Consensual-hallucination stocks and crypto just keep on giving.

By Wolf Richter for WOLF STREET.

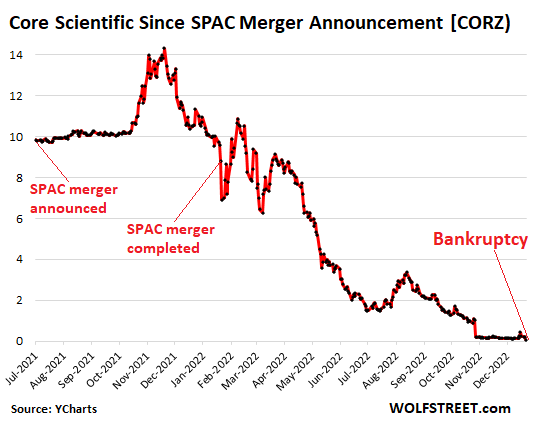

Austin-based Bitcoin miner and crypto-hosting-platform Core Scientific – one of the largest publicly traded crypto miners with data centers in several states, including Texas – filed for chapter 11 bankruptcy on December 21, just about exactly 11 months after going public via merger with a SPAC on January 20, 2022.

The day the merger with the SPAC was completed on January 20, the stock had a market cap of $2.8 billion, already down sharply from the peak of $4.5 billion after the announcement of the merger but before the completion of the merger. Today, forget it. Shares are at a few cents (data via YCharts):

On November 22, it reported that it had lost $435 million in the third quarter, on $162 million in revenues; and that it had lost $1.7 billion in the first nine months, on $519 million in revenues. So now Core Scientific is another one of the heroes in my pantheon of Imploded Stocks to have filed for bankruptcy.

Don’t worry, no one is going to jail here. Regulators slept through all this. This is just another act in the superb hype-and-hoopla show that is drawing to a close. A restructuring deal with a group of creditors representing “over 66%” of $550 million in secured convertible notes has been agreed on. Stockholders have already kissed their money goodbye because they eagerly believed what they were told at the time they bought this stuff, eagerly participating in what I call consensual hallucination.

There are no victims here, just investors who lost money because they eagerly participated in consensual hallucination. Money-printing and interest rate repression by the Fed has turned investors’ brains to mush. That’s how it goes.

In the bankruptcy filing today, the company blamed:

- The “prolonged decline in the price of bitcoin”

- The increase in electricity costs to power its data centers

- The default of its biggest customer, crypto lender Celsius Networks, which filed for bankruptcy in July. The entire crypto space is so interconnected that, as I’ve been saying, they went to heaven together, and now they’re going to heck together.

- Its own decision to have “significantly overcommitted for construction costs to build out additional mining capacity.”

The company has been a great bankruptcy candidate because it has over $1 billion in debt in addition to other liabilities.

It defaulted on $275 million in equipment financing. It failed to pay construction contractors for $70 million in invoices whereupon they asserted mechanic’s liens. It’s entangled in litigation with a former executive. And then, the stiffed equipment lenders accelerated the debt they were owed which triggered a “cross default” on the $550 million in secured convertible notes.

In the chart above, the little nipple last week was when B. Riley Financial offered the company new financing of $72 million to keep it out of bankruptcy court. B. Riley had lent $42 million unsecured to Core Scientific, which it defaulted on in October. B. Riley’s $42 million loan is now listed among the unsecured creditors in the bankruptcy filing. So good luck. Being an unsecured creditor in a bankruptcy like this is not fun.

Before the bankruptcy filing, the company worked out a deal with a group of creditors representing “over 66%” of the secured convertible notes that it defaulted on. This group – this is the playground of distressed debt investors that buy such debt for cents on the dollar – agreed to provide a Debtor-in-Possession (DIP) loan of about $57 million as part of the bankruptcy to fund the company during the bankruptcy proceeding, and it agreed to support another DIP loan of $18 million.

The secured convertible noteholders will then end up with 97% of the equity of the restructured company when it emerges from bankruptcy, according to their proposal. The existing stockholders might get some crumbs and warrants, if anything. If the proposal makes it through the proceedings, it will reduce the company’s debt by hundreds of millions of dollars and would lower its interest expenses.

