In 19 months, prices in San Francisco dropped nearly as much as in the first 19 months of Housing Bust 1. Overall Bay Area is well behind. We’re keeping score.

By Wolf Richter for WOLF STREET.

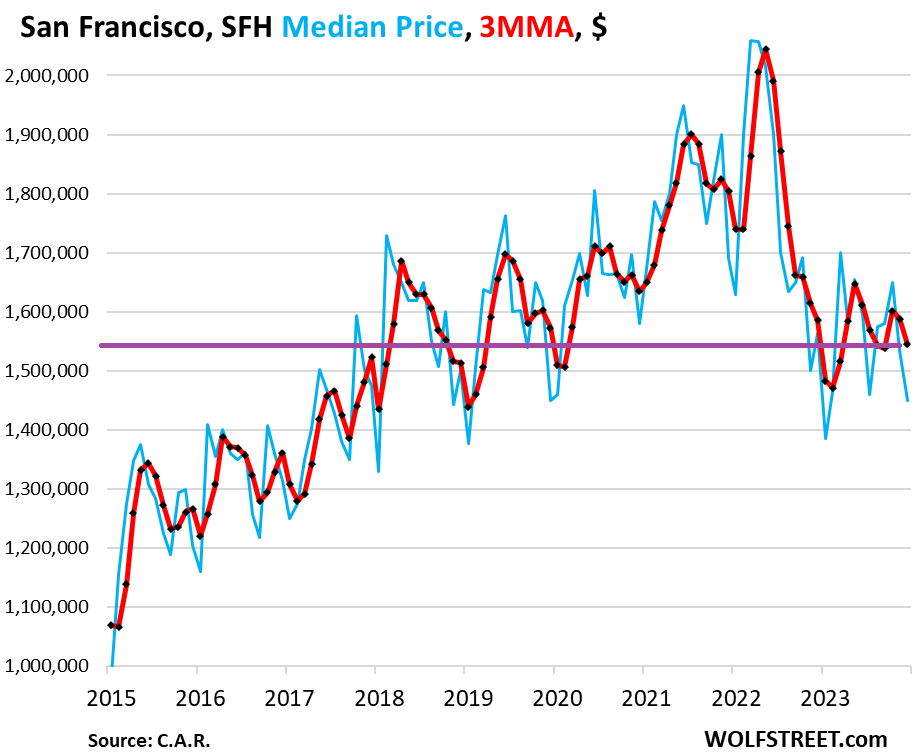

The median price of single-family houses In San Francisco dropped to $1.45 million in December, down by 29.6%, or by $610,000 from the nutty peak in March 2022, and below the Decembers in 2022, 2021, 2020, 2018, and 2017, which was six years ago, folks, and same as December 2019, according to data by the California Association of Realtors (blue line in the chart).

The three-month moving average (3MMA), which irons out some of those ups and downs, dropped to $1.54 million in December, down by 24.4% from the peak, and the lowest for any December since 2018, so that was five years ago (red line in the chart).

January is when the median price drops a whole bunch, and February usually comes in close to January. The two lowest months in the chart since 2018 were January and February 2023. So you can kind of see where this is going in January and February 2024:

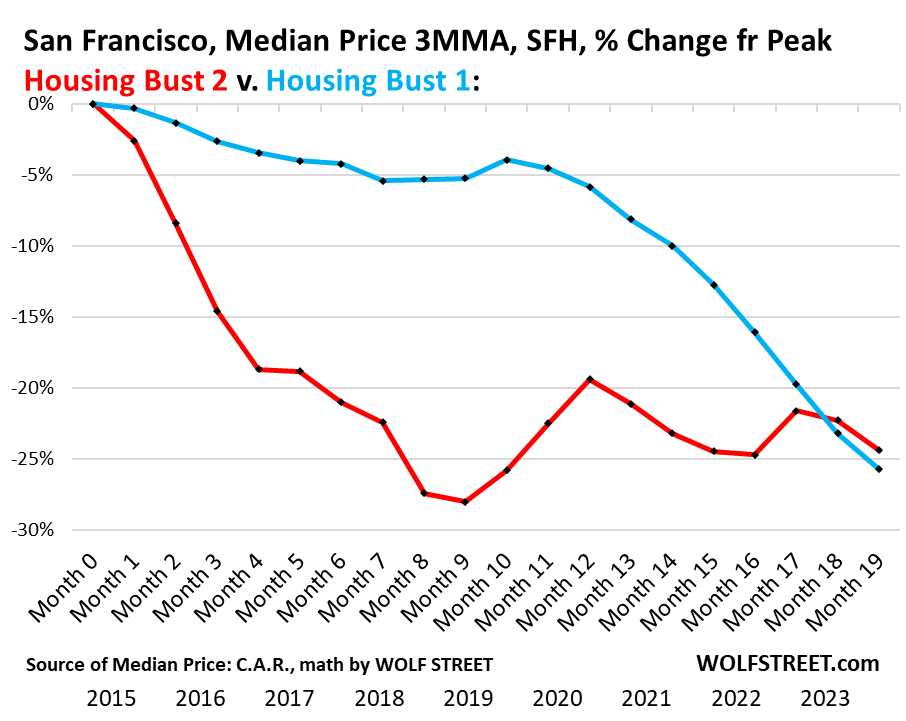

Housing market downturns are erratic and slow-moving. They’re not like cryptos that can collapse overnight. Housing market downturns can take years to play out.

In terms of Housing Bust 1 in San Francisco, the three-month moving average of the median price had peaked in May 2007 and then headed lower. In March 2012, after nearly five years of QE and 0%, the 3MMA bottomed out, having dropped 30% from the peak.

