Beneficiaries got whacked over the head in 2021 and 2022 by raging inflation that outran the COLAs.

By Wolf Richter for WOLF STREET.

Among the raging and worse-than-expected inflation data released today was the Consumer Price Index for All Urban Wage Earners and Clerical Workers (CPI-W), which the Social Security Administration uses to calculate the Cost-of-Living Adjustment (COLA) for Social Security benefits.

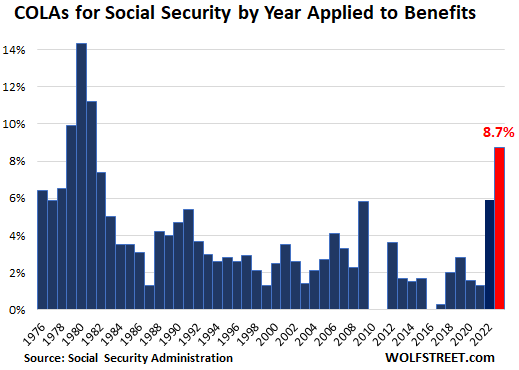

For September, the CPI-W jumped by 8.5% from a year ago, after the 8.7% jump in August and the 9.1% jump in July. The COLA for 2023 will be the average of the three: 8.7%, the highest since 1981.

For 2021, the COLA was only 1.3% (set in the third quarter of 2020), even as inflation began to rage, and the purchasing power of the Social Security benefits dropped sharply.

In October 2021, with inflation raging, the COLA for 2022 jumped to 5.9%. There was some jubilating among beneficiaries that there was finally a big increase to keep up with rising costs, after the 0% to 2% increases for most of the prior decade. But those hopes got whacked down by reality because in 2022, as benefits rose by 5.9%, CPI inflation jumped by over 8% and in some month well over 9%, and that big COLA got eaten up by inflation plus some, and the purchasing power of the Social Security benefits dropped again.

There are now hopes that the Fed’s rate hikes and QT will finally put a cap on inflation this year and will bring it down next year. If that’s the case, the 8.7% COLA may actually be larger than CPI inflation in 2023, and benefits might actually regain a little of the purchasing power they’d lost.

If that’s not the case, if inflation continues to dish up nasty surprises, which it has a tendency to do, 2023 might be another year of further belt-tightening.

For the younger people who read this with amazement, let me share with you what the dad of my high school sweetheart told me, when I was 17 and he about 40. He had his own CPA firm, and he said that he’d never get any Social Security benefits because Social Security was a scam and would blow up before he reached retirement age.

And then decades later when he retired, he got his benefits, and a few years ago, when he passed away, his spouse got the survivor benefits. And despite all the nonsense being bandied about out there, Social Security will be there for me, and it’ll be there for you, even if the system needs to be adjusted from time to time, as it has been in the past.

But the most crucial thing to know is that Social Security alone won’t be enough. CPI-W may not fully capture the increases in actual cost of living that you may experience, and so year after year, the purchasing power of those benefits declines in an insidiously cumulative manner – just a little every year, but it adds up. That’s why it’s so important to create some kind of retirement nest egg.

And for those people who can, the best thing to do – for all kinds of reasons, not just money – is to keep on working in some way past retirement age. Even a part-time gig will vastly improve, or at least slow down the deterioration, of the finances later in life when work becomes impossible. And look at all the elderly in Congress and the White House. A bunch of them are from the Silent Generation, and they’re having a blast.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Medicare premiums will swallow up the increase.

Uninformed math-challenged BS for two reasons:

1. Medicare premiums were lowered for 2023. Base Part B Medicare was cut by $5.20 a month, to $164.90 a month in 2023 (from $170.10 a month in 2022).

2. In some other year, if you get the average SS benefits of $1,600 a month, and the COLA is 8.7%, your benefits rise by $139 per month. So if in the same year, your Medicare Part B premium rises by $10 a month, you still have $129 a month left over from your $129 a month increase.

I’m always astounded by the idiotic BS that gets spread about Social Security.

May be I am wrong about use of contributions for pay outs, but will love to see this data.

I would want the social security to be there and be effective when I retire in 30 years.

How much millions of families’ productivity and lifestyle be affected by destitute and sickly parents on their doorstep? And the grocery expenditures, rents, etc., backstopped by social security. We could similarly say the military is unproductive and largely a welfare program (especially family benefits) in some abstract world. but this is the world we and our economy are embedded in. Would you like ten times as much cars and furniture produced,with destitute and sickly aged everywhere?

It’s not idiotic, I have been in Social Security for 17 years and a great portion of the SS increase was impacted by the increase in medicare premiums leaving with a SS increase less than the COLA % increase.

Chuck C,

That is total braindead BS unless your SS benefits are less than $200 a month.

Do the friggin math instead of spouting off idiocies. If you get a COLA of 8% on $1,500 and Medicare part B rises by 10% on $170, you will get $120 more in benefits and you’ll pay $17 more in Medicare. So:

$120 -$17 = $103… so your monthly net increase = $103.

SS has some issues, but not the kind of BS you’re spouting off here. Don’t abuse my site to spread BS lies about SS.

Wolf, I read Chuck C’s comment a little differently. I think he means that when the medicare premium percentage increase exceeds the social security COLA increase, then your net social security benefit will increase less than the COLA adjustment percentage.

Using your numbers, the beneficiary’s net benefit after medicare was initially $1,330 ($1,500-$170) and increased $103 after the COLA adjustment and medicare premium increase. That’s only a 7.74% increase in the net benefit despite the 8% COLA adjustment. In one year it’s not much, but if it happens consistently over time it will add up.

I’m not on Social Security so I don’t know, but perhaps when the COLAs were very low for the past decade, the medicare premiums increased at a higher percentage eating into the COLA adjusted Social Security benefit.

Of course, as you point out to rankinfile, the opposite is true if the COLA adjustment exceeds the increase in medicare premiums as looks to be the case in 2023.

Along with Wolf I am also astounded at the nonsense people insist on believing. A great percentage of the US population has completely lost their minds and are unable to do basic arithmetic let alone critical thinking about anything. Instead they just wallow like pigs in whatever conspiracy theory catches their tiny little attention spans!

Rojogrande….agree. That’s how I looked at it with the nuance that I still net up – depending on tax bracket changes – just by a smaller amount (i.e., percentage). In the bigger picture – for those who have worked hard and been decently compensated, SS is a net negative (assuming 8% historical growth rate in markets over one’s work life).

SS is directly deducted from SS.

The Variable Supplementary Medical Insurance Premium or “hold harmless” provision of Medicare is especially important to understand for those it doesn’t protect. It doesn’t protect me.

Since we can all presumably read and we’re all here, I’ll leave it at that, as I’m sure I don’t know what I don’t know yet and maybe not then.

One way to beat this whole conversation about Medicare Part B increases eating up the SS COLA increases is to move to a low/lower cost of living country and cancel Medicare Part B. Mexico, Ecuador and other Latin American countries come to mind. In February I was in Ecuador where I cancelled my Medicare Part B. My monthly SS payment went up by $170 per month. Ecuador uses the USD as their currency and hadn’t had any inflation for the previous 10 years.

Note: none of the above comments are intended as investment advice nor should anyone take any action on the above comments without consulting with an investment professional first.

wolf, I dont understand how a large increase in the COLA doesnt further cause Social Security’s future liabilities to stack up even worse against future income of the program? If they raise the COLA 8% in a year and then the economy goes into recession (and stock market losses reduce income), how doesn’t that cause the date that the fund runs out of surplus to happen significantly faster?

A past barrons article said that due to COVID, the date SS fund runs out of money is now projected at 2034, but I think with a stagflation environment, couldnt that be moved up even sooner?

And another article I see says that a benefits cut of 21% would be required for the program to continue after the fund runs dry unless changes are made.

