The Good, the Bad, and the Ugly?

By Wolf Richter for WOLF STREET.

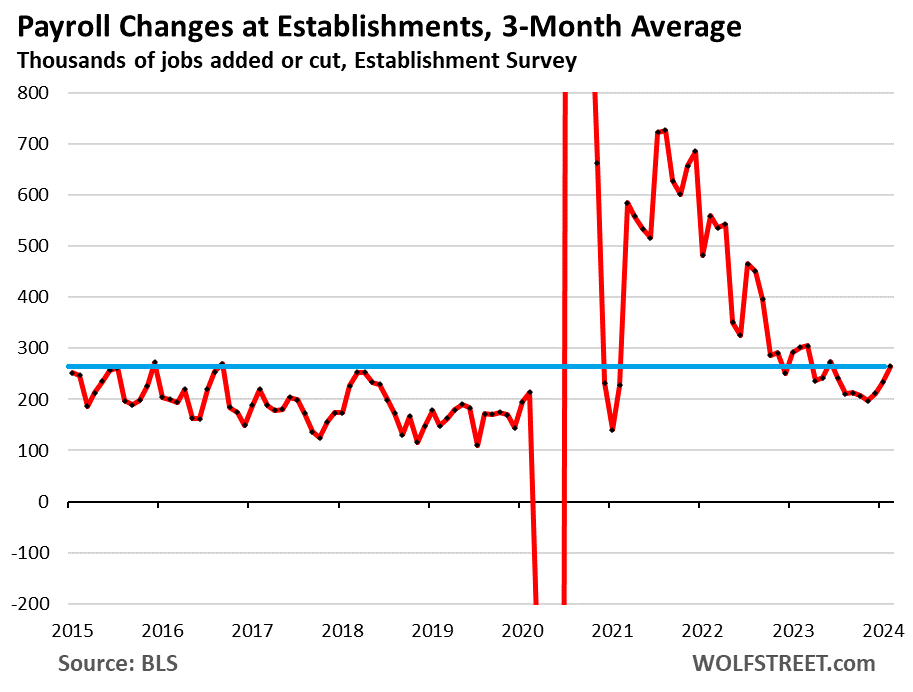

Employers added 275,000 employees to their payrolls in January. Over the past three months, they added 794,000 employees or on average 265,000 per month, according to data from the Bureau of Labor Statistics today. These increases are at the upper edge of the increases before the pandemic. But they’re not spread equally across the economy.

Some sectors have surged to new highs, such as construction. Others are plateauing at very high levels, such as Manufacturing and Professional & Business Services. But others are heading lower. Retail has a structural problem. Information, where many tech and social media companies are, dropped sharply, but in recent months re-added jobs hand over fist. And then there’s oil and gas extraction: US production has soared, making the US the largest producer of crude oil and natural gas in the world. But employment around drilling rigs is a fascinating phenomenon. And we’ll look at all of them.

In total, business and government entities added an average of 265,000 employees per month over the past three months:

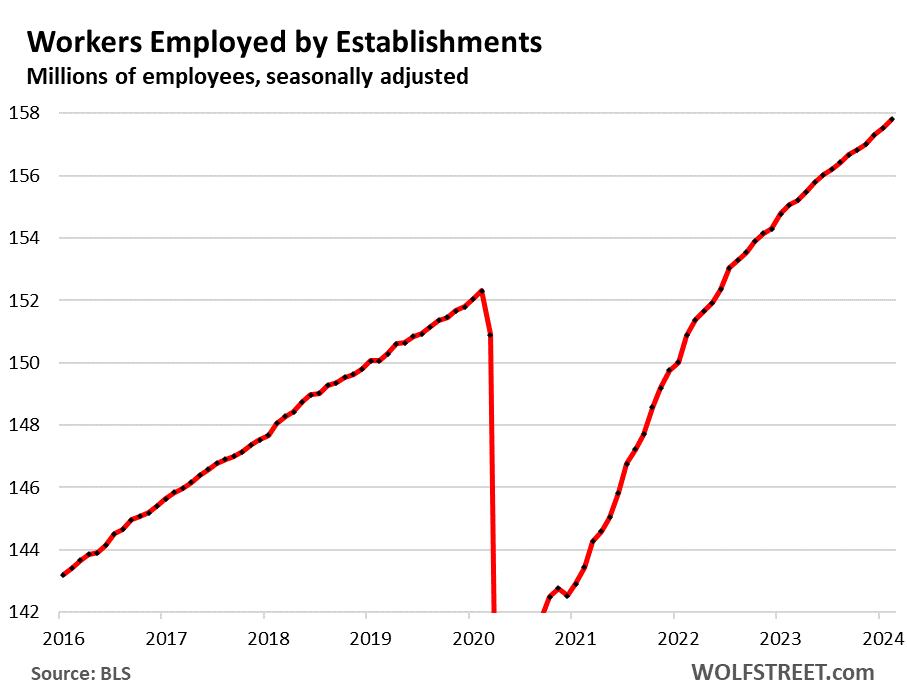

This brought total payrolls to 157.8 million, up by 2.75 million from a year ago.

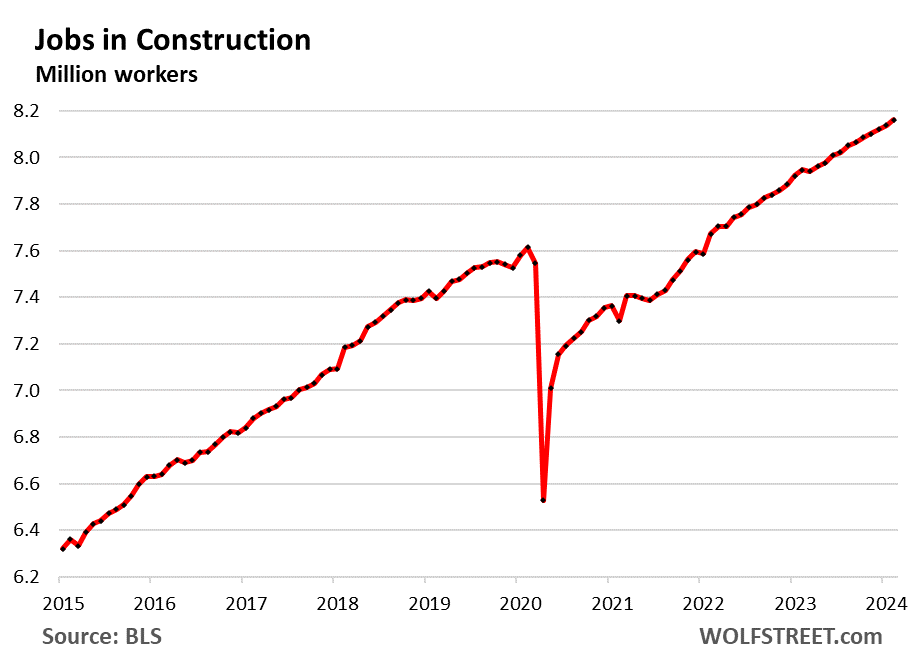

Construction, from single-family housing to highways. We have watched how homebuilders are maintaining sales by cutting prices and buying down mortgage rates, and they’re building at a solid pace. And we’ve been amazed by the eyepopping boom in spending on factory construction. And overall construction payrolls surged to another all-time high:

- Total employment: 8.16 million, new record.

