The median price of existing homes dropped further, high was June 2022, demand remains collapsed, active listings highest in 4 years, days on the market rise.

By Wolf Richter for WOLF STREET.

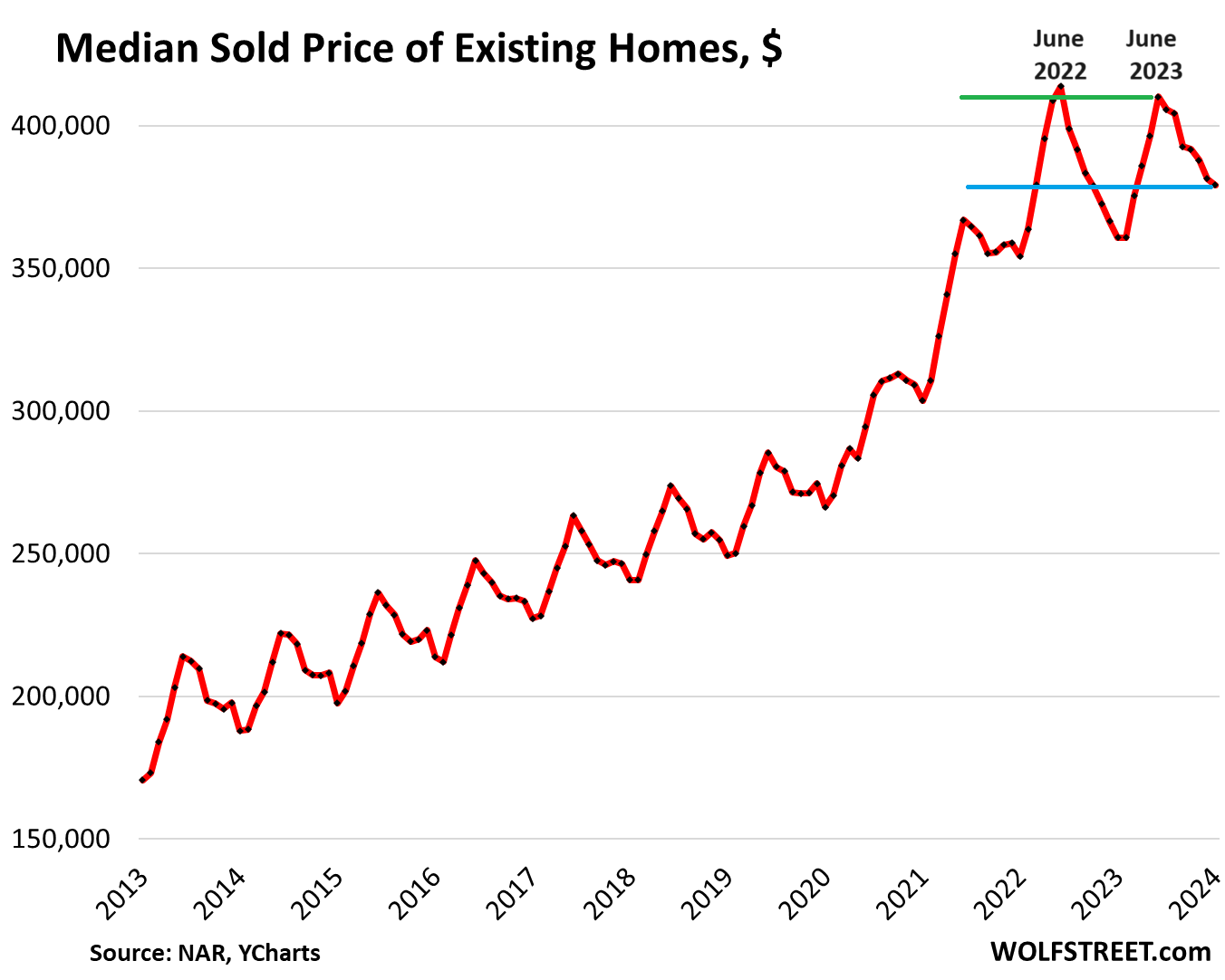

The national median price of existing homes – single-family houses, condos, and co-ops – declined to $379,100 in January, down by 8.4% from the peak in June 2022, according to data from the National Association of Realtors (NAR) today.

The year 2023 was the first year since the Housing Bust when the seasonal high in June was lower than the seasonal high and all-time high a year earlier (June 2022). Year-over-year, the median price in January was up 5.1% (historic data via YCharts):

This was based on deals that closed in January, many of which were made in December and November, when mortgage rates were careening lower, falling well below 7%. But things have changed this year, inflation turned out to be more resilient, the Fed has been pouring cold water on the rate-cut mania, mortgage rates have been rising for weeks, and currently are over 7% once again, and mortgage applications have re-plunged from already low levels. So this is what the housing market will have to deal with going forward.

Demand has collapsed.

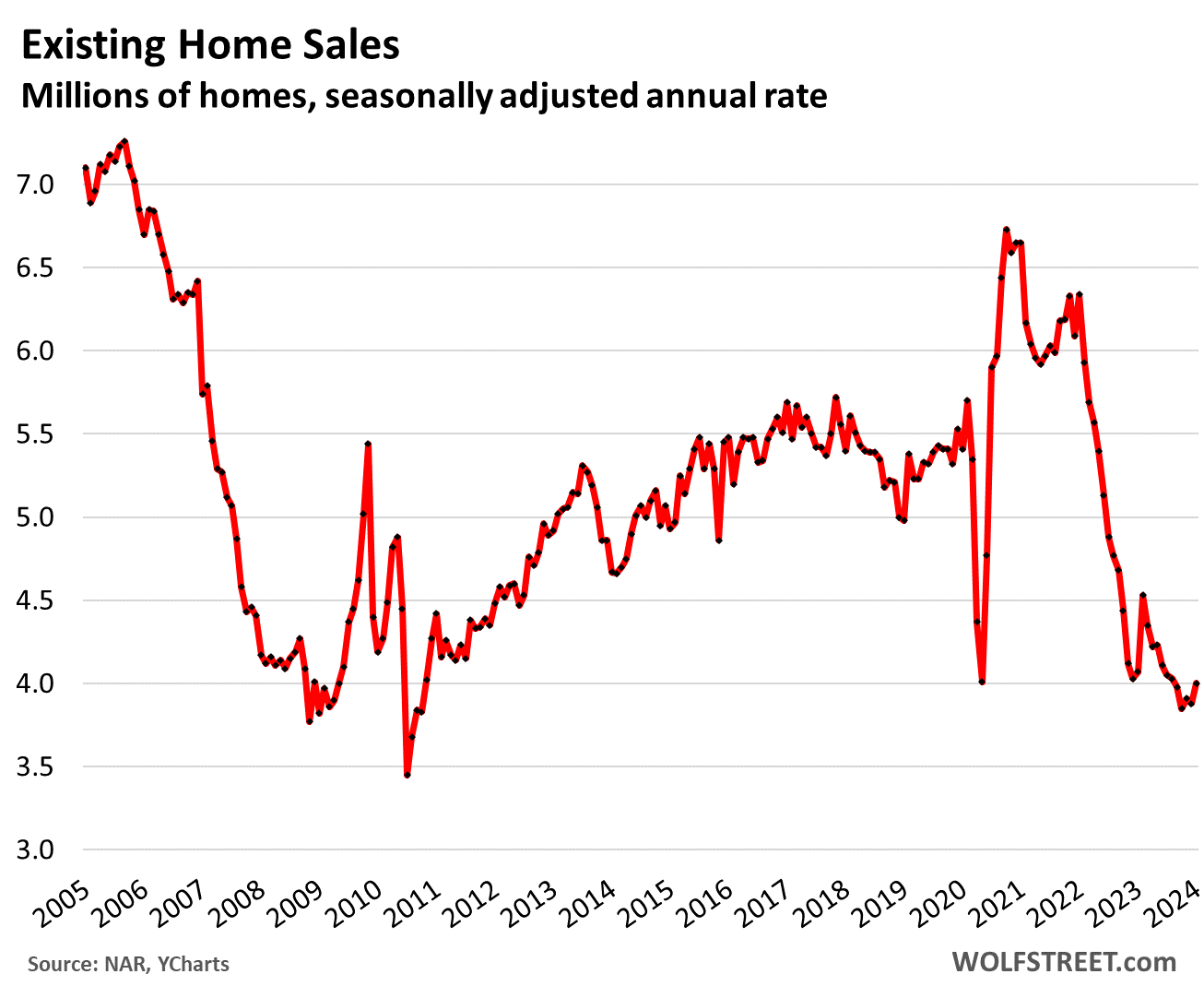

The seasonally adjusted annual rate of sales ticked up to 4.0 million in January from 3.88 million in December, and was down 2% from the collapsed levels a year ago.

In the last few months of 2023, the rate of sales had been the worst since the two worst months of the Housing Bust in 2010. January was just a hair higher.

Sales compared to prior Januarys (historic data via YCharts):

- From 2023: -2%.

- From 2022: -37%

- From 2021: -40%

- From 2019: -20%.

- From 2018: -26%.