Are these not correct? And isnt Medicare in an even worse condition?

Trust fund update coming in a few days. Also note hot labor market and sharply rising wages due to inflation, which increase the income to the fund.

Funn how in a election year ,all of a sudden we get a decent increase

Augustus, correct. The Social Security fund is owed the money by the Treasury. The Treasury can always issue new debt to pay these tbills held by the trust fund, which the Fed can monetize if necessary.

But that doesn’t mean those Social Security dollars can actually buy anything.

Thomas Sowell:

Would you sign a contract that enabled the other party to change the terms of that contract at will, while you could neither stop him nor make any changes of your own? Probably not. Yet that is exactly what happens when you pay money into Social Security.

No matter what you were promised or at what age you were supposed to get it, the government can always pass a new law that changes all of that. But you still have to pay into the system.

A private annuity plan run by an insurance company is legally required to pay you what was promised, when it was promised, and to maintain assets sufficient to redeem its promises.

max,

“A private annuity plan run by an insurance company is legally required t…”

Hahahaha, you’re hilarious. And then the insurance company that sold the annuity fails, and then it gets bailed out by that state’s taxpayers that guarantee the first $100,000 per beneficiary, but it can take years to sort it out, and the rest of your benefits you can kiss goodbye and all promised terms, such as interest to be paid, are out the window. Privatization of profits, socialization of losses, and the little guy that bought the thing gets screwed.

But please buy an annuity — they’re very profitable for the insurance companies, and folks who sell them make huge commissions, and all this is really good for the economy, unlike Social Security, which doesn’t have fees, or commissions, or profits for Wall Street, LOL.

unlike Social Security, which doesn’t have fees, or commissions, or profits for Wall Street, LOL.

free lunch as well?

My parents had all had all that promised as well in SFRY — free this and that from cradle to grave country lasted from 1945-1991

USSR had all that country lasted from 1922-1991

You are older than me you are going to get your entitlements, my entitlements are already y changed in Australia from 65, to 67.

my kids and your will find out hard way not to trust in political promises.

max,

For my vintage, full retirement age has been changed years ago to 67. I’ve never once complained about it. I’m not there yet. If they move it to 69 the day before I get to 67, and I’ll have to stay unretired for two more years, LOL, then, well that would be a hoot.

But it isn’t a “free lunch”: I paid into it for 40+ years, and I’m still paying into it, and if we (my wife and I) die together in a plane crash, like my parents did months are retirement, well then, the whole system benefits, rather than me, and I’m OK with that. It’s a good and efficient system that attempts to keep ALL older people out of abject poverty.

Wooosh.

The point there was that an insurance company can not change its terms – it is forced to go belly up if it is mismanaged. Govt on the other hand can change the rules anytime – retirement age, compensation formula, surcharges, taxes on benefits, etc.

(Ask Joe. He might or might not remember that in the 80s he voted to start taxing SS benefits).

And another important point Max was making – that irresponsibly run countries eventually do fail, just like those poorly run insurance companies.

Thanks for the education.You could lighten up a little on your rebuttal.

I do respect your fact driven conclusions and deeply appreciate your blog.

rankinfile,

Sure, I could “lighten up a little on my rebuttal,” but I won’t.

Folks have been slinging around SS BS my entire life since I was 17, as I explained in the article, and this BS exasperates me. It’s the same BS every time, year after year for decades.

SS has some problems, and they’re fixable with relatively minor policy adjustments. But it’s hard to even address the issues when the BS that people are slinging around clouds up any discussions.

I deleted a lot of SS BS on this thread because I didn’t want to waste my time shooting it down each one of them. You just lucked out.

I will not allow my site to be abused by the SSBS spreaders. I’d rather shut down the comments entirely forever.

Persistent high inflation means only one thing. Our politicians in both parties are incompetent and Powell can play both of them like a fiddle!

From Fed:

Inflation is transitory!

Our 4% rate will control an 8% Inflation!

Our tiny QT will make housing affordable again and control inflation.

Having dealt this this issue last year on behalf of my mother- there might be missing information here. Her premium increases last year did completely eat the entire COLA increase, but she had one year of over $125,000 of taxable income due to a rollover of an annuity contract left to her by her father. The Medicare premiums are total-income adjusted and her adjustment upwards did eat the entire COLA. This year, her only taxable income is SS, so I expect that her Medicare premiums will revert to the 2020 level.

Yeah. It’s really sad when government cheats the needy elderly.

Depends on the year. Overall, you’ve been net positive…it just didn’t feel like it.

Congressional Research Study for 2009-2018: avg benefit up by $132, medicare part d up by $34. Net = +$98/mo…$1175 to $1308.

Of that $98 per month rise, $65 was in one year: 2009. No increase in part d.

Next two years: part d up more than cola but net changes = $0. (Hold harmless provision prevents a decrease in monthly benefit.)

Net increase in 2012: $39. Next 3 years net rise: $16, $19, $21.

2016-2018: $0, $0, and $.35.

BOTTOM LINE: In half the 10 yrs, no net monthly increase. The other 5 yrs: +$20 per month.

You were in the black…it just didn’t feel like it.

And then there is the big one: insurance premiums to cover what Medicare does not, which is 20%. Even a Medicare Advantage plan has copays for some medicines.

As Wolf says, better have a nest egg. Average net worth 2021 age 65-74 = $266k…including equity in their homes.

I’m no bond maven, and I could be error, but………

ZB on a Quarterly Chart is almost exactly where it was on 7-1-11 when it lifted off to 147.

TRIX and RSA are lower than they have ever been on that same chart.

???????

If recession sets in, that benefit + COLA is layoff–proof too. If you calculate how much you would have to set aside to equal social security benefits, it is a LOT.

George W. Bush, flush from his (puzzling to me) 2004 victory, wanted to privatize social security. Imagine if that had succeeded, and then 2008 happened: tens of millions of seniors suddenly on the streets.

But sadly, I hear, the rising interest liability for the USA debt will soon equal the whole budget for Medi-Cal.

He just did a really bad job of selling it, and did get the whole idea slightly wrong.

We should have moved to a sovereign wealth fund model (and still should), where instead of individuals choosing how their SS is invested, the government does it for everyone. Every state in the Union does this already for state employees, Alaska does this for the Permanent Fund, and many countries do it at the national level for their pensions too.

These assets are well diversified, not just investing in stocks but bonds, real estate, natural resources, private equity, inflation-proofing strategies and so on.

Now a lot of US state pensions are deeply underfunded, but that’s not the fault of the sovereign-wealth or defined-benefit model — it’s mostly the fault of lawmakers, various regulations and in a few cases self-dealing (think Illinois pensions investing the manager’s cousin’s office buildings). And some are extremely well run; I’d name states but not sure anyone cares.

No US public plan or SWF I know of went insolvent in 2008-09, and I don’t know any now that is running into problem we didn’t already know about. And absolutely no one is clamoring for the disbanding of say, the Australian Future Fund or Temasek.

The fallacy of sovereign wealth funds investing in private-sector securities is that it will of necessity be done by something akin to buying S&P500 index fund shares. This places the “ship of fund” on a totally predictable straight-line course, enabling the Wall Street wolf pack to torpedo it at its leisure.

I’m not sure “fallacy” is the right word when it’s being practiced all around the world, and at all levels of US government lower than federal.

“Fallacy” is the wrong word here.

jm

Excellent analogy.

MoreCreativeMatt,

The pension funds in the UK are now in the process of imploded based on a leverage investment strategy that is also widely used by US pension funds.

Lots of corporate pension funds in the US have already blown up, and then the Federal Government’s Pension Benefit Guaranty Corporation has to try to clean up the mess.

If you want a privately-run pension that is broadly invested, fine, get an annuity, but thank god that SS is not dependent on markets.

Worked in pension consulting, and you are broadly incorrect/misleading on several counts.

