Markets already started to kiss that easy money goodbye.

By Wolf Richter for WOLF STREET.

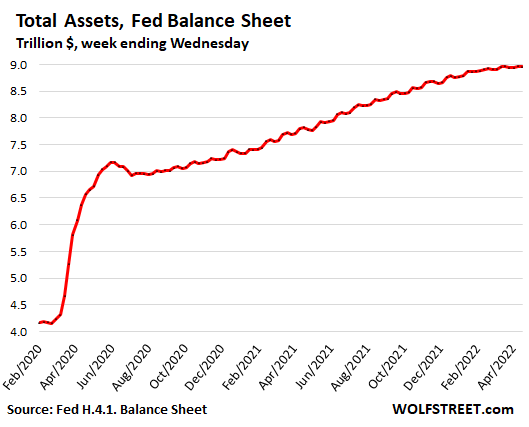

Total assets on the Fed’s weekly balance sheet as of April 20, released this afternoon, declined to $8.955 trillion, roughly the same as on March 16 and below the levels of March 23 and April 13. Beyond the week-to-week ups and downs, caused by the peculiarities of Mortgage Backed Securities (MBS), which we’ll get to in a moment, the balance sheet has flattened out. Balance sheet growth has ended. QE has ended. That part of the marvelous show is over.

Since March 2020, when this whole money-printing orgy began, the Fed has increased its assets by $4.65 trillion, a mind-boggling amount of QE in the span of just two years.

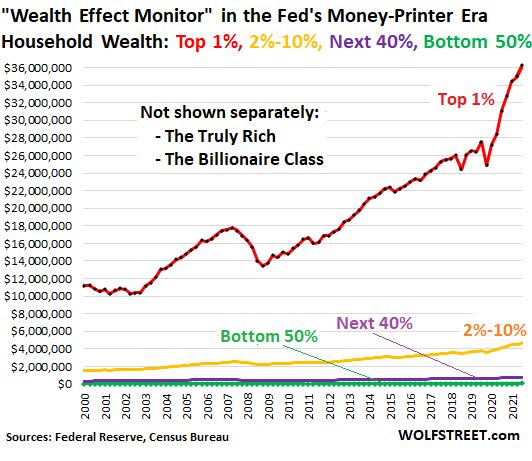

QE was designed to repress long-term Treasury yields, mortgage rates, long-term interest rates of any kind, and to inflate asset prices. It thereby created the biggest wealth disparity ever, documented by my Wealth Disparity Monitor, based on the Fed’s own data.

But then raging inflation got in the way. And the Fed finally started “tapering” its asset purchases in mid-November. Tapering means that the Fed bought less of Treasury securities and MBS than it did before tapering, when it was increasing its assets by about $120 billion a month. After the tapering began this monthly increase began to shrink. Now the balance sheet is no longer increasing, tapering is finished, and QE has ended.

Now markets started to kiss that easy money goodbye. The bond market has been getting hammered since last year. The stock market has been getting hammered since January this year, and numerous stocks have imploded.

The Fed has also unwound and brought to zero numerous of its emergency measures that it had started in the spring of 2020, including its repos, which it ended in mid-2020, and its corporate bonds and bond ETFs, of which it never bought much to begin with. We’ll get to them in a moment.

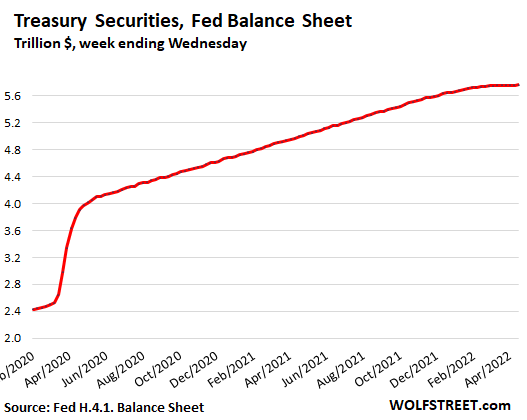

Treasury securities flat at $5.76 trillion.

Since the beginning of March 2020, the Fed’s holdings of Treasury securities have ballooned by $3.24 trillion, to a total of $5.76 trillion. The balance has now remained roughly flat for several weeks.

In order to maintain the balance of Treasury securities at the current level, as maturing securities come off the balance sheet, the Fed buys new Treasury securities in the amounts needed to replace the maturing securities.

TIPS decline, accumulated Inflation Protection rises.

The $5.76 billion of Treasury securities include Treasury Inflation-Protected Securities (TIPS) and the accumulated Inflation Protection on those TIPS. The government compensates TIPS holders for CPI inflation by increasing the principal of the TIPS. The Fed tracks this “Inflation Protection” amount separately from the face value of the TIPS. On its balance sheet today:

- TIPS, face value of $381 billion, -$7 billion from March 16.

- Accumulated Inflation Protection on TIPS, $81 billion, +$4 billion from March 16.

The Fed’s sleight of hand with TIPS on market-based inflation expectations.

Since March 2020, the Fed’s proportionally huge purchases dominated the relatively small TIPS market and pushed the TIPS yields into the negative.

The TIPS yields are called “real yields” and form a factor in the “market-based” inflation expectations (such as the spread to regular Treasury yields) that the Fed cited in its statements to show that market-based inflation expectations were “well-anchored,” when in fact these “market-based inflation expectations” were the result of the TIPS yields that the Fed manipulated down with its purchases of TIPS.

With its purchases, the Fed pushed the 10-year TIPS yield into the negative throughout the pandemic. But the Fed has now stopped buying TIPS, and the balance of TIPS is declining on its balance sheet, and TIPS yields began to rise in January (from -1.1% at year-end) to just above 0% on April 19, the first time since March 2020 that 10-year TIPS yield closed in the positive, though for only one day.

Manipulating the TIPS yield to show that “market-based inflation expectations” were “well-anchored,” though inflation had already begun to rage, was one of the cleverest monetary sleights of hand.

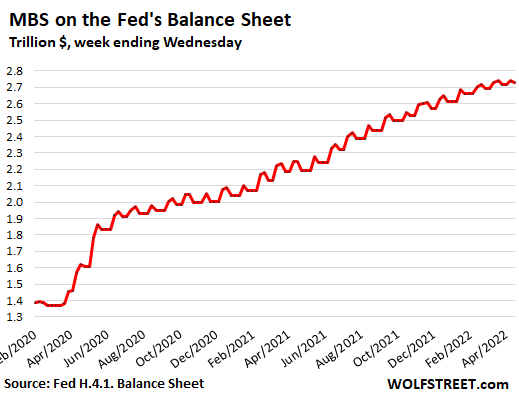

MBS: $2.73 trillion, flat with March 16.

The Fed’s holdings of MBS dipped to $2.73 trillion on the balance sheet today, and was roughly flat with the balance on March 16. Since March 2020, the Fed has added $1.36 trillion in MBS.

MBS differ from regular bonds in that holders receive pass-through principal payments when the underlying mortgages are paid off after the home is sold or the mortgage is refinanced, or when regular mortgage payments are made. As a passthrough principal payment is made, the balance of the MBS shrinks by that amount.

During period of low and declining mortgage rates, such as during the pandemic, mortgage refis are a huge thing, and the passthrough principal payments become a torrent, and the balance of each MBS shrinks rapidly.

Conversely, the surging mortgage rates now have largely killed refis, and pass-through principal payments have slowed down.

In order to make up for those pass-through principal payments, the Fed buys large amounts of MBS in the “To Be Announced” (TBA) market. Before the taper, it bought over $100 billion a month to make up for the passthrough principal payments and to increase the balance sheet by $40 billion a month.

Now it is buying just enough MBS to fill in the estimated amount of passthrough principal payments in order to keep the MBS on its balance sheet level.

But there are two problems with it:

- The unpredictability of the passthrough principal payments

- The 1-to-3-month delay before the Fed’s MBS purchases in the TBA market settle.

Trades in the TBA market take one to three months to settle. The Fed books its trades after they settle. So when the Fed was three months into the taper, that’s when the first tapered MBS purchases started showing up on its balance sheet. This is delayed data. And the MBS on the Fed’s balance sheet kept rising at the pace of purchases two to three months earlier.

In addition, the timing of the passthrough principal payments and the settlement of the purchases don’t match from week to week. So the Fed’s balance of MBS jumps up and down from week to week.