But reducing the interest expense isn’t going to help all that much: In Q3, when it lost $435 million, only $25 million were interest expense. So maybe the secured noteholders will try to sell those new shares quickly to the public before the company sinks into bankruptcy for a second time?

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Rat poison?

I blame fed for wasting megawatts of energy in bitcoin mining, and burning the environment for nothing.

As crypto falls to final demise, I wonder if these datacenters can be repurposed for productive computing. Will I be able to buy them for $100,000 in bankruptcy sale (the price of land?).

They make specialized chips tailor made to mine bitcoin. Don’t think it’s worth much outside it’s intended use.

After being run 24x7x365, those mining rigs are about played out anyhow.

They are useful for a few other things too – some AI/ML tasks, and sone cryptography uses too.

Reconditioning old data centers built for one generation of technology for use by a different generation of technology ain’t cheap. Most simply build new data centers & the old ones becomes warehouses or skating rinks or storage lockers…or vacant.

Blockchain isn’t going away.

You could say the same about Corn Flakes.

No internet protocol ever goes away they just get deprecated and abandoned. eg Routing Information Protocol (RIP). When’s the last time anyone used Gopher (an alternative to http)? Blockchain is like this although never an official internet standard due to it being and incredibly inefficient, resource-intensive, append-only, hard-to-search *database*. Other than being used by countless scamcoins (all on their way to zero) there are no serious IT professionals who can see any use cases for it. IT academics and cryptographers have been thinking about this since at least 1979 when Ralph Merkle patented his Merkle trees, a chain of linked, hashed blocks. The Australian Stock Exchange recently abandoned an attempt to put its settlement system on blockchain after wasting AUD250 million. Blockchain is useless.

IT professionals don’t determine how the Internet evolves. That thought is laughable. I have participated in the evolution from the gov’t/private sector since the 1980s. IT professionals populated the conferences, many (including myself) wrote papers on this or that new “paradigm”. But they didn’t control the money; they didn’t control decision-making at the highest levels; they, very often, didn’t fully understand the protocols they were charged with “managing”; and, they sure as **** weren’t up to the challenges of integration and cybersecurity.

As a very senior gov’t boss once explained a quixotic decision to me: IT is a white collar employment service.

The creators of blockchain foresaw many uses. That cryptocurrency deteriorated into an unregulated value proposition (an “asset”) that, like other inflated assets, was birthed during one of the greatest banking liquidity/speculative eff-ups of all time is unfortunate. Corrupt people will use technology for corrupt ends – regardless of how efficiently energy slurping GPUs are deployed in the infrastructure. You really think Cloud is energy efficient?

Any discussion of technology in service of application has to first consider requirements and intended uses/outcomes. Any economic argument must obviously consider value created against cost – what happens at the margin?

In the event, I eagerly await what the IT professionals tell government is the “better/best” technical suite of database and identity management systems for CBDC! I trust the IT professionals will receive all due credit and reward for whatever ensues.

Cornflakes aren’t a technology. But who cares?!

“Productive computing”?

That’s in the beholders eyes.

The money lost is evaporated, right? But still on the national debt.

Energy gone, money gone. Fed prints more, no worries. No hurry at the moment with inflation, it should go away according to business as usual in Congress.

Can someone explain to me what “Crypto Mining” is all about??? What do you mine?

Basically it is all about numbers, long groups of numbers that are difficult to hack due to their length.

People give these “keys” that have common variable numbered link with your bit coins- each another bunch of numbers recognizing your key as owner.

I picture them like derivatives of ownership keys that have an initial value that only goes up and down in value because people buy and sell the crypto sub derivatives of keys.

Hard for the government to track it all. There are a lot of people that look at the system, and just think it is so corrupt that what the hell this is no more corrupt than other market stuff

Must be about capturing fractional ‘pennies’ floating around in the ether, like Lex Luthor did in Superman. 🤑

Yes.

But nothing like the ****storm that CBDC is going to be.

I can’t help wondering where the bottom is in the crypto market?

When everything hits zero?

It sure is interesting to follow.

A lot of stuff, including thousands of cryptos, and this thing here, have already hit essentially zero. But this thing here will hit zero again. Each time, it takes down a new layer of believers.

And these a@#holes screwed up the chip industry royally for literally nothing.

Dotards.

I’m wondering what will become of all those crypto mining computers that they invested so heavily in?