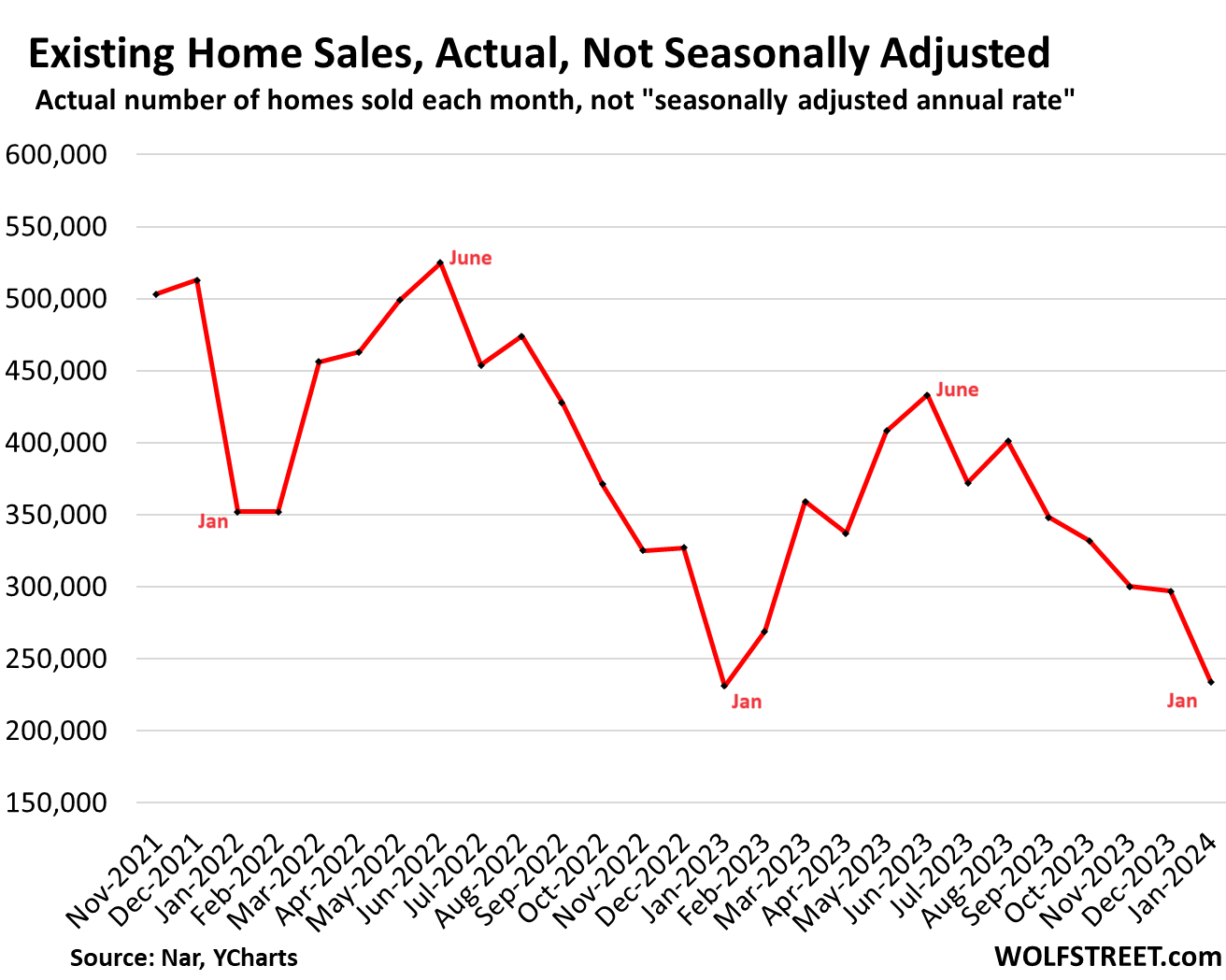

Actual sales – not the seasonally adjusted annual rate – fell to 234,000 homes in January. But that was up 1.3% from a year ago.

Seasonally, January and February mark the bottom of the year in terms of closed sales, as they reflect in part deals over the holidays. June is usually when closed sales peak, reflecting deals made during the end of “spring selling season” in April and May. During the second half of the year closed sales decline (data via NAR):

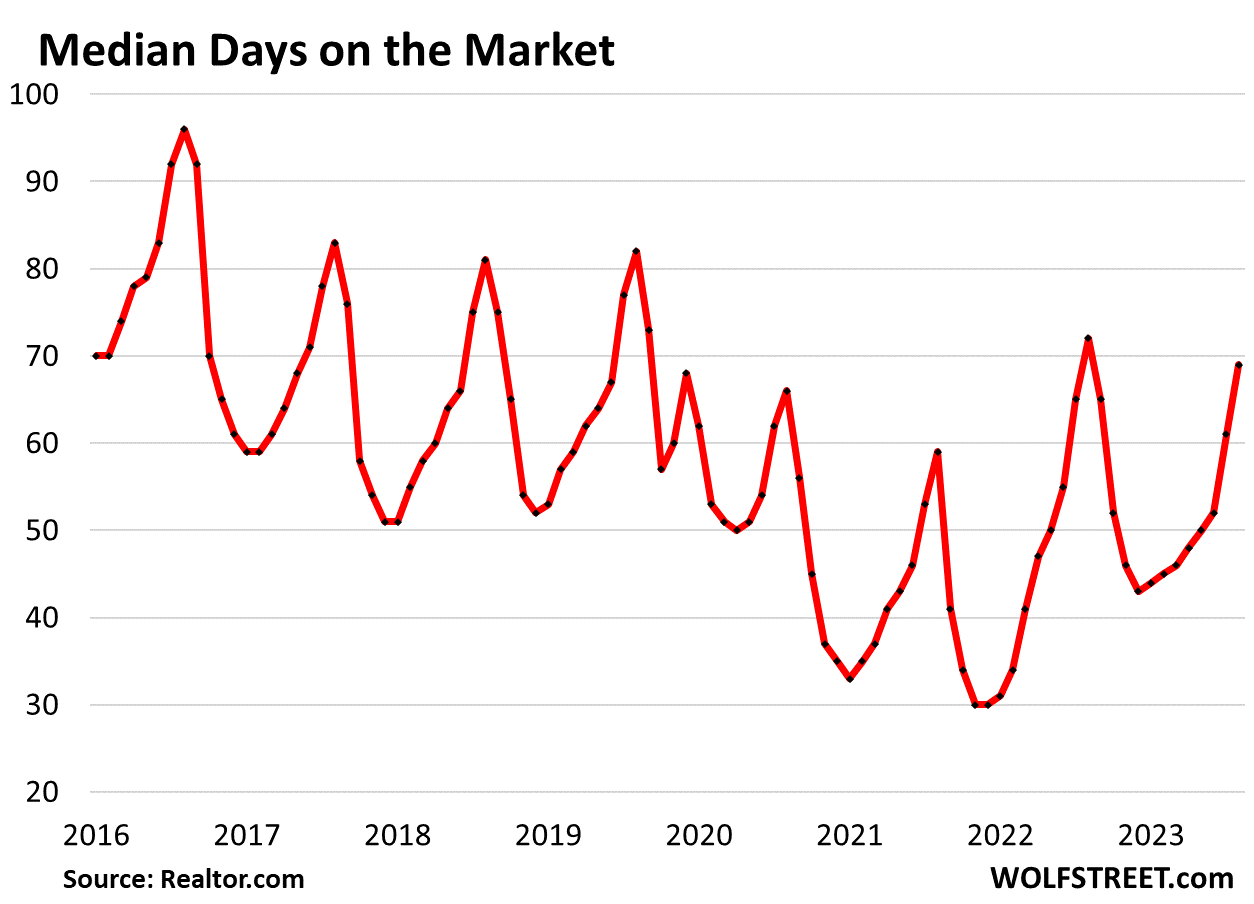

Median days on the market jumped to 69 days in January before the homes were either sold or pulled off the market, according to data from realtor.com. This metric reflects in part how quickly sellers pull their listings off the market when they don’t get the hoped-for response.

