Japanese, Canadian, and European banks started to confess. And for over a year, huge losses have hit investors, not banks.

By Wolf Richter for WOLF STREET.

What’s amazing about the mess of the office sector of commercial real estate (CRE) is just how far and wide these mega-losses – by some estimates, they may ultimately amount to $1 trillion, or whatever – are spread in diced and sliced form globally. Which is a good thing for US banks.

Some US banks have started to reveal the damage in bits and pieces and warn about office CRE loans. But foreign banks are also up to their ears in this stuff – Canadian banks, Japanese banks, European banks…. And some warnings have emerged. But a big portion of the office CRE loans are held by investors, not banks, and they have gotten the short end of the stick.

We have discussed this phenomenon here for a year – how the biggest office CRE losses haven’t hit the US banks as much, but have hit investors in Collateralized Loan Obligations (CLOs) and Commercial Mortgage-Backed Securities (CMBS) which are held in big baskets of relatively small slices by institutional investors, such as bond funds, pension funds, insurance companies not just in the US but around the world.

And losses have hit publicly traded and private property REITs and mortgage REITs whose investors span the globe; they’ve hit PE firms and hedge funds and other nonbank entities whose investors span the globe – to the point that we espoused the theory that US banks had been able to sell their riskiest worst office property debt, back during the “office shortage” when times were good and money was free, by securitizing it or selling it outright to institutional investors around the globe.

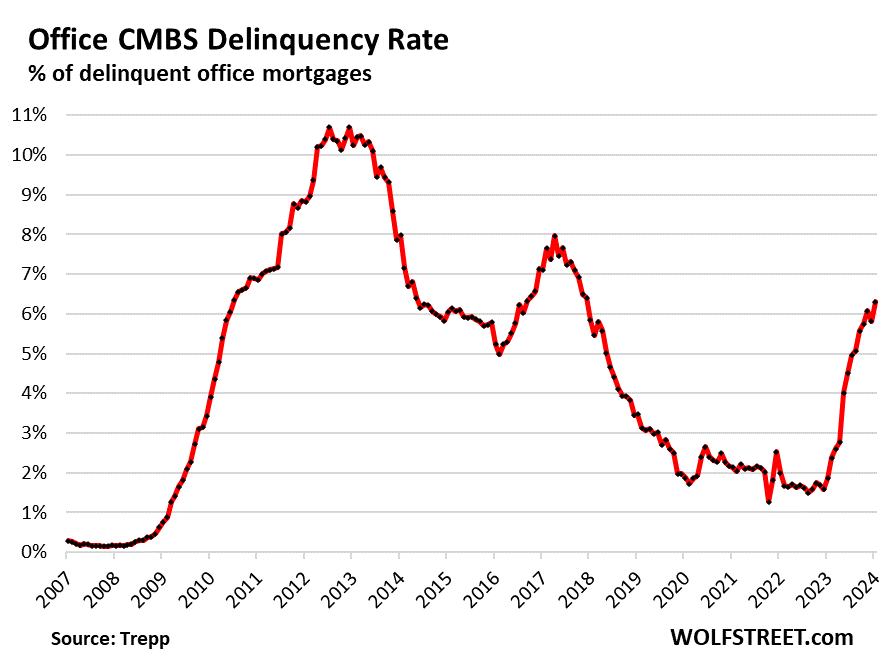

The delinquency rate of office mortgages that had been securitized into CMBS spiked to 6.3% by loan balance in January, having more than tripled year-over-year (up from a delinquency rate of 1.9% in January 2023), according to Trepp, which tracks and analyzes CMBS. This is a ferocious deterioration:

The office CRE losses are split among lenders and landlords. Landlords lose their equity in the property – even giant landlords such as private equity firm Blackstone and private equity firm Brookfield have walked away from office properties.

It’s the older office towers that are emptying out, or that have emptied out, that take the biggest beating. The latest and greatest office towers benefit from a flight to quality, as companies are abandoning older towers.

Lenders have lost between a substantial portion to nearly all or all of their loan value when they sell the office tower they’d seized via foreclosure or deed-in-lieu-of-foreclosure.

At the high end of losses was a 12-story, 50% vacant, old (read “landmark”) office tower at 300 W. Adams St., in Chicago, which recently sold for $4 million. This was the value of the building only – the “leasehold interest.” Land and building had been separated.

Alliance HP had bought the property for $51 million in 2012 and then divided it into a leasehold interest in the building and a 99-year ground lease. Alliance defaulted on the loan on the leasehold interest (the building). That loan had been securitized into CMBS, and the special servicer representing the bondholders then seized the building via a deed-in-lieu-of-foreclosure, and now sold it for $4 million. But Alliance HP still controls the ground lease, and still collects rent on it. No hard feelings, this is just CRE.

At the high end of losses was also the vacant 46-story office tower, built in 1985, in downtown St. Louis, which sold for $4.1 million in an April 2022 foreclosure sale, which after fees and expenses, left nothing for CMBS holders, and they took a 100% loss.

Now it’s the banks turn to confess.

So now the credit losses at banks are coming out of the woodwork.

