From SPAC merger to Chapter 7 bankruptcy in 12 months. That was fast! Congratulations on the speed and on being first!

By Wolf Richter for WOLF STREET.

Electric Last Mile Solutions, an EV startup that went public in June 2021 via merger with a SPAC, was featured on May 30 in my article on EV SPACs and IPOs that are already announcing that they’re running out of cash. At the time, the company said that its cash would last only “into June.”

I wrote – because you just have to keep your sense of humor about these shenanigans – that “Electric Last Mile has the unique opportunity to be the first EV SPAC in this cycle to go to zero because its cash-burn machine ran out of cash. No hard feelings, folks, this is just how the game is being played during bubbles, and someone always gets to hold the bag.”

OK, so now, we’re “into June,” and here comes the SEC filing about the company’s decision to file for Chapter 7 bankruptcy. Chapter 7 covers liquidation, not restructuring. It’s the end. Meaning the company’s assets, if any, get sold to the highest bidder, and the lawyers and some creditors will get the proceeds, if any, and the stockholders will get to hold the bag and get nothing. So the company said in the SEC filing:

“On June 12, 2022, following a comprehensive review with the assistance of the Company’s outside advisors, and upon the recommendation of the Company’s management, the Board determined that it is in the best interest of the Company and the Company’s stockholders, stakeholders, creditors, and other interested parties to commence the Chapter 7 Case. The Company is currently completing preparations for the Chapter 7 Case.

“Following the commencement of the Chapter 7 Case, a Chapter 7 trustee will be appointed by the Bankruptcy Court to administer the Company’s estate and to perform the duties set forth in Section 704 of the Code.”

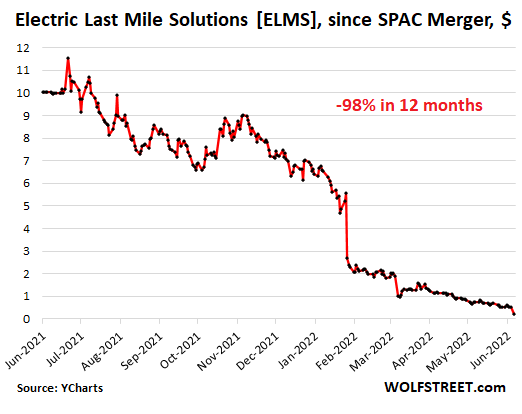

Upon the news, the stock [ELMS] kathoomphed 62% today from nearly nothing to almost nothing, to $0.20 a share, from $0.51 on Friday. It’s down 98% from the high on June 28, 2021 (data via YCharts):

That stock will be delisted from the Nasdaq and then will trade over the counter where some jockeys are going to bounce it back and forth for a while, to then be abandoned and die. The ultimate shareholders – all the outstanding shares are always held by whoever, and these whoevers end up with worthless shares in their brokerage account that they cannot sell and will have to look at for years to come, unless they contact their broker and ask them to remove the shares manually.

So this is the first of many stocks in my Imploded Stocks column that will die. From SPAC merger to Chapter 7 bankruptcy in 12 months. That was fast! Congratulations on the speed and on being first!

The company, which was working on urban delivery vehicles, has failed to file its 10-K annual report with the SEC, and it has failed to file its 10-Q quarterly report with the SEC. The company’s auditors walked away in February. This was also when CEO James Taylor and Chairman Jason Luo, both co-founders, were forced out after an internal probe. And it’s under investigation by the SEC.

This is a mess even for class-action lawyers because now they cannot fish for a settlement with the company to pay their fees, but will have to fight for scraps in bankruptcy court. And good luck with that.

I doubt that anyone on Wall Street – or any of the celebrities that promoted all kinds of SPACs – will go to jail over these pump-and-dump collapses. That’s just not how it happens. But people are getting sued, even celebrities. And lots of people will end up losing lots of money. And lots of other companies will follow Electric Last Mile into bankruptcy court as their shares go to zero, and as the majestic Everything Bubble unwinds.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Good riddance…as Goldberg once said “Who’s Next?”

My guess is NKLA next?

