Cost-of-Living Adjustment for 2024 plunges from 2023 mega-COLA, which outran inflation by a wide margin. This one will fall behind inflation.

By Wolf Richter for WOLF STREET.

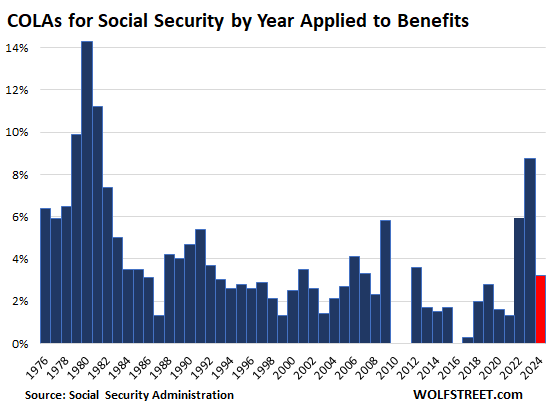

The Cost-of-Living Adjustment (COLA) for Social Security benefits for the calendar year 2024 will be 3.2%, according to today’s release of the inflation data by the Bureau of Labor Statistics.

The COLA is based on the Consumer Price Index for All Urban Wage Earners and Clerical Workers (CPI-W). The Social Security Administration uses the year-over-year CPI-W for July (2.63%), August (3.40%), and September (3.56%) and averages them out to obtain the COLA for Social Security benefits for next year, starting with benefits paid in January 2024.

Because COLAs are based on inflation data in Q3 of the prior year, they’re based on past inflation data, to adjust benefits paid out in the future. This means that there are years when inflation surges, and COLAs lag way behind and beneficiaries lose purchasing power; and there are years when inflation cools, and the COLAs are well ahead of inflation, and beneficiaries regain some purchasing power.

In 2021 and 2022, when CPI inflation began to rage, COLAs (1.3% and 5.9%) were way behind CPI inflation, and beneficiaries lost purchasing power. In 2023, when inflation cooled, the COLA (8.7%, biggest since 1981) was way ahead of this cooling CPI inflation, and beneficiaries regained purchasing power.

For 2024, we’ll have to see if the 3.2% COLA will keep up with CPI inflation in 2024. But it’s likely in this inflationary world that this COLA will be left behind once again.

For younger people who are maybe decades from retirement, and who are constantly hearing wild stories about Social Security going “broke” or whatever, and that they’ll never receive the benefits, etc. etc., I’ll just say this: Those are the very same copy-and-paste stories, with only slight edits, that everyone who is now receiving Social Security benefits has heard all their lives. Those stories have become ingrained in American lore. I started hearing those stories when I was in high school, before I really knew what Social Security was.

Sure, Social Security gets tweaked every now and then. There were some tweaks during my lifetime, including when I was in my 30s when my full retirement age was moved out. And those adjustments “fixed” the program for decades and created an accumulated surplus of currently $2.7 trillion in the Trust Fund.

Social Security comes with spousal benefits and survivor benefits, and it’s worth checking out well before you get even close to retirement age.

The most crucial thing to know is that Social Security alone won’t be enough to retire on unless you do a lot of belt-tightening. The benefits it provides are smaller than your peak income was; and CPI-W may not fully capture the increases in actual cost of living that you may experience, which causes the purchasing power of those benefits to decline a little every year, which adds up over the years which can turn into decades.

And you may get older than you think. Life expectancy at birth in the US is 74.1 years. But it’s not like you have to turn in your keys when you get to 74.1 years. Over the years, as you get through the events that kill people in their younger years, your life expectancy rises.

Someone who is 65 today has an additional average life expectancy of 16.9 years, so about until they’re 82. Someone who is 82 today has an additional life expectancy of 6.8 years, so until they’re about 89. Someone who is 89 today, has an additional life expectancy of 4.0 years, so about 93 years, etc. You can look this up in the Social Security Administration’s actuarial table.

So it’s good to prepare for a long retirement. Social Security is only the bottom layer of this preparation. That’s why it’s so important to create a retirement nest egg during the working years, and to work for as long as possible in some form: Look at our politicians, they’ve figured this out, and they’re having a blast, LOL. Even a part-time gig helps, and it can be a great way to remain active.

Here is my notoriously detailed discussion of today’s CPI data — including the nastily jumping core services CPI: Acceleration of Inflation Continues, Core Services Inflation Spikes despite the Massive Health-Insurance Adjustment

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Social Security takes in less than it spends but it is in the “fixable” range by changes in taxation. As I have noted before, it is Medicare and Medicaid that are the source of severe budgetary issues. I’m getting tired of politicians obfuscating this by referring to the two together as if they weren’t 2 separate issues. And I’m also tired of them referring to these programs as “entitlements” when you are forced to pay for them. I consider legalized Congressional insider trading an “entitlement” needing a cut if they want to go down this road.

It’s not fair to call it a savings program either.

