Income jumped by $105 billion to a record $1.04 trillion as more people worked and earned higher wages, and contributed more.

By Wolf Richter for WOLF STREET.

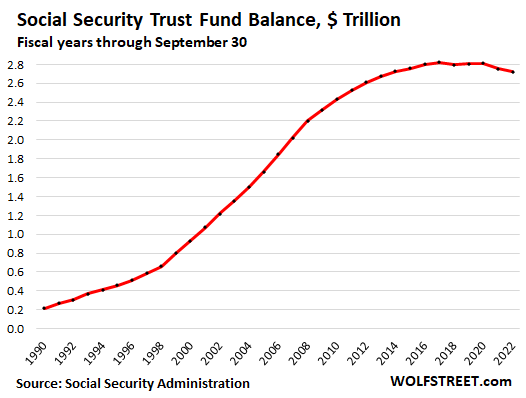

The balance in the Social Security Trust Fund – technically known as “Old-Age and Survivors Insurance (OASI) Trust Fund” – declined by 1.2% during the US government fiscal year through September 30, to $2.72 trillion, according to figures released by the Social Security Administration. In the prior year, the balance had dropped 2.0%; in 2018, the balance had dropped by 0.8%. Those were the only three fiscal-year declines in the fund balance since 1987.

Despite those declines, since 2010, the balance of the fund has risen by 12.1%. These figures to not include the Disability Insurance Trust Fund, which by law is a separate entity from the OASI Trust Fund, and is not part of this discussion here.

How the fund invests this $2.72 trillion.

The OASI Trust Fund invests in Treasury securities and short-term cash management securities. These securities are not traded in the secondary market, similar to the I Bonds that many readers here have at TreasuryDirect.gov.

The fact that securities in the Trust Fund are not subject to the whims of the secondary market is a good thing: The value of these holdings – similar to the value of our accounts at TreasuryDirect – doesn’t fluctuate from day to day with the whims of the secondary market. Because the Trust Fund holds Treasury securities until they mature (when it gets paid face value), the day-to-day price fluctuations are irrelevant, similar to our holdings at TreasuryDirect.

At the end of the fiscal year, the Trust Fund held $2.66 trillion in interest-bearing long-term special issue Treasury securities and $57 billion in short-term cash-management securities, called “certificates of indebtedness.”

Because these securities are not traded in the secondary market, their value equals the face value at all times, which is the amount that the Fund paid for them when it invested in them, and the amount it will be paid at maturity by the US Treasury Department.

The strategy of investing in Treasury securities and holding them until they mature is a low-risk conservative strategy that essentially eliminates credit risk.

This allows the Fund to operate with ultra-low administrative expenses, amounting to just 0.14% of the assets in the fund.

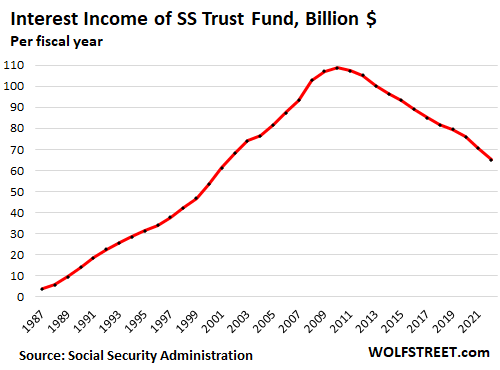

Interest income crushed by Fed’s interest rate repression.

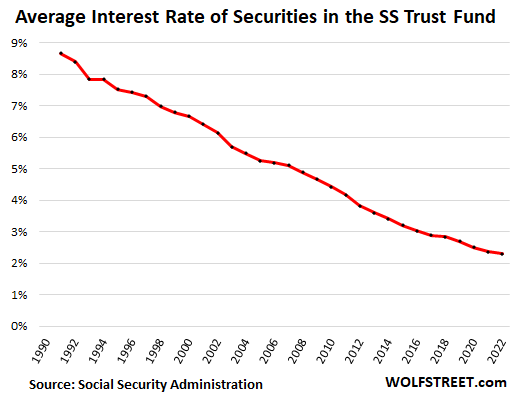

In the fiscal year, the Fund earned $65.1 billion in interest on its Treasury security holdings. This interest income was 40% lower than in 2010, the year of peak interest, though the Fund balance was much lower at the time. The long-term securities it held were paying much higher interest rates than the new long-term securities that replaced them when they matured during the era of the Fed’s interest rate repression.

Retirees counting on their fixed income investments, such as CDs and bonds, for their supplemental cash flow have seen an even worse devastation of their cash-flows following the Fed’s interest rate repression that started in 2008.

Gap between income and outgo narrows.

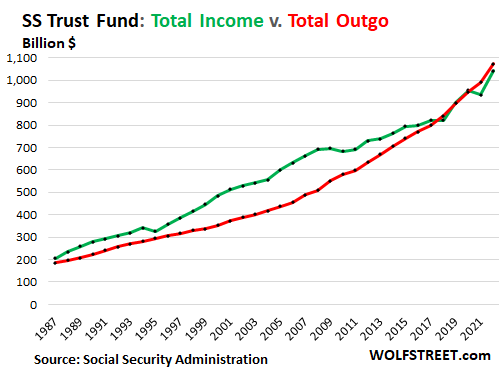

Total income from all sources (green line in the chart below) jumped by $105 billion from the prior year, to a record $1.04 trillion in the fiscal year ended in September because more people were working and they were earning higher wages and contributing more than during the pandemic year:

- Contributions jumped by $98 billion to a record $929 billion.

- Interest income fell by $5 billion to $65 billion (see chart above).

- Taxation of benefits rose by $13 billion to $47 billion.

Total outgo rose by $82 billion to $1.07 trillion (red line). Nearly all of it was in form of benefits paid.

The deficit (total income minus total outgo) of the fund narrowed to $32 billion, down from $55 billion in the prior year.

When the green line (total income) was above the red line (total outgo), the Fund accumulated assets. When the green line fell below the red line, the Fund shrank:

The costs of the Fed’s interest rate repression.

If the Fed hadn’t repressed interest rates since 2008, then interest payments would have roughly followed the increase in the Fund balance, and the Fund would have a surplus.

In 2010, the Fund earned interest at an average rate of 4.4%. In 2022, it earned interest at an average rate of 2.3%. If in 2022, the Fund still earned interest at an average rate of 4.4%, it would have collected $120 billion in interest, instead of $65 billion, and this additional $55 billion in interest income would have generated a surplus of $23 billion, instead of the $32 billion deficit. Yield investors around the country have gotten crushed even worse. Thank you, Fed!

