But if you invested USD three years ago following Buffett’s hype, you lost 5% because the yen crashed, thank you hallelujah BOJ.

By Wolf Richter for WOLF STREET.

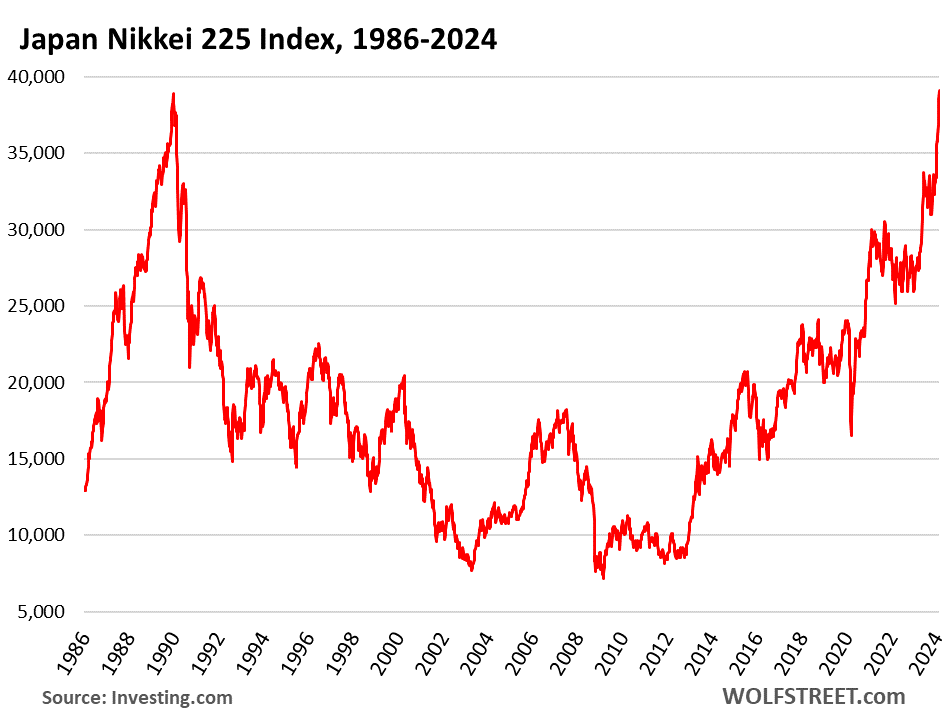

The Nikkei 225 jumped 2.2% on Thursday to close at 39,099, the first all-time high in 34 years, finally surpassing its December 1989 high of 38,916. And the happy moment occurred only after:

- 11 years of massive QE by the Bank of Japan under the doctrine of Abenomics, which included large-scale purchases of equity ETFs.

- Record share-buybacks by Japanese companies in 2022 and 2023.

- Warren Buffett’s hype about Japanese stocks in 2020 (the man who moves the needle with a few words).

- Massive foreign buying, following Buffett’s signal.

So, finally after the 17% gain so far this year and 24% last year, the Nikkei 225 is back where it had been 34 years ago:

The Nikkei 225 is a price-weighted index of 225 large Japanese companies. The composition has changed over the decades. Back in 1989, banks and utilities were the most heavily weighted in the index. Now about half of the index is comprised of technology and related stocks and about a quarter is consumer goods.

By market cap, these are the largest 10 companies in the Nikkei 225:

| Largest 10 Companies in the Nikkei 225 by Market Cap | ¥ trillion | $ billion | |

| 1 | Toyota Motor | 55.5 | 370 |

| 2 | Mitsubishi Corp | 25.5 | 170 |

| 3 | Mitsubishi UFJ Financial Group | 18.3 | 122 |

| 4 | Keyence | 16.7 | 111 |

| 5 | Sony Group | 16.4 | 109 |

| 6 | NTT | 16.4 | 109 |

| 7 | Tokyo Electron | 16.1 | 108 |

| 8 | Fast Retailing | 13.3 | 89 |

| 9 | Softbank Group | 12.3 | 82 |

| 10 | Shin-Etsu Chemical | 12.1 | 81 |

By comparison…

It took the Nasdaq 15 years, until July 2015, and trillions of dollars of money-printing by the Fed to recapture its Dotcom bubble high of March 2000.