By now, most of the delayed settlements of the taper MBS purchases have been booked, though there might still be some stragglers out there. And the balance of MBS, despite the ups and downs from week to week, is roughly flat with March 16:

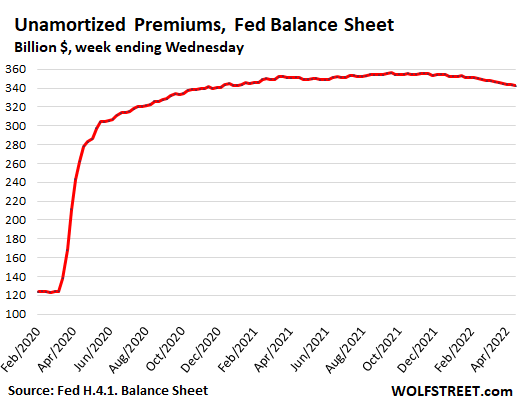

Unamortized Premiums decline to $342 billion.

This is the net amount that the Fed paid in “premiums” over face value and in “discounts” below face value when it purchased Treasury securities, MBS, and agency securities in the market. The net unamortized premiums peaked in November 2021 at $356 billion and has now declined to $342 billion.

The Fed – along with everyone else that buys bonds — has to pay a premium to buy securities whose coupon interest payments exceed the market yield at the time. For example, when you buy a 10-year Treasury security with seven years of remaining maturity, and a coupon interest payments of 2.5% a year, while the 7-year yield in the market is 1.5%, you have to pay a premium over face value to get those 2.5% coupon payments for the remaining seven years.

The Fed books these securities at face value and books the premium separately. The Fed then amortizes the premium in a straight line to zero by maturity date. Which means the Fed writes off the premium over the life of the bond. These securities have a higher-than-market-yield coupon interest payment, and the amortization of the premium is smaller than the coupon-interest payment.

By the time a particular bond matures, and runs off the balance sheet, this premium has been amortized to zero, and there is no loss at maturity. In other words, the Fed is taking the losses of this amortization on a constant basis, while it is earning the higher coupon interest income that these bonds generate.

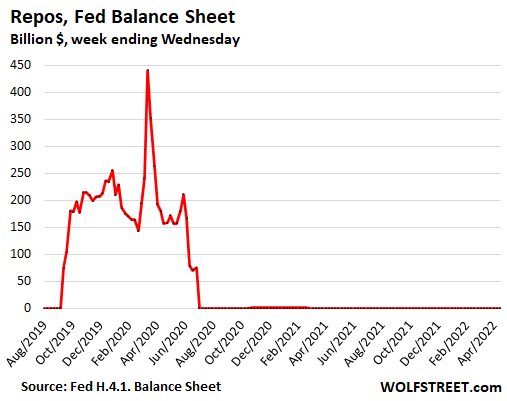

Repurchase Agreements (Repos) at zero:

The Fed is still offering repos but has raised the rate it charges to be unattractive (currently 0.50%), and there have been no takers since July 2020, when the balance fell to zero.

With these repos, the Fed lends cash to counterparties in the repo market, in exchange for collateral (Treasury securities or MBS).

Repos are in-and-out transactions. On their maturity date – the next business day for overnight repos, or longer for term repos – the Fed gets its cash back, and the counterparty gets its security back. Repos are a quick way for the Fed to send lots of liquidity to the markets and take it out when the repos mature.

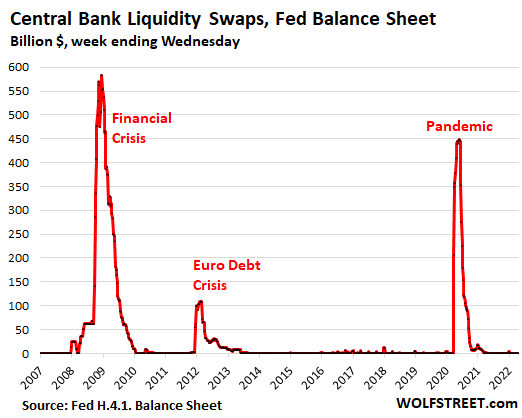

Central-bank liquidity-swaps at near zero.

The Fed has been offering dollars to 14 other central banks via “central bank liquidity swaps,” in exchange for their currency, to provide dollars to those economies for their dollar-funding requirements. The Fed did this during the Financial Crisis in 2008-2010, during the Euro Debt Crisis in 2011-2013, and during the pandemic.

Almost all of those swaps have matured and were unwound, with the Fed getting its dollars back, and the other central banks getting the local currency back. Only a minuscule $233 million of swaps remain outstanding:

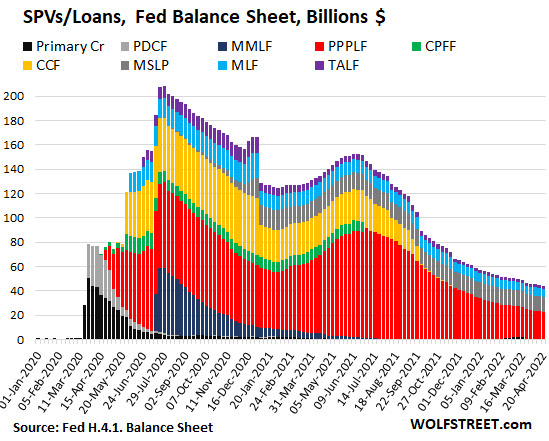

SPVs continue to decline.

Special Purpose Vehicles (SPVs) are legal entities (LLCs) that the Fed set up during the crisis to buy assets that it was not allowed to buy otherwise. Equity funding was provided by the Treasury Department, which would take the first loss on those assets. The Fed lends to the SPVs, and shows these loans and the equity funding from the Treasury Dept. in these SPV accounts.

The total amount of the SPVs dropped by 79% to $44 billion, from a peak of $208 billion in July 2020.

The PPP loans that the Fed bought from the banks account for $22 billion, about half of the total SPVs, down from $90 billion in July 2021. Over the summer and fall of 2021, the Fed sold all of its corporate bonds and bond ETFs into the hottest corporate bond market ever, and they’re gone (yellow columns, CCF). The remainder are the Main Street Lending Program ($12 billion), Municipal Liquidity Facility ($7 billion), and TALF ($2 billion):

In addition to having fueled the worst inflation in 40 years, the past two years of the Fed’s QE and interest rate repression have created the worst wealth disparity ever, based on the Fed’s own data on the distribution of wealth in the US. The ultimate outcome of the Fed’s reckless money printing are raging inflation and this:

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

If the FED wanted to lower inflation they’d announce a 1% rate hike tomorrow morning. Instead they want continued high inflation to continue the wealth transfer to the 1%. With inflation at 17%, the FED is destroying the wealth of 95% of American’s. Jay Powell, all talk no action. Lock these criminals up, end the era of central bank fraud. Jefferson was right:

“If the American people ever allow private banks to control the issue of their currency, first by inflation, then by deflation, the banks and corporations that will grow up around [the banks] will deprive the people of all property until their children wake-up homeless on the continent their fathers conquered. The issuing power should be taken from the banks and restored to the people, to whom it properly belongs.”

I am announcing that as of tomorrow I will hike rates 1% to end this temporary residual inflation!!!

Wow! Heavy man!

Check out the markets. They’re starting to take Powell seriously, even if you don’t.

but the bond markets are not?

Wolf – even you have said it yourself, that the FED is doing too little, too late. How is too little too late “serious?” It’s an honest question. These people hem and haw over chintzy rate hikes when they should have had an emergency 5% hike months ago. They could stop this inflation in its tracks, but they don’t want to.

“It is hard to imagine a more stupid or more dangerous way of making decisions than by putting those decisions in the hands of people who pay no price for being wrong.” Thomas Sowell

and there you have it…

We “hope” they do the right thing. But there is no consequence for them if they don’t….or even CHOOSE not to. There wasnt even a consequence for those three Fed Folk who resigned in shame.

I think what the Fed is shooting for is threading a needle by slowly working off debt by slowly reducing inflation from 8% to 6% to 4% to 3.5% and so on for the rest of the decade. They need to inflate away the debt by at least 30% and slowly inflating it way without a recession is the goal, but very small chance they succeed.

A large hike like 5% would have to be supported by equivalent open market operations, presumably earlier QT.

Not by “jawboning”.

Old School,

The chance they succeed is virtually and effectively zero.

If it happens, there really is something for nothing.

There has been far too much accumulated social rot in American society over my entire life, going back to the 60’s.

It isn’t just a matter of dollars and balance sheets.

At some level, they must know the financial system and economy are a house of cards. It’s the most logical reason everyone is frantically trying to avoid a recession (an entirely normal and expected event) presumably because of the political and social “blowback”.

Old School, the fiscal irresponsibility of the US makes that almost impossible.

DC, reading Wolf’s later comments

>They’re going to stop this inflation, and they have the tools to do so. It will be too little too late to stop it now, but over the next few years, and with lots of pain, they’ll stop it. And tightening globally is how they’re doing it.

You’re talking about a Volcker-like intervention, but inflation ran hot for quite a while in the 1970s too. I was pretty young then (in middle school when Reagan was elected), but I definitely remember the pain.

