Subprime doesn’t mean “low income.” It means “bad credit” – and some is high income. And subprime loans are coming home to roost.

By Wolf Richter for WOLF STREET.

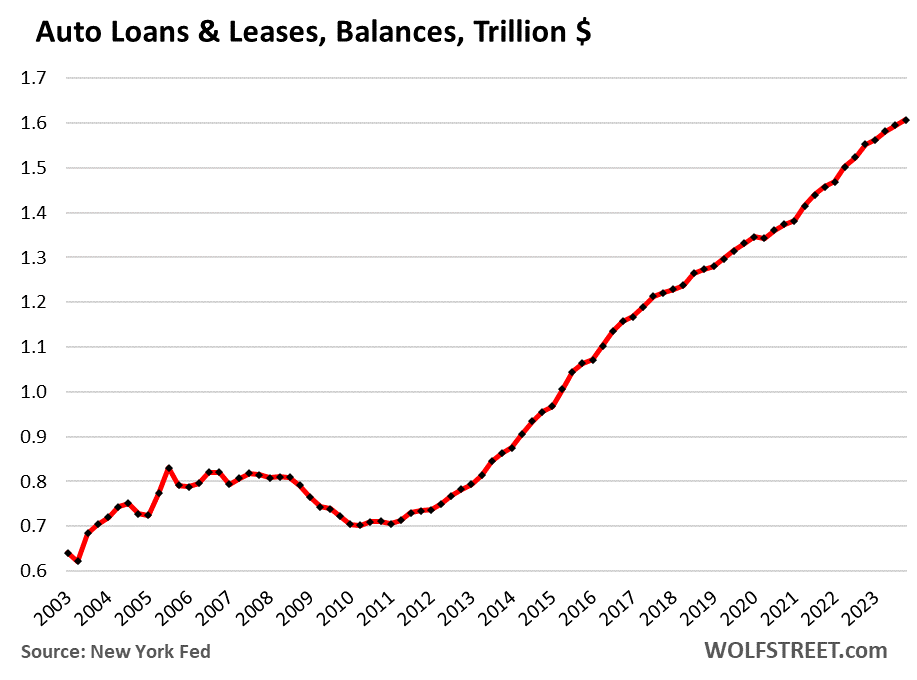

The balance of auto loans and leases rose by 0.8% in Q4 from Q3, and by 3.5% year-over-year, to $1.61 trillion, according to data from the New York Fed’s Household Debt and Credit Report.

This was a small year-over-year increase in loans and leases, given that new-vehicle unit sales jumped by 12% in 2023 year-over-year, while used-vehicle unit sales were roughly flat, and while disposable income jumped by 7%.

Spiking prices caused loan balances to jump in 2020-2022. Used-vehicle retail prices spiked by 55% and new-vehicle retail prices by 20% during the pandemic, and so the amount financed surged, even as unit sales plunged in 2020 and 2021 due to the shortages.

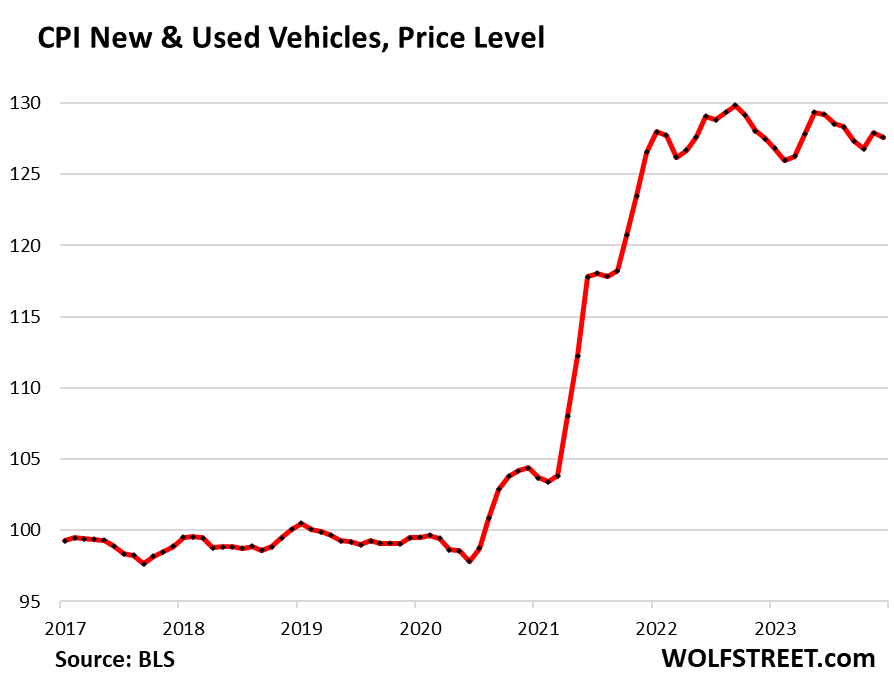

Starting in mid-2022 and through 2023, new-vehicle prices began to level out, rising just a little, while used-vehicle prices entered into a historic tailspin that has now knocked out one-third of the pandemic spike.

Combined, the new-and-used-vehicle CPI spiked by 31% from January 2020 through September 2022, and has since then dipped about 2%.

The amount financed is dominated by new vehicles because 80% of new vehicle buyers finance or lease a new vehicle, but only 39% of used vehicle buyers finance or lease; the rest pay cash (data by Experian, based on registrations).

The combined new-and-used-vehicle CPI is also dominated by new vehicles because new vehicles cost more than used vehicles and weigh more in the CPI basket (new vehicles weight 4.2%, used vehicles weight 2.5%):

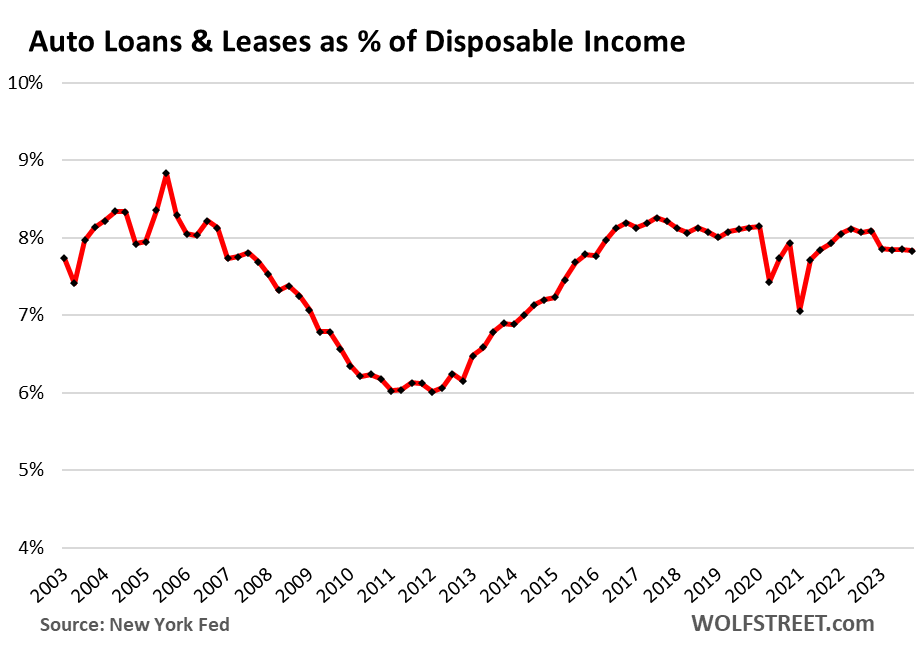

The auto-debt burden dipped. Rising disposable incomes have more than kept up with rising auto-loan balances. Total auto loans and leases outstanding dipped to 7.8% of total disposable income, lower even than during the years before the pandemic.

