Including by 7.9% annualized for the not-seasonally adjusted PPI, worst since June 2022. So we’ll take a look.

By Wolf Richter for WOLF STREET.

The Producer Price Index data got a lot of attention today because it didn’t increase as sharply as a month ago, and so that was seen as a relief on the inflation front.

The thing is these figures are very volatile from month to month, as the blue lines in the charts below show, and the smaller increases in March on top of the spikes in February weren’t nearly small enough, and all the three-month rates – the month-to-month increases in January, February, and March combined – that iron out some of the month-to-month volatility, jumped.

The other thing is these figures are seasonally adjusted – and that makes sense, a lot of this stuff is very seasonal, such as gasoline prices, which drop to their seasonal lows in the winter and rise to seasonal highs during driving season in the summer. And seasonality is not inflation.

But the seasonal adjustments in March were huge.

Those seasonal adjustments in March were far larger than in the Marches during the years before the pandemic. So we will look at the seasonally adjusted PPI and at the not-seasonally adjusted PPI. And we will see that the seasonal adjustments this March were much bigger than in the five years before the pandemic, likely skewed by the distortions during the pandemic that then became part of the base for current seasonal adjustments.

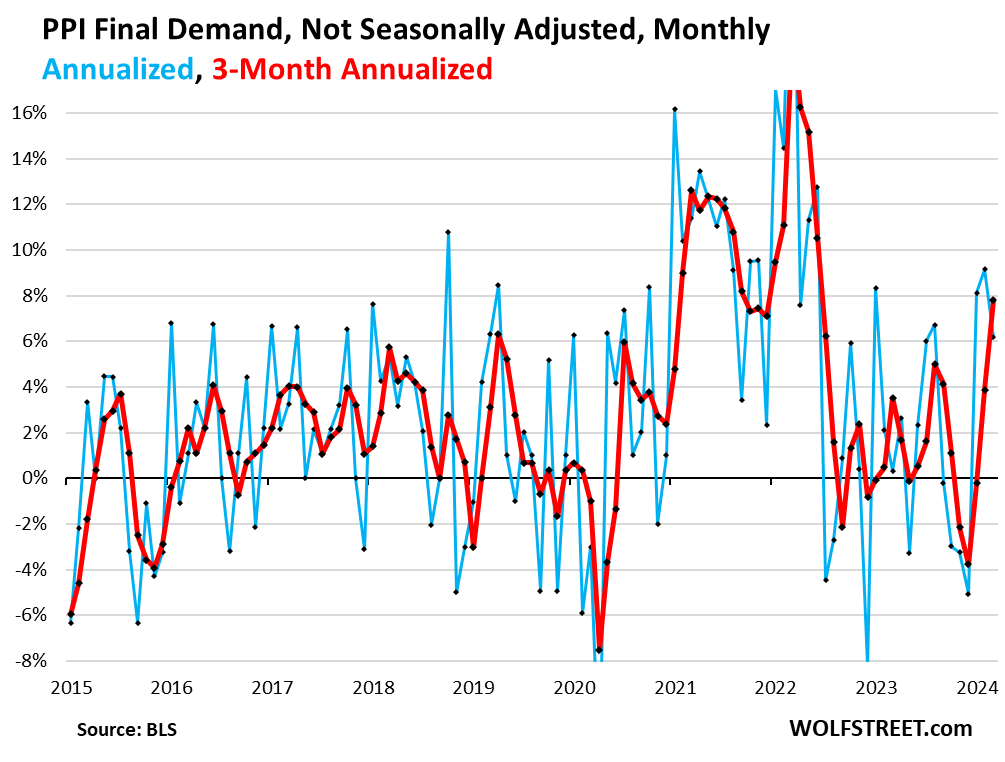

The PPI, not seasonally adjusted, jumped by 6.2% annualized in March from February, which was a smaller spike than the 9.2% in February.

The three-month rate, which irons out the month-to-month squiggles, jumped 7.8% annualized, the highest since June 2022. You can see from the blue line how crazy volatile the non-seasonally adjusted data is. The three-month rate irons out only some of that volatility (red):