Wolf – love you man! But really surprised how you seem to believe the FED is actually even remotely close to being serious about any significant rate hikes, ending QT, buying MBS, etc. They have let this inflation absolutely rip roar higher to probably 15%-20% in the real world (CPI is a joke). They are bluffing/lying as usual. Sure we will get a few hikes, but then they will lay an egg and come up with their usual excuses to take a “pause”. They want all this inflation, but would never publicly admit it.

JG,

Maybe you were born after the 1970s, or were too young to understand what was going on at the time.

So let me help out: there is now raging inflation out there like the majority of the people alive in this country have never ever seen, and it’s not disappearing, it’s raging, and it’s raging globally, and the central banks are watching the beginnings of the collapse of the monetary system, a consequence of global QE and interest rate repression, and they’re freaking out. They’re going to stop this inflation, and they have the tools to do so. It will be too little too late to stop it now, but over the next few years, and with lots of pain, they’ll stop it. And tightening globally is how they’re doing it. Because the alternative is too terrible.

“…the central banks are watching the beginnings of the collapse of the monetary system, a consequence of global QE and interest rate repression, and they’re freaking out…”

I sure hope you’re right, Wolf. I really, really want you to be right. But I am such a cynic that I don’t imagine them “freaking out” at all, I imagine them smiling amongst each other as they pour another tumbler of single malt, $2,500 per bottle scotch.

I just watched Mary Daly talk yesterday, and these are her words:

“…in order not to tip the economy over by reacting abruptly, we need to take a measured pace. But that measured pace still gets us up to the neutral rate, which I put at about 2.5% by the end of the year.”

This does not at all sound like somebody concerned with inflation, this sounds like somebody who doesn’t want to let go of their greedy bubble gains.

Wolf,

Sorry for asking maybe should be an obvious question. The federal government is certainly going to run deficits of at least 2 to maybe $3T over the next two years. The increased tax receipts may only last through say September.

Assuming the FED somehow is able to engineering a “soft landing” over the this time period, this would mean that the FEDs balance sheet will NOT grow by making ANY bond purchases from the Treasury to fund our deficit spending, correct?

Again, big assumption is that the FED successfully sheds at least $2T off its balance sheet in the next two years, how is this going to affect bond yields?

So while the FED is jacking up short-term rates with FUNDS rate hikes, there’s going to be significant liquidity sucked out of the market with the purchasing of all these bonds & MBS.

Do you think there’s enough money out there to purchase all these FED assets and deficit spending bonds?

Correct me if I’m wrong, but this will be at least $4-5T in treasury bond & MBS purchases in just two years. That seems like a lot of liquidity. I guess my question is what happens to yields if demand dries up? That would mean decreased demand pushing yields even higher than everyone might otherwise expect them to go, especially if inflation proves harder to tame than the FED expects, correct?

Thanks!

“…how is this going to affect bond yields?”

They’re going to be a LOT higher. CPI inflation = 8.5%. Bond yields across the board should be ABOVE the rate of inflation. Ideally, inflation will come down some, and bond yields don’t have to rise that far to be above the rate of inflation. But if the Fed is going to crack down on inflation, it will have to drive Treasury yields above the rate of inflation, including short-term yields.

“Do you think there’s enough money out there to purchase all these FED assets and deficit spending bonds?”

Sure, but yields will have to a lot higher to attract this money in those quantities, including my money :-]

Yield solves demand issues. That’s the beauty of it, if you let it — meaning if central banks don’t screw up the market with their interest rate repression policies.

True, but how long can a person hang by their thumbs?

For those of you who bought SRTY and SQQQ, we have a healthy profit. Whenever I start feeling I know what I am doing, I take some chips off the table.

Harry , your comment resonates with me

whenever, i start feeling like i’ve got things figured out, i know it’s time to take a little off the table as well

Central banks tried to go negative interest rates but that would hurt the banks and people would reject that .So they did the next best thing suppress interest rates and push up inflation as much as they can.effectively giving you negative returns.The fed have no intention to slow inflation .Why are they still buying MBS

Bruce said: “So they did the next best thing suppress interest rates and push up inflation as much as they can.effectively giving you negative returns.”

===========================

the next best thing for who? Why is this the next best thing? What does it accomplish and for who?

Exactly! 100% agree. The FED is lying/bluffing as usual.

You tightening deniers are just hilarious. I mean you make me crack up. If you base your investment decisions on it though, good luck!

Wolf, a lot of people have lost all faith in the current financial system and decided to pull out before it’s too late. Can’t really blame them, except maybe they’re a a little early.

I’m playing both sides, trying to time the final boat sinking. Results will be the same.

I don’t understand the faith some people have in this central planning committee which is demonstrably clueless most of the time. Remember the “inflation is transitory” mantra of 2021?

I am not saying they won’t raise the rates. I am saying if they do, it’ll just be another one in the series of clueless actions they have taken in the 21st century.

And of course, I am not talking investment advice from this forum – doesn’t exactly have a stellar track record.

Nacho bigly libre,

How exactly are the higher ups clueless? They’ve wringed the lower and middle class dry, separated them from their meager paychecks, and laughed all the way to the bank.

The wealth disparity is harkening back to the great Gatsby and robber barons. I’d say if anything, they are the most competent collective of the elites.

We can all sit around and call the fed idiots for saying inflation is transitory but at the end of the day, what is their individual net worths and what is yours? I’ll gladly get in front of a microphone and say the sky is red, not blue for millions of dollars.

You’ll gladly do that while also being in a role with a responsibility to the public? Are we saying the success of public officials is dependent on what they do to maximize theor individual net worth? Are you high?

The FED is lying/bluffing as usual.

FED job is to save biggest banks — they will not admit that.

patter is inflate, stop inflating, and when shit hits the fan, inflations again.

but problem is bubbles are getting bigger and bigger same as balance sheet and outstanding currency in circulation.

LK,

Are you saying officials do what is best for the public?

I’d personally sell out my neighbors for millions of dollars. You would too given the opportunity. Only deluded people think they wouldn’t. They can just preach on their high horse because they’ve never been in the position to choose.

I’ll complain that what they’re doing is evil because I’m one of the peasants getting screwed by it. But given the opportunity, I’d do the same thing they’re doing.

The FED is looking for a soft landing. They need to go slowly with rate hikes. You cannot put that kind of shock in the system.

Lets see if they really do follow through. Inflation is raging so much they will need to increase rates.

But looking at the wealth gap chart….The bottom 50% did not gain much wealth so a 50% drop in the stock market will not really effect them at all.

Will the FED allow a 50% drop. Depends who their overlords are I guess.

If the FED follows through, that means they are really intent on slowing down the economy. Push companies to not expand manufacturing capacity, not to do upgrades to equipment, etc.

My company has ordered some Cisco switches for a small business a month ago and Cisco keeps saying they cannot give a delivery date. That is how unsure they are on the backlog and supply chain.

Tried to order some office grade printers. July at the earliest.

These are must haves. Not want to haves.

ru82-

Ru82-

They want to tame the inflation that they kindled.

I suggest two other motivators behind Fed decision-makers’ tardiness:

1. Legacy — they don’t want to be stamped for all time in the textbooks as having led the country (world) into Great Depression 2.0 ?

2. Institutional Credibility — they have a desperate longing to protect the concept of central banking. I believe this is due to a sincere belief that central control of the economy works (though the current predicament proves otherwise), and more selfishly, because their livelihood depends on its continued existence. For Fed decision-makers, Depression 2.0 will tarnish CB reputation, and ruin a great gig.

The good to come out of this situation might be a serious national re-think about alternatives to central banking.

“ As against the working of the law, your raising the rate of interest, or your attempting to sell government securities, will be just as effective as Mrs. Parrington’s mop against the Atlantic Ocean…..My objection is that the bill permits a vast inflation of our currency…”

– Senator Elihu Root, Congressional Record, Dec. 13, 1913

It appears Root was on to something!

Some wise person long ago said something like, ”The FIRST and FOREMOST ”job” of every bureaucracy is to preserve and protect and promote that bureaucracy.”

certainly appears to be true these days in USA,,, and have read extensively that it has been true in old world for eva???

@John – Well said.

Exact same sentiments of everyone in every single corporation…..all management covers their asses and jobs/pay whether private or public, the stiffs closer to the bottom actually do the “mission”. Higher up in management you go, the more selfish and nasty and richer they get……why else would they fight their way up?

BIG difference between having a good work ethic and ambition.

The REAL question is; Is ANY organization’s “mission” good for the people and the planet!

Growth for growth’s sake (making someone money) is the ideology of a CANCER CELL.

