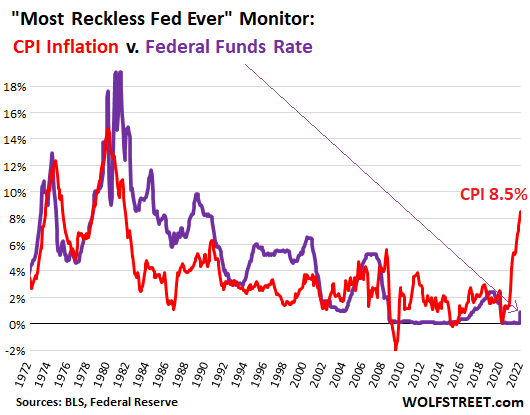

Most Reckless Fed Ever on the move finally, biggest rate hike since 2000, QT next, but too little too late.

By Wolf Richter for WOLF STREET.

“The Committee is highly attentive to inflation risks,” the statement from the Fed’s policy committee said today, adding to its inflation concerns the lockdowns in China that “are likely to exacerbate supply chain disruptions.”

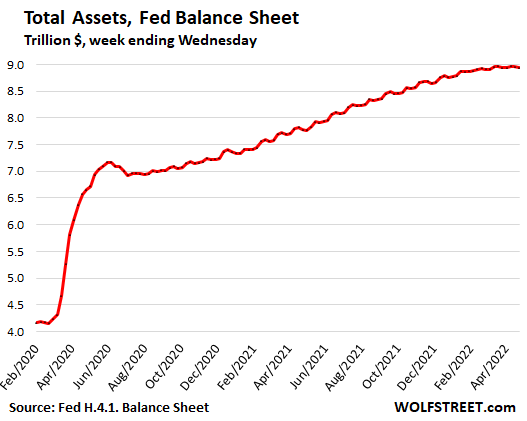

Nowhere in the statement does the Fed explain that the raging inflation followed $4.6 trillion in money-printing in two years that unleashed all kinds of craziness, including in the markets. But that party is over.

“Soft or softish landing” for the economy. Markets on their own.

Tightening might be “unpleasant,” Fed Chair Jerome Powell said, but labor markets are very strong, and the balance sheets of consumers and businesses are solid, and they can handle higher rates, and “we have a good chance to have a soft or softish landing,” he said. “The economy is strong and is well-positioned to handle tighter monetary policy,” he said.

He was speaking of the economy – employment, GDP, etc. – and not the financial markets, which are on their own and can figure out their own landing amid higher rates and QT.

Fed hiked all policy rates by 50 basis points, most hawkish move since 2000:

- Its federal funds rate target to a range of 0.75% to 1.0%.

- The interest it pays the banks on reserves, to 0.9%.

- The interest it charges on overnight Repos, to 1.0%.

- The interest it pays on overnight Reverse Repos (RRPs), to 0.8%.

- The primary credit rate it charges banks, to 1.0%.

How and when Quantitative Tightening (QT) kicks off.

QT starts on June 1. The whole thing is going to take place in a “predictable manner” by letting maturing securities roll off the balance sheet, subject to “caps.”

During the phase-in period in June, July, and August, the Fed’s securities holdings will drop by $47.5 billion per month: $30 billion in Treasuries and $17.5 billion in MBS. Reductions will come from maturing securities being redeemed, and from pass-through principal payments for MBS.

The full-speed period begins in September when the Fed’s securities holdings will be allowed to drop by $95 billion a month, with the “caps” set for Treasury securities at $60 billion and for MBS at $35 billion.

There were no surprises. This was largely spelled out in the minutes of the last meeting. And this is how this Fed will continue to operate: everything will be telegraphed well in advance, and there will be no surprises.

Powell takes 75-basis-point hike off the table for next meeting, puts 50-basis-point hikes (plural) on the table.

During the press conference, Powell said that a 75-basis-point hike “isn’t something the FOMC is actively considering,” but “there is a broad sense on the committee that additional 50 basis point increases should be on the table at the next couple of meetings.”

So 50 basis points at the June 14-15 meeting and 50 basis points at the July 26-27 meeting would bring the federal funds rate target to a range of 1.75% to 2.0% by the end of July. Then there would be further rate hikes.

We may get the “softish landing” and keep the inflation.

Powell was confident that these and more rate hikes, up to “neutral,” whatever rate that might be, would bring down inflation without causing a recession – the “soft or softish landing.”

He might be right about the softish landing: The rate hike path lined out to “neutral” might not cause a recession, given the huge excesses in the economy, the huge demand that has created shortages of all kinds, including labor shortages.

If the Fed considers “neutral” 3%, and inflation is 8.5%, then this neutral is still stimulative, and it will likely not cause a recession though it might take some of the excesses out of the financial markets and lower inflation pressures somewhat, without actually getting inflation back down. So, look mom, no recession!

Yeah but… inflation will then still be raging. This type of inflation cannot be brought down by short-term policy rates of 3%. So we may get the “softish landing” but keep the inflation.

Trying to slow demand via higher interest rates.

Monetary policy attempts to impact demand via the mechanism of interest rates, particularly long-term interest rates that would increase the costs of borrowing for consumers and businesses.

Higher costs of borrowing will make it more difficult for some consumers and businesses to borrow, or too costly, and they might not buy what they could have otherwise bought, which would reduce sales for companies – some might feel it more than others.

Credit tightening also tends to push zombie companies, that were held upright by yield chasing investors, off the cliff into default and a debt restructuring, which could get rough for stockholders who usually end up with nothing or nearly nothing in a debt restructuring.

And the Fed knows that falling asset prices are likely to lower inflationary pressures because asset holders who’re getting slapped around in this environment will eventually spend less and might forgo that $100,000 pickup truck or home remodel job, which would take some pressure off the shortages.

Classic bear-market rally powered by short-covering.

During the last 90 minutes of trading, after Powell took the 75-basis-point hike at the next meeting took off the table, stocks spiked by around 3% amid panic-buying by speculators trying to cover their short positions.

Still the Most Reckless Fed Ever, pouring fuel on the fire.

The Fed’s target range for the federal funds rate is now between 0.75% and 1.0%. The effective federal funds (EFFR) rate, which reflects actual trading in the federal funds market, is normally close to the midpoint of the target range. With the Fed’s new target range, the EFFR will be somewhere near 0.87% going forward.

But CPI inflation is now 8.54%, and the “real” EFFR is now a negative 7.67%, which represents the amount by which the Fed has fallen behind, and it’s unprecedented. OK, lots of stuff is “unprecedented” in our crazy times, but this sticks out, and it means that the Fed continues to pour fuel on the raging inflation fire, which makes it the Most Reckless Fed Ever.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

At this point I think higher gas prices will do more to tame demand/inflation than the Fed. It is hard to get rid of your gas guzzler… and those gas prices take money out of your wallet that you could buy other things with.

People cannot cut necessities. The bottom 50% are already buying lowest priced factory made junk food. We cant expect them to start going hungry.

Some will say that the bottom 50% did not work hard or were pure dumb and this is just Karma.

To them, I would say that read Tolstoy’s writings where he realized that all he achieved could only be because he was born smarter than others. He then set on the path to push himself to do more than just benefiting from his smartness. He worked hard to not benefit from what he was born with but to use it for the greater good. We chose the wrong leaders!

And soon, perhaps, our leaders will no longer allow us to choose them.

They already don’t.

I doubt that we have any real choices of leaders for a long time now. The major parties are just two wings of the same bird. Their financial, foreign and other polices are all pretty much aligned and all heading in the same direction. Just that some progresses faster than others. Otherwise no difference at all. Look at the 2008 situation, the burst that was supposed to correct all the malinvestments was prevented from the top from both sides against the wishes of 90% of the voters from both sides.

We have two full blown anti labor fascist parties in the USA. Just one of them pretends it’s not.

The oncoming elections may be decided by “votes” or “pitchforks”!

That chart has Vietnam War costs/profits, then deficit spending/de-reg/union-busting/monopolies, then QE written all over it.

So, one copy went to my WS folder, one to my Vietnam folder, one to my Reagan folder, and one to my GFC folder.

All I have to do now is think the “policy” timeline through. Maybe I should make a “9-11 wars” and dot-com bust folder, too.

