Another big investor that pulls back from the housing market: it’s now a net-seller.

By Wolf Richter for WOLF STREET.

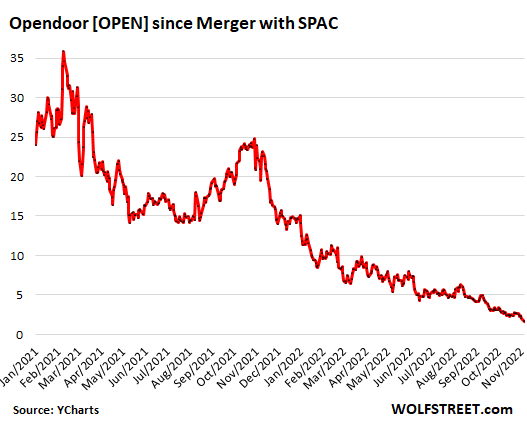

AI-powered home-flipper disruptor real-estate-tech company Opendoor Technologies had gone public via merger with a SPAC in December 2020. The SPAC was a creature of “SPAC King” Chamath Palihapitiya. All of his post-SPAC creatures have crashed. Investors buying tickets to his media-savvy hype-and-hoopla show lost tons of money, but it was a huge amount of fun and worth every penny. And the show goes on.

Opendoor decided to stay in the home flipping business after Zillow, seeing what was coming based on the vast amount of data it churns through, bailed out last year at a huge cost. Turns out home flipping profitably at a large scale is not a business model. It’s a costly dream. Zillow woke up and went back to its roots, and its stock crashed 84% from the hype-and-hoopla peak.

But Opendoor’s roots are in the noble activity of losing money in AI-powered home-flipping, and so it stuck with it and has been successfully losing a ton of money, $2.2 billion from 2019 through Q3 2022, including $928 million in Q3.

The loss in Q3 included an “inventory valuation adjustment” of $573 million, where it wrote down the value of the homes in its inventory, after prices have fallen since it had purchased the homes.

In other words, the company realizes that it will make a massive loss selling those homes because prices have dropped while it owned the homes – and because it’s AI-powered genius overpaid for the homes.

It sure is a lot easier to jump into the market and buy homes when price doesn’t matter, than selling homes when price does matter.

All this would have been a good thing back in the days when the free-money virus was still turning investors’ brains to mush, when losses were equated with success, and when bigger losses were equated with bigger successes.

Now the free-money virus is abating, interest rates are surging, mortgage rates have more than doubled, QT has started, and Opendoor is laying off 18% of its staff – 550 folks in all. “The reality is, we’re navigating one of the most challenging real estate markets in 40 years and need to adjust our business,” CEO and Co-Founder, Eric Wu, told his employees to explain the layoffs on November 2, after having lost money even in the hottest housing market ever a year earlier.

The company has $7.1 billion in debt, collateralized by the homes in its inventory, whose value it just wrote down by $573 million.

And the stock [OPEN] is getting annihilated, having long ago become one of the heroes in my pantheon of Imploded Stocks. Today the shares fell 5.5% to a new low of $1.64, and are down 96% from the high in February 2021 – that infamous February when the whole show started coming unglued. But there is a bigger impact on the housing market.

Opendoor is another huge investor in the housing market that is stepping back!

Opendoor is a huge buyer and seller in the housing market, and it’s getting crushed by falling home prices (wrote down the value of its inventory by $573 million in Q3), and it’s losing a ton of money (lost $928 million in Q3), and it’s slashing its home purchases, and it’s trying to reduce the homes in its inventory. It got battered, and it’s bleeding, and it’s trying to step back from the housing market.

- Home purchases cut nearly in half in Q3: It purchased 8,380 homes, down by 45% from a year ago (15,181 homes).

- Home sales jumped by 42%: In Q3, it sold 8,520 homes, up from 5,988 homes a year earlier — selling more homes than it purchased.

- 21% of its homes have been “on the market” for 120+ days from initial listing date.

