Subprime is the mother lode of profits – until it isn’t.

By Wolf Richter for WOLF STREET.

Subprime is re-getting into trouble, after having somewhat gotten out of trouble during the free-money pandemic, when folks used some of the free money to catch up with past-dues.

In the auto industry, subprime is largely confined to older used vehicles. Less than 5% of new vehicle sales are financed with loans or leases to subprime-rated customers (more in a moment). The sweet-spot is 8-to-12-year-old vehicles, only a corner of the used vehicle business. But in that corner, several subprime-specialized dealer-chains – owned by PE firms – have already filed for bankruptcy this year, and we covered a couple of them here. Others are struggling.

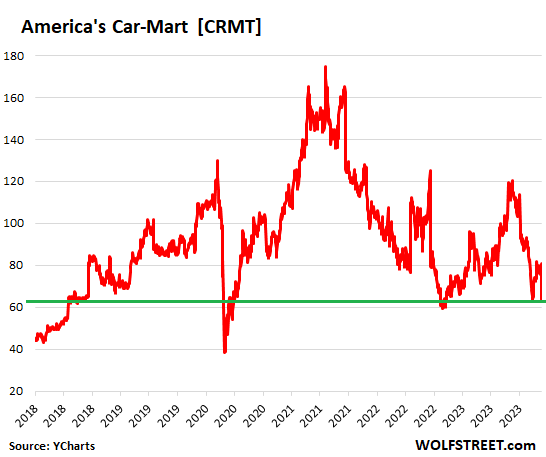

Yesterday, it was the turn of America’s Car-Mart – a publicly traded subprime-specialized used-vehicle dealer chain – to confess in its quarterly earnings, upon which its shares [CRMT] tanked by a combined 21% yesterday and today. They’re down by 61% from the free-money peak in August 2021. What felled the shares yesterday and today was the disclosure of a massive jump in charge-offs and loan losses (chart via YCharts):

Car-Mart has 154 stores in smaller cities in the South-Central US. It sold over 15,000 used vehicles in the quarter and generated $362 million in revenues, including $59 million from interest income from those high-interest rate loans that its subprime customers use to fund their purchases of the overpriced vehicles.

Subprime is the mother lode of profits – until it isn’t.

Car-Mart is a good example. But they all work on a similar principle. Subprime-rated customers are the motherlode of profits for subprime-specialized auto dealers because these customers have few other choices left; they tried other dealers and got turned down because their credit is bad, and so they find a dealer that will provide the loan, and the rest doesn’t matter.

These specialized dealers make huge amounts of profits on each sale in several ways, well, until they don’t:

- Selling the vehicle at a ridiculous price and profit margin

- Charging dizzying interest rates on the loans

- Selling insurance and warranties, usually provided by their own affiliates.

- Charging late fees

- Servicing the loan after it has been securitized and sold to investors.

Huge gross profits per unit sold. Car-Mart reported an average gross profit per vehicle sold of $6,835 – on vehicles with an average selling price of $19,035. So that’s a gross profit per unit of around 35%.

Dizzying interest rates. For the auto industry overall, data from Experian shows how high those interest rates were for “subprime” auto loans (FICO score of 501-600), and “deep-subprime” loans (300-500). The table compares Q3 2023 and Q3 2022. Note the increases in rates:

| Average Interest Rate by FICO Score, per Experian | ||

| Q3 2023 | Q3 2022 | |

| Deep subprime | 21.2% | 20.2% |

| Subprime | 18.4% | 16.8% |

| Near prime | 13.5% | 11.3% |

| Prime | 9.3% | 7.0% |

| Super prime | 7.4% | 5.0% |

Car-Mart provides these loans via its finance subsidiary, Colonial Auto Finance, and generated $59 million in interest income in the quarter, up from $48 million a year ago.

So let’s ballpark an average interest rate based on the sparse numbers Car-Mart provided: It carried $1.1 billion in finance receivables at the end of the quarter. So very very roughly, the quarterly interest income of $59 million ($236 million annualized) would amount to an average annualized rate of very very roughly 21%.

Average total collected per month per customer in principal, interest, and late fees rose to $533. So these customers are paying out of their nose on a monthly basis for an older used vehicle.

But only about 80% of the outstanding loans are “current,” roughly unchanged from a year ago, while 20% are in arrears.

What makes this business extra-risky is that dealers are selling hugely overpriced cars at huge interest rates to people who can least afford them. It’s like a self-fulfilling prophecy: Because the people have a history of defaulting on their debts, they represent a big risk to lenders, and many lenders won’t lend to them. Lenders that do lend to them make up for the risk by charging them extra, which inflates the monthly payments, which further increases the risks.