A very good chart, thanks.

Ever since Carter tried to do the obviously right thing and got shit canned for it, our leaders (public and private) have been playing “get in and get out with minimal personal damage and max wealth”.

We went from the Ugly American to the Stupid American….not sure which is worse…..guess both are bad.

Bush 1 was the last (albeit small) bit of Carter-like integrity seen at public higher levels…Private leadership is a wasteland, human dregs :-(

I win.

It’s ironic how some politicians vilified oil and now oil could cause their political demise.

Oil was vilified for the exact reason it is hurting now. Some countries use it as a weapon, for geopolitics and war, and have oil importing countries on their knees.

along with humanity.

You can think that way in the US about every essential consumption good: housing, higher Ed, healthcare, energy, childcare.

They will be the determinants of discretionary consumption for the average household. Americans will keep on saving almost nothing on average. Meaning they aren’t working for themselves, they are working to keep the status quo of a system designed against them.

Those on fixed incomes are sacrificed to satisfy the top 1%.

Negative real rates means the top 1% is still subsidized to borrow and acquire even a bigger share. Politicians of either team and Powell will get their leashes yanked hard if not.

This was always a possible path of this system. It has veered closer and further from this. Plutocrats have all the cards this time. Any leader deviating from this will be excoriated in the press. And frankly, will be proposing some different kind of madness. Like Powell’s Fed, far enough down some paths, there are no good alternatives.

The alternative is moving to LCOL areas, work remotely and tell the NIMBYs each time they want you to pay for their bloated healthcare bills: “sure! Right after you fix access to affordable housing”.

Meaning, solutions are only possible at the individual level.

Exactly. There are good reasons (for the .1%) the Fed is still doing what it did for over 10 years, but with a little fluff of misdirecting talk.

Did people ditch the gas guzzling SUVs and trucks in the last massive gas price runup that topped out in summer ’08?

It is much more that gas friends.

Everything is up and up way more than the figures presented monthly. They also don’t reflect the inflation of price vs volume. A pound a few years ago is now 14 ounces. A 35 pound bag of dog food went form that to 33 lbs to now 30 lbs. Price per bag is up too abut 25 to 30 percent. Just a simple example of the carnage that is cutting the life out of budgets all across the nation. Consumers are drained so look for the inevitable recession as the summer approaches and worse when the fall miserable harvest, and its huge costs come home to roost.

“If the Fed considers “neutral” 3%, and inflation is 8.5%, then this neutral is still stimulative, and it will likely not cause a recession though it might take some of the excesses out of the financial markets and lower inflation pressures somewhat, without actually getting inflation back down. So, look mom, no recession!

Yeah but… inflation will then still be raging. This type of inflation cannot be brought down by short-term policy rates of 3%. So we may get the “softish landing” but keep the inflation.”

Did anybody bother to ask this psychopath to explain how he intends to stop inflation without getting in front of it?

Inflation is the most Brutal form of tax as it hits the poor the most. That last chart clearly shows that Fed is not interested in controlling inflation.

The poor don’t turn out at the polls, so they kinda are getting what they pay for.

The poor don’t turn out at the polls so we elect sociopaths? If our elected officials and other powerful leaders only care about themselves, their families, and perhaps any friends; we are screwed.

The masses will pay for our excesses, they always do, but hopefully not enough to drive them to serfdom.

We’re still under the impression that voting makes a difference? Both parties work for the same master

Short term candy to keep the poor quiet in 2020 (spending what we did not have, or rather borrowing against future inflation) was part of a solution but now definitely part of the problem. This system (by its mass voters) fires anyone who proposes sacrifice, and hires folks who promise candy. So goes the Republic. The poor seem to be becoming synonymous with “the bottom 50 percent.” See their “wealth” in the charts around here.

Plenty of poor folks are bad risk managers. This is true alongside the policies and environment they arise in. They are duped and manipulated by the major parties and firms hawking childish escapist trash to them. It has a 1930s Europe feel.

“The poor don’t turn out at the polls, so they kinda are getting what they pay for.”

Not with mail-in ballots during pandemics which are harvested en masse and placed in ballot boxes for them. We then get simple, but wrong, answers from their preferred pols who are even worse than the “conservative” posers in the other half of the UniParty.

So, even though we peons are scr*wed not matter who we vote for, votes from very low information voters is even worse.

But if things get bad enough, the do show up with pitchforks.

Unfortunately we don’t vote for Fed chair or Fed policy

> Inflation is the most Brutal form of tax as it hits the poor the most.

It hits those on fixed income the worst, along with the disabled and the sick.

The poor who are healthy can work, even when old.

It hits working people because their income doesn’t keep up with inflation, and the purchasing power of their labor declines, and their standard of living declines, though their pay goes up. Inflation is insidious for working people.

> It hits working people because their income doesn’t keep up with inflation, and the purchasing power of their labor declines, and their standard of living declines, though their pay goes up. Inflation is insidious for working people.

It depends on what you consume. I don’t consume the three items with the higher inflation: housing, healthcare and higher education, and now grow my own food as well.

I’ve also been enjoying DEflation for years thanks to remove work. The more resourceful you are, the better. You can actually benefit from inflation as well.

It is also the “tax” that never reduces. Wages take forever to catch up if they ever do, and those on fixed or limited incomes are permanently damaged, and taken out of the ranks of consumers.

Something is missing.

Most are saying inflation is more like 15%, or double what the Government is claiming. So, inflation is 7 – 8% higher than the Gov figure?

OK, lets go with that. This means to me, that when the Gov said the inflation was 2% it really was 7-8% higher, at 9-10%?

This would explain why prices are higher than the last 10 years, last 20 years, last 30 when supposedly inflation was low? Obviously it wasn’t.

Where am I wrong?

This tells me that inflation has been around 10% per year for decades. It would account for gas going from 34 cents a gallon, when I drove my Pontiac Gran Prix, 2-door tank, off to college, versus the $4.50 I pay today?

“… inflation has been around 10% per year for decades.”

Do the basic compounding math. If inflation is 10% a year for 7 years, your income would need to DOUBLE over those 7 years to maintain your standard of living. We might be there now. But we weren’t there in the prior decade. That’s total nonsense, designed for people who can’t do compounding math.

Wolf,

off the topic, or can be related too,

Should I sell my airline stocks? (AAL, DAL, LUV, ALK) or wait for rebound due to the travel season?

I am getting worried now since everything goes heck together , talking about the entire stock market

Well I certainly feel like my standard of living has dropped by about half for each reelected U.S. president.

I would not be able to send my (hypothetical) kids to private school today.

I would not be able to afford college by working between classes today.

I would not be able to afford a house today (at least not until I had maybe enough retirement saved up to pay for the down payment).

I would not be able to pay my doctor or hospital bills out of pocket today, even for relatively minor treatment.

I would find it implausible to buy a new car today, at least in cash (although I’ll admit the cars last much longer than back then).

I would not be able to run the household (with children) on a single person’s income today. And that’s a big 50% cut in standard of living right there.

It may not show up in “the numbers” but our lifestyle has diminished greatly since…well, anytime in the (with anyone still living) past.

That is certainly not the end of the list, but maybe some retrospection on what middle-class lifestyles in the past provided for without so much government “help”.

How much would my income have had to go up over the past 10 years to buy the same home?

Let’s factor in understated inflation on homes, at the real rate.

Then let’s factor in the marginal tax rate of my higher salary.

Then let’s admit that you have to *more than double* your income to live in the same home as ten years ago with the same standard of living.

End the age apartheid. Crash housing.

Home prices are asset prices, subject to big declines. See all my housing charts. Homes are not consumption items because you don’t consume a home and their value doesn’t go to zero (normally). Homes are assets that you can sell. So you’re talking about asset price inflation, not consumer price inflation.

Crunchy,

You’ve added another variable that is very important to keep in mind. Living standards are a reflection of both consumer price inflation and wage inflation. If wage inflation doesn’t keep up, living standards decline without necessarily having a high consumer price inflation environment.

