Quantitative Tightening has now removed 35% of Treasury securities and 25% of MBS that pandemic QE had added.

By Wolf Richter for WOLF STREET.

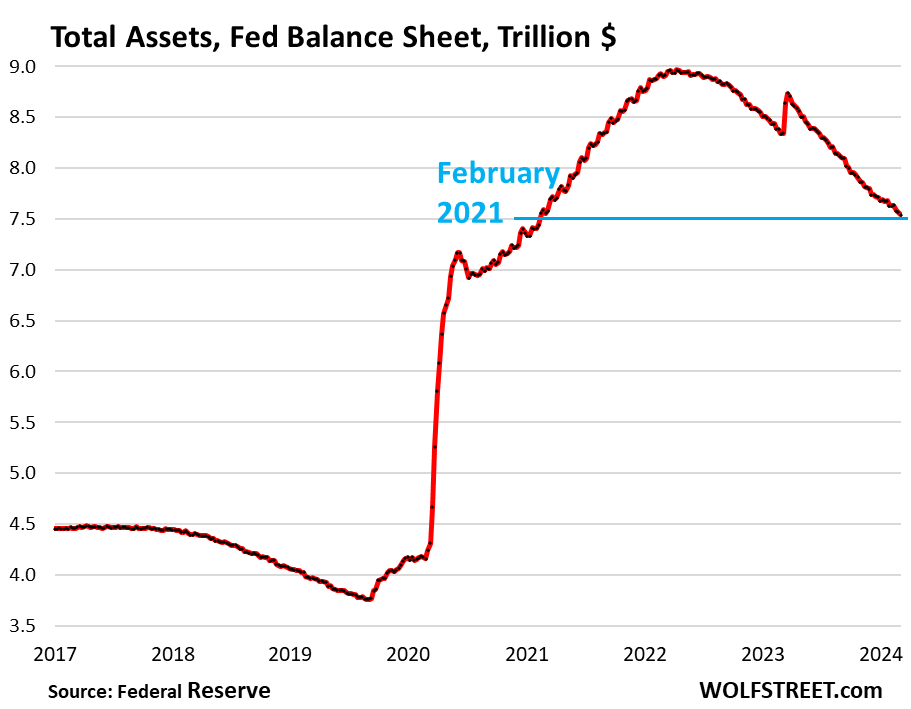

Total assets on the Fed’s balance sheet dropped by $91 billion in February, to $7.54 trillion, the lowest since February 2021, according to the Fed’s weekly balance sheet today.

Since the end of QE in April 2022, the Fed has shed $1.43 trillion, as quantitative tightening continues on track.

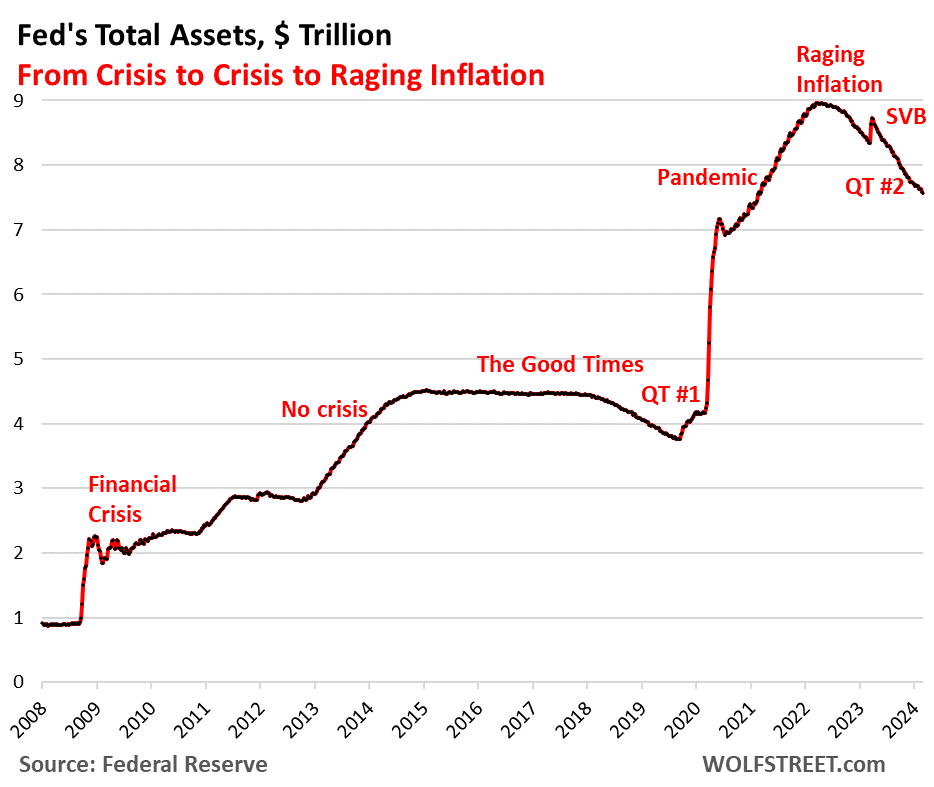

During QT #1 between November 2017 and August 2019, the Fed’s total assets dropped by $688 billion, while inflation was below or at the Fed’s target (1.8% core PCE in August 2019), and the Fed was just trying to “normalize” its balance sheet.

Now inflation is hot, though it has come down a lot, driven by price drops in durable goods, and a plunge in energy prices. But services inflation didn’t cool off enough and now “core services” inflation had gone into a nasty acceleration.

The Fed has now started discussions on when and how to slow down QT so that it doesn’t blow up something that would cause the Fed to halt QT prematurely. Fed governors Waller and Logan have come out with some basic principles on what a plan might entail (see our explanation: Fed Discusses Balance Sheet “Normalization”: ON RRPs & MBS Go to Zero, Reserves Drop a Lot, Slower QT Reduces Risk of “Accidents,” SRF Calms Repo Market, Future QE without Increasing the Balance Sheet).

QT by category.

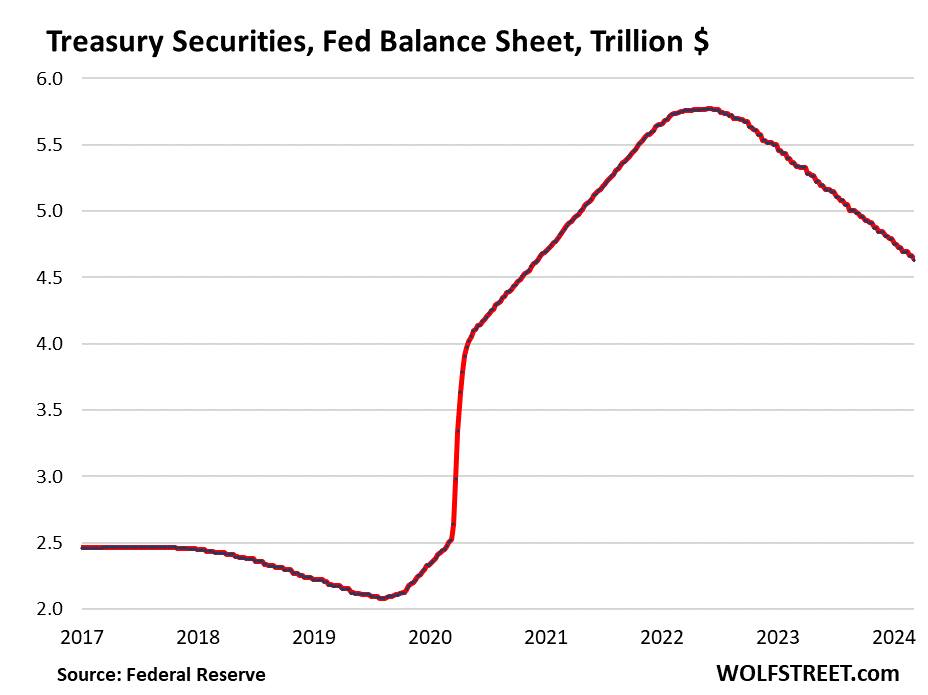

Treasury securities: -$61 billion in February, -$1.14 trillion from peak in June 2022, to $4.63 trillion, the lowest since December 2020.

QT has removed 35% of the $3.27 trillion in Treasury securities that QE had added during the pandemic.

Treasury notes (2- to 10-year securities) and Treasury bonds (20- & 30-year securities) “roll off” the balance sheet mid-month and at the end of the month when they mature and the Fed gets paid face value. The roll-off is capped at $60 billion per month, and about that much has been rolling off, minus the inflation protection the Fed earns on Treasury Inflation Protected Securities (TIPS) which is added to the principal of the TIPS.

