By Wolf Richter for WOLF STREET.

Folks looking for yield have options now. Won’t beat inflation, but won’t get their face ripped off either.

Amid hair-raising market “volatility” this morning, double-digit bloodletting in cryptos, and a steep sell-off in stocks that surely will bring out the dip buyers soon to prove once again that markets are far from the bottom, Treasury securities are selling off, and yields are spiking, on top of Friday’s yield spike, following the CPI report that had crushed the false hopes of peak inflation.

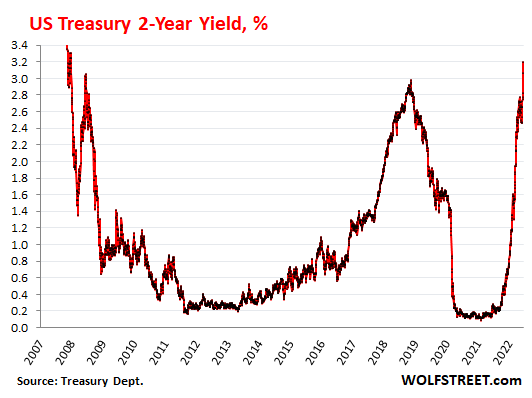

The two-year Treasury yield, which had spiked by 23 basis points on Friday, spiked by another 14 basis points so far today, to 3.20%, the highest since November 2007, when yields plunged as the Financial Crisis was cracking the slick surface. But now is the opposite crisis: Inflation that is threatening to run away, with CPI inflation having reached 8.6% in May, and anything yielding less than that is getting eaten up by it.

The 23-basis point spike on Friday was the biggest since February (25 basis points) which had been the biggest since June 2009 during the Financial Crisis.

The Treasury market is belatedly beginning to price in the Fed’s coming policy actions to crack down on inflation, but both the Fed and the Treasury market are woefully behind the raging reality of inflation.

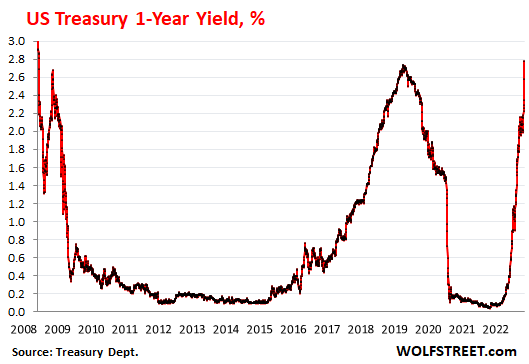

The one-year yield, after spiking 23 basis points on Friday, spiked another 26 basis points so far today, to 2.77%, the highest since January 2008:

The short-term yields are reacting more directly to the expected rate hikes by the Fed over the next few months. But there has been some reaction at the longer end as well.

The Fed locks down the very short end of the Treasury yields via its policy rates, including the rate it charges for overnight repos (1%) and the rate it pays on overnight reverse repos (0.8%), which box in the overnight yields in the gigantic repo market. Both those rates will be raised by at least 50 basis points on Wednesday.

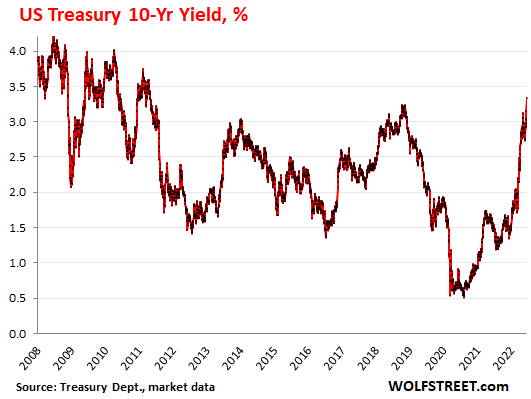

The Fed has been manipulating down the longer end of the Treasury yields by having been the single biggest and most relentless buyer of Treasury securities during QE. QE was designed to push down long-term yields, and it did that. Now QE ended, and QT is setting in gradually in June, and long-term yields have risen, but not nearly enough.

As QT picks up, with the single biggest and most relentless Treasury buyer now reducing its holdings, it will allow long-term yields to rise. Those yields should be well above the rate of inflation and have a long way to go.

The 10-year Treasury yield, after spiking by 11 basis points on Friday, spiked another 17 basis points so far today, to 3.34%, the highest since May 2011.

Yields go up and yields go down, which is what makes a market, and when the 10-year yield went down below 3% for a little while in May, the tightening deniers came out in droves and said that this was proof of the impending rate cuts by the Fed, and that the peak of inflation had already occurred, and that inflation was winding down, and that the Fed would restart QE all over again. It sounded silly then, and it sounds silly now.

When yields rise, it means that prices of those bonds fall, and prices fall the hardest of bonds with the longest remaining maturities.

And it’s a massacre for people who invested in long-term bond funds, such as the iShares 20+ Year Treasury Bond ETF [TLT], which tracks an index of Treasury securities with at least 20 years of remaining maturities. It dropped another 2.7% this morning, to $110.66 at the moment. It is down 23% year-to-date, and has plunged by 35% from the peak in August 2020, which marked the moment the greatest bond-market bubble in US history began to implode. It’s back where it had been in April 2014, and where it had first been in November 2008.

The TLT bond fund has been a high-risk bet that long-term Treasury yields will always go down forever, conceived during the greatest bond bubble ever. It was a high-risk bet on long-term interest rates, and this high-risk bet was sold to unsuspecting investors as a conservative and prudent investment in Treasury securities.

If you want to invest in long-term Treasury securities, unless you’re a speculator, buy them at auction with the intent to hold them to maturity, and you won’t face this kind of Wall Street-engineered disaster (data via YCharts):

It’s not a massacre for yield-investors who buy at auction short-term Treasury bills and Treasury notes with maturities at the shorter end, and hold them to maturity. Yields have been surging, which means that the securities are becoming less disgusting, by offering more income to those who buy them at the new higher yields. And people who bought at auction earlier will get the yields they locked in at purchase, and when the bond matures, they’ll get their money back. No drama there.

And for CD investors, it now pays to shop around: Brokers are once again offering “brokered CDs” with one-year yields over 2% and longer yields over 3%. “Brokered CDs” are regular bank CDs that these banks offer through brokers to get new funds from new customers, though they might not offer them to their existing customers.

Folks looking for yield that blows away the interest that bank accounts are paying, and that blows past the dividend yield of the S&P 500, they have some options now, and they will have better options coming up as yields rise. They won’t be able to beat inflation, but at least they don’t get their face ripped off.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

I think we’re going to see $160-180/barrel oil soon enough. The inability of China to keep major metro areas re-opened throughout its “dynamic zero covid” policy interventions has been a godsend for keeping oil prices depressed – but it’s not enough.

Skyrocketing oil prices provide the backdrop for the fed to say “Well, this is a supply-shock and thus not something that can be addressed with monetary policy tools”.

My two good friends in asset management are still encourgaging their clients to unload US treasuries, but they maintain that the Fed can’t raise beyond 3.50%. And that’s the same number they gave me last September.

I still clearly remember the 1970’s “stagflation” era when my bank CD’s we’re paying me 18% yields! Most younger investors can’t relate to the incredible pressure that run away inflation exerts on interest rates of all kinds and durations. As NOW, inflation was primarily due to high oil prices (then controlled by OPEC oil cartel), but now we also have the staggering effect of $9 TRILLION of irresponsible QE interest rate suppression over more than a decade! Toss in labor market distortion due to disastrous government payouts (covid, unemployment, PPE loans, etc.), supply chain disruptions, Russia war, and more.

Consequently, IF THE FED IS ACTUALLY SERIOUS, INDEPENDENT, AND BRAVE ENOUGH (which I seriously doubt), they must follow Federal Reserve Chairman Paul Volker’s 1979-1982 “tough medicine” approach of painful and drastic rate increases to SQUASH INFLATION. And this will still take many months or years to actually put inflation back in the bottle. Your advisor friends are not even close to being realistic as our current predicament is WAY WORSE THAN THE 70’S STAGFLATION.