Are these basically just high performance desktop computers?

Mining rigs are only useful to mine crypto.

No they didn’t.

INTC and the like did a great job screwing up their businesses all by their lonesome.

“…doesn’t ANYONE here KNOW how to play this game?!?!?!?…”. (Casey Stengel, ‘the ol’ perfesser’, upon managing the first-year ny Mets…).

may we all find a better day.

And removes some of the money supply?

Business schools have been teaching financialization and elitism since the 80’s. The “Greed is Good Generation”. CEOs prior to that were making maybe 50 times the average wage of their employees, not 300-500 x.

This is absolutely correct S:

Worked with a wonderful client CEO as you say in early ’80s, then with his younger brother, a grad of biz school.

Younger brother was SO different,,, greedy AND malicious, constantly seeking opportunities to hurt rather than help as did older bro…

Really amazing difference with older a totally trustworthy ”handshake” guy and the younger no good no matter how much signed paper, etc.

VVNv,

I’m wondering if the younger brother was so untrustworthy that he could be seen as such? The clever ones, like SBF, put up a screen of philanthropic holiness to screen their true intentions. Very few can do it for long periods of time…

The tale of two brothers that you recount hits home beyond belief for me VVNv.

On topic of crypto mining, I understand the draw of a medium of value or a transaction device outside of the USA dollar and its Fed’s manipulations, plus Congress’ continued devaluation of the dollar (Omnibus Bill), but the unbridled burning of electrical energy is a waste.

Speaking of waste, both of my state’s Senators have signed on to having 15% ethanol gasoline-fuel be supported and subsidized year-round. Another fuc#ing waste supported by Congress in D.C.!

Sounds like the difference between my husband and his younger brother, exactly. Sad but true.

You ask two different questions. The first: don’t know, probably follows the timeline of the dot-com bust. For the second, I do know: never. It will never go to zero barring apocalypse because crypto is indispensable, much like the internet. MaidSafe, Cardano, ZeroCoin. This is the best and only way to separate state and money/banking.

Thousands of cryptos have already gone to zero and stopped trading. You may still have it, but it’s worthless and you cannot sell it because no one wants to buy it. There is nothing “indispensable” about crypto or cryptos outside of your fantasies. Crypto is NOT like the internet. Crypto is a scam that is now blowing up.

An irony I noticed about cryptos. The advocates always blast fiat money as being backed by nothing. Then they create stable cryptocoins that are directly (supposedly lol) tied to the dollars value 1:1 in order to prove its worthiness as a currency. Which is it crypto peeps?

“Can you excuse some old fools for not having eyes to see, nor ears to hear?” “Dear Uncle Ebenezer, you’ve made Fed so happy.” Cue the piano and strike up the Stoparjeva Polka!

-When tensions grow, in ‘ol Mosko,

It’s Poly, oly, arny for me;

-I’ll find my grub, down in my sub,

Beyond the Great White Sea;

-We’ll sing and dance, we’re in a trance,

Our birds are a sight to see;

-Poly, oly, arny…Poly, oly, arny…is where I’ll put to sea;

-Poly, oly, arny…Poly, oly, arny…It’s Polyarny for me, ee, ee!

Happy Christmas Carol-ing.

Jingle Bells

Santa smells

Easter is on the way

If you can’t afford a Ford

buy a Chevrolet

The ripple effect of FTX and high interest.

…but crypto is a hedge against inflation!!!

😝

Ha! A hedge against reality is more like it. The crypto dumpster fire is burning brightly. But I’d still agree with Wolf that more “believers” (read: sheared sheep) will be added to the flames before this is over.

Well, BTC still is “worth” $16,783 as I write this post. Up $15 on the day even as stocks and metals are lower.

Yes, plenty of room below.

Amazing how we don’t hear that argument any more from the Crypto Bros.

It’s all the out of work miners I feel sorry for. And don’t tell me they can be retrained for other work. Mining is all they’ve ever known.

Lol, they can always learn to (compile) code.

…(with a nod to a commenter’s news report here of a couple of weeks back) what day of the ongoing crypto mine cave-in is this?

may we all find a better day.

Which miners are you referring? Surely you jest!

Miners for a heart of gold

but I’m getting old

(Young)

Nice!

There were children crying and colors flying

All around the chosen ones.