Reagan ended our Republic (without knowing it) when he dismissed the government as always ‘the problem.’ Absent an engaged government, the oligarchs took over Congress and, thus control the nation’s money supply. Serial tax cuts emboldened the Olitarchy. You can have Democracy or billionaires. You cannot have both.

not too sure about the not knowing aspect pp,,, but for the rest, damn sure correct

raygun was likely the very worst governator of the state of california, ever,,, as evidenced by his edict to spray tear gas over thousands of people because one or two, clearly criminals,,,

later proven likely to have been GUVMINT plants,,, were damaging storefronts, etc., in the southside area of Berzerkeley in the spring of 1969///

and while IMO he did that to ”make his chops” with the reactionary rightists, he then parlayed that into enough financial support to become elected POTUS,,, once more proving the theory that the most money wins EVERY USA election.

Time and enough for USA to go to a totally public money ONLY election system AT EVERY election…

( Not holding my breath.)

YEP! The Reagan-bot had a well laid out script, and nobody here voted for any of it….even if they voted for Reagan and think they did!…. or (gag) still think he was a “awesome president”. They aren’t simply are NOT rich enough to write ANY of this country’s “script”…..which they likely will discover….as they ARE NOT “voting members”.

Although there is always hope….just less all the time.

The Feds primary purpose is to help the government fund it’s deficit spending and now it is out of control.

They can’t let rates go to a normal number, 2.5% is historically not neutral rates, yet that is the Feds target here.

Neutral would be more like 4 or 5%. But the government can’t afford the debt payments at 5%.

So it is unlikely that inflation would be tamed with a 2.5% rate if inflation is 8.5% that they admit, but really is closer to 17% if you use the CPI from the 80’s.

Maybe if we have a deep recession that would clear out the excessive debt from the system and slow inflation.

But will the fed and the government allow that much pain? I doubt it, if we have a stock market down 50% and housing prices going down,

will the fed just lower rates to 0 again and restart QE? And will the government actually cut it’s spending?

Or will they say we need to give people more stimulus money and rekindle inflation to new highs?? We will see…

The FRB cannot prevent a stock market crash. That’s a complete myth. This fiction is believed because of the existing mania.

The basis of any central bank’s power is the national currency. Watch the DXY which hit a two year high this week. It’s at 100 which gives the FRB 30 potential points of leeway for “printing”. Anything below 70 breaches the all-time 2008 low and risks a run on the currency. There isn’t a viable replacement now but that doesn’t = unlimited “printing” either.

If the FRB insists on “printing to infinity”, the markets can crash the USD whether they succeed in “preventing” any other market from crashing or not. If the USD crashes, practically every USD holder will be (a lot) poorer.

Most of it is fake wealth anyway.

When the chips are down, the markets, economy and the public will also be thrown under the bus to preserve the Empire.

Real Inflation is being driven by retail corporations raising prices above their costs to make huge profits. More wealth stealing by Rich from Middle & Poor. “Accountable.US said it examined financial statements of nation’s top 10 retailers over past 2 years — incl Lowe’s and Target — They collectively increased their profits by $24.6 Billion for a grand total of $99 Billion.”

Amen!

B

PS. Our Constitution addresses the issue: Congress coins the money and monitors the spending. Sadly, we have lost to the power elites.

100% agree. The FED for the most part is all talk/bluffing. Sure we will get a couple obligatory rate hikes, but then they will find an excuse (C19, Ukraine, bad weather, supply chain, etc.) to “pause” those hikes prior to the midterm elections. All tools will be used to keep house prices, property taxes, realtor/loan broker commissions, propped up higher. They will do debt forgiveness for student loans right before the elections in the FALL, as well as launch 40/50 year mortgages, rent and foreclosure moratoriums, mortgage forbearance,…whatever it takes.

apparently that is Spurious Quotation.

https://www.monticello.org/site/research-and-collections/private-banks-spurious-quotation

let’s assume that is true –it would mean that he approve of politicians in congress to control fiat money:

Thomas Jefferson is elected to the second Continental Congress on March 27, 1775. Jefferson,

June 22 Congress issues Continental currency On June 22, 1775,

end result “not worth a Continental,” that proved worthless due to rapid depreciation, drove up prices, ruined the economy

Great article. Especially the TIPS and SPV details.

Inspired me to go read the history of why the FED was created and the political action around it.

The whole “Jekyll Island” deep dark conspiracy crapp I hear about was just business as usual. I saw a lot of similar players at Hilton Head (just a little ways south) but never got to see lobbying work happen at the Beech Mountain house or the hunting lodge on the Olympic Peninsula. This wasn’t banking lobbying, it was Military Industrial Complex stuff, and I wasn’t privy to anything except the usual “private is better than government” battle, as they ostensibly always do what’s “best” and government never does.

I remember once being told, “I wish I could tell you what the Russians have, but I can’t” (as in I would then understand why it’s so important to throw money at CorpX). Same with banks, they are just private corps….the Fed was supposed to be a “middle ground solution” (e.g., please everyone), but it looks like the banking corps won that one quite handily.

Wolf, the Fred data shows reverse repos still near the highs – any commentary?

They’ll stay there until QT starts eating them up. QT hasn’t started yet. RRPs and reserves will be the two liabilities on the Fed’s balance sheet that will decline with QT.

Which means the real economy won’t see any tightening of conditions until both those balances are close to zero, no?

First a clarification: RRPs can and will go to zero. But the reserves (bank cash) cannot and will not go to zero. They will come down a bunch but not go to zero. I think the minimum will be somewhere in the $1-2 trillion range.

Financial conditions are already tightening some in the real economy (higher rates, wider spreads, etc.), which make borrowing more expensive and harder to get (housing, corporate, etc.).

The natural end result of massive government spending and cheap/easy money.

“In addition to having fueled the worst inflation in 40 years, the past two years of the Fed’s QE and interest rate repression have created the worst wealth disparity ever,”

Fed balance sheet and fund rates

Jan 2021: 7.3T, 0.25%

July 2021: 8.0T, 0.25%

Jan 2022: 8.8T, 0.25%

Apr 2022: just shy of 9.0T, 0.5%

How will Biden support his Free Lunch Economics™️ if cost of borrowing goes higher?

True, will the REAL King of the Hill, please step forward!

This whole economy reminds me so much of the 1970s’s that I feel like someone put me in a time capsule and send me back in time. Everything is the same as then. Runaway inflation, rising interest rates, rising housing prices, energy crisis and shortages, disfunctional government. But actually things are even worse now. Back then we didn’t have this gigantic balance sheet to unwind, this large budget deficit, and a War in Europe. The Vietnam war was over and there was peace on the college campuses. The younger generation just wanted to go and get a job and enjoy the American dream. None of these positive things are true today.

And we still had a manufacturing base within our own borders!

Now we’re riddled with debt and our creditors are beginning to lose interest in using our zimbabwe fiat currency. We’re so much more screwed than we were back then.

Jerusalem Post just said Israel is diversifying its foreign reserves into other currencies, now including Chinese RMB as well as Aussie and Canadian dollars. US dollar is still biggest, but the percentage is dropping.

If that picks up (a lot, in a lot of places), we will feel, not like Zimbabwe, but maybe somewhat more like a constrained Euro state. I am not sure, given the super-rich’s probable wish to keep defense strong, where the cuts will be, but I suspect they will appear as trouble in my neighborhood. Not least is the psychological impact in a nation of already precarious personalities given to short attention spans, grandiosity and “free” stuff.

I think a lot of countries are taking a HARD look at their Dollars in US banks and US Treasuries….. Iran, the Taliban, and Russia are case studies for anyone found on the wrong side of fickle and changing American foreign policy.

China is taking notes if they desire to take Taiwan and the safety of the $1 trillion they hold in T-bills could/should be diversified. Saudi and India would be wise to keep their options open too…

https://wolfstreet.com/2021/07/05/us-dollars-declining-status-as-dominant-global-reserve-currency-v-the-dollars-exchange-rate/

That guy Wolf, he’s pretty ahead of the game. July 2021! Feels like a few weeks ago.

Why did gold and silver drop and the USD strengthen? Not saying that I disagree.

What is the saying the USD is the best student in a bad class. U.S. central balance sheet is only 30% of the U.S. GDP while the ECB is 60% and Japan is 130%.

What about cryptos. In the free crytpo give aways by all these crypto companies I have amassed $200 worth of crypos. I am a HODL. My $200 is now worth $80.

Cryptos are not the answer of store of value.

HODL ? Hold On for Dear Life?

Ok

GDPs can and have collapsed quickly.

Central Bank/Treasury debts don’t (in fact the latter are used to falsely prop up the former through “QE”).

That is a big reason not to take comfort in ratios containing GDPs.

*And* the US debt to GDP is over 100%.

So it all depends upon which ratios you look at.

DC can invent new ones to cultivate false comfort (see sausage innards of unemployment rate calculation)

The social fabric was still largely intact in America in the 1970s, and trade unions were strong. America still made stuff rather than trading paper and endless litigation. Globalism was in its infancy back then.

