S&P 500 still down from 2 years ago, Nasdaq back to Aug 2021, small caps back to 3 years ago, but the Mag 7 blew out.

By Wolf Richter for WOLF STREET.

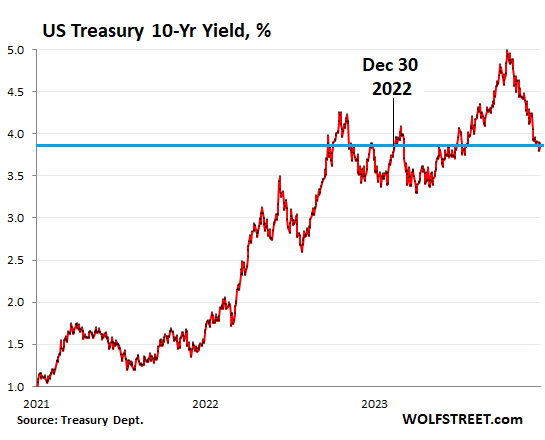

The year 2023 was a huge year for stocks, after a terrible year for stocks. A handful of huge stocks provided extraordinary power to push stock indices higher in 2023. And then, over the last two months of the year, there was the mania over the Fed’s gazillion rate cuts in 2024, which not only threw more fuel on the stock market, but also turned around the Treasury market and caused the 10-year Treasury yield to hop-scotch down the mountain in two months that it had spent eight months climbing.

These huge movements in the stock market undid much of the damage that 2022 had done, but not all, and it was unevenly spread.

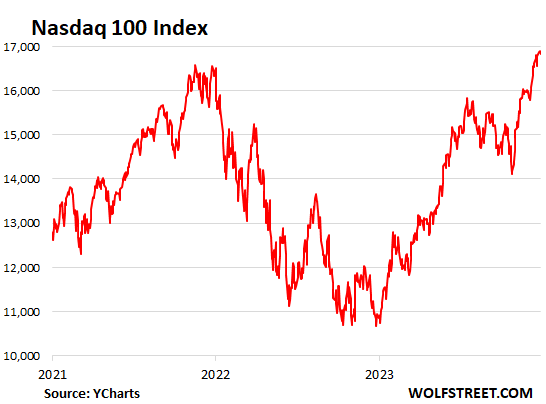

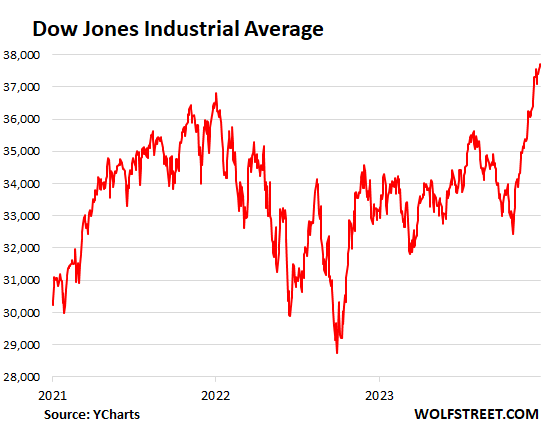

Indices that are dominated by the largest stocks – including the Magnificent 7 – reached new highs (Nasdaq 100 and the Dow).