All SPACS should be declared illegal, prohibited, and then shut down.

You’d like that to happen. But that would make too much sense. The same thing should have happened with cryptos, ride-sharing, homestays and every other “disrupter” that just walks around existing laws until they’re big enough to pay for their own lobbyists.

In America you just bully your way to legitimacy, then ask for forgiveness.

DD-check.

may we all find a better day.

“n America you just bully your way to legitimacy, then ask [demand] for forgiveness.’

under the protection of the political administration —

not the law.

Fixed it for you

SPAC was merely a way for companies to go public. The investment bankers would love to kill all SPACs and force every company to go public the old way.

There are some SPACs that will turn out to be great investments. For example, I like HIMS, a company in the telemedicine area that projected 30% annual revenue growth and has been hitting 70% revenue growth for 5 consecutive quarters instead. Actually, it was up to 100% year over year growth in the most recent quarter. Despite outperforming their guidance, the company is trading way down from the $10 SPAC price. I call this opportunity. Over the coming months, we will see the SPACs with real businesses emerge from the trash bin and they will offer great returns for the intrepid investors that can see the difference between well-run businesses and hype.

The only way to really outrun inflation is to invest in companies that will outrun inflation with growth. But most of the overvalued high-growth companies are just story stocks and will not have durable growth, so they are still overpriced.

This is a real stock picker’s market, imo.

Yeah, Goldman would appreciate to not have the competition.

Part of me thinks what a colossal waste of money. But I admire the brave insanity of swinging for the fences with all the cash floating around, even though some of these bets are crazy in hindsight.

Be prudent if it’s your money. Be reckless if it is someone else’s money and you get your payday from the profits.

> to go public the old way

… means all kinds of diligence and serious disclosures, for which there is accountability, not a loophole for fantastical projections of future worlds of shining levitation, hawked to the public. Exhibit A: this article.

HIMS?

Isn’t that the rewrapped generic Viagra sold via Facebook?

NKLA TSLA

Ohhh…TSLA, now that would be a dream come true. Not going to happen though sadly but it would be nice to see them crashing back down to earth close to fundamentals, I would settle for that, maybe that would be enough to get EM to be completely unhinged and do more self inflicted wounds.

It can happen. A couple of years ago, the Fed was invincible. Feet of clay that turned out to be turds and all that. Who will be the next Ozymandius?

Yes, thinking of mighty Lehman Brothers. And suddenly reminiscing of Chapter 7 filings, Mervyns and Circuit City. Straight down the tubes to liquidation.

Of course it is going to happen. No cult lasts forever. But the fact that it IS going to happen is already priced-in in options (more or less). Still, another face-ripping rally may offer some opportunities to short it. I certainly will not be shaken out of my position. Eventually, Toyota or BMW, or other, will buy Tesla for less than what Elon offered for Twitter.

Wasn’t TSLA close to the abyss a few years ago, until China bailed them out with a cheap factory and dirty cheap labor?

They lose money on every car they produce, but they make up in volume. Wolf had an article on that.

ALL stocks can go to zero and die as clearly stated in each and every stock prospectus which buyers need to read before they buy the stock, and many stocks will do just that as this year moves forward. This is partially the fault of the SEC in not requiring that no stock can be publicly listed without at least 5 years of being a profitable and stable company.

Color me not surprised as to the Society Enabling Corruption, whose members should all be investigated for allowing so many fraudulent investments-stocks and financial innovations-scams. They deserve to be treated royally like the French king and aristocrats were.

Financial “innovation” (which the banksters and financiers claim as justification for their parasitic existence) amounts to fraud (constructive or intentional) because it amounts to complicated schemes for financiers/banksters to profit from the inferior knowledge of investors, while not fully disclosing to them all the information or dangers of each financial innovation “investment:” e.g., with subprime mortgage backed securities or now, with mainland, CCP securities if China were sanctioned like Russia: search for “McDonalds” and “Russia news” online. LOL Personal liability would be imposed on those financial advisors in a court system that was not so corrupt.