And sentiment is shifting into reverse on globalization in so many places and ways. People feel overstretched and insecure. It will have to be at least more stealthy in the future, given nervous home voting bases in various countries.

For 40 years corporations,have stepped on working class people.Now a revolt is starting = union membership rising ,they got to greedy ,time to pay the piper

The social fabric had been pretty strained in the 60s. There were riots, bombings, remember? Everybody was protesting something in the streets — even the Mob. It wasn’t all over in the 70s, still weird. New Deal helpfulness + LBJ’s money-print extension had run dry. Discipline in 1970s factories was bad. US cars were poorly made. Full employment and money giveaway policies were out of gas. It was the “malaise” era.

Stuff was weird. Remember Patty Hearst? But we pulled out of that doldrum. At a price though.

I don’t see any relative “good old days” to resurrect there. Or much time for nostalgia. The time arrow points forward only, with its foot on the gas.

”good ol’ days” WERE good for some folks at some areas at some times, maybe all the times,,,

but only for some folks, just like now

think right after WW2 for the most equitable distribution of ”good times” for most folks,,, as long as you were not black folks in the very racist parts of USA or anywhere similar in the world

”elites” were taxed at up to 90% of income, and some of them actually paid that rate — on income

most of course did not, though the publicity of the rate was helpful in the equitable PR

looking at home ownership prior to and then after WW2 might be indicative of more fairness starting after GI Bill was introduced, etc., etc.

guess maybe our current elites have forgotten???

Swamp…

All comparisons to the 70s should begin with this fact..

In the 70s, we had a Fed that FOUGHT inflation.

Today we have a Fed that PROMOTES inflation….even at 2%, their self authored goal…..this is a brand new aspect of the Fed, and a curious and blatant violation of their stable prices mandate.

Now we have a situation that IF inflation reverts to say 3%, the Fed will declare victory. But in a ten year window, with year one at 8%, add 9 xs 3% and do some compounding. The purchasing power of the dollar will have dropped 40% in ten years!!! (and with a Fed patting themselves on the back for having returned inflation to their target “area”).

It is sad the people of this country dont know what’s going on ….most think the Federal Reserve is a bourbon or an Indian Reservation.

“ It is sad the people of this country dont know what’s going on ….most think the Federal Reserve is a bourbon or an Indian Reservation. “

Good one, historicus!

“In the 70s, we had a Fed that FOUGHT inflation.”

Nope. Volcker arrived in August of 1979.

Yes, um, Arthur Burns? Loosening for the ’72 election? That was comparable to the foolishness of this latest episode.

Volcker came in with alongside the deregulation start in the quite late Carter admin, at the end of the 70s.

The Fed raised the rates to meet the inflation rate…and at times surpassed it. That is responding to inflation. The “new Fed” since 2009 never did that. That is fighting inflation IMO.

Burns may have been a poor fighter of inflation and harbored bad policies, but he NEVER promoted inflation, and he did raise rates to make certain holders of dollars were not harmed and also to arrest inflation.

Compare to the Powell Fed which promotes inflation …. even the 2% – 2.5% rate is damaging when compounded out.

c smith-

But in the 1970’s the Fed was, at least, allowing interest rates to rise along with “inflation expectations.”

Nominal rates averaged about 8%, and the real rate was positive, at least according to Homer and Sylla.

It took Volker to make the heroic and ultimately convincing move, though, as you state.

I had fond memories of the 70s. Back then a middle class home was a 1500 sq ft home with 2 car garage and 3 or 4 bedrooms. There was not such a huge wealth gap. CEOs did not earn 1000x the average salary of their employees. It seemed like they cared a little bit more about the company instead of their stock options / investors.

When you jeans had a whole in it your mom put a patch on the whole.

You could have a coversation with someone who was not constantly not checking their smart phone.

But the weed wasn’t as strong as today’s…. I hear!

John, the weed was OK, but clearly not a strong a today. My college prof in 1970 in one class has real good stuff. When he held Saturday class on the beach in New Milford, CT, he was gracious enough to share it.

I really miss those days. And this was Connecticut, not the West Coast cities.

I was two years out of the military and working on getting an Engineering degree. Paid for with G.I. Bill money ($222/month) and my savings from my part time jobs.

No, there was no asset mania back then. Over 40 years less of social decay too which is even more important.

If it was just a matter of balance sheets and numbers, ending inflation is easy. Reverse the spending and default on the national debt to start over.

Can’t do that without breaking practically everything because it’s not possible to put the toothpaste back in the tube without destroying it.

AF-

“No, there was no asset mania back then [1970’s]”

Wasn’t there a bit of a mania in commodities? Gold went from $40 to $800….

Housing exploded upward too. Oil.

Because MBS mortgage bonds were introduced to “increase affordability”.

Isn’t the “FED WINDOW” still open for borrowing at .5%? Also known as “Primary Dealer Credit Facility”. Isn’t this where the Elite get the money to buy Grandma’s house at 75k over list price and All-Cash? Since 2013?

Stan Sexton,

Primary credit (discount window) loans had an average balance this week of $411 million with an M, which is nothing on a $9 trillion balance sheet. Banks can borrow for less in the multi-trillion-dollar repo market and in the federal funds market.

Primary credit (discount window) loans are in my second-to-last chart, the black columns you see on the left that have now faded out.

Primary credit peaked in the week of March 23, 2020, at $50 billion. Which was small compared to all the other stuff going on.

I understand that some bloggers out there have spun up some fun financial fiction about primary credit (fiction = creatively invented stories for entertainment purposes) but the black columns in the second-to-last chart show the reality.

Welcome to 1929 ,sorry to see 1928 go bye

Rising wages. Rising food prices. Chip shortages. No gold standard. Money printing like a Weimar Republic. Instead of a bubble bursting, a surge in inflation. The price of a home in my subdivision went up again, like the 70’s. Price of gasoline is not 62 cents a gallon like 1977. Remember a 5 cent Hershey bar during the Vietnam War?They may tighten until it hurts. Then what? Stocks and bonds go down. Good companies raise prices to preserve margins. What is safe?

Ladies and Gentlemen-

Nothing but the unadulterated truth dispensed daily in a form easily digested by those seeking wisdom.

In this retest of the market lows; is the market going to break down or is there another market rally before the bottom drops out?

Good Question

For my 2 cents, I expect the major market averages to get cut in half. But, I do not allow my bias to affect my trading decisions. It may take 2 years or who knows.

The first dead cat bounce of the bear market we are in is apparent on all the US markets. Those who bought SQQQ and SRTY at the peak of the bounce have a huge gain made in a very short time period. Remember, these trading vehicles are fighting a designed asset decay which favors not holding them while you are waiting to profit. In other words, you want to try to buy them at the peak of the rallies in the bear market we are in (which history shows us are huge rallies on the way down), selling them with the falls.

Personally, I went from nearly entirely in SRTY and SQQQ to nearly entirely in cash in the aftermarket on Friday, April 22, 2022. This could be a huge mistake because the bottom may fall out of the market. If it does I will sell the rest of the SRTY and SQQQ. But, I did lock in a hefty profit and holding less of a declining asset should we be in the absence of a falling market. It is more difficult to increase your brokerage account value in a bear market then in a bull market.

We just saw the Nasdaq 100 breach 15,000 and then retest the 13,000 near term low not getting near the 16500 top – this sure looks like a dead cat bounce. However, if we get one more rally before the bottom falls out, I am ready.

Harry,

you posted this under the wrong article. Re-post it here:

https://wolfstreet.com/2022/04/22/now-alphabet-broke-microsoft-lets-go-meta-already-in-free-fall-one-by-one-the-giant-stocks-that-held-up-the-market-are-letting-go/

Bank practically never borrow directly from the Federal Reserve and when they do so it is based on the FEDERAL DISCOUNT RATE which is always set 0.5% higher than the interbank lending Federal Funds Rate. The outstanding balance borrowed from banks from the Federal Reserve is less than $500 million dollar and that borrowing carries a stigma and the borrowed funds may not be used by banks for speculative purposes.

Good article – thanks

They are all good. And a lot of patient corrections with additonal new info in the comments. All that and entertaining to boot.

I understand that the last Repurchase Agreements self-liquidated back in 2020, but if/when this facility is used again, does the loan show up as an asset?

And what about the collateral held for the short duration of the loan?

Thanks

What do you think happens first (1) a drop below $5 trillion or (2) a rise above $15 trillion??

2

You people are funny. The Fed is taking you out to the chopping block, and you’re dealing with it by being in denial LOL

No, they are indeed funny and heading to the chopping block, but they *may* be correct. You think the Fed is going run down its b/s faster than $1b/year? Doubtful. ~4 years from now, they’d hit $5T. A lot can happen in 4 years, including a stinging recession and whatever crisis is next, in which case the Fed could double, triple down, doing “whatever it takes” again.