It took the Dow Jones Industrial Average 25 years, until November 1954, to return to the high of September 1929.

There are number of major global stock markets that are still below – and in some cases far below – their all-time highs a decade ago or two decades ago, including the major stock indices in China, Hong Kong, Italy, and Spain.

But you lost 5% in three years on Japanese stocks because the yen crashed.

The yen is trading at ¥150.6 to $1. If you took $100 three years ago in February 2021 and bought yen with them at the exchange rate of ¥106 to $1, you would have received ¥10,600. If you invested that ¥10,600 in the Nikkei at the time, and sold today, you would now have ¥14,310, for a nice 35% gain.

But now the yen has crashed, thank you hallelujah Bank of Japan, which is still practicing negative interest rate policy and QE, even as inflation is circulating in Japan, and as global central banks have hiked their rates and are pursuing QT.

So, when you reconvert those ¥14,310 into your beloved dollars to spend in the US, at today’s exchange rate of 150.6, you would get $95.02.

Yup, you made two bets: the first bet on the yen, and you lost; and the second bet on Japanese stocks, and you gained; and the net is that you lost 5% in three years.

Buffett, who’s in the same boat, is praying that the yen will un-crash promptly.

Thank you hallelujah Bank of Japan.

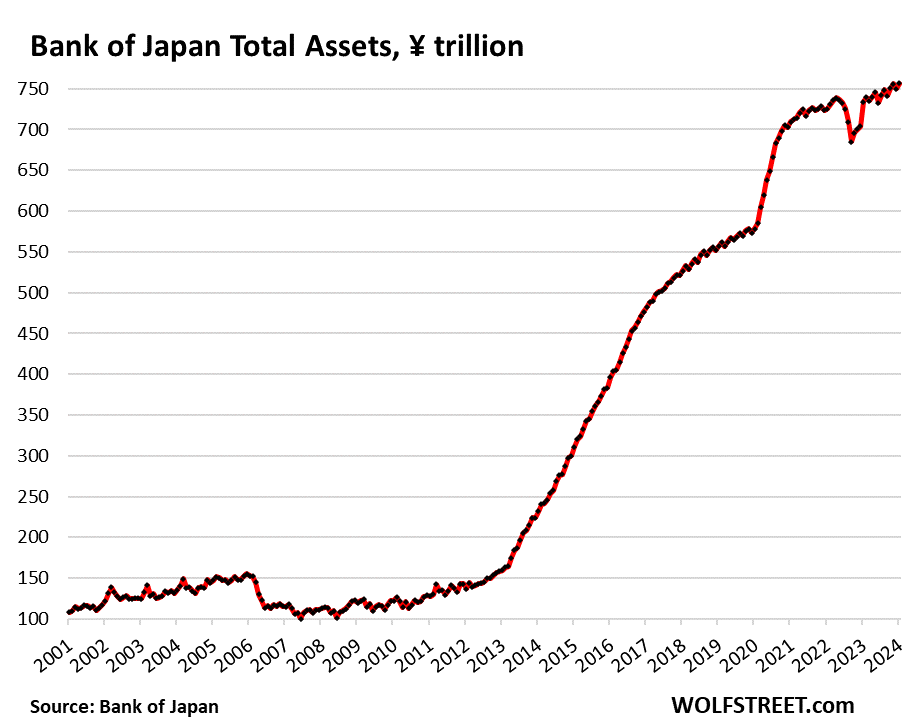

From the beginning of Abenomics in 2012 through today, the Bank of Japan engaged in a huge money printing spree, during which it took its total assets from ¥150 trillion to ¥756 trillion. It now holds ¥597 trillion of Japanese Government Bonds, over half of all JGBs outstanding; and along with a bunch of other assets, it now holds ¥38 trillion ($253 billion) in Japanese equity ETFs and REITs.

So that 400% increase in BOJ assets since 2012 puts the 286% surge of the Nikkei over the same period into perspective. Money printing did it:

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

” high of September 2029.”

That should probably be “1929” :)

Yes, back to the future, thanks.

All gains should be inflation adjusted at a minimum

If the Nikkei 225 were priced on gold, around $420 in 1989, today’s Nikkei is worth about 1/5th of the value back then.

