, are:

- Tesla (10.1%)

- Square (6.0%)

- Roku (5.4%)

- Teladoc Health Inc (5.3%)

- Spotify (3.7%)

From the March low to the peak of the spike, ARKK had skyrocketed by 358%, or by $120. So now it has given up $31.50 or over one-quarter of those gains. The biggest culprit, in terms of weight, is Tesla, whose shares have plunged 26% from the January 26 closing high ($883) to $653. During the February-March crash, ARKK plunged 40%. So now, there is just a minor dip in the S&P 500, and ARKK has plunged 20% already:

When funds that track the most world-changing disruptor highfliers that had skyrocketed over the past 11 months by several hundred percent suddenly swoon, it shows that there is a change in sentiment. People are suddenly eager to sell those stocks, while others are more reluctant to buy them at current prices, and for sellers to be able to sell, prices have to drop further to bring out the buyers. It’s a sign that blind and crazy exuberance is becoming a tad less exuberant.

But the whole market has been powered by blind crazy exuberance, with market participants engaging in huge and highly leveraged risks. So when blind and crazy exuberance becomes less exuberant, the very foundation of the entire market begins to wobble.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Now’s your chance to cash in ya gamblers. Don’t be late when it’s time to deflate.

If you watched the Space X rocket attempt to land Wednesday, the main nozzle had to shift drastically and quickly to create “stability”. The rocket landed perfectly at first observation, and yet all that energy used for “stability” ended up “over-heating” the system, and thus it turned into a catastrophic fireball failure, without warning, at the moment “invested participants” were at peak euphoria…

Kind of sums the same experiment J-Pow is forcing on the entire global economy. J-Pow forces too much “stability”, overheats the “system”, and J-Pow turns said system into K-Pow?

J-Pow is attempting to control forces more complex and unpredictable than any rocket system, so good luck with that genius, using pseudo-science economic “guesstimate” equations and four hundred Ph. D. staff who have limited real world business experience.

Beware too much stability. Dead people are stable.

Thanks for the tip. So I watched a version with sound and was more impressed by the audio and the “attitude” the techs had than the visuals. I’d say they don’t think it’s ever going to “work”, just like the techs in fusion, self crashing autos, Star Wars Defense of the 80’s, etc, etc, etc, but like techs anywhere they love playing with expensive and cool new toys and getting paid for it.

Like I’ve said before, some “entrepreneur” or politician has a “vision” and then gets the money to send all the little scientists scurrying about and making their vision happen…..or so they almost tragically believe.

“All the real talent is siphoned of into the arts and sciences, and that leaves the dregs to put it all together”

Bucky Fuller’s lament….and mine.

And if it was all “INVESTED participants” (which I just noticed in Yort’s post) instead of techs behaving that way, then we have quite a different type of organizational problem here. Either way, someone very important in this ‘endeavor” doesn’t give a rusty for some reason.

“forces more complex & unpredictable” ??

as opposed to unorthodox .. highly irregular .. risqué .. deceptive .. unviable …… there is a word that eludes me at this moment ??

Forces more complex & unpredictable are unviable companies living on fresh air & love notions.

In my beloved country, the pandemic hit everyone, the supermarket chains including. I shop Coles online, today delivery is the very next day due to less customers, real market share has been lost which will never be regained.

The pandemic forced consumer to utilise other means of, & even feeding the family, new shopping habits have been formed.

It is safe to say that across the board the SMart’s have lost substantial customer base = less profit.

So .. where is their money coming from ??

Government subsidies ??

= Hard earned tax payer dollars ?? .. because we the people get to pay the ultimate bill in the end.

Q: How long can a government of a nation subsidise it’s corporate entities before the nation goes broke to the point of no return.

Is there any real & devastating consequence to endlessly printing funny money to prop us a nations economy ??

Yikes Yort

400 Phd’s

That frightens me more than an H-bomb

Are they all in one place?

It could go critical.

Run, get out now.

An ETF for ONLY 2 year old IPOs!……Aside from Wolf’s analysis, which I didn’t fully understand, after reading twice, but that’s nothing new for me, and why I’m here, for that “aha” experience and whatever else I can pick up from Wolf and a bunch of usually pretty sharp, widely informed people (whether I agree or not), and add my 2 cents….plus it doesn’t degenerate into name calling……..it made me think of what I’ve always heard about Britain, and that is that someone will make book and odds for just about anything one might choose to gamble on. Like whether Musk’s latest “Space-X” toy will blow up or not.

Who cares it’s all a bunch of BUll S**t

I kept saying everybody the yields are beyond control.

If you haven’t been paying attention to the 10y treasury perhaps tell me what I’m missing?

“I kept saying everybody the yields are beyond control.”

How exactly do you mean this?

Considering that an honest, un Fed manipulated 10 yr should be 8%+ (compare US debt ratios now vs 90’s when 8% rates existed) but 10 yr is only at 1.5%…it would very much seem that rates still wear the Fed dog collar.

(Very much not approving it…just observing)

I wouldn’t call that a pop. More like correction to where it seemingly just was, and not necessarily and indicator for heavyweights in the S&P 500.

A drop to pre covid territory would be one epic drop though.