In 1992 I worked at a union grocery store in Santa Monica and was paid $14.70 per hour as a journeyman clerk. Out of nostalgia I continue to follow the industry. A new three year contract was just approved in March 2022 raising the top pay from $22.50 to $26.75 over 3 years for my former job classification. After going up only 53% over 30 years, it is now going up 19% in 3 years. Obviously, this is a job where living standards have gone backwards, but it also confirms that the notion of 10% price inflation (or even 5%) for decades is absurd. Inflation over the period was relatively low, but the raises were even lower. Thus, the standard of living for grocery workers declined significantly even when price inflation was relatively benign.

Going forward, the 6%+ average increase for the next three years tells me that inflation is unlikely to abate anytime soon. Given the history of the past 30 years, that is a massive increase and reflects the “inflationary mindset” (as Wolf says) on the wage side of the equation. It is the failure of wages to keep pace with even relatively low consumer price increases that have devastated many workers’ standard of living for several decades. Workers may get better raises going forward, but I doubt it keeps up with inflation.

No I’m not talking about asset price inflation.

The primary cost of a home in urban areas is the land. The location value. This value is created by society and the rent on the unimproved value of land should be taxed and shared among all.

Instead we are forced to pay more now than 20 years ago in labour time for this land, which is not progress, it is a regression.

We have to work longer to exist in exactly the same house as 20 years back. Labour time is worth far, far less now. That is inflation.

What clearer definition of inflation could we ever have than having to work twice as long for the same thing?

The rate of inflation can’t be judged accurately by a few items the government arbitrarily chooses to measure.

I actually agree with you. The magic was to average in the highly inflating necessities like health, housing, education with endless, cheap deflated crap from China. Shazam! the average was lower. But the things Americans need have been out of control for a long time.

The American middle class lifestyle has been plummeting for 20 years. Covered up by ever more debt. Most “middle class” Americans today are just closet lower class.

> The American middle class lifestyle has been plummeting for 20 years. Covered up by ever more debt. Most “middle class” Americans today are just closet lower class.

Agreed. Does it matter in the big scheme of things when the environment in the next 2-3 decades might be unlivable anyway? The permafrost is melting FAST.

Mish over at Mish Talk substitutes the Case-Shiller Index for home price increases for rent & OER, and he comes up with inflation at about 11%.

Even that seems low, given my chicken sausage at ALDI has gone up 67% in one year and the value of my home has gone up at least 25%.

The adjustments made to CPI by BLS from 1983 to 1998 intentionally underestimate inflation to keep SS COLA increases from being real world.

Jay,

I can’t wait for the day that housing drops and the Case-Shiller drops for four years in a row, like it did between 2006 and 2011, and then Mish will have to show low or even negative CPI, meaning CPI DEFLATION, based on this model, while CPI = 8%, hahahaha.

I bet you that Mish genius will bury this math when the Case-Shiller starts to decline and then turns negative year-over-year hahahaha

If the Case-Shiller had been used instead of the “Homeowners equivalent rent” index, CPI would have been negative (DEFLATION) from 2007 through 2011. Is Mish ready for this?

Wolf,

I’ve always liked this chart. It clearly showed the housing bottom in 2012. The Home Price Index returned to the CPI Owners equivalent of rent. The bottom was when they intersected.

Currently the CPI owners equivalent of rent in rising with inflation. The Home Price Index is still rising but slower.

When will they intersect again? I believe that is the optimal time to buy a house.

Will inflation continue to rise slowly while the home index flattens? That would be a safer to prevent a spiraling 2008 housing crisis again with massive foreclosures.

Wolf, same sentiment here, there’s nothing I would enjoy seeing than for these prideful house humping cheerleaders to eat a giant serving of humble pie…

Although in their typical rationalization, they will look at it as minor setback and continue to sing the gospel of housing goes up forever…

JPowell is, more than anything, trying to construct a soft landing for residential real estate. The FED is slow poking MBS runoffs in hopes that 30FRM don’t exceed 6% in the near-term. That remains to be seen with the FED owning close to 60% of government backed mortgages.

As homes sales continue to tank through the summer, the MBS runoff will not take off meaningfully. Runoff means home sales payoff mortgages, lowering the FEDs MBS holdings. I just don’t see enough government financed housing activity by September to fully support $35B in MBS. So, they’re going to have to start selling MBS outright. By fall, we’ll be entering into a multi-year period where families are going to start hunkering down, not moving as easily, change jobs as much and will reduce overall spending.

Selling MBS will put pressure on higher mortgage rates, meaning investors will have to scoop up the excess along with the treasuries and new government debt.

I sincerely hope by September it all starts to go sideways and we’re looking at 30FRM north of 7%. That becomes the doomsday scenario which pushes us towards a real housing downturn in 2023 – 24 of at least 20%. Anything less than 20% will be a soft-landing win for JPowell.

Jay-

Good post

Are you including the returns of principal — that occur each month in every mortgage payment — in your computations.

I don’t know the ratio of principal/payment on the Fed’s massive MBS portfolio, but would be interested to know how significant it is versus the $95B targeted reduction.

The fed is clueless just like we are, just like wall street and just like “experts” at banks. They are HOPING to tap the brakes as many times as it takes to slow the economy just a little, but enough to chill demand and inflation. When you are on ice and you tap the brakes it is very easy to cause a skid.

That is the hope. But it never worked in history. Once inflation starts it doesn’t stop until there is a bad recession. Just take out your oiji board and ask Paul Volcker.

I still say these small steps are just jawboning. Nothing “real” will happen until after the election. The dems are putting a lot of pressure on Jay, and he would like another term. He won’t get it if he causes bad economic news between now and November, which causes a big shift to the red team.

If Powell is handing out candy (sub zero cost credit) to the rich, the red team then wins, by promising the poor (white voters) it will crush the “correct” poor groups. Poor whites will stream to a guy who will make them FEEL like they are not on the bottom and in decline. Everybody is trying to extract something for free (low cost), and the lowest rung will eat the losses. Discipline will be harshly restored among the poor, with help from the cultural moves exemplified in the Supreme Court majority now: heavy on religion and abstention. Expectations will be adjusted.

Remember which politician said it’s the economy,

The Fed is not clueless, they are dishonest. The only issue Powell is partly honest about is that they “have all the tools to contain inflation”. He just missed to say that having the tools and properly using them are two very different matters. The rest is old tired BS.

Wolf: “the Fed’s securities holdings will drop by $47.5 billion per month: $30 billion in Treasuries and $17.5 billion in MBS, Reductions will come from maturing securities being redeemed”

Those who understand the bond market know full well that this isn’t going to reduce inflation.

Tom Bond,

“Those who understand the bond market know full well that this isn’t going to reduce inflation.”

Those who understand the bond market know that QT will raise long-term interest rates (and even the threat of doing it raises long-term interest rates, as we’re seeing), just like QE pushed down long-term interest rates. That’s the reason for QE and for QT in the first place. So higher long-term interest rates hit the real economy, housing, business borrowing, etc., and asset prices, and demand. That’s why central banks are trying to manipulate long term interest rates. And DEMAND is a huge factor in inflation. There are also psychological aspects to inflation – the “inflationary mindset,” as I call it – that higher long-term interest rates will impact.

Personally, I doubt that what Powell does or doesn’t do at this late date, will not tame consumer inflation, and the underlying inflated costs that have yet to percolate into the consumer market.

One of the major components, oil, a base for so much of our products and almost all of the transportation of goods and services, is not relenting on its path as we produce less of it for world markets.

At 8.5% inflation and deeply negative “real” interest rates, the majority of the population’s living standards will decline and they will become poorer if the mania is over.

Avoiding a statistical recession because GDP is (supposedly) increasing doesn’t change this reality.

Since when has monetary policy been so reactive.

The idea should always to be get interest rates above inflation quickly when it is rising.

It is like they are doing all they can to not tackle inflation

Almost like a plan.

Now guess where this end…

With Everybody having a FedCard with Digital Currency (and no paper money, Gold or Silver).

The dream of the bankers since, perhaps, 1450.

Well, maybe the bankers will notice there is a catch. With central bank digital currency there is only one bank.

“One Bank to rule them all, One Bank to find them,

One Bank to bring them all and in the darkness bind them.”

Modified from JRRT

Didn’t you hear Biden bragging about deficit reduction ,inflation is paying for iy

Hopefully, not with a very large “bang” heard all around the world.