But inventory barely declined, and there’s a long way to go. At the end of Q3, it had 16,873 houses in inventory that are now hanging over the market, and it has been trying to cut its inventory by slashing its purchases, but it was able to reduce it by only 3% (from 17,164 homes in inventory in Q3 2021).

In terms of the impact on the real estate market: Opendoor helped pump up prices with its algo-buying over the past few years, and now it sits on nearly 17,000 vacant houses that it must find buyers for, while at the time cutting its purchases, and becoming a net seller.

Opendoor has joined a slew of other big institutional investors that are stepping back from this housing market, each for their own reasons – Opendoor because its investors have run for cover, and it managed to lose money even in the hottest housing market ever (2021), and now the housing bubble has popped, and it’s losing huge amounts of money, so much money that there is simply no hope to turn this AI-powered home-flipping disruptor into a self-sustaining business.

And big institutional investors stepping back from this still ridiculously overpriced housing market adds to the demand-issues the market faces.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Wow, good timing. Covered my short of Open today.

Might have to do another Katoomphed article, bunch of stuff is crashing today and after hours – bitco(i)n, robinhood, affirm, sweetgreen, upstart, coinbase.

Just a matter of time until Uber tanks – they have no choice but layoffs. Have way more bodies than Lyft, although more cash flow.

Whole market should be 25% lower me thinks.

Disney tanking too afterhours. Even mickey is hurting these days.

It broke today that Disney is exploring developing an Indiana Jones series. Coincidence? You can beat the Star Wars horse (equinoid?) within an inch of its life, and price out most families from your theme parks, but you cannot mess with Indy.

Well, there already was an Indiana Jones series

Hollywood just can’t come up with any new ideas.

Upstart, Affirm, Opendoor all join the 90% off club this week. Waiting for a Fed pivot is the only hope shareholders can hang onto,but even that won’t bail out most people, who bought at much higher prices.

I wonder if the glee people felt on the way up was worth the anguish on the way down.

Stick it out guys. It may be a winner yet!!!

It’s still humorous that anyone participating in stocks, refuses to believe the entire market won’t go down 80% from its all time highs. Every index. There is no where to hide, and while these imploded stocks dropping 90% may seem obvious candidates in hindsight, the economic situation is not improving really at all for the rest of the companies that are publicly traded. QE and zero Fed rates forever, pumped stocks up beyond any reasonable valuation. It has yet to be recognized that so many companies kept buying stocks with forever cheap debt, at ever higher prices to keep their stock prices elevated even during QE. In otherwords the zero rates and QE were not enough on their own to keep the stock prices high, but so many firms felt compelled to take out debt or simply burn cash to buy back their own stock. Stock buy backs used to be illegal. American investors are about to learn why that was. The very hard way. 10 years from now, when their stock portfolios are no higher than they are now, or possibly lower, they might begin to question the prior ‘wisdom’ of buybacks.

Stock buybacks are geared to reward C level execs by who happily burn cash to pump their stock option positions into the strike zone, pure and simple. It’s capital destructive, says to the world, we run this company but we’re too stupid to deploy our cash to create real growth through innovation. Should be outlawed again.

It wouldn’t be surprising if CNBC soon quits giving the crypto quotes space on its main billboard along with Dow, Nasdaq, metals, and FX. At some point the network’s participation and thereby validation becomes an embarrassment.

Bitcoin next stop is 12,000. Maybe then crypto will be relegated back to its formal space as nothing more than a useless money laundering platform for drug dealers or tax avoiders.

Bingo!! Next stop, multiple country ban due to aforementioned reasons.

Comments like these illustrate the widespread lack of understanding of Bitcoin. It’s about the worst thing for money launderers, drug dealers etc. As the entire blockchain is open and records every single transaction, forever. It’s incredibly easy to trace for the 3 letter agancies, or especially private sleuths. Now other cryptos, invented in order to be private, are a different story.

The last couple of days when I log onto Fidelity I have been seeing this message:

====================================

“Fidelity Crypto℠ is coming

Our focus on education will help you invest in crypto with clarity.

Get on the list”

====================================

I was a little surprised by this.

Don’t be too surprised. They aren’t your fiduciary, in spite of their moniker: “Fidelity”.

