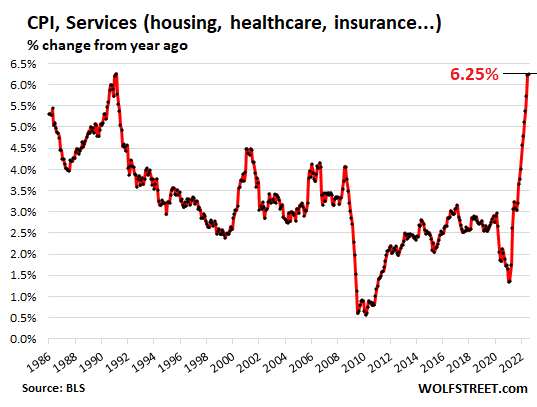

Inflation in services is now where the action is, not commodities or durable goods.

By Wolf Richter for WOLF STREET.

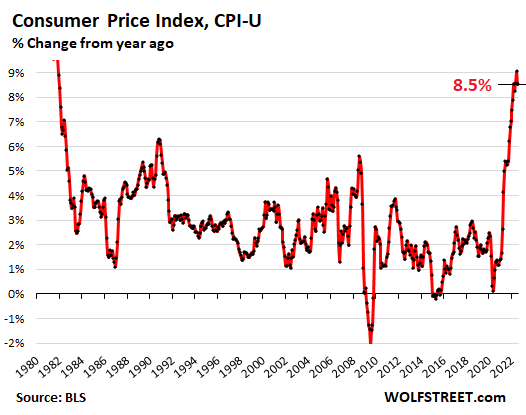

Inflation as measured by the Consumer Price Index backed off a tad in July to a still ugly 8.5%, from the super-ugly 9.1% in June, as food prices continued to spike, but gasoline and natural gas prices fell sharply, and prices of durable goods backed off their crazy spike.

But inflation in services rose to 6.25%, the highest since 1982. The CPI for services is still below overall CPI and is still pulling down overall CPI. But it has been getting worse every month for 11 months, and as other price spikes back off, the services CPI pushes to the forefront. That’s how inflation works after it’s entrenched: it cycles from category to category and pops up in different places, while backing off for a while in other places.

The headline Consumer Price Index (CPI-U), released today by the Bureau of Labor Statistics, was unchanged for the month, after two ugly month-to-month spikes, and rose by 8.5% year-over-year:

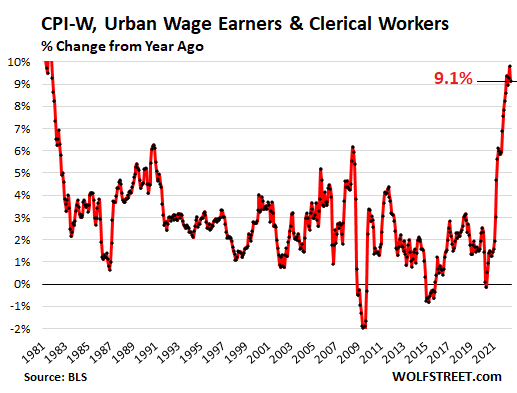

Social Security COLA: CPI-W, the first month of three.

The Consumer Price Index for “all urban wage earners & clerical workers” (CPI-W) backed off to a still horrible 9.1% in July. The average of the July, August, and September readings will be used to determine the COLAs for Social Security benefits in 2023, and July’s 9.1% is the first month in this average of three months:

Services Inflation worsens.

The CPI for services continued its relentless spike, rising by 0.37% in July from June and by 6.25% year-over-year, the worst increase since 1982.

Some services, such as airfares, are indirectly influenced by commodities (fuel). Others, such as insurance, healthcare, housing (based on rental factors), etc. are not, and a decline in the prices of commodities don’t reduce inflation in these services.

Inflation in services is now where the action is, and it’s very tough to get inflation in services under control:

Service categories where CPI rose year-to-year:

- Health insurance: +20.6%

- Rent of primary residence: +6.3%

- Rent, owner’s equivalent: +5.8%

- Motor vehicle maintenance, repair: 8.1%

- Auto insurance: +7.4%

- Medical care services: +5.1%

- Delivery services: +14.0%

- Pet services, including veterinary: +9.3%

- Airline fares: +27.7% (-7.8% monthly)

- Hotels & motels: +1.0% (-2.7% monthly)

- Other personal services (dry-cleaning, haircuts, legal services, etc.): 6.3%

- Admission to movies, theaters, concerts: +6.2%

- Video and audio services, including cable: +3.8%

- Water, sewer, trash collection services: +4.4%

Service categories where CPI fell/remained flat year-over-year:

- Telephone services: unchanged

- Car and truck rental: -11.9%

- Admission to sporting events: -2.7% (but +4.9% monthly)

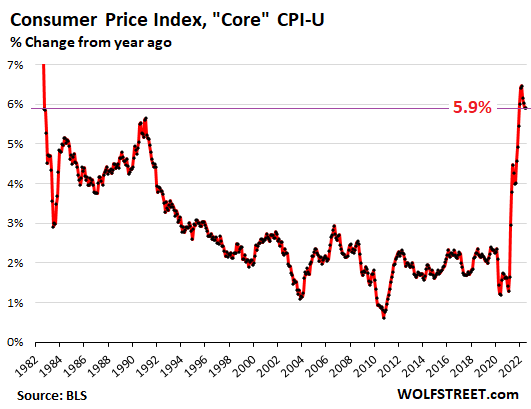

“Core” CPI.

The “core” CPI excludes the volatile commodities-dependent food and energy components to track inflation in the broader economy. Services are a big part of it. But so are durable goods.

It rose by 0.3% in July from June, after the red-hot spike in June, and by 5.9% year-over-year, same as in June:

Food prices spike worst since 1979, but shift among categories.

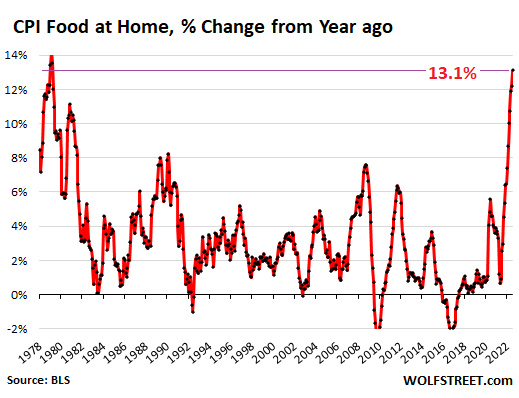

The CPI for “food at home” – food bought in stores and at markets – spiked by 1.3% in July from June, and by 13.1% year-over-year, the worst spike since 1979.

Food is one of the categories where inflation hits consumers in the face on a daily basis. And it hits people in the lower part of the income spectrum much harder because they spend a relatively bigger portion of their income on food.

Inflation cycles from category to category, in a game of inflation Whac-A-Mole. For example, as you’ll see below, beef and pork prices, which had spiked over the past months, have now stabilized at very high levels, as folks changed to poultry. And with some demand shifting from beef and pork to poultry, poultry prices are spiking. And eventually, price spikes might return to beef. This is the same principle everywhere.