Because the Fund invests in long-term securities – average remaining maturity is 6.2 years – and because interest rates of securities don’t change until the securities mature and are replaced with new securities, there is a lag of years before changes in long-term yields work their way into the “average interest rate” and into the interest-income stream.

Inflation, COLAs, and reality.

Social Security payments to beneficiaries are adjusted annually for inflation via “Cost of Living Adjustments” (COLA). The percentage of the COLA is the average CPI-W inflation rate in the third quarter, and is applied the following January for the whole year. The Social Security COLA for 2022 was 5.9%, the biggest since 1982. The COLA for 2023 will be 8.7%, the biggest since 1981.

The massive 5.9% COLA for 2022 was not nearly enough to overcome CPI inflation that raged at 8.2% for the 12 months through September. The 8.7% COLA has a better chance of at least matching CPI inflation in 2023. But there are no guarantees, and CPI inflation could still get worse.

Depending on where beneficiaries live and how they live, their actual costs of living may increase faster than the COLA.

Each year that the COLA falls behind actual costs-of-living increases, it affects all future years of benefits because inflation and COLAs are compounding, and that gap between them is compounding as well. Even small gaps year after year compound into big differences after 10 or 20 years.

In other words, if you think you’re comfortable living off your Social Security benefits when you retire, you will likely be squeezed 20 years later.

Depletion of the Trust Fund: whenever.

In fiscal year through September 2022, the gap between income and outgo narrowed to just $32 billion. This reduced the Fund less than expected. At this rate, which is unlikely, it would take 85 years to deplete the Trust Fund.

All predictions of how the next 10 years will work out – based on estimates for demographics, employment, wages, retirements, mortality, births, immigration, and the like – have been wrong in the past. They get adjusted up or down every year. No one knows. This year was better than expected. If there is a big recession next year, it will be worse than expected.

Several changes could put the Fund back on a growth track, likely a combination:

- Long-term interest rates stay in today’s range of 4.3% or higher for many years.

- Workers pay more, likely via a higher taxable maximum. It’s already indexed to inflation and will rise to $160,200 next year; it could be raised more than the inflation indexing.

- Full retirement age for future retirees could be delayed further but that poses lots of problems for people working in physical jobs and also due to age discrimination – when it’s impossible to find appropriate work.

- Benefits for future retirees, particularly the wealthiest, could be cut.

- The inflation measure for COLAs could be changed, such as replacing CPI-W with a chain-type price index, that will impoverish retirees in increments year after year, the most insidious way to cut benefits later in retirement when people can least afford it.

- Or a combination of them.

Note that long-term interest rates that prevailed before 2008 – before the Fed’s QE and interest rate repression – would eventually produce enough of a boost to interest income that it would go a long way toward overcoming the deficit in future years, and not a lot of other adjustments would have to be made to keep the fund balance growing. I’m rooting for the old normal interest rates.

Social security will be there, but it won’t be enough.

Retirees can rely on Social Security being there, but they should not rely on it as their only source of cash flow. Even if they can live off the benefits at first, they will find themselves in a tough spot as the COLAs are outrun in increments year after year by the rising costs of living that people actually face. This compounds over the years, and gets worse over the years.

Social Security wasn’t intended to provide comfortable retirement on its own, and it won’t. Some people move to a cheaper location in the US. Others move to cheaper countries, which works for a while and can be great fun. But the exchange rate could change to their disadvantage, and then the situation gets even more difficult.

For these reasons, it’s very important to build a sufficient nest egg during the working years. And it can be good for a host of reasons beyond money to extent the working years, even if it’s just with a part-time gig, maybe even something fun and interesting, that brings in some extra cash.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

I am one of those who moved to a low cost of living country in S. E. Asia. Much to my surprise, when my new wife and I had a son, I discovered that Social Security pays a benefit for up to two children to parent(s) receiving their retirement benefits. We now have two children and a third on the way.

The child benefits effectively doubles my benefit.

Are you saying the US social security system pays a benefit based on the number of children? I’ve never heard that before, so I question whether that is accurate. Maybe you are talking about Medicaid.

Bobber,

Per SSA:

When you start receiving disability benefits, certain members of your family may qualify for benefits based on your work, including your:

Spouse.

Divorced spouse.

Children.

Adult child disabled before age 22.

If any of your qualified family members apply for benefits, we will ask for their Social Security numbers and their birth certificates.

If your spouse is applying for benefits, we may also ask for proof of marriage and dates of prior marriages, if applicable.

also applies when grandparents get legal custody of grandkids

of course with run away devaluation I plan on taking early payout next year

figure the 5 years of early payout of MORE VALUABLE fiat $dollars makes sense

Thanks for that clarity WR!

Never heard of this benefit before, but, in fact, it makes sense… As long as there is clear rules and procedures to ”vet” anyone, VET or not…

Certainly, at least ONE of the metrics of a fair society is taking care of those of WE the PEONs who at least try to work and support our families,,, and get ”disabled” doing that work.

Would it be better in a totally and only ”MERIT” based system???

YES, clearly far damn shore,,, BUT, equally clearly, ONLY if that merit only system included SO many ”insurances” for those folks willing and able to put their lives on the line to do the work needed.

For reference only, a friend did as many years as he could before being unable due to medical exam, as one of those heroes who went 1000 feet down into the gulf of Alaska to WELD, in a hyperbaric chamber the structures needed…

OF course he died young,,, R.I.P.

Because of his UNION, he was OK when unable to continue that work, and his lovely young widow is also OK, so far…

Would anyone here like to challenge his union???

As one never in any union except the cab drivers in the city of the angels in the sixties, I won’t…

IMHO, oligarchs, no matter if cubanistas, meh i canoes, or any of the most later ones in USA, better get their shit together and mighty fast…

Are there any citizenship requirements?

Green Card holders, like my wife, who have paid long enough into the system, are also eligible. They’re considered “US persons.” I don’t know about other visa categories. But H1b visa holders, if they work long enough in the US, usually end up getting Green Cards.

Illegal immigrants with a stolen SS# — or anyone with a stolen SS# — who apply for SS benefits commit fraud. Easy to detect, and folks end up in jail, but a hassle for the person whose SS# was stolen. That’s why people should get an online SS account asap, which locks it in and provides some protection against this type of fraud.

Wolf said: “When you start receiving disability benefits, …..”

————————————-

does this also apply to retirement benefits, with no disability involved?