SS has been a hybrid savings/welfare program from the start. You pay hard earned money into the system, but the benefits are skewed to reward low-income folks relative to what they contribute. If you earn income greater than the SS tax cap every year, you are not getting a fair return on that money. If you are low-income, such as the minimum to qualify, your financial return is extraordinary.

You nailed it. The idea was to reduce elderly poverty. At some point the elderly can no longer work so they have limited options to support themselves. From the homeless pictures I have observed, most appear to be of working age, so SS appears to be working. If you were able to invest your SS deposits would you be better off? Yes. But the folks who would invest successfully are likely the same ones who don’t need SS when they retire. There is a subset of folks that if you gave them control over their SS deposits, it would be a disaster. So a bit of nanny state to keep old folks off the streets.

If people were able to invest their SS deposits, Wall Street would be the biggest beneficiary. I imagine they would be able to steal all of the money with their hidden fees and subterfuge.

However, as we have become more of a service based economy, people can work a lot longer.

Yes, you can’t work in a coal mine at age 70 or as a construction worker, but there are plenty of people who could work well into their 70s doing all sorts of jobs.

This for Einhal actually:

Spot on! When offered the salary I wanted due to shortage (continuing as far as I can figure out) of folks with the hands on AND digital experience needed to do the very special type of analysis, etc., I worked until age 75, and at that point figured we had enough, in spite of the respect I was getting along with the pay…

IMHO, each individual needs to concentrate on Wolf’s Wonder along with all other rational information available, and again IMO, there is actually tons of such Info out there in the ”free” part of the web…

Only caveat is to take EVERY info with what is usually referred to as ”a grain of salt” for some reason.

Good point, E. With 2 Tramadol and leaning on table, I can be at this computer 6, sometimes 8 hrs a day.

Maybe send people with grievances/equipment problems the right forms to fill out and forward into the big circle.

May have to soon, if Medicare deduction goes up, along with generic Tramadol, flip phone, PB, etc.

Completely likely people working mindless, or any job, want to work to 70 or beyond. Makes more sense to me as a society to prioritize allowing people to retire earlier, like in many countries, rather than continuing to extend the age because we don’t have enough money for it. Societies functions and wealth exists as a result of the working class so perhaps they could get the surplus value they should have received their whole life at least at the end.

The whole system labors under “and now for the rest of story”:

– SS income is taxed at whatever one’s marginal rate happens to be (i.e., to include COLA increases; lower return)

– returning to the same old debate about curves and metrics…there is average age life expectancy, there is the deviation and skew of the distribution, and there is the shifting of the curve where the starting point for comparisons makes a big difference (for example, telling someone who was in their 60s who lived in NY in 2019 “wait til you’re 70 to claim” probably changed after 2020/2021!)

Well said. Congress should lift or remove the cap on wages and even consider taxing some LTCG’s as there is where the real money is and it’s taxed at a ridiculously low rate as it is. I’m a top 5%’er FWIW.

I love the – ssi has $2.7 Trillion in Trust Fund

what a JOKE

it has a 3-ring notebook in Terre Hoate with pieces of paper saying TREASURY OWES US $2.7 T

already spent 10 x by CONgress

joedidee,

Your comment is idiotic ignorant vicious bullshit and an outright lie that Reagan threw out there to rile people up, and right-wingers have repeated it endlessly ever since as red meat for the braindead.

The Trust Fund’s $2.7 trillion are invested in actual Treasury securities that pay interest, and that get paid off when they mature, just like the ones I have.

I hate it when morons abuse my site to spread this stupid-ass ignorant shit.

Read this

https://wolfstreet.com/2022/11/08/status-of-the-social-security-trust-fund-income-and-outgo-fiscal-2022/

It’s not fixable by making changes to taxation unless you transform it even more from a pension program to a welfare program as Bobber described below.

I constantly here moronic mouthpieces on the left saying that all we need to do is eliminate the cap (I think it’s $160k this year?) and that solves all the problems.

However, those people aren’t calling for benefits to rise commensurately, so while someone who pays in that maximum every year gets the maximum benefit, if someone made $1 million a year, they’d pay 12.3% on an extra $840,000 a year and get NO additional benefits.

That’s welfare, not a pension, and it’s not a reasonable fix.

Why are the rich so opposed to helping the elderly?

They are rich precisely because they only help themselves. Even charitable donations must benefit them in some way.

I have apartments full of retirees living on less than $1,000 a month

Rent chews up 70%+ not including utilities

over 50% retirees live below poverty line

—–

time to lift cap entirely on w2 wages and stock option benefits

Because we already pay most of the taxes. Better question: why do you feel you’re entitled to my $ just because you weren’t skilled/wise enough to make your own?

JD , they’re not “your” dollars — the first clue being that your picture isn’t on them …

Nice, eg.

JD, has “skilled/wise” now replaced the well worn out “hard earned”, or are you testing it for a think tank?

Einhal,

There’s nothing “moronic” about calling for Congress to raise the cap without also demanding that Congress raise their benefits commensurately. The Social Security system is not an investment program. It was designed to provide most American workers with the means of surviving when they are too old or otherwise unable to work. Even the most hard-working, God-fearing people can have their lives turned upside down if they are maimed by an earthquake, a drunk driver, or a nasty virus. By the way, I doubt that Jeff Bezos will need a larger Social Security check when he reaches retirement age.