Why is house speculation such a cancer?

I was reading a Bloomberg article how a tiny country in South America discovered oil and the locals, instead of rejoicing, are not happy.

When I researched the country, they are suffering from a massive housing bubble because American companies are buying up the real estate and advertising extremely high prices in the local market.

Honestly these corporate flippers and AirBnBs are cancer.

In other words oil value is getting sucked up into urban land value.

The locals there work for US$500 a month. They are complaining that they can’t afford to buy land in their own country.

How does oil inflate property values?

There is a theory called the Resource Curse/Dutch Disease (usually applicable to smallish nations that strike oil).

Basically, the concept is that the huge flood of foreign currency into the nation (to buy the oil) hugely inflates the value of the local currency (foreigners have to buy up local currency to pay for said oil).

While that huge boom in the value of the local currency allows locals to buy all sorts of foreign consumer goods, it badly hurts the *export competitiveness* of all non-oil exports of the small oil rich nation.

That is the curse…the gutting of intl competitiveness…in everything other than the oil “gift”. Once the oil fades, they are screwed, because all other industries have atrophied or vanished.

You usually don’t see mention of the Curse’s impact regarding local housing…but I imagine that the dynamics are roughly the same.

The huge surge of wealth into the country (but only mostly to *some* of its most connected/relevantly skilled citizens) creates a sort of slanted/rigged auction for locally produced goods…like housing (wood, concrete, labor…which is also being seduced into the rich oil sector, etc).

So the nouveau rich oil people start building McMansions and local non-oil people see their own needed inputs/products be bid away for said McMansions.

Just a theory, but possible for a period of time.

Thanks for the comment.

It’s amazing how the American speculators are trying to cash in on third world countries, but the locals are not gaining any of the benefits unless they already own property.

A crap ton of airbnbs sit empty and unrelated, yet another absurd business concept, where people thought the internet could make a successful business model of something that is not a viable business without or without the internet.

Do you have evidence to support your comment? I keep hearing about an ‘airbnb busy’, but I see no proof of that.

Ugh, Airbnb bust I mean.

Stated at a air bnb in Idaho falls co ,owner lived in basement rented top level .Nice but overpriced,ratarting to remind me of depression days . Rent a room a room at boarding house,don’t pay lock on door

It really needs regulation and curtailment globally. Caps on SFH ownerships and all foreign ownership, extreme taxes and fees on empty units etc. You can fiddle with rates and all it does is make it cyclic. Doesn’t help ordinary people in the long run.

“In terms of the impact on the real estate market: Opendoor helped pump up prices with its algo-buying over the past few years, and now it sits on nearly 17,000 vacant houses that it must find buyers for, while at the time cutting its purchases, and becoming a net seller.”

This is a company which should never have existed in the first place, which did nothing more than price working families out of shelter over their heads. This is the society that the reckless, corrupt FED and crony capitalist politicians have created. There is a special place in hell for Bernanke, Yellen, Powell and Co.

What if it was all a front to goose up prices on existing inventory? (…takes off Reynolds Wrap fedora)

AFAIK almost all politicians are invested in RE.

DC

Agreed

This is the kind of society that existed in Weimer Germany in 1922/1923. Most people working in useless jobs, manipulating paper, no moral values, decadence predominating in every aspect of society. All honest work ethics were destroyed in favor of greed and speculation. You all know where that led to.

Now here today, we have about 1 million financial planners doing nothing for God & Country but getting commissions for manipulating people’s investments. I believe we have about 100 Realtors for every property listed for sale here in the Swamp, another job where there are too many unneeded people working in this field. All the fake companies that are collapsing should have never existed in the first place and wouldn’t have but for the irresponsible actions of the Fed and prolific spending by Congress.

We need to clean out the whole ball of wax like Paul Volcker did in 1981/1982.

Unfortunately with the gargantuan debt levels, there is no way on the planet anyone can imitate Volker’s actions from the 80s. Fed fund rates will hit a self imposed ceiling of about 6%. Due to the cost of the interest on all the debt, it won’t be possible to go any higher without massive defaults that would lock up the entire financial system.