There goes my real estate. All near major Navy bases. I can open a glass shards store. Until the ocean rises.

The Fed has never done that in history. Go back and look at every single 2 year yield, when it reached that rate, and how the Fed reacted to it every single time. The Fed is taking their rates to where the 2 year yield is now, and when it hits that, there will be a full blown recession. It’s inevitable, and the landing is going to be very very hard. As in all stocks in the indexes will be down at least 60% from their all time recent highs before year end 2022. You will see one last new peak in the indexes, before that crash. It will be the most harrowing crash anyone alive today has ever been through. The Fed saying it won’t do .75 hike ensures such a crash. All of the rate increases from here are not only futile, but they are literally adding more fuel to the raging inflation inferno. CPI is hot, but wait until you see where it’s at by end of summer. You will see readings well north of 10. When you hit 10%, that is hyperinflation, and once that takes root, there is no reigning it in. Forget about what Volker did. Back then the US had virtually no debt. What he did cannot ever be done again. So basically the US dollar is now in a rapid spiral downward, and it’s value will be halved in the next 24 months, this is a currency reset folks. The Fed has baked that into the cake. You think the Dow market is at 33000. Nope. It’s really now the equivalent of half that. Because that is where the dollar is heading. Your buying power is going to be halved folks, in 2 years. Mark these words.

Neither Volcker nor a recession curbed wage inflation in the 80s. The US imported massive deflation from China at the expense of leaving its working class behind. Who’s going to provide the deflation now, the Moon?

The outsourcing of labor was not a conspiracy. When, on a phone call with the linen buyer from Walmart, the CEO of Fieldcrest Cannon was told that he’d have to cut his prices – to negative profitability – or lose the Walmart business, he folded. His company lost 35% of their business on that phone call. And that began the end of local manufacturing of textiles.

Multiple that by every industry, and you get the wholesale outsourcing of goods to Asian and other low labor cost manufacturers. Companies could not compete carrying local/US laborers. So labor-intense work went overseas. It was the result of the success of low cost products being sold to the lower classes here by Walmart and then online sellers. From Walmart, it went to all other retail competitors who had to price match. As we bought cheaper goods, laborers in the U S got the shaft.

I remember when a TV reporter from one of the major networks was at a UAW factory site and said that more than half the cars in the employee parking lot were Japanese cars (this was back in the 80s), just before the union went on strike.

This wasn’t a corporate conspiracy. This wasn’t a conspiracy of shoppers buying cheap goods. This was an inevitability of the “free market”. Without an industrial policy – which would gag Libertarians and the ultra-wealthy oligarchs – you don’t need to be a genius to know what the outcome would be.

HowNow I was fairly young but tuned in and vividly recall Ross Perot warning of the NAFTA labor outsourcing during the prez debates.

“You implement that NAFTA, the Mexican trade agreement, where they pay people a dollar an hour, have no health care, no retirement, no pollution controls and you’re going to hear a giant sucking sound of jobs being pulled out of this country.”

Boy were they quick to jump on that sound bite and dismiss him as crazy, but he called it good.

Lily Von Schtupp — if you can find it, James Goldsmith also warned about the impact of importing wage deflation via the GATT in “The Trap”

“It is like they are doing all they can to not tackle inflation”

That’s how you do it- Do nothing until the midterms. Sacrifice the country (again) for political gain. Let inflation rage to protect the rich. This is business as usual.

It’s all fun and games until the food riots start.

Or soldiers and police start “supplementing” their small and shrinking pay.

After Jan 6th, I think we know who will be doing the rioting.

I think the dataset used to cont to your conclusion suffers from sampling bias.

I’ve been doing this for 27 years professionally. Run a medium-sized family office. Can someone from the irrational exuberance movement explain to me how a hike in interest rates justifies the DJIA up 900 points? I’m not a Buffet disciple but he may’ve nailed it on the head when he recently said [paraphrasing] Wall Street has been a casino for the past two years.

Bear-market rally powered by short-covering. Oldest trick in town. Only in a bear market.

Thanks for your reply. Post GME every move in either direction is attributed to shorts covering or market makers manipulating. I don’t play short squeezes so it’s hard for a dinosaur to decipher when shorts are actually covering anymore.

Inflating the currency will drive up “prices”.

Take a DOW at 30,000 and double the currency.

Dow now 60,000? Value? The same.

In Zimbabwe everybody in the market was a millionaire, or even billionaire. Hell, in Weimar Germany, towards the end of their inflation , the average income was, what, 1 Million Marks a day?

Fun Fact: If a baby were born when Greenspan first introduced that “Irrational Exuberance” term to the world, back in 96, next year that baby would be 27 years old: the exact same number of years that you ran your medium-sized family office!

27 years sure fly by real quick, huh? And for yet more number oddities: Greenspan, the former “Objectivist” and member of Ayn Rand’s “Collective”, also sometime Fed Chair, just turned 96!

Bear market rally followed by beer market rally.

Not today. Stocks kathoomphing 3-4% at the moment.

QQQ reached a top of 117.75 on March 17 2000. Here are the gyrations that followed.

Date Price % Swing # Days % Loss

Date ……… Price ……. % Swing…. # Days ……. % Loss

27-Mar-00 … 117.75 ……. 0.00 ……….. 0 …….. 0.00

14-Apr-00 …. 80.37…….. (31.75) ……. 18 …… (31.75)

01-May-00 …. 95.62…….. 18.97 ……… 17 …… (18.79)

10-May-00 …. 79.75…….. (16.60) …….. 9 …… (32.27)

16-May-00 …. 90.16…….. 13.05 ………. 6 …… (23.43)

23-May-00 …. 74.81…….. (17.03) …….. 7 …… (36.47)

17-Jul-00 …. 101.75…….. 36.01 ……… 55 …… (13.59)

02-Aug-00 …. 86.68…….. (14.81) ……. 16 …… (26.39)

01-Sep-00 … 102.65…….. 18.42 ……… 30 …… (12.82)

10-Oct-00 …. 75.12…….. (26.82) ……. 39 …… (36.20)

20-Oct-00 …. 86.32…….. 14.91 ……… 10 …… (26.69)

30-Oct-00 …. 76.76…….. (11.08) ……. 10 …… (34.81)

03-Nov-00 …. 83.06……… 8.21 ………. 4 …… (29.46)

30-Nov-00 …. 62.98…….. (24.18) ……. 27 …… (46.51)

11-Dec-00 …. 74.37…….. 18.09 ……… 11 …… (36.84)

20-Dec-00 …. 55.73…….. (25.06) …….. 9 …… (52.67)

28-Dec-00 …. 61.56…….. 10.46 ………. 8 …… (47.72)

02-Jan-01 …. 53.43…….. (13.21) …….. 5 …… (54.62)

A lot more ups and down but LOST ANOTHER 62% to

reach final bottom of 20.35

30-Sep-02 …. 20.35 ……. (61.91) …… 636 …….(82.72)

A lot more ups and down but LOST ANOTHER 62% to

reach final bottom of 20.35

30-Sep-02 20.35 (61.91) 636 (82.72)

My apologies for the bad formatting. The 2000 downturn was bad but not horrible for the economy. The stock market viz. the Nasdaq was another story altogether. So was the real estate in certain prime localities in the Bay Area. I was smart enough to cash out of the Nasdaq right at the top, but was still screwed because I went in again when the Nasdaq was again trading at 4000. I dollar cashed averaged a couple of times till I threw in the towel. I was 30+ at that time. Me and my wife both lost our jobs. We had bought a house in Cupertino in September of 2020 and saw it crater in value by 20 percent. It came back to the original price in 2007 but then again cratered and did not see the price I paid till 2016 and 2015. So 15 years of no growth.

Your Nasdaq experience I think is very typical of what happened to a lot of investors and will happen again this time:

People who are lucky enough to get out near the top think that they have an excellent deal to get back in once it dips -20%. They will be adding even more (if they still can) at -30%. Then they get slaughtered when it craters to -70%.

If the bubble is exceptional, the collapse will be exceptional too.

Some people argue that stocks are an inflation hedge, which is true to a point. Suppose inflation stays another year at 8%… Then theoretically stocks are “allowed” to go up by 8%, provided that profit margins stay intact. But profit margins are likely to shrink, because people lose spending power, wages go up, high inflation makes people insecure about the future so people reign in spending, etc.