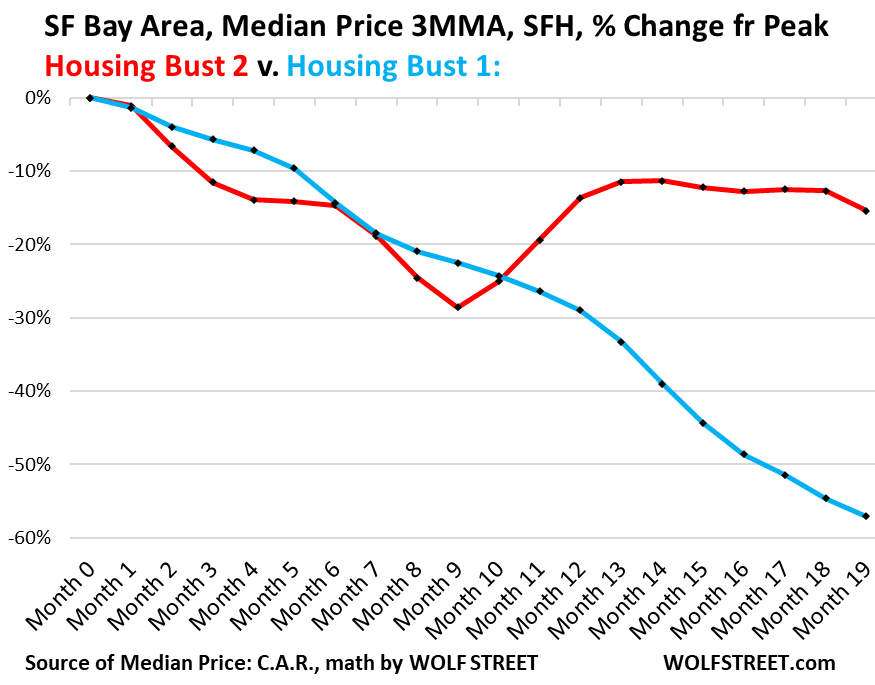

In terms of the entire SF Bay Area during Housing Bust 1, the 3MMA of the median price plunged by 58% from peak to trough, but it was front-loaded with a massive drop over the first two years, and then, despite QE and 0%, wobbled along these low levels till early 2012.

So we’re keeping score, comparing San Francisco’s Housing Bust 1 and Housing Bust 2 in one chart, in terms of the percentage drop from the peak (“Month 0”) of the 3MMA of the median price.

For Housing Bust 2, the 3MMA of the median price peaked in May 2022, that’s month zero; December 2023 is month 19. For Housing Bust 1, May 2007 is month zero.

Over the first 19 months of Housing Bust 2 in San Francisco, the 3MMA of the median price has dropped 24.4%. During the first 19 months of Housing Bust 1, the 3MMA dropped 25.8%. The drops are very close in magnitude, but the trajectories are different:

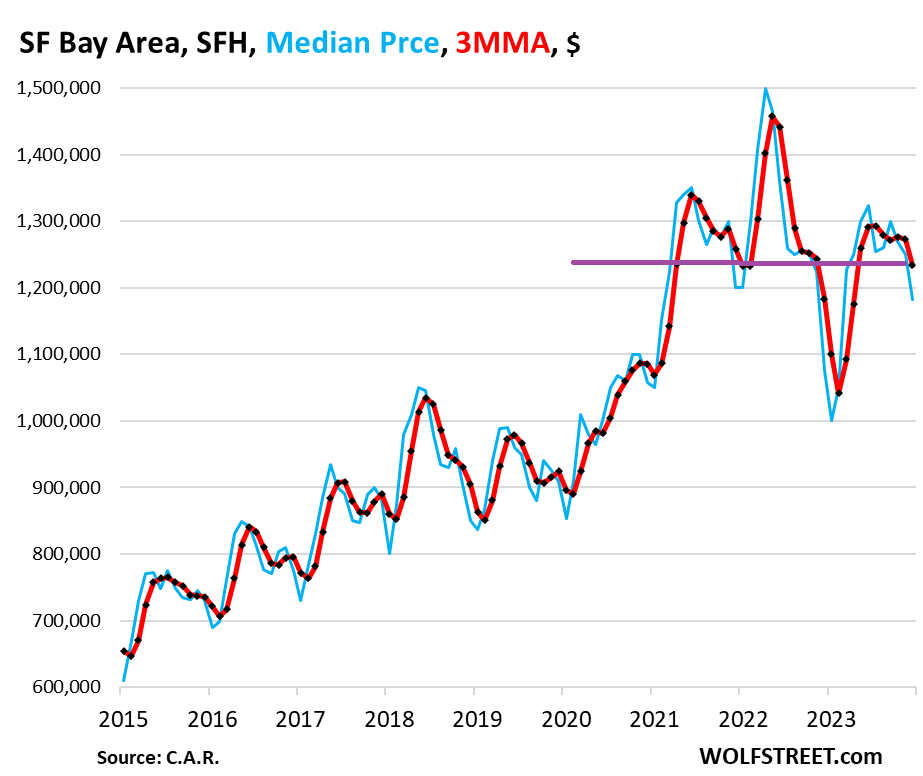

In the entire San Francisco Bay Area, the median price of single-family houses dropped to $1.18 million in December, down by 21.2% from the peak in April 2022.

The 3MMA dropped to $1.23 million, down by 15.4% from the peak. We’ll get to the remaining big counties of the Bay Area – the counties of San Mateo, Santa Clara, Contra Costa, and Alameda – in a moment.

Note the huge plunge of the 3MMA last year in late 2022. That was wild. The entire plunge from May 2022 through February 2023 was wild, after the wild spike in the two years before. So compared to that wild drop in December 2022, the 3MMA in December 2023 was up by 4.2%. But it was down by 2% from December 2021.

These are really crazy price movements since March 2020:

During Housing Bust 1 in the Bay Area, the 3MMA of the median price plunged by 58.5% over the first 19 months. Prices just kept plunging without any kind of uptick. That was very fast and furious for housing downturns.

Housing Bust 2 started out just as fast, but then the 3MMA recovered some before re-descending.