When the three regional banks collapsed last year – Silicon Valley Bank, Signature Bank, and First Republic – it wasn’t because of bad credit; it was because of their unrealized losses on their Treasury securities and MBS, whose market prices had tanked because yields had shot up, and uninsured depositors got spooked and yanked their money out all at once. These unrealized losses among all banks have exploded.

New York Community Bancorp [NYCB], which had bought from the FDIC some of the Signature Bank assets, caused a stir a few days ago when it disclosed a slew of issues: a Q4 loss, falling interest income, the new regulatory headache of having become a bank with over $100 billion in assets, and net charge off that rose to $185 million in Q4, mostly due to two loans, including, well, an office loan that had defaulted in Q3. And it has set aside $552 million in loan loss reserves to digest future loan losses, largely from its CRE portfolio. It holds $3.4 billion in office loans.

There have been and there will be other US banks to disclose in bit and pieces the issues in the office loan portfolios.

Oh, the foreign banks gorged on US office loans?

Aozora Bank, a mid-sized Japanese bank, disclosed that it had $1.9 billion in US office loans, mostly in large cities such as Chicago and Los Angeles, accounting for 6.6% of its total loans. And losses at these US office loans will likely lead to a loss for its fiscal year ending in March.

US CRE was a big thing with Japanese banks and other financial firms. With yields in Japan ultra-low due to the Bank of Japan’s decade-plus of interest-rate repression, Japanese firms were chasing yield in US CRE, and now they’re having to deal with the fallout.

The big Canadian banks have been dragged down by exposure to the US office sector and have set aside piles of capital to deal with the expected losses. Canadian regulators have been warning about it – in a soothing manner; yes, earnings will be hit, but banks have enough capital to withstand the losses. Canada’s Imperial Bank of Commerce (CIBC) may be the most exposed to US office sector, with about 1% of its assets tied up in loans backed by US office properties; and according to Bloomberg News, it’s trying to offload some of its US office loans.

And European banks. Deutsche Bank AG more than quadrupled its loan loss provisions for US CRE to €123 million, up from €26 million a year ago. About 1.5% of its total loans are loans backed by office towers in New York, Los Angeles, San Francisco, etc.

A lot of these CRE loans are coming due this year and next year, and need to be refinanced, or extended, but interest rates have jumped, and many of these office properties are dealing with the structural collapse of demand for office space, so refinancing is going to be tough, and extending-and-pretending is going to be tough, and banks are going to have to deal with losses.

The point: Losses are spread around the globe, not just among US banks.

The losses related to office CRE are more or less thinly spread among institutional investors and banks around the globe. US banks have to eat only a portion of those losses. So the losses will hit earnings and dividends, and share prices, and some investors are going to lose their shirts. And it’s going to get worse over the next couple of years, and there will be more confessions from all directions. But thankfully, the US banking system shoulders only a portion of those losses.

The problem is structural and won’t just vanish when the mood changes or rates drop.

There were years when the real estate industry spread the notion that there was an “office shortage,” and companies bought into it and grabbed every office space that came on the market, to be used in the future, and due to this office shortage, developers kept building new office towers, while companies were hogging office space for the future that then didn’t come.

But during Covid, the realization came to corporate headquarters that no one needed this much unused office space, and at that moment the office shortage turned to an office glut, as companies put their existing leased office space on the sublease market and tried to get out of other leases. In many cities, the collapse of WeWork added to the office problems.