So… if the BoJ is buying stocks (ETFs), which is not unique to Japan’s central bank alone, what are those stocks really worth?

In my paranoid moments I imagine that our Fed uses AI to keep the market on a believable pace of moderate increases. A few dips, here and there, to give it cred. If the BOJ does the same, and they buy ETFs as needed, they can backstop their market until the cows come home. Evidently they have been doing that; the cows have not returned.

I guess the cows will come home when no one shows up to buy Japanese stocks. Or when some good looking bulls show up.

It makes more sense to quote all these foreign stock exchange indexes in US dollars. If the German DAX rises 1% in one day, and the Euro drops 1.5% vs. the US dollar the same day, I have a loss of .5%. I live in a country that uses US dollars.

Looks like someone at FRED already did it and saved it publicly – https://fred.stlouisfed.org/graph/?g=VW4

I especially like that, restated in USD, you can more clearly see the 2021 highs versus today – tracks a lot closer to the S&P.

Yep, the graph shows in dollar terms, the Nikkei is still well below its 1989 high. FRED does nice work.

Interestingly in December 1989 UJ was about 146. So if you had invested in the Nikkei you’d be about even in dollars but down apparently by 2.24 as a result of inflation.

Assuming you bought 100% of your position at the extreme top of the market and received no dividends in 35 years.

I really wonder if the “fiat-print inflation is a a magical fix for debt” scam is really going to work for long in the era of the internet and the much, much better informed masses that it has created.

Even DC seems pretty half-hearted this go-round…sure, Biden occasionally bloviates about malefactors of shrink-flation – but that ain’t a lick on historical episodes of DC blame-shifting, patsy-framing, and villain-inventing when it comes to inflation.

And I’m pretty sure that few in Japan are terribly excited about equity “highs” (outside of the usual meat puppets of the MSM)…not after 30+ years of stagnation (at best).

It would be interesting to get a read on long term Japanese price trends (in housing, retail,…everything) in the wake of all the endless Japanese fiat-priming.

TANSTAAFL.

People always say that we’re immune, because the USD is the “cleanest dirty shirt.”

My position is that it’s not that another fiat currency will replace the USD as the reserve currency. Rather, the risk is that the people, worldwide (and largely because of the internet and its ability to inform), will start demanding real assets. In other words, a global crack up boom. No one will want to hold any fiat as long as there’s a coordinated effort by central bankers to debase it.

Exactly.

For, all their shortcomings, this is precisely why Altcoins get endlessly yabbered about…if the USD still had the faith/ignorance of its holders to rely on…nobody would have *ever* yabbered about Altcoins.

But countries (predictably) abused their currencies to death and public faith has permanently eroded to a point where an enormous army is continually looking for superior stores of value to diversify into.

The politicians did this to themselves (and us) and it will never stop until better stores of value are found. Having seen the future “fix” for excess private leverage/bottomless G debt in 20 years of ZIRP/fiat printing…nobody has *any* faith to lose in fiat any more.

In the end, debauched currencies are like Hitler in his bunker…hysterically trying to command resources/real assets that no longer exist.

You mean bitcoin?

Now manipulated and obfuscated by Wall Street through their ETFs… just as gold was with “paper gold”

A small fraction of bitcoin is actually ‘held’ by people. Most will be pretend bitcoin, or bitcoin that’ll “aaanddd it’s gone” (South Park reference), or can’t be redeemed when the funds are frozen etc.

And housing? Artificially propped and true price discovery difficult to find as most requires debt to get exposure.

REIT and CRE are even protected via their liquidity induced lock-downs so prices can’t tank.

This is the basis of all this mess. Greed. People want a way to get out with their gains, but by definition they can’t, or in doing so they cause the crash they want to escape… or cause bubbles is the things they believe are safe havens due to some new unicorn feature (nvidia?)

I’m sure I read it here before by a commenter, but the only thing worth doing is investing it in yourself, your home, or tools/means to make a good living.

Everything else is at worst an illusion. At best it’s something someone else will exchange something for.

Altcoins and bitcoins etc will be worthless when you actually need them.

And in the meantime WS will now be making sure no one gets a free ride out of them over the long haul.

Huh?

The US dollar is backed by the full faith and credit of one of the biggest, most dynamic economies the world has ever seen.