Disposable income is income from all sources except capital gains, minus taxes and social insurance payments. This is the income that consumers have left to spend.

There are two reasons for this dip in the burden: slightly more buyers are paying cash for their new and used vehicles as interest rates have surged; and disposable income has jumped by 7% year-over-year.

Subprime is called “subprime” for a reason — and it’s not income.

Selling and lending to customers with subprime credit rating is a high-risk high-profit specialized activity, largely limited to older used vehicles. It has attracted specialized lenders and dealers, often backed by PE firms. The system hinges on being able to securitize the subprime auto loans into Asset Backed Securities (ABS) and sell the investment-grade tranches of those ABS to pension funds and other yield-seeking institutional investors, and that works until it doesn’t.

Bad loans are made in good times. During the free-money covid era, specialized subprime dealer/lenders loosened their credit standards and got very aggressive and very greedy. At the same time, used-vehicle prices surged. And the risks piled up. In 2023, several PE-firm-owned subprime-specialized dealer-chains filed for bankruptcy. Investors have gotten leery of buying the bonds that subprime auto loans are securitized into – and those ABS make the whole system work. And even the large publicly traded subprime dealer/lender Car-Mart disclosed massive problems in December, and its stock tanked.

And lenders are belatedly tightening their lending standards. About 61% of used vehicle buyers pay cash, according to Experian, and it doesn’t matter what credit rating they have. For those who borrow to buy a vehicle, the share of subprime has dropped to 14% of total loan and lease originations, down from 20% in 2018, according to Experian’s Q3 report. For borrowers with subprime credit ratings, financial conditions have tightened.

But subprime doesn’t mean “low income,” it means “bad credit” (a history of not paying debts, which caused their FICO score to drop into the subprime category). And subprime is only a small part of the used-car business and of the auto-lending business.

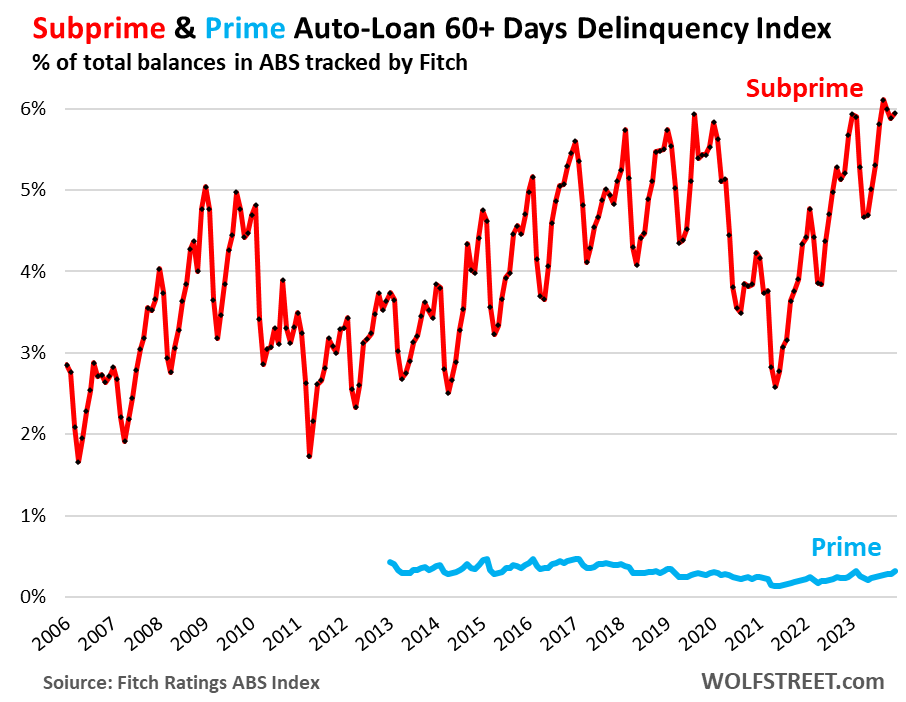

Subprime loans that are at least 60 days delinquent had hit a record in September but have since then backed off a little and in December were at 5.9% of total loan balances (red line in the chart below), according to the auto loans backing the ABS that are tracked by Fitch Ratings.

Prime loans are rock-solid with minuscule and relatively stable delinquency rates near 0.3% (blue).

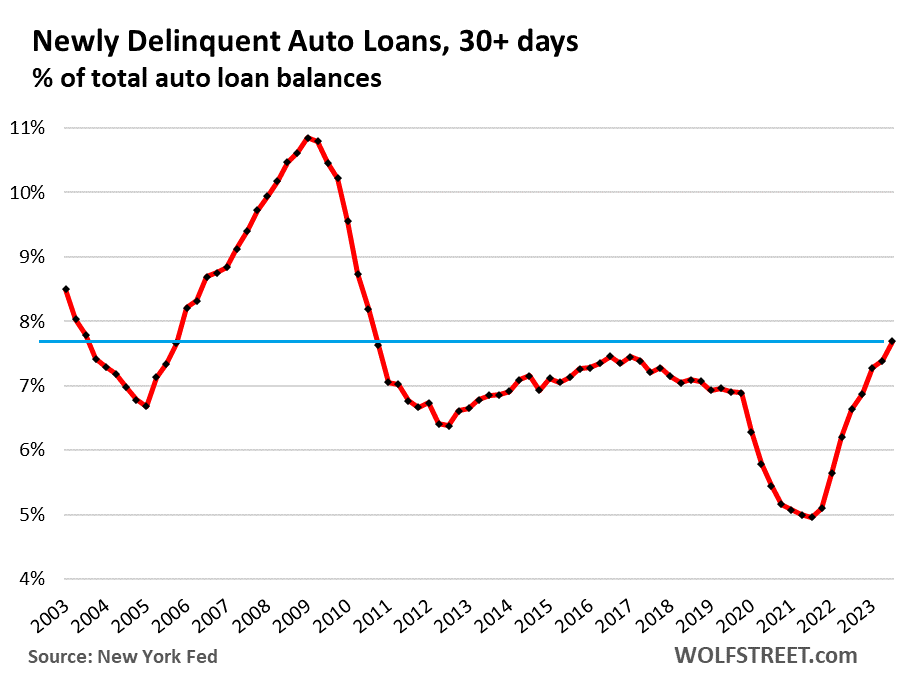

Overall delinquency rates, according to the New York Fed’s metrics: The 30-plus-day delinquency rate – auto loans and leases that transitioned into delinquency by the end of Q4 – rose to 7.7% in Q4, a little higher than in the years before the pandemic, when it ranged mostly from 7.0% to 7.4%.