Investors in these stocks must be getting advice from the same financial advisors who just advised all to “buy” into mainland-CCP Chinese “stocks” (which you will not even actually own under Chinese law) and who must be advising Turkey’s Erdogan. Clearly, those financial advisors hate Erdogan or Turkey (or maybe made a mean bet and/or are playing a horrific, practical joke on Erdogan and Turkey, LOL). They are effectively telling him: “do not worry about that gigantic mountain in front, just keep going toward it, and accelerate your plane into it; do not worry, your plane will just pass through it and emerge unscathed on the other side.”

As to the CCP’s financial advisors, thank you; thank you very much. You are going to make my dream of taking a certain selfie come true. As to precious metals ETFs, LOL, just LOL. Thanks for the laughs.

LOL, Electric Last Mile. It really fits well ….

good one

Straight to the electric chair.

Now, that’s funny.

But it’s a green last mile.

a cineast, I see…

It’s walking the green mile.

There is more of a challenge to posting here than just words.

The assets will be bought out of BK and the company started again.

I have seen this happen with oil & gas assets in North Dakota! But real oil wells are much different than a garage full of old truck parts. But with today’s markets, anything can happen.

Yeah, there’s always some “Goodwill” in the name of a company that went to hell in a handcart and screwed all of the people holding an ownership stake…or so the corrupt lawyers and bean counters claim. Afterall, a serial killer is just a songwriter/superstar gone bad… but his name’s worth an address listing in the phonebook! Is PanAm’s shell still floating about or did they finally close the books on that one…been a few years since I saw their railcars in a lumber siding in Oregon. Yeah, boxcars with the name that used to connect up the world with flying boats and 707’s.

Well, from PanAm I, II, and III on until activated 01 June 2022 again under CSX! Just will not let that poor kat off the name hook. Like the old kitten poster, “Hang in there baby!”.

Panamflightacademy dot com

They train commercial pilots in the US and Japan.Facilities are state of the art.

Where is Braniff ???

I miss Braniff more than I miss Pan Am (mainly due to happy childhood memories)

I don’t think that company has anything that anyone wants.

If the company had seen any kind of chance, it would have filed for Chap 11 bankruptcy, to restructure and keep going.

If it owned any equipment or other physical assets worth having it might have been bought out at the bottom of its stock price. That didn’t happen either, so now it’s been reduced to an industrial rummage sale.

The registered stockhodlers (sic) list would be a valuable asset. Kinda like the “marks” on the picket fence.

Or marks on a headboard……

The end of the bond mania also means what you describe is coming to an end, if not now then shortly.

If it’s in full on Chapter 7 liquidation (with no possibility of assets exceeding debts?), why should anyone be permitted to trade “ownership” positions at this point? This is not a dead cat, it’s a skelton. Are they promising bone soup a la carte? What a farce…no wonder the whole damn investment world is on the edge of ruin. It’s nothing but Brickbat Alley to club the baby seals of the population. Anyone in charge capable of saying to the moneychangers, “No god damn way are we letting you dump that crap on anyone else in either the temple or the courtyard. Take a hike buster!’.

Shares of dead companies keep trading until people lose interest in trading them. These shares don’t represent anything anymore and they still keep trading. That’s a funny thing to watch. They go from $0.005 to $0.01, and someone doubled their money, LOL

Were there paper stock certificates issued by this company?

I see old stock certificates on Ebay all the time. I even own a few of the odder ones, like a sheep farm in Lacrosse, and an oil company in Shawano, Wis.

I have 100 worthless shares of GM from 2009. Bankrupt and a bailout gave them a do-over. Not fair.

I have certificates for 100 shares of BCRIC, a government of BC corporation originally. The government gave each citizen 5 free shares valued at $6.00 each, and my wife and I bought 90 more, so we could register them if we wanted to. Never did, and the shares went to zero eventually. It was a not too expensive lesson for this neophyte investor. I’ve kept them all these years in case I get a cabin with an outhouse somewhere that I can use them for wallpaper or whatever.

Wish I still had some of my 1 sq inch of Yukon property deeds I cut off cereal boxes as a kid. Unlikely they were adjacent, but it’s still land and may have had gold on or near it.

