Meanwhile, massive trading in hundreds of imploded stocks that still haven’t been delisted inflates overall market trading volume.

By Wolf Richter for WOLF STREET.

Our pantheon of Imploded Stocks, which we started in the spring of 2021 as this stuff was coming apart, is full of stocks that, after imploding, did massive reverse stock splits so that the share price would go back above $1 in order to keep the shares from getting delisted. Most of them are traded on the Nasdaq. Many are SPAC or IPO creatures of the free-money-era.

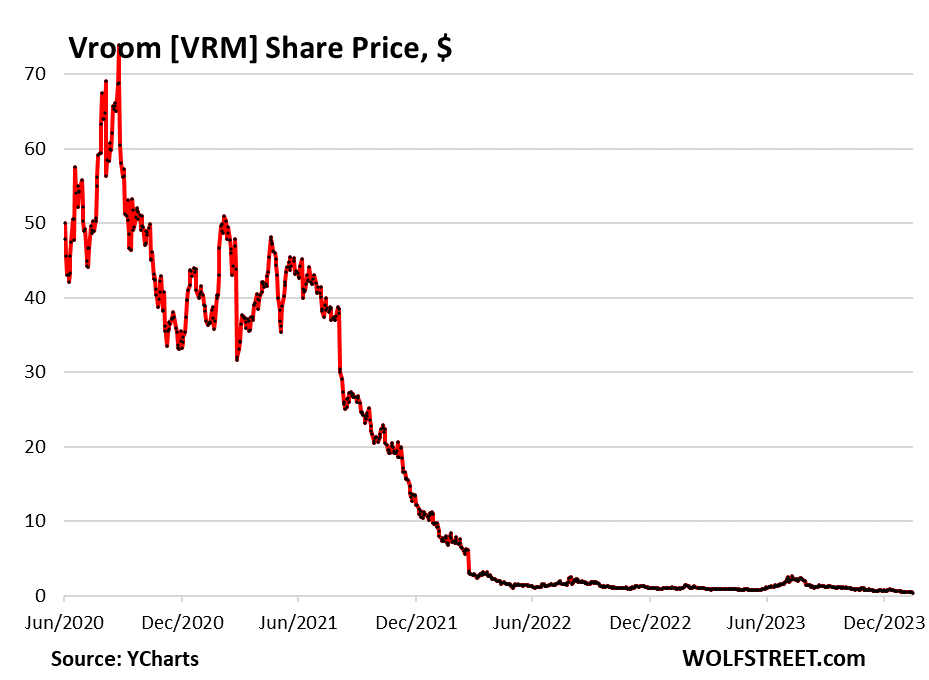

Take online used-car dealer Vroom. It has been one of our favorite Imploded Stocks for a while. On January 23, it announced that it would shut down its used-car dealer business, 3.5 years after its hype-and-hoopla IPO, lay off 90% of the employees involved with its used-car dealer business, wholesale its remaining inventory, but keep its subprime auto-lending platform and its used-vehicle listing platform. Its shares [VRM] had kathoomphed to $0.31 at the time.

To keep the stock listed on the Nasdaq, Vroom did a 1-for-80 reverse stock split effective on February 14: Your 80 shares would become 1 share, and that 1 share would be worth 80 times the pre-reverse-split value. But shares have continued to collapse.

Today, those reverse-split-adjusted shares trade for $10.36, instead of 13 cents without reverse split.

Vroom went public in June 2020 at $22 a share and then surged to $73.87 by September 2020. This $73.87 high, adjusted for the 1-for-80 reverse split, then became $5,909. At today’s price, shares collapsed by 99.8%. Charts like this are just hilarious:

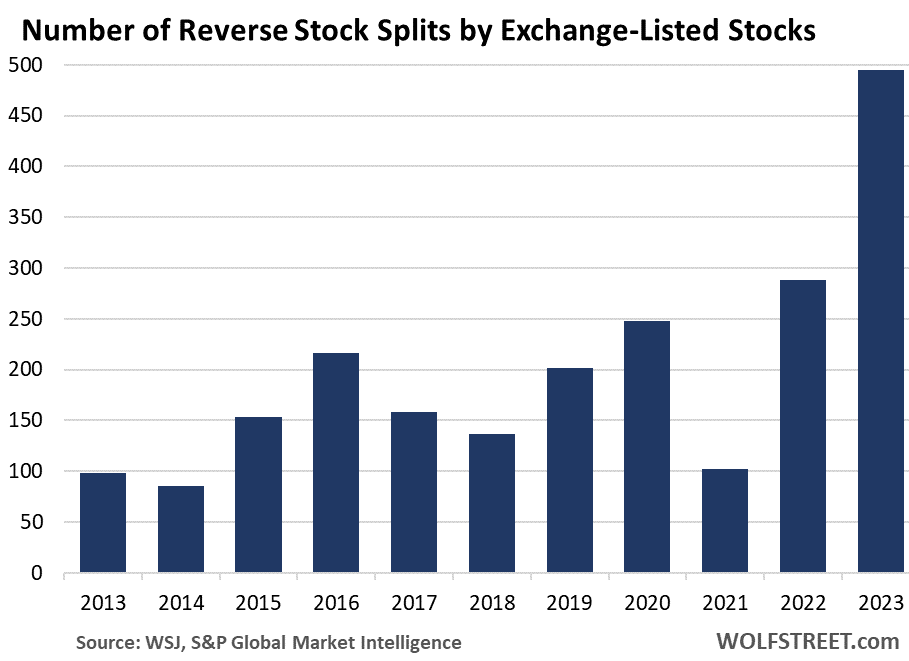

The boom in reverse stock splits.

Among the other prominent members of our Imploded Stocks with reverse stock splits is WeWork: it did a 1-for-40 reverse stock split in August 2023. In November 2023, WeWork finally filed for bankruptcy.

Another one of our infamous imploded reverse-split heroes, AMC Entertainment, is still out there wreaking havoc on investors. The stock has collapsed by 99.4% from its 1-for-10 reverse-split adjusted high of $726.20 in February 2021 to about $4.50 today.

I mean, this stuff can be hilarious. Bit Brother [BETS], a Chinese company that went public via IPO in 2015 on the Nasdaq as “Urban Tea” and pivoted of course to crypto and became “Bit Brother,” announced a 1-for-1,000 reverse stock split in early January 2024, after it had already done two prior reverse splits, a 1-for-15 in December 2022, and a 1-for-10 in August 2020. Its shares now trade at $2.15, down by 99.9999% from the three-reverse-splits-adjusted $4.2 million shortly after the IPO. The Nasdaq doesn’t really care what kind of rip-off garbage gets listed; it just rakes in the fees. Eventually Bit Brother might get delisted.

In 2023, there were 494 reverse stock splits of stocks listed on the exchanges, the most in the data going back two decades, and up from 288 in 2022, and up from 102 in 2002, according to the WSJ, citing S&P Global Market Intelligence.

The boom in imploded stocks.

As of yesterday, there were 493 stocks trading below $1 on exchanges, most of them on the Nasdaq, and not counting the already delisted stocks trading over the counter, according to the WSJ, citing Dow Jones Market Data.

In early 2021 – remember that infamous February 2021 after which all this stuff started coming apart – well, that was peak consensual hallucination, as we have come to call it, and at that peak, fewer than a dozen stocks were trading below $1, according to the WSJ.

Normally, the companies would be delisted from the Nasdaq and banished to over-the-counter trading if they trade below $1 for a while. But there is a grace period and appeals, and it can take a year or longer before a stock gets delisted from the Nasdaq. And the slow delisting makes sense for the Nasdaq because it makes money off those stocks while they’re listed.

Imploded stocks inflate trading volumes.

Before its 1-for-1,000 reverse stock split, Bit Brother made history in December 2023, when its shares, worth then about 2 or 3 cents, suddenly traded in huge volume. On December 27, trading spiked to 3.5 billion shares (billion with a B), each worth a couple of cents, so the dollar amounts were small, but this trading volume accounted for 28% of total market volume that day, according to the WSJ.

Other penny stocks are also trading at very high volumes. For example, on January 16, trading in Phunware [PHUN] hit 1.6 billion shares, accounting for 12% of total market volume that day.

And there are nearly 500 stocks out there below $1. So the trading volume on the Nasdaq, that everyone looks at as a sign of market dynamics, is massively inflated by these ridiculous penny-stocks that are so slow in getting delisted.

“Fueling these frenzies are individual investors who use zero-commission trading tools to pile into stocks that get buzz on social media,” the WSJ says.

“When such stocks trade for pennies a share, it is easy for day traders to place enormous bets on them. Then the high volumes themselves become a source of buzz, with the stocks appearing on leaderboards of heavily traded stocks where other investors take their cues,” the WSJ says.