This is quoted from the SS site. To find out the nitty-gritty, Google it. The SSA.gov site has lots of good easy-to-understand info online.

You’ve never heard that before because most 65 year olds you know don’t have young children that qualify.

That’s neat, we’d heard similar things before but didn’t know about the details. A bunch of old associates and partners have moved to Europe in past three decades, esp as SWE and IT salaries have soared in some parts of the EU in things like fin-tech, trading, cloud servers and software deployment (huge number of startups recently). Knew some guys saying something like this, married women there (often coming from Russia or Belarussia themselves apparently, basically visa-free in the EU) or brought their American kids over. Retired with SS and said they got a boost from a child benefit–initially ran into hassles with Fatca and taxes overseas but ultimately didn’t cause much of a problem (most Americans there don’t need to renounce), and the child benefits were a nice boost.

Expense ratio of 0.14% is cheap? For a $2.6T fund, that’s almost 4 Billion dollars. How is that cheap? There is hardly any research or active management required.

Vanguard and Fidelity have bond funds that charge less than 0.03%.

Fidelity or Vanguard do not write 55 million checks per month to beneficiaries.

Neither does the SSA. It’s mostly direct deposit – just like FIDO and Vanguard.

Nacho Bigly Libre,

You’re comparing the expenses of a pension fund that takes in money and pays out benefits to the expenses of a freaking bond index fund. This is the kind of manipulative or just dumb BS about Social Security that drives me nuts.

Post that crap on Twitter. That’s where it belongs, not here.

How is the interest on the trust fund determined? What’s to stop Congress from simply inflating it to be whatever is necessary to secure SS for all future retirees?

The interest rates are close to 10-year Treasury yields and are based on market Treasury yields during the month before the new security is issued.

This is determined by a formula specified by law.

You can look up the monthly historic rates here:

https://www.ssa.gov/oact/progdata/newIssueRates.html

Never actually knew how that was calculated. Thanks.

Interestingly, when we retired several years ago in Texas, our combined SS income (wife and I) could basically cover our periodic living expenses and taxes (property, Fed income (no state here)). We do have a moderate size nest egg (IRAs) and a paid off house as a backup but no pensions (other than SS).

But now that inflation is ripping us a new a$$h0!e, we are into our nest egg taking RMDs from our IRA’s, and those RMD funds are basically covering the excess that SS can’t cover anymore plus additional Fed taxes on the withdrawal. But it’s a losing battle as inflation keeps punching away at us. And at 79 years old, with a very sick wife, getting a job is not what I am planning to do (who would hire me anyway?).

Our big costs that are increasing are health related (Medicare supplemental insurance, drug costs not covered by Medicare, and other health services and equipment not covered by Medicare) and those alone are up $4 K annually over a few years ago. Our annual spend on health services and drugs is $12+ K this year. The Medicare Part D program for drug coverage is a joke. Who ever put this in place should be jailed or at least be subject to the plan themselves.

I’m not even thinking about thinking about a new vehicle anytime soon and hope our not too old Hyundai Tuscon will carry us along for many years to come.

Last years 5.9% SS increase and this coming years increase of 8.7% will help us a lot.

Message to young folks still in the workforce: Save all you can while working, stay healthy, and hope for the best for your later years.

You should definitely look into a Medicare Advantage plan. I pay zero $ for a premium. My 9 prescriptions are very cheap. I was hospitalized for 2 1/2 days with some kind of mystery cardiac avent and had every test known to medical science. I paid $450 for all this. I also get $1500 of dental a year and other benefits. Traditional Medicare is not enough these days.

By zero for a premium, do you really mean that the standard automatic deduction for “traditional Medicare” (maybe $170 per month now) is instead re-directed to a Medicare Advantage HMO/PPO?

Medicare Advantage can be worthwhile…but it isn’t (can’t) be “free”.

Your money (deducted from SS benefit) is still going out…just to a different entity, with different limitations and benefits.

The $170 for part B is separate and you have to pay it. Advantage plans are on top of it and can be free to the beneficiary – and most of them are free.

Advantage plans completely change the system. Under them, Medicare pays the insurer upward of $1,000 per month to take care of the Medicare beneficiary. This monthly amount can be much higher, and go up to $4,000 based on the health issues that the insurer claims the beneficiary has. There is a big scandal about that right now because insurers abuse the system. But that’s between Medicare and those insurers. For users of Advantage plans, this can be a good deal (depends on the state and the insurer).

As far as I know, Advantage plans, just like Medicare, do not cover treatment in other countries.

Wolf,

I think we are saying (mostly) the same thing in different ways…the monthly Part B premium is still automatically deducted from SS payments (that is the beneficiary’s money) – but it is then sent on to the Medicare Advantage provider (along with a lot more from Medicare/Taxpayer/DilutedDollarHolder).

The bottom line is that MC isn’t “free” to the recipient (or anybody else).

I only bring it up because Joe Namath has befuddled a *lot* of seniors with jibber-jabber about “Zero payments” and even “Cash back!!”.

Those are only true if everybody ignores the Part B auto deduction from SS beneficiaries…that is the (a) source of all the “goodies”.

And…”cash back” Medicare Advantage plans? I kinda imagine they must be awful in terms of HMO coverage/limitations.

The system is a financial disaster as it is…anything pulling expected cash from it has got to be making things worse.

And you may not have coverage out of the region you are in with an Advantage program (state, certain counties within a state, etc., in-network or not, as you said, it depends on the state) – unless it’s an emergency. Emergency medical care is covered (if it’s a procedure that Medicare covers!) anywhere in the U.S. I do not think you get coverage with Advantage or any other Medicare plans outside the U.S. You need a private insurer for out-of-the-country coverage.

And for those who aren’t initiated, Medicare doesn’t cover discretionary procedures (nose job, breast enlargement…), so there are some limits to Medicare.

Advantage plans are limited to an area and the Dr.s signed up in that area. If you become seriously ill and need to go to Mayo or Sloan-Kettering, etc. you are out of luck unless you bought additional private insurance.

As Dick Gregory said, “If you have something really good, you don’t have to sell it to people, they will find out and steal it from you”

He was talking about proselytizing religions, but it applies to anything advertised, especially when it’s heavily advertised. The “advantage” ads will go away when open season ends, like election ads, but reverse mortgages and ambulance chaser ads won’t.

And I think SS should NOT have a cap when one reaches a certain amount and should also be heavily means tested. Would beef it up immensely.

It is a SAFETY NET for those who NEED it. THAT”S ALL.