But of course the Fed is actually NOT INDEPENDENT or brave! They, like most federal institutions, have become mere political puppets of the ruling political party and elites of all persuasions! Consequently, they may in fact program their policies to appease the short term political pressures and markets and actually do the EXACT OPPOSITE OF WHAT NEEDS TO BE DONE (no matter how painful in the short term).

My advise, keep your cash invested only in short term treasuries until expiration and ratchet them up as the rates ultimately explode higher. Patiency and liquidity are key here for money investments.

Meanwhile, massive inflation will provide massive returns in hard asset “inflation hedge” investments that will explode in real value along with inflation. Well located local real estate would be my choice.

I agreed with everything until the last paragraph. Real Estate is already massively inflated and in a bubble. It won’t be the hedge against inflation that people think it will be. Runaway inflation = continuing interest rate hikes (already at 6%). Considering these massive bubble inflated prices generally require loans to finance and housing is the only bubble left to pop; it wouldn’t be too much of a stretch to see housing prices going the opposite way over the next few years. Just wait till the massive layoffs and bankruptcies in the months to come and people start to struggle with payments. No doubt we’ll have interventions from government and seller resistance but eventually the bubble will deflate. And for society’s sake, I hope I’m right.

I agree with most of what you said, except that the “FEDERAL” RESERVE is controlled by the ruling party, which it will “coincidentally” bury 6′ under in the coming election. The banksters’ represents the ultrarich period.

That said, due to the power of the ultrarich, which has prevented them from bearing the proportional burden of society borne by the poorer, 95% of Americans, their “Fed” cannot raise interest rates enough without triggering a vicious circle of involuntary hikes in how much the US government must pay in interest on new and rolled over treasuries. (Real estate, the bottom end, is going to be a decent, safe harbor, since the ultrarich bankster parasites are buying it aggressively to become Americans’ landlords with borrowed funds borrowed at what are actually negative interest rates due to long term inflation created by the 2019 to 2021 money printing by their “Fed” (actually the poorer 95% of Americans since the “Fed” effective inflation-tax hits them most) and gullible depositors paid 3% returns while inflation races at 8%+ per year.

Banksters are happy, happy sucking your wealth out due to their “Fed” scam! Unlike in the 1980s, the “Fed” now will not tame inflation; luckily, the CCP may crash China’s economy and reduce a lot of demand from it. LOL Thanks, CCP parasites!

Ultimately, it doesn’t matter whether the FRB (or any other central bank) can or can’t raise rates above some arbitrary point. They will be left with capitulation, a crashing currency, or both.

I am arguably the biggest bear on this board, but everyone is so bearish now. I feel market has to bounce here somewhere. Especially if the Fed chikens out.

Dollar is retesting previous high today, and many stocks retesting their May lows. Sold some of my earlier expiration puts today. Even bought couple of TQQQ calls for fun.

Look for a big bounce (15%)? into July, August. Then the bulls will be butchered again. This will be a gift to the bears!

Sounds about right, in time and magnitude. Need to see another face-ripping rally. The buy-the-dip crowd still have some money left to average in.

Lacey Hunt not looking so good anymore

Hunt thought that inflation couldn’t arise, just like other central bankers, because the inflation would remain hidden in asset prices but the inflation is now transferring from asset prices to CPI. He also assumed central banks could never lose credibility and control, and that assumption is backfiring as well. Given the massive monetary mistakes made by central banks, we have to wonder if they will be around in five years.

The key problem is the rise in RE prices. 65% of families own a home. They’ve seen the home prices rise 20-100% or more in two years, and they think they have lots of wealth to spend. Elevated stock prices are a contributor as well. When a majority of people think they have wealth, they spend it, the top 50-95% wealth percentile in particular.

Two hikes of 2% to flatten the curve.

Nacho Bigly Libre,

Muchas gracias for the chuckles.

Brutal, bloody month for the belly of the curve. 2-year up 87 bps since May 31. 3-year up 85 bps. This is a feature, not a bug of QT.

Waiting to read of more breakage. Which hedge funds weren’t hedged appropriately?

Also been wondering about what the SNB might be up to these days? How’s that portfolio, financed by conjured Swiss francs, doing?

Actually commodities with the exception of core components like food and oil are down 20-30% over the last 3 months. Just pull up a 3 month chart of lumber, copper, aluminum, nickel, cocoa, oats, etc.

Semiconductors are coming down, as well. DRAM is dropping so hard that it’s affecting Micron’s numbers.

I think CPI looks very different next month.

“ I think CPI looks very different next month.”

Possibly, but I think not…

Food and energy is big… last months print didn’t have the full effect of either, just partially…

The housing component wasn’t fully baked in either…

The biggest problem is that, even if does reduce, what we’ve had isn’t going away… it will just increase at a lesser pace carrying the last two years with it…

It’s the CPI for services that’s now spiking.

https://wolfstreet.com/2022/06/10/false-hopes-of-peak-cpi-inflation-prices-of-services-housing-food-fuel-spike-dollars-purchasing-power-goes-whoosh/

The internet search I just made shows mortgage rates in my state as 5.93% 30YR fixed 20% down FICO >740. I presume it’s ballpark accurate.

I’m waiting for RE listings to come “out of the woodwork” and increase supply noticeably in the not to distant future.

Sounds about right Mortgage News Daily has the 30 yr conforming at 6.18% today. Ouch.

SW Florida Punta gorda area, several agents report while prices are softening somewhat, number of monthly sales has dropped 60 to 70% over last 3 months. From red hot to lukewarm. Expectation is direction of trend will only continue. Many listings here are old say 20 to 30 years with little in the way of upgrades. When mkt was hot they would sell at almost any price, now sitting. Contractors and subs and handymen who were in such demand and short supply they were quoting weeks and months out are now becoming available and looking for work. There is a sea change occurring.

hello, with a barrel at 180 u$ the world as we know it will not exist. Just think about transportation, asphalt, plastics, electricity and all the dominoes that would fall! Not to mention gas and coal costs. and I’m forgetting many more. A greeting for you

If only there was a way to lower our dependence on oil.

Unfortunately its totally impossible.

Of course it’s possible. I gave up my car couple of years ago. Walk or sometimes Uber. Uber is so subsidizes by other people it’s ridiculous.

Hello, Good article. Read the whole thing. I promise. My apologies ahead of time if I misunderstand.

The fed is behind the market though. The 2 yr yield and the fed funds rate are way different if you compare. The fed really doesn’t have to do anything and the bond market is doing the work for them. It is interesting in that the fed just has to hint at raising rates, and then the market will just do it based off that hint.

I know you’ve mentioned it in the article. I”m just reiterating.

My question is, why does the fed need to front run inflation if the market does it for them?

Tony,

Last year, the Fed was doing QE and repressing interest rates even as CPI inflation was already soaring, but markets were in TOTAL denial because they followed the Fed. Then the Fed did its “pivot” last fall. That’s when the Fed began telegraphing that it would tighten, and that QE would go away, and that rates would rise, and markets gradually began taking the Fed seriously.

There are still lots of folks out there who are blowing off the Fed as an inflation fighter because the Fed has lost all credibility and is now trying to reestablish it.

If markets didn’t still blow off the Fed, the 10-year yield would be at something 7% now.

In their defense who believes Powell won’t slash rates and do qe if a major recession hits? Some might be guessing that Powell just trying to build some powder and guessing a recession is inevitable.

Forget the recession. It’s inflation that matters. If inflation comes down enough, they will pause or cut. And that’s the goal. If inflation doesn’t come down enough, they won’t cut.

6.13% 30YFRM, WOOHOO!!! Go JPowell!

Yes, Mr. Richter, and the 30 year yield would be around 10%.

The yield curve seems to get a lot of attention, especially the inverted curve. The Fed owns enough treasuries to create whatever type of yield curve they want.

Mr. Richter, what market? Do you mean the one that creates price discovery? The Fed is the market.