Agree – And since Volker, we have had numerous overseas collapses tied to Fed tightening. And post 2008 it is all more tightly coupled to the US$. With so much debt, directly or indirectly, tied to the US$ it will make the global collapse huge.

A lot of people realize the Fed has backstopped the EU. They don’t (I didn’t until I recently read Helen Thompson’s Disorder) realize that they also backstopped the Chinese. Everything is so tied together through the US$ that you can’t just take corrective actions and assume your going to have an economy when you come out of it.

Yup. Financial planners only plan for their own well being. Stay away. Far away.

(Fingers burnt on stove).

My mother and father got tangled up with one of these characters and he was churning their account like nobody’s business. I tried to talk to Mom about this but she shut me down. After all, this guy was their *friend.*

Now that Mom and Dad are both deceased, believe me, I am staying the you-know-what away from this and other financial planners.

Lesson learned.

Oh, as for Opendoor, a couple of nearby neighbors purchased one of their houses.

According to one of them, they are having to do a lot of work to redo what the Opendoor people messed up. She warned me and others to stay away from Opendoor.

DC….You forgot one of the old masters of the Fed…Greasespan !!!🤑🤑🤑

Greenspan 2.0 was a disaster like the rest of them.

Greenspan 1.0 was a gold bug

Does anyone here ever consider that the FED, politicians and globalists have done all of this on purpose?

Any corporation that owns a house that is vacant should be taxed 100% of the purchase price of the home — each month.

Agreed, these mass purchases of housing inventory just to drive up housing prices represent the very worst form of crony and parasitic capitalism. All made possible by QE, ZIRP and the reckless Fed policy in general of the past 40 years. Only now are they reversing this dangerous course but JPow needs to go full Paul Volcker to even begin to undo the damage. A mass housing bubble at this level (let alone the asset bubbles all over the everything bubble) are a sign of a fast declining society.

A jenga tower of buzzwords.

If you say it quickly enough, “algo-buying” sounds like “alco(hol) buying”.

Same outcome. Drunken recklessness.

“AI-powered home-flipper disruptor real-estate-tech company”

At the time, it probably sounded pretty cool.

Don’t know till you tried. And evidently they did!

It reminds of the original Rollerball film (James Caan, etc). A very underrated half-genius, half-addled, half-assed film (that’s right…three halfs!)

Caan spends the film trying to get to the bottom of his future society, to find out who really makes the decisions, and why. (Mainly because his first wife was compelled to marry an “Executive”, the Rollerball rule changes are becoming more fatal, and because he is being heavily strong-armed into retirement…despite being the best Baller).

Anyway, towards the end of the film, after much struggle/battle he finagles his way into the central computer complex, where the AI that more-or-less runs things and is the central repository of all human history and government control exists.

When he gets there and talks to the AI…

…it turns out it is senile.

(Ladies and gentlemen of the United States…meet your corporate and DC elite.)

Gotta see that!

Time for me to pivot. This is not going as planned.

My buddy in PHX sold to Open Door. Deal was made in May 2022 and closed June 29th. I warned him to not be surprised if they tried to lower the offer at the closing table. I recommended even if they did, take the money and run. I figured if even a schlub like me could see the market rolling over maybe they would try to take advantage. They did nothing but hand over a check which was likely higher that what a private party would have paid. Just crazy!

It would seem Open Door is conflicted.

The inventory it would hope to sell at the highest attainable prices would be compromised by the housing it might otherwise seek to acquire at a discount.

The business model is in pieces. It’s intractable. The entire portfolio needs to be dumped.

Open door is same as house flippers on tv ,except they have no experience and contractors fleecing them .Even flipping loses money sometimes Bad investment idea

I hadn’t thought about that part of it. Fleecing or otherwise, contractors get dear on the ground in a busy housing market. Presumably they aren’t so busy now, but it is a little late for that quick flip.