Major food-at-home categories, and % change from a year ago (and % change from June):

- Cereals and cereal products: +15.0% (+1.8%)

- Beef and veal: +3.4% (unchanged)

- Pork: +7.6% (-0.2%)

- Poultry: +16.6% (+1.2%)

- Fish and seafood: +8.7% (-0.1%)

- Eggs: +38.0% (+4.3%)

- Dairy and related products: +14.9% (+1.7%)

- Fresh fruits: +9.0% (+0.2%)

- Fresh vegetables: +7.3% (+0.1%)

- Juices and nonalcoholic drinks: +12.9% (+2.0)

- Coffee: +20.3% (+3.5%)

- Fats and oils: +20.8% (+2.2%)

- Baby food: +15.0% (+2.1%).

“Food away from home” CPI – restaurants, vending machines, cafeterias, sandwich shops, etc. – jumped by 0.7% in July from June, and by 7.6% year-over-year. Both June (+7.7%) and July (+7.6%) had been the worst since November 1981.

Energy…

The Energy CPI plunged by 4.6% in July from June, driven by plunges in gasoline and natural gas, which were a big contributor to the headline CPI getting a little less hot. But year-over-year, the energy CPI was still up 32.9%:

- Gasoline: -7.7% for the month, but still +44.0% year-over-year.

- Utility natural gas to the home: -3.6% for the month, but still +30.5% year-over-year.

- Electricity service: +1.6% for the month, +15.2% year-over-year.

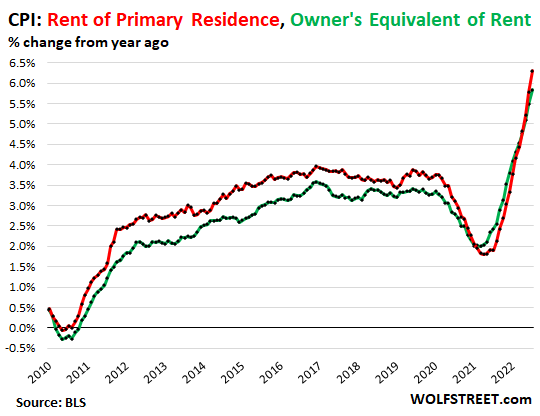

Housing costs.

The CPI for “rent of shelter,” which is included in the services CPI and accounts for 31.7% of total CPI, attempts to measure housing costs as a service – “shelter” – not as an investment asset to be purchased. Its two components:

“Rent of primary residence” (accounts for 7.2% of total CPI) jumped by 0.7% in July from June, and by 6.3% year-over-year (red in the chart below). It’s based on what a large panel of tenants reported about their actual rent payments over time, including in rent-controlled apartments.

“Owner’s equivalent rent of residences” (accounts for 23.5% of total CPI) jumped by 0.6% for the month and by 5.8% year-over-year (green line). It attempts to measure the costs of homeownership as a service, based on what a large panel of homeowners report their home would rent for.

Both measures have been surging relentlessly, but are still below overall CPI and are still holding down overall CPI, but are holding it down less each month, and will become a major driver of CPI inflation:

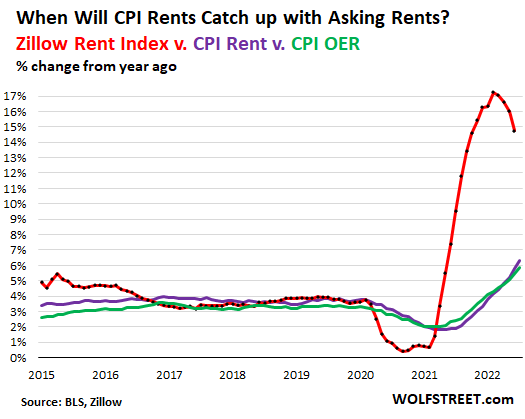

The “Zillow Observed Rent Index” (ZORI) reflects asking rents – meaning the advertised rents of apartments and houses listed for rent. They’re a measure of rents that landlords are trying to get on their vacant units.

In June, the latest data available, the ZORI jumped by 0.8% from May, to a record of $2,007, but that 0.8% jump, though still huge, was smaller than the prior month-to-month spikes.

Year-over-year, the ZORI spiked by 14.8%, which is little less massive than the prior spikes.

It takes a while for asking rents (red line in the chart below) to turn into actual rents that tenants are paying and reporting as part of the CPI panel, where they’re eventually picked up by “rent of primary residence” (purple) and by “owner’s equivalent rent” (green).

The rent spike since mid-2021 has been so sudden that it accentuated the lag between the CPI rent indices and the ZORI (my discussion of this phenomenon, the lag, and what it means for CPI into 2023):

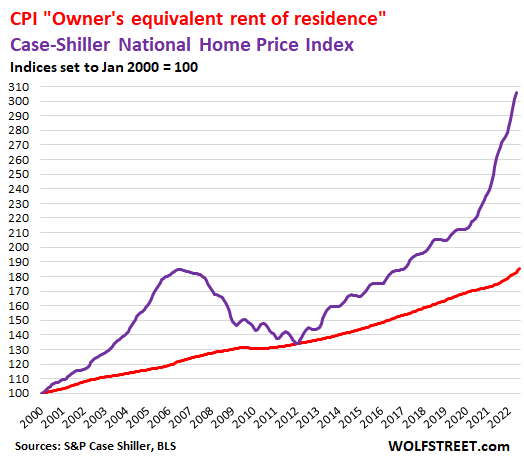

Home prices spiked by 19.7% year-over-year, according to the latest Case-Shiller Home Price Index (purple line below), which lags four to six months. I’ve been documenting this raging mania since 2017 with my series, The Most Splendid Housing Bubbles in America.

But the CPI attempts to measure the cost of housing as a service via its “owner’s equivalent or rent” (red). Both indices here are set to 100 for January 2000:

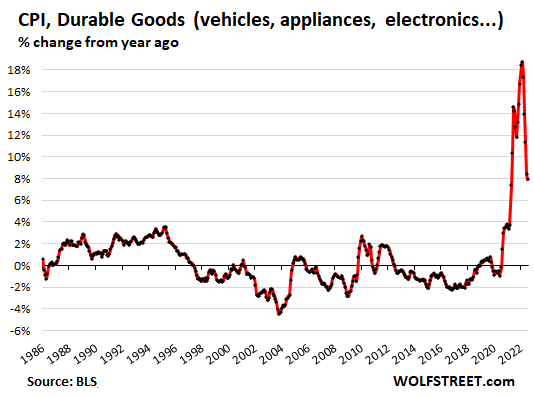

Durable goods CPI.

Durable goods went through a huge boom during the pandemic that caused prices to spike in a ridiculous manner, notably in new and used vehicles, but also in other categories. This boom is now winding down as consumers are shifting their spending to services.

The CPI for durable goods rose 0.3% in July from May, and was up by 7.9% year-over-year, which is still a huge amount of annual inflation, but it was down from the crazy levels in the 17% to 19% range early this year, and was the smallest year-over-year increase since April last year

Some major categories of durable goods:

- New vehicles: +0.6% monthly, +10.4% year-over-year

- Used vehicles: -0.4% monthly, +6.6% year-over-year

- Household furnishings (furniture, appliances, floor coverings, tools, etc.): +0.6% monthly, +10.8% year-over-year

- Sporting goods (bicycles, equipment, etc.): -0.2% monthly, +5.2% year-over-year

- Information technology (computers, smartphones, etc.): -0.9% monthly, -8,1% year-over-year

A word about prices and CPI in information technology products.