The $5 trillion doesn’t matter. It’s completely irrelevant. The markets will shit all over the place long before then. They’re already starting to, and QT hasn’t even begun yet. Think of short-term rates of 4% and $1.1 trillion a year in QT, and holy moly in terms of asset prices. That’s what I mean by chopping block.

Wolf said: ” Think of short-term rates of 4% and $1.1 trillion a year in QT, and holy moly in terms of asset prices. That’s what I mean by chopping block.”

————————————————-

a lot of “you People” will cheer that chopping block …….

Yes. The Fed’s QE and interest rate repression since 2008 has been hugely destructive to a lot of households, while others made out like bandits. The Fed engineers wealth transfer as a matter of course. Some of that is now reversing.

‘Chopping block’ seems too quick and easy. The guillotine was intended as a humane method of execution. I was thinking whipping post. More prolonged. More American.

@ Wolf –

What people are being taken to the chopping block? How so?

Savers and prudence have been hacked for years. The projected unwind might now help their situation.

The imprudent might get spanked, rightfully so. The front runners and manipulators should get creamed, but probably not; they are insiders and front runners on both sides of the move.

And, if as Historicus says, the FED maintains it’s stated (and corrupt) goal of 2% inflation, it’s actions won’t be anything but PR across any meaningful time frame.

So is the FED lying? or which lie is real? The lie about fighting inflation? Or the lie about “stabilizing” inflation at 2%?

They are pathetic and ruinous to middle Americana social fabric. They exemplify all the worst of insider dealing.

You know when the FED is lying ,there lips are moving

Vice Chair Clarida, Dallas Pres Kaplan, Boston Fed Rosengren all resigned without penalty shortly after a jealous insider snitch revealed the boys were actively front running their own interest rate decisions and wu-wu announcements, rolling as much as 5 million per transaction. “I will miss his wise counsel and valuable insights” Chair Powell said in a statement announcing Clarida’s early departure.

TREASON!

Those guys ought to spend the rest of their lives without parole in Florence Supermax prison. I am not joking.

That’s getting off light. As the poster above you said, they are traitors. That is punishable by death.

sadly, that has become expected behavior of those at the top

and it continues to corrupt the fabric of America

cheaters get ahead, while the honest are stepping stones and collateral damage

It should come as no surprise to anyone that central bankers would do double-duty as an organized crime syndicate. And vice versa.

A rising tide lifts all yachts, but dinghies get shipwrecked.

and boats with holes, which a majority of Americans are in, result in many drownings

That “rising tide lifts all boats” is one of the most misleading of all quotes. Only a blue blood would infer that all Americans have boats – as he spoke from his yacht.

The 10 year and longer are below 3%.

If the Fed is going to Stop QE, then they will no longer be a buyer of longer term Treasuries . If they actually do QT, they will be a seller .

Why are rates still below 3% , when the biggest buyer is turning into a seller

“Markets already started to kiss that easy money goodbye.”

“Check out the markets. They’re starting to take Powell seriously, even if you don’t.”

Wolf

Give credit where credit is due. Congratulations to those who saw the corruption and the insanity in our economic system, and took advantage of it to get rich. Those of us like me who relied on Australian Economics missed the boat.

A hedge fund manager said two years ago that you should look at Trump and the Fed as criminals, and predict what they will do accordingly because these people are not rational. They will destroy the future of the country for their own survival. The same guy made a lot of money on the way up; has sold most of it at the top, and will make more money on the way down.

I believe the current hike in rates is not being done because Powell had a Come to Jesus moment. He is again thinking about his own survival, and so is Biden. Someone called him both an arsonist and a firefighter.

It is time for Powell to pull the rug since the greater and the greatest fools have already bought. The transfer of wealth for this round is mostly complete. You will see it in your 401k and housing soon.

True. Biden and Powell need inflation to drop. Inflation hurts the bottom 50%. As seen in Wolfs charts, they have not really gained any wealth from the stock market run because they do not own stocks.

But high inflation will make them vote for a new person who promises to stop inflation

A crash in the stock market will not effect them. The people I know in the bottom 50% do not even follow the stock markets or care.

80/20 hamburger is 5$ a pound @ 8% inflation = 100% inflation or price gouging .there’s no one guarding the hen house ,poor people revolt soon

Australian Economics

Is that like Austrian Economics? Zoroastrian? Astrological? ;)

Typo: Austrian Economics

P.S. Wolf did say to ignore typos. Read the message.

For a second I thought ‘Australian’ economics meant MMT! MMT is the only macro economics that was built specifically for monetary sovereign nations. Price stability is its primary goal. The creator of MMT is Australian economist Bill Mitchell.

He only coined the term to give the old debunked method of monetary destruction a new and appealing name in order to rope people in. He did a pretty good job too, and I’m busy blocking MMT trolls on this site :-]

It was a particularly noteworthy typo. :D

But I liked “Australian Economics”

Just funnin’. he said he ignores typos.

Australian economics is also known as “monetary theory innit” for the record.

“Australian Economics” means you turn your country into a colony for international finance. We are all governed by psychopaths.

Is MMT just Civil War greenbacks on steroids?

Was watching a travel show maybe 5-6 years ago and the guy said Vienna was “filled with retired central bankers”, more or less in the context of a lot of “high culture” things to do there.

Don’t know if it’s true or not, or if it’s at all relevant to the Australian School Of Economics.

Yep…I find the Austrians’ ideas pretty interesting. Their apocalyptic predictions about the US economy probably will be proved right at some point.

I’ve been buying short ETFs to profit off the Wall Street train wreck. So far they have been a good trade, and the major indexes have still barely moved. I can only imagine what they will do when the market really takes a dump.

I have a chunk of VIX ETFs, but that would need a relatively time-compressed freakout to really pay off. The beauty is, unlike options, these don’t expire (unless theoretically they go to zero market value, but that’s extremely unlikely, methinks).

Right now they are languishing, barely in the money, but every few months they wake up, and a little more rarely they pop. (Check the one-year and five-year charts). It is so fast, I have preset limit sell orders, at certain tripwire levels.

An interesting exercise is to compare the $VIX.X index to the ETF, UVXY. As you know, UVXY is not an inverse ETF, but is still a good example of manipulation.

$VIX.X logged an intra-day low back on June 29, 2021. To date, that low has not been eclipsed. On a daily chart, short-term bottoms have been drifting higher. Today, the index has crossed above, and will likely close above, its 50-day simple-moving-average.

UVXY, however, logged an intra-day low back on Jan. 22, 2022, much later than that of $VIX.X, and nearly breached that low as late as yesterday. It is still trading below its 50-day simple-moving-average at the time of this post.

While $VIX.X short-term bottoms have been drifting higher, UVXY short-term bottoms have been drifting lower to sideways.

I’m not saying one cannot profit or successfully hedge using VIX-related ETFs and inverse ETFs in a down market. I’m merely pointing out that they are not true representations of their parent indexes. A negative bias exists for VIX-related ETFs and inverse ETFs, even when the markets are down and the ETFs are up, such as today.

There are a lot of meme stocks that are 50% to 80% down from their covid peaks. I am amazed the indices are not lower. I guess TSLA, AMZN, Microsoft have held up the QQQ.

Look at Zoom, VROOM, EXPI, OSTK, Rivian, SNOW, NOW, SE …… Some of these are down 90%

If Powell announces a 0.5% rate FED rate increase on May 6, perhaps the market won’t suffer a big crash anymore?

Why not? Because the market HAS ALREADY factored the 0.5% FED rate increase + 90 billion QT over the last week or so.

I think that is the Fed’s hope, and has a fair probability. The market has factored in loss of some recent froth in NASDAQ, sure. I think the recent times were so frothy and extreme, there are further shoes to drop. Lots of names are seeing big drops on what seemed mediocre news (Netflix for example).

But if and when things freak out, and I am thinking 2008(ish), things can happen quickly. Today’s “fair value” financial asset can become a fire sale item. That was what created the modern vast Fed scale, reach and balance sheet to begin with. The Fed cannot control all the inputs that make this second scenario possible. It was sort of good at picking up pieces creatively (with a good US dollar behind it), but not “good” enough for those who went insolvent. Those are the ones (like me) at the bottom of Wolf’s wealth charts, though I am 81st percentile in household net worth. It gets much steeper above my level.

“When the levee breaks, mama you’ve got to move.” — Led Zep

Share buybacks purchased through debt issuance is about to be totally off the table at any company. Expect huge stock crashes as all companies suspend buybacks. This will be a “cleanse” for the long term real economy, and a sign the Fed is actually doing its job for the first time since the early 1980s.

Actually cleansing the economy requires a massive economic depression, worse than the 1930’s since the accumulated distortions Are easily the worst in history. The distortions have been accumulating since WWII.

