They’re in absolutely no mood to slow down. And they still saved part of their income. So why should they slow down?

By Wolf Richter for WOLF STREET.

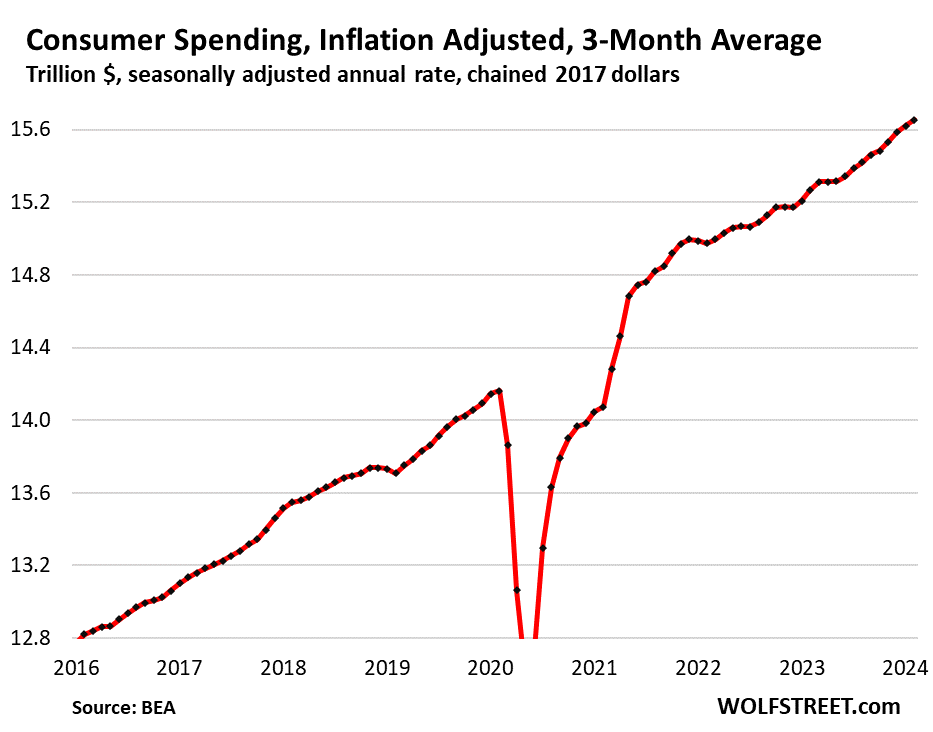

Consumer spending, adjusted for inflation, rose by 5.3% annualized in February from January, after a lull in the prior month. Year-over-year and adjusted for inflation, spending was up by 2.4%, according to the Bureau of Economic Analysis today. As has been the case for a while, spending on services is hot.

The three-month moving average irons out the monthly squiggles and shows the trends better. Adjusted for inflation, it rose by 2.7% annualized for the month and by 2.5% year-over-year.

This inflation-adjusted spending growth of around 2.5% year-over-year is at the upper end of the range over the past 24 months.

Drunken Sailors not so much. Consumers keep splurging on goods and services, despite endless expectations that they would run out of steam. But our drunken sailors, as we’ve lovingly and facetiously called them for over a year, are not that drunken after all.

A record number are working, and they have gotten substantial pay raises, and they’re making record amounts of money. Yield investors have been receiving 5%-plus in interest on their trillions of dollars in money market funds, CDs, high-yield savings accounts, and T-bills. Mom-and-pop landlords received nice rent increases. Retirees received 8.7% COLAs for 2023, though for 2024, COLAs are down to 3.2%. And it all adds up. And folks spent much of their incomes.

But consumers still made more than they spent, and they saved the rest, which added to their wealth and provided a cushion for future spending.

The personal savings rate in February was 3.6% — they saved 3.6% of their disposable income (after-tax income) and blew the rest. The savings rate of 3.6% is about where it had been in 1999-2000; and it’s higher than it was in 2004-2007, but lower than it was in the years before the pandemic.

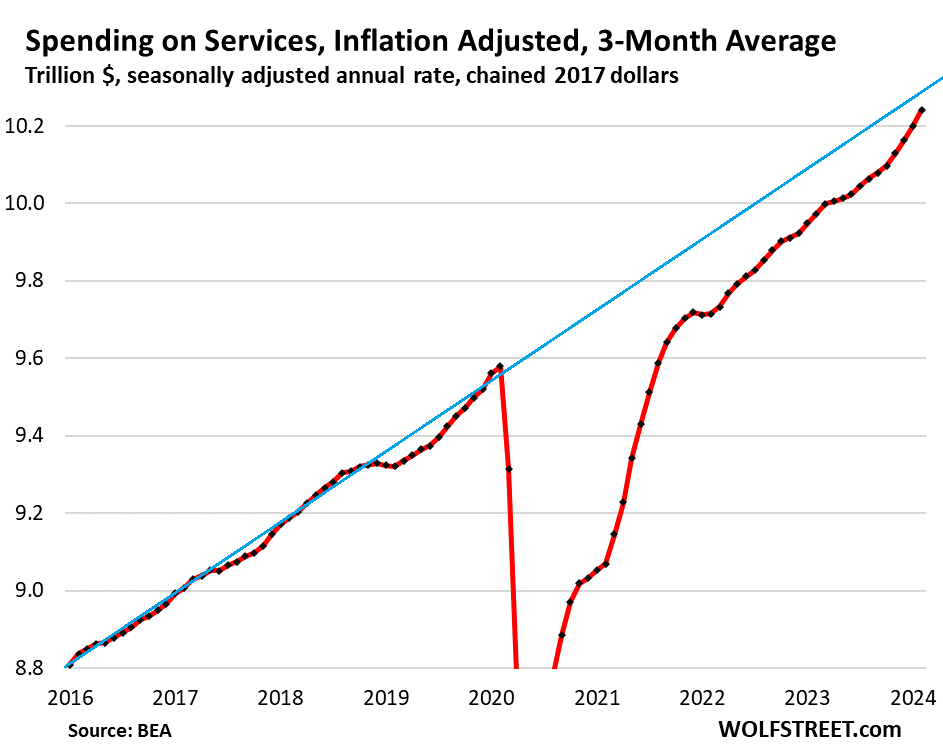

Spending on services, adjusted for inflation, spiked by 7.6% annualized in February from January, and was up 3.0% year-over-year.

The three-month moving average, adjusted for inflation, rose by 5.1% annualized for the month and was up 2.7% year-over-year.

Inflation has now gotten entrenched in services, and inflation is reheating in services, but consumers are outspending services inflation by a good margin.

The blue line indicates the prepandemic trend, and the acceleration in recent months is bringing spending on services closer to the prepandemic trend.

Still not back to normal. Spending on services accounted for 65.6% of total consumer spending in February, the largest share since the beginning of the pandemic.

Services include housing costs, utilities, insurance, streaming, broadband, cellphone, entertainment, healthcare, airfares, lodging, rental cars, memberships, etc. That’s where people directed 65.6% of their spending.

The remaining 34.4% are spent on durable goods (cars, computers, furniture, appliances, etc.) and non-durable goods (food, gasoline, clothing, shoes, supplies, etc.).

But the share of spending on services (65.6% in February) is still not back to pre-pandemic times, when the share was about 2 percentage points higher, averaging around 67.5%. The reason for this is in part that spending on durable goods is still far above prepandemic trend. People just refuse to slow down buying stuff, as we’ll see in less than a moment.

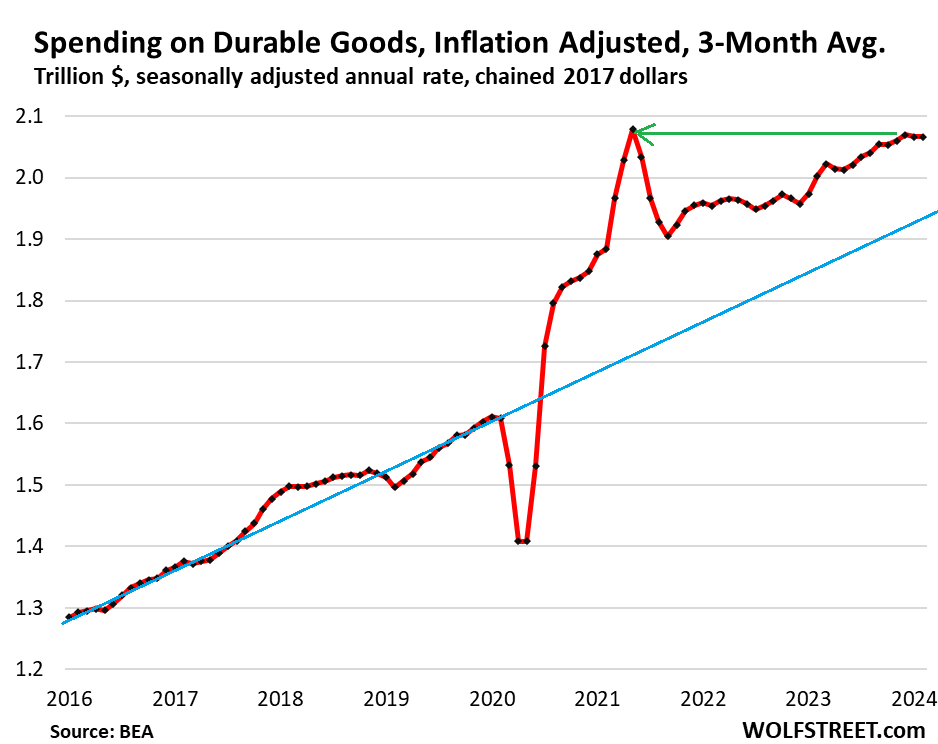

Spending on durable goods, adjusted for inflation, jumped by 15% annualized for the month, LOL. This is Exhibit A why we like the three-month moving average which irons out this kind of drama.