The corporate pensions that the PBGC took over didn’t “blow up”, the companies’ core businesses did. So they had no way to keep making the required contributions to pay out beneficiaries. This was so with the railroads, then the airlines, then General Motors. This is not a problem at the national government level, especially when you (still) have the world’s reserve currency which is little danger of being challenged.

US public pensions have nowhere near the exposure to levered LDI/fixed income strategies that the UK does. By this I don’t mean zero exposure, and I’d say that anyone using levered risk parity is especially in trouble. But European stock have gone nowhere for 20 years so there was a TINA element to their decisions we don’t have in the US.

I would absolutely not say levered LDI is “widely used” in the US (again, not to imply “not at all used”), and invite you to cite sources to back up that assertion.

If companies fully funded their pensions, there would always be enough money to pay retirees.

“If you want a privately-run pension that is broadly invested, fine, get an annuity, but thank god that SS is not dependent on markets.”

Yes, thank god. Many beneficiaries would not manage their money effectively enough to provide even the base level of benefits that social security provides. It’s a social insurance program, not an investment fund. Sadly, too many people already depend on it as their sole source of retirement income.

MoreCreativeMatt,

“The corporate pensions that the PBGC took over didn’t “blow up”, the companies’ core businesses did. So they had no way to keep making the required contributions to pay out beneficiaries.”

That doesn’t make any sense. If a pension is dependent on a companies’ core business for funding and the core business blows up, as you say, then the pension by definition blows up too. Saying the pension would have been fine if the companies continued to make the required contribution, ignores the reality that the pension doesn’t exist separate and apart from the companies’ ability to fund it.

rojogrande, I knew someone would call me out on that. And some of those corporate pensions consisted of a lot of company stock or bonds which got zeroed out.

But all the assets in the plan that WEREN’T company stock were still there, and were worth something, so had some value to pay beneficiaries.

But this argument is completely irrelevant at the level of a sovereign wealth fund. No public plan or SWF owns, say, just AAPL or predominantly AAPL. Some are concentrated in resources such as oil, and most such funds are well aware of this and attempt to diversify away, modern portfolio theory 101 and all. (More like 001.) With oil it’s safe to say we’ll still be using it and it will have intrinsic value for many years to come.

If anything, SS has this kind of exposure the way it is now. Any gap between payouts and revenues has to be made up for, at some time and on some level, by issuing Treasuries. Which is the “company stock” of the Federal government.

Had SS funds been invested responsibly in markets, it would not be insolvent as it is today…..

Had I personally been able to invest my SS deduction, instead of paying into a sinking ship, my monthly annuity today would be 2X to 3X higher than what is currently is, and it would be inheritable, so my heirs would benefit…..

Ok, we’ll re-have that discussion two years from now. Markets are already down over 20%.

Personally I think ZIRP and QE are a major contributor to the use of leveraged bets as the ability to earn real return was manipulated out of the market by global central banks. Not saying the fund managers aren’t culpable but the conditions that central banks created also screwed up the normal channels for securing real yield without undue risk.

“it’s mostly the fault of lawmakers, various regulations”

And you think it would work here because our lawmakers and regulators are such outstanding and non corrupt individuals… LOL

This is at least the third time I’m saying this, but it already DOES work here to an extent, has for decades, and works quite well in some states that are otherwise polarized in one direction or the other but have committed to good governance.

Hog Wash

MoreCreativeMatt,

Very good comments. I have a friend who moved to Norway back in 1980. They have a great Sovereign Wealth Fund.

The attempt to privatize SS was a gambit by Wall Street to put more money into their own pockets. Same thing with the attempt to create tradeable energy credits to solve global warming. Wall Street will try to find a way to financialize everything so they can dip their greedy beaks into another pool of cash.

A much better path is to de-financialize everything. Cut the maximum mortgage term down to 15 years and it would cut housing prices and allow people to pay off a mortgage and pay alot less in interest over the term of the loan. Pass a law to lower the maximum credit card interest rates that take advantage of the poorest people and it would actually go a long way toward repressing loose credit standards (because there wouldnt be a large financial incentive from the high interest rates). Cut down dramatically on the fees that banks can charge. Reinstate the wall between investment banking and traditional banking, so that banks cant borrow money from the Fed and then use it to play risky games in the markets. That might make banks actually focus on improving and expanding their lending programs to business, which can drive economic growth.

De-fi not more-fi.

Cutting the housing values of the 65% of Americans that own homes sounds like a winning idea.

65 percent of Americans live in a home where somebody in the residence is a homeowner, but that’s very different from saying that 65 percent of Americans own their own homes. Obviously kids and dependents don’t hold a title deed, but even if limit to working adults, there are a huge number of working Millennials and zoomers, even professionals who’ve had to move back home with parents as they save up money due to the inflation of real estate costs with the ZIRP and QE-fueled housing bubble. Big extended families may live on the same property esp in expensive regions like SoCal or Seattle suburbs and they’re part of a homeowning unit, but it’s not like all the working adults there have their own separate home. We certainly don’t have 65 percent of young working Americans owning their own homes–Millennial and Gen-z homeownership in the US is actually lower than a lot of places in Europe, Asia (incl. China) and South America–and it’s even worse in ex. Canada and Australia, where the real estate bubbles are so out of control that even a starter home is now basically a luxury item.

As for homeowners being upset about loss of home value–well, that’s basically what has to happen if the Fed is to have any hope of stifling this raging inflation and popping the asset bubbles that have created the Everything Bubble, and inflation is by far the greatest threat to the very viability of the United States as a nation. And for many it’ll be a benefit since their costs of insurance, property taxes and repairs will go down too. Even as homeowners we’ve never understood this attitude that we should want our properties to keep rising in value, unless we’re on the brink of selling (and in almost any year we’re not), they’re not liquid assets and rising value just means we have more costs without any extra real income. Too, this makes it harder for our kids and nieces and nephews to move out to afford their own home. Besides there’s a bigger picture, asset bubbles always have to pop when incomes don’t sustain them, but bubbles in essentials like housing, education and healthcare are far worse than frivolous things like tulips or the South Sea Bubble. The birth rates in Canada and Australia are utterly plunging so far that soon they might fall below Japan levels (at least for everyone outside the indigenous and aboriginal communities there), and they’re plummeting in the USA too, only slightly masked by higher TFR for ex. undocumented immigrants. The biggest reason for this is housing prices and being more expensive for young working Americans to even get a starter home to start their families in. So for basic societal good, housing prices have to come down, and again I’d suspect most homeowners would be fine with that. The big mistake was inflating home prices and the housing bubble in the first place with ZIRP and QE, that was an historic error and there’s no totally painless way to unwind that.

There is a reason libertarians don’t win elections.

Replying to Miller..

I agree 100 percent with your views.

I am a homeowner and if my home valye goes down by 50 percent it does not impact me as it is not for financial purpose but for shelter only.

Fed has taken too much fancy with the word wealth effect.

Yes, Banks can borrow money from the Fed Window and play risky games in the market. Since January of 2013, Banks borrowed from the Fed Window at .25% to loan to their wealthy friends to buy Grandma’s house at 75k over list price and All-Cash to use as a rental. Now they own thousands of rental houses. They are called the “Rentier Class” and now rent extraction is a bigger industry than real production. Read economist Michael Hudson at nakedcapitalism or his web site for more on the Rentier Class.

Stan Sexton,

“Since January of 2013, Banks borrowed from the Fed Window at .25% to loan to their wealthy …”

BS. There was no borrowing going on at the “Fed Window” correctly called the “Discount Window” or “Primary Credit” “since 2013” except in March 2020, because the banks were sitting on trillions in cash and had so much cash they didn’t know what to do with it. Here is total borrowing at the “Fed Window,” aka Primary Credit from the Fed’s balance sheet, weekly. In recent weeks we’ve seen some nibbling. But the rate they’re borrowing at is over 3%

Relying to.wolf and stan..

