As Powell said, the labor market is rebalancing; it’s still tight, but it’s not out of whack anymore.

By Wolf Richter for WOLF STREET.

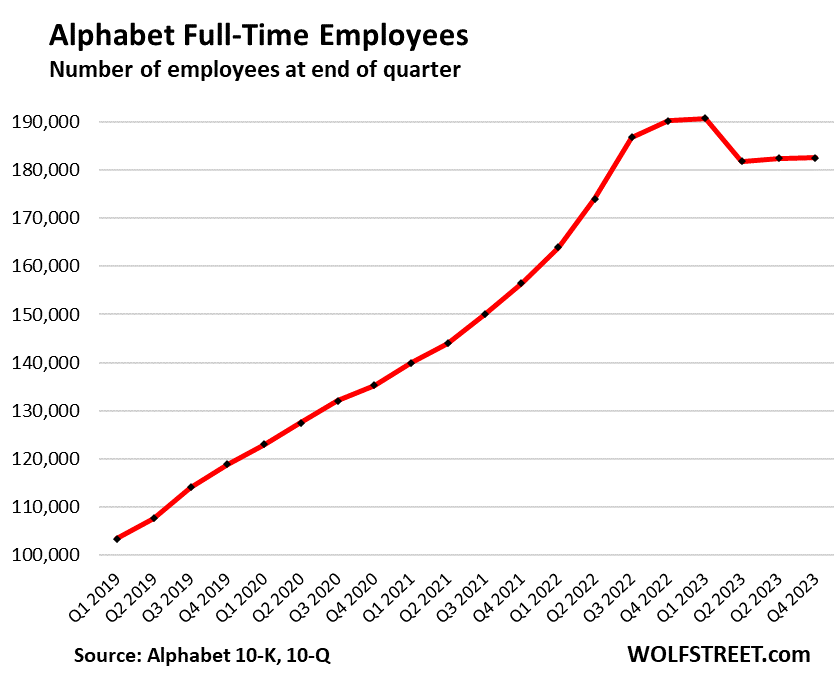

Just briefly here, because we’re tracking actual employment counts versus widely trumpeted and scary layoff announcements. Alphabet is our example. Google has announced a series of layoffs. In January, it confirmed the layoffs of several hundred more employees, on top of those in prior layoff waves. The big kahuna announcement came in January 2023, with 12,000 layoffs. These are announcements of global layoffs, not US layoffs. In its annual report (10-K), released yesterday, it disclosed $2.1 billion in “employee severance and related charges” for 2023.

But it also disclosed that its total headcount increased a tad to 182,502 employees globally in Q4, the second quarter in a row of small increases. It did show a big drop in Q2 last year of 8,913, but has since then added to its headcount. Since the headcount peak in Q1 2023 (190,711), total headcount has only dropped by 7,732 employees.

This shows that Google is laying off people through the left door but is hiring other people through the right door, with the overall effect of a relatively small workforce reduction that brought the headcount back to where it had been in roughly mid-quarter of Q3 2022:

But the layoff announcements have had a much bigger effect on the worker bees: They re-explained to them who the boss is. Apparently, they’d become somewhat confused about that amid the huge hiring binge and “labor shortages” during the pandemic.

Over the three years from the beginning of 2020 through the headcount peak of Q1 2023, Alphabet had added 71,812 employees to its headcount, having increased its headcount by 38% in three years, which is huge for an already big company like that.

Other big tech and social media companies, and companies like Amazon that are partial tech companies, have done the same thing: Go on an unprecedented hiring binge all at the same time.

Success was measured in how many people per quarter these companies could hire, and hire away from each other, and these aggressive efforts to fatten up the headcount by chasing after workers and offering them all kinds of deals led to huge churn in the workforce and apparently to some confusion among the workers who the boss is. And suddenly they didn’t want to go to the office anymore when they were asked to, and they were clamoring for a better work-life balance, etc., which endlessly aggravated the CEOs.