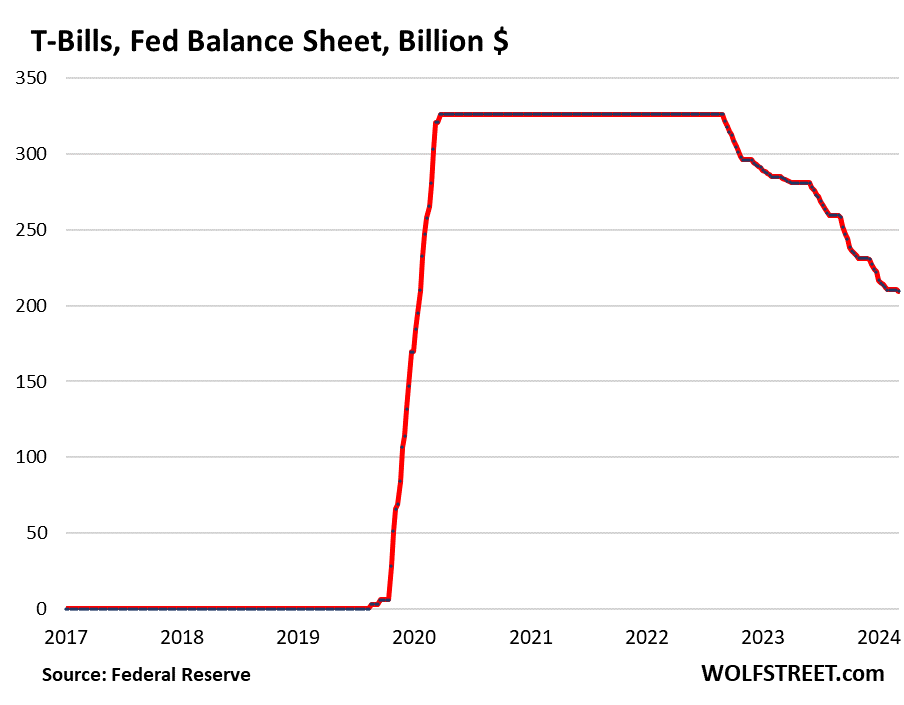

How Treasury bills fit into QT. These short-term securities (1 month to 1 year), now at $209 billion, are included in the $4.63 trillion of Treasury securities on the Fed’s balance sheet.

The Fed lets them roll off (doesn’t replace them when they mature) if not enough longer-term Treasury securities mature to get to the $60-billion monthly cap. As long as the Fed has T-bills, the roll-off of Treasury securities can reach the cap of $60 billion every month.

At the current pace, the Fed will run out of T-bills in June 2025, which is when the Treasury roll-off would slow naturally as fewer securities of the by then much reduced pile will mature every month.

In February, $77 billion in Treasury notes and bonds matured, and no T-bills were used. In March, $45 billion in notes and bonds will mature, $15 billion under the cap; and the Fed will let about $15 billion in T-bills roll off without replacement to get to the $60 billion cap.

From March 2020 through the ramp-up of QT, the Fed held $326 billion in T-bills that it constantly replaced as they matured (flat line in the chart). In September 2022, T-bills first started rolling off to fill in the gap to get the Treasury roll offs to $60 billion a month.

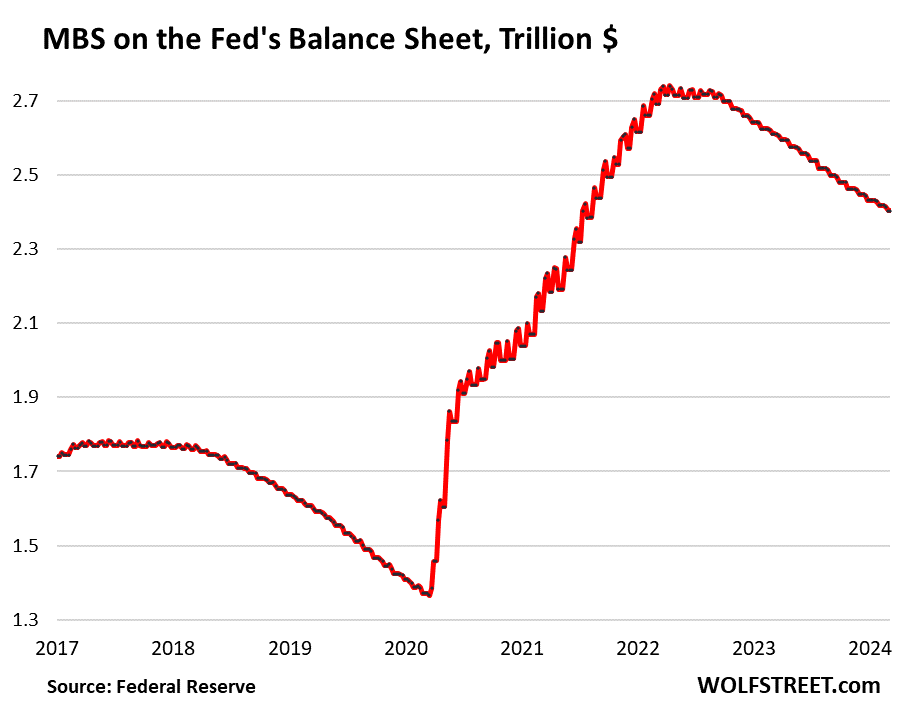

Mortgage-Backed Securities (MBS): -$12 billion in February, -$334 billion from the peak, to $2.40 trillion, the lowest since August 2021. The Fed has now shed 25% of the MBS it had added during pandemic QE.

The Fed only holds government-backed MBS, and taxpayers carry the credit risk. MBS come off the balance sheet primarily via pass-through principal payments that holders receive when mortgages are paid off (mortgaged homes are sold, mortgages are refinanced) and when mortgage payments are made.

But the market for existing home sales is frozen and sales have plunged, and fewer mortgages were paid off. In addition, mortgage refinancing has collapsed.

All of this dramatically slowed the pass-through principal payments to MBS holders, and so the MBS are coming off the balance sheet only at a glacial pace that’s far below the $35-billion cap.

Bank liquidity facilities.

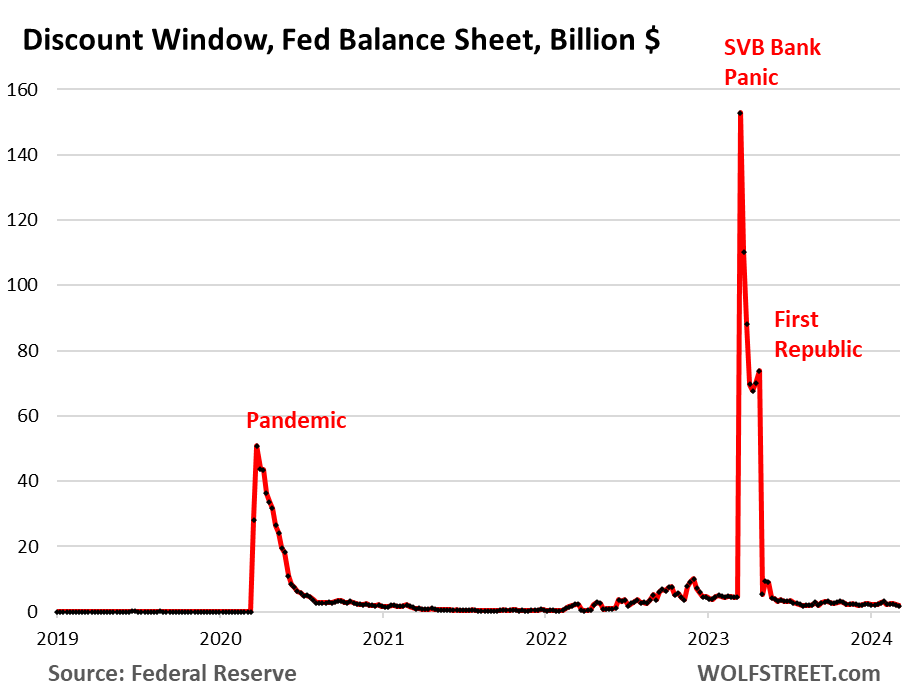

Discount Window: $1.8 billion. Roughly in this range since July 2023, and down from $153 billion during the bank panic in March 2023.

The Discount Window is the Fed’s classic liquidity supply to banks. The Fed currently charges banks 5.5% in interest on these loans, and demands collateral at market value, which is expensive money for banks, and so they don’t use this facility unless they need to. The rate is one of the policy rates that the FOMC sets during its policy meetings.

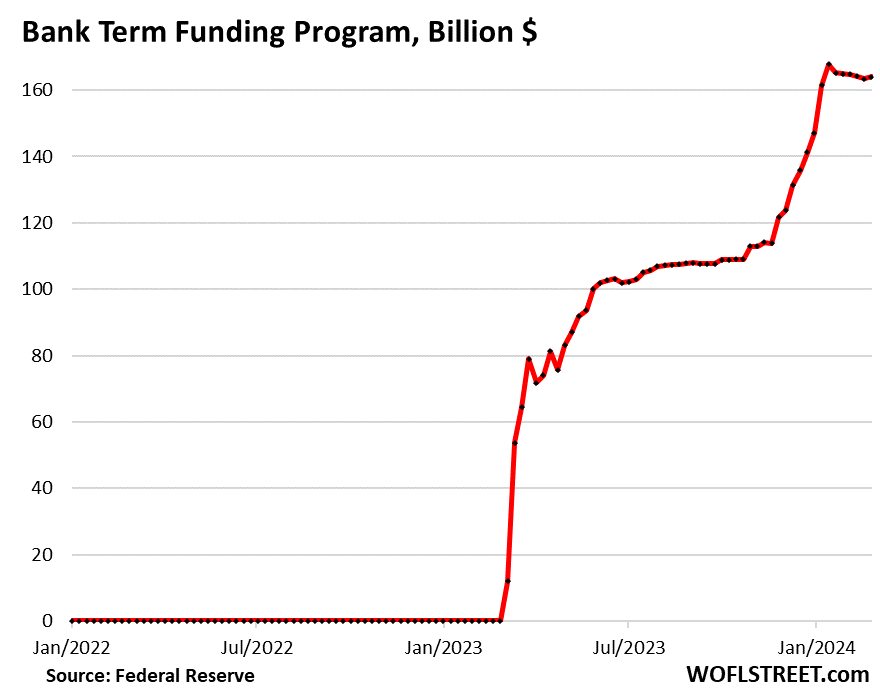

Bank Term Funding Program (BTFP): This bank-bailout facility was cobbled together over the panicky weekend in March 2023 after SVB had failed. To borrow at the BTFP, banks had to pay the Fed a rate equal to the one-year overnight index swap rate plus 10 basis points, fixed for the term of the loan of up to one year. At the time, the rate was a little lower than the rate at the Discount Window, and collateral requirements were easier. So some banks used it. Through the summer and into the fall, the BTFP balance held steady at about $108 billion.