Wolf is missing the forest for trees although Wolf is factually correct.

I guess what stan meant was .. fed made the money cheap and it was primarily and easily availability to rich people and companies which basically inflated all the assets.

Everyone got this cheap money: 2.7% 30-year fixed mortgage rates, no? That is just effing nuts.

I’m replying to your comment, but it also applies to other replies to your post.

Bush II was either proposing it as a slush fund to Wall Street (probable) and/or because he fell for the false premise that the sum is the equivalent of its parts (also probable).

When any individual’s portfolio increases in value, they are wealthier because there is the broader economy where this increased “value” can be monetized into goods and services.

This doesn’t apply in the same way to an economy with a population the size of the US especially with a rapidly aging population.

In the aggregate, higher financial values don’t increase actual wealth a single cent. It’s no different than if the USG were to “print” this “money”.

This is also why comparisons to Norway or in the post above mine to Alaska are irrelevant. Both have a population lower than metro ATL where I live now. The US has a population of 330MM+ and more importantly, about 20% of global GDP.

It’s also ignores that if the US were to attempt it, why not other major economies at the same time? Are all of these societies supposed to finance their social retirement programs through fake inflated paper “wealth”?

Augustus Frost,

I agree with you. That’s why I used to explain to my retail clients that they had an advantage over mutual fund managers, large endowments and pension plan managers. They could shift their portfolio from stocks to bonds and back again without impacting the markets.

At the rates we’ve seen in the past 20 years, yes, it’s a lot. At normal 5% interest rates, you’d only need about $800k in a savings account to get the maximum payout.

If we were allowed to take a portion of the money we pay in SS taxes and invest it in a tax sheltered account in trade for less SS payment in the long run, I would do that in a heartbeat if were young, the rate of reton SS payments is well lower than stock market returns. Why not allow this?

Medicare part B premiums:

2022 – 170.10

2023 – 164.90

Medicare part b deductible:

2022 – 233.00

2023 – 226.00

COLA:

2022 – 5.9%

2023 – 8.7%

That’s some inflation relief for us SS recipients

It will be interesting to see what happens. Of course, the main expenses for seniors are food, rent, utilities and for some, of course, property taxes. A lot of that–especially food and utilities–has seen price increases far above 8 or 9%.

I meant “some relief” is a relative term, unless you have well-to-do relatives :)

Go ahead and feel suspicious. And then remember those recipients *paid in* over the years, and the benefit they receive depends on just how much they contributed.

I wonder how messy the UK pension thing could get, in terms of breaking pension funds. The bond market could someday decide this for the USA too, but for the UK it has been this very week.

It comes at a time when their variable rate mortgages (and impending energy bills) are spiking too. The staid Brits (especially not getting financial bonuses or rich folks’ tax cuts propped on government borrowing) may start expressing some big outrage. The hills are alive with the sound of pain.

I’m so glad I’ve dutifully paid my (fixed rate) mortgage and am almost done.

The problem with the UK pension thing, is basically they are treating debt as a hard asset, which it is not. Debt is nothing more than a promise, and promises are often broken….

“And for those people who can, the best thing to do – for all kinds of reasons, not just money – is to keep on working in some way past retirement age. Even a part-time gig will vastly improve, or at least slow down the deterioration, of the finances later in life when work becomes impossible.”

Totally agree with this! I’m 59 1/2 years old so people are always asking me when I’m going to retire. I tell them my goal is to work full time until age 67. A lot of people look at me like I’m crazy.

Harvey,

Good point! I am planning on working/volunteering/babysitting grandkids until I die. I will never stop doing something at least part time. Multiple part time jobs = Full time with flexibility.

What I’d like to retire from is the 60-80 hour weeks in a Tech job.

The monetary pay in Tech is much better than anything I will do in retirement but the mental and emotional toll of long stressful hours will shorten my lifespan and I’m not having fun.

The question is: When can I “retire” into doing something more enjoyable with likely less pay?

My job currently does not allow “Quiet quitting”.

I am not the type to retire on a sofa/beach with a can of beer for decades. Well, maybe only for a short time….

Unless you love your job, which is a pretty small percentage of the population, working in old age can be pretty miserable.. The older you get, the worse it is. Early retirement is a much better option if you can afford it.

A good way to know if you can afford it is to increase your 401K contribution to 30%+. If you can live comfortably the last 5 years you work on 2/3rds of your income, then you are much more likely to be a successful retiree. On top of that it gives your 401K a huge boost and provides a nice cushion for the unexpected things that always come up.

Most people are getting down to the their last 15 yrs. or less, by retirement, so the value of each of those years becomes something to consider. I had about 5 co-workers who retired the same year I did, 2 of them never made it to 67….

I’m also late 50s, but plan to retire in the next 5 years, there is plenty fulfilling volunteer work and I don’t need my job to fill my day. Work can be very stressful and much as I enjoy it, there are other priorities for my last chapter.

So if interest rates are still effectively negative, but the COLA increases by 8.7%, does that mean the SS Trust Fund would take a more painful hit than in previous years?

Trust-fund update coming over the next couple of days.

looking forward to it thanks!

As always, thanks for the #’s Wolf. BTW, If I ever had any doubt that the Fed Put was real, today’s action disavowed me from that….

No. Just a long needed bounce. Nothing goes to heck in a straight line.

Wolf, I do get that the markets were poised before the report to go higher… but after that HOT report, it seems more than just a well needed bounce for the Dow to go from down 500 to up 500 and the Nasdaq from down 350 to up over 200. I defer to your experience, but it did seem there was a TON of buying 10 minutes after the market opened until 90 minutes later…

I guess the combo of a needed bounce, perceived good news in England and even the EU, along with everyone and their brother being short caused a nice squeeze. It still seems (to me), that after this cold, damp towel of a report, the bounce might have delayed a day or two?

My SQQQ options were in place and was feeling good about the early move… but I held out for another point on them and ended up throwing in the towel for a small gain (20 minutes later would’ve been a loss)… Fear & Greed :-)

The problem is that there is too much algorithmic trading. Ban that, and require all stocks purchased be held for 30 days, and watch this nonsense volatility disappear.

It’s been 7 months since the FED first hiked and we have seen ZERO effects. These crooks are so far behind the curve that they should have been raising 100 basis points every meeting, minimum. Instead, we have a raging mania continuing, unabated.

Just don’t blame the Fed for every bounce. The Fed doesn’t have a green button in its office that it presses to make markets go up, and it doesn’t have a red button that it presses to make markets go down. If markets were predictable, there would be no markets. Up-and-down is how markets operate.

But sure, it’s a surprise after the plunge in the futures market. But that’s how it goes lots of times.

Last thing the Fed needs is a massive sell-off right before its meeting. A bounce going into the November 1-2 meeting would take pressure off the Fed, and it could peacefully raise by 75 basis points and talk about the next hike, instead of listening to the wailing and gnashing of teeth coming from Wall Street.

A little more than a “bounce.” And absolute wall of BTFD money just came. DOW up almost 1,000 on bad news. Imagine what it would have done if the FED announced a pause. We’d probably go right back to all-time highs and then some. WAAAAYYYY too much money sloshing around.

BTW, it’s a 1,300 point reversal. That’s got to be near some sort of record. These price swings just emphasize how out-of-control the FED is.

I think this is more a testament to algorithmic trading being out of control than anything else.

I wouldnt get carried away by a one day rally. We have seen those melt down very fast.

Many stocks had fallen back down to the previous low, so there was money sitting on the sidelines just waiting to pounce on any rally. When it got heavily oversold in the morning, the rally just materialized.