But since mid-2022, the massive announcements of layoffs have thrown some cold water on this dynamic. Voluntary quits plunged, churn normalized, employees stuck it out when things didn’t go their way, pay increases moderated, and now there are reports the actual layoffs are hitting workers disproportionally who’re working remotely. This is a sign, as Fed Chair Powell said yesterday, the labor market is rebalancing, it’s still tight, and the pay increases are still strong, but it’s not out of whack like it had been.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Military contracts

Atlanta fed is now projecting a 4.2% GDP in Q1. One can certainly understand why J POW pushes back on rate cuts anytime soon. And as long as the labor market remains strong there isn’t even a reason for a recession concern.

I’m sure plenty of people will be forecasting a recession, doom & gloom gets more clicks.

Is GDP growth adjusted to inflation? How much of it is on the back of huge government deficit spending?

“real” GDP is adjusted for inflation. “Current-dollar” (nominal) GDP is not adjusted for inflation. Generally, real GDP is discussed in the headlines.

A good old fashioned recession will improve the economy by

1) eliminating zombie companies, making capital more productive

2) lowering the price of real estate, making it more affordable

3) teaching a generation that debt is slavery

The Fed is right on queue; Powell noted that their mandate is stable prices (Wolf Richter was dead on correct that the services inflation would be sticky) and full employment (looks like a March rate cut is less likely), “NOT GROWTH”

The ridiculously cheap puts available now are telling us no one thinks the stock market is going down from here.

Possible higher layoffs tomorrow. Ground hog day.

Don’t think tech hiring in general is going anywhere. AI doesn’t write itself, yet, so lots needed there and then of course all the application of it in various goods and services. As the famous quote goes, “AI will destroy humanity but first it will create a lot of successful companies”.

Here is the quote I was looking for.

“AI will probably most likely lead to the end of the world, but in the meantime, there’ll be great companies.”

— Sam Altman, OpenAI CEO

Not like I believe it but some truth somewhere in it as well.

Elon Musk was also a founder of openAI. So anything they say should be taken with a grain of salt. Lots of marketing to lure in investors. Let’s see the profit. Or will this be another cash furnace like the spac’s?

I can see AI eliminating jobs like the printing press eliminated scribes.

AI will be eliminating lots of jobs in writing (in addition to the hundreds that have just been laid off in the past month at the LA times and other media outlets) and I just got an email that Google Bard AI now does images that will result in designer layoffs. It is crazy how fast it created a (pretty good looking) design for an event I am planning.

From 1957 to 1974, AI flourished. Computers could store more information and became faster, cheaper, and more accessible. Machine learning algorithms also improved and people got better at knowing which algorithm to apply to their problem. Early demonstrations such as Newell and Simon’s General Problem Solver and Joseph Weizenbaum’s ELIZA showed promise toward the goals of problem solving and the interpretation of spoken language respectively. These successes, as well as the advocacy of leading researchers (namely the attendees of the DSRPAI) convinced government agencies such as the Defense Advanced Research Projects Agency (DARPA) to fund AI research at several institutions. The government was particularly interested in a machine that could transcribe and translate spoken language as well as high throughput data processing. Optimism was high and expectations were even higher. In 1970 Marvin Minsky told Life Magazine, “from three to eight years we will have a machine with the general intelligence of an average human being.” However, while the basic proof of principle was there, there was still a long way to go before the end goals of natural language processing, abstract thinking, and self-recognition could be achieved.

Stemcell stocks, dope stocks, wind power stocks, water power stocks windmill power stocks and the next house of cards is AI stocks. Wake me up when they all go to zero.

I worked at several of these tech companies. Layoffs are the norm. They like to test out new product ideas, give it a couple of years, then dump it when it doesn’t pan out. They also brutally cull the low performers. Annual reviews are a blood thirsty competition between managers. Who gets the bonuses or who gets laid off often depends on your manager’s skill in ass kissing.