But starting in November, the BTFP balance began to spike. What happened is that Treasury yields and related yields began to drop amid the rate-cut mania. By the end of December, banks could borrow below 4.7% at the BTFP, and then keep that cash in their reserve account at the Fed and collect 5.4% interest from the Fed, earning risk-free income off the difference. This arbitrage of the Fed rates pushed the balance to $168 billion.

The cash stayed at the Fed and didn’t go anywhere, and didn’t add liquidity to anything, it just made some banks some risk-free profits.

But in January 24, 2024, the Fed finally shut down the BTFP arbitrage opportunity by changing the interest rate banks have to pay on new loans from the BTFP; that rate now cannot be lower than the interest rate they earn on their reserve balances. And that stopped that arbitrage.

Since then, the BTFP has declined by $3.7 billion, to $164 billion. The facility will cease making new loans, as scheduled, on March 11, but existing loans can be maintained for up to one year after the loan was issued. So at the latest by March 11, 2025, the BTFP will go to zero.

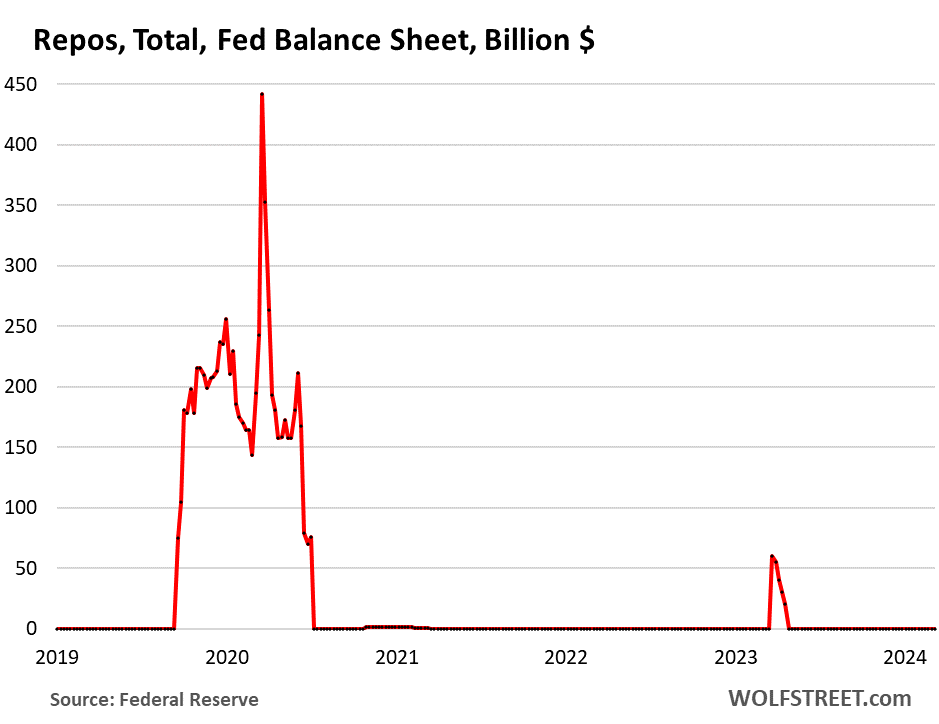

Repos: $0. The Fed currently charges counterparties 5.5% on repos, as part of its five policy rates. The Fed’s repos come in two flavors:

- Repos with “foreign official” counterparties were paid off in April 2023.

- The repos with US counterparties faded out in July 2020 and have remained at around zero.

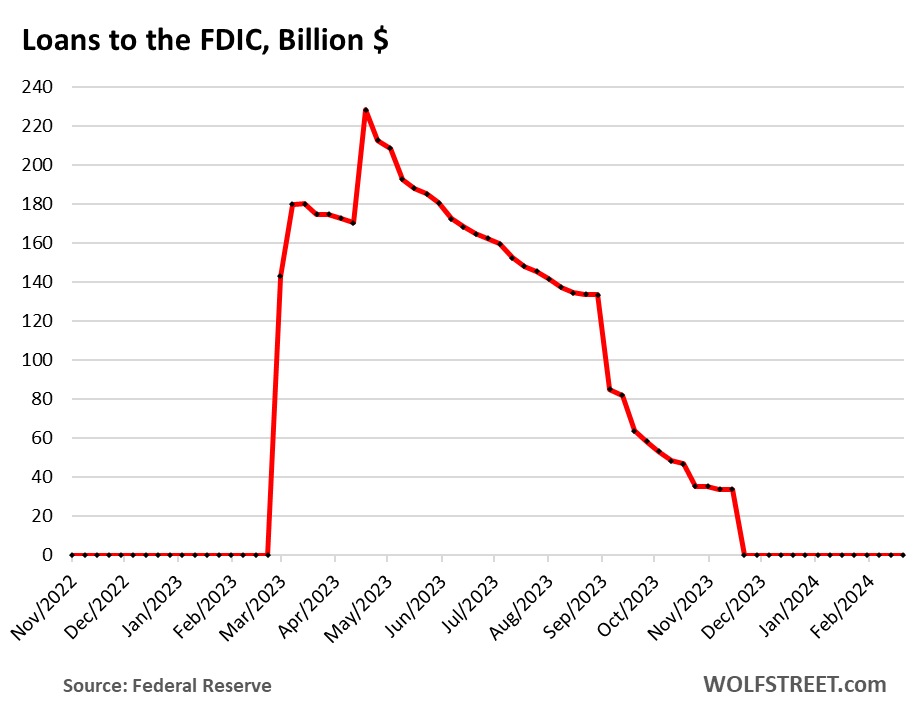

Loans to FDIC: $0. This facility was put together over the panicky weekend in March. The funding allowed the FDIC to quickly make whole all depositors – not just the insured depositors – of the failed banks, before it could sell the failed banks’ assets. The FDIC paid off the remainder in November.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

What made the Repos go up so high so fast in latter half of 2019?

The repo market blowout. We’ve discussed this a lot here. The Fed has brought it up recently again. Avoiding that kind of “accident” that would end QT prematurely is why… you should read this:

https://wolfstreet.com/2024/03/02/fed-discusses-balance-sheet-normalization-on-rrps-mbs-to-go-to-zero-reserves-drop-a-lot-srf-to-prevent-accidents-future-qe-without-increasing-the-balance-shee/

and this:

https://wolfstreet.com/2024/02/22/the-fed-wants-to-drive-qt-as-far-as-possible-without-blowing-stuff-up-and-its-working-on-a-plan-fomc-minutes/

Perhaps there should be an option to see these all on a single graph. It would show how many of these are insignificant compared to the total.

At current rate, how long until MBS goes to zero? :-)

The two big ones are Treasuries and MBS. Those are the QE instruments. Nothing comes close. Most others are at zero now, or near zero, so they’re “insignificant.” But they’re liquidity facilities for the banking system, not QE instruments, and so they’re very significant for banking issues (not for QE/QT), and if they’re on the same chart as the big QE instruments, you cannot see the details of those liquidity facilities, and you get fooled into thinking that they don’t matter.

Exactly. There are the liquidity/short term vs QE/twist long term things. My suggestion is to make this more clear, indicate a fraction of the total balance sheet in each section (and list by highest fractions). You are the only one providing clear data and logic on this !

Perhaps add a note on each category on average/typical maturity (not exact … integer months or years)

Wolf,

I would love to see in your future updates a horizontal line in the “total assets” chart marking where you previously figured the assets would not drop below (given, if I recall correctly, things like the amount of U.S. Federal Reserve bank notes in circulation, etc.)

Here you go. I just did that for you:

And this is the article from Sep 2022, just after QT started, where I tried to calculate the lowest possible floor ($5.2 trillion).

https://wolfstreet.com/2022/09/05/by-how-much-can-the-fed-cut-its-assets-with-qt-feds-liabilities-set-a-floor/

This chart does an amazing job of illustrating the 800% increase in the Fed’s balance sheet over the past 16 years.

Equally interesting is the revelation that lowering the total assets to a point where they are only up 400% since 2008 is a victory.

You couldn’t make a more cogent argument for the out-of-control nature and insidious power-creep of central banking under a fiat currency regime. Thank you, Wolf, for providing this historical portrait of “authority in delirium.”

(I still see a rat in the upper right hand corner of the chart!)

“the out-of-control nature and insidious power-creep of central banking under a fiat currency regime”

I’d argue that a lot of the balance sheet ‘bloat’ is a result of actions the Fed has taken to defend the dollar on the global stage.

John H,

You absolute MUST READ the article I linked, and you MUST make an all-out effort to understand it so you understand what you’re looking at. You’re spouting off nonsense because you have no idea what you’re looking at.

Something is up. The economy ran fine with a much smaller balance sheet for decades prior to 2008. Reserves were much lower. It’s evidenced in Wolfs charts. What would reserves be if we extrapolate from 1980’s levels to account for GDP growth? Today’s reserve levels should be rationalized relative to the past.

I don’t think the banking system needs ample reserves. What it needs is increased capital requirements, so banks are on the hook for their own judgement lapses. Nobody is going to run on a bank that has ample capital. Investors, and depositors, will put money into it.

But we can’t talk about that because it reduces bank profits and requires discipline.