My guess is that this is really short lived and that by next week, the market is selling off again. If the indexes breach the past lows in a significant way, then a real plunge could ensue

We are headed into earnings season and if a bunch of companies issue downbeat forecasts, it will start the snowball going downhill.

Apparently this was the catalyst:

Reuters is reporting that an ECB staff model (presented the model to policymakers at a retreat in Cyprus last week.) puts the target-consistent terminal rate at 2.25%. That is dramatically less than the market is expecting will be required by The ECB to tame inflation…

Someone didn’t want the NASDAQ to fall below 10000. The 1300 point swing is a little much to chalk up to disinterested “market forces”.

Also consider that the CPI, unemployment, and other news that came out today was all negative for the stock market, when considered either directly or in a contrarian sense. Saying the market mysteriously went up today, given those circumstances, it like saying the US Strategic Petroleum Reserve mysteriously lost half its contents.

Jeff, when you realize that many algorisms are programmed to start buying when others start buying, and when you consider that many funds have puts in place, it’s not hard to see how algo-fueled buying created a positive feedback loop and subsequent short covering.

Crazy how low unemployment is now bad news for the stock market.

@Einhal, ok. I’ll buy that the algoritms kicked in to keep the NASDAQ from falling below 10000.

Ok, so it was S&P 3500 being defended. But think of it like the Maginot line in 1940 WW II. Next stop, fall of France.

Totally expected bounce.

Look, from a technical analysis perspective, the DOW, S&P, and the NASDAQ since January 2022 have been in major descending price channels, with lower highs and lower lows.

Take the DOW (DJI) for example. When the descending price channel begain in January, the DJI was at ~36,900 or so. In June, the DJI hit the lower line of the descending price channel at ~30,000, and then made a major bear market rally back to the top of the descending price channel at ~34,181, where it then started back down again until it hit the lower line again @ ~29,000.

Today’s DJI move marked a double bottom of the lower descending price channel, where it has now done a major bounce. Let’s see if it continues in the next couple of months.

The top of the descending price channel is now near the 33,000 point, which would signify another lower high if the DJI goes that high.

Impediments that could stop this market rally are the 50 day moving average (which is also descending) at 31,000, or the 200 day moving average (also descending) at ~ 32,600 or so.

The stock market is in bear market mode, and will continue. IF the DJI does make it back to the top of the descending price channel, I fully expect it to reverse and head much lower. Here’s why:

All those major multinational companies took on massive amounts of debt based on very cheap interest rates to buy back the company stock to reward the C-Suite clowns. And here’s the thing… they never pay that debt back; they make their low interest rate payments. Then they simply roll the debt over when it comes due with more debt at artifically low interest rates provided by the Fed. Taaa daaa, better earnings because lower interest rates paid on the debt result in better profits.

However now these companies actually have to pay that debt back at much higher interest rates because the new debt that they might want to roll over into now comes at a higher interest rate and now their earnings are lower. Earnings are now lower due to higher interest payments and thus their stock will get hammered in the markets.

As Wolf says, nothing goes to heck in a straight line!

Well, while it might’ve been a predictable bounce… I don’t think it was reasonable to predict a turnaround of historic proportions, following the heels of that particular inflation report. All the report did is raise the feds terminal rate even higher. I understand it’s a downward trend, And things don’t go down in a straight line but that moved today was one for the record books and highly unpredictable in total.

Rosarito Dave,

All I was saying was, after looking at the technicals on the charts, that a bear market bounce was predictable, but the size or scope of said bounce was not predictable. I will agree with you that today’s move was one for the record books. Who knows… could have been a major short covering rally by the Wall Street traders, for all I know.

It’ll be interesting to see how long this rally lasts. I won’t be surprised if this DJI rally retests the descending 50 day moving average.

According to Sentiment trader, bearish option bets were at an all time record as of last week. A rally was imminent. Will be interesting to see if it has legs.

Who’s on the “Reason of the day committee”. A select group of financial reporters and their editor? Do the seats rotate?

An easily equal mystery to the market movements themselves.

Need ME’s help.

I dunno Wolf, some of those imploded stock charts you published showed a pretty straight line. Gotta get a micro scope to see the teeny tiny fluctuations on the way down…. :-)

Back in 1983 the Greenspan Commission caused Social Security tax rates to be raised above the level necessary to fund the system on a pay-as-you-go basis, investing the surplus into the Trust Fund, which can invest only in U.S. Treasury bonds. As this made it unnecessary for the private sector to buy those bonds, this financed part of federal spending, lowering general-fund taxes, and freed that amount of money to be invested elsewhere, so that private sector entities could borrow at lower interest rates. It was absolutely implicit in this that someday those Trust Fund bonds would be sold, either back to the government or into the private sector, to fund SS payments when the SS tax income would be lower than the pay-as-you-go level — and that if he were sold to the government, general-fund taxes would need to rise to buy them back. But now there are those who wish to call those Treasury bonds, “just IOUs”.

In one sense, this might be thought just accounting slight-of-hand, because the goods and services retirees consume have to be produced at the time they’re being consumed, so the reality is pay-as-you-go. But it might also be justified if the investment of that forced saving had increased the productive capacity of the economy to make that ultimate production of goods and services easier.

Alas, in fact much of our capacity to produce goods has been off-shored to China, due to that nation’s pegging its currency exchange rate at levels that make its citizens’ wages and minerals seem far cheaper than they really are. And much of the savings invested here have been invested not in capacity to produce goods and services retirees might consume, but rather in mansions, vacation homes, boats, private jets, and other such non-productive assets.

In essence it was always implicit that the SS Trust Fund bonds would be bought back by the government itself, which would need to raise non-SS taxes sufficiently to fund the buybacks. That’s why the wealthy and their agents want everyone to view the Trust Fund bonds as “just IOUs”, and to view Social Security in general as a Ponzi scheme. They don’t want to pay the taxes needed to buy those Trust Fund bonds back.

Social Security is an insurance program, and no more a Ponzi scheme than car insurance, which is just as much, pay-as-you-go. This is an enormously wealthy country, well able to fund Social Security on a pay-as-you-go basis forever.

jm – disagree with your reality.

This is an enormously wealthy country – Really? So much of the wealth is tied up in stock market and real estate values that are built on the foundation of low interest rates and massive government debt and subsidies. Every single adult in the United States would have to pay 100K to pay off their portion of the national debt, How many people can actually afford that?

We are a country with a bunch of very rich people (based on asset values) and a whole lot of debt and people who are living paycheck to paycheck. And we have an economy which has shipped most of our manufacturing base to other countries.

Yes, there is alot of value in many of the companies that are headquartered here and the individuals that own those companies. But there is also a whole lot of debt.

I just ask you one question. What would happen if a balanced budget amendment were passed and the government had to live within its means? Would we be able to raise taxes enough to cover the expenses, or would we cut enough expenses to cover it? I can guarantee that the financial markets would trash all asset values if we were not able to run a large deficit.

This isnt a sustainable situation. Our government is not making investments into future production, they are merely goosing current consumption. That is NOT sustainable over a long term.

I think total net worth of all households in the US is about $105 trillion. Take out $31 trillion gov’t debt and you still have $74 trillion left over. (And much of that debt is held by US citizens, thus a domestic redundancy in that area.)

Still seems enormously wealthy as a country, though inequality is severe. Either that or our ability to dream up bigger and bigger numbers on a carrot to keep the workhorses working hard is unparalleled!

Most household “wealth” is someone else’s debt, mania priced stocks, and bubble valued housing.

Return asset values to approximate pre-mania levels and most “wealth” diappears.

That averages out to about $500,000 net worth per household in the US, based on 150 million households. That average seems way too high. Might be something wrong with your figures.

A couple of adjustments to your calculations. First the statistic of household wealth is listed as household wealth and non profit organizations. Second, a third of that household wealth is held by the wealthiest 1% of Americans.