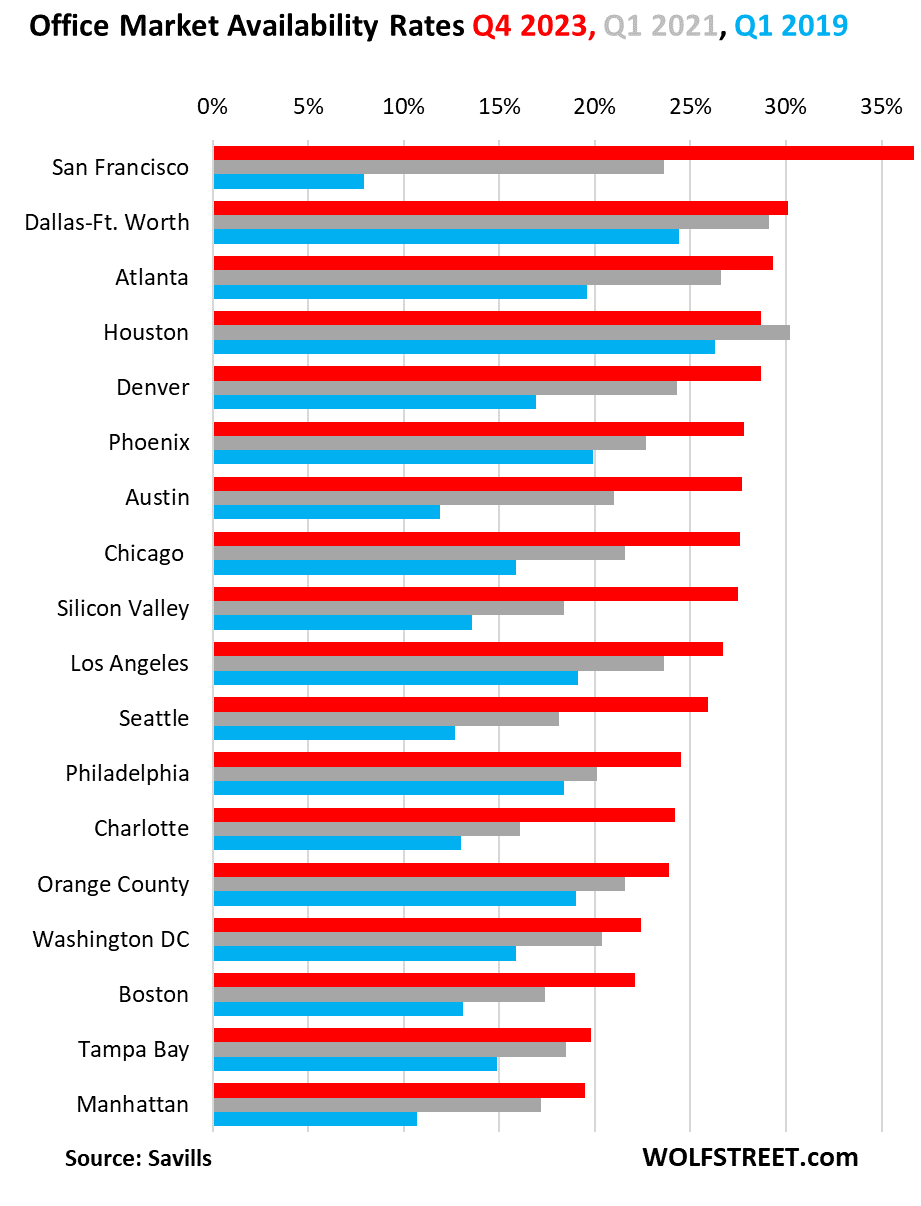

And availability rates – office space that is on the market for lease either by the landlord directly or by a tenant as a sublease – exploded. In San Francisco, the availability rate exploded from the single digits in 2019, when it was the hottest office market in the US, to 36.7% in Q4 2023. Dallas is also over 30%. Atlanta, Houston, et al. are not that far behind (data by Savills):

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

“US Banks Eat only a Portion of the Losses”

How much? And when are they going to reveal the extent of losses?

That’s the trillion dollar question.

They’ve started to reveal it, and it’s not huge. Office CRE will hit earnings and dividends, and share prices, and share buybacks. Banks are more exposed to multifamily loans. By contrast, we have seen big investors take HUGE losses on office CRE debt for over a year. This has been a massive bloodletting, but no one really cares (outside of investors) because they’re not banks.

Here are some tidbits, from my article last year:

https://wolfstreet.com/2023/04/10/banks-and-commercial-real-estate-debt-a-deep-dive-investors-and-the-government-on-the-hook-the-majority-of-cre-debt/

Office CRE loans are only 16.7% of total CRE loans.

Office mortgages account for only 3% of their total bank assets.

In terms of all of CRE loans, not just office:

The Fed can backstop $1T in 24 hours if necessary. I just don’t see this turning into a big deal. Sure, a handful of smaller regional banks will fail, but this is not going to have a major impact on the economy in 2024. JPowell has got this. He said so last night on 60 Minutes.

Hmm.

I think insurance companies hold a fair amount of office CRE.

Perhaps not the crappiest tranches…but if skyscrapers are being liquidated for $4 million…

And I wouldn’t be surprised if the DC forgers could easily convince themselves that a systemic insurance “crisis” would be yet another “national emergency” “requiring” further money printing/inflation.

As I said further down in the comments — and this includes foreign banks and insurers:

https://wolfstreet.com/2023/04/10/banks-and-commercial-real-estate-debt-a-deep-dive-investors-and-the-government-on-the-hook-the-majority-of-cre-debt/

There are $4.5 trillion CRE mortgages of income producing properties (total CRE, not just office). Here are the holders (domestic and international):

This is just the CRE debt. But there are also the property owners, and the include insurers, property funds, REITs, etc. So they stand to lose their equity.

If it hits buybacks, that is fine with me.

This!

This is the best situation possible. The losses should be as wide as possible and affect investors.

That is how it should be and will cause the least damage.

Swedish pension giant Alecta lost $2 billion. In 2022 they sold all of their shares in national banks Swedbank and Handelsbanken, the latter they had owned since 1951. What did they buy instead? Shares in Silicon Valley Bank. Value today? 0, while Handelsbanken is still going strong and looks set to pay a nice dividend this year.

And this is why I encouraged my son (who works for the state) to open a Roth IRA…

Swedbank has not yet escaped the wrath of Uncle Sam due to large scale illegal washing of russian funds. Swedbank’s former ceo had to resign after lies thatweren’t appreciated by US authorities

Looks like another nothing burger for US banks that will not bring doom to our never ending good times or some kind of bank failure recession/collapse…

Unfortunately, this is not how MSM is spinning it and they are all sounding the alarm bell already as if Great Depression is right around the corner…

Exposure to all of CRE (not office alone) is going to dog banks for years – losses and lower earnings, dividend cuts, etc. Banks have already largely worked through the enormous mess of retail CRE loans that started in 2017; retail CRE, which is even worse than office CRE, though not as big, didn’t take down any banks. Lots of investors lost their shirts though.

