This is funny, in a central-bank kind of way.

By Wolf Richter for WOLF STREET.

The Fed confirmed today in a press release at 7 PM EST that its infamous tool to deal with the March 2023 bank-panic and bank-liquidity crisis, the Bank Term Funding Program (BTFP), will cease making new loans to banks, as scheduled, on March 11. Existing loans can continue for their term of up to one year. This decision was disclosed on January 9 by Michael Barr, Fed Vice Chair for Supervision, at a panel appearance.

What’s new – the funny part – is that the Fed also said that, “effective immediately,” it would shut down the arbitrage with which banks have been gaming the BTFP to make some extra bucks. We’ve been discussing this BTFP arbitrage for a while, including here with a chart. The whole thing was a hoot.

The BTFP was conceived in all haste over a weekend in March 2023 and was announced on Sunday after two regional banks, Silicon Valley Bank and Signature Bank, had collapsed and were shut down by regulators on Friday, with visions of contagion turning this into a full-fledged financial crisis.

But the BTFP had a fatal flaw: under certain conditions, the interest rate that the Fed charges on loans at the BTFP (the rate is market-based) could fall substantially below the interest rate the Fed pays on its reserve balances (the Fed sets this rate).

And that’s exactly what happened starting early November during rate-cut mania. It opened up a riotous risk-free arbitrage opportunity that banks took advantage of.

Today the Fed had had it with this deal and shut down the arbitrage for new loans “extended from now through program expiration.” In the press release, it says that the interest rate to borrow at the BTFP will be “no lower” than the interest rate on reserves. And with this change, the arbitrage becomes unprofitable for new loans. The press release:

“As the program ends, the interest rate applicable to new BTFP loans has been adjusted such that the rate on new loans extended from now through program expiration will be no lower than the interest rate on reserve balances in effect on the day the loan is made.

“This rate adjustment ensures that the BTFP continues to support the goals of the program in the current interest rate environment. This change is effective immediately. All other terms of the program are unchanged.”

On the new BTFP term sheet released today, applicable to new loans, the rate calculation paragraph now reads (I marked the new language in bold; IORB = interest on reserve balances):

“The rate for term advances will be the one-year overnight index swap rate plus 10 basis points, provided that the rate may not be lower than the IORB rate in effect on the day the advance is made; the rate will be fixed for the term of the advance on the day the advance is made.

When the worker bees at the Fed hashed out the terms for the BTFP over the weekend (eating pizza and sleeping on the floor?), they overlooked the possibility that the market-based interest rate to borrow at the BTFP – the one-year overnight index swap rate, plus 10 basis points – could fall substantially below the Fed-set interest rate that banks earn on their reserve balances.

In March 2023, the rate at the BTFP was close to the rate the Fed paid on reserves. But during rate-cut mania starting in early November, Treasury yields from one-year on up plunged, and related yields plunged in parallel. By mid-December, banks could borrow at the BTFP below 4.8%, and then leave the cash in their reserve accounts at the Fed and earn 5.40%. Risk free, hassle-free income for nothing.

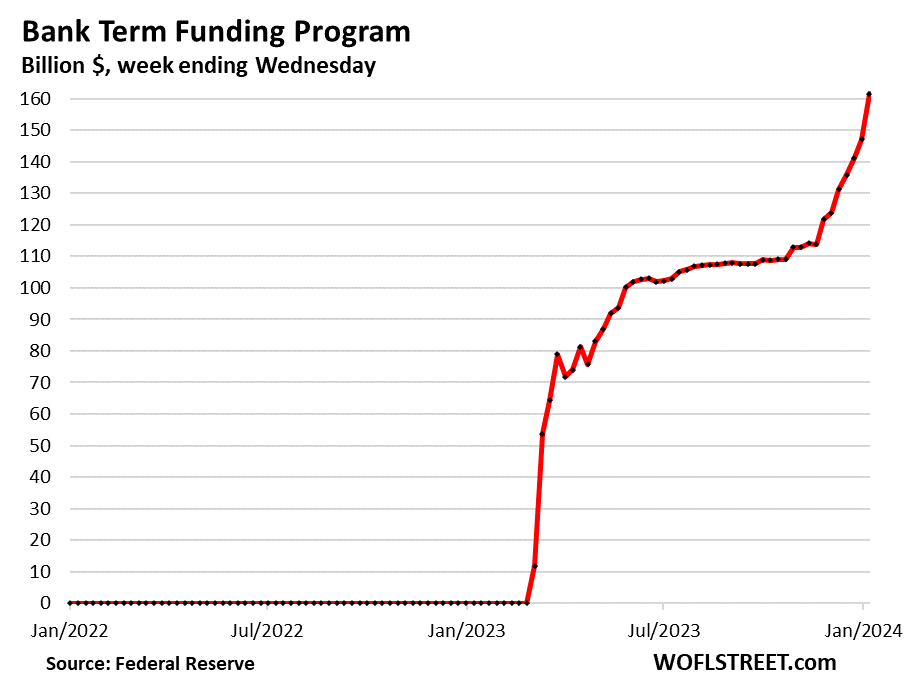

From July through October, the BTFP balance was around $110 billion. But at the beginning of November, it began to surge. Last week, it jumped by $14 billion. Since November 1, it has jumped by nearly 50%, or by $52 billion, to $161 billion.