As the list just above shows, information technology products had at a negative CPI. Computers, smartphones, and other electronic devices have gotten immeasurably more powerful and useful over the years. Some of those products didn’t even exist 20 or 30 years ago. A good PC with two floppy drives and no hard drive, and no internet connection cost around $2,000 to $3,000 in 1985. This would be a useless boat anchor today. A $1,000 laptop today is immeasurably more useful and powerful.

CPI attempts to track the loss of purchasing power of the dollar, in other words how much you pay for the same product over time. So when a product gets a million times better, it’s not the same product anymore. If the price stays the same, or declines, though the product gets better, then this is “deflationary.”

Tech products, thanks to constant invention, have been “deflationary” from the beginning of time. And that’s a good thing. That’s how it is. CPI adjusts for this via hedonic quality adjustments. And that’s why the CPI of tech products should be negative, and it usually is.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Didn’t see professional services. Maybe I missed it. My Civil Engineering firm adjusts billing rates every July. An average 10% increase this year.

Insta,

“Professional services” between a service provider and a business are never part of CPI = CONSUMER price inflation.

CPI tracks only prices of goods and services that CONSUMERS commonly purchase.

What is included are “personal services,” and they include all kinds of stuff, such as legal services and haircuts. But consumers rarely hire civil engineers, and so it’s not in the basket of goods and services that consumers commonly buy.

Really good article Wolf.

Haircuts were $5.50 – $7.00 in 1986. Motel chain Super 8 cost $8.00 per night. Politicians called a top countless times, especially around voting times. Pay attention to Wolf and his readers, they know more than the politicians who want to stay in office until they die.

Just before pandemic haircut was $15.Recently the same place is charging for the same haircut $21, that is a whopping ~40% more in 2 years. I know lot of people are now used to cut their own hair at home but man this is a large increase.

What is really amazing is that the Federal Reserve didnt start liquidating MBS a long time ago, as prices of homes started to skyrocket. They still havent really done much to liquidate that support of mortgages.

Fed can only roll-off MBS.

MBS holdings in its books yield 1-2% less than current levels.

Selling in open market will force the Fed to mark to market (nice big haircut). Which in turn will force Fed to write off the value of its MBS holdings.

Someone can correct me if that’s not the situation.

In rising rates environment, number of refis drop.

People who don’t have to sell or take out equity, won’t have a reason to refinance. This means less mortgages terminating. That makes rolling off MBS even slower.

Clearly, Wall Street sees it differently. Stocks are up; bond yields are down; and federal funds futures markets are confident that a policy pivot is coming in the next 6-12 months.

Wall Street has been calling the top on inflation every single month, but like a broken clock, they’ll eventually make the right call & scream “told you so!”

Maybe a top, maybe just noise volatility. Although we’ve been recently seeing some straight lines, that usually doesn’t hold up.

Feels a bit top-ish though overall. Maybe it will plateau, which would be too high, maybe inflation heading down. I’m not sure of anything — pandemic and post-pandemic have been a wild ride.

I doubt fed will declare victory from a muddled picture like what we are seeing but may at least signal a bit of backing down if declines continue. Folks seem to read what they want out of weathervane Powell. I certainly wouldn’t think a rational market would really but speculators going to speculate.

Gasoline goes from 2 to 5 average and it drops to 4 and politicians do cartwheels to say all is well. Got it.

This reminds me of when I lived in Denver. During a drought year, the fear mongering began of we are going to run out of water now (I will concede sometimes rightfully so) and they would encourage or require residents to cut back on water. Then the water utilities and newspapers would rejoice and the reward for everyone lowering their usage was a nice rate hikes because they didn’t make enough money for maintenance and other needs. So rates went up but of course they never went down even when the next year or years were of normal or high precipitation and reservoirs were refilled.

And reminds me of a book if you give a mouse a cookie.

Thanks Wolf for informing!!!

So funny to see my book being used in this comment! Thanks for the mention!!!

Wow! WHAT are the odds of that?

I looked up your book and it looks like a great lesson for kids about the unintended consequences that can come from good intentions or, in some cases, intentional consequences to develop and maintain dependency for political reasons. “The road to hell is paved with good intentions.”

No way!!! So fun!!! We are big fans!!!

Wow!

I read “If You Give a Mouse a Cookie” to all of my kids and now I am reading it to my grandkids.

Good book and great job!

Actually, We are reading “If You Give a Moose a Muffin” to our grandkids.

If you have an excess cookie, give it to a homeless person’s kid….make his day…..and maybe give him some faith in other people.

This stupid book analogy is about PEOPLE, right?

(although I once solved a real bad ant problem at our kitchen at work by buying them off with Karo syrup behind the stove…it worked for years….never told anyone, but they were all very pleased the ants were completely gone.)

You are going to raise a generation of pigs.

If you let a pig take something from you without resisting, you you will just raise more pigs.

Constitutional Max net wealth ($10-15M?) with IRS as part of the Military!

Fuck planetary pigs…..although they seem quite willing to do it themselves.

Maybe I made all the ants diabetic?

Nah. They exercise too much….hard workers.

If you thought that $2 dollar gas was anything more than a temporary blip, I have a bridge that I want to sell you that spans the East River.

When gas gets under 4.00, then I’ll consider it back to inflation adjusted historical norms.

Thank you for the break down wolf. Judging by what you are saying it seems that headline inflation will come down a bit then settle at a still very high level until rent and service inflation begins to drop? How long would that take?

If it’s up to the ‘Market’, never would be my bet.

I bet Powell feels the same way.

Once the dollar drops the speculators will drive commodity prices back up. Oil only fell because the speculators flip-flopped on their positions and took profits midyear. Inflation should spike sharply higher the first quarter of 2023 as the U.S. dollar falls.

If China falls apart, you’ll see a new trick for inflation. Keep an eye on that property crisis there.

The “Market” didn’t create this inflation. It was rampant “money” (actually mostly debt) creation which shows up as someone’s “wealth”. Then the combination of partly distributing it to the masses during the pandemic, shortages associated with the pandemic, and the change in psychology shows up as price inflation as everyone tries to spend this “wealth” and “free” purchasing power on goods and services that don’t exist in sufficient supply.

Depends on how long the FED ‘allows’ this to play out by tip toeing through the tulips!

Salary rises must feed service inflation.

And if people pay higher costs, it’ll be passed on in consumer inflation eventually.

The money has to come from somewhere, and the longer it runs the higher the pressure for pay rises all round.

This is bullish for the Fed cranking rates higher.

The job won’t be done until jobs are a smoking crater.

Demand is going to come down because the increase in core prices is simply too high to sustain spending. Rent isn’t coming back down, and wages didn’t increase enough to cover increased rent. How severe and for how long demand is destroyed is a function of the gap between wages and rent. I don’t know if we will see people in the streets but we are already seeing more unionization.

Need to unload the balance sheet so the bond market can function again and rein in govt megacorp stimulus.

Rent has a higher priority than most other expenditures, but it’s not exempt from math.

If people can’t afford it, it has to come down in price. It doesn’t matter if it’s a necessity.

Something being a necessity doesn’t mean its affordable. People will just have to double and triple up, whether they like it or not. Most of the rest of the world has always lived this way.

The US isn’t exempt from reality, even though many Americans seem to act like it.

Richard Russell predicted years ago that 5 bedroom McMansions will house 3-5 families, just like all the other poor countries.

He’s been wrong a long time then hasn’t he?

There’s a house for sale on our street, 4700 sqf, 2 master bedrooms and 2 full kitchens. These multifamily houses are popping up everywhere.

This is already happening in San Diego for the last few year.