I never believe the hyped up stories about tech layoffs. Usually it’s just the normal routine.

Pretty spot on Harrold. The only addition I’d make is biotech/life sciences had an over investment during the COVID years. Resulting in expansions that are not profitable and excess inventory. The layoffs in bio/LS is exceeding the normal cleaning house restructuring activity. Would love for Wolf to write about that sector in particular.

My understanding is that GAAP requires that employees be actually given notice (email) about their layoff before the financial hit is reported, although actual layoffs may take weeks or a few months to conclude. Headcount is a payroll number as of a certain date. So I would expect HC to be higher since that is usually a quarter end actual number, with actual layoffs to follow within a month or two. Some of these are GAAP requirements or consistent reporting requirements.

1. GAAP (Generally Accepted Accounting Principles) has no requirements for layoff announcements to the media. Those announcements in the media are PR regarding a future event (“we’re going to lay off…”). It has nothing to do with accounting. Companies do not have to make those media announcements at all. Like I said, it’s PR.

2. WARN notices have to be given to employees subject to mass layoffs, and they have to be filed with state labor agencies, but that’s not a media announcement (it seems to me you might have mixed up GAAP with WARN). They’re by state, and don’t include layoffs in other countries. And you cannot piece together a total number of global layoffs from the WARN filings.

3. The company decides how it wants to compensate laid-off employees, and companies report estimates of those costs on their 10-Q and 10-K (on an accrual basis) as soon as they can estimate what it will cost them.

4. Alphabet said back when it filed its Q2 10-K in July that the “substantial majority of the employees affected by the reduction of our workforce” – the 12,000 layoffs announced in January – “are no longer included in our headcount as of June 30, 2023.” I discussed this at the time. And at the time, it included a cost estimate.

5. The 8,900-drop in headcount in Q2 2023 from Q1 2023 was the result of the 12,000-layoff announcement. Since then, the headcount has been rising.

Just curious. Does severance pay come into play? You know here’s 6 month severance with healthcare etc. are these people still on the books for 6 months?

No, severance pay doesn’t keep them on the books.

I see Wolf says no here, so probably my faulty memory;

I was pretty sure I heard Lacy Hunt say in recent interview with Adam Taggart that severance is reported as on the books by companies? Danielle DiMartino Booth made the same claim a while back.

Am I remembering wrong Wolf, or if they’re wrong, could you elaborate please?

Stegelberg:

Severance pay is reported obviously ($2.1 billion by Alphabet, RTGDFA) but employees that receive it have separated from the company and are no longer part of the headcount. I cited what Alphabet said about it in its SEC filings. So all you have to do is read it, instead of listening to Hunt and Martino.

This is what I said in reply to Cassandro above: All you have to do is read it:

4. Alphabet said back when it filed its Q2 10-K in July that the “substantial majority of the employees affected by the reduction of our workforce” – the 12,000 layoffs announced in January – “are no longer included in our headcount as of June 30, 2023.” I discussed this at the time. And at the time, it included a cost estimate.

Hi Wolf, I have been involved with GAAP FS and announcements for decades. There are a number of accounting requirements, perhaps from accounting firms, that deal with layoffs, reserves related to layoffs, timing and measurement of reserves related to layoffs. Not every item is specified in GAAP rules since most GAAP rules are general, unlike many tax rules which also can be quite general. For instance, the Big Four and most other financial statement auditors require actual notice to employees to be laid off with a detail computation. Some items can be reported in the FS as subsequent events. But the era of companies announcing layoff reserves as part of quarterly or annual audited FS WITHOUT meeting very specific requirements disappeared decades ago. My comments did not pertain to media announcements, which most large publicly traded companies have vetted by their auditors before releasing, for liability reasons. My point is simply that there may be short term differences between HC reports, layoff news and FS reports, which would be expected. It’s more complicated that footing an Excel schedule. Accounting practices for audited companies is more complicated than most people can imagine.