Augustus,

So all these Internet disruptors aren’t worth a bazillion $?

Having been accumulating years since WW2, I have to agree with AF in spite of ”wishing” not to do so.

Mom was correct 70 years ago, when she said, ”If wishes were horses, every beggar would ride.” ,,, and that is exactly where we appear to be heading once again: dreamland.

( Unfortunately, I don’t mean the world class BBQ in Tuscaloosa for you who might know it.)

At east we do not have China’s stock market returns. FXI is lower than it was 10 years ago and is almost at 2009 lows.

SPY is up 300%.

Just think if you live in China and have to invest in the Chinese stock market.

We are luckly to have 300% returns in are 401k.

I know several people who retired in their late 50s because of the SPY returns the past 10 years. They thought they would be working until 67

Chinese opacity still produces totally weird events. Huge stock crash in ’15 after huge public pump. Whole cities built and locked down in a finger-snap.

Now they are cutting deals with Europe to float securities there.

China unemployment rate around 6% ,economy growing at 3.5% ,this is phony .I must have a phd the numbers don’t add up

They want to rip off Europeans too. Read about the large, Chinese provinces that admitted to overstating their GDP by 23% or more. Compounding has that effect when you make up fake financial figures for DECADES. That was before the hit to GDP that they will take when their RE developers go under.

The CCP does not have the Forex reserves to bail them and also other, corrupt, Chinese companies out. They depend now on FDI which they are seeking desperately.

The CCP Ponzi-companies will thus be the next subprime-like disastrous scandal: like in 2008 when they held subprime bonds to then sell them to gullible investors through fraud, banksters now hold Chinese-CCP investments that they will not be able to unload fast enough when the guano hits the fan as in 2008.

They will again scream for more free money and more government bailouts.

For example, read in Newsweek an estimate that for nearly a decade China overstated its GDP growth by 1.7, which was in years before their tyrannical,, current presitator consolidated his power: now, the wise fake everything, which is why covid will be intractable in China. Their figures are all lies.

Correction: 1.7% PER YEAR.

Thus, due to its food and other issues, I predict China’s implosion will be the next, black swan in 2022 or 2023. Mark my words.

Yes. There have been many beneficiaries of the FED and GOV corruption.

In the upcoming major bear market, many retired people will attempt or need to work again when the value of their portfolio declines or crashes and/or their purchasing power is eaten alive by inflation, if they can find work and get hired.

I’m 57 (not retired) and someone my age potentially has 30+ years left. A lot can happen in 30+ years to turn someone’s financial life upside down, like the upcoming economic depression. Most people, even the currently now wealthy, will remain “invested” in hugely inflated markets when the financial markets tank.

The financial position for most of them will change substantially where they are going to end up poorer or a lot poorer.

Agustus,

Learn to code.

Eat lentils.

…You will own nothing…and you will LIKE it!

Been eating lentils all my life. They’re super-delicious. You can fix them in a huge variety of ways. I love them (beans too). Super healthy too. I have no idea why people keep referring to them here as some kind of inferior product.

As a pejorative, smoked carp might work…

Mr. Richter,

It is a current meme generated from a Bloomberg editorial…a “let them eat cake” revisited. I also am enamored with legumes of all varieties… The meme suggests that lentils are…pedestrian…somehow suitable for the lumpen only.

30 year mortgage is around 5.2.

That is still a historically low rate. I am just tryin to put things into perspective.

Those artificial rates of 2.75% for 30 years were crazy. That is why most banks are not holding those loans and sold them to the Fannie Mae.

I have a 2.25% for 15 years on my current house. I will rent the house out when I move.

I have a friend who picked up a 2% for 15 years last December.

He always planned on moving to a bigger house in 5 years and move up to a 3 car garage house but will he now?

He bought the house for 320k 4 years ago. Refinanced last december at 2% for 15 years. The house is now worth $420k. His new loan is for $300k @2% for 15 years or $1100 a month payment.

Lets say houses stay flat in 5 years. He owes about 280k on the loan. Even if he tried to buy the same house 5 years from now, the loan will coast him $1600 instead of $1100. So his move up to a $500k home will cost him $2000. Even though the house is only 80k more than his current house he will almost have to double his house payment

When that shitbox is only worth $150,000 he will bail.

Might never happen because $150,000 might not be worth shit alone, much less a shitbox.

They create dollars from nothing ………………

and they create lots of them

it’s the greatest theft out there,

When my shit box is worth $115k I will let the bank have it. Nice thing is the bank can’t come after me financially. So I will take my savings and buy a house cash while letting the bank eat a 200k loss. Can’t believe there are still people too dumb not to buy.

What you describe works to support housing prices as long as enough people don’t lose their jobs where the trigger will most likely be significantly tightening credit conditions, regardless of rates.

Most housing equity is fake bubble equity and most people are at least somewhat dependent upon fake growth for both their income and employment.

In other words, just because someone doesn’t plan or want to sell doesn’t mean they won’t have to anyway. I expect the government to implement another mortgage moratorium in an attempt to forestall another housing crash if it becomes necessary, but that doesn’t mean sales volume won’t crash and the market won’t freeze up anyway.

Job losses are painful but temporary. Companies go bankrupt, but the population remains that needs goods and services, and that means jobs to provide them. When a company goes bankrupt, the plant still exists. Just the investors get wiped out.

You’ve just explained why the housing market will be dead for the next 5 years.

In order to show recent relative wealth disparity development the graphs for the wealth categories should be shown as indexes. Is relative disparity getting worse or better? Hard to see with graphs of absolute amounts.

Not so easy to do ofcourse.

The absolute numbers are the honest numbers. If someone in the lower 50% went from $1000 in assets to $20000 in assets, does it really make sense to say their wealth increased 19x while the “unlucky” wealthiest 1% of households increased their assets by *only* 50% ($24 million to $36 million in a year)?

Jan de Jong,

In the linked article on the wealth disparity, I blow your theory out of the water, written just for you, but it seems you missed it:

https://wolfstreet.com/2022/04/03/my-wealth-disparity-monitor-of-the-feds-money-printer-era-holy-moly-april-update-of-the-greatest-economic-injustice-in-recent-history/

The below is quoted from my article:

Irrational Exuberance & Dot Com Bubble – History Repeats Itself. Check list of Imploded Stocks on Wiki page. https://en.wikipedia.org/wiki/Dot-com_bubble “Low interest rates in 1998–99 facilitated an increase in start-up companies” Sound famillar?

Like now, everybody who could work a computer & access internet, usually at work, were day trading. I was making bigger daily gains than my $200 pay in 1999 as a late 20s CPA. Everybody checking their investment & retirement accounts several times a day. Wealth effect drove people to spend like crazy racking up CC balances. Using those gains to buy their 1st house, cars, etc.

“Before the taper, it bought over $100 million a month”

Just $100 million/month? Chump change?

Thanks!

“QE was designed to repress long-term Treasury yields, mortgage rates, long-term interest rates of any kind, …”

And this is why the Fed touts the “dual mandate” mantra. For the third carved out mandate “promote moderate long term interest rates”, if honored by the Fed, would have precluded this antic of pounding long rates to FORCE investors to take more risk.

So, essentially, the Fed violates TWO of their THREE mandates….the second being “stable prices.”

In a system that boasts of checks and balances, Who Checks the Fed?

“Who Checks the Fed?”

In theory, Congress has oversight authority.

In theory, there’s no difference between theory and practice.

But in practice, there is.

Unamused; think Yogi Berra said something similar. The best one I like is ‘If you don’t go to their funeral, they won’t go to yours.’

The Fed was following the Yogi wealth enhancement method: he was very hungry, so he asked for his pizza to be made into 8 slices, not 4.

Those who create something are not the ones who provide the checks & balances in this system. It would be up to the Executive or Judicial branches to do that. Now the players change, but there is and has only ever been one First Supreme Court of the United States. Treason is a military matter as it relates to national defense and the security of the Constitution/Republic/People…therefore, it is the concern of the Executive to decide if the court has failed and must be put on trial. If found guilty, then the entire court must be dissolved and the justices lose all lifeime guarantee of office as that body is gone. This crazy game of executing the value of money is nothing less than “cruel and unusual punishment” and the court has not said a word to stop it. Put ’em on trial. Then pass a new amendment banning all lawyers from ever holding this highest of offices due to a conflict of interest which prevents them from overtuning barrister bullshit. Get this machinery back on track before these headless idiots put us all into a civil war that will surely terminate what is left of a well designed Republic. Use the law to save the law.

“The bureaucrat begins, perhaps, by doing only what he conceives to be his sworn duty, but unless there are very efficient four-wheel brakes upon him he soon adds a multitude of inventions of his own, all of them born of his professional virtuosity and designed to lather and caress his sense of power.”