Naa, mom & pop house-flippers are usually just run of the mill opportunists, and many of them get crushed in the downturns. Opendoor and its kin are much more evil. A small-time local flipper can limit how much they pay in the first place with a decent understanding of what they’re buying. They can monitor their projects and adjust to changes in the market much more quickly. They’re also usually working with their own money & debt which at least gives them some sort of incentive to keep things reasonable. In normal times, the flipping business is based on buying a beater, cleaning it up, and selling for a reasonable profit because the market can’t support huge profit margins. And if they fail, they’re the ones that directly feel the painful hand of justice as it smacks them off their feet.

Opendoor and other i-buyers are big blind entities steered by scumbags who have no skin in the game, just skimming other people’s money off the top of their designed-to-fail investment operations. Their blindness and easy spending have played a big role in driving prices to unimaginable heights.

We should continue to allow primary resident owners to do what they want to do with their own properties, but tax the heck out of profiteers big and small who want to quickly flip single family homes. If the property is held short-term and vacant during that time, tax it hard enough that only really blighted properties make financial sense to clean up and resell. That alone would break the boom & bust cycles while making housing much more affordable. Coupled with interest rates kept closer to the inflation rate, it would keep greed in check while reinforcing something that society desperately needs like healthy family formation.

But instead, we can count on our institutions of power to do the exact opposite of anything that would actually work in the best interest of average Americans. Ds or Rs in power doesn’t matter.

Payday someday!

The payday has already come and gone. Somebody made money on this, but they got out a long time ago.

Just a cynical guess…

SPAC, a great way for professional investors to unload at the top of the market onto unsuspecting retail investors backed by taxpayer funds.

SPAC sounds vaguely raise-ist.

Apparently an illness ultimately cured by the Quote-duh! system.

“I just used the laws of the land” -Chamath whatever

and first said by the other “deal making” guy.

Now I gotta go see who our rich bought this time to make even more corporate, financial, and tax law for them.

…or if government isn’t really needed anymore……

SPAC, a great way to substitute wild projections for traditional financial disclosures (as would happen with a regular IPO before offerings for sale). And the suckers couldn’t get enough of it.

“Disruption” and “innovation” nowadays often means repackaging old scams. “AI” has turned out to be the marketing buzzword of the decade (the last decade’s, still lingering, was “green”).

Anyone that invested homes for flipping or rentals after 2018 was taking a huge risk. I’ve been flipping and renting for 45 years. I ONLY buy homes at the bottom (like 2010-2012) as many as I can (avg $35K ea) and fewer and fewer as prices rise. I can invest with debt at that bottom as long as they are paid off in 5 years or sold. Opendoor, Zillow, and anyone that bought after 2018 were fools, including white bread home owners.

Sounds like a plan – but how will prices ever find a decent bottom in the foreseeable future? No stomach myself for flipping/renting, but sure do want to buy my own home after missing the opportunity a decade ago.

I bought in 1993 in the Midwest – after another banking-related disaster (S&L debacle and don’t know what else) though not as bad as 2008-10. But sold in 2017 before the crazy runup, leaving me w/no home.

It seems like the mortgage lenders themselves need to go belly up in order to really suppress buying – hence prices – but at this point the lenders seem too well cushioned.

Upstart, Affirm, Opendoor all join the 90% off club this week. Waiting for a Fed pivot is the only hope shareholders can hang onto,but even that won’t bail out most people, who bought at much higher prices.

I wonder if the glee people felt on the way up was worth the anguish on the way down.

Im short Affirm too. Just another cash furnace – the business model makes NO sense.

All this is actually health restoring to the markets. The last 3-5-10+? years were a speculative frenzy based on fed printing and sociopathic liars. Now we need to see housing fall 50-75% over the next 2-4 years.

They bought the house directly behind me back in May for $766k. Must have put at least $20k into the place. It has now had two price reductions since being listed back in early Sept currently sitting at $756k.

Guess the AI still needs some tweaking.

Most people have no clue how an “AI” works.

There is no “tweaking” an AI because noone has any clue how it really works internally. That includes the people who “trained” it. It’s not like a ttaditional computer Program where you can look at the code and Change it, because there is no code.

Basically AI’s are super – hyped pattern matching Programs that scan huge amounts of data from the past for patterns and whenever they identify such a pattern in current data, they do something that worked in the past when that pattern occured. Like buying or selling a stock because it went up or down after said pattern occured in the past in the chart.