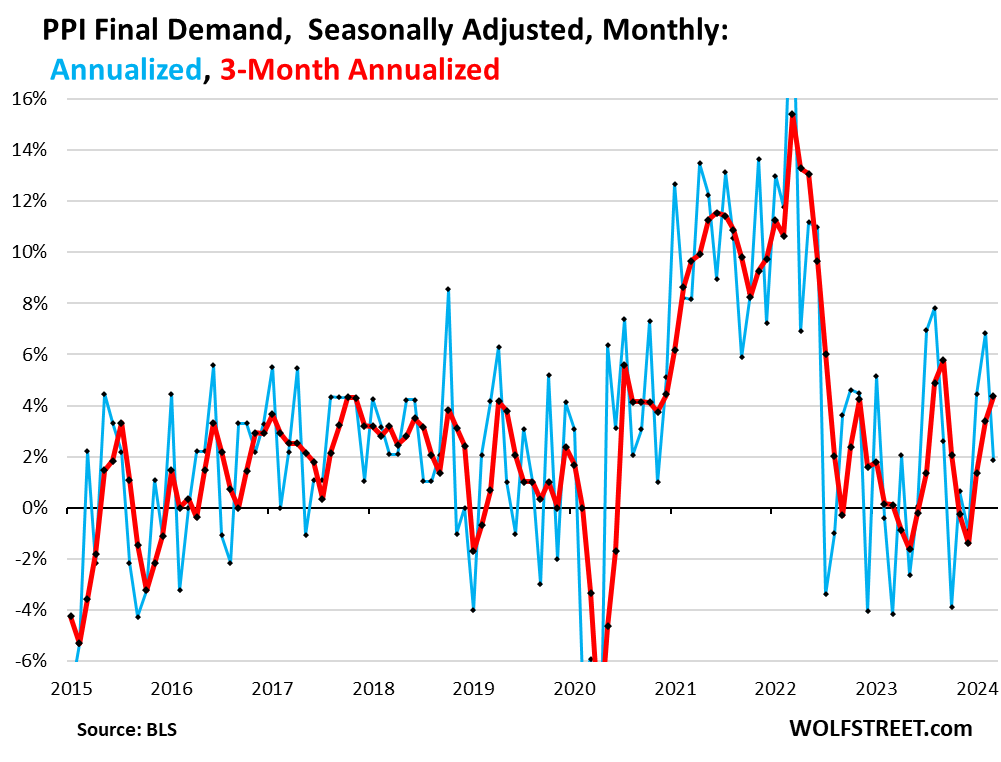

The PPI, seasonally adjusted, rose by 1.9% annualized in March from February, a sharp deceleration from February’s 6.9%. The three-month rate jumped by 4.4%.

A much bigger difference than before the pandemic. After seasonal adjustments, the three-month rate in March (4.4%) came in a lot tamer than not seasonally adjusted (7.8%). A difference of 3.4 percentage points! That’s a big difference.

In the five years before the pandemic, the difference in March was between 1.5 percentage points and 2.5 percentage points. This March, the difference was 3.4 percentage points, meaning that the seasonal adjustments were much larger than before the pandemic, likely skewed by the distortions during the pandemic as the past years.

When seasonal adjustments go awry, they self-correct later in the opposite direction, like a pendulum. So we will likely see some surprises in the next few months in the other direction, and then we won’t be surprised by the surprises.

On a three-month basis, the PPI rates jumped.

As we can see the charts above, the three-month rates jumped both seasonally adjusted and not seasonally adjusted. This is based on the big increases over the last three months.

Below we look into the seasonally adjusted major categories – core PPI, services PPI, and core goods PPI – and all of them jumped on a three-month basis in a disconcerting manner.

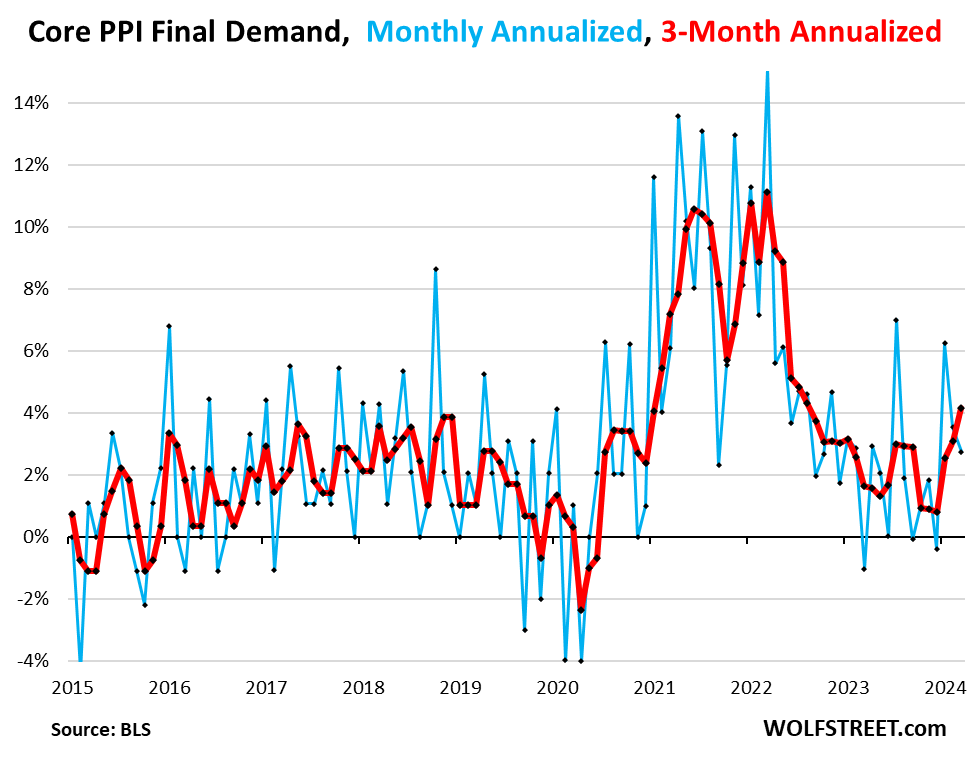

Core PPI, which excludes energy costs, rose 2.8% annualized in March from February, and that was less hot than the 3.5% and 6.2% readings in the prior two months (seasonally adjusted).