The three-month moving average, adjusted for inflation, was unchanged for the month, and was up year-over-year by 3.2%. So that’s a lot in inflation-adjusted terms.

Durable goods prices have been dropping for over a year – so negative inflation. But in February, the PCE price index for durable goods, released today, rose by 2.8% annualized from January, after a similar increase in January, perhaps indicators that the deflation in durable goods that we saw in 2023 may be coming to an end.

The blue line indicates the prepandemic trend. On an inflation adjusted basis, spending is now almost where it had been during the very peak of the stimulus craze.

This kind of spending behavior – even as the Fed is attempting to slow demand by tightening monetary policies – is mindboggling, and it hammers home the point that Americans are in no mood to slow down; they’re buying stuff whether they need it or not:

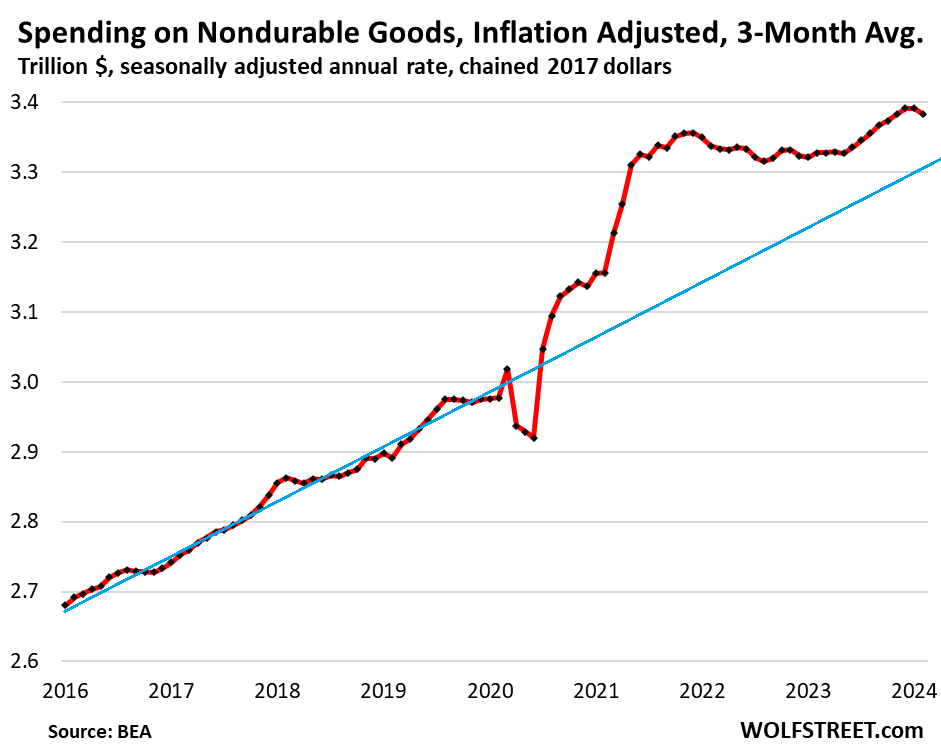

Spending on nondurable goods, adjusted for inflation, fell for the second month in a row from the record in December. The three-month average fell by 3.0% annualized in February from January, but was still up by 1.7% year-over-year.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Where’s the Powell cartoon? I need it.

The poor chap needs a break and let his hair grow back.

Thanks Wolf. With the economy strong, it’s crazy the government is running $2 Trillion deficits.

Those $2 trillion deficits are probably what’s fuelling a lot of this drunken sailoring. The data from the banks is showing credit card delinquencies at highest since the GFC and a lot of debt carry-over (so the record cc debt isn’t Americans just paying off after each month), more making just minimum payments and auto loans and repos up, also highest since GFC. There’s a lot of confusing, contradictory data here though bottom-line I agree, it’s crazy to be even thinking about rate cuts, we really need more rate hikes and stronger QT. Maybe this record-high deficit spending explains a lot of the contradiction, it’s more of the same over-stimulus even after Covid and another sign the Fed and national debt are drunken sailors shoveling printed money into the economy, that leads to these numbers even with more Americans falling into delinquency.

And too, like Wolf points out the heavy spending is still lopsided services, and among those is insurance, healthcare and housing costs. That doesn’t seem to reflect actual production of greater value, it just means things are getting a lot more expensive and Americans don’t have much choice except eat those extra costs, and with the basket as is it doesn’t seem like inflation measures really capture those cost increases. Down in Florida and Texas homeowner insurance costs are soaring because of all the natural disasters, health insurance is getting more expensive just like medical bills even though waits are getting longer and quality isn’t really going up a lot (life expectancy is bad here), rent is still shooting up.

All these things point to a need for the Fed to be more aggressive in monetary tightening, forget about cuts or even a pause right now. If a lot of this extra consumer spending is due to higher costs in insurance, healthcare costs and housing, those are areas where there’s not much choice and some basically monopolies, and hard for Americans to avoid the extra costs. So that doesn’t point to a happy healthy consumer, but since those costs are in a lot of ways connected to over-stimulus and spillover from asset bubbles, either way it’s same conclusion. The Fed needs to get on the ball and be more aggressive in fighting inflation.

Your credit card stuff is nonsense

Credit cards are the dominant consumer payments method in the US. $5.8 trillion in payments were made in 2022 with credit cards. Each of the other payment methods (debit cards, ACH, checks, cash, etc.) lagged far behind credit cards.

That $1 trillion in credit card balances = the statement balances. But most of the credit card balances are paid off the next month and never accrue interest.

Growing credit card balances show increased SPENDING (including due to higher prices), not increased interest-bearing debt.

Most consumers with credit cards collect their 1% or 2% cash-back, or their double-miles, or loyalty points, or whatever, feel good about the kickback, and pay off their cards by due date. And there is no interest to be paid.

This includes the vast amount of credit card spending that is on company expense accounts where either the company pays it off directly or reimburses the employee or consultant. A five-day conference in a distant city or country, a business-class flight, staying at a convention hotel, eating out, etc. can easily run into the five figures, all charged to credit cards and paid off by due date.

Credit cards are not primarily used as a borrowing method, but as a payments method.

Only about 28% of adult consumers (18 years old and over) have one or more cards with interest-accruing balances.

Comment to Wolf – that “Newly Delinquent CC chart” shows a rate of increase from 2022 to now that is even worse than 2007-9 when people ran out of HELOC funny money. People may still be spending like drunken sailors but more and more of them are tapping out, just like in the lead up to the GFC.

People rightfully say that the government’s trillion-every-100-days is paying a lot of the salaries being spent like this. If things do go south and a massive recession materializes, the Treasury and Fed could team up again and amp that to a trillion every eight weeks. QE and the BS to ten trillion in no time. ANYTHING to keep the music playing.

The GFC was caused by mortgages going bad. Mortgage debt is about 20-30 times the interest-bearing debt on credit cards. No comparison in terms of magnitude.

Also you MUST read the part about credit cards being the dominant payment method, not borrowing method.

Delinquencies are normalizing from abnormally low pandemic levels. They’re just a fraction higher than they were in 2019. The bounce mirrors the plunge.

Miller’s comment and your comment is why people are constantly surprised that consumers are doing well and are consuming, and that their debt levels are low. The government and businesses are overleveraged, not consumers.

Per the Federal Reserve Bank of NY

“Household Debt Reaches $17.5 Trillion in Fourth Quarter; Delinquency Rates Rise

Total household debt rose by $212 billion to reach $17.5 trillion in the fourth quarter of 2023, according to the latest Quarterly Report on Household Debt and Credit. Credit card balances increased by $50 billion to $1.13 trillion over the quarter, while mortgage balances rose by $112 billion to $12.25 trillion. Auto loan balances rose by $12 billion to $1.61 trillion, continuing an upward trajectory seen since 2011. Delinquency transition rates increased for all debt types except for student loans.”

Exco,

This is context-less BS to titillate morons, the kind I shred here with my brains tied behind my back, because it ignores rising incomes and population growth, DUH!!! But this braindead BS does waste my time because you people never ever read the articles here, but you just crap into the comments, and then I have to clean up your mess, and that BS gets old.

So here is total consumer debt in relationship to disposable income (after-tax income), and it is at record lows, except for the stimulus periods:

In FY 2023, the federal government spent $6.13 trillion and collected $4.44 trillion in revenue, resulting in a deficit. The amount by which spending exceeds revenue, $1.70 trillion in 2023, is referred to as deficit spending.