It his hilarious that you think the U.S. dollar is backed by resources/assets that no longer exist.

Stop, just stop already. Go read “Confessions of an Economic Hitman”. The Federal Reserve Note (FRN) is a debt instrument, the dollar is long dead. The FRN is backed by the U.S. military and the Pentagon.

>No one will want to hold any fiat as long as there’s a coordinated effort by central bankers to debase it.

For something to be a reserve asset it needs to be (a) a huge market, (b) transparent and easy to move in/out of, and (c) an orderly market (rule of law applies).

If you like you could add a fourth condition: (d) not being constantly devalued by printing.

When people talk about some currency replacing the USD, or a basket of currencies, usually the reason they’re wrong is some combination of (b) and (c) — only a few national currencies are big enough to act as a liquidity sink, basically only the yuan, and the yuan has extreme capital controls which attempt to prevent people getting their money out of there. And if the Chinese government were to relax these controls there’d be a flood of money out of the country overnight.

So let’s apply the same reasoning to hard assets. No hard asset comes close in market size to the USD, but let’s imagine that in a crack-up boom they would. As far as ease of moving in/out, maaybe bitcoin could work, if you imagine the Lightning Network was technologically mature and everyone has payment channels established, but anything physical is hard to exchange without transportation costs, assaying, certification, etc etc etc.

But then you get to (c) “orderly markets” and you see that bitcoin is like gold on steroids … sure, it’s a hard asset and has “intrinsic value” in many peoples’ opinions, but its price is set by the marginal actions of coked-up high-leverage traders who are exchanging apocalypse narratives with people trying to operate outside of the mainstream financial system.

Again, you could argue that in a crack-up boom that swelled the size and mainstream-ness of the market, this volatility would somehow go away…but I’d like to see an historic example of that.

Looks like the nutty time or maybe the new normal is just not limited to US…Nikkei back to all time high…Nvidia only knows one way up and now closing in on $2T value? Tightening financial condition? LOL what a joke…

Money made and not spent has to accumulate somewhere. Given mass wealthy inequality is not spent. Bezos but a few hundred million of houses in Florida and that is perhaps a cup of coffee to most people. Ideally earning would be significantly taxed and that money would flow into the society for the good of everyone, especially in cases where societies money significantly contributed to the success(development of GPS for example). Admittedly that will never happen. Every person or class of persons for themselves. A populace divided keep those in power right where they want to be. None of it is accidental.

And that’s exactly the problem with printing money. The foolish central bankers always thought that it would only inflate stonks and that they didn’t have to worry about the price of housing, groceries, energy or anything else.

The problem is that once you print money, you lose control over where it goes. You can’t guarantee it’ll all “flow into the stock market” and stay there.

Investors going on a rampage through the housing market is a good exmaple of what happen.s

Bernanke, pg. 287 in his book “The Courage to Act”, “Lower long-term rates also tend to raise asset prices, including house and stock prices, which, by making people feel wealthier, tends to stimulate consumer spending-the “wealth effect”.

Link: “Changes in Wealth and the Velocity of Money”

https://files.stlouisfed.org/files/htdocs/publications/review/87/03/Changes_Mar1987.pdf

Why isn’t this criminal (and yes, he is a criminal) in prison breaking rocks and making license plates?

Escrierto,

Exactly what laws did he break?

I think he was horrible at his job, but that isn’t illegal.

Rule of law us useless in this country if people refuse to understand what it means. Chanting “lock her up” at a idiot rally is not rule of law.

Yes, Jim, you are right. There are no laws against looting the country to benefit the oligarchy and putting millions into crippling poverty.

“From the beginning of Abenomics in 2012 through today, the Bank of Japan engaged in a huge money printing spree, during which it took its total assets from ¥150 trillion to ¥756 trillion.”

Not just Japan, but all countries. Consensual hallucination or Masterbati_n :)

Today, our markets are also marching in tandem :)

Howdy Lone Wolf. If a stupid question, sorry, it comes from an old fool.

During ZIRP, did you think the US was considering or could have gone to negative rates??

There’s no such thing as “zero-bound”.

An amendment to the Federal Reserve Act in 1933 established The Federal Open-Market Committee and gave it the power to control Total Reserve Bank Credit. The Fed can now buy an unlimited volume of earning assets. (With the federal debt at over 34 trillion, and expanding, and billions of dollars of “eligible paper” available, the term “unlimited” is not an exaggeration in terms of any potential needs of the Fed.)