In this case, the dealer-lender charges them extra for the vehicle and finances it at very high rates, which caused the payment on these old cars to be very high, which increases the likelihood of a default. And you know what’s coming.

The risks came home to roost.

In its quarterly report, Car-Mart announced that it had a pre-tax loss of $35.6 million. By comparison, a year ago, it had a pre-tax profit of $4.1 million.

The reason was a massive increase in the allowance for credit losses. Credit losses are always big, which is in the nature of the subprime business. And the above discussed big-fat profits more than make up for them, normally.

But for the quarter, provisions for credit losses jumped by 52% from a year ago, to $135 million (from $89 million a year ago).

Net charge-offs jumped to 7.2% of average finance receivables in the quarter, up from 5.8% a year ago.

But wait… a return to pre-pandemic normal. That 7.2% of net charge-offs was in line with the pre-pandemic rate. Over the five years before the pandemic, net charge-offs had averaged 7.0%, the company said, “signaling a return to pre-pandemic net charge-off percentages.”

But wait again... more than just a return to pre-pandemic normal. The company said:

“Both the frequency and severity of losses played a factor in the increase, with frequency driving approximately two-thirds of the increase primarily due to the external environment.

“Severity was driven by longer contract terms and lower recovery values.

“We have experienced increases in both frequency and severity on some 2021/2022 [loan] pools as well.”

Tightening a little late. Car-Mart is doing what everyone else in the subprime business is doing: tightening their underwriting, including “higher down payments” (down payments averaged just 4.9% in the quarter) and shorter terms (the average term was 44.1 months).

Subprime hinges on auto-loan securitizations.

For subprime-specialized dealers, it all hinges on being able to securitize those loans and sell these Asset Backed Securities to investors, and slough off some of the risks. Dealers sell the vehicle, and make a ton of money on the sale, as Car-Mart has shown, and they provide the loan at a very high interest rate, as Car-Mart has also shown. And they gather those loans into big loan pools, and once or twice a year they securitize those loan pools and sell the resulting ABS to investors.

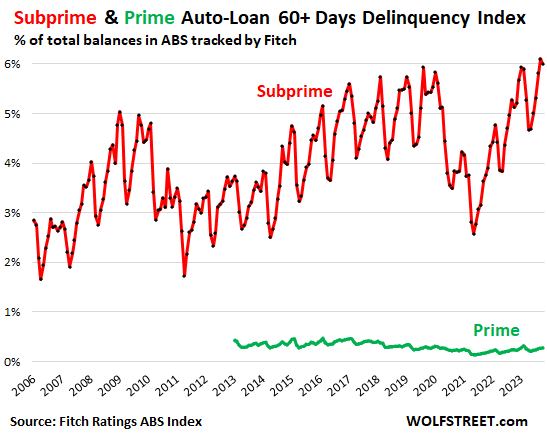

The 60-day delinquency rates of the subprime loans in the ABS that Fitch rates rose to an all-time high in September of 6.1%, having squeaked past the pre-pandemic high in August 2019. In October, it dipped a hair to 6.0%. A dip in October is seasonally typical.

But note that prime-rated loans are in pristine conditions (green line).

During the era of interest rate repression, yield-hungry investors loved those subprime auto-loan-backed ABS, but now, they don’t. And the fabric is coming apart.

As ABS investors have started to take losses and get skittish, a bunch of subprime-auto-loan backed ABS deals got scuttled recently, and dealers got stuck with those loans. Other deals had to be renegotiated before they could be sold.

When these deals cannot be sold, the dealers get stuck with the loans and can run out of money. As mentioned a minute ago, several subprime dealer-chains have filed for bankruptcy this year.

So credit is tightening in subprime. But just how big is it?

4.3% of new vehicles sales: In Q3, 21% of all customers paid cash, according to Experian which uses the credit data it collects from lenders and from registrations (liens). Of the remaining 79% of customers that financed with a lease or a loan, 5.4% were rated subprime, which translates into 4.3% of all new vehicle sales.

7.7% of used vehicle sales. In Q3, 63% of customers paid cash for their used vehicle. Of the remaining 37% who financed, 20.7% were customers with subprime credit ratings, which works out to be 7.7% of total used vehicle sales.

So subprime is a high-risk-high-profit business on the specialized fringes of auto sales. But the players in that small portion of auto sales are taking big hits. The risks they had taken were too big, and during the 0%-era they’d gotten too greedy, and now they bear the consequences of loading their customers up with ridiculously overpriced vehicles financed with usurious rates, all of which was very profitable until the risks came home to roost.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Subprime is an interesting area for sure. While there are subprime buyers who want a car it is unfortunate we don’t invest more in public transit. Not sure if that would address the issue but owning a car is incredibly expense for so many reasons. People get in over their head not likely because that is their intention!