With the exception of credit card debt, your analysis is excellent. I find it amusing that Wolf Richter decides to merely point out some flaws in your cc analysis, but ignores all of your excellent points about the massive debt burden, massive debt servicing costs, and massive deficit spending that are the underlying reasons for this continuing inflation. Our government’s debt load is unsustainable and cannot possibly be paid off. And huge fiscal deficits while our economy is booming are insane and unprecedented. Wolf Richter is very good at pointing out the RESULTS of this madness via his excellent inflation analysis, but for some strange reason, he is not as inclined to mention the obvious culprit: our political class who continue to make promises they cannot possibly keep.

Glen Dawson.,

I have addressed Miller’s stuff about the “debt burden” right here, so I will repeat it for you:

It’s BS because it ignores rising incomes and population growth, . I have addressed all this with data in my articles about consumer debt. But Miller doesn’t read them, and so he doesn’t have the data.

So here is total consumer debt (mortgages, credit cards, auto loans, students, other loans) in relationship to disposable income (after-tax income), and it is at record lows, except for the stimulus periods:

I think the bimodal is those getting the extra .gov money and those that are not.

Yeah. I think it’s time for a wealth inequality article, too.

I think you are referring to how our economy divvies up wealth VERY UNFAIRLY.

And forget the “political class who run the government”. They are mostly all bought off by immense wealth (even if indirectly, by appointed agency heads, or reduced budgets).

ALL generated by years of “corporate growth and privileges” that individuals or small business simply DO NOT HAVE.

And over the years, these “privileges” have become THE LAW OF THE LAND. They don’t like to be taxed, so their paid minions saw to it they are not, and our National debt mostly goes to them. Soon the will not need a “democracy show”…..I fear, and we will be dividing up the austerity produced by climate change based on WEALTH alone. Might as well have a King, dictator, Royalty or a politburo as far as those on the lower levels of our “system” go.

By “political class” I refer to elected officials, and higher level gov’t employees, and party officials. The easily interchangeable ones….also exchangeable with top corporate slots or lobbyist positions….in short “the swamp”, which Trump parked his chosen crew and their pirate ship in the middle of.

That much despised park ranger who tells you which is the best or easiest trail is merely a friendly pawn that you can bitch about paying his salary if you are in the mood to bitch.

And how did I forget talking heads on cable TV as another career option for that bunch….and high ranking Military……hell even starting a hedge fund is an option.

You can even sell magic OTC (sleep, brain, weight loss?…I forget) drugs like ex Gov Huckabee…..I think the primary ticket in is law school. You have to be able to generate the appropriate words and fast!

EXACTLY like “fast comeback” (especially with an audience) in the halls of grade and HS…..which I hated.

If you say FY, you lose immediately, but I said it as fighting words, so they left me alone…..little did I know the immense value in it later on.

I think the FED cannot worry about what congress does with Federal deficits, beyond the effects thise deficits have on employment and inflation.

Congress needs to deal with taxes and spending. If the FED just worries about employment and inflation then eventually congress will have to deal with deficits because the yield curve will force them to.

These “2 trillion deficits” ARE “the economy”.

Well, I stopped eating out. $40 for pancake & eggs for my wife and I was absurd.

I’m glad everyone else doing great though.

I worked last nite til dark(7pm) on friday

went to greek place and did takeout $17

then again give me list of mils, Gen Z who did same(work on friday nite)

going to church tonight, work begins in earnest sunday morning

You are an outstanding citizen amongst lazy useless slobs………I’m sure of it now.

Mil here Work starts in the dark and ends in the dark most of the time Greek food sucks usually eat food I make on Sunday to save time from having to stop between working multiple times a week to eat food

Give me a list boomer, gen x others who do the same

Church is for people who believe someone can fix their problems for them

Household chores bein in earnest Sunday morning, the day I do the work the other six do not accommodate

Who needs god when you are a god

Publix chicken tender subs are again on sale this week for like $8.50 and it’s basically like two lunches and two dinners combined for me. I’m convinced this has to be a loss-leader for them like the hot dog at Costco. Probably try to find a loss-leader food deal in your area.

bulfinch cure you of your frippery? (still gotta look that up, but I think it’s one of those words that sound like what it means).

Everything posted at WS stays at WS, whether you change your mind about comment or not. People can go back a lot of years.

Sounds like IHOP- I went with my son (who gets a kids meal) and I spent $36! Nope, won’t do that again. My homemade pancakes are better too

We did the same. Rarely go out anymore. A local Greek spot used to be $30 for two for takeout, and the portions were large. I went once on my own and it was $34 just for myself and the audacity to put 20/22/25% on the auto tip selection was absurd. Prices went up by double and you want 25% tip on top of that? GTFO.

I’m seeing tip options of 20%, 30%, and 40% at some businesses in Seattle. The clerks are usually so ashamed of it, they look away after they put the card reader in front of you. I give in and tip the extra dollars, but it causes me to eat out 50% less often. I’ve got a special disdain for hidden costs and add-ons. I’m sure some retail businesses permanently lose customers over it.

Bobber,

Don’t give in and pay it, dude. You’re ruining it for the rest of us. Damn those tip-shaming scum.

I only use c-ash at small independent establishments. I only tip in c-ash. Hopefully none of it is funding the war machine.

If you are a single diner these days it’s about 30.

Z33: I think you bring up a point that seems to be generally neglected/ignored. Rather than just talking about “average” consumer spending data I hope FRED can generate income/spending data, say, consumers at the bottom 60% compared with the top 40%. Dividing it into four categories, like 0-50, 50-9, 90-99 and top 1%, like they do with their great distributional wealh data would be even better. I think that would give much more insight about the economy.

The bottom of the wage scale — especially lower level service jobs — got the biggest wage increases over the past three years, far outrunning overall inflation rates. And they’re spending every dime they make.

Yep, same here in UK, £30 for a family breakfast that used to be £15 is getting crazy.

I don’t want it. I just need it. ;) 🎸 🥁

Is food considered a “service”? No. Can anyone give me one good reason why SHELTER should be considered a “service”? The same “sorta” goes for health care (as in trauma care, for sure), but I dropped out after completing the first year of Pharmacy School because I saw it was basically mostly all a racket, and it’s getting worse as I study more of the details….especially DRUGS!!!!

Naturally there can be un-needed (for life, I guess, is the bottom line) excesses in food and shelter, and definitely are. And the way this country is laid out, including our “operating system” one could also make similar cases for transport, personal or public and the negative results of a lack of it.

Again, it can be overdone….why can’t we have the little cars the same companies we buy from make for the Japanese, or that heavy duty but small and simple Toyota truck that even the damned terrorists or smugglers get? Hell, there are many Armies that use them.

Doesn’t explain my Adderal question, but I’m going to chase it down. Another Sackler/Oxycodone scandal in the making?

“Is food considered a “service”? No. Can anyone give me one good reason why SHELTER should be considered a “service”?”

Food is a service because someone else did a bunch of work to get it from its natural state to an edible state. You didn’t grow the crops or slaughter the animal that you’re eating yourself.

Housing is a service if you rent because you’re leasing an asset from someone else.

Food that you buy at the store is merchandise, and therefore goods, and not service.

Food that a restaurant cooks for you and serves to you with a smile is a service because you’re paying a lot of money for the service of food preparation, sitting at a table inside a restaurant, being served, etc. That’s why the restaurant/cafeteria business falls under “food services”

This also probably sends the signal to companies that if people are spending then they can keep their prices high or even raise them further. I am still blown away by the prices of most things at the grocery store but perhaps someday I will get used to $6 bags of potato chips. Admittedly I could also do with fewer of those anyway.

Glen-

Your comment raises a confusing new line of causation: Might price inflation actually lead to quantitative easing (of one’s waistline)?!

Paralleling Milton Friedman’s comment, “waist inflation is always and everywhere a caloric intake phenomenon…”

Cheers

Funny and interesting but probably leads to more unhealthy foods and an increase in malnutrition and diabetes and related diseases beyond what it is already. Calories are only a part of the picture as “you are what you eat” is also fairly true.

soon it will be bugs with catsup, hot sauce, fried and baked

Small shrimp are like bugs, and people love them. Fry them long enough to where the shell gets crispy, and you can eat the whole thing, from the feelers via the head and legs to the tail, the whole thing. Super delicious.

Bugs and lobsters and crabs (and shrimp) are all the same, Arthropods, is how they are often grouped, I think. Same as far as diet goes…..and much healthier than other mammals. If you want to eat mammals you should only eat people. See CMAH gene and glycogens, wikipedia will get you started.

Make that the glycocaylx, its how ALL single and multi celled critters tell self from non-self and the deal with non-self harshly….as in kill whenever found.

If you can’t or won’t bother to understand the significance of the CMAH event, it’s YOUR tough luck.

Take your damn prevagen and ageless male, etc, and Rx drugs for your metabolic syndrome.

I do think that processed trash food, in general, has inflated more than real food. The producers know that people just can’t help themselves. One if those little things that make the poor poorer…

That’s the spirit!

Last year we had the unending recession fears and this year we have the exciting (building) giddiness narrative of what to do after the soft landing.