Think of it as another “caring human being” charitable contribution and sharing your good fortune with those in need.

Annuities are another one to be careful of. Big commissions and who insures the insurance company?….tolerance for future gov’t bailouts is pretty low, I bet.

Although stock market players are betting on them, I’m sure…..TBTF and all that contrived BS. Nationalize them and dismantle them carefully…plenty young MBA’s out of work….and ad some clawbacks for that “fearless entrepreneur” moral hazard bunch near the top.

Please forgive my lack of business/finance/econ knowledge, but I think my point is clear enough

I have heard many a horror story about Medicare Advantage programs. My sister is presently in the ICU in FL. The hospital folks all said she’s lucky she has regular Medicare as the coverage is superior.

Also: Medicare Advantage policies often aren’t good outside your home state network. You have to go to the ER (as I have been told by those who have one) to get services outside their service area.

As far as drugs go, I rarely use my Part D. I have found that the guy who owns the Dallas Mavericks drug website to be the best value around. One drug was $94 for 90 days from an online pharmacy but from the Maverick’s guy it was $16.10 delivered to my house – including postage. However, the Maverick’s guy site is only good for generics.

I have an HMO Advantage plan and I’m seeing a specialist outside of my network (in a different State) next week. It took a couple of days to get authorization, just as it does in network.

roddy6667, we have looked into MA plans for several years now and the downsides for us comes down to two issues

1. My wife’s current doctors as she has four (PDP, three specialists). Of the four, two specialists, her pulmonologist (for her advanced COPD) and heart guy, are “not in network” by any MA plans we can find for the area we live in. Therefore, we would have to pay the “full freight” for her to see them ($$$).

2. Drugs: Her two Tier II and her one Tier III COPD drugs – One Tier II and the Tier III are not “covered” by any MA plan here. Those alone would cost ~$1000/month each as there are no generics available yet.

So, MA plans sound nice if you are healthy, and maybe you will stay that way until you die at home in your sleep after your gym workout, but for 99% of us, getting old, especially very old, will be painful and you will need lots of medical help and costly drugs. Even with Plan D under Medicare, her drugs are very expensive.

Check out Goodrx or other discounts. You can get some the COPD medicine as well as others for instance at a big discount depending on what store has the best price and available to you.

You have to shop around very carefully and decide what Part C plan perks and benefits you actually need, and which of your providers and drugs are in-network. Most Part C plans offer dental and vision benefits Medicare doesn’t, but some can hook you in with catchy things like food delivery after a hospitalization, when you really needed sub acute rehab but the Plan denied it, but here’s a box of free food that a prison wouldn’t serve. Yum.

In my observational experience, Part C seems to work best to offset costs for people in their healthier years that still use a fair amount of typical medical services, but when the more expensive benefits are needed such as skilled rehabs, cancer drugs, etc. they can hit authorization walls and red tape that may or may not be an issue with straight Medicare.

Not an election to take lightly. Definitely compare plans, read the fine print, see if your providers participate and consider what benefits and restrictions would affect your needs.

There’s an excellent, free government advisory service called: SHIIP. I know of a few states that have it – it may be that every state has a program like this. SHIIP stands for Senior Health Information Service Program. They are available by phone (!!) and will walk you through the whole process, and even help you with specific drugs on various Plan D programs – your annual cost, which program is best suited to the kinds of drugs you use, dosages, etc. down to the gnat’s ass.

They’ll price the various Advantage plans, supplemental plans, drug, dental et al, and the alternative of choosing Supplemental Plans if you don’t want to use one of the Advantage plans. It’s incredibly convoluted. Initially, at age 65, you are guaranteed coverage with any plan you choose, but that doesn’t continue…

Too complicated to explain. Just check with the SHIIP advisors.

In my experience, they have been totally objective and genuinely helpful.

Going from Medicare to an Advantage plan is pretty easy. Going from Advantage back to traditional Medicare not so much – if you even can.

You can switch from Advantage plans to original Medicare every year from January 1 – March 31.

Didn’t know that, but who can predict their precise health needs for a year?

My doc of 20 years was driven out of private practice long ago by the insurance/hmo bunch and into a clinic, but before that his receptionist told me they don’t take advantage plans, FWIW.

We need triaged single payer. That’s all you get in the Military, and screw private rooms with phone and TV…if you are sick you need treatment, not luxury.

When you decide to go back to a traditional Medicare plan from an Advantage plan you will find that the insurance carriers want a heck of a lot more money than they were taking from you before you switched to an Advantage plan. That’s assuming they still offer traditional Medicare in your area. Many are bailing out.

The motto of the Libertarian Party is TNSSAAFL; There’s No Such Thing As A Free Lunch. Medicare Advantage plans are great but if you stray out of their “network,” expect to be socked hard. I have a supplement plan that costs about $250/mo and I can see any doctor anywhere that accepts Medicare. I can afford peace of mind. Worked my ass off my whole life, still do at 66, including an auto parts junkyard and after that a gas station. Hands weren’t always soft. Loved Testosterone Pit. I digress…has that been turned upside down since 2020?

The motto of economic libertarians is “devil take the hindmost”.

Get some Ageless Male and get that testosterone boosted so you can keep kicking ass.

Anthony A wrote: ” The Medicare Part D program for drug coverage is a joke. Who ever put this in place should be jailed or at least be subject to the plan themselves.”

I agree. Subjecting politicians to Social Security and Medicare go a long way towards fixing problems with these programs.

But don’t hold your breath waiting for any meaningful reforms.

Best bet…detailed study of generics.

Almost every single drug class has a ladder of treatments that has been created over time…so almost every drug-treatable condition is going to have *some* generic alternative.

Pharma salespeople (er, excuse me, “Drs.”) frequently behave as though only the latest, greatest, and surprise – most expense, on patent drug is even conceivable.

The truth is (spend time on Pubmed and Google) that the newest generation drugs’ incremental improvements are smallish, frequently overstated, sometimes completely illusory.

On occasion, new patent medicines (ahem) turn out to be *worse* than their generic predecessors.

Ultimately, it is up to individuals (and taxpayers-via-Medicare) to decide if 10%-20% improvements (defined how? It matters) is worth an extra $5k to $20k per year.

Congrats. That comment surprised me.

Good luck to the zoomers hoping to afford to buy a house. Best scenario they buy it cheap from a boomer going bankrupt.

I have a high deductible supplement for medicare and consider it a total waste of money. So far, regular medicare pays for most of my expenses with very reasonable co-pays. I am seriously considering dropping the supplement whose cost is higher than my regular medicare expenses.