@Glen… it’s not unfortunate. Everything is by design. Vested interests fight public transit by scaring people so that they vote against “the riff-raff” moving into their backyards – classic NIMBY-ism. On a larger scale, there is opposition to intercity and high-speed trains even in densely populated corridors. Unless people start thinking about the common good, there will never be viable transit and transportation options especially for the poorer sections of our society.

There are bus routes EVERYWHERE here in Southern California, but practically NOBODY has any interest at all in using them.-

here in Tucson, bus rides are free

still limited use

You forgot to add the /sarcasm tag at the end of your message.

I’m a SoCal resident and I have yet to see a metropolitan city (US and abroad) that is worse in terms of public transit than any SoCal city.

“I have yet to see a metropolitan city (US and abroad) that is worse in terms of public transit than any SoCal city.”

Come to Boston and ride the MBTA. Your mind will be changed.

MM – …did Charlie ever return? Was George O’Brien ever elected? (…nod to the Kingston Trio’s parody of ‘The Wreck of Old 97’…).

may we all find a better day.

It is also interesting that Uber/Lyft (their era of ill-thought-out hype having ended) still haven’t pivoted to the one area where their algorithm-routing power would make a true, honest difference to unit economics…shared rides (optimized by computers).

They have divisions covering it…but they give it little emphasis.

Shared rides cut true economic costs, can significantly reduce 2nd car demand for work commutes, battle insane new car inflation, etc.

And nobody has to get in the doomed political gutter to try and amp up mass transit at the alleged cost of hundreds of millions/billions.

91B20: Do you mean Chahlie? We don’t use the lettah R in Boston.

MM – I stand cahh(r)ected! (…and now understand the blank looks when I asked the location of the ‘car park’…).

may we all find a better day.

It’s true, we have similar challenges in Canadian cities. To me it seems sprawl is so much more profitable for so many more people that public transit, while existent, can’t really compare to networks in Europe and I’d assume Asian countries (since I’ve never traveled there), the incentives are just not there I guess. There is just enough transit to allow lower wage workers to stream into the core from slightly more affordable areas on the periphery in the suburbs to make the city viable. For me unfortunate is the correct word though because transit isn’t just for poor people, when transit is good I’ll take it over driving through traffic and hunting for parking, but anything along major subway routes with good connections is quite a bit more expensive.

I’ve had few life threatening experiences, but they’ve all occurred while riding or waiting for mass transit in big cities.

Why take the chance? I think many people ask that question.

I’ve seen lots of drugged up folks on mass transit. There’s no telling what they’ll do for $30.

I think the experience varies a lot. I’ve been living without a car in Sacramento CA for like 15 years now and take transit all the time. It’s super cheap, I don’t have to drive and I can just read a book or do work instead, and I still think the light rail is kind of fun. As a guy a least I’ve never really had any problems with the people, although yes there are a lot of homeless, and a few stations in bad areas that you could have a problem at.

I’ll say it’s hard to take transit to work though – it’s fragmented between the cities, it mostly doesn’t run early mornings or late nights (which are most of the low-wage job schedules that exist), it’s been a lot less reliable since COVID, and I also don’t like taking it during flu season since it seems like I’m always getting sick, although I don’t know that for sure. I work jobs within walk or bike distance instead and use transit for various other things.

Bobber,

40,000 people die in traffic accidents a year in the US, and millions of people get severely injured. That’s how Americans squander their lives in the US, not with mass transit.

WR, you’re reminding me of a motorcyclist I know who drove Route 66 but was terrified when he drove to the coast, driving through California. He was terrified of dying in an earthquake.

As someone who has spent decades of my life riding public subsidized transportation, your post is a big LOL.

I can’t help but laugh at the bedwetting that happens by those that are clueless.

Hi Glen,

It seems we are investing more in public transit, just slowly. I guess it comes down to energy/capita. Public transit is more efficient but not as convenient and or sometimes as pleasant.

I saw where high speed rail from LA to Vegas got base funding out of the infrastructure bill money.

I see continuing general improvement in public biking/walking pathways.

What I am looking forward to are the electric/AI driven taxis. With these need for individual vehicle ownership will diminish. That will be a big improvement because we will have more convenience and comfort over mass transit and net lower cost than individual car ownership.

Things in public transportation are improving but as always, slowly…

AI taxis will just worsen traffic. All the vehicles that clog the streets moving one person, will clog the streets driving empty locking for passengers, too. And driving in circles is probably cheaper than paying for parking.