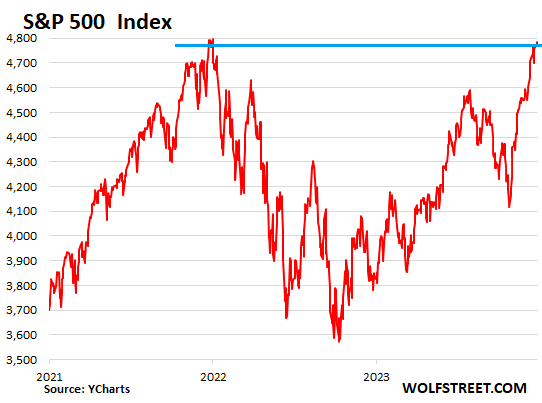

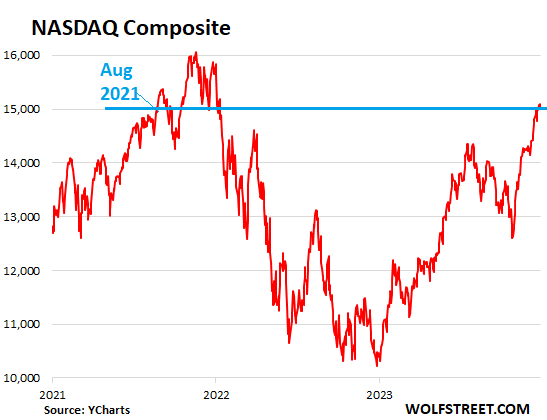

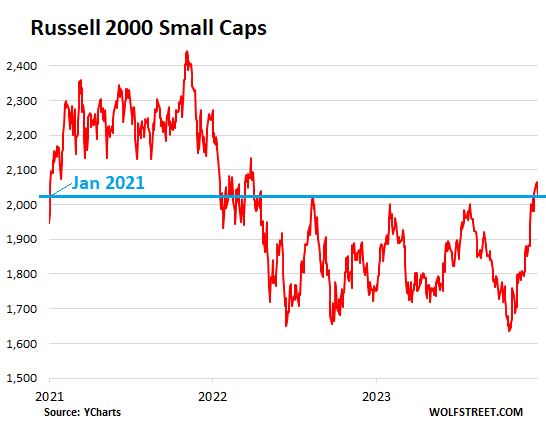

Despite this huge year for stocks, the Russell 2000, which tracks 2000 small-cap stocks, ended where it had been in early January 2021 – three years ago. The S&P 500 index ended below where it had been two years ago, and the Nasdaq ended where it had been in August 2021. So here we go:

The S&P 500 index surged 24% in the year 2023, thereby reversing the 19.4% decline of 2022, and closed the year at 4,770. Almost but no cigar. At the close, it was 0.5% below the all-time closing high of 4,796 which had occurred two years ago on January 3, 2022. Oh well, maybe next year or whenever.

The years 2022 and 2023 were quite a show, with lots of massive ups and downs, to end up in nearly the same place as where it had started two years earlier (all historic index and stock data via YCharts):

The Nasdaq Composite surged 43% in the year 2023, a huge rally, thereby reversing nearly all of the 33% plunge of 2022, and closed at 15,011. But that was still down by 7% from its all-time high in November 2021.

The index had first reached this level in August 2021. So after 27 months of rabid volatility, it ended up in the same place.

Let’s break this down a little.

The Nasdaq 100 [NDX], which tracks the largest 100 stocks on the Nasdaq excluding financial firms, exploded by 54% in 2023, erasing its 33% plunge in 2022, plus a little, and started hitting all-time highs in December. It closed at 16,825, up by 2.4% from its previous high in November 2021.

That 54% climb was the best year since the dotcom boom in 1999, which was followed by… OOPS.

A handful of huge stocks with huge rallies powered those indices. Those mega-caps weigh more heavily in the Nasdaq 100 Index and fueled its rise.

The Dow Jones Industrial Average, which track the largest stock in each industry, 30 of them, rose 13.7% in 2023 and in December started hitting all-time highs, closing the year at 37,690, having more than wiped out its 8.8% decline in 2022. It is now up by 2% from its previous all-time high on January 3, 2022 (the Dow is structured as an average of the prices of 30 stocks, and so it has some quirks).

By contrast, the Russell 2000 Index, which tracks 2000 small cap stocks, ended the year below where it had been three years ago. In 2023 it rose 13.7%, not enough to make up for the 21.6% plunge in 2022. At an index value of 2,027, it was back where it had been in early January 2021 – three years ago.

And it’s down 17% from its all-time high in November 2021. So those three years have been an ongoing wild ride through heck.

The Mag 7 since Nov 16, 2021.

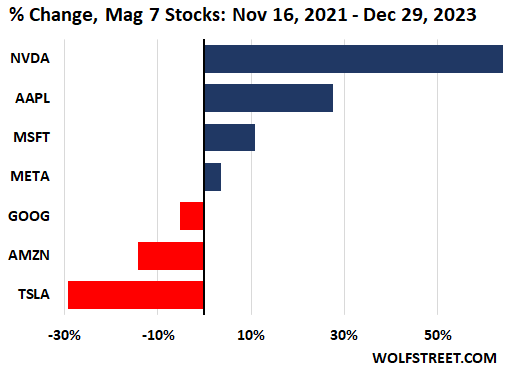

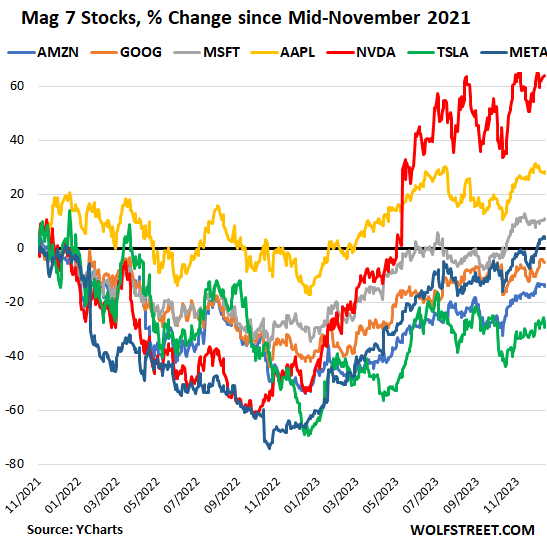

The Nasdaq had peaked in mid-November 2021 and is still below that level. So we will use November 16 as our starting point.