(ditto)

Nothing from nothing leaves nothing.

(Billy Preston)

“It’s all the out of work miners I feel sorry for. And don’t tell me they can be retrained for other work. Mining is all they’ve ever known.”

Candidate for the Non-rant Post of the Year, IMO.

Caroline Ellison (SBF’s former partner) pleads guilty

Ellison pleaded guilty to seven counts. Damian Williams, the US attorney for the Southern District of New York, announced the guilty pleas and criminal charges against Caroline Ellison, former chief executive of FTX trading affiliate Alameda Research, and Zixiao “Gary” Wang, a co-founder of FTX, in a short video statement. His office had brought eight charges against Bankman-Fried last week.

Yes, there will be a lot more to come in the greatest Ponzi scheme in history (cryptos), completely create by the Federal Reserve’s easy money policies.

Sam Banking-Fraud was just the salesman. The VCs and PEs are just as guilty.

John, as you probably know, these characters, SBF and Caroline Ellison come from some pretty high pedigreed people who were in the professorial ranks of Stanford, Harvard and MIT. One would think that parents of that ilk would have done a better job teaching ethics and morals to their children. If they couldn’t have taught them about having decent values… what does that say about higher education?

It is hard to teach something you don’t possess yourself.

Very true.

Yes, this really is exposing that, isn’t it ?

Pedigreed? Professional? Dirt bags span all walks of life.

Doolittle – triple check.

“…as you travel through this lifetime, you’ll meet some funny men” (or in this case, women) “some rob you with a six-gun, and some with a fountain pen…”

-Woody Guthrie, ‘Pretty Boy Floyd’

may we all find a better day.

But this dirt bag can post a 250 million dollar bond and is sent home to live with his parents. After all he’s just a kid who admitted he made a mistake. We should be compassionate and let them knock off 15 years of his sentence. That leaves 100 years which is just about right.

They sure do – most especially HOA board of directors!

As I told my father who was upset when a PhD. friend of his (who directed a government laboratory) was arrested for public corruption… “Intelligence and Greed are not mutually exclusive.”

Good points, but then again:

1. These “high pedigreed” people probably learned to exemplify the culture of “every man for himself.”

2. They also probably watched Gordon Gekko while at their Ivy League schools, and learned their ethics from him: “Greed is good.”

3. They also learned very early in life that you won’t get anywhere in America these days if you are a wage earner, and fraud and deceit are the quickest paths to riches rather than innovation and contribution to the society.

Since dad had a Ph.D in plant pathology and genetics, and since we ran a wheat seed genetics company together (he was the brains of the organization) for 18 years, please allow me to expand on pedigree and genetics for SBF.

First Generation:

Alan Joseph Bankman: Father. Yale Law graduate. Clinical psychologist. Law professor at Stanford. Author and expert on tax law.

Barbara Helen Fried: Mother. Harvard Law graduate. Professor at Stanford. Founder of Mind the Gap, a secretive political action committee in Silicon Valley.

Second: generation:

Sam Bankman-Fried: Went to MIT, worked for Centre for Effective Altruism in 2017 and began fundraising. Started Alameda research in November 2017, and then started the crypto trading company FTX in 2019. He ran FTX until recently. He and FTX became the second-largest donor to the Democratic Party; at least $38 million ‘donated.’

Gabriel Bankman-Fried: Brother of Sam. Ran ‘Guarding Against Pandemics,’ a lobbying organization supporting “pandemic planning” (lockdowns & vaccine mandates). The headquarters of this group are located at Capital Hill & cost $3.3 million. Gabriel has also been a Congressional staff member.

A couple of thing about making crosses to breed new varieties of wheat, not all traits of the parents make it through to the progeny, and the first generation will have a varied genetic make-up. But in general, traits of the parents are seen in the offspring.

Thanks to Jeffrey A. Tucker for the bios.

” you won’t get anywhere in America these days if you are a wage earner, and fraud and deceit are the quickest paths to riches rather than innovation and contribution to the society.”

This may very well end up being America’s epitaph.

Prairie Rider – indeed the proverbial acorn often doesn’t fall far from the tree.

Moral culpability, however, resides with the individual.

Enjoyed reading your post.

The ability of parents to teach their children right and wrong has nothing to do with anyone’s educational level and looking to the educational system to do it is backwards. It’s the parent’s responsibility to properly raise their children, not the government or some academic institution.