Reducing the need for personal car ownership reduces our ressource consumption which is important. But AI taxis won’t solve anything regarding transit/ moving people from A to B but worsen the situation in many regards.

That stupid bondoggle will reduce necessary spending and infrastrucure investment because that “silver bullet” is just around the corner.

Traffic, transit are solved questions. There is no need for an techbro fantasy-start up to save the world. But the answers costs money and might be boring and require to implement solutions that work and not to think that american exceptionalism means to constantly to reinvent the wheel.

Imagine Vegas would have spend the money with a brain instead of building three different mono rail systems, lmao. And now they’ve got musked with an undergound amusement ride where driverless taxis are driven by minimum wage drivers without access for people with mobility problems….

AI taxis will be great for people who only rarely use 4-wheel transportation, people who generally walk and use bicycles. They will also reduce congestion as society will not need as many parking places. They will reduce pollution because society won’t have to produce as many vehicles. They will be safer.

This is reply to TC:

GREAT experiment on this subject, at least at the question of sharing transportation options, going on in Paris at this time.

Agree that AI ”free floating autonomous passenger vehicles” COULD be a HUGE benefit to cities…

Patience folks,,, just like every other new product/service, it will take some time to sort out the challenges…

…might want to also consider consumer society and it’s relation to public transportation, as well as the primary one of commuting to the workplace. Example: person responsible for shopping for a family of four (…more or less) is going to, say, Costco or Wal-Mart. Take the bus (assuming one has that choice, of course…)?

(…and how much is the revival of delivery affecting THIS dynamic?).

may we all find a better day.

Uber and Lyft have created more congestion than ever in NYC. Instead of parking in a parking garage at a destination, they unload and keep driving, either to their next fare, or to a place they can go cool their heels and idle their cars while they await their next fare. As you say, AI taxis will need to do the same, although eventually, algorithms will do a better job of matching supply with demand. Sadly. congestion is so bad that in order to reduce it, NYC is imposing fees for driving anywhere roughly south of Central Park. This, in a city with a robust (albeit, decrepit) transportation system.

We rode all over Mexico City on their subway system for 25 cents! Second largest metro after NYC. 4.5 million riders a day. Musicians play in some of the cars. It’s awesome.

What timing for this article. My good friend has a son in law truck driver oil field west Texas horrible credit.

Had a wreck in a 1 ton truck and was paid 5k after truck was totaled. 50 years old flew to Houston from Odessa bought a 2013 dually diesel with the 5 k down . Just yesterday Dec 5 after having truck 2 months repo wrecker shows up says repo time . Customer called used car dealer and was told no one to sell the loan to so repo time. What about my 5k? Can’t take my truck I have contract. They could take truck but refunded him 2500 because of past business. Sub prime credit drying up. Higher for longer I hope. They repo truck even though not one payment was asked for and customer had been calling where’s payment book.

Crazy. Does he take a hit on his credit for this?

He should have gotten in his truck and driven off and let them take him to civil court. See if it was worth it to them to take him to court. Sometimes you have to play hardball with the financial types, they certainly do.

I used to work in F&I – we would call it subterranean finance. GMAC D tier would be around 30% back then. Lenders of last resort for borrowers with low credit scores.

I have a car from car mart unfortunately I got screwed not reading the paperwork throughly at the time (I work overnights and was very tired) it turns out my payments are every 2 weeks so everytime I get paid they get paid instead of only once a month. I’m nearly 700$ a month just in car payments for a car from 2010. When I tried to talk to them they said I’m stuck with the car etc absolutely high way robbery of a company and deserves to go under.

I would suggest attempting to refinance the vehicle. I got my older car from the back lot before I fixed my credit and the payments were every two weeks. My credit was total garbage at the time but I was still able to get it refinanced for slightly longer and with a once a month payment. I would suggest going online and applying through Upstart. They use AI for underwriting so when traditional financing options turned me down they were a lifeline. I hope all is good cheers!

Whats the penalties if you stop paying and they take the car back? Thats robbery.

I think your right. He might be much off if he just drives the car back to the lot and throws them the keys.

You didn’t understand your monthly payment or interest rate?

Then walk away and get some sleep.

Three day cancelation window?

Does the contract have a pre-payment penalty? In many states, those are illegal. Can you just pay the car off?

Einhal:

If he could pay it off?

He wouldn’t have financed it.

I used to think a $600/mo. Car payment was huge (my last vehicle purchased/ 2013 Tacoma bought new).

We are considering buying a hybrid in the next 6 months. Online shopping is showing me an “average” of at least $500-$750/ mo. (For a $30-$45k vehicle).

My wife drives a lot for work. We both make decent money. With a “prime” rate of 9% we will be saving for a big down payment.