Some people are all about protecting the wealthy and privileged in this country. Then they complain about the Federal Reserve!

Einhal:

Not all people remain wealthy. Some suffer financial setbacks late in life and their wealth evaporates. Those that don’t recognize that are fools.

Social security was never meant to be the sole source of income for a person’s retirement, and it was built to be related to the income a person actually earned. Anyone who makes it to 65 without long-term savings is not living prudently and there is no amount that will keep such people insulated from their own foolishness.

Happy,

Since you somehow know the original mindset from back when Social Security was created, where did the other parts of the mindset of that time go?….. like the Tax Rate Schedules and Corporate and Financial Laws?

Escierto,

They are either Calvinistic because they were taught that way when very young (everything is predestined and becoming rich is just a calling from their deity’s predestined plan, and if they pray hard and fill the bowl, their turn may be coming sooner and in this life, not in heaven and eternal bliss, which awaits, anyway…see Joel Osteen show for 10-15 min) or they are fairly wealthy (Maybe $2-10+M net worth and increasing) and think they are along for the ride with the 0.1-1%.

They are completely wrong in either case.

Poverty trickles UP, and we have 40-60% or our population who simply can’t face the mystery of existence without a sky-daddy.

Look up creationism to see % chart, Wikipedia.

Also some people realize banking punches WAY above it’s weight in what will happen to/in our economy/society, and it’s a good thing to keep an eye on.

When I read things like, “I constantly here…” instead of “I constantly hear…” it’s like chalk on a blackboard. Yeah, yeah spell checker. Nevertheless.

Here, here. I second that.

Oh deer, its sew unbareable!

A Zoomer English teacher perhaps?

I would have had no problem paying extra over the max, especially if it gradually cut out at a much higher threshold. Why should I have gotten a break just because I made top dollar for a number of years? I wasn’t paying my fair share compared to someone making $20,50,60,70…K/ year. I also think that over a certain wealth and income, you should not get any benefits. Why give someone worth, say, $10million a monthly check that just rounding error at that point. Yes, I understand that is wealth redistribution, but with people living longer, those not in those high brackets will need it for longer. That’s what SS and Medicare were designed to address. On the other hand, I also think the retirement age should be gradually increased. Maybe one month per 5 years, starting with those 50 and younger. i.e instead of 65y5mo, if I was 40 my full retirement would’ve been 65y8mo. If I was 25, my full retirement would be 65y8mo. Might need adjustment, i.e. 2 months per 5, or 1 month per 2 years, but that change would surely shore up SS for the future. And moving the goalposts a little at 30,40,50 would be a negligible hardship with that much warning. I believe similar adjustments for medicare would be advisable for similar reasons. We can’t afford healthier, longer life expediencies as currently constructed.

The 1983 Social Security changes Wolf references in the article already increased the full retirement age for everyone born in 1960 or later to 67. Any increase in the retirement age at this point would need to be phased in from age 67.

Raising the retirement age in principle sounds good, but it’s more complicated. As we age, we usually develop health problems that affect our ability to be productive on the job. These problems don’t necessarily manifest at age 65 or 70, and many of them affect blue collar workers more than white collar workers. Moreover, when older workers stay on the job longer and longer, their jobs don’t become available to younger workers. Do we really want young people to delay the start of their careers until they are 40?

The problem with Medicare isn’t Medicare, it’s out of control hospital corporations and big pharma. Fix those and Medicare is fine. There’s no reason a bump on the head should cost $18K for the ER (no overnight stay… in and out) and an MRI. None. Zero. Then there’s the 900 ancillary doctors who walked through the ER, said “hi”, and sent a bill for “services”. The woo woo wagon was $2K for a 10 minute ride.

That’s your problem.

Whenever the government gets involved in any services, the grifters come out and figure out how to hose it and costs skyrocket because the 500 hands in the cookie jar. That’s why you can’t pay for a college degree flipping burgers or visit a doctor about a cold for less than $300.

People are living longer…until recently.

So what’s the solution? Raise SS or work longer?

There is an argument to be made that poorer people tend to be non-white (whatever that means) and they have a shorter life span. So they get kinda shafted both ways. Tougher working lives, paying in all their lives, no LTCG’s at 20% and die younger. “Provisional data from 2021 show that overall life expectancy across all racial/ethnic groups was 76.1 years (Figure 14). Life expectancy for Black people was only 70.8 years compared to 76.4 years for White people and 77.7 years for Hispanic people.”