Ah yes, what we’ve come to call consensual hallucination. We mean, there are no victims here, just people seeking fun and thrills and getting cleaned out in the process. But it is disconcerting that the universally cited market volume numbers are becoming meaningless.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

If you want a great example of RS, check out JAGX.

Just curious, does the number of reverse stock splits have any correlation to the number of stock splits? Guessing inverse, but I have no idea. Still, I am wondering if that ratio might be able to show us something interesting?

TEMPLE

Let’s see. Nasdaq headquarters are in Las Vegas, right?

No actually adjacent to the Federal Reserve in D.C.

Where are the grown-ups, who should be de-listing these pet rocks permanently?

The meme stocks and the blank check reverse merger phenomena are typical of euphoric investor behavior exhibited during major bull markets. For more speculative investments, declines of 80% and greater are not uncommon in the aftermath of the bubble popping. History also has shown that even Dow Stocks and S&P 500 blue bloods frequently decline by 50% or more once the bubble pops. The only remaining question becomes, how much longer until the current bull drops from exhaustion?

There is an old saying about bubbles: all bubbles end the same way, badly.

But Mark Cuban just announced we’re not in a 2000 style stock bubble because AI is real and very different than the old tech and dot.com days. AI companies have actual earnings, unlike those dot.com companies.

I believe he’s right in at least one respect – the stock market run hasn’t reached a bursting point yet.

Cuban’s statement, while true in the earnings sense, is a bit of an oversimplification.

While it’s true that the chip companies, namely Nvidia, have enormous profits from the sale of their chips, the “bubble” aspect is twofold. First, that demand for Nvidia chips, based on AI, will continue to grow at the rate needed to justify its current $2 trillion valuation. It’s not impossible, but nothing grows to the moon, and it becomes harder and harder to double your revenues as you get that large. So it’s not that the companies have NO earnings, like they did in 2000, but that they don’t have earnings large enough to justify their valuations.

Second, and this is somewhat related to number one, but many companies, including big tech companies like Meta, are buying tons of Nvidia chips to try to “front run” the AI play.

If the practical benefits to AI aren’t what they’re expected to be, I can see the demand for these chips falling like a rock.

In a way, it’s like commercial office space. As Wolf has written in the past, many large companies (especially tech), leased tons of office space they didn’t need, in anticipation of needing it later, and wanting to get it while it was hot. My sense is that the AI chip mania is unfolding in the same way. If it turns out that they don’t need these chips going forward, there won’t be a doubling of chip revenues every year.

Third, and while this is somewhat dependent on market forces and the competition from other chip makers, but I’m skeptical that NVidia will be able to maintain its enormous profit margins (75%?! or so) going forward. Look at Tesla. While they have expanded their market share enormously, they had to reduce their prices (and thus, their margins) significantly to do that.

Anyone else have any thoughts? I’m just thinking out loud here.

If people regard Nvidia only as a chip company, that is their first mistake, a sign that their knowledge about the company is superficial. They are primarily a software company that just happen to make the best chips, which are assembled into SYSTEMS that only they have, which can be designed to tinker in any field. Oh, and they also look like their slowly morphing into a CSP that will generate recurring SaaS from leasing their systems and software stack. While expensive, not exactly outrageous with 55% net margins. Forward PE = MSFT.

The AI chip boom reminds me a lot of the fiber optic boom of the late 1990s. Remember how everyone was convinced that more and more fiber needed to be produced and buried? Some of that fiber is still unused.

And if you require anything else to be convinced, the curly-haired James Altucher is promoting AI stocks. He’s always late to the party and makes his money promoting what’s already popular. Remember in 1999, every grocery store checkout lane was filled with magazines featuring mutual funds on the cover? There’s money selling picks and shovels even when all the gold has been mined.

JustAnObserver,

I remember there was a time when Intel was overpriced and people tried to justify it by saying that they were really a software company (drivers).

Thing was Intel was actually overpriced at the time. Plain and simple. Here is a scary thought for you though, they were nowhere near as overpriced as NVIDIA is right now.

If the practical benefits to AI aren’t what they’re expected to be, I can see the demand for these chips falling like a rock.

You got that right as Wolf’s article suggests. AI is a thief, the perfect forger, trained too maximize the profits of whoever is offering access to the idiot model.

Do a web search using the keywords AI and hype. You’ll see all kinds of hits from reputable sources.