Bobber,

You too MUST READ the article I linked. I’m getting really tired of this constant nonsense. I’m going to go into delete mode now.

You are right Wolf, about me not understanding. I think I remain confused about the nature and reasoning behind the Fed’s shift in 2000 from a ‘’required reserves” regime to “ample reserves.” What series of events caused the central regulator to drop a primary tool of risk control at the commercial bank level??

“Ample reserves” strikes me as a communal reserves arrangement that pardons banks for aggressive lending and balance sheet structure, then charges the Fed with picking up the pieces after bank-investor panic arrives on the scene.

I’m trying to understand, have reread the link you supplied, and am searching elsewhere too.

Thanks for your articles.

Optimist.

$100 says that the Fed cannot get their balance sheet below 7 trillion.

People said that about $8 trillion too.

I’m more concerned about getting to the below-$6 trillion level. There is a good chance that it will not happen, but it could.

Look, there’s $160 billion in the BTFP, which will go to $0 a year from now automatically. There’s $450 billion in ON RRPs which will go to zero, and so the balance sheet will then be below $7 trillion. Then the Fed can more or less easily take $1 trillion out of reserves, which are still plump full, which will get the balance sheet to $6 trillion. The closer it gets to $6 trillion, the riskier it will get. But getting to $7 trillion is a breeze.

@Wolf,

I like that line, and hope it stays in future graphs! A picture is worth 1000 words.

The LPL should be more fluid. Fed wants to shorten its maturity rate. That would extend and pretend QT and act like a cushion under RRPO which keeps pressure on the small banks. Fed is pumping the market in an election year and the market likes being pumped. I wouldn’t call it love but it will do.

The LPL is set by the Fed’s liabilities, which is what the linked article is all about. Two of the four big liabilities are outside the Fed’s influence, and both are growing (cash in circulation and the government’s checking account). The third will go to zero (ON RRPs). And the fourth will decline (reserves), but it cannot go to zero. How low can it go? No one knows, the Fed said. But this is where I calculated the LPL will be, and it’s a long way to go, and it will take years to get there, and it will require that the Fed slows down the roll-off because it’s sucking a lot of liquidity out, and if it sucks too quickly, liquidity will not be able to flow where it’s need and something will blow up which will then be the end of QT. The blow-up would happen well before the $5.2 trillion.

It’d be interesting to see blue line plotted vs time with the primary components also noted as separate lines.

I assume it’s jumped a lot in 2020 due to paper dollars?

All now in bitcoin and Nvidia? Hehe.

Potential stupid question: Can it ever go below the $5.2 trillion now?

Yes it could, but at least one of two things would have to change:

1. The Fed would have to abandon its current setup of “ample reserves” and revert to minimum “required reserves,” in which case reserves could be a lot lower.

Or/and:

2. People around the world would have to stop demanding US paper dollars (Federal Reserve Notes) to stuff their mattresses with and start returning those paper dollars to banks, which would then return them to the Fed, which would then return to those banks the securities they’d posted as collateral, which would lower the Fed’s assets. Currency in circulation has flatlined over the past 8 months, which is unusual; it normally grows. So if it turns south hard enough, it would have an impact. This is a possibility if interest rates stay high enough, which increases the carrying costs of holding paper currency, and enough people might want to get T-bills or whatever.

It’s a great article, but the part about sagging asset prices doesn’t ring true to the average American (and mostly boomers tbh) who is looking at the value of their house and their 401k, which both influence their spending behavior.

Hi Wolf,

How do you interpret Jerome Powell’s comments that “We believe that our policy rate is likely at its peak for this tightening cycle,” and “If the economy evolves broadly as expected, it will likely be appropriate to begin dialing back policy restraint at some point this year.”

Read my articles about it. It’s a rehash of his prior comments, and of what pretty much all Fed heads have said this year. Make sure you also include all the if, if, if stuff they couch that in. Lots of ifs (“IF inflation continues to decline toward our 2% goal” etc.) Those are big ifs.

If, if, if,

Today, the ECB’s Nagel also sees a growing chance of a rate cut before the summer break.

Here’s what you need:

*The last mile of monetary policy is regularly difficult, you have to stay calm, you can’t get too euphoric too early claiming you’ve beaten inflation.

*German economic growth is too slow, but he expects momentum to return “if we do our homework”

*Germany’s debt brake allows some leeway

BoC

The general consensus remains that the economy continues to weaken, and inflation is coming down. However, the Governor sounded more cautious about upside risks than he did just a few weeks ago.

“…with inflation still close to 3% and underlying inflationary pressures persisting, the assessment of the Governing Council is that we need to give higher rates more time to do their work,” said BoC Governor Tiff Macklem.

So if I read you correctly, your take on the widely published consensus that “it will likely be appropriate to begin dialing back policy restraint at some point this year” is that this sentiment is a case of selective hearing on the part of an overwhelming majority of the financial community, perhaps accompanied by a good deal of selective reporting as well.

The Fed is (trying to be) the adult in the room, when all the children just want more free money.

Watching Powell’s testimony in congress was illuminating… some of the reps were asking the same dumb questions that the reporters do at the fomc pressers. Trying to bait him into saying when rate cuts would happen etc.

Children, the lot of them.

@MM,

Maxine Waters implied that the Fed should base it’s definition of housing inflation to focus on asking rent rather than rent paid, Lol!

Jonno

You’re twisting everything around. You’re not “reading me correctly.” This is getting exasperating.

Market moron mania took over and bet on 6-7 rate cuts in 2024 after the Fed penciled in 3 rate cuts later in 2024. The Fed has pushed back against this 6-7 rate cuts BS, and for now it’s still seeing 3 rate cuts later in 2024, if inflation….

The next dot plot will come out in March, and we’ll see where they are. No one said the Fed wouldn’t cut rates if inflation continues to decline. But it’s not going to cut 6-7 times this year.

If inflation continues to decelerate, rates are high. If inflation is 2% solidly, 5.5% policy rates are high, and they can be and should be cut.

The only question is if inflation will accelerate or decelerate. That’s the only factor here. And over the past few months, we’ve had re-accelerating inflation data.

If this acceleration in inflation continues, the Fed will dial back on its 3-rate-cuts-later-in-2024 scenario. If the acceleration fizzles, the Fed will stick to its 3-rate-cut scenario. But the 6-7 rate cuts mania was just another mania on Wall Street.

That’s why they keep saying they’re “in no rush” to cut rates, and that they want “confidence” that inflation decelerates, and doesn’t re-accelerate.

JeffD – yeah I was surprised she came right out and said it like that. I assumed a sitting congresswoman would understand the difference between asking rents and those actually paid by tenants.

Wolf,

Thank you for the timely and detailed updates. Appreciate it.

As per article, in Feb 2024, FED had 70 billion maturing in Notes and Bonds. That means FED participated in Treasury market by buying 10 billion in Notes and Bonds. That does help Treasury in terms of keeping yields lower.

You shared March 2024 FED will roll off 15 billion in Bills as they only have 45 billions maturing in Note and Bonds. So when Treasury does 10 yr and 30 yr Auctions, FED will not be participating. That will put upward pressure in 10 yr and 30 year yields. Do you also think so?

In earlier articles, you mentioned you will do article on Maturity Calendar of Treasury Security hold by FED. Do you have any timeline for that?

The Fed’s influence is disproportionate to the amount of money it flings around. Its actions also continually act as signals to the market on what’s going to happen next, and this is reflected in buying and selling of notes and bonds.

I don’t think the FED buying in a particular auction affects the yields all that much. For one, for an individual auction it isn’t that much money. For two, their buys are well telegraphed ahead of time. Everyone knows how much the FED is buying.

So let me get this straight: 30% of COVID money printing has been unprinted, mortgage rates are more than double they were in 2021, consumer debt rising, zombie companies dying off in record numbers…and yet we’re at Bitcoin ATH, Gold ATH, NASDAQ ATH, S&P ATH, sky-high prices on housing, 80 PE ratios, food and insurance unaffordable and still increasing – as if we’re still living in the nightmare of ZIRP and QE without actually living in ZIRP and QE.

Fueled by an illusion that the US Dollar’s reserve currency status will disappear in the next 5 years, a fantasy that the Fed will drop rates to further ‘stimulate’ a stock market and housing to even more absurd levels, and a hype train for a software product that’s supposed to take all our jobs…but can’t even write a procedure to calculate what day Easter lands on.

Yet look at corn, oats, pork, natural gas, palladium, cotton, and other commodity prices that no one is paying attention to, and they’ve crashed to almost pre-COVID levels. I know inflation is bad, but if it was as bad as the anti-fiat crypto bro naysayers claim, why would *any* commodities be down at pre-COVID levels?

I just can’t make sense of it all.

Is everything looney, is everything driven by lies and fantasy, or am I just missing something?

Because the ‘markets’ are sentiment driven. And the sentiment is “to make a quick profit as easy as possible”. Commodities don’t fit into that sentiment. Those take hard work and a lot of energie to produce. And the margins are low. The only ways to get prices up are: problems in the supply chain, or sudden spikes in demand. Creating a lot of hype around a thing is also a way. But all those are temporary. Eventually the market will find a new equilibrium. And often that is “back to how it was”.

It’s different for the newest thing on the block. It has no history and can be hyped to the moon. Untill the dream is over and everyone sees what the emporer wears.

Because crypto bros themselves fail to see the irony of measuring the success of their investment thesis in the very thing they hope to make irrelevant and replace.

When you say “crypto bros” are you referring to Black Rock, Bitwise, Fidelity and other new entrants? Also what do you call Cathie Wood?