Since November 16, the stock prices of these seven huge stocks changed in different directions, with Nvidia at the top (+64%) and Tesla at the bottom (-29%). Amazon and Alphabet are also still down from mid-November 2021:

It wasn’t smooth sailing getting there. By November 2022, all of the Mag 7 were in the red since mid-November, with Meta down 73% at the low end and Apple down only 3% at the high end.

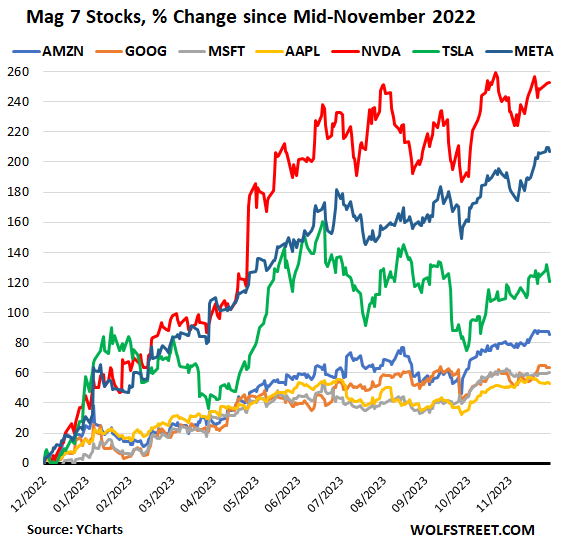

The Mag 7 since November 16, 2022.

Prices of these 7 stocks exploded higher. At the high end, Nvidia spiked by 252%, Meta by 207%, and Tesla by 120% in those 13 months. At the low end, Microsoft, with a market cap of nearly $3 trillion, was up 60%; and Apple, the largest company in the world with a market cap of nearly $3 trillion, was 53%. These two companies combined gained $3 trillion in market cap in 13 months!

These are stocks with gigantic market capitalizations. Combined, the seven stocks have a market cap of $12 trillion. And so they move the overall indices in a big way, and over the past 13 months, their massive surge fueled the rise of the overall indices that they dominate.

Ok, the 10-year Treasury yield... That was funny too. It ended 2023 at 3.88%, to the basis-point where it had ended 2022 (3.88%), and so it went absolutely nowhere over those 12 months, but it sure climbed a big mountain for 10 months with a lot of blood (including banks that collapsed), sweat, and tears, and then, amid the mania about the Fed’s gazillion rate cuts in 2024, it hop-scotched all the way back down in two months.

In this cycle, the 10-year yield had first reached 3.88% on the way up in September 2022.

Barely visible on this chart: the 10-year yield actually rose for the past two days by a combined 9 basis points, as the mania about the Fed’s gazillion rate cuts began to fade.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

My prediction is mag 7 will have a correction by march – April

I agree with you. They have been overhyped and overbought. NVIDIA up 250% in a year???

EPS CAGR TTM: 1270%; FCF CAGR TTM: 264%; price CAGR TTM: 175%. Doesn’t that explain it?

Earnings turned Nvidia into a value stock. If 2024 earnings do come in at the average analyst estimate of $20 a share in 2024, then at its low of $150 in 2022 is was trading at 7.5 times its 2024 earnings. Since its exploding earnings make it a growth stock, it is not surprising ti has shot up.

But how much of those earnings are actually available to investors? Whatever the company has to plow a back into the business just to stay competitive is ultimately a cost of doing business. The only real earnings are those paid in dividends, plus whatever portion of buybacks aren’t offset by stock based compensation to insiders.

Value stock? Where is the dividend MF-er?

WB

Logic only dictates that the needs of many far outweigh the needs of few or the “Mag 7”.

What these charts miss is the logic and reasoning, because there is nothing that really explains the rise of Mag 7, our Everything bubble has become a Mag 7 hyper bubble.

The Mag 7 must go up, or they crash. There cannot be middle ground left at this point. Let’s see if tax-delay selling materializes in Jan. Bought few testing puts yesterday.

Diamond 💎hands everyone, diamond hands!

To the moon! 🚀 🚀

I DCA into S&P biweekly so not something I try to time and don’t try to predict or put too much weight into predictions. Only other person I read is similar to Wolf in suspecting yields are bottoming now/soon and will go back up as will inflation and as a result equities down with this being a temporary peak in equities. That would be Felix Zulauf (I have no relation to him). He was wrong in 2023, but the SVB collapse and Fed response were things that messed up his timeline. Not surprised if we get an ATH in S&P like he said to ~4900 before yields and inflation go back up and S&P back down (Q1 2024 is his guess on this). I will keep DCA’ing…current 401k since Feb 2021 job start is up 15% or so…was 0% return at the end of October so all those 401k gains only in last 2 months…

Thanks for the reference. I went back and read his newsletter from March 23, 2020. He was predicting a bottom “in late 2021 or more likely in

2022”. Little did he – or I – know that it had already been reached.