On Thursday, the Fed will release the new figures through Wednesday, and the balance likely jumped again. But that should be the last increase in the BTFP balance because the door to make money on this circus has effectively closed now:

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

The BTFP handout became too visible for the electionyear. I’ll find another way to make billions for my club soon.

Tired act.

The FED is doing something smart and logical, but they still get crap from the one note Debbie Downers like yourself.

That’s what they do. Keyboard warriors.

The Fed is UNDOING something not so smart, IMO.

They could have written, initially, into the regulation safeguards against interest rate disparities that allowed this situation. Maybe they learned a lesson here.

““interest rate to borrow at the BTFP will be “no lower” than the interest rate on reserves. ””

Could have been in the original language of the BTFP

Sometimes Wolf says Powell and QT is performing well I don’t see a one note band from Wolf. Just the opposite with Wolf reporting facts without any bias.

notice only access is for banksters

now there ought to be special tax on this income

So the Fed makes a one sided deal that leaves an obvious door open to give away millions banks and doesn’t close it for 3 months and you think that is remotely acceptable or competent? If anyone in the private sector had constructed a deal with such an obvious loophole they would immediately have been fired. This is incredibly incompetent.

“So the Fed (insert dumb thing they did) and you think that is remotely acceptable or competent?”

Indeed. This can’t be overstated. The Fed is so egregious in it’s constant errors, it begs the question of whether they’re just stupid, or just plain evil.

They’ve made so many obviously bad decisions over the decades, blowing then popping massive asset bubbles, I now just think they’re evil. Nobody can be that consistently bad at their jobs without eventually seeing the error of their ways.

Giving taxpayer money away to the banksters is a feature, not a bug.

One tends to think of the Fed as being fiscally “better” than the give-a-way Congress or Administrations. But, as we can all see there is a lot of interaction between Fed personnel and bank execs, by design. But that interaction often leads to the regulated actually controlling, in part, the regulators. This is a classic example.

The capitalist bankers, like the blood sucking vampires of the movies, can’t withstand the light of day.

So why did it take such a smart Fed over 6 months to correct something so obvious? As if they cannot see who is borrowing from an emergency lending facility for distressed banks and parking the money back for a higher interest rate?

While I commend the Fed for the move, the very fact that is happening in an election year fuels speculation about the Fed getting caught without their panties.

“over 6 months to correct something so obvious?”

Less than three months, from November 1 through January 27 (and it included the holiday period).

“The whole thing was a hoot.”

To call this a hoot is ridiculous. It’s bad enough that QE just creates money out of thin air is then “lent” out to the major banks and who make tons of free money that pad their bottom lines and fill the pockets of executives.

It’s not a hoot. It’s criminal on the part of the Fed. The arbitrage should have been shut down immediately.

Laughing at things totally beyond our control can be healthy. Fed has a lot of leeway. It was not criminal, as no charges were filed.

J. Pow tickles me and right on the money as usual.

Some folks don’t get satire I guess.

Howdy Mr Powell. Love your best line. I am from the Govern ment and here to help.

While not a significant amount this does reaffirm that US businesses have no other interest in making a buck regardless of the intentions. Not unlike pandemic money that was eaten up regardless of need by businesses. The decline of most and the ascension of the few. If somebody can game the system they will.

American Dream

That’s what came to my mind as well.

Whatever’s alive that moves that they can fxxk.

Finding and (ab)using markets irrationality, that’s all.

If the Fed gave you the ability to make free money like this, wouldn’t you take it?

Don’t hate the player, hate the game.

No. I am a business owner, but I believe in making my money honestly and ethically by providing my clients a service at a fair price.

I don’t try to schnorr every dollar I can. But then again, I’m not a sociopath like most of the tech billionaires and banksters.

My salute to you 🙏

I am in awe with people like you and have huge respect .

Free is a loose word given conceptually this is the money of US citizens. However, I don’t disagree. It just creates an every ‘man’ for himself which isn’t healthy. The only thing that unites this country seems to be killing of those in other countries, good cause or otherwise. The enemy is inside the gates already!

The purpose of business is to make money.

Many of us did this back when student loans had a lower rate than bank money market accounts. If the gov’t is dumb enough to leave free money laying on the ground, why not pick it up?

how is that possible when the sole purpose of student loan is to pay tuition and living expenses? The borrower has to demonstrate the need for such a loan.

That is the letter of the law, but apparently gross violations are rampant. The student lone debt – since its non-dischargable and thus theoretically “a sure thing” – is super valuble debt to lenders. As a result a number of them were more than happy to bend the law a bit if it ment lending more to generate more valuble debt.

Is there a source to this, or is it more ‘youvdon’t want to pay for your Fine Arts degree’ propaganda?

College tuition has been ungodly expensive since the late 90’s, plus insane interest rates and servicer fees. Anyone who did this couldn’t have been taking a Federal Loan, you have to fill out a FAFSA first and the FAFSA does not account for yoyr living expenses, but it wpuld factor the gold in your parent’s teeth if it could. You could’t even get Financial Aid, grants or loans on your own income (without parental co-signer) unless you’re over 21, or can prove with court documentation you were legally emancipated from your parents.