Hello – today my ‘retirement’ age is 66 9 months

I’m 62

“Needs Based” would get interesting if it was tied to a “Lifestyle audit” that looked not only on how well an individual paid their bills, but “what” they bought in the process. Govts would fight such a concept as the best way to get votes is to ensure the citizens can’t afford their lifestyle, and offer “a solution” to solve all their financial problems. Plus tax collection is amplified if everyone spends every last penny they make and receive, thus the constant complaints that “consumers save too much” at only a 6% savings rate…HA

I’d guess that society would be more pliable to helping someone who lost everything due to a medical emergency, after getting screwed over by an insurance company yet had lived a frugal lifestyle; VERSUS a lifestyle audit of an individual who had bought eight campers, five speed boats, and taken a dozen trips to Vegas during their lifetime and then needs everything paid for in retirement by Uncle Sam as they failed to save a single penny in the last 50 years of their lives…

Yet future A.I. will track every individuals move, purchase, etc…so “Lifestyle Audits” will be instantaneously available for banks and govts to view. This could be used for many purposes, some more beneficial than others.

I have a feeling that a majority of humans are not going to enjoy the fruits of the A.I. evolution, as algorithms based on unlimited personal data will likely be used to make auto-mated decisions for billions of individuals daily…

Not necessarily AI but CBDC’s will be like the money in Adjustment Day by Chuck Palahniuk. They can be programmed to expire, buy less junk food, liquor, no ammo, etc. Very creepy.

Your lifestyle audit should include how the “beneficiary” was screwed by employers underpaying them, healthcare providers over charging them, along with banks, landlords, and the legal system. Or we could all just mind our business and pay up.

We lost a friend at 62 who was a large man, he never received a dime from SS. Would your lifestyle audit refund his estate.

I took mine early and don’t regret giving up 27.5% of my benefit, it’s a big help.

bingo – I agree

however I’m self employed and that $14,900 is so low I’d be giving it all back

thinking couple more years then pull trigger

besides I need another camper and few more trips

for some reason I feel like I’m living paycheck to paycheck

now forgive me but I need to get ready for our camping trip we’re going on tomorrow

If you want to “fix” social security, then have everyone pay into it. Many government workers and teachers (depending on state) do not pay into social security. Their pensions are much better than someone in the private sector making the same money that pays into social security. The government workers and teachers can have pensions, but they should have to pay into social security first, then have a supplemental pension on top of that. Social security has break points, where you receive 90% of your average inflation adjusted earnings, then 32%, then 15%. Most of the government workers would fall into the 15% return, but because they are not part of the system, then they do not have to support the low income people drawing a higher percentage out of the system. The factory worker and blue collar people are in the 32% return, so they end up having to support the low income 90% people and the government workers do not. If it good for the goose, it is good for the gander. Quit thinking the consistent workers need to pay more. Instead, make the government workers pay into the system they made for us “deplorables”.

Actually they just recently discovered that Medicare performed really well over the last 5 years. Congress predicted that medical costs would be much higher than they have been. They have plateaued and they cannot really explain why exactly. But there are some theories. It saved so much money that it’s almost 4 trillion dollars.

4 trillion dollars saved to taxpayers. That’s impressive.

Seeing parallels to this in job growth. Real earnings down on CPI report and wage increases on jobs report have been mild… This seems to be lining up for another bout of inflation and very unhappy consumers … More employees strike anyone!?

It’s all about oil though right. It looks to be correcting and will probably consolidate long enough for markets to jerk themselves off but if it follows through with another leg higher then this inflation cycle kicks back up and at that point it would certainly be entrenched after a four to five year battle. I don’t see how this ends without chaos unless that is oil costs quietly fade…. Maybe the government gives everyone a Tesla as a stimulus to fight oil prices lol call it an election promise for 2024

Now let’s see what the increase for the Medicare part B deductible will be? More than 3.2% I would wager.

Out of curiosity went to check part b deductible. Found this

The Medicare Part B deductible is projected to increase to $240 in 2024.

Increase of $18.00 or 6.2%

That 3.2% just got eaten up by my 2024 house and car insurance cost increases over 2023 rates. Plus, I moved this summer to a lower COLA area away from Houston, TX (Harris County). It seems you just can’t outrun this inflation monster.

But “FED pause.” These guys are assholes. This is all intentional.

How much I don’t know but SS increase not keeping up with inflation is deflationary though the folks on SS will need to figure out ways to make up the difference if they have no outside incomes .

I’m voting with my feet. I know if I outlive my husband I will be living in some Spanish speaking country, because I have no other choice.

Excellent article: succinct and instructive. Two questions and a comment:

1. Is CPI-W subject to revisions down the road, and if yes, does SS COLA get revised?

2. Is there any precedent for “means testing” for either SS (or Medicare) eligibility. Is it at all realistic to expect some combination of lower benefits or higher benefit taxation for recipients who have diligently saved (beyond compulsory contributions to these programs) for their own future?

American Dream’s comment above about oil is particularly relevant when one considers how the Strategic Petroleum Reserve has been used as a tool to control the short-term inflation readings.

Means testing rewards people who have been irresponsible.

Means testing rewards people who are smart enough to hire financial advisors to hide their wealth.

Ha, that too.

But I know a lot of people making a combined $100,000 who finance/lease $75,000 Porsches. There are a lot of Americans out there who blow every dollar they earn on crap they don’t need or can’t afford. Then, when the SHTF, they vote for our money. I’m tired of it.