Multifamily is huge, it’s 44% of total CRE loans, and banks are more exposed to multifamily. So if multifamily goes across the board, it might take some smaller banks with it that are heavily concentrated in it. But multifamily doesn’t have a structural problem, unlike retail and office. There is plenty of demand for apartments; it has an interest-rate problem, and a pricing problem, and that can be overcome with time even if rates don’t go down because rents tend to continue rising.

Have you followed anything from Melody Wright? Do you believe multi family is overbuilt which will lead to vacancy?

How come there are people who scream “housing shortage” and “underbuilt” when it fits their narrative, and then scream “housing glut” and “overbuilt” when it fits their narrative? Pick and choose.

Actual rents paid by tenants are still rising rapidly.

If renting is substantially cheaper than buying, people switch to renting from buying overpriced homes. The housing market is not very liquid. So this takes time, but that arbitrage is already happening. People can rent houses, and they can rent apartments. There are lots of nice apartments that are the same square footage as a small house (1,200 to 1,500 sf). In expensive cities, people can save thousands of dollars a month that way (mortgage interest, property taxes, insurance, trash, water). People do the math eventually. There is no Chinese wall between renting and buying.

Melody Wright has been gloom and doom on housing for quite some time and she has been very wrong.

There is no crash coming whatsoever, at least in my hood.

BTW, this CRE mess would be a nothing burger, mark my world.

Melody Wright’s methods of “data” collection are, to put it very mildly, not rigorous. Her schtick seems to be traveling around the country looking for grabby visuals that seem to confirm her bias, and then posting about them as if they were highly significant.

So for example, she’ll visit a newly completed housing tract and shout about what a “ghost town” it is–as though we were meant to expect that builders could press a button like in Sim City and immediately place little homeowners in each new spec house upon completion.

Or visiting a soup kitchen and pointing out how poor and hungry the customers are, which proves…what exactly? That soup kitchens exist, and that poor and hungry people can be found there? Wright would have us believe that it’s evidence of a faltering economy. (And no one here will be surprised to learn that Wright is a big believer in the “Americans have no money for an emergency” fallacy that WR has debunked here.)

The actual hard data that she publishes on her Substack (which is now subscribers-only, lol) does seem to be on the up-and-up, although some of it (Airbnb rates in specific cities, for example) seems to be incredibly noisy, swinging wildly from month to month, and thus of questionable utility.

The US has under built housing and multi family for a decade and had population growth during that time as well. It will take 10 years to catch up. There isn’t going to be a glut of anything in housing for a long time.

What happens when people are priced out of both renting and buying? When their income doesn’t qualify them for a mortgage or a rental application? Don’t pooh-pooh it — we are almost there in California. Two more years of 6%+ rent increases (more like 8% in California) and 4% wage increases could be a tipping point.

PS Huntsville Alabama will likely be the most overbuilt for multifamily in a year or two. If you want cheap rent, it may beat Tulsa!

@JeffD asks “What happens when people are priced out of both renting and buying?” They will move to a more affordable place where they can rent or buy something they can afford (they won’t build a house out of stolen pallets and blue tarps under a freeway overpass since 99% of the “homeless” have drug and/or mental issues and less than 1% moved under the freeway or next to the railroad tracks after a 6% rent increase).

“What happens when people are priced out of…renting…”

Roommates.

That’s been the case forever. I had roommates back in the day.

Same. I always had roommates to split the rent with. I could never afford a place for just myself.

When I bought my first condo in SF I paid a little more for a 3br so I could have “two” roommates. After three years of rent increases my “roommates” (other single guys in their 30’s with good jobs) were paying 100% of my fixed rate mortgage PITI.

No Problem – The Fed can print the funds to make investors whole –

This is the greatest country in the Universe

Dream on

Sounds familiar. I remember many years ago, the Japanese went on a spending spree and bought up a bunch of office buildings in the US, and sure enough, they later incurred huge losses. Timing is everything.

Who can forget the Nakatomi Plaza debacle? A huge loss.

Die Hard?

Ok … I’ll bite.

Die Hard was a Christmas movie.

Ducking now … VBG

Howdy P Relief. HEE HEE Thanks

Yippee ki-yay mother….

That movie has a pretty surreal premise from our point of view — there were still fears at that time that Japanese investors were going to take over the United States and the terrorists in the movie were German. I’m not sure what was going on there, maybe it was leftover paranoia from the World War II era? Anyway, it looks quite silly considering the way the world has gone since then. I enjoyed the movie though, despite all that.

Die Hard is one of the finest movies made in my opinion. It was and is more respected by the masses than by the elite Hollywood opinion makers to this day. But Hollywood reflects the reality that the audiences perceive… and in 1988 America was just beginning to come out of a quarter century funk.

It was barely a dozen years after we had “lost” our first war… Vietnam. Watergate, stagflation, and the Iranian seizure of 52 American diplomats were seared in our recent memory. Meanwhile the “Big Three” automakers and other U.S. conglomerates had their lunch handed to them for over a decade by Japanese manufacturers.. who used the profits to buy American skyscrapers with (Rockefeller Center in NYC springs to mind).