Many homes in my neighborhood are multi family.

A 2 car drive way has 4 cars or so.

I disagree only because corporations, and landlords with multiple properties, will set a floor for the market. Why lower rent (and indirectly asset value) when you can wait for the govt to fix the demand issue? I mean look at California, rent doubled while the homeless population skyrocketed.

This difference in the at-home vs out-of-home food costs is interesting, and confirms what I’d noticed in pizza… Dominos still has their typical $5.99 take out medium pizza deal, but I am less sure I could make a whole pizza for much cheaper than that!

With Domino’s pizza, you are most likely eating garbage, so I don’t think it’s cheaper.

It’s easier than foraging in dumpsters.

chipotle raised the price of Chicken Burrito Bowl to $11.10 from $9.50 a few months ago. I always see teenagers and 20 somethings with $8.00 Starbucks beverages. How are they affording this?

Millennials and especially generation z NEVER eats at home. this cohort is larger than the boomers so food at home prices are not coming down any time soon due to these demographic changes.

But they can’t pay their college loans that are median $1800/yr, which calculates out to less than $5/day.

Because this home they would eat at is not theirs but their parents’ place – therefore the don’t want to be at home, they want to eat out with their friends, they don’t pay rent, don’t save, and spend all their money on convenience.

Agreed, and the price difference applies to frozen pizza too. My son likes the CPK frozen pizza and I indulge the habit, but unless I get it on sale it’s now $9.49. That seems ridiculous for a frozen pizza.

I re-watched Pulp Fiction last night and John Travolta whines about a $5 milk shake. Seems like a bargain now!

Domino’s mixes pizza dough a ton at a time and distributes it along with everything else their restaurants need through their commissary system. Their ingredient cost per pie is a small fraction of local shops or from scratch. They are an iconic brand and reasonable quality is important but repeatable uniformity of product no matter which Domino’s you get your food from is vital. Big Macs aren’t the best burgers but they’re the same in every McDonald’s in the land. I rarely eat pizza but Domino’s is okay. Although they left the Italian market today. That’s very easy to understand and seems prudent. Italy is a difficult place to do business for Italians, and they take their food seriously. It’s probably still just as good as remembered, and assuredly more expensive. Well, Italy was a great bargain for many years.

Domino’s $7.99 for 3-topping large is actually a better deal than the medium $5.99 in terms of cost per square inch.

I’m ashamed to say I know this too well, but at least I can also charge it to my 2% cashback credit card & build points towards free pizza, too.

If you use Discover, you can also buy Domino’s gift cards with your cashback balance at a 10% discount to face value.

Really squeezing margins to the bone there, I would think. Almost a ‘loss leader’ qualification.

JJ, Thank you for this wisdom! You are a master!

My electricity rate is set after approval from the PA utility commission(PUC). Not sure what other States do. Our PUC authorized a 30% increase in our rate effective 7/1. So we consumers are just starting to feel it. Our electric bills are tiny during the summer compared to the winter months. All of the service sector businesses will have the same increase. So there is some pain coming and we shouldn’t assume inflation is slowing. Also, we installed a gas heating appliance when nat gas was under 3 dollars. It has more than doubled since those days. The PUC hasn’t approve a rate hike yet for gas, but I know it’s coming.

The days of cheap gas are over. We are exporting LNG to Europe as fast as we can and our natural gas prices will reflect world market prices. I bought (stock symbol) LNG for my grand daughter’s custody account in January and it is up 20 percent while the market is down an equal amount. Long term hold, should do well.

My electric bill went from $150 to $220 for the last few months due to the natgas fuel surcharge…

That will not be included in the inflation numbers because the base rate hadn’t changed…

I’m really glad I could help out the rest of the world with your shitty ESG choices…

I love getting scrEUed…

PS… congrats on the investment choice… short term should be good… watch the long run….

It’s amazing how much energy is saved by air drying clothes. The clothes appreciate it (well not faded Jeans that need a little tightening.)

The glutinous society could take a baby step here;-) also McMansions are part of the fraud, waste and abuse of the Davos Man West. It will change sooner or later.

It’s amazing what people get use to. I’ve lived in the same town for 60 year’s. Now everybody is renting room’s out where nobody rented rooms. Multiple family’s or generations living in the same house. People become acclimated to living at a lower standard.

No private embezzlers or bank robbers in history have ever plundered people’s savings on a scale comparable to the plunder perpetrated by Inflation. It makes the wealthiest people richer and the masses poorer.

Inflation makes a great excuse to price gouge.

… unless and until it becomes stagflation. Then, stuff is expensive and lots of folks lack jobs. That was my coming-of-age era. I came out of high school and college in recessions while inflation had not been tamed.

This isn’t the first time through this rodeo. Last time resulted in a generational change from New Deal (1933-1980) to Neoliberalism (1980-2008-ish, maybe – 2016?). The wind could change again.

Unemployment rates keeps sinking though.

Because of mini S#@* – jobs. Germany knows all about this as they carp about all the unfilled, cleaning WC type Jobs out there. It’s cooking the books pure and simple.

Renting out a house that is paid off is a great stagflation investment. Rents go up with inflation. Your expenses are relatively fixed and lag the inflation rate. Tax write-offs help lower your reported income.

who is forced to buy any product or service. ?

Man thanks Wolf for all these. Don’t need to read much else to get a good sense. Blessings

There seems, from my perspective, a randomness and capriciousness to the current inflation. I remember from the way past (the 1970’s) that inflation was usually attributed to rising wages (itself attributed to a successful labor movement, and external forces not controlled by the country, such as petroleum prices rising. At that time, inflation was caused by forces the country could not control, except by governmental regulation, such as price controls (something not even being considered now regardless that it might help the vast majority of Americans). Today, although wage increase is mentioned as a factor in the current inflation despite wages still not coming close to the actual cost of living for all but the most well off, it seems as though the products and services that are increasing in price are relatively plentiful relative to demand are nonetheless having their prices increased. And other things, like housing, are having their prices forced higher by various private entities, such as private equity firms and housing flippers purchasing affordable housing units and turning them into expensive housing units. In other words, prices are being increased merely because they can be, for the benefit of the well-off minority and their corporations. And there is no attempt by our policy makers and regulators to stop this nonsensical greed.

It’s called the inflation of the rich

It’s a combination of factors, mostly “printing” and psychological. “Printing” isn’t inflationary if it never leaves the financial system into the “real” economy.

But you can also throw in lack of competition in many industries due to oligopolies. There is competition from outside the US, but many industries are dominated a low number of large companies.

Corporate house buying at scale is substantially if not mostly due to artificially cheap money and loose credit standards. I’ve read many comments here indicating this is a minority view, but tight credit and noticeably higher rates will crash the housing market turning corporate landlords into large net sellers.

Price controls are a guaranteed failure. Believing otherwise is only evidence of economic illiteracy. The only price control (and yes it is one) which practically everyone seems to believe does work is central bank monetary policy distorting interest rates.

The day of reckoning for this distortion lies ahead in the future with the outcome being (much) lower living standards for the (vast) majority of the population.

Price controls (and rationing) work — that’s why they’re employed during wartime. I’m not sure how you’ve managed to draw the opposite conclusion.

eg

You might ask a Venezuelan about their experience with price controls and the resultant rationing in their socialist paradise. Repeated instances have shown the quickest path to shortages is to lock prices during a period of inflation.

“(much) lower living standards for the (vast) majority of the population”

Said but true.