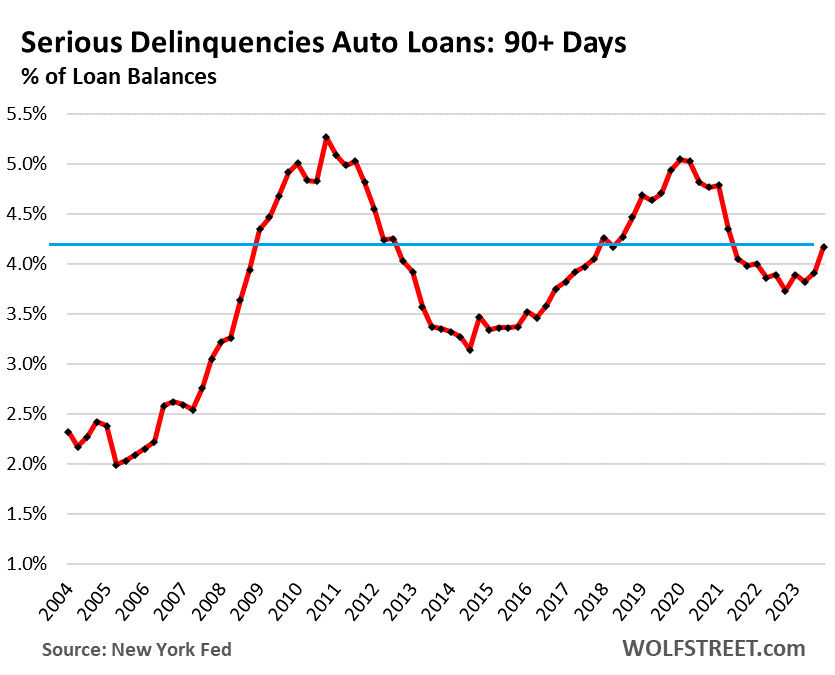

The 90-plus-day delinquency rate – auto loans and leases that are 90 days or more past due by the end of Q4 – rose to 4.2%:

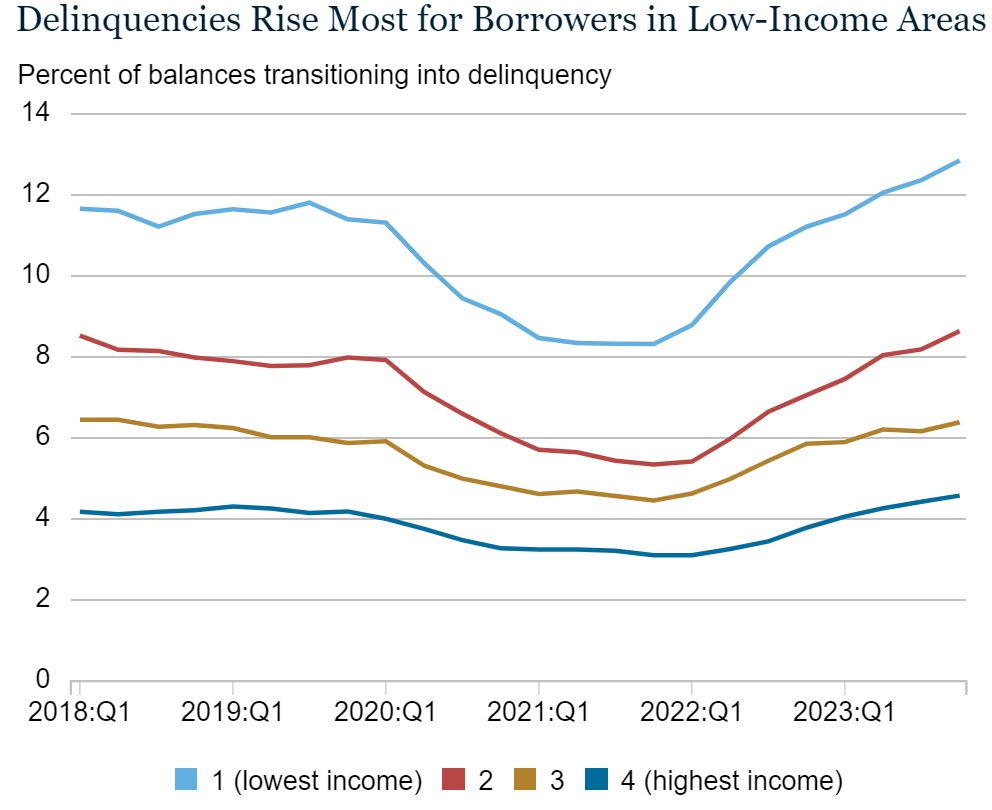

Delinquencies rise the most in the lowest-income zip codes.

In a blog post, the New York Fed grouped the delinquencies by zip codes into four income categories from lowest-income zip codes to highest-income zip codes, and found that delinquency rates drop as income levels rise. In addition, it found:

In the lowest-income zip code category, delinquency rates rose more sharply and exceeded 2018 by a big margin, 12.8% v. 11.7% (light blue in the chart below). It is these low-income borrowers that are behind the increase in auto loan delinquencies above their pre-pandemic levels. These low-income borrowers are also the ones who are struggling the most with inflation — including the price spike in vehicles that they’re now having to make payments on.

In the three higher income zip code categories, delinquency rates were either just below or just above their 2018 levels – they essentially just normalized from the free-money drop during the pandemic.

That even the highest income zip code category (dark blue in the chart below) had an auto-loan delinquency rate of 4.6%, or any delinquencies at all, demonstrates that “subprime” doesn’t indicate “income” but “bad credit,” and that bad credit happens even to people with high incomes if they get into debt too deeply, if there is a major uninsured medical issue, etc. (chart via New York Fed):

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Thanks for this data rich summary Wolf and interesting to see the rising auto loan delinquencies are happening even in the higher income areas. Anecdotal we’ve been suspecting something like this just from looking around in our extended neighborhood, way too many new luxury cars, huge shiny new SUV’s and monster huge pickups. Even for people who’ve told us before they’re struggling to manage costs from a recent home purchase or repair, or the even more insane costs of college tuition and their student loans now are coming due. And knowing how expensive new and even used vehicles have gotten, the question “how did they have the money for this?” Indeed a lot of them even with high incomes don’t have it. (And at least one got repo’ed in November).

I know you’ve talked about it but this is been for us one of the more undesirable changes in the US culture since at least 1990’s, this huge tolerance for going into debt to become one of those drunken sailors. And it’s one of the many causes of this recent inflation surge, housing bubble and the everything bubble across many asset bubbles. When so many Americans are willing to drown in debt and over-pay for homes, cars, college tuition costs (and then all the crazy prices for healthcare and childcare), get into buy now pay later trouble in addition to credit card bills, they aren’t just hurting their own finances. They make it harder even for Americans who try to be thrifty and save, because it’s now culturally “acceptable” to go deep in debt and the prices reflect that. Even for necessities the rest of us need. Hopefully the rising delinquencies are finally starting to impose some discipline on the drunken spending habits, may be one of the few things to force these bubbles back down to earth a little.