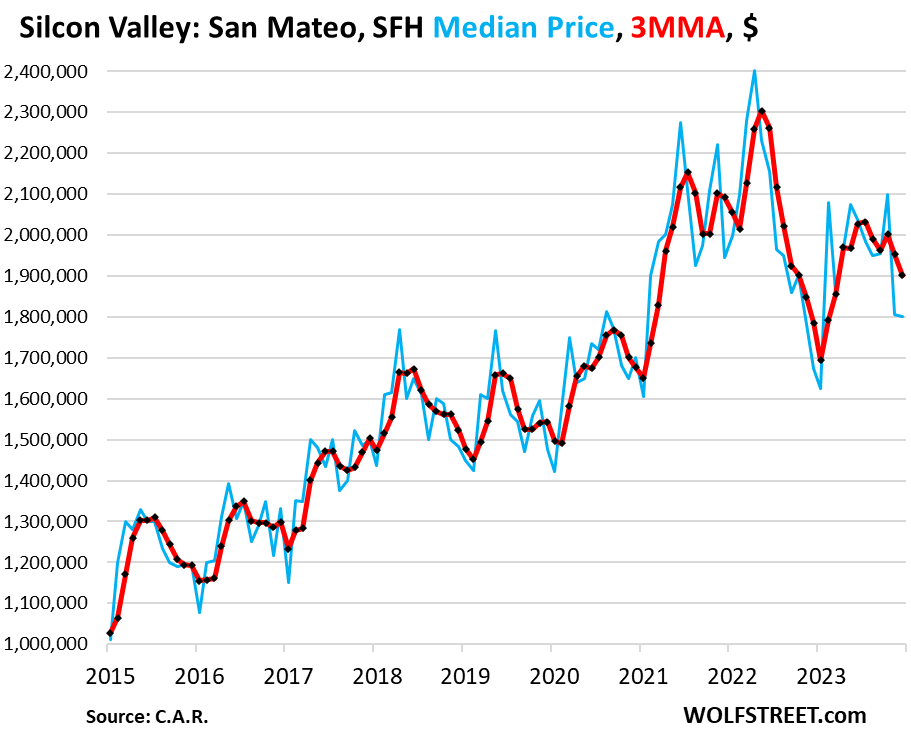

San Mateo County (Silicon Valley): The median price in December dropped to $1.80 million, down by 25% from the peak in April 2022, and down by 7.5% from two years ago, December 2021, but up by 7.5% from December 2022, due to the huge drop toward the end of 2022.

The 3MMA in December dropped by 17.5% from the peak to $1.90 million, down by 9.1% from December 2021 but up by 6.5% from December 2022, again due to the huge drop toward the end of that year.

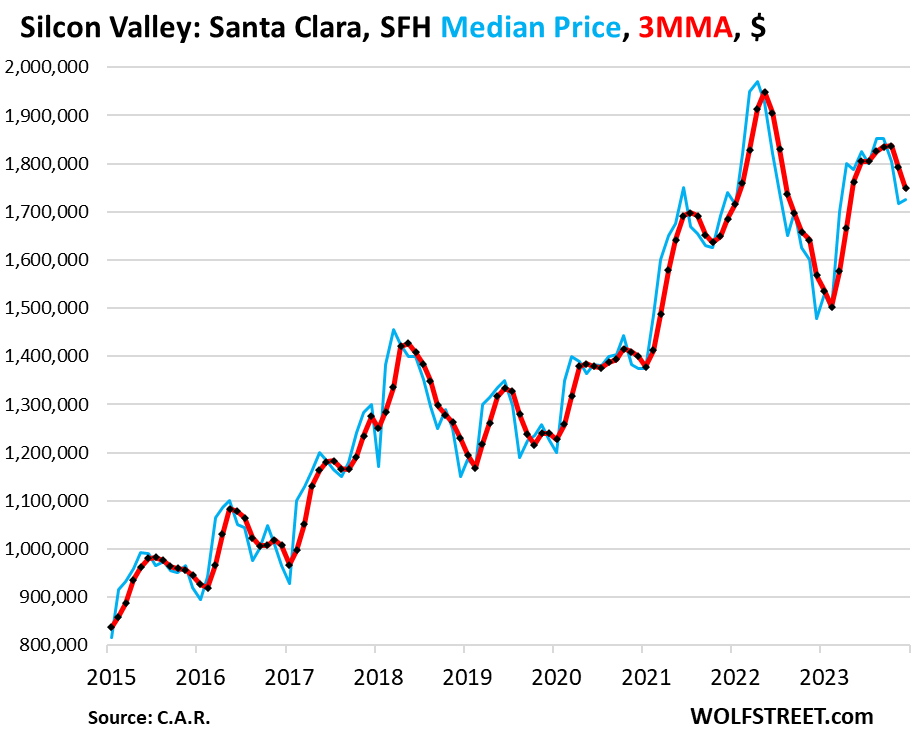

Santa Clara County (Silicon Valley): The median price in December dropped to $1.73 million, down by 12% from the peak in May 2022, and down by 1% below two years ago, in December 2021, but up by 16.7% from December 2022, due to the huge drops toward the end of 2022.

The 3MMA in December dropped by 10% from the peak to $1.75 million, and was the highest 3MMA for Decembers.

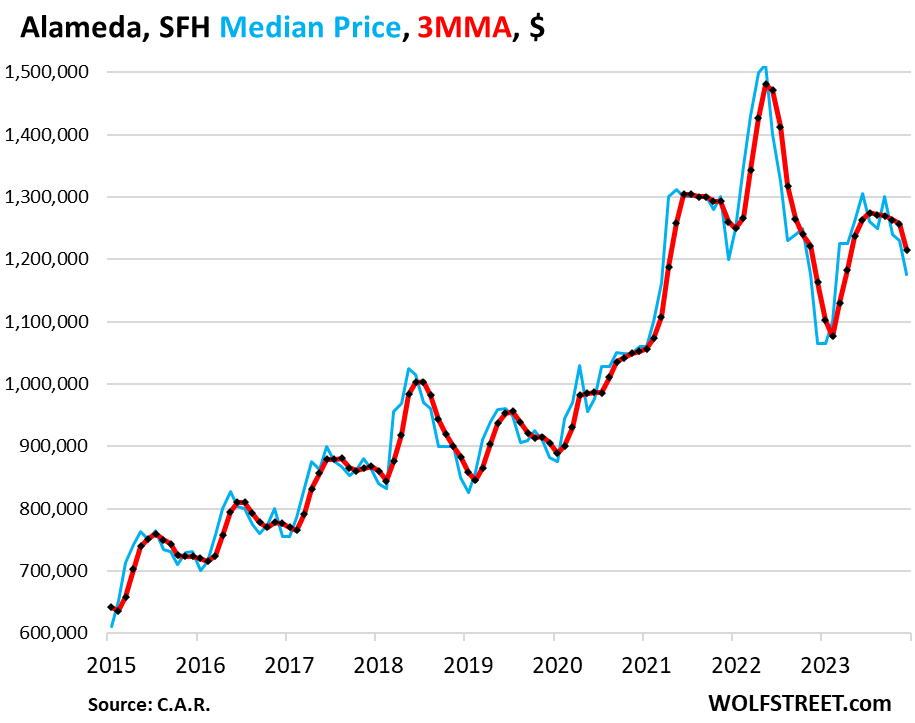

Alameda County: The median price in December dropped to $1.17 million, down by 22% from the peak in May 2022, and down by 2% from December 2021, but was up by 10.3% from December 2022 given the huge plunge late that year.