Or you could just buy a practical, reliable used Honda/Toyota for $10,000 that does the same thing as the ego inflating, unnecessary truck does. Minivans are more practical for 95% of truck and suv drivers that say they “need” one and there are plenty. You could probably get a Honda Odyssey for $5K that will last you another 100K miles without much issue and that’s a nicer one.

Almost all the time the answer to these discussions is “just get what you can afford instead of what you desire and be smart about it”. No one should be buying anything at over 5% interest that doesn’t make them money or is life saving … an organ maybe, a truck no… and if you “make decent money” why don’t you try saving some, hold off on what you want and then buy it so you don’t have to spend 2x as much for it. ( I know, I know, then you couldn’t buy all the other stuff you want right now right?)

It’s expensive to be poor. Trickle down not trickling quite far enough. You’d think with unemployment this low more people would be able to make that monthly payment. But with the surge in car prices outrunning wage gains I suppose not.

It’s expensive to be poor and stupid.

Plenty of “poor” avoid all these scams.

Correct. I’d add “impulsive” to your list.

“It’s expensive to be poor.”

Subprime doesn’t mean “poor.” It means bad credit. It means people fell behind on their debts, not just once, but repeatedly.

Young dentists with big incomes and lots of debts falling behind is a classic example of subprime high-income. And it happens.

Other reasons why people screw up their credit include medical expenses and other catastrophes that can happen in life.

The majority of reasons why people screw up their credit is recklessness with personal finances — not poverty.

The “poor” have trouble even getting credit, and if they get credit, it’s small amounts.

So subprime goes across the board.

But yes, no one should ever buy a car under these rip-off circumstances, that’s just my personal opinion.

I think you’re over-simplifying the problem. Poverty itself can lead to poor decision making, without the person being “stupid.” There was a study published in the journal Science several years ago that got quite a bit of press. The study found that the stress of worrying about finances can impair cognitive functions in a meaningful way. Here is part of the issue from a paragraph in the Slate article about the study:

“But the impact on cognitive skills is especially noteworthy for how it should influence our understanding of poverty. Poor people—like all people—make some bad choices. There is some evidence that poor people make more of these bad choices than the average person. This evidence can easily lead to the blithe conclusion that bad choices, rather than economic conditions, are the cause of poverty. The new research shows that this is—at least to some extent—exactly backward. It’s poverty itself (perhaps mediated by the unusually severe forms of decision fatigue than can affect the poor) that undermines judgment and leads to poor decision-making.”

When anyone is tired, stressed, or fatigued, they are more likely to make “stupid” decisions. Unfortunately, poor people find themselves in that situation more often than more affluent people.

Yep, I was thinking of a single mother who understandably lets stress and immediate needs get in the way of their long-term planning. Loan sharks happily prey on these people.

I hadn’t considered what Wolf said above about high earners with bad credit. It does make sense that they would jump into (and qualify for) a high payment plan option due to their high income. There are definitely brilliant people out there who are terrible with money.

“Poverty itself can lead to poor decision making”

This!!!!

I am always amazed at the people who cannot separate poor decision making from desperation. Sometimes people make the decisions they make because they have no other choice.

As a lifelong “car guy” working in the apartment business I have personally known tenants over the years that have been ripped off by the “buy here-pay here” subprime dealers that sell the worst cars ever at the highest prices ever (and then add “dizzying interest rates on the loans” rip off insurance and warranties). Sadly most of these people are not real bright to begin with and have had a tougher than average life usually due to a lot of bad luck combined with lots of bad decisions. I don’t see public transit helping many people since at least in the Bay Area we don’t take care of the public transit we have and a big reason ridership is down is because few people want to get on a bus or subway that is also a mobile insane asylum and homeless shelter. The new central subway in SF cost over a BILLION a mile (and was years late). I just read this week that the Federal government is giving Billions to both the LA to Vegas train (that they have been talking about for 20 years) and the LA to SF “bullet train” (that will give billions more to politically connected union contractors but has no chance of ever going from LA to SF in my lifetime since the tunnels will cost more than the central subway)…

Some stuff just can’t be fixed.

Many of America’s problems stem from the deinstitutionalization that began in the 70s.

AGREE,,, like, totally, dude or dudette!

And most of it can and should be laid on ronnie ray gun:

Starting with his totally outrageous tear gassing from helicopters of thousands of folks on the ”southside” of Berkeley because ONE,,, repeat ONE dude, who was most likely an FBI ”plant” was doing serious damage to storefronts when he walk up Telegraph and then down Bancroft.

