Raging inflation ends an absurdity.

By Wolf Richter for WOLF STREET.

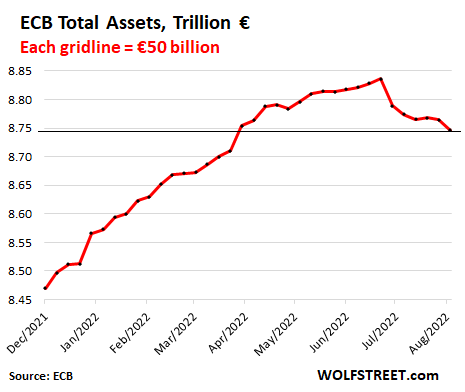

Total assets on the ECB’s gargantuan balance sheet as of August 5, released today, dropped by €18 billion from the prior week, to €8.75 trillion. It was the fifth week-to-week decline over the past six weeks.

Assets have fallen by €90 billion from the peak on June 24, to the lowest level since March 25. But given that gigantic pile of assets, the €90-billion decline, which in normal times would seem like a huge amount for normal people, is just a dip of 1%.

The two categories of the ECB’s QE assets – lending related to Monetary Policy Operations and securities holdings – both fell:

- Lending peaked on June 27, 2021 and has since fallen by €92 billion to €2.22 trillion.

- Securities holdings peaked on June 26, 2022, and have since fallen by €13 billion, to €4.44 trillion.

On July 21, the ECB announced a rate hike of 50 basis points across all its policy rates, which brought up its deposit rate to 0.0%, thereby exiting its absurd negative interest rate policy.

At that time, the ECB also announced a new tool – the Transmission Protection Instrument (TPI) – that would allow the ECB to perform quantitative tightening without triggering a euro debt crisis where government bond yields of fiscally weaker Eurozone countries spike, threatening their ability to roll over maturing debts and issue new debts.

During the Euro Debt Crisis, spiking sovereign bond yields caused Greece to default on its government bonds, and threatened other countries, such as Italy, Spain, Portugal, and Ireland.

The TPI is designed to prevent a sovereign debt crisis and keep the Eurozone glued together, even as the ECB hikes rates and sheds assets to fight raging inflation. It’s called the anti-fragmentation tool for that purpose. I call it the glue gun.

Under this policy, the ECB is able to unequally shed assets, for example allowing German and French assets to roll off faster than Italian or Spanish assets.

The end effect is still QT, with overall asset holdings declining, but this QT is spread unequally across the sovereign bonds of various countries. It may mean that the ECB’s bond holdings of some countries, such as Italy, might not decline, or might even increase, as its holdings of German, French, Austrian, and Netherlands bonds might fall more sharply.

And it’s working, sorta: The spread between the German 10-year yield and the Italian 10-year yield is currently 2.14 percentage points, with the German yield at 0.92% and the Italian yield at 3.06%. And that’s considered to be in the acceptable range.

Why QT and Rate Hikes? Worst-ever inflation in ECB history.

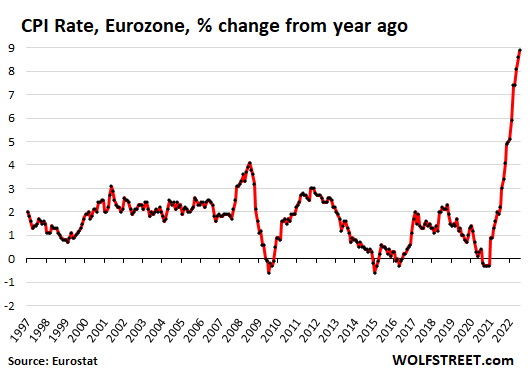

In its history of just a little over two decades, the ECB has never encountered the kind of raging inflation that is now tearing into the economies of the member states. And people are getting very frustrated.