BTW, may I interest you in some Bitcoin. /s

AI and hype are two words that belong together.

Artificial intelligence is based on data sets composed from human subjects who have been selected to attain the result the model is programmed to attain. The point of the model is how to groom to inputs to attain the desired outcome.

Bubble implies a lack of utility (see Bitcoin). AI definitely has utility, we just don’t know the extent yet. AI is a prime example of the Gartner hype cycle. AI is still headed up the curve toward Peak of Inflated Expectations. Contrast with EVs: recent price reductions and production cutbacks signaled arrival at PoIE, and we are now barreling down the hill toward EV Trough of Disillusionment. Some event or series of events will trigger this for AI as well. Enjoy the ride.

Customers (traders) enjoy the thrill of these penny stocks. They have a get-rich-quick buzz about them. We all know it’s middle-class gambling. But if those folks can’t get their fix on the stockmarket, they’ll just go someplace else, like cryptos or forex.

Don’t forget sports gambling. More and more states are legalizing it so they can get a cut of revenues.

All of this is just gambling, much is due to people desperate to get into or remain middle class in the face of brutal inflation. More and more signs that the markets are on shaky ground. This is like 2000 and the GFC combined, how could it not end in disaster?

There is nothing better than the feeling when one has lost their home to an online betting whore. I’m sure the Super Bowel produced a number of examples.

NYg – so when d’you see ‘point-shaving’-excuse me-‘insider trading’ really ramp up on this ‘exciting new investment opportunity’?

may we all find a better day.

No doubt.

Sports books and “fan” web sites come to mind as well.

How much “imaginary money” is there in the Tinkerbell economy of stocks, crypto, nfts and maybe even real estate? Doesn’t this belief fund much of consumer demand and therefore inflation. People must know by now that the imploded stocks have little to no value.

Many people have plenty of pain for being suckered into those gimmick assets. but in this culture, as elsewhere, failure becomes extremely quiet. Nobody is going on internet videos flashing around handfulls of lost money.

AMC “should” make it. Crazy situation but the stock price is way too low IMO. Might be a Carvana sort of situation if all things fall into line..

The PHUN thing was wild 400 percent in a day ?

Sweet

“Hilarious” is the wrong word. “Tragic” would be more appropriate. No one wants to lose money on an investment. Not even those who thought they were making diversified investments in high-risk-high-potential-return projects — but that in many cases were being sold a project that had already failed or that at a minimum was in decline.

I love this article but I cannot reproduce the VRM chart. The time axis appears to be shifted by 5-6 months in the figure shown here. In particular there was a “speed bump” pump/dump in June-August 2023, but in the figure shown in this article that is labeled as early 2023? Might be worth a double-check. I’m guessing that since the IPO was midyear, some dates got goofed up in the plotting.

It would also be hilarious to include an inset or separate figure showing the sequential 95% implosion from July 2023 (split-adjusted price around 200) to today’s closing price of 9.95/share. That’s barely visible on the current chart, which being on a linear scale can’t show full details of the recent action.

In the case of VRM, a 99.8% price collapse involved a 50% plunge, a 97% plunge and a separate 95% plunge. After the initial IPO rush, VRM had a 50% collapse from a split-adjusted high of 6000 to below 3000 in 2020. That was followed by some plus/minus 40-60% wobbles up and down through mid-2021, ending back near 3000 again. But then things really went wild with a 97% swan-dive from 3000 in mid-2021 to the 100-level in mid-2022. Some more plus/minus 40-60% wobbles left the stock briefly at 200 in July 2023, followed by another 95% cliff-dive to the current closing price of $9.95 today…

In terms of the time line, it started in June 2020 with Vroom’s IPO, and showed only the years (2020, 2021, 2022, 2023). So each year-label (that little vertical line) was in the middle of that year.

I now inserted the same chart into the article but with time labels every six months (June and December), instead of every 12 months. The Jun-Dec labels (that little vertical line) are now at the end of the six-month period, while in the original chart (which I re-posted below for your reference), the year-labels are in the middle of the 12-month period

For comparison, this is the original chart:

Nice to know you’re still commenting here, WS.

Stocks should not be allowed to split or reverse split, and any rules encouraging them to do so should be abolished.

No splits and many stocks would end up like brk.a at $300,000+ per share. How is the average person supposed to invest in that?