The “borrower” should not be an 18yr old, for starters.

Parents should cosign.

And while we are at it, why dont these universities with BILLIONS do the tuition financing?

If you want to buy a Ford on credit, you deal with Ford Credit.

If you want to go to ABC University, deal with ABC University Credit. IMO.

What would the price of Fords be if the government offered easy financing? (for example)

WB,

“I have several college rentals (duplexes). Best investment I have made.”

The government should charge the cost of student-loan forgiveness to your account. You took this money, now it’s time to pay it back.

I’ve been saying this for years: education is so ruinously expensive because of the government funding of the profits in the educational-industrial-CRE complex, via student loans, which includes you.

One of the original ideas in economics that we don’t really see anymore is that there’s a difference between the utility value of the house and the scarcity value of the land it sits on, and that the latter is true “rent” in the economic sense that should be taxed away and reinvested in the community rather than being allowed to accumulate upwards.

“…However, if higher real estate prices simply reflect higher prices for land sites that have no cost of production, then using tax policy to facilitate the inflation of those prices is “merely [to] make new buyers” and non-owner occupying tenants “pay more,” in mortgage and rental payments, respectively. In other words, the less that the growth of real estate prices comes from investing in new construction and capital improvements, the less can it be argued that “rising property prices elicit more investment in the form of construction activity.” Moreover, if the growth of real estate price values is really coming from “bidding up” land prices, it is not the case that more land, as a limited asset “provided freely by

nature,” will somehow come into supply. Rather, the activity of providing the homes, office buildings, and industrial plants that already sit atop such land will garner an increasing economic rent. Consequently, it would make more sense to shift to a policy portfolio geared toward taxing away this economic rent rather than facilitating its insulation from taxation.”

-Chaudhry, “Property As Rent”, St. John’s Law Review, 2020

I think you can substitute”tax breaks” with “taxpayer-funded student loan money” and get the same effect.

The Dept of Education’s budget , now circa $85 Billion has a chart that mirrors almost exactly the increase in college tuition …since 1979 when the Dept of Ed was created.

Imagine if each state could keep KEEP $1 Billion a year….A YEAR…to invest in their own State’s education system. There would still be over $30 billion to appease the bureaucrats that nest in the Dept of Education.

This is a prefect example of the Federal Govt taking money from the People/State….then redirecting it back to the States, often conditionally.

You sure like to get the government money via student loans that pay your rent — “I got my government money, I’m not giving it back”– but then complain that the government spends too much and complain about student loan forgiveness. Socialism for those with assets. THAT is called hypocrisy. That’s why I put it out there. You profited from the student loans!!! And student-loan forgiveness means that taxpayers pay for YOUR profit. This type of hypocrisy is sickening.

I owned my house outright before the 2006-2008 crash. When mortgage rates dropped to absurdly low, I decided to take a decent sized chunk of equity out of my house in the form of a mortgage. It took forever and I had to jump through numerous hoops (I literally went through 4 or 5 loan officers as they kept getting laid off) before I was able to close on the mortgage.

When I got the money I immediately transferred it to a stock account. Over the next few months I gradually invested in a few large blue chip companies (healthcare, defense, consumer goods etc). After 5 years or so I was able to pay the mortgage solely from the dividend payout of the blue chips I had purchased. Meanwhile the underlying securities kept appreciating.

Unfortunately in 2017 I had to move due to life reasons and had to close out the whole thing.

When it was all said and done I had made a few hundreds of thousands in profit. The thing is, I invested very conservatively. I only invested the money on the bluest of the blue chips (think Pfizer, JnJ, ExxonMobil, Pepsi, etc). I could have been far more aggressive and made much more money. Millions.

Where I am going is that there was an opportunity available even to the little guy. I have no connections to Wall Street, Banks, or the FED. I just saw that mortgage rates were crazy low*** and equities were reasonably priced.

Like you said, the government left free money laying around on the ground. Anyone could have picked it up. Anyone blaming the “system” or the FED taking care of bankers is missing the point. There is plenty of opportunity for the little guy to take advantage. They just need to step outside of their own hardwired views to take advantage of it.

*** it should be noted that a mortgage is one of the greatest gifts available to the little guy. It is literally an uncallable loan and generally low rates. Plus it is a possible tax deduction.

Huge.

No, I am not advocating a person mortgage themselves to the hilt, but I is one of the most safe forms of debt a little guy can take advantage of.

Jim L-

I’ve been puzzling over the meaning of “populism” over the last few years, and I think you’ve put your finger on it. Populism, in an effort to buy votes, is the broadening out of state subsidies and giveaways such that they are available to most everyone.

Hooray for government largesse.

“More ‘gifts’ to the little guy!”

“Two chickens in every pot!”

The government understands very well that people will support handouts as long as everyone gets one. It’s only welfare when just a select few get it. When the prior and current Presidents gave thousands for Covid relief, it was hugely popular. Had it been given to just those who needed it, it would have been rejected.

John H.