Tesla priced at a PE ratio of 25? That would still be high. And it would also be an epic drop. Automakers have been priced with PE ratios in the single digits because it’s a horribly mature industry. The current stock prices, even if down, are still so high that they’re beyond meaningless.

Oh yeah, no question. I’m don’t think such epic drop would be enough to correct Zoom, Peleton, and future IPOs to reasonable levels.

I’m just saying the bubble hasn’t popped yet. Renaissance and ARKK are merely at January 2021 levels, when they were still rather spicy.

I agree we have time before popping. The $2T Stim checks are just rolling out and CPI-adjusted bond funds are not a hedge against inflation, so where else are you gonna go ??

Beardawg:

“CPI-adjusted bond funds are not a hedge against inflation, so where else are you gonna go ??”

Buy physical silver…if you can find it.

re: “Buy physical silver…”

Nope. Rhodium-there’s $400-worth in a catalytic converter, which are being stolen by the thousands.

California Bob, why would you buy rhodium now of all times while it’s in a supply crunch? You buy it years ago when it isn’t, expecting that sooner or later it will, and then you sell it at times like now.

This is when you buy gold, and maybe silver if you can stomach the premiums.

Junk bond prices have also been radically affected by the underlying sky high stock prices. Instead of going into the bond market to raise money, these companies can just sell stock.Those companies that do not have earnings are in essence financing at negative interest rates when they are able to sell stock at silly prices. As long as stocks remain so high , the bonds of these stocks will not be affected by movements in the larger credit markets.

You aint seen nothing yet Wolf

If GM and China pull off their<$4000 electric car that does what it says on the tin.

They actually did, its called Wuling Motors / WLMTF, and looks like they sold more cars than Tesla this winter, not sure if it was December or Jan, and they expanding in all Asia, where people can’t afford Teslas…I think its just the begining

There was a article from SeekingAlpha that compared ARKK to the high flying Janus 20 fund during the dot com crash, and it also rocketed up just like ARKK, then crashed.

I agree we are starting to see cracks in this “blind crazy exuberance” of investing, and I saw this movie before, and believe it won’t be a good ending.

Anyone remember the story of Icarus….

I knew the end was near when ‘Mr. Wonderful’ started pitching his scheme to help the ‘little guy’ get in on the IPO bonanza.

Yeah. Have been noticing many celebrities and semi-celebrities picking up some extra bucks pitching this or that lately. Guess what (likely considerable amounts) they have isn’t yet enough, for some reason. Probably a bad omen of some kind.

I hope it is not like the dotcom bubble.

i know several employees who went all in when Lucent (Bell Labs) spun out from AT&T in 1996. World renowned Bell Labs.

!996: $45.75

1999: $112.56

2001: $6.39

2006: $2.54 – Sold to Avaya.

Many tech stocks had similar fates or worse. The ones that survived didn’t fully recover until 2014. The NASDAQ valuation didn’t recover until 2014.

There was no floor back then.

Is there a Pre-Covid price floor today? Was the Pre-Covid price also in a bubble?

FED, please save us and our bloated, risky retirement funds!

Very superstitious, how the financial war events of the last 40 years mirror crypto spikes on a compressed scale. NOT!

‘We sell air. Its the best air and therefore very expensive. Get it before it’s gone, one time offer, going fast…Never mind it’s all junk, can I deliver you a truckload my electricity bill just exploded. Never mind the gov bought it all and is paying me to relax’

Yes pre-covid was a bubble. Yes trump was pumping the markets thru Twitter. Yes the people should matter now were checking out pre-covid. Yes the entire Northeast is still in the 2008 bubble/depression. Yes ‘we’re not going back to pre-covid good times’ its all part of the psycho narrative. And finally Yes there will be plenty of ‘foreign guest’ here for your FINAL wishes from your gov housing bed, They don’t speak English very well but your stats will make great propaganda and GDP for the books

Do NOT consent, do not go into the dark night, RAGE with all his GLORY. This too shall PASS, Cheers

Never bet against America – the odds are actually quite terrible.

Speaking of the S&P 500, we are dying to hear an update on your short. Did you cover? Re-short higher?

Yes, I was just wondering what became of the Wolf’s short.

Still short. I’ve been getting asked this question generally when the market jumps 1% or 2%, with some folks gleefully pointing out what an idiot I am, and other folks commiserating with me. And each time, I have said I’m sticking to my theory. I have not covered the short yet.

I have coined a term for this short: It was supposed to have a window of “several months” which became a Spandex several months.

So this is my “Spandex short.” ?

Same boat, probably with a lower entry point though. I just reroll on red days.

The odds are in your favor as long as the FED does not attempt yield curve control.

Just one piece of advice to others who wish to go short. Avoid those stocks with a high % of short interest / float. Although every one of such companies has questionable fundamentals,short squeezes are a distinct possibility

Excruciating being short, but I’m jumping in now. I’m calling a long term top.

Never wear Spandex shorts out in public. ☢?☢

When Wolfe said “several months” he meant it in the African, not American, sense!

I learned the hard way in Africa, that time is money.

They had the time, and I had the money!

A feller can look awful sexy in Spandex Shorts, Wolf! :)

I’m holding on to my cash to buy a home once these prices come back down to earth. Of course I may be wrong and many things are different from 2008.