Wolf

’10-year yield went down below 3% for a little while in May, the tightening deniers came out in droves and said that this was proof of the impending rate cuts by the Fed, and that the peak of inflation had already occurred, and that inflation was winding down, and that the Fed would restart QE all over again. It sounded silly then, and it sounds silly now.’

You stuck to your gun! Bravo!

It was their ‘wishful’ thinking and positive spin narrative from the Fin media, made them incapable of thinking outside the box! Many still don’t get the message.

I am fairly certain that S&P will be close, if not 50% decline, faster than any one suspects. The Demand destruction is coming very acute and deeper than I expected.

It was all about LIQUIDITY provided by Fed (CBers) Once it disappeared, reality is descending to the consternation many including Wall ST pundits!

There are still lots of folks out there who are blowing off the Fed as an inflation fighter…

I guess I’m one of those :-)

It’s not so much a matter of inflation. If he raises rates then everyone can kiss their pensions goodbye because they are dependent on the stock and bond markets. So, am I resistant to giving him credibility? Yes. But only because crunch time hasn’t happened. Crunch time comes when people realize their pensions aren’t worth anything. It’s then I’m betting he backs off.

“If markets didn’t still blow off the Fed, the 10-year yield would be at something 7% now.”

Indeed, I find it so puzzling that there are still FOMO types, denialists and-or asset bubble enthusiasts who STILL keep pushing the dumb line of “the Fed will chicken out, cut rates and re-start QE if we have a recession, housing and stock market collapse or if the national debt gets too high”. NO THEY WON’T. As Wolf keeps saying, inflation at this level is a mortal threat to the US economy and the USA’s very status as a major power, and it’s now urgent, all hands on deck priority to bring it back down. A recession and-or increasing deficits are troublesome but not such a threat, deep though temporary recessions in fact are just part of the business cycle and among the few ways to cure such raging inflation and the housing bubble.

OTOH if the global business and investment community senses JPow isn’t serious about fighting inflation and preserving value of the US dollar–and that point is getting dangerously close–then confidence in the US and American financial management vanishes, the dollar loses reserve status and the USD gets even more worthless faster, then all heck breaks loose and it’s (literally) blood in the streets across America. The Federal Reserve has no choice but to go full Paul Volcker now.

Also backing up Wolf’s conclusion here, and on how serious the Fed is (and must be) in aggressively fighting inflation now–the seeds of even worse raging inflation are being planted based on our business partners and suppliers. We’re now hearing open contempt for the US dollar as never before, and the response is an even more dug-in determination to raise prices ever higher as businesses angrily complain that their dollars they’re earning are worth less and less in true revenue and profits. Same reason the Saudis and oil majors are jacking up prices (and taking more RMB and other currencies)–the dollars they have and earn are depreciating in actual purchase power, so they have to raise costs more to just tread water in their holdings, thus higher and higher costs.

This is what the delusional “Fed will back off” morons don’t get–it’s not a choice between a bad outcome and good one (the latter somehow if Fed went back to QE or lower interest rates), it’s between bad (painful but temporary, manageable recession and asset bubble corrections) and catastrophic (uncontrolled inflation, total collapse of confidence in USD and management, fall of the US as a major power, bloody social unrest, possible civil war and breakup of United States amid all the other divisions). Jerome Powell and the rest know this, they also know the hoped for “slow walk” of gradual QT and 50 bp rate hikes aren’t enough. It’s either go full Volcker or disaster, which is FOMC is already getting much more hawkish.

RedRaider:

“If he raises rates then everyone can kiss their pensions goodbye because they are dependent on the stock and bond markets.”

The flaw in this thinking is that uncontrolled inflation wipes out those pension values too, but much more aggressively and on a broader scale, while also wiping out the actual buying power of US earnings and other investment profits as the dollar’s value plunges–and thus also crippling the financial viability of hundreds of millions of other Americans without major pensions. High inflation is the worst of all worlds for a currency and economy like Wolf is saying. Also, you’re assuming that pensions are necessarily closely tied to equities markets but that’s also a flawed assumption–esp now with inflation so dangerous and the Fed forced to fight it Volcker-style, any competent fund manager would be moving pensions investments out of equities and into safer securities. The stock market, real estate market and other asset bubbles (esp housing bubble) simply have to pop and are grossly overvalued based on price to earnings ratios and home price to income. Tesla worth more in market cap than all other car companies? And TSLA is just tip of iceberg–stocks have to fall hard to return to sensible levels. Any pension manager who doesn’t realize this, and leaves pensions invested in overvalued stocks, real estate or crypto with inflation this high and interest rates going up, is just incompetent.

I have been trying to decide if I should pay off my house or not with the yield on 5 year treasuries now more then my mortgage interest rate the calculus has gotten more complicated.

I’d pay it off. I’m too old to look only at math and ignore risk. Good luck, whatever you decide.

If you have an mortgage interest rate in the 3’s or even 2’s as we have, why give the money back to the bank when you could invest those funds at 4 – 8%?

I wouldn’t, except that the calculation needs to be done net of tax. Most homeowners receive little if any tax benefit since 2017 while having to pay taxes on interest in taxable accounts.

What safe investment do you have yielding 4-8% for the next 15 years? I don’t foresee that kind of return in stocks or bonds.

Same situation here. What we did was put the “mortgage payoff” money in a separate account, make sure it earns more than the mortgage interest (after tax considerations) each year, and make sure there’s enough liquidity to make the principal payments.

AA or better muni bonds can be better than Treasuries for this, right now, depending on your bracket.

Sometimes dividend stocks can also be good options for part of the portfolio, but not right now. Have to be extra careful with mortgage money under the “margin of safety” aka “never lose the principal” rule of Graham-and-Dodd type investing for this.

Wisdom Seeker

All div paying stocks will get hit, once the earnings fall! Guaranteed! Just look what happened in late 2008!

I plan to pay back my HEL taken a while ago by ‘winnings’ by going against the mkt. This is the ONLY way, profits can achieved during BEAR mkt. Been in the mkt since ’82. Gone thru more one bear.

This on coming will be unlike any other b/c of humongous DEBT build up in USA and globally unlike any time in human history! All the excesses built up (courtesy of Fed+CBers) has to be addressed. Not going to be easy.

Those who know and experienced in OPTION trading will have no problem. That’s how, I survived the GFC without losing a penny! After wards is a different (sad) story!

Unfortunately majority don’t know or NOT willing to learn options. It is NOT easy but once you master it along with some experience in trading, one NEVER fears BEAR mkt! This is the only way( other than using inverse ETFs deadly for the novice!) the retail investor can protect their portfolio. NO ONE ELSE will!

None of the Pension funds, managers of 401K or most MFunds (unless Bear MFunds) fail to protect investors; portfolio. Many will be sitting ducks and get churned out by Algoes and or high frequency traders!

It’s impossible for most “investors” to avoid the consequences, since someone has to own every security all the time.

I would also factor in your employment situation (moving forward). If your house is paid off and then you lose your job, that might be a less stressful situation than if your house is not paid off, and you money is tied up in 5 year treasuries.

McQueen’s Ghost-triple check. House wholly-owned when wife&i both lost our jobs in the last GFC saved our tails…

ymmv, but counsel thinking long and hard about betting even a piece of your ranch…

mmay we all find a better day.

A f&c home is one of the most secure things you will ever have. Also relieves a great deal of stress now and in your future. You have options when the home is paid for in full.

Just remember that if you owe taxes you don’t own anything. The government can levy 99% tax on ‘your’ assets at any time. You’re at best renting from the government.

If I hear that.. ‘you still have to pay taxes’ idiotic argument one more time I’m going to break something. Yeah, yeah and I still have to pay registration on my car and I still have to wash my clothes. And zip still have to feed my stomach so I don’t ‘really own’ that either.

Two questions – What effect has the falling value of Treasuries the Fed holds done to the value of their balance sheet (could they be underwater)? And – what effect will the higher interest rates on Treasuries have on the government’s ability to make their payments on the debt?