MarMar-

Zulauf’s recent interview on David Lin’s channel is worth listening to once or twice. He doesn’t get everything right (as another commenter observed when I mentioned him a few weeks back), but he’s an insightful thinker, IMO.

And Lin is a wonderful interviewer. For a musical diversion treat yourself Lin’s 5 minute holiday violin solo from just before Christmas! A remarkable young talent…

The best thinkers get almost everything wrong most of the time. Perhaps it is more prudent to pay attention to what less-smart money is doing?

Zulauf is awesome thinker but wrong most of the time .

These smart people forget that fiscal policies would dominate the monetary policies and there are no fiscal prudence unless things are at breaking point.

Do you really expect the politicians from either side to reign in the deficit spending?

Well I think part of what makes analyzing markets so tricky is precisely the balance between “intrinsic” value and value from fads and trends. You can have the best analysis of intrinsic value but “the market can stay irrational longer than you can stay solvent” etc.

I correctly predicted the March 2020 crash (although in late January I thought it would happen in February), and it took me many, many months to finally believe that the Fed put was real and working and not just a sort of dead-cat bounce.

John H. –

Just watched that interview – loved the quote at 32:55: “I think the craziness about the Magnificent Seven is rather smelling of an end period of an era rather than the beginning of a new era.”

The markets are levitated by despicable manipulation by the FRB and the Treasury. A true masterclass on Macro finance and what really happened in 2023 with liquidity (the only thing that matters for markets) was delivered by Bloomberg’s Simon White on Adam Taggart’s Thoughtful Money podcast. Do yourself a favor and get educated before the rugpull.

Careful here

So much is riding on cloud data center spend it seems. Microsoft, Oracle, Google, and Amazon haven’t given fantastic guidance recently so it makes me wonder who is buying enough GPUs to sustain these valuations. Add on top of that the Chinese market being cut, EV sales dropping, and enormous capex spending from the likes of Intel and its a real head scratcher. Then it seems we just sort of forgot about treasury issuance and QT.

I heard an NVIDIA funded startup in AI was pledged to buy a bunch of their chips, in which case they’re buying their own chips with their own debt. Anyone buying their stock is looney on hopium.

It is also really remarkable that very, very, very few ever mention that the absolute core demand for Nvidia chips is for highly specialized Bitcoin/Altcoin mining rigs (not some AI baloney puffed up over a little more than a year).

Nvidia hyper-valuation and Bitcoin demand are welded at the hip.

Not saying that is good, bad, or otherwise…but it is amazing that it is so little known.

Not surprised that the CNBC touts (ai, Ai, AI, AIIII!!!!) hide this fact but there are a lot of pretty decent sources that are pretty lazy on this point too.

Interesting dot connecting Cas127

So does Bitcoin mining get more efficient with the latest nvda AI chip ?

GPUs are obsolete for Bitcoin mining and have been for a decade. Those use specialized ASICs or simply aren’t competitive.

GPUs are good for Etherium but since it switched from proof-of-work to proof-of-stake, the demand dropped by some 99%.

Of the altcoins, many actually run on top of Etherium so also don’t need GPUs. Others use the same ASICs as Bitcoin. Those that do benefit from GPUs are an insignificant portion of the whole.

So no, the GPU market is not driven (any longer) by crypto.

What’s remarkable is that we hear next to nothing about the outright energy/environmental waste and destruction that is BitCON/crypto “mining.” What a joke.

Brian,

You are exaggerating how far in the past Nvidia’s core reliance on Altcoin mining is/was.

This is a pretty good explainer (https://blog.johnluttig.com/p/nvidia-envy-understanding-the-gpu) and the chart labelled Nvidia Quarterly Revenue really lays it all out.

Lustig is more positive on Nvidia than I am (it is very, very hard to actually earn out insane PE levels) mainly because a tiny handful of big players are throwing billions at AI/GPU clusters in The Great AI Paint Huffing.

As if rich people/companies never make insanely excessive malinvestments…hell, every idiot VC boom/bust (see 2000 and…now) involves allegedly “smart” people making pretty obviously unwise excess investments (so *many* in fact, that entire websites have been dedicated to tracking them).

The way I read Lustig is that absent The Great AI Paint Huffing of 1 year’s tenure, Nvidia’s actual revenue relies upon Altcoin rigs. Ditto Nvidia’s insane triple digit (and then some) PE ratio.

(Note, one easy way to have an insane PE is to have…a pretty low actual “e”…but a lotta hype).

Doesn’t bitcoin use asic processors?

Nvidia gpus were for the etherium mining.

I’m pretty sure the ai stuff from nvidia is for ai… but the value of that has to be seen.

It’s a bit like Tesla and EV, they’re valued as if the entire car industry will be replaced by Tesla.