On the positive side, this newly impoverished world will hopefully be a sane one.

‘Sad’ not ‘said’.

The GDFA does mention that some services are affected by commodities like fuel while other services aren’t affected by commodities. However it’s not clear to me how components or materials used by service providers are counted (forgive me if this has been covered in some previous article or comment section).

For example, if an appliance repairman fixes an appliance (a service), the invoice he hands his customer could be affected by a more expensive replacement part (a good) that he installs. Or maybe a car insurance company may have to charge more because they know that replacement parts are now more expensive. A hair stylist may charge more because the cost of her supplies went up. I sort of sense that this may be one cause amongst many for the lag between the inflation of goods (which came first) and services (which is now hot as goods cool). Perhaps where the inflation of goods is cooling down, so will services follow after that lag time has been covered. Especially with fuel costs cooling off, we may be around the peak of service inflation.

Am I onto something here or way off?

To stick to your example of a repair involving a part: Any repair place, such as auto service shop, sells two items: parts and labor. And usually they’re separated on the invoice. So if you get your car repaired, you might see $100 in parts and 2 hours of labor at $x per hour (flat rate), plus maybe some other stuff, such as a percentage for “shop supplies” or whatever.

The labor = service; the parts = goods.

Also, there are only two “repair” categories in the CPI basket. Household appliances repair is too small and doesn’t have a number anymore, because hardly anyone gets any appliances repaired and there may not be enough data points in the sample; and motor vehicle repair and maintenance, which weighs 1% of total CPI.

That Sir, is why you are the creator of the finest financial articles available while I’m a simple commenter! Thank you for clarifying.

Markets soaring, 30 year mortgage down 22 basis points. Markets pricing in the return of the spiked punchbowl.

There’s plenty liquidity, it never left.

Yep…at best we have only scratched the surface.

Watch out if the Fed takes it even semi seriously.

Longer-run, the hangover could be historical, despite the blurring of this by the markets’ euphoria today. But today is the situation where we all live.

My volatility etf (VIX) is below its 52-week low. It”s like Fed overreach and inflation never happened.

Markets in complete denial.

Someone, without a doubt, is delusional. We’ll see whether it’s the markets, or the people insisting that the Fed will break the animal spirits that have returned to running wild.

If you know the history around the time of broke French government in the late 1700’s they pumped and pumped with paper promises, but when it got out of hand they tried and couldn’t get confidence back no matter what and the paper notes became worthless. Very hard times followed.

Bizarre. Markets fighting the Fed.

This is going to be long and painful. There will be multiple waves down in stocks . The first wave down was just a teaser. The Boomer Asset era is going to get de-leaverged or liquidated. It is the eternal and natural end point and starting point to bring in the next group of suckers to be exploited by a criminal financial system and government that the suckers always and only believe in. Liberty would break the cycle but it is a scary son of a bitch and requires discipline and courage and is therefore not an option. I am and will enjoy the shit show during my lucid moments.

How long can I stay away before FOMO drags me back in only to punish me one more time?

I hate the market. I hate myself for how the market makes a monkey out of me.

It’s GS, Citi and Chase and MS etc. ripping shorts, then ripping the longs against what should be happening, just because they can see everyone’s positioning and set you up.. The only denial is these thieves who control the markets not getting taken out as their crimes require.

The market participants responsible obviously have not availed themselves to this website.

Pure wisdom served up fresh daily.

It should give it all back and more tomorrow.

Mortgage rates were 3% and markets didn’t price in anything because they didn’t want to. And then mortgage rates were 6% and markets priced in whatever. And then mortgages rates are 5.2% as right now… Markets price in whatever. It doesn’t mean anything other than markets betting on stuff and bets going awry.

I suppose by some measure inflation receded for a month. They were able to hide some inflation, but the price of a new home has been rising faster than the CPI for years. I know deflation is transitory. Gasoline was 30 cents/gallon in 1959. There were phone booths instead of smart phones.

There is still a chip shortage. The war in Ukraine has reduced grain available for export. The price of fertilizer is so high some farmers switched to using cow manure instead. Britain has a plan for rolling power blackouts this coming winter.

So you are saying ‘markets’ will reach the moon?

Gamestop, AMC, BlackBerry, Palantir have been rallying.

Makes me check my own sanity…..

The longs in oil a lot of them took profits at midyear at the end of June. If they anticipate the dollar falling they’ll drive oil back up to the 115 to 120 dollar range.

Hey Wolf. Long time reader. Biden said in a conference today that inflation was 0% for the month of July. I don’t think he is lying (probably just embellishing) but for the life of me I don’t know what numbers he might be referencing (or cherry-picking). Any clue?

He’s using a month over month number meaning inflation rate didn’t rise over previous month. Completely disingenuous. Joe just reads what’s in front of him.

MasterCrabby,

It’s not my job to explain what Biden meant. They have highly salaried people in the White House who do that and who walk back this stuff.

If Wolfstreet expanded its reach to provide “the stories behind business, finance, money, and politics”, then it could be your job to explain what Biden meant. ;-)

Wolf is too clever to go into the No-No Land of politics. Way to many quiet eyes that matter on his site.

God Forbid!!!

IMHO, Wolfstreet.com is THE BEST,,, of what it currently does report on.

Politics, everywhere, and especially the so called reporting WE see,,, is a long dead dungeon of fatalist and fascist and frequent fantasy.

Wolf should and must stay out of any other than the commentariat responses that mention any political person or trend,,, as all or almost all of those are SO corrupted before WE the PEONs see even a bit of their clearly ”programmed” polemics.

Thanks again Wolf for your very clear graphs and other examples ”telling it like it really IS.”

“ Biden said in a conference today that inflation was 0% for the month of July. I don’t think he is lying (probably just embellishing) but for the life of me I don’t know what numbers he might be referencing (or cherry-picking). Any clue?”

What he is referring to is the index numbers…

The cpi-w index number actually decreased from June to July by a couple of points…

Even still, the cpi-w stands proud at 9.1 % July ‘23 compared to July ‘22…

For the COLA watchers, the COLA is at 8.9% (compared to 3Q last year) with todays index number with 2 more data points to go…

It doesn’t matter what mushmouth says. People get a basket of groceries and then just about faint at the cash register when it comes time to pay. Ditto the fuel pump, etc. Mushmouth can gaslight all he wants, it means nothing.

“Mushmouth can gaslight all he wants, it means nothing.”

It actually aggravates President’s situation. First people are shocked by rising prices, then they hear this obviously manipulative statements that add insult to injury. All that these disingenuous statements do is to provoke a lot of ridicule and increase anger.

Now we find out how smart this Fed really is. If they don’t deliver 75 basis points at the next meeting, expect thim to stop what they are doing in the first few months of next year.

Right now the Fed Funds rate is 2.5%. It was 0.25% from 2009 to 2016, and peaked before at 2.75% in 2018.

They can raise it to 3.25% next month but it does not seem to help in the current stagflation environment.

The Fed is in a trap. Please read what Nouriel Roubini has been saying. MarketWatch . com has stated the same.

Nouriel Roubini says doomsday for years. The broken clock is right twice a day.

///

Shared markets create shared inflation…

Example 1. It is quite interesting to observe the global market in terms of goods. I live in a country where fruits and vegetables are a major aspect of the export portfolio of the country. The strong inflation in surrounding countries has created a strong incentive to export goods at inflation driven higher prices, also due to increased cost of labor, fertilizer, chemicals etc. On the other hand due to this forced incentive the same goods are not any more available on the local market, creating somewhat of a scarcity and pushing the price upwards.