The overall consumer price inflation rate for the Eurozone in July spiked to 8.9%:

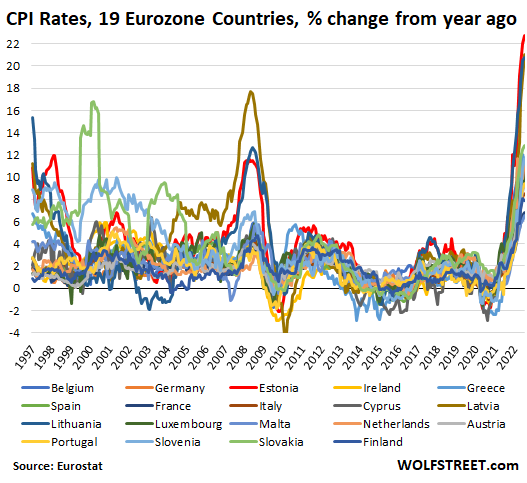

But inflation rates vary widely by country. In Germany, the inflation rate is 8.5%. In seven countries, the inflation rate is between 10% and 13%: the Netherlands, Belgium, Greece, Spain, Cyprus, Slovenia, and Slovakia. And in three countries, the inflation rate is over 20%: Estonia, Latvia, Lithuania. This is some serious-ass inflation.

The ECB is ridiculously far behind the curve with €8.75 trillion in assets still on the balance sheet, and declining way too slowly, and with interest rates at 0%, while inflation is 8.9%. At this point, the ECB is still throwing lots of very volatile monetary fuel on the raging inflation fire. It’s still an inflation arsonist, and not an inflation fighter. But it is making the first tentative steps in the right direction, though loo slowly, too little, and way too late.

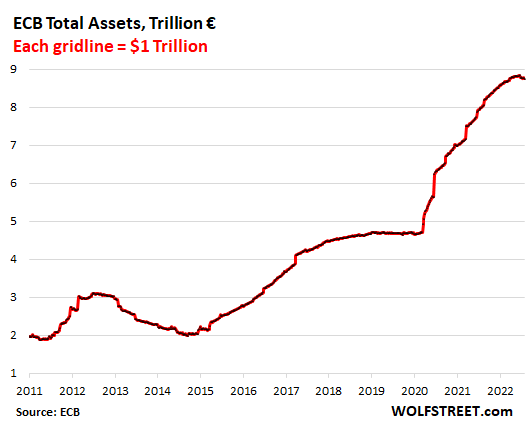

But the ECB has managed to do QT before, and in a fairly big way: In the period between mid-2012 through early 2015, its total assets fell by about one-third. But the chart also shows just how unthinkably crazy the ECB got afterwards, particularly in March 2020, and that the huge bout of inflation shouldn’t really surprise anyone:

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Ah, so now the ECB has hiked rates all the way up to zero.

That seems like hiking their pants all the way up to their ankles.

In US, markets are already celebrating for anticipated Fed Pivot due to minor drop in inflation to ensure negative real rates for long term future

Those hoping for correction in prices are now realising that “THEY ARE PERMANENTLY POORER”.

Lol, and the 700Billion dollar of additional government spending will “not” add to inflation. As if they are really going to collect additional taxes before (or even after) this spending.

The power of perception continue to reign over reality, along with crazy volatility. If the inflation # comes below 8.5%, next month, asset bubble will continue to increase.

Yeah, I think people are looking at the derivative of the inflation rate and if inflation does not increase each month everything is fine. I guess they can’t figure out that inflation is the derivative of prices and even a constant or decreasing value is bad until it gets to zero.

A German “Billion” is an American trillion, so it’s all correct.

always learning something new!

A large part of the price hikes is expensive energy as Russia is sanctioned and have cut supply. About 40% of the natural gas supply could be lost and it maybe is 20% down. (Half of the Russian supply is gone.)

Now, how will higher interest rates cure this supply constraint?

Demand destruction, well that Russian natural gas is around 10% of the total energy supply. Then comes Russian oil. Cutting more than one tenth of the energy use may also cut the economy activity by the same amount.

It is possible to use interest rates to supress demand to lower prices, but there may be a catch. What do a 10% or larger contraction of the economy look like?

You will freeze hungry in the dark.

But you can proudly say “We are sticking it to Put!n!”