I do not think the charge of populism is used toward the party prone to giveaways and larger government.

My question is usually based around those who say they promote Democracy but have a problem with populism. …that position needs to be explained. IMO

So basically, you gambled with your primary residence and got lucky, and now you’re on this board posting self-congratulatory tripe and lambasting anyone else who wasn’t willing or able (because they were in middle school, for example) to do the same.

In addition, the strategy wasn’t nearly as sophisticated as the poster thought and he was taking enormous risk buying a few individual stocks. These ‘blue chip’ stocks, nor any small group of individual stocks, are risky to own on their own and your risk is not compensated with commensurate returns.

Sam, exactly. That’s one of my largest complaints about people who were old enough and wealthy enough to benefit from the Fed’s irresponsible monetary policy from 2008-2022. They don’t see themselves as lucky. They all see themselves as brilliant, and thinks their “hard earned gains” must be protected at all costs.

This is completely rational balance sheet management. I cashed equity out of primary residence for 30 years at sub 3% pretax. It’s all invested, not spent. It’s prudent.

And if the market collapses, you end up underwater and without a job, will you be out there whining for a taxpayer bailout in the form of mortgage “forbearance” or “relief?”

Of course you will!

JimL: do you not think that having owned your home before the first housing bubble gave you an advantage (vs new potential homebuyers today)?

Could you afford to buy your currnent house now? Honest question. I couldn’t afford to buy my own house if I were in the market right now.

Just some perspective to consider. I often shake my head at those who isnsist on living in expensive areas, but there’s no denying that home prices across the board are much too high.

I was going to say.. the little guy does not own a house…

JimL congratulations on your strategy working out.

But I think the main point is that we ideally should build a society where the correct behavior should be rewarded without knowledge of interest rates, finance etc. Not everyone is privileged to have the education and knowledge that you and I have.

And if you think this through, if everyone was as smart as you then GFC wouldn’t have happened and you wouldn’t have gotten the arbitrage that you benefited from.

The point is that information and knowledge in society will always be unequally distributed. While individuals have incentive to exploit this asymmetry from their fellow men, laws and systems are designed to prevent this such that in aggregate no one is taking others for a ride.

Western world has been so by and large but the deregulation of finance created opportunities to mislead and cheat.

Aman – the steepening inclines on either side of the medians…

may we all find a better day…

It’s always a zero sum. – Somebody wins, somebody loses.

Robert (QSLV)

I’d say you were old enough, lucky, a good conservative investor, and patient.

For instance, if you had taken money out of your primary home in 2006, at both the housing bubble and stock market peak in 2006, you’d be white knuckling it through the 50% fall of the S&P 500 in 2008 while watching your home value continue to drop until 2012 up to 50%.

You didn’t panic and bail out so with your patience, you did very well by 2017.

I think today is very similar to 2006.

I’d also point out that most people who bought or refi’d homes at below 3% are doing the same thing. They are not paying off, paying down, or selling that home and are instead making 5+% in safe insured CDs or TBills with their extra arbitraged money.

I’m still trying to figure out whether that was a genius move by the Fed to keep every homeowner from having to experience the last HB crash and likely lose their house if they lose their job, or if it is a conspiracy to keep wealthy asset holders from losing their shirts. Time will tell.

It surely isn’t helping the younger potential homebuyers who can’t afford most houses now and benefit from this arbitrage. It isn’t a “house in every pot” for young people.

“it’s so easy for the ‘little guy’ to make lots of money!

Step 1: Purchase a fully-paid off house…”

“Why don’t the poors just buy more money?”

It’s actually gambling. You don’t need to buy a fully paid off house.

You just need to qualify and have a down payment to buy a house at a 7% mortgage.

The gamble is that if the Fed raises rates and Treasury rates rise to 15% like they did in the 1980’s, and you keep your job with a healthy COLA, you will do VERY well.

My middle class parents did this and their 30 year Treasuries at 15% along with COLA, made their 28K 6% mortgage affordable. Over that time their income went from 6K to 50K.

Over time, buying a house with a mortgage has many advantages.

Personally, my house started at an 10.5% mortgage and i refi’d every time the rates dropped 1.5%. Sadly, savings rates kept falling at the same pace until my bank was paying less than 1%. It has only been the last 3 years since that changed and I can experience what my parents benefited from for 10 years. During that time, I should have invested more in the stock market but my crystal ball was broken.

This is the dumbest thing I’ve ever read.

Here’s what I read: the game is not rigged because I happened to be able to play it, and others should too, if they luck out just like I did

I bought my foreclosed house in 2012 for 27k cash. It’s probably worth 150k now. Did I earn it? Deserve it? No…I got lucky. I was the right age to participate. My little brother was in high school at that time, so he rents for 1500 a month today. But I guess I should tell him to pull himself up by his bootstraps, and pretend I deserve my privilege and that it’s not just dumb luck. Plenty of opportunities for the little guy right? Just gotta look! LOL

This shouldn’t be an engineered game of highs and lows where chance dictates opportunity. How are people too stupid to realize that? The American dream shouldn’t be dead, but it is, unless you are or were fortunate for various reasons

The Fed is NOT “the gov’t” – it is a private institution run by private banks. The only stupid thing is YOU believing this was a dumb mistake.