In the process of buying Treasury Bills etc., new Inter-Bank Demand Deposits (IBDDs) are created. These deposits can be cashed by the banks into Federal Reserve Notes, without limit, on a dollar-to-dollar basis.

The Fed has always steered clear of negative policy rates. They always called 0% the “lower bound.” And they still do. “Lower bound” means they consider it the lower limit below which they will not take their policy rates. They obviously could take their rates below 0% but don’t.

I always took those pronouncements seriously because they made sense. The US Treasury market underpins much of global finance, and negative yields could be catastrophic, including blowing up money market funds that would ALL “break the buck.” So I was always pretty sure that the US would never see NIRP. It’s just too risky. And for what benefit?

According to sources familiar with the matter, the ECB governors are praying on their knees every day before they go to bed, thanking God that He brought inflation upon the Eurozone to give the ECB an excuse to get out of NIRP. It did a lot of damage there, including to the private pension system that individuals buy into voluntarily which is mostly run by life insurers (annuity-type programs). I know this from German friends. Those private pension payouts got devastated, and that is now hurting consumption and the economy.

Howdy Lone Wolf and Thanks.

“the ECB governors are praying on their knees every day before they go to bed, thanking God that He brought inflation upon the Eurozone to give the ECB an excuse to get out of NIRP”

Initially, Mrs. Legarde had no desire to raise interest rates and argued that inflation was transitory.

At that time I cursed and prayed every day to God to punish her. lol

Great report.

If Buffett had bought a hedged Nikkei 225 or Japan ETF, such as CNKY or IJPD, he’d be up 50-100% since 2020.

He is short the yen, so he’s crushing it. He issued billions in yen-denominated debt against this trade.

I’m still trying to figure out how Japan with its 3 times debt to gdp and growing is able to run close to zero interest rates. If Argentina tried that, they would get nobody buying their paper.

And nobody seems to care. Wtf.

Two very different economies/societies.

Quick, name a multinational company from Argentina. Now name 3 from Japan.

Exactly.

Almost all of Japan’s debt is owned by Japanese institutions, including the central bank, so they are impoverishing themselves but there aren’t enough outside investors to really affect rates. Something like 70% of the debt is held by the central bank.

A unique market event met with a boring article describing the market event. Japan’s stock market went up dramatically and then it fell dramatically and it took 34 years to recover, Yipee.

Wait, what? Japan’s debt to GDP ratio still dwarfs that of all other nations on the planet.

Hallelujah, a simple explanation for simple minds, Google approved!

Printing money works for some but not for others. Japan and the USA are not the only central banks that can print their own money. That said the outcomes of doing so can vary dramatically but we must be mindful, so, let’s not dig too deep.

Global debt has exploded since 2008 but what has not changed is how it has to be paid back. That is right, it must be paid back in US dollars. Until mass defaults occur, the dollar will always be in high demand.

Inflation averaged over 1.0% per year over the period so even in terms of inflation adjusted yen it is down nearly 100% over the period. In dollar terms it’s even worse.

I believe Japan will be the first G7 economy to go bankrupt in recent times.

A country which prints its own currency can never go bankrupt.

The only repercussion is: Japan would keep printing and purchasing power of JPY would keep going down.

Same thing for USA: In last 2 decades, USD has lost most of its purchasing power –> lowering of quality of life for US citizens where basic home has become a luxury/un affordable to most but US would never go bankrupt.

At least it used to be that most bonds were gotten by Japanese folks.

Of course the big players are able to hedge and when they do it they can do it cheaper than an ordinary person.

Good ole Buffet probably is 100% hedged which is not mentioned in the article…

But, who cares if this or that index is at an all time high or even low.

Unless you only invest in an index fund the number is meaningless.

Individual stocks have zoomed and also fell like a rock during that time.

How have the Japanese people not rioted over the BOJ’s policy? Inflation went above 4.0% a year ago, although it appears to be moderating recently.

Japanese people don’t riot. They try to figure out how to politely live within the system they’ve got, and at night, they cry into the pillow, as they say. But the government is also taking care of some of their needs, such as healthcare, pensions, providing infrastructure, etc. with all this money it borrowed.