After that, raygun closed the places where the seriously mentally ill had been housed and cared for,,,

After that, most folks know his record of abuse of unions trying to protect their members from the very clear challenges of the oligarchs, etc., etc.

Never been in any Union other than ”apprentice” in the cab drivers union in the area of the Angels in the sixties who not only trained me, thoroughly, to take care of my passengers first, then worry about personal and company profit, but made sure I complied.

VVNV/WGH – my mother was violently, (and only ‘managed’ with shock treatment, and later, drugs of always-limited efficacy) paranoid-schizophrenic, but, as you well-observe, was turfed-out of Patton under Gov. Reagan. As you note, WGH, she was overlooked as much as possible by those whose care she was left to, and by those least-prepared/qualified to deal with her (‘family’).

Not the same mental issue, and it certainly doesn’t speak well of me, but often found myself wishing, in his dotage, that Ronald Reagan would have been found lifeless in a filthy alley of a slum, having wandered there in his confusion…

may we all find a better day.

Mental illness is something always overlooked in the US.

Do “private credit” players invest in subprime auto loans (and/or mortgages) either outright or via securitizations?

I’m curious because private credit is growing so significantly and shows signs of competing for investments. Credit standards seem lax….

Is there a systemic risk there that is off the radar, or is this corner of the debt markets too small to matter much?

Private credit might extend a line of credit or a term loan to a subprime dealer. Several of the collapsed subprime dealers were owned by PE firms, and had funding through them, and that’s a form of private credit.

But I don’t think that private credit would buy the ABS – that’s what pension funds and bond funds do. Private credit would lend directly.

‘..new vehicles sales: in Q3. 21% of all customers paid cash, according to Experian..’

So, more than one in every five new car buyers paid cash?

Seriously?

That statistic amazes me.

“That statistic amazes me.”

It doesn’t amaze me at all. It’s low compared to my own experience in running a dealership back in the day. We (all dealers, even today) had a metric that we tracked carefully, called “F&I penetration” (F&I = finance & insurance), meaning the percentage of new vehicle sales where we were able to talk customers into financing/leasing through us and that we were able to sell additional warranties and insurance to. F&I was the big profit center of new vehicle sales. And that’s still the case today.

People who pay cash are the bane of auto dealers. That’s why dealers are pushing leases on people who want to pay cash.

Leasing has become very popular, and many people that could pay cash lease for tax reasons and/or because they like the hassle-free experience of getting a new car every two years and not have to worry about anything and with no loose ends dangling off.

The data is actual, not survey based. Credit bureaus get this from liens on the titles and from the data that they get from all lenders in the US.

I’ve owned two cars in my life and paid cash for both.

It amazes *me* that anyone would finance a depreciating asset at such high rates.

Many people suffer from Magpie Syndrome ‘.

They can’t resist shiny things.

Einhal:

If he could pay it off?

He wouldn’t have financed it.

I used to think a $600/mo. Car payment was huge (my last vehicle purchased/ 2013 Tacoma bought new).

We are considering buying a hybrid in the next 6 months. Online shopping is showing me an “average” of at least $500-$750/ mo. (For a $30-$45k vehicle).

My wife drives a lot for work. We both make decent money. With a “prime” rate of 9% we will be saving for a big down payment.

Seeing more hitchhikers these days as they don’t have their own wheels and Greyhound has shut down routes in BC. Fill in bus company start ups have arisen, but the tickets are expensive. There is nothing for poor people who need to travel somewhere other than cadging rides.

And just think about the costs beyond the purchase price. A set of tires might be $1K. A decent battery $200. The servicing will never get done, face it. My wife and I are saving our old Yaris for when, not if my nephew’s car breaks down. He lives in Victoria, works full time making a decent wage, but isn’t even treading water let alone buying a decent car. And we wouldn’t get dick for the Yaris so will give it to family.

Do workers in sub prime institutions think they are providing a service? Criminal.

I loved hitchhiking in my younger days. I hitchhiked all over the place, halfway across the country. Mostly a wonderful experience, meeting other people. I even hitchhiked a few times to go see my girlfriend in Tulsa when I was in high school. I still hitchhike when I’m traveling and there is no mass transit, for example, when coming down from the mountain in the Dolomites at night (because the refugios had closed due to early snow), and when we got to a road, we hitched a ride into the next town. We hitched a ride in Taiwan….

But in terms of reliable transportation to work, for example, it’s probably not ideal.

Used to be a line of hitch hikers at the last stop in Oakland, Emeryville, and Berzerkeley every work day morning.

Drivers would stop and pick up one or more in order to go across the Bay Bridge toll free. It was relatively reliable back in the sixties and early seventies in my personal experience

Does this still happen?