Inflating the interest is one way or return interest rates via Fed to a more normal amount compared to GDP . Interest rate suppression created the inflation issue. The SS forecasts have been wrong and will continue to be wrong for various issues that are difficult to forecast.

Great article. Thanks.

Why don’t we impose FICA taxes on stock options granted to executives in addition to their taxable income? Don’t top executives, like Elon Musk, avoid most FICA taxes by taking a “low” salary and a lot of stock options?

There is also the “carried interest” tax loophole in private equity, which presumably works similarly. It has top dogs paying a far lower tax rate than their lowly employees. There was an attempt to close that loophole this year, but the good senator from AZ was swamped in piles of industry money, and strangled that. If you are not at the table, you are on the menu.

Yes, I think a hedge fund donor called Sinema and said “You aren’t voting to close this loophole”. End of conversation.

There is no moral or business justification for that loophole. The practical justification is attraction of campaign money from wealthy political donors.

She and similarly weak politicians should be escorted behind the woodshed.

Kyrsten Sinema is the name. Identify her for the scumbag actions she takes and hope she loses elections because of it.

Weak actors should be called out by name and advertised at every opportunity. And names should also be used when referencing unworthy actions. This site isn’t a damned guessing game. No acronyms and use names. What are you afraid of phleep? Aren’t you a professor? Speak clearly.

Greenspan, Bernanke, Paulson, Geithner, etc —— scumbags. Why mince words?

weak, or corrupt?

You guys are forgetting the 50 Rs on the other side that refused to vote for this.

hahaha, yes, amazing how that works.

Sociopath Raccoons all the way down, h/t Ben Hunt. See e.g., Jaime Diamon: “I don’t set my salary.” Dick Fuld, Repo 105, Angelo Mozillo, orange before it was Presidential…

Fine, but the revenue raised will be a drop in the oceanic nightmare of the G’s multi-decade over-promise, under-fund entitlement crisis.

May be worth doing from a morale perspective (who doesn’t love a good public burning) but pretty inconsequential from an actual “fixing things” perspective.

There are plenty of rich and/or corrupt dolts running around…but not 10% enough to fix the continent-sized disasters that the political class has designed, cultivated, and profited from.

That last line in comment ,says it all .

Mere political minions DON’T get to “design”, “decide”, or “cultivate” JACK S (but I can guess where you two get your political perspective, such as it is, from)…..and it’s still the SAME big money the politicians do.

They just do what their bosses tell them to do, enjoy a nice high lifestyle while in office, and get their BIGGEST rewards later. Seats on boards of directors, speech fees, or a book or two, maybe a spot explaining things to you two, etc, etc, whatever their bosses decide is best for their bosses.. Or maybe they get such a kick out of the ego boosting things they can do with their power they die in office. Certain their families will be covered well.

There are some exceptions, but you guys are quickly taught to hate them for whatever reason…..with “lines that say it all”, usually.

FICA taxes already apply to any stock compensation executives receive. Though as a practical matter executives’ base salaries often exceed the income cap on FICA taxes ($160,200 next year as Wolf states in the article). For highly paid executives, FICA taxes are often insignificant as a percentage of taxes because of the income cap on which they’re applied. FICA taxes on $160,200 in income is not worth the effort for any executive, much less Elon Musk, to avoid. In addition, deferred compensation plans require current payment of any applicable FICA and medicare taxes on the deferred compensation.

The only real way to address your concern is to significantly increase the income level on which FICA taxes apply, or make it unlimited like medicare taxes. Congress has been hesitant to do this because wealthy people lobby and donate a lot, but also the social security program will lose its pension and insurance like qualities of benefits tied (loosely) to income and be more akin to a welfare program. I’m agnostic on what to do here, and understand the arguments of both sides.

Avoiding FICA taxes in the manner you describe is more common among small business owners who operate as S Corporations. If they pay themselves $50,000 in salary, the 12.4% FICA tax (employer and employee contribution) they save on the remaining $110,200 of the income cap can be very significant as a percentage of their profits. In this case, the small business owner pays themselves a low salary and takes the rest as S Corporation dividends, which aren’t subject to double taxation because S Corporations pay income taxes in very limited situations. If the business owner is too aggressive, in my experience this is an area the IRS likes to audit.

Leona Helmsley had a good quote about this.

Do you think billionaires really care about a 12.4% tax on their first $150,000 of income?

Yes because what they care about over all else is $ Take Powell for example

“Take Powell for example”

Naw ….take Pelosi for an example.

She has 3 times the stolen money as Powell …..

@ 2Banana –

I think they care about a 12.4% tax on their income beyond $150,000.

The U.S. let ‘er rip Covid strategy is also shoring up Social Security, for those who live through it. Best data I could find is that about 75% of the U.S.’ over 1 million Covid deaths were people 65-85+ years old. Removing 750,000 Social Security beneficiaries in about 2 years is quite an accomplishment for our predatory government.

The other side of that coin might be China’s Zero COVID policy: put entire cities in strict lockdown for months at a time. That puts a dent in wealth of all generations, perhaps lowering old-age mortality some. If the USA’s local howlers want to see a meddling government, they should try that alternative. We struck a weird semi-disordered middle path between innovative vaccines, elder mortality, and vax resistors. It cobbled into one sort of answer to the dilemmas, in, I would say, a quite orderly-disorderly, complex American way.

do you even know what you are thinking?

I got his general point. There aren’t any professional writers here as far as I can tell. Wolf gets to set the reading/writing skill standards.

“We struck a weird semi-disordered middle path between innovative vaccines, elder mortality, and vax resistors. It cobbled into one sort of answer to the dilemmas, in, I would say, a quite orderly-disorderly, complex American way.”

What a well-summed analysis.

Just ignore all the extra innocent casualties that came about from the American Way. That’s when you know you are one of us.

There hasn’t been a true zero COVID policy there since around the spring of 2020, the media love to get into the lockdowns as a juicy headline to sell ads but actual shutdowns have affected few cities, are targeted and brief and especially of late, highly disfavored as policy. The focus there has been on improving the ventilation and filtering of air, a lot of testing and tracing, nasal vaccines and holding events outside. US media in general gets almost everything China-related wrong and usually very wrong (most reporters on the ground don’t even speak Chinese), esp anything financial-related. They’ve actually had a lot better economic performance there than anywhere else even with the public health measures. Not saying I’d like to be there for all kinds of reasons but our associates there say events and trade in general are basically proceeding as normal, they don’t even need masks indoors if the ventilation is going well.