- 1-month growth: +23,000

- 3-month growth: +60,000

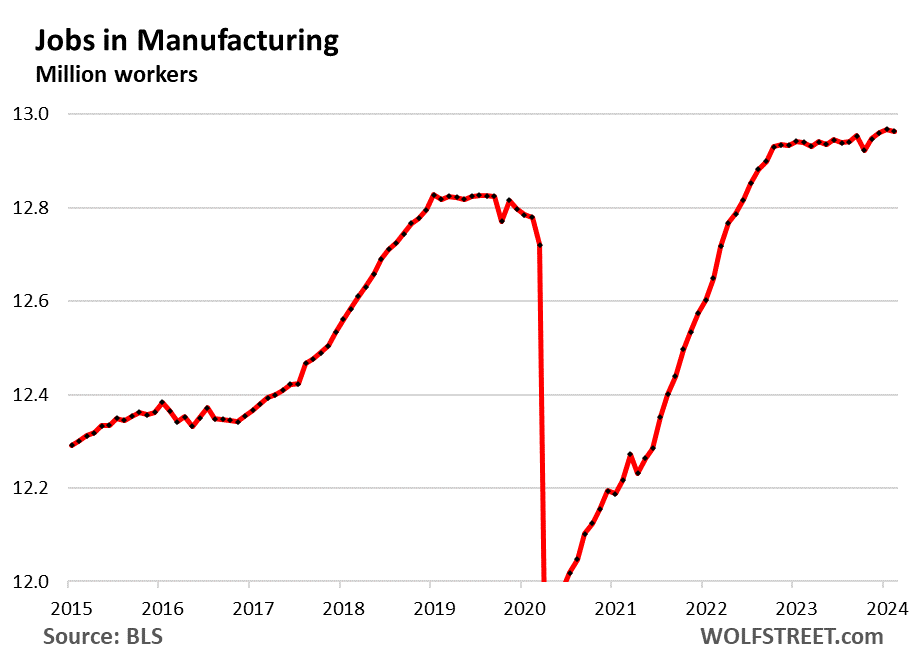

Manufacturing: Employment has formed an upward slanted high plateau for a year after the post-pandemic employment boom. Strikes are occasionally putting a dent into it, but when the strike is over, employment recovers. February employment was the second-highest, after the recent high set in January.

- Total employment: 12.96 million

- 1-month growth: -4,000

- 3-month growth: +16,000

The categories are by work location. The surveys are sent to business facilities by address. The primary activity at that facility is what determines the category. Just to illustrate: A worker at an Amazon fulfillment center counts under “transportation and warehousing”; a driver operating out of an Amazon delivery center also counts as “transportation and warehousing”; a worker at an office of Amazon’s AWS division would count under “Professional and business services”; a worker at a location that deals with the retail aspects of Amazon’s business would count under “Retail”; a worker at an office that primarily works on the software aspects of Amazon’s ecommerce business might count under “Information.”

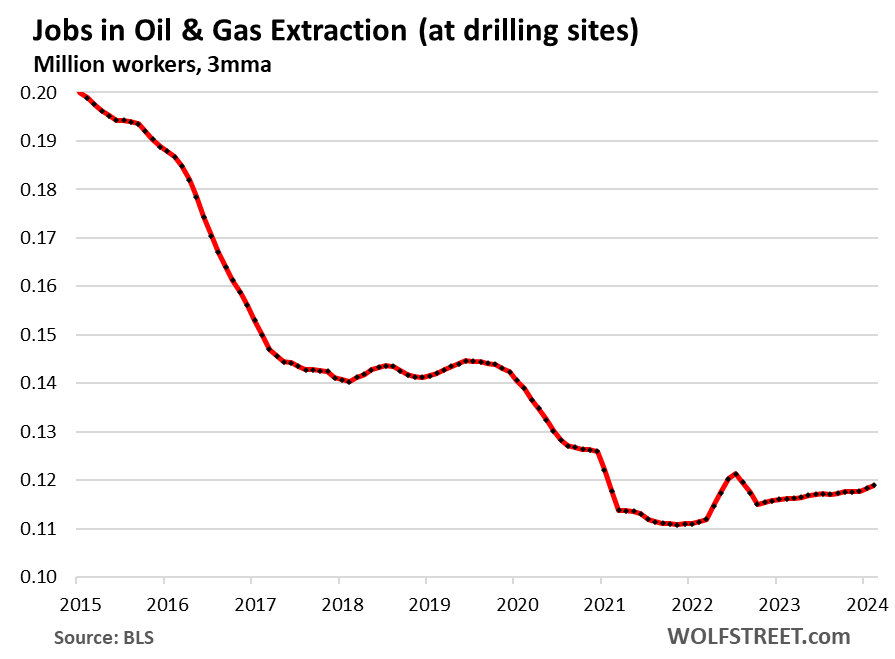

Oil and gas extraction, tracking employment on drilling sites. This tiny sector in terms of employment is huge in global significance.

US production of crude oil and natural gas has exploded since fracking became a big factor in 2008. By now, the US has become the largest producer of crude oil and natural gas globally, with crude oil production in 2023 soaring to a record of 12.9 million barrels per day, as the US became a net-exporter of crude oil and petroleum products; and with natural gas production soaring to a record 41.3 trillion cubic feet in 2023, as the US became the largest LNG exporter in the world.

The oil and gas sector has armies of workers engaged in technical, scientific, management, and support work in office towers and labs, and those employees are accounted for in the vast sector of Professional and business services and other sectors. And it has workers engaged in the Transportation sectors, etc., that are accounted for in their respective sectors.

But only a small number of people work around drilling rigs. And even as production has soared, employment plunged during the years of the Great American Oil Bust starting in 2015, when over production cause the price of oil in the US to collapse, and hundreds of drillers filed for bankruptcy. The solution was technical innovation, cost cutting, and labor efficiencies to bring down production costs.

Employment around drilling rigs bottomed out in late 2021 and has since then picked up some but remains very low despite record production.

- Total employment: 119,000

- 3-month growth: +2,000

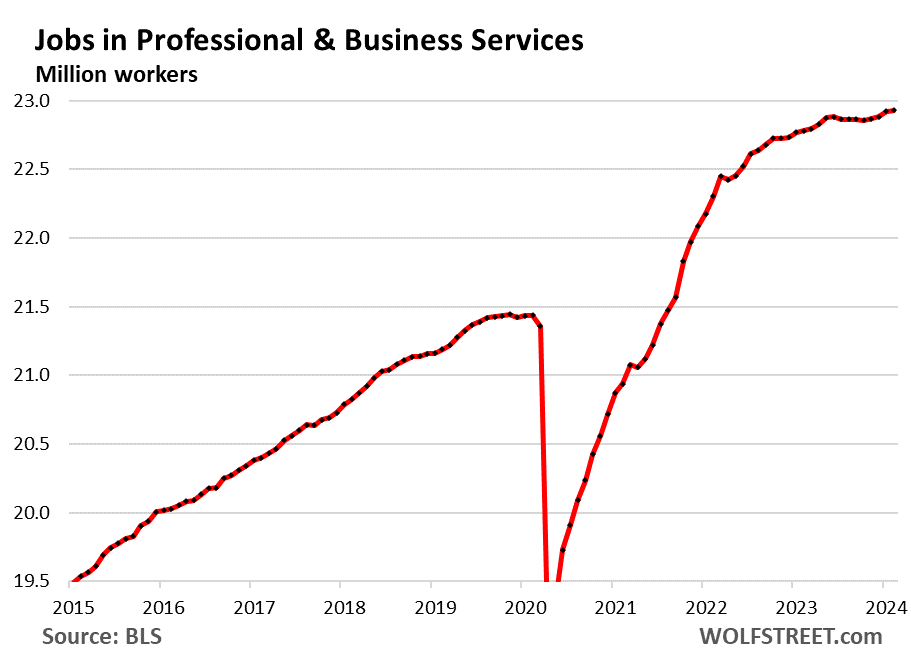

Professional and business services, the largest sector by employment, includes Professional, Scientific, and Technical Services; Management of Companies and Enterprises; Administrative and Support, and Waste Management and Remediation Services.

Some of the tech and social media companies are included here, others are in “Information” (below) or in other categories.

- Total employment: 22.9 million, a new record

- 1-month growth: +9,000

- 3-month growth: +62,000

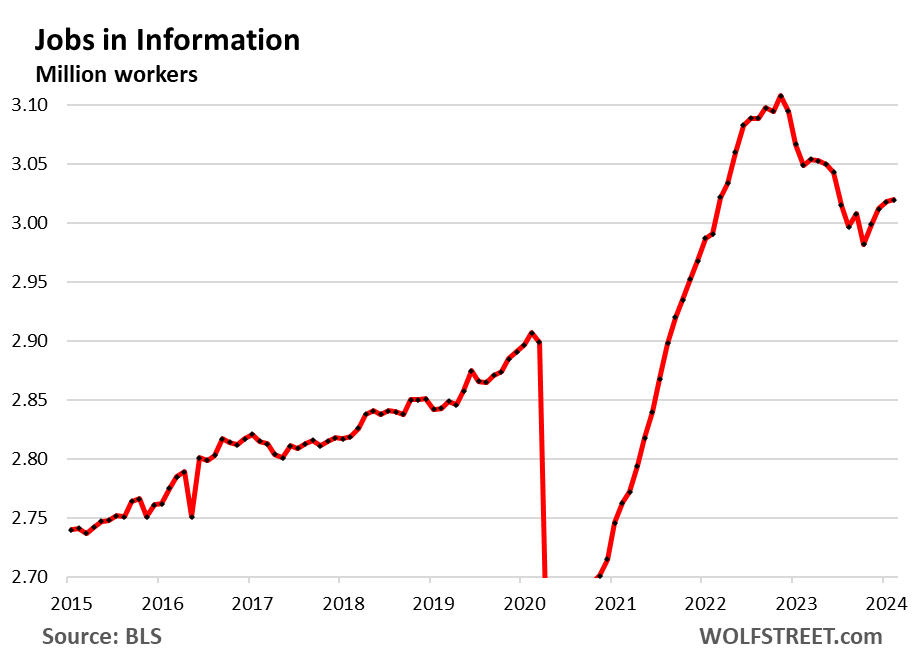

“Information” is a small sector that includes some of the tech and social media companies with big layoff announcements in 2022 and early 2023: web search portals, data processing, data transmission, information services, software publishing, motion picture and sound recording, broadcasting including over the Internet, and telecommunications.