Failing to engage in conflict is a terrible decision, one that puts our temporary comfort and the avoidance of discomfort ahead of the ultimate goal of our organization.

–Patrick Lencioni

OK. I’ll be over next week to forcefully take your car. I wouldn’t want to comfortably sit at home when I could achieve the ultimate goal of my organization to build wealth.

Wouldn’t want to disappoint you by failing to engage in conflict. Live in a no cash bail area?

Not engaged in the conflict? Aren’t we sending like half a billion dollars of our money each week? On top of that bipartisan $40 billion?

Very profitable war for the MIC. Laundry machines humming along.

Europe is finding substitute dirty energy (coal) for the lack of Russia Nat Gas. I read France seems to be running their Nuclear power plants a little harder than they would like.

EU did import coal from Russia too…

A number of French nuclear power plants are shut down fro maintenance. They found cracks in them.

And with the heat wave several nuclear and coal fired power plants had to run at reduced output due to cooling issues.

The price of electricity is 500 % more than it was 2 years ago. And Europe is buying gas from the US at what? 3-times the Russian price?

Welcome inflation, it’s here to stay.

Just be glad we are not in China and can invest in a stock market that over time always go up.

The ETF FXI is the same price it was 10 years ago while the SP500 is up a couple hundred percent.

The FED is so much better that the Chinese Central Bank. LOL

The Chinese credit mania shows up in real estate. That’s the difference with the US.

The US stock market valuation wise is alone in deep outer space. Some other markets have recently broken out above the late 90’s and 2007 peaks but not nearly as much.

So…only 49 more years to go!

“to the lowest level since March 25. But given that gigantic pile of assets, the €90-billion decline, which in normal times would seem like a huge amount for normal people, is just a dip of 1%”

It took the ECB a little over two years to cut its assets by a third (mid-2013 to early 2015). But when that started, it was slow-moving too and hard to see at first.

Well from 3T to 2T, so now from 9T to 6T? With Germany already facing recession?

It’s really incredible that the Germans who would give everything to have their Deutschmarks back, let the ECB drop the ball on inflation. It is really astonishing to see that.

It just looks like nobody cared about what was going to happen in the medium or long run.

Now there is a sevenheaded beast outside, raging and no one wants to take responsibility for that … well, except for Russia – they are the scapegoats for everything.

To be honest…it is still pretty absurd.

“On July 21, the ECB announced a rate hike of 50 basis points across all its policy rates, which brought up its deposit rate to 0.0%, thereby exiting its absurd negative interest rate policy.”

1) The Rhine was drained. Shipments to & from Rotterdam, Europe largest, are limited. Barges are moving slowly at 1/3 capacity, about 10cm/ 40cm above the bottom, in the shallowest areas.

2) Transportation cost are rising.

3) A new heat wave will make things worse. There is not enough water in the Rhine. Shipping might totally stop. The Rhine is clogged.

4) House boats are stranded. People walk from side to side.

5) Europe water and energy shortages are growing. The ECB cannot fight

exogenous causes by raising rates from (-)0.50 to zero.

If only they had alternative methods of shipping.

Maybe something that runs on metal tracks and can move heavy bulky objects long distances without too much trouble.

Ah, we have some of those things here in Germany but they are not working as well as the y used to after 20 years of US-Style neoliberal politics here in the Fatherland. In fact most stuff here is starting to look like Biden runs this place as well. Once the US foreign policy has destroyed what is left of the European economies then we will all look like Alabama.

Yes, I am rather annoyed.

Not to detract from your main point, but you might want to take another look at Alabama. Some of your fellow Deutschlanders did, and built a giant Mercedes manufacturing plant in Tuscaloosa. Spinoff industries are popping up all around, too. At least that part of the state is doing well.

You haven’t been to Alabama in while. The northern part of the state is crushing it. Huntsville is flooded with MIL, GOV, and space money.

They have, but rail shipping cost more than barge.

Cool.

For a second…I was pretty worried.

“Shipping might totally stop.”