One of the plethora of contradictions of the government “science.”

We knew early on that Covid was a major threat to the elderly and those with already existing serious health issues but fairly benign to the young and healthy.

And what happened? Nursing homes were forced to accept Covid patients and schools were shut down.

America’s current four-star admiral in the United States Public Health Service Commissioned Corps, Rachel Levine, removed her own mother from her Pennsylvania nursing home before she order all nursing homes in Pennsylvania to accept Covid patents as Pennsylvania Secretary of Health.

Talk about fuel for conspiracies…

If this is true, she should be in prison ,,,,,,,,,,,

permanently

at least

“there are more important things than living, and that’s saving the economy”

–Lt Gov Dan Patrick

It is true, Cuomo did the same in New York and was going to be investigated for it before he was “me too’d”

Nothing about Covid made sense and still doesn’t and nobody will ever have to answer for it. Ain’t it grand to be completely powerless?

If you didn’t trust politicians and i’m not sure why you would if your memory can even remember back 20 years, its almost like they were trying to add to those statistics they blared in the news 24/7 for over a year.

How many people in your personal circle can you actually say this has happened to? And how old are you?

Quite a many, actually. Several associates in our companies have wound up with blood clots or other kinds of heart disease in the months after Covid infection, others with ongoing lung problems or neurological, many in their 20’s and 30’s, perfectly healthy before. Beyond just any anecdotes, the doctors and researchers are documenting this and the numbers are significant, our health advisers showed us some peer reviewed published papers and there are millions of Americans in this category. Fortune, Forbes, Barron’s have been writing articles about the losses to the US workforce from this so it’s a widespread phenomenon

Well i must be lucky or have good genes, had it in 2021 and haven’t had any complications since. Nor do i know of a single person who has passed from it or been overall hindered by it. Nor do i know anyone who has had any issues from the jab. The only place where i see constant hysteria about it on either issue is via the media…………

Hard to know what to believe these days.

I’m 39 by the way, you never stated your age.

An interesting possible impact of the pandemic. (Probably not so interesting if you’re a retiree). Run the “retiree number” value from the SSA through a %-change y/y, and see what happens in 2020.

Note how exactly opposite it was for recessions in 2000 and 2008.

http://www.ssa.gov/cgi-bin/currentpay.cgi

Its a little painful to use.

What you see:

1. Surge of Boomers retiring starting in 2010; then in 2020-2022, larger mortality rates among people receiving SS benefits due to covid (which hit the oldest people the hardest)

2. Fewer people receiving disability benefits starting in 2015 and ongoing (green line)

Wolf said: ” These figures to not include the Disability Insurance Trust Fund, which by law is a separate entity from the OASI Trust Fund, and is not part of this discussion here.”

————————————

With this being the case, it is confusing that disability enters the charts and discussion. for me, anyway

Per the SL Fed: Working Age Population: Aged 15-64: All Persons for the United States = ~207M

In 2000 that was ~180M, that’s a growth of 27M or so.

Per the chart above, it looks like about 67M are current beneficiaries and there were about 45M in 2000. So 22M have come onto the rolls.

So would you say that the number of working people supporting the SS beneficiaries is increasing?

I know that has nothing to do with the amount of money coming in and going out because that is dependent on taxable income vs. accrued benefits.

But I always heard the refrain that when the boomers retired there wouldn’t be enough workers to support them. Seems this may not be the case.

And yeah, I get that some folks on SS are also still working, so maybe that is another factor!

Again, really interesting picture you’ve painted Wolf, and THANKS!

Just to be clear: “..about 67M are current beneficiaries” => that figure (blue line in the chart) includes disability beneficiaries, which are not discussed in this article and are not included in any of the numbers I cited. This will be a separate article someday.

I pulled up this chart in reply to a commenter. It’s not related to my article.

In terms of the boomers retiring… the millennials are an even bigger generation now, and they’re replacing the boomers, and they’re entering their peak income years now, and many of them make a lot more money than the near-retiring boomers, and their payroll deductions are adding a lot to the income, just like when boomers were in their peak earnings years.

Yes I saw the same thing looking at the raw numbers.

Then I ran these same numbers (specifically your purple line) through a “% change y/y” function, and it more forcefully supports the “more deaths due to COVID” claim you made, since it lines up right on the timeline. It also helped me to quantify the magnitude of the impact, and the timerange over which the impact is being felt. Lastly, it pointed out to me that “people retire early during recessions.” Which I may have already known, but forgot.

I just thought it was interesting. A way to zoom in. Can do the same thing with (say) M2SL.

ANY actual REAL data comes in in Histograms, and I prefer that more than any derived charts…..I can play with them if I think it’s necessary.

Like Wolf said a while back, most people have come out ahead with SS. Comparing the payroll deductions to the benefits received, I’m glad I paid in all those years.

it saves a heck of a lot of tax money going toward social programs that would be needed if SS wasn’t there. Probably almost 100% SS benefits go straight back into the economy. I’m sure it’s a large portion of revenue for retailers such as Walmart.

I’m very pleased with my social security and Medicare I have a Medicare advantage plan that is the bomb SS is not a retirement plan It’s a supplemental plan Like my dad said spend less than u make and invest the rest So many of my friends have refinanced their houses a couple of ghimrd paid off credit cards snd gone on trips Not the wsy to financial security Thank you Dad!!

If employees weren’t forced to pay into the social security program, which is in effect a retirement insurance plan, they would piss that money away and have nothing in old age.

And I think it’s good that they can’t “invest” that money themselves. If they could, they’d all be holding title to bitcoins and NFTs, if they hadn’t squandered it earlier. The general public is incredibly gullible. That’s what worried James Madison. That’s why he wanted an “Electoral College” – to avoid having populists choose an unworthy representative based on something pitiful, like celebrity status or “charisma”. Don’t believe me? Read the Federalist papers. Madison, if he’s watching, is probably spinning in his grave.

I have a VERY persistent sales outfit that somehow got my Docs name and the clinic name. Just got another one who says she’s from the clinic and they want me to call back. Talked to first one and she wasn’t too good at sales and finally admitted she was at home. Another name now. Same number always. It’s not the clinic. Like the old “boiler rooms”, I guess.

If these “advantage” plans are so good why are they hammering away at the advertising? TV is non-stop. I question your “joy”, C, and there aren’t any senile old folks here, so go cheat some elsewhere.