AI’s are terrific for stuff like diagnosing cancer based on radiological images or finding occurences of natural resources based on geological data, i.e. whenever the context does not change.

When it comes to everything where human behaviour or changing macro contexts are involved however, they just do the same thing over and over again, regardless of context.

Which is a definition of insanity.

Maybe the Zuck is on to something with his Metaverse. Might be a good place for a CEO to hide out while this shit un-winds. The Opendoor CEO could sell Rolex knock-off watches while wandering around in the Metaverse. The CEO might run into the Zuck and Jack Dorsey feasting on the Zuck goat kill do-over. The dude that launched New Coke will definitely be there.

Buy a flipped luxurious ex-ICBM silo with M16 armed security and safely wander the Metaverse to get out once and awhile?

But nobody wants their money in bonds (interest rate crush) or cash (inflation). I think the real wake-up call only comes when credit goes bad. Corporate credit defaults crippling liquidity. Otherwise the money is just being shifted from one stock to another in the hopes of riding out the storm. And nobody wants to miss the ride back up. But I have a big hint for those investor types, the ride is not coming for 3 years. Go cash and hold. Cash or gold if you want to play risky.

If you want a real world example of Opendoor operational effectiveness, look up the current listing of 109 Clove Hitch Dr, Statesville, NC, on Zillow. It is one of their properties. History:

5/3/2020 Prior owner buys property for $216,000

6/13/2022 Owner sells to Opendoor for $378,500

7/11/2022 Opendoor lists property for $406,000

7/21/2022 Opendoor drops price to $399,000

8/4/2022 Opendoor drops price to $360,000

8/25/2022 Opendoor drops price to $351,000

9/15/2022 Opendoor drops price to $337,000

9/29/2022 Opendoor drops price to $328,000

10/20/2022 Opendoor drops price to $312,000

11/3/2022 Opendoor drops price to $308,000

So they are already conceding at least a $70,500 loss (18.6%) on this one property in four months… and they haven’t even sold it yet!

They’re the pros. That’s how you move something. You cut the price until it moves. Homeowners should learn a lesson.

Sounds like the car business.

Cut the price of the dogs on the used car line. If that doesn’t work, sell them to a wholesaler. If that doesn’t work, they go to the auction.

Then, fire the UCM who bought those dogs in the first place.

LOL, yes that’s sort of the process.

I find it an interesting commentary on their cost of capital, and where they think real estate values are headed.

Similar story to a nearby house to me (although Opendoor hasn’t quite taken that insane a level of a haircut on this one). Opendoor bought it 5 months ago $643,000. Within a month, they tried flipping it for $706,000. I’m guessing all they did was some repainting (including making one room a really dated ugly orange color) and maybe put in some cheap new appliances.

After 6 price cuts, if they get the current asking price they will be out about $25,000 (ignoring any additional initial purchase costs, carrying costs, money spent on renovation and selling related fees whenever it does sell). I suspect that the house being on a very busy road is the issue because it’s stats and current price otherwise aren’t too out of line with other recent sales.

I’ve seen the same in my area, algorithms are deeply flawed in real estate as there are too many aspects to consider with homes. AI pricing cheap, cookie cutter, all vinyl siding starter homes at the same price per square foot as custom homes. I’ve been watching one home they purchased in a cheaply built starter home neighborhood. Opendoor bought for $318k, previously sold in 2016 for $139k, no renovation, no upgrades since this time. Opendoor listed for $339k back in May of this year, and the price now sits at $266k which is still waay too high for this property with no offers! Looks like they’ll be eating the property taxes on this one too, so minimum net loss thus far of $52k!! This seems to be the case on many homes they’ve gobbled up and has been the main driver of inflating our market here as we weren’t seeing this before they began to prey on our area. One thing is sure, AI home buying is in imminent failure and they deserve every bit of it!!!

AI trend forecasting typically sees runaways in the sense that if things are going they will go up FOREVER. The opposite direction is true as well.