The central banks in the EU should not be considered ‘sovereign,’ because they do not control the euro, which is the currency of record. If they each retained their national currency, then a lot of adjustment would have been made to mitigate inflation. There would have been inflation, of course, caused by the pandemic destruction of supplies across the board. Toss in a stupid invasion by Russia of Ukraine and you increase the supply reduction. Debt centric financial systems create boom and bust economic cycles. It’s baked in the cake. There may have been other cases, but the only inflation caused by money printing (that comes to mind) was probably the fiat greenback that paid for the northern armies of the Civil War. And that inflation subsided after the war.

You omitted US foreign policy. That’s even more stupid than Russia’s. Go back to 2014 or even earlier when it all started. This wasn’t a “black swan” happening out of the blue.

perpetual perp

“The central banks in the EU should not be considered ‘sovereign’ …

You mean the central banks of the Eurozone. Central banks of other EU countries have their own currencies: Denmark, Hungary etc.

Freight in Northern Europe has to share the railroad network with local commuter rail and longer distance passenger service, all of which dwarfs the busiest areas of the US rail system. It’s well out of the ordinary to travel any distance by rail in this country. But anybody behind the wheel of a car on America’s roads today doesn’t remember a time before interstate highways and drive-ins. Driving any distance was often indirect and congested in Europe, Autobahns and autoroutes and autostradas notwithstanding. Lots of lighter trains make sense in crowded Europe, here they’re heavier freight and need range to pencil out. And in the Munich area some of the small train stations in country hamlets are being closed for lack of riders, but even those people might drive to the nearest train station now and park, or take the bus. They were the stations that I remember as a kid where the same three or four people got on the train each morning. There’s more cars now, but people still have no problem with taking a train. Mostly untrue here, other than the northeast.

The Rhine and nearby rivers are also significant tourist destinations, and cruise boats usually draw more water than barges. This has to impact transporting the area harvests too.

I’m sure that the Italians and Spaniards and Greeks will band together to save their EU compatriots from the consequences of having joined the wrong club of mooches for transitory economic gain. Borders create value, and will return to Europe. And maybe other places too.

Contrary to popular belief there is quite a lot of freight moving on rail in Europe. One of the largest marshalling (switching) yards is found in Germany. Most of this freight moves at night when passenger traffic is less. The biggest holdup to more (tonnage) moving by rail is the old out of date “Hook and Screw” coupling system used in Europe. This limits how heavy and long freight trains can be. The EU has been trying to push more freight to rail as most of the European rail network is electrified.

Prepare for a hard recession. Too much debt too kill inflation without a lot of pain. Being so far behind the curve means it’s going to be a crash landing I believe.

Only 8.5 % inflation and the stock markets roar ahead. What will it truly take to flush ALL the gamblers out of the financial system? The participants are so addicted to movement in the markets. Slow consistent growth just won’t do. Movement downward won’t do either, as that will cease to bring in the new money of the man in the street. So, the day traders, the private equity,and even the bankers can’t really help themselves, such is their addiction. They can fool themselves and some of the great unwashed for only so long. Will it take a soup and bread line for day traders like in ’29 to flush most of the excesses out of the system?

A market crash like the 1930’s. This mania is bigger than that one.

Everyone was worried during the 1st few months of the year we were going to have run away inflation. Maybe we would see the 10% plus interest rates of the 1970s.

This de-acceleration inflation print is calming and the market is thinking we hit peak inflation. A couple of more interest rate hikes to get to around 4% to 5% is probably it.

So this is a big sigh of relief. The FED will probably be done raising rates by the end of the year.

Just my opinion.

You’re forgetting one key thing. The market is obscenely overvalued if interest rates are 4-5%. The valuations were only justifiable under permanent ZIRP.

You also are forgetting that many zombie companies will fail under a 4-5% interest rate regime.

Einhal – Good points. Most of the Zombie companies have already lost 80 to 90% of their valuation. Even if a bunch of them fail, will they effect the markets at all?

I say that because the top 10 companies in the SP500 make up 30% of the SP500 valuation. I am not even sure if there are any Zombie companies in the sp500? There may be one or two but their weight would be small.

Just the top 4 companies in the SP500 make up 20% of the SP500 valuation.