But the 3-month rate jumped 4.2% annualized, the worst since August 2022 (seasonally adjusted).

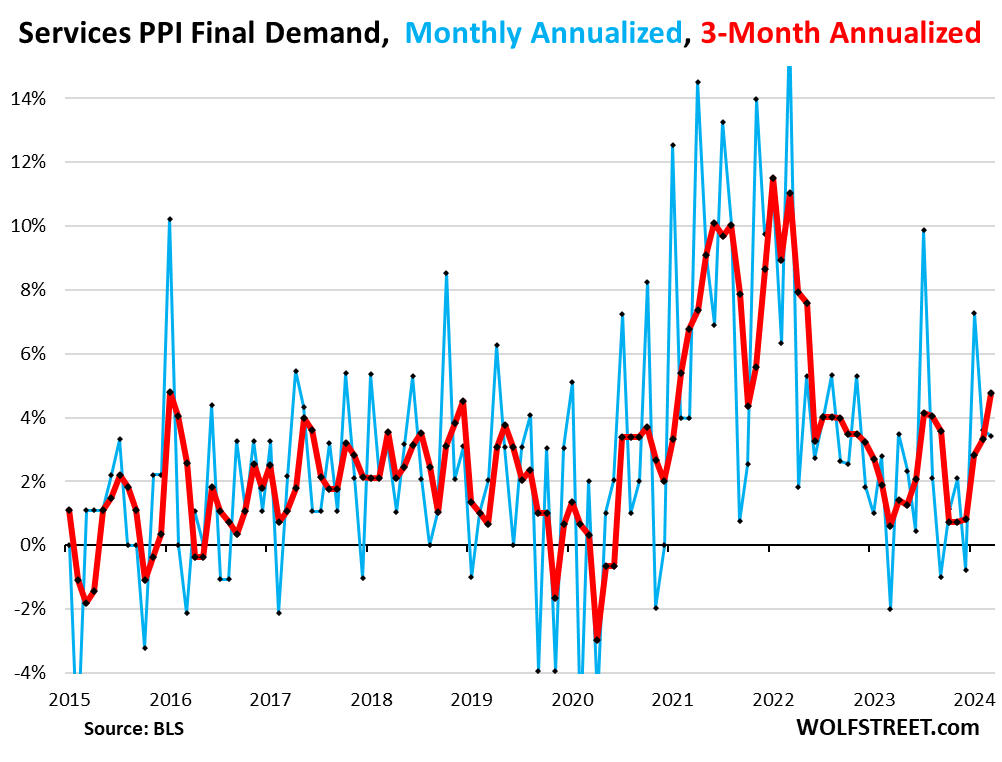

Services PPI rose 3.4% annualized in March from February, not much slower than in February (3.4%). But the 3-month rate jumped by 4.8%, the highest since May 2022 (all seasonally adjusted).

These are services that producers use. They weigh 62% in the overall PPI. And producers will try to pass those price increases on to their customers.

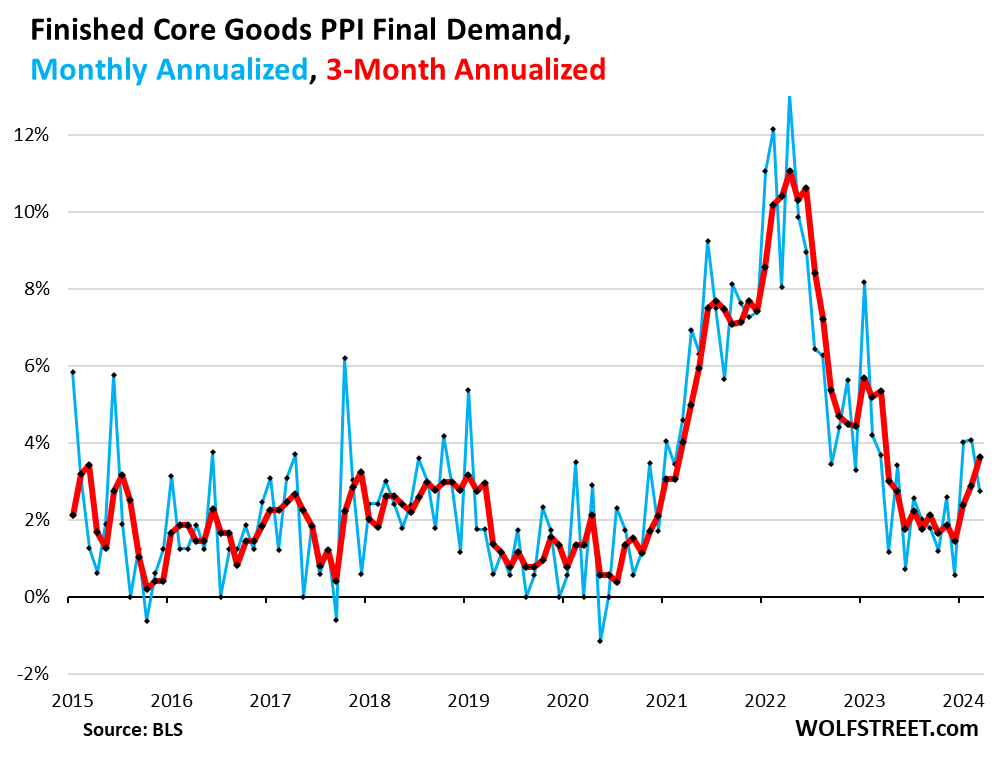

The finished core goods PPI, which excludes energy costs, rose by 2.8% annualized in March from February, a smaller increase than the 4.1% jump in February. These are core goods that producers buy, and whose costs become part of their input costs.