I believe RE:

-Is still typically a trailing economic indicator.

-Price booms lead to price busts (aka revert to the mean)

Even with all the differences, this looks, sounds and feels a LOT like the last bubble to me. I learned my lesson last time and am happy to wait and see.

from my (unsuccessful) trading days.

what do you call a trade that loses money?

an investment.

rooting for you. just looking at QQQ from the ’09 bottom, the parabola was getting dangerously vertical. i figured there might be another 10% pop over a month or two to get us to 370-380 and make it really crazy, but jerome may have popped it early. if this isn’t the end of the 12 year bull market and we rocket higher, i don’t know what will ever stop it.

200 on QQQ seems far away (~40% from highs) but only takes us back to like april of last year. even pre-covid it’s only november of 2019. that would just be getting rid of the fluff. wouldn’t even break the uptrend from ’09 or ’16 lows.

Michael Burry was a little early in his short of the MBSs in 2006. This was in the book “The Big Short” but not the movie. Buying Puts is the only way I would play the short end of the market.

Puts have an expiration date. That’s why most puts expire worthless — meaning you lost 100% of your investment. That’s a huge loss.

Wolf,

I think a very interesting post might be made from discussing various invt tools that can be used to short a very clearly overvalued mkt.

(The Fed has long been wholly/dementedly committed to trying to artificially resuscitate US employment – gunshot by China – by using ZIRP/inflation…creating idiot asset bubbles instead. But insane fiat forgers have more staying power than sensible investors…thus the need for optimized shorting tools).

There are multiple options (true shorts, futures, short oriented ETFs, multi yr options, etc.) and they all have pros and cons.

A broad review of the choices would not only benefit your audience, but also might help you to uncover new/more obscure tools that might help you to outlast the mad Fed.

I say this as someone who has been outlasted by Fed madness…but who knows it to be madness all the same.

If I buy some of these absurd stocks subject to a “short squeeze” does that make them a “short – shorts?” Thank you for your patience, sometimes I can’t help myself.

Cas127

‘There are multiple options (true shorts, futures, short oriented ETFs, multi yr options, etc.) and they all have pros and cons.’

I concur with you. I used them during during GFC ( when genuine Free Mkt Capitalism functioning) lost ZILCH but in fact made some profit.

NOT any more under crony/Tax supported capitalism and easy -peasy monry spigot by Fed! The conventional investment matrix on it’s head, now!

Puts should be supplemented with calls as hedges, to mitigate whiplashing. Same with inverse ETF.

(in the mkts since ’82)

Buying short SQQQ calls were immensely profitable yesterday and the day before. Never keep them overnight!

The meme stock tracking “BUZZ” ETF trades on Thursday, and unfortunately I’m serious. I’ve always thought the govt was cruel to allow “non-mathematically inclined” individuals to spend unlimited sums on a 1 in 300 million odds lotto ticket. Now I think the govt has outdone itself turning the entire socity into stock gamblers, who at some point will be forced to gamble in an attempt to survive the coming inflation tsunami, that has a good chance of becoming stagflation long term. And since I noticed that PPP loans for 401(k) matches by employees qualify for “forgiveness”, it would suggest the govt is very happy to print unlimited sums of money in order to enhance the everything bubble indefinately. Although it did make sense that PPP loan forgiveness is not allowed for health insurance, as that is a great stick to force people back to work in America, and has become a very efficient “entrapment” to keep them working from craddle to grave, least they go bankrupt from getting sick…

So what next, “pee tokens”…oh wait, I remember as a kid having to put a dime into the bathroom door at a big box corporate business bathroom door, just to enter. That was not that long ago, I just happened to grow up in one of the most poor areas of America, and they definately tried to squeeze the pee out of us one dime at a time. That pee dime policy only lasted a few months as it turns out people just peed on the floor when they didn’t have a dime. Funny enough I noticed there is an actual “PeeCoin” (PEE) Token today..which is worth $0.00 so I guess Pee Tokens are a bad investment period, yet perhaps J-Pow can fix that too in his attempt to make fiat money cheaper than toilet paper? Personally I prefer my dollars in uncut sheets when using them in the bathroom. A roll of dollars would be nice though. Oh, and shredded dollars might work nicely for pet cages. Have you seen the price of lumber lately, shredded dollars are way cheaper than cedar chips…HA

Wolf- On a side note, one of your recent inflation articles was referenced by Alex Pollock at “LawLiberty” on March 2nd, in a facinating inflation piece concerning the changes in Fed behavior over the last few decades, and he questions the legality of the Fed two percent mandate.

FYI, article is titled “Inflation Comes for the Profligate”…

I remember those bathroom doors. We crawled under if I remember correctly. :-)

I guess I’m not the only one worried about stagflation?

Also, the article description of the wobbling IPOs, “World changing” etc, made me smile. These tech companies are so full of themselves.

From 1951:

TODAY’S BEST LAUGH: Nowadays when you read the papers, according to Irving Heller 2, you feel like saying, “Stop the world! I want to get off.”

Sound familiar? It’s what I think when I see people on their phones in a waiting area, people all around and no one exchanging a word or smile. World Changing IPOs? Wobble away and bah humbug. It’ll one day all be viewed as an extravagant blip when the excesses are no longer affordable despite all free money and desperation.