Swimmer,

1. Don’t worry about the Fed’s Treasuries. The Fed will not sell them, but will let them mature, and at maturity, it will get paid face value. The premium it paid, if any, when it bought the securities is already accounted for on its balance sheet and is being amortized to zero over the remaining maturity of the security.

2. Don’t worry about the government’s interest expense. The Federal Government’s burden of interest expense is about half of what it used to be, as % of GDP (St. Louis Fed chart):

All of which indicates that they might hike rates a lot more than most are currently expecting.

Wolf, it better be swiftly and decisively and still the “peaceful protests” of last Summer likely will be nothing compared to the ones we’re in store for this year. It’s looking like the all-around hottest Summer on record, in my opinion.

Great time to visit the Pacific NW. Our house has seen only 1 or 2 days above 70 so far this year. Remember last year around this time we had the famous heat dome above 110. We all have moss on our back.

Maybe time for a post on the integrity/accuracy of the GDP…

Leaving aside measurement and methodological issues, there is the issue of the “G spend bootstrap” wherein the G can allegedly improve quality of life (GDP) simply by spending more (since GDP includes all G spending) regardless of all other considerations (G debt, currency value, inflation, percentage control of entire economy, etc.).

Ignoring the bootstrap would suggest that 20 years in Afghanistan, culminating in absurd failure, was an economic “win”.

“Government” is a reduction of GDP. At best the Government contribution to GDP should be discounted at least 50% for overpriced, sloppy, uneconomic services.

Government is not a contributor to interest payments on Government debt. That interest must be harnessed onto the ever shrinking private sector tax payer.

The demographics and overall government/private debt load make similar rates impossible without crashing everything.

Assume crash position.

I downloaded data on household debt service and financial obligations ratios (as a percentage of disposable personal income) since 1980 (federalreserve.gov).

Surprisingly, household debt service and financial obligation ratios appear to be at record lows for he last couple of years.

Good chart. It is good to look in the past.

If interest expenses do increase, the Government will probably need to increase their YOY spending budget to account for the increase in interest payments but as of now, they are still loaning money out a very low interest rate compared to inflation.

So maybe that is good as they are inflating the debt away (inflation rate is higher than the rate they borrow money)?

Just guessing.

Yes, inflation will lower the burden of the debt on the government (as revenues rise more or less with the rate of inflation), even as the government has to pay more in interest expense.

True, except that the deficit as a % of GDP is hardly low. It’s also going to explode higher with any economic slowdown, much less the savage recession (at minimum) which will come later.

Fair enough, but that chart is an artefact of rate supression. At the same time debt to gdp has increased (125%) and average duration has decreased over the last decade and is now at ~5Years. It will not take long for changes in rates to change that chart. In addition, the budget deficit is -12% and this is in a booming economy with high tax receipts, we can expect it to worsen as taxes evaporate in a recession so there is a lot of debt added at current rates. Luke Gromen makes the argument that current tax receipts just barely cover fixed entitlement and interest expenses. Maybe we could pull out by significantly increasing taxes, i.e. applying the fiscal solution to high debt+inflation, I just can’t see that as politically possible in the US. It’s political suicide. Lynn Alden makes the argument that because of our debt level a 80s Volker move is highly unlikely and we are rather in a period similar to the 40s war economy and will see official yield curve control of the entire duration. At that point inflation fighting will be done by regulatory restriction of the access to credit rather than by fed funds rates. All of this happened in the 40s/early 50s. Now the consequences of these arguments may still be some years off, and obviously timing will be critical. In the short term I agree, we may see the FED acting as if inflation fighting by hiking rates is their thing and may even get another brief deflationary scare. But the US fiscal situation cannot endure positive real rates for long.

I agree the budget deficit and debt to GDP ratio will “blow out” for the reason you give.

I don’t believe the government will be successful at interest rate control very long. Ultimate limitation on any government or central bank is the currency. It’s one or the other and my prediction is that the currency will be chosen first, as long as the Empire can be maintained. Everyone and everything else will be thrown under the bus. They have 30+ points on the DXY to “print”.

Suppressing credit expansion will crash the economy, as it’s totally dependent upon both artificially low rates and the loosest aggregate credit standards ever. The end of the bond mania should eventually take care of that naturally. There is nothing normal in the credit standards of the last few decades, going back at least to the late 1980’s.

Regardless of the specifics, my primary prediction remains the same. One way or another, the majority of Americans are destined to become poorer or a lot poorer for the indefinite future. Poorer as in noticeably lower living standards, not just a “spot of bother” or a reduction in fake “wealth”.

Wolf

What about MBSs?

Is there a market out there, with mortgage rates rising?

I mentioned this week end after reading a blog re ‘NO BIDS for MBSs’?

Who will buy them?

Yield solves all demand problems. There was no bid because the price was too high, and yield too low. Then suddenly there were lots of bids at a much lower price and higher yield. This is how this gets resolved. Who wants to bid on a MBS that yields 5.2% when inflation is 8.6%? Since the Fed is no longer the relentless bid, yields will have to come up to find demand.

7% mortgages, woohoo!

Multiyear stagflation means our GDP isn’t going to grow all that much and will fall as we move through whatever length / severity recession that’s looming. And, we can certainly say that our interest expense isn’t going down anytime soon. So, let’s look for that chart to invert in the next 3-5 years, at which China will be on the verger of surpassing us in terms of GDP.

Wait… Debt to GDP is measured as not-inflation adjusted debt divided by not-inflation adjusted (“nominal”) GDP. Of if inflation = 8% and “real” GDP (inflation adjusted) stagnates, then “nominal” GDP (not adjusted) grows at about 8%. So if the debt grows 4% and nominal GDP grows 8%, then the debt-to-GDP ratio declines.

The value of US Treasuries do not fall in the slightest when they are held to maturity and the Federal Reserve has no interest (pun intended) in selling any of its US Treasuries at any time prior to maturity.

“Amid hair-raising market “volatility” this morning, double-digit bloodletting in cryptos, and a steep sell-off in stocks that surely will bring out the dip buyers soon to prove once again that markets are far from the bottom, ”

Yup, waiting for the next bull trap rally to my RSU position off the table, missing my last window there in the last 2 weeks.

As for bitcoin price, wonder how much Michael Saynor and their likes are sweating it now? Then again seeing his latest tweets, looks like he is still hyping/hinting it to be another buy the dip moment. It’s getting pretty close to his $21K margin call so better turn up those extra hyping, I think there’s still some more fools to milk this market backup a bit until it forever implode like Beanie babies..

Risk parity strategies are going to sh!t with both stocks and bonds going down. From everything bubble to everything crash.

Crypto is one of the excesses of the bubble. Market cap of all crypto was >$3T(!) in November. Last time I checked it was <$1T (which is still ridiculous, but 2/3 off in half a year is pretty epic).

This is one of those days when the US$ (money-market fund) is your only friend in the financial markets…

Craptos are nothing other than an absurd Ponzi Scheme fraud.

Crypto is gone when the lights go out. And they will.

Or when the lights go ON.

I can’t see the fed getting rates up to 3% by year end before something breaks. Likely already in a recession per some of the bloggers I follow. Place your bets accordingly. Thanks for the article Wolf

Something has ALREADY broken: purchasing power of the dollar. Inflation is THE single biggest problem the US faces — and it’s a huge global problem. People need to understand that. A market sell-off or a recession is nothing compared the long-term damage that runaway inflation does to the economy.

Well, I expect to see a decrease in the prices of assets; stocks real estate, vehicles, etc. Is that deflation?

OK, so there is asset price inflation and asset price deflation. This includes house price inflation and house price deflation. Bot are common events, and by large amounts.

There is wage inflation and wage deflation. Both are fairly common.

Then there is consumer-price inflation and consumer-price deflation. Consumer-price inflation is the standard in the US. In my entire life, there have only been a few quarters of minor consumer-price deflation. Everything else was either consumer-price inflation or raging consumer-price inflation.

We almost never get consumer-price deflation.