But the three-month rate jumped 3.6%, the biggest increase since March 2023. After the plunge of the 3-month rate from mid-2022 through late 2023, the rate has turned around.

So if we get three months of low PPI readings going forward, the three-month rates will back off their jump. But if we continue along this path of higher lows, and higher highs, the trend goes in the other direction, which will eventually feed into other inflation data. And aside from that, we may be dished up a surprise in future months when the too-big seasonal adjustments self-correct.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Timely update. Wonder if Wolf has any explanation for the soft healthcare number in the PPI compared to the strong gain in healthcare in CPI this month. The media was cheering on this because this might mean a lower PCE number for this month.

The PCE price index includes all kinds of PPI elements, not just healthcare. PCE includes stuff that consumers don’t even buy. It’s a much broader index than the Consumer Price Index (CPI).

Wolf, I think I heard you mention on Thoughtful Money podcast a while back that above 5% you might start to see 10 year treasury bonds attractive. I know you don’t give financial advice, but is that still the case?

“Above 5%” is a pretty broad range. So yes. Somewhere above 5% I will probably start nibbling, not sure how far above. I’ve nibbled on stuff too early, and it’s not fun. I’m “data driven” LOL (sometimes you just have to love Fed lingo).

I’m really more interested in the 20-year bond, because it’s generally higher yielding than both the 10-year and the 30-year (because it’s harder to sell due to lack of liquidity, but that doesn’t bother me).

“…it’s harder to sell due to lack of liquidity, but that doesn’t bother me…”

Is this due to your personal circumstances (hold to maturity?), or is there something the rest of the market is missing about the liquidity of the 20?

+1

Both.

Over the years, I have turned into a buy-at-auction-hold-to-maturity guy when it comes to Treasury securities. I don’t buy Treasury notes and bonds to speculate short term. If I want to do speculative bets on interest rates, I use a bond fund, such as TLT.

I got burned selling corporate bonds a bunch of years ago; as a retail investor, the price (yield) I got was not anywhere near the market rate because everyone was getting their spread off of me (that’s the liquidity risk, see below).

If the 20-year bond pays me an extra 10-25 basis points over the 30-year bond to compensate me for the liquidity risk, to me that’s a good deal because I don’t intend to sell: higher yield, less duration.

The Treasury Department started issuing 20-year debt in 2020, and there was not a lot of enthusiasm for it due to fears about liquidity because there wasn’t a pile of older 20-year bonds out there that were being traded – it was either 10-year or 30-year. Last year, the difference was about 20 basis points (this fluctuates some). In recent months, the difference has shrunk to about half as people are getting more comfortable with the liquidity risk. But still, higher yield, less duration.

Looking at the market today, looks like they found that temporary crack relief in this data to go back to the narrative that, inflation is not that bad and rate cuts still coming guys…hopium is hell of a drug..

Jerome Powell said the Federal Reserve was “data driven,” but he never described the action that the Federal Reserve is driven to.

And it doesnt matter how you jigger the numbers – core / noncore, seasonal / non seasonal, adjusted / non adjusted, smoothed / un smoothed, moving average / monthly….

Those are just tools to get a number closer to what the numbers crunchers want.

The data, raw or jiggered, points to the same thing – inflation is heading back up.

Which leads to the same conclusuon – policy isnt restrictive enough.

To break inflation, you have to break the economy = recession

AGREED 100%.

But, we all know the Fed isn’t going to do that, so inflation will continue to build slowly throughout most of ’24. The Fed stopped 50-basis points too soon. CRE isn’t going to be a major issue in ’24, which will add pressure to the Fed.

YES, a recession IS the fix, but the Fed will force us to live with higher for much longer. What will be really interesting is if Trump wins. That create a pretty big bounce in consumer & business expectations. Then, the Fed may be forced in December to raise rates. Biden is a lame duck with is JPowell building towards that status as he heads towards his May 2026 departure.

The questions are these: How does he react to all this to preserve his legacy? And how much does he dislike Trump, if he’s re-elected. These are very key considerations.

JPowell and Trump are simpatico….after all, Trump nominated him!

Following O’Keefes videos, I would say dislike is too polite.

As a statistic I would say that inflation measurements are still below the average and that double the measurement, 7.5 pct inflation is just as likely as 3.5. Since the hive moves in response to a random sample as if were determinative.

The long rates, to me, seem to be mispriced, the risk being capital loss if the rates adjust upward as the increasingly free market begins to reestablish itself as the monetary control is relaxed.