Also, central banks will then really have to up their game with much higher rates, so bond yields will be much higher. Then stock valuations have to fall to compete with bonds. Also, companies will have to deleverage because debt gets too expensive. This further shrinks profit margins.

Some people argue that in 1920’s Weimar hyperinflation, stocks did OK. That was true, eventually. But stocks first lost about 80%+ of their nominal value during the high inflation year before the high inflation turned into true hyperinflation. Look it up!

Stocks aren’t an inflation hedge. Look at the 1970’s and 1940’s before that.

Earnings rose in the 70’s yet performance was mediocre to terrible. Stocks weren’t in a mania (not even close) the entire time.

Valuations at the 1973 peak prior to a 45% haircut were bargains compared to this mania. The “Nifty 50” which were overpriced weren’t anywhere near as ridiculously overvalued as the most overpriced stocks now. The stocks were also real businesses, as opposed to mostly a bag of hot air.

Balance sheets were rock solid then compared to the stable rags where companies record their results now.

Thank you for the data, Satish!

I also experienced this wild ride back in 2000-2002.

I said several times after large company stock fell 20%, “It can’t go any lower”, so I cautiously bought more which then dropped another 20% before I gave up.

Is this a repeat of 2000?

When the stock market started to drop in early 2019 (Pre-Pandemic), the Fed lowered rates to near zero and prevented a crash and resumed the bubble inflation. There was not the inflation like we have today.

Pension funds, 401K’s, and 1% wealth are mostly all in stocks.

Most of the voters have some or all of these.

Will the Fed jump in to save us from another DotCom Bubble that affects the wealth of the majority of the voters?

Who will be sacrificed? The wealthy and upper middle class with retirement accounts? The middle class and poor who are severely affected by inflation? Or both?

The good news is that current homeowner and stockholders who purchased before 2019 have a huge bubble buffer to prevent them from becoming underwater. They will likely not be destitute like some who went all-in with tech stocks back in 1999 or houses in 2006.

Thank you for posting that question. It reminded me of my stock trading days.

Very often on fed days the market will do the opposite of what you’d expect. But then the next day, watch out for the reversal (doing what you originally expected). Let’s see if that happens tomorrow. I think I’m about to feel sorry for people who bought this dip.

You have to do risk management to ensure you don’t have a wipeout in a recession because multiple bad things tend to happen. Current setup could play out like this:

1. Paper assets drop 50%

2. No buyers for your home

3. Inflation runs at 8%

4. You lose your job.

You can’t be living on the edge and survive a severe recession. Got to have a stash of cash to see you through til things stabilize. Cash is a waste 95% of the time, but it’s insurance against a severe recession.

Loss in cash value is the insurance premium. Steep until the day you need it and have it.

I wonder about complex and underfunded pensions too. Could be some nasty awakenings for comfy folks.

#4 can be especially catastrophic. Loss of a job means loss of income, loss of health insurance and whatever other benefits you had with your job.

Yes, having survived 2000 and 2008, having a stash of cash to survive 2-3 years is my plan.

Goals:

1) Buffer if I lose my job. I can likely get some job within this timeframe to cover some income and health insurance.

2) To prevent losing my house and all of the equity in it. Despite being underwater for a year in 2009, it was better to keep the house using the cash than to walk away and lose it.

I missed out on many stock and house investments in 2012 so having extra cash would help not to miss out again. I was bad with timing in 2000 and jumped in too soon. I was bad with timing in 2012 and didn’t jump in at all.

OS,

Agree with you entirely but the really bad thing that has happened over the last 20-25 years are the successive meteor strikes followed by long slow crawls out of the impact craters.

1) 2000-2002 Internet implosion

2) 2003-2008 Very slow jobs growth due to China and DC genius

3) 2009-2014 Housing implosion (thanks, ZIRP 1.0)

4) 2015-2019 Somewhat faster jobs recovery (maybe, but details…)

5) 2020-2022 Pandemic

6) 2022 Decades of ZIRP’ing finally offset China price goods deflation to re-introduce America to late 1970’s

If you were unlucky enough to get nailed by every negative event above, that would have needed to be a big old pile of cash in 1999.

You are 100% right about cash = safety, I just wanted to make the broader point that a nation in serious decline is going to drag a lot of the just (along with the unjust) alike down with it.

You are correct.

As of last week, I have cash equivalent to one years expenses.

It is an awesome feeling.

Yes. I am losing 18% this year due to inflation, but I am adding 18% of this cash reserve as we speak.

This does not include the Gold and Silver Coins.

Only a very low proportion are prepared for a worse and inflationary version of the GFC.

Excellent call so far!

Rally is based on what they didn’t do but that was pretty much programmed into the narrative. The strong hands haven’t sold along with the crowd. Some like Buffett are buying and hedge funds are making a comeback. Large blocks of money are trying to get into, or out of the market at opportune moments. Sometimes the market is just too small to accommodate them. The monetary base has tripled in just a few years. The dollars spending power is down, which givers vendors incredible leverage. Most reckless Fed ever and with high dollar value stocks most retail investors are priced out of the options market.

I’m amazed that Democratic politicians think that extending the pain of hot-running inflation into 2024 will be better for them on Election Day 2024 than ending this mess in 2022 or 2023. Perhaps they need more time to unload their overpriced assets.

The consensus in the Biden administration is they think high inflation with a very hot job market is less politically damaging than high unemployment. That’s why they’ve always erred on the side of overstimulating the economy.

The midterms will tell whether or not voters agree. I’m just praying for a clean referendum on the economy this November, without other distractions.

Too late for that.

I feel like that might have been true last year but the administration’s thinking did change fundamentally by Feb. 2022–the Cabinet and top advisers came to a general understanding that sustained high inflation was much more harmful to the Dems than a short, sharp recession, and Biden himself singled out inflation as the biggest threat in his SotU speech. Yellen has turned hawkish and that pressure is a big reason why even Lael Brainerd, once the most dovish member of the Fed, has turned hawkish and JPow himself is invoking Paul Volcker as a model now. (Remember there was talk for a while about the Fed backing off QT and interest rates hikes entirely in May, or keeping at 0.25–but they’re absolutely moving more hawkishly as Wolf is pointing out here.)

I have some relatives who do canvassing for Dems and they agree the consensus and even the core strategy have changed totally, in part since working-class Dems esp are getting angrier about the financial hits from inflation, and some of the crime and social unrest in the US are being linked to it. So the thinking has shifted into a need for tougher inflation-fighting, with a growing acceptance that it’s better to have a controlled recession–even if a deep and painful one–that we exit out of, to pop the bubbles and stabilize prices, which the Dem base is demanding. This was Brainerd’s own reasoning in switching to a more hawkish stance.

I’m guessing the government’s strategy is to tighten monetary policy and loosen fiscal policy, maybe not to the downpour of “free” money during the pandemic but at a higher level than before March 2020.

I’m taking the “under” on any claim of avoiding a recession, expect it will be worse than most people anticipate and that this “can kicking” exercise (which is exactly what it is) will create another set of “unanticipated” economic problems later, again.

I agree with your comments on social “blowback”. It’s coming. The country is so divided (balkanized) even now and there has been noticeable social and economic decay over the last 50+ years.

The country is in a very poor position to handle a recession (at any time) given the actually awful long-term fundamentals, but this doesn’t mean it won’t get one anyway.

No, there isn’t something for nothing, ever.

The majority of Americans are destined to become poorer or a lot poorer once the end of this mania is confirmed.

“financial hits from inflation, and some of the crime and social unrest in the US are being linked to it.”

Wow, they are finally getting that clue. That was the first thing I thought of when seeing that flash mob robberies were targeting both jewelry and baby diapers.. Not surprising. Baby needs the rent paid..

Yeah, everyone is blaming the democrats for high inflation. Even the democrats.

Kind of makes me wonder if Powel is really still working for republicans..

Jackson y: “Clean referendum on the economy”

Why? Is the economy the only thing that matters in any country?

Economy is important, however, we need to be able to move forward as a society on all fronts.

As individual families, we watch our finances. But we pay attention to all other things that impact on the well-being of all our family memebers.

Why should the country work differently?