Side note; this is how you know that buttcoin I mean bitcoin is not a real currency.

Nothing is actually /priced/ in bitcoin. Even on websites that accept it for payment, the stuff is priced in dollars, and the amount of BTC you send is based on the current USDBTC exchange rate.

I have not considered using any of my bitcoin or ethereum for buying anything. It’s more of a store of value and it has done well over the last several years.

I enjoy reading Wolf’s blog and learn a lot from his content but I also read lots of blogs on crypto. I’m sure if you spent just a few hours reading up on bitcoin, you would probably never refer it to buttcoin again.

Aruba – sounds like I should take a stab at this and name it: ‘Yellowrock’…

may we all find a better day.

Aruba,

You can’t be serious. Bitcoin has been an absolute disaster as a store of value. It has huge movements month to month, year to year, and even day to day. That is not a store of value.

You can argue it has been a good investment for you, but not a store of value.

Unfortunately I have spent far too much time reading on Bitcoin. Buttcoin is an appropriate nickname. I have an extensive background on computer science (and specifically databases). I suggest you look at the power/computing requirements for Bitcoin to even take over 1% of the global transactions that are done in dollars. It is ridiculous. The world would have to build hundreds of nuclear power plants that did nothing but process Bitcoin transactions. All of this is due to the inefficient nature of the way transactions are done.

Lunacy.

Unless you are dealing in black markets or hacking, bitcoin is nothing more than Greater Fool Theory in action.

For a commonor, this is great stuff…do you by any chance know how much QE took place with all the central banks combined at peak covid? Ty

As Wolf has demonstrated, consumer debt is rising but people are getting paid more. It’s somewhat of a wash.

…until it isn’t.

I wonder how much of that is due to the recent rise in rates.

I’ve commented previously that I don’t pay extra principal on my mortgage, because I can loan my extra $$ to the gov’t for a much higher rate.

I also have a personal loan @ 4% that I took out to purchase my solar array. I’m also making minimum payments on this loan for the same reason.

I imagine I’m not the only one arbing the difference between current short-term rates & lower fixed rates taken out years ago.

Food at home has 1.2% over the last 12 months per the cpi. Food outside the home is 5%. Seems driven by wage gains.

Insurance is more complex. Auto insurance will likely stop going up because car prices have stalled out. Medical insurance is doing a statistical game. Home insurance is going to keep going up because Florida and Texas can’t legally address the causes of their current crisis.

Car prices aren’t the only factor in auto insurance. Repair costs are, and those are often driven by wage gains as well.

Sometimes a mechanic has to spend 4 hours taking something apart to get to and replace a $20 piece.

I just received my auto insurance renewal yesterday from Geico. They are trying to jack it up over 25%. It is an increase of $50 per month. It’s outrageous.

Carlos,

You say that commodities such as pork belly and oats are down, as if food is cheaper at the grocery store ?

You say natural gas is down as if that indicates heating bills for consumers are now lower ? Electric to consumers homes generated from nat gas has gone down ?

Would it be far fetched to consider that farmers and consumers are being squeezed by middle men ? Maybe some numbers are off or fraudulent ?

How confident are you that inflation is going down ? Maybe food is becoming cheaper in every grocery store except the ones we visit in person ? I wonder where are all these people who are being taken care of by the Fed’s hard work are ?

Who among us can afford to be the last ones to figure it out ? Who here is so fat and happy that they will be the absolute last person to figure out “Hey, oats prices went down more than ever at the commodities exchange but I can’t find any oats in a grocery store that dropped in price for a 1,000 miles!”.

Or will a detailed propaganda piece about oat demand being down due to animal feed trends put your mind at ease for another 6 months ?

Inflation is bad for a lot of things, sure, but oats are so extremely cheap that the even with the recent price inflation, you get more in heath benefits and savings that you’re effectively getting paid to eat them. A 42oz. container, which can make a lot of bowls of oatmeal, of the Walmart brand, costs around $4.

The US losing reserve currency status on 5 years is ridiculous. It is being challenged? Sure, but given the dominance in transaction compared to anyone it isn’t close. I would love to see it but at least talking in the decades timeframe and then of course just won’t go away but be more balanced. Good thing in general for all.

At this rate, it will take 10 years to get to 1.0 trillion!

Just kidding, Wolf. I know this will bottom out at around 5 trillion, if that.

:)

Thanks for the review Wolf.

I wonder how the charts will look once you add $100B+ of counterfeited “stablecoins”…USDT alone added $50B of “money supply” since January. Most ended in propelling crypto, but I also bet some leaked into speculative tech and considering it’s ultra-concentrated weight in indixed propells the broad indices makes the “stablecoin” impact comparable with FED monetary policy.

stable coins are part of the world of gambling tokens and do not add to money supply. They just add to mania.

Casino chips don’t add to money supply either.

Do Casino chips take away from money supply?

I don’t think that’s the right analogy here. I think it’s more like whether counterfeit bills add to money supply (which they do) – if it’s true that stablecoins aren’t backed 1:1 with real currency

So the Fed creates 5 trillion out of thin air in no time, sending gobs of money to institutions and asset holders that didn’t need it, then slowly claws back 1.4 trillion. Meanwhile Congress threw another 5 trillion, mostly to people that also didn’t need it and suspended many legal debt obligations to boot. Then Congress continues to deficit spend at well over 1 trillion per year with no signs of this recklessness abating. Assets are still absurdly valued and unemployment is ridiculously low, yet somehow QT can be decoupled from rate changes and this will magically fix inflation? And still continue to talk about rate decreases as if they’re needed soon?

Is it just me, or does it seem like fixing inflation is not really a goal here?

Much like the other battles (militarily, socially) the US has been engaged in for the last 70 years or so, the political will to do the job correctly is lacking.

No, it’s not just you.

No doubt that the gov’t as a whole benefit from inflaion vis-a-vis the nat’l debt.

But a lot of mkt participants don’t care about inflation, they just want their low rates & free money back. This crowd is trying to influence the Fed to abandon their inflation fight altogether.

I’m sure Powell is frustrated that fiscal policy is reducing the impact of the Fed’s attempts to tighten.

Inflation is a 100% a Main Street problem, not a Wall Street problem.

Just look at how US stocks performed in 2021 when inflation was raging at 8% but rates were artificially fixed at 0%.

Same thing in Japan.

Other way around – 0% rates caused inflation.

Remember, when banks loan out money (ordinary banks not the Fed), that money is created into existence. Low rates cause the money supply to increase.

Main St does not dictate interest rate policy (although Wall St sure does try).

The Fed NEVER should have purchased MBS, but they OWN congress and can do whatever they want to keep their Wall Street cronies afloat.

Having said that, I do think that Jay is trying to send a message that FISCAL policies need to change, specifically that CONgress needs to balance the damn budget.

Unfortunately, this is akin to trying to get a junky to give up heroin after you have been providing him copious amounts of free drugs for 12 years!

“Jay is trying to send a message that FISCAL policies need to change, specifically that CONgress needs to balance the damn budget.”

Yes, but Congress doesn’t hear on that ear.

“Yes, but Congress doesn’t hear on that ear.” —

Well, then there is definitely no way the Fed’s balance sheet gets below 7 trillion. Moreover, the outcome will be much worse than most are expecting. The junky is starting to go through withdrawals.

You just don’t get it do you? Maybe you refuse to get it? The QE mongers always hope that the Fed HAS to buy Treasuries because of yada-yada-yada. But no, there is huge demand for Treasuries, hence the low yields, and if yields rise, Treasuries will attract even more buyers. That’s how that works. Yield solves all demand problems. And inflation is reducing the burden of the $34 trillion in debt because inflation also inflates tax receipts. So you will be bitterly disappointed.

There is plenty of debt that has to be rolled over (~6 trillion I believe), plus CONgress is still deficit spending.

I understand completely. Unlike you, I see plenty of new issuance coming and not enough buyers, especially if the Fed stays out of it, but you even admitted that the Fed may have to “twist” again…

Place your bets, as it were. Guess we will find out who shows up to buy all that new debt…

“…not enough buyers” means you don’t understand the function of yield – what yield does. Yield solves the “not enough buyers” problem in real time.

So, much higher for a lot longer?

I hope you are correct Wolf.

My favorite monthly update.

Someone asked how long until the MBS is gone..well there’s still 2,400 Billion in MBS and the pace is ~12 Billion a month.. so 200 months. 16.6 years. 2040 or so – and that’s assuming there’s not another “housing crisis” where the Fed buys MBS again.

I think I’ve been thoroughly convinced that the BS floor is $5T now, possibly reached by ’26, ’27. We are not too far from the pre-GFC ratio of an $800B BS out of $10T National debt. The Fed may consider holding 10-15% of outstanding Treasuries necessary for their normal operations.

It won’t take that long because those MBS will be called by their issuer well before then as the underlying mortgage pool shrinks.

It seems that a simultaneous call of large amounts of MBS held by the Fed is the only way that the $35 billion cap will be reached in any given month…

Wolf, minor typo in the 3rd paragraph in the btfp section. Assuming you meant ‘stayed’ there.

Our government and millions of others love low interest rates and easy money.

“In finance, everything that is agreeable is unsound.”

— Winston Churchill

When the markets won’t buy the bonds & bills, the Fed must step in and monetize the debt. My guess is that the Fed will capitulate.

B

Nothing goes up in a straight line?

I’m looking at Gold right now and ….

Your graphs quickly and clearly tell it all. Thank you for spending the time where others fall short.

Let’s be careful…..the model for all administrators…..the people who never built a thing. While they watch it erode and speculation explodes.

Meanwhile yellow rocks are up about 200 an ounce in a month. Up 100 in the last week.