- Total employment: 3.02 million

- 1-month growth: +2,000

- 3-month growth: +21,000

Employment had peaked in November 2022, then over the next 12 months had dropped 4.2% through October 2023. But in November, employers started adding again, and February marked the fourth month in a row of increases. AI mania had a lot to do with it:

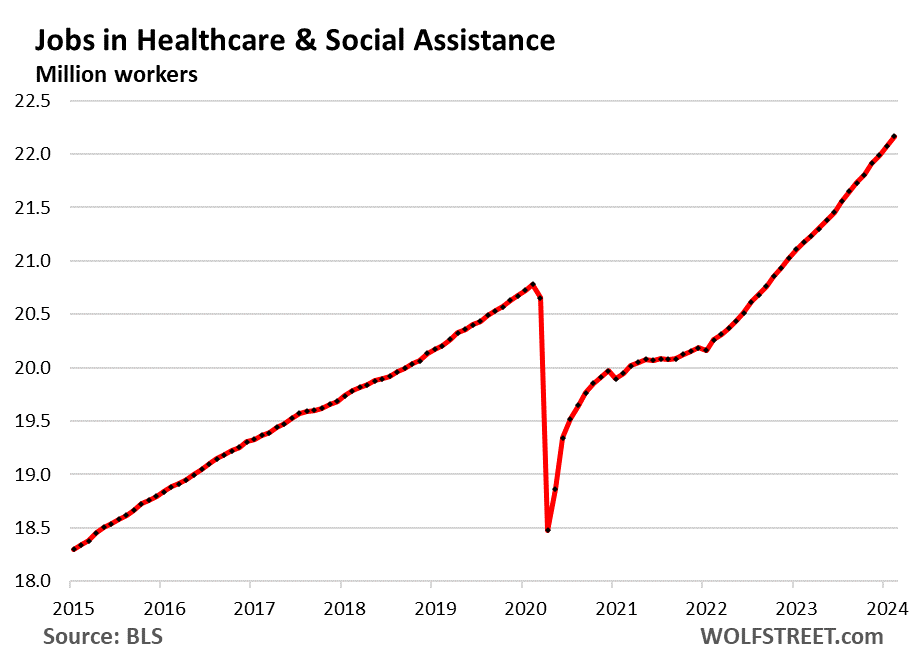

Healthcare and social assistance: This second largest sector is an employment juggernaut.

- Total employment: 22.2 million, a new record

- 1-month growth: +91,000

- 3-month growth: +253,000

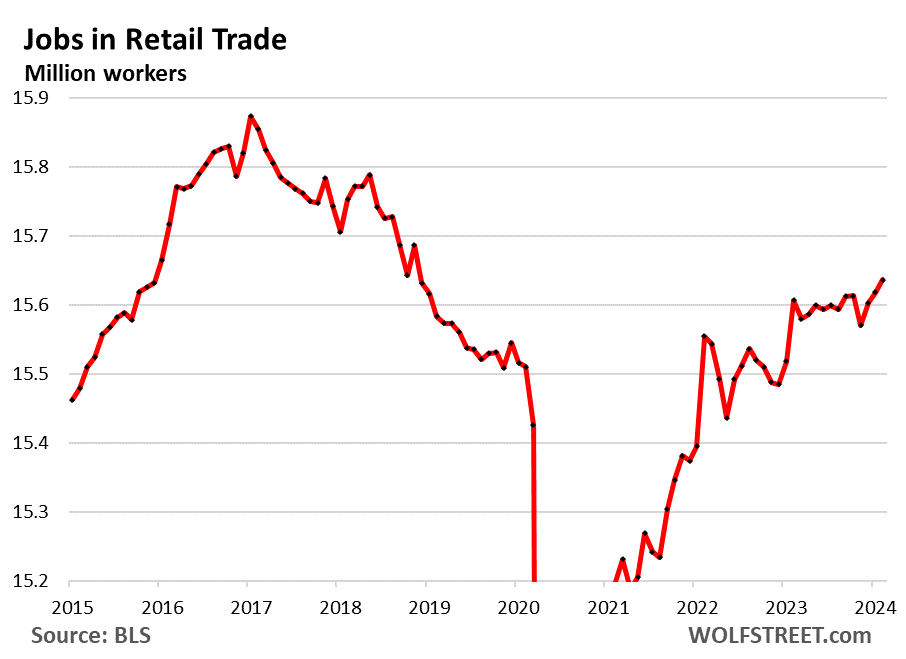

Retail trade includes workers at brick-and-mortar retail stores – malls, auto dealers, grocery stores, gas stations, etc. – and other retail locations such as markets. It does not include the tech-related jobs of ecommerce operations, and it does not include drivers and warehouse employees. A big portion of this sector has been under heavy pressure from ecommerce:

- Total employment: 15.6 million

- 1-month growth: +19,000

- 3-month growth: +66,000

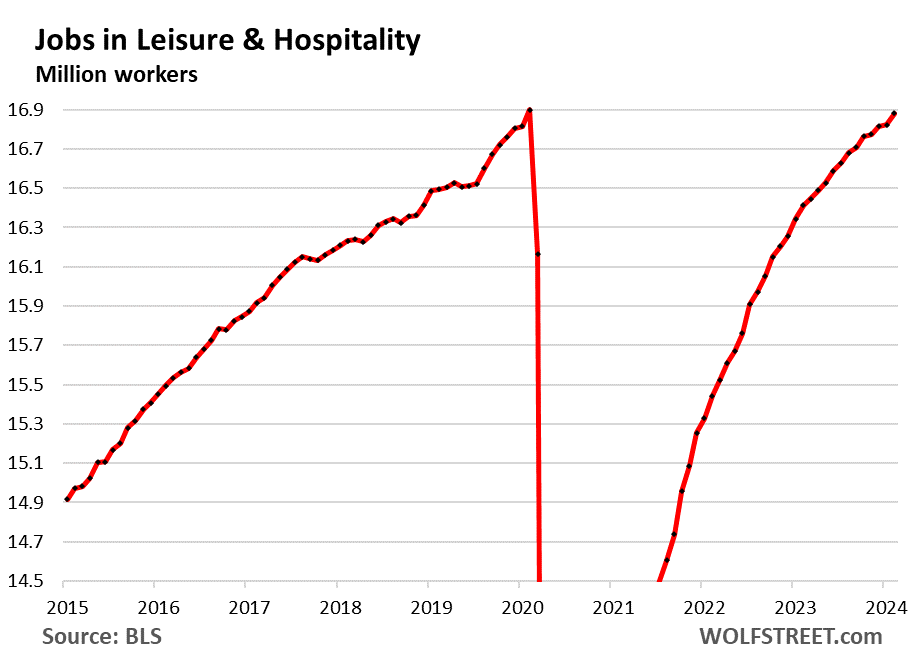

Leisure and hospitality – restaurants, lodging, resorts, etc. – is now back at its prior record of February 2020. Employers have had a hard time hiring, as working conditions and schedules are often tough, including split shifts, weekends, holidays, and evenings. And pay can be relatively low, and other sectors with higher pay were aggressively recruiting. But they’re back where they had been four years ago.