Families (functional ones anyway) have a shared purpose.

The US is a dysfunctional balkanized society. It’s not a nation, it’s a political entity. Nationhood and nationalism imply a mostly shared culture or at least enough of one where its members have enough in common to have a reason for “cohabitation”. The US doesn’t have that, not even close.

For a further analysis of what I am talking about, read the section in “The Sovereign Individual” by Davidson and Reese-Mogg titled “bogus kinship” and the related concept of “coefficient of relatedness”. That’s what you are inferring in your post.

Bogus kinship is the pretense of equating citizenship or residency with family. This is the idiotic premise behind the inferred expectation that taxpayers are supposed to volunteer to put the interests of people they don’t even know and will never meet over their actual kin (and community). You’re never going to hear this absurd thinking expressed explicitly but that’s the primary idea behind the supposed imaginary “social contract”.

From the standpoint of the state, the “coefficient of relatedness” is always 1. In reality, it’s either at or closer to a big fat ZERO.

The idea was bad enough even when American society was a lot more cohesive in the past. Now, it’s supposed to apply to a population of over 330MM, the majority with little if anything in common, other than sharing the same geography.

No, this doesn’t mean I believe in “me first” for everything. It means exactly what I wrote.

Augustus Frost: You wrote:

(1) “This is the idiotic premise behind the inferred expectation that taxpayers are supposed to volunteer to put the interests of people they don’t even know…”

Ok, I understand this extreme position.

(2) “No, this doesn’t mean I believe in “me first” for everything.”

I find this contradictory with (1) where you called it an “idiotic premise”.

This is the everyday struggle human beings face. Whether to stand alone and move forward in their own self interests OR whether to act in everyone’s interests.

Here is a kernel of an answer: Though all of us are very different, almost all of us would rush to help a stranger who has fallen down. Why? There is absolutely no self interest. In fact, there may be some costs of efforts, physical strain, distraction from our own task, and time. We still do it because there is an innate human bond.

So the answer is not to go in the direction of kinship=0 because it goes against our basic human tendencies. And we can do it only for ourselves without worrying about what the broader society is doing. That is completely irrelevant because Life is a personal journey…!

Too bad a “major distraction” is already leaked by Politico. This coming election would not be a pure referendum on economics. Perhaps that is the reason why they “leaked” the document in the first place, to divert attention from the economic front and to galvanize a certain voting bloc for the upcoming midterm.

Possibly but it was going to be announced before there midterms anyway.

Confused: Hmm…I thought the Fed was independent…? Perhaps you can clarify.

On a side note, Warren Buffett during their recent AGM said that “Powell was a hero”. I take it to mean Buffett was appreciative of Powell keeping the economy afloat during Covid times.

If all it takes is keeping interest rates down and doing QE forever, I think most everyone on this site can do it without blinking an eye.

Guess it doesn’t take much to be a “hero” as long as you are taking care of the 1% while shafting everyone else.

There is nothing heroic about running up a massive bill that somebody will have to deal with in the future.

The stupid thing is that most of the excesses have been committed when there really was no justification for them. Of course in the darkest days of the GFC in 2008-2009, the Fed had to step in. But in 2010 it was safe to start (and keep) unwinding these excesses. A similar thing can be said of March 2020.

The ECB is even more stupid. They introduced negative rates in 2015(?) and still maintaining them to this day! And buying massive amounts of public and private debt each month (at negative yields!). But the economy was doing fine at the time. They just thought 1.5% CPI inflation was “too low”. It’s beyond ridiculous and their will be a high price to pay for this nonsense.

YuShan: I agree, I see things the same way as you. That is why I put the word hero in quotes.

But it speaks to the short-term selfish outlook and the lack of wisdom on the part of Buffett who has been forever praised as the “Oracle of Omaha” and an investment wizard. He and the other billionaires have been the beneficiaries in this financial la-la-land over the last 40-50 years. And I see neither wisdom nor heroism on their part at all. On the contrary, I see selfishness, greed, and hypocrisy.

Hi, Sean Shasta,

The Fed is supposed to be independent just as the U.S. Supreme Court is supposed to be nonpartisan. I wasn’t suggesting that President Biden should browbeat Fed Chair Powell the way Trump did, but the Democrats have blamed inflation on greedy corporations, a broken supply chain, Vladimir Putin, and the Wicked Witch of the West. They could say that the Fed has suppressed long-term interest rates far too long. Better still, they can take away the Fed’s temporary authority to use QE. Moreover, when selecting new members for the Fed’s Board, President Biden could have tried to determine whether the candidates understand finance or live in the theoretical world of an economics textbook.

Hi Confused:

“The Fed is supposed to be independent just as the U.S. Supreme Court is supposed to be nonpartisan. I wasn’t suggesting that President Biden should browbeat Fed Chair Powell the way Trump did, but the Democrats have blamed inflation on greedy corporations, a broken supply chain, Vladimir Putin, and the Wicked Witch of the West. They could say that the Fed has suppressed long-term interest rates far too long. Better still, they can take away the Fed’s temporary authority to use QE. Moreover, when selecting new members for the Fed’s Board, President Biden could have tried to determine whether the candidates understand finance or live in the theoretical world of an economics textbook.”

==================

Neither party is going to do anything to end the party!

I am learning that both the parties are on the same side – and both parties are under the control of the bankers, billionaires, and the 1 percenters. As George Carlin puts it – “It is a club and you ain’t in it”.

Almost all the politicians on both sides, if not all of them, are extremely wealthy. So they are not going to let their wealth trickle down at all if they can help it.

To paraphrase George Carlin – the 2-party system is just an illusion, we are being played and we don’t even know it.

And I am not being cynical at all. Just realistic after observing how things work over the last 30+ years.

Hi, Sean Shasta,

I totally agree with your last comment to me about Greenspan, etc.

Did you hear that the State of California is now offering to give first-time homebuyers an interest-free, down payment loan equal to 10 percent of the cost of the house, provided their income is low enough? The loan will be forgiven if the buyer stays in the house for five years. This is another program that likely will drive house prices higher in California.

Hi Confused:

“Did you hear that the State of California is now offering to give first-time homebuyers an interest-free, down payment loan equal to 10 percent of the cost of the house, provided their income is low enough?”

No low-income or even middle-class family can buy a decent home in major California cities anymore. House prices have been inflated with foreign buyers who leave their homes locked and unoccupied, a massive bubble in the FANA(G) and other tech stocks, and widespread home speculation due to ZIRP.

It is such a shame that a beautiful place has been brought to its knees by bad policies both at the Federal and State level.

Confused,

You’re spreading BS. This applies ONLY to CalHFA first mortgages. I doesn’t apply to any other mortgages.

Laying blame on “Democrats”? Your handle appears justified.

Hi, Not Confused.

I think the Democrats are largely responsible for enacting three rounds of stimulus spending. However, that PPP loan program smells more like a Republican idea. Given the $4.5 trillion of money printing by the Fed over two years, the addition of the last two rounds of stimulus spending probably caused house-price inflation and general price inflation to soar. At least where I live, house prices were normal until after Election Day.

Confused: How about the multi-billion dollar tax cuts by the Trump administration? And earlier under Bush? With non-stop ZIRP under Greenspan during the Bush years?

Both parties have consistently played games with our finances. That is why our economy has been hollowed out over the last 40-50 years.

The excesses must be paid for, by the masses through inflation, using the slowly boiling frog mechanism.

Dalit says riots start after 2024 elections ,we’ll see . But there plan is always to turn the people against each other,they win simple

Divide and conquer work, util it doesn’t. It does not work any longer when there is nothing but chaos and anarchy. Some bad judgement and there is division and nothing to conquer.

Perhaps they are eyeing your assets.

I don’t understand the logic behind committing to only 50 basis point hikes going forward as all it does it limit your options and for what gain? As usual it’s the slidey way of speaking in that 75 basis point hikes have not been “actively considering” so it may just be double speak but again to what end I can’t possible understand. My best guess is it’s to reassure markets but that should be the last thing he wants to do if inflation is the target.

This reminds me of a point when I was very new in my profession. I was speaking to an older and well experienced colleague about a strange discussion I had had with a member of our executive team where the manager asserted something that my education, training, and experience told me was factually incorrect. I looked for clarification as to what I wasn’t understanding to which he replied that I was right and our executive was speaking complete nonsense.