The 3MMA in December dropped by 18% from the peak to $1.21 million, down by 3% from December 2021 but up by 4.4% from December 2022, again due to the huge drop toward the end of that year.

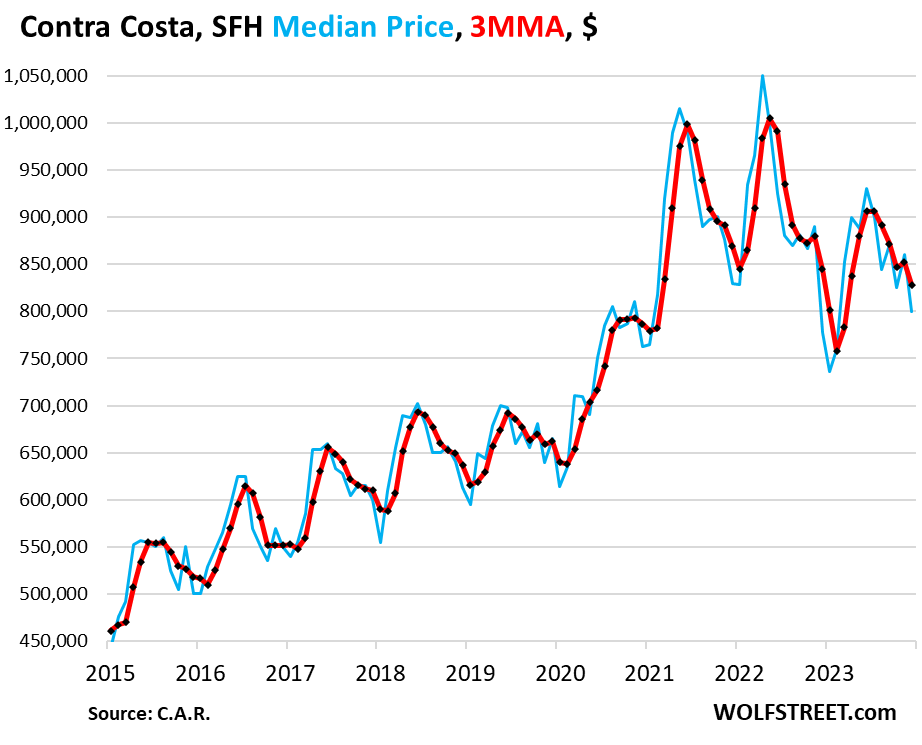

Contra Costa County: The median price in December dropped to $800,000, down by 24% from the peak in April 2022, and down by 4% from December 2021, but was up by 4.4% from December 2022, again given the huge plunge that month.

The 3MMA in December dropped by 18% from the peak to $828,000, down by 5% from December 2021 and down by 2% from December 2022, despite the huge drop toward the end of that year.

“Housing Crisis” – that’s the term being used to describe the problem in San Francisco and in the Bay Area overall of housing being so expensive that normal people with good incomes cannot afford to buy a house. And rents are too expensive too. Pressured by these housing costs, companies are having to offer enormous salaries to recruit people into this area, which makes employment costs very expensive. There are all kinds of taxpayer-funded initiatives – from federal, state, and local governments – to lower the burden of those housing costs, but they’re expensive for taxpayers!

But here is finally a market-based solution. Bringing down these oppressive housing costs that had spiked from already ridiculous levels in 2019 to super-ridiculous levels by mid-2022 is a good thing. It’s good for the local economy, it’s good for people looking to buy, it’s good for businesses and employment, it’s good for all kinds of reasons. For the market to bring down these oppressive housing costs and getting to some reasonable prices – reasonable in the Bay Area may still be high compared to other parts of the US – shouldn’t be lamented; it should cause a massive sigh of relief.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Love it, hopefully this will be contagious for SoCal markets in 2024 and we will see similar % drop right behind SF.

Possibly. I’m in Sacramento and don’t sense we will have anything like this as lots of building going on and while prices are down from extreme highs still relatively stable. All the new building might force existing to decline if people want a smaller footprint house on less land. Those house have advantages as if you run out of TP your neighbor can pass right over! Really small lot size.

All areas benefitted from low rates.

This downturn would be seen everywhere over time but not in my neighborhood 😀

Not seeing it in San Diego. We’ve always been much lower than the bay area so have lots of upward potential, and with all the Bay Area transplants coming here and saying that socal is a good deal compared to up there, prices of single family homes are definitely on the rise. There’s a lot of reasons we’re seeing these increases, though.

Asking prices starting with a 1 (million) are common place now. Even in the spike a few years ago things starting with a 1 were out of the ordinary.

Hahaha WR 😆

Not in my neighborhood peeps are gonna come and haunt your comment section

Not in my neighborhood /s

Interesting that SD home prices started increasing in conjunction with the Gov’t intervention it the banking crisis in early 2022. Seems that as soon as people saw gov’t intervention then they decided to jump right back in.

Bailouts,

Typo? The banking crisis was in early 2023, not 2022.

wolf,

Yes. Meant to say Jan 2023. Seems RE turned around soon as gov’t intervened in the market.

I live in SD and there are a lot of people who think the insanity will return as soon as the feds cut rates.

San Diego is special. Everyone wants to live there. There is no more buildable land. It is boxed in by the Pacific Ocean, Mexico and Camp Pendleton. San Diego values will not plunge. Everyone wants to live there. San Diego is special.

Love,

2006

Precipitous housing price drops rarely are good things for the salt of the earth population that are the bed rock of our society. While I agree that housing is grossly overpriced when viewed through a lens of classical economic and monetary sanity, which, unfortunately doesn’t apply to the current situation.

The most undervalued asset in the current markets is uncertainty.

The drop in price of SFH in the Bay Area is no where near the 2023 low, if I’m reading the graph correctly. The correction from that low is mysterious.

A 25+ pct drop is nothing to sneeze at which leaves the current price substantially more expensive than the humble family can afford. Which is unusual for the Bay Area, a snob magnet, generally priced by a larger amount than you know who can afford.

Love SF. They will figure it out. It may seem weird to someone from the interior of the country but, seeing as California has it’s own economy, what are you going to do.

I mean since the beginning of time the status quo has been unstable.

Things change in spite of the policy. The surveillance society, granting a predatory industry ownership of one’s personal life, has a half life.