Then your wealth is whittled away w the insane fiscal spending in order to win an election

Man, drunken sailors been upgraded, I think they should now be known as Rasputin instead. Can’t kill this spending, just like Rasputin, not even poison will do it…

On the other hand, Pow Pow pad yourself in the back, this is the soft landing you want right?

This ain’t a “soft landing,” this is no landing with acceleration and altitude gain. The FED paused too soon. They know it, they’ll just never admit it. They were licking their chops to pause.

This is an aborted landing. Coming in on final and realizing that you don’t like what you see so you just hit the throttles and take off again.

But, all planes must eventually land (or crash)

I sometimes wonder what Gregory Peck would do, Once I saw him jump on a white whale. He could land a plane. My next choice would be Anthony Quinn.

Sometimes falling looks like flying

Aborted Landing-

“…hit the throttles and take off again.”

Sort of a “touch and go” strategy. Sounds about right.

The problem for the Fed is that this seemingly aborted landing is happening into a monumentally consequential Presidential election.

They are running out of room, and mistakes could lead to big economic and political problems.

Imagine, if you will, a possible bad scenario, with inflation indicators in April and May continue to show an increase in inflation. The Fed doesn’t cut in June and July and and begins to signal that if warm/hot readings continue, the Fed may need to raise rates. Stock markets start to go down, possibly even tank. Inflation and the markets become a main issue on the Presidential election. Trump pummels Biden on the problems.

Does the Fed hike in fall? Does it wait until after the election to raise rates? Does that wait cause even greater inflation and a terrible 2025? Stagflation in 2025?

My guess is the Fed has botched things when they let the 6-7 cut narrative run. They didn’t stoke the delirium, but they sure didn’t tamp it out either.

Possibly a massive mistake that will come back to haunt them.

What’s the famous 3 things of no use to any pilot?

Runway behind you, fuel you burnt, and altitude above you.

Julian-

Make that ALWAYS, to a relative work skydiver…..body pilots.

The Fed needs a resurgence of inflation in order to protect itself from the likes of Senator Warren and friends, who are screaming that rates are already too high. Proving them visibly wrong will ease the political pressure on the Fed when it has to start raising again…

I heard a smililar theory the other day: the theory of Machiavellian Powell.

It postulated that Powell is deliberately going to let inflation to pick back up a little so that he can say “I told you so” to the more dovish fomc members (and people like Liz Warren), and get support for another tightening cycle in 2025.

It seemed a little farfetched to me tbh. But maybe Powell is playing politics as you suggest.

Yesterday, I went shopping for lamb shops at my local grocery chain. Figured I’d join the drunken sailors and splurge over Easter. To my surprise I could not find an eatable cut like I used to. Nothing but the worse quality lamb put out on the shelves. Why would anybody buy this crap is beyond me. I am forced into higher end store where I am starting to buy more and more of my fruit and produce. The prices are 30% or 40% higher across the board. This is some serious inflation. I see no alternative to get decent food quality but to suck it up and PAY UP.

Have you seen how much Salmon is?

I used to eat Alaskan Salmon on a pittance of a wage. Now it’s $70 a pound I think? The stores around me do not even sell it.

They sell Chinook, its flavor is not to my liking. And that is $30 a pound. At least Vegetables are still relatively affordable.

Prices have risen but a certain country’s merchantilistic policies (using subsidies to undercut and drive out their US/EU competitors) have partially hidden those rises. That will end soon as that country loses the ability to keep up the subsidies, particularly if itts gambit to take over the auto industry via electric cars are rejected or tarriffed highly. (I love how a billionaire invested in that country complains that we are not sharing openly US AI technology advances (presumably with that country, so it can make the best weapons to kill us with. Nothing suspicious there. Will that country bribe LA county judges enough?)

If it’s whom I think you are talking about then… he’s from South Africa. South Africans think wayyyyy differently than Americans. Think of mixing indiana jones with a space cowboy on crack, and we might get close to their thought process.

Lol, just kidding.

salmon in omaha costco $10

Just looked online at Costco’s prices.

If you do not want the farmed disgusting kind that is dyed red then sure it maybe a deal.

However, if you like the wild, free and healthy (good for you) kind of salmon, the prices I quoted look pretty on target.

I just read an article on how people who eat farmed salmon would be better off eating the bait they feed the farmed salmon, lol!

SS at 70 $54000 = 2 month scuba in Waikoloa HI.

Enjoy your life.

Keep Smiling !

Don’t worry, be happy?!?!?!?

Born and raised there! Visit from San Diego once a year as a drunken sailor. Enjoy the island!

Howdy Folks I love these sailor articles sooooo much. You are welcome, I am making more, spending more, saving more. NO more ZIRP for you and loving it. ……..Signed

Sober Sailor

Party on Wayne……

…. With all this positive news, its a wonder why anyone would want lower rates and get that inflationary fire heated up again. No wonder the markets are running at all time highs. The great news keeps on keeping on! Break out the spatlase!

And just wait until they cut rates 3 times this year!

Not Today!!

Lol

And just you wait and see what happens in June when we get the rate cut!!

More punch please!

And what happens if we don’t?

“And what happens if we don’t?”

That is the real question. What is the Fed seeing that we can’t, that could cause a true economic catastrophe if rates aren’t lowered? CRE, banking, etc. not to mention USG interest payments skyrocketing. I am retired and like the interest rates where they are now, unfortunately I don’t get a vote.

“And what happens if we don’t?”

This is the real question. What can the Fed see that we can’t that might cause an economic catastrophic contagion? CRE, banking, etc. not to mention the cost to the USG for interest payments

I hope we find out.

I def think someone needs to be put into the fed chair that has younger people and the future in mind. Or else the young will give up and no one wants that.

Too much gatekeeping of wealth, the greatest generation never did that.

The spice must flow

sufferinsucatash,

I think you should read the article. People who work for a living (generally youngish adults, i.e. not retired and not in school) are doing great. Their incomes are rising faster than the things they are buying. They are able to spend on what they want to spend on and still save for their future. No gatekeeping going on.

I know many here want to spon this intonsome differentvnarrative, but the stats say otherwise.

Wolf, there seems to be some angst about where the spending power is coming from. FYI, my granddaughter re-financed her house during the bottom of the interest rate cycle. She was able to cut her mortgage expense by 1000 dollars per month. she also got a raise in her job. I suspect there are millions of people like her. Those kind of folks are doing well and they are likely a good source of who the drunken sailors are. Don’t you think?

Spending power is coming from many sources.

Workers wages are increasing at a phenomenal rate, so workers (making up a large portion of the economy) have a lot more to spend.

The stock market has been hitting ridiculous highs, this means retirees have seen their retirement accounts go through the roof as their expected lifespan keeps shrinking so they are spending like there is no tomorrow because there literally isn’t.

Entrepreneurs/speculators/the delusional (depending upon your point of view) have seen their holdings in crypto and AI stocks go through the roof so they are spending and enjoying the fruits of their gains.

There are plenty of sources of spending power that are driving the drunken (buy rational) sailors. We can argue about how sustainable some of these sources of spending power are going forward, but right now it is very foolish to think they are crazy.

If this keeps up, I can easily see 5+% interest on savings for years and years. All I know is I don’t want to hear any excuses from the feds when my treasuries mature. Pay up beeatch, want my principle and interest to get another 5% on that!

Amazing graphs. Thanks Wolf.

A breakout of who would be interesting. Guessing some of these: Seniors with invested assets and elevated yields now realize they can’t take it with them? Professional and trades who did elevate their wages/salaries/prices way more than inflation? (Saw this locally). Wealth managers who work as % of assets? Kids of boomers who inherent significant investable assets or housing?

There is the other economy too, composed of those are cutting back, or doing without, to cope with inflation.

Millennials are now in their peak earnings years, and they’re making a ton of money. Gen Z are following behind moving up in their earnings power. Millennials far outweigh retired or retiring boomers in their spending. Millennials and Gen Z are huge, and they’re forming families, buying stuff for their kids, they’re buying their first homes, they’re equipping their new homes, they’re buying cars and electronics, they’re going out to restaurants and bars, and they’re travelling all over, they’re moving to different cities, they’re huge spenders. This boomer nonsense is getting ridiculous.

I did read once that Boomer’s are supporting their kids to their own detriment.

And I have seen it in person, where the adult children use their parents like ATMs.

I have 2 millenial children mid thirties . One had a family and is in a week long vacation with another family in Mexico for spring break . Cost was 20k. Kids are 7 and 11. The other is taking their work bonus and buying new windows for the home and adding a new patio to the back of the house at a total cost of 60k. The millennials know how to spend .

Ain’t HELOCs jes grande?

60k for a patio and windows?

Holy snikeees batman.

Sounds like they need to be sat down and listen to clark Howard for 30 days straight.

His chant of “I want to welcome you to the Clark Howard Show!!…” will grow on them. ;)

And now your kids have $20K less for their kids’ college educations or retirement. Not very bright, in my opinion. But maybe they’re wealthy; I have no idea.

Howdy Lone Wolf. This post of yours reads just like my True American Story of old. Americans doing what they do best, individuals prospering.. Only question I have is how the 3% ters can move?? HEE HEE

Lay off the one man circle jerk, you’re getting annoying like a fly.