– H.L. Mencken, On Politics: A Carnival of Buncombe

The brakes on the Fed are clearly inoperative…

“he soon adds a multitude of inventions of his own,”

2% inflation goal..

Climate and green energy

Gender and demographic make up of the Fed

Inclusive employment

etc.

“The urge to save humanity is usually a false front for the urge to rule it.” HL Mencken

You forgot one:

“Personal Enrichment”

I am not a Ray Dalio fan, but he has some good perspectives on the financial system.

He basically says when there is too much debt you can pay it off honestly causing a recession or you can inflate the debt away making bond holders and savers pick up the tab.

How does one define the “truly rich” and the “billionaire class” and is there a way to track their wealth onto your wealth disparity chart?

Right now, Dalio and his funds are picking up the tab. So he’s still talking his book, trying to manipulate markets his way. But he sounds increasingly moronic.

Thank you. Ray Dalio is terrified of getting taken out behind Cathie Woodshed’s residence. Unfortunately, he can see her shadow at this point.

If you’re government you resolve old debt with new growth (and spending) You outgrow it. (There are sometimes parochial limits put on spending) The real reason the markets are tanking on the lame jawboning efforts of the Fed is that the associated risk to GDP is real, and is not being disputed by any of them either. If things were as dire as the market supposes the Fed would raise rates NOW. The one thing Fed doesn’t want is to raise FFR to 3% while the 10Y is at 2 1/2, the difference between murder one and manslaughter on the economy. The Fed is not going to blow up the economy in an election year.

“Balance sheet growth has ended. QE has ended. That part of the marvelous show is over.”

I think I heard a bell toll.

Poor like you,

did you create the image you linked? If yes, can I upload it here for everyone to see?

Yes, I sure did! You hereby gift it to you.

Pure wisdom dispensed daily with humor.

NPR reported yesterday that The Fed is trying to control inflation with higher interest rates without causing a recession, without mentioning that they won’t be able to do either. They will, however, save the big banks, for a little while.

Una-

“They will, however, save the big banks…”

More pointedly, they will save the big BANKERS, many of whom have swung through the revolving doors between academia, government and banking, and some several times over.

Ike should have warned about the “Banking/Government/Academia complex.”

Ike should have warned about the “Banking/Government/Academia complex.”,… Pharmaceutical/Medical industrial complex.

We have all been financial used for sure.

Slacker

Ike did indeed warn of the funding of science by the government. He believed, and rightfully so, that as politicians directed the funding, academia and science would be funded regarding their beliefs on big government. Corporations would control academic science by controlling politicians. Academics who played the game would get the benefits of grants and funding. And research results were tailored to keep the stream of money flowing. The founder of the weather channel did an interview in which he said those who promote climate change get the grants, and those who have conflicting views seem to not receive them. One can wonder about COVID studies as well.

Hist,

That is a woefully incomplete set of facts without also including QAnon’s take on it.

unamused,

The Fed (and other global central banks) will be able to knock down inflation with high enough interest rates and lots of QT. That will do the job. With their HUGE balance sheets that they can unload, they’re uniquely positioned to knock down demand enough to kill inflation. Right now, they’re trying to do this more or less gently and slowly. So this is going to drag out for years.

What they will likely not be able to do is avoid a recession. And a real recession that cleans out the excesses and gets rid of the overhang of corporate debt and gets rid of corporate zombies would be a good thing and would allow the economy to refresh.

A recession lasts a few quarters, and the economy is better off afterwards. Inflation is a terrible thing, can last for many years, and can have devastating consequences for a generation or longer.

//And a real recession that cleans out the excesses and gets rid of the overhang of corporate debt and gets rid of corporate zombies would be a good thing and would allow the economy to refresh.//

I have not read ANY economic textbook, saying an economic recession is a good thing. However, based on what you wrote above, a recession benefits our society because it allows the strongest entrepreneurs survive, and the weakest die.

If so, then why are we afraid of a recession?

“If so, then why are we afraid of a recession?”

“We” are not afraid of a recession. A recession can cause investors a lot of damage as their zombie investments have to be written off or lose value. So investors dread the moment that reality settles upon their investments. But that’s not “we.”

I’ve been through many recessions in my life. Let them happen. And don’t bail out the rich.

Recessions are an essential part of the business cycle. They’re needed to do exactly what I said. If you don’t get smaller recessions more often because you try to prevent every recession with new stimulus, you’ll get one big one that will blow everything away.

The economy and safety structures we have (such as unemployment insurance) are well suited to handle recessions, and if left alone, and if they’re allowed to happen and clear out the deadwood so that the economy can move forward with less debt, well, that’s a good thing.

“And a real recession that cleans out the excesses and gets rid of the overhang of corporate debt and gets rid of corporate zombies would be a good thing and would allow the economy to refresh.”

No more people driving trucks that cost 3x their annual salaries will be a good thing as well.

“So this is going to drag out for years.”

Probably longer, I think.

“And a real recession that cleans out the excesses and gets rid of the overhang of corporate debt and gets rid of corporate zombies would be a good thing and would allow the economy to refresh.”

The zombies wouldn’t let us do that last time, so now we have to do it twice.

Is is realistic to at least question if we can recover? With the national debt, trade imbalance, QE off the charts. Do you really believe that a couple of adjusted to interest rates and QT will do the trick. Have not they unleashed some wild financial shenanigans that have never been done before to this level.

Milton Friedman Monetarist Economics…

Of course, most of us experienced investors realize how abrupt and significant the current rout in bond prices, all across the maturity spectrum, is as we converse on these pages! Looking at a chart of short ETF for 10-year and 20-year Treasuries, it is like a rocket ship ride for months now, starting around the beginning of this most momentous year. We are also at the beginning of a very severe recession, the inflation genie will bat consumer spending back into the dugout.

Bond investors, the High Yield crowd will get their comeuppances as the corporate bodies pile up in the Bankruptcy and Default fields of play, have already had their heads shaved, and stock investors have only just begun to sit down in the barber’s chair of reality. Raging inflation, surging interest rates, a slow to the draw Fed, and political uncertainty, to include armed conflict, have never been conducive to the upward trend of bond and stock prices.

What bond investors were thinking about when they bought bonds with already grossly negative Real Yields in the pre-inflation Genie days of 2020 and prior is beyond me. Could only have been the chase for yield at any cost, and now the delayed bill is coming due. What little interest they obtained on an annual basis has been wiped out in several weeks of trading in today’s The Vigilantes Are Back bond markets.

The rapidity of the bond market’s reversal is historic. And if it were not for daily interventions by the Plunge Protection Team out of NYC via the trading desks of Goldman and Morgan and maybe, BofA, the stock market would be very clearly in bear market mode for all to see. The exponential ascent of the stock market since the Covid virus came to our shores was a warning sign in itself, and an experienced investor, one with 30 to 40 years under his or her belt going through many a market cycle and economic cycle, has plainly seen the writing on the ticker tape.

Many Americans hoping to retire on their current financial market gains, all unrealized for most, will be working much longer, if not until judgement day, due to what is to unfold. Cash is not trash, and the next Fed meeting may allow one to get a whooping 1% annual rate on their cash savings account in the weeks ahead. What is a Negative 7.5 percent Real Yield amongst friends. Time for the banks and money markets to start paying us for our hard-earned money.

People better start looking at global bond markets ,there two trains on one track ,spectacular crash .whole world is over leverage ,this will take whole system out to woodshed

Thank you for this excellent post.

“Back to the 70’s” was a great time for so many people. As said above a lot of what made America great still worked then. Opportunity was abundant. And yes we still made things. The “Valley” was really getting rolling. You could literally leave your car in the parking lot of where you currently worked and walk to neighboring companies for an interview during lunch. Just remember to get rid of the visitors badge..😬👍

> And yes we still made things.

Since then (70s), many Americans had a nice ride on the entry of China. We got the unpolluted country with the cheap manufactured stuff, gliding on the cheap manufactured credit China recycled right back to us. many of us got to do stimulating service jobs. They got the super-low wages, pollution and steady growth.

Now the worm is turning. That era is ending, or at least fragmenting pretty badly, all over the globe. My sound balance sheet, such as it is, is my life raft. Credit turns into an anchor that drags all kinds of folks down. That is, if the Fed doesn’t concoct some trick to float the hyper-rich to new lofty levels, as they seize assets from the sinking. Hmm — are those properly termed “oligarchs”?

YES islandT,,, as long as you were white or able to ”pass” as white, and many times not even then…

many places, including especially TX were SO bad in 1970, that I was hounded out of a restaurant because my hair was slightly over my ears due to being too broke to get the usual haircut

when ”waitress” came out of the diner and yelled at me to get the feck out of there because they didn’t serve dirty hippies, my girlfriend and I got out of there asap,,,