Januarys are the high months. This is down a tad from January 2023, but above 2021 and 2022 (data via Realtor.com):

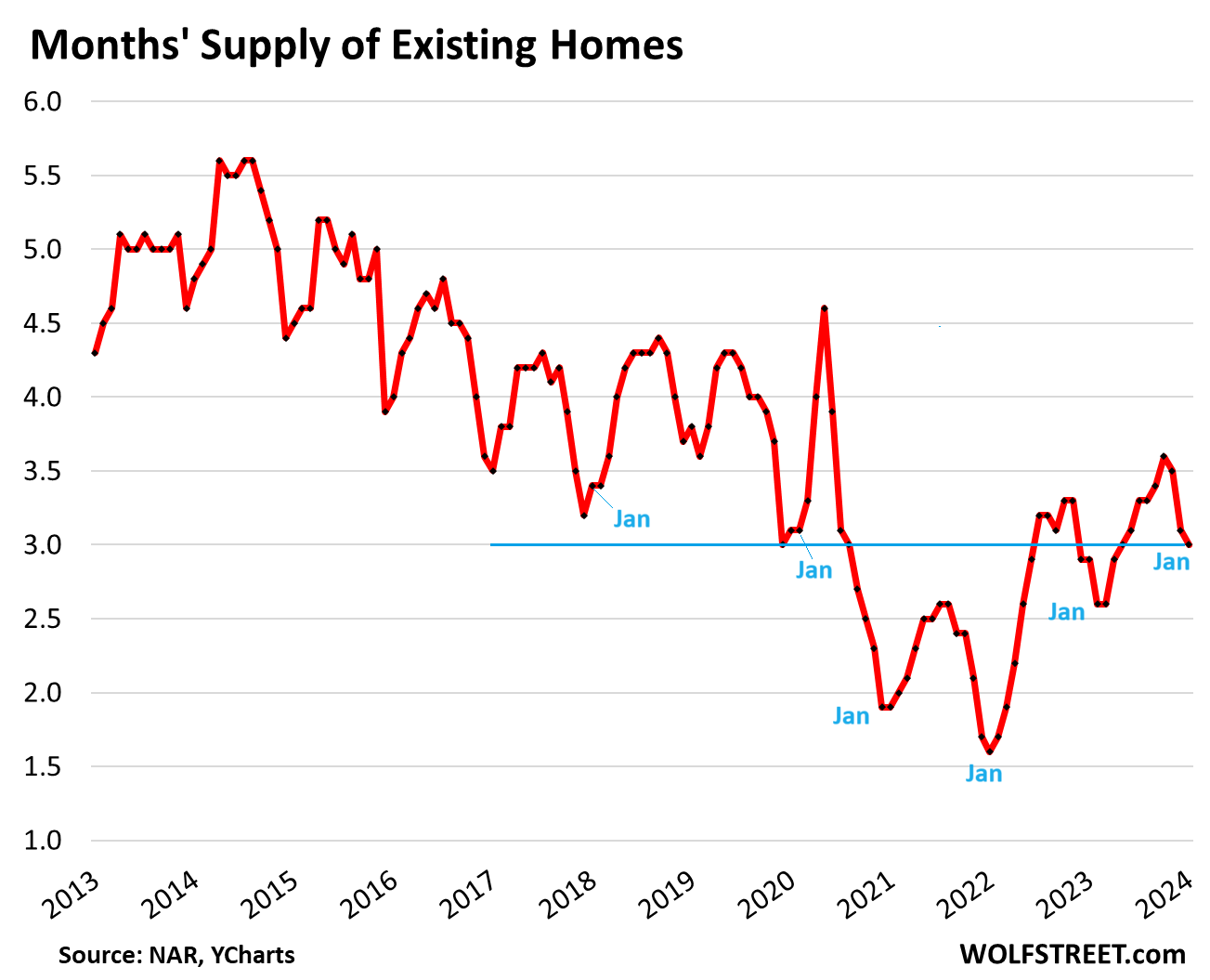

Supply of 3.0 months was about double from the low in January 2022, and was the highest for any January since 2020 when it was 3.1 months. This is adequate supply, but not ample supply (historic data via YCharts).

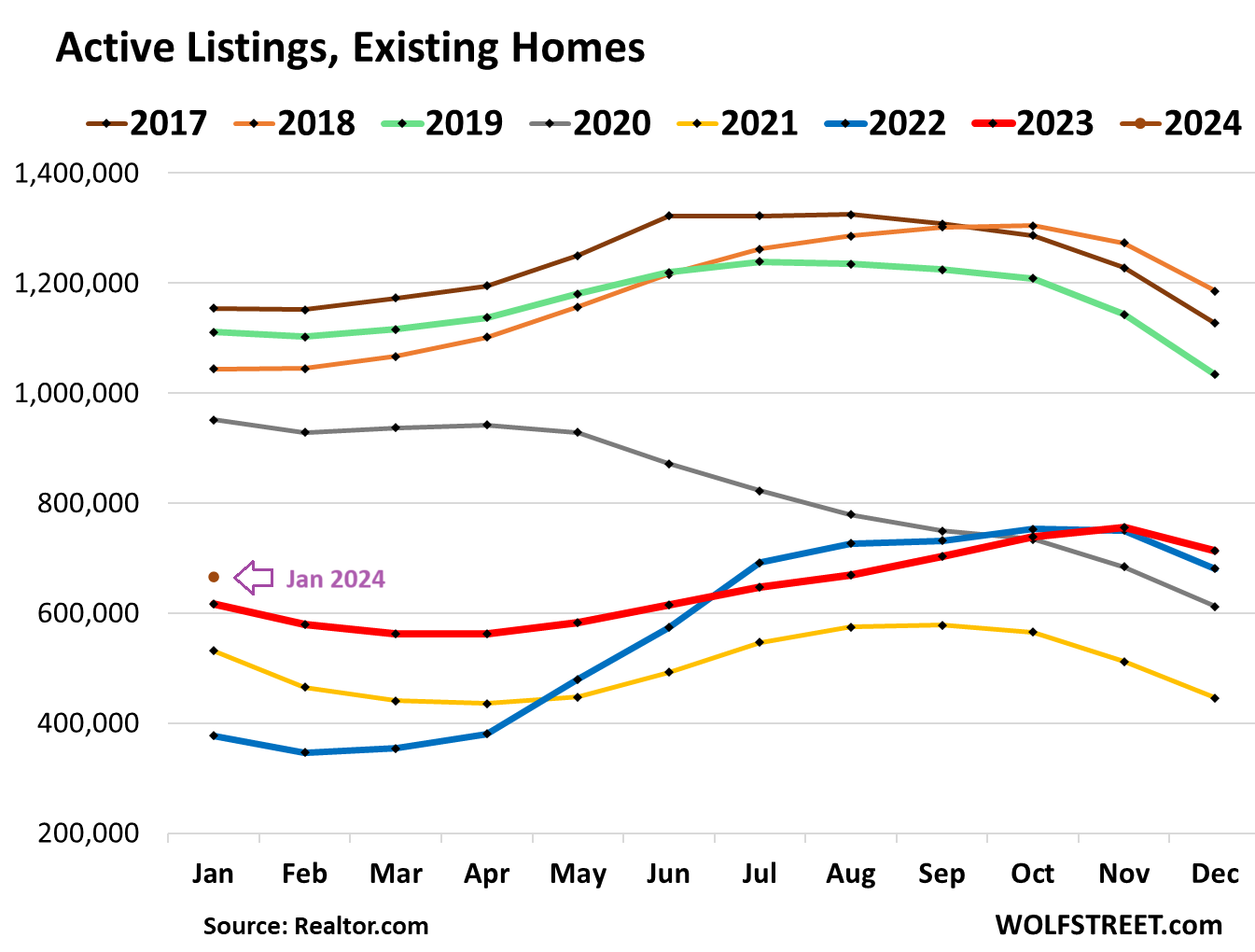

Active listings are always low this time of the year as sellers pull their homes off the market before the holidays, and they’re slow coming back on the market.

In January active listings at 665,000 were the highest since January 2020. Active listings are inventory minus homes listed as “sale pending” (2023 = red; 2019 = green; data via Realtor.com)