As to the German terrorists… they were definitely a thing back then. EVERY western nation had a small contingent of Marxist terrorists running loose. Americans were either number one or number two on their target list. The father of my roommate at the Naval Academy was a Navy captain and the U.S. Naval Attache to Greece… and he didn’t get a turnover from his predecessor because his predecessor was assassinated. The captain he turned the job over to was ALSO assassinated.

So yeah… in 1988 America couldn’t seem to get its footing while the nations that we had defeated in WWII seemed to be able to do no wrong. In that sense, Die Hard is a movie of its time and place in history. It still holds up pretty well because Americans are normally BOTH naturally confident AND fearful of being lapped by others… which the John McLane character shows really well.

But it is interesting to think of how it might have needed to have been tweaked if it was made just five short years later after the Berlin Wall fell (OCT 1989), Iraq’s military was defeated in 100 days (JAN-MAR 1991), the Soviet Union ceased to exist (Christmas 1991), and the Japanese stock market crashed (1990-1992).

Waithout doing my own research, some of this report is amazing. The investors must have terrible advisers or attorneys: such investors coupd have demanded guarantees and absent a term limiting a deficiency judgement (like laws prohibiting them as to residential RE in many states) collect the reminder invested from the borrower by judicial foreclosure and a deficiency judgement. E.g., Alliance HP, mentioned above, could get its rents taken by creditors to collect a post-foreclosure judgement for the deficiency if it defaulted and the investors had judicially foreclosed on the RE security instead– as they could have as implied above.

Indeed, in the very few jurisdictions in which you must elect between foreclosure and pursuing the debtor, pursuing a wealthy debtor instead makes more sense! Investors should sue whichever person created this unfair deal for them, making them eat a $37 million loss, unless disclosures were given. Malpractice?

Good perspective on the relative magnitude of the US CRE (office) problems.

How does non-US real estate (e.g. European and Chinese holdings or projects) fit in. You point out that US banks have relatively light exposure to the US markets… is the same true regarding US exposure to foreign real estate (especially the SIFI institutions are regards Europe and China.)?

Also, do the banks finance (in any major way) private equity or private credit managers who are themselves tied to US or foreign CRE, but not categorized as such?

Thanks, as always!

…”SIFI institutions as regards Europe and China.”

If the CIBC’s exposure to US CRE amounts to only 1% of its total loans outstanding and it has the lightest exposure of any of the Canadian banks, that does not seem like much Wolf.

It’s not much. It’s not much for US banks either. Like I said, it’s spread far and wide, and banks are going to take losses, and they’re going to raise their loan loss reserves, and some banks will cut their dividends, etc. That was the whole point. if you spread a $1 trillion loss across the world, it really isn’t that much for each player.

Wolf, are the credit default swaps, you know the insurance policies taken out by the cmbs bond holders, are those spreads starting to blow out, like they did in 2008 when the mbs all went to heck? I cannot access that info anymore and so I simply don’t know, but I’d wager insurance on any cre, as in cmbs orcdo’s gotta be going way up with this distress.

Aig part 2 anyone?

Where did this Credit Default Swap data previously exist? There is an archive website on the internet, perhaps it has clue.

Absolutely this. Did the US banks sell insurance because its hard to see the foreign investors not hedging at all. For the US banks the insurance would have appeared like free money as well !! (until now)

Like a mini-Big Short was more like what I was thinking.

I notice you track San Diego on the residential side, but not on the CRE side. Is that because it is not as large as the other cities or is there another reason?

I track SD, Orange County, and LA. But they’re essentially in the same market and have the same trends though the numbers differ some. So I use LA, which has the biggest office market, as representative example to keep the table short enough. SD’s availability rate has risen to 21.4%. Orange County’s has risen to 23.9%.

“Canada’s Imperial Bank of Commerce (CIBC) may be the most exposed to US office sector, with about 1% of its assets tied up in loans backed by US office properties”

If I lost 1% on my investments that would a very small price to risk making a buck. Learn the lessons and do not repeat. But not much pain really.

Agreed?

Thanks for this perspective Wolf, helps me to see more deeply beyond the blazing headlines, as usual. I have a family member who works for a large NYC contractor. They are buying mostly vacant CRE on the cheap, and doing those upscale retail/residential conversions. They seem to be in demand as high net-worth individuals who miss the city life are coming back.

I wonder how big of a hit the blue chips will take that are based out of the Bay Area. I’m keenly aware that companies like Google and Facebook bought large tranches of CRE for the express purpose of holding them as an asset. They are normally subleased to smaller companies. Wolf, I believe you’ve written on this topic before and will likely need to take another look in a year or so when it starts becoming hard to ignore. Do you think something like this would affect their bottom line?

William L.

“The Japanese went on a spending spree & bought up a bunch ofd office blogs in the US and layer incurred huge losses. Timing is everything.”

You’re right..remember the song, “I’m gonna move to Japan?” Well I moved to Japan (with my J. wife in Aug 1989) and it was the top or very near the top of their RE * stock mkt bubble. Vegetable sellers were selling their small retail spots for MILLIONs of $. Everybody felt rich.