Mike P

Common misconception here, it’s BS, and I have shot it down a gazillion times, so here we go again:

The Fed is a hybrid organization.

The Federal Reserve Board of Governors is a government agency, and all its employees are federal government employees with a government salary and a government pension, including the seven members of the Board, including Powell. These seven members of the Board of Governors are appointed by the President and confirmed by the Senate. The Board of Governors has lots of employees, and they’re all employees of the Federal Government. They’re headquartered in the Eccles Federal Reserve Board Building, the main office of the Board of Governors of the Federal Reserve System. This is a federally owned building on 20th St. and Constitution Avenue in Washington, DC.

The 12 regional Federal Reserve Banks are private organizations that are owned by the largest financial institutions in their districts. They include the New York Fed, the San Francisco Fed, the Dallas Fed, etc. All their employees are private-sector employees.

The FOMC – the policy-setting committee – consists of the 7 members of the Board of Governors who are federal employees and have permanent votes on the FOMC. The New York Fed governor also has a permanent vote. The other 11 regional FRBs rotate into and out of 5 voting slots annually.

The FOMC is designed to give the 7 government employees a voting majority over the 6 presidents of the regional FRBs.

More intervention = more programs = more edge cases

Fed seems determined to eliminate business cycles and in doing so creating financial crisis.

So far fed has not created any crisis but has only enriched friends and family at the expense of common Joe and tax payers.

American dream is dead because of Fed.

A home with 2 car garage is no more affordable to most.

Simply not true.

Your words are the words of someone who was incapable of seeing what is going on and acting appropriately. Therefore you had to blame others for your failures.

Simply not true. Seeing what is going on and acting on it may be a moral or an immoral exercise. It also relies on having money to play the game. Your defensive comments here imply you were playing games to make a lot of money. (Not the same Jon.)

How disingenuous. Capitalism only works if capital is respected and bad behavior suffers real consequences. If a person/company takes a risk and invests it’s capital wisely, the person/company should reap the rewards, HOWEVER, if the person/company goes bankrupt then the managment/owners should be forced to SELL ALL THEIR ASSETS TO PAY BACK CREDITORS.

NO BAILOUTS.

Moreover, if a person/company breaks contract laws (like slicing and dicing mortgages) then SOMEONE NEEDS TO GO TO PRISON.

Tell us schmuck, has any of that happened? You can ignore the reality, but you cannot ignore the consequences of ignoring reality. True price discovery will return, and the longer we allow the Fed to manipulate markets, the more violent that transition will be. History is very clear on that.

Has

I am not saying this for myself.

I did pretty well for me.

I am dating based on what I am seeing around me and what the numbers tell us.

Housing affordability is lowest ever.

I already have few homes in most expensive housing market in usa .

I am also fully invested in stock market .

Why .. because I believe thr market is rigged in favor of asset owner.

But I don’t think it is good for the society with this increasing wealth inequality.

Few guys getting rich at the expense of others is a recipe for disaster in the long run.

Many people saw what was going on, but didn’t have paid off houses to gamble with. They had to go to work and pay bills and raise a family and stuff.

“Why .. because I believe thr market is rigged in favor of asset owner.”

And that’s ultimately the Fed’s problem. Enough people believe that the Fed will slowly (or quickly) destroy the currency. If everyone starts to believe it at once, and no one is willing to trade assets for cash, then the dollar is toast.

I am someone who benefitted from FED’s policies immensely.

I have been sitting on real estate and stocks since 2013 and made few mills.

I could do this not because I was smart. I simply got lucky that FED cared for asset owners more than anyone else.

I also believe that FED would keep the policies for last 13 years continued for next few decades or so until people lose total confidence in the Fiat USD.

I know a lot of people who made money like me and they think they are super smart.

Few college going kids who bought BTC for pennies and are now sitting on 10s of millions of dollars think they know everything.

I don’t know if they are right or wrong.

I just know that I am not that smart, I am lucky and FED helped me at the expense of others/haves-not.

Clueless. Policies shouldn’t be picking the winners and losers. But they did. And they still do. That’s cool that you’re the beneficiary, must feel good. Doesn’t mean what everyone says here is untrue. The fed has Fkd the avg American and enriched asset holders. At least some of us are asset holders who can still acknowledge this. Others pretend they did it all on their own.

Blake, any and every policy will create winners and losers. Period.

Lots of whiners in this thread. Listen, if you’re young and think you’ve been screwed or you’re getting screwed or whatever….give it a decade or three and see then if you’ve been a recipient of “luck” or being the right age, etc. When in our late 20s, I remember my wife bitching that we never travel. I kept telling her to be patient, to save, etc. A decade later we began traveling a lot, and now we have a great travel resume. PATIENCE.

Free markets tend to balance winners and loses a little more equally and without such abrupt shocks. Rather than the constant boom to bust intervention we have now. Why should someone have to wait 30 years to luck out when you could just have a balanced free market economy???

Seems stupid to me. Government shouldn’t decide who wins. let markets work.