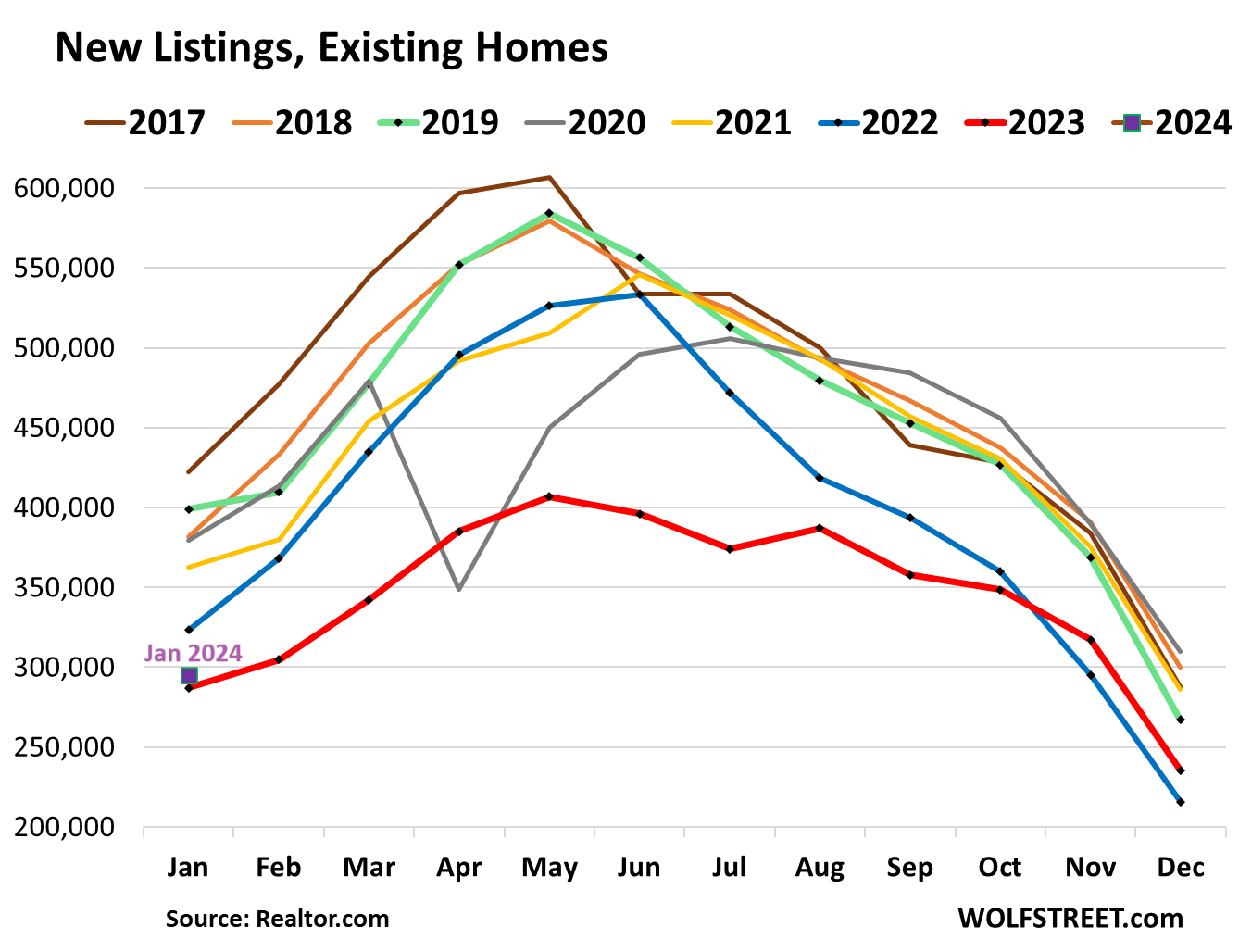

New listings at 295,000 were up a little from a year ago (2023 = red; 2019 = green; data via Realtor.com):

This market is still frozen, marked by collapsed sales despite mortgage rates that had fallen during the time many of the deals were made, amid adequate but not ample supply, rising days on the market, and a national median price that for the first time since the Housing Bust failed to make an all-time high in well over a year, as many potential buyers and sellers are trying to outwait this situation.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Comment. (Couldn’t resist writing the first comment.)

Well done. Try to add value next time.

Love it!

don’t care = with limited inventory you either NEED home or don’t

mine is worth every penny

given 30% annual DEVALUATION of fiat $dollar

next year if it doesn’t sell I’ll raise price to reflect same

Swing! And a miss!

Dedicated to all the baseball loving wolftarians out there.

At least value was not subtracted as is the case in some posts, but mostly this.

I’ll try.

I was talking to some local realtors today trying to find a family friend an apartment. She’s on the verge of being priced out of her hometown. Rentals use to be 500-700, and good usable homes were 50k-100k. The realtors are telling me the market is still red hot, with homes lasting 1 week. This is moribund central NY. All the money is downstate. Rentals are now 1200 and homes are 150k-250k.

What hasn’t changed is still not great jobs and a shrinking community. The realtor drank some coolaid, the local chamber of commerce is telling everyone people are moving in. What they don’t say is relative to what. Some very low bar no doubt. Home town of IBM all but gone, 13,000 overpaid IBMers gone. All the manufacturing left in the 90’s. Nothing left but a couple of defense contractors keeping the people addicted to jobs that build bombs. Sad Sad times.

No idea how this makes sense. Seems like homes are just another trade.

Are higher interest rates supposed to soak up liquidity, right? If so they need to be higher for much longer.

Homes become another trade when people saw that the Fed was willing to debase the currency to pay for unnecessary stimulus spending. Why hold cash if it can be confiscated at any time? Better to buy anything, houses.

Agree with you on the dynamics…but the (rather large) irony is that in many, many ways a house (non-relocatable, very illiquid market compared to many other assets, etc.) is an *even plumper sitting duck* for the G to incrementally confiscate (though through property taxation rather than fiat dilution).

And that is even before getting to the issue of property taxation based upon unrealized valuation (every single year) built upon 80%+ *borrowed money*.

There is no doubt that ZIRP hugely incentivized an exit from fiat…but finding the right, positive yielding real assets can be much trickier than it looks.

I also heard a Dalio comment about inflationary mindset: once the ball is rolling people ask if they have any inflation resistant assets.

This causes people to buy “real assets.” This obviously includes a house.

Housing as an investment has been around forever and been en vogue for decades (reinvented from flipping to vacation rentals).

In the inflationary environment it is a store of value at the least.

I live in a high end market and people are still moving money. Owners see unrealistic nosebleed valuations and they will take the money. Future owners are both eager for a lifestyle change and looking for somewhere to hide (assets and personally).

It’s good to be in the house of the king. I can easily live off the scraps. Being in the 3% 30y fixed group is the insurance that guarantees the scraps are sufficient.

Why would you be surprised that the issuer is unconcerned about debasement? They have an infinite supply.

IMHO Areas like what you described are hot because they are a good deal relative to the rest of the US. Those are affordable rents and house prices based on the average family income of $72k. Hot areas that saw a lot of price appreciation are not so hot.

Huh, I would have expected the existing sales nsa to make a lower low this past Jan vs 2023.

Still thinking this year’s spring selling season will be a dud. Rates will be higher and prices are still too high.

Fed Gov Christopher Waller: “What’s the rush?”

They’re trying to walk back the rate cut pivot using multi-channel choreography.

If rates stay higher for longer. Say the 10 yr stays above 4.5% for a few years. How can the home buyer market ever normalize? With these high prices (assuming they don’t fall) how can it possibly normalize at 7%+ rates? What will be the effect be on the economy of years of much lower than past home transactions?

Also, if the 10 yr stays above 4.5%, CRE is going to be in a world of hurt. And corporate bond refi’s? Yet the high yield and investment grade corp bond spreads are so low!

It can normalize by rising wages. The market could stay in a range, practically frozen, while wages continue to increase. This would mean in real terms they become more affordable while nominally staying ostensibly still. In previous articles we have seen that there has been real wage growth, so should both a frozen housing market and a real wage growth environment continue then this is a probable outcome.

What happens if wages don’t rise or unemployment ticks up, even a little more, with all else staying equal?

Right. And what added value will be all these people be providing to earn those higher wages? Who will the USA be selling all these products to?

Are you another another MMT believer or believer in infinite growth in a biosphere with finite resources? Have you seen the trade deficit lately?

LOL!

It’s not that they will be adding additional value. It’s more that the wages will grow to meet the inflation that has already occurred.

Again, where is the money coming from to grow the wages?

When wages grow is when inflation is taken seriously. That is not allowed.

No added value, just modifying the tape ruler and rearranging relative costs. Prices of consumables goes up, wages go up, housing prices stay. This happen not just in the USA, but around the world too.

This wage and price “rise” do mask what really happen. In practice it is just the relative price of labour, consumables and housing that are adjusted.

Some trades get more paid, some less, people of all trades pay more for consumables and less for real estate. After a preiod where they paid less for consumables and more for real estate.

You put some pretty weird comments into his mouth that he didn’t day. Kind of dishonest.

That said, you can willfully ignore the data all you want, but he was correct. Real wages have grown faster than the housing market.

“And what added value will be all these people be providing to earn those higher wages?”

Do you…just not understand how inflation works?

The problem is that if wages keep rising, so will inflation…

The minute stocks become perceived as safer than bonds by everyone is the exact minute stocks will go super nova.

And who ever mentioned Dailio , “Mr. Cash is trash” probably gets his insights from Jim Cramer on CNBC.

I have a funny feeling that history repeats itself….it’s just a feeling though.

I dont get my news from the “Fed horse whisper” either.

I get paid by the hour to be cynical. Darwins law is tattooed onto my heart.

I wish Wolf would turn to the doom & gloom folks, but he wants to be neutral like Switzerland .

I need napalm in my financial research analysis. If you listen closely, even Lacy Hunt can put the fear of God into any financial analyst.

But whom am I ? A nobody. And Wolf Richters biggest fan.

Were you not watching? Stocks are up

The S&P added 10% yesterday in 1 day.

I call it my “imaginary retirement money”

Because it goes up and down so much. Haha

If I can ever spend it on things, it will blow my mind.

It’s a standoff. Buyers have been lead to believe that interest rates are the culprit when in reality it’s price. Then you have stubborn sellers not willing to budge on price. I was the RE industry for 40 years and have never seen anything like it.

Of course, because in the past 40 years, the Fed was smart enough not to do what they did. But pouring gasoline on a raging housing market inferno (sub 3% rates) only to increase them to 7-8% in a year and a half was bound to cause this.

Smart enough? How is breaking price discovery with money printing and near-zero interest rates smart? The last 40 years saw all *sorts* of distortions in the market, with the Federal Reserve Board squarely at the top of the list of causes.

I’d amend to say they were “arrogant enough” and then “cowardly enough” not to pour gasoline on a housing market that was only raging because of the monkeying the Fed had already done. They are trying to take away the punch bowl at the party they threw, and I’ll allow them no quarter for it.