Yeah but is it really ‘right’ if it won’t get you that far in life, while all the people in the ‘wrong’ get rewarded for their immorality? Maybe what’s moral is actually wrong, and up is down in the corpse of America.

I wonder if the 20/80 Pareto principle will hold true, and the froth of crypto and the losses therein, will eventually be followed by 4x loss of value in other foolish ventures.

The only way you can ever make money from a crypto currency is to sell your “unit” for more to another player, so somebody holds the bag at the end.

Exactly, it’s like going to Vegas. If you have a lot of dough, you don’t care as much. I never owned any, but it will be a while before it goes away, if it ever does.

Reading the news from the company it appears they will write down a bunch of their mining equipment, renegotiate that loan and keep mining BTC.

If BTC stays at current level or increases they should be able to come out of bancruptcy.

Im kind of shocked but BTC has been pretty stable for awhile.

Surely you’re joking? BTC’s price has droppped over 20% in the last 40 days. Maybe it just doesn’t faze you anymore?

No it hasn’t. It dropped that 20% in the beginning of November, and has basically traded sideways since then. I see his point.

You are correct, i phrased it poorly. It still boggles my mind that ~40 days without much change would account to “pretty stable for awhile”. I guess some people really do seize the day. Or maybe crypto’s rollercoaster behaviour has changed perception for some.

Rodolfo,

What I said was that yes, they restructure and emerge from bankruptcy… they already have the funding lined up to do so. And the secured noteholders, that will get 97% of the shares of the restructured company, can sell those shares to the public, take their money, and go home. Then the company will file bankruptcy a second and final time – liquidation. Some call this a Chapter 22 filing, LOL, fairly common.

This isn’t about the company ever being able to make any money — it won’t, it’ll keep losing a ton, the crypto dream has collapsed. But this is about the current secured noteholders (hedge funds and distressed debt funds) that will get the shares and make money selling those shares to new investors if they can.

They bought those secured notes for cents on the dollar. They don’t have a lot money at stake here.

Yeah you are right Wolf, As it doesnt matter since BTC will tank further surely and then its all moot.

Just looking at the BTC chart vs nasdaq, BTC tracks nasdaq. Dec 13 recent interday high for nasdaq 12,339 and right now interday 10,981 or down 11%

BTC had a high next day the 14th and right now down 8.6%. So amazing BTC is a bit better but still tracking.

And of course these BTC miners will be history soon.

Funny how this works out. All the stiffed vendors can’t reclaim their equipment, so they just have to get in line with the other secured and secured vendors. But savvy bottom feeding financiers can swoop in and reclaim the company to squeeze it one more time. And then the equipment gets firesaled and the vendors have to buy it back if they still want it. It tells you what we value here – not the people who build or manufacturer. Just the money people.

As a tradesmen I’ve been an unsecured creditor in several bankruptcies of clients. Probably recovered about 5 cents on the dollar total.

Wow! Who could’ve ever seen this coming?!!?

Horrible cave-in @ Bitcoin mine, but utilizing a whole mess of pennies, experts were able to fill it in.

“A gold mine is a hole in the ground with a liar standing on top of it.” – Mark Twain. A bitcoin mine is an imaginary hole…

XC – there you are! Appreciate the cave-in update…

may we all find a better day.

LOL!

Jesus, doesn’t anyone recognize a ponzi scheme? Crypto ‘sells’ you a worthless casino chip and you, an idiot, give the scammer your dollars. If the scammer sells more chips for dollars than dollars are cashed in, then the scam continues. Bitcoin, I suspect, is held aloft by criminal organizations who wash their dirty laundry that way. They and tax cheats need the money laundromat. Plastering Bitcoin all over TV on CNBC implies legitimacy. Several states have endorsed crypto as a legal substitute for the dollar. That effort is part and parcel of an effort to legalize crypto as a substitute for the dollar. The most brazen, and so far, successful con job in history. Welcome to Libertarianville!

“Bitcoin, I suspect, is held aloft by criminal organizations…”

Yeah, the G printing unbacked money for 10-20 years, destroying interest rates, had absolutely nothing to do with creating an environment where alternatives to a continuously diluted dollar are desperately/recklessly sought.