Similarly, nvidia are seemingly priced like every thing in the world will be processed by their ai chips and someone will pay for that ai ‘improved’ information.

I’m certain there is value there, and has been, and has been growing for years… but I consider a great deal of it is recent and speculative in its nature.

Agree with Depth Charge. I thought of this long time ago. The carbon emission of Bitcoin mining was mentioned in the media briefly two years ago and then it all became silent. This shows the corruption of the government who is not doing anything about it.

Cas127,

Another, perhaps more limited, use for Nvidia chips is in computer gaming. But those are, usually, single unit at a time sales.

I don’t do computer gaming so I have no clue as to their effectiveness in this area.

Why should the government get involved in Bitcoin mining?

Should the government dictate what you can do with the electricity you purchase?

With respect to the environmental consequences of cryptocurrency mining, I think one reason we heard less for a while is because the whole industry was in scandal (eg the collapse of the Terra stablecoin, the FTX fraud and bankruptcy) and the value of Bitcoin declined heavily. Now that it’s back up quite a bit, and there’s renewed interest (the SEC will probably approve a Bitcoin ETF soon), I’ll think we’ll see more stories about it.

It is noteworthy that in September of 2022, the second most popular cryptocurrency by market cap, Ethereum, changed the way the coin is mined, reducing the energy cost by something like 99.9%.

I don’t follow the altcoins much as I believe them to be pointless, just fun tokens that some insist on gambling with. However, their combined size is dwarfed by the major tokens so I don’t feel that they could have a significant impact compared to what Bitcoin (and Etherium) would achieve, which was the in the original statement.

The electricity used by Bitcoin for proof-of-work is an issue. Etherium moved to proof-of-stake and removed that issue.

Bitcoin mining will always be somewhat proportional to price TIMES REWARD. The basic block reward halves every few years meaning only fees will eventually remain as the reward. That helps, but probably not enough.

For that reason, I can see Bitcoin facing opposition that could hurt its future. But the same pain that would make it less popular would also lower fees and thus the mining reward. That then makes mining less profitable and energy use would reduce to match, resulting in less opposition. Already, layer-two systems like Lightning reduce the demand and thus lower average fees.

I like to tell myself that the Magnificent 7 are named for the song by the Clash, and it’s somehow connected to how horrible it is to work a regular job.

Was never into cowboy movies

Joe Strummer was amazingly prescient.

Get your head out of the sand. There is no stopping AI and Nvidia is going to keep printing those chips, that demand is only going to increase. AI is the next gold rush and it’s only going to make the Mag 7 richer.

Does this comment ring the bell of the AI bubble top?

he forgot /S or maybe that’s Tom Lee in disguise…

Lay off the paint chips, potato chips, and computer chips. This isn’t a Joe Rogaine podcast. I can almost feel the need to claim ‘AI has become sentient.’

Not yet.

2 years ago, Jan 2, I purchased some extra QQQ since it felt that to the moon.

Next week I will not repeat that, so the top is not in, yet.

Planning doing some selling, so can’t be the top…

The AI industry has reached a permanently high plateau!

/S

I see you haven’t yet spent an afternoon messing around with AI tools… powerful they are, but all-that they ain’t.

AI has been here for a decade,what it will do or won’t do is to be determined.Just another pump and dump .And Nvidia is corrupt it’s on the internet research it = or lose your ass

A decade?

Texas Instruments was doing AI in the 1970’s and their Speak and Spell was one of the resulting products. I have to laugh every time I hear how AI is dangerous and could lose control.

Conjuring up memories of “program trading” (aka algorithmic trading) and the convulsive markets of 1987.

Not much truly new under the sun…

One way to think about how over-concentrated the indices are…

Off hand, I would say that the median mkt cap for the other 493 stocks of the SP 500 is somewhere in the range of 20 to 40 billion.

That means the tiny handful of “the Magnificent” (with perhaps an 800 billion to 1 trillion mkt cap qualifier) are *each* worth 20 to 50 times any given non-magnificent 493.

And yet they occupy the same planet, with the same aggregate growth rate…except the Magnificent have mkt penetrations already far in excess of the other 493.

No wonder the Street has to insanely babble about the AI Millenium.

A crowded trade. Just as “news” always needs a train wreck every day, whether there really is one or not, stocks seem modernly to need a giddy “gold rush,” a promise of something for nothing, in a hurry. Subprime mortgages were a biggy. Then crypto piggybacked on the post-GFC cynicism (and eternal greed), served the “need” for a new gimmick, and collapsed but keeps coming back, undead. AI is taking its turn. Granted, it will be significant, but how much (at what P/E) is anybody’s guess. I bought some MSFT early this year, happily, cynically, but I’m much more shy now.