Real estate prices almost always peak 3-4 years before a crash. Where the peaks are exceptionally high, the crashes are exceptionally severe. The move away from real estate taxes under Jarvis-Gann made California real estate exceptionally expensive and volatile.

Definitely a challenge for people in the service industry to find anything affordable. I remember growing up in Lafayette, which back at that time is was more of a cow town. We literally had salt licks on the other side of the fence. An entirely different place now. People simply buy a 1950s ranch house, tear down 3 walls to avoid consequences on full rebuild and build back a significantly larger house. They pay over a million plus simply for the land essentially.

From the totality of your post, I think we are talking Indiana rather than Louisiana. A profound difference in an understanding of what exactly the constitution guarantees.

Trump country.

Promising to balance budget with another cut in the corporate tax rate.

Lafayette is a suburb in Contra Costa County…. east of Oakland, CA.

A serious question, when will we see this kind of correction in mid west or other parts of the country? I know some people think that as some of the places did not have hb1 or did not go up that much after hb1 so that do not qualify as crazy bubble but damn the prices of lot of places have gone up 50%+ in just last 2 years and make things really unaffordable as lot of sellers are still asking 2021 prices in 2024 interest rate environment.

Hope to see some light at end of the tunnel……

It’s a matter of time I think.

It may take recession to the domino’s to fall further but simply math woops tell you.

If an area is very expensive w.r.t income then more susceptible.

Don’t believe that you will see similar drops across the country. The bar area is heavily dependent on high paid tech workers. Techies moved out of the city during covid and worked remotely. Now they are slowly coming back to the city.

Even in other high cost areas of California you are not seeing the same drop as in SF. Take San Diego for instance. Sure prices dipped but not as much.

The only way to get prices to continue dropping is if inventory goes up significantly.

If you think about it, prices actually help up well considering how high prices are and how rates skyrocketed.

What happens if rates go down……I think we all know.

…with genuine sympathy for those in my old home town who are now, physically, under water…

may we all find a better day.

LoL, facts don’t care about your anecdote..I am sure this graph is not representative of the not in my area special part of San Diego /s

This is only the 3rd year of rising rates. The high prices were caused by 40 years of continuously lowered rates. Each time rates came down, it meant a smaller monthly payment. But instead of taking the lower payment, buyers raised their bids. Just look at a long term chart of the 10 year treasury rate for perspective on this.

If you believe zirp is coming back soon, then so will the bidding wars on houses. However, to believe that you have to also believe the federal gov’t can get $2-3 trillion deficits under control. So far they’ve been unable to cut any amount from any program. Good luck in what ever bet you make.

The what is going on in the housing market in the Bay Area is excellently explained here. The part I am curious about is the why?

Supply isn’t necessarily keeping up with demand per CAR, and interest rates have led to a grinding slowdown, dampened by layoffs at tech companies and continuation of strong work from home trends, so why is the market crashing? And is the decline in prices, a factor of significantly lower inventory that’s meeting a lack of buyers, and could it get turned around once the rates fall and the $90 billion open ai and other startups start unlocking a new hype cycle? We live in interesting times.

Don’t you read the headlines, every week another store is closing in SF and another commercial building defaults. Crime and taxes may have something to do with it.

If you look at Wolf’s retail charts, sales have been falling in brick and mortar stores for 20+ years now.

This is braindead bullshit, Petunia.

The Huge spike in home prices through mid-2022 was caused by your “every week another store is closing in SF and another commercial building defaults. Crime and taxes may have something to do with it.”???

Laughing effing out loud.

Quit clicking on the clickbait BS spread about SF. They’re lying to you. I have blown up even the WSJ for this bullshit.

https://wolfstreet.com/2023/06/12/ive-had-it-with-stupid-stuff-about-hotels-in-san-francisco-park-hotels-wall-street-screwed-shareholders-bond-fund-holders-and-pension-funds-but-blame-san-francisco/

My article slamming the idiot WSJ reporter includes these paragraphs:

Here are department store retail sales:

And here are ecommerce retail sales:

And here, Petunia, are the crime rates for San Francisco, by category.

https://wolfstreet.com/san-francisco-homicides-rapes-robberies-aggravated-assaults-burglaries-larceny-thefts-auto-thefts-and-arson/

54 homicides in 2023 for a population of 820,000 is a homicide rate of 6.5 per 100,000 pop, one of the lowest of any major city in the US.

Unfortunately, a whole lot of comments here are equally brain dead and not thought out or researched.

Folks act like a bunch of drunk parrots repeating the clickbait news of the day or repeating the ignorant crap their neighbors or workmates tell them.

Let’s elevate the quality of our comments here. There are so many trustworthy and easy to reach research sites with great, accurate info that will make for better discourse.

Rule number two after Don’t Fight the FED is Don’t Fight Wolf. He actually DOES do his homework and research.

Petunia – its so much easier to steal from e-commerce retailers than brick & mortar. Just saying.

Beware, I had my debit card # hacked twice last year on prominent websites where I had ordered merch previously. Somehow crooks can log into an account, make an order, use your card on file, and then change the delivery address. I had to order a new debit card 3 times last year. I got refunded to my bank account, but it makes me not want to buy online now.

Brant Lee – It may be better to not save any card to any website. Sure it is somewhat of a hassle to type in your card every time, but lots of online companies lack robust protection against hacks.

“use your card on file, and then change the delivery address”

This is why we do not allow address changes after an order is placed at my e-comm operation.

Fraudsters have also realized they can abuse the chargeback system to get free merchandise.

Dealing with fraudulent orders is a big part of my job, unfortunately.

…trying to work out how Woody Guthrie might have crafted this situation to fit in his final stanza of ‘Pretty Boy Floyd’ (“…as you travel through this life, you’ll meet some funny men-some rob you with a six-gun, and some with a fountain pen…”).

may we all find a better day.

The collapse of retail occupancy is a result of Amazon’s dominance.

Well that explains that.

If prices are falling then supply is certainly above demand as you learn in Econ 101. No matter what propaganda the realtors spew.

Speaking of falling prices, how are those condos doing in San Francisco’s famous leaning skyscraper ?

Why “crashing”? Bubbles eventually burst or at least deflate and hopefully, the return to sanity is happening now. *Prices*, not rates, are still way too high for many buyers. Greedy speculators are running out of people to flip too and they’ve been getting hit by inflation along with buyers. That’s what happens when you hoard something that decent working families need. QT is taking some of the ridiculous amount of recently printed money out of the system and people can get 5% interest without the taxes hassle and expense of home ownership.