Certainly not yet. All the Fed asset bubbles have been reinflated by the relatively cheep availability of currency combined with deficit spending by Congress, acting like credit card novices.

Like the man said, “I know what it means to have mayonaise sandwiches for dinner. “

I also felt the same when I analyzed the numbers as soon as the data was released but the two clowns from FED said something different and the tech stocks soared. I guess they want to have the cake (inflated assets) and eat it too. So, the peasants can eat the dirt!

There’s just no conspiracy; the lords of the manor do not want the peasants to eat dirt. Everyone is out to get rich, be free. How else do you explain boom and bust and animal spirits.

The stagflation in the ’70s and ’80s was a long, slow burn and included some lower highs, but also included many beatings along the way. When enough people get thrashed and scorched, they behave themselves. People were so bruised that it took several years, and low interest rates, to regain belief that people can dip their toes in the investment waters and not get hammered.

your statement is breathtakingly absurd when scaled to a general consensus.

Fed lost the battle for inflation against the bulls. 2020s will be decade of chronic inflation. They lost the battle multiple times by printing exorbitant amounts of money, being too late and too slow for QT and throwing the BTFP lifeline to bullish investors. The markets are irreversibly distorted.

Fed is like a boxer who wants to punch his opponent (bulls) lightly not to knock him down. But the opponent is not sparing any punches. That’s why bulls won and the fed lost.

Well sorta. The Fed knew full well what they were doing and now knows full well what their going to do when the numbers aren’t so cheery. Wall street is long the Fed imposing QE again.

Otherwise, what the hell are we paying for !

The higher, the better.

Why? What’s the reason behind?

Since the beachdude’s not around, I’ll try to answer.

Most likely he wants to get as high as possible.

I also would like to get as high as possible.

As a point of reference, the cost of a dubbie is a fraction of the cost compared to what it was when I was budding teenager. Inflation is relative. The cost of mowing my own lawn hasn’t changed much either, over time.

I live in an emerging market, (that’s essentially dollariszed); local inflation is over 30%, interest rates are over 20%. Anything imported is relatively expensive, meanwhile anything domestically produced is cheap (in dollar terms of course); property and other assets are BOOMING. Good for asset holders, very bad for people living on depreciated currency or deep in debt. So yea, inflation isn’t so bad, all depends on one’s perspective.

OutWest — Ha! “budding” teenager buying expensive doobs, lol

Home toad wants higher rates = more $$ from treasuries preferably 10yr

DM : Stamp prices to rise by record amount – with the cost of sending a letter or card increasing for the SECOND time in a year

Stamp prices are set to increase again in July under new proposals designed to combat losses from falling mail volume.

Of course the cost of sending an email has been pretty flat for a couple of decades.

Higher price lowers demand? Who knew?!

I can’t recall the last time I sent a physical letter in the mail….probably decades.

Can’t say the same since my city has absurdly high surcharges for online bill-pay. They’ll keep getting a check via snail mail as long as that’s the cheaper option.

Sometimes legal correspondence must be sent that way.

What I don’t get is the Fed backing down on QT. I get the treasuries as they want to make sure there is enough there to support short term lending to banks, but the MBS should then increase to at least make up for that, if not accelerate given the uptick in inflation. Seems like they are trying to keep the stock market up instead to me.

They’re NOT slowing the runoff of MBS, they were explicit about that. They want the MBS to come off their balance sheet entirely. So that will continue at the current pace until they’re gone.

They’re slowing the pace of the Treasury runoff from $60 billion a month to $30 billion a month, starting in a few months. They’re doing this so that nothing blows up like it did in 2019, so that they can keep QT going for a long time. Easy does it.

We have for months discussed this here. All you have to do is read it:

https://wolfstreet.com/2024/03/02/fed-discusses-balance-sheet-normalization-on-rrps-mbs-to-go-to-zero-reserves-drop-a-lot-srf-to-prevent-accidents-future-qe-without-increasing-the-balance-shee/

https://wolfstreet.com/2024/02/22/the-fed-wants-to-drive-qt-as-far-as-possible-without-blowing-stuff-up-and-its-working-on-a-plan-fomc-minutes/

https://wolfstreet.com/2024/03/20/what-powell-said-about-slowing-the-pace-of-qt-by-going-slower-you-can-get-farther/

https://wolfstreet.com/2024/03/23/the-feds-liabilities-how-far-can-qt-go-whats-the-lowest-possible-level-of-the-balance-sheet-without-blowing-stuff-up/

“They’re doing this so that nothing blows up like it did in 2019, so that they can keep QT going for a long time. Easy does it.”

But they are so far from things blowing up that they could continue at the current pace for another 2 years. They are coddling this market like a delicate egg when it’s an iron dumbbell.

Financial innovation is always dangerous, and now the FED is concerned that the private banks (their club) will pay a price for ZIRP and QE. The greatest danger is surely from the over priced assets that were pledged to back the debts to the private banks.

I have not noticed any crashing markets myself. But if crypto went to zero tomorrow, that would be a significant sign QT was working.