“auto loan delinquencies are happening even in the higher income areas” = higher income subprime

You cannot tell from the outside, it’s the young dentist that got in over his head. As you can see from the chart, high-income delinquencies are low, but they always happen, because there is always part of higher-income that got in over their heads and has become subprime.

For most people, subprime is a temporary status. After a while, they get their credit straightened out and their FICO score improves.

That describes it well from the cases at least we know something about, young (mostly young) professionals getting in way over their head. Sometimes being fair it is factors outside their control–out of the blue someone’s daughter gets really sick from a bad flu and has to spend a week in hospital or ICU, or they get in a car accident or injured somehow (won’t even get into how divorce wrecks finances..) And then they get a painful demo at how medical bills in the US can pile up even if have that supposed “good health insurance” with the Cadillac plan. Or cases when a relative gets sick and seniorcare costs hit, or childcare shoots up if they have to move to a new city for a job. Sympathy in those cases, that can happen to anyone. So higher income subprime (or any income subprime) can sometimes be a case of just that wrong place wrong time financial hit, even with a lot of savings for some of these hospital bills.

But it’s bothersome when even middle or high-income Americans get up to eyeballs in debt with unnecessary purchases just to keep up appearances, or pay extra “for the brand”. (uggh, one of our least favorite phrases) Cars are long term purchases true, but it’s aggravating to hear those cases of the office manager already complaining about costs for keeping up his expensive new home in the burbs near the big city–and then goes out and buys a brand new full decked out $80K Dodge Ram on an 8 year financing plan “just because”, even though he’ll never need half that payload or horsepower. We even had to give our daughter a stern talk about paying an outrageous price for the latest and greatest iPhone even when she had a perfectly good working one for less than a year, and even with much cheaper but better android options for her needs. (that she did eventually switch to, to her proud parents relief)

My wife and I grew up with the old “20/4/10” curmudgeon advice for car buying. Even it’s now more common to extend the financing beyond 4 years, it’s just boggling for the mind that so many Americans would even consider getting ripped off with the interest piled onto car loan financing over 84 months, leave alone 96 months. Almost like a huge culture change, “it’s OK to drown in debt for things we don’t need, we’re Americans”. So different than what we grew up with, and unfortunate that attitude of high debt tolerance just makes things more expensive and prices inflated for the rest of us too.

Miller, I too have never understood this mindset.

I’ve only paid cash for my car purchases, and only bought what I could afford at the time (despite an 800+ credit score).

To each their own I guess.

Excellent comment and advice that I offer to my own millenial offspring –I understand 20/4/10 in my dna–20%down, no more than four years, but what is 10? I suspect there is a culture shift among younger folks who have never experienced having “laissez le bon temps roulez” roll the very wrong way fast. Having an $80k “accessory ” (an unnecessary accoutrement that is not jewelry, but an ugly pick up truck!) repo’d is bad, but so is buying one unless you are hauling concrete and landscape plantings for a living.

People can do what they want, and government should support that, provided they don’t send me the bill. Unfortunately, conservative folks have been paying the tab for the prolifigate via inflation, subsidies, bailouts, etc.

“Americans would even consider getting ripped off with the interest piled onto car loan financing over 84 months, leave alone 96 months”

It’s not a ripoff if people voluntarily sign up for it. There are always other options.

Besides, cars last a LOT longer than when likely you (and I) bought our first cars.

Amen Miller! So good to see your well written posts, stranger. You are correct on so many points. There is now an entire generation who didn’t live through the gfc. I did. Debt was a normal way of life. You just got into it. For whatever… a house… a car. When the rug got pulled out in 08, it was like the curtain was pulled on the wizard of oz real economy. “over their head” wolf pertains to those who think tomorrow will be the same as today. Near everyone gets in over their head…. think about it. 30 year mortgage when who knows if you’ll even live that long. Too many folks caught up with ‘liven’ not really concerned about cost. They’ll figure that out later. Glad to read your posts miller.

I have never heard of “20/4/10” but Google found “To apply this rule of thumb, budget for the following: A 20% down payment. Repayment terms of four years or less. Spending less than 10% of your monthly income on transportation costs.” This may be better than what “most” people do but my advice would be “Try to Pay All Cash/If you need a car loan pay it off as fast as possible/Try to spend as little of your income on transportation until you have a high net worth”. I was just talking to a friend and I never really thought about it before but like “delayed gratification” is a trait that many wealthy people have he mentioned “don’t buy new things when the thing they have still works” is another trait that rich people have.

@MM, Dick, Apartmentinvestor

Totally agreed, that’s been our thinking too especially for a car that’s basically a deprecating asset once you roll it off the lot. Just no sense to finance payments for something like that beyond around 3 to 4 years top’s, money straight out the window. Even for home purchases that supposedly appreciate, it’s just a huge risk to buy at a level way beyond incomes because a lot of things have to go right over course of a 30 year mortgage. Even when rates were low from the ZIRP and QE boon-doggle, the huge principal still means high monthly payments for length of the mortgage. The scary thing with the recent news of those “atmosphere rivers” bringing all these nasty winter storms for the US, is even cities with the supposed perfect calm Mediterranean or dry weather, like San Diego, Los Angeles, Phoenix or basically most of Texas no longer have that guarantee.

We used to vacation in San Diego and an old Airbnb host we stayed with is now saying people are in shock at the level of flood and weather damage from last month alone. How can those crazy home prices be justified when the “perfect weather” isn’t so perfect anymore (and even dangerous)? Despite the recent conventional wisdom real estate isn’t guaranteed to go up anymore than the dot-coms were–Wolf’s article this week on CRE is another reminder here. (and if it becomes “insurance” against Fed policy to “let inflation run hot” and devalue the US dollar, it basically means US finances have gotten so bad the USD is crumbling and we have much bigger problems anyway–including the social unrest and looting kind that means the expensive home isn’t a safe haven at all)

@Richard Jackson

yeah those $80K toys with the huge payload are maybe the most garish signs of many Americans losing their minds with reckless spending on unneeded purchases. I’ll admit the marketers of the Ram got the manly man marketing down to a science, Imo more than even the F150 or Tundra, they practically look like powered up tanks on the freeway or parking lot. But with exception of a contractor we knew, we’ve about never known someone who actually needed one of those monster pickups for practical needs, it’s usually just an extremely expensive “accessory like you say to show off. Same with so many unneeded “phone upgrades”. For business purchases, I recall a few years ago they did a study that for company phones, businesses could save millions in over-paying “for the brand” and just use flip-phones, or even the less pricey names–Nokia, Moto, even TCL or Kyocera–that cover just about everything work related. But even for personal purchases it’s nuts to pay these sky high prices for extra features almost never used and just for flashing the brand around. Especially when so many Americans are now falling into BNPL debt because they can’t actually afford to make the payments in cash or with what they have on hand

I, too, enjoy your commentaries, Miller. One suggestion: instead of gritting your teeth and writing “about the ‘brand'”, use something more timely: “aspirational purchases.”

Correct Miller. Thomas Stanley (author of “The Millionaire Next Door”) studied this phenomenon at length. He found a substantial perceptual and behavioral difference between those who are income statement affluent (or IAs, who have high incomes but low net worth) vs. those who are balance sheet affluent (or BAs, who have a relatively high net worth for their income level.)