Example 2. Money has no safe heaven, and looks for opportunity elsewhere. While agricultural land is hard to buy in most countries, realestate is not. The large funds have invested significantly into realestate, pushing the prices upwards and selectively building higher end apartment buildings and condos, for target audience with deep pockets. Local builders are mimicking the trend hoping to get part of the action, completely neglecting needs of the local population…Causing a surge in realestate prices…But now after years of growth you can negotiate the price down by 7-10%…It is wonderful to see what a few basis points and an energy crisis can do to the market. What I am surprised by is the speed at which the local market reacts…

///

Disney’s profits are up 50%, and revenue up 25% from last year. That’s not a sign of an economy where inflation will be slowing, but unless Disney’s business model changed dramatically in the last year, that increase is a sign of too much money out there. And that means that inflation is not coming down on its own.

The only other alternative is that printing trillions, years of ZIRP, and locking portions of our economy for a year made us that much stronger. I see no evidence of that.

“Disney’s profits are up 50%, and revenue up 25% from last year.”

How are they compared to 2019?

Not favorably.

Just saw the president say inflation was zero for July.

My dear old dad, long gone far shore,,, called that kind of thingy, ”peeing in your own nest.”

Clearly for us old folks,,, Biden is not only senile,,, but pretty close to expired, as a very good old black neighbor told me a few years ago when he was…

Being not too far from expired me own self,,, I really and truly HOPE that the young and younger folks in our USA ”political arena” these days not only prevail,,, but absolutely predominate.

REAL question IS, who should be able to vote for thingys that our young and younger folks will have to deal with for most of their lives???

VVNV-what an absolute gem of a closing sentence! (what used to be the prevailing American attitude towards our younger population. more than ever, the younger, as you indicate, will need to accept the pain-in-the-a** realities of making our form of gubmint work and get cracking if they truly want a hand on the wheel of their future ). Kudos!

may we all find a better day.

Inflation blah what’s a 38% increase in price, transitory!

It took 18-24 months to reach current peak inflation from this cycle’s lows. Looking back at prior CPI runups, the return to mean or to something close to the starting points takes years, not months. I don’t expect this cycle to be any different, except for expectations for immediate results and a 2.5 CPI reading by October.

Inflation will take a second leg up at the very beginning of 2023.

‘… but unless Disney’s business model changed dramatically in the last year,’ Of course it did! There is a lot of money out there!

‘…made us that much stronger.’ Now that’s hilarious! It certainly made a certain group a lot richer!

About a year ago lots of people were praising MMT which proposed unlimited money printing, while any inflation could be easily dampened by raising taxes. Now I see an “Inflation Reduction Act” that does everything except raising taxes. Where have all these MMT evangelists gone??

( I’m asking this for a friend )

I haven’t seen the whole Act, but isn’t its overall fiscal position negative?

The service sector is where the most workers bailed out. 11 cruise ship departures from San Diego cancelled due to labor shortages. I am sure there are people with plenty of money ready to go, being the discretionary income demographic. The new Covid variant is due out, and no foreigners allowed. This could go on for a long long long time. As long as we have racial purity and mandatory conception for females at age 16, I guess it’s worth it.

“The service sector is where the most workers bailed out.”

You’re confusing services with “bartenders” “cleaning staff” “hotel staff” etc. Service workers also include the coders and managers and AI gurus and other engineers and specialists and non-specialists and CEOs employed by Google, Facebook, Microsoft, Amazon, Oracle, Wolf Street Corp, etc.

That is significant from an overall economic impact. These companies are laying off, and the domestic trade is just MIA.

So workers bailed out of crappy service jobs for better jobs. How is this surprising?

Surveys say: Social Security Cola is Pepsi.

So energy and in particular gasoline fell in the CPI report.

What percent of the total CPI is the energy and gasoline?

I find it quite astonishing that a $4 or $5 item in the CPI can offset the other components to result in zero inflation for the month.

Motor fuel = 5.3% of CPI.

Total Energy = 9.2% of CPI.

So if that plunges, it can easily drag down overall CPI by a bunch of basis points. And that’s what we’re talking about — basis points.

Inflation? Biden insists that US is undergoing zero inflation now. The markets responded today on the news.

Where is the White House team that’s going to walk that nonsense back?

And so one month, we may have 1% inflation from month to month, and you’re going to say that we have “1% inflation and are below the Fed’s target?” That would be a hoot.

Like I said here somewhere, it’s not my job to explain what Biden meant. They have highly paid people in the White House who do that, and who walk this stuff back without breaking a sweat.

I have no idea what Biden actually said or may have been thinking. What I (we) do know is core monthly inflation was “only” 0,3%. That’s “only” 3,6% annualized.

It’s easy to see how SOME PEOPLE out there see this as bullish, especially if the Fed is looking at this data month by month instead of big picture. With sub-4% core, does the Fed really need to crank down the screws tighter? It doesn’t sound all that unreasonable of a position to say NO.

The funny part is that anyone thinking that…. must believe that Fed policy works REALLY fast, because the Fed just began tightening in earnest a couple months ago!

Walk back? More like Circle Back…of course since Psaki isn’t there anymore, I highly doubt any circling back will even go on. Seems Pierre isn’t even capable of doing that. Clarity of meaning most definitely won’t be coming from the press secretary…they better scuttle Yellen out there to try and explain away Joe’s comments.

They don’t think that this is nonsense.

Month to month CPI inflation for July was reported as zero. In June it was 1.3% month to month CPI inflation. That is a rate of 15.6% annualized. One month of data does not make an entire year.

As long as it makes Joe feel good, that’s all that counts. His handlers will walk it back and Joe won’t even know it happened.

Price gouging for NG. ?

The oil and gas companies do not I repeat do not set the price of NG that they sell.most of the smaller NG producers in fact hedge their gas sales so they can meet their debt obligation.

If the oil and gas producers se the prices that they sell their product one would not see the fluctuations .

Wolf, I have to disagree with you here, “So when a product gets a million times better, it’s not the same product anymore..” That may make sense on paper, but in the real world, what a smartphone can do today, say land a rover on Mars, doesn’t give me one bit more value than when it was just a phone, text yeah, ok. All that whizz-bang value is hardly “redeemable” for the average consumer. Star-spangled college geeks are the froth, they aren’t the economy.

cobo,

Hahahaha… This site wouldn’t exist without those innovations and those lower prices for that much better tech, and you wouldn’t be able to comment on it, because you wouldn’t have the device to comment on it, and even if the internet existed in 1985, I couldn’t afford to buy a server of the power that runs this website. You’re talking millions of dollars. So these lower prices and innovations matter hugely even in YOUR life. You’re just not using your brain all the time, but you’re using the tech all the time.

It wasn’t too long ago that you couldn’t get on the internet with your cell phone, or if you could, it was very slow and practically useless. And remember when you paid $16 a month for dial-up internet that was so slow that ecommerce, as we know it today, didn’t really take off until broadband was widely used. Same with internet publications. You could use dial-up but “www” was called the world-wide-wait… remember? Those were the good times you speak of.

People take all this stuff for granted. That’s why you don’t think you need it or that it’s “better only on paper,” because you take it for granted.

Wolf-so well-said. Might be extended to the term ‘civil society’.

may we all find a better day.