Depth charge – This “experiment” by the Fed sure is a wild ride! They sure had no problem turning on the fire hose at full blast on the QE, but the QT sure is going sloooowww!! They certainly weren’t worried about breaking anything with all that excessive QE. But now they are? Aren’t they precious. Well, us lab rats can only hope for the best out of this mad scientist experiment!

We were just a nvidia away from breaking things this week. The market isn’t as strong as it may seem.

The issue to me is the messaging. Multiple times they had opportunities to be more hawkish and clamp down on inflation but it’s like a you’re at an upper middle class wedding with all the doves flying around.

Should never have even been talking about cutting rates until the meeting before they need to cut

It’s as if the true mandate of the Fed is to create asset bubbles. Watch them pop. Rinse repeat.

If the sp is at 4400 right now we don’t have inflation accelerating again. So pathetic

“Blowing up” comes not just from the absolute level but also, and likely primarily, from the rate-of-change. As the absolute value lowers, a constant draw becomes a higher rate-of-change (because of… you know… math).

Had the Fed limited their run-off to something specified as a percentage of assets then it would automatically slow.

“I have not noticed any crashing markets myself. But if crypto went to zero tomorrow, that would be a significant sign QT was working.”

Yes, they need to wipe out the crypto market. Destroy it completely.

MBS runoff has slowed on its own as we all know.

Reduction of QT is essentially a new tailwind. Why?? We don’t need it.

I suspect that the new plan is to slow QT into rapidly rising liabilities until QT can no longer be performed.

On top of profligate spending fiscal policy the Fed is hoping to cut rates.

The middle class is doomed.

What is this middle class is doomed nonsense? My seven children live like freaking kings, every one of them in their palatial houses driving their Teslas and Lexuses. I don’t begrudge them anything that they have because they are all hard workers but the idea that they are doomed is ridiculous.

AGREE w fly one, but w smaller # direct offspring on official record:

All nephews and similar, total 12-16 first cousins, ( w no intent to marry another 1st cuz, etc., per TN,) are doing between ”wonder full happy hippy world” to ”hard core top dog old blue chip exec vp.

As my better half reminds me from time to time,,, ALL ”times” similar to ALL ”places” have their plusses and minuses,,, NO EXCEPTIONS!!!

ALL can be ”heaven on earth” and ALL can be ”HELL”;;;; totally a personal choice.

DEGUSTIBUS NON DISPUTANDUM EST

Escierto, would your kids be able to afford their own house if buying today?

Honest question – I couldn’t afford my own house if I was in the market right now.

MM, they can all afford their own houses and then some. One of them is just finishing a million dollar remodel. The others are busy buying second homes all over the world. Middle class is doomed! Whatever!

Since when is a million dollar remodel middle class? Nice brag, but it makes no sense.

“million dollar remodel”

“buying second homes”

I’m happy for your kids’ success, but consider that these are discretionary purchases enabled by above-average income and/or wealth.

I’m not poor, but that million bucks is 3x what my entire house & plot of land are worth.

Well there is also the view that a crash in asset prices caused by raising rates, which would already be considered restrictive if there weren’t so much money available. Crashing the asset price markets is not prudent from the perspective of the asset holders who try to make the argument that a deflation in asset price will trigger unemployment.

Wolf, has this actually been officially announced? Or are you pronouncing your (admittedly educated) analysis as fact?

It was in the minutes of the FOMC meeting. So it’s not an “official announcement,” but being in the minutes, it’s an official report of what they discussed and largely agreed on.

Previously, it was discussed by Waller and Logan in speeches.

My guess is that at the next FOMC meeting, we will get the official announcement with all the details and a start date.

I’d sure feel comforted if someone could directly ask Trump if he’d consider firing Powell or FOMC members before their terms are up. Best I can tell, POTUS can fire any and all “for cause”, but I’d think it’d more likely they’d be pressured into resigning if Day One Dictator stated he’d press it.

I’m struggling to commit to any play without knowing whether or not anyone on the FOMC is going to be there next year. I think our protections here are that it’d break with “norms and tradition” (which Trump assigns zero value to), the fact Trump didn’t try this in his first term despite publicly implying Powell was an enemy of the American people (but this was before Biden re-appointed Powell), and that it’d be insane and devastating to US economic and monetary policy, but the guy’s pretty spiteful and difficult to predict (at least for smoothbrains like myself).

Comfort might be hard to come by… the future is yet to be written.

Worrying about the future is pointless but the nightmares you create are very real.

Not sure what a smooth brainer is but guessing that you’ve gone bald on your brain?.

As we all remember, Trump fired Yellen and hired Powell who took his orders from the White House, reestablishing QE and presiding over a doubling of asset prices in 3 years. And now the inevitable general inflation.

Powell seems to be better than anyone Trump is likely to replace him with. The current standstill of monetary policy seems to the preferred approach.

US inflation for Mar 2024 looks like a blip. China today is near deflation. EU inflation is down. UK inflation is down. In a globalized world, the US cannot buck the rest-of-world trend (i.e. down).