So when you base everything off an algo that sees a trend and “forecasts” it without any additional assumptions you are in for a world of hurt. Forecasts require quite a lot of adjusting but ultimately you’re aiming for a trend that includes outside factors. I do this for work at a Fortune 500 and if I called a number Jan. 1 everyone would assume I had no idea what I was talking about. There’s only one way I’d come out ok at the end of the period and that would be entirely based on luck. Not a great business strategy, as open door and others are quickly figuring out.

This sounds very familiar — as essentially the same critique of the statistical models that blew up in 2008. And it happened in the same field: house prices. It seems a fancy new label for old failed attempts at pseudo-science, keeps finding new takers. The best calculation of this, flawed as it is, still involves a human brain, IMO, because there are always subtle inputs that need adjustment in real time. (Same for contracts, which can blow up easily with a pre-programmed, self-executing so-called “smart contract.”) People can get lazy and dependent with fancy models, which can give slick, precisely wrong answers.

Yes and Opendoor will also probably get out of paying their $67 million settlement for ripping off Hard-working blue-collar homeowners just struggling… The company executives will take their money and run they don’t care

There’s no need for AI to build a money losing business, human stupidity is more than sufficient.

Haha. That’s really a good one. This is one of the best quotes on AI that I’ve ever heard.

Boy, sure glad I got full ask last month in the city, think u sf city worker loan assistance, u made up for my crazy property taxes

Cool! I suspect they might have some houses in one of the areas I’ve been looking at.

Does anyone know what they put as “owner” of these individual homes through the counties paperwork? Is it Opendoor LLC or something like subsidary LLC #8567666?

They have a huge number of LLC’s and Trusts. Start with “Opendoor” and see where it takes you. In our county we have:

Opendoor Property C LLC

Opendoor Property J LLC

Opendoor Property Trust I

Opendoor Property Trust C

Thanks for that GP:

And WE will be watching as the ”price” of RE in our hood goes, once again as always, back to some ”basic” level…

Most of the neighbors talked to have said they purchased their HOMES for even less than ours, $75K,,, including some for less than $30K ”back in the day(s).”

NONE,,, repeat, NONE of these later days prices are anywhere near the basic prices of homes in our hood…

OTOH, who can tell with all these recent GUV MINT ”interventions” into ALL markets???

Wolf wrote: “The company has $7.1 billion in debt, collateralized by the homes in its inventory, whose value it just wrote down by $573 million….”

Does anybody know who these creditors (the designated bag holders) are?

I’ve been seeing a lot of news articles and advertisements come out on REITs lately as a hot investing trend. Hope regular folks don’t bite that hook in large numbers.

I saw Wolf on Youtube today talking to Wealthion’s Adam Taggart. Discussing “The most splendid housing bubble”. I didn’t finish it yet but its good.

I’ll prolly post it here pretty soon.

Your tongue in cheek reporting of the SPAC-o-mania bubble, decompressing, reminds me of a dialogue that seems to capture the “stars in your eyes” hope that inflates such cockamamy schemes, in the clarity of 20/20 hindsight:

So, Mary, tell me. what are my chances, one in ten.

Well, no, Loyd, more like one in a million.

So what your saying, is there a chance,

Although, I admit, I enjoy the sweet irony of foolish commupance, I am aware that the con men that invented this garbage, walked away with billions to employ in the next con.

The naivete of western economies, which are riddled with this kind of get rich quick schemes, concerns me.

Craftmanship and honest business are being lost to the lowest common denominator in a race to the bottom.

But, I am old school.

I am also old with a central tendency to cling to the meme that yesterday was better than today, let alone tomorrow.

Thankfully, I have turned responsibility for the outcome of mankind to the younger generations. So far, it doesn’t feel like they’re doing such a good job.

One of the points I wanted to comment about was how uncertain artificial intelligence solutions are. From my experience with neural networks, I have commented several times on this site about the unreliability of AI when applied to a social environment.

They tend to choose the worst behaviors as the best independent variable to minimize the sum of the squared variance error, based on a data set developed from a human population. Once the training session is completed, the best “model” can be used to predict the best set of inputs (social construction) that will maximize profits.