What differences did he observe? As you’d expect, the IAs were prodigious consumers of luxury goods, including automobiles. They spent the majority of their income on consumer items and subsequently had a relatively low net worth. Haven’t those people ever heard of a rainy day?

In contrast, the BAs budgeted their money carefully and always invested a percentage of their income. I’d fall into this category, and I can’t imagine not saving part of my income. But many people get caught up in the “keeping up with the Jones” game and wind up with a set of fast-depreciating consumer goods but few appreciating (and/or income producing) investments.

One footnote – I heard once that many players in the NFL have little net worth despite their (very) high incomes. One player I saw interviewed said he went from “making minimum wage to receiving a half-million dollar signing bonus.” I’ll give you one guess as to where most of that half-million went.

Cold in the MW,

I had been thinking about the IA/BA dichotomy as well, but didn’t realize there were formal labels for it. Thanks for sharing.

BA definitely decribes me too. I don’t make a lot, but I live an ultra low-cost lifetyle & I squirrel away every extra penny into bonds & CDs.

I too hate it when people buy things I think they shouldn’t.

I once heard that psychiatrists have two opposing types of patients.

– Spendthrifts who demand immediate gratification. These guys spend money they don’t even have and have no self control.

Vs.

– The hyper thrifty who hang on to their money dearly and defer gratification to the grave. (moi)

I believe Dante put these two groups in eternal opposition in the same circle of Hell.

As you say, bad luck can happen to anyone, but I also consider poor financial literacy “bad luck”. It isn’t a subject I had in school, so in the end kids are dependent on family, and not everyone has financially literate parents, mine immigrated from a communist country for instance, at least they were educated and intelligent, but I still learned more through experience (good and bad) because everything works so differently in capitalist countries, my family didn’t have that experience to pass on. My sister in some ways is worse off, I liked math, she’s a humanist, it’s been a long process to get her on the right path 😆.

I was rather surprised few months back when my daughter(22) said she wanted to buy newer vehicle – she owned 2016 ford expedition

so right before she graduated college in december(with no student loan debt)

she bought 2020 with 20k miles – and PAID CASH

now we didn’t pay for her university tuition and books – she worked for it

I bought a new auto in 2023 and the manufacturer gave me $2000 to finance a small portion with their loan division. In the fine print it said I could pay it off any time without penalty, thus I paid it off a few days later when the first payment arrived.

For some reason this simple act tanked my credit rating from mid “800s” to mid “700s”, and it slowly went back up over many months to near the previous score. I found that “odd”…

Questions:

1. Even though I bought the auto with cash, I’d be considered a loan buyer? (only borrowed 20% of total cost for a few days)

2. Why are cash buyers on new autos so low at around 20%, when cash house buyers see to run in the mid 30%? (is it wealthy investors driving up cash purchases on houses versus autos)

Yort – I’m pretty sure your score went down just from opening the line of credit, even though you closed it out shortly after.

I thought everyone in America was rich, drunken sailors, wage increases outpacing inflation by lots? Looks like inflation is making fools of many

The lowest-income category is about 25% of the households. That’s where it hurts. It always hurts there.

The higher-income subprime are small and their delinquency rate is roughly back where it was in 2018. It normalized.

RTGDFA.

Howdy Miller. They quit teaching simple math. Just about everyone says buy stocks instead of saving $. ZIRP taught a generation its pointless to save $. Not many squirrels out there anymore. Its a lonely place for some of US. Very Happy being a retired sober sailor squirrel.

D-F-B – would suggest destruction of a savings mindset goes back generationally further, to those who grew up in families of the stagflationary ’70’s-’80’s with any thoughts of belt-tightening offset by super-easy retail credit availability…

may we all find a better day.

91B20 1stCav (AUS)-

“destruction of a savings mindset goes back generationally further, to those who grew up in families of the stagflationary ’70’s-’80’s with any thoughts of belt-tightening offset by super-easy retail credit availability…”

You can go back a bit further to the installment credit companies of the 1940’s.

My dad had a friend who started one after WWII that lent money on high collateral at high end of rates, all administered from a rural midwestern community of about 2000 people.

Upon failure to make timely payments, the lender quickly took possession of the collateral, and auctioned off the collateralized property to liquidate the loan. Borrowers knew the rules and did their best to avoid re-possession, and a resultant blotch on their credit record.

This entrepreneur in the ancient sub-prime lending industry offered a valuable “shadow-banking” service to a rural population that previously had no access to credit. His business grew dramatically.

I’m still not sure if I think of such lending as a service to the community (raising standard of living), or if I condemn his business for teaching his clients how to live beyond their means today at the cost of a comfortable and secure future. At least the community learned that the reneging on contractual obligations was met with swift consequences.

He eventually sold out (1970’s I think), for a princely sum, to a well known mutual insurance company. That firm later de-mutualized, and is now facing challenges as a for-profit life insurance company.

For me the ethics of such lending are still murky. An interesting case study for a 5000-level business administration or an advanced ethics course!

John H. – illuminating take on the rocky road to here. Am trying to pinpoint in my tired, old memory when I noticed the term “…what’s my monthly payment?…” (spread over multiple credit cards) becoming common in the lexicon…best.

may we all find a better day.

Debt-Free-Bubba,

We do much of what you do.

We are debt-adverse so have no mortgage or car loan.

Even though I really, really WANT a new pickup truck I have no NEED for it … so we’re keeping our 2019 crossover. I have learned that anticipation is much more enjoyable than the actual ‘having’.

And we do have 18 months or so of our typical monthly expenses, with more going into it most months, in a very low interest paying checking account. Kind of like a savings account but with worse interest payments.

But we are NOT risk adverse.

So the bulk of our financial assets ARE invested almost exclusively in the US stock market. We do have a small percentage invested in a tiny, little democracy on the eastern shore of the Mediterranean Sea.

anon – good post .”…Even though I really, really WANT…” demonstrates the long-term efficacy of near-MIC levels of investment by the advertising/entertainment/media sectors in generating that repeatable dopamine hit (that never lasts) among many, many consumers…

may we all find a better day.

If one can afford a nice vehicle but if they want one. Great thing about USA is choice. In Norway and Denmark an ICE has approximately 200 percent VAT tax at least they did 15 years ago

@Debt-Free-Bubba yeah you have our sympathy here, we kind of have same tendencies, save vs over-spend, careful vs yolo investing, keep debt to minimum but like you say, the whole rewards and price discovery system got messed up by ZIRP and QE, and by this culture change in the US “debt is a good thing”. (even high-interest debt, esp what we’ve been seeing with our own once responsible friends credit cards and BNPL). And things like the worsening delinquencies and debt over-extension may be a long term price for Americans here. That’s our dilemma now with investing, we’re now truly confused and without any idea on a “good investment” anymore, if to use Wolf’s on point description that the markets are in a “collective hallucination” is there even any such thing as a smart investment anymore? At these valuations? I was always taught in econ there are very good, simple math and econ reasons a company’s stock (and the whole market) has to settle around a P/E of 6 to 8 of earnings, top’s. So–rhetorical question of course, rules about no investing advice and that–is it even makes sense to invest in a “safe” index fund anymore at these valuations?