What you might not remember is that the Imperial Palace “compound”

(lands& blds) were appraised to have more value than all the RE in Manhattan!

In addition to the “bunch of office buildings” they bought included Pebble Beach Golf Course & Clubhouse and The Waldorf-AStoria Hotel

in NYC.

Less than 3 years later the bloom was off and they did indeed take a HUGE (like 20 cents on the dollar) loss on those two trophy “assets.”

SO yeah…Timing is everything!

On a related note, I see in my local newspaper (Mpls), that collection rates for the county are decreasing as we have not seen since the 2008-2009 recession. This is because of commercial property dropping values and unpaid taxes.

Is it fair to make an analogy that office loans are like a batch of dog poop highly diluted but spread evenly through the food supply, just low enough that nobody gets sick?

Probably some issues with that analogy.

At any rate, thanks for covering this slow-mo train wreck. I see some fallout in the architect’s job market from this. There may not be another office building built for a generation. Hopefully, those folks can switch to working on apartments or other projects.

@ChrisFromGA I agree that we will see a reduction in demand for new office space, but they will not stop building the new stuff. There is a “reduction in demand” for fine china and hand cut crystal (ask anyone in their 50’s or 60’s how much they got for their parent’s Wedgewood china and Waterfod crystal after they died), but despite the drop in demand and nice old stuff selling for pennies on the dollar there are still people that want “new” china and crystal (just like there will be people that want new office space built exactly the way they want it).

I just had one of those moments during which I felt like I caught a glimpse of the calamity that is being ignored. Typical human behavior to be corrected by robots trained to think like us. Good grief I better tell the one’s I love, that I love them.

I’m talking about the collapse of the CRE bubble, which seems to be one of first expected event in a general collapse of an asset price bubble.

Crashes happen slowly at first, then all of a sudden.

A buddy of mine is a senior executive at a private investment fund that owns and operates around 4,000 units. Their model is built on leveraged purchases, upgrades, and then they cash out after holding for 36 to 60 months. All of their leveraged properties are underwater when marked to market. Additionally, they are negotiating with lenders to prevent defaults.

And so it begins. Detox, while educational, is not attractive.

The bloom is off the rose for CRE, for now.

Society may decide that they prefer to know other people. I know I sure did and I think I remember them all 50 years later.

Which would reconfigure the CRE market. Anyway, it’s not real money on the hook.

Who is going to want to lend on these empty commercial buildings going forward? Not gonna be a lot of domestic lenders eager and we’ve burned the bridges to foreign banks. Going to take some years to get confidence back. In the meantime a lot of these buildings will probably rot, not unlike the dead malls all over the country. Maybe we could have a contest with China, who has the least number of empty cities, winner gets Taiwan

Is this the skyscraper curse people have been talking about? I’ve remembered from 2010 to 2015, office towers were being constructed everywhere: even as far as Morningside in Scarborough (a suburb east of downtown Toronto).

Despite this, it’s surprising that Canada is facing real estate difficulties when the powers that be encouraged millions upon millions of population growth from 2021 to 2023. Canada’s population was 35 million in 2012. In 2022 it skyrocketed to almost 40 million.

Wolf – What does the data tell us about the entities buying up CRE towers? What on earth do they want the towers for? Even at a bargain price – are they banking on return to work, or do they have a better idea?

There’s an 8-story mid-rise for sale near my house. It’s a brutal old office bldg from the 70s, they want $6.5 million for it. I’m trying to figure out – even if someone got it for $2m …why buy an old asbestos-filled concrete fossil? Residential conversion is usually cost prohibitive. Just curious if you see a pattern in what types of outfits are buying these things.

You can buy it for land value, tear it down, and build an apartment or condo tower on it. Land value is the fate of most office buildings after a while. That’s why they’re depreciated to zero over 30 years. That knowledge has gotten lost however during the free-money bubble. But it’s coming back.

In some cases, if you buy it for cents on the dollar, you can spend some money, fix it up a little, and offer rents that undercut the market by a big margin, and fill the tower with tenants that can’t afford fancy offices, and make nice profits at much lower rents. That’s the best-case scenario. But it might not work, and then you can tear it down and build a high-end condo or apartment tower on the property.

@Wolf in most cases only the “politically connected” can buy an office building “for land value, tear it down, and build an apartment or condo tower on it.” since most (but not all) land is zoned for both office and residential. I won’t name any names but there was a dumpy single story office building on San Mateo that sat empty for close to a decade (from the early 80’s to the early 90’s). When it sold a commercial broker told me who bought it and thought he was crazy since the property was not a good office location and he said others (that were not politically connected) tried to get the site re-zoned (the politically connected guy that gives millions to politicians got the site re-zoned and build condos in the mid 90’s (just as the Bay Area RE market was bouncing back).