100%!!!

The single most important price or cost in a functioning market is the cost of capital. There will be consequences. It isn’t personal, it’s just MATH and PHYSICS.

I didn’t say it was smart. I said it was “smart enough” meaning “smarter than what they did in 2020-2022.”

yep. day 1 of econ 101. time value of money.

removing that is crazy. so crazy that only an academic would suggest it.

Agreed. The Fed suppressed rates which caused a massive housing price spike with existing home buyers under ZERO pressure (i.e., no recession) to drop prices. Wolf has outlined this many times over the last 3 years. Rates @ 7% with consecutive quarters of 4.9 & 3.3%, historic low unemployment, and approaching $2T in deficit spending all suggest the inflation head fake is happening as we speak.

Back in the old days before Fed QE & massive deficit spending, a recession would have already taken care of this problem. We don’t have non-pandemic recessions anymore due to our MMT-based economy.

The real question is: When does America wake up sometime in the next 10 years, when the CBO expects interest on the debt & Medicare costs to each cost $1.6$ a year? And the cost of Social Security is going to be out the wazoo as well.

Ugh, this again. The US has had an “MMT based economy” since the Nixon shock (if you know what that was) and the end of Bretton Woods.

Of course, this requires you to have an understanding of what MMT is, rather than the ubiquitous canard that it’s simply unrestrained money printing.

yes this again.

MMT is quackery. Doesn’t matter if it started in the Nixon era.

From investopedia

The central idea of modern monetary theory is that governments with a fiat currency system under their control can and should print (or create with a few keystrokes in today’s digital age) as much money as they need to spend because they cannot go broke or be insolvent unless a political decision to do so is taken.

It is a catch-22. Sellers are not so stubborn. I know people who would sell and try to downsize or upsize but it is too expensive. They are stuck.

I know retired people whose houses are paid for but would like to downsize in into a ranch villa. Those ranch villas cost more than their 4 bedroom 2 story home. Some would like to downsize into an all expense retirement community but those run $5 to $6k month. Thus they do not want to take out a loan to downsize nor do they want to blow all their retirement in renting. So they just stay in their current house.

For them to sell, they need new home builders to build smaller houses like 2 bedrooms or 3 bedrooms so prices are lower than their current 4 bedroom house.

I rode by a very nice neighborhood here in Raleigh today. When I was home, I zillowed it. Bought for 725,000 in 2019, up to 1.19 Million now. Almost 400k for free, if they sell.

And I’ve never seen moulding THIS good.

Makes me wonder who had 725k in 2019. Now everybody has it, but not 2019.

Oops mi maths are off.

Apologies math ocd people

This seems unrealistic to me on a number of levels. How much in maintenance and improvements might have been made and how did zillow, who never steps foot in a house come up with the number they did. One would really have to drill into the entire entity to see how much of this is “free money”.

Is it really downsizing if the new place costs more?

There are dumps in my neck of the woods that have been sitting online for over 300 days. 659 for a shell of a home, when in reality it’s worth less than 200. The agent will laugh if you try to give them an offer under asking.

Never negotiate with a delusional man selling tulip bulbs.

I remember many thought back in 2018 that home prices were already very high and late cycle. And people would say back then “if rates ever got over 5% for an extended time prices would crash”.

Well, then prices went up 40% MORE in 2020 and 2021! And now rates have been over 6% for almost 2 years and over 7% a lot of that.

I’m amazed their isn’t more weakness. But I guess its many homeowners being fully employed and with 3% 30 yr fixed that is causing the lack of distress in the market. But I would still think the new home market at 7% rates would basically slow to almost nothing. Yes I know the home builders buy down the rates….but still….even if buy down to 5.5%….that is a lot higher than 3%, AND at much higher prices than 2019.

Prior to the 2008 financial collapse, 30 yr rates were from 5.8 to 6.5% over a 4 year period. Those “low” rates (and slipshod lending) greased the skids which led up to the housing market and financial collapse. Were those rates “abnormally low” at that time?

7% rates were normal back in the 70s and a few decades beyond. After the Volcker crack-down, rates came back down to about 7%.

I imagine that when news of mortgage rates hitting 7%, today, many knickers were soiled.

+10 points for working “knickers” into a sentence, mate.

I wet my knickers laughing.

“I remember many thought back in 2018 that home prices were already very high and late cycle”

I was one of those. I passed on many a good house thinking finally the market would soften up. Prices did fall in So Cal, but the moment the Fed caved to Trump, prices resumed their climb.

“Well, then prices went up 40% MORE in 2020 and 2021! ”

All clearly from ZIRP. But then to your point, it’s amazing prices haven’t fallen off much. I wouldn’t say this market is frozen at all — it’s not like transactions are zero. Plenty of homes are still trading hands. This tells me that somehow a decent chunk of buyers have increased purchasing power, and/or willingness to pay than they did a year ago.

I agree. It’s slowed down but there is still alot changing hands. Upgraded properties go fast. Dated properties seem to sit alot longer.

Yes, the appetite for luxury vinyl flooring and cheap cabinetry rendered in funereal tones of gray seems to know no end.

“luxury vinyl flooring and cheap cabinetry rendered in funereal tones of gray seems to know no end.”

Blahahaha. Spot on.

All the flips in Cent FL are tombstone gray with fake wood vinyl flooring.

Prices are absurd, I guess everybody has a rich uncle or cashed on PPP “loans”

The fake wood vinyl flooring is better than the fake wood ceramic / porcelain tile. You can tear the vinyl out much easier. Both are hideous.

Forty percent of homes have no mortgage. That’s why there aren’t as many sellers. It costs peanuts to carry those homes, and many overhead costs can be deferred for half a decade or more. It’s a very long drawn out staring contest at this point.

Costs peanuts? Where have you owned homes? In many parts of America with bubblicious housing markets, there are very high property taxes that can easily be $1,000 a month, and then insurance has gone through the roof in recent years.

Poeple won’t hold houses indefinitely as empty carry trades.

No kidding. 60% of my mortgage payment is taxes and insurance.

Average property tax here is 11-16k for a South shore home. If you’re selling and have it close to 10 or under, it usually results in a bidding war.

Rent can easily be $3500/month in many parts of America. So what? I promise you that wherever you are living rigt now, if you divide your home appreciation over your property taxes, the ratio is well above 1.0, meaning you are making a tidy profit.

Yeah Raleigh just doubled theirs.

I think this is a good strategy to shake out those who perhaps “could move” somewhere else. And increase funds to the roads these “hanger on’ers” and their family destroy everyday.

Go away or I shall taunt you a second Tima!

And now that money market rates are 5%, there is an opportunity cost related to not selling that did not exist when those rates were 0.000001%…

Now divide total outlays in property taxes over the last three years by the amount the home has appreciated over that period. Home insurance is optional if you don’t have a mortgage. California, for instance, has a Property Tax Postponement program where taxes are attached to your house as a lien, and you can defer paying them until you sell in the future.

PS California experiences 90% of the country’s earthquakes, yet only 10% of homeowners carry earthquake insurance. The statement that you *have* to have insurance is BS. If someone has picked a home site in a location where they would be a fool to not get insurance, I’m not going to take the blame for willfull bad decisionmaking.

This has to be one of the few countries that is proud to have a supply and demand market for an essential (food, clothing, and shelter). Local authorities that control building zoning just like any petty regime. The civil war made Federal law supreme so why are we stuck with the lowest level local governments controlling a fundamental human survival need?

Not sure that I’d prefer politicians in DC over the local city Aldermen deciding whether or not a factory can be built in my neighborhood.

I believe that is called “central planning.” See also “Soviet Union” and “Maoist China” to see how that goes.

Stupid ideological statements like that suck the oxygen out of any real conversation in order to have real reform.

How is it stupid if Zaridin is replying to an ideological statement? You can agree with Gary, or you can agree with Zaridin, but I’m hesitant to call either comment stupid. As it stands, the United States has neither the extreme suggested by Gary (markets in food and shelter are not dictated solely by supply and demand), or the prospect of what Zaridin suggests. Does your comment apply equally to Gary?

In Florida, local governments revenues come from property taxes. And we have a state constitutional amendment, like California, that limits increases on taxes for existing owners. New, higher taxes comes from new construction. So every fiber of local government is bent on encouraging new housing developments. Supply is high, but prices keep shooting skyward.

Counties in FL have an option for local sales taxes up to 2% on top of the state sales tax of 6%.

Municipalities also have local control of most charges for the utilities on which they have a monopoly, such as garbage, water, sewer, storm water.

And they keep increasing all of the above as fast as they dare.

Texas has some limits on prop taxes but can reach over 4 percent of appraised value lots of variables including city county municipal district and school district and college taxes . Mine is 2 percent lowest in state I have seen is 1.6 percent

We’re “stuck” with local government and thankful for that, remote governance through history has always led to revolution and war. It’s easier for human nature to accept the requirements of organized society if they are locally enforced by peers in the same circumstances, with local grievance resolution.