Even before we get into the whacko P/E’s above 50 or worse (coughing.. Tesla, speaking of owners with crazy auto-loans and repairs that break the bank for a fender bender), it’s a big question even for the FAANG’s. Profitable, steady, highly valuable sure, but trading this high above the historic pattern? With higher for longer interest rates and higher consumer debt and delinquency? Surging competition meaning those drunken sailor profit margins post-covid are not coming back? Amazon’s seeing this for both it’s e-commerce and cloud services, and not just from the surging new bullies on the block (Temu, Shein) the media’s always on about–even plain old Walmart, Target, Costco or Sam’s club, Aldi and discount grocers and local retailers are getting better e-commerce arms (or just co-ordinating with delivery apps), while new cloud providers are offering more affordable prices. So how can any of the FAANG’s claim these valuations with lower profit prospects? Oh, that’s right, just mention “AI”, except it often doesn’t add much value and then all the embarrassing times it’s been used and makes the results even worse..

It’s like every stock now is based on whatever meme is talked up more than it’s actual fundamentals. And yes, TSLA.. nothing against it, have had mixed or so-so feelings on it but also some good rides, but Tesla worth more than every other car company combined? When it’s lost the global leadership even in EV’s (BYD) and even losing EV market share in the US to Hyundai-Kia, the legacies, BMW, Volvo-polestar and all the others? And not even getting started on crypto and NFT’s.. It’s just very frustrating, we used to know what being “financially responsible” meant and the wise ideas of saving and investing instead of going yolo on stupid purchases, debt, bubbles and questoinable assets. With ZIRP and QE that got punished and the speculative yolo’s got pumped up, but now with QT, higher for longer and even JPow more channelling up Volcker (and Treasury yields often still heading up), the valuations and drunken sailoring is still going on, and the pivot-mongers are still pushing their irritating hype about how a rate cut–and even worse, more QE and helicopters full of loose liquidity-right around the corner. It’s hard to even know what responsible financing even means anymore. At least there are some HYSA’s (for now) available.

PEs are high because of supply and demand. There are only 3400 stocks in the Wilshire 5000. Wilshire 5000 was an index created to comprise of all US stocks. Well, it was called 5000 because there used to be 5000 stocks. It actually grew to close to 6000 in the 1990s.

So the number of stocks have dropped from 5000 to 3400 while the money supply has risen from 3 trillion in 1990 to over 20 trillion.

Think of it this way, you have 500% or 600% more money (demand) chasing 32% less supply (stocks). Prices go up. companies do not have pension departments that may have invested in other assets besides stocks. Now all the employee’s money retirements are sent to 401k plans that only have two choices, stocks and bonds. The amount of money going into stocks keeps growing but the number of companies to invest in keeps shrinking.

PEs of around 20 are probably here to stay unless more companies do IPOs.

@Ru82 interesting and does make sense. So maybe there are mathematical reasons the P/E’s can vary like never before. Too much money printed, and too few investment choices. Surprised to hear there are less stocks in the Wilshire 5000 than before. Maybe this also explains a lot of the crypto and NFT speculation

Sub-prime lending seems sleezy. Is it even ethical?

Then others would say it is unethical to not lend to these people… especially if they are from the right demographics. Subprime lending has the appropriate risk priced in. Predatory lending is unethical.

I just did personal loan to friend(in 50’s) – he set interest at 15%

for him it is bridge loan and I’m glad to earn income

we work together so I’m not worried about repayment

You might read up on the ursury laws in your state.

Ethics isn’t a part of business transactions on either side, unless your doing business with your grandmother. It should all be a free market. Lend to someone who pays you back, lucky you. Lend to someone who walks away with your money, learn your lesson. The problem comes in when the powerful use the power of government force people to take actions they don’t want to take like paying you back.

BS.

Ethics is the cornerstone of any functioning capitalist democracy.

Remind me not to do business with you!

caveat emptor

WGH – especially when buying or selling money (add Latin equivalent of ‘vendor’ to the saying, and get gov’t. out of most of the mundane ‘backstop’ business)…

may we all find a better day.

While the level of new auto delinquencies is not concerning (yet), the slope of the line from the pandemic bottom definitely is.

Look at the “Subprime & Prime” chart (red and blue). The slope of subprime might be “concerning.” Prime is pristine. OK, here it is again so you don’t have to go upstairs and dig for it:

But subprime is self-correcting. Dealers/Lenders got too aggressive and greedy, and now a bunch filed for bankruptcy, and others are struggling, and the survivors are ALL tightening their lending standards, and subprime lending has become more careful. So the future delinquency rates will come down. This is not an economic issue, but the result of the subprime free-money bubble.

Bad loans are made in good times! Once those loans have washed out, subprime delinquencies will drop…

… unless there is a recession with lots of unemployment, and then we’ll see delinquencies shoot up even among prime loans.

“But subprime is self-correcting. .. So the future delinquency rates will come down. This is not an economic issue, but the result of the subprime free-money bubble.”

That’s good to hear, and good lesson for the Fed. Hopefully JPow and company are listening. The distortions from ZIRP and especially QE were needless and not helpful to the real economy and real sustained spending, encourage bad decisions, excessive debt and foolish lending. I

t’s why higher for longer really has to be defining Fed policy from now on, not just in the interest rates but with the QT too. The real US economy and responsible Americans are hurt by all the bubbles that fuel needless price rises esp from ultra loose monetary policy. Fed needs to ignore all the dumb pivot-mongers trying to find the latest lame du jour excuse for rate cuts or QE, they’re a plague on the parts of the economy that actually function

Miller-

Excellent thoughts. A government (Treasury and CB) ought not set a bad example through its own actions.

I posted this 19th century quote a week ago, but it fits your comments so well I had to repost again:

“There is a natural tendency in men to follow the example of the Government under which they live. The Government is the largest, most important, and most conspicuous entity with which the mass of any people are acquainted; its range of knowledge must always be infinitely greater than the average of their knowledge, and therefore, unless there is a conspicuous warning to the contrary, most men are inclined to think their Government right, and, when they can, to do what it does. Especially in money matters a man might fairly reason—’If the Government is right in trusting the Bank of England with the great balance of the nation, I cannot be wrong in trusting it with my little balance.’ “

— Walter Bagehot, Lombard Street, 1914 ed., p 58

Besides being big, important and conspicuous, the Fed and Treasury are littered with highly educated PhD’s. How can they teach such harmful lessons about personal finance to so many without the least sense of remorse.

And to top it all off, it’s not just our government encouraging an indebted lifestyle.

Like drugs (both ethical and illicit), debt use entails unintended and often dangerous consequences.

John H. – …wonder how many of the Ph.D’s ‘littering the Fed and Treasury’ had to work their way through college? Results might indicate their perspective…

may we all find a better day.

It was not all the dealers and lenders. They had more customers to lend to.

During Covid there was a shift in the distribution of credit scores, enough so that borrowers were able to move out of subprime to near-prime and near-prime to prime.

The politically correct term is “consumer credit score migration” which is just a fancy way of say “lets boast up a bunch of people to a credit score that we can lend too”.