Make that BRK.A $628,000 + COB Friday…

I wonder if part of the reason for these reverse splits is not so much that the companies don’t want to be de-listed; rather, they don’t want their stocks to be literal penny stocks. I.e. its about the perception.

What’s the downside to trading OTC? I imagine most brokerages can still sell you those shares. The only stock I still own is a microcap that trades OTC.

If a stock is permanently banished to the OTC, the company loses its big steady institutional investors. It just gets kicked around by retail traders. Companies can no longer raise funds by issuing more shares. Bond holders get very nervous, and it’s likely that a company like this cannot raise funds by issuing new bonds. It’s really a miserable existence on the OTC for a normal company.

Ahh makes sense. Thank you Wolf.

By normal company, I assume you mean one that wants to grow. This company has been downsizing (sold off two parts of the biz last year).

I like microcaps bc I don’t have to compete w institutional investors.

Talking about bonds those 20 year Treasury bonds are having a hard time finding buyers. Dealers are getting stuck with them. Tick Tock every day we get closer to the dollar being dirt. Which is about what it is anyway! Will the Fed have to come back in as the buyer of last resort?

I’ll be happy to buy some 20-year bonds if the yields are high enough — and so will be the rest of the world, no Fed needed. This Fed-must-buy stuff is just nonsense.

The low yield is the problem. Right now we’re looking at higher inflation for longer, and no one has any idea where that will go, which is a risk that I need to be compensated for with a higher yield. There would be huge demand TODAY for 20-year Treasuries at 5.5%, for example. People would kill each other to get them.

The Treasury Dept. has done everything it can to repress long-term yields, including by switching issuance to T-bills. So now demand for bonds at these yields is low, makes sense. I’m not interested at all at these yields.

BTW, dealers don’t get “stuck” with these bonds. They buy them at auction and sell them to their clients or in the market, no problem.

Specifically, if a stock is included in an index then the stock will automatically be purchased when the index rises at a higher price. Otherwise, the stock will have to be valued at its intrinsic value, which is likely to be less than the index value.

Of course if one were to adhere to Occam’s razor, they would not be wrong to suppose that the reason for doing a reverse split may, in fact, be a ploy to maximize the cash flow to a small group of insiders with larcenous intent.

I’m new to “the market”. Can you explain the mechanisms for r/s split being an opportunity for insiders to maximize cash flow? Thanks in advance!

AMC is getting by because a significant amount of mentally ill people have convinced themselves that owning shares of it will result in them getting infinite money through a financial glitch.

The bond market is ground zero for the integrity of the financial system.

The long bonds with leverage even Hercules would strain to sustain the weight, are a con designed to attract suckers. The long bond rates are a continuing artifact from whatever the FOMC did to take control of the free market because it was failing.

Rather than take the opportunity too institute needed reforms and prosecute the presumed criminals that stole from the American people the most wealth in human history.

They decided to bail out the presumed criminals and reinstate them to the same social level that they previously enjoyed by compromising by the holy grail of competitive monetary markets.

Though not classified as stocks, the so-called inverse ETFs and ETNs are due for reverse splits, if they haven’t already. SQQQ, SOXS, SDOW, SRTY are some examples. The beauty of trading these dog-shits, relative to put options (more dog shit), is that they don’t expire worthless; they reverse split ad-infinitum. The trader can hang on to them, catch the reverse split and sell into the inevitable rally and cut his loss or hold on for another reverse split. Unfortunately, they are not stocks and the trader will not receive a class-action notice in the mail.

There are commenters on this website who’ve bought this garbage and who’ve been awfully quiet for quite some time. Look for them to reappear in the comments section once those dogs start to bark.

Interesting. I use SRS to short housing.

The prospectus says its not intended to be held longer than a day, i.e. meant to track only intraday moves in housing. So its not a buy-n-hold short to bet on long term housing declines.

But it does trade within a fairly consistent range, and pays a dividend bc the fund manager keeps excess cash in bills (the fund uses CDS as its short vehicle). So trading in and out of it as it bounces around, using limit orders, and collecting the dividend income, one can make money of housing’s slow grind down.

Only the poor buy the doggy poo poo that you have cited.

Hey, they were promised that God would take care of them no matter what.

Like the last trip to Vegas where some actor pretended to place her rent money on a long shot gamble.

I think that each one of us are born with a capacity to gamble which forms the basis of innovation. That being said, life is normally distributed. To each his own.