“The civil war made Federal law supreme so why are we stuck with the lowest level local governments controlling a fundamental human survival need?”

Because the constitution limits the authority of the Federal Government.

The Supremacy Clause with respect to Federal laws was part of the original constitution: Article VI, paragraph 2. The amendments to the Constitution following the Civil War merely increased the areas in which the Federal government could pass legislation.

Longer the existing home market stays frozen, the longer the new home market will stay attractive and shift focus on increasing supply. The more the better.

Break the wheel.

Not frozen. Stalled.

Good to see this is going down..hopefully it will stay down and go lower, especially when it comes to price, plenty of room to go especially in area like SoCal.

Hopefully this spring season we don’t see the market bounce back to all time high like Nvidia stock or bitcoin…since I just said it…it probably will sadly..

Nah, home prices should be going down. I know because I just had an offer accepted on a house (cash buy). Top confirmed you’re welcome. :)

Hopefully you’re the seller in this transaction.

Fed needs to come out and state that rates won’t be dropping.

Everyone is waiting on the sidelines for this to play out. Sellers think rates will drop and home prices will rocket again. Buyers either think rates will come down so they should wait or they think they need to get in now and refi once the market booms again.

The Fed and gov’t royally screwed up this housing market.

Whatever happens , it has taken so long to fix, the lowest prices will go is 10-30% and then they will increase again by 100-500%.

So buying now or a bit later at a super small discount does not matter much.

Who can plan a home purchase deffered by years anyhow? Life happens

The FED would never announce that rates won’t be dropping. That would be silly and useless.

Two major economies (UK and Japan) recently went into technical recession. If that happened in the US, the FED would look silly if they had just announced no rate cuts.

The FED is doing what they should be doing. They have made it clear that they are going to be flexible on rates going forward depending upon what inflation does. That is literally the best thing they can say

It’s crazy that # of existing home sales is down to 2009 levels, but prices haven’t dropped significantly if at all (at least not in my neck of the woods – central coast, ca). Maybe prices will start falling soon?

Prices won’t fall unless there is a big catalyst.

7-8% mortgages rates are a very big catalyst. After 3%. At these prices.

But if the homeowner has a 3% mortgage and sitting on a home that’ appreciated 70-100%, what is in it for them to sell? Sure, there are circumstances that forces people to sell in such a scenario (divorce, death, unemployment), but I bet people will try to do about anything to keep that cheap mortgage locked in.

They won’t sell, and they won’t by. They have left the market. They don’t add supply, they don’t add demand either. And that’s exactly what we’re seeing. Which is why inventory AND sales are down a bunch. I estimated that the entire housing market — buyers AND sellers — shrank by 20% to 25% because of the very situation to describe.

Only Realtors pay the price here because they don’t make the commission coming and going.

https://wolfstreet.com/2023/07/21/entire-housing-market-buyers-and-sellers-may-have-shrunk-by-20-25-because-of-the-3-mortgages/

“7-8% mortgages rates are a very big catalyst.”

…and were the norm for almost 30 years. Most people could onlt dream of getting a mortgage rate that low in the 70’s and 80’s. All I can say Suck it up buttercup.

@Jon

This. And one big missing catalyst thus far is layoffs. Not the onesy, twosy tech layoffs that always make the financial news. I mean widespread layoffs in multiple industries.

As Wolf has previously noted, the 3% mortgage loan holders WILL NOT relinquish that lavish financial gift unless they are compelled.

It will take an exogenous shock to separate some of the 3% loan holders from their coveted (to use a BS real estate sales word) gifts. That black swan of large-scale layoffs has yet to emerge. The drunken sailors may stay drunk and continue spending until those layoffs happen.

Fed rate hike cycles USUALLY result in layoffs. Not this time – at least not yet.

when stocks crash, the fat lady sings.

Honestly if they were smart, their home will be paid off in 11 years. That’s not bad and they are saving 100’s of thousands over a 30 year mortgage.

Then they have no mortgage and zero reason to move. You’ll have to wait till their corpse is cold to sell that property. Hehe

Typically to get price drops you need forced sellers, aka unemployment need to go up. Basically you need a recession to start the dominoes falling.

Too much mania and manipulation. Probably years before the dust settles…

If you’re in Monterey, you’ll be waiting a VERY long time! Lots of people want to live on the Central Coast!

And here in metro Boston/Southern NH prices still up per Zillow’s index anywhere from 7.5-9.5% YOY depending on the zipcode. Listings are down about 15% from last year in my Boston suburban town, and there’s still so much demand. Crazy crazy crazy!

Another FED Governor (Waller) coming out today 2/22/24 and saying not going to ease soon. His Speech Title says it “What’s the Rush?”

“The hotter-than-expected data that we received validates the careful risk management approach that Chair Powell has advocated in his recent public appearances. And, with most data indicating solid economic fundamentals, the risk of waiting a little longer to ease policy is lower than the risk of acting too soon and possibly halting or reversing the progress we’ve made on inflation.”

Also “I am going to need to see at least another couple more months of inflation data before I can judge whether January was a speed bump or a pothole.”

So far FED talk is very hawkish and they are cautious. Hope they change SEP in March meeting and match their words with actions.

Basically it’s called “we want inflation to eat your lunch money. You have too much! French Truffles? You Beast!”

Is the computer automatically deleting my comments?

You’re welcome to make a deal with me for a real-estate-hype-promo banner ad on my site, and I will make a good deal for the spot at the bottom of the article and just above the comments. But no more free RE promo on my site.

Let’s see what Case Shiller says about December. I bet it’s gonna surprise some folks. All us San Diego folks are doing is posting what we’re seeing. Not trying to hype it.

Here’s San Diego, month-to-month -0.8% in December. From peak in May 2022: -3.4%. Beautiful double top and going down the far side of the second top. Agreed, I wouldn’t try to hype this either:

https://wolfstreet.com/2024/02/27/the-most-splendid-housing-bubbles-in-america-feb-2024-update-20-city-index-drops-for-2nd-month-from-double-top-biggest-price-drops-from-2022-peak-san-francisco-seattle-portland-denver-phoenix/

Sellers will only cut prices meaningfully once they run out of other options.

Current seller confidence is sky-high, mortgage rates be damned.

Asset holders have plenty of cash, equity, HELOCs, credit cards, rental income, and good jobs to carry them through the freeze up.

Housing and Employment reports will remain strong through 2024. The powers that be intend to keep the boat from rocking,

No big changes for at least 2 years.

And then what?

In 2 years? No idea. I was inebriated when I wrote that. This is not financial advice. I am an idiot on the internet spewing nonsense.

But I do talk to a random sample of homeowners all day every day. They aren’t even slightly worried right now. “Not in my neighborhood!”

So I don’t foresee any significant price drop opportunities for buyers in the next year or two.

What I’ve noticed is that most people are out-to-lunch on most subjects extending 3 feet from the end of their noses. I don’t think insouciance is an indication of anything.

My bets would be on anything not resembling normal in the RE market or any market going forward. It’s abnormal in the stretch, ahead by 10 lengths. We have a winner it’s abnormal followed by cluster *** and total disaster is in third.

I know you mentioned that you were drunk when you wrote this, but I sort of agree. Sort of some economy wide shock, I do not see home prices dropping rapidly. They may slide sideways/drop slightly, but current homeowners have too good of mortgage rates and too good of jobs to panic sell. They will just stubbornly hold on until their hand is forced. They are in too good of position to panic and can survive a bit of turbulence.

So, what’s the best term to describe pouring on inflation for the things we can’t live without? Ultra-Monetize perhaps? The Fed and cronies target the needs in life, healthcare, homes, vehicles, etc, and of course now food.

If they could control the air we breathe, most people would be suffocating to a slow death.

Kuato lives!

Nice!

I got 5 kids man…

Hopefully you are not that closely attached!👾

Looking around on the net it seems about 2/3 of Americans are home owners and around the same are stock holders. Can’t tell if that’s the same bunch but strikes me that might be a contributing factor to the sanguine attitude for holding out on the real estate sale prices. No pressure to sell.

If the market takes an extended dive I’ll be interested to see if the housing prices follow.

It still seems like this market is Wile-e-coyote after he runs off a cliff, but before he looks down and then plummets.

For 14 years beginning in 1993 the average number of new single-family homes averaged 110 ending in July 2007. Then there were never over 100 (in thousands of units) of new single-family dwellings built in any month between August 2007 and September 2021.

The average number of new single-family homes then averaged 57 (in thousands of units), for the 13 years between Sept. 2007 and Sept. 2021. That’s a huge shortfall.

Society has changed over those decades: Population growth has dropped dramatically over those decades, and urban cores have become dense housing areas, with high-rise condo and apartment buildings. Over those decades, single-family residential construction has been taking place further and further away from urban cores, with longer and longer commutes. And people have a choice.

Multifamily construction (mostly high-rise condo and higher-end apartments for renters of choice) in urban cores has boomed over the past 10 years.

The old math about everyone living in a house is outdated. You need to look at the totality of housing units built, and at population growth. Someone here linked a FRED chart of housing units per household, and that has been going from record to record.