I’ll say it.

Wannabe/DFB

What’s with all the hate? Somebody stalking poor Bubba? This has been a trend lately…

I think Gen X also has a lot of spending power (peak earning years in their 40s and 50s). Those of us on the younger side of Gen X are spending lots for our pre-teen kids and family experiences, and those on the older side seem to be traveling, doing short term rentals and spending money that way.

This. I’m 41 and a lot of my discretionary spending has been towards events and experiences with our 5yr old daughter, taking her on trips to Florida to visit grandpa and our friends in VA. Do I still really want that 911? You bet, but the reason behind acquiring one changed from ‘this is badass look at me’ to ‘i get to do daddy-daughter time with the top down on morning drives to the beach’

See I don’t understand the “family experiences” excuse.

I did a ton of cool stuff when I was a teen with my family. And NONE of it helped me in life today.

So perhaps you have to ask, “is this fun helping Me or is it helping my kids future?”

tbh I wished I had just learned more back then, honed some skills or languages better. Become much smarter and sharper. Humans can become very sharp with dedication.

Me either. There are lot’s of cheap convertibles. Why bother to convince people here, anyway?

Seeking absolution? Go to a priest and put money in the box.

Come down to Naples Florida where I spend my winters, and tell me that Boomers are not spending money. You have got to be kidding. The Boomer generation is the massive gorilla in the room. And, by the way, they are the ones who are collecting those Treasury interest payments, along with a recent huge increase in Social Security COLA. I am not disagreeing with you that Millenials are also a big factor here, but don’t discount the huge amount of wealth and huge population of Boomers who are definitely in a spending mood. And they don’t blink twice at this massive inflation in restaurant and service costs. They spend a huge amount of money on services, including the majority of healthcare expenditures. Millenials buying houses? Not in Naples. At any rate, agreed that Naples is an outlier, but I don’t buy your comment about this so-called “Boomer nonsense”.

Boomers don’t start families and they’re unlikely to be first-time homebuyers. Those two things require huge amounts of spending. Because kids are expensive every single day until they’re out of college, and you gotta put something nice into that house and get the yard done so it looks good. And then you gotta get a couple of cars that match the house, etc.

And Millennials and Gen Z are HUGE generations, and they’re still growing through immigration. Boomers are shrinking.

So as a counter example, come to San Francisco, which is packed with young people, and you’ll see mindboggling amounts of spending. And there are SO MANY young people.

To generalize from snowbirds to the rest of the economy is bizarre.

For those who are fact impaired, here are the facts. Each generation as a percentage of the US population:

Greatest Generation 0.2%

Silent Generation 5.49%

Boomer Generation 20.58%

Generation X 19.61%

Millennial Generation 21.67%

Generation Z 20.88%

The Baby Boomers are steadily diminishing in numbers and importance. Their egos are still huge however.

The fertility rate for US females in 2021 was about 1.6. Well below replacement. in 2022-2023 there was some improvement as you would expect with the end of the Covid scandal. But still a good ways below replacement.

I look around at my friends who have adult daughters. Not one is even talking about having babies and only 1/3 are even talking about getting married.

Longer term, the demographers seem to be expecting overall US fertility per woman to decline to 1.5. Ex immigration, that would mean a population reduction of 1/3 (100 million people) in the US in 50 years.

Worldwide, India is still growing, but even there fertility is at around 2.1, just about at replacement level.

China is, Japan and Korea are all on the road to a 50% decline in population within the next 50 years with Chinas population expected to be 500 million by 2100.

The only place in the world still experiencing rapid population growth with high rates of fertility is central Africa.

The economic model for the world is going to have to change. No telling what that change will be, but it’s coming and change normally means conflict.

I suppose things are great in the US now. Thats certainly true for me. No debt, sufficient income, lots of cash earning 4-5% a tax strategy that seems to be working.

Lot of people are scare mongering about demographic cliff in usa but immigration would solve all problems.

Unemployment is low, wages are up, SS COLA is up, Savings interest rates are up, BTC doubled last year, and the stock market is at record highs. There’s so much wealth to draw from.

Inflation is flattening (except for services as Wolf points out.)

The people who I know who aren’t doing well are people who are renting (their wages did not track rental price increases) and people who purchased a house in the last 2 years at a higher interest rate (Sales volume has been low so that is a small percentage). Homeownership is at 65% and I suspect most purchased greater than 2 years ago at a greater than 30% discount from current prices and are now locked in at a 3% mortgage. This is likely much cheaper than renting today.

It is likely 35% of the US population who are non-homeowners (renters who didn’t see a wage increase) are struggling.

65% of us are still partying. 64.999% are partying and I am saving.

You’re uninformed about the rental market. Renting is an option. “Renters of choice” could buy but choose to rent. Every single multifamily building that has been built since 2008 has been targeted to renters of choice with above average incomes. They’re all higher end. Because that’s where the money is. Every build-to-rent single-family house has been targeted to the renters of choice because that’s where the money is. The median household income of those is $150k, per some of the big landlords.

Lower-income people have to rent something old and run-down, or something subsidized.

If you don’t understand this, you will never understand the rental market.

I moved 15 times in my career and bought 10 homes . I always tried to get my wife to rent until I knew the moves would cease. I am a big believer in renting vs owning depending on one’s profession .

I moved 8 times in my career. Never, once, did we entertain renting as an option. I sought what I could afford that provided for my family’s needs in that time and space (schools, primarily), and bought it. Usually the one with the worst curb appeal and smallest square footage in the best neighborhood. Location in the tract was key. A community adjacent to the *fancy people* was usually the target.

Never lost a dime. Ever.

I broke even owning a home from 1987-1993. Prices were mostly flat.

I would have lost my shirt owning a home from 2006-2014.

I would have done very well owning a house from 2012-2020.

If you have control of timing, you can do well. Job transfers are not controllable.

Buy and hold for at least 10-15 years and you will at least break even.

You just described my wife and me. We sold everything and moved onto our sailboat 7 years ago. After sailing the east coast, we put the boat on the hard last fall and are renting a moderately nice apartment with a combined retirement income a bit north of $150K. We could easily afford to purchase an $800K home but we are really enjoying the interest income that substantially covers our $2K monthly rental. Besides, we don’t want to be in the position of catching a falling knife by purchasing a house that will undoubtedly drop in value over the next 3 years. Time will tell if we made the right decision.

Thank you Wolf! You have correctly pointed out that many renters of choice are not extremely hurting. If your average wage was 150K and you got a 6% wage increase over the last 3 years, Your rent likely did not go up 10K/year over this time so you are not hurting too much.

If you are making $20/hour =40K/year, an extra 20% in rent increases does hurt. Your rent likely went up 5K year. You have to downsize your rental unit or tighten your food/beer budget.

Looking at my youngest son’s friends, this is typical. They are mostly renters by choice since they are planning to relocate frequently to move jobs but their wages are barely above $20/hour today.

I was wrong about suggesting that the 35% of non homeowner people in the US are hurting. It is lower than that so more than 65% of the US are still partying. The lower wage jobs are still hurting due to rent increases that exceed wage increases. They can’t be homeowners both by choice(moving jobs) and are locked out of homeownership due to lack of income. That is likely a good thing given prices are inflated with higher rates.

And you can’t blame the landlords too much.

One of my son”s friends were told that their rent was going up from 18K per year, 1500/ month, to 25K per year due to an 7K per year increase in insurance and property taxes Services inflation and government tax windfalls are causing this.

25K per year in rent on $20 per hour (above min wage with a 20% increase in wages from $17/hour 3 years ago) 40K job is too much. They rent by choice but now they are trapped. 63% of their income is now going to rent due to government property taxes and insurance company profit/cost increases. They rent by choice but are hurting at $20/hour despite their 20% raise.

This is an argument to raise minimum wage above the current $7.25 per hour so anyone making $20/hour can float higher and afford to live. More inflation.

$2000/month rent doesn’t sound like much these days but if you are making 150% of the federal minimum wage, you are hurting.

This affects mostly younger adults in their 20’s who are just starting a career.

Wolf,

Do you have a sense of geographic distribution?

If I have a choice of renting vs. buying in Florida, I would probably pick renting because of the hurricane risk (insurance costs, plus the hassle of needing to rebuild). Ditto for parts of Texas and Oklahoma due to tornadoes.

If I don’t have the natural disaster issue I would always prefer to buy.

Is this a major factor in the rent vs. buy decision in your opinion based on the data?

If you buy in Florida away from the coast any hurricane will do minimal damage at most. It’s bs that hurricanes are increasing and putting more homes at risk, as long as you don’t live on the coast. The reason sfh’s are so expensive is because there aren’t enough of them.

Not sure I agree with “renters of choice” misnomer here in coastal CA. The delta is huge for renters and owners and buying really isn’t a choice in this market. My wife and I are renting a 3b2.5ba for $3,650/mo while an equivalent place to buy would be $6,000/mo with no PMI and a $190,000 20% down payment (7.2% 30 yr). This does not include repairs. My wife and I would need to make $300,000 per year combined and not have any student loans or childcare costs to comfortably afford to buy an equivalent rental. And no, we really can’t buy a house anywhere near our jobs with space for our kids near this market. I bet there are many “high earners” like us out there now in the rental market who still can’t afford housing.