Just goes to show how incompetent the Fed is “managing” the economy despite its countless economics PHD Keynesian bureaucrats. Keynesian economic theory has been proven useless many times, therefore the Fed should be disbanded and economic forces should be allowed to sort it out.

We would all be better off without the politically indoctrinated Fed.

You would have thought that these propeller heads might have learned that a managed economy does not work. After all the Iron Curtain countries tried it for decades with predictably disastrous results. The Federal Reserve Politburo’s attempts at creating an economic paradise have been equally disastrous. Why don’t we try actual capitalism instead of bankrolling the oligarchy with free money?

Really, you cannot tell the difference between a centrally managed economy where a bureaucrat tells a factory how many boots to produce and a central bank that literally every first world economy has?

That says more about you than itndoes about central banks.

You do realize you are making the point against managed economies at least in favor of central banks (that are not managed economies the way Iron Curtain countries were). Maybe something would be better than a central bank, but the style of capitalism we have has outperformed other approaches by a stupendous amount.

“Capitalism”? LMFAO!!!!!

That would actual require that we RESPECT CAPITAL and allow bad management, bad ideas, and bad behavior to ACTUALLY FAIL!

True price discovery will return, and the longer we pretend that our system is working, the more violent that transition will be. Have you ever been to the “Iron Curtain countries” since the collapse of the soviet union? I have, and have done business there, and I can 100% tell you that we are heading to that same end, if only from a different direction. The arrogance and hubris of our “style of capitalism”…

LOL!!!

Amen

A. S

Amen.

Then we should go back to steam driven trains and horse drawn carriages as well.

There are reasons that literally every first world economy has a central bank. If you cannot figure it out that is on you.

JimL

You sure are an all-knowing self-agrandizing individual, obviously above the rest of us.

My condolences to you spouse ( if you have one)

Your opinion which you always seem to think is the correct and only opinion as evidenced by your sparky replies to many comments. Many of us don’t covet the excessive materialism and greed that appear important to you. Some conveniences are nice, sure, but our society is over the top with greed, especially wall street. Yours isn’t the only opinion. My opinion: You are the problem.

Agreed. If there was a way to ignore users, he’d be on my ignore list.

The obvious reason is so that countries can borrow far beyond their means and inflate away the value of their fiat currency. This is not helping the average citizen, it’s a gift to the political and banking class, if you had any knowledge of history and economics you would understand.

Happy – …this, of course, begs an reasonably accurate, contemporary definition of the ‘average’ citizen…

may we all find a better day.

You are the problem. I can’t wait until the day that your type of thinking gets their wake up call. It can’t come soon enough. Of course you praise the current system and ‘new normal’, as clearly it has benefitted you at the expense of many others.

Fed doesn’t practice fiscal policy. So anyone who believe in Keynesian theory would not work for Fed. Fed practices monetary policy and PhD working there should be students of monetary theory of Feldman and alike.

Apparently biden is a big fan of Keynes and so is every president in recent memory

“interest rate to borrow at the BTFP will be “no lower” than the interest rate on reserves. ”

Yes, they needed AI running on 1000’s of NVDA uber-costly processors for hours to look at all possibilities /s

Is there a way which banks took advantage of this rounding error gift by the Feds?

Yes, that’s why the Fed shut it down.

Has the Fed been following and reading your posts? If so, that’s a compliment!

“When the worker bees at the Fed hashed out the terms for the BTFP over the weekend (eating pizza and sleeping on the floor?), they overlooked the possibility that the market-based interest rate to borrow at the BTFP – the one-year overnight index swap rate, plus 10 basis points – could fall substantially below the Fed-set interest rate that banks earn on their reserve balances.”

Those worker bees do have quite a tendency to overlook the possibility of unintended consequences every time they pull out their various liquidity bazookas, don’t they?

LOL!

Yes, this is the understatement of the century (well post 1913 anyway).

ROFL… even the Fed hates bankers!

Right move by the Fed, but it should have been much sooner.

Curious George-

Wasn’t “rounding error” arbitrage the basis of the crazy scheme in the movie Office Space?!

Oops. Meant this as reply to Curious George above…

I think it was Superman 3 as well. The Richard Pryor character got in trouble for redirecting “all the half-pennies” in the payroll department to his personal account.

Yes but no. That was the original idea but their code moved over a decimal place so it started taking noticeable chunks of money.

Thanks, vvp. Probably 30 years since I saw that movie so I’m glad I only partially misremembered it. :)

Rather than closing the arbitrage window by raising the BTFP rate, could the Fed not have closed it even more efficiently by LOWERING the bank-enriching IORB rate… perhaps on its way to zero?

A less “active” Fed is a better Fed, IMHO.

And the best Fed would be no Fed

John H.,

“… could the Fed not have closed it even more efficiently by LOWERING the bank-enriching IORB rate… perhaps on its way to zero?”

That would have been a huge “rate cut” — a change in monetary policy.

The interest rate the Fed pays on reserves is one of the five monetary policy rates. I always list them in my FOMC-meeting articles:

https://wolfstreet.com/2023/12/13/fed-holds-rates-at-5-50-top-of-range-sees-three-rate-cuts-in-2024-qt-to-continue/

The often cited “target range” for the federal funds rate is the least important policy rate because it impacts only the interbank lending market, and interbank lending has nearly vanished after the Financial Crisis.