Long ago, I friend of mine who had just gotten out of college hitch-hiked to work for an entire Winter. On the border between Westchester and Connecticut. On the back roads.

The funny thing was that he started to get picked up by the same people: There were maybe half a dozen who were going from the same place as him to the same place as him. One or two actually worked at the same company (Perkin-Elmer).

Of course, this worked mainly because he was doing it during obvious business hours. . .

A blue-collar friend bought a five-year-old 100K mile Fusion five years ago via deep subprime lending. I read his 8-page contract/purchase agreement and have never seen anything like that in my life. Like many, the dealer had him walk away from what he was driving then, so there was no negative equity from another vehicle going into the Fusion. I’m sure the lender on the pricey Jeep he walked away from got theirs later.

He found another career and worked his way out of his hole. He still has the Fusion, and it’s been a very good car for him.

Any statistics that track ‘sub-prime loan borrower’ layoffs? I would guess that sub-prime borrowers would be among the first laid off in a recession.

More probably the subprime loan companies screwed up their statistics on how much risk to take.

I wouldn’t guess that at all. Many sub-prime borrowers are working class or low-income. As an example, the Targets of the world are more likely to lay off high paid office positions than cashiers.

They do cut their hours though. Those jobs are never 40 hours a week.

A lot of my friends working on low paying jobs can’t work 40hrs or full time hours because if they work full time hours, companies would need to provide other benefits/health care insurance which increases the cost.

I person may be working full time 40 hrs between two jobs, 20 hrs each/week but still end up with no benefits.

“I would guess that sub-prime borrowers would be among the first laid off in a recession.”

It’s the other way around. People with good credit and some debts (mortgage, auto loan) can become subprime AFTER they get laid off, and cannot find a job for six months or so and then fall behind on their bills, and suddenly, they’re subprime. This happened a lot during the Great Recession.

Thanks Wolf. I was equating the poor with subprime borrowers when really it is a poor credit history that makes a subprime borrower. As you said above, the poor have a hard time getting any credit at all.

Howdy Folks. Always live within your means, stay out of debt. Simple math when starting on your own. Don t feel sorry for people refusing to learn simple math…………. Purchase a Starter home too, NOT a new home.

Thats is great advice for living in the 1960s!

Actually, it’s good advice for today as well. People who manage their money vs. letting their money manage them will likely prevail – or at least weather better – in any economic climate.

After looking for the copy of The Richest Man in Babylon that I bought years ago I bought a new copy on Amazon (for less than the cost of a gallon of gas) last week and re-read it before giving it to my son. My favorite quote is: “If you have not acquired more than a bare existence in the years since we were youths it was because you either have failed to learn the laws that govern the building of wealth, or else you do not observe them”. Most people know that spending less than they make and investing the rest is a good idea, but few do it since (another quote from the book): “That what each of us calls our ‘necessary expenses’ will always grow to equal our incomes unless we protest to the contrary.”

I reread The Art of War by Sun Tzu for all the same reasons.

You’re quite wrong, DFB, about not feeling sorry for those who can’t do math. You haven’t seen the look on the face of a 5th grader who cannot “get” the idea of fractions, of decimal fractions, or, good God, percentages. They know that others in the class get it, but they can’t. It’s part of a cycle of self-doubt and self-hatred that has no end. And there are plenty of kids who simply cannot figure it out. Good kids, decent kids. It’s a heartbreaker for teachers.

Howdy HowNow… I am sure there are plenty of Govern ment programs for those that cannot add or subtract. So many youngins are just afraid to get their hands dirty with hard work.

DFB …could be they’re only mirroring the fears and attitudes of many of their elders…

may we all find a better day.

Howdy 91B20 1stCav (AUS). Too many soccer moms AOK with participation trophies? America should have winners and losers and it is AOK to be the best at something……

That is very simplistic.

Debt is nothing more than a tool. Sure, it can be a dangerous tool, but still a tool.

My net worth would be literally less than half of what it is without debt. Granted, it was mostly smart debt (uncallable debt taken to fund very profitable situations), but debt none the less.

I would advise most people to avoid uncallable debt, but smart debt is a way for someone to advance in life when presented with a profitable opportunity.

Howdy JimL. Personal Debt and Business Debt are different types of debt ?