I am curious, what are you basing your overvalued metrics on?

For valuation, if you look at (trailing 12 months) TTM PE we are at 19 for the SPY I believe. That is barely overvalued. It was 39 at the peak last year. Historical average is 16. It has not been this low since 2012

Now if real earnings later this year come up short of the expected earnings, then the calculation will show overvalued. I just do not know how much. Earnings have been coming in better than expected so far.

I have to believe the new normal prices (homes, cars, food) is going to take a bite of the consumer spending habits eventually and 70% of the U.S. economy is consumption.

Some stock market sectors may do well with inflation as big monopolistic companies can pass price increases to the consumer. Small companies may not be able to do so going forward.

I think the consumer is in for a bit of hurt moving forward.

Ru82 – I’ll address these one by one, in quotes, so it’s easy to read.

“Good points. Most of the Zombie companies have already lost 80 to 90% of their valuation. Even if a bunch of them fail, will they effect the markets at all?”

We are defining “zombie” differently. What you have seen in Wolf’s imploded stock list are companies that failed and were either absurdly overvalued meme stocks or never had a viable business model. There are many companies that can last quite a while (for example, the Bed Bath & Beyond and Macy’s of the world), but rely on cheap money to pay operating expenses. There are many of those that will not be able to refinance their loans if they have to pay 2-3% more.

“I say that because the top 10 companies in the SP500 make up 30% of the SP500 valuation. I am not even sure if there are any Zombie companies in the sp500? There may be one or two but their weight would be small.”

See above. Even many of those top 10, while healthy at first glance, derive much of their valuation from the availability of cheap money to their customer base (both individual and corporate).

“I am curious, what are you basing your overvalued metrics on?

For valuation, if you look at (trailing 12 months) TTM PE we are at 19 for the SPY I believe. That is barely overvalued. It was 39 at the peak last year. Historical average is 16. It has not been this low since 2012”

The last 12 months have been based on trillions of excess “stimulus” floating around the economy. That isn’t likely to be repeated, unless one is to argue that suddenly our economy was twice as strong coming out of COVID as it was before.

“Now if real earnings later this year come up short of the expected earnings, then the calculation will show overvalued. I just do not know how much. Earnings have been coming in better than expected so far.”

I guess where we differ is I put ZERO value on earnings “beats.” Even in normal times, companies beat estimates 75% of the time. That just shows that either analysts suck at their jobs, or that they intentionally set estimates low so that companies can “beat” them. In any case, what good is beating estimates if your earnings are still down 25% year over year?

“I think the consumer is in for a bit of hurt moving forward.”

Here, we agree!

Energy prices plunged. Some goods prices dropped. Most services and housing spiked, food spiked. So that plunge in energy prices is going to end pretty soon. And then what you have left are the others.

“What will it truly take to flush ALL the gamblers out of the financial system?”

Wrong question IMO. Should be”when will we stop the Fed from manipulating our lives so much?”

Roaring twenties was a direct consequence of crazy credit expansion by the Fed.

Traders act based on artificial incentives created by the Fed – be it 1920s or 2020s.

And here in the US we are rejoicing at the fact that the CPI is at 8.5% (Truflation says more like 9.6%), but I’m sure Wolf will have something to say about that! *;o)>

The big news is that it’s 0% MoM. That’s a HUGE victory for Powell and co. No surprise to see stocks and crypto blasting off today. They should be up way more, but the day is still young.

indeed very good news. but it is still unlikely that the fed will pivot in september, at least one more 50 bps hike i assume.

Except that if they start loosening monetary policy again, those gains will be reversed. Anyone who thinks that this means the Fed can stop hiking and start cutting doesn’t know how inflation works.

I agree, but it is not what the market thinks. one hopes that the country learned from its mistakes early in the pandemic. in that case we were looking for the pivot as well in the form of “15 days to stop the spread”. of course that only ended in surge after surge.

So the second derivative (change of change) is now zero. All hail Powell!

So, are we seeing a big divergence from the path of the USA? US markets this morning are partying like it’s 1999. I wonder of there is capital flight from Europe to our equity markets, etc.? One common denominator, though, IMO, is weak central bank credibility.