I am tired of listening to shills who believe that Jeff Bezos, Mark Zuckerberg and Elon Musk are not rich enough.

Escierto, what a silly straw man.

Whenever people point to Bezos and Musk, they then propose increasing the ordinary income tax rate on the dentist/architect couple making $700,000. These are the people I call the “working rich,” they’re not the rentier class that can live off investments.

Rich on paper. They can barely afford to buy back their own stock at these prices.

Means testing Social Security and Medicare is wrong because it is changing the rules of the game while the game is being played. Anyone who has contributed to these programs for 40 years has a reasonable expectation of collecting the promised benefits. Similarly, imposing a work requirement on people who receive Medicaid benefits is changing the rules of the game. Medicaid is a health program, not a jobs program. For what it’s worth, I think the government needs to step up its efforts to root out fraud in all government programs.

Medicaid is a handout program, not a pension program, so no, changing the rules mid-game is just fine for that.

The fact that you get charity now doesn’t entitle you to charity forever.

Einhal for President!

Based on his inane comments and predictable bad takes? Talk about low standards.

JD, the only people who think self-reliance and individual responsibility are inane are the parasite class. Are you one of them?

The bigger problem is it wastes resources on yet more bureaucracy, both directly (assessors) and indirectly (lawyers and accountants wasting their time and intellect on financial gaming instead of doing something actually productive)

There is already a primitive kind of means testing on SS benefits, because whether the benefit is taxable depends on your total income. See https://www.ssa.gov/benefits/retirement/planner/taxes.html

John H,

All of CPI is subject to revisions, including CPI-W. But the biggest revisions (if any) happen to seasonal adjustments, and the year-over-year percentage change is based on the not-seasonally adjusted CPI-W, and should not be impacted by revisions.

Medicare is already means tested, it’s called IRMA. And there are several bills out there that would change how SS calculates benefits, but congress is too busy giving money away to other countries to vote on any of them.

SS was never meant to be the sole support, and the government has never advertised it as such. The idiot media have given us this myth along with the frequent scares. The scares are more effective if we’re led to think that SS is the only income for old folks.

We get just the same propaganda in Britain. It’s almost as if there are politicians who make a career of misleading people.

It’s so easy to google this stuff. Of elderly Americans, 40.2% receive their sole income from Social Security. That’s a lot of people so the scares are justified. What is not justified is people pretending that this is not the case!

The messages are so convoluted. Why does the media scare you? It has nothing to do with s.s. Why are you so hateful of the wealthy? Because you aren’t? Why is the message everyone in America is poor, underserved, uneducated,etc.? Why in this day of inclusion do you hate so much? Do you ever think of what you say? Do you utilize critical thinking? Analysis? This is a comment for everyone here, the answers are just a bit more complicated than all the broad stokes. Who’s responsible for whom? Some folks truly need assistance, but what about those who didn’t save or learn about financial planning? Think it through folks, more than sound bites.

Careful on your way back down, bub.

If everyone took care of their own families, there would be less dependency on “programs”. Living in cities has wrought this. The loss of the nuclear family and multi-generations under one roof. It was made clear to me when living in SoCal and watching the Asian families move their elders into their home, often building suites for them so they could be cared for.

I had friends when in college that were farmers and the sense of community out there was striking to a city kid from Chicago. Neighbors helping each other in the fields, lending farm equipment when someone else’s combine sh*t the bed. The grannies cooking for the workers… it was like a big party made up of hard work and pride.

Now, it’s deteriorated (for the most part) to “gimmethat”.

Right. To quote directly from an SS statement: “Social Security benefits are not intended to be your only source of retirement income. You may need other savings, investments, pensions or other retirement accounts to make sure you have enough money when you retire.”

The media? No one, including the media has ever said that SS is or should be the sole source of retirement income.

Yes. Anyone who cannot live within their means over 65 years gets what they have earned by not saving for retirement.

They just did not want GI vets/people on the street with no food or anything to do.

Having a bunch of homeless 60 year olds is a bad look for any country. Let alone millions and millions.

I guess when we were planning social security we were a much less successful country. Kinda where say your italy or Greece is in the pecking order. Now we’re so rich, not too rich obviously. And the rich hate handouts.

I think it is Switzerland or Austria?, they planned a social security type situation. They controlled rent for like 50% of their population. And now most can afford to stay put in their apartments with that

Mental security to have a nice stable life.

Man, did you nail it right on this one!!

SS is just a smallish part of keeping your nose above water in retirement. A pension, as archaic as that is, has helped a lot, but those too are eaten by inflation.

I look at my retirement inflows and outflows and can’t seem to get below about 15% annual rise in the cost of basics of life. Not a scientifc approach for sure. Excluding mortgage expenses, which I have none. Worst is food, followed by fuel and insurance costs. The odd trip to the home improvement stores is simply shocking. I now more often leave empty handed.