Apparel retailers cutting prices on stuff they mis-ordered or that’s left over from the season is standard procedure and happens all the time. That’s not deflation of any sort. Folks need to get realistic.

RE prices have deflated considerably many times, and certainly food prices go up and down constantly in the last 50-60 years I been in those biz.

”Manufactured” stuff OTOH, not straight, but close enough to up up up and away to Heck, eh

So, where’s our magical balloon???

I agree.

I was looking at the finances of close relatives. I would say out of the 6 or 7 families, only 2 are invested in the stock market or care about the stock market and none care about the price of crytps. They do care about the price of housing (most rent), the price of food, cars, and the price of gas.

Jim Bianco said on a podcast the FED will target the stock market as a way to bring down inflation. Because the rise in assets like stocks and crypto’s allow people to buy the 2nd homes, vacations home, or multiple cars…etc. Take away some of that wealth effect.

Just my thoughts and could be wrong.

“ Jim Bianco said on a podcast the FED will target the stock market as a way to bring down inflation. ”

Probably not targeting the stock market per se, just removing the food the beast needs to eat in order to survive in its present form…

The stock market didn’t cause inflation… stocks rose a long time with very little inflation…

Cowg

‘The stock market didn’t cause inflation… stocks rose a long time with very little inflation”

WRONG!

Stock market was one of primary instruments in blowing up asset inflation, which Fed either ignored or declined to consider, b/c it won’t fit into their agenda! What did you think ‘Everything’ bubble was? 3rd largest in the 21st century! Financed by ( Easy-peasy money spigot by insane credit creation)prolonged ZRP, multiple QEs, stimuli and what NOT!?

What did you think, when Fed is/was talking about ‘Wealth Effect’ and it’s impact on consumer spending ( although 90% of Wall ST wealth is owned by top 10% – a big blind spot in their thinking!)

As I pointed out, the biggest flaw in the Fed’s thinking, confusing Mkts for the real economy. That’s why we are in this mess!

Sunny,

I see what you’re thinking…

However, go back and look at the increase in the S&P between 2012 and 2020 then compare the CPI rate…

The S&P went from ~ 1400 to ~ 4000…

Appx 300% increase…

CPI during that same time frame was 1.4% a year on average…

I think you’re confusing asset “appreciation” in a couple of areas to overall inflation…

That being said, as Wolf has pointed out, until recently the asset “appreciation”, has not been picked up and reflected in the “current” CPI…

But is now starting to get factored into inflation…

Not in the asset valuation, but in the services side for rent, etc…

Asset appreciation is concentrated in a (very) low percentage of the population and the majority of the “wealth effect” doesn’t have much of an impact on what most people buy.

On occasion, I have read write-ups on the luxury segment, and the asset mania definitely caused inflation there even before the pandemic. Things like art, some collectibles, expensive real estate.

The Wall Street Journal used to publish an index in the weekend edition, but I haven’t read it in a long time, so do not know if it’s still covered.

The Fed will do all it can to promote price INstabiliy. Their record is pretty remarkable.

Fed is owned by 15 mega global banks and they do their bidding and NOT the Country!

The 12 regional Federal Reserve Banks are owned by the banks in their districts. The Federal Reserve Board of Governors is an agency of the US government whose chair and other board members are appointed by the Prez and confirmed by the Senate.

and only 5 regional bank Presidents can be on the FOMC, and they rotate in and out from the 12

sunny129,

Here is the one of most important facts about the Federal Reserve System. This is taken from the federalreservehistory dot org website on the passage of the 1927 McFadden Act:

“The McFadden Act tackled three broad issues.

The first issue involved the Federal Reserve’s longevity. The original charters of the twelve Federal Reserve District banks were set to expire in 1934, twenty years after the banks began operations. This twenty-year limit mirrored the twenty-year charters given to the First and Second Banks of the United States, the Fed’s nineteenth-century forerunners. Congress refused to recharter those institutions. Everyone knew this fact. The precedent threatened the Fed. To alleviate uncertainty, Congress not only rechartered the Federal Reserve Banks seven years early, but also rechartered them into perpetuity.”

You got that? Congress gave the 12 Fed District Banks immortality!

The Fed’s website continues with the next paragraph:

“As it turned out, if Congress had waited to renew the Federal Reserve’s charters, the debate over renewal would have occurred during the Great Depression. The decision may have been different, and the Federal reserve as we know it today may not exist.”

Today’s Fed exists because of 1927’s Congress. The man behind this was Henry M. Dawes, Comptroller of the Currency.

Every U. S. citizen should know this IMO. But it is not part of public schools’ curriculum, and very few are aware of how the system that controls our financial lives on a daily basis was put into place.

To me, the stock market’s behavior since the May CPI release is basically investors trying to spook the Fed into not trying to take more forceful steps to reign in inflation (steps which, of course, the Fed should undertake).

In other words, the market is telling the Fed “you’d better not do any more than you previously said you would fighting inflation, otherwise we’ve got more of this bear market thing coming your way”.

If the Fed has the balls then it would ignore this and proceed with fulfilling its two legal mandates: low unemployment and low inflation. Unfortunately, the Fed has also unofficially decided to add a third mandate to itself: rescuing investors from their own foolish behavior. I guess only time will tell how much of the “third mandate” the Fed will try to adhere to.

I think the 3rd mandate is political. #3 — To avoid making the party in power look terrible by causing a recession if possible.

And I think #4 is something like; give time for the big money to fleece retail investors and clean up some of their messes during the early portion of a financial downturn.

Ultimately let Wolf’s motto ring true “nothing goes to hell in a straight line.” A hard won motto I’m sure after watching the dotcom bubble fizzle out.

The third mandate is there to prop up government employee pensions. Don’t kid yourself.

In the last recession, govt employees formed syndicates to buy the discounted houses of the unemployed private sector. They get the returns but never take any risk. Worse than Socialism.

“They get the returns but never take any risk. Worse than Socialism.”

Socialists using capitalist ploys. What is the world coming to?

“I think the 3rd mandate is political. #3 — To avoid making the party in power look terrible by causing a recession if possible.”

Inflation at this level makes the party in power look far worse than a recession (and makes the party supposedly out of power look terrible too–high inflation wrecks American institutions in general, and trashes confidence). Even by political calculus, it’s far better to have a deep recession than uncontrolled inflation (esp if recession happens in early 2023, which looks likely, leading to recovery).

This again is a fundamental flaw in so many of the arguments fantasizing that the Fed might back off aggressive rate hikes and QT, Volcker-style–a deep recession is part of the solution, the only way to confront this inflation and asset bubbles, and is far preferable to runaway inflation. That is, it’s not a choice between good and bad options (with the “good” being some magical policy that avoids a recession somehow). The reality is it’s between bad but temporary and manageable–a deep and agonizing recession and popping of the housing bubble and other bubbles, which is short-term, resolves inflation and resets the economy in a healthy place–versus catastrophic, in form of uncontrolled inflation that ruins the US dollar, leads to a global crisis of confidence in US finances and leads to bloody social unrest. Volcker understood this in 1982, his aggressively hawkish policy was short-term pain (that awful recession) for long-term gain of a solid currency and finances. Now for the Fed in 2022, the Volcker option is the one they must also adopt.

far from bottom. not holding anything but a longer term cvx that has been in the family a long time and not selling. holding too much cash. a house. some beaters to drive. plenty of cold beer for the hot summer. stay well folks and enjoy the summer. far from bottom. it is interesting to see crypto behave like the market should (absent the fed’s consequence avoidance therapy). what ever happened to consequences? i am sitting here wondering when they let it bleed. not dipping a toe in this right now.

Crypto is not a commodity. It’s a speculative investment, crowd funded and managed. Like dutch tulips.

No one has any idea how much is bitcoin’s real value. Say what you will about government fiat currency, at least the Treasury will accept it as tender to pay your taxes.

Crypto’s actual value is zero (since it is nothing) and not comparable to fiat for the reason you stated.

The only reason crypto even exists is because of the mania.