Yort,

Concerning your last paragraph: I’ve been in contact with Alex Pollock for a while, and we’ve been discussing these things. He has very deep professional background in these matters.

Except sadly the Fed has proven, repeatedly, that in exigent circumstances it can bend its legal mandate beyond recognition, and get away with it.

Legally, only Congress has the power to overrule the Fed, and they aren’t up for that, perhaps because the powers behind the Fed also own Congress…

Speaking of dimes, I just went to the grocery with my pocket change jar, and they now want 12.5%.

Got to check this out here. 12.5% sounds like a rip off. It used to be 11.5%.

Cute. But it begs the question, “at what point is it a ripoff?”

@Yort,

Nice posts, and from the previous post this part I totally agree:

“J-Pow is attempting to control forces more complex and unpredictable than any rocket system, so good luck with that genius, using pseudo-science economic “guesstimate” equations and four hundred Ph. D. staff who have limited real world business experience.”

It’s all a big science experiment, – He knows it, I know it, the American people know it – as Bob Dole would say.

Your last post I agree too, talking about the new ETF called BUZZ

“The govt has outdone itself turning the entire socity into stock gamblers, who at some point will be forced to gamble in an attempt to survive the coming inflation tsunami”

Years ago a stock was valued on factors like P/E, returns, future earnings, YOY performance, and when news came out people would buy, not sell on the news!

The market has changed into a casino, at least the casino rules don’t change day to day.

The Fed was created by Congress and they basically give them the utopia mandate. We are where we are with fiat, roughly $30 T in debt and interest rate repression because that is what Congress wants. J. Powell is the spokesman for the technical team to give Congress maximum spending ability. Even the smartest people don’t know how this is going to play out, but you can see with Covid that Congress is abusing fiat currency. Something big is going to have to break to get people’s attention.

That was a long time ago, and it won’t come back. Today, stock prices are mostly data-driven, by patterns in the dataflow generated by the market.

“The Market” does not make sense to people, because it evolves into a structure that makes more sense to the machines interpreting patterns and trading “The Market”.

Human investors are bystanders. We are like the dogs in the Moscow Metro, who can use the trains, but, do not actually understand trains or what a train is. The dogs know that one get on and go to another place, where one gets out, depending on the smell of the train and probably other things that dogs now about.

Forget about “understanding” and sequential reasoning. Analysis of fundamentals does not matter, it only slows one down, causing missing oppertunities.

Exactly like overloading a dogs brain with understanding of Trains would not help a clever Moscow dog traveling from “A” to “B”, as much as the “smells”, “hunches”, “the crowd” and “momentum”, the movements of the crowd, does.

That is how to “invest” Today, be like a Moscow Metro Dog.

And the future will become even stranger!

Excellent. A blogger I follow (Unsupervised Learning) quoted a blogger he follows (I forget) as saying we’ve gone from a fundamentals based market to a narrative based market. Wall Street has become a social media network.

Read Ben Hunt and Rusty Guinn.

That’s not how I invest or how I ever will invest. I think you underestimate how many people still invest based on fundamentals.

Sure, wouldn’t be “A Market” if everyone agreed all the time.

But, Fundamentals never really did anything for me. In today’s “Market” they are meaningless.

This is not a new problem, btw:

True. The market is all quants with near-zero relation to real.

There is a fellow, Nathaniel Whittimore of the bitcoin circuit, who says that now stocks are acting like bitcoin. It’s an interesting thesis…

For centuries in the human mind a bird in the hand was worth two in a bush.

Now we’re so clever?

We can make a bird in the hand

worth only 0.0001 of a bird in a bush

Magic!

It’s always ‘different’ this time, until it isn’t.

The timescales of collapses between ‘different’ markets is getting shorter and shorter over time. viz 74, 87, 99, 09, 16, ??. Is it because it costs the FED more and more every time it has to intervene?

Dividends are much more stable over time than prices, which rely on a bigger sucker being found.

The real wizard is the man who spots the next ‘fad’ before it arrives.

According to Forbes, in Aug 2020, only 55% of Americans invested in the stock market, down from a peak of 67% in 2002. Worse, the richest 10% control 84% of the value of stocks in the whole market.

The statement, “The govt has outdone itself turning the entire socity [sic] into stock gamblers,” is not very accurate. In fact, the opposite is true.

I doubt Forbes can easily calculate the tens of millions of younger generational folks who have turned their re-occurring stimmi and unemployement bonus checks into robonhood daytrader accounts, of only a few hundred dollars invested per each person.

The media likes to portray they know everything that is occurring in real time. They know exactly how much stimmi was spent immediately, on what it was spent on, when it was spend, etc. Thus the govt now has cover to not give stimmi to “the rich” folks making $80,000, to redirect as will end up bribing the most votes for future elections, etc. There is no way, unless some all knowing supercomputer (God?) is tracking every move you make in every account you own and/or joint own, in real time, to get the data they say they have on how stimmi money was spent to the level and detail that is talked about in the MSM. And polling the data…yeah, that does not work very well as seen during the last two elections. American behavior is very difficult to track via polls as we have no issue lying about what we believe, in order to fit into a world that doesn’t make sense yet we have to exist and attempt to fit into the ever changing tribal woke crowds.