Most states pay the advantage plans at least $1K a month per medicare recipient. That’s why it is so profitable to get enrollees.

What should the COLA actually be to be in line with real inflation? 18? 20?

And how far behind is someone right out of the gate, being that benefits have been falling way behind for decades?

Beneficiaries are not “behind out of the gate.” That happens little by little every year, and it’s cumulative, so after 20 years, it’s painful. But not at first.

“Anthony A.” commented on that here from his own experience.

“For these reasons, it’s very important to build a sufficient nest egg during the working years.”

And attempt to own outright your house before retiring — no mortgage payments. That is helpful.

And being in the same position as you gentlemen, retired and in my 80’s,

I moved out of the SF Bay Area, sold my car, turned off my cell, and am

now living in South Carolina. A culture shock but necessary for survival.

Bought a large place here with two relatives, we all had horses and didn’t want to dump them.

I would go back to work in a heartbeat but who would hire me. I no longer can drive.

It felt like the FED did everything it could to snuff me out but I don’t hear

anyone else complaining so keep my mouth shut, if it’s my tough luck, at least I’m alive.

My brother and I both read every Wolf column when it comes out, it’s helped both of us a lot to maintain some balast.

John V said: “It felt like the FED did everything it could to snuff me out but I don’t hear

anyone else complaining ”

—————————-

Sorry for your plight. Happy you have something. As for your FED comment, they are regular whipping boys on this site, larcenous lacky bastards that they are.

Don’t blame you. Maintaining horses in CA is almost as expensive as maintaining yachts/sailboats….probably a lot more if the boat is easily trailerable. Anyway, enjoy.

Have had so many old friends attempt to do this, professionals and good investors planning things out meticulously–then all their plans went up in smoke, either from a bad illness or divorce. Esp divorce–the family courts are a profit center in the US (and Canada and UK too esp, though not in the EU or South America where it’s more about mediation and shared custody and not seen as a money-making opportunity), and costs of American divorce are crippling compared to rest of the world. Then the hard workers and planners so often lose that home they paid for and a chunk of their savings. Or worse–the divorce courts can impute a wide range of demands for alimony or child support, including a very high previous income year that isn’t manageable anymore, with jail if the ex-spouse can’t pay. (Happened to Robin Williams–the court said he had to pay based on some of his highest earning Hollywood years when he wasn’t making that income, all while he had Parkinson’s, drove him to suicide) Has happened so often and hit so many good Americans so hard that I sort of-wonder if another addition to this good advice would be “don’t get married in the US” or at least, if you do get married and have kids, use your savings to move to a country that doesn’t hammer you into poverty through divorce proceedings that can be initiated at anytime, for any reason

Just be careful not to assume any reasonable return on the nest egg you accumulated. The Government may destroy that expected return at any time.

And not having a mortgage doesn’t mean you own your house. You rent it from the Township and pay them rent once or twice a year. Oops, I meant property taxes, but it’s the same thing. See how long you “own” your house if you stop paying them.

According to the SSA, 55% of Social Security recipients were women and 45% were men.

A third of people decided to receive Social Security at 62.

During recessions more people retired early.

Women live longer than men. A man who is 60 today has a remaining life expectancyt of 21.8 years, compared to a women’s 24.8 years. That’s three extra years at that age to be collecting SS.

Another reason is that spouses can collect spousal beneifts when they hit retirmeent age, while still working, and later, when they retire they can switch to their own retimrent benfits if they’re larger.

This is by far the biggest problem with SS. When it was first implemented, life expectancy was 62. It was not meant to be a retirement fund. It was meant to support those who were disabled or lived beyond the normal lifetime. This age has not kept up with modern health conditions and has only recently started to increase but is still lagging.

Earlier comments also mentioned the cap on collection. I mark that date on my calendar each year when I can expect a 6.25% raise (my employer pays the other half). I don’t understand why this cap exists. It only benefits the rich and lowers their effective tax rate. There is no similar cap on Medicare.

Russell,

“I don’t understand why this cap exists. It only benefits the rich and lowers their effective tax rate.”

The cap exists because there’s also a cap on the benefit you can receive. Symmetry. If you lift the cap, you’ve got to lift the cap on benefits, in which case then you’re just grossing up both sides of the P&L. Kind of pointless.

women live longer, but a third of people receive SS at age 62,

men included, collecting more benefits.

Widow’s can receive SS at age 60.

Yeah. Have yet to find a reason for that longer life span…..a decent “reason” is still mired deep in Nature/Nurture land.

Ms Swamp retired early and is still working. So, this is a case of double dipping.

I did not appreciate the impact of interest rate repression on Social Security until this piece. What an exposure of how not to manage a program that was started in 1935 on the heels of a difficult time period in our country’s history, by leaders with good (arguably) intentions, with a pathway to keep it solvent.

How ironic we are now at the wealthiest (arguably) period in our country’s history, with leaders that have turned “Social Security” into an oxymoron, and the pathway to solvency being ignored like heart attack symptoms.

I never understood all the hand-wringing about Social Security. It is going to keep going regardless of what happens. Nothings is, or needs to be, “in budget” in the US Government.

The only constraints on government spending is spending which pushes overall money supply in excess of GDP causes inflation like we have now.

Congress finds plenty of money to give special interests and fight wars we have no national interest in, and when the time comes they will find plenty of money to shore up Social Security. Of course they never miss an opportunity, so expect them to also use this as an excuse to raise taxes just like they did in the 80’s.

Retirees are still a huge voting block, and the Congress is never going to dare do anything that will anger them.

Wolf said: ” I’m rooting for the old normal interest rates.”

———————————-

So am I, but without inflation. Zero, or maybe .2% inflation. NOT 2% inflation.

I’d be for that kind of inflation.

Same here, in fact Iirc someone commentated here that the “2% inflation target” was basically pulled out of thin air (some note scribbled on a napkin by a Bank of New Zealand official?). No reason to imagine that’s a “good” level of inflation at all, .2% and price stability should be the goal

FED and banks aren’t the only ones who can “print money”, evidently.

In one of Warren Buffet’s earliest annual letters he tries to explain why a company promising retirees an inflation adjusted pension is a promise you should never make. It’s got a tail risk you can not cover. It’s easy to make the promise, might be impossible to keep.

That’s from the perspective of making big profits, and having nothing get in the way of big profits. Social Security isn’t a profit-seeking entity of Buffett.

BTW, a t fell off and vanished.

It’s under the table below the deviled eggs.

Great & timely article Wolf, since I’m planning to retire and begin taking benefits next year!