Keep in mind that the only country in the world whose economy is growing strongly is the USA. Those other countries you mentioned are flat at best if you believe their published numbers and are more probably declining in reality. Their population pay a heavy price for socialist policy, which is why they are so jealous of the Americans. They would dearly like growth with some inflation.

BS.

The U.S. is growing because of federal deficit spending.

Other countries can’t seemingly borrow and spend an unlimited amount without breaking something. So far, we apparently can…

Thank you, Einhal. A trillion every hundred days! That’s not growth.

Let me take on debt of, say, $50,000 a month and spend like Wolf’s drunken sailor. I guess my neighbors would wonder how I’m “doing so well.”

Thank you in the hall for saying exactly what came to what’s left of my mind:

Until we actually working people are taught enough basic arithmetic and the math used by all these fancy pants phonny ones parading as ”for the people”,, while pandering only to their real rich supporters, it seems certain we will be rewarded relatively minimally for our best efforts.

@Einhal,

“Other countries can’t seemingly borrow and spend an unlimited amount without breaking something.”

It’s worse than that. Those other economies ARE borrowing similar proportions of GDP, and STILL aren’t getting growth.

India is growing. Actually….India is booming. For example, look how much Apple production in India is surging. Why is India booming? Young demographics. Developed economies are all greying quickly, especially the ones allergic to immigration.

Ummm india is growing due to exploitation by an autocratic government. A government proven to be newcomers to the world stage.

Just Google their blunders in Canada

India needs to unshackle itself from hysteria bordering on religious zealot ism for their ummm “elected” leaders.

But sure if you’re pitting them against Russia and China, you can polish that 💩 up nicely

“US inflation for Mar 2024 looks like a blip.”

Huh? Is that you, wall street? The last three months have shown reacceleration. Nope, far from a blip. Inflation will only get worse with the idiots in congress spending like drunken sailors.

With an investment environment that features SPACs, cryptocurrency, meme stocks that are fundamentally insolvent, NFTs, and IPOs that consistently lose money, there is no reason to think that there’s some logic that can applied to investing today.

Unless… momentum is your measure of value. I’m reminded of Slim Pickens, riding the nuke at the end of “Dr. Strangelove”.

…or Buck Turgidson’s classic quote from the same great flick: “Mr. President, I’m not saying we wouldn’t get our hair mussed.”

George C. Scott could be playing Ben Bernanke when he proposed QE…

Government in delirium!

Which is exactly why the short term treasury market is attractive.

You forgot the /s at the end of your post.

Interesting post from Out West on the cost of DIY yard mowing . When I think about how the Fed might calculate the cost of a yard mow mine has increased significantly.

1 . 1/3 acre size

2. Trees are much larger so I have to mow and mulch year round so depreciation on mower and blower have risen exponentially

3. Mowers require self propelled options because the guy mowing is not strong enough self push up hills

4. Mowers are now plastic wheels and plastic covers and last 1/4 the time

5. Repair costs for plastic stuffs basically require me to replace mower every 4 years vs my lawnboy mower that lasted 20 years .

6. The only improvement I have seen is no more tune ups required on gas powered mowers. Points and condensers are obsolete !!

7. A new toro 22 inch mulching mower self propelled gasoline is 600 usd with plastic all over the thing. Double the price from 2020.

8. So I’m thrilled Out West has managed to overcome the challenges I face with DIY mowing.

With my hills and trees I’m even contemplating a stand on zero turn mower in order to continue the DIY but a 36 inch stand on is 9k.

(Cost of a mowing crew is 125 per week when I last asked last year )

So bottom line is just this year on deprecation cost my DIY mowing is increasing 25 percent annually.

If they can get these robotic mowers to climb a 45 percent slope and last several seasons I’m buying one

But but. Wait a sec. If you get the 10y bills then the more $$ u get, beats the extra costs of mowing. /s

I have been happy paying the “mowing crew” to do the mowing so I have no more mower to deal with, store, maintain and drive to buy gas for. I also sold the gas blower, string trimmer and hedge trimmer and replaced them with battery powered tools that were cheap since I bought “bare” tools that use the batteries I already have for my drills, saws and impact drivers. I use battery powered blower almost every day to blow the garage and driveway. Taking mowing off my (and the kids) plate gives us more time to do detail work to really make the yard look great…

I live in a coastal desert region. My crazy neighbors mostly have grass lawns. Constantly requiring irrigation and mowing. I have drought tolerant trees, palms, cactus, and shrubs. Birds like my yard; I don’t have to listen to garden crews wake me at 6am from noisy lawn mowing. – also saves on irrigation.

In the high desert of CA, it’s not usual to see “rock scaping” which features colored gravel instead of a lawn. Your lawn maintenance is done with a blower and a paint brush. For the more creative ones, you may find a small statue of a cement lion perched on an old tree stump.

Get one of the older ”walk behind” type of commercial/industrial mowers bsin; I especially prefer the skid steer type, that can also accommodate a ”velky” if you don’t want to walk that much.

Even new ones of the professional level are likely similar in performance though, as you say, likely double or triple a few years ago for a very good reason: “Commercial” or some times ”Industrial” rated equipment is still made very well.