Oh and don’t forget, what the SS giveth with its right hand, SS also taketh away with its left hand in Medicare costs. At least to some degree. If feels like we see less reporting of that in the main stream media.

That is why I come to Wolf Street daily. Gets right down to the facts.

“Likely to be outrun by inflation”…

LMFAO. Understatement of the century Wolf, but what really burns my brisket is when you hear talking heads call social security an “entitlement”. Complete BS, if that’s the case then I want all my contributions back, with interest.

If you live long enough, you’ll get way more than your contributions-plus-interest back. Lots of people live way into their 90s and past that. It’s a great deal. Your family also gets survivor benefits, and if the spouse qualifies, she can also get 50% of yours (or vice versa) if yours is more than the benefits under your spouse’s own plans would be. If you have a spouse, you need to read up on the spousal benefits.

Or in the case of my neighbor, you croak at age 54 having paid in your whole life for nothing. Yin to the yang.

Basically the same as auto, health and home insurance. However, do you really want to get your money’s worth with any of those? My 16 year son just had knee surgery and much rather not be getting my money back I paid in for that.

Social Security is by definition an “entitlement”: the fact of having a right to something. Workers who contribute to the system are “entitled” to the benefits provided by the system. As with all insurance and pensions, everyone doesn’t recoup what they pay in, but others recoup more.

Why shouldn’t talking heads call it what it is?

LOL!

SO insurance is an entitlement now, equivalent to SNAP?

LMFAO! I think I see why society is failing.

Social security is a social insurance program operated by the government. It is an entitlement, but it is funded directly by beneficiaries unlike the SNAP program. You need to pick yourself up off the floor, pick up a dictionary, and look up the word “entitlement.” (I tried to help by providing the definition in my previous comment.)

If you think society is failing because too many people have no idea what words mean, and therefore lack understanding, I agree that appears to be the case.

Howdy Folks. ZIRP and QE taught the yougins not to save. Everyone in the so called know it alls , preaching ” saving $ is stupid “.. Don t listen to the know it alls.

Sober Sailor enjoying life till death

Ray Dalio declared “cash is trash”, then the Fed started raising rates.

Wolf: For starters, I could not get too excited about the 3.2% raise to my small US Social Security Pension…

However, what I found most interesting, was the link you provided to the US Actuarial tables.

Back in 2015, when I got laid off from the oil patch, I decided I had to do some financial planning for my retirement. I am not exactly sure how I came up with my drop dead date back in 2015, but I expected to croak at 85 years old. As I am 71 now, I am on my 14 year plan based on my initial guesstimate.

So when I consulted the current actuarial tables, it would suggest I am going to croak at 71+12.14=85.13 years old.

I also checked the 2015 vs current actuarial table, and it looks like our life expectancies have been reduced. Perhaps too many cheeseburgers and fries, being fond of Coke instead of Diet Coke? (or being governed by the Trudeau Liberals since 2015?)

Anyway–I’m sticking with the 14 year plan although I recognize there is a smallish error bar.

Make that 83.14 (correction)

It’s hard to find a family doctor these days in Ontario, so you miss years of bloodwork which can detect cancer, diabetes and other ailments which should have been detected in the first place.

And then when you get a tumor that leaves a swollen stomach, or your feet and fingers tingle and take long to heal (diabetes), it’s too late to prevent further harm.

Gen Z, you don’t need a doctor to get a blood test. You can order that yourself as many labs are happy to bill you for the tests. Then with the results, you can look up any abnormalities via the internet. If you suspect a problem (data variation from normal), then you can schedule a Doc appointment.

I’m not sure if this can be done in Canada, though.

I believe covid was responsible for reducing the actuarial numbers.

In the US, Covid subtracted about 2 years from the life expectancy in the actuarial tables. You can google that to get the actual number. You can also google that for Canada.

Wolf – I think over the long term, that number will be lower. The majority of the individuals who died from COVID were the same people at risk for the flu, pneumonia, COPD, etc.

“Excess mortality” during covid was used to move the figures.

The point, Russell, is that Covid killed them BEFORE they were actuarially due to die from those other causes — that’s what “excess deaths” means, not that somehow there were more total deaths than were going to happen anyway; obviously the total number of deaths eventually equals the total number of births. What changed was that Covid brought those inevitable deaths sooner.

Yes Ian,

It was the cheeseburgers and fries for sure.

Thats what I was thinking….and why I am on Ozempic and down 38lb so far…Blood pressure has improved but still more lard to lose LOL.

Well, also Covid, opioids and alcoholism, Ian Thomson.

Have they considered no longer buying avocado toast or perhaps no longer buying starbucks coffee?

I switched to Pete’s Coffee and avocado toast delivered with Instacart. Then I check my Nvidia stock.

Time to delete the tiktok vid saying you cant afford the $700 rent hike.

Paid for in crypto?

Credit card.

Pete’s coffee is so bitter!

I still have to do my Starbucks French roast ground. As my grinder kept gumming up. Got tired of un gumming it. Always look for the sales on coffee. Don’t pay 3-4$ more a bag.