I read an old Japanese proverb: “The nail that sticks out gets hammered down”. Also losing WWII to us round-eyed devils did not help the Japanese psyche. The Japanese economic miracle was mostly due to successfully copying American production innovations. I remember growing up when Japanese products were considered junk, much like we consider Chinese products today. Now they make some very fine products.

JITP, W. Edwards Deming and learned all that biztech at the time at JHU from an old retired US ARMY Colonel who just loved Deming. Surprised the Japanese never deified him to Godhood status as in their Manga/anime culture. Perhaps they did and I missed it but still have the student loan to pay from that ride

At the manufacturing company that I work for, they are all about

Kaizen events and the Shingo model. Japanese companies may have copied American production innovations after WWII, but American companies are now copying Japanese companies.

To some degree, the Japanese have deified Mr. Deming. We saw several statues honoring him when we toured Japan.

WilliamL – you might find some interest in reviewing Deming’s effect on Japanese industry after being politely-but-generally scorned by the American one post-WWII, followed by the governmental role of the MITI in the realm of Japanese exports in engineering the rise from-the-ashes of the ‘tin-toy’ era…

may we all find a better day.

For some reason, the financial media decided to highlight NVIDIA & A.I. bubble hype as their lead story instead of the world’s 3rd/4th largest economy’s main stock index reaching a 35-year high, which is a far more momentous occasion.

Many in the financial industry weren’t even born when the Nikkei last reached 38,000.

I had to laugh when you began your comment “For some reason…” Yeah, right. Motto of the media, “Nothing to see here. Move along.”

Pretty sure Buffet made the trade based on issuing nearly zero percent yen bonds, and then using those proceeds to buy stable undervalued dividend paying equity. The dividends exceed his bond interest payments, so he is effectively getting the equity for free. Buffets trades are always something like this.

ATH across the entire globe… This surely couldn’t lead to more inflation and higher rates… Quick better pull the rug so we can get a rate cut

Tesla’s market cap is nearly twice Toyota’s; no one can print money like the Federal Reserve.

It goes against everything he has ever stood for, but if I was Warren, I would be tempted to dump after his pump

Gee..what a bunch of comments by folks that really don’t know WTF they are going on about!

I’m not a genius, but I’be liked in Tokyo between August 1989 until May 1999 and I’ve been married to a Japanese lady for 46 years. I’m spending half my time in Tokyo with her and the other half living off grid in the San Luis Valley CO.

SO to answer a few questions….Jackson Y the Japanese have not rioted over BOJ policy because 1) they’ve been trained (brainwashed) since 2 yrs old NOT to rock the boat & to not to make too many inquires into subjects that above above their paygrade.

To Michael Donahue…No…the Japanese economy will not be the 1st G-7

economy to go bankrupt. Even though the BOJ (as Wolf points out) has

printed alot of 10,000 yen notes out the Wahoo and bought a shitload of

J Bonds and owns a high percentage of the Nikkei 225 ETFs (& stocks) it all works until it doesn’t (again as Wolf has pointed out many times) there is the “carry trade” where many BILLIONS of Yen are borrowed by many countries in Europe and Amerika (which benefits the Japanese) and

then it id arbitraged against other currencies or investments (trades) on other countries to profit from the difference between what the G-7 countries pay to borrow the Yen and invest in something other than the Yen or Japan.

Actually one should be more worried about when (not IF) this is not possible (especially for the French, Dutch and Germans) because the BOJ is making an environment where the overseas Yen will be repatriated to

Japan by large companies which will be “good” for Japan and a “disaster” for the “Carry Trade.”

AND….I read a blurb on Bloomberg a few days ago written by one about “Value Trap (PRC) versus Growth trap (Japan) and how “the Japanese Economy has fallen into a RECESSION” because of a slight decrease in GNP for the 2nd consecutive quarter

(which is of course the definition of a “recession.”) & Germany’s 4th quarter GNP came in like (decimal point) TWO Tenth’s lower than Germany!

Well I don’t know where the author is living…probably NYC or maybe Singapore or Shanghai….But I wrote her and email some pics & my “boots on the ground” anecdotal evidence/opinion that ‘NO…I don’t think the Japanese economy is “in a recession.”