- Total employment: 16.9 million

- 1-month growth: +58,000

- 3-month growth: +107,000

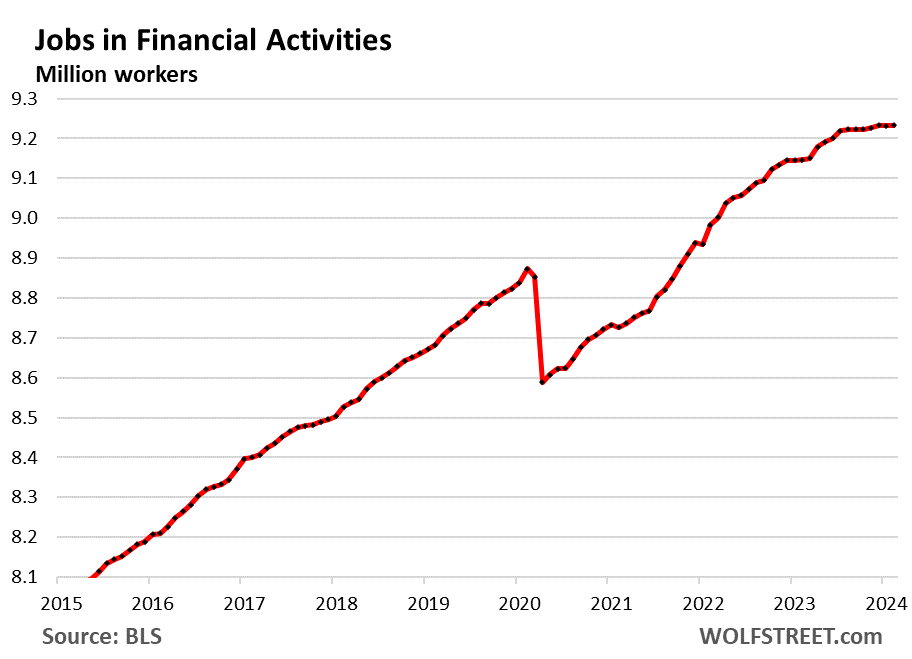

Financial activities include finance and insurance plus real estate (renting, leasing, buying, selling, and management). Employment has been on a slightly upward-slanted plateau for the past 8 months, after the big gains in the prior years.

- Total employment: 9.2 million

- 1-month growth: +1,000

- 3-month growth: +6,000

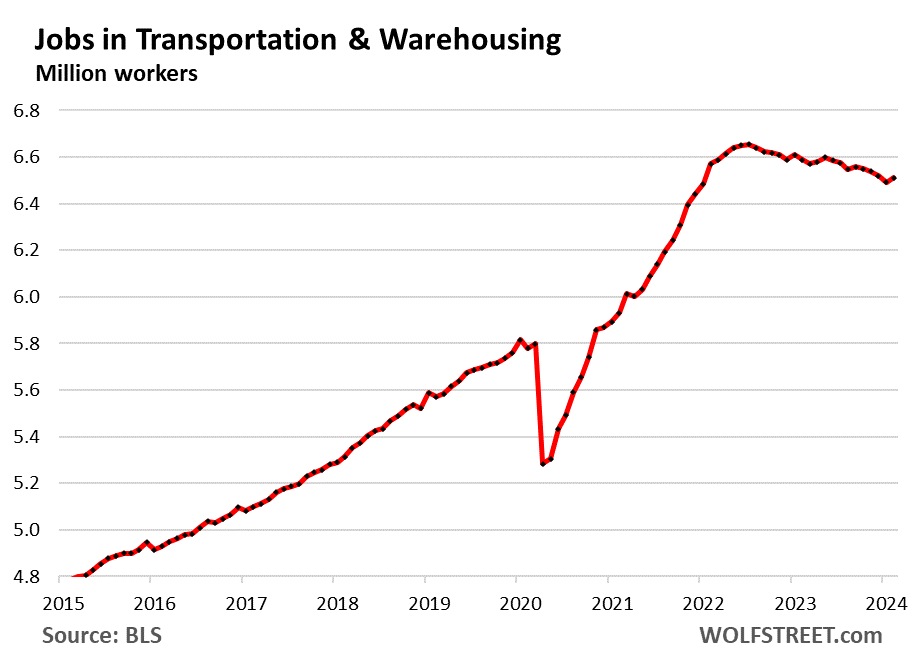

Transportation and Warehousing: the breathtaking demand for goods in 2020 through 2022 (that all had to be transported) triggered transportation nightmares and led to record surging employment. But then the goods sector reverted to something close to normal, and employment in transportation and warehousing began to decline off these record high levels. But February showed a big increase in employment, the first increase in months, and the biggest in over a year:

- Total employment: 6.5 million

- 1-month growth: +20,000

- 3-month growth: -28,000

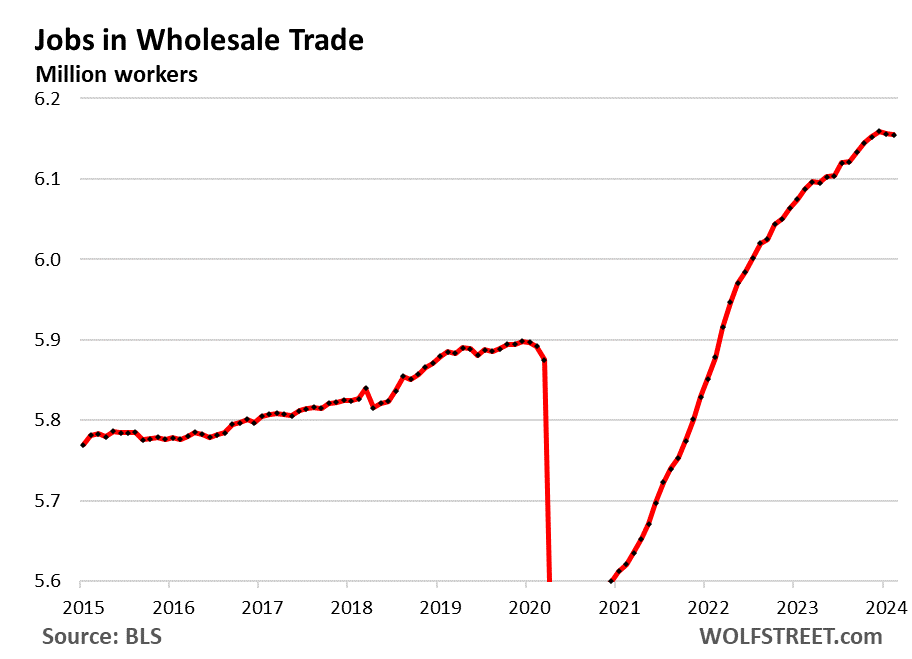

Wholesale Trade, the second month in a row of declines, after the huge surge:

- Total employment: 6.2 million

- 1-month growth: -1,000

- 3-month growth: +3,000

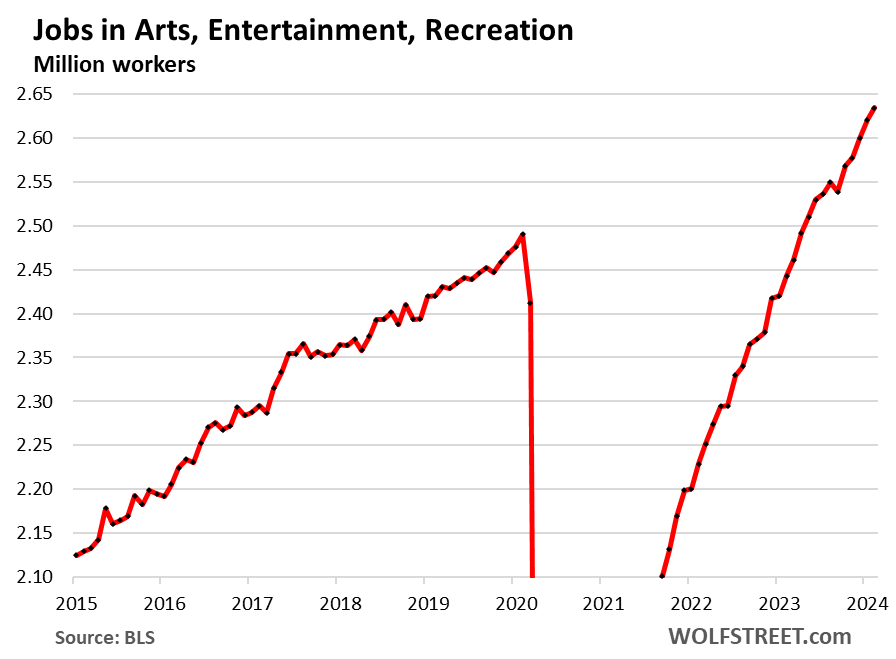

Arts, Entertainment, and Recreation includes spectator sports, performing arts, amusement, gambling, recreation, museums, historical sites, and similar. The relatively small sector booked big employment gains that took it from record to record in recent months. Consumers are splurging on experiences, and companies are staffing up.