Could have maybe FD up that gold mining reality show…..and sure would have.

Reality shows have done as much to FU this country as the FED….or damned close.

I share your distaste for it, but does it even matter? People love to speculate on stuff that doesn’t have any value.

Take the many crypto currencies out there. I bet most people buying them don’t really believe they have any real value, but they still buy them because they hope to sell them at a higher price to people like themselves.

What amazes me is that, for a bust to happen this fast under a SPACS and yet somehow Ignite International Brands with Bilzerian still attached to it by name managed to still survive and still listed (although not NASDAQ) is quite dumbfounding.

Banksters want a chance at his sloppy seconds

Just the beginning, HA HA!

So Wolf, a dumb lowlymoke question .. what do you see in your other krystal cajone regarding any derivative action, pos. or neg. .. in light of current events?

“krystal cajone ”

I never heard that one before! Has a nice ring to it. I think I’ll start using it, Lol!!!

HEY **FOMO! … you’re gots to pay me my ‘royalty$’ upon usage.

…or you be sleepin wid tha fishies… ‘;]

**Fear Of Messing Up

Actually, l’ll allow mr. Richter 1st rights.. you can duke it out with him, capiche..

Prego!

It would be interesting if there was some sort of chart that showed exactly how much is lost for each bankrupt spac company

Should be simple enough to Google how much each SPAC raised (there probably is a website that has already done at least a partial summary of SPAC raises too)

The appeal of SPACs for the buyside was always a huge mystery.

What investor worthy of the name invests blindly?

Reputation of SPAC managers? Please.

99.9% of managers are unknown drones without even the pretense of a “magic touch” let alone a proven track record – that can be credited to them personally.

Can anybody provide even a superficial explanation of SPAC functionality beyond blind monkey poop flinging?

And who treats their money like poop?

(The G?)

It’s the modern version of the purported South Sea Bubble’s “An undertaking of great advantage, but no one to know what it is”, on steroids.

Don’t know about you, but I’m going completely chart blind. l’ve been viewing so many, they’re all running together .. downward like!

More than $50.

Bring ’em on! Time and time again, history has taught us that those who get sucked into get-rich-quick schemes nearly always suffer because they let their greed overcome their better judgement. It’s been a common theme in mythologies from all over the world for thousands of years. A tale as old as mankind itself.

I just can’t bring myself to feel sorry for folks who dumped their savings, their retirements, their kids college funds into these dumpster fire companies. It’s sad when regular folks are taken by really sophisticated and well orchestrated scams. But 100% of these SPAC deals are such transparently bad gambles. Watching the vast majority of them go to $0 is actually going to be pretty entertaining!

It’ll be about as funny as watching the government cancel out all the student debt while continuing to prop up the whole big education sham. One way or tuther, you and the whole darn country will be paying penny by penny to cover it all over. And you might not even notice it happening. Better to see it all fall at once and force an accountability regime right onto the jerks running these cons. That’s why they invented the sickle.

Student cancellation may well happen. If not the Dems soon, it’ll be the Republicans for the next round of elections… We only have one party operating under two brand names anyway. Don’t forget that our government already set a precedent for pausing mortgages. And given the way that moral hazard tends to work, I wouldn’t be surprised if either party (whoever is in power) jumps right back onto the forbearance train or even partial mortgage cancellation if the housing market tanks 2008-style. If you’re underwater due to your bad decisions, the government will cut you a check to bring you back up to the surface. If you budgeted accordingly and paid your mortgage responsibly, no freebies for you!

I’m 38 and for the entirety of my adult life, the government has established increased moral hazard with every financial crisis that I’ve lived through. Each crisis greater than the last, and each dose of moral hazard greater than the last. I wanted so badly to be a good guy, play by the rules of economics, and make my own success the honest way without milking the system and living on debt. Instead, I now feel as though I must focus all of my attention on predicting what type of bailout is next and position myself to take advantage of it. Savers are punished while irresponsible fools are handed money. What an awful game to be forced to play.

Amen!

Another class-action lawsuit coming to mailbox near you.