Indeed. Anyone who thinks that there is no difference should try running windows 95 and the software designed for it. That’ll straighten them out in a hurry.

Wolf, even the simple one hour power outage I had the other day reminded me of how we as a society would quickly regress into the Dark Ages without the relatively young innovation of electricity itself. How utterly dependent we all are to electricity, along with all the fragile constructs built upon the assumption of its existence.

I had a fun time walking into a casino once during a power outage; the entire environment stopped so hard and fast with hundreds of thousands of dollars of betting halted, it was though the entire world had ended there.

Yep, just look at Disney!

– Disney streaming subscriber growth blows past estimates, as company beats on top and bottom line.

– Disney lowers longer-term forecast for Disney+ subscribers by 15 million

– Disney raises streaming prices after services post big operating loss

Look, we blew through everyone’s estimates of who wants our service but we still lost our shirt, so we’re raising prices!

And yes, I did RTFA… I believe this is captured under: Video and audio services, including cable: +3.8%

I was being sarcastic about Biden said zero inflation. The masses have short term memory

No no no, you are wrong. Inflation is Zero, repeat, zero!

Biden has said so in person.

1) The gap between Case/Shiller price and owner equivalent rent is higher than in 2006.

2) The latest price/rent is : 305/185 = 1.65.

3) in 2006 : 185/125 = 1.48.

4) The difference between 2006 and 20222 : in 2022 prices are rising vertical up. In 2006 it’s curving, rounded, Adam & Eve.

5) Prices are too expensive.

Thank you Wolf.

Saw the headline number and stock market knee jerk reaction. Turned off all talking head blather. Knew that Wolf would have the real story later in the day. Was not disappointed.

1) For over 20 years rent is rising constantly almost in same angle. Rent never seriously dipped, even in 2009/2010.

2) If so. in the next recession C/S might breach rent.

3) Since rent is the biggest component of the CPI, inflation is built in.

4) But if the vacancy rates will be high and persist, both C/S and rent might dip, C/S might fall faster, breach rent. In real terms it’s a disaster.

History is the best guide to the future.. The FRED chart of FFR superimposed on the YOY CPI for the years 1967 – 2022 reveals 7 instances of rate rises to curb inflation. The time lengths of these rate rises in years: 2, 2.5, 3.2, 2.5, 1.1, 2.1, 2.1. Conclusion: the curbing of inflation requires at least 2 years of a rising FFR. So expect rates to rise throughout 2023 and into 2024. The PTBs should reverse course in early 2024, stick saving western civilization just in time for the Nov. election.

Service inflation may be due in part to the high level of employment or historical low unemployment rate as low as 2% in some cities. The Fed will raise rates until they get that up to maybe 5% before they consider a pause.

“CPI attempts to track the loss of purchasing power of the dollar, in other words how much you pay for the same product over time. So when a product gets a million times better, it’s not the same product anymore. If the price stays the same, or declines, though the product gets better, then this is “deflationary.”

Tech products, thanks to constant invention, have been “deflationary” from the beginning of time. And that’s a good thing. That’s how it is. CPI adjusts for this via hedonic quality adjustments. And that’s why the CPI of tech products should be negative, and it usually is.”

There’s another way to look at this. Those price decreases have nothing to do with inflation at all … they’re real price decreases. They’re not deflation … they’re not monetary, they’re part of the completely different process of technological advance. In other words, in the absence of inflation – if the value of the dollar remains constant – these prices should fall.

The use of real price decreases to offset monetary inflation is tantamount to the government claiming for itself all the benefits of technological advance. It’s part of a larger problem; the core assumption that consumer goods and services are an immutable standard of value. It’s never really been justified, just sort of morphed out of the original concept of the Consumer Price Index as a measure of consumer prices and the exclusion of other classes of prices – such as those of assets – from consideration. Why one would only consider one narrow subset of prices in order to measure the value of currency has never been explained.

And if you’re not trying to track the depreciation of the currency, and instead merely trying to track consumer prices, then you still have no justification for hedonic adjustments … the prices people actually pay are the consumer reality.

Brilliant post, Mr. Finster.

Inflation went down by 0.5% and the mkts just took off. As I have been repeating, the power of perception+Hopium is much stronger than the reality including fundamentals. .

How an investor (short or long term) will manage his/her portfolio is going to be a challenge. Apparently there is hardly any discussion on that issue. This is purely a traders’ mkt.

Mkts and the Economy remain disconnected. All depend upon Fed’s whisper, positive narrative from the vested interests, FOMC members’ pontification every other day and what NOT! Front running is a feature and not a bug any more. I am glad I never discounted the power of perception in managing my portfolio.

Passive, dollar cost average, diversified (not just one country) indexes held over long time horizons seem to work.

You don’t get rich but rarely would you go poor. Of course you get punched in the face but if you can hold, things work out. But who knows, maybe the everything is a bubble we’re all fucked guys will be right for once.

“Inflation went down by 0.5% and the mkts just took off. As I have been repeating, the power of perception+Hopium is much stronger than the reality including fundamentals.”

The “fundamental” is that they printed way too much f**king money. If they didn’t do that, then the markets wouldn’t “just take off.”

This is what I keep bringing up here, and I will continue to bring it up… A third of all dollars ever created were created in a 2 years! The first third took well over 2 centuries to create. The next third was created from the GFC until 2020. And that last third was conjured up in 2 years. Again, we created the same amount of money in 2 years that we did in over 2 centuries prior! It’s a money supply tsunami that skews everything and crushes all in its path. It warps asset prices beyond recognition. It laughs in the face of the Fed’s feeble fractional interest rate hikes because the Fed knew darn well what they were doing when they unleashed it. They could have easily stopped printing at “only” one century’s worth of money, but nope, they kept going. That changes everything, and if the Fed does not remove most of it at a meaningful rate (which they won’t), then we’re stuck with a totally different valuation of the dollar along with everything it buys.

They printed themselves richer, at the expense of the society.

What surprised me in the CPI number today was the change in natural gas, which I was expecting to substantially increase and to offset much of the increase in motor fuels. According to Trading Economics the price of natural gas in July went from 538.7 on July 1 to 821.2 on July 29, USD MM/Btu, a 52.5% increase. This enormous increase did not show up in consumer prices. For example, Piped Gas Services fell 3.6% from June. Maybe it will show up tomorrow in PPI. Unless natural gas falls precipitously it will show up eventually.

What is the theory on why the Fed is hiking rates so much more aggressively than they are shrinking the balance sheet (QT)? Don’t get me wrong, I think they are also way behind on hiking rates, but at least the 50-75 bp moves are meaningful. Compared to QT, were they have barely even started pulling the excess money out of the market. Hurting the gamblers (QT) versus hiking interest rate (more likely to hurt main street & companies), seems like Powell is more worried about hurting his ol budddies in the private equity world than hurting the average American. Why is he so scared to really start QT? Or his he just evil?

They have no control of the economy

Don’t count on energy falling forever. The US is pulling 5 to 7 Million barrels of oil out of the Strategic Petroleum Reserve each week. This ends in I believe October (just before congressional elections). There is no production out there to replace these inventory draws once they end. So oil hikes might come back to haunt inflation….kind of like the various oil shocks of the 70’s reignited, cooled, reignited inflation over and over…..