Cryptos are worth whatever foolish people are willing to pay for them, but that doesn’t mean they have any value. They’re like speculative stocks without the stock.

Fiat currencies are at least backed by national governments. Cryptos are backed by wishful thinking. Crypto’s have been shown to be mostly useful for

(1) money laundering and tax evasion,

(2) cryptoscams, for which there are extensive online lists,

(3) demonstrations of human cognitive deficiencies.

Buffet bought up a billion of what he earlier called rat poison squared, which leads some people to suspect that dementia is setting in.

Bitcoin is gone when the lights go out. Sell now and buy silver.

Say what you will about government fiat currency, at least the Treasury will accept it as tender to pay your taxes.

Nate,

More specifically, the government REQUIRES you to pay with the fiat currency…you have absolutely no choice in the matter.

imafuckoffer

One cardinal rule, NEVER fall in love with a STOCK. There are always other alternatives! It is well known in the last 200 yrs of Mkt history, Stocks go up and then again FALL! Bull & Bear are the two faces of the same coin. One follows the other eventually. That’s what happening now!

Oil may go under 70 or even below 50, if the demand destruction is deep and continues! THINGS Change! I own/owned a lot of energy stocks/ETfs including CVX and XOM. I reduced my exposure and bought puts against the energy in the short and intermediate term, to control the risk. Option trading with puts come handy, this kind of situation.

The only certainty is IMPERMANENCE!

Agree, paid for home, cash, a beater car and wine/beer. Cheap internet connection.

It’s so weird how difficult/impossible it is to buy bonds in a 401(k) or IRA. Funds go from the biggest feature of bonds, boring collecting of a stable rate of interest, to bouncing around like mini-stocks.

*to buy bonds at auction. They have no technical difficulties with selling friggin’ annuities to 401(k) clientele, but individual bonds are too hard.

Fidelity lets you buy bonds at auction in a IRA, I am sure there are others. Just roll your funds into an account that lets you do what you want. 401(k)s are a different matter, just make sure to roll the funds over to your brokerage after you leave the job, that way you get control over your investment.

THIS.

Bond funds suck in another way: denial of our rights as investors to choose what we invest in. What if I don’t WANT to fund the national debt racked up by Congress? What if I don’t WANT to fund the too-big-to-exist banks? What if I don’t WANT to lend to giant monopolies borrowing my money to buy back their shares?

With individual bonds I can lend to whom I choose; with a 401K fund there’s no choice, I have to invest in “aggregate” funds where someone else chooses what bonds get issued and I have to own them.

You didn’t mention big fees charged by the 401K administrator.

I give it 5 months for housing prices to retrace the gains they have made in the past year, so about 20% declines in many areas. And that is just the start.

The biggest things propping up inflation are gas prices and home prices. Once the home price bubble bursts stupid people will stop spending recklessly.

“ I give it 5 months for housing prices to retrace the gains they have made in the past year, so about 20% declines in many areas. And that is just the start.”

Possibly in cold country, but I don’t think so in the warmer areas…

If oil stays high, the cost of heating this winter will a shocker as well as the costs for governments to provide services… that might be enough for folks to pull the plug…

Which will keep housing in the warmer areas higher…

What about the cost of Cooling your house if you are SW or Texas on the verge of blackouts at the beginning of summer or how about lack of water and therefore insurance rates through the roof or insurance in Florida or east coast due to flooding? In some areas cost prohibitive already?

“Stupid people” have been spending wrecklessly far longer than anyone in this planet can recall. Only now, through a series of intricate deceptions, are they able to spend Other People’s Money in the most direct pipeline available at little to no cost to themselves. You’ll always ultimately pay for their wild weekend in one way or another, but now you’re not even being asked to participate through the inducements of paid out real interest on your “deposits” which would lessen the damages you suffer. Short of a complete economic failure causing a majority to vote with their stomachs for sound approaches to regulate the nonsense and promote wisest investment activity, this shiteshow ain’t gonna change in the lifetimes of anyone still breathing. It’s not just The Bubble, it’s the whole direction of the planetary parade and we’re the dumbasses who stoked up the band. Blind alley ahead!

Also watch out for the Italian 10yr and Greece 10yr.

I was expecting the collapse of these two guys a while while back.

Let see if this can run up to 10%.

As I write the euro is par with the USD.

Wild that the ecb might be more dovish than the fed. But we haven’t seen the early 2000s so there is some room for further declines. Germans are not going to push during ukr war.

There should be a premium on US $ over Euro, considering what’s happening their, including their virtually insolvent banks ( loaded with sovereign bonds, losing value with rate increase coming) EU has to spend more for energy including natural gas.

This will happen gradually. Remember EURO was worth 90 cents (1999) against US $ when it started, went all the way to 1.40 and now 1.04 against US currency!

so what does it mean that euro was 90 cents, then $1.4, then $1.04

and similarly yen was 300ish when i last visited in ’66, now apparently increasing from 105ish?

thanks sunny, et alia

Be interested to know who much premium is being built into the short term auctions, what the effective yield is going to be on say the 2yr. The Fed has no control of interest rates, the market is going to call the shots. Once they abandon RRPO then more supply gets to market instead of being swapped for cash and yields drop. They need to get off RRPO and into RPO as liquidity issues in the stock market become problematic. The banks should be swapping bonds for cash, not the other way around. That’s a 2 Trillion dollar market, which is about the size of the crypto market which is being liquidated…..

The 2-year that I bought at auction at the end of April was sold at a slight discount.

“Be interested to know who much premium is being built into the short term auctions, what the effective yield is going to be on say the 2yr”

You can bid a price or bid “non competitive”.

Couldn’t what the Fed has done, ZIRP, QE and such be considerd treason?

How about a Judgement at Nuremberg trial for all since Greenspan to Powell.

don’t we already have enough political circus from all sides of currently dish?

”careful what you ask for” is a fave quote of a dear one

I guess the Central Banks and Governments will be intervening soon.

They intervened in 2008 and the debt was half of what it is now and there wasn’t the inflation rate and oil price.

I can actually see Government handouts coming to avoid possible civil unrest.

Nope.

Thank you Wolf for shining a light on treasury yields. All we hear about is “only 1/2% rate hikes” this and “fed has no ammo” that, but folks are almost universally ignoring how much power the fed has by controlling the speed at which they roll treasuries and MBS off their balance sheet. The short term fed funds rate is great for headlines, but it seems like small rate hikes are just a little razzle dazzle… A diversion while the fed pulls out the big guns in the form of QT. The short term fed funds rate doesn’t govern the cost of mortgages, commercial loans, corporate bonds, etc. But treasury yields sure do. The 10-year yield is up nearly 2/10ths of a percent inside of 24 hours… THAT should be the big news, because it’s typically the discount rate used to calculate the value of stocks. It’s what governs mortgage rates. It’s what controls the cost of corporate debt. Treasury yields are driving today’s sell off, not the other way around.

We didn’t really “print” money. We monetized debt, and each dollar created using this method has something like an anti-dollar sitting on the fed balance sheet. The fed has a $9T store of anti-dollars. That’s a lot of inflation fighting firepower should the fed have the balls to stay the course and actually use some of it.

The US Dollar just hit 105 on the DXY as its value continues to surge upwards with it being the ultimate safe haven asset.

The collapse of the USD’s purchase power through inflation strongly contradicts that assumption of it as a “safe haven asset”, in fact the businesses we’re in contact with are indicating the opposite, in both words and deeds. They’re now aggressively raising prices and fueling even worse inflation specifically because the US dollar is losing value so rapidly, and they’re losing confidence in the USD, thus the push to raise prices to recoup the losses in their dollar holdings from prior earnings. They have open contempt for USD as a store of value. If the dollar was truly a safe haven, there wouldn’t be so much inflation and buying power would stay stable or increase. FX markets are a mess right now partly due to the ruble’s historic collapse and the BoJ actually trying to foster some inflation (given Japan’s deflationary struggles, amusingly they’re probably one of the few countries to be somewhat happier right now about the inflation picture).