“This is a mess even for class-action lawyers because now they cannot fish for a settlement with the company to pay their fees, but will have to fight for scraps in bankruptcy court. And good luck with that.”

Oops, guess not. No class-action lawsuit trade for this flea-ridden mutt.

“But people are getting sued, even celebrities. ”

You missed this part. I can see a lot of it, and they deserve it for profiting off of a scam.

Those who “invested” in it also deserve to lose every cent for being so dumb. Unfortunately, both can’t be true at once.

In the heady Fed put days, this would have been a Chapter 11, or maybe not a bankruptcy at all. Just roll over the paper and keep snookering the gullible! How many zombies are still stalking the backwaters of Nasdaq? It is the moment of a die-off, a culling. “Oh gee, I have to have actual profits? Wow, man!”

Yeah, building the future, blah blah blah — straight into the crapper. Ignoring fundamentals, putting too much into marketing. It soured the dotcoms too.

Zombie crapocalypse.

Night of the Grifting Dead.

Grab those entrails while you can..

This sounds like a good stock for the reddit apes . Low price, worthless stonks with short squeeze potential… I might buy some for a trade.. can only lose 20c

Note to MarMar:

MarMar, the vertical axis for the chart in this article goes to zero.

Next to fall: all these startups paying you at a loss to buy their pizza, ridesharing, etc. Now distance makes a difference.

I agree.

Cash burn machine “disrupters” are next on the list. The ARKK fund isn’t even close to a bottom.

If you open a window, you can probably hear me guffawing several times a day when I check the price of ARKK. She should rename it the Gravity ETF.

The stimulus check losses of retail investors to the financial sector are effectively deflating local economies, is this the hope that inflation will rollover?

In other ominous news, articles have started appearing about the losses to pension schemes which I don’t see in the US yet but probably will be similar when they arrive.

“A 65-year-old with a pension pot of £300,000 would lose £30,000 of income if they increased their withdrawals by just 8pc as the stock market fell by 10pc,…run out of money aged 73 instead of 75, assuming that markets recover after one year and continue to grow at 3pc annually and that a tax-free lump sum of 25pc is taken.”

The loss has already been baked in the cake. When the price of a stock doubles, this doesn’t mean that the value has doubled (it is still the same stock). It only means that the last guy has paid more for it.

At the end of the day, it is about the profits that the company generates. Therefore, a rising stock market is terrible for people saving for a pension, because they can buy less future profit for a given price.

The infamous “wealth effect” that the central banks have created by inflating the stock market is basically fooling people into spending more because they feel more wealthy than they really are.

“Wealth” destruction that is happening right now (and I suspect will continue for some time) are not losses that are happing now, but merely revealing losses that were incurred in the past when people overpaid for their assets.

Retail:Institutional is 3:1.

Stupid bubble stock but the bag holders are regular people.

Important to point out that Pan Am did exist as a railroad and a brand until the first of this June when they were purchased by the railroad CSX. They were selling retro Pan Am swag online . They did try to restart air service as well, not sure if they’re still there but they owned a couple of 727s. Its a very silly story

Name ran through PanAm I (old airline), II (new airline), III (Guilford) as PanAm Railway. Re-activated by CSX on 01 June as two subsidiary operation arms. Hard to say what actually happened to Juan Trippe’s corporate shells over the history.

One of the comments higher up pointed out that there’s still a pilot training school running under the Pan-Am name. Would be amusing if they did well enough that they decided to start up an airline for their graduates to fly at.

COINBASE is going to zero, soon.

Check out micro strategy, they bought a ton of bitcoin three years ago.

I wonder has much Tesla lost on their BTC.

There may be an indirect loss too: many millennials and Gen-Z now hate Elon Musk because he talked then into BTC, then posted a broken heart with BTC (causing a crash in BTC) and started pushing Dogecoin instead, which is now down -83% from its top. Now they feel screwed over (feeling that Musk can drive the market and uses that to screw them), so they will never buy a Tesla as a matter of principle. :D

“But people are getting sued, even celebrities. And lots of people will end up losing lots of money.”