And thus Forbes “knows” about all those robinhood traders, on a free app, using free money to daytrade a few hundred bucks? Not likely…yet it presents a very powerful arguement to control the populace if everyone thinks everything they do is documented and known by a higher being…our new American religion of sorts.

Interesting response.

Nailed it

I scanned through the entire ARK portfolio and found ONE stock that I owned (VRTX. It’s probably the only one on their list that is reasonably valued at P/E 19).

I promptly sold it. The lemmings will follow Cathie Woods off the cliff and they will take some decent companies down with them.

The noise of a million lies will meet the bubble when it pops again*

*It popped in September of 2019 within the REPO market. They sent in the virus-clown to distract us from that fact and give us a reason for our goring.

Why is Square a disruptive technology? Isn’t it just a credit card processor?

Disruptive is the buzzword, but most likely referring to the fact that it lowered the barrier on who could accept credit cards.

I like a saying Buffet has ‘”Risk comes from not knowing what you are doing”.

“Pure Research is what I’m doing when I don’t know what I’m doing.” – Wernher von Braun ?

re: “‘Risk comes from not knowing what you are doing”.

Pithy–WB is known for pithy one-offs–but untrue (WB’s made plenty of mistakes). There is risk–physical/financial health, financial, etc.–in any worthwhile endeavor (see: life). Flying is a ‘risk,’ but do you think the guys/gals in the ‘front office’ don’t know what they’re doing (unfortunately, a very small few don’t)? If you did think that way, you’d never fly anywhere. Even when you ‘know what you are doing’ there are risks.

What’s pertinent is ‘risk management;’ i.e. understanding the risks, and being prepared to manage them. The FAA has shifted its emphasis from rote recitation of facts and ability to perform requisite maneuvers–though those are still required–to a ‘risk management’ approach (too many good ‘stick-and-rudder’ pilots were doing stupid pilot tricks). It’s now ‘scenario-based,’ with pilot candidates expected to demonstrate both knowledge of potential risks–weather, fuel exhaustion, spacial disorientation, ‘get-there-itis,’ etc.–and the ability to manage them (not a bad approach for any of life’s challenges).

As an aside, I’d like to purge the word ‘safe’ from the English language (except, perhaps, in baseball usage). Every activity has some kind of risk; there is, for instance, no such thing as a ‘safe’ automobile (though Subaru and Volvo would like you to think otherwise). There are only various levels of risks. Some autos are only more crash-worthy than others and, in some cases, one of the ‘safety’ features my save your bacon (when the driver wasn’t paying attention to the risks).

CalBob-outstanding post! Kudos!

may we all find a better day.

I think mainly he means in not blowing up a company to wipe out equity. He has a few good principles. 1). Keep lots of cash. 2. Borrow long term 3) have very high interest coverage 4) Have multiple income streams. He has proven you can have a conservative balance sheet and still get good long term returns.

Also demonstrates that it helps to be politically connected too…

Spot on Calbob

Old engineers like me say, “If it can go wrong it will go wrong.”

Further, for modern times, ” The more there is to go wrong the more likely it will go wrong.”

Hubris ignores these ancient wisdoms.

It’s just spacs replacing IPOs, competing for the same capital i don’t know if arkk includes them but i think renaissance doesn’t. So no popping of the bubble yet.

Speaking of capital and bubbles, a certain twitter character, has launched a new ETF! Oh yes…it’s an ETF that tracks meme stocks reddit mentions and tweets. This bubble is the most undocumented transfer of wealth in the history of the world. Some commentators here have mentioned tether and bitcoin and what is happening in that space, and thanks to them i have read and understood the fraud that is going on right now with bitcoin, now we have spacs, we had GME that made over 20bln USD for big institutions and left people holding it at triple digits, under the guise of revolutionizing and democratizing finance. So no bubble bursting until those that are inflating it take all the money they need.

Anybody else hear a bell tolling? Ring ding ding Jay ……

“They all had the politics of horse thieves. He believed in the Republic as a form of government but the Republic would have to get rid of all of that bunch of horse thieves that brought it to the pass it was in when the rebellion started.

Was there ever a people whose leaders were as truly their enemies as

this one?”

― Ernest Hemingway, For Whom the Bell Tolls

Mark,

Epic and timely quote!

More Hemingway

The first panacea for a mismanaged nation is inflation of the currency. The second is war.

Both bring temporary prosperity . Both bring a permanent ruin

There are a few stocks you can value pretty closely. In checking a few valuation models they all have went from sort of cheap to expensive in less than a year. The Fed is really jaw boning they are going to keep the heroin flowing so I guess assets are going to stay high until patient convulses.

My stock exposure is down to 4% and that is an international index fund to diversify some assets out of dollar. About 1% gold and silver. The rest cash or cash substitutes.

If stimulus checks are sent out in March/April I wouldn’t be surprised to see a major market correction in May.

The wolves on Wall Street will demand it.

An IPO based on expensive stationary bicycles was quite something, but imagine if Peloton had a grid

powered by all those humans going nowhere fast, and was a threat to oil-based energy?

One thing you realize when you are a Realtor is that almost every home has an unused exercise bicycle collecting dust or covered with clothes. They get used 6 weeks. We called them “sculptures”.