So too much BS in the MSM and too much BS about Japan and how screwed up their economy is/was & will be.

Conclusion….even though their debt is about 280% or more than their GDP….compared to America’s 125-133% (which basically means that for every ONE US dollar spent by the government to “goose the economy”

it is really only generating 0.65 (65 cents) towards the GNP.

Obviously it’s much more complicated than this and all long time WolfStreet reader’s are aware….I’m, not an economist & I’m not Debt Free Buba either.

Buit I would be much more concerned about what’s going on in the good old US of A and what’s coming down the pike than I would be about what’s going on in Japan!

As the Japanese idiom says, “There’s no cure for stupid.”

> ‘NO…I don’t think the Japanese economy is “in a recession.”

Have you walked down Azabujuban shopping street and surrounding streets lately? I do every day, and count about 8 “brand” (a.k.a. pawn) shops. There were none before COVID. Something has changed, and not for the better.

Comparing Japan to America is silly. HUGE cultural differences between the two countries and considerably more stupid in the latter.

In fairness, you can hedge forex. Don’t know if Buffett did, but he could.

I’m not saying that makes Nikkei a great play, especially compared to the US, which aparently can do no wrong.

Just that “Buffett… is praying that the yen will un-crash promptly” assumes a lot. Maybe he made that someone else’s problem.

And if not Buffet, then someone else who correctly predicted that the Yen would depreciate and the Nikkei would appreciate under the BoJ’s policy. Which seems obvious with hindsight — as it always does.

Bubbles everywhere all over the world. Nikkei bubble, Nasdaq bubble, mother of all bubbles Nvidia bubble, AI bubbles, “super microcomputer” bubble, Arm bubble and several other bubbles created by money printing and false hopes of happily ever after AI world. We are living in end times and there will be more wars and worst recessions coming on the way. When the next disaster strikes things will fall apart very quickly and Fed will have no option to print money with mounting debt. Until then keep blowing these bubbles.

Bubbles inflate slowly, but when they pop, they pop very fast. Like taking the stairs going up, and the elevator going down. First ones out win, most everybody else loses. After the sudden collapse, the winners pick up the remains for pennies on the dollar. Rinse, repeat. Seems most every market is a bubble now.

I live in Tokyo. Unfortunately, due to the junk exchange rate, Japan has suddenly become a backpackers’ paradise. Never thought I would see that, but the government is apparently happy with it.

When I spent half a year “traveling the world with a backpack” in the 80’s I didn’t go to Japan since it was so expensive. I recently read Wolf’s “Big Like” book where he mentioned Japan was still expensive for young travelers in the 90’s. My one and only trip to Japan was about 20 years ago when I traveled with US Army Colonel friend who had been stationed at “Camp Zama” for the previous three years (and learned some Japanese).

Tokyo was regularly in the top 5 cities in the world for cost of living for decades – until a couple of years ago, now it’s down to 60th out of 173 (per Economist Intelligence Unit).

It’s a great value tourist destination now, and not so crowded now the Chinese aren’t traveling like they did before Covid.

Japan for whatever reason has been able to maintain an extremely closed society and more importantly an extremely closed economic environment while it continues to expand its economic footprint in a much more accepting economic world.

The USA which does allow much more accommodating social and economic liberties, at least has a similar unified debt structure.

Compare this reality to that which the EU and China face.

The EU does not operate under a unified debt instrument but it does utilitze a common currency. Germany can borrow at dramatically lower rates than say Italy, this is actually important.

China’s debt problems are even less opaque than that of the EU.

Sure, China’s external debt to GDP as reported is insignificant and yet its internal localized debt is actually catastrophic.

To me, so many economic realities that should be discussed are simply glossed over.

I get how an extremely overly compensated govt. employee would want to paint a statistical portrait of a great US/world economy to keep their job.

What I do not understand is why it must be parroted by so many others?

Nasdaq with a 500 point rally today. All time highs everywhere.

I’m sure it’s part of the FED’s ‘let the financial conditions be loose so we can keep those conditions tighter for longer’ brilliant self contradicting nonsensical plan.

How much of that gain was NVIDIA?

Probably most of it at this point. The Mag 7 isn’t even really 7 stocks anymore. Down to probably Mag 4.