Wonder how much of this “funniness” of the market contribute to the wealth effect of our favorite drunk sailors to keep feeling good about spending. Sure they are making more but if most of them also know they are gaining in their bitcoin portfolio or home value, it keeps the drunk partying going and going…

Let me be clear saying I agree that the markets are fully overvalued. No doubt. 100% agree. I have more cash (really money market) in my investing account than I ever have had.

That said, a person doesn’t have to invest in the market. They can invest in individual stocks. It is tough, but there are a few stocks that should do better than bonds over the next 10-20 years.

I don’t think investing in the stock market is wise, but I do think people need to separate the stock market from individual stocks. It is literally missing the forest through the trees.

I don’t disagree, but most people will not invest well doing that, and if they do, it’s because they got lucky.

Most people just buy index funds, which means buying Apple, Microsoft, Nvidia, Tesla, Google and so forth at obscene valuations.

Yup. The single stock I still own paid out a ~20% dividend this year.

No mention of gold making ATH?

LOL, this was about stocks and Treasuries. Not soybeans or anything else.

BTW, gold’s 2023 ATH was up about 10% from its 2011 ATH. And for those 12 years, it paid neither dividends nor interest. So it’s good that it finally got out of the hole.

Gold at 2011, $1870 would have to be $2531 now via the BLS inflation calculator so it’s not out of the woods yet. Dec 2015 low around $1075 then / $1400 now looks a bit better around 5% keeping up w median inflation mol.

A lot of economic indicators out there still throwing flags tho so will see how it goes. Maybe all that moolah floating around will keep the sailors sailing.

Wolf,

Whats your prediction/analysis for 10 yr note in 2024?

In 2023, 10 yr note gave up all its yield gains in last two months and came back to same place where it started. Since 10 year is tied to so many lending rates, 10 yr matters the most in terms of Financial Conditions.

Oct end, treasury announced the funding plans and smartly reduced the 10 yr purchase amounts and increased 2,3, 5 and 7 years amounts. This soften the blow and kicked the can to future. Idea being FED will reduce the rate so the yields will come down and Govt can save on interest payments in long term.

Yea government time the bond market without the Fed as a backstop of QE . Would this not increase the volatility of the interest rate swings ? Both directions . Would love to have the biggest drunken sailor consider reducing spending for a few years (Federal Government) !

Seems pretty clear to this old boy following Wolf’s Wonder to the point of, FINALLY, understanding the relationship b/t price and yield of treasuries, from T to B, and including Ns.

Right now, in my very humble opinion, the fat cats, etc., are doing their best to drive up price of treasuries to help the ”banks” SO many of which are still upside down on their many treasuries…

After ”they” do their best to help clear out the very low yield holdings of the banks, I suspect/expect to see a huge increase in yields based on the incredible $33TT current debt.

NOT any kind of advice, far damn shore.

Very soon to be 34.

My advisor, who admitted they were previously wrong, believes the 10 year will get back up above 5 if not 5.5 in 2024. They are at least honest to admit that even people within their own investment house see everything different.

I think your advisor may be correct but possibly 2025/2026 on those high yields.

👀 On oil tho could push inflation higher again sooner

SRK,

What the Fed heads said in unison:

If (if, if, if) core inflation continues to drop to our 2% target, we will cut rates later in the year.

Markets completely tuned out the “If (if, if, if) inflation continues to drop to our 2% target.” They just heard “cut rates.” And they added “in Q1.”

So if core inflation doesn’t continue to drop, if it turns back up, as it has a tendency to do, the Fed is going to watch this play out without cutting rates. They’re not going to cut rates if inflation starts rising again. And there is a good chance of that. They gave themselves about 6 inflation reports before they get to the rate-cut decisions. So they have time.

So if that happens, there will be mayhem in the Treasury market because all this stuff will have to be repriced.

Even if inflation kind of meanders along above the Fed’s target, the Fed may only cut 2-3 times this year and then indicate another wait and see pause. That would also trigger a repricing.

The government is going to pile new securities on the market at a massive rate, and they have to find buyers. If those buyers lose interest due to inflation not subsiding as hoped for, yields will have to rise to find demand.

The long-term Treasury market went through a mania the past two months, based on hopes of massive rate cuts the kinds that you would see if there is a big recession and vanishing inflation. That could happen too, and then yields would stay low. But I just don’t see data at the moment that point at this scenario.

Howdy Lone Wolf. Really enjoyed reading your comments above. Shame so many others talk and type so much nonsense…..Gets clicks I guess……..THANKS

What I don’t understand is why the media says rate cut will have direct impact to the 10 year rate. The 10 year rate has been dropping for 20 years, which started at furious pace to 0 due to QE in 2008 and then 2019. For the 10 year rate to stay low, QT has to stop and QE has to restart. This is drive gold price to the moon. Whether dollar will depreciate depends on whether EU, Japan, and China will do similar QE concurrently. One thing is for sure, foreign buyers of US bonds are there anymore. Will pension funds be convinced to buy these bonds while getting hosed by inflation later or big banks be bullied into buying them with some tacit promise to take care of them later?