No one cares about the CB credibility when Stonks are going to the Moon!

The few stocks I follow are not pricing in a recession. They are priced about right if there is a soft landing.

Virtually every stock is at least twice what it should be. The gold and silver stocks being the exception.

And do we know where this $91 billion of assets landed? Is it just another ECB front company/bank?

Those assets matured, were paid off by the issuer or borrower, and rolled off the balance sheet without replacement. No one got those assets.

But the money (the €90 billion the ECB received for them) was destroyed, just like it was created when the ECB bought those assets.

QT destroys money in the reverse way in which QE creates money.

The printers roll backwards?

No silly, they burn the cash for heat and to keep the forges working!

And the Magical Money Tree starts withering.

The FED wants to get inflation down. That means prices still go up but do not rise as fast (9%) but only at a target of 2%. It looks like they are now succeeding in slowing inflation down. It will not happen overnight.

This does not mean prices need to fall….just not rise as faster that 2%. The money for the COVID stimulus was printed and sent out and is in the system. It is not going away. There is more money to buy the same amount of stuff but it is being absorbed by higher prices and higher interest rates. Now QE, that was going on for 10 years and is mostly debt I think. They can remove some of that liquidity by maturing the debt.

I had some puts on housing and travel starting last week. Boy, I was wrong looking at the market today.

So I think the FED is correct that some of the inflation is transitory from the Covid Stimulus cash that that was put into everyone’s saving account. FYI… Just 3 weeks ago car dealers were telling me 3 to 6 months to get the type of SUV I want. About a week ago they are calling or texting every other day that they have several SUV I am looking for in the lot now.

The FED will look successful if prices stabilize. I don’t think we are going to see much of a drop in the price of new cars, houses, or food. Prices may drop a little as the input costs have come down but wage increases are sticky.

Interest rates has certainly cooled demand but time also cools the demand as people use up their stimulus. 1st it was goods and now it is services.

But I have to believe the last 3 months drop in oil prices and food prices will decelerate the rate of inflation.

Yes, the Treasury had to sell new bonds to come up with the cash that the Fed then destroyed.

Who bought those new bonds? The Fed will buy some of them, the rest have to find a home in the bond market.

” going to see much of a drop in the price of new cars, houses”

Wishful thinking. Prices have to come down or interest rates have to come down. Which one is it?

1) No more forbidden Russian coal coming to Europe through Rotterdam.

2) Europe might import coal from other countries, but the Rhine is clogged.

3) No coal/ no natgas.

4) Coal/ natgas prices are going crazy.

I have the premonition that it is a lost cause for the western fiat banking system to get their act together; yielding to the whims of the IMF / WEF or being slowly rolled over by the emerging BRIC system supported by gold.

What say you, WOLF ?

Ewwww… there’s a nasty four letter work! Not BRIC, but GOLD!!!

Only old men watching “Gold Rush” on Discovery care about gold. It’s a barbaric relic some say. Others say gold is money, everything else is credit.

US still running 1T budget deficit for 2022 and politicians still act like they are upset about inflation. Next couple of years going to be interesting.

All of the QT is apparently transitory. CPI for the US just came in at a massive 8.5%, but since it’s “lower than expected, and cooling,” the DOW just blasted off because infestors have decided that the FED will only be doing 50 basis points, not 75, and a pivot is coming. If that’s actually true, it goes to show the FED actually doesn’t care about inflation and is beholden to Wall St.

I wrote it last month- new highs in August/September are not impossible or even improbable.

This market looks to me like it will bankrupt everyone, bull and bear alike.

They printed too much money. People will not be bankrupted by “the market,” they will be bankrupted by inflation.

In the Fed’s defense (and I rarely defend them), they haven’t given any indication that they’re going to stop QT and stop raising rates because of a slightly lower inflation reading. That’s all market hopium.

Let’s see in 6 weeks what they decide. But with CPI so far ahead of inflation, it shouldn’t even matter that if it came in at 6%, they should be aggressively raising to get in front of it. The fact that CPI fell by a few tiny decimal points month over month is like statistical noise when you factor in the fed funds rate.