The central banks are just about fed up with the US and its careful fed.

You’ve got inflation up the pipeline (wazoo) and the fed dithers about taking back 30% of the biggest injection of drugs in history.

Let’s not let Jimmy worry about his job…..after all…..he is special….Let’s talk about rate cuts…..AT 4% unemployment…… full employment.

Did they all flunk economics? Probably smoking grass with the gals after skipping class.

Just disgusting…….but……it’s just another investment opportunity.

Wolf, why is there a $35-billion monthly cap on MBS roll-offs at all? Did the FED set the cap itself or might it have been Congress? Is that cap adjusted for inflation, too?

I understand a cap was probably set to reduce massive MBS roll-offs from shocking the system. But $35B seems low compared to the rate at which the FED added MBS to its balance sheet.

If the FED drops rates and/or the housing market greases up such that sales increase, MBS roll-offs could hit that $35B cap. Is the cap just allowing the FED to keep kicking the can down the road?

The way Powell explained the caps ($60 billion on Treasuries and $35 billion on MBS) was that they were a compromise. Some FOMC participants wanted to go higher, some lower, and that’s the compromise everyone could live with. they’re almost double the pace of QT-1.

But in this QT-2, MBS have never gotten anywhere near the cap.

Obviously the MBS cap has been meaningless so far during QT. However, that can always change. I have a feeling that the FED really doesn’t want to be in the MBS market. So when the FED addresses how they are going to taper QT it wouldn’t surprise me to see them put something in where if MBS runoff exceeds the cap, the excess will be replaced with treasury bulls/notes instead of other MBSs.

Liquidity is the same, it just results the FED holding less MBSs.

It hardly matters, though, when the cap is never even remotely met anyway.

I guess it would matter if the market ever unfroze enough to cause a normalish amount of existing mortgage debt to get paid off via sales and refis, but what are the chances of that happening any time soon?

AD = M*Vt. If AD stays the same, and oil prices increase, then other prices decrease. Contrary to Alan Blinder, the FED overcompensated for OPEC’s price rises.

Housing prices and interest rates fell when Bernanke conducted the most restrictive monetary policy since the GD. Housing prices rose along with interest rates when Powell conducted the most expansionary monetary policy in U.S. history.

We have both supply-side and demand-side inflation.

Looks like everything is melting up again. Nvidia up another 4% today based on nothing. Gold up. Bitcoin up.

Nobody trusts the Fed to do the right thing.

And now Nvidia is down 3%. What a f***** up manipulated “market.”

Burn it all down.

“F***ked up” yes. “Burn it all down” no. It’ll burn itself out.

So now, at this moment, the S&P 500 and the Nasdaq are in the red. And NVDA is DOWN 4%, an $84-swing from $972 to 888. This stuff is just funny.

In this market, nearly everything that is said this minute is outdated an hour later.

But that’s just my issue. The capital markets in America used to be a way to connect people with extra money with good companies that needed money.

Now it’s become a toy for Wall Street to play with. It’s hard to see how the capital markets benefit America as a whole today.

It needs a reboot.

Einhal,

Jessie Livermore would disagree with your assessment.

Markets may have appeared to be “… a way to connect people with extra money with good companies…” after the great depression because people were afraid of markets and had pensions to rely on. That changed in the 1980’s and got supercharged when people were given “fee free” trading accounts.

Einhal,

The capital markets are still a great way to connect people with extra money to good companies. Capital markets are also a toy of Wall Street. Capital markets are also a way of people to gamble on things they barely understand without leaving their house and going to a casino.

All three of those are not exclusive and can be true at the same time. You don’t have to participate in the market as a whole. Only participate in the parts you want to. If other people are bidding up Nvidia, Gamestop, Bitcoin or whatever SPAC is the latest trendy purchase it doesn’t affect me in the slightest.

I don’t care if people are bidding up Beanie Babies either. Doesn’t affect me.

The only way it could affect me is if I was envious/jealous. I learned long ago that envy/jealousy is the worst of the 7 deadly sins. It is the only one you don’t get to enjoy the ride to hell.

Greed, gluttony, etc all at least provide a good trip. Envy/jealousy provides none of that.

Why do you care what the market price of Nvidia, Bitcoin, etc is? Why does it matter to you?

The FED is going to make sure this everything bubble lasts through the election.

The problem for the current administration is their lies aren’t working. Blaming inflation on corporate shrinkflation and other nonsense while gaslighting people, telling them everything is great is not working. Oh, here’s your $8 reduced credit card late payment fee.

The damage is done. Goolsbee of the FED just came out today and said the rate of inflation is all they care about, not price levels. Translation: enjoy your permanently higher cost of living.

You’ve been had, people.

LOL

That is most certainly not true. That us laughingly demonstrably false.

Sure the markets are up now, but when they cratered a bit ago the FED literally did nothing to support them. Theu continued to hike rates and continued QT. That directly disproves your assertion that the FED is going to do everything it can to support bubbles. But I am also quite certain you won’t learn from that.

As for your political nuttiness, it does nothing other than show you use sources of information that take advantage of you.

Stop playing the fool. Use better sources of information. Think for youeself.

You should really read Buffett concerning markets. Specifically weighing machine versus voting machine.

Markets are nothing but a tool. You only have to use them when they are convenient and beneficial for you to do so. The rest of the time they are nothing but noise that can be ignored and have absolutely zero effect on your life.

If you asked me the price of Nvidia right now I could not tell you. It doesn’t matter to me. I don’t own it. Why should I care?

Why do you care at let it get you angry?

The market goes up and down. Doesn’t mean much of anything in the short term.

Go to the St Louis FRED site and look at Government debt over the same time frame. $9.4 Trillion at the beginning of 2008 to $34 Trillion now. That is 24 trillion injected into the system. Plus add this 7 trillion from the FED. That comes to $31 trillion in 16 years.

That is roughly $215k household. It is just money. Easy come and easy go. It has to go somewhere. In the late 1970s, the Wilshire 5000 index had about 5000 stocks for investing. In the 1990s it hit 7000.

I am going from memory but in 2018 there were 3700 stocks and now it is down to around 3400 stocks. It was an index to try to capture all the traded stocks (not OTC). Thus every year since 1998, there is more money chasing fewer stocks.

So now the Fed BS is down to about where QT should have started…

QE should have never been used in the first place. The Fed should have dealt with the market panic in March 2020 with repos, and three months later, let them expire.

And yet the Fed saw fit to explain how QE will work next time. QE 2.0

QE without increasing the balance sheet, LOL:

https://wolfstreet.com/2024/03/02/fed-discusses-balance-sheet-normalization-on-rrps-mbs-to-go-to-zero-reserves-drop-a-lot-srf-to-prevent-accidents-future-qe-without-increasing-the-balance-shee/

Which will skew their duration to the long side and they will be stuck waiting for the bonds to mature to replace with T-bills. I dunno, I guess I’m skeptical it will all work out in the end without an increase in balance sheet. Time will tell.

TBF, QE started in 2007-2009.

I disagree with how it was implemented, but I understand why it was implemented. Something needed to be done. Markets had locked up. Free markets literally failed.****

That said, there is no excuse for QE 2.0 in 2020. The FED should have learned from QE 1.0 and gone back to traditional tools to deal with the fallout from the pandemic. Especially since due to congress and the President actually being on the ball, there was no need for more than temporary short term action by the FED.

While I agree that QE never should have happened in 2020, I am somewhat in disagreement that it should have happened at all. I would have preferred a different form, but I understand why it happened.

*** For those ideologues who want to argue about free markets, just realize free markets did fail. If one is educated, one of the first things you learn about free markets is that they require symmetric information betweenbuyer and seller. If buyers do not know exactly what they are buying, they will not participate. In 2007-2010, no one knew what they were buying (turns out sellers didn’t know much more, but that is irrelevant), so markets stopped.

“TBF, QE started in 2007-2009.”

QE started when Lehman filed for bankruptcy in Sep 2008.

In early Sep 2008, just before Lehman filed for bankruptcy, the Fed had $905 billion in assets on its balance sheet.

By mid-Nov 2008, two months after Lehman filed for bankruptcy, the Fed had $2.2 trillion on its balance sheet. But much of it were liquidity swaps with foreign central banks, discount window loans to US banks, repos, etc. The Fed started buying MBS at the beginning of 2009 for the first time ever.

But that was done with repos, the Fed’s classic tool, which technically isn’t even QE.

QE with MBS started at the beginning of 2009.

DM: America’s red-hot labor market added 275,000 jobs in February – slashing chances of an imminent interest rate cut

Some 275,000 jobs were added in the US in February as a hiring boom persists.

What is the vegas early line on the revision?

Until it’s revised lower next month….

There were big upward revisions in January.

I’m seeing:

“Nonfarm payrolls for December were revised down to 290,000 from 333,000, and January payrolls were revised down to 229,000 from a surprising 353,000, the Labor Department reported Friday. The total revisions for those months resulted in 167,000 fewer jobs than previously reported.”

?

Yeah, but they were revised UP in January by a lot. Todays revisions reversed some but not all of the January’s Up-revisions.

Original Dec. employment: 157.232 million (released early January)

Today’s Dec employment: 157.304 million

So today’s lowered December figure is still 72,000 higher than the original figure.

Yes, there were upward revisions recently, but the nutty conspiracy theorists need to believe that hundreds of thousands of non-political bureaucrats are lying to them and keeping it a secret from everyone but them. Only they know the truth, and all of those bureaucrats are all in cahoots and not is going to the IG with evidence of fraud.

Nutters going to nut peddle.

But wage growth was only 0.1%.