That doesn’t say much for the economy.

During the last bust it was treadmills. There must be something very deep going on.

Over here labradoodles and cockerpoodles, possibly the most brainless mutts ever bred, seem to be all the rage. When it all goes sour there are going to be some mighty hungry dogs.

We had a great labradoodle, all poodle intelligence and hunting instinct, but would eat like a lab.

Looking on Zillow over the last 6 months, every house here in the PDX area over about $550,000 has an entire room filled with new looking exercise equipment. Stationary bikes, stair climbers, Treadmills, huge barbell racks etc. Not sure if this is the case everywhere or just virtue signaling WFH Nike employees, ( exercise is equated to virtue at uncle phils place). Would not want to be in the fitness equipment business when all that stuff comes on the used market.

Fools and there money are soon parted and govt wants to raise taxes on rich haha they don’t pay taxes

Great point. We are going to increase the taxes by X% on the uber rich. So let me tally the math…move the decimal point….round the figure….and the total is $0 tax liability…Oh wait we need to add the new tax. So that balance is $0 tax liability. The bill for CPA services will be $500,000.00

Warren is a corporate lawyer, she made money advising companies on how to use loopholes. Do you really think she will be taxing her customers? I don’t. More spin for the masses.

Bit of an oversimplification for someone who also spent a large part of her legal career representing consumers’ rights to bankruptcy and for a time was persona non grata to the financial industry for strongly supporting the CFPB. Not to mention her current stances on monopolies, white collar crime, etc.

We are seeing the market stall because if inflation coupled with slower growth from the new president. This administration is killing jobs while promising to flood the country with money. That is stagflation.

The similarities to the post Vietnam war wind down of troops began in the previous administration, does raise the issue. The second surge of Covid had an adverse effect on employment, (JP). Powell said less than max employment equals zero interest rates. He does consider those who are not in the system and wanting jobs, his view of max employment is narrow. He disavowed the relationship between tight employment and inflation as no longer valid. He is serving his final term and demurred on whether he wants a second term.

Can’t see much diff from old admin vs new admin. Except maybe for a brief moment this Admin pretended it wanted to reduce yes reduce wages to $15/hr by 2025 – a very substantial pay cut.

Wrong. The Paris accord climate thingy sends lots of jobs out of the country. This is a massive difference. There are more. Less jobs + more printed cash = inflation with a possiblity of stagflation.

???? What are you taking about

timbers, under the Parris accord, China is allowed to run factories that pollute while the US is not. Where do you thing all the factories will be build? Hard to imagine the American public is dumb enough to support the Paris climate deal. Clearly, some of the American public is low IQ.

SocalJim,

A few things not right here. I fix it for you:

“China is allowed to run factories that pollute BECAUSE SHE IS A SOVEREIGN NATION while the US has chosen to enact laws to achieve clean air and environment to protect the health of it’s citizens.”

Yes, but the whole Paris accord is being sold to us because of a supposed need to reduce CO2 emissions. CO2 emissions are not “contained” within the emitting nation. So if China isn’t going to follow the rules, and they’re producing the most, what is the purpose?

Umm, 1.9 Trillion in additional needless spending is nothing?

Yes, compared to the corporate tax cuts dwarf it. They are permanent.

This administration is resembling the Carter administration more and more with its policies. Only Carter was at least an honest guy, and meant well, although completely incompetent. We now have someone in there with all the bad aspects of the Carter administration and none of the good.

Such as?

“There will be no substantial change in policy” – New Admin Dude

Some start up companies got in a cycle of issuing more debt and stock to try to pay their bills. Edison made a fortune with his inventions, but lost money backing a NJ iron mine. A mine is a hole in the ground investors poured money into.

‘A mine is a hole in the ground investors poured money into.‘

What a classy, financial convolution, Sir. Said hole in the ground will be more valuable for investors then most of this techno-psycho corporate garbage and old, legacy, corporate bed sores. A mine in Jersey! Those electricity folks have a special gene for sound decisions.

Newflash 2024: Andrew Coumo sells Adirondack state park mining rights to Tesla Super-Zombie Inc for rare earth metal extraction. The GREEN revolution is truly here. F-yea we want green! Once the flatscreen goes we just throw the whole car away. AOC ‘On this day the people of NY have truly embraced what it means to be green, while ted Cruze is surfing on a diesel powered surfboard in the gulf!’ President Trump ‘after the trees burned down it was nothing but a bunch of lazy woodchucks left, trust me, it’s a great deal for the people’

Hey wolf how about a article on the great reset truth or fiction

In some ways I think we are in the midst of the slow motion reset. With ZIRP and NIRP financial assets are maxed out.

Anyone who didn’t benefit from the asset increase now has a tough road as it looks like instead of needing say $500,000 nest egg to supplement social security, you are going to need to work longer and need 2X or 3X that nest egg to provide the same standard of retirement. That’s a lot of years of extra labor to set the extra savings aside.

If you control interest rates you basically control it all. What is the value of a $1 million if interest rates get repressed 5%?

Very little.

Old man Murphy has been kept at bay for quite a long time, but that does not mean he is dead. He is alive and well and will ultimately get the last laugh, as he always does. He never allows foolish behavior to go unpunished.