I don’t get the 3% (buyer) +3% (seller) realtor fees in US. In the UK I recently paid one realtor 1% plus sales tax. Legal fees are about the same so the big difference is the realtor fee. Same process here and there – realtor puts house on the main national web sites and gets most or all viewing requests because of that. Realtors probably also do much less now than in pre-web days. So on a $375k sale that’s a $22,500 realtor fee to sell in the US vs $4,500 in the UK. $18k more to sell a house in the US that only benefits the realtors and reduces the sellers received sales price seems nuts. Easy money for realtors though (at least in the ‘good’ times).

This will be changing as we had a big case go against NAR in the fall. Commissions will come down. Probably not to 1% though

I note that the number of realtors in the NAR is below a recent peak.

2007 saw a peak of over 1.3 million, recently we have been over 1.5 million.

Once the decline started back then, it declined to less than 1 million in about 2012, before turning back up.

As the profit dries, the industry dies?

Not completely, for sure, but restructuring and AI assisted/ Redfin et al will have the same effect on profitability as the assembly line, cotton gin, or the internet 1.0.

Production enabled, margins destroyed.

Howdy Ian In the US For Sale By Owner is an option. Local MLS will list your home and the commission offered is set by the seller. In the olden days that is, and things could have changed here.

Why anyone uses an agency has always puzzled me. I’ve never used one. Armed with an attorney and a property inspector, that is all one really needs. For buying or for selling. I’ve always felt the national association of realtors was a fraud.

Howdy Louie NAR is a powerful group, and their lobbyists have the Govern ment ear. They have the numbers and clients, especially out of town clients that produce a sale.

There is a new law they passed only in NY it seems from my research…..the sellers agent is not obligated to split the commission with the buyers agent anymore. If they go that route, you’re on the hook for covering your own agent, but it’s usually told to you beforehand and before you sign anything with your lawyer. I would tend to believe this will result in a concession with the seller to drop the price if they want to sell the home, but with the demand of buyers here, I and several others could theoretically tell the buyer to go pound sand Im not agreeing to that, but there will be another couple/family willing to step right in and take your place.

To echo a few comments above, people will sell when they have to sell. Meanwhile, they’ll hold out for a while yet. One small example, a couple’s marriage fell apart just down the road from us. They listed over a year ago at a crazy overprice probably to recover their extensive renovation costs. And there it sits. It will sell when the lender wants to be paid out or when one party insists loud enough, I guess. Been on the market a solid year.

One thing I have also noticed in RE is listing poachers. It used to be that one specialist that had the bulk of the listings around here as she was born and raised in this area and knows the market. Now there are new folks and new RE companies no one has even heard of. If someone tells a seller what they want to hear, it won’t make the property sell any faster.

I have fixed 3.85% on 400K mortgage on a rental house, I am crazy to sell the “cash cow” to get 7.5% rate for another one.

That is why people aren’t selling.

Howdy Bruce. HELOC the asset and purchase?

I was thinking about doing that.

But I am scared to buy RE with high interest rate.

Howdy Bruce YEP Spent most of my life RE investing, rentals, rehabs. Not as easy as on the TV shows…..

What’s compelling you to get another one if you sell the one you have? If the cap rate of the one you have falls below the cap rate you could earn by investing that equity in a different vehicle, then that’s what you should do if you decide to sell the rental.

Howdy shangtr0n. YEP, all depends on the vehicle you love to drive. Exactly what makes US Americans, Freedom to choose. Well, it use to be that way.

Bruce, people will sell or walk when their equity in their ‘asset’ rolls over into negative, and they realize they’re holding paper that’s worthless. Or worse yet, the nut isn’t covered because rents have all of a sudden dropped and they keep dropping. And then the squatters take over empty houses, like they did before, dropping rents even more, because they have no skin in the game, like before; and the whole charade hits the fan. Like before.

History may not repeat, but i’ve been told it surely rhymes.

Rents are dropping?

Invitation Homes earnings call showed lower rents on their SFH new leases in Jan. One data point, and they were focused on occupancy, but still, a data point in the right direction.

What they actually said during the earnings call:

“January blended rent growth was 3.5%, comprised of renewal rent growth of 5.9% and a negative new lease growth of 1.5%.

75% of their tenants renew. And that’s where the rent increases are (+5.9% in Jan).

“Early indications lead us to believe that new lease rates have already begun to turn positive again in February’s activity to date.

“And what we’re seeing already from January into February is an acceleration into February and into spring leasing season. As we lean in on that rate, you can also see that renewals have stayed steady.

“…but we’re seeing acceleration from January to February, and we expect that will continue into spring and summer demand.

Howdy Youngins Have no fear, still a long way to go. Thinking about purchasing a home??? Just be glad you don t have a 3 % Mortgage. We are prisoners enough as it is……

Ha Ha!

I keep thinking about the term “prisoner” for every homeowner that holds a 3% mortgage.

It must be a pretty nice prison when everyone on the outside is clamoring to get though the 3% heavily guarded gates.

I’ve never considered it a prison. It is a financial advantage that I would happily give up with the right incentives.

1) I’ve said before that you can pry my 3% mortgage out of my cold dead fingers. Given my age, that could be a possibility.

2) Interest rates could drop again for TBills below 3% instead of the current 5+%. That might motivate me to try to pay off the mortgage for the peace of mind of owning the house.

3) My wife could run off with the Pool Boy causing a divorce which would force selling the house. We don’t have a pool.

4) My wife and I could decide we need a much smaller house closer to the kids and sell and pay cash for a house half the size.

5) We could receive a job offer for a hugely significant raise somewhere else that makes the rate spread between 3% and 7% insignificant.

6) Similarly, Winning a Powerball jackpot or inheritance that makes the rate spread small change.

None of these are very likely in the next year so we will continue to enjoy our current house and job (with whatever inflation based raise I get). We will use the rate spread between 3% and 5+% Tbills to travel and visit the kids instead of selling or paying off the house.

It just makes financial sense to do that now. I can’t guarantee what will happen in 1 year.

The benefit of the low mortgage rate accrues gradually over time, as reduced mortgage payments occur. In a declining market, people need to compare that gradual benefit to the potential detriment of losing 1%-10% home value per year. It doesn’t make sense to pay any amount of interest to own an asset that is declining in value, and we could be at the start of a long-term home price downtrend.

Even people with 3% mortgages need to track home prices carefully, particularly if factors (aside from home price) make the current home sub-optimal.

It is still worth it to carry a 3% mortgage on an asset that loses 1% per year when you can get 5%+ in T-bills on your savings.

Simple math.

Is 1% price loss for five years your worst case? In my mind that’s a favorable case. What do the numbers say if we punch in a 3% loss for 5 years, which is only half of prior recession losses.

Howdy BobE YEP HEE HEE Home ownership is a prison, which I made a great living and retirement doing. Currently homeless and RVing around the country. Doubt I will ever sign a HUD 1 ever again….

Always wanted to the rv-ing thing, roam around, kill a snake and eat it. So many interesting sites to see and experience. Takes a certain type to go that route and do it well, stress free. Home is where I’m at, and right now I’m in my little RV crapper looking at this fly.

My financial knowledge is lacking but will improve in time.

Howdy HomeToad. About 1 million full time rvers and that is still too many for me. Motorcycle rides are on the bucket list. Checked off riding into Key West from the everglades with alligators as road kill. Next up is a ride across the Golden Gate Bridge and look for Alcatraz and the Wolfs Lair . HEE HEE

I’m in ur camp BobE. Home is home, not a prison. :) Can’t sleep under a stock certificate eh?

Howdy Natron. YEP, I never owned a stock certificate and doubt a roof could even be patched with one? HEE HEE

In a lot of conversations over the last couple of years I have pointed out the history of inflation and the timing relationship of wages. If you look back to the 70’s/80’s, inflation raged, and the 2 largest percentage increases in income (per SSA) were 1980 and 1981. The third largest increase on record was 2021. Inflation eats the lower classes alive (percentage base of income) and then wage increases follow. For all of the talk on this site about excess, i.e. the drunken sailors, government spending, reserves, and general liquidity, why is the one target that real estate has to be grossly overpriced? Are we not just in a reset to new asset plateaus? I know the default ZIRP answers, blah blah, but those willing to move and sell are still finding lines of buyers in most markets–a third of all real estate transactions last month were cash.

There a lot of VA Mortgages out there that can be assumable to anyone under qualified conditions. This could be a factor, somewhere — where, I have no idea!

But I did call the VA today and they have two circulars out on the topic, since no Zennial remembers the 80s fixed rate assumable loans:

VA Circular 26-23-10, 22 May 2023 Title: VA assumption updates

VA Circular 26-23-27, Dec 2023 Title Non Compliance on Processing Assumptions 2023

(so looks like the VA is kicking the Mortgage lenders in the rear as the Mortgage lenders probably are stonewalling this effort in smoke-screen of German-like bureaucracy? who knows.)

Howdy BB. The USDA may still have no money down programs.

VA Mortgage assumption is not all that it seems. The Assumable amount is only the outstanding balance from the original loan. So, if the property has appreciated at all, the new buyer can only assume the original balance. Any difference requires the seller to arrive at closing with the rest.