“And now you realize you know more about our job than the ones tasked with overseeing it.”

I get a similar feeling with Mr. Powell & Friends in that they aren’t nearly are smart as they need to be past, present, and future.

“Oh what a tangled web we weave, when at first we practice to deceive.”

Powell is a paid and practiced liar. These people are ripping the country off blind, and bamboozling everybody to cover their tracks.

100%

Ok, you know he’s a liar and I know he’s a liar along with all the other readers of this blog. Among the general US population he’s a hero worthy of respect. Therein lies the problem. Until the man on the street regards Powell and his henchmen as lying criminals who deserve to be taken out and shot, nothing is going to change.

Gosh Escierto,

“Ok, you know he’s a liar and I know he’s a liar along with all the other readers of this blog.”

Nearly the full description of communism/fascism…(take your pick)

It goes,

They know they are lying,

We know they are lying,

They know we know they are lying,

We know, that they know, that we know, they are lying,

But they still carry on lying…

had to put lots of commas in the 2nd last line but they are not really there in the true line…… lol

The Federal Reserve was CREATED BY CONGRESS AND IS FULLY ACCOUNTABLE TO THE US CONGRESS and it is the only profitable agency in the entire US government and rebates 94% of its profits each and every year to the US Treasury and it has done so for nearly 110 years.

The FRB’s “profits” aren’t real profits. The claim is a farce.

The “profits” are the result of “printing”.

In a system that boasts of checks and balances….

who checks the Fed?

The Fed became the de facto legislator of stimulus circa 2008 and now. Those supposed to check the Fed (Congress) are so busy posing at throwing bricks at each other, and promising candy to their constituencies, they don’t get the big choices done (like major national immigration law reform 30 years overdue). It also provides the classic organizational shell game where one can always point suspiciously at the other as the reason the customer will be disappointed, and ejected into the street.

The checks and balances that was designed in to the system has long been gone and ignored. Also, the federal reserve was not part of the original system anyway.

Supposedly we have checks within the federal government, but they usually end up working with each other.

The checks against the federal government (State rights, nullification, etc) have been pretty much destroyed after the War between the States. Federal government now rules supreme.

Federal reserve system created in 1913 was totally outside of the original Constitutional scheme. There’s no one really there to hold them accountable. No the Congress, not the President, not the Courts, not the States, and definitely not the people. We are still waiting for a complete audit of the federal reserve banks and a list of all their stock holders.

RT,

IMO, two key points to keep in mind regarding the creation of the Fed.

First, when it was signed into law, it had a twenty-year charter. It would need a renewal by Congress in 1933 to continue operating.

The first two central banks of the USA also had this twenty-year charter written into their creation. And, the first two central banks did not have their charters renewed by Congress.

Second, Congress skirted this potential event from happening on 25 February 1927, by the passage of the McFadden-Act. The Federal Reserve System is now, essentially anyway, immortal. Congress could kill it, but that will not happen in my lifetime.

As Nick Lowe sings, “And so it goes.”

Powell needed to apoligize to the American people for his total mismanagement of the Money supply and interest rates. He didn’t do that and blamed everyone but himself. Further, he should have then announced his resignation.

Yeah… I didn’t understand that either. A little mystery about how high the Fed will go each month is a good thing when fighting inflation. Volcker didn’t tell anyone how high he was jacking up rates. He just did it and let them guess as to what he would do next.

Perhaps this is just at the start of the process. They could always have a called session and add a .50% hike in the middle of the month as well.

There is a long history of why central bankers have come to telegraph their intentions. It is to avoid massive value destruction and sudden depressions. Greenspan took the cryptic secret stuff very far and the backlash now is from that. The public wouldn’t anymore stand for drastic surprises, nor would the huge swaths of suddenly bankrupt companies.

And of course, the FED members won’t have time to unload their market positions ahead of any unannounced surprises.

Did Powell lose his job few months ago or not?

If not, he’s as smart as he needs to be.

He hasn’t been confirmed yet.

The frightening thought is that they may know exactly what they are doing.

Marcus Aurelius: Absolutely. When no other conclusion makes sense, this is the only conclusion that’s left. So it must be the correct one!

Levi,

I think in the Fed’s mind they need to lower demand to the right level. There is so much debt and speculative gambling they have to telegraph everything to ensure they don’t blow up the plumbing in the “nobody fully understands” financial system.

There is such a delay in their actions and the affects on the real economy. Maybe current mortgage rate is enough to cause a housing crash. It will take a few months to find out.

Levi,

How can you question the smartness of the great FED?

This is their words,

In 2021, Inflation is transitory, 2022, ah well….Let’s jam in a few 50 basis points, the damn thing is raging hot.

These might very well be their future words,

2022, softish landing, 2023/2024, oops, we didn’t see that (hard landing) coming.

These people are supposed to see 10 to 20 years out and plan monetary policy accordingly.

There are no more FED governors who have the balls like Volcker.

None!

The FED is doing everything in their power to make it look like they are serious about stopping inflation while doing as little as possible to actually stop it. That’s why everything is always too little, too late.

“We could raise interest rates in 15 minutes if we have to.”

~Ben Bernanke

Don’t listen to what they say, watch what they do.

This. The market gave them the green light to get back to neutral ASAP (as of yesterday, futures were still pricing in a 90% chance of a 0.75% increase at the June meeting), yet they took that off the table. And they’re going to delay the first baby step towards balance sheet reduction for yet another month, for no apparent reason.

It’s a complete dereliction of duty and the entire committee should be fired.

The Fed didn’t put the 75 basis point hike on the table. Some Wall-Street manipulators did. And I never bought it. 50 basis points was the base case all along.

And the Fed didn’t “delay” anything. In the minutes from the last meeting, it said what it would do: announce QT in May, start phase-in in June, go full-speed a few months later. And that is exactly what they announced today. There was no surprise.

This is just a rehash of what I wrote in the article. I wish people RTGDFA before posting anything.

I suggest you put the entire article in the title to get people to read it 🤣

Yeah… I was really surprised yesterday when I heard the market went up because the Fed hadn’t done a .75% hike. “Where did that idea come from?” was the thought that ran through my head. The Fed had been pretty specific that the discussion was from 0.25% to .50% TO START WITH.

People who think the Fed isn’t going to do “anything” DEFINITELY have it WAY wrong. The people who think the Fed isn’t going to do “enough” PROBABLY have it wrong. The concern needs to be that they aren’t going to do “enough fast enough”… Powell’s desire to seem “reasonable” undercutting his true power to influence Americans into cutting back on demand enough to strangle inflation in its crib.

Maybe Powell will get more aggressive with rate hikes and QT as soon as he gets confirmed by the full Senate. Maybe it will happen once the November election is over with… even Volcker had to stand down his first attempt until the 1980 elections were over. But I don’t see how this ends right (for the markets OR the economy) if the Fed keeps trying to be “reasonable.”

Last December ( so long ago), the Fed was selling 3 quarter point rate hikes in 2022…

Depth Charge* Ya know ya right but ya know why? Cuz their stupid plan is to try talk down speculators & bring down inflation, that’s why the delay & procrastination, they believe the threat of tightening will bring down commodities without having to do it, it’s failing.

The Fed think they’re smart, gambling is an addiction & they encouraged it, look at what happened, commodities & stocks surged, they made it worse, they created an uncontrollable monster, a hyper bubble & only a total collapse will teach the market. This is historic, it’s psychological, people have been overcome with greed & fantasies of wealth, this is worse than 1929, far more participants, no smartphones in 1929.

The black-out period of company buybacks is over also!

Well, so what would happen if they really decide to raise the FFR to 8.5% overnight to match the published official inflation rate?

What would that do to the market and to the economy over night?

It would definitely benefit the savers, the people who have no debt, the people who paid their houses and cars off, the people who have no credit card debt.

Who would lose out in such scenario?

There have been situations where the cause of inflation

was high-interest rates. I don’t think we’re there.

Erdogan’s School of Economics?