So who wins? The lawyers win. They always win.

Lawyers will take everything you have, and then move on to the next victim.

Thus, we feel compelled in making sure that they cease to function, no?

After all, William S. said as much..

Lawyers do have a function in society, but I don’t have enough time in life to figure it out and I can’t afford the cost of asking one to answer the query.

If you ask a group of lawyers to figure out how to dig a hole to put a plant in, the plant will be dead by the time you get a concensus. Then, one of them will sue you for negligence.

I’m sure there are some good ones somewhere, I just have never been able to find them. Most of them seem to be of the Michael Avenatti persuasion – you know, the guy who was representing a p0rnstar and who the Dems once said would be running for POTUS to unseat Orangus Horribilis. He’s now going to the slammer for years, of course, because he was a fraudster through and through. Big shock.

If there’s nothing left of the corpus, the lawyers have nothing to win.

An incompetent attorney will cost you far more than an expensive competent attorney. Wisdom is knowing when you need one.

I usually put in my contracts that “lawyers are for losers that cannot settle their squabbles between themselves”.

If you cannot go to court wearing the white hat, settle. If you go to court, your strategy must not be just to win, but to completely decimate your opponent. Always wear the white hat.

Attorneys specialize in transferring your children’s inheritence to their children.

Were I to explain to myself why US stock futures are presently UP it would probably make me ill.

That said, I am persuaded that the US economy, and that of the world, only functions because most people drag themselves out of bed in the morning to go to work, against their better judgement. Civilization is built on labor, not finance.

“Upon the news, the stock [ELMS] kathoomphed 62% today from nearly nothing to almost nothing, to $0.20 a share, from $0.51 on Friday. It’s down 98% from the high on June 28, 2021”

So you’re saying there’s a chance! Hey, wallstreetbets, get in on this before you miss out.

People should be sued for this type of thing, it is fraud through and through.

Buyer Beware.

I took less than five minutes of reading for me to put SPACs on the same level as the pink sheet when it comes to disclosure. I’m not one to invest in IPOs regardless.

The sad thing is that the creators of such vehicles usually walk away with millions, even when it was never a viable business.

Choosing to go Chapter Seven rather than Chapter Eleven is the first sensible thing this Board of Directors has done since going public.

The only two SPACs I liked were PSTH by Bill Ackman and GSAH by Goldman Sacha though I have always avoided “get rich quick” stuffs, IPOs etc…Against my better judgment, I bought GSAH which ended up buying Mirion Technologies, one of the very few profitable companies ever taken public through SPAC and a leader in its industry. My justification was the terms, Goldman can’t sell its shares before the stock hitsca certain value which at the time had great upside for my investment but because of the “SPAC” story attached to its name and the economy, I am deep in the red. Lesson well learned fir deviating from my ways that netted me good returns over the years. The only closure I have is, atleast its a money making company and not a meme stock at all

Gee, based upon unicorn investing philosophy of fools with money, it has been an exceptionally good first half for the FOMO ELMS investors:

JUNE 12, 2022

Electric Last Mile Solutions, Inc. Announces Chapter 7 Bankruptcy Filing

MAY 24, 2022

Electric Last Mile Solutions Announces Receipt of Notice from Nasdaq Regarding Late Filing of Quarterly Report on Form 10-Q

APRIL 11, 2022

Electric Last Mile Solutions Announces Receipt of Notice from Nasdaq Regarding Late Filing of Annual Report on Form 10-K

FEBRUARY 4, 2022

Hear from ELMS interim CEO & President Shauna McIntyre

FEBRUARY 1, 2022

Electric Last Mile Solutions Announces Leadership Transition and Financial Update

JANUARY 5, 2022

Electric Last Mile Solutions Product and Tech on Display at CES

If ELMS has all this power and is a multiple hundreds of millions into manufacturing, I am just curious: Why is the only signage outside ELMS’s corporate HQ office building at 1055 W Square Lk Rd, Troy, MI, a diminutive smallish 2 story office building, say “Mahindra North America Technical Center”??

High stakes scammers aren’t only running on line auctions!