While the debt itself is not really significant, the debt service is. It is an actual government expense that must be paid like any expense. The increase in interest is affecting that debt payment exponentially. In the real world, neither the non profits, or the 1% are going to pay a lot of that debt service. That will be put on the backs of the working class as it always has been….

Bobber, $500,000 average per household does seem high until you see how enormously skewed the distribution is.

It’s the median number that’s more important, which is closer to around $100,000.

Augustus is correct that if the ‘everything bubble’ deflates it would take a lot of air out of that $105 trillion figure I mentioned.

Agreed. We’re not wealthy in reality. We only appear that way from the outside.

Ultimately, wealth is the ability to produce. That’s been dwindling every year.

I think that we are still highly productive in some areas – like technology, medical innovation, etc. But that productivity is so concentrated that it is not like the broad middle class that once was the economic engine of the country.

Travel to a developing country and you will quickly realize that the US is very wealthy indeed.

Agreed, but all that ultimately does it facilitates other stuff. Medical innovation isn’t productive if no one can pay for it without government transfer payments.

Harrold, what would be like if those developing countries weren’t willing to give us their goods and services for our printed dollars? How wealthy would we appear if we actually had to produce everything we consume?

Back in the 1950’s the US was very wealthy when it produced everything we consumed.

At least thats what the older generation tells me.

Not only was the 1950s a time of amazing prosperity, but it was culturally stable and peaceful.

Our modern society is not, even if GDP is nominally higher and we have better technology.

So at well past 75, I guess I’m an old-timer.

We grew up in 900-1300 max sq ft tract homes, 2-3 bedroom, one bath, one TV (maybe) and one car per family.

(in white neighborhoods only)

Then the ad folks REALLY went to work on us, ALL of us, from cradle to grave.

We just didn’t consume enough, obviously.

Why still more and more consumption was needed, I’m not really sure, it is a sickness, but I escaped pretty immune (probably because I became a hippie 66-67) to it and advertising, and am still quite busy discovering things I/we don’t need.

OH, and enjoy all your “medical innovation”……Bio and Tech were/are my lifelong bag…I’m good at it….

“a magic bullet a day or bust”!!

Har-har-har.

“Tech”, meh……some is handy…..like this computer or my dumb phone.

“What would happen if a balanced budget amendment were passed and the government had to live within its means? ”

Pipe dream, nowhere reality-tested or evident in a real world. That defies human reality and human nature, and the public needs to sometimes spend beyond current cash (i.e., the fundamental idea of credit). USA’s citizens demand and expect all kinds of services and benefits, but (ever since the Revolutionary War), demand not to pay taxes for them. These were rich elites driving it.

Government is not a for-profit business. It has to fund all kinds of public goods like freeways that we use every day, but do not pay adequately for. The deadlock in politics is the rich and their lackeys insisting government is nothing but mismanaged and evil, to excuse the rich from paying taxes (though their assets are buoyed up astronomically). The angry noise is for the cheap seats, as there are so few rich, they need masses of gullible votes. The latter cut their own throats at the altar of the rich.

Mentioning schools and freeways is a red herring. 80% of the federal budget goes to Social Security, Medicare, Medicaid, defense, and debt service.

SS and Medicare have a dedicated funding source. Its a red herring to throw them in with discretionary spending.

Arrant Nonsense. One of the core arguments in the Federalist Papers for a national Constitution was rational (in tune with the prevailing philosophy of the time) management of a limited set of shared needs (e.g., central currency, a Navy, etc.).

While gov’t has been inordinately influenced by the rich, it can be operated on a fiscally responsible basis – especially if the hyperbolic growth in what is defined as “public goods” and rights is rationally managed.

Harrold, money is all fungible. If the 15% collected from ordinary people wasn’t collected separately, it would be available for general revenues. That’s basically all of the federal taxes that the lower middle to middle classes pay.

Funny but most states have a balanced budget amendment…

Reagan was the first to prove “Deficits don’t matter”. And he put our money where his mouth was.

“Balance the budget you dummy!” was what my very successful conservative businessman stepfather yelled every time he accidently saw him on TV.

Then he went back to watching sports. As far as he was concerned, 24 hr sports was the best thing since sliced bread.

I understand COLA increases are necessary to assist those on fixed government income plans, but they’re also “inflation-perpetuating” as they increase the amount of money chasing goods and services. Hence the “baked in” quality of inflation.

It appears that the Fed’s relatively recent monetary actions are producing very minor gains in the fight against inflation—but it’s likely to be a long slough, especially without dramatic 200+ basis point rate hikes.

My take from today’s news is that a soft-landing is off the table.

I guess a question is, if someone’s ox will be gored in this process, whose? I would argue, people on low incomes who were productive and paid into a fund for a lifetime, ought to be protected, versus people whose asset values exploded in a sheer parabolic windfall upward (hence protecting the latter from inflation).

That should be fun! We can add a social productivity metric to the planned social scorecard!

You only just got that figured out from today’s report? I think you’re a little behind the curve. There Maybe a soft landing is equivalent to inflation is transitory

They are not inflationary for the following reasons. The COLA increase is simply a mechanism to correct for the loss of value of the dollar. If your benifit is $100 and there is 5% inflation, you real benifit is $95.

The amount of the COLA is always less than the actual inflation rate because of the dishonesty in the calculation of statistics.

Inflation is caused by the amount of money exceeding the available goods and services, which is caused by credit purchasing, not by purchases made with dollars that are losing value faster than the COLA adjustments.

I’m thinking that raising the bank reserve requirement from the present zero to 10% or more would drain vast amounts of currency out of the system and subsequently bring inflation down.

It wouldn’t drain anything because banks have $3.1 trillion in reserves at the Fed, which is about 20% of total deposits, and about double a 10% requirement.

If really heavy inflation rears its ugly head, might SS recipients be getting a diet COLA?

How about an unCOLA? Remember that? (7Up soda ads)

Nope. A COLAnoscopy.

Wolf,

Thanks as always for being out in front on CPI-related topics.

Question: Has Zillow updated its ZORI lately? Can’t seem to find it easily at their website.

I ask because Owner’s Equivalent Rent was a big driver of Sep CPI. Some seem to think that this will now start to moderate but having an updated ZORI would help in making a determination.

Wait for my article on CPI. Coming shortly.

Fund fact:

The original monthly payment for SS recipients was $15.

According to wikipedia, Ida May Fuller received the first Social Security check numbered 00-000-01 in the amount of $22.54 in January 1940.

Why do you have to pay more than you receive? That doesn’t make sense to me. Even if you are high income, you’d owe the top 37% or whatever it is on the Social Security amount. You wouldn’t be paying more than you receive.

I’m sure glad I held off on taking social security until age 66. I got pushed out of my engineering job at age 62 but managed to work as a contractor, doing the same work for the same company but with no benefits, until I took SS at 66. Now this COLA adjustment comes on a bigger basis than if I had unwisely started SS at 62.

You and me both, my friend, you and me both.

In fact, I get my first SS payment this week.

Ed C,

Not everybody is better off waiting until full retirement age for their benefit. I took mine early because I have a higher earning spouse and half of his benefit will be more than my full amount. So I get to collect the lesser amount for 5.5 years and still get “the full amount” at my full retirement age, when my spouse retires. In the meantime, I get the lesser amount in cash for 5.5 years.

Get yourself a nice handbag to hold all that cash!

No thought req’d at all on my part. I was losing net profits saved after off-grid house sale FAST. Tucson GF I met in 07 on match was surprised I only had CRT TV, computer, some card board boxes, folding 6 ft work table, and 4″ futon for furniture. Still have last two, am at table now.

Good downsizer.

I knew a fellow who decided to hold off getting SS till he was 66, but it didn’t matter when he died @ 65.

Yes ! I waited until my full retirement age of 70, because I felt very healthy and comfortable at the time.