Augusto

“The US is pulling 5 to 7 Million barrels of oil out of the Strategic Petroleum Reserve each week”

Use of oil in USA per day around 20 Million barrels

Oil like most commodities is priced on the margin on the last unit/barrel sold. With long lead times to production, limited storage space, pretty well every barrel will be consumed. If you remove 700,000 to 1,000,000 barrels a day from the market the price at the margin will rise very rapidly On the other hand, if you suddenly add large amounts of oil to the market prices will fall (perhaps crash) just as fast. It is primarily a physical market of production and consumption, which is why draw downs and build ups in inventory are so critical. In other words, 5 to 7 million barrels a week added to supply is a lot in the oil and is a primary reason why oil has fallen from what from around $120 to $90 a barrel in a matter of few weeks, which is why Biden did it.

I suppose after all my long years everything is not as bad or I am not concerned.

I am not concerned so much because where is the value with product indexes? Without *itch-slapping I may say “there is little value in with you borrow or buy”.

CPI sure let’s get started.

In a land of easy answers the problem sometimes could be found within a simple equation called the “Proof of Pudding.

Proof of Pudding can’t include the change of definition of financial terms for profits?

Until recently?

Sorry Wooffers two dimes shift.

Today, the stock market was elevated by a mysterious force, almost like an “invisible hand” of the Fed

The minimum number of observations required to establish a wall street trend, is 2, as opposed to the three observations that are generally accepted as a requirement for claiming a trend.

Don’t get me wrong, I am thankful that I can still afford to live in America.

It’s the kids that can’t afford it. It is a different world from my world, growing up under FDR versus Reagan.

“ Today, the stock market was elevated by a mysterious force, almost like an “invisible hand” of the Fed”

No invisible hand of the Fed…

The market is competing with the Fed to see who is in charge of the economy…

The capitulation of the Fed in late 2018 proved to the market that with enough pressure, Powell would cave… They’re going to try it again…

CPI-W was still 9.1%… a horrible number for the masses…

Since July 2020, shortly after the pandemic started, inflation is 15.7% … which will never be recovered…

Every month that goes by at these levels will destroy more and more of the bottom 50% that has had no asset appreciation to try to stay above water…

Look for the Dems to start trying everything under the Sun to milk votes from the destroyed class…

Anyone racing out of

I just saw another Kohl’s ad on youtube that started with “Inflation? No match with Kohl’s…”

It’s becoming a marketing slogan, at least at Kohl’s.

That’s a bad sign — it shows just how entrenched inflation has become.

Everybody is talking about it. And lots of complaints about groceries, fuel and auto prices. In the past, I’ve never heard anybody breathe a word about inflation.

NQ rolling hills approach Jan 2022 low.

Yesterday the Dow gap up above Jan 24 low. It’s might close May 4/5 gap and spike above dma200. This bear market rally might be over by Fri. After a short battle on dma200 the Dow might turn down first slowly, then faster. The stock market are rising, but the 10Y don’t care.

The 10Y-2Y is getting deeper in negative territory @(-) 0.45.

Totally agree, Michael. Yesterday’s buy-the-big-dipper is like a financial fart in the wind. Very rapid dissipation. Excuse the vulgarity, but we live in vulgar times. Watching the bond market yesterday, esp. the longer maturities, the yields went down in the morning and then went back up in the afternoon. Realization: inflation is still tearing a big hole in Americans’ purses and wallets!!

A technical intra-day reversal, which along with other trading behavior over the last 10 days, points to the bond market bear coming back out of his or her den (must be non-sexist in all copy) and yields heading back up from this mere/ recent/ ending correction.

Now the Junk Bond or (more polite) High-Yield Bond market traders have not gotten the memo yet: that market is going to see Defaults and Bankruptcies and Disappearances in the next several years like never before in our history! More profit challenged companies have floated more garbage debt in the last 10 years than the history of the universe. Eventually, poo-poo (less vulgar) seeks its own level, which is down the toilet and out to sea. The average yield of say 7.50% for Junk today is looking mighty good to the Unwashed Speculative Debt buyers, but don’t forget that a 50% haircut to principal flushes many years of interest payments down that shaky debt toilet. There will be 100% haircuts for more companies out there than one dares to ponder.

Inflation is still hot. And based on the PPI clocking in at a 10% year-over-year rate this morn, there are more hot numbers coming down the pike. Yeah, let’s put Green Fanaticism restrictions on carbon output at farms in 2022! Let’s pile costs on a critical industry that is already suffering from fertilizer costs and availability, droughts, and other constraints such as diesel costs by making it more expensive to produce a bushel of wheat. Like living in an alternative universe, but these aliens aren’t green. Oh, they are green in their politics. Pathetic timing to say the least.

The less a person earns, the more severe is the impact of inflation.

All the blustering, and frankly lying, politicians, and empty talking heads, can’t produce one extra dime to pay for food or energy that has now moved beyond reach for a growing number of earners.

All they have managed to do is to massively dilute dollar value, including earnings and savings to the point where it no longer covers even the basics. .

Earnings no longer covers very basics of food energy and housing. Savings are being used up to cover the shortfall. Next comes borrowing and credit cards to cover the gap or even those basics.

Nope, no amount of media or political blather will change this escalating mess.

This administration and Congress has put our train into a slow motion train wreck. Nothing can now stop the damage that is occurring around us. We are left to simply grab hold of anything possible to ride out the wreck and hope that we are still able to move once this train stops moving.

No worries. Our bean counter ran the preliminary tax impact

from the latest fleecing bill. Only a 10% hike on our business

taxes. Just another cost to pass along.

The cause of inflation has always been hidden. I dub it a conspiracy. Then the dynamics changed in 1981, as predicted in 1961.

Both the S&L crisis and the GFC were predicted in May 1980 in IMTRAC.

And Powell went “Full Monty”. Get used to it. Interest is the price of credit. The price of money is the reciprocal of the price level.

The effect of the FED’s operations on interest rates is indirect, varies widely over time, and in magnitude. What the net expansion of money will be, as a consequence of a given injection of additional reserves, nobody knows until long after the fact.

The consequence is a delayed, remote, and approximate control over the lending and money-creating capacity of the payment’s system.

Waiting for the Wolfstreet Headline: CPI, Nothing Goes to Heck in

a Straight Line.

I kind of said that already – just not in a headline. I’m on record saying that CPI will go down in the second half, and we had some discussion about that here, about how far, and why. And I also said that it will then bounce off those levels again next year. I based this on several factors that we already know.

Yes. And the Fed knows it. They know that if they declare victory early and stop raising rates/QT, that inflation numbers will return with a vengeance.

I’m starting to love this “bear” market rally

It is the power of perception+Hopium+positive spin narrative from Financial media 24/7 + a lot of liquidity of CASH sloshing around+ Foreign buyers!

How long this go on? No one knows. I stop discounting the power of perception about 3-4 weeks ago. Swing trading using leveraged ETFs of major indexes, on BOTH sides + continue to buy Energy & Div paying numerous ETFs across sectors/global has kept the volatility of my portfolio to minimum. 40-50% cash always, since I am retired.

we are in uncharted waters. Mkts for nimble traders’ only.

“The Inflation Reduction Act provides $4.5 billion to provide rebates of up to 100 percent for lower income families to purchase and install new energy efficiency appliances including heat pumps, water heaters, stoves, and clothes dryers. Families with incomes of up to 80 percent of area median income (AMI) will receive a 100 percent rebate of purchases up to $14,000”

Maybe they should call it the Inflation Resurgence Act. If you want cheap appliances or installation services, better act fast before this goes into effect.