READ WHAT I SAID. What I said is this:

1. WARN (federal law) requires that EMPLOYEES be notified in a mass layoff.

2. There is no requirement at all anywhere to announce layoffs to the media. That’s “PR.”

3. GAAP is a set of accounting principles and deals with how the FINANCIAL aspects of layoffs (the costs) should be ACCOUNTED for on the financial statement.

4. Alphabet disclosed in its 10-k filing with the SEC how it dealt with the headcount. Don’t argue with me, argue with Alphabet’s SEC filing.

Wolf,

That quarter by quarter workforce level graph for Google is very useful (actually yr by yr is good we enough for me…)

Do you know of an online tool that can easily shoot out similar employee counts by yr for other public companies (or did you just go quarterly report by quarterly report to get to the data)?.

I ask because while FRED and BLS provide helpful aggregate data, being able to randomly sample very large employers over time provides a cross/sanity check of sorts for aggregated data.

If Amazon, Walmart, etc. ain’t been hiring at similar growth rates as the aggregated data…I have questions…

In this day and age it should be getting easier and easier to reconcile/cross check reported data by every level of granularity…but I haven’t been seeing it yet.

AI? Bloomberg Terminal? Other Big Data?

I’m a low-tech buy, I do this by digging through the SEC’s Edgar data base and pulling out 10-Qs and 10-Ks. Getting the historic data for a few years back is a bitch. But it’s easy to update every quarter.

Lots of huge companies have been hiring hand over fist without any slowdown, especially now that they’re having an easier time recruiting. It’s just the tech and social media companies that over-hired during the pandemic that have recently shed some people. There are still labor shortages in some industries, including construction, education, etc.

“In this day and age it should be getting easier and easier to reconcile/cross check reported data…”

LOL, you’re delusional, the US economy is immense and hugely complex. Large random surveys are far better than a non-random selection of companies. Plus, there are a gazillion companies that are not publicly traded and therefore do not report employment figures. So you can’t even get that data. But they will fill out employment surveys by the Census because they have to.

The whole exercise with Alphabet’s headcount had the purpose of showing you that the actual headcount reductions are far smaller than the big-fat layoff announcements. You missed that, didn’t you?

The gaming industry ( centered in the US in LA) has undergone a headcount reduction across nearly all the big companies of around 10%. The unusual things is that all the big companies ( Blizzard, EA, Riot, etc.) cut about the same amount at the same time, so the immediate prospects for those laid off with specialized skills is grim in the short term.

This industry had quite a boom over Covid and green-lit a lot of new games and ventures that did not pan out once people had to leave the basement and go out in to the world. So it is an industry that is still growing ( and very profitable) but overdid it during Covid.

Right on the money. I have friends that worked at some of those companies that were laid off during the post-Covid hangover. Lots of them got together and started indie dev companies and are now enjoying their work while putting in sweat equity into their product.

“laying off people through the left door but is hiring other people through the right door”

That is true but unfortunately for the most part the left door is in the US/Europe and the right door is in India. Outsourcing in IT has been going on for years so this phenomenon is not new but it would explain why US workers are hesitant to voluntarily quit because many of the new jobs are not in the US.

I love the often-bizarre emphasis on “remote work” being the scapegoat or culprit for those being fired. It’s almost shoehorned on every other article on MSN and Business Insider.

Some of these headlines read, ‘Don’t want to get cut, show up in the office’.

It’s such a pathetic suck up by mainstream trash to cover up the death of large CRE.

Many in tech are getting fired right now and it has nothing to do with whether your manager sees you on a daily basis or has even met you.

I’ve seen huge swathes of people fired recently that are in office, hybrid, or fully remote.

These are people getting paid $300k/year out of college up to millions/year for experienced developers. Goldman Sachs & JP Morgan also required their highly-compensated investment bankers to work in-office 4-5 days a week.