TSLA – peaked July 19 @ 299.29

AAPL – peaked Dec 14 @ 199.62

GOOG – peaked Jan 29 @ 155.20

So META, MSFT, AMZN, and NVDA left. The latter being the only one of those four having substantial gains and the rest flattening out a bit the last week. So maybe becoming Mag 1 soon and then sense gets knocked into people/algos.

“TSLA – peaked July 19 @ 299.29”

Sorta. It actually peaked at $414.50 in November 2021 and has dropped 53% since then.

Sorry Wolf yes you are correct! I meant to say in 2023 high when the media kept using Mag 7 term (FAANG/FAANGM prior to that in media). Thanks for the correction as it makes the Mag 7 look less impressive zooming out. :)

And the Shiller PE currently stands at 34.25 with a mean of 17.09 and median of 15.96, which has only been higher at Y2K and recently in October 2021. Even 1929 only made it to 31 and a half.

At the moment the Japanese reflation isn’t working because although nominal wages have growth, in real terms the Japanese are earning less.

The Japanese still have the same issues as before. Last week my Japanese wife started her 6 months unemployment benefit at 70% of salary(around that not sure exactly but its relatively generous but short-lived). After 6 months of this government expenditure she will be re-employed by her old employer in exactly the same job and exactly the same conditions. The reason for the 6 month employment break is that at 5 years she would otherwise receive the legal protections of a full-time employee.

The whole place is like this. So of course everybody saves.

The reason for the interest in the Japanese stock market, or Japanese real estate, is purely imo the repatriation trade of 7 trillion USDs worth of overseas assets. This is additionally why the BoJ can be so insouciant about yen weakness, because they have 7 trillion watching the yen waiting for a purchase.

Also, for the government debt position, in aggregate with private debt the position is 500% roughly equivalent with the UK.

Eventually, one way or another, 7 trillion heads back to the yen, whether its for inheritance tax or care homes. Having said that, and thinking in GBP, I’ve been over when Japan was at 240 yen and its now at 190 so there is no reason to assume we are seeing the bottom now.

So. With all of that “money printing”, and for all those many years, where is the raging inflation?

Someone somewhere is wrong about interest rates, “money printing” and inflation, but damned if I can actually figure out what.

Easy to forget how long ago that was. Back then the Nikkei high was bubble territory. If I recall Mitsubishi bank went bust and had to be bailed out. The directors were put on prime time TV having to apologise in humiliating fashion, bowing and crying at the same time. They looked like they’d have preferred 12months behind bars.

Why didn’t they do the honorable thing and disembowel themselves?

It will be like MERVAL Index of Argentina soon, which means Yen be like Peso…

Wolf,

To be fair to Buffett, he is hedged against the yen because he was able to borrow at ridiculously low rates in actual yen in order to make his investment.

The dividend from his investments cover his interest payments (and more), and he is hedged against currency swings. He has enjoyed the upside jump without any negative currency stuff.

Having the world’s strongest balance sheet guided by one of the sharpest investment monds does have it’s advantages.

FYI, Buffett’s comment on house purchasing.

He is recently quoted as saying he bought a house 60 plus years ago but would be money ahead if he had rented all these years and used that house money instead for “investing”. An interesting comment for sure.

It is important to remember that like most high profile investors Buffet is a pro at “talking his book” (he wants people to buy Berkshire stock not homes). I’m sure that if “he” (one of the most successful investors of all time) invested the $32K his home cost in 1958 he would have more than the $1.36mm Zillow says the place (at 5505 Farnam St. in Omaha) is worth today. Since Zillow also says the place will “rent” for just over $100K/year I’m betting that he has not done a DCF analysis of how much he would have if he “invested” the extra cash he had (~$70K/year today) from owning vs. renting each and every year for the past 60 years. I was just talking to a friend that “made money” on a car he bought a decade ago and just sold. I reminded him that he forgot to back out the money he “could” have made if he rented his garage on the SF Peninsula for over $1K/year and put the money in an index fund if he didn’t need the space for his toy 356).

You didn’t factor in the currency conversions assuming the people live out side of Japan. I wish they’d imprison the people responsible for this rigging like they did to the bankers in Iceland for basically the exact same thing.

Excellent, excellent read Wolf, thanks again.

Will share it with my gaijin and non gaijin buddies here.