IMHO Federal Reserve is acutely aware that their credibility as currency guardian is badly damaged, and are very eager to restore their credibility. Their next meeting is an excellent opportunity for them to do that. My bet is that they use this opportunity, and will go for 75 bps hike just to show to everyone how determined Federal Reserve is to defeat the inflation, and how little market expectations matter to Federal Reserve vs the inflation threat.

Jus looking at lAst 15 yrs or so. Market knows how the fed will react. Powell is minions are useless bunch….inflatio is what they prefer. There is no going back.

Butters,

You still don’t get it: for most of the time since 2008, inflation was at or below the Fed’s target. Now it’s around 3x the Fed’s target. You’re in dreamland.

Once the U.S. dollar falls all the commodities will spike higher in the first quarter of 2023 after the midterms are over. Inflation will make new highs in the first quarter of 2023.

The Social Security COLA is determined by the CPI-W computed in the third quarter, Jul-Aug-Sep. The Gov would like to hold CPI-W as low as possible in the third quarter but it has kinda gotten out of control. Therefore they will fudge the numbers or manipulate the data to perceive inflation has been checked (change-in-change 0%) until Nov (coincidental the mid-term elections) and then the inflation flood gates will open again. Can’t let those pesky retirees get too much comfort.

Regarding the chart showing the CPI rates for the 19 Eurozone countries. I think it would be interesting to see same CPI chart for non-eurozone country Switzerland.

Just for a fun comparison.

CH has low inflation, 3% I think due to the massively overvalued franc. However, the Rhein is drying up and Switzerland gets most of its stuff via that route so maybe difficult times ahead if it doesn’t rain.

Switzerland had to cut a deal with the Germans during WWII for energy, they had limited hydro and nothing else. After the war during the first winter the conditions were almost as bad there as in the defeated country. They learned not to trust or rely on other nations for security or sustenance then. Becoming a respectable haven for foreign loot helped them up, and nobody’s been really poor there ever since. The swiss have advanced aeronautical manufacturing capacity and large pharma, the two things grownup countries usually have. Culturally they’re Swiss surrounded by high-powered cultural Mecca ‘s like France, Italy, and Germany so no fair comparison is possible. The watches and the chocolate are just laignappe. I remember a good bit of river traffic at Stein an Rhein, and the dry riverbed bottoms won’t be good, but they are Swiss and being swiss means they plan for contingencies. They’ll have a plan for this too. The Genossenschaft won’t go hungry. The traffic light coalition next door may be asking them for juice this winter.

Stein am Rhein, verpflixtem spellchek.

“Infestors”……very good DC 😂😂

There has been a lot of talk recently regarding QE and why the Fed and ECB both insisted on running QE well past any reasonable monetary amount and period of time. This caused me to think about why would a central bank insist upon running QE for too long. After a little thinking I came up with the following. Something like 90% of all institutional assets are owned by either the mega banks, mega corps and the uber wealthy. In other words, inflation is good for our financial overlords. Please also notice what happens when inflation spills over to wage inflation, this is when the calls go out to kill the inflation. This leaves me to wonder if the central banks aren’t influenced by conflicted self interests along with distain for working people.

Gee, ya think? This was intentional. 100%. They used a health crisis to personally enrich themselves to fantastic proportions. Now they are trying to make those new asset prices “stick.” They’ll never admit it, but that’s exactly what they’re doing.

The slower, longer and more drawn out an inflation response is, the higher prices go. And, as Wolf has pointed out, they don’t reverse. Some people think that once inflation is tamed, prices go back to what they were. No. They just stop going up so fast. These pigmen are planning on keeping all of those sweet gains of their own making.

All of this feeds into dollar denominated assets. CPI is down 1/2%, 2Y yields are off 11 bps, so the BE widened! And stocks are up 2%. Not sure the dollar index won’t break 200 before this is over. The Fed clown car has no effect. SBs on main street go bankrupt while corporate Am waits for the Fed truck to back stop them. In 2008 my cousin said his bank wanted to charge him 20% operating loan for supplies in his business. So he took out a home REFI.