The fact of surging US inflation and the value of the dollar plummeting in real terms of buying power, and the faster diversification of currency holdings in central banks and private sector, shows what the world really thinks about the USD, and it’s not anything good. If anything the United States is among the most vulnerable countries to inflation shocks due to our trade deficits. Hard to say there’s any safe haven now, aside from a diversified currency basket and commodities.

I expect The Fed to stay the course and do a half-point rate hike to preserve the financial markets and continue the salvage operation on what’s left of the tattered shreds of their credibility.

What they do after that will depend on how markets and inflationary pressures react. They probably won’t, so another half point hike is likely to come early.

I’m standing on my prediction that The Fed will be able to neither prevent a recession nor bring inflation under control any time soon. Sitting, actually.

It’s tools are blunt instruments and there are too many Serious Problems to suppose a recession could be avoided, The Fed itself being a relatively minor one. You really only need one or two Serious Problems at the same to precipitate a recession and the US has half a dozen of them or more, depending on how you prefer to quibble about the definition of Serious Problem.

Expect a hot summer all around. Your best investment may have been in a swimming pool, but you should have done that last year. This year you’re SOL. Electrical grids in Texas will be taxed, but not financially. They’re expected to make out like bandits.

The price of presciption anti-depressants is also expected to rise because of increased demand.

The problem with the delayed central bank response to this inflation crisis is they no longer have the luxury of waiting to assess the impact of their tightening.

Monetary policy operates with a time lag, and inflation numbers (both CPI & PCE) are backward looking. So they really have no choice but to continue tightening until inflation numbers substantially come down.

They’re stuck between a rock & hard place. The key is not to get into this kind of situation in the first place.

With the FOMC BOG now consisting of all Biden appointees except Bowman, if they wanted to salvage their party’s 2024 chances, it might be more advantageous to just get the recession over with so the economy is in recovery by then.

“With the FOMC BOG now consisting of all Biden appointees except Bowman, if they wanted to salvage their party’s 2024 chances, it might be more advantageous to just get the recession over with so the economy is in recovery by then.”

This, exactly. It’s why Ronald Reagan won so lopsidedly in 1984. He and his Cabinet were initially anxious about Volcker’s hawkish monetary policy and interest rate increases due to recession fears, but they eventually bit the bullet in part because they realized that a harsh recession in 1982 and 1983, as painful as it would be, would be long term beneficial (including politically) by breaking the wildly unpopular inflation then and allowing for a recovery by 1984. It’s a fairly similar situation now. For all kinds of reasons, financial, political, economic, administrative, social, it makes sense for the Fed now to get aggressive and follow the Paul Volcker script. And to do it sooner than later on both interest rates and quantitative tightening.

“Sitting, actually.”

Thank you for the clarification. 😒 (look, the have a face just for you!)

Great comment btw.

“Great comment btw.”

I owe it all to the inspiration provided by Our Illustrious Blogger. He does all the work, so I can just blather.

Amen!

I have two pools at my condo complex that are almost never used. They are like my private pools. Most of the units are empty (Mexican drug money) or the tenants are too decrepit to go swimming.

If you recruited pool decorations from the local college you wouldn’t have this problem.

Actually there are a few college students but you seldom see them at the pools. Once in a while…

Used to live in “the newer” similar near LAX. Left a message on the answering machine (that’s right) that we were too darn busy partying in the empty lavish pools to answer calls. One day I ran into the mailman who could barely speak a broken phrase in English….had to tell him which boxes to put which mail in! Knew we were all to be in the deep water end henceforth. Some thirty years later, wouldn’t be surprised if all those pools were filled with sand and the carrier was parking a camel to deliver Chinese knock-off Persian rugs to fools with no decorating sense other than what they got from a fly-by-night internet “expert”.

It is the same at our small townhouse complex, only 34 units. We are the only people at the pool.

I find it odd because there are several units that have kids in the family. Taking kids to the pool for an hour after dinner and they go right to sleep.

The cost to build a pool has literally doubled since March 2020. It’s the craziest thing I have ever seen. Some of that increase is warranted because of huge increases in cost of concrete, vinyl, equipment, and labor. Some of it is just extra pure profit because they can. Dealers need to get it while they can as new building contracts are grinding down rapidly. Middle to upper class luxury industries are going to take it in the shorts. Wolf if you want to hear from someone that has been through incredible upswings because of stimulus money and interest rate suppression just email me.

They are selling a drug on TV now that treats BOTH sides of someone who is diagnosed with “Bipolar…(whatever the fuck is latest) Disease”

How do it know?

Those new magic bullets certainly do run completely wild with a gutted (enough to be bought off) FDA.

The Federal Reserve is plagued by mission creep. There’s

1) their legally-mandated mandates of managing unemployment & inflation

2) the interests of Wall Street: keeping markets pumped up & free money flowing. It’s particularly important for FOMC officials not to upset their future employers once their public service ends.

3) their personal financial interests (the 2020 bailout included specific muni bonds that were held by FOMC members)

4) the interests of politicians who nominated & confirmed them: ESG, climate, trying to delay recessions until the next party takes power, etc.

For much of 2020 & 21, the Federal Reserve prioritized juicing markets above doing what’s right for the American economy, and stuck their heads in the sand while inflation was spiraling out of control. Now, the fallout is far more disorderly than what would have happened if they started tightening earlier.

Wolf, if it were up to you, what kinds of structural changes, if any, would you propose for the Federal Reserve to prevent these conflicts of interest from distorting policy?

Congress can redo the Fed, no problem. They’re not going to, obviously. But if I were the sole dictator in Congress, I would:

– abolish the 12 regional Federal Reserve Banks and just keep the Board of Governors

– make it illegal for the Fed to lower its short-term policy rates below an average of various inflation measures

– make it illegal for the Fed to participate in the repo market (no repos, no reverse repos). Let it blow up. The banks should do the lending, that’s their job.

– make it illegal for the Fed to buy any assets except Treasury securities

– make it illegal for the Fed to buy any Treasury securities except as backstop to prevent the US government from defaulting. The yield at which the Fed buys would be a punitive yield, such as for C-rated deep junk bonds, at maybe 10 percentage points above the average measure of inflation (see above). Which would amount to about 18% today. This will make sure that this doesn’t happen often, and it will make sure that when it happens, market participants will also lose their ass.

I’m just fantasizing though. None of this is ever going to happen. We’re going to have to live with the Fed the way it is.

Mr. Richter, was there anything wrong with consistent 2% GDP growth? The Fed aimed for 3-4% and now has 9%. LOL

Wow. Really great list. In some unique emergencies, the Fed may need to cut below average inflation measures, but still rock solid as-is. Unfortunately, it’s more adult responsibility than politicians can stomach. They need a way to get their fingers in the cookie jar when no one is paying attention.

Wolf…

add in..

The money supply can not expand beyond a certain level per year, as dictated by GDP growth.

Doing away with the regional banks….you would have lost the input of Hoenig….and others outside the politics of governorship appointments inside the “swamp”.

IMO regional participation sans appointments in Washington is important.

JacksonY

“their legally-mandated mandates of managing unemployment & inflation”

don’t get tricked by the “dual mandate” game…designed to carve out the third mandate that would have, if honored, prevented the entire mess we are in..

in the Federal Reserve mission statement you will find the third mandate..

“Promote moderate (not extreme) long term interest rates”

Pounding the long end, ignoring this third unmentioned mandate, FORCED…..the investor to take more risk. In other words, they skewed risk return ratios and traditional metrics such as price earning ratios.

– Traders have gone sghort T-bonds based on the assumption that rising inflation pushes yields higher. But rising yields are actually DEFLATIONARY.

– I am preparing to go long T-bonds again. I expect the 10 year yield to go down by about half in the 2nd half of this year.

10 yr to 3.41, and I was told by a few smarty pants(folks that get paid to think about such) within the last week that the 10 might reach 3.5 at max this year. I suggested I did not agree. I guess they could still be correct, but I don’t think so.

The 10 year US Treasury yield should already be at 5.25% and the sooner it gets there the better.