Lots of zombie companies I though would go out of business with high interest rates seem to be surviving. Crazy. Carvana is rising from the dead. It is up 30% today and it rose 1000% from the lows of $6 last year to $68 today. Crazy.

CVNA is on fire. All the magic of adjusted EBITDA.

The Real estate industry and their cohorts in the mainstream media are still trying to bamboozle people. Here is a headline from our local newspaper (the Oregonian) that just came out in the last hour.

“Home sales rose in January as easing mortgage rates, more homes for sale enticed homebuyers”

Well, very sad.

The rarest commodity are not gold, diamonds & etc.

these days the rarest commodity is intellectual integrity and mainstream media don’t have it.

Bruce – ‘the media’, being overwhelmingly in the entertainment business, cares only about ‘integrity’ (intellectual or otherwise) when it is a solid paradigm of, practiced by, and genuinely desired by the audience…

may we all find a better day.

Sorry to say how often I laugh at story after story of a squatter setting up in an empty 4br. Sanctioned shelter theft and destruction has become a sport.

Theyre all the same though. Always some deceased elderly family member who left the house to heirs only to get unwelcome company.. Never a story about empty investment properties sitting vacant waiting for a bid. Ironically the latter would invoke more empathy.

For the squatter.

Howdy AV8 Investment properties should be checked almost daily or weekly. If someone has entered, thats burglary and easy to enforce laws.

I just now received this email from Marcus Goldman Sachs:

Home prices to rise as mortgage rates fall

Home affordability remains a hot topic as mortgage rates are expected to fall, as the Fed anticipates rate cuts this year.

While Goldman Sachs Research expects 30-year fixed mortgage rates to fall to 6.3% by the end of the year, US housing prices could increase 5%, a jump from the previous forecast of 1.9%.

hahahaha, what clowns

Goldman was just forced to backtrack on their rate-cut predictions for this year. Now they’re down to 4, starting in June, from 6 starting in March.

In 2022, Goldman predicted that rates would top out at 2.5% followed by rate cuts in 2023.

Yes, clowns.

They may be clowns to us (me too!) but they are the ones who get heard. God given opportunity to put these firms to rest in 2008 was snatched away by these conniving politicians….

I’m not so sure they’re clowns. Rather, sharks without a single shred of integrity who broadcast whatever narrative is most to their financial advantage overall.

I would take issue that these guys are clowns. Criminals, possibly, but definitely not clowns. There is a great book out there called “BLACK EDGE”. It gives good insight into the workings of wall street types. There are many more books on the subject of wall street types. When these types say anything, they are just talking their book; framing the narrative for their next big score.

Longtime reader, first time poster. Anectodal evidence of the on-the-ground insanity. I live in SoCal, where apparently RE prices only go up! (Everyone likes to forget about that crash in 08/09). Earlier this week I put a full-price, all-cash offer on a decent house that I thought was listed for a fair price. Maybe a little more than it was worth because it was on a busy street, but not crazy overpriced. I’ve literally been looking for a house on and off for over 3 years and this was the first time I actually thought it was worth making an offer on something. From the start my agent told me he thought the listing agent had purposely listed low to get multiple offers and it would go for over asking. I told him if he really thought that then there was no point in making an offer, but he said he didn’t know how much over asking it would go for and I should “get in the game.” We decided to start with an offer at $5K over asking. I was OK with that and figured since my offer was all-cash, that would give me a leg up.

When he spoke to the listing agent yesterday they supposedly had 5 offers over asking (including mine) so they went back to everyone saying give us your best and final offer. Agent tells me again that he thinks it will sell for $100K over asking. He sends me a bunch of comps for the neighborhood, but all the ones for this busy street were a little older (2021-2022). Based solely on square footage of the house, my offer was a little under those older comps but not by much. Plus, I’m all cash.

I spent the night thinking about it and decided that I wasn’t willing to go higher. I liked the house itself, but I didn’t love the busy street it was on and that was the one thing I could never change. I felt that if I could get the house for the price I was comfortable paying for it, it would be worth buying. Otherwise not. I assume someone who loves it more than me will offer more for it and that person will get the house instead of me–and I’m okay with that. There’s always another house!

I email my RE agent this morning and tell him I’m holding at my original offer for the reason stated above and I was okay if I didn’t end up getting it. He calls me and reams me for not offering more. Yelling at me that I keep saying prices are going to fall and they’re not going to fall, and that he told they had purposely priced it low to get multiple offers and why did I even bother making an offer in the first place if I wasn’t willing to go up, yada, yada, yada. I held my ground and will not be using him in the future if I ever find another house I want to make an offer on. But if you ever wonder why the market is still crazy and why people are still overpaying for houses, this is why. Someone else might have caved to this guy and upped their offer. I wasn’t going to.

Seems like all offers should be validated in some way and made public. Otherwise, what’s to say RE agents aren’t simply shill bidding just to get buyers to come up off as much cash as possible? By fomenting FOMO, all sides benefit, except for the buyer.

Anyway, why 5 over? I don’t get when buying a house became an auction. If they want price discovery, list it at auction or with a starting price of $5 USD.

Houses with flaws, like busy streets, are the first and hardest to drop in a down market. Good Decision.

People that have kids or plan to have kids don’t like busy streets. Plus, there’s the noise factor.

Not surprised at all by any of this.

Crowded open houses and bidding wars came back to SoCal about a year ago, right around the time in March 2033 when markets saw the fear in the Fed’s eyes and responded (sensibly, from their perspective) with a sustained rally in asset prices.

Apartment dweller – You said the single most important thing in four words.

“There’s always another house”

Good for you! I was taught as a teen to NEVER play another man’s game. Play your own.

@Apartment Dweller my advice if you really want to “buy” a place is to dump the “buyers agent” and only work with “listing agents”. In most markets the top few agents sell most of the deals and you can meet them and let them know that you are a no BS “cash buyer” and that you will only work with them if they have the listing (I have had a CA RE license for over 40 years, but I have never “represented myself” or used a “buyers agent” since the best way to get a property you want at a good price is to let the “listing agent earn the whole fee”). Most listing agents will do anything to get a full fee and since they make $60K if you buy a place for $1mm but only $33K if a guy with a “buyers agent” offers $1.1mm they will do anything they can to kill “buyers agent” deals if they have anyone that will buy a place for any price.

I’m a 45+ year “grizzled veteran” in real estate in the Chicago area. I squirm when I hear stories of agents who behave like this. You are the customer. We appreciate and value you. NAR is on its heels right now due to the lawsuits… but the real issue is the bar being set too low to join NAR. Virtually no training on sales, how to write a contract, how to deal with people, etc. NAR brags it is the largest trade organization in America…of course…because all you need to join is a real estate license and pay their dues. The consumer suffers because they end up working with an agent who just got their license, or is part-time, or doesn’t know what they are doing. The changes coming in real estate (i.e. the demise of NAR) will benefit the consumer, as you hopefully will be dealing with an experienced professional focused on service…instead of a “door opener” like apartment dweller mentioned.

A lot of inventory came out this week in the Seattle area at the same time that rates went back to 7%. So this is all very good. The bad news is that every decent house has an offer review date (bidding war). This has all happened very quickly though so it will be interesting to see how it all plays out. Wolf is right — 7 to 8% is a big difference. I priced one decent house’s 20% down monthly mortgage at 177% of its monthly rental. That’s too high. Kudos to you Apartment Dweller for not caving in the secret price bidding war. Who knows what the other offers actually are? This stuff is very shady.

When they say offers are reviewed on a certain date, it doesn’t mean bidding war. I live in one of the hottest areas of Seattle. A seller down my block used that tactic, but there were no offers on the offer review date (Monday) or 12 Mondays after that.

It’s becoming an indication of a greedy seller and an overvalued house that will sit on the market. Don’t bite.

True. Not all sell. Most do though. Looking forward to when most don’t.

They are Used Homes, I would like see you a exsisting car.

Yes, I have said that too, for example here:

https://wolfstreet.com/2023/07/26/prices-of-new-houses-drop-below-prices-of-used-houses-for-first-time-since-2005-sales-languish-inventories-sky-high/

But it didn’t stick. “Existing homes” and “resale homes” are the two entrenched terms, and this site isn’t big enough to change that.

Ha, I’ll see ur Used Home and raise u a Beater Home lol. Those are great for rehab and rental and/or living.

The quality of the new ones going up around here plus the lot size they are on doesn’t have much over a good rehab. Plus you know what you are getting then.

It’s a lopsided market, with huge benefits accruing to people with 3% mortgages, paid for by renters and current homebuyers with 7% mortgages.

The people getting screwed by paying elevated prices for shelter have less money to spend on other stuff. Could that lead to problems? All wealth transfers have consequences.

Housing inflation has exceeded non-housing inflation the past decade. Does this mean income and jobs are leaving non-housing sectors, with nowhere to go? Only 20% of home sales require construction. 80% is transfer of an existing home, not requiring any construction.

How do 10 million to 30 million new “migrants” looking for housing impact rental demand and prices?