The other four rates — the two repo rates, interest on reserves, and the discount window rate — bracket repo market rates and target other short-term market rates, bank deposit rates, money market rates, etc. They really matter.

Thanks for this explanation Wolf. I had to think it over for a day.

My question (about IORB going to zero) centers around the relatively newer practice of paying banks to park balances as riskless Fed reserves through the payment of IORB.

I think I get that the Fed achieves their FFR target by setting IORB as an upper bound, and ON RRP as a lower bound. These mechanisms exist to “encourage” buyers and sellers of fed funds to set their “free market” prices within the Fed’s policy window, thereby establishing rates within the policy windo. Please guide me if that’s wrong.

But if IORB is a permanent mechanism, how is this not a direct subsidy from a government agency to commercial banks, who no longer need to rely on demand for profitable commercial lending activity to remain viable entities?

If it is NOT a permanent mechanism, what does “normalization” entail?

Please disregard if my confusion seems irreparable…

I’m still waiting for the recession that the inverted yield curve has been pointing to for about ten years.

Maybe the inversion means nothing. Perhaps it is just the way the Fed wants it to look.

The recession always happens when it un-inverts. So we’ll have to see what happens when that happens.

And its inverted July of 2022, not 10 years ago.

“The recession always happens when it un-inverts.”

That’s not true anymore. That was true before QE/QT. But it has proven to be false in the QE/QT era. There was only one time when the yield curve inverted-and-uninverted in the QE/QT era, and that was in 2019 (it uninverted in Sep 2019), and we didn’t get a business cycle recession. Then half a year later in 2020 we got a pandemic and lockdown, but that was half a year later and it wasn’t a business cycle recession. The yield curve is supposed to predict business cycle recessions, it cannot predict pandemics.

What happened is that the Fed’s QE/QT destroyed the signaling from the bond market. The yield curve now reflects in large part Fed action (pushing up short-term yields) and the weight of the Fed’s balance sheet (pushing down long-term yields).

You could be right. I think its too early to tell.

The 2019 inversion was such a small inversion though, it reflects what happened in 1998 when there was a very small inversion-universion, but then 2 years later it was a much deeper inversions, which led to the recession.

I could be wrong and we’ll see when it un-inverts this time.

Now there are daily policies to fix previous programs created to address issues from earlier decisions.

This looks and smells more and more like a centrally planned economy.

Maybe just let the market define the cost (and definition) of money? A simple demand-supply.

This just shows the fallability of the Fed. Anything done on a this scale that’s not incrementally applied is going to end up with unintended consequences.

The money supply can never be properly managed by any attempt to control the cost of credit.

And FED credit should never be used for profit.

“And FED credit should never be used for profit.”

👍

Now the talking heads are saying that the strong GDP growth is good news, because the Fed can lower rates.

There is no reason to lower rates in March (or really, at all this year) and everyone knows it. You don’t lower rates with GDP growth in the mid to high 3s

Let’s see what happens in March.

The Fed won’t cut rates in March. That’s completely delusional. None of the Fed heads have been promoting that, none. They all have been pushing against that notion. Markets are refusing to listen to the Fed.

I agree Wolf. I will also add that, not only is the “market” ignoring the Fed, but CONgress also seems to be ignoring the Fed…

What could possibly go wrong? If history is any guide, we muddle along until it becomes politically expedient to sacrifice more of the dollar’s purchasing power, if not simply because other currencies are depreciating…

Definitely interesting times.

Man makes infinite money with this one simple trick! Fed members hate him!

CLICK TO LEARN MORE

I’m waiting to see that add on this site, LOL

More interesting would be, whether the banks pay back any amount they taken from the BTFP, as the conditions now changed. From the banks perspective, i would not pay back anything until the loans expire.

Here again the Fed is reacting much too slow as in all areas: The interest rate for the RRP facility is not as since yesterday on the actual level, also why is the Fed continue lending out liquidity so long for “generous” conditions?

Three rate cuts in the second half would clean out the BTFP.

1. The BTFP will go to zero by March 11, 2025. We know that – that was the announcement, part one.

2. The BTFP will go to zero sooner: when the IORB in the future is lower than the rate banks pay on the BTFP, which is fixed for the term of the loan. After March 11, 2024, the banks can keep those loans through their 12-month term but they cannot refinance them (at a lower rate). So if the Fed cuts its policy rates in the second half 3 times, it will reduce the IORB to 4.65%. That is lower than the lowest BTFP rate at the low point in December 2023. So even those loans taken out with a rate of 4.7% will then be paid off because the spread is negative.

In other words, rate cuts will speed up paying off the loans of the BTFP. If the Fed does not cut its policy rates before March 2025, the BTFP loans (at least a part of them) will stick around until March 11, 2025.

“eating pizza and sleeping on the floor?”

Eating pizza with lawyers in the middle of the night – yeah. Sleeping on the floor – nah.

Worth it? Nah. Just fooled into thinking the government works for the people.