There can be plenty of scams in alt-coin implementation, but the origin of them all starts with the debasement of the dollar.

Yup.

You know Wolf, one wonders how battered their financials were as they went public and how can they be allowed to do so where they have no demonstrated history or realistic potential to make money. If you and I went to bank with this plan we would be shown the door. Great Article and have a nice Christmas.

Joe

We will look back at this money-printing era as one of the most astounding episodes in the history of finance.

Yes, which has transitioned America from a manufacturing and innovation powerhouse to a financialized economy.

This will be the enduring legacy of the Fed in general, and Bernanke and Powell in particular.

The evidence is a nation that has gone from the largest exporter and creditor to the largest debtor and importer.

80% of the jobs in the U.S. are service jobs.

I always thought the financialization of everything started under Saint Ronny of Santa Kleptocracy in the 1980s.

More like as one of the most ‘deplorable’ episodes in the history of finance.

Jejune Question: what has been Fed Reserve Board (FRB) policy for purchasing US Treasury securities servicing enormous Federal debt such as one can expect from the $1.7 trillion omnibus bill? Are FRB OMC decisions based entirely on target inflation/unemployment/price stability objectives or does the FRB intercede to ensure US Treasury debt is serviced as an unexpressed responsibility? In theory, Central Banks are instituted precisely to prevent gov’t from feckless money creation.

Where does accountability really fall for the excess liquidity jammed into the economy starting in 2008?

BTW, the Omnibus bill is NOT in addition to regular spending. This is in lieu of a regular budget because Congress cannot get a budget passed. It’s not like it spent $1.7 trillion more than it would have. It means that spending goes on at the current rate. But like everything Congress does, it includes a lot of pork-barrel stuff. A regular budget would have included the same.

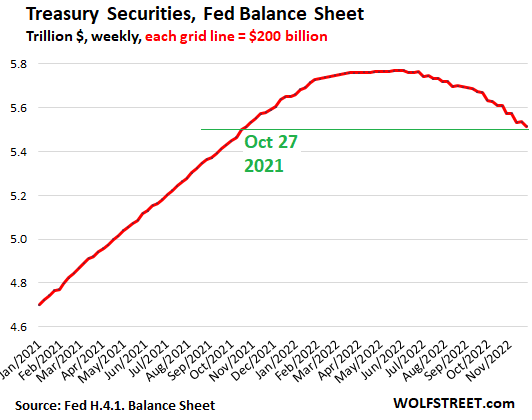

The FRB is shedding Treasury securities at a rate of about $60 billion a month. This is QT. I cover this extensively here. The Fed is out of this game of supporting the Treasury market.

The Fed publishes detailed data by CUSIP on its holdings, additions, and maturities. You can look it up and download the data.

The government sells Treasury securities at auction. There is a lot of demand for Treasury securities at today’s higher yields. Higher yields create demand.

https://wolfstreet.com/2022/12/01/feds-balance-sheet-drops-by-381-billion-from-peak-december-update-on-qt/

Thank you for taking the time to explain Wolf! I have read all your posts with full cognizance of the Wolfian RTGDAF sword of Damocles! This stuff can get confusing. I was after who is creating the money. In traditional macro explanations Treasuries are gov’t debt issued to whomever is willing to buy. MMT eschews this for straight-up gov’t money printing. Given NIRP/ZIRP policies it became more difficult to discern whether traditional (Keynsian) or MMT was in play 2008 to present.

As an aside, I would note that Congress has not followed the formulaic appropriations/allocations process since 2008. Mr Reid et al were more than clever in exploiting aspects of baseline budgeting.

Belay my last.

Understand you covered it. Had to reread your response for “oops” to kick in.

If Core Scientific and some of their ilk cease operations, I wonder how much power will be returned to the grid for we commoners to use this winter instead of them using it to dig up this digital fools gold?

Only 33 cryptos left above $1 billon in market cap, not counting the stable coins. I’ve enjoyed watching their number dwindle. Soon now, I expect a stable coins to dissolve into unstable.

“only”????

Wolf, did you mean “nipple” or “ripple?”

nipple, with an N, because that’s what it looks like.

…as compared to an udder?

may we all find a better day.

To give you an extra free learning experience, LOL: Heard of a “grease nipple?” When they’re installed, they look just like that little thing in the chart.