What your lament tells you is that houses are way overpriced, and a terrible deal right now, and that it’s smarter to rent at this point. And you chose to rent. You COULD buy, but maybe not the kind of house you want, or where you want it, but you chose to rent the house you want where you want it.

This kind of behavior is directly signaling to businesses that they can keep on raising their prices. It’s the perfect spending storm. You have the boomers, also known as the Yolos. They are ALL spending like they are gonna die in 2 weeks. The millennials are making more than they’ve ever made and they are damn sure spending it. $250 Nike sneakers for a 10-year-old no problem! And then you have the Gen Zs that are making money too, higher wages, and they don’t have any reference for what things used to cost prior to the pandemic, so they are spending. And then the Gen Xers, many of them are making more money than they’ve ever made as well, and keeping up with the Joneses just fine!

That’s why I call it the perfect consumer spending storm!

Just more mass insanity, no different than during the plandemic when people were afraid to go outside but in reverse. Buy imaginary coins, there will only be so many of them made! Ignore the naked emperor!

Except it isn’t insanity. It is perfectly rational. They are making lots of money so theybare spending some of it while saving a portion of it.

Perfectly rational.

I’m an Xer with a 10 year old. No way is he getting $250 sneakers he’ll outgrow in 10 months!

That’s why God made outlets.

Wow, what a collection of gross generalities, narrow stereotypes and assertions with embedded statistics not supported by data. So glad I don’t think like this. All these people can be summed up with some quick phrase each, eh? I’m a boomer and I don’t fit your image at all. Probably plays well at the corner bar, though? I prefer to listen to someone like Wolf who is demonstrably data-driven.

it’s amazing what 3 trillion of graffiti can buy .

Why are we in the weird ass double peak again?

It’s like consumers were shocked and now just surprised. Soon it will feel like normal to fork over most of your salary to Corps.

Thank you Corps! You can do no wrong!

You would like to add antibiotics back? Can I say no? Oh no, well ok then you just add those antibiotics back to the chicken. And I, the moron consumer will eat those antibiotics right up! To my body’s detriment. Thank you Corp!!

Consumers aren’t as sensitive to price increases when they can just throw their purchases on a credit card and make a minimum payment each month. Or purchase a vehicle with ever longer and longer years to pay. Take away the VISA and MasterCards and see what happens to consumption.

Nonsense. Credit cards are the dominant consumer payments method in the US. $5.8 trillion in payments were made in 2022 with credit cards. Each of the other payment methods (debit cards, ACH, checks, cash, etc.) lagged far behind credit cards.

That $1 trillion in credit card balances = the statement balances. But most of the credit card balances are paid off the next month and never accrue interest.

Growing credit card balances show increased SPENDING (including due to higher prices), not increased interest-bearing debt.

Most consumers with credit cards collect their 1% or 2% cash-back, or their double-miles, or loyalty points, or whatever, feel good about the kickback, and pay off their cards by due date. And there is no interest to be paid.

This includes the vast amount of credit card spending that is on company expense accounts where either the company pays it off directly or reimburses the employee or consultant. A five-day conference in a distant city or country, a business-class flight, staying at a convention hotel, eating out, etc. can easily run into the five figures, all charged to credit cards and paid off by due date.

Credit cards are not primarily used as a borrowing method, but as a payments method.

Only about 28% of adult consumers (18 years old and over) have one or more cards with interest-accruing balances.

https://wolfstreet.com/2023/08/19/how-many-americans-have-interest-bearing-credit-card-debt/

https://wolfstreet.com/2024/02/09/our-drunken-sailors-credit-cards-balances-burden-delinquencies-and-available-credit/

Wolf so I agree that the consumer balance sheet as evidenced by things like consumer debt vs. GDP, etc. is healthier than most make it sound, but… can you speak a little bit about trend here?

While I see some positive signs in certain parts of the economy, I do see some detioration that isn’t very conducive to a normal story of a growing economy.

Even looking at your 2 graphs the steepness of card balance increase & delinquency rate don’t show any signs of slowing. And if you specifically break out auto loan performance it is fast becoming once in a generation ugly particularly when looking at the subprime segment.

But furthermore I’m seeing a lot of data where “the peaks and valleys” are incrementally worse from 2022 to 2023 and onto now 2024.

In all of continued claim history in Fred there are only 2 ~12 month periods of noticable increases 76 and 95 without a recession that followed and one period over the mid 80s where it was essentially flat with a very faint move up. We’re now approaching 2 years of fairly steady continued claim increases. And I’ll point out that doesn’t include an influx of long severance layoffs, early retirement offers, and layoffs disguised as returned to office quits (which increasingly I’m hearing rumors from executives that it’s an intentional strategy).

Big ticket discretionary goods including new and used cars are now entering their 3rd year of slight detioration in fundamentals with each year showing bigger inventories, slightly lower pricing than prior year, etc.

Housing whose fundamentals (lack of inventory) are much stronger than big ticket discretionary is exhibiting the same trends when you overlay YTD 2024 vs 2023 vs 2022 in terms of days on market, pricing, % of price declines, inventory, new listings, etc. each year is slightly worse. We’ll see but it’s highly possible that peak house price may still end up being June 2022 after this year completes.

Look at the corporate sector and it seems even worse. Corp debt as a percentage of GDP is high, corp restructurings are skyrocketing (you could say normalizing, but it’s also steep line). There are many companies heavy reliant on variable rate bank loan financing particularly in PE and increasingly

reliant on 14%+ NAV loans to float their portfolios. Also the weirdest thing is that while office building performance has steadily deteriorated (vacancy, rent PPSF, cov breaches, market values of property, etc.) with almost no hope for improvement the loans underpinning that class of commercial propery are in the best shape they’ve been in over a year which just reeks of a canary of over optimism across the entire market.

I’ll also add that the anecdotal data I’m getting on layoffs, hiring freezes, reduced budgets, etc. from sources with a lot of corporate clients has been noticably uglier and that includes comparing to 2018/2019.

And doesn’t all of this stuff get worse if we get one more 0.4% MOM CPI print anywhere? Wouldn’t the market immediately conclude that rate cuts are off the table and the entire yield curve snap quickly upward in intermediate and long term rates?

I say all of this and the same time I get reminded over and over again:

-Economies are way more resilient than most people assume

-A solid argument can be made that productivity is in the beginning stages of skyrocketing with AI integration across so many industries/use cases.

Thoughts?

This is long list of ZH headline BS. You can read my articles to crush that list one by one, if you want.

For example, your ZH BS about subprime auto loans. If you had ever read any of my articles on subprime auto loans, you would know:

1. That it’s not a problem of consumers collapsing or whatever BS; but it’s a problem of companies that had specialized in subprime — many of them owned by PE firms — collapsing because during 0% they got super-greedy and reckless, and they sold those loans via ABS to yield-chasing investors, and now the ABS market has changed with higher rates, and these companies can no longer fund their subprime auto loans.

2. That subprime auto loans have zero impact on new vehicles; almost no new vehicle loans go to customers with subprime credit ratings. But new vehicle sales (manufacturing!) is what really moves the economic needle. Shuffling 10-year-old used vehicles around has almost no impact on the economy.

3. That subprime is only a small part of the used-vehicle market, largely limited to older (10-years plus) vehicles, sold by subprime-specialized dealers.

There are lots of articles on this site to clear this ZH BS out of your brain, for example:

https://wolfstreet.com/2023/12/06/subprime-comes-home-to-roost-for-specialized-auto-dealers-lenders-their-investors-car-mart-was-next-to-confess/

https://wolfstreet.com/2023/04/18/second-pe-firm-owned-subprime-auto-dealer-lender-suddenly-shuts-down-after-its-subprime-auto-loan-bonds-make-huge-mess/

https://wolfstreet.com/2024/02/06/auto-loan-balances-subprime-delinquencies-and-income-who-are-those-drunken-sailors/

The fact that you never read any of these articles is your problem; don’t make it my problem.

Wolf,

Little of that came from ZH. I am in the industry and I’m capable of doing my own research. Some examples of sources:

-Cox automotive

-Blackbook insights

-Fred (in a lot of areas)

-Redfin housing data

-Altos Research

-Credit Reporting Agency reports

-Gundlach (who I dont agree with on a lot of things) has been putting out pretty useful market updates

-Many more sources.

You didn’t really address most of anything I put out there including the main question which is trend (not where we are right now).

You only focused on subprime auto loans and within that only subprime securitization channel.

1) Obviously subprime has nothing to do with new purchase. But what does have to do with new purchase is the fastest growing increases in new inventory on lots in the history of cars with no signs of slowing down. At current trend lines within 18 months we’ll be way past record new car inventories in all of its channel stuffing glory as manufacturers offer dealers more and more special flooring line specials to book a sale for the manufacturer and house that inventory on dealership books.