Interesting how steep the rise was in the 2018-2020 range before the pandemic when the Fed was trying to raise rates. Looks like it is cooking up again at a decent rate now that rates are going up after the pandemic.

It will be really interesting to see that Outgoing vs. Income chart in a couple years once these high interest rates begin to take effect.

Then again, the COLA will probably balance some of that out.

You also have a lot of wage inflation, which pushes up SS income. Part of what you see in the income jump for 2022 is the result of wage inflation. There are a lot of moving parts to this, which is why it’s impossible to accurately predict where this is going.

Every time I read one of Wolf’s Social Security posts, I stop, lean back in my chair, and think, “My God, there is a lot of BS about Social Security out there.”

The BS “out there” isn’t limited to Social Security. The average ninny gobbles that BS up, so you won’t have to step in it if you watch where you’re going.

Very informative article Wolf. Interest rate repression is the gift that just keeps on giving.

Under Medicare A&B, with TriCare for Life, spouse had an in-hospital cardiac ablation procedure, pericardial effusion, with one day in the ICU. Total out of pocket expense… $47. Thank you Medicare and TFL.

As the difference accelerates between contributions and payouts, it is yet another bill coming due. These payouts technically will need to be paid by future tax revenue, the money has already been spent.

“Full retirement age for future retirees could be delayed further but that poses lots of problems for people working in physical jobs and also due to age discrimination – when it’s impossible to find appropriate work.”

So such people – indeed anyone who wants to retire early – need to plan ahead and set aside extra savings to bridge the gap. We all need to anyway, because:

“Social Security wasn’t intended to provide comfortable retirement on its own, and it won’t…”

In the US, “full in retirement age” for people born in 1960 or later is already 67.

Many physical jobs are those that don’t pay a whole lot, such as those in the services industries and restaurants. So it’s kind of hard to put a big nest egg aside.

Many jobs in the trades literally wear your body out long before 65.

A lot of people end up with joint replacements, or spine problems that puts them on SSI before they reach retirement, and they miss the latter year contributions that are the most important for most recipients…

^^ so true ^^

1) Many millennial make more money than boomers. They tend to

buy on credit and pay tomorrow. Millennial in their late 30’s started a family, make a baby and buy a house.

2) QQQ might make a lower low.

3) 100% of META $96B buybacks benefited employees, not shareholders. 90% of GOOGL $156B buybacks benefited employees, not investors.

4) The Fed screwed up the buybacks system. The pyramid above programmers will shrink fast.

5) If QQQ fall and Xmas will be a bust, layoffs will start.

6) The debt ceiling might rise to the 34 Fl, before reaching the penthouse.

7) The Fed will do whatever it takes to have negative rates and prevent

runaway inflation.

8) The gov will blame the other side, but there will not be enough when the boomers generation will retire/ expire.

9) COLA might be cut by half by medicare. Medicare might rise higher than COLA.

For funding SS, I’m struggling to understand this matter of the government issuing IOU’s to itself. If these special Treasury securities pay more interest, then doesn’t that just mean that the government needs to pay more money to itself?

It’s not like my owning a Treasury bond, where the government is paying me money (out of tax revenues, presumably) so I have a net gain.

Treasury securities are Treasury securities and it doesn’t matter who holds them, whether me or the Fed or you or the Trust Fund.

Forget this BS about the government owes this to itself. This money is owed to the workers — it’s THEIR money, they paid it into the Trust Fund, and the Trust Fund bought Treasury securities with the cash from the workers, and the Trust Fund is going to pay it to them when they reach retirement age.

Social security fund peaked in 2017. The deficit narrowed to 32B because

more people are working, earning higher wages and over a million

expired within two weeks, instead of twenty years.

A little off topic, but I had to announce that I just got my 2021 Fed Tax refund which i filed on March 2022. The return was so simple, that you could do it on a 3 x 5 index card as former Speaker, Paul Ryan once boosted. Tax simplification was the goal. Yet it took the IRS 6 months to process the return. Maybe that dude who sold me a hot dog from a truck across from the IRS building on Pennsylvania Ave was correct. He said, the IRS personnel were working 1 1/2 day workweek, and it was hurting his business. He wasn’t kidding. Now they want to hire 87,000 more IRS agents because they are short on people to process returns.

I forgot to add, the IRS gave me $5 more of a refund than I filed for and expected. Because, I’m a numbers person, and obsessed with spreadsheets (my Excell spreadsheets are bulletproof), I wondered why they gave me an extra $5. They didn’t give me any reason.

I went over my 2021 receipts with a microscope and after 3 hours of re-checking the numbers by hand with a calculator I found the reason. One of the SSA tax statements stated that about $50 of income from 2020 was mistakenly reported in 2021 by the SSA. When you take that out it explains the $5 difference in the refund.

The bigger point of all of this is:

THE IRS HAS ALL YOUR TAX DATA BEFORE YOU EVER DO YOUR RETURN! THEY’VE GOT ALL THE DATA IN THEIR COMPUTERS. REPORT EVERY NICKEL!!!

Thanks to Wolf for clarity. The politicians have been trying to muddy up this issue for a long time, and I used to believe them until I started looking more closely.

The SSA itself has done a good job of clarifying facts and breaking myths on its website, but media and politicians don’t want facts.

I enjoyed the article and the comments. I’m about 3-5 Years from retirement. So far, I’ve read doing the normal medicare method with a supplemental policy, and select Part D for drugs is the best way to go.

But, I’m still studying my optioins.

Very clear and informative article, Wolf. Thank you.

Social Security will be fine. The plan will never go out of business. What is going to happen is that you will be paid 75% of your promised benefits in 2035 which will be higher than today. This is fearmongering by the Financial types to demand privatization which if French for Wall Street stealing it.

Also, thanks to Opoid pandemic and the mis-handling of Covid 19 life expentancy is only 76.6 now. Thus, the pension plans will be fine.

Excellent article Wolf,

I would add some concepts. 1) we’ve been sold that it is a retirement plan when it is mainly a generational tax (workers pay for former workers). And as a generational tax, the threshold should be eliminated so the ultra-wealthy pay their share of the generational tax. 2) Why the Republicans want to “fix” it now is that since there is really no trust fund, the on paper decline means it is no longer revenue positive or off setting all the cuts to corporate taxes. They want payroll taxes to remain cash flow positive. 3) Since it really is a pay as you go, raising the threshold would allow a lower payroll tax rate which would be economic positive. But the top 1% don’t want this.