ApartmentInvestor,

If a bank or bondholders owns the building after the loan defaulted, there’s nothing political about selling it. The problem is finding a buyer that’s willing to pay more than $1 million. There have been a bunch of foreclosure sales of office towers, and I have covered a few of them on this site, and I mentioned one in this article (100% loss to lenders). And I mentioned another sale in this article, and I covered plenty of office tower sales in prior articles that sold at 50% to 70% off, including in San Francisco, Houston (-80%), New York, Chicago, St. Louis, etc. There was nothing political about it, and the sales went pretty quickly.

AFTER the purchase, the developer is in for years of planning, permitting, and construction. Building something big on that land can take years because the developer needs to get funding, needs to make plans, and then needs to get the permits, and that’s never quick and easy on a big project. Once they have the building approved, they need to build it, and that can take a few more years. And then the hope is that they don’t run out of funding, which is what China’s Oceanwide did in LA and in San Francisco. The LA project has been stalled but is nearly finished. The SF project is a huge ulcer near the Salesforce Tower.

Thanks Wolf for very detailed insights.

In 60 mins interview, Powell sounded very confident on CRE mess. and FED’s ability to manage it and US banks can sustain it. He said some banks may go down but overall he was very confident. Today Wolf’s article kinds of explains a lot. Whole world investors and Bank’s are stuck together in this mess and not just US banks. Some US banks will go belly up and some will lose lot of money but will survive.

Many people on Wall St are expecting and counting towards FED cutting rates faster because of this CRE mess. This article explains will reduced chances of FED’s intervention CRE mess is very well spread and across borders. IF JP/EU banks goes down, so what? FED didnt care for US banks, why would it will ever care for Intl banks and institutions?

New York Community Bank looks like the next one to drop. Stock price on Jan 30, $10.39. Stock price on Feb 6, $4.20. The have a lot of CRE problems, more than most banks. Moody’s today cut its rating to junk. It has $111 billion in assets, so it’s no small bank. It is the 35th largest bank in the US. Curiously, on March 19, 2023, NYCB acquired $38.4 billion in assets from the liquidated Signature Bank in a $2.7 billion deal.

Here’s a short story on trying to catch a falling knife: During the 2008 & 9 banking collapse, I bought B of A shares at $6 a share. In a few days, it dropped to about $4. I sold, thinking it was likely to go bankrupt. It stopped falling at $2.53.

It’s easy to look back to that time and think, “well, this was clearly a time to buy”. But in real time, it ain’t that easy.

Location, location, location…

Looks like things may be turning around in Houston. Thanks for compiling this data Wolf.

One thing I have always wondered is how much these vacancies actually impact property tax revenues.

Regardless, you’re correct about vacant CRE space simply being demolished if it sits vacant. That seems to be the most common fate.

For a picture of what it looks like when property tax revenues erode away, visit any small tobacco town in the South.

Not the rust belt? Shit, look at Chicago, and Detroit.

There are two absolutely true things in life:

1. Location, location, location.

2 Price, price, price.

I any type of real-estate transaction, the those are the two most important details. Literally nothing else matters.

Insurers also have exposure to the Real Estate Market. I suspect it is worse as much of the CRE portfolio was not syndicated. ZIRP made life insurers for the most part losing causes as well. This is a story ready to be told and appraisals typically lag the reality on the ground. Coupled with higher than expected death rates something has to give. When/how I don’t know. Thoughts?

https://wolfstreet.com/2023/04/10/banks-and-commercial-real-estate-debt-a-deep-dive-investors-and-the-government-on-the-hook-the-majority-of-cre-debt/

There are $4.5 trillion CRE mortgages of income producing properties (total CRE, not just office). Here are the holders (domestic and international):

This is just the CRE debt. But there are also the property owners, and the include insurers, property funds, REITs, etc. So they stand to lose their equity.

Years ago, a friend/mentor was trying to teach me about stock investing. His advise: steer clear of banks, insurers, REITs and similar. Businesses that rely on “funny money”.

It became pretty evident, during the ’08 – ’09 meltdown, that many CEOs had no idea about what had developed in the bowels of their organization.

“Years ago, a friend/mentor was trying to teach me about stock investing. His advise: steer clear of banks, insurers, REITs and similar. Businesses that rely on “funny money”.”.

For the novice investor I would totally agree.

For more experienced investors banks and insurers are huge moneymakers. There are very few greater investment boosters than bank leverage or float.

However, (big but, huge butt), the reason these are such great moneymakers is bank leverage and float which can be killers if misused.

If gotten right, these are incredible investments. If gotten wrong , you will lose everything.

Unfortunately a lot of it depends upon knowing the competence and experience of management. That is near impossible for the average investor.

Might be some cool slow-motion implosion videos coming to YouTube, as these high-rises get demolished.

“This was the value of the building only – the “leasehold interest.” Land and building had been separated.”

Uh oh. Watch out if this becomes a trend. I lived on leasehold in Hawaii and you are absolutely at the mercy of the landowner in a forced conversion to fee simple. There were some condos that were worth $1-4 M that dropped to $50-200 K shortly before land lease expiration that was not going to be renewed. I left around then so I don’t know what eventually happened. I think the landowner took possession and converted to a hotel.

My point being conversion to leasehold is a scam and you might as well rent vice “buying” a leasehold building. Although commercial leases can be the very devil itself.

BTW, I believe all property in China is leasehold.