I’m curious how the Treasury buyback program will help with the soft landing.

This is above my pay grade, but seems like the Fed process of allowing roll offs to take place will be somewhat synchronized with Treasury buybacks — and the apparent desire to increase liquidity (while short term rates stay higher for longer).

As a passenger in decent, I’m feeling a lot of ambiguous turbulence and just hoping the pending (election) civil war isn’t too messy.

Sorry to add on here, but my confusion is related to Treasury buybacks (in May) will essentially be QE that will offset “some” Fed QT.

Apparently, this is unusual for Janet to be conducting monetary policy, but fairly bizarre to be adding liquidity at the same time that the Fed is doing QT.

I assume this prolongs a state of Schrodinger’s Cat ambiguity and adds to confusion about the future. This is somewhat of a hybrid expansion of the fiscal stimulus that’s kept the economy magically floating along.

The Treasury buybacks replace old debt with new debt. That’s all it’s doing. The government has no cash to buy back debt, and unlike the Fed, it cannot create money to buy back debt. It has to issue new debt to raise the cash to buy back old debt. There will be no economic impact from that, no money-creation, and no monetary policy impact. It’s a debt exchange, that’s all it is. It might create a little bit of a market for old debt for which there is now almost no market.

The people who’re saying that the Treasury buybacks are “QE” are spouting off ignorant braindead or manipulative lies.

After the state of the insanity speech last night…..gold jumped to over 2200 an ounce this morning. That is the central banks response to the speech. It’s still dirt cheap.

China has about 750 billion in treasuries to convert……which is what they are doing. Russia did it a while back. Others are starting to join in.

Bullard just stated that the weak jobs number means the fed needs to act at the next meeting to cut rates…….wow…….just wow. Full employment is a weak number. Last night we were told……we can do anything.

Yep……we can slit our wrists and the world will just giggle.

most FED governors as well as Powell are saying that rate cuts will only follow drops in inflation.

As for Russia and China selling treasuries, that is resounding “duh”. You don’t monetarily support countries you are trying to undermine. They recognize they are enemies of the U.S. so they are not going to support its currency.

That said, the dollar is a way better bet than either the Ruble or the Yuan. Good luck investing in either. It looks like China is about to pay the price for their real estate orgy of the past decade and Russia will be cranking up the printing presses in a few years as the results of their stupid invasion of Ukraine come home to roost.

fred flintstone,

Bullard is now on someone else’s payroll. He’s got different priorities now. He’ll say whatever will benefit those priorities.

Russia sold its Treasuries in 2014, and no one even noticed? Like who cares? We wrote about it at the time, and it didn’t even make a ripple. But the ruble has collapsed since then.

China already shed part of its Treasuries. It has an economic crisis on its hand and issues with capital flight, and it does what it needs to do to keep the economy from sinking, including trying to prop up its stock market that is down by over 60% since 2008.

If the MBS roll-off reaches the cap of $35 B will the Fed buy MBS to replace the amount over the roll-off or will they buy treasuries instead?

That won’t happen until mortgage rates drop a LOT, meaning back below 4%. So don’t worry about it now.

But the Fed will address this in the new QT plan over the next few months. The plan will likely call for letting MBS run off to zero, and if there is a cap, and when QT ends in the future, the excess will then be replaced with Treasuries. That’s how the Fed did it in 2019 through March 2020.

We are almost to the point in the balance sheet of bidens inauguration in 2021

If the Fed were really serious about fighting inflation, they would increase the speed of QT. Financial conditions are extremely loose, so this would be the time to do it.

Of course, that would be like paying down the deficit when the government is running a surplus (just doesn’t happen, need to buy votes instead).

My guess is that the Fed will chicken out at the first sign of serious market distress.

If you read Volcker’s book, he talks about inflationary pressures creating the conditions for speculation (excess return seeking to outrun inflation).

Possibly Powell can’t handle the political pushback coming his way (it really is hard getting attacked all the time for just doing your job). So I don’t know if I can really blame him for wimping out.

Yeah, I read Volcker’s book. Dr. C.Y. Thomas flew Dr. Leland Pritchard out to meet with Volcker in 1980. Dr. Pritchard came back exasperated.

Volcker didn’t understand Bob Roosa’s “little red book”. In 1980, Paul Volcker, Past chairman of the Board of Governors of the Federal Reserve System, appeared before the House Domestic Monetary Policy Subcommittee. In response to a question as to why the Fed had supplied an excessive volume of legal reserves to the member banks in the third quarter 1980 (annual rate of increase 13.2%), Volcker’s defense was that there are two types of legal reserves: 1) borrowed (reserves obtained by the banks through the Federal Reserve Bank discount windows), and 2) non-borrowed (reserves supplied the banking system consequent to open market purchases).

He advised the congressmen to watch the non-borrowed reserves — “Watch what we do on our own initiative.” The Chairman further added — “Relatively large borrowing (by the banks from the Fed) exerts a lot of restraint.”

This is of course, economic nonsense. One dollar of borrowed reserves provides the same legal-economic base for the expansion of money as one dollar of non-borrowed reserves. The fact that advances had to be repaid in 15 days was immaterial. A new advance can be obtained, or the borrowing bank replaced by other borrowing banks. The importance of controlling borrowed reserves was indicated by the fact that at times nearly 100% of all legal reserves were borrowed.

1. The FED has made it quite clear why they are not speeding up QT. They do not want to screw up and cause a situation where they need to restart QE. While it is true that there is still lots of loose money sloshing around in the economy, when you get into the nitty gritty details it isn’t even and draining excess liquidity too fast can cause problems because it does not hit equally.

2. There was market distress recently. The markets were down a lot. The FED did not waver. They continued with the rate hikes and continued QT. That goes directly against your assertion they would chicken out.

3. As for political pushback against Powell, on the past multiple decades, there is only one political figure who has actively and openly pushed back against the FED doing its job.

It just has not been fast enough. This is what I would call an “inflation entrenchment operation,” where they ignore their mandate completely for decades, then pretend to care when inflation is roaring, but drag their feet while taking steps to address it.

Jerome Powell admitted “inflation is a tax.” It’s a regressive tax which hurts the less fortunate and favors the wealthy. I have completely given up on the hope the future of the US. It’s game, set, match. There was a class war and the wealthy won without even firing a shot.

But isn’t everyone posting here part of the “wealthy” bucket. Most of us have positive net worths and portfolios, something the “poor” don’t have. If the extremely rich benefit, don’t we ad well (maybe to a lesser degree as they have some additional advantages)?

Your premise fails because inflation is not “raging”. It has “raged” in the past (when the FED was raising rates at a historical pace), and inflation might “rage” in the future (no one knows the future), but right now inflation is not “raging”.

Unless your definition of “raging” means having a glass of wine with dinner.

Right now inflation has been slowly decreasing, but it is showing signs of breaking out. However, there are also signs of recessions happening worldwide in closely related economies.

Inflation is definitely at an inflection point, however inflation is not “raging” right now. You are just being a scare monger.

Be better.

Also, as for Powell’s comments about inflation being a tax on the less fortunate, historically that has been very true. The wealthy are generally better equipped to deal with inflation because they have more resources available to them to deal with inflation. Whenever it comes to change, in general the wealthy are better equipped to handle change than those less fortunate than them. Simply because they have more resources available to them.

That said, this recent bout of inflation has been a working class dream. Wages (which is where most of the working class derive their wealth by definition) have been the primary driver of inflation.

I doubt there has ever been a better time in history to be a worker.

Gold and Bitcoin are surging. Why? Because money is loose. The FED’s definition of retail MMMFs is wrong.

To:You

Mon 1/22/2024 10:12 AM

Spencer

Thank you for your question. Net assets of retail money funds are a component of the M2 money stock, while net assets of institutional money funds are not. For more information on the money stock measures published by the Federal Reserve, please see the H.6 statistical release (https://www.federalreserve.gov/releases/h6/current/default.htm). If an investor transfers funds from a deposit account at their bank and places the funds into a retail money fund, the funds are accounted for in the retail money fund component of the M2 money stock rather than in the deposit components of M2. If a money fund is holding funds with a bank in the form of a transaction account (e.g., demand deposit or other liquid deposit) or small-time deposit (time deposit held in amounts less than $100,000), then those funds would be counted in the money stock but those amounts are likely to be rather small.

Sincerely,

Board staff

It’s just like MSBs balances between 1913 and 1980.

TOWARD A MORE MEANINGFUL STATISTICAL CONCEPT OF THE MONEY SUPPLY

Leland J. Pritchard

First published: March 1954

Wolf, When those bonds “roll off” what happens to the maturity proceeds? I’ve always imagined an elf at the Fed clicking a mouse to “delete” all those dollars from the economy. But maybe they recycle them into bitcoins, casino chips, or fleece outerwear? Just curious.

As always, thank you for this update.

The Fed gets paid face value by the Treasury. These reserves are then removed from the system.

These treasuries are just an electronic book entry. Paper treasuries aren’t really a thing anymore.

The money would come out of the TGA (government checking account), not the reserves. But both are liabilities, so overall, no difference.

Yes, the Fed destroys this cash as a matter of routine.

The Fed does not have a cash account on its balance sheet. Modern central banks are the only entities that don’t have cash accounts. So you look on Apple’s balance sheet, or on any company’s or bank’s balance sheet, and right at the top of the assets is an account called “cash” or “cash and cash equivalent,” or similar.

But not with central banks. They do not need a cash account because they create and destroy cash as a matter of routine every time they pay for something or get paid for something. So when the Fed gets paid from the Treasury Dept for some maturing bonds, the Fed destroys that cash. It just vanishes, just like it created the cash to buy the securities. This takes place via the interaction of the TGA account at the Fed.