For example, motorcycle swingarms, back during my time at least, had “grease nipples.” They’re so called because that’s what they look like. They’re now often called “grease fittings.” They allow you to pump axle grease into the bearing.

And when building up a bicycle wheel, the nipples get extra attention. A tiny bit of Phil Wood grease is applied where the nipples seat into the rim. And a small amount of Hercules pipe joint compound is applied to the spoke threads before they go into the nipples.

That way the spoke tension will stay constant and it’s easy to true up the wheel as the nipples won’t bind against the rim. Also, as the wheel is ridden at first, everything seats in and a couple runs on the truing stand is smart to do before the wheels are ready to race on.

I would have loved to use today’s carbon-fibre rims back in the day, but man, they are nice to ride on; light, aero and damn near bullet-proof strong.

GREAT extra experience, Wolf! (LOL and guilty as charged, read through the GDFA too quickly!). Have not-so-fond memories of trying to find metric nipples back in the day that would accept the SAE standard gun fitting rather than the JIS OEM ones on my ’72 DT2’s swinger…

may we all find a better day.

I thought the money was made in supplying the gold rush, not the rush itself.

This could further damage the time honored reputation of cryptocurrency.

I suspect that Wolf’s Consensual-Hallucination list is going to get longer.

Money laundering and preserving wealth on a thumb drive in your pocket will always be in style. The winners of the “fixed” game will be meeting in Panama to discuss the lift off of their next “ground floor” opportunity! Probably tranches of bundled short positions in the real estate market as NFT linked to MBS puts which will cause margin calls for Blackstone and other. 2023 the ” Cascade Year of the Financial Domino” Side benefit: New rust belts form in California, Washington and North Carolina and tax entities collapse.

Investor’s forgot renters could move. Trigger: March heating bill.

I was 43-years-old in1995.Our company had switched from defined-benefit to defined contribution; I then had to do my own saving and investing via 401k.

With the help of three companies, l earned a pretty valuable (and, looking back, fairly inexpensive) lesson between 2000 and 2002.

Thank you, Global Crossing, WorldCom and Enron for only taking $160,000 and leaving me with enough to grow. I won’t say I remember you with fondness but I do remember you!

During that bust, I knew tech stocks were in a bubble, but I thought I would be safe in Blue Chips as the NASDAQ went down. I was wrong. Everything went down. I learned from that experience to assess the macro environment first. If it’s a hard macro environment, reduce ALL your stock holdings. Huge market waves are like tides that lift all boats up and down to a significant extent.

Like a replay of the mistaken idea that not all home subprime mortgages all over the country, underlying MBSes and CDOes, could bust at the same time and therefore were safe assets for banks.

I was 41 in 2000.

I learned the same hard lesson with World Com and Enron sold to me in my SEP IRA from the good folks “looking after me and my $” at Paine Webber.

Dropped a bundle. Learned a valuable lesson. Never bought another stock after that.

Worked hard and saved. Invested in many other things, never stocks.

2008 I saw many friends wiped out again who didn’t learn the lesson well enough. I saw the SM for the scam it is, the house stacked against the little guy. Peddled to the naive by ruthless sharks.

Am retired now and am doing just fine financially. In my opinion, SM not the only way to invest and create wealth, at least for me.

Just the retirement model brought to us by the financial industry lobbyist who have the 535 morons running the country in their pocket.

Okay I’ll bite, can you tell us what your investment strategy was after you stopped buying stocks?

I am betting real estate.

Hope it’s not real estate. Even that is almost like casino these days.

This is ridiculous. The stock market has its ups and down, more now because of the unwashed masses that buy on gut feelings and twitter posts, but it’s the most reliable way to build wealth over the long term.

Any idiot can make significant returns just by buying quality companies (or an index fund) slowly and consistently over time and not selling. The more you try to play the market for higher returns, the higher the risk but at least the odds are in your favor (unlike Vegas).

The problem is that people aren’t patient enough to “get rich slow”. They see how someone did better and think they should do the same so they take more risks.

Of course you dropped a bundle in 2008. Everyone did. But if you didn’t sell and instead _bought_ in 2008, even slow and steady, you’d be doing very well.

As these bankruptcies continue, the money destruction caused by them becomes contagious and spreads to other assets. It is the beginning of a chain reaction that still has a long way to go.