My last one was a 36” Exmark with a 14hp Kawasaki: that mower could work side hill as steep or steeper than I could,

and cut anything up to about 1/2 inch without hesitation.

Misread one line as “cost of a mowing cow” and wondered if you would get to keep the additional fertilizer to offset the cost.

In rural Uruguay (highly recommended), it’s very common to see a horse tied to a stake in the front yard of roadside homes. Move the stake 3 or 4 times during the day and your yard is “mowed”

Why are you still mowing your grass? You create an almost dead habitat that attracts crickets and a few grassland birds. If it is an indigenous species of grass just let it grow. Remove invasive intruders and in a few years you will have a fascinating zone of your own nature reserve that will give you many hours of interest. Eventually the grass becomes so dense that the invasives no longer grow. Add as many local field flowers as you can by taking seeds annually and set up bird feeders, the birds will bring plenty of seeds as well. Keep mowing some paths through and around the area to allow walking access and soothing of your criticising neighbours.

Hiking interest rates is not the right thing to do. The right thing is for Congress to install progressive tax rates and apply other regulatory tools to fight against inflationary impulses. There are data points that have a clear link to the economy. Called the “observables.” The interest rates are not observable. The impact of raising or hiking them is not predictable. And whatever impact they have is far too broad. Fiscal tools are more efficient and the results more predictable.

So taxes and regulation by swamp?

And in return they will be…..

Correct. It was irresponsible to cut taxes without addressing previously committed spending. A look at the overall budget would also be prudent. I haven’t run numbers, but reducing military spending from 2023’s $820+ billion seems intuitively appealing.

For the last time, we don’t have a Federal government revenue problem, we have a massive spending problem. If spending was cut back to 2019 levels, there would be no problem. And what do we have to show for it? Basically nothing. It’s criminal.

And what exactly are these magical regulations that take care of inflation? Inflation is almost entirely a function of money supply. So unless you are talking about reinstitution of the gold standard, there is no such regulation.

It is said that politics always Trumps economics (LOA)…

Hence, the bond market vigilantes (apologies to those on this site) are dying like the dinosaurs…

But there remains one vigilante and his name is GOLD and he is flashing red…

GOLD bubble?

Gold is just a laughable manic speculative bubble and nothing else.

Gold can be both bubbly at current prices, but still useful as an insurance policy for one’s portfolio.

The market is reality. Ignore the seasonally mal-adjusted #s.

The market is in the slow process of figuring it out. That’s why the 10-year yield rose yesterday, after initially dropping. Markets can stay in denial for a surprisingly long time, but eventually, they figure it out.

MW: 10- and 30-year Treasury yields end with biggest two-week advance since October

Howdy Folks Not even close to FEDs 2 % So called Target, no matter how they figure the numbers. Just use simple math and know its a long way to go. Just 20 to 28 years and some folks can even start thinking about selling their house ????? HEE HEE

Well with some seasonal adjustments we’ll be there in no time!

12:46 PM 4/12/2024

Dow 37,956.60 -502.48 -1.31%

S&P 500 5,121.92 -77.14 -1.48%

Nasdaq 16,173.56 -268.63 -1.63%

VIX 18.16 3.25 21.80%

Gold 2,358.10 -14.60 -0.62%

Oil 85.51 0.49 0.58%

DM: True scale of US retail bloodbath revealed: How 5,500 shops have closed in just one year… and even Walmart, Bed Bath & Beyond and Nike have suffered

Shop closures in the US acclerateted last year – the number of stores shut was 30 percent higher in 2023 than the year before. The closures affected a whole range of sectors, from clothing stores to discount stores and drugstores, as American commerce increasingly takes to the internet. But the home and office sector was hit hardest, accounting for more than 30 percent of all closures – more than twice the amount in 2022. Driving the high tally was that many retailers, such as Bed Bath & Beyond and Tuesday Morning, went bankrupt in 2023 and closed almost all stores as a result. Other retailers, like Signet Jewelers, announced closures amid poor sales.

DM finally catches on to what I have called Brick & Mortar Meltdown since 2017?

https://wolfstreet.com/tag/brick-and-mortar-meltdown/

Bed Bath & Beyond didn’t “suffer.” It got wiped out in bankruptcy court and was liquidated, after wasting $6 billion on share buybacks.

https://wolfstreet.com/2023/04/23/after-wasting-11-6-billion-on-share-buybacks-to-return-value-to-shareholders-lol-bed-bath-beyond-goes-bankrupt-will-liquidate/

Walmart is thriving online and in the grocery aisles (largest grocer in the US), the rest of the aisles are in Brick & Mortar Meltdown.

https://wolfstreet.com/2024/02/20/walmart-and-ecommerce-sales-in-the-us/

This is what is causing the brick & mortal meltdown:

There is weakness out there.

Was looking at used mini excavators.

Of course that means I get bombarded with adds.

Currently I can purchase new from 2 manufacturers

for 60 months @ 0% interest, or 72 months @ 0% interest.

Curious….checked their Q1 reports. Sales down double digit.

Favorite lines in awhile,” So we will likely see some surprises in the next few months in the other direction, and then we won’t be surprised by the surprises.”