So, the shoe is not dropping in the residential real estate market. I believe that market is healthy despite a shortage of homes and home loan rates back up above 7% this week. The problem is in CRE. Decades of over building office space and then Covid came along and companies realized that a lot of their workers could work remotely. Even though it’s been 3 years since Covid, about 1/3 of workers have not returned to the office – that’s a lot of workers and a lot of empty office space. The new office building might be doing better than older buildings, but they are also walking that fine, ,razor blade. It’s a matter of time before there is an historic collapse in CRE and the the investors and small banks will be left holding the bag. Will the government bail them out this time like it did the banks 16 years ago? I doubt it, but time will tell. Cheers and thanks for all the fish.

Residential Real estate market is not healthy. It is frozen, no big price decline. You may call it healthy though.

There is no shortage of homes, although shortage of inventory, though increasing over time.

A lot of sellers sitting on the sideline hoping they get peak prices or they are made to believe by FED in last 15 years that asset prices can only go up.

CRE would collapse but it’d be a nothing burger.

One of the reasons for the current passion on the part of business to force workers away fro work-from-home and back to the office is to partially justify the over expansion into the now tomb-like, empty spaces around the country.

Hope for the empty towers? The WeWork guy is recently trying to raise money to buy it back out of bankruptcy.

But wait – is that still a viable business model? Don’t many people want to continue to work from home?

“Don’t many people want to continue to work from home?”

Yes, but employers are pushing back on this.

My employer begrudgingly setup a VPN for me to work from home ~3 years ago, but I was recently told I can no longer WFH without prior approval. I was already in the office most of the time anyways, and only did WFH on days when e.g. my car was in the shop.

I suspect many employers still don’t trust that their workers are as productive at home vs in the office.

‘Don’t many people want to continue to work from home?’ – without paying for it themselves … the WeWork idea was that small operators (not corporate employees) would pay from their own pocket to work in a social workspace and travel to some central location to do so.

Whether this is now (or was ever) a viable business model remains to be seen.

And yes, for corporate employers, at-home work efficiency for most core employees has never been as productive for the obvious reasons like distractions and diversions etc. Here, the nature of the individual is important. For the self-motivated types, like a good salesman that came to the office weekly or periodically, it was never a problem as results are apparent and performance can be easily quantified.

He’s trying to buy back what’s left over after bankruptcy, meaning after it shed a big part of its debts and lease obligations, and he is offering a bankruptcy price.

A 1% nominal loss spread across the world’s financial institutions and investors does sound manageable. However, what about leverage? None of these players do unleveraged investments. Leverage does bite hard when investments tank.

This IS the leverage. This is the DEBT of CRE, the leverage of CRE.

The equity of CRE is also losing value, and even more rapidly, going to zero when a landlord walks away from the property, as is now often the case, to let lenders worry about it.

I always thought a small skyscraper in a downtown somewhere would make a great single family home.

One more note. I’d be surprised if there were not credit default swaps against some of these defaulting loans. Who wrote those? Surely not AIG again.

Wolf,

Unrelated, but may I request an article/explanation on the recent SEC rule change, that requires hedge funds exploiting the treasury basis trade to register as dealers?

I had briefly read the TBAC’s presentation on the basis trade from last month, but am struggling to wrap my head around it. I understand that HFs are arb’ing the difference between the actual TSY and a futures contract, but I’m curious about the mechanics of the trade and why the Treasury is so concerned.

It sounds like it can be managed but earnings are definitely going to get a hit. Even the big banks that end up paying the fdic for other banks having issues will be dinged.

On top of bond pricing issues and normal write-offs.

Good luck bank investors.

Working in a major city in a hybrid format, I can state that time wasted sitting in traffic going to places other than the city and crime have permanently changed the dynamic. Traffic was always an issue but now workers rightfully feel unsafe walking around. These professional workers will never return to being in the office 5 days or even 3 days. Sad but it is what it is.

Good overview of the US CRE loan issue. “What’s amazing about the mess of the office sector of commercial real estate (CRE) is just how far and wide these mega-losses – by some estimates, they may ultimately amount to $1 trillion, or whatever – are spread in diced and sliced form globally. Which is a good thing for US banks.”

I’m wondering about the other side of the coin, foreign commercial and government loans made for example in Europe and Japan when interest rates were negative for years. Like the US CRE loans, there must be a huge number of foreign borrowers with low or negative rate loans which will be maturing soon in the current higher interest rate environment without any market to refinance at a viable rate. I would guess trillions more to come out of the woodwork globally.

For all its benefits, the capitalist system does not work well in reverse.

The largest building in Missouri, the AT&T Center in St. Louis, sold for $200 million in 2006 which just changed hands for $4 million in 2022. At 1.4 million square feet, that is $2.86 a square foot.

I love it when humans building structures now point to the cost to build, as if it assures them of some value. Mr. Market does not care what you paid. I only buy real estate below replacement cost, and I am looking forward to buying plenty in the not to distant future.

How much per does demolition cost per square foot?

C’est dommage …

James Dimon’s vociferous RTO push makes more sense through this lens. I had been thinking he was just a bad/controlling manager, but obviously he wants these commercial properties better utilized and worth more.