It is still the case in tech that if you’re really good at what you do, and you want to be full time remote, you can find work easily.

A lot of these tech companies that demand RTO/RTP (return to the past) are basically self-selecting the weakest employees, or those that lack the best tech skills but sort of make up for it by kissing bosses asses and subjugating themselves to long commutes and office politics.

Hence, they also have more turnover as the best ass kissers survive.

Layoffs are a win-win-win-win-win for Big Tech.

They get to cut costs, increase profits, make Wall Street happy, get rid of poor performers, tilt leverage from workers to managers, and increase unemployment (which along with lower inflation is one of the 2 catalysts for rate cuts.)

They’re not cutting jobs because they’re financially struggling.

Look at Amazon & Facebook ripping higher after reporting earnings.

Yep, It’s an excellent time for Tech companies to clean house. We are going through this right now in biotech / life sciences.

I forgot to add life science stocks with all those other pipedream stocks that ended up all falling off a cliff. Life science stocks are among the worst of all times as a long term hold.

I started following the layoffs at fierce biotech a couple years ago. Not a week goes by without at least a couple companies chopping a huge number of employees, sometimes it’s basically all of them as they were a 1 drug pony and rolled snake eyes. I’m guessing big pharma provided a lot of the seed funding

Amazon, Facebook, Microsoft and the other tech companies are huge beneficiaries of the deficit spending and ZIRP economy (which has yet to be unwound). Their customers have plenty of cheap money to spend there.

When the rest of the economy starts to falter, so will they.

No other industry in history has been as good as selling rainbows & unicorns as Big Tech. Whether it’s Web 2.0, cloud, generative AI, etc., they always have another buzzword every few years to trigger mass FOMO among corporate clients. The A to Z of Fortune 500 megacorps are now buying AI technology hand over fist from Big Tech, as they’re afraid they’d be behind the curve on the next big technical revolution if they didn’t.

Correct me if I’m wrong. These tech companies derive their revenue from advertising. Clicks. All these large and small companies pay for clicks. In turn your business gets orders for their product thus profits. When orders go south your advertising goes south? Hence tech companies revenue goes down? Just trying to learn here. Thanks.

The seven stocks holding up the stock market has been reduced to just two:

NVDA, a chip maker at almost 37 times sales and…

META aptly renamed by the 49 year old founder and current CEO to reflect the most consistent money losing portion of the business

It’s not poor performers tech is laying off, it’s the older workers. Poor performers – esp managers – get promoted..

What Alphabet/Google is going through is similar to what Microsoft went through.

Both corporations needed to grow fast, so they made some questionable hiring decisions. When they realized some people weren’t a good “fit,” they ditched them — but continued hiring, albeit at a much slower rate. It makes perfect sense.

The layoffs announced in January didn’t actually happen yet. Employees are given at least two months to find another role at Google. Until then, they are technically still employed (but they aren’t doing any work).

I’m in similar situation but for another big tech company. My whole team got layoff but I suspect most of us will get another role within the company before our 2 months to find a new role is up.

Zuckerberg has lots of pet projects that lose billions each year. Now that money is a little tight he is thinning out those positions. Over all hiring keeps chugging along.

Similar process is happening at my ex-employer. Announced 100+ headcount (corporate positions, administrative positions, overlapping positions) in layoffs in early January. Yesterday, announced they are midway through their goal of hiring 300 engineers by Q2. Cut the non producers, add producers.

I’m usually a day late and a dollar short when it comes to commenting here, but among the news today it’s been reported that 350000 jobs were added in January, almost double what was expected. Not directly related to tech or anything.

Maybe Wolf will have a separate write up regarding that, but with more jobs than expected added and the unemployment rate not moving, while wages are continuing to increase, (although marginally) it seems things are chugging along just fine and there’s no reason at all to cut rates yet. I think I saw a headline on some other site that now that the market gamblers are only expecting a 10% chance of a rate cut happening in March.