I was checking out home inventory in my city.

After 5 months of increasing inventory, it dropping. Maybe because interest rates dropped or just the seasonal real estate cycle.

I do see price reductions, but not many

Vacancy rates for homes and apartments are still lower than aveage but there are plenty of apartments in my area being built for the people who cannot afford a Single Family home. Thus it appears there shortage of housing units.

The power of perception and hopium are too strong over the reality. Fed will accommodate them by slowing the rate of increase or even pause.

This is a ultra dovish Fed with ‘hawkish’ skin. Long way to go before ‘fundamentals’ matter.

I still say that the real story is that a very small amount of QT is already impacting the economy and the Fed will not be able to go very far with it. The real story is that we are trapped with these very large balances of debt on the Fed balance sheet, due to a really weak economy, where we make NOTHING.

That is the real story here, not the story of endless inflation. Sure, the Fed and ECB will need to keep tightening for the next 3-6 months or so, but they wont get close to liquidating the balance of debt that was purchased during the COVID era.

So it is fully structural now and will continue to make our financial system more unstable, will cause asset bubbles, etc.

What we really need is a Fed that is willing to just sell this stuff no matter what happens to the economy. We need to get our production and consumption to match up, and that will be a painful process.

I dont think any politicians or bureaucrats have the stomach for it. Too bad we dont have a guy like Volcker in charge.

Negative rates are an acknowledgement that currency has no value. Maybe not so absurd, the way they are running things.

Hi WOLF, could you please do an inflation, housing & interest rate analogy for us CANADA people.

We need to know the good, bad & the ugly , please.

Here are a few of them:

https://wolfstreet.com/2022/07/13/things-are-not-normal-right-now-bank-of-canada-hikes-by-monster-100-basis-points-after-us-cpi-fiasco-the-fed-might-do-too/

https://wolfstreet.com/2022/06/24/inflation-forecasts-arent-worth-the-paper-theyre-written-on-this-is-about-the-bank-of-canadas-reaction-to-inflation-but-its-the-same-in-the-us-a/

https://wolfstreet.com/2022/04/21/the-most-splendid-housing-bubbles-in-canada-april-update-as-yields-spike-bank-of-canada-hikes/

https://wolfstreet.com/2022/04/13/front-running-the-fed-bank-of-canada-hikes-50-basis-points-to-1-0-kicks-off-official-qt-unofficial-qt-already-shrank-assets-by-15/

As I see it, the biggest problem with this monetary system is the distortions it causes in markets. It stands to reason that in a capital intensive economy, correcting those distortions would require time to retire plant and equipment, and even more time to build plant and equipment to service the needs highlighted by price discovery. I think the central bankers think they’re flying a jet fighters when they pull their levers, when in fact they are at the helm of the Titanic.

These graphs, especially when compared against similar charts for $US valuations over time, seem to illustrate that “they are all irrationally valued in the first place”. The problem in holding currency is trying to decide which is ‘most irrationally’ valued, but how do we do that when they’re all based on a #DIV/0! error in the first place?

Unless you’re sitting on paper dollars, you’re NOT holding currency. You’re holding an asset of some sort that may or may not earn interest, and that may or may not rise or fall in value.

In the past months German, French and Dutch bonds held by the ECB dropped by 18.9bn euro’s (due to the bonds maturing) and nett purchases of Italian, Spanish, Portuguese and Greece bonds by the ECB totalled 17.3 billion Euro’s. Of which 9.8 billion was in purchases of Italian bonds. That is monetary financing of Italy. TPC or no TPC, no need for Italy to keep their debt on a sustainable path or apply sound macroeconomic policies.

The ECB is selling German debt to “the market” (whatever that is) and using the proceeds to buy Italian debt. This can only go on for a while though as the ECB will run out of German bonds. I suppose it would be easy to look up the numbers and see when this particular sticking plaster is going to come unstuck.

That last chart is fascinating. The ECB was much more hawkish than the fed-until 2015, when they went bonkers and the fed kept tightening.