- Total employment: 2.6 million, a new record

- 1-month growth: +13,000

- 3-month growth: +57,000

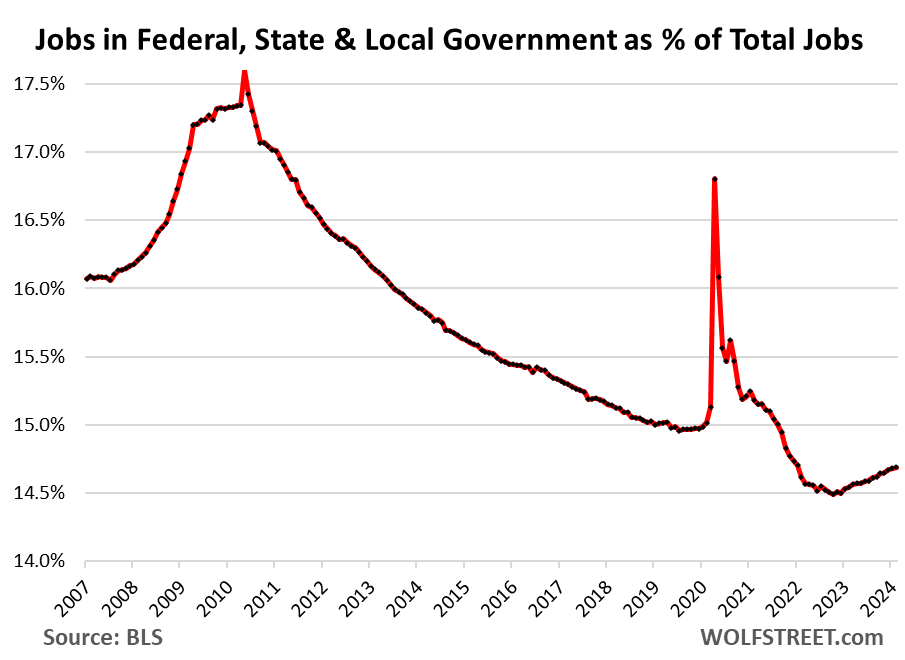

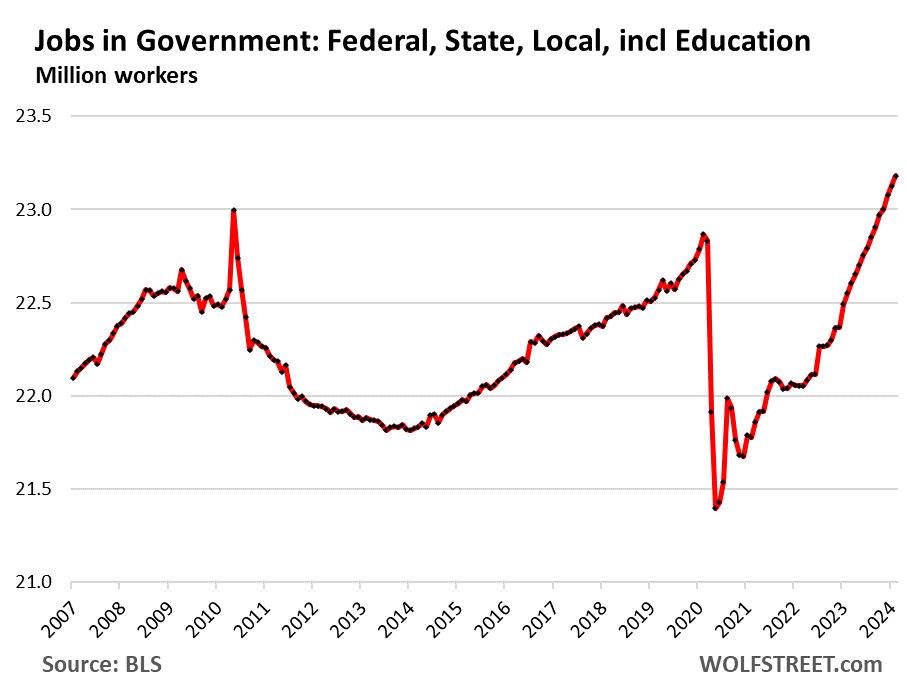

Jobs in federal, state, and local governments. A large portion of state and local government employees work at schools, colleges, and universities. Note that employment at the federal government spikes every 10 years for taking the census.

First, we’re going to look at total government jobs – federal, state, and local – as a percent of total employment:

And the number of employees:

- Total employment: 23.2 million of which 2.9 million are federal civilian employees

- 1-month growth: +52,000

- 3-month growth: +180,000

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

The analysts on CNBC are calling it an “ambiguous” jobs report, with bulls/hawks pointing to the strong headline number, and bears/doves pointing to the higher unemployment rate (3.7 to 3.9%) as well as downward revisions to previous months. As a result, treasury yields didn’t move much.

I see yields dropping in the near term based on technicals but fundamentals could support a drop if unemployment actually ticks up over the next few months. Probably blowing out after that with inflation and deficit spending etc

The real wrench is if inflation is hot again and continues to heat up or stay sticky while unemployment goes up to…I think that’s the hard landing scenario… look out below 💥

“I see yields dropping in the near term based on technicals”

Such as?

TLT is above rising 20wk ma

Higher low from last year’s low

However it’s still in a down trend on monthly timeframe below decling 20ma

What Dan said plus macd has positive divergence and with the size of the decline from the highs we’re due for a pretty good bounce.

All the stock money also has to go somewhere once the selling begins.

Zoom out on that tlt chart. Long term decline.

TLT is even more rate sensitive than buying the actual 20 year treasury since there’s no pull to par with bond funds.

Disclaimer; I am currently short TLT.

California’s unemployment rate keeps going up. Now 5.2% which is recession territory. CA has typically been a leading indicator for job losses that occur elsewhere across the country. Actually this is the highest unemployment rate still during the local peak Fed funds rate in the last three recessions, barring one month after the dot com bubble. Essentially the Fed will be way too late in lowering rates to stop significant job losses (at least in CA).

I’m sorry I can’t parse this comment. California had a higher unemployment rate between 2007 and 2017. Then during Covid. I can only find brief stretches where it’s below 5%.

All the leaves are brown

And the sky is gray

Sorry I was not clear. My point was the fed was already lowering rates by the time unemployment hit 5.2% in CA during the last few recessions. Pretty much the whole period you quoted 2007-2017 the federal funds effective rate was going down, and mostly near 0%. It is highly unusual for the fed to not start cutting rates when employment is this high in CA and its overall trajectory upwards. CA seems to be doing quite poorly in relation to other states right now.

Drewman,

Who cares about CA’s UE rate. Fed needs to leave rate where they are. I’m not going to sacrifice with higher inflation to save that irresponsible state.

If CA is doing poorly, it’s because actions have consequences. Rest of the country couldn’t care less about CA. I doubt the Fed does either.

No reason to lower rates.

National unemployment is at a two year high as of January and trending upward, so not just uniquely California. The 12-18 month lag from fed rate effects means it will be too late to lower rates when unemployment already starts to skyrocket. Look up the graphs on FRED and you’ll understand the relationship between Fed funds effective rate lag and unemployment.

There has been a lot of discussion about the Census Bureau’s underestimation of the huge waves of immigrants we’ve had in the past two years. The CBO now has a much higher population growth figure than the Census. But the BLS uses the Census Bureau data. This underestimation of the population growth ends up underestimating the labor force, total number of working people, and the various rates that depend on it, which would cause the unemployment rate to be overestimated (because the labor force is underestimated).

So there may be some big adjustments coming. And I’m not going to get too excited about the one-month household data. And the Fed isn’t either.

That due to the high cost of living and they can’t hire workers because of it. It’s what’s called an an anomaly where the unemployment rate is zero but since they can’t find workers it shows as high. It’s the same where I live no one works and every place is looking for workers but due to the high cost of living they can’t hire any workers.

Hurr durr give me lower rates I miss my free money.

5-7% unemployment is ideal. Below 5% is over employed, especially if governments are running a deficit, which generally reduces new business startups and innovative competition. Over 7% generally indicates the economy is unhealthy, or getting so. Unemployment alone isn’t necessary an indicator of economic health, just like any other 1 number.