2) There is not just a problem in securitization. Credit unions that have mostly stayed out of securitization have had major issues with large increase in deliquencies as well. What I’m specifically referring to is that the sub prime auto delinquency rates are the highest rates “since we started measuring that data” from major players like CRAs, Cox, etc. depending on what measure you grab (some yes, some not) and the rate of change is the most extremely steep the auto loan market has ever seen.

If you think that the only issue in auto loan market is difficultly selling ABS because of too attractive of financing offers you’ve got very rose colored glasses on. Its easy to see that specifically auto loan is self imposed craziness with no doc, 140%+ LTV, high DTI acceptance, etc. relative to all other consumer loans products, but the crazy lending market is just as much apart of the market as anything else. And today if comparing average (non subsidized) auto loan interest rate vs lets say the 2 year or 4 year vs the average from 3-10 years ago it’s clear that even prime interest rate spreads have exploded higher over the risk free equivalents which is reflecting a substantially lower appetite among lenders to bid this market to thin spreads presumably because of the worsening default picture.

But most importantly care to speak about everything else that I pointed out (that I didn’t get from ZH)? New car inventories/demand, continued claims, home inventories/pricing/days on market/etc. office building loans, corporate bankruptcies, etc.?

I’m going to blow all of your BS out of the water with the Q1 new vehicle sales this coming week.

Yes, inventories are back, FINALLY. They’re supposed to be back. We need those inventories, and those prices that spiked NEED to come down, Americans want them to come down, people are still getting ripped off buying a car. What’s your effing problem?

Cox is very positive on new vehicle sales. You just didn’t read that part. JD Power is very positive on new vehicle sales, and you didn’t read that part either because it doesn’t fit into your narrative.

Gundlach is a bond fund manager that MUST HAVE lower interest rates to make money. And he is pushing with all his weight to get the Fed to cut rates. Back in 2020, he was talking about negative interest rates. I don’t know why anyone still listens to that guy.

Will you please consider posting a graph of M2 on top of the Consumer Spending graph?

Money supply M-2 is not correlated with consumer spending. It’s directly affected by certain aspects of QE and QT, and by other factors. It peaked in April 2022 when QE ended, and then declined as QT began. But the way M-2 includes certain measures and excludes other measures garbles the signal. For example, when reserves decline, it will push down M2, but when ON RRPs decline it doesn’t have that effect, which is why it stopped declining when ON RRPs started draining out. For that reason, I don’t think it’s a good measure for anything. It needs to be replaced with a modern measure.

Just looking at the Fed’s balance sheet gives you a much better indication.

Consumers aren’t sensitive to price increases when they can just walk away from that product or segment. What you don’t buy doesn’t cost any more.

Our favorite (well, ex-favorite) ice cream brand shrunk the package 25% and raised the prices 40% a few years ago. We stopped buying it. Lately, it’s priced at the same cost per ounce than it was before we rebelled. Coolers were stuffed with it. Sales languished. Dairy products don’t have a great shelf life. Sale prices ensued. Volume returned only when on sale. Seems they learned their lesson as “regular” price is back down where one can justify buying it once again.

Yes, there’s price increases on some things you can’t avoid buying. However, there’s things you can do. Don’t cry victim. There’s all kinds of discount days for geezers (usually first Wednesday of the month), military (first Friday of the month), fire and police discount days…. at the grocery stores. 10% off. That’s when we stock up and we also play their coupon game. 30% percent off per trip is not uncommon… I’ve had gusts up to 50% off the entire purchase. Home Despot has military discounts. Ya gotta ask as they don’t serve them up voluntarily.

Same with pharma. Our generic prescriptions we get from the guy who owns a Dallas basketball team. One of mine is 1/3 the cost from them than from the local chain drugstore. I don’t even bother using my insurance as 90% of the time it’s cheaper through the website.

Buying stuff is a blood sport these days.

45 – 50 years ago the only debt I heard of in my working class / middle class circles was a 15 year fixed rate mortgage. The only people with credit cards were traveling business expense account types and once is a while someone with a Marshall Fields ‘charge plate’.

I remember on a trip once in the 50’s we had to use Western Union to have a relative wire us money to the next town. Everything was cash or maybe traveler’s checks.

Also, most everyone had a 900-1300 sq ft 1 bath house, with 1 wall heater (CA), and few mothers worked (PT if they did). Everyone had one car they could fix/maintain (until it hit 100K) and NOBODY cared about the stock market AT ALL….it was just something “rich” people did. We never knew who’s house we would be having baloney sandwiches and kool-aid for lunch at.

All the fathers had UNION jobs or had a small biz like a meat market or an insurance agency. IKE was prez. Top tax bracket (of at least 20) was 90%. Budget was very close to balanced, even the WW2 debt.

We were all FN lucky as hell. I give a some credit to the fact that most all our fathers had very recently spent 1-5 years at some job related to killing people, and were all at least trained to do it, if not an outright professional.

You don’t trash such people’s lives for a while, at least, even though the wealthy are ALWAYS hoping to squeeze evermore money out of ANYONE they can.

Yes, being the only industrialized country left standing due to a fluke of geography helped a lot.

It’s the Roaring 20’s!!

One trillion dollars in debt – every 100 days.

This is gonna blow sky high

Yeap! I still have to live to see a good article talking about the impact this extra one trillion dollar print q/3month will have on financial market and overall economy.

Maybe Wolf already addressed the issue but I didn’t see it!

Howdy Truthseeking You are at the right place. The Lone Wolf taught me how Govern ments use inflation to cover their debts/a$$. ???? We will have to wait and see if it works again. Keep on Truckin…. 35 trillion is not that much compared to 1 decillion.

Howdy RobertM700. YEP and why not. Govern ment taught them how with all their programming. ZIRP, QE, Spend and print.

After all, you only live once so why take your foot off the pedal?

For some reason, the final scene of “Thelm And Louise” comes to mind.

As a retiree that’s how I am living kicking the can down the street knowing the culdesac is at the end where one can just drive in a loop.or maybe a huge roundabout.in the mean time enjoy the trips down the street. I have noticed a drop in 20 year old trucks lately.

If the mere hint of a rate cut induces the same effect as an actual rate cut, what happens when the rate cuts never come?

The date who says they can’t wait until we get home, but ends up saying “another night” due to headache and being tired.

Seems like things would cool off very suddenly and unpleasantly.

After reading how good everything is here for americans and with markets at all time highs daily, to back this up, tonight i opened the good stuff; the trokenbereenauslese and a fat piece of keylime pie to celebrate good times!

Let the good times roll!

Laissez le bon temps rouler!

It seems like nothing will stop these working class from paying their Wall Street oligarch inflated rents.

The worker’s sobbing children with a paramilitary jack boot of capitalist oppression goose stepping on their throats are still begging for a second helping of porridge.

Took a while to dumb them down enough and then learn how to best prey on their prejudices, though.

Didn’t happen overnight.

Ah the great All American rat race on steroids, much to do about nothing. Top 20% are doing extremely well, those at the bottom soon will be replaced by cheaper labor. The constant fight for survival is and will continue to be the bottom caste of the system. The fight for basic resources such as affordable housing and rents will continue as a plague. Gun ownership is a must as the gap between the haves and have nots expands. The Hunt for Red October sets the precipice for the most civil unrest the USA will ever witness.

As good a prediction as any, although I don’t get the movie part. I’m not worried about A-birds flying, except for a few from rogue states……all “leaders” and their offspring die too, plus the Military “leaders” have the last word.

More worried about climate change….but it could FORCE a “Green New Deal”….some hope, anyway, for some countries.

Sorry Wolf, the M2 graph request was intended as a standalone comment (not as reply to your post). Apologies, I’m a new poster.

It’s increasingly challenging to not get sucked into the Soft Landing Black Hole, the drumbeats are growing louder, as all the worrisome fears of stress lags evaporate— or at least continue to be ignored.

The whole lag issue of something breaking has become an uneventful reality, adding to a case of resilience and a profoundly different economic cycle that defies any connection to history or risk.

The euphoria of new daily gains in wealth effects are proving that risk doesn’t matter, as bears are ground down and run over like idiots, on a regular basis.

The drunken sailor narrative and the recovering economy versus recession fantasy share a common pivot point, which is, the reality of physics.

How common is it, in the past hundred (thousands) of years for markets to go straight up, without real correction? We have to be honest and at least take notice that in the past 25 years, we’ve seen at least 3 recession corrections. It’s extremely unlikely we’re going into a period of nonstop AI growth, where every part of the economy will be uniformly resilient. Financial innovations, technology and political cycles are not going to align into a new paradigm where everything is perfect.

On that note, this dude is worth watching, because he’s focusing on how debt is being repackaged into innovative new investments, that eventually are going to be stressed out:

From Grants:

“ That barrage has helped substantially whittle down what had been an imposing principal repayment schedule for speculative-grade borrowers. Bank of America relayed Friday that U.S. issuers of junk debt and broadly syndicated loans have managed collectively to reduce debt maturities though 2026 by $329 billion over the past year, equivalent to 40% of that maturity wall.