1) SPX [1M] : in Sept 2002 and in Feb 2009 SPX entered recession territories. Since Feb 2009 SPX [1M] was not in recession.

2) In Dec 2013 RSI reached a bullish territory. Five years later, in Jan 2018 RSI peaked. Four years later, in Aug 2021, RSI high was a lower high.

3) In Mar 2020 and in Sept 2022 SPX [1M] wasn’t in recession. Since Aug 2021 RSI might be on the down to a bear market territory.

4) Happy new year.

Wolf-

Thanks for adding the 2 years of perspective for all of the charts.

Is it possible to overlay total return performance of S&P 500, Dow, NASDAQ 100, and 10 year in one chart? 2 year and a somewhat longer period would be instructive.

Would it become too confusing to consider real returns rather than nominal?

Love your thought-provoking work!

P.S. My 2024 check contribution will be initiated next week.

Oops, meant to say “10-year Treasury.”

I suspect that the visual cliff that the inflation adjusted value 10-year Treasury fell off of in 2022-23 will be striking…

Microsoft and Apple have a LOCK on personal computer operating systems.

Imagine if there were only two Oil Companies? Two grocery chains? Two car manufacturers?

This biopoly is an undue concentration and deserves some attention.

What about Google/Android/Chromebook? Isn’t it like 30%-60% now?

no they don’t. its called linux. burn the latest mint ISO onto a thumb drive and pop it in. you wont ever go back. if you are incompetent on a computer, youtube how to do it. if you still cant figure it out, buy a pre loaded stick for 7 bucks off amazon. your captivity is an illusion.

if you dont take this advice, never complain about it again.

Many of us here have used Linux. It’s not a new thing. It isn’t a business standard so you spend a lot of time learning something you can’t bill for. Stick that into your obsolete thumb drive… :)

Happy new year everyone!

It’s a standard in high performance computing (cluster), where the real work gets done.

And I use neural nets (AI) almost 25 years ago for image analysis. Now they’ve trained networks to BS in a slick manner like any politician. Some progress!

Linux is free.

In the Embedded Systems world there is a saying.

“Linux is free, but it’s gonna cost ya!”

They are starting to resemble utilities.

Another interesting chart is the regular S&P vs its equal-weighted counterpart… big difference.

5) SPX [1M]. If correct, after reaching recession territory, possibly in late 2024/25, RSI 1M might bounce up and down, still in recession territory, for a decade, or longer. The next low might not be the final low.

6) The Jan 2022 and Dec 2023 dbl hump is too short.

Look, if the Fab 7 is not up, then Madame Pelosi will have to sleep at the Tenderloin, and we simply can’t do that to old people, because that’s just elder abuse.

Ah, the stock market. Traders and investors and a host of bloodsuckers swim in the same sewer. Investors, by being slow and patient, will, over time become quite wealthy mostly by simply ignoring the other swimmers. Traders, on the other hand, will from time to time feel like they figured things out only to learn too late the lessons of Jesse Livermore: “Traders die broke”. Jesse, as you may or may not know, completed his journey by shooting himself.

Except the traders who are doing it on individuals behalf. They get their slight cut regardless, not unlike sports betting where they don’t care who wins and loses as a small slice of a massive pie is still a lot of pie.

Unless your basic assumption that matters only go up over time isn’t correct.

Maybe a couple decades of losses will change this thought process

So if the yields fall over the next few years on things like treasuries where will all the money go if not back into the markets? Admittedly more of the population, boomers, are in spending mode, but taxes are generally low and profits generally high so money has to end up somewhere. I was hoping, and still am, for the 10 year to be a good place to park money but at current rates and given I don’t need income from my investments seems way too low at this point.

Howdy Folks. You like your stocks? You can keep um. Even if ZIRP returns, this old fool will not play….. Stay out of debt, live within your means for a happy life.

Sorry Bubba,

It’s time for the ants to give up; the grasshoppers have them surrounded

Howdy Bigal. There are survivors in all battles and wars.

@Debt-Free-Bubba,

Agreed. Typically those who are nowhere near the battlefield.

But you gotta identify the theater before you scope out the battlefield.

As long as you have inflation “covered”, this is a good plan. Otherwise, you will be eating second rate cat food with your devalued dollars.

You ate truly liberated if you are really out of this.

More power to you 💪

Monetary flows, the volume and velocity of money, hit an all-time high in November 2020. But Powell thought any inflation would be transitory.

On the other hand, Powell has held the means-of-payment money at the same level for 21 months. Since the distributed lag effect of money is about that length, we can expect further progress on a 2% inflation target.