There really was nothing bad enough in that report to justify rate cuts, not even close. 3.9% lol. Ridiculously low, yet corrupt wall street expects the Fed to cut on that. Wall street needs to continue to pound sand.

The unemployment rate isn’t the important number from the report for rate cut expectations. It was the 0.1% wage growth and the downwardly revised January number.

But the report for January had revised UP the prior numbers, and the down-revision today of December wasn’t as big as the UP-revision in January of December, and today’s DOWN-revisions only partially undid the prior UP-revisions, and so today’s employment number for December is still 72,000 higher than the original number.

Original Dec. employment: 157.232 million (released early January)

Today’s Dec employment: 157.304 million

So today’s lowered December figure is still 72,000 higher than the original figure.

All my charts show the latest revised figures, so you can see. As I said at the top of the article, in the past three months, the average job gains were 265,000 per month (Chart #1), based on the revised figures.

Wolf, sorry, I was referring to only wage growth. I’m aware that the job numbers go up and down regularly and are overall still quite good.

The unemployment rate increase (3.7% to 3.9%) was mostly due to black unemployment (5.3% to 5.6%). White (3.4% to 3.4%) and Hispanic (5.0% to 5.0%) were unchanged. Asian increased (2.9% to 3.4%) but Asians are a very small proportion of the total employed (6.9%). 80.3% of the total employed are not black or Asian. Their unemployment rate was unchanged.

Don’t forget the massive infrastructure projects like high speed rail that will connect Fresno to Bakersfield in only a few years.

The bullet train to nowhere has been promised for over a decade, and the only thing that happened has been costs continue to spiral out of control.

I doubt it will ever happen.

The rail line is actually under construction in the Central Valley, massive viaducts, all kinds of stuff is being built, for example some videos of construction sites:

https://buildhsr.com/

Better than videos, talk to some of the inspectors and people in Fresno whose recommendations and reports have been ignored in Sacramento. A person I visited in Fresno a few years ago described one of the early meetings they attended in which one of the old hands declared that “Before this is all over, somebody is going to jail.”

Few in Fresno want to go to Bakersfield. Few in Bakersfield want to go to Fresno. Nobody in the Bay Area or Southern California want to go to either place. The only people to benefit from this boondoggle are the construction companies and workers.

High-speed rail would be great to have between LA and the Bay Area. This is an ideal setup for high-speed rail: two huge population centers not too far apart. This works great all around the world. Those lines are busy and making money. Even the NYC to DC Axela Express, which I used to take all the time, is busy (Amtrak’s other slow long-distance lines are losing money).

The problem is the line through Silicon Valley and into SF, and into LA/Orange County: There is huge local resistance by some of the wealthiest people who don’t want high-speed rail in their backyards. They’re fighting this tooth and nail.

The other problem is property values where the rail has to go.

In China, where the government owns all the land, they’d just compensate the homeowners and raze their buildings, and the rich people can move somewhere else. We’re a little squeamish about that in California. Everything gets contested in the courts, and that takes many years and costs lots of money.

Ha ha yes, there will be massive demand for train travel from Fresno to Bakersfield, massive wealthy metropolitan areas with high travel demand, well worth 10s of Billions and the 20 year wait. Must feel great to be a CA taxpayer seeing such a worthy use of funds.

“Must feel great to be a CA taxpayer seeing such a worthy use of funds.”

CA taxpayers should be used to it by now, like frogs in slowly heated water unknowingly being boiled alive. Taxes and living conditions just continue to get slowly worse there, and unless they realize it, they’ll be slowly cooked too.

I’ve always had jobs that required travel, and as such I was able to see how crazy living conditions are in CA compared to everywhere else I went. I finally convinced the wife to leave a few years ago, and we’re in so much better shape financially and mentally now that I regret not leaving earlier.

Those who say “don’t let the door hit you on the way out” are truly delusional, as emigration will only increase and those remaining will be left to foot an ever-increasing tax bill used to benefit everyone but themselves.

“Good weather” is not worth your financial and mental wellbeing.

Thank you for leaving California. Much appreciated. This place is way to crowded — nearly 40 million people, good grief 🤣

WOLF – people in cal say thanks for leaving; people in new york say thanks for leaving; people in new jersey say thanks for leaving – the cops from NY said to FL – “thanks for the $10,000 pay raise” when they went to FL.

so – are all the people leaving these states just nuts – or are they just fed up?

What’s great about the US is that everyone gets to live where they choose to live to be happy. I spent a big part of my life in Texas and Oklahoma, and I finally left in 2000, and maybe the stayers-behind said good riddance too. My two best friends here are Texans, and they left decades ago and will never move back either. There is sort of a self-selection going on.

The Wolf Report here paints a fairly clear case that the economy is doing well and maintaining resilience, but that’s at odds with the polling statistics that suggest everyone hates Biden for destroying the economy.

Furthermore, demographics — that are rapidly unfolding, project a massive tsunami of old timers flooding the economy with dominance.

I’m wondering if this silver tsunami-dynamic is under-represented in political and economic significance?

At this point, nothing makes sense, but it’s interesting that 2024 is The peak for Boomer retirements. Are they all unhappy?

The polls reflect the power of the Republican echo chamber, not reality. Propaganda works; reasoning and logic, not so much.

What it goes to show is that people hate inflation. The people who said uncontrolled inflation was worse than a recession, as a recession only hurts the 4% extra who get laid off, while inflation pisses everyone off.

I also question how well the economy is really growing. While there has been some growth, I think a lot of the growth has really just been inflation, regardless of what the government statistics say.

The strange thing is that DESPITE the inflation and record-low consumer sentiment as a result of it, AMERICANS CONTINUE TO SPEND. They’ll grumble about it, but at the end of the day, they’ll eat the costs. Consumers are spending like drunken sailors right now, with spending growth in excess of inflation.

Politicians & policymakers don’t seem to be punished for it either, as evidenced by 2022 in which almost every major incumbent seeking re-election won another term, and the competitive polling for the 2024 cycle. They can always point fingers at external factors like sUpPlY cHaInS & cOrPoRaTe GrEeD, absolving themselves from any blame in excessive government spending.

Historically, politicians tended to err on the side of higher unemployment in favor of stable prices. Maybe they were scarred by the 1970s. But now it’s the reverse, and so far the outcomes suggest they can continue this way.

“DESPITE the inflation… AMERICANS CONTINUE TO SPEND”

Despite it or because of it?

Inflationary mindset.

…ever notice that many folks, after a good b***h-session, stop there, secure in the thinking that something was accomplished? And, some, in thinking so, expand the b***hing in lieu of personal action? (…not without purpose, though, monitoring the complaintosphere may aid in avoiding the dreaded ‘who knew?’ syndrome…).

may we all find a better day.

I inflation pisses everyone off?

I think UPS workers and auto workers would beg to differ

Workers love wage inflation.

Consumers hate consumer price inflation.

Asset holders love asset price inflation.

Businesses love consumer price inflation because they can raise their prices, and boost revenues; and they hate wage inflation, and they hate wholesale inflation because it balloons their costs.

Not the peak for boomer retirements but the end of boomer retirements meaning virtually all the boomers are now retired. The peak was about 5 years ago.

“virtually all the boomers are now retired.”

This ignorant BS about boomers needs to stop.

The youngest boomers are 58. And mid-boomers — now mid-sixties — are still heavily represented in the labor force, including yours truly and many of his friends.

Same here, Wolf. 70yo, still going at it 50-60 hrs/wk. I could retire, but I enjoy my job and retirement doesn’t pay very well.

Howdy OSP. Way to go. Doing what you think is best. As a proud mid-boomer, retirement in my 50s is just as rewarding. An old school American ideal. Individual Freedom. What a great concept. Seems to dying in the US lately….

The longer the stock market continues going parabolic, the more retirements there will be. Not just boomers, but people in their 40s, 30s & even 20s who invested in NVIDIA or virtual funnymoney years ago.

Augustus Frost (I miss his posts) used to say that people can only not work if someone else is willing to support them. Ultimately, being able to retire based on paper wealth requires a functioning economy where people who do work can produce the things you need to live.

Einhal,

Everyone needs a functioning economy in order to purchase the goods and services they need to live, not just retirees. Very few people are self-sufficient. It doesn’t make sense to distinguish between spending a dollar someone saved for retirement from a paycheck years ago versus spending a dollar someone got from a paycheck last week. Both people need a functioning economy to get what they need, and if they earned (whether through work or investment) the money they are spending no one else is “supporting” them.