When to take SS is a very important decision. My Dad took his early, but also held two mortgages for commercial properties that he sold. He always worried about how he would live after the mortgages were paid. Unfortunately, he passed away 1.5 yrs before the last mortgage was paid off.

I have an in-law who was going to wait to take SS until her daughter needed to borrow money. She then took it early knowing that was her only retirement. She is still working and really can’t afford to live off just SS.

Retirement is a complicated issue. It is something you need to educate yourself about and do a lot of serious number crunching.

There are a lot of things no one tells you about. A lot of people make serious mistakes and it can have serious consequences.

Even the time of year you retire has to be planned to avoid taxes.

Making too much while drawing benefits can make the benefits taxable also…

I have known a least a couple of people who retired taking lavish vacations, and driving luxury cars, and 15yrs later were driving Hyundai’s and Kia’s and struggling to get by….

If people have zero debt, own their home and live in a low cost area, SS might provide all that’s needed.

All the Medicare Comments are interesting Thanks all

Medi-Cal is changing the Rules January 1st and you can have any amount Assets now and apply !!! This is a Big deal

Bask Bank just raised Saving rates to 3.05 % APY no fees

next Month more >

Grandpa figured out he was going to receive about $100 a month from SS in about 1950, so he kept working long enough to build a sailboat to live on, on the hook in order to live on that amount without touching his capital.

He did so into his early 80s, about 17 years IIRC.

After that, he sold the boat to buy a house where is younger wife wanted to live.

The inflation adjusted amount today would be about $1,000.00. Could a very hand person in their sixties with no debt live on a boat, on the hook, for that???

Surely so, especially if, like GP they used no drugs, including coffee, alcohol, tobacco, or any others.

Please folks, keep in mind that most, if not all, of those whining about being poor are spending tons on those three drugs alone, not to mention all the other ”stuff/thingys” that are WANTS,,, NOT NEEDS.

I see homeless people close up almost every day. I have never seen a person in the USA with visible, serious malnutrition (I’ve seen it elsewhere), though obesity here is quite common. Every one of them has a fancier phone than I do. This indeed is a rich country, relatively speaking.

The modern day equivalent of the boat is the van.

There was an Academy Award winning movie a few years ago called Nomadland about older folks living in vans for little money.

Harrold,

I lived in a Nissan NV 2500 HD step truck from 2015 until last summer.

Good show. I was in an old Ford bread van 72-76…roughly…total about 4 years. Was building off grid container house when back was trashed bad…and for good….Sept 2013.

Coffee is a need.

Yep. Safeway Signature Select instant. 8 oz “makes up to 120 cups”.

Goes on sale for $3.99 (kid at register gave me a club card).

I swear by it, good stuff, caffeine is all I want, anyway.

Might be $4.99 now…..but still…..never had a Latte or any of that other weird stuff….even a stereo….very bad consumer….trashing economy……

It must be, I see people lined up 10 or more cars deep waiting in line to spend $6 for a cup on their way to work. It would only take a couple of minuets to make it at home and save about a grand a year.

Coffee is indeed a cheap drug 4-5 cups a day

We will need to get UBI set up. Elon’s got his new robots that is going to put a bunch of people out of work. Not that automation and AI is anything new, it’s just becoming more obvious UBI is needed.

ubi/mmt arrives with our new cbdc…courtesy of project hamilton.

cbdc also good for new bail-in’s = special appropriation.

Agrarian Justice….

You should keep working part-time past retirement because it’s GOOD FOR THE BODY AND MIND. Human beings weren’t designed to be strict creatures of leisure. We’re meant to be doing something. May as well do something that lines the pocketbook.

The corporation thanks your for your dedication.

Anyone who thinks retirement is leisure has never been retired.

Most retired people all say the same thing, ” I am so busy now, I cannot figure out where I used to get the time to work a job”.

You know all those things you never have time to do when you are working, like home, and vehicle maintenance? Those things still need doing in retirement.

“You should keep working part time …”

I have been retired many years and haven’t had to return to work. That isn’t to say that I don’t work, just not in the traditional sense, in that I cut my own firewood and have a large garden that provides us with a good portion of our sustenance. Plus, maintaining the house and land is work and good for my mind and body.

The geriatrics are having a blast – at our expense!

If SS is the primary variable, then the decision criteria breaks down to life expectancy/health, family history, etc……and……as one retired friend put it to me after a round of golf…..this is why we worked so hard!

It’s called a social contract. We worked hard and paid in, for decades on end. Take away that promise, and the whole society comes unraveled, and becomes based on short term grasping and treachery. Almost everyone on SSI can’t afford golf. Bad sample.

You completely missed the point.

Point being that at 65 plus you might not be around to enjoy retirement at 72!

Review your JJ Rousseau. I’m thinking social contract theory/abstraction is not the ideal vehicle for extolling the virtues of SS.

What if society is no longer collectively wealthy enough to pay? Then what should happen? What happens when we can no longer borrow and print?

Well then, according to the prior poster’s posts, the “rich” should just pay more.

Armageddon……followed by Judgement Day……then Lake of Fire…….and your catalytic converter gets boosted………

This was probably addressed somewhere and I missed it. Why is the next FOMC meeting so close (and before) the mid-terms? Independent or not, that just doesn’t seem like the best planning given the current environment, IMO.

There are eight meetings every year (in recent years), and the dates are decided and published a year before. Four of the meetings line up with quarters, which is when we get the “dot plot.” The other four meetings fall in between. Just how it is. There is always a meeting end of October or beginning of November. Followed by a meeting in mid-December. You cannot just stop everything because there is some kind of election going on.

Thanks, Wolf! Appreciate your insight!

Soviet citizens were given social security like payments, but when the ruble plummeted to 1,000 r = 1 $ in the early 90’s, it didn’t buy anything and life expectancy went down quite a bit.

But that would never happen here…

Then we’d get 1000% COLAs LOL

Russia and China are dumping US Treasuries. What are the implications for the US dollar and inflation?

You’re a little late on Russia. It dumped nearly all its Treasuries years ago, what little it had. And nothing happened in the US. Everyone just shrugged. I reported on it at the time.

China still holds $970 billion and has a lot left to dump, but it has its own simmering financial crisis, amid a HUGE real-estate development sector that is now in slow-motion government-controlled collapse. China is selling dollar-assets to keep his own house of cards from collapsing.

Currently, there is still too much demand for Treasuries, which is the reason the long-dated yields are so low (and Treasury prices so high). The 10-year yield should be above the rate of inflation, but there is too much demand, and as soon as the yield approaches 4%, more demand materializes. It will take a while for this demand to be satisfied to where the yield can go to 6%. I’m waiting for it, but it’s gonna require some patience.

First, all government statistics are lies. The fact is, government lies, it lies all the time, and it lies about everything. If you are going to believe government lies, you are going to have a very hard time navigating rational economic decisions.

For lower income retired people this increase will mean next to nothing. Food inflation, energy inflation, rent inflation, and inflation on taxes and insurance has outpaced this 8.7% increase by 2 or 3 fold when indexed for the portion of expenses they represent in the budget of low income households.

I have noticed that while Social Security recipients will receive an increase of 8.7% early next year, those who have yet to receive their Social Security will not receive an increase of the same amount in their expected future benefits.

For example, if you are in your 40s-50s, and you note that current Social Security recipients will receive an increase of 8.7% in January of 2023, do the following:

1.) Sign in to your Social Security portal today and make a note of how much you will hypothetically receive at 67. To make the math easy, let’s pretend this number is $1,000 a month at age 67 even though it’s too low for most people.

2.) Then in early January of next year, repeat step 1. My bet is the increase will likely be considerably less than 8.7%. My belief is the portal will say $1,030 or around 3% increase for hypothetical benefits at age 67, not $1,087.