I manage a finance company directed to sub and deep subprime, I used to consider it a good business and a service to comunity, we were offering people with poor credit a second(or third) chance to improve it. Yes interests are high but also historical default rates, we currently have a 30% reposession rate. Keep in mind repos are the last resource, usually cars are poorly maintained and are worth much less than payoff amount at the moment of repo. All that beeing said currently an alarmingly increasing number of prospective customers just dont care about fixing their credit and use the vehicles for ride sharing, delivery services etc, this renders the vehicles worthless 5 times faster than normal use, so they just pay for a year and return a ultra worn off car with 0 residual value to just to go and get another one and continue the cycle. This translates into massive loses for the finance companies and many like us are moving away from the subprime market. That’s bad news for subprime customers, soon they will run out of credit options and will have to buy cash or ride bicycles… just my two cents

…sounds like another lap in ‘The Race to the Bottom 500’…

may we all find a better day.

Hi Wolf. Under what circumstances do trade-ins at new car name brand dealers find there way to the used car only lots? Too old, too many miles, condition (obvious or not obvious mechanical issues)? Is the post-holiday time good for buyer for 3 to 7 year old used car at dealer, assuming inventory of same increases after the purchase of new car with red bow in driveway by new car gift buyer? Is that really a thing?

So just to clarify. Used vehicle dealers are divided roughly in two:

Roughly half the used vehicles sold by dealers are sold by franchised dealers (“Ford” or “Chevrolet” etc.).

The other half of vehicles sold by dealers is sold by independent dealers, such as CarMax, Carvana, Vroom, Car-Mart, etc., and by the gazillion of smaller used-vehicle dealers.

So these are the sales by dealers. In addition, there are private sales of used vehicles (people selling to each other).

Franchised dealers, along with big independent dealers such as CarMax, Carvana, etc., will wholesale units to other dealers that they don’t want to retail, or cannot retail, for whatever reason. This could be vehicles that are too old, or damaged, or even decent vehicles that have been sitting on the lot too long. Those decisions are made on a case-by-case basis.

Franchised dealers are usually pickier on what they place on their lot. They have more to lose in the event they sell a POS.

New car dealers will off a vehicle with tagged CarFax’s (accident damage), etc.. Also vehicles that are miled up, sketchy maintenance histories, lemon law buy backs or that need to much reconditioning. Much of that inventory goes through “gyppers” who will purchase and resell vehicles to another dealer. Others go through local and national auctions.

When to buy? Traditionally, the end of the month…. sales staff needs to make their volume bonus. Dealer needs to balance aged inventory (cars on lot 60+ days as they get “lot rot”) and used management tries to get them sold before they have to be written down and their gross profit takes a hickey.

Keep your eye in age of inventory and price reductions. Most dealers still price high to try to hit home runs on what they perceive to be “hot” models. When they don’t sell during their over-priced first month, they start reducing the price until it gets sold. Some dealers will hold onto these units too long and get more and more anxious to move them. Smart dealers don’t, but smart dealer prices will also be more competitive, so that they keep inventory moving. Rather than tying up inventory dollars hoping to score big on one car, they buy/sell, buy/sell with velocity to make the most of their inventory budget. If you’re not in a big hurry, you can learn quite a bit by researching price movement.

Used sales are usually not as “end of month” affected as there are not usually bonuses from the factory for used vehicles. There are some incentives, but nothing like the new car volume bonuses. January/February used to be pretty good as dealers dealt with massive trade-in inventory from year-end new car pushes and the sales floors become barren of customers.

Hope this helps.

That seasonality in the Sub-Prime 60+ day delinquency rate is something you can set your watch to, wowsers.

Anyone in the biz know why? Does it coincide with tax return time?

I bought a used 2022 Toyota in October, paid 25% cash down and was able to get a 5.5% rate from a local bank. The lowest the dealership could do was 8% through BofA.

Enjoying your articles for some time Wolf. Thank you. A breath of fresh air in an otherwise rotting corpse of media.

Slightly off point. One of the most satisfying interactions with a dealership in 2017 purchasing a new base model vehicle using a bank draft. The finance dept viewed my docket and proclaimed “Ohhhh…you won’t be needing these!” and placed 4 inches of finance paper work aside.

I gleefully sighed.

@Natty I don’t know your car situation, but I have always wondered why so many people (at least 3 out of 5 car buyers) that don’t really “need” a new (or nearly new) car or truck decide to borrow money to buy cars that are dropping in value vs. keeping their current cars on the road a little longer and investing the money they would be spending on interest so they have the cash to buy the next car (and avoid paying thousands to the lenders). I know some people want to impress their friends’ with a fancy $50K Tacoma TRD, but and older well maintained Tacoma can be purchased for less than half that and do pretty much the same things.

Wonder if tech helps auto outfits with loans? We know onboard tech can monitor location…how about shut off if payments too far behind. It could only shut car down in ‘Park’ not while running of course.

Don’t worry subprime borrowers, state governments have other programs to help you get out of debt: Powerball, Mega Millions, cannabis, alcohol…you’ll be fine.