Hi Wolf, could we have an update on Australia, seemingly the last man standing in housing bubble land?

Respectfully Mr. Wolf and having read your comment it takes housing years for a bubble to play out; however, these graphs have volatility, but it seems like something is fighting hard to prop them up. This San Diego example of down once then back up and coming down again isn’t natural. Some financial entity has to be affecting the supply of houses.

I don’t really get what people are supposed to do with “it takes years for the bubble to play out”.

Take a family who can afford to buy today. Are they supposed to wait in hopes for lower prices? What if rates go down and prices climb higher?

What if they buy now and prices dip in a few years? Are they supposed to regret buying? Every time we bought a house we were told it was a peak or top. But all those tops and peaks are just blips on a chart. Nobody says buy now if you can barely afford it. Owning isn’t a right for everyone. Housing can’t go much cheaper because people who have more money than you and me combined would just scoop up those homes and rent them out. There are the have’s and the have not’s. That’s just life in a capitalistic country, no?

If you buy a home, make sure you can make the mortgage payment even if you lose your job for a while, understand that a home is an expense, not an income-producing asset, quit looking on Zillow, and be happy.

If you’re buying as house/condo as a rental, it’s an investment (income producing asset), and it’s an entirely different math.

“Nobody says buy now if you can barely afford it” LOL! Nobody except every mortgage lender and RE company in the country. That’s on top of some states and the federal government inventing “programs” to get individuals into a house. Not the time!

“Housing can’t go much cheaper because people who have more money than you and me combined would just scoop up those homes and rent them out.”

I need to make an “in muh area” comment here.

My area is Orange County, CA. I am seeing price-to-rent ratios of nearly 30. After accounting for the California property tax rate of 1%, that makes a rental yield of 2-3%, which still needs to pay for maintenance and potentially very expensive fire insurance. No hedge funds are going to be racing in to buy these even with a 20% drop.

@blahblahbloo

This is only one view when it comes to RE investing. What about investors who target appreciation instead of cash flow?

The city of San Diego took the state’s ADU law and put it on steroids. Developers of all sizes are snapping up SFR properties within the city and adding anywhere from one to 100 additional units. In some cases close to 150 units (a particular parcel in Encanto within the city limits). Existing stock is under extreme demand by these developers. Combine that with low rates of yesteryear that locked folks into their homes. Would you sell a 3% property? I wouldn’t and haven’t. There’s also the real problem of no land left, which is a huge driver in the building of numerous regular multi family projects all over the place.

Your assumption that there is a financial entity affecting the supply is very intuitive. Also massive code changes within the city. On several occasions I’ve mentioned this on this site and almost every time I end up being a “not in my neighborhood RE cheerleader” poster or get flat out moderated away into commenter purgatory. I’m not sure why this happens when it can all be substantiated.

Are you in a rush to buy in SD? Hopefully those greedy developers will learn from overpaying for their property, and not get bailed out this time , but if they build more dwellings, that might reduce demand and prices. Imo, the main sources of your grief was the current parties, who are leading the polls for the next election (so have we learned yet?) interfering with the free market with trillions printed, the suppression of rates through FED “buying” of bills, notes, bonds, mortgage backed securities, the public’s “consensual hallucination” in RE speculation.

Which makes me to want a different, more kind world.

San Diego is definitely holding up firm.

In my neighborhood, the home prices begin at about 1.5 million.

12 years back, there used to be lot of young families with little kids.

The kids have grown up, the young families can’t afford to move in my neighborhood. the neighborhood elementary school is reporting lower and lower enrollments.

It looks like, in 10 years or so, my neighborhood would be a neighborhood of very old people.

On top of this, population growth has slowed down drastically and in next few year, SD would experience population loss.

Also, in last 3 years, homeless population in SD has increased by 67% or so.

I wonder, what is the future of SD and other places with high housing cost ?

Australia: “We’re the last man standing in housing bubble land!”

Canada: “….. hold my beer.”

The fact is that Canadians don’t drink beer excessively, in fact, the average Canadian gossips about other Canadians that drink too much beer.

Australia’s gravity defying real estate market is supported by an immigration ponzi (with a liberal definition of “ponzi”).

For comparison, in 2023:

Australia (year to June 30) – about 520,000 of net migration, on a population of about 26 million

USA (year to December 31) – about 1.1 million of net migration, on a population of about 335 million.

Making per capita net migration into Australia about 6 times that for the USA.

Someone has to be willing to man the outback. The migratory numbers that you claim, without a source, are preposterous.

Else, Australia is a land of mental handicaps, unable to discern the solution to the above described preposterous claim.

https://www.abs.gov.au/statistics/people/population/overseas-migration/latest-release

What are price-to-rent ratios in Australia like? When housing prices go up due to increase in population, it should affect rents as well as sale prices.

@blahblab

Price to rent ratio can lead you in the wrong direction. The ratio is just a snapshot in time. Plenty of examples where price/rent would favor renting but when you fast forward to today, you can easily see how buying would have been the better choice if you like money and trust in math. Simply put: a mortgage remains stable (for the most part) while rent trend up over a larger timeframe. On top, prices and rates went up tremendously. Great for those who bought, very bad for sideliners, sitting in cash.

Thanks for this article, and for once again emphasizing the slow moving nature of real estate cycles.

An interesting parallel with stocks: S&P 500 in the 2001 and 2009 busts fell approx. 50-60%…. very similar to the magnitude of the 58% SF drop during Housing Bust 1. Maybe just coincidental…

Anyone have insights or data on historical correlations between real estate and stock market reversions (if any exist)? Which usually leads, and which lags I wonder?

Well, first of all, the price of the so called stock market is setting new highs which means that it is unprecedented, there is no valid, previous comparison. Even 1929 pales in comparison.

Irving Fischer’s sin was believing that the stock market had reached a permanent high.

Your guess is as good as mine what comes next.

Hey wolf

Thanks for sharing. Is Seattle market following a similar trend?

I think Seattle’s June 2022 to June 2023 bounce back was worse than San Fran, coming back to almost the previous peak. Yeah bummer. But is now down pretty good again near the 2022 low. Wolf posted this in one of his articles.

Wow. Someone who bought a house in SF back in June of 2022 just saw over half a million dollars get vaporized in a year and a half. That’s gonna leave a mark.