Murphy is now just waiting for the “worst possible time and place”!

The only problem with Murphy is that he was too damned optimistic.

Not yet. Wait till Dave Portnoy’s ETF comes into the market.

Also Powell is scheduled to speak later today. He’ll try to goose the market some more.

Oh wow, looks like $buzz has arrived, and it’s not looking good. Ok, the market can pop now.

Shh, Jerome is about to speak, buy stocks…

You can’t pop anything with a pin as dull as 1.4 on a 10-year treasury. Are rates going higher? Doubtful. In fact, 0 is still quite probable.

Division by 0 will continue until morale improves.

There is a difference between many of today’s IPOs and the dotcom. Companies like UBER are exploiting existing market inefficiencies. Drunkenmiller said, the problem in dotcom was companies trying to reinvent the internet, after the internet had already been invented. He is big on China, [which is a synergy nation]. If the US had a technological advantage I don’t think he would be all in on China. Rock bottom yields for businesses to borrow money to squeeze excess out of older less efficient industries is deflationary, and a good thing probably. So when AARK collapses it is probably supposed to.

@Ambrose, speaking of deflationary,

Don’t forget yield curve inversion coincided with the last two recessions! This means FED will go full yield control from now on, and short rates can never rise again.

With this kind of gravity, all kinds of IPO junk can levitate. Meanwhile, tech and global demographics exert deflationary pressures that even the fiscal side won’t easily overcome.

I don’t believe the question was raised yesterday and Jerome did not off any guidance on YCC.

Uber, Zoom, Crowdstrike, Pininterest, Peloton momentary black holes !!!!! (5 pronunciation for each massive scheme) Combined Profits 2017-2020 negative 21 billion !!!!!!!!!!!!!!!!!!!! (…for each billion) All stripped while the stagflation turnED hyper. Where is the investment, WOLF? The apps are nothing more then data nodes for wild, captives. 13 years of moar; zero gravity; you don’t have to guess anymore; it’s all pension and government funding design to sustain the techno-psycho corporate garbage. And it’s being INJECTED into our existence

Years and years of anti-proof to their entire agenda, and the only answer is moar junk. The sweet talk of quarterly reports (and all the fudging factors) is repulsive and disgusting to anyone with a pulse. but very telling of corporate culture ran amuck everywhere. ‘Make money on moving money’, how short sighted and ignorant so many are. Look at the all the deception. Crypto’s, pump and dump media, shell companies, endless media hype to instill household names, Zombies propped for years for buyouts, buybacks for decades maintain while circling the stagflation drain, apps that have infinite value yet infinite reproductive ability and minimal value or destruction nature to life. Look at the manipulation to labor, it’s called human trafficking and they not only know all about it, there supporting it with your money, while they export all they can and bring in the rest. ‘You can’t have your meat if you don’t eat your pudding’ 13 year of moar and moar pudding! shall we all work for the pigs?

“The stock market will party until the bond market takes away the keys” is and old adage I believe I first heard on Louis Rukeyser’s Wall Street week a million years ago. (who would of thought those were the good old days!)

IPO stocks, SPACs, Growth Stocks and gold (initially) will all begin a major correction if yields continue to rise. Such a correction will be persistent and merciless as millions of new day traders cry out in terror, then will be suddenly silenced.

Fav quote from Louis, the day of the 1987 23% crash, (still largest % drop) as he asks head elf (technical analyst) Bob Nurock, who had seen no problems the day before. “So do you still believe in this stuff?”

Thanks for the reminder about 1987!

A softening market with no fundamental backing, and everyone convinced they have downside protection, can implode really fast, for no reason.

I’d been thinking the current market would be fairly safe (“because printing” and “no new COVID crisis”), and at most put in a slow top like in 1999-2000 or 2007 into early 2008. Normally it takes time for the sentiment tide to turn. But with debt levels so high, and trading bots running most markets, things could blow up fast and for no visible reason.

‘Millions of new day traders’ for real? The new little guys with stimi checks? Oh yea I remember this play. It’s the little people with garbage mortgages! Aaaahhh…drain those 401k’s pronto, we got houses that just sold to resell!

Here a little anecdote regarding free money. In 2008, yes 2008 mentioned above, a man starts producing amazing green technology so he is promised 1.5 billion by the gov for the first 200k units. In the form of fancy toys none the less. Fast forward to 2021, the same man takes the same amount, 1.5 billion and invests it in buttcoin, digital tokens. Which require the consumption of massive energy, needless waste. Or arguably waste to dessert the gov money, lol and lol again. On top of that, China’s burning the coal (possible from Tennessee) to mine most of the buttcoin. So at least most of the toxic pollution and waste is somewhere else ;.) endless waste turned endless waste see how sophisticated we’ve become!

WOLF bring out the WTF printers! QE, UI, PPP, bailouts, buybacks, carbon credits, UBI…moar pudding for the pigs, they don’t care what flavor it is.

For the first time the fed has stated for the camera’s that soft monetary conditions will continue with no chance of tightening…………and the market has ignored the fed and collapsed.

Each other time it has exploded upwards.

IMO this is meaningful. Bad times are acoming. The government is losing control of our economy for the first time in 50 years.