So current recipients will receive 8.7%, future recipients will receive … I’m going to guess around 3%. Last year current recipients received 5.9%, future recipients received around a 2% increase in anticipated benefits.

This was an unpleasant surprise for me.

Green,

If you are 62 or older and still working, the COLA is applied to your current estimated payout amount.

I will check when I am 62 and see if this holds true. I am unlikely to be working, but that shouldn’t make a difference to the COLA adjustment.

I am in my mid 50s, and in January of this year, I was expecting the hypothetical $1,059 at age 67 from last year’s $1,000 at age 67 and instead the number was $1,020 @ 67 in 2022 from $1,000 @ 67 in 2021.

The COLA adjustment had not been applied in full to my future benefits at the same age between years.

Why? Who knows.

Expected benefits at retirement are based on wage growth, not inflation. As wages increase, your FICA increases and your expected benefits increase just a bit less than that FICA increase for most workers. 3%/year sounds about normal.

Green Acres,

Your current SS statement for “not-yet on SS” folks is through 2021, not through 2022. So the COLA for 2022 is not reflected in your current statement for 2021, and you’ll have to wait a year to see it. Go check the dates.

Thanks Wolf,

I was referring to the online portal, not the printed statement.

There could be a greater lag than I expected however…

You might be right if a review of the portal for January, 2023 reveals a 5.9% COLA jump which is meant to cover all of 2021.

Perhaps January, 2022 increase was the COLA for all of 2020 and the COLA for 2020 was 1.3%. 1.3% is closer to the roughly 2.0% I viewed in January, 2022.

I will keep my eyes open for this.

“I was referring to the online portal, not the printed statement.”

So was I (the annual version that changes only once a year).

I can’t live in the heads of the economists, investors and Fed bankers, playing with paper dolls and paper doll clothes. Unfortunately, they can suck my life and so many others into their debacles. I’ve managed to survive through 4 “downturns” precipitated by the jackals. It’s the jackals that will augur in and get the runway foamed for them. I hate to think what will happen when they have nowhere to turn.

I guess I’ll just amuse myself reading Nomi Prins’ autopsy.

Everyone at a different place on SS. Wolf advice very sound get a new job to reduce the cash outflow for as long as possible if u don’t need the cash give to the children or charity of your choice.

I’m 65 next month and am looking for work! Moving to Medicare and looking forward to savings earning some interest! Can’t find work in my field because of age. (Pet Engr)

All things being equal if I take SS at 62 and you take it at 70, you do not beat me in your larger payment until we are 80. And when we’re 90’s we might be better off broke.

Of course if you do not have other retirement income work til 70.

I stole this from another site (smartasset.com) so that people can see what you are talking about. It assumes that your age 62 benefit is $1200 per month, age 66 benefit (or 67 for younger people) is $1700 per month, and your age 70 benefit is $2200 per month.

Your cumulative benefits at age 72:

$144,000, starting at age 62

$122,400, starting at age 66

$52,800, starting at age 70

Your cumulative benefits at age 82:

$288,000, starting at age 62

$326,400, starting at age 66

$316,800, starting at age 70

Your cumulative benefits at age 92:

$432,000, starting at age 62

$530,400, starting at age 66

$580,800, starting at age 70

For my money I would have to say that age 66/67 is the winner. By age 82 there is precious little total difference between that benefit level and the age 70 benefit level. If you pass away younger than your 80s and you come out the winner.

What you do not include SG, is that according to the actuary tables once one reaches age 75, your ”life expectancy” goes UP.

Last I looked, several years ago when I reached that age, it goes up to 86.

Of course that is an average, of which WE, in this case the Family WE, have recent experience as my FIL died age 93+ in early 2020, and MIL is still kicking with a very good appetite at age 92+, and no indication of any end soon…

With that in mind, one would suppose your conclusion might need revision?

In my personal case, upon advice from spouse, I am doing the ”intermittent fasting” thingy, have lost 40#s since peak of ”covid fat” in dec2020, and am now working out with weights to rehab, maybe, to prepare for another decade or so,,, just hoping NOT to be too much of a burden…

And to be clear, the VA folks are doing their best to help me, as they did my FIL, a bronze star guy in WW2 and Korea,,, in spite of my and his clear enjoyment of almost every form of ”sins above the waist.”

At this point, my motto, as was his, is, ” I can resist anything except temptation.”

Have FUN folks,, that and enjoying every minute you can is the ultimate insult to our current owners, really NOT that much different in the last thousand years or so except for some of the ”newbie oligarch families.”

Now you have to factor into your numbers the average life expectancy of people and how many people actually progress from one age to another as they get older.

Your last table with age 92 is no more than fluff with the actual number of people alive at 92 minuscule in the overall scheme of things.

And although I think your tables are interesting what you should actually do is adjust for inflation and also show the additional income per year generated by waiting.

1. Lot of physical blue collar workers cannot work beyond a certain age. Their bodies would be already broken down. They should be able to retire honorably with full hot meals. There should be no compulsion for them to work

2. White collar workers mostly do brain based job. They can write funny articles about economics, moderate the comment section and sell some beer mugs. Here also they have the option to work if they want. Unlike India, they should not be forced out of work.

3. In case of blue collar workers, they dont want but the economy might force them to work. Sometimes, people do not want to deal with office politics, deadlines and work place drama.

4. People who commented here that work keeps brain sharp, gives meaning to life and so on. Yes, I agree but if possible, evaluate your priories.

5. By the time Cobalt might retire, there will be no social security (may be pays but has no value). So the only way forward is no retirement, work until the last day.

6. My idea is to stay single, no family, maintain a frugal cheap life, save as much money and treasuries.

The best policy is to set yourself up so you can survive without SS. That way if you do get it that will be a nice bonus.

BTW they have been saying no one was going to get their benefits since the 70’s.

My idea is to survive my parents, don’t like my chances. He’s ninety and shacked up with his girlfriend in New York. She’s ninety one and races around in her Accord all day. I’ve buried one sibling. No wife kids debt thankfully. The road goes on forever and the party never ends. But you may leave early.

I will be interested to see what level of COLA the military gets in January. Is the formula different? My retirement from the Navy Reserve doesn’t start until just over another two years but at this inflation rate it should be 25% bigger than it is now.

On one day, October 13th, one headline seems to address the statement from the other headline, “Unless inflation dishes up more surprises” .

“Social Security COLA for 2023 Biggest since 1981, Might Finally Outpace Inflation, Unless Inflation Dishes Up More Surprises”

“Services Now Drive Inflation: Worst in 40 Years Services CPI & “Core CPI” Show Inflation Is Entrenched in Broad Economy. Some Goods Prices Fall, Gasoline Plunges”

Sorry, finding that the basics like food and fuel in the real world are at least twice the “official” inflation figures, and the SS increase announced. On top of that pile on the product volume reductions of at least 15% in many cases.

Billions dished out to favored causes of the Greens that won’t produce anything except millionaires most certainly will help the inflation.

Want to know how I know it? Look at the title of the bill to fix it.

“The Inflation Reduction Act of 2022” Honesty in politics at it finest.

Folks need a paycheck COLA adjustment too. Healthcare costs up something like 25% in one year? If this keeps up, half the country will be on those “sharing” programs because premiums will be unpayable. $2,400/month on health insurance premiums for my family now. $10,000 deductible and they didn’t cover my flu shot (clinic billed me $80, wuut?).

Sometimes I wish I were Norwegian. The taxes might be worth it because America is just about a total mess across the board these days. I’ve never felt like this in my life until recently.

If one million old people averaging $1,000 monthly in SS payments, died of Covid, then

it saved the government $12 billion for the year. Might be another big savings this winter.

Don’t count on it. The newer variants are not as dangerous and there is substantial immunity generally. It’s most likely going to be the best winter yet since the pandemic started. This fall certainly the best fall.