Slightly off topic. I’m a partner in a small commercial real estate investment banking firm that specializes in small balance CRE lending. Over the past couple of weeks, we have been contacting the banks that we use to fund various CRE purchases and refinancing. The picture in California at the small regional level is that of extreme caution. Many of the banks have limited lending by tightening lending criteria to include reduced max loan size, lower loan to value, and higher debt service coverage ratio requirements. Many of the banks have moved to relationship lending only (versus transactional), because they want/need borrower deposits to offset customer withdrawals chasing higher yields elsewhere. This is straight from the source versus some of the crap that is published in the corporate media. Overall, this is another straw on the camel’s back that does not bode well for the economy going forward.

This is the kind of post wolfstreet is good for.

There haven’t been as many guest articles lately, I enjoyed those.

So, if I understand you right, your company is going after folks who need to refi loans with ~4-5% cap rates and they need to bring money to table to get LTV and DCR into harmonious balance. You are polling these smaller banks, especially community banks, to see if they have folks that need your services. Nice gig and helpful for the banks and borrowers who need folks like you to keep the force flowing. Price discovery is going to be a real, real b1tch when the dam breaks. Approach with caution.

I have relational banking with some smaller regional banks by forcing their hands to give me 5.3% MMA rates or I will just go t-bills. I am taking a small hit, but it gives me options to get a loan if I ever need it. I am considering getting into relational private lending since it appears that there is a need. Good post! Keep it coming.

Not exactly. We represent CRE property owners who are either seeking purchase loans or to refinance existing properties. Over the years, we have brokered everything from multifamily, warehouse, retail, office, hotels, and you name it. We are currently primarily focused on cannabis real estate, a special purpose sector which has been extremely hard hit. Later this year, our goal is to create a series of partnerships to purchase defaulted properties, hopefully at pennies on the dollar.

“Overall, this is another straw on the camel’s back that does not bode well for the economy going forward”

On the contrary. Banks are finally doing the right thing, trying to clean up the CRE mess of over-hyped and over-valued properties. The Fed’s 0% interest rates for way too long have distorted the entire CRE space — in addition to structural changes, such as ecommerce clobbering about half of retail, and the office sector being hopelessly overbuilt thanks to years of hype and hoopla about the office shortage. There needs to be a reset in CRE, and this stuff needs to be repriced, and investors and lenders need to take their losses and clean up, and it’s happening. And that’s a good thing for the economy overall.

Regional banks are large players in the small balance CRE sector, holding a large percentage of originated loans on their books versus off loading for securitization. The impact of tighter lending standards is going to limit liquidity and ultimately it will negatively impact the CRE market for properties under $50m or so. Additionally, the tighter lending standards with lower LTVs combined with current reduced CRE valuations will reek havoc with CRE loans coming due for refinancing. Many property owners will be forced to bring in additional funds to roll over their loans with balloon payments due at maturity (25 year AM, due in 10, etc). When it’s all said and done, this is going to put additional downward pressure on the small balance CRE market. The last time it was residential, perhaps this time it will be CRE??? BTW. Back in Q2 2023, the Fed created a bank watch list for regional banks with CRE exposure, there were 540 banks on the list at the time of release.

Funny thing you said about cannabis. That is my current world for the last 8 years as an insider of a small club of folks and consolidation is the word. One of the survivors, like end of Prohibition.

Honestly, I wasn’t thinking of the round 2 of investment opportunities in this space. I didn’t think that there would be an appetite for such after the multiple beatings folks took. I need to explore this a bit. Thanks for nudge.

Effective immediately, Tesla’s stock is down around 26% today!!!

I wish! not quite. Only -12%

Here’s a better Idea: eliminate interest on reserves held at the Fed. That’s the way it used to be.

That would have been a huge “rate cut” — a change in monetary policy.

The interest rate the Fed pays on reserves is one of the five monetary policy rates. I always list them in my FOMC-meeting articles:

https://wolfstreet.com/2023/12/13/fed-holds-rates-at-5-50-top-of-range-sees-three-rate-cuts-in-2024-qt-to-continue/

The often cited “target range” for the federal funds rate is the least important policy rate because it impacts only the interbank lending market, and interbank lending has nearly vanished after the Financial Crisis.

The other four rates — the two repo rates, interest on reserves, and the discount window rate — bracket repo market rates up and down, and target other short-term market rates, bank deposit rates, money market rates, etc. They really matter.

Just a got email from my insurance broker, my auto insurance increased by 80% for coming renewal.

He cited inflation as reason.

I can only say Ouch.

Time to start shopping. You’re getting ripped off (unless something big changed, like you added a vehicle and a teenage driver).

Thanks WR,

I am very value conscious and I am shopping around. So far, I didn’t find anything much cheaper unless I decrease my coverages.

No change in my situation otherwise.

If you have paid off your vehicle, make sure the beneficiary stated is you, and not the bank of the original loan. This may help clean up some current and future situations.

@DawnsEarlyLight,

Yes, my vehicles are paid off and title on my name.

Wondering if I need to do anything else.?

What a circus we live in.

Years ago there was a movie about fractional skimming by a teller who worked at a bank (Richard Pryor). I believe he went to jail.

Robert (QSLV)