Tony,

They keep redefining boomer. Thirty years ago the last boomers were born in 1957, now they were born twenty years after WWII ended. My thoughts are, they don’t want to show the real data on the initial boomer age range, because the numbers may show how they are really doing…

On that note, I know someone who lost his job a few months before his full retirement age. He had no choice but to apply for his SS, good thing too, because his next job paid a lot less and he needed the money.

I am a boomer and had to take SS early because we needed the money too, higher cost of living and also now higher tax bill.

I don’t recall Boomers only being born until 1957 thirty years ago. My understanding has always been Boomers were born between 1946 and 1964. It’s a clear memory for me because my mom was born in 1948 and my older brother was born in 1966. I always thought it was funny they were almost in the same generation.

Einhal is correct.

Inflation is a truly regressive tax.

Statistics Canada released its labor force survey for February today.

Gaining 41,000 jobs but the unemployment rate ticked up 0.1% to 5.8% based on job creation not keeping pace with population growth.

Public sector +18,800

Private sector -16,400

Self employed +38,300

I’m not sure about my American neighbors, but I personally have a healthy bit of skepticism about the accuracy of my country’s labor force participation rate figure – which remain unchanged from month to month at 65.3%.

One bothersome statistic – the comparison of the rate of job creation between public sector and private sector, year over year (Feb. 2023 to Feb. 2024). Precovid, Canada averaged a ratio around 3-4:1. For every 3 or 4 private jobs there is 1 public job created. The total year over year is basically, 160,000 private jobs to 197,000 public jobs. A ratio of 1:1.23 – even including self employed year over year (+11,000) still doesn’t even break even. Not a sustainable rate.

No definitive answer on public/private but might be related to COVID and that state workers trend a little older so perhaps they have seen more retirements and thus more replacements.

It’s been well documented that the current Canadian government has expanded the federal workforce around 30% to 40% through covid until present.

Astute observation.

Lacy Hunt has pointed out to us that the multiplier effect of government jobs is a negative number.

Private market job creation has a positive multiplier.

How do stock market bubbles end? At some seemingly random point in time the selling starts. Sort of like NVDA today.

They have to keep wage gains hush, hush in the Canadian statistics as there can’t be 2.9 percent inflation if wage gains are coming in at 5.4 percent. As math is a perfect science its impossible to have 2.9 percent inflation with 5.4 percent wage gains.

Don’t forget to subtract the 7500 jobs from Rivians in 2026 or whatever since they’ve postponed the Georgia plant.

Can’t wait for the EV hater crowd to say that’s the newest round of proof for EVs definitely going under this time. Definitely this time guys, for real!

I’m skeptical of EV’s mostly because I see how inconvenient my friend’s electric Mercedes is. That said, I love the look of the new Rivian.

In most people’s circumstances an EV would be awesome once you can get them used and at reasonable prices. If you’re married or living with someone you likely have two cars. One can be an EV. No range worries. Tremendous savings in gas. Likely living in a house so you don’t have to worry about charging.

If you’re single, big road trip vacations are unlikely in my experience and even still you can just rent a car. Same for old retired people.

Once EVs mature maintenance will be very low and infrequent. As renewable energy proliferates, energy prices will go down or possibly be eliminated in the case of home solar. The prices of EVs should drop dramatically as the logistics, parts, assembly, etc are far lower than ICE cars.

My biggest fear with EVs will be the risk of auto companies moving to a “transportation as a service” model where you pay a subscription to lease a car. Perhaps with self driving cars the big auto companies will end up being little more than taxi drone companies.

Hopefully there is more consumer backbone than I am expecting. It didn’t work so great for BMW recently but it won’t be long and it will become common, and then expected I think.

I sure hope in 15 years I can purchase outright a cheap, used Toyota EV and drive it until the wheels fall off and do my own maintenance without it getting soft locked by the ECM, ahem (John Deere)

Exactly. I’m waiting for version 3.0 of EV cars for an improved battery solution, and a significantly greater amount of competition to lower the price. I will love losing all the maintenance hassles and costs of ICE someday.

Only time will tell if self driving vehicles translates into lower auto insurance rates. My guess is probably not. In Markham, Canada everyone drives a new white Mercedes and the thing beeps if/when you drift into the next lane hopefully preventing sideswipe accidents yet no savings on auto insurance rates.

I appreciate the optimism. Despite being a Tesla driver, I’m a bit more pessimistic about the future given my printer is locked to only HP cartridges, my fridge is locked to only GE water filters, and my TV, movie, and music media are tied to a subscription, etc..

I can’t see us paying less (less corporate profit) in the future, for energy or materials, but believe we will all become accustomed to the new prices.

@squeezed

HP is garbage. I have a cheap brother printer that does black and white. Still on the original laser cartridge thing and have printed a hundred pages or so and still probably have 7/8’s left. Generic after market toner(?) trays or whatever are cheap. No HP subscriptions or any of that crap or 100 dollar ink cartridges that last for 10 pages.

I can’t speak to the fridge. My fridge at home is a door room style horizontal split Walmart special. No filters or touchscreens.

I pay for Spotify and that’s about it. Ad blockers and Russian streaming sites let me see any TV. Not that much TV is worth watching anyways. If it’s a video and I watch it, it’s 99% coming from YouTube.

The great thing about technology still is so much of it can be hacked, bypassed, pirated, etc. Most people won’t put in the effort to get digital stuff for free but hardware consumer stuff usually has something that’s less “scammy.” I wouldn’t buy a 2024 Mercedes and expect not to get raked over the coals for as much money as possible.

But buying a 10 year old Honda Accord base model trim would be much more financially sound.

Or you could go pre OBDII and get some early 1990s Jap jalopy for 2k bucks and fix it yourself as needed and save on depreciation, insurance, purchase price, etc.

That’s what I did. 1980s Chevrolet truck for the winter weather and rare hauling, 94 Accord for running around.

Can you cite an instance where renewable energy deployment resulted in lower consumer energy prices? I only see the mythical “well it would’ve been even higher”

Home solar only works in certain locals and the capital cost is still significant and most people I know fail to take that into account over the life of the asset + maintenance cost.

I’m against neither. Just don’t like the fairly tale of this cheap energy utopia people sell.

Estimate was 200K and they came up with 275K new jobs. Better than expectations. But the unemployment rate went from 3.7% to 3.9% The economy is doing Great. I read all the data this AM. Plenty of Jobs for Low paying Jobs. Another Nothing Burger.

Far from a nothing burger. These new jobs are new money for the market. Take a look at Secure Act 2.0 and the state laws that inspired it in CA and IL that are adding a significant number of new enrollees to 401K plans this year and the escalation of contributions over the next several years. The water level is rising.

I know people aren’t required to contribute to their 401k, but at the same time, they’re automatically enrolled if they don’t opt out (they can still stop contributing at any time later) and this probably brings in a decent amount of money due to people trusting their employer to do what’s right or not taking the time to learn about it. But valuations revert to the mean so that might eventually cause some unpleasant surprise and disappointment. Interesting you say CA and IL as these states are among those said to have expensive pensions so I wonder if they were trying to support the values of the stocks and bonds in their pension funds.

Why then have gas & oil prices soared over the moon in US in recent past & continuing today?”

By now, the US has become the largest producer of crude oil and natural gas globally, with crude oil production in 2023 soaring to a record of 12.9 million barrels per day, as the US became a net-exporter of crude oil and petroleum products; and with natural gas production soaring to a record 41.3 trillion cubic feet in 2023, as the US became the largest LNG exporter in the world.“

The huge exports by the US tie US prices to global prices. Once it’s no longer a landlocked market, you sell to the highest bidder globally.

GREAT post Wolf, THANK YOU for doing this work!

Excellent point, which I had not considered, Wolf.

Only 119,000 oil & gas extraction workers? Thanks Biden!!!

Just kidding, Wolf. One of the many awesome things about this site is that you actually take the time to understand, and explain, what the numbers actually measure, e.g. —

“The oil and gas sector has armies of workers engaged in technical, scientific, management, and support work in office towers and labs, and those employees are accounted for in the vast sector of Professional and business services and other sectors. And it has workers engaged in the Transportation sectors, etc., that are accounted for in their respective sectors.

But only a small number of people work around drilling rigs.”

— a very clear explanation. Learning is fun.