And I find the warehouse bags to not be as good as the smaller grocery store bags.

Dear Einhal:

Yes, this is a site about money and finance, BUT, as I hope

Wolf would concur, money is not life.

In a healthy society there is some level of solidarity with all the other citizens, no matter what socio-economic niche they might inhabit. One sees this more in some European countries. (Oh, horrible socialists! s/). Are not empathy and cooperation signs of an evolved humanity?

Life is random. Before you admonish those careless or unsophisticated with their financial planning think of this. Luck of the draw. There, but for the grace of dog go I. Shit happens–car crash, cancer, natural catastrophe.

Act human all the time. It has its rewards.

“Act human all the time”.

Yeah. Reminds me of when my uncle flipped his gigantic motor home he had no business driving on the causeway in the Florida Keys. They walked out through the windshield and it looked like a yard sale with their belongings scattered all over the highway. The “humans” stole all they could carry. To hear them tell it, only one couple inquired about how they fared.

Maybe a better term would “act with compassion all the time”.

I guess I’m more optimistic about human nature than most. Always thought that 95% of people are “good” in a low-stress environment. That said, I’ll take compassion because it is an inherent human trait.

Ignore this guy, Elissa. He is all over the place. Few comments you can learn from or reflect on, kinda like an empty shell of of a “human”.

As in that story was likely totally invented.

What economic level would YOU have to be pushed down to need to seize that “economic opportunity” Katz? Probably not much.

I doubt your uncle suffered economically as much for AT MOST a half day or so, insurance covered everything…plus some things he DID NOT HAVE, as in profit, I saw that in out 2017 Fountaingove (wealthy area fires) AS those people do DAILY.

Sorry, poorly written, implications in Katz post upset me. Still decipherable and true.

“He got the action, he got the motion

Oh, yeah, the boy can play

Dedication, devotion

He turnin’ all the nighttime into the day

And after all that violence and double-talk

There’s just a song in all the trouble and the strife

You do the walk, yeah, you do the walk of life

Hmm, you do the walk of life.”

The Einhals of the world are always with us. Fortunately they are always outnumbered.

So let me get this straight. We don’t get to say we don’t want more illiterate immigrants, and then once they’re brought here by the elite against our will, it’s our responsibility to care for them too?

We also have an economic system based on winners and losers. There are ways to offset that but unions are way down from where they used to be. Employers, even with what is going on will always control the power imbalance. Workers work most of their lives to create surplus value for those that often have literally nothing to do with the good or service produced. As a society we have chosen that one could say but that is a hard sell.

I guess, real wealth in the USA means, you are able to pay the “bills” if one family member becomes very sick for a long time….

> if one family member becomes very sick for a long time….

Real wealth in the US is accepting mortality as inevitable and opting for quality of life instead. There, I fixed it for you :-)

FIRE

So you espouse the ” So die already ! ” philosophy ?

Do TIPS make sense in this environment? Let’s say 5-year TIPS.

Supposedly should pay above I-Bonds rate for duration risk, but I can’t quite find what the going rate is (for TIPS). Is this something where I need a calculator to figure this out?

Also, why do small caps keep crashing while Magnificent Seven keep going up? A conundrum. Paradox even.

Because retail/meme stonk gamblers/investors don’t pile into small or microcaps, which would require actual research and DD.

Personally, I try not to buy anything with a market cap >$1B.

MM, I think you have less duration risk with I-Bonds because you can get all your money back after 12 months. With TIPS the shortest term is 5 years. So if you have to get out of TIPS after a year or two you could be looking at half of your money gone, who knows. Look at the geniuses buying 10-year treasuries at 0.5%.

So all considered TIPS should be north of 6% now.

Good point, you do arguably have more flexibility with them.

It’s almost a rule of investing. Large caps are viewed as security in uncertain times, while small caps drop. Small caps rise hugely when the uncertainty is lifted.

It’s a good idea to shift out of small caps when recessions are in sight. It doesn’t make total sense, but it’s what happens without fail.

Andy, go to “tipswatch_dot_com” for all you need to know about TIPS.

They are basically a hedge against inflation with some complicated rules.

Thank you, Anthony. Will check it out.

I believe both I-bonds and TIPS are indexed to CPI-U.

I was just about to comment that recent I-bond rates have stunk, but I suspect they will go back up next year, when inflation inevitably goes back up. When I bought my I-bonds last year, the rate (semiannual, but extrapolated to APY) was >9%.

Also, I-bonds are 30-year bonds, but can be redeemed after 5 years with no interest penalty – so you’re technically exposed to more duration vs TIPS.

I know Wolf generally disallows links, but here’s the TreasuryDirect page comparing the two:

https://www.treasurydirect.gov/research-center/history-of-savings-bond/comparing-tips-to-i/

Thanks MM, this is good page. So 12 months redeemable with 3 month penalty for I-Bonds. Still better than TIPS in my head. If only we knew what the rate is for TIPs.

And it is the last 3 months so if you have them over a year then when they fall very low you wait 3 months and take it at the lowest rate.