My VIX ETF did that. Had a nice bump up in 2021, but then took a steady road to nowhere, with a reverse split along the way. In that case, it would have surged only if there was a very big market-disrupting disaster. So I’m happy that didn’t happen, I guess.

The first “hard lesson” I learned about stocks was in 2000 while working for a private biotech company with a 400 million dollar annual income stream. Yes, there were profitable biotech companies in the 90’s. The company was going public and my first tranche of stock options would mature. We had a reverse split prior to the IPO and then watched as the folks at the top sold their shares and the stock lost 70% of it’s value in the fall of 2001…

The lessons were, ignore what the CFO says and do what he does; also that profitability doesn’t matter it’s all about capital flows and inside deals among club members.

That is definitely an accurate description of a pile of bullshit from the 90’s from my point of view.

One who lost a fortune is rarely so obnoxious.

///

This is really good news, as much as I am concerned. Definitely a sign of , what I hope to be, a beginning of P/E ratio impact on company stock values, and the return to some level of normal in company value assessment. Let us hope this “disease” keeps spreading. As they say in the heard, you dont have to be the fastest, only the second slowest to survive. Let us see who gets this lesson in finance next.

///

First of all the P/E ratio is a meaningless statistic that always promises more than possible. Next year may be like last year, which continue for the next 5 years, then the earnings will decline for the next 5 years, all the while the cash return from owning the stock is negative if one would have simply sold it and bought short term treasuries.

Or not.

///

Hmmm…You know what? I’m going to read up more on the reality of P/E index, to get to know it better! Thanks for the comment!

///

I remember the big driver of the herd was “block chain” anything. Now seems like “AI” has taken over that spot.

Consensual hallucination seems to be quickly morphing into consensual delusion.

AI is a thief, the ultimate sociopath forger.

To my knowledge the winner may be HNU.TO, a Horizons natural gas bull leveraged ETF trading on the Toronto exchange. The equivalent 2008 price is something like 7.5+ million dollars, yesterday’s price 3.74. The many consolidations come out to 1 for 160,000. But – there’s a news release of Feb ’23 announcing a 1 for 15 reverse split but it doesn’t seem to show on Yahoo’s chart of splits so maybe it’s 1 for 2.4 million.

They call it the Widow Maker, and the average volume for the last year is 5.6 million a day, lots of traders with high hopes to strike it rich, but last year’s value loss was 92%. May be time for another consolidation!

Global X funds and Mirae Asset group just made my growing list of companies to never do business with again with their forced liquidation of the CHIR Chinese Real Estate ETF. Funny timing as they did it just after supposed “support measures” were announced.

Wolf,

Is that 494 reverse split number out of the approx 4500 publicly traded companies number commonly quoted (NYSE + NASDAQ presumably, maybe including SPACs running out their string) or is it pulled from the much larger OTC/Pink Sheet universe?

Either way, Christ on a cracker.

The number of viable publicly traded companies seems to shrink relentlessly, year after year.

Which, given intermediate term macro realities…makes sense…

Money never sleeps is a cardinal variable to be entered into the AI model as one of the candidates that will predict the world that the model is being programmed to do.

AI is the ultimate forger, nothing more.

I believe your catalogue of irrational stock price trajectories will be assimilated and eliminated. A decrease in asset prices seems impractical at the current time. Therefore, the FOMC, members of a club that the great unwashed that rightly own this, potentially, wonderful place to live, are not represented. All decisions of this so called, August Body, should be reviewed with suspicion.

In the neighborhood that I grew up in, opportunity was defined as education.

Your comments are definitely hitting it out of the ballpark today!🌠👍

Regarding the Imploded Stocks List:

Like in “Jaws”, we’ve just seen the giant increase in reverse stock splits in 2023.

“You’re gonna need a bigger spreadsheet”

I’m watching a stock called Latch (LTCH) an electronic deadbolt system. I recently moved into an apartment that had this door lock system and I basically accepted that a keyless entry would ne annoying but ok.

After experiencing multiple problems with the door system and regretting moving to a complex using this cool technology, I was somewhat forced to learn more about the company, and much to my surprise, learned this SPAC-based stock, was an IPO that cashed in a few years ago around $16 and now hovering around seventy cents.

The accounting fraud and stupid technology is interesting, because I’m wondering how this will play out with tenets in buildings, after bankruptcy. I have no idea how many doors are fitted with this crap — but it’s an excellent example of post pandemic stupidity.

Along with AI and a dishwasher and washing machine with remote app access, what more can I hope for?