Yes, learning (here on Wolf St.) is fun. But I’m still puzzled by why inflation in services is still high but is not “discussed”. I watched some of the banking committee’s questioning of J. Powell. Services inflation was never mentioned.

Howdy How Now. Its called concealing, obscuring. covering.

suppressing. disguising. masking. cloaking. shrouding You will learn the truth at Wolf Street. You will not watching Congress.

Here’s a dose of micro-level perspective. Someone close to me got fed up in their current position and took a new job making just shy of 20% more. They were replaced with someone making just shy of 15% more. Pay was the leading factor in this change as it directly influenced their pension.

Net 1 person caused two positions to increase their pay. That has happened all over the place.

I wonder how much automation & computerization has reduced the need for on-site employees.

It’s my understanding that there were about 106,000 workers employed in the frac fleet in 2023 and these workers are in addition to those working on drilling rigs. It appears that “at drilling sites” is not the same thing as “at the well.”

The number you cited is people employed by fracking services firms, which includes engineers, lawyers, support staff, management, etc. at these firms’ offices, plus people driving trucks to bring equipment and materials to the site, people doing the actual frac jobs, etc.

But that’s not how employment here is counted. It doesn’t go by company. You need to read the example I gave about how Amazon workers are counted. And you need to read what I said in the article about oil and gas extraction:

“The oil and gas sector has armies of workers engaged in technical, scientific, management, and support work in office towers and labs, and those employees are accounted for in the vast sector of Professional and business services and other sectors. And it has workers engaged in the Transportation sectors, etc., that are accounted for in their respective sectors.

But only a small number of people work around drilling rigs…”

So oil and gas extraction does NOT include people that work in offices somewhere — they’re counted in other categories. And it doesn’t include people that drive trucks to transport materials and equipment to and from the site. It includes only the small number of people doing the actual frac job on site.

Many lifetimes aging I did dome small business consulting. Most of it involved installing various computer systems that made the business more efficient, or at least give them more insight into their operations to allow future improvements.

One business I worked at though the biggest recommendation I made was to hire a statistical analyst who could monitor their operations.

Basically the product they produced was an extremely low margin (5-10%) specialized product that they made in huge volumes. There was also huge waste in the manufacturing process. They would make 500,000 pieces that they sold for $1 each with a $.10 profit per piece, but they would make that particular product only once every 5 years. Given there was some defects in manufacturing, they would have to make slightly more product than they sold. They would have to decide how much to make before they started the run.

If they made too little they would be short on the order and have to do a very expensive emergency run that would wipe out their profits. If they made too much, they would have all of this extra product that they probably wouldn’t sell for another 5 years.

The owners solution was that he always made too much product. The operational employees were low skilled/ low wage employees. So for him too much was better than too little. The problem was that that often resulted in them making twice as much product that they needed. The excess product would then just sit around forever (spoilage wasn’t an issue). Lots of money tied up in inventory.

I worked with him and for a couple of runs he did i did some statistical analysis and optimized the amount he should plan to produce. It made/saved him tons of money. He immediately wanted to hire me full time. I obviously didn’t want that job. However, I made it clear that he could hire a kid out of college (or someone with similar experience) and they could do the same thing.

Hiring an expensive back office employee who didn’t contribute directly to production was a big step for him, but that one expensive employee allowed him to use his dozens of lower paid employees much more efficiently. As sales increased, he did not need to hire more workers to handle the increase load because there was not an increase in production work, the work they did was just efficient.

Long story short, in an ideal world, paying a cost to make your lower level employees more efficient at what they do can have a huge impact on results.

I am pretty sure that is what has happened in the oil industry. People have figured out how to properly deploy field workers more effectively so they produce more.

Some of these increases in employment may reflect structural changes in the economy.

For example, the situation concerning leisure might just be a new normal. This may be driven by generational shifts. Social studies have shown that Gen Z prefer experiences to material possessions. So this trend may be with us for a while.

Similarly, we may be entering a period where government employment trends upward again, after the neoliberal era, where privatization of government functions led to a smaller public sector (though still not small in absolute terms).

Based on recent trends, I also think we are seeing the comeback of unionized labor after decades of decline.

In many ways it is too early to say about all of these things, but it is at least worthy to speculate on it, especially if these end up being trends that stay with us.

Good points all, CSH

I tried to see older data on leisure and hospitality, wondering if it may be a “sign of the top.”? BLS only goes back to 2014 (no major top besides the VID).

Anecdotally in richville ski town: We’re down overall on the season but my (top end) property is hanging in there.

Sometimes a leading indicator/ the MOST expensive vacations?!

I am going to admittedly pick a nit.

It isn’t that newer generations PREFER experiences to material possessions, it is more that the Calculus surrounding the decisions have changed. Possessions like houses and cars have gotten outrageously priced, so they have looked elsewhere to derive their joy. Experiences make more sense than material possessions given the price.

Howdy Folks. Another Obvious Observation

The Lone Wolf needs to list the cities where job growth is occurring most. ZIRPed youngins can t replace their house or move without spending more to replace the house they own and just think if you lose that 3 % Mortgage. A new job would need to cover those increased costs. Still think you are not a prisoner after being ZIRPed?

After 8 years of renting, I can finally drill holes in my walls, play loud music, and work on my car in the driveway. Previously I would have been yelled at by the landlord for doing any of these things.

Needing to mow the lawn & shovel snow myself is a pita, but I just don’t consider homeownership prison.

Howdy MM My point is about ZIRP. ZIRP created bubbles everywhere especially RE. The RE bubble cost homeowners more in taxes, insurance, upkeep. Lost Freedom to move where and when because of ZIRP. Now having a 3 % mortgage, how much more difficult will it be for the next decade or two to move??? Just an old fools way at looking at ZIRP. Believe it or not and is AOK with me.

DFB, absolutely no disagreement from me re: the harmfull effects of zirp.

I guess my point is, everyone’s circumstances are different. After years of apartment hopping, I bought a place to settle down in for awhile.

My house is a long term “buy & hold” asset. I know I’ll always need a roof over my head.

“The Good, the Bad, and the Ugly?”

Perhaps a preview of finance articles based on Westerns or Clint Eastwood movies?

Thank You for work Wolf! Power (&#Health) to the Mid-Boomers!!

How does FTE employment move relative to non-FTE? There has been much discussion in the exit from COVID about the latter representing a large share of jobs. A variation on that discussion is that much of the job growth has gone to immigrants, whether legal or otherwise.

If true, that could also reflect lower income drivers, lower or non-existent benefits and other drags on economic performance.

Are there some Fed or similar stats or graphics that review those topics?

I think you can check out Mish talks site.

Believe he charted using BLS #’s.

Otherwise…I’m sure BLS has the numbers.

Here you go:

I’m of the opinion that it’s obscenely wrong that the public can’t access an itemized list of the basket of goods that’s used to calculate cost of living increases. Doesn’t seem to be an issue for most Canadians though.

Yes, the BLS & BEA don’t release the raw pricing data that goes into these indices. It’s ridiculous. I wonder if it’s possible for a well-resourced media organization to file a FOIA request for it.

Here is the basket of 330 categories of goods (such as “eggs” or “milk” or “used cars” or “Men’s suits, sport coats, and outerwear” or “Beer, ale, and other malt beverages at home”…) and services (such as “postage” or “rent of primary residence” or “Garbage and trash collection” or “Dental services”) and their weights in the basket:

https://www.bls.gov/news.release/cpi.t02.htm

Used to be able to track individual items and their price levels and changes in the basket of goods in Canada. The reason I remember is because some of the media gave Stephen Harper and the conservatives flak over discovery one of the items labeled as coffee was actually tea. The same government also got caught fudging job opening numbers from the government job bank site as it was uncovered that there was many jobs on the site with multiple postings for the same job but captured and reported as individual jobs (deliberate or laziness… I don’t know). I still appreciate the link though Wolf.

Most AI is fake so those are bullshit jobs.

I continue to maintain that IT type jobs peaked and it’s all downhill from here.

This site, namely the Wolf Street media mogul empire, whose employment = 1, is in the Information category, subcategory “Internet publishing.” Nothing in this shop is AI powered.

Bravo!

That is a terrible take.

I don’t doubt that much of AI is just hype, but there are real benefits that are going to come out of it. AI is nothing new, machines have nmbeen learning forever. It has been decades since machines have been able to crush even the best chess players in the world.

I wouldn’t overpay for any of the overhyped “AI” stocks, but I also know that a decade from know is going to look very different than now because of AI.