Of course – that’s the plan, isn’t it. Inflation has to eat away at the public debt or it explodes into outer space. COLAs will always understate true price inflation, especially for retirees. This is why the policymakers fiddle with CPI numbers.

The only way immaculate deleveraging can work is if inflation depreciates debt over the long term.

When the headline CPI number or whatever economic data is released I flip to this site for the analysis. If it’s not there, I can’t help but think, “man that Wolf guy is lazy”.

Then I return in the afternoon and the analysis is there. All is forgiven.

Looking forward to the update, as always :)

Correct me if I’m wrong but it’s my understanding that Congress has their own government retirement plan separate from Social Security. They live and operate in their own “parallel universe”.

Looks like the joke idea of the 1980s repo man movie of the white label can with the black letters saying “food” could be the next unicorn startup of the Jerome Powell Era. “Put it on a plate son, you’ll enjoy it more,” Repo Man movie 1984.

This country needs a government required service by everyone of 2-3 years. Maybe then we can get back the meaning of community. This is te best country in the world.

Apparently you’re not familiar with the 13th amendment. Thankfully we have a constitution that protects us from people like you.

I doubt that most Americans know about the 13th Amendment.

Yep, we need universal military service. Everyone serves 2 years. No exceptions. No more rich man’s wars and poor man’s fight. Been there, saw that in raw color.

I recommend a return to the Draft that begins with the offspring of families at the top of the income and wealth distributions and works its way down from there to the poorest.

Then watch the appetite for foreign adventures plummet among your elected representatives …

“There were some tweaks during my lifetime, including when I was in my 30s when my full retirement age was moved out.” You are referring to the 1983 Amendments that went into effect in 1984. They also made SS benefits partially taxable for higher income beneficiaries. The income levels at which these additional taxes on SS benefits kicked in were never adjusted for inflation. The Reagan income tax cuts of that era helped mask increased Social Security taxes and taxes on future benefits.

We are collecting Social security and are still in the workforce contributing to SS via the self employment tax . Weird. They adjusted the annuity to account for our contribution.

Yeah that’s normal if you still work. So your work has to be worth the loss of income. But you get it all back later when you stop working, so it’s meh. Working is good for your mental health.

1) Covid was a cytokine storm. Alzheimer is a cytokine drizzle, a slow, stealthy killer.

2) People who are hooked to salt, sugar, alcohol, pastry, refined carbs, coffee…are subjected to systemic change in their 30’s and the 40’s. The symptoms, Alzheimer and dementia, appear 20/30 years later, in their

50’s and the 60’s, but that’s too late.

3) Feed your gut bacteria with fiber, avoid fatty liver, support the

brain, protect your tongue.

4) Mouth wash and toothpaste flouride kill good and bad bacteria. At

40’s Nitric Oxide NO Endothelial production is down 90%, but oral NO production can go on. Dentists kill it : who will fill our chair if America stops eating junk food.

5) Kids develop insulin resistance caused by excess salt and fructose. Insulin resistance and diabetic II develop in the brain. The cortex

is depleted from oxygen, memory’s synopsis are dying. The brain is totally out of balance, full of toxic plaques.

6) Fat is ok. Complex carbs are ok. But a combination of : fat, carbs, salt or sugar are bad for health. MCD french fries are bad. Big business and

big pharma love MCD.

Awesome, thanks. Now back to my Diet Coke. It’s my method of assisted suicide at 70.

The tweaking of COLA to under the real inflation rate is what will keep SS solvent basically forever, assuming no meteors or WW3.

Medicare is a different animal altogether, though, and either needs to be means-tested, capped, or some combination of the two, else it will crowd out everything else.

“Likely to Be” ? Did I read that correctly? Likely? LIKELY?

I’m thinking of a more definite adverb.

As of current CPI data through September (=3.7%), it WILL be outrun by inflation. But the CPI data that matters is through Dec 31, 2023, which will be released in January 2024. So a miracle could happen that could cause yoy CPI to drop to 3.2% or below, in which case the COLA will not be outrun by inflation. I don’t believe in miracles. So I’m seeing CPI of 4%+ for December, in which case 4% CPI inflation yoy for 2023 will outrun the 3.2% COLA.

There would be no problem with the Social Security Trust Fund for the next generation if there had been no interest rate repression for the eight years of the Obama/Biden administration when the interest rate income of the Trust Fund fell like a rock.

How many hundreds of billions of reduced income did the Trust Fund suffer as a result of those low interest rates?

High rate instruments matured and were replaced with those that had negligible income and now those have to run off the books and replaced with higher yielding issue in the future so the Trust Fund is still suffering the hangover from those years.

I ❤ your political comedy. But reality stinks in that interest rate repression started with Bush in 2008 and ended with Biden in 2022. So there, I fixed it for you.

But I agree, the impact of interest rate repression on the trust fund was substantial. I discuss this once a year in November when the fiscal-year data come out. Last one here:

https://wolfstreet.com/2022/11/08/status-of-the-social-security-trust-fund-income-and-outgo-fiscal-2022/