Yet the repayment date reshuffle – which “represents one of the most aggressive instances of maturity extension in the history of leveraged finance,” per BofA credit strategist Oleg Melentyev – has largely been confined to more creditworthy firms. “Lowest quality market access remains substantially constrained,” he added. Speaking to that dynamic: global corporate defaults registered at 29 over the first two months of the year, S&P Global finds, marking the highest January & February total since 2009. ”

Excellent insights. Thank you for sharing. While Jim Grant probably wouldn’t appreciate your quoting him verbatim from his pricey newsletter, he is a very wise man who is worth paying attention to. And so are you. Over thousands of years of financial history, there has NEVER been a fiat currency that has survived the onslaught of endless promises by feckless politicians who just keep borrowing and spending until everything inevitably blows up. For those commenters here who think it is funny to “party on”, I feel sorry for them when the party ends.

Fyi, that quote was from Grant’s free Almost Daily Grant’s column, a worthwhile read. I would love to subscribe to their regular material but don’t have a company paying for it, so I’m content to read their daily crumbs.

Howdy 3% Prisoners. We are peaking everywhere for how long? 20 to 30 Years? Will Wolfs charts never show a drop no matter what article he works on? Will you miss out on the party? Looking like the roaring 20s are back? You will just have to stay locked in your homes to find out how this all ends….Don t forget, you cannot get mad at the boss at work either.

HEE HEE

DFB,

Using your twisted ” locked in ” logic it would follow that homeowners with a paid off home are locked in as well.

Seems like you are mad because you perceive that your opportunities to profit off of real estate churn are reduced.

Howdy OTB. Not at all and people should not be ZIRPed into stupidity.

We leave the door unlocked here at the sunshine mental home ” where no one is a prisoner”

Howdy bubba, I miss you, come home.

Howdy Home Toad Don t worry, I never really left the sunshine common sense mental home. Should I try and explain ” Starter Home” to non members of Sunshine? Probably not.

Yes indeed. Ironic, isn’t it? Here we are in the 20s again, and they are roaring! Wait a minute. Didn’t this have a bad ending back in the 1920’s? Uh oh…

US is the world’s Goldilocks economy.

GDP is soaring. Stockmarket is soaring. Crypto ETFs are soaring. Wages are soaring. Bonuses are soaring. Savings are soaring. Big tech is soaring. Dollar is solid. Inflation is falling.

If the US can just rein in its public debt and trade deficit, it will be Goldilocks Plus.

And be glad you don’t live in the EU or UK. Most countries there can only dream of 3-4% GDP growth and 100k salaries for delivery truck drivers.

The Goldilocks soaring and thermal waves that are lifting Pegasus higher and higher, are helped by the deficit flames that are heating the air flows. This perfect moment in time, eventually faces the reality of slowing earnings growth from AI fantasy. The underlying reality of the Russel smaller companies, and smaller firms that are fueled by junk bonds, creates a dangerous house of cards, through overconfidence in over-concentrated Fab Five future value.

Maybe it’s sustainable, but it’s definitely a story of haves and have nots. The $100k truck drivers are probably too young to remember the truck drivers that bet their 401ks on JDSU — they were soaring along, until they lost the updraft.

Here’s an interesting analysis from a substack called base money:

“If the price-to-earnings ratio falls to 15 in 2033, but AI-adoption helps generate $500 in earnings for the S&P 500 in 2033, it generates a price target of 7500.

That’s a 44 percent price increase over the next decade.

That works out to a 3.7 percent annualized gain from here.

If interest rates stay above 4 percent, stocks lose to money market funds. If inflation averages more than 4 percent, stocks will lose money in real terms.

The problem for stocks is not a dire economic scenario. The problem is there are dire price predictions (within a range of possibilities) using optimistic economic scenarios. It all goes back to valuation.

Let’s goal-seek the earnings growth needed to get an 8 percent annualized market return at a p/e of 15 in 2033.

The current year forecast is around $230 in earnings.

The S&P 500 would have to be around 10,000 in 2033 if it gains an average of 8 percent each year. Earnings would be around $670 per share at a p/e of 15. This requires earnings growth that averages about 12.6 percent over this period.”

“smaller firms that are fueled by junk bonds”

I love how people throw around the term ‘junk bonds’ implying they’re some crazy risky investments.

If you own an s&p index fund, then you own shares in these same “junk” companies, and your shares are lower in the capital structure than debt.

And health insurance, shelter, education are significantly coming down as well as military spending. Combined with wealthy inequality almost eliminated we truly are moving into the Golden Years of the US. With the wealth we have here we are probably only a Congress away from ensuring more basic rights for all citizens. The shining beacon of hope in the World will fulfill its destiny. Queue outro music….

You win the award for the Most Deadpan Humor Evar.

Public sector deficit = private sector surplus. You already knew this right? You noted soaring private figures alongside the increasing public deficit and debt. A Goldilocks economy would be a soaring economy with a government SURPLUS not a massive deficit that we have now. Simple math really…

Hilarious comment. Everything is soaring until it’s not. Just a matter of time my Star Wars friend. Dollar solid? You mean like real money – gold? US reigning in its public debt and trade deficit? Well, that’s certainly light years away but more likely will never happen.

Gold isn’t real money and hasn’t been for decades. Just like horse and buggies are not the primary form of transportation. Gold is just a speculative commodity with some minor industrial uses and mostly decorative uses.

I would guess that the “inflation adjusted” spending is adjusted based upon official inflation figures.

I gotta tell you that the “official” inflation barely reflects the prices now being paid for everyday items. Some are up, some even down, but most are way up, much above the official rates I think.

So if those consumer spending dollars were inflation adjusted by what is a higher inflation rate, would that reduce the chart data significantly?

Sorry, I’m just a retiree whose formerly decent fixed income just isn’t going much beyond true basic costs these days. I don’t have data to show my gut feeling about true costs but it sure shows up in the monthly spending.

You have more insight as to the inflation adjustments used for spending, do you think those are true to life adjustments?

Drunken Sailor and credit cards. From the Internet, must be true:

“Groceries Paid for Over Time

Even though the monthly rate of inflation has declined dramatically over the last 12 months to roughly 3.1%, overall prices have increased by 18% since January 2021. According to the latest CPI data, the cost of food is 20.9% higher in 2024 than it was in 2020. That’s why the crowing about reduction in monthly CPI continues to fall on deaf consumer ears. It’s their grocery store receipts that consumers look at when they say their wages have not kept pace with inflation.”

Households and Nonprofit Organizations; Checkable Deposits and Currency; Asset, Level (CDCABSHNO) | FRED | St. Louis Fed (stlouisfed.org)

For drunken sailors and zombies, from Grants:

“law firm Proskauer Private Credit Index showed a 1.7% default rate across 2023, less than half the 3.6% rate for global speculative-grade credit tracked by Moody’s Investors Service. Leveraged loans have defaulted at a 6.22% clip over the 12 months through February, TD strategist Hans Mikkelsen finds.

Simple semantics may help explain that yawning gap, thanks to private lenders’ ready willingness to engage in so-called liability management exercises. As investment bank Lincoln International found last fall, 425 private equity-backed companies – equivalent to 15% of the firms under its analytical purview – managed to amend their credit agreements over the first half of 2023, extending maturities and/or reducing the amount owed in return for stronger legal language protecting their creditor(s), i.e., amend-and-extend and distressed exchange transactions, respectively.

Crucially, such maneuvers are typically considered an event of default by the rating agencies (see the Oct. 13 edition of Grant’s Interest Rate Observer for more on this dynamic).”

I’m just curious about why zombies and drunken sailors are still partying — I’m hopefully not settling alarm bells off for too many posts.

I’m finding these credit quality concepts interesting and obviously, creative and innovative solutions are being found to extend the pandemic business cycle. If anything, this innovative debt management may be a reason why so many inverted spreads are so unusual. Above my pay grade, but if normal loans are being modified with undisclosed terms, a lot of models and data are “probably “mispriced.

From the web, must be true:

“ The problem is more pronounced in loans than in high-yield bonds, because loans are usually floating-rate obligations, meaning their interest costs are adjusted higher more quickly in an environment of rising rates than fixed-rate bonds.

“The loan market from a coverage ratio is much worse off than high yield,” said John Lloyd, lead for the multi-sector credit strategies and a portfolio manager at Janus Henderson. “The evidence of that is that you’re seeing many more downgrades and slightly higher defaults in leveraged loans than you are in high yield.”

While fixed-rate borrowers are more insulated from the rate-hike cycle, they will be subject to the same pressures when they need to refinance, assuming the rate backdrop doesn’t change.

“Stress will intensify for those borrowers that are not bringing leverage down to maintain adequate coverage ratios,” said Bill Zox, a portfolio manager at Brandywine Global Investment Management. “If borrowers have their heads buried in the sand, betting on much lower base rates, I am a seller.””

Howdy Redundint ” I’m just curious about why zombies and drunken sailors are still partying ”

How about a sober sailor story? Worked and saved always and now as always, continue with life the way WE have always chosen. Even when the lock downs of entire countries was going on, some of US continued on doing what we always did. Was easier to spend more then because no one was ahead of US making US wait……Stop doing what we have always done? Why?

In several of your comments here you cited “loans and bonds.” So that everyone knows: these are business loans and bonds, and the loans you’re referring to are high-risk leveraged loans by nonbanks to junk-rated companies, and the bonds you’re referring to are junk bonds.