But then again .. maybe it is the dealers and lenders ….

Credit scores inflated when student loans were deferred and the delinquency/late pays stopped being reported. Ditto rent, where the funds that should have been made to rent were redirected. People that once were “sub prime” were now upgraded…. and, once the deferments expired, have now returned to their normal level.

As far as dealers/lenders, I have never met anyone who had a gun held to their head and were forced to buy a car or take out an unaffordable loan. These were decisions made by people of legal majority. Ill advised? Probably. The dealer/lender’s fault?

Nope.

EK – by that rationale, drug dealers are less culpable than drug abusers.

(No.)

It’s an oversimple framing. Predation is real, and it’s not blameless.

EK, your comment: “The dealer/lender’s fault? Nope.” – just a bit simplistic. If you don’t think that the power of persuasion isn’t the reason people are buying shit, you need to rethink. If advertising didn’t work, you’d be kissing most “free” entertainment” goodbye.

The ideas that there are “free markets” and that “people can think and choose for themselves” is largely bullshit. If people could really think and do their own homework, they wouldn’t be reading Wolf Street.

Rereading what I just wrote (I got up at 3 am), I see that I made a jump in what I wrote. I meant that the daisy chain of consumption – from building the vehicle to ending up being the sub-prime borrower – includes the dealer/lenders. They’re all part of the need to entice someone to buy something to earn a living. 6-degrees of predation, give or take.

And when it comes to “thinking and choosing”, it takes a village – Wolf Street – and similar. The lone ranger, fending for him or herself is more fantasy than reality. Ultimately, aside from the British Royal Family, have to wipe their own rear ends.

Left out “we”… Sorry. Need more coffee.

The big change was medical debt not being included on credit scores. The majority of personal bankruptcies in the US are due to medical debt.

Wolf, why is the subprime 60+ day delinquency chart saw-toothed? Are the defaults seasonal??

Yes, seasonality is everywhere, even on this site. This is really raw data, which is kind of what raw data looks like.

Drunken sailors can never consume enough clothes, junk, cars, toys, and everything else.

We are a consumer society and we consume. Lenders feed the consumers with ever longer term loans and pass the risk and losses on to yield consumers and it eventually ends badly for a lot of folks, including those who consume the junk bonds

Speaking of that, BNPL is now yet another loan burden encourages Americans to spend yet more and go yet deeper into debt for things they don’t need. Even worse Afaik we don’t have much data on how bad the buy now pay later debt is. Klarna and some of the other companies said it was getting higher and higher, and most of their BNPL customers don’t make their full payments on time which means nasty interest penalties. So, concerning as the credit card and auto loan delinquencies may be getting, looks like now we’re getting a new type of delinquency too. Is there any kind of systemic data collection for BNPL numbers?

Americans learn from their own government, the biggest drunken sailor there is. Government is an example of BN. Leave off PL. There is no PL acronym in the halls of congress.

Are we pretending all of a sudden that BNPL is new in America? It’s at least as old as Miller’s “Death of a Salesman” which I read in high school back in the 70s — which was the first time I ever heard of buying “on the instalment plan.” But then, my parents were children of the Depression, so there was never any of that nonsense in our house. We never wore brand name clothes and couldn’t afford to join any fancy school trips, but never went cold or hungry.

Unfortunately, my own children have (by comparison) “affluenza.” I couldn’t figure out a way to insulate them from it while keeping something like peace in the house, so …

@eg: Exactly…I have been wondering the last couple of years why they morphed the old installment plan into BNPL…and the whole business punditry have been discussing BNPL as if it is a new innovation. Crazy stuff!

ONLY way to ensure AFAIK so far, that might be too late for you:

Very simply:

1. Let them have anything they want to buy with their own earned money from age 5 or 6.

2. Figure out how to let them earn ”piece work” money as soon as they have basic work skills, that WILL occur at age 5 or 6 with their observation of appropriate adults earnings/pay due to piece work perseverance and productivity improvements.

This strategy, more or less, worked in every single example of which I am aware; anecdotal to be sure, but sample likely around a couple dozens at least.

Its not new, but definitely more accessible to customers. And now with e-commerce, its fairly easy to add a “pay with Affirm” (or whatever company) button to your site’s checkout, therefore enticing even more customers to do BNPL.

That said, on my little corner of the internet, BNPL payments are a tiny % of our overall sales. Most people pay with their credit cards to scoop up the points, or apply for the manufacturer-sponsored financing which still offers 0% for 6 months.

eg – I find serious conversations with someone about their ‘wants vs. needs’ endlessly fascinating, illuminating and revealing…

may we all find a better day.

An unlikely source for subprime auto talk: Brit talk show guy John Oliver. Someone traced a very used car: sold and repo 3 or maybe 4 times in 2 years.

Moving on, is subprime lending ethical or should it be legal?

I was watching Squawk Box Europe on TV years ago and two of the panel: one upper- crust with plummy accent and other with cockney accent, got into such a heated argument about this, the show briefly went off the air. I know the show was live cuz I once emailed a comment they read on air right away. The upper class guy thought it should be illegal. The cockney, who one suspects might know more about poor people, insisted this would leave those who need a loan open to ‘leg breakers’ who charge by the week.

PS: the argument on Squawk Box was about ‘payday loans’ which have no security and are costlier than the worst auto loans.

This is correct. If 10% of subprime poor people go delinquent, then actually the system helped the other 90%. And if you’re buying a 10yr old Sudan 100kmiles for 8k, you probably buying it cuz you need to get to work and your last car just died needing a 4k repair. If you can get a low monthly payment you’re probably gonna be happy about it. And if you don’t default and if it doesn’t need that expensive of a repair before you pay it off, you’re gonna end up loving that car and your decision.

Aaron – I’m sure it’s the auto-whatever, but given it’s history going back to Gordon and the Mahdi to its brutally tragic situation today, I’d steer well-clear of a ‘sudan’…best!

may we all find a better day.

Yes sedan not Sudan lol

The ‘old car needs 4k repair, so bought a 10 year old car with 100k miles’ is almost verbatim my last auto purchase. Though it ended up being about 10k total, since I bought it early last year.

Of course, 6 months after I bought it the engine died and I had to spent a couple grand to get a new motor put in, but c’est la vie. At least my credit is good enough that I was able to open one of those “0% for 12 months” credit cards that keep filling my mailbox and pay off the engine before the card started accumulating interest, but it would have been nice to use that money for other stuff.

re: Rising disposable incomes

Did they dip during the pandemic cpi bump, and are now recovering or recovered and growing?

Who takes out these subprime loans? My friend underwater in debt from university, who cannot stick to a budget (he’s a physician assistant). A family member who is an assistant manager at a chain pizzeria. Another family member working in maintenance at a golf course. Anecdotally, too many people buy new cars they shouldn’t. Stick with sedans people…Corollas are wonderful.

Wolf, hoping you have mercy on me for sharing the below link. It compliments your piece nicely by discussing how loan issuers (e.g. Santander) bundle loans into bonds, and then sell those bonds to Wall Street. Very very similar to subprime mortgage loans in how the bonds are divided into tranches with different bond ratings.

https://www.bloomberg.com/graphics/2023-wall-street-subprime-car-loans/

Howdy Folks. Drunk or sober, some sailors waited most of their lives to spend more than normal. Keep up the good work sailors….