MW: A record share of S&P 500 stocks underperformed the index in 2023 as ‘weirdest bull market in decades’ marches on

Not much news here about the muni bond market. I’ve got a lot of funds in a short term muni bond fund. The fund has underperformed over the last several years. Lots of red flags. Major redemptions and poor performance all around. I was thinking of unloading my position, but if I do it will probably be at the worst time. With interest rates trending down, I see the shares appreciating, making back some of the losses during the period of rising interest rates. I wonder if Wolf has an opinion on this investment. I know he is not a fan of bond funds.

re: “it will probably be at the worst time”

Bond prices historically track the 24-month moving average of money flows. I.e., they track momentum, (the → “arrow of time”). So, bonds can become oversold and overbought.

But I have a problem with 2023’s $1.15TN uptake in MMMF volumes. If that money represented a transfer of funds from the banks, through the MMMFs, then this represented an increase in the supply of loanable funds.

That and considering that the swing in O/N RRP volumes was 1,606TN, what’s left for 2024?

Without an earthquake tsunami might cover CA.

With CA dispensing free medical to any arrival in ’24, the tsunami probably won’t be of water, but rather of debt and people.

Yes, it sure looked like that yesterday when a few freak waves washed over the shore.

It takes a brave man to not blanche when pondering higher maths terms like”gazillion”. That’s a lot isn’t it?

Happy New Year to All

I don’t mess with the stock market because I do not have the necessary insider information to make an informed decision. I also despise the financial media, which almost universally hypes the stock market, and looks more like a confidence game than anything else. I pull back when people are trying to con me.

I am pretty sure the stock market would have had a bad year if not for Powell’s bizarre about-face in his last press conference. I’ll stick with T-bills for the time being. If we seem to be heading for a recession (no signs yet) or if inflation is getting to 2% (maybe), I will move to longer duration CDs. I prefer low risk investments, since I have adequate resources so I do not have to take big risks. My expenditures are also not extravagant.

and the lowly little 4 week T bill has been above 5% since may 4th of 2023 with no risk

sometimes swinging for the fences (high returns) works but the steady stream of 5% works just fine for me

5% is a low return would take 20 years to double your money.

Not 20 years. You left out compounding of interest (earning interest on interest).

At 5% interest, your money doubles after 14.3 years due to compounding = 100% gain.

After 20 years, you made 165%; after 22.5 years, your money triples (+200%); after 25 years you made 238%.

Thanks

Everyone is waiting for a rate cut.

Some even expect them to return to zero levels.

Even if interest rates go down, they won’t go back to zero for at least the next decade.

And when they begin to fall again, a wild buying of assets will begin, which will instantly raise inflation. Then the interesting moment will come when the banks will have to raise the interest rates again, this time to higher levels, perhaps.

I fully expect rates to be at zero again in the next recession. Plus QE.

The Federal Reserve’s estimate of a neutral interest rate is 2.5% (or 0.5% net of inflation.) So far, the hawk vs. dove divide on the FOMC seems to be primarily centered on *when* they think inflation will sustainably return to 2%, not *what* they intend to do once that happens — that is, cut rates back down to neutral even in the absence of a labor or GDP recession.

2.5% does not leave a lot of room to stimulate the economy in case of a real recession or major external shock to the economy like COVID lockdowns. So they’ll have little choice but to return to ZIRP & QE … or maybe that’s by design.

As for your second point, 13 years of ZIRP & QE from 2008–21 didn’t cause traditional consumer price inflation, just mainly asset price inflation. Too few Americans own stocks & financial assets in liquid, non-retirement accounts for any wealth effects to drive up the prices of bread & milk. Even at the peak of the first internet mania (1994-2000), when retail speculation seemed broad-based, CPI never exceeded the mid-3’s.

The Federal Reserve knows they can get away with ZIRP & QE. The stimulus checks were a far bigger contributor to the recent inflation spike than ZIRP & QE.

There is no recession on the horizon, even here in Europe the recession is far from the one in 2008. Economies are doing well with these interest rates.

If not QE and zero interest rates what the hell caused this inflation?!

Without free money there would never be inflation and the more it was printed the more inflation flowed from assets to services and commodity prices

I’ll take the other side of a Javier Milei bet. State your terms.

You made predictions for 2024 not 2025. How would 45 do anything in 2024 or are you assuming the pivot will happen as a result of primaries?

I do find predictions interesting as too many unknown variables to call economics a science outside of just the theoretical. It is like arguing the merits of various economic systems trying to dismiss the idea that it isn’t intricately tied to the political system.

I don’t have a clue. I will be watching market behavior and listening to as many smart guys as I can.

You all can say that again.

Anecdote: I check ebay periodically for a used machine tool typically priced in the 15-25k range. From 2019-2022, there were usually 3-6 listings for these items. Today there are 35 of them listed. Prices are still a bit high, but the inventory is up. Means nothing I suppose. But I wonder what happens if a recession arrives.