For sure. The first domino has fallen. You can set your watch to the residential real estate valuation cycle. Regarding devaluation, this is exactly where we were around 1990 and exactly where we were in 2006.

All you can do is say “ouch!”

Gotta feel for such folks. Of course, if they bought the house to be a home and not primarily an investment and are planning on being where they are long-term, then all is well-ish.

@MiTurn,

“Gotta feel for such folks. Of course, if they bought the house to be a home and not primarily an investment and are planning on being where they are long-term, then all is well-ish.”

Yes, assuming they bought the house with a fixed rate mortgage, and assuming they can keep their jobs for the foreseeable future.

Well, anyone with a 2 pct mortgage can buy 30 yr treasuries and pay off their debt for 50 pct less.

Wolf,

How about a comprehensive list of all the stores that have closed along side these numbers.

Macy’s just announced they are closing a store near me in Simi Valley, CA.

Macy’s has closed many dozens of stores around the US over the past five years. They’re a store closing machine. Their ecommerce business is thriving, their department store business is dead. But they include ecommerce sales in their same-store-sales, as to hide the demise of their brick and mortar business.

They announced 5 store closings last week — and only the store closings in California are cited, not the store closings in Florida (LOL) and Virginia?

Governor’s Square (Tallahassee, Florida)

Ballston (Arlington, Virginia)

Kukui Grove (Lihue, Hawaii)

Bay Fair (San Leandro, California)

Simi Valley Town Center (Simi Valley, California)

“But they include ecommerce sales in their same-store-sales, as to hide the demise of their brick and mortar business.”

Sounds like “Click and Brick”.

Macy’s has a good ecommerce operation, one of the largest in the US. No need to go to their stupid stores. They deliver it to your house for free if the order is over a minimum. I’ve used it against Amazon.

…gotta wonder how long before the Thanksgiving Day Parade goes to a CGI-online format, (…with ‘AI’ commentary, natch…).

may we all find a better day.

Petunia,

Here you go… They’re right here, nationwide:

https://wolfstreet.com/tag/brick-and-mortar-meltdown/

I have been reporting on the NATIONWIDE Brick-and-Mortar Meltdown since 2016. Tens of thousands of store closures, malls defaulting on their debts, zombie malls, mall REITs filing for bankruptcy, hundreds of retail chains from Sears Holding on down filing for bankruptcy, and most of them getting liquidated… Do you ever read anything here?

Go through this and look at the headlines. They’re kind of amusing, put together like this:

https://wolfstreet.com/tag/brick-and-mortar-meltdown/

Then Google: brick and mortar meltdown … see what’s the top entry?

Here are department store retail sales:

And here are ecommerce retail sales:

This San Francisco/California doom loop is really tiresome. Wolf is one of the very few correcting the obituaries with facts. Why people want to believe stores are closing due to crime when it’s obviously because brick-and-mortar has been declining for decades is weird. Have they been to a department store lately? Corporate propaganda, paranoia and politics are really skewing perceptions.

This is from a recent New Yorker:

But in the past forty years the number of malls in the United States has declined by nearly three-quarters, and a tour of downtown San Francisco today, its streets packed, its bars busy, can seem an odd me-or-your-lying-eyes experience. By many measures, San Francisco is the safest it has ever been. Violent crime is a third of what it was in 1985, and currently twenty per cent below the average of twenty-one major American cities.

The city has a triple-A credit rating. Most of its residential neighborhoods are clean and green and bustling. With the exception of the Tenderloin, the neighborhood from which most dire imagery comes, a walk through San Francisco is a stroll around an affluent Pacific capital of small bookstores and night markets and weekend festivals—so much so that one can almost wonder where the idea of a city in decline emerged.

I agree. Due to its geography, weather, architecture, and age, San Francisco will always be in demand. The demand may wax and wane with the economy but it will always be in more demand than a Rust Belt city.

Politically, it seems to be popular for certain parties to describe a dystopian city, which avid mindless readers, who don’t get out much, blindly accept as alternate facts.

Sam: “…who’s got trouble?”

Rick’s Cafe crowd: “…WE’VE got trouble…”

Sam: “…oh, look! Squirrel!”

(…kudos to Wolf, as we knock on wood and give our apologies to the script of ‘Casablanca’…).

may we all find a better day.

Relying to @Bobe below:

If demand is there then prices won’t fall 29% or so.

Let’s stop living in our own bubble.

Jon,

It is all relative to the rest of the country.

Since the median price is over $1.5M, I’d say the demand is still high compared to almost anywhere else.

Wolf, Do you track this Data for other cities or states? Namely, Dallas/Texas? This is great data, thanks.

No, I don’t. I did post in the comments some charts for Houston the other day which I got in the email from the Greater Houston Partnership.

https://wolfstreet.com/2024/01/19/amid-collapsed-demand-for-existing-homes-prices-drop-further-supply-highest-for-any-december-since-2018-new-listings-come-out-of-the-woodwork/#comment-565379

Is {State} Association of Realtors data to be taken with any grain of salt relative to say Case Shiller in your experience (ignoring the fact CS is direct house comparison and the others are market averages). I trust Zillow data about as far as I could throw a rack of Zillow servers. But the #AR data seems comprehensive and gives visibility into locals CS doesn’t touch.

This is median-price data. All median-price data have their problems, as you can see in the volatility. This is a particular problem when the sales numbers are low in small markets (for example, in the small Bay Area county of Marin with only a small number of transactions, the median price is all over the place, which is why I don’t show it).

I use the three-month moving average and longer-term charts so you can see the potential issues, rather than just citing numbers.

Median prices can be skewed by a change in mix, for example if a larger number of higher-end homes than normal sell in that month, or a smaller number of lower-end homes than normal, it would increase the median price without home prices overall actually having to change.

But “median prices” are not skewed by outliers. “Average prices” are skewed by outliers (the Warren Buffett in a Starbucks example… the average wealth of 21 people in the Starbucks would the sum of their wealth divided by 21, and the average wealth would be over $1 billion. For the median wealth, you make a list of all 21 people, ranked by wealth, and the wealth of the 11th person down (the person in the middle, hence “median”) would be the median wealth, with Buffet’s wealth (the outlier) having essentially no impact.

The Case-Shiller shows similar trends but it’s about four months behind, and it only covers metro areas, not counties. And it only covers 20 metros in the US. For example, the C-S called “San Francisco” is for a five-county portion of the 9-county Bay Area. I like the C-S’s methodology (sales pairs) but these limitations are not good.