Yes. I benefitted from this strategy and perhaps a deeper understanding of the industry I worked in.

Question: is this thesis undermined by the growing prominence of ESG, huge hedge funds, large financial institution (e.g., JPM) market manipulations? Or are these simply factors in the valuation calculus?

Pretty busy today, may post more detail later but…

These sort of implosions might serve as useful case studies of the various steps/parties involved in pre-bankruptcy, post-bankruptcy – a likely important topic because a helluva lot of public companies (some sizeable) are likely to go down this road.

Leaving the SPAC/bitcoin exotica out of it, when companies nose dive this quickly, there often is a kind of “purity”/clarity as to who gets zeroed out and who is left standing post bankruptcy.

Multiple parties gave money to this company – who gets what (and how much) of the carcass/resurrection candidate (and why) is an interesting story.

We are finally seeing some price discovery in markets today in the right direction. Was an easy call, if you haven’t been brainwashed by greed or mainstream financial media.

More likely just tax-loss selling.

I like ‘price exploration’ in lieu of price discovery, sounds more Indiana Jones.

XC – you for got to add: ‘ In the Temple of Doom’…

may we all find a better day

What is interesting is the collapse in commodity prices. That makes me think their is some pretty good demand destruction occuring behind the scenes that we will not know about until data is collected and takes a few weeks or month to report?

I just read that sales for the Big red Car bows sold to auto dealers to put on cars bought for Christmas presents are way down this year. Is it low supply, or higher interest rates, or people are worried about an upcoming recession and are cutting back.

I say this because after every oil spike and then collapse, a recession is riding its tail.

That’s funny. Maybe the new fad will be gift certificates from Goodwill, Aldi, and Discount Grocery.

Dollar General

Yes!

I decided last year, after cashing in 90% of my stonk holdings to adopt an “asymmetric” approach (given world events) in mineral/precious metal commodities, energy and shipping. Strategy is long-term based and “analyzed” as best as this amateur can muster. New experience for me – one’s fortitude/commitment is severely tested in today’s volatile markets.

Wolf, speaking of imploded stocks, does Tesla make it to the Imploded Stocks Index based on today’s intraday low so far? Or do you base it on closing price of -70%?

All-time closing high of 409.97 on Nov 4 2021. Today’s intraday low 122.26. That represents a decline of 70.18%.

Another 50% decline from here for TSLA would not surprise me at all. Actually I would expect it to be somewhere in 60’s range.

Then again another 100% gain would not surprise me either. :)

With a current p/e in the high 30s, there will be a lot of BTFD buyers who keep it from cratering another 50% from here. A p/e of 15 would be much too reasonable for it to ever attain. But I’d like to see it (after it’s kicked out of the SP500). :-)

It dipped into it in intraday but closed a hair above it. Be patient. This is structural, not a trading moment. It’ll get there and stay there. My headline is ready to go :-]

I wonder if Cathy Woods is buying Core Scientific on the way down, like Tesla. She’s already lost the quick 2020/2021 gains, so now she’s playing with investors’ hard-earned money.

Let’s not forget that the Chief Moron of the state of Texas, Greg Abbott, was a cheerleader for Core Scientific. Back in October, 2021 they thanked him for all his help. I bet they were really grateful!

Let the unregulated cat fighting begin, you got to love the soap opera playing out in crypto – Dec 22 (Reuters) – Collapsed crypto exchange FTX on Thursday asked a U.S. bankruptcy judge to stop crypto lender BlockFi from laying claim to more than $440 million worth of Robinhood stock purchased by indicted FTX founder Sam Bankman-Fried.

How interesting. Two of my replies have been deleted. One where I disagreed, respectfully, with Wolf on one of his comments and another where I explained to Dave (again, respectfully) what a stablecoin actually is.

I don’t allow people to abuse my site to promote scams of any kind, including cryptos. I’m like so through with that.

Promote scams on Twitter. That’s what it’s for.

Core Scientific HQ is a few blocks from me in a building that used to house a doctor I used to go to. Crypto has been crowding out real businesses in places like Austin. Perhaps crypto’s demise will free up scarce assets for the rest of us to use…

The computer Miners use CAN BE repurposed to do complex calculations for other important tasks…

I thought that getting electricity in Texas in the winter was a dicey proposition.