Monetary high interest rates are inflationary. High interest rates create more money than low interest rates. That is the math of interest rates.😉

Sams,

Low interest rates increase demand funded by borrowed money. They also increase asset prices, and these assets can be sold or leveraged, and the proceeds can be spent, which increases demand. That’s why central banks lower interest rates: to increase demand. And this artificially stimulated demand can create inflationary pressures.

High interest rates reduce demand funded by borrowed money. Many projects stall or don’t happen. Asset prices fall and leverage backfires and absorbs cash. This puts downward pressure on demand, which reduces inflationary pressures.

But inflation is also a psychological phenomenon – I call it the “inflationary mindset.” Meaning that businesses are raising prices and get away with it because their customers are paying those prices, and it cycles through the economy. For inflation to thrive, the inflationary mindset needs to be widespread. And that’s what we have now.

That is the economic textbook explanation. It is not wrong, but by some contested and it may not be all of the explanation.

Historically inflation was defined as an increase in the amount of money. When I say that interest is the inflation it is in the context that interest as an mathematical operation on the amount of money expand the amount of money.

Manipulating the interest rate in the market is an indirect way of manipulating the amount of money in circulation.

Think what could be done if the currency was digital and with a built-in feature where the central bank could set the interest on the money itself. Think of a dollar bill where the value face value did change on command from the central bank.😉

The FED has starved more old ladies on fixed income than a Chinese Gulag Camp. These FED bankers are sick evil people and have only served to keep a boot on the neck of the USA for over a century. All the boom and bust we see from housing to stocks to interest rates result from the FED. Shameful and disgusting. End this criminal banking cartel before they end America.

So — go back to the wonders of 1893? The crash lasted years and years. The US Gov has to be bailed out by a super-rich guy wheeling and dealing profitably in gold (John Pierpont Morgan). Then 1907? We had to beg a hyper-rich guy to save the financial system (John Pierpont Morgan). GREAT.

Or there was good old Adolf renouncing his country’s debts. Next stop was to balance the books by confiscating the world from the neighbors.

So you want the likes of Elon Musk and his peers as the kings of the financial system?

Or put monetary policy in the hands of Congress? Have you HEARD those people lately? They can’t screw in a lightbulb, and should be nowhere near such policies. Hard enough to keep them from their fellows’ throats. Who then? Biden? Trump?

The cycles of boom and bust before 1913 were all well documented. They happened due to malinvestments and bad business decisions and plenty of other bad business decisions. The bust is to correct those malinvestments and to force investors back inline. Those boom and bust cycles are not the “end of the world”. Besides, the US dollar were bind to gold and silver and so it was not a fiat currency. The business cycles of boom and bust can go on, but it won’t affect regular people who are not in the market. Their US dollar holdings (in gold and silver) are not affected by the business cycle, as long as they do not make any reckless investments.

Fractional reserve banking and the completely fiat currency are the major causes that makes the business cycle even worse. The creation of the Fed and the belief that a small group of bankers can control the entire market, and influence business cycle is truly arrogant. And history since 1913 has proven that such small group of bankers are not capable of controlling the “market” and business cycles.

So the intervention, plus fractional reserve banking and now a completely detached fiat currency all contributed to the significant loss of wealth by the lower and middle class. The normal people like most of us are, now have less and less ways to work hard and save the fruits of our labor for us and for our children. In this case, going back to the system before 1913 seems to be a good and wise decision.

The lack of any system at all prior to 1913 regarding central banking proved to be catastrophically disastrous as we clearly confirmed by the “Panic of 1907” after which the stability of a system with a central bank was fully conceived and then implemented in 1913.

Wolf – Just checking my math and logic: $4.6 trillion divided by $95 million per month equals approximately 48 months or *four years* to complete the tapering. Seems like a heck of a long time. Am I missing something? Thanks.

They don’t intend to get back down to $4.6T and there’s a good chance market tantrums will “force” them to stop before reaching $7 or $8T.

Nonsense. INFLATION is forcing the Fed’s hand now. INFLATION. Look up what that means. It destroys the currency. And it’s raging.

Federal Reserve Credit last week

added $2.0bn to a record $8.918 TN.

Over the past 137 weeks,

Fed Credit expanded $5.192 TN, or 139%.

That’s some “war” against inflation !

No guns or heavy artillery.

Just fly swatters.

But that’s reality so far.

Everything else is just talk and promises

for the future. I prefer to live in reality.

The inflation problem has been serious

for long enough to expect more from the Fed.

But this is an election yea, and Democrats are in trouble. EVERYTHING is political these days, including Fed policy.

I made that comment here months ago, and “The Big Bad Wolf” disagreed with me.

I believe The Wolf was wrong.

Richard Greene,

“Federal Reserve Credit last week

added $2.0bn to a record $8.918 TN.”

You’re spreading BS. That gets you thrown into purgatory.

Federal Reserve assets FELL last week for the second week in a row and are $20 billion BELOW where they were on March 16.

The Fed’s total assets have been essentially flat for two months, though they go up and down on weekly basis. After the last two weekly declines, the balance sheet that comes out later today will likely show a small increase.

Read the linked article so you understand what is happening with MBS.

https://wolfstreet.com/2022/04/21/peak-balance-sheet-feds-assets-dip-to-5-weeks-ago-level-end-of-qe-end-of-an-era/

Click on the chart to enlarge it:

No ya not missing anything but it’s 95 billion, the Fed won’t last 6 months, in fact QT will stop before they get to 95 billion a month in Sep cuz it’ll all collapse by then.

Precisely. QT will not last 6 months & Powell will do a U turn. shrinking the balance sheet is myth. Politicians just kicking the can?

Anil,

At first they said that the Fed is trapped and can never end QE, and when it ended QE, they said that the Fed is trapped an can never raise rates, and when it started raising rates, they said that the Fed can never do QT, and when it got ready to do QT, they said that the Fed will stop after six months, and when the Fed…

Last time they did QT, they did it for 2 years, and inflation was BELOW the Fed’s target, including when he did the U-Turn. Now inflation is raging. Entirely different scenario.

Jack X, that’s ridiculous BS. RAGING INFLATION is the issue now, in case you haven’t noticed.

Wolf ya missed my point, I agree 100% with you, read my other comments.

The point I’m making is the Fed has a record of doing ruinous things worrying about their& their wealthy friends assets, we ca see that clearly over the last decade, They are corrupt & need to let the system correct, by no means do I advocate any reversal I actually believe rates should be far far higher & rising 1% at a time, QE is corruption & a disaster.

What is at issue is MASSIVE CORPORATE PRICE GOUGING which is what is causing so-called ‘inflation’ in the US and globally as well as record high levels of DEBT AND SPENDING.

Doubting T…

The part you are missing is that they can accelerate the monthly QT. That is what they did last time so it wouldn’t be unexpected for them to do so this time. Quite the opposite… and with an election coming up six months from now it would be in line with their historical practice of showing restraint in an election year. But the minute that election is over in November… hang on! I don’t think Volcker waited a week after the election in 1980 before he made his big move.

Oops, $95 Billion (with a “B”) per month. I made the same mistake as Dr. Evil in the Austin Powers movie.

Doubting Thomas

This tapering will never get completed. I’m wondering if if will even get started. We’ll be in a recession or depression before any serious reduction in the balance sheet occurs. Then it will be taken off the table.

Swamp Creature,

“Tapering” has already been completed. You’re talking about “Quantitative Tightening” or “QT,” which hasn’t started yet, but will start on June 1. No one knows what “completed” means in terms of QT, and the Fed yesterday was vague about the end point. But they’re going to do it for a long time, years, before they feel they got to the end point. The end point might come when something goes haywire.

Something going ‘haywire’ happened a very long time ago.

Mr. Richter, it may/will be interesting to see what the real market driven bond prices will be if and when the Fed phases out all their buying…

Yes, lots of people dread finding out.

The Fed said they liked to “average” …

so if year one is 8%…..the next four years should have a Fed inflation target of 0%.

But they are sticking to the 2-2.5% game….

So if year one is 8%…and the next nine somehow drop down to 2.5%….

thats over 30% drop in purchasing power BEFORE COMPOUNDING!

And that is “stable prices”?….and thats IF inflation comes down to 2.5%…

This Fed is quick to save markets….

and slow to save the citizens of this nation from this damaging inflation.

Where is an honest Q & A of Powell?