Zillow has two things:

1. its estimate of what a home might be worth (“Zestimate”). This is worthless.

2. median price data based on actual closed sales (MLS data). It has several versions of this data, including a trimmed median price, and data by size of house (e.g. 2-BR), and it has seasonally adjusted and not-seasonally adjusted versions, etc. This data is pretty good, and it’s good that they’re trying to soften the problems of median-price data, but it’s pick-and-choose. I might use it in the future because it covers every major city, and it goes back far enough. But I have to decide which version I want to use that makes the most sense to me (such as trimmed median prices, houses or condos, not seasonally adjusted). I just haven’t decided yet.

Thanks for the breakdown. That all makes sense. Much appreciated.

With the current bubble, the city core is dropping faster than suburbs, which is the reverse of what happened in the 2009 bubble. Perhaps WFH explains that. People are still holing up in the suburbs. This would also explain why stores in the core are folding.

Plus, the tech labor hoarding movement appears to be reversing. Lots of people, including my friend’s kid, moved to city of San Fran to stand around as excess capacity for a couple years and share an apartment with others in similar position. He bailed out of that situation over a couple years ago, but they still might be whittling away at excess headcount in the city and the entire area.

North CA dynamics are interesting and all…but still a high end outlier.

For me, the interesting part of Bubble 2, is how much more wide-spread it became relative to Bubble 1 (in other words, plenty of sizeable metros avoided getting sucked into Bubble 1…but many fewer avoided that fate in Bubble 2).

Why?

I still think that nationwide inventory is sooner or later going to have to come online (likely at 7% mortgage rates, not 3.5%) and do in the Wiley Coyote-Acme Anvil-Cliff price elevation that abnormally low for-sale inventories have propped up…but unZirp started about 2 yrs ago and the *national* unwinding is going pretty slow.

Wolf, typo in 2nd paragraph under “Contra Costa County.” Remove the “million” behind “$828,000.”

Thanks!

I cheer the drop in housing prices. However, the cost of building has gone up significantly so while there will be a ‘leveling out’ of supply/demand I do not expect prices to go down to the ‘old days’ nominally.

“the cost of building has gone up significantly ”

Buyers don’t care about builder costs.

If it’s expensive for them, they don’t buy, and if the builder can’t sell, he goes bankrupt. Market logic….

When prices go down, as they do now, buyers disappear from the market because they wait for even lower prices. It’s like an avalanche.

That’s right. Happens in stock trading too. People buy into rising prices and stay away from declining prices. It’s the opposite of what you should do if you follow buy low sell high principles. I don’t believe in a falling knife in housing because long term housing goes up. If prices declined and you have an opportunity to buy you should see it as a buy the dip opportunity IMHO.

It’s absurd that real estate is still being treated as a speculative asset instead of a place to live. Real estate has a high carrying costs with taxes, maintenance costs and insurance all sky rocketing. Any regular costs only serve to depress prices further.

I thought the same during previous Housing Bubbles.

At some point in time, things would go back to fundamental valuations in housing this would be tied to monthly payment aka monthly income.

We all suffer from recency bias.

Yep!….Inflation is under control……Southwest airline pilots just agreed to settle their labor disagreement…….29.31% pay increase upon the agreement being ratified.

I wonder if this cost will be reflected in airline ticket prices…….sarcasm.

Maybe you can attribute this to the “Airline Deregulation Act”.

Whoever coined the phase ‘inflation is transitory’ surely had a twisted sense of humor. I’ll say that.

Our system cannot handle a big pile of falling house prices for long durations as that decreases taxes going to municipalities, it restricts most of those cash out helocs from happening, and most likely reduces home owner insurance premiums, heaven forbid. Not to mention raises the credit default prices, which opens another box of worms, And if people have negative equity in their piggybank , i mean house, then some folks will simply walk handing the empty upside down mortgage back to the bank and with no payment going to MBS bondholders. Creating copious problems all the way around. Just like 2008-2009 revisited.

Having said this, the fed has had lots of experience handling these kinds of problems, because they fixed nothing within, from the last go around, and just re-upped more of the same. I wonder what new tool will be extracted from the plethera of tools in the feds tool box this time around to save our system again? If anyone does see the newest tool being displayed by the fed please inform us, if you think about it because it took me 6 months to figure out what quantitative easing was on the last go around, being slow to understand that these things actually do take place.

Have you heard of the term “millage rate”? No matter how far your home price sinks, the local government can just jack that up to compensate…

I grew up in Contra Costa and rarely go back to visit. When I do, I am struck at how low-density most of the housing still is. IDK if it is the earthquake codes or something more manipulative. Compare the Bay Area to other high-density, expensive areas across the country and across the world and you might see part of the problem with lack of affordability.

David S – …the long tail of history always leaves a wake reflecting the patchwork result, good and ill, of the succession of efforts conducted for reasons oft-believed sensible in the ‘contemporary’ situations in the past. There is very rarely a clean ‘present’ sheet to work from…

may we all find a better day.

I think the NAR is still tied up in a 1.8 billion dollar lawsuit for conspiring to keep commissions artificially high. The last article I read stated that along with this the NAR has been trying to defend itself against antitrust litigations for years namely due to anti-competitive practices. I could be dreaming, but if they just had a flat fee instead of a percentage based commission, we could hypothetically get housing prices to adjust accordingly? Or maybe I’m just nuts.

I hear there is a ton of shadow inventory. And builders are building like crazy in places people don’t want to live.

It sounds like there might be a lot more inventory but the developers and investors aren’t releasing it because they don’t want to wreck the market.

Is this multi unit housing or sfh?

In flyover land here. Went through gfc. Ton of spec homes

leading up to the collapse. This time around…at least were I work,

very little sfh spec building.

I’m one of the 1st guys in line for getting on property. So I ..usually…have a good pulse for how spring will break. As of 2nite we have close to 50 new builds on the schedule….and its still January in the frozen tundra.

Does not feel like the gfc days……yet.

There are multiple new condo developments in LA in the last 5 years, not including the carcass sitting incomplete scarring the skyline. The metropolis condos near trh 110 has 3 towers originally planned as all condos. one tower was converted to a rental and the second tower was not “released” as complete when I checked a few years ago and I don’t believe anything has changed. Many withholding units from the market to prevent a market collapse from my experience searching for units to buy. It’s just a game of how long they can hold on, really. So much funny money….