Speking of debt, Yellow Corp paid off the entire government loan of $700 million plus $151 million in interest. IRR of about 5.5% for Uncle Sam.

Is a bailout really a bailout when the government makes a profit?

I guess that depends on whether or not all the newly unemployed folks are on the government tit.

Interesting times.

That makes no sense. Yellow would have gone under during covid without the loan. The loan did not cause the company to fail.

Shocked that auto loans as a percent of disposal income is largely at good time levels even after the covid price mess. Guess those giant raises really are the great equalizer.

Plus… in 2020-2022, new-vehicle purchases plunged due to the shortages while used-vehicle sales wobbled up and down some, so despite much higher prices, dollar volumes financed didn’t increase much.

The jump in new and used car prices is STUPID. There are no new innovations to justify the price hike. We were fortunate to preorder our last new car at the beginning of the pandemic.

Ultimately, I think these number continue to reflect the moral hazard being unleashed by irresponsible monetary and fiscal policy.

Price discover is the most important part market function, something that has been utterly destroyed by The Fed and coordinated efforts of central banks around the planet.

This is it at the core. Fiat money is a store of value and medium of exchange. If you can print tons of it at will, no one knows what it is really worth.

…check out Wolf’s extensive archives for his long and distinguished views on price discovery and it’s evisceration…

may we all find a better day.

The justification is inflation the thing that’s broken . If demand falls off for vehicles then the price will fall accordingly but with the Millinium generation plus the Z right behind them the demand for large trucks will stay high and those families will enjoy the ride as they should .

Houses, cars, medical care, education, you don’t need innovations to justify the price hikes. Just a limited supply of important stuff and a bunch of money doled out to the population that was borrowed from their (or someone else’s) future. It’s kinda simple really

My old boss told me “good times breed bad businessmen”. After 40 years in commercial construction credit and collections, it is absolutely true.

Imp – quadruple check. (…and to really, horribly, misappropriate and transmogrify an old George Wallace meme, a heavy commercial price is guaranteed to be paid if: ‘…SWOT then, SWOT now, and SWOT forever!…’ is neglected…).

may we all find a better day.

In Devil’s Advocacy of buying new (anecdotal but stick with me). Had excellent credit, til a bad divorce. My car blew a head gasket, I was driving all day working community care spending $250 week in gas and god knows how much more in FiberLock to get by til it wouldn’t drive another foot. Damn car was the final straw and put me into bankruptcy. My bad for marrying wrong and all that but…

Finances being what they were, used was what I could swing at the time, and in the NE, used cars in super budget range are generally in rough shape and not safe to put almost 1k mi/week on plus tote infants around. Had 5 or so used cars break down, seize up, whatever. The cost of missed work and to constantly repair the damn things wasn’t worth it, warranties on used cars are crap, and I’m a gal who can do a good chunk of my own auto repair but it was unsustainable. Lemon Laws exist, but good luck with that cuz I had none.

Got to the point I could finance new, barely, and did despite over-extending myself by conventional standards. Mercifully got in before prices skyrocketed. Any repairs needed are under warranty, the car has been reliable and not rotted out from salt, and I timed the trade in as small cars inflated, so was able to trade down half of the insane rollover I was carrying from all the financed lemons. The payment is now cheap by current measures and no missed work over car issues. Hell, we can take road trips now, knock on wood.

After the hell I went through with a string of used cars, I don’t begrudge a credit re/builder financing new, if you can swing the payment and get a decent warranty. Reliable wheels get you to work, and very little used is reliable especially in some areas.

Buying a used BMW for appearances when working retail, or a new Masarati because you got your first 6 figure salary while nostril deep in debt, that’s a special kind of stupid I can’t defend.

Great move trying used and figuring out that your reliable transport needs trumped the options of cheap used high mileage vehicles. You should be very proud of yourself

Your sincerity oozes.

With lower income folks getting driven out of their towns and cities, many are relocating further away from their jobs and having to super commute. A lot of that happened in the NE in the past 3 years. Add in abysmal US public transportation and there’s plenty of drivers who need cheap but reliable transportation.

The general vibe among the comfortable types is you’re poor and so you deserve nothing but the table scraps. Automotive table scraps don’t jive with getting to a service/humble job, or any job for that matter, reliably. But condescention when pointing it out is always cool too /s.

LVS – a good observation on the long-term effects of slowly attitudinal-stripping the last crumbs of genuine respect/societal ‘honor of work’ from any who are less-compensated. The traction of the slope on either side of the median is always tenuous, and turns to ice on a dime (negative gravity conundrum noted…and, with apologies to my old friend NBay, one might reprise Kipling’s ‘Tommy’ and then think about who you would call upon, should the need arise, and why should they answer?)…

may we all find a better day.

@Lili Von Schtupp sorry to hear about the divorce. I have never bought a new car (or borrowed money to buy a car), but you are correct that anyone putting 1K a week (over 100K in 2 years) on a car needs a new one. I’m a long term “car guy” who like a lot of people that grew up poor wanted a nicer car when I started making good money. I was lucky that in my late 20’s I realized I would be happier increasing my net worth and investing in real estate then buying fancy cars (I drove the same 4Runner for 15 years). Having a short commute is also a great way to build wealth. Driving over 4K miles a month is going to cost a minimum of $2K (and take a LOT of time where you could be making more money at a part time job).

32 years ago, and old man gave me an advice:

“do something very few pople do in 10 years and you will have something that very few people have in 30 years”

I listened to him, and I paid off my house mortgage in 9years & 8month.

That was the best advice I have ever received.

I refuses to be slave to bankers.

But, the new generation want everything and want them NOW; thus, accumulating high debt. Nobody sacrifices anymore.

From what I see, no generation alive today is really doing much sacrificing.

Bruce – your final paragraph might be seen as the best of all possible worlds to those in the money-selling biz…

may we all find a better day.

So it looks like the algos are pumping tech stonks on the grounds that the bank “crisis” means that the Fed just HAS to lower rates and resume QE!

There is no bank crisis, and everyone knows that. Some banks’ profits are going to get crushed, and it’s not a great time to hold bank stocks, and a few of these heavily exposed banks might not make it, and that’s fine. That’s how it is, banks are shut down every year, that’s what the FDIC is for, and everyone knows it.

They should listen to the lineup of Fed governors speaking today, who are seeing between 0 to 3 cuts in 2024 — and if any cuts, then later in 2024, LOL. But listening to the Fed would be too much to ask?

I know. But we’re clearly in “bad news is good news” territory, but the problem is, the bad news is not THAT bad.eIN

Man, this topic really bought out the geezer parade. More than the normal amount of the olds patting themselves on the back.

Coil – actually trying to scratch an itch, but time and mileage hinder me from doing either, in any case…

may we all find a better day.

Wolf, please post a link to the NY Fed blog post you reference. I’ve found some NYF content that is similar but doesn’t appear to be the exact source.

https://libertystreeteconomics.newyorkfed.org/2024/02/auto-loan-delinquency-revs-up-as-car-prices-stress-budgets/

Thank you!