Thank you!

DM: Mohamed El-Erian says he’s ‘paralyzed’ by ‘ambiguous’ jobs report

MW: Barron’s Nvidia Sinks Amid a Chip Pullback. The Stock Is Headed for Its Worst Day in More Than a Year.

Bloomberg headline:

Summers Says Fed Is ‘Wrong’ on Neutral, Warns on Rate-Cut Bets.

– Former Treasury chief says neutral rate more likely above 4%

– Fed officials have projected policy rate at 2.5% long term

“The neutral rate is much higher than that,” he said. “Neutral rates are closer to having a 4-handle than they are to having 2-handle.”

The former Treasury chief noted that last month he had indicated about a 15% chance that the Fed doesn’t lower rates this year. On Friday he said, “If anything that 15% may have drifted slightly upwards.”

=====================================

These statements provide some cover for Powell if he is willing to continue doing the right things.

If Summers is right, policy rates are not too much above the neutral rate, perhaps 1.25-1.5% higher which is not very restrictive.

Also, Summers’ view is that the chances of rate cuts in 2024 are getting lower as more data comes in.

@Wolf: What is your view on neutral rates given that the economy has continued to perform very well and has generated a huge number of jobs since the started hiking rates 2 years back and reached the current peak last July?

To me, it seems like Summers has a very valid point that the neutral rate is somewhere in the 4% range rather than the Fed’s 2.5% (which could be very inflationary).

No such phenomenon as R *. The Wicksellian r-star rate is fictitious. Investment “hurdle rates” are idiosyncratic. Business expenditures depend largely on profit-expectations, and favorable profit-expectations depend primarily on cost/price relationship of the recent past and of the present. Cost/price relationships are crucial, and they are particular; they cannot be adequately treated in terms of broad-aggregates or statistical weighted “averages”.

It’s good that Summers is talking about it. I think everyone can see that this theoretical neutral rate is much higher than 2.5%. If it were 2.5%, our 5.5% policy rates would be very restrictive and the economy would be tanking. But that’s not the case. The theoretical neutral rate may be higher than 4%, it may be higher than 5%, given how the economy is growing with 5.5% policy rates.

Neutral meaning neither stimulative nor restrictive.

@Wolf: Thanks. It is scary to think that our current policy rate may actually be pretty close to neutral rate. Actually, quite a few posters here have mentioned that 5.5% is not restrictive…kudos to them.

So why the heck does Powell and the rest of the Fed governors even talk about interest rates cuts at this time?

Things seem to be so wrong at the Fed that it stinks to high heaven.

If you pay attention to source material, you will see the FED governors and Powell don’t really talk about rate cuts without qualifiers.

Most talk about rate cuts only if inflation drops and trends towards 2%. If that is true than the current rate is overly restrictive.

Unfortunately lots of information sources ignore the qualifiers and just report upon the rate cuts as if they were a given. Thise information sources are deceiving their users. Why people continue to use information sources that continually deceive them is something I find fascinating.

Neutral rate is likely between 3.5% and 4% at the moment. We are still experiencing turbulence from the pandemic fly through, so who knows where it will land.

@JeffD:

Summers thinks: more than 4, less than 5%

Wolf thinks: more than 4, maybe higher than 5%

Fed is way down at 2.5%.

You say 3.5-4%. How did you come up with that, is it a guesstimate?

Core CPI inflation rate has been sticky around 4.0%, and the neutral rate is always lower. I firmly believe it will continue to hover around 4% +/-0.4%.

… core CPi will hover around 4%, not neutral rate. Also, the 10yr Treasury yield is way too low for a neutral rate that tracks the 2yr Treasury yield.

Wolf,

Did you hear that El-Erian was promoting moving the inflation target to 3% because of inadequate global supply? And it is not just him.

He explained the rationale being that it is too hard to get to 2% inflation, too much pain, and that 3% would be a better target for now, until at some unspecified time in the future global supply has caught up.

This is likely the groupthink of most if not all of the Wall Street crowd, global central bankers, economists, etc.

I am increasingly sympathizing with Powell, because it is very difficult to control the inflationistas.

My guess is that this is exactly what people told Arthur C. Burns.

Do you think that the Fed has the moral rectitude to do the right thing in the face of this nonsense?

Fine with me. 10-year yield will instantly jump to 6% if the Fed announces this.

Me too. Bitcoin will explode higher than it already has.

///

Though I like what I see, I am not happy to know that there are no more cards in the deck. As if you “drank all your health potions” and are not sure how far you have to go until the next “check point”.

///

What I am surprised about is that no one mentions the un-repealing of the Glass-Steagall act. Turmoil is coming sooner or later, and I doubt it will be a nice site to behold. I am afraid that when the ship crashes not the shareholders but the customers will pay the bill. It worked for the Great Depression, in one or the other form it would work today.

(please take this comment with a boat load of salt, as I am in no manner a financial expert).

///

Good question which I assume is why not re-institute the Glass-Steagall restrictions against most of the larceny that the banking industry has been convicted of or plead out since the repeal of the GSA.

The bank bailout in 2006 was evidence that the people that claim to own our persona, are not nice people.

I absolutely hated the repeal of Glass-Steagall. Hated it.

I loved the idea that it made banking simple.

If you want to use fractional banking (and the huge advantages it entailed) you could only engage in these simple loan activities. If you wanted to do more complicated sh… er, stuff, then you were an investment bank.

That made banking regulations relatively simple and straightforward. Banks still failed, but they effects were relatively easy to deal with.

Unfortunately investment bankers wanted the leverage advantage fractional banking provides. It is a juicy incentive. They paid lawmakers quite well to repeal GS.

So the law got repealed.

Now banking regulations are a mess. They are far more complicated and are near impossible to keep up with as an outside investor.

This allowed banks to grow so large that they are too big to fail. So big banks are supported by extraordinary measures.

Unfortunately the ship has sailed. Re-instating Glass-Steagall is near impossible. I cannot even imagine the big banks like Chase even trying to comply under GS. It would be a mess. Bizarre. Impossible now.

As much as I hated the repeal of GS and long for it’s reinstatement, Pandora’s box has been opened. The toothpaste is outside the tube. There is no going back.

Better to spend energy figuring out how to deal with the world as it exists rather than how I wish it was.

Well if you really want to know, it was Federal Reserve policy that precipitated the need for the Repository for Excess Bank liquidity.

The extraordinary amount of currency that was issued during the quest for attainment of the zero interest rate and below.

Well, that distribution of excess currency is inflationary.

The graphs of the Fed’s assets,

that they bought in pursuit of the ZIRP paradigm.

The first time in the history of mankind ever recorded, that zero percent interest rate policy was considered as a rational economic prescription.

We forget, which is often, a blessing.

The monetary policy that was adopted transferred the wealth of the middle class to the antithesis of free markets, the oligarchy and monopoly market structures.

As long as the largess ends up in the pockets of the median citizen.

Only in the frictionless world created by the mathematical model builders are the asked prices in equilibrium with consumer spendable income. In the real world, there is always a purchasing power deficiency gap of varying proportions.

This is just another way of saying that to have high levels of production and employment, we need not only a vastly more competitive price structure, we also need a steady but slightly inflationary monetary policy (prices increase c. 2-3 percent annually), and a tax policy that contains some elements of compulsory income redistribution – downward.

It axiomatic that the smaller the degree of price competition in a market and the greater the degree of private unregulated monopoly power over prices and output, then the higher the amount of unit prices, the greater the tendency for restricted output and employment and the smaller the degree of downward price flexibility. Example: Repeal the “Gramm-Leach-Bliley Act”

Under these conditions, unless money expands at least at the rate prices are being pushed up, output cannot be sold and hence the workforce will be cut back.

Love generally wins.

@Wolf Thank you for this analysis! This is truly excellent!

1) QE causes inflation because it puts more money into the economy- more money / same number of products for sale => inflation. I know deficit spending is bad because eventually the government cann’t pay it’s bills and goes broke / prints money. But as long as government funds the deficit via borrowing (and people will lend them the money), why does this create inflation? You are merely moving money into areas that are most likely less productive long term.

2) QE should (and did ) create inflation. But now QT should create deflation. Supply bottlenecks also did create inflation, but they are mostly back to the normal logistics problems we have always had. Once inflation starts, it is hard to stop that ongoing momentum. Finally we are running a massive federal deficit – how much do each of these elements affect inflation? Assuming Congress continues unchecked, what happens to inflation in the next 2 years and why? Any other significant items for the US – productivity, trade, etc? I know the FED dot plot but would like your insight.

3) Note the S&P500 has only returned 3%/year over the last 3 years once you remove inflation. And after inflation, bonds (using the Vanguard BND ETF as a guide) are down 8%/year. Losing 5%/year is not a good long term solution if one has a 50/50 stock/bond split (I am much heavier on the stock side but still…). For people looking at their retirement portfolio, inflation is a very scary monster.

For your #3, why were people buying the SPX and BND three years ago or now? I’m not too knowledgeable on valuations, but people who are, such as Hussman, show that buying at these times has a high chance of low or even negative returns over the next ten years. It seems that many people are uninformed and unaware of valuations and some are taking a big risk by ignoring them. That, along with people not paying attention to, or not caring about our reckless, deranged, government spending suggests our society as whole is lacking in appreciation for financial responsibility and the risks of not maintaining it.

With a few exceptions, retirement accounts are limited to either buying a piece of a business (stock) or lending someone money (bond). Yes, you can sit you money in cash or gold or a few other things but stocks / bonds are fundamentally your investment options.