All due to drunken sailor behavior by just about every person in the US.

Looks like tech is in correction and the S&P 500 just went negative for the year. Tech benefited greatly from the pandemic, so it is not surprising to see a sell off now with vaccines in major rollout. Tech slaughter is dragging the S&P 500 down with it. It is a healthy correction that will move capital to where it is needed most, or at least where it is most profitable. The Fed will let rates rise until they get that phone call like they always do. I won’t be buying the dip today. A 10% correction in the S&P 500 from the high would not be surprising. That would be a tremendous buying opportunity. Just be patient and watch and wait.

“That would be a tremendous buying opportunity. Just be patient and watch and wait.”

A 40% reduction in the S&P would be a tremendous buying opportunity. Anything less is still iffy since you’re betting the Fed will be able to control yields forever; Hint it can’t if there is real inflation in the pipeline.

‘Buy the dip in stocks’ was really ‘buy the bonds’. So what’s the opposite of ‘buy the bonds’????? You’re forgetting that funds need a reliable hedge to keep pumping the market . Zero hedge with bonds means risk department say you no buy stock.

If you believe that stocks are generally overpriced today, I have T-bond to sell you.

Would be nice if the other bubbles popped too. NASDAQ looks to be at that moment on the roller coaster when it starts going down and everyone throws their hands up in the air right now (if you zoom out to the 6 month graph).

Hey Wolf — can I get a black box around my comment? I know it’s only for the author, but I thought it would be fun to have one just once.

I have no idea how to do that. The black box (I call it “tombstone”) is written into the commenting software.

Dang! Well it was worth a shot.

The market is severely appreciated compared to historic measurement.

The democrats seem determined to raise corporate and individual income tax.

Capital gains tax may be altered eliminating step up and making them income.

Long term rates are increasing.

The fed is in reality at negative rates right now. Return less tax less inflation equals negative return.

The international community may be straining to revolt against the dollar standard for a nation running a 60 billion per month trade deficit.

Margin and leverage at all time highs.

Yep, this is just a 10 percent correction.

The sudden fall in the number of covid cases reported started January 13th, when the WHO/CDC quietly reduced the number of cycles performed by labs conducting these covid tests. It is all politics.

P.S. The higher number of cycles gives more positive results.

“severely appreciated” is one of the best euphemisms for this mess I’ve heard. Bravo!

Perhaps by the time Stimulus goes out they’ll decree that the word is defunct and that they have been officially renamed “Stop-Loss Checks”.

hey everybody…

Just passing thru on the tricycle. Not gonna stop, looks kinda unsafe. Markets are some guys nuts.

I concur from what I said before ..

There is a ton on funny money to be made in these markets.

Have at it

The market is selling off so they can all buy into bitcoin. Just like Amazon mastered and gutted the retail space. Bitcoin will master and gut the asset space ;)

Amazon gutted the tax laws and infiltrated the government. Retail was primed to be an easy target. Just like work from home, order from home is symptom of increased anxiety

pushed into society. There’s value (from Both sides) in face to face exchanges and engaging the physical world but that won’t surface in current conditions until the option is completely removed. At which point a new better, face to face will arrive. Or life will just be a little bit lonelier for all. Who cares more suicide, nobody tracks that. Malls turned zombies since mid 90s, still propped on Amazon‘s behalf. Nothing makes you look better than a garbage model that isn’t allow to die!

Bitcoin can’t master anything it’s unbacked fraud, just a symptom of the beast the Fed continues too feed. It’s taking advantage of the monetary insanity. Too much money looking for a home. High flying evaluations to draw the bigger-est fool in. Do you really want a nonfunctional, form of money with undisclosed fees?!? Or just a store of value. Of course you do, that’s at least half the options now. Actually similar to an empty mall in more ways than one. Three words; waste of electricity ;.)

YacosModernLife,

Please use one of the proper terms for bitcoin (“bitcoin,” “BTC,” “crypto,” etc.), and that pejorative. Otherwise I have to go in and fix it, or delete the entire comment. Makes my life harder. Thanks.

ARKK…New Economy…No profits needed! Party on…Fed providing the coke.

Yeah, the Aqua Regulator Keliodoscope landed somewhere on Turkey and phound Caesars commemorative silver coins. Whats that worth in Lindy’s Deli? a half trillion? I was looking through the keyhole and saw youse all in inscribing Buckminster Fuller quotes on tokens.

I’m betting on inflation 75% probability. But because I’ve been wrong before I would bet 25% probability of deflation. So you need to hedge your bets. Don’t go 100% with the mob which seems to be hedging against a Jimmy Carter style inflation.

75% chance of inflation is a very optimistic view.

For any real inflation to occur, each generation would need to leverage enough to compensate for aging demographics and declining birth rates. How is this going to happen? Congress spending on millenials’ behalf?

Immigration? Changes to retirement age to keep the debt serfs from retiring? The tidal wave of aging demographics is just so powerful, any inflation will be drowned out by savers anyway.

Chamath, Cathie and Portnoy “still believe” in their portfolio choices. They believe they have the right companies. No one is asking if they are at the right prices.

Chamath sold SPCE last week. He didn’t use the term “margin call,” but the bank “asked him” for the money. He said he was down $2 billion last week.