10y just ripped through resistance

Mortgage > 6

SP below 3800

Crypto in collapse

Wolf… seeing any traces of red in the streets yet?

Too early. Falling knives all around. Let’s wait to see how far Apple goes below $80, then assess the situation.

First actual QT Treasury maturity runoff occurs on Wednesday, so the puking is happening before the party has even started!

” seeing any traces of red in the streets yet?”

Nope. But we’re going to get a bounce pretty soon. Maybe Tuesday.

If we get these kinds of sell-offs back-to-back for a few more days (I doubt it), I’m going to go back out and look on the sidewalk with a magnifying glass. I’ll let you know if I see any blood.

Today* likely marks the end of the 12 year, 10 month secular bull market from March 6, 2009 to January 4, 2022, a massive 623% climb from 666 to 4,818 juiced by $10 trillion of fiscal spending (everything from TARP to TCJA to CARES to ARP) and $10 trillion in QE.

After bouncing off the 3800s three times, it was only a matter of time before the bottom fell through.

RIP. What a run.

* technically confirmed today but of course, the bear market actually started on 1/4/22.

My iPrecious!

Too funny! MW: With the S&P 500 now in a bear market, despair and capitulation are the next stages of investors’ ‘grief’…

Despair and capitulation come much later. We’re just now limbering up the panic stage. Today was a good preview. Proclaiming a bear market is what will finally spook the herd. Another 1000 down on S&P we’ll start to see despair, another 1000-1500 after that capitulation. And this could take years.

I finally got to nibble at a few items today, first time since March 2020. I won’t be full and burping until S&P 1200-1500.

What should the Fed balance sheet be to reflect the money supply, $3T or so? I don’t think we’ll see it go as low as $6T. The key question for me is, how much unemployment is the Fed willing to accept in its fight against inflation? Remember both of those are Fed mandates, can they really ignore either one?

Good luck out there y’all.

If Jerome had any gonads (which of course he doesn’t) he would announce a 500 point increase. Just blow it up shock and awe style. If I was Biden (another geezer who has no gonads) I would be in Jerome’s face demanding that he take dramatic action. I am no fan of you know who but he did have gonads.

Gonads are an organ in animals that produces gametes, either testis or ovary.

You could say, more accurately, that psychopathic narcissists often project domination and superiority, but their actual testis in real situations more likely resemble screaming prima donnas.

Wonder if we’ll have another National penis size debate? Or gonad size?

Maybe they are already happening at some mid-term debates?

Who will be the first to demand someone flop their junk out? Hope a female candidate demands it.

And settles the argument (I mean “debate”). The guy can then switch to cerebral cortex size, which 45 was obviously lacking in.

How do I Series Savings Bonds Work? Is this a save place to park some cash if one imagines Inflation staying high for the next couple years? On a related question when to start guying longer term Treasury Bonds? Even if inflation comes down in the next couple years how high does the interest rate on a 10 year note need to be for it to have a real pay out?

I bond – you pay face value for the bond and interest accrues while you hold it. Interest indexed to inflation, adjusts every 6 months

You need to hold it at least one year. When you redeem, you give back the last 3 months interest accrual

Most you can purchase in a calendar year is $10,000, which I did last month.

It’s at a stratospheric 9.62% right now and it could adjust higher in November at the rate we are going. It’s a great place to hide up to 1Ok for a mimimim year

Long bonds – I don’t see the reward.

I would say stay short and keep rolling them for now

Question on – overnight reverse repurchase operations (ON RRPs) at an offering rate of 0.25 percent, in amounts limited only by the value of Treasury securities held outright in the System Open Market Account (SOMA). Has the rate or payment on these continued to increase and set to increase even more from the article? I would think the FED would want to get the banks to stop using this tool. Seems like they are sweeting the pot to use these financial MOP up tools

A lot of zombielike business need access to cheap short term credit to function. I think we will see some bankruptcies and then the labor market will start to cool down a little. The psychological shift that ensues from realizing the labor market is not quite so strong will finally slow inflation. But this is going to take a long time to play out, sadly.

Oracle is up over three percent!

Let the good times roll!

ORCL – 52 wk range 63.76 – 106.34 P/E 24!

I “think’ about it when it dives below $60!

Then I may buy a call for Jan 24!

Thank you for the insight!

Treasuries are still nuts. The 2 year pays 3.4%. So does the 30 year, more or less. So you get nothing for tying up your money for an additional 28 years.

That tells me the bond market still thinks inflation is transitory. Meaning, you should lock in that 30 year rate because it won’t be available for longer than 2 years. Not what I’m saying. It’s what the bond yields are saying.

I’ve been buying closed end funds that pay dividends in the 7-8% range. If they can pay that div thru the recession it’s a good deal. They did in 2008. So, we will see!

The yield curve is completely controlled by the Fed.

It used to be they only controlled the front end…

but with a 8 Trillion plus balance sheet …and allegedly selling off some holdings….their choice in what to sell controls the curve.

Their wish, IMO …is to paint the scenario that the curve shows recession or worse…setting up for a halt or reversal in the rate hikes.

‘buying closed end funds that pay dividends’

I have gone thru them for the same reason. Great during secular BULL. Another story during BEAR!

– Check out their Exp ration much higher than ETfs

– Div payments made out of your own capital

– How much discount vs premium?

Parking Place: Bask Bank Interest Savings Account ( Texas ) is paying 1.50 % APY no fees has anyone seen a better rate then that ? they keep jacking

the rate.

Seems they are not waiting for the Fed.

Wolf’s Yield Charts are mind boggling to me anyway Wow

The Fed looks to be in a Hot Seat but no doubt have a different story

U.S. Treasury Direct pays 2.89% on a 1 year treasury. Series I Bond paying a little more than 9%. $10k per year per person max purchase. I Bond Rate resets in Oct. $100 increments when you buy and you get the $100 no matter what the bond market does if you hold to maturity. The Gov’t website explains the program fairly decent. You won’t get rich but you can sleep at night. I guess one might miss listening to Jim Bob Cramer and his stupid buttons.

DR DOOM,

Actually, you can set it up to have a $5k IRS tax refund that allows you to buy both a ten grand I Bond direct, and in addition per year, a five grand I Bond straight from your tax refund.

I will do that for next year, assuming things continue on as is. Just have to throw a few extra thousand to federal withholding in December, I reckon.

4.0% is the new .30%

“Folks looking for yield have options now. ”

and why were they ever denied such?

That will be a great question for History to try to answer.

1 year bank GICs in Canada are at 3.55%, and will be higher tomorrow.

This time is a little different. There is always a lag from when a policy changes until you see the impact of that change (dead time).

But this time we are at more than full employment (rare place to start a recession from), so it will take a bigger shock AND more time to see the impact of higher rates. BUT when the impact finally hits it will be harder and deeper than expected because the Fed will have over shot as they will have lost patience in waiting for the expected outcomes.

I’m going to try and time some nice juicy 5-10 year deposits as I suspect inflation will come down quickly once the recession really sets in and the Fed scrambles to reduce rates. Then hopefully I get more than inflation on my savings for a while with minimal risk.

Wow, bitcoin now sitting at just above $21K…talk about a great deceleration. who knows though, dip buyers might still pull last ditch effort to just to bring this one back up a little bit before the inevitable.

If they don’t come out and play, then I can see it breaking $20k barrier then it becomes like Free Fall at Six Flag…

As I have said many times, the Fed does not control rates, it follows the markets. Mortgages are now over 6% and the Fed is belatedly following with what looks to be a .75 raise on Wed.

The stupidity of print and spend, is reaping a whirlwind, and our inept government is steering the ship into the reef. Liberal government economic policy is the gift that keeps on driving the people into poverty.

That may not be a bad thing though. A little real economic pain may be just what the country needs to pull its collective heads out of its collective backsides and realize we need to get out government under control.

“Yeah, it’s much better to put your faith in the Corporations….they are more honest because they have a